Free Avon Invoice Template for Easy Billing

Managing financial records is a crucial task for any business owner, especially when it comes to issuing statements to clients. Ensuring your documents are professional, organized, and easy to understand can make a significant difference in maintaining a smooth workflow. Whether you’re running a small side business or a larger operation, having the right tools to simplify this process is essential.

One of the most effective ways to handle your financial paperwork is by using a ready-made document structure designed specifically for business transactions. These pre-designed files not only save time but also help you present your services in a clear, consistent manner. By customizing them to suit your unique needs, you can streamline your entire billing procedure without the hassle of creating documents from scratch.

These solutions provide the perfect balance between efficiency and professionalism. They include all the necessary fields to track payments, itemize services, and ensure accuracy in your transactions. With a little customization, you can have your paperwork ready to send to clients in no time, all while maintaining a polished and trustworthy image.

Free Avon Invoice Templates for You

For anyone running a business, having access to well-organized, professional documents is essential. The ability to easily generate structured forms for customer transactions can help streamline the process of managing finances. These ready-to-use documents provide an efficient way to bill clients, track payments, and maintain accurate records, without the need for complicated software or time-consuming manual entry.

Here are some key advantages of using pre-designed billing documents:

- Time-Saving: Pre-made formats reduce the time spent creating new documents from scratch.

- Consistency: Standardized forms help ensure that all necessary information is included, creating a consistent experience for your clients.

- Professional Look: Ready-made files are designed with a clean, polished layout, helping to improve the overall presentation of your business.

- Customizable: Many formats allow you to add your personal branding, making it easier to align the document with your business identity.

Whether you are just starting out or looking to streamline your current processes, these tools offer a simple solution to create professional transaction documents quickly and efficiently. By using these resources, you can stay focused on growing your business while leaving the administrative tasks to easy-to-use, pre-built systems.

Why Choose an Avon Invoice Template?

When managing client transactions, having a well-organized and professional document is essential for smooth business operations. Utilizing pre-designed documents helps save time, maintain consistency, and ensure accuracy, all while presenting a polished image to your clients. These ready-made solutions provide the structure needed to track and manage your business dealings without the hassle of starting from scratch.

Key Benefits of Using Pre-Designed Documents

- Efficiency: Using pre-made layouts allows you to generate accurate billing statements quickly without having to manually create each one.

- Consistency: These ready-to-use forms ensure that all necessary information is included in every document, creating a professional and consistent appearance for your business.

- Cost-Effective: Instead of spending money on expensive software or hiring a designer, you can use easily accessible, customizable documents to meet your needs.

- Ease of Use: Most of these forms are user-friendly and require little technical knowledge to edit or personalize for your business requirements.

How These Documents Can Help Your Business

- Time-Saving: Instead of designing each document from scratch, you can focus on your business’s core activities, leaving administrative tasks to be handled quickly.

- Professional Presentation: Ready-to-use documents are designed to present a clean, professional look to your clients, building trust and credibility.

- Flexibility: Many formats are highly customizable, allowing you to add your business logo, contact details, and other branding elements.

By choosing to use a pre-designed document system, you can simplify your administrative processes, reduce errors, and present your business in a more polished and organized manner. This is an ideal solution for both new entrepreneurs and established businesses looking to optimize their operations.

How to Use Avon Invoice Templates

Utilizing pre-designed billing documents can greatly simplify the process of managing customer transactions. These ready-made forms provide all the essential sections to help you record details accurately, ensuring your financial records remain organized. The best part is that customizing them to fit your business needs is quick and easy, allowing you to focus on the more important aspects of running your business.

