Free Automotive Shop Invoice Template

Running a business requires efficient management of financial documents, and this is especially true in the repair industry. Having the right tools to generate clear, professional statements for your customers can save time and reduce errors. By using a well-structured document for transactions, you ensure both accuracy and transparency.

Using pre-designed solutions to manage charges can help simplify the entire process. These options are designed to handle all the necessary details such as costs, taxes, and payment methods. By utilizing these resources, you can focus more on your services and less on the paperwork.

With a simple and adaptable layout, you can quickly create tailored documents that meet your business needs. Whether you’re sending out routine service bills or finalizing large projects, a customizable solution can enhance your workflow, leaving a lasting professional impression on your clients.

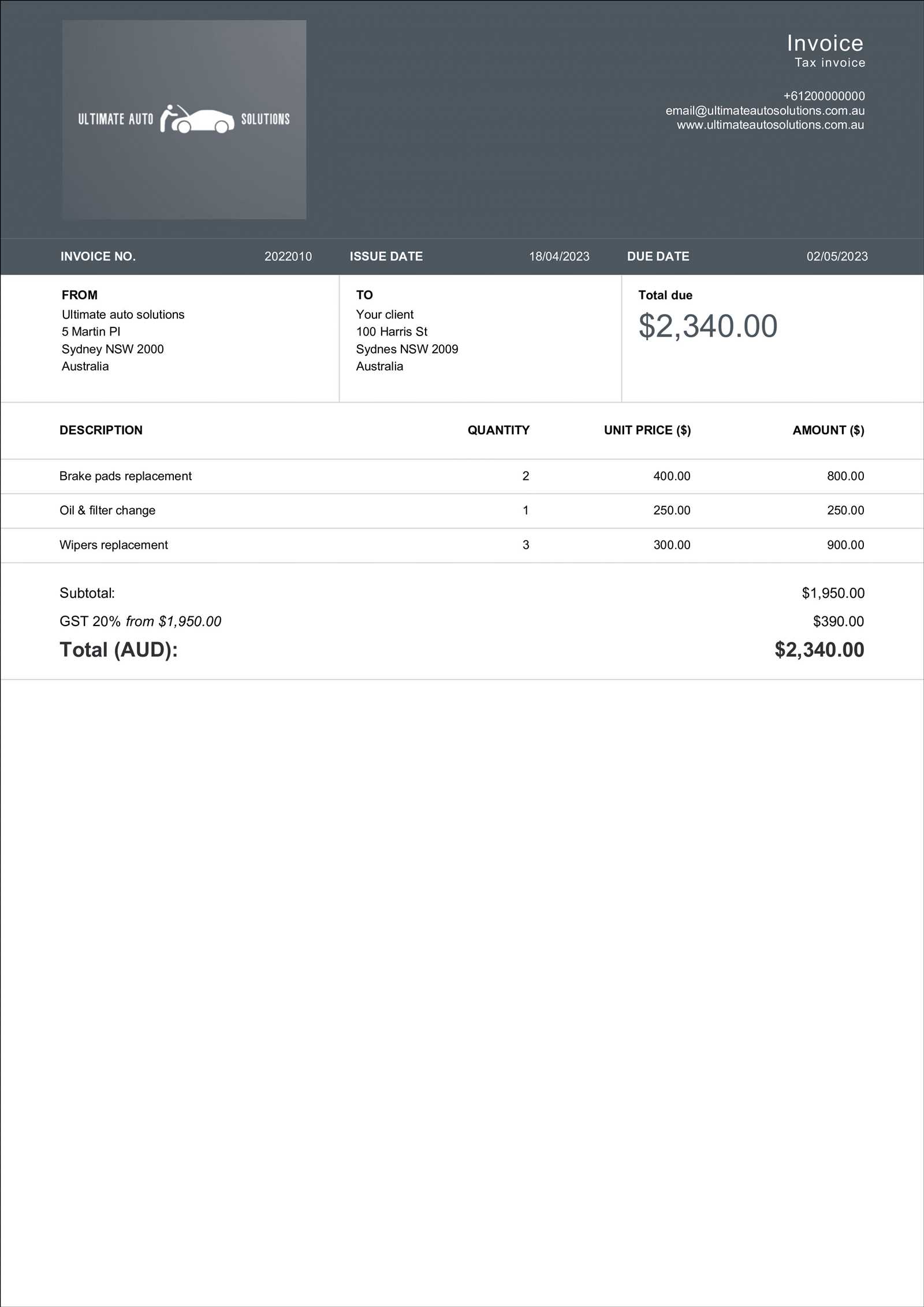

Free Invoice Templates for Auto Shops

Managing billing is a crucial aspect of running any business, especially in industries where services vary greatly from one client to another. Using a consistent and well-organized document can help ensure that all charges are clear, accurate, and easily understood by customers. A ready-made solution can provide the structure needed to quickly generate statements that reflect all necessary details of the transaction.

