Essential Babysitting Invoice Template for Easy Payment and Professional Billing

When providing childcare services, it’s essential to have a clear and professional method for requesting payment. A well-organized document ensures transparency and helps both parties understand the terms of the arrangement. Whether you’re caring for children on an hourly basis or have agreed upon a flat rate, having a structured approach to billing can make the payment process smoother and more efficient.

Creating a professional billing system not only enhances credibility but also reduces misunderstandings about fees. By using an easy-to-read document, clients can quickly see how the amount was calculated, which fosters trust and clarity in your business transactions. A carefully crafted payment request can set the tone for a positive ongoing relationship with clients.

In this article, we will explore how to craft an effective document for requesting payment, the key components it should include, and how to adapt it to your specific needs. Whether you’re just starting or looking to improve your current method, you’ll find valuable insights to help streamline your financial interactions with clients.

Why You Need a Babysitting Invoice Template

When offering childcare services, maintaining a professional approach to financial transactions is crucial for both you and your clients. A clearly structured document outlining the payment details ensures that both parties are on the same page and minimizes the chances of confusion. By using a formal payment request, you can reinforce professionalism and foster trust with your clients.

Having a predefined structure for payment requests helps you stay organized and ensures consistency in how you charge for services. It provides a straightforward way to track earnings, making it easier to manage your finances. Additionally, a well-designed document reflects positively on your services, showing that you are thorough and reliable.

Here are a few reasons why you should use a standardized billing document:

- Clear Communication: A detailed document leaves no room for ambiguity regarding the amount, hours, and services provided.

- Professionalism: A formal document helps establish trust and credibility with clients, ensuring they take your services seriously.

- Time-saving: By using a ready-made format, you can quickly generate accurate payment requests without needing to start from scratch each time.

- Organization: A well-structured document allows you to easily keep track of payments, due dates, and any outstanding balances.

- Legal Protection: Having a formal record of services and payment terms can help protect you in case of disputes.

Ultimately, using a consistent and professional billing method can streamline your payment process, allowing you to focus on what you do bes