Steps to Get Started

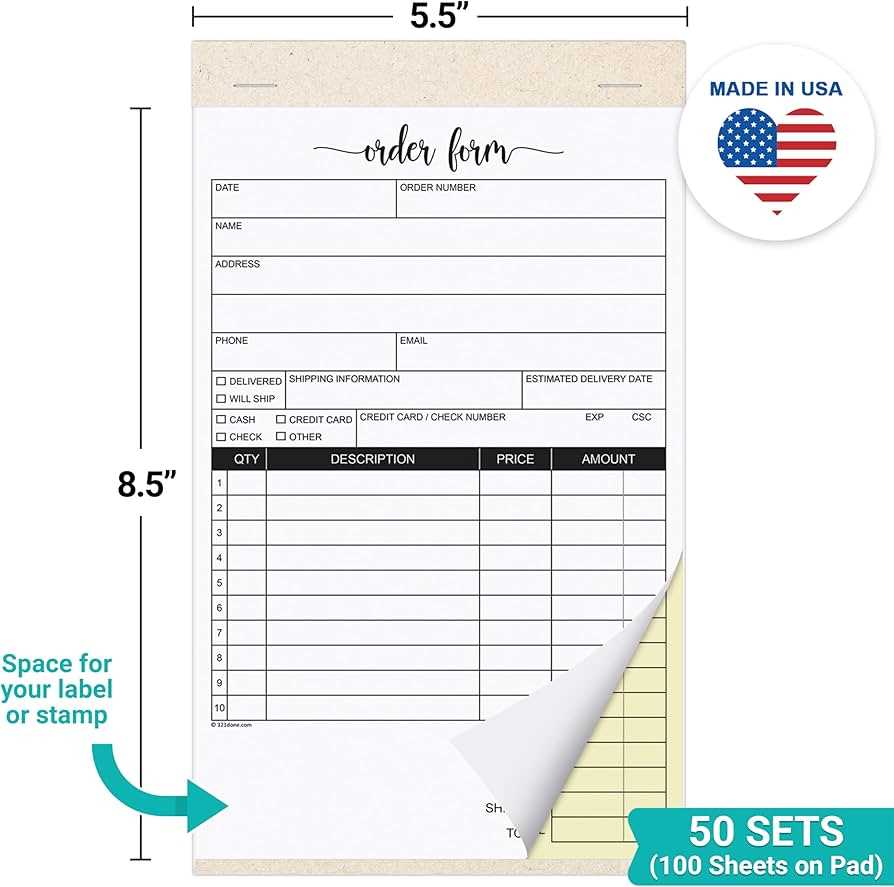

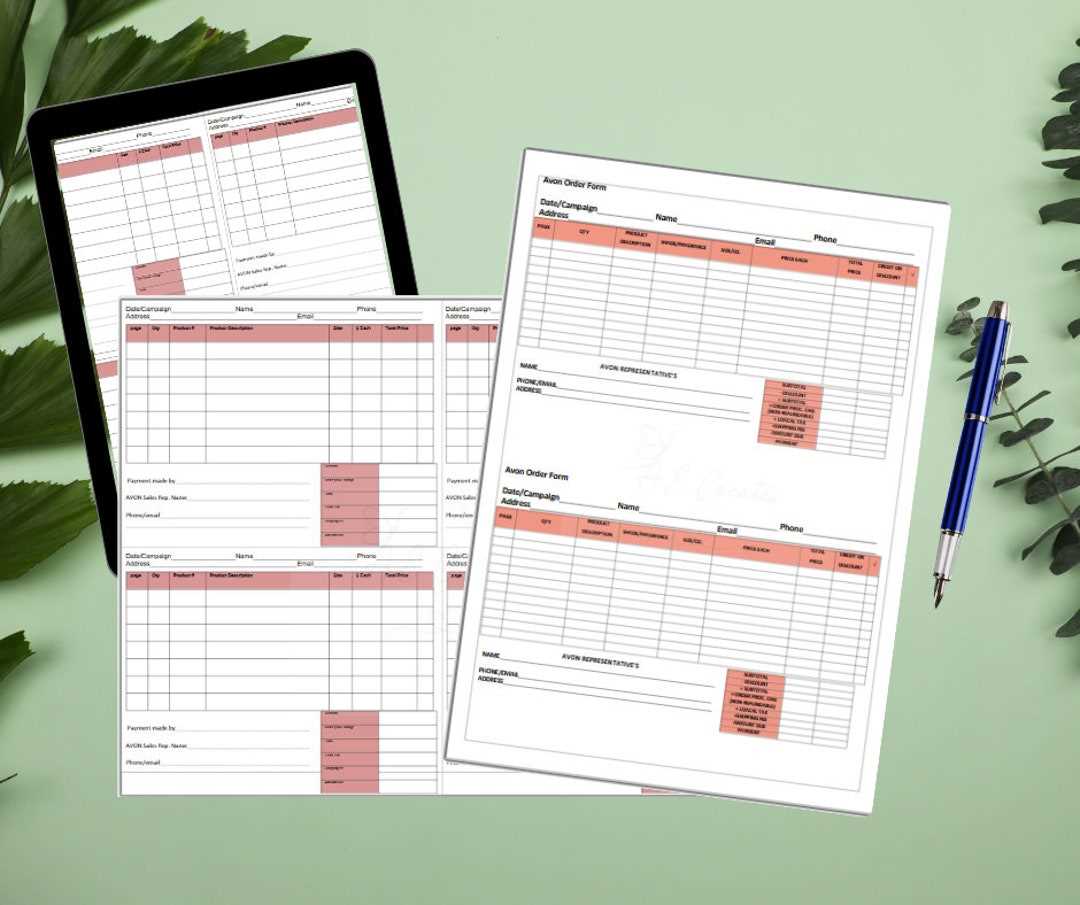

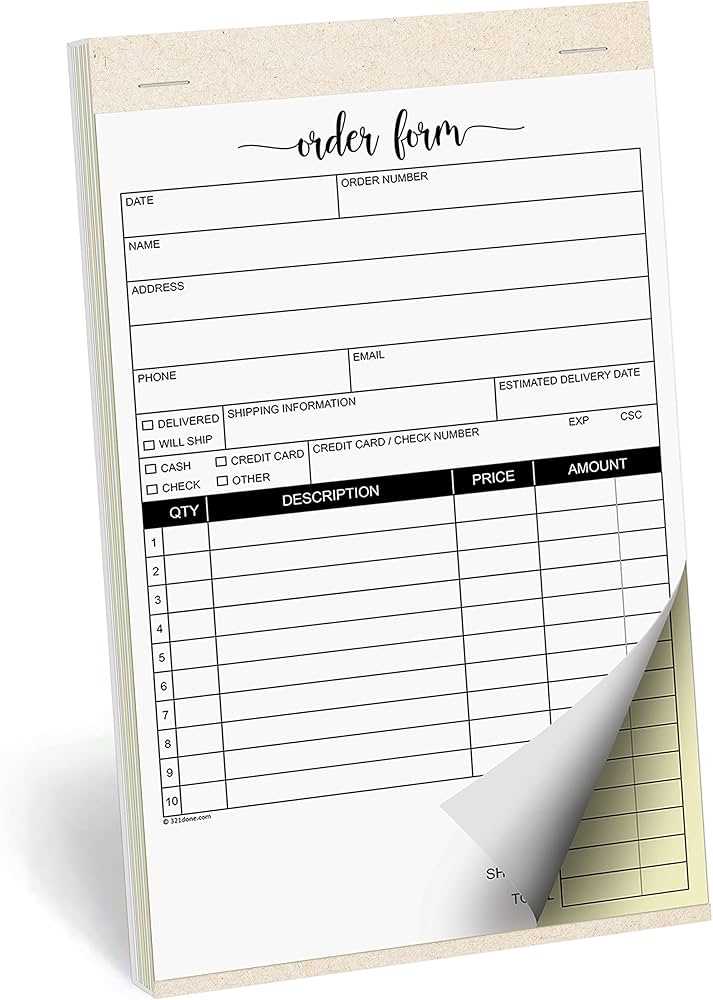

- Download the Document: First, locate a reliable source and download the template that suits your business style. Most platforms offer various formats such as Excel, Word, or PDF that can be customized according to your needs.

- Open and Edit: After downloading, open the document in the preferred software. You can edit the fields like client information, product or service details, pricing, and payment terms.

- Customize for Your Brand: Add your business logo, contact information, and any other branding elements to ensure your document reflects your company’s identity.

What to Include in the Document

- Client Details: Make sure to fill in the client’s name, address, and contact information to ensure proper communication.

- Itemized List: Include a detailed list of the goods or services provided, along with their quantities and prices.

- Payment Terms: Clearly state the payment due date, accepted methods of payment, and any penalties for late payment.

- Business Information: Include your business name, address, phone number, and email address so the client can easily reach out if

Benefits of Using an Invoice Template

Using pre-designed billing documents offers numerous advantages for any business owner. These ready-to-use formats simplify the process of creating professional, consistent, and accurate transaction records. By eliminating the need to manually design each document, you can focus more on growing your business while ensuring your financial records are kept in order.

Here are some of the key benefits:

Benefit Description Time Efficiency Pre-made documents save time by providing a ready structure that only requires basic customization, allowing you to generate bills quickly. Consistency Using a standard layout ensures every document includes all necessary information and maintains a uniform appearance for your business. Professional Presentation Pre-designed forms are created with a polished, professional appearance, helping to build trust and credibility with your clients. Customization Most formats allow easy customization, enabling you to add your company branding, adjust payment terms, or change content as needed. Accuracy These forms typically have all the necessary fields for tracking payments, preventing omissions or errors that could affect your records. In addition to these advantages, using pre-built forms reduces the chance of mistakes that can arise from manually drafting each document. This ensures that your financial paperwork is both organized and easy to manage, ultimately contributing to the smooth operation of your business.

Customizing Your Avon Invoice Template

Personalizing your business documents allows you to create a more professional and consistent brand image while ensuring all necessary details are included. With pre-designed forms, you can easily adjust various elements to suit your needs and reflect your business identity. This level of customization helps make your transactions more organized, clear, and visually appealing to your clients.