There are several benefits to using these pre-designed solutions:

- Efficiency: Quickly create professional documents without starting from scratch.

- Customization: Easily adjust details like service description, pricing, and taxes to match the specific job.

- Accuracy: Reduce errors by using a format that includes all necessary fields and calculations.

- Consistency: Ensure all documents have a uniform appearance, reinforcing your brand’s professionalism.

Many of these tools are available for download at no cost, offering a simple yet powerful way to streamline your billing process. Whether you need to issue a quick charge after a routine service or prepare a more complex statement for a larger project, these resources are designed to fit a variety of needs.

Some key features to look for in a suitable document solution include:

- Pre-filled fields: Fields for client names, service descriptions, dates, and amounts that can be easily filled in.

- Tax calculations: Built-in sections for adding taxes and any additional charges.

- Professional layout: A clean and readable design that enhances your business’s reputation.

By incorporating these tools into your daily operations, you can ensure that every transaction is handled efficiently and professionally.

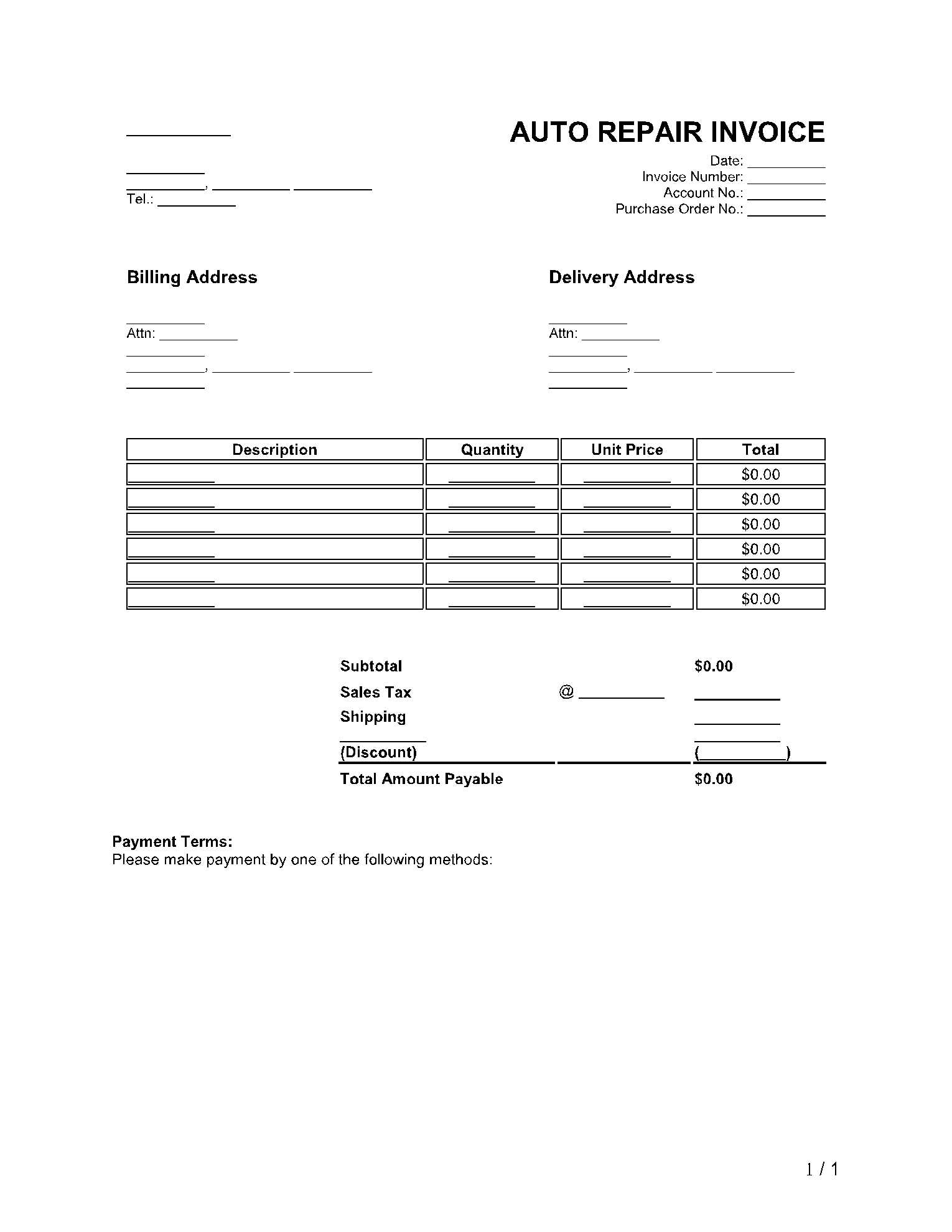

How to Create an Automotive Invoice

Creating a professional billing document involves gathering all relevant details, organizing them clearly, and presenting them in a way that is easy for clients to understand. Whether for routine services or specialized repairs, a well-structured document is essential for maintaining smooth financial transactions.

To start, you’ll need to include some key elements to ensure accuracy and professionalism:

- Client Information: Begin by including the client’s name, address, and contact details to clearly identify the recipient of the bill.

- Business Details: Your company name, address, and contact information should also be prominently displayed at the top of the document.

- Unique Reference Number: Assign a unique number to each transaction for easy tracking and future reference.

- Itemized List: Break down the services provided or parts replaced. Each item should have a description, quantity, unit price, and total cost.

- Taxes and Additional Charges: Include applicable tax rates and any extra fees associated with the service or products.

- Total Amount Due: Clearly display the total cost at the end of the document, including taxes and any other applicable charges.

Formatting Tips: Use a clean, easy-to-read layout. This ensures the customer can quickly identify important details such as the total cost, payment methods, and due dates. Include spaces for payment instructions, such as accepted payment methods or bank account details if needed.

Double-check the accuracy of all figures and calculations to avoid any discrepancies that might lead to confusion or disputes. After confirming everything is correct, you can send the document to the client for payment processing.