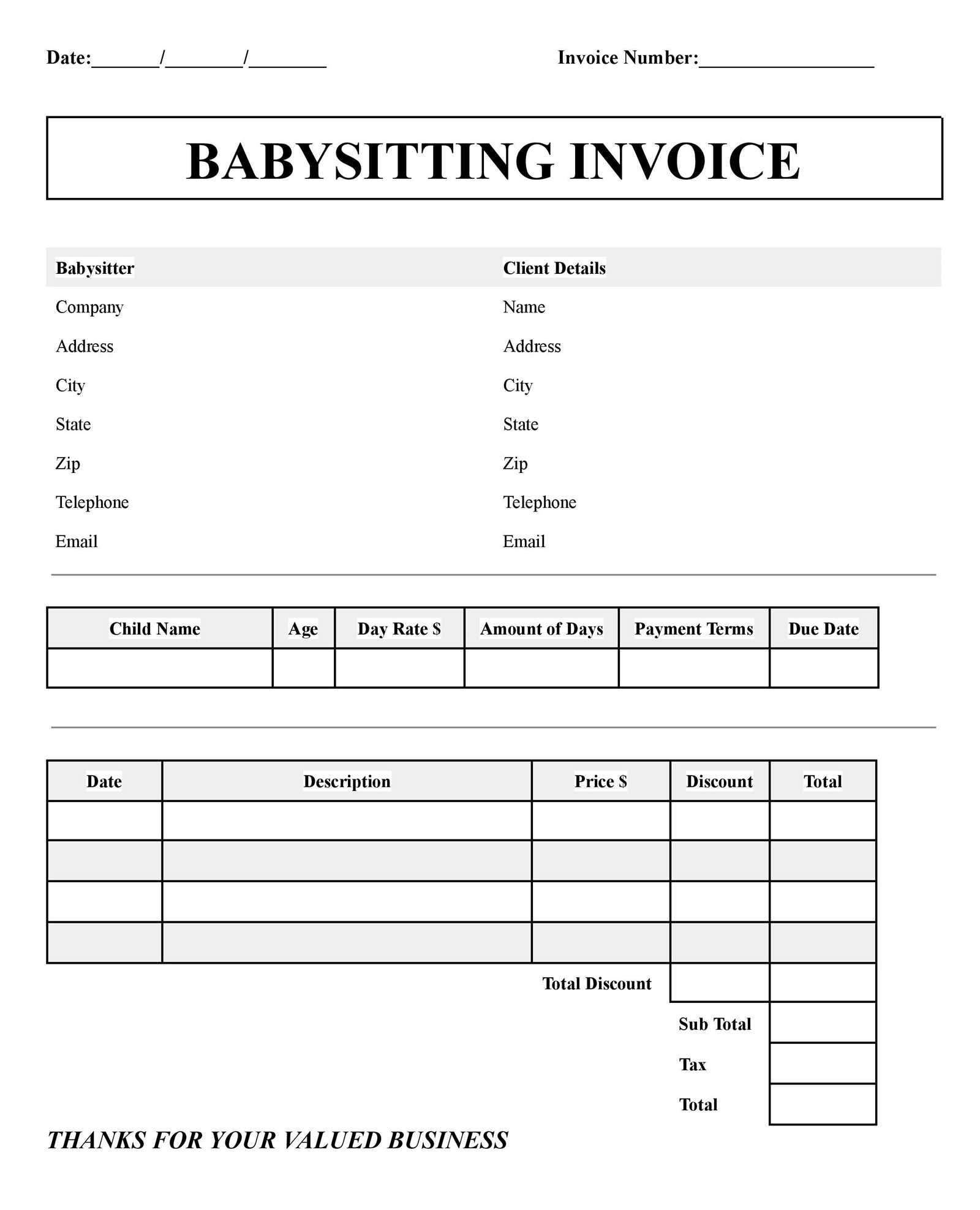

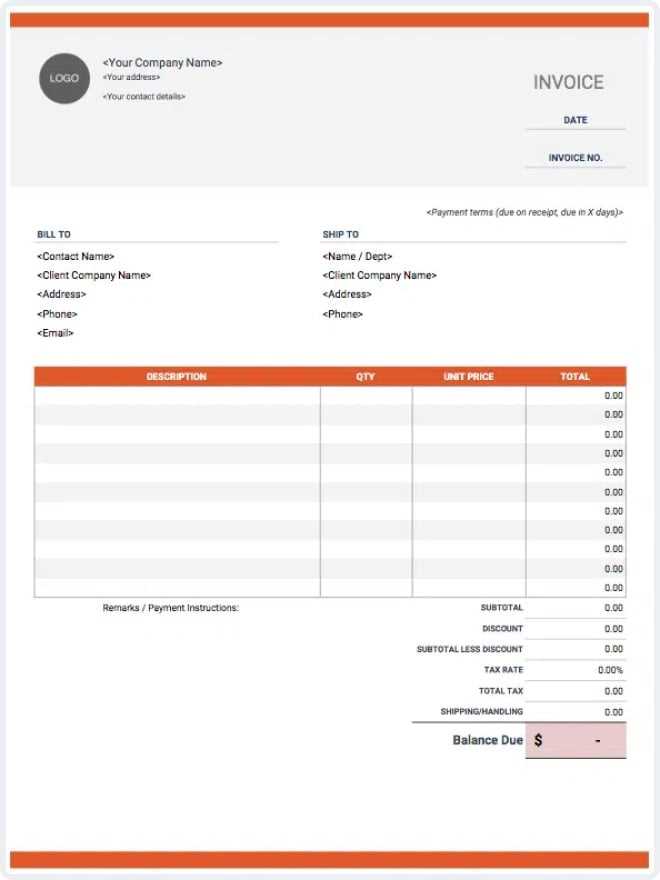

Key Elements of a Babysitting Invoice

When preparing a formal request for payment, it’s important to include specific details that ensure clarity and avoid misunderstandings. A well-structured document not only communicates the amount owed but also provides transparency regarding the services rendered, making the payment process straightforward for both parties. The key elements in such a document can help organize your financial transactions and maintain professionalism.

Here are the essential components to include when creating a payment request for childcare services:

- Your Contact Information: Include your full name, phone number, and email address. This makes it easy for the client to reach you if needed.

- Client’s Contact Information: Ensure the client’s name, address, and contact details are listed, so they can easily refer to the request and keep records.

- Service Date(s): Specify the date(s) when the service was provided. This helps track which dates are being billed and clarifies the scope of work.

- Hours Worked: Clearly state the number of hours worked, or the agreed-upon rate for the period covered. This ensures that both you and the client understand how the total amount is calculated.

- Hourly Rate or Flat Fee: Include the rate you charge, whether it’s hourly or a flat rate. Make sure this is clearly defined to avoid confusion.

- Total Amount Due: Highlight the final amount to be paid after any additional charges, discounts, or taxes have been applied.

- Payment Terms: Specify the payment deadline and any late fees if applicable. This sets clear expectations for when the payment should be made.

- Method of Payment: Indicate the accepted payment methods (e.g., cash, bank transfer, check, or online payment platforms).

- Notes or Additional Information: If necessary, include any special instructions or additional services provided, such as transportation or ex