Here are some key ways to tailor these documents for your business:

- Adding Your Branding: Include your company logo, business name, and contact information at the top of the document to help clients easily recognize the source and maintain a professional appearance.

- Adjusting Payment Terms: Customize payment due dates, discounts, or late fees according to your business policies, ensuring the terms reflect your operational standards.

- Modifying Item Descriptions: If needed, adapt the description of services or products listed to better fit your offerings, ensuring clarity for both you and your client.

- Changing Layout and Style: Customize the document’s layout, font, and color scheme to align with your brand’s aesthetic, making the final product visually consistent with your business materials.

- Personalizing Notes: Add personalized messages or instructions at the bottom of the document, whether it’s a thank-you note, payment instructions, or next steps in the business process.

By taking the time to adjust these pre-made documents, you ensure that each record is not only functional but also reflective of your business’s unique identity. Customizing forms helps maintain a level of professionalism and trust that clients will appreciate, making the overall process smoother for both parties.

Where to Download Free Templates

Finding reliable and accessible resources for business documents can be a game changer when it comes to streamlining your processes. Many websites offer downloadable options that allow you to easily customize pre-built structures for your business needs. These sources make it simple to find a format that suits your style and requirements without having to invest in expensive software or design services.

Reliable Sources for Downloading Ready-Made Documents

- Business Website Platforms: Many business-oriented websites offer a variety of document formats for entrepreneurs, ranging from billing forms to contracts. These platforms often provide basic versions at no cost.

- Online Marketplaces: Sites like Etsy and Template.net feature free and paid options for customizable business documents, often designed by experienced professionals.

- Cloud-Based Tools: Services like Google Docs and Microsoft Office offer downloadable business documents that can be customized directly within their platforms.

- Small Business Resources: Government and nonprofit websites, such as Small Business Administration (SBA), sometimes provide free document templates for entrepreneurs to use as they manage their operations.

- Professional Blogs: Many business blogs and freelancers offer free downloadable documents in their resource sections. These are often tested by professionals and are a great starting point for customization.

Choosing the Right Resource for Your Needs

- Check Reviews: Look for resources that have positive feedback from other users to ensure the quality and reliability of the document.

- Consider Customization Features: Some websites allow you to edit documents directly online, while others provide downloadable files that you can open in various editing programs.

- Evaluate Compatibility: Ensure that the document format you choose is compatible with the software you use, whether it’s Word, Excel, or another program.

By utilizing these resources, you can quickly find and download documents that are both effective and easy to modify, ensuring you can focus on running your business rather than creating paperwork from scratch.

Essential Features of an Avon Invoice

When creating a document to track payments and transactions, it’s crucial to ensure it contains all the necessary information for both the business and the client. A well-structured billing document should be clear, comprehensive, and easy to understand, offering all the essential details that help avoid confusion and ensure smooth communication. The following features are critical to any effective business transaction record.

Key Elements to Include

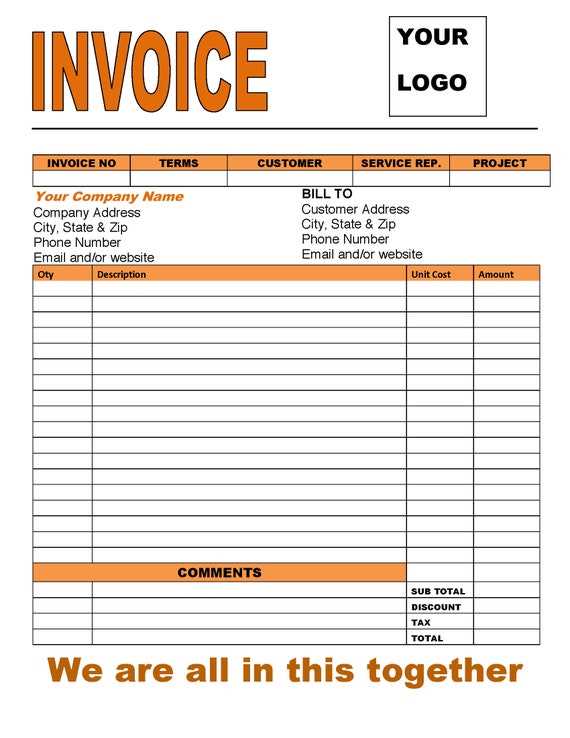

- Business Information: Your company name, address, phone number, and email should be prominently displayed at the top. This ensures your client can easily reach you for any inquiries or concerns.

- Client Information: Include the name, address, and contact details of the person or business you’re invoicing. This ensures the document is properly addressed and can be linked back to the correct party.