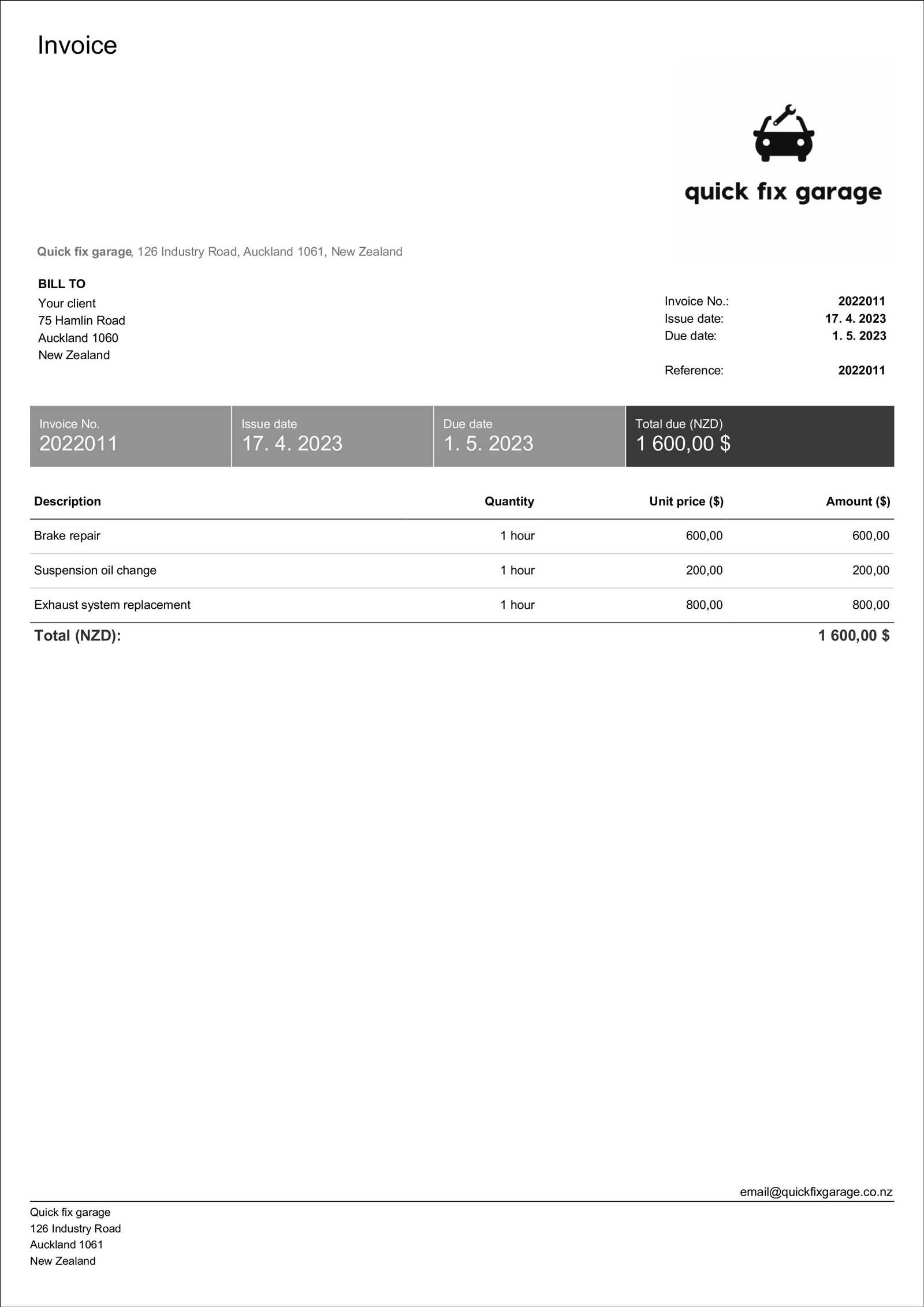

Key Features of Auto Repair Invoices

When creating a billing document for repairs, it’s essential to include specific elements that ensure clarity and professionalism. These key features help both the business and the customer stay organized while providing an accurate record of the transaction.

The first important aspect is the itemized list of services. Each service or part should be detailed, including a description, quantity, individual cost, and total cost for each item. This transparency helps the customer understand what they are being charged for.

Another crucial component is tax calculations. Depending on the location, businesses must include appropriate tax rates and calculations. This ensures compliance with local laws and avoids potential confusion.

Payment instructions are also vital. Clear guidelines on how the client can make payment, whether by cash, card, or bank transfer, should be provided. Including your payment terms, such as due dates and late fees, is also necessary to ensure timely transactions.

Professional appearance is another key feature. A clean, well-structured design not only makes the document easier to read but also reinforces the business’s reputation. It’s important to ensure that the layout is organized and all key information is easily accessible.

Finally, including a unique reference number helps track each transaction for future reference, making it easier to manage records and resolve potential disputes if needed.

Benefits of Using a Template

Using a pre-designed document for billing purposes offers several advantages, particularly in streamlining your workflow and ensuring consistency. Instead of starting from scratch each time, a well-organized solution provides a foundation that can be easily customized to fit the specifics of each transaction.

One of the primary benefits is time-saving. With a ready-made structure, you no longer need to manually create each field or worry about formatting every time you need to issue a document. This allows you to focus on other important tasks within your business.

Consistency is another significant advantage. By using a standardized layout, you ensure that all of your billing documents look the same. This consistency enhances your business’s professionalism and makes it easier for clients to understand the information presented to them.

Moreover, pre-designed solutions often include essential fields and calculations, reducing the likelihood of errors. Automatic tax calculations, totals, and space for client information ensure that all the necessary details are included without the risk of overlooking important elements.

Customization is also a key benefit. These documents can be easily modified to suit your specific needs, whether you need to add or remove sections, update pricing, or change contact details. This flexibility allows you to maintain a personalized approach while saving time and effort.

Finally, using a pre-designed document helps maintain organization. With a consistent format, it’s easier to track past transactions, handle disputes, and keep accurate records of all payments, ultimately supporting smoother business operations.