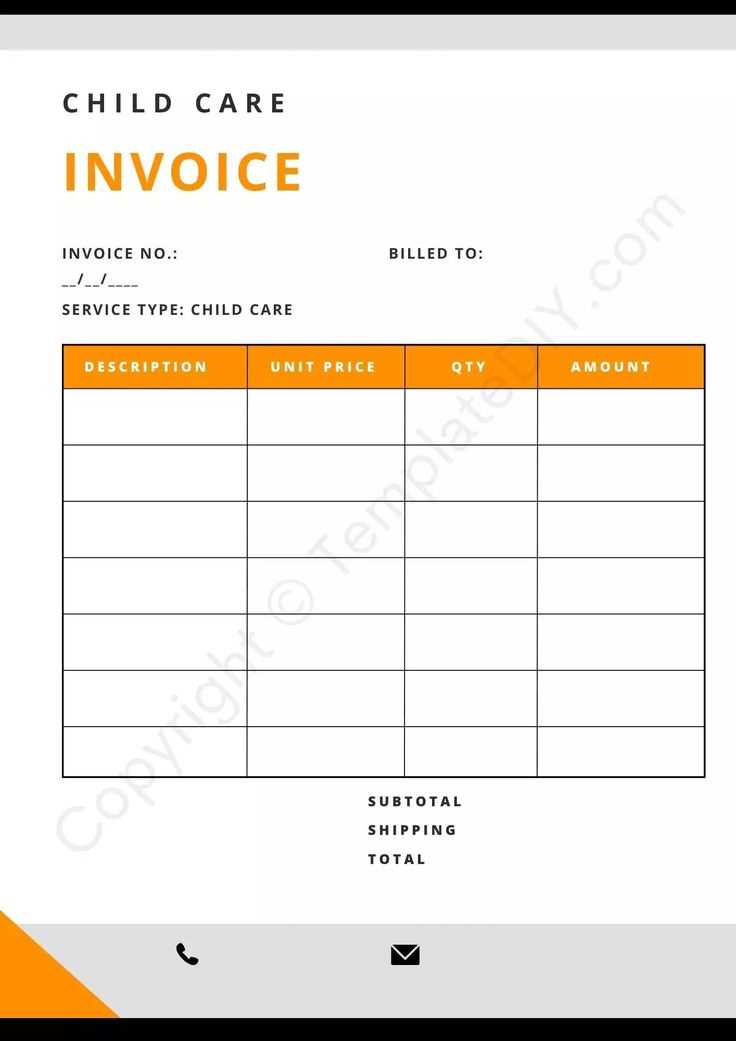

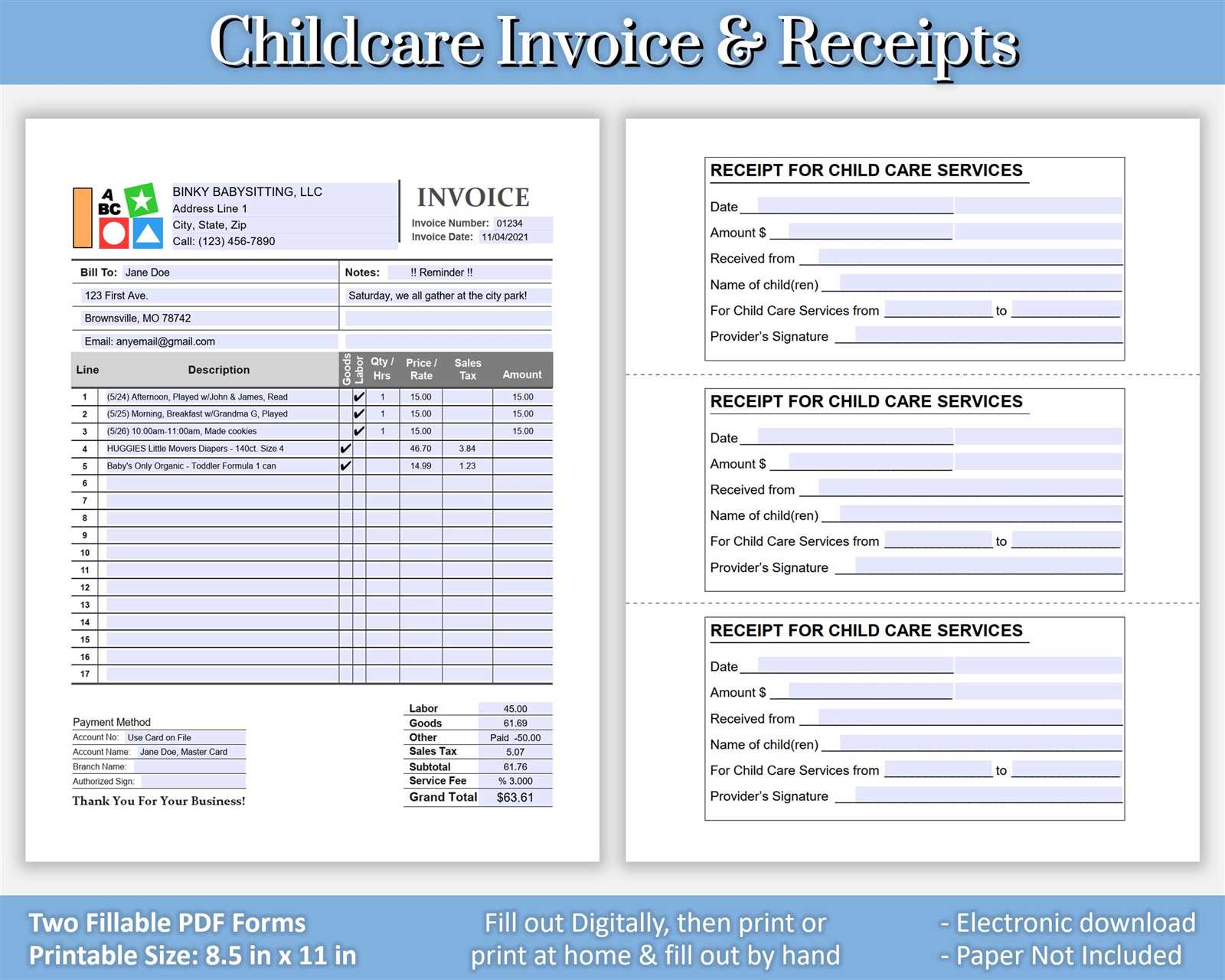

How to Customize Your Payment Request Document

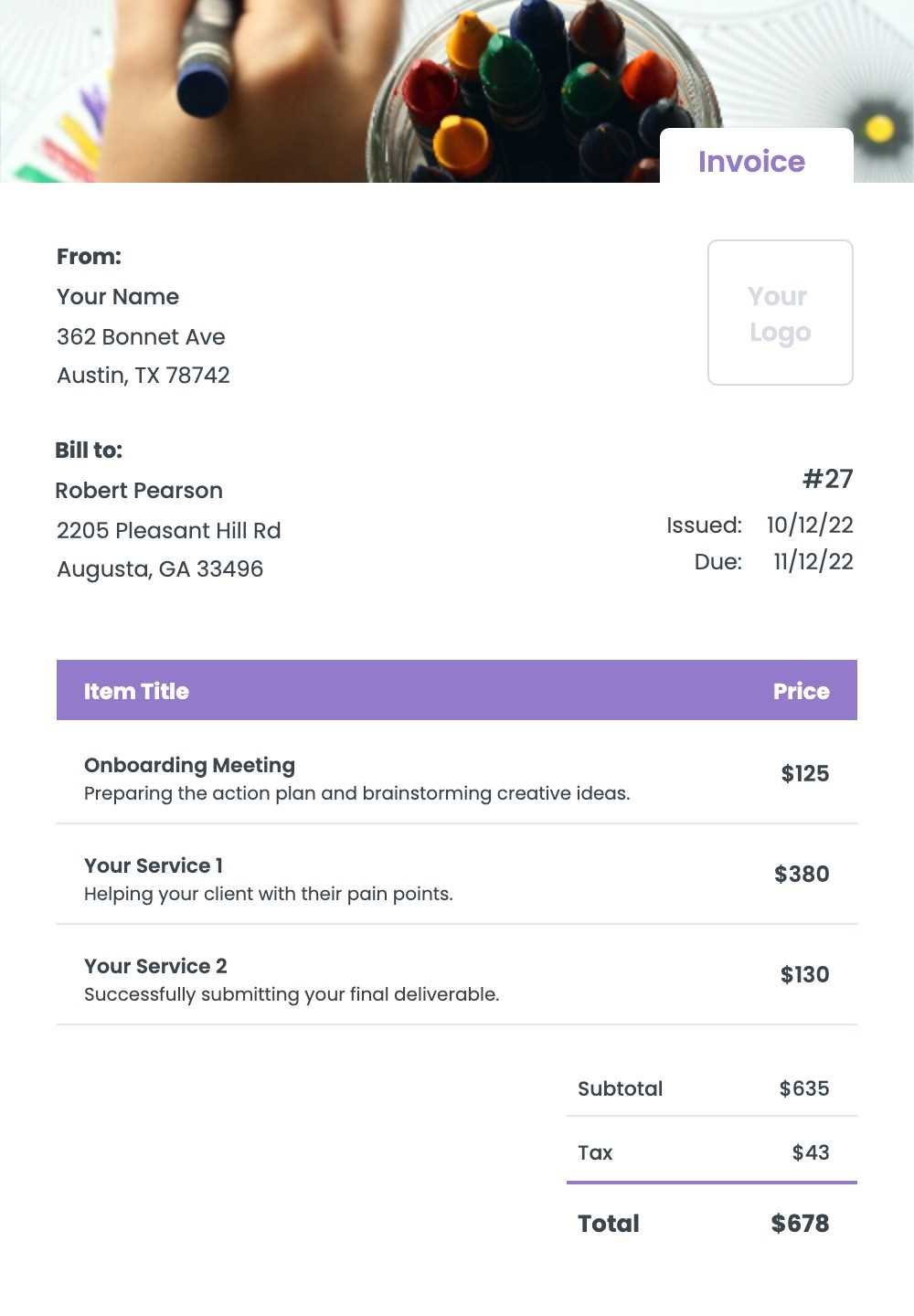

Customizing a payment request document allows you to tailor it to your specific needs, ensuring that all relevant details are included and presented in a way that reflects your professional services. By making adjustments to the layout, design, and content, you can create a personalized version that suits your business style while maintaining clarity and accuracy.

Here are a few steps to help you customize your payment request document:

- Adjust the Layout: Choose a clean, organized format that includes sections for your contact information, service details, and payment terms. A structured layout ensures your document is easy to read and professional.

- Add Your Branding: Include your logo, business name, and any other branding elements that represent your style. This adds a personal touch and reinforces your identity.

- Choose a Color Scheme: Pick colors that complement your brand while maintaining a professional look. Soft tones are ideal for keeping the document clean and easy to read.

- Include Payment Instructions: Customize the payment methods section with clear instructions on how clients can pay, whether through bank transfer, cash, or digital platforms.

- Adjust Terms and Rates: Modify the rate and payment terms to reflect your unique pricing structure. You can also add information about discounts or late fees if applicable.