- Unique Identification Number: Each record should have a unique reference number for tracking purposes. This helps avoid confusion, especially when managing multiple clients or transactions.

- Detailed List of Services or Products: Clearly describe the items or services provided, including quantity, unit price, and any applicable discounts. This level of detail reduces disputes and ensures transparency.

- Payment Terms: Clearly state when payment is due, the accepted payment methods, and any penalties for late payment. This ensures both parties are aligned on the expectations surrounding payment.

- Total Amount Due: Display the total amount due, including any taxes or additional fees. This should be prominently shown to prevent any confusion and ensure clarity in financial matters.

Additional Features for Better Clarity

- Due Date: Specify the exact due date to avoid any misunderstandings regarding payment schedules.

- Notes and Special Instructions: Use this section to

How Avon Templates Save Time and Effort

Using pre-made documents for billing and record-keeping can significantly reduce the amount of time and energy spent on administrative tasks. With a ready-made structure, business owners no longer need to create each record from scratch. Instead, they can focus on customizing the details, ensuring that their documents are accurate and professional in a fraction of the time. The convenience and efficiency these solutions offer make managing finances a much simpler task.

Time-Saving Benefits

- Quick Setup: Pre-built formats come with all necessary fields and sections, allowing you to simply input client information and details about the transaction. This eliminates the need to design or organize the document from the ground up.

- Reduced Mistakes: Using standardized layouts helps ensure that no important information is left out, such as pricing, payment terms, or contact details. This minimizes errors and avoids the time spent correcting mistakes.

- Faster Processing: Since the structure is already in place, you can generate and send out documents quickly, speeding up the entire billing process and reducing delays in receiving payments.

Effort-Efficiency Advantages

- Easy Customization: Pre-designed forms allow for quick customization, such as adding your branding or adjusting payment terms, without needing advanced design skills or software.

- Consistency: By using the same structure for all your records, you ensure that every document looks uniform and professional, reducing the mental effort involved in creating unique formats for each client.

- Automatic Calculations: Many pre-designed solutions include built-in fields for taxes, totals, and discounts, which automatically calculate amounts based on your inputs. This saves both time and effort when managing pricing and financial details.

By implementing these ready-made solutions, you streamline your workflow, saving valuable time and energy that can be better spent on other aspects of your business. With minimal effort required to produce a polished and accurate record, these tools prove to be an essential asset for any entrepreneur or business owner.

How to Add Personal Branding to Your Invoice

Customizing your business documents to reflect your unique brand identity is an important step in creating a professional and cohesive customer experience. Personal branding goes beyond just a logo; it’s about infusing your business’s personality into every interaction, including the documents you send to clients. By incorporating key brand elements, you ensure that your communications feel consistent, trustworthy, and aligned with your business values.

Key Elements to Customize

- Logo: Place your company logo at the top of the document, either in the header or near the title section. This helps your client immediately recognize the document as coming from your business and strengthens brand visibility.

- Color Scheme: Use your brand’s color palette throughout the document, from the text to the borders and background shading. This subtle use of color reinforces your visual identity and gives the document a polished look.

- Typography: Choose fonts that align with your brand style, whether it’s formal, modern, or creative. Consistent use of fonts that reflect your business’s personality helps strengthen recognition and communicates professionalism.

Additional Branding Touches

- Contact Information: Include your business phone number, email, and website in the footer or header, so clients can easily get in touch. This also helps maintain a sense of professionalism and accessibility.

- Tagline or Mission Statement: If your company has a tagline or a short mission statement, consider adding it to the bottom of the document. This reminds clients of your core values and purpose.

- Custom Notes: A brief, personalized note at the end of the document thanking the client for their business or providing information about upcoming promotions can make your communication feel more personable and aligned with your brand’s tone.

Incorporating these simple but effective branding elements into your billing documents not only enhances their professionalism but also helps reinforce your business identity in every client interaction. A well-branded document reflects the care and attention you put into your services, leaving a lasting positive impression on your clients.

What to Include in Your Avon Invoice

To ensure that your transaction records are complete and accurate, it’s important to include all the necessary details in your billing documents. These documents not only provide a clear record of the sale but also set clear expectations for your clients regarding payment terms and the goods or services provided. A well-organized document can help avoid confusion and streamline the payment process.

Essential Information to Include

- Business Information: Your company name, address, and contact details should be easily visible at the top. This makes it simple for the client to reach out if they have any questions or need further clarification.

- Client Information: Include the name and address of the person or business you’re invoicing, so there is no confusion about who the transaction pertains to.