Customizing Your Invoice for Clients

When issuing a billing statement, tailoring the document to reflect each client’s specific needs can enhance professionalism and foster a better customer experience. Personalizing the details ensures that the charges, services, and terms are relevant to the individual client, making the process clearer and more transparent.

Key Areas to Customize

There are several key areas where adjustments can be made to better fit each client’s requirements:

- Client Information: Always ensure that the client’s name, address, and contact details are correct and up to date.

- Service Descriptions: Tailor the descriptions of the services provided to accurately reflect the work done or parts used. Avoid generic phrases to make the statement more specific.

- Pricing and Discounts: If you offer different pricing for different clients, include any applicable discounts or special rates.

- Payment Terms: Adapt the payment instructions and due dates based on the agreed-upon terms with each client.

Formatting for Clarity

Ensure that the document is easy to read by using clear headings, bullet points, and organized sections. A clean layout will help clients quickly locate important information such as total amounts due, taxes, and payment methods.

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Labor for engine repair | 2 hours | $50/hour | $100 |

| Replacement part – alternator | 1 | $200 | $200 |

| Total | $300 | ||

By customizing each document, you can better reflect the nature of your work and strengthen the business relationship with your clients, making it easier for them to understand the breakdown of costs and payment expectations.

Essential Information on an Auto Invoice

For any business providing services or products, it is crucial to include all necessary details in the billing document. This ensures clarity for both the business and the client, helping to avoid confusion and disputes while ensuring timely payments.

Some of the key elements that must be included in a billing statement are:

- Business and Client Details: Include the full name, address, and contact information for both the business and the customer.

- Document Reference Number: A unique identifier for each transaction. This helps track payments and ensures easy future reference.

- Date of Service: Clearly specify the date when the service was performed or the product was provided.

- Itemized List of Services: List each service or product provided, along with a description, quantity, individual cost, and total for each item.

- Tax Information: Include any applicable taxes and calculate the total amount due after taxes are added.

- Total Amount Due: The total cost of all services or products, including taxes, discounts, or additional fees.

- Payment Terms: Clearly outline the accepted payment methods and the due date for the amount to be paid.

It is essential to keep the document organized and professional-looking, so that the client can easily read and understand all details. Keeping these core elements in mind ensures that your billing documents serve their purpose and support a smooth business transaction.

Steps to Download a Free Template

Accessing a ready-made document for billing can save a lot of time and effort, especially when you need a standardized solution for multiple transactions. Whether you’re looking for a simple format or a more complex layout, there are easy steps you can follow to obtain a template that fits your needs.

Step-by-Step Process

Here are the essential steps to download a suitable document for your business:

- Search Online Platforms: Begin by browsing reliable websites that offer a variety of pre-designed solutions. Many websites provide templates in various formats, such as Word, Excel, or PDF.

- Select the Right Format: Choose the format that works best for your business and preferences. Some clients may prefer digital documents, while others may need printed copies.

- Customize for Your Needs: After selecting a suitable document, download and open it on your device. You can then easily modify the details to match your business and client-specific information.

- Save for Future Use: Save the completed document on your computer or cloud storage so that it can be accessed whenever you need to issue a billing statement in the future.

Finalizing and Using the Document

Once downloaded, make sure to double-check the accuracy of all the fields and ensure that it reflects your branding, payment terms, and service descriptions. This will help you present a professional and organized record to your clients.