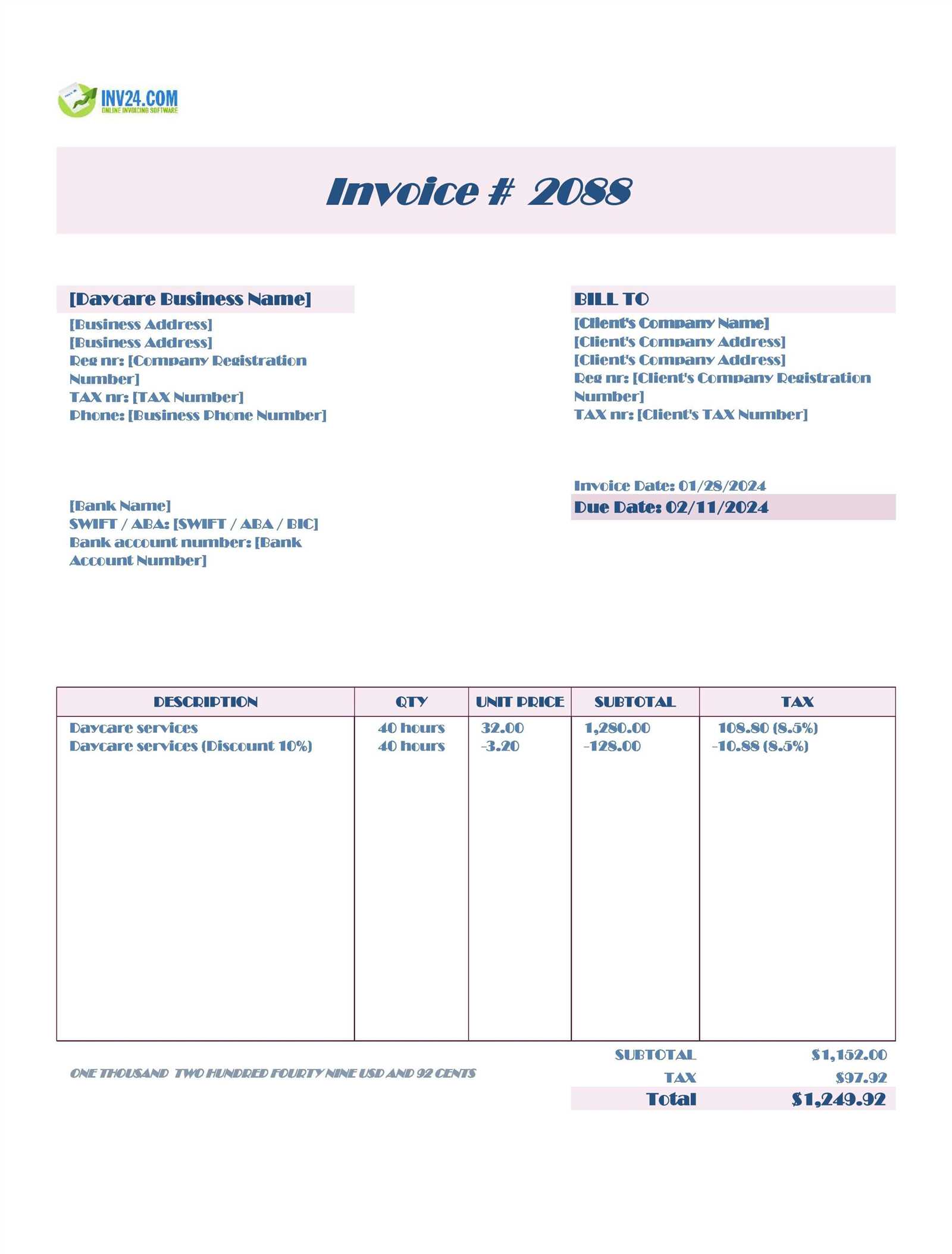

Below is an example of how you can organize key details in your document:

Item Description Amount Service Provided Childcare for [Number of Hours] $[Amount] Hourly Rate $[Rate] per hour $[Total] Discount Special offer or promotional discountEssential Information for Childcare Billing

To ensure clear and accurate payment requests, it’s crucial to include all relevant details about the services provided. A well-documented record of the hours worked, the agreed rates, and any additional charges will help avoid misunderstandings and ensure that both parties are on the same page. Whether you’re working with a new client or continuing a long-term arrangement, providing complete and transparent information is key to a smooth financial transaction.

Here are the key details you should include in every payment request for childcare services:

- Your Contact Details: Include your full name, phone number, and email address for easy communication.

- Client’s Information: Make sure to include the client’s name, address, and contact details so they can easily reference the request.

- Service Date(s): Clearly list the date or range of dates when the service was provided. This helps clarify the billing period.

- Hours Worked: Specify the number of hours you worked or the agreed-upon time frame for services provided. This ensures that clients understand how the total amount was calculated.

- Rate or Fee: Indicate whether you charge hourly or offer a flat rate. Be clear about your pricing structure to avoid confusion.

- Total Amount Due: Include the final amount due, including any additional charges, discounts, or taxes. This should be the most prominent part of your payment request.

- Payment Terms: Specify the payment due date, late fees, or any special payment terms you have established with your client.

- Payment Methods: Clarify how clients can pay (e.g., bank transfer, online payment, check, cash) to make the payment process easy and convenient.

- Additional Services: If you provided any additional services, such as transportation, special care instructions, or extended hours, be su