- Unique Identification Number: Each billing document should have a unique reference number for easy tracking and to ensure both parties can easily reference the transaction.

- Itemized List: List the products or services provided, along with quantities, unit prices, and any applicable taxes or discounts. This level of detail reduces misunderstandings and ensures both parties agree on the specifics of the transaction.

- Total Amount Due: The total amount due, including taxes, shipping fees, or any additional charges, should be clearly displayed. This ensures the client knows exactly how much they owe.

Additional Elements to Consider

Feature Description Payment Terms Clearly state the payment due date, accepted payment methods, and any penalties for late payments. This ensures both parties are clear on the expectations. Notes or Instructions A brief note can be added at the bottom to thank the client, provide instructions, or offer discounts for future purchases. Terms and Conditions If applicable, include any relevant terms regarding returns, cancellations, or special agreements made with the client. By ensuring these key elements are included in each document, you create a clear and professional transaction record that helps both you and your clients stay org

Common Mistakes to Avoid with Invoices

Creating accurate and professional billing documents is key to maintaining smooth business operations and healthy client relationships. However, even minor errors can lead to confusion, delays in payment, or strained interactions. It’s essential to be mindful of common mistakes that can undermine the effectiveness of your billing process. By avoiding these pitfalls, you can ensure that your documents are clear, complete, and professional.

Common Errors to Watch Out For

- Incorrect or Missing Information: Failing to include essential details such as your business name, client’s information, or transaction reference number can cause delays or confusion. Always double-check to ensure every required field is filled out correctly.

- Unclear Payment Terms: If payment terms such as due dates, late fees, or accepted payment methods are not clearly stated, clients may misunderstand expectations and delay payments. Make sure these terms are explicit and easy to find.

- Calculating Errors: Simple math mistakes, such as incorrect totals, taxes, or discounts, can lead to discrepancies between what you expect to receive and what you actually get. Always review your calculations carefully before finalizing the document.

- Omitting or Mislabeling Items: Leaving out products, services, or pricing details can cause confusion. Ensure that every item is correctly listed with the appropriate quantity and price. Any omission could result in misunderstandings or disputes.

Additional Mistakes to Avoid

- Using Unprofessional Design: A poorly formatted document can leave a negative impression. Stick to a clean, simple layout with legible fonts and appropriate branding to maintain professionalism.

- Not Including a Unique Reference Number: Without a unique document number, it becomes difficult to track transactions, particularly if multiple clients are involved. Always generate a distinct number for each document to make referencing easier.

- Missing Client Confirmation: Failing to get approval or confirmation from the client before sending the final document can lead to disputes about the amount owed or terms of the deal. Always confirm details with your client before finalizing any bill.

By paying attention to these common mistakes, you can create billing records that are professional, accurate, and clear. Avoiding these errors ensures a smooth process for both you and your clients, helping to maintain trust and facilit

Creating Professional Invoices with Ease

Designing effective and professional billing documents doesn’t have to be a time-consuming or complex task. With the right approach and tools, you can create well-organized, clear, and professional-looking records that enhance your business reputation and streamline your financial processes. Whether you’re new to managing transactions or looking to improve your existing system, there are easy ways to ensure your billing documents reflect your professionalism and attention to detail.

Streamlined Approach to Designing Documents

- Choose a Simple Layout: A cluttered or overly complicated layout can confuse clients and make the document difficult to read. Use a clean and organized design with clearly defined sections such as business information, client details, items or services provided, and payment terms.

- Use Automated Calculations: Many modern document editing tools allow you to automate the calculations of totals, taxes, and discounts. This reduces the risk of errors and saves you time when generating multiple documents.

- Brand Consistency: To reinforce your brand, make sure your document uses consistent fonts, colors, and logos that align with your overall business identity. A professional and cohesive design helps to establish trust with clients.

Quick Tips for Simplifying the Process

- Leverage Pre-Formatted Structures: Pre-designed documents can save you a lot of time and effort. By simply filling in the relevant details, you can quickly generate a professional record without starting from scratch each time.

- Double-Check Details: Before finalizing the document, ensure that all client information, transaction details, and payment terms are accurate. Small mistakes can lead to confusion and payment delays, so take the time to review everything thoroughly.

- Keep It Legible: Use clear, easy-to-read fonts and avoid dense blocks of text. Clear headings, bullet points, and spacing make the document more readable and professional.

By following these simple guidelines, creating polished and professional billing documents becomes a straightforward task. With the right tools and approach, you can ensure that your transactions are documented accurately, efficiently, and in a way that reflects well on your business.