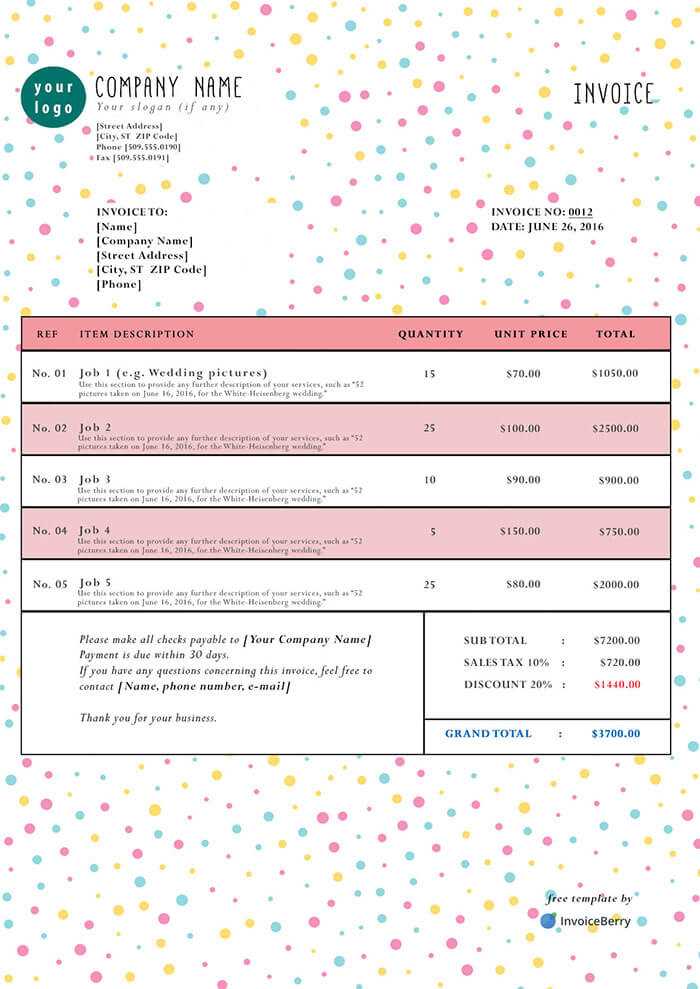

Choosing the Right Invoice Format

Selecting the right structure for your billing document is crucial to ensure clarity, accuracy, and professionalism. The format you choose should reflect your business’s needs while being easy to understand for your clients. A well-designed billing document helps avoid confusion, ensures timely payments, and supports better organization.

When deciding on the best format, consider the following factors:

- Business Type: The format should align with the type of services or products you provide. For instance, if you offer complex services, an itemized format may be necessary to break down the details clearly.

- Client Preferences: Some clients may prefer simple and straightforward documents, while others may need more detailed information. Understanding what your clients expect can help you choose the appropriate layout.

- Legal and Tax Compliance: Ensure the format includes all necessary fields for tax calculations, legal information, and payment terms required by local regulations.

- Ease of Use: Choose a format that is easy to fill out, edit, and maintain. This is particularly important if you need to generate billing documents regularly.

Additionally, consider whether you need a digital or printed version. Digital formats are more convenient for online transactions and can be sent quickly, while printed formats may be preferred for in-person or paper-based transactions.

By evaluating these factors, you can select a format that best suits your business operations and client needs, ultimately leading to smoother transactions and a more professional appearance.

How to Add Tax and Fees

Including taxes and additional charges in a billing statement is essential for ensuring compliance and transparency. It’s important to accurately calculate and present these amounts to avoid confusion and ensure that both the business and the client are on the same page.

Here’s how to properly incorporate taxes and fees into your documents:

- Understand Local Tax Rates: Before adding taxes, research the applicable rates for your location and industry. This ensures that you are charging the correct percentage and adhering to any legal requirements.

- Specify the Tax Type: Clearly indicate the type of tax being applied, whether it’s sales tax, VAT, or another specific levy. This helps clients understand the breakdown of costs and prevents any misunderstandings.

- Calculate the Tax Amount: To calculate the tax, multiply the subtotal of the services or products by the tax rate. For example, if your subtotal is $100 and the tax rate is 10%, the tax will be $10.

- Add Additional Fees: If there are any extra charges, such as handling fees or delivery costs, list these separately with a clear explanation. This ensures transparency and avoids hidden costs.

- Show the Total Amount: After calculating taxes and fees, make sure to add them to the subtotal and present the final amount clearly. The total should be easy to find, usually at the bottom of the document.

By accurately adding taxes and any additional charges, you create a clear and professional document that helps foster trust with your clients while ensuring compliance with legal requirements.

Best Practices for Creating Billing Documents

When creating a billing document, following best practices ensures that your transactions are smooth, professional, and efficient. Properly designed billing statements not only help in receiving timely payments but also contribute to a positive relationship with your clients.

Key Guidelines for Effective Billing

To ensure your billing process is seamless and transparent, consider the following best practices:

- Use Clear and Simple Language: Avoid jargon or overly technical terms. A clear, concise statement makes it easier for clients to understand the charges.

- Be Consistent with Formatting: Consistency is crucial for readability. Use the same layout for each document and ensure the structure is simple yet professional.