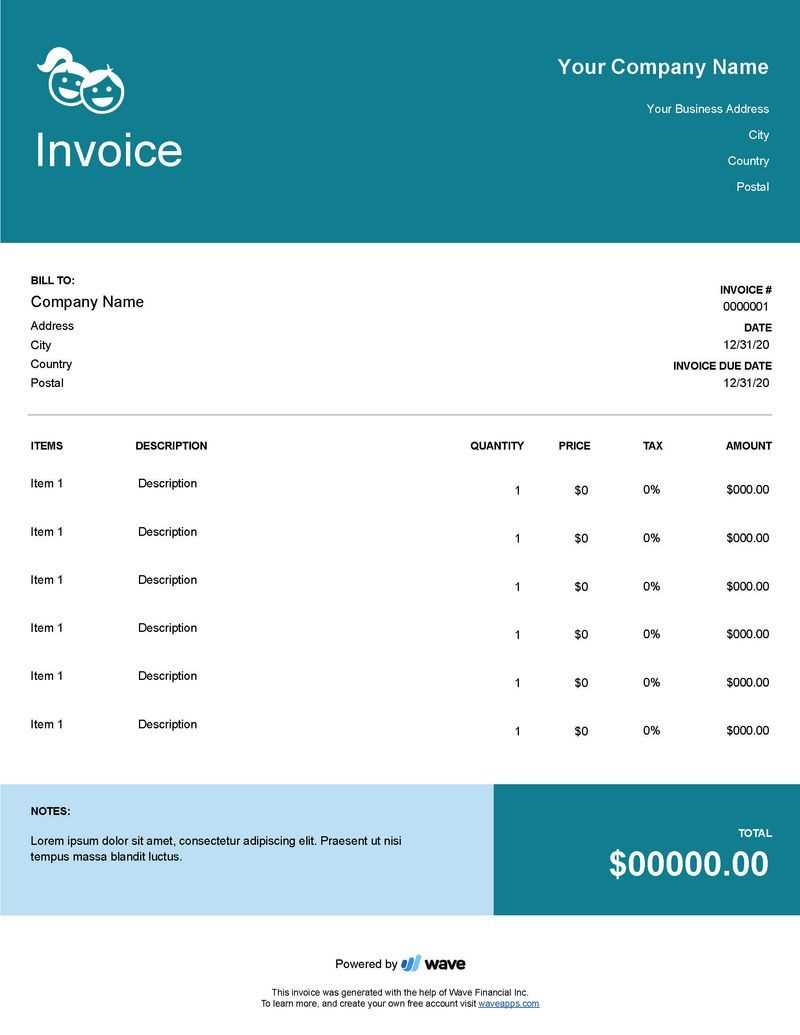

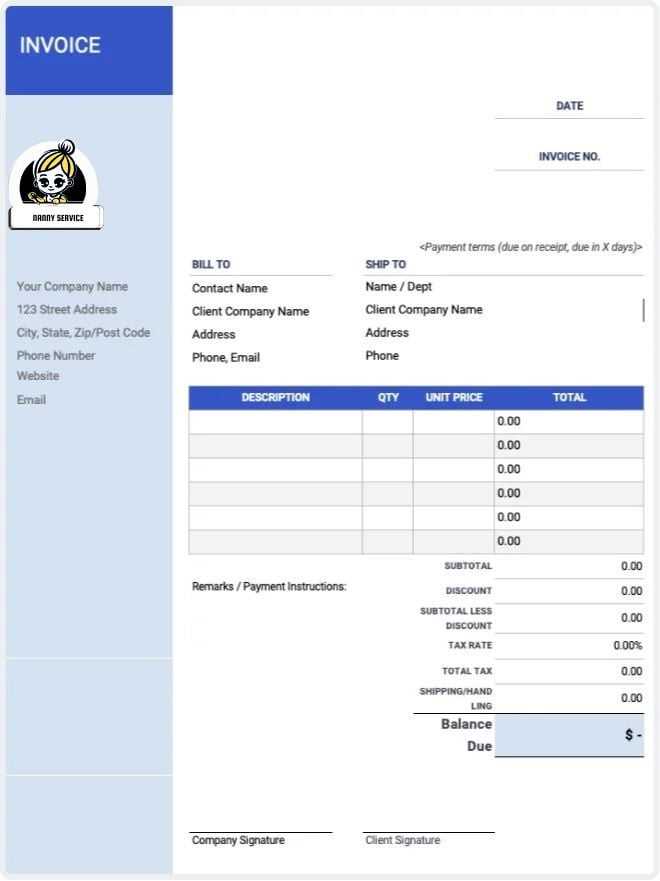

Free vs Paid Babysitting Invoice Templates

When it comes to organizing payments for childcare services, there are two main options for structuring the necessary documentation: free and paid formats. Both types serve the same purpose–ensuring clarity and professionalism–but they differ in the level of detail, customization, and additional features they offer. Understanding the advantages and limitations of each can help service providers decide which route is best suited for their needs.

Free options are typically simple, offering basic fields to input essential information such as hours worked and the agreed-upon rates. These can be a quick and no-cost solution for those who only need a simple record of transactions. However, they may lack the advanced functionality or aesthetic flexibility needed for more complex business models or higher-end clients.

On the other hand, paid versions often come with enhanced features such as automatic calculations, integration with accounting systems, and more refined design elements. These tools can save time and help establish a more polished image for providers who offer a higher volume of services or wish to present a more professional appearance to clients.

Ultimately, the choice between a free or paid format depends on the specific needs and goals of the service provider, as well as the level of professionalism they wish to project in their business transactions.

Choosing the Right Format for Your Invoice

Selecting the appropriate format for documenting your services is crucial for ensuring clear communication and efficient payment processing. Whether you opt for a simple or a more advanced structure, the format should align with your business style, the complexity of the services provided, and the preferences of your clients.

Consider Your Business Needs

If you are just starting out or working with a small number of clients, a straightforward and minimalistic structure may be all you need. A basic document with essential details such as service hours, rates, and total due is often sufficient for most situations. However, as your business grows or your clientele demands more professionalism, you may want to opt for a more refined layout with additional elements, such as logos, itemized services, or integrated payment options.

Professional Appearance vs Simplicity

Professionalism is key in creating a lasting impression. A polished format with a clean design can convey a sense of trust and credibility. On the other hand, simplicity can be effective for those who prefer efficiency and ease of use. Consider the impression you want to leave on your clients and how much effort you’re willing to invest in formatting.

Choosing the right approach involves balancing functionality with the level of formality you wish to project.

How to Calculate Babysitting Rates

Setting the right pricing for your childcare services is essential to ensure fair compensation for your time and skills. It’s important to take into account various factors that can influence the rate, such as your experience, the number of children, the duration of service, and the location. Understanding how to determine your hourly rate and any additional charges will help you maintain professionalism while keeping your clients satisfied.

Here are some key elements to consider when calculating your rate:

Factor Considerations Experience Higher experience may justify a higher rate, especially if you have specialized skills or certifications. Number of Children Taking care of multiple children may require an additional charge due to the increased responsibility and effort. Time of Day Rates might be higher for evening, weekend, or holiday services. Location Travel time and transportation costs could influence the price, especially if the service is in a distant or remote area. Special Requests Additional services like preparing meals, helping with homework, or providing overnight care may warrant extra charges. Once you’ve considered these factors, you can determine an hourly rate or a flat fee depending on the situation. It’s also helpful to research what others in your area are charging to ensure your rates are competitive.

Adding Tax Information to Your Invoice

Incorporating tax details into your payment documentation is essential for both legal compliance and transparent communication with clients. Taxes can vary depending on location and type of service provided, so it is important to understand how to calculate and display these charges correctly. This ensures that both you and your clients are clear on the total amount due and that you remain in accordance with tax regulations.

Understanding Tax Rates

Before adding tax information, it’s important to know the tax rate that applies to your services. This may depend on your state, country, or local municipality. Some areas may charge a general sales tax, while others might have specific rules for services like childcare. It’s also possible that certain exemptions apply. Be sure to verify the current rates for your area, as these can change over time.