Best Software for Editing Invoice Templates

When it comes to creating and modifying billing documents, the right software can make all the difference. Whether you’re a small business owner or managing a larger operation, having access to user-friendly tools that allow you to easily customize, edit, and format your financial documents is essential. The best software not only simplifies the process but also ensures that your documents look professional, accurate, and tailored to your specific needs.

Top Software for Document Creation and Editing

- Microsoft Word: One of the most commonly used word processors, Word offers a range of customizable templates and formatting options for designing professional-looking records. It’s easy to add your business’s branding, adjust layouts, and input necessary details with this versatile tool.

- Google Docs: A great cloud-based alternative, Google Docs allows you to create and edit documents from anywhere. Its simple, collaborative features are perfect for businesses that need to share and edit documents in real-time with multiple team members.

- Canva: Known for its user-friendly interface and design tools, Canva is an excellent choice for those looking to create visually appealing records. It offers a variety of customizable templates and allows for easy incorporation of graphics, logos, and color schemes.

- Zoho Invoice: Specifically designed for business billing, Zoho offers a comprehensive platform for creating and managing financial documents. It allows for easy customization and includes built-in payment tracking and invoicing features to streamline your workflow.

- QuickBooks: Ideal for managing all aspects of your business’s finances, QuickBooks includes tools for generating, customizing, and sending billing documents. Its integration with accounting features helps keep everything in one place for easy access and management.

Factors to Consider When Choosing Software

- Ease of Use: Choose software that is intuitive and easy to navigate, especially if you are not familiar with advanced design or editing tools.

- Customization Options: Look for software that allows you to modify documents to suit your business’s unique needs, from adding your logo to adjusting payment terms and layout.

- Integration with Other Tools: If you already use other software for accounting or project management, consider how easily the new tool can integrate with your existing systems.

- Cost: Depending on your business size and frequency of use, you may want to consider the cost of the software and whether it offers good value for your specific needs.

By selecting the right software for creating and managing your billing documents, you can streamline your administrative processes, maintain consistency, and ensure that your business transactions are clear and professional.

How to Send Avon Invoices Efficiently

Sending billing documents in a timely and efficient manner is crucial for maintaining smooth business operations and ensuring prompt payments. The process of dispatching these records should be streamlined to save you time and reduce the chances of errors or delays. Whether you’re dealing with one client or many, having a structured method for sending documents can make all the difference in your business’s cash flow.

Steps for Efficiently Sending Billing Records

- Choose the Right Delivery Method: Depending on your client’s preferences and your business model, decide whether to send documents via email, postal mail, or a dedicated payment portal. Email is the fastest and most common method, while physical mail can be used for larger, more formal transactions.

- Automate Where Possible: Many business management tools offer automation features that allow you to generate and send documents automatically once they are created. This can save you time and reduce human error in the sending process.

- Double-Check for Accuracy: Before sending any document, ensure that all information is correct, from the recipient’s details to the amounts and payment terms. A mistake can lead to confusion, disputes, and delays in payments.

- Attach Clear Instructions: If necessary, include any additional instructions regarding payment methods or due dates in the email body or as a note within the document. This will ensure that your client understands how to complete the transaction without confusion.

- Track Your Documents: Use a system that allows you to track when the document was sent and whether it was received. If you are sending documents via email, consider using tools that provide read receipts or confirmation of delivery.

Tips for Improving Efficiency

- Use Professional Email Templates: Having a pre-written email template for sending documents can save you time and ensure your messages are consistent. Include necessary attachments, polite reminders, and all relevant details in the body of the email.

- Group Transactions Together: For clients with multiple purchases or recurring transactions, consider sending a summary document that includes all outstanding charges or payments, rather than sending individual records each time.

- Offer Multiple Payment Methods: Make the payment process easier for clients by offering multiple methods, such as credit card payments, bank transfers, or online payment systems like PayPal. Include clear instructions on how they can complete the payment.

By following these steps and utilizing the right tools, you can streamline the process of sending billing records, reduce administrative workload, and ensure that clients receive and act on their documents promptly. Efficient document management is key to maintaining smooth business operations and ensuring that your cash flow remains consistent.

Tracking Payments with Your Invoice

Effectively monitoring payments is an essential part of managing your business’s finances. Keeping track of payments ensures that your cash flow remains consistent and helps you quickly identify any overdue amounts. With the right tools and approach, you can efficiently track payments and avoid potential misunderstandings with clients. By including tracking mechanisms in your billing documents, you can make payment management a seamless process.

Key Methods for Tracking Payments

- Assign Unique Payment Reference Numbers: Including a unique reference number for each transaction allows you to easily track and match payments. This is especially useful if you manage multiple clients or handle large volumes of transactions.