- Itemize Your Charges: Break down the costs of services or products clearly. An itemized list helps clients see exactly what they are paying for, which can reduce the likelihood of disputes.

- Include Payment Terms: Always specify the terms of payment. This includes due dates, accepted payment methods, and any late fees or discounts for early payment.

- Ensure Accuracy: Double-check all numbers, including prices, quantities, taxes, and totals. Accuracy in your billing documents is essential for building trust and avoiding confusion.

- Keep Records: Maintain a copy of every document you issue. This helps in tracking payments, managing disputes, and ensuring you have a record for tax purposes.

Enhancing Client Experience

Following these practices not only makes your billing documents more effective but also improves client experience. A well-organized and professional document reflects well on your business, making clients more likely to return for future transactions.

Improving Client Experience with Billing Statements

Enhancing the overall client experience is essential for fostering long-term relationships and building trust. One of the most effective ways to do this is by ensuring that your billing documents are clear, professional, and easy to navigate. A well-crafted statement not only helps in securing timely payments but also leaves a positive impression of your business.

Here are some strategies to improve the client experience through your billing documents:

- Provide Clear Breakdown of Charges: Clients appreciate knowing exactly what they are paying for. Clearly itemize services, parts, or products, and specify any additional charges such as taxes or fees. This reduces confusion and potential disputes.

- Use Professional Design: A neat and visually appealing layout enhances the overall experience. Ensure that the document is easy to read with consistent fonts, clear headings, and well-organized information.

- Offer Multiple Payment Methods: Flexibility is key. Provide various payment options (e.g., credit cards, bank transfers, online payment systems) to make it easier for clients to settle their bills according to their preferences.

- Include Detailed Contact Information: In case of any questions or issues, provide clear contact details for your customer service team. This shows that you’re approachable and committed to assisting your clients.

- Respect Timeliness: Ensure that your clients receive the billing statement promptly. Sending it in a timely manner helps avoid delays and shows that you respect their time.

- Make the Document Accessible: In today’s digital world, consider offering your clients the option to receive their statements electronically. This is faster, more convenient, and aligns with clients who prefer online transactions.

By focusing on these elements, you can improve your client’s experience with billing statements, turning a routine transaction into an opportunity for positive interaction and long-term business growth.

Tracking Payments with Billing Documents

Effectively managing payments is essential for maintaining healthy cash flow and ensuring that your business runs smoothly. One of the most effective ways to track payments is through well-organized documents that clearly reflect each transaction’s status. These records allow businesses to monitor outstanding balances, confirm paid amounts, and keep a detailed history for future reference.

Here’s how to effectively track payments using billing documents:

| Payment Status | Description | Action Needed |

|---|---|---|

| Paid | The full amount has been received. | Mark as complete and issue a receipt. |

| Unpaid | No payment has been received yet. | Send a reminder or follow up with the client. |

| Partially Paid | A portion of the amount has been paid. | Track the remaining balance and send follow-up notifications. |

| Overdue | Payment was due but not yet received. | Contact the client for immediate payment or arrange a payment plan. |

By using clear and organized documents, you can effectively manage each payment’s progress, avoid delays, and ensure clients are promptly informed of their payment status. This tracking system also helps identify patterns in late payments, which can be addressed proactively to maintain smooth financial operations.

Why Auto Service Providers Need Billing Documents

In any service-based business, clear and professional documentation is essential for maintaining smooth operations and ensuring financial transparency. For businesses offering repair or maintenance services, detailed records of services rendered and payments made play a critical role in tracking revenue, managing expenses, and fostering strong client relationships.

Here are some key reasons why these businesses need structured billing documents:

Ensures Accurate Record-Keeping

Properly organized documents allow for clear tracking of completed work, the cost of materials, labor, and taxes, ensuring both the business and the customer are on the same page. This reduces the risk of errors and confusion over payments and services rendered.

Improves Professionalism

Using a standardized format for billing documents presents a professional image to customers. It reinforces the business’s reliability and competence, helping to build trust and encourage repeat business.

In addition to financial clarity, these documents also serve as a legal record for both the business and the client, helping to avoid disputes and ensuring all agreements are properly documented. By adopting a consistent approach to billing, service providers can focus more on their work and less on administrative tasks.