How to Add Taxes to Your Payment Record

Once you’ve determined the applicable tax rate, you can easily add this information to your documentation. Include a clear breakdown of the amount being taxed, the rate applied, and the total tax amount. Then, sum up the original amount with the tax to show the final balance due. Displaying this clearly will help avoid confusion and promote professionalism in your financial communications.

Tracking Hours with Babysitting Invoices

Accurate tracking of the time spent on each service is crucial for both you and your clients. Properly documenting hours worked ensures that clients are billed fairly and that you are compensated for the full extent of your services. This process can be streamlined through clear time records and transparent calculations, making it easier for both parties to understand the final cost.

Methods for Tracking Time

There are several ways to keep track of the hours spent providing services. Choose the method that works best for you and your workflow:

- Manual Time Logs: Record the start and end times of each session in a notebook or digital document.

- Time-Tracking Apps: Use smartphone apps or software designed for tracking work hours automatically.

- Clock-In/Out Systems: Some clients may have a clock-in system, or you can create one yourself using a digital tool.

Including Time Details on Your Documentation

Once hours are tracked, it’s essential to display them clearly in your service record. This allows clients to see exactly how the final amount was calculated. A good practice is to include:

- Start and End Times: Clearly show the time you began and ended each session.

- Total Hours Worked: Sum up the hours for each session to show the total amount of time spent.

- Hourly Rate: Specify the agreed-upon rate per hour to ensure transparency in pricing.

- Breakdown of Total Amount: Show the total charge, including an

Setting Payment Terms in Babysitting Invoices

Establishing clear payment terms is an essential part of any business transaction. Defining when and how payments should be made helps to avoid misunderstandings and ensures that both parties are on the same page. By setting straightforward guidelines for payments, you can maintain a professional relationship with your clients while protecting your time and efforts.

Important Considerations for Payment Terms

When determining the payment conditions, there are several factors to take into account to ensure smooth financial transactions:

- Due Date: Clearly state when the payment is expected. This could be immediately after services are rendered, within a certain number of days, or by the end of the month.

- Accepted Payment Methods: Specify the methods you accept for payment, such as cash, bank transfer, credit card, or online payment platforms.

- Late Payment Fees: Consider adding a clause for late fees to encourage timely payments and protect your income.

- Deposit or Advance: For longer or ongoing services, it may be wise to request a deposit or partial payment upfront.

Communicating Payment Terms Clearly

It’s important to present your payment terms in a way that is easy for clients to understand. Here are some tips:

- Be Direct: Use simple, direct language to describe your payment conditions.

- Highlight Key Points: Ensure the due date, fees, and accepted methods are clearly visible on your records.

- Confirm Agreement: Before starting any work, discuss and confirm the payment terms with your clients to avoid surprises.

By defining and communicating clear payment terms, you help establish a sense of professionalism and trust

Common Mistakes to Avoid in Invoicing

When it comes to creating payment documents, small errors can lead to confusion, delayed payments, or even loss of income. Ensuring accuracy and clarity is essential to maintaining a professional image and building trust with clients. Below are some common mistakes that service providers should be aware of to avoid potential issues and streamline the payment process.

1. Missing or Incorrect Client Information

One of the most common mistakes is failing to include or correctly list client details. This includes the client’s full name, address, or contact information. If these details are incorrect or omitted, it can lead to confusion and delays in payment. Always double-check client information before finalizing your payment record.

2. Not Clearly Stating the Due Date

Vague payment terms can create unnecessary uncertainty. Always include a specific due date, whether it’s “due upon receipt” or “net 30” (30 days after the service date). Without a clear due date, clients may not prioritize payment, and you may face delays.

3. Failing to List All Services or Hours Worked

Ensure that every service provided, and every hour worked, is listed with accuracy. Missing services or incomplete hour logs can create confusion and lead to disputes. Itemizing each task or time block makes the payment calculation transparent and helps clients understand exactly what they’re paying for.

4. Not Including Taxes or Additional Charges

Another common error is failing to include applicable taxes, travel fees, or other additional charges. Make sure these are clearly broken down and visible on your documentation. Not including them could resul

How to Send Babysitting Invoices to Clients

Once your payment document is complete, the next step is to send it to your client for processing. Choosing the right method for delivery ensures that the client receives the information promptly and in a way that suits their preferences. There are several options for sending payment documents, and understanding the pros and cons of each can help streamline the process.

Methods for Sending Payment Documents

There are various ways to deliver your payment record to clients, each with its own advantages:

- Email: The most common and efficient method, allowing for immediate delivery. Attach the payment document as a PDF or another preferred file format to ensure it’s easy for the client to access and store.

- Postal Mail: For clients who prefer paper documents, mailing a physical copy might be necessary. This can take longer and incur postal fees but is still a valid option for formal transactions.

- Online Platforms: Some clients may use online payment systems that allow you to submit payment requests directly through their platform. This is often the fastest and most seamless way for clients to process payments.

- In Person: If you regularly work with local clients, handing over the do

Why Timely Invoicing is Important

Sending payment records promptly after services are rendered is essential for maintaining a healthy cash flow and professional relationships with clients. Delayed billing can lead to confusion, missed payments, and strained business dealings. By issuing payment requests on time, you not only ensure that you’re compensated fairly and quickly, but you also reinforce your credibility and reliability as a service provider.