- Record Payment Terms: Be sure to clearly state payment due dates and terms within your document. This gives both you and your client a clear understanding of the timeline for payment and helps you track when a payment should have been made.

- Use Payment Status Indicators: Including a section to mark the status of each payment (e.g., pending, paid, overdue) can help you quickly assess the state of all transactions at a glance. This reduces the likelihood of missed payments or confusion over amounts owed.

Tracking Payment Status and Methods

Payment Method Status Amount Paid Remaining Balance Payment Date Credit Card Paid $500 $0 Oct 15, 2024 Bank Transfer Pending $300 $200 Oct 25, 2024 PayPal Overdue $150 $50 Oct 5, 2024 Using a sy

How to Protect Your Avon Invoice Data

Ensuring the safety and confidentiality of your financial records is crucial in today’s digital world. Personal and payment information is sensitive, and unauthorized access to this data can lead to serious consequences, including identity theft or fraud. By taking the necessary precautions and utilizing proper security measures, you can protect both your business and your clients from potential risks. This section provides some effective strategies for safeguarding your financial documents.

Essential Steps for Securing Your Financial Data

- Use Strong Passwords: Always ensure that your accounting software and digital records are protected by strong, unique passwords. Avoid using easily guessable information, and consider using password managers to store complex passwords securely.

- Encrypt Sensitive Information: Encrypt your documents when sending them via email or storing them on cloud services. This ensures that even if the data is intercepted, it will be unreadable without the proper decryption key.

- Limit Access to Data: Only allow access to your records to authorized personnel. Implement user access controls that grant different levels of access based on roles within your business, ensuring that sensitive data is protected from unauthorized users.

- Back Up Your Data Regularly: Regular backups are essential for protecting against data loss due to system failure or cyber-attacks. Store backups securely in both physical and cloud-based locations to ensure you can recover your data if necessary.

- Implement Two-Factor Authentication (2FA): Add an extra layer of security to your online systems by enabling two-factor authentication. This requires users to verify their identity using something they know (password) and something they have (e.g., a mobile device or security token).

Best Practices for Safe Document Sharing

- Use Secure Email Providers: When sending sensitive billing documents, choose secure email providers that offer encryption options, such as ProtonMail or Gmail with encryption settings. Avoid sending sensitive data via unprotected channels.

- Limit File Sharing: Share documents only with trusted recipients. When sharing files through cloud storage services, ensure you set proper permissions to control who can view, edit, or download the files.

- Label Confidential Files: Clearly label sensitive documents as “Confidential” to remind recipients to handle them with care. This simple step can encourage recipients to take extra precautions when managing your data.

By incorporating these practices into your workflow, you can significantly reduce the risks associated with handling sensitive billing and financial information. Data protection is an ongoing process that requires vigilance, but with the right tools and practi

Free Tools to Enhance Invoice Templates

Creating professional and visually appealing financial documents is an important aspect of running a successful business. Fortunately, there are numerous free tools available that can help you enhance and customize your billing records. These tools allow you to add your unique branding, improve layout design, and automate parts of the document creation process, making it easier and more efficient to generate high-quality records.

Top Free Tools for Enhancing Billing Documents

- Canva: Canva is a popular online design tool that offers a wide range of customizable templates, including those for financial documents. With its drag-and-drop interface, you can easily add your logo, change colors, and adjust text to match your brand’s aesthetic.

- Google Docs: Google Docs provides easy-to-use templates for creating documents. Its collaborative features also allow you to work in real time with team members or clients, making it ideal for businesses that need to share and edit records quickly.

- Zoho Invoice: Zoho’s online tool is designed specifically for businesses that need to create and manage billing records. With free features available, it allows you to automate payment reminders, track expenses, and customize your documents according to your needs.

- Wave: Wave is a free accounting software that includes customizable billing templates. It’s perfect for small business owners and freelancers looking for a simple yet effective way to create, manage, and track financial documents.

- PayPal Invoicing: If you already use PayPal for transactions, their free invoicing tool offers an easy way to create and send professional billing records. You can customize them with your business logo and payment details, making it seamless for both you and your clients.

How These Tools Improve Your Billing Process

- Customization: These tools allow you to modify the design and content of your documents, making them fit your brand identity. Whether it’s changing the font, color scheme, or layout, you have full control over the look and feel of your records.

- Automation: Many of these tools offer automation features that can save you time, such as automatically generating recurring documents or sending payment reminders to clients.

- Ease of Use: These platforms are designed to be user-friendly, even for those with little to no design experience. You can create polished, professional documents in minutes without needing advanced software or skills.

- Cloud-Based Access: Most of these tools are cloud-based, meaning you can access and edit your documents