Tips for Professional Billing Document Design

Creating a well-designed billing document is crucial for making a lasting impression and ensuring clarity in financial transactions. A professional layout not only enhances the document’s readability but also reflects the business’s attention to detail and commitment to quality service. A polished design helps avoid misunderstandings and reinforces the business’s reputation for efficiency and reliability.

Here are some key tips to help you design effective billing documents:

- Keep It Simple and Clean: Avoid cluttering the document with unnecessary details. Use clear headings, adequate spacing, and legible fonts to make the document easy to read and understand.

- Use Your Branding: Incorporate your business logo, colors, and fonts to maintain consistency with your brand identity. This creates a cohesive and professional look that clients will recognize and trust.

- Organize Information Clearly: Structure the document in a logical flow with distinct sections for services, payment terms, client details, and pricing. This organization makes it easier for clients to review and understand the charges.

- Highlight Important Details: Use bold text or colors to emphasize key information, such as total amounts due, payment due dates, and contact details. This helps ensure that important data doesn’t get overlooked.

- Ensure Accuracy: Double-check all figures and descriptions to ensure there are no errors. Mistakes can undermine the professional appearance of your document and lead to confusion or disputes.

By following these design tips, you can create billing documents that not only look professional but also enhance the overall client experience, helping to streamline payments and build strong business relationships.

How to Send Billing Documents to Clients

Sending a clear and professional billing document to a client is a key part of the transaction process. It ensures that both parties are on the same page regarding the services provided, the costs involved, and the expected payment terms. The method of delivery can affect the client’s experience and may influence how quickly payments are made. Choosing the right approach to sending these documents is crucial for maintaining a smooth workflow and professional relationship.

Here are the most effective ways to send billing documents to clients:

- Email: Sending billing documents via email is fast, convenient, and allows for quick delivery. Ensure the document is attached in a common format, such as PDF, to maintain its integrity. Always include a clear subject line that specifies it is a billing document and a brief message in the body of the email explaining the details.

- Online Payment Platforms: Many businesses use online payment systems that automatically send billing documents to clients once payment is processed. These platforms often allow clients to view, download, and even pay directly from the document, making the process seamless and efficient.

- Physical Mail: Although less common in the digital age, some businesses still choose to send printed copies of billing documents by mail. This can be a good option for clients who prefer paper records or for formal transactions that require a physical receipt.

- Client Portals: Many businesses create secure online portals where clients can access their billing documents, payment history, and upcoming charges. This option is great for businesses that have a high volume of clients or recurring transactions.

Regardless of the method chosen, always ensure that the document is clearly formatted, contains all relevant information, and is sent promptly to avoid delays in payment. A timely and professional delivery not only streamlines the payment process but also strengthens the relationship between you and your clients.

Common Mistakes to Avoid in Billing

Properly documenting charges and sending them to clients is a crucial step in any business transaction. However, there are several common errors that can occur during the process, which can lead to confusion, delayed payments, or even disputes. Recognizing and avoiding these mistakes can help maintain professional relationships and ensure that payments are received on time.

Here are some common mistakes to watch out for when preparing billing documents:

- Missing Key Details: Omitting important information, such as service descriptions, dates, or payment terms, can confuse clients and delay payments. Always ensure that all necessary details are clearly included.

- Incorrect Amounts: Charging the wrong amount, either due to a mistake in calculations or misunderstandings about pricing, is a significant issue. Always double-check your figures to ensure accuracy.

- Failure to Specify Payment Terms: Not including payment due dates or instructions for payment can lead to confusion about when the amount is due. It’s essential to be clear about deadlines and acceptable methods of payment.

- Inconsistent Formatting: A disorganized or hard-to-read billing document can cause frustration. Ensure that the format is neat, consistent, and easy to understand, with clear sections and legible text.

- Not Including Taxes or Fees: Sometimes, businesses forget to add applicable taxes, surcharges, or other fees to the final amount. Be sure to account for any extra costs and itemize them clearly.

- Late Delivery: Sending billing documents too late can affect cash flow and create unnecessary delays. Aim to send documents promptly after services are rendered or products are delivered.

- Not Following Up: If a client hasn’t paid within the expected time frame, failing to follow up can lead to missed payments. Always track outstanding bills and send reminders as needed.

Avoiding these common errors ensures that the billing process runs smoothly, keeping both your business operations efficient and your clients satisfied.