Benefits of Timely Payment Requests

There are several advantages to sending your payment documents without delay:

Benefit Explanation Improved Cash Flow Timely payment requests ensure you receive funds promptly, keeping your finances stable and preventing cash flow issues. Better Client Relationships By maintaining a consistent billing schedule, you show professionalism, which strengthens trust with your clients. Reduced Payment Delays Clients are more likely to pay on time when the payment document is sent immediately after services are completed, preventing procrastination. Minimized Disputes Clear and prompt billing reduces misunderstandings, making it easier to resolve issues before they escalate. Risks of Delayed Payment Requests

Failure to send payment documents on time can result in several negative consequences:

- Late Payments: Clients may forg

How to Follow Up on Unpaid Invoices

When clients fail to settle their balances on time, it is essential to approach the situation professionally and tactfully. A timely follow-up ensures that you maintain good relations while encouraging prompt payment. This section covers the best practices for reaching out to those who have outstanding payments, from the first reminder to more persistent actions if necessary.

1. Send a Polite Reminder

As soon as the payment due date has passed, it’s crucial to send a courteous reminder. This initial communication should remain professional and non-confrontational. Here’s how to do it effectively:

- Send a brief email or letter with a gentle reminder of the unpaid balance.

- State the original due date and provide any necessary details regarding the agreed amount.

- Give your client a chance to explain if there were any issues preventing payment.

- Offer multiple payment options to make the process easier for them.

2. Follow Up with a Second Request

If the payment remains unresolved after the first reminder, you may need to follow up more firmly. A second reminder is an opportunity to reinforce the importance of settling the balance while keeping the tone professional.

- Send a second reminder, preferably a few days after the first one.

- Politely request a clear timeline for when the payment will be made.

- Express the impact of delayed payments on your business.

- Consider offering a small incentive or late fee as a motivator for quick payment.

By following these steps, you can effectively address overdue payments without damaging the professional relationship with your clients. Keep your communication clear, respectful, and concise throughout the process.

Creating a Professional Image

Establishing a professional appearance is crucial when offering services that involve personal care and trust. Whether you are looking to attract new clients or maintain current ones, creating a polished and reliable persona can set you apart from competitors. This section focuses on how to cultivate professionalism through communication, presentation, and conduct, ensuring clients feel confident in your abilities.

1. Clear Communication and Reliability

Effective communication is a key element of professionalism. Clients should feel that they can easily reach out and receive timely responses. Here’s how to improve your communication:

- Always respond to messages and inquiries promptly and courteously.

- Set clear expectations about your availability, services, and pricing upfront.

- Maintain transparency regarding any changes in scheduling or service details.

2. Professional Appearance and Behavior

Your personal presentation plays an important role in building trust with families. Look and act in a way that reassures clients of your competence and dedication.

- Dress appropriately for the role, ensuring comfort and a neat appearance.

- Demonstrate respect for the family’s home and space by maintaining cleanliness and being polite.

- Always remain calm, patient, and attentive, especially in challenging situations.

By focusing on clear communication and maintaining a professional appearance, you can create a strong reputation and build lasting relationships with clients. These small efforts can significantly enhance the perception of your services and lead to positive referrals and repeat business.

Tips for Organizing Your Payment Records

Efficiently managing your payment records is essential for staying on top of your financials and ensuring smooth transactions with clients. By maintaining clear and well-organized records, you can avoid confusion, track earnings, and quickly address any discrepancies. This section offers practical advice for organizing your financial documents, making it easier to manage your business operations.

1. Create a Consistent System

Having a consistent method for tracking payments is key to staying organized. Whether you prefer digital or paper records, the following tips can help you stay on top of things:

- Set up a separate folder or digital file for each client or service period.

- Use clear naming conventions for your files, such as including the client name and date of service.

- Establish a regular schedule for updating and reviewing your records, such as weekly or monthly.

2. Use Tools and Software

Leveraging technology can significantly improve the efficiency of record-keeping. There are various tools and apps designed to help streamline the process, making it easier to track and access payment details.

- Consider using accounting or invoicing software to automatically generate and store records.

- Cloud storage options can help you access your documents from anywhere and provide backup in case of system failures.

- Keep all payment-related correspondence, such as emails or receipts, organized within your software or file system.

By creating a consistent system and utilizing digital tools, you can ensure that your payment records are organized, accurate, and easily accessible whenever needed. This will not only save time but also reduce the risk of errors and financial confusion.

Legal Considerations for Payment Requests

When offering services that involve handling clients’ personal matters, it’s crucial to be aware of the legal aspects surrounding financial transactions. Proper documentation and clear terms are vital to avoid misunderstandings and to ensure compliance with local laws. This section discusses the key legal considerations that service providers should keep in mind when requesting payment for their work.

1. Clear Terms and Conditions

Establishing clear terms before any work begins helps protect both parties and sets expectations for payment. The more transparent you are, the fewer chances there are for disputes down the road. Consider the following:

- Set clear payment deadlines: Specify the due date for payment, whether it’s upon completion of the service or within a set number of days.

- Outline the payment methods: Make it clear which forms of payment you accept, such as cash, check, bank transfer, or digital payment platforms.

- Include late fees: Consider adding a clause for late fees if payments are overdue, ensuring this is communicated up front.

2. Legal Documentation and Record-Keeping

Maintaining proper documentation is essential for legal protection. Should any disputes arise, well-organized records can serve as evidence in your favor. Here are a few tips to ensure your paperwork is in order:

- Maintain a record of services rendered: Keep a detailed log of the services you provided, including dates and times.

- Provide receipts or confirmations: When payments are made, always provide a receipt or confirmation that the payment has been received.

- Comply with local tax regulations: Be sure to follow local tax laws, including keeping track of your earnings and reporting them as required by law.

By understanding these legal considerations, you can protect yourself from potential issues while ensuring a smooth transaction process with your clients. Proper documentati

- Late Payments: Clients may forg