Free Automotive Invoice Template for Your Business

Efficient billing is essential for any business, especially those in the vehicle repair and sales industry. Keeping track of payments, ensuring accuracy, and maintaining a professional appearance all depend on having the right tools. One of the simplest ways to manage these tasks is by using a structured document for recording transactions. By utilizing such resources, businesses can save time and reduce the chance of errors.

Instead of starting from scratch every time, pre-designed forms provide a quick solution. These forms are tailored for specific needs and can easily be modified to suit your unique requirements. Whether you’re offering services or selling parts, having a consistent and polished format helps keep everything organized and clear for both you and your customers.

Using a structured document not only simplifies the billing process but also contributes to smoother financial operations. With just a few edits, you can quickly produce a professional record of each transaction, ensuring both accuracy and a positive experience for your clients. These tools are an invaluable resource for businesses looking to streamline their workflow and enhance their professionalism.

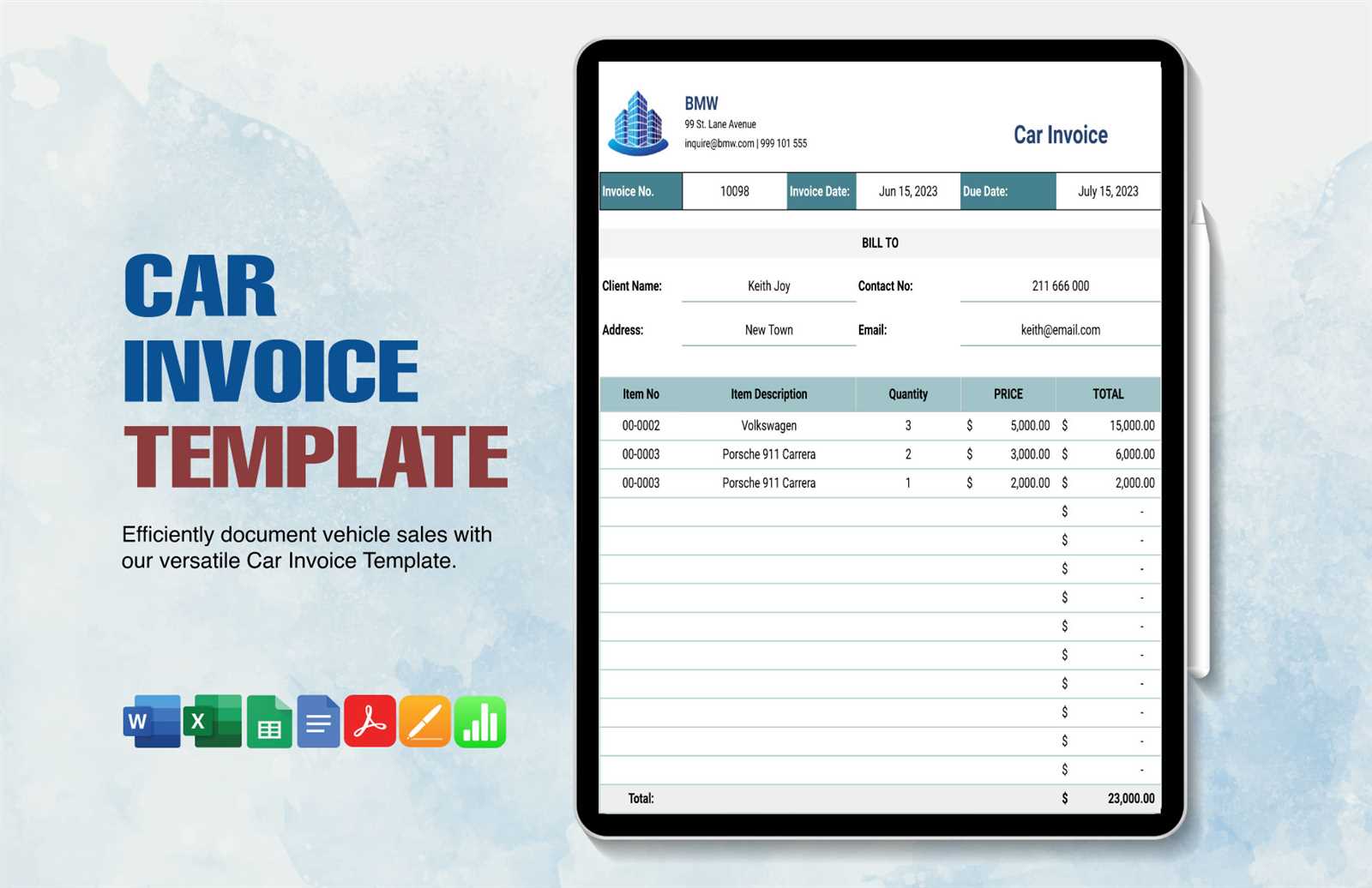

Free Automotive Invoice Templates Explained

When managing transactions, having a well-organized and professional document is key to ensuring clarity and accuracy. For businesses in the car repair or sales industry, using a pre-made document can save both time and effort. These documents are designed to capture essential information quickly, ensuring that all necessary details are included for both the service provider and the customer.

Ready-to-use forms provide a simple solution for handling sales or service charges without the need to start from scratch each time. These documents are fully customizable and can be adjusted to fit the specific needs of a business, making them a valuable tool for maintaining efficiency and professionalism in financial dealings.

Key benefits of using ready-made forms include:

- Time efficiency: Quickly fill in the required information without having to design a new document each time.

- Consistency: Ensure all documents follow a uniform structure, which enhances clarity for both parties.

- Customization: Adjust the layout, text, and design to match the specific branding or services of your business.

- Accuracy: Reduce the risk of missing essential details by following a pre-structured format.

For those unfamiliar with document design, these pre-made forms can be easily downloaded and adapted. Many options are available online, and most of them provide intuitive interfaces for customizing content. By using these resources, businesses can streamline their financial processes while maintaining a professional appearance for customers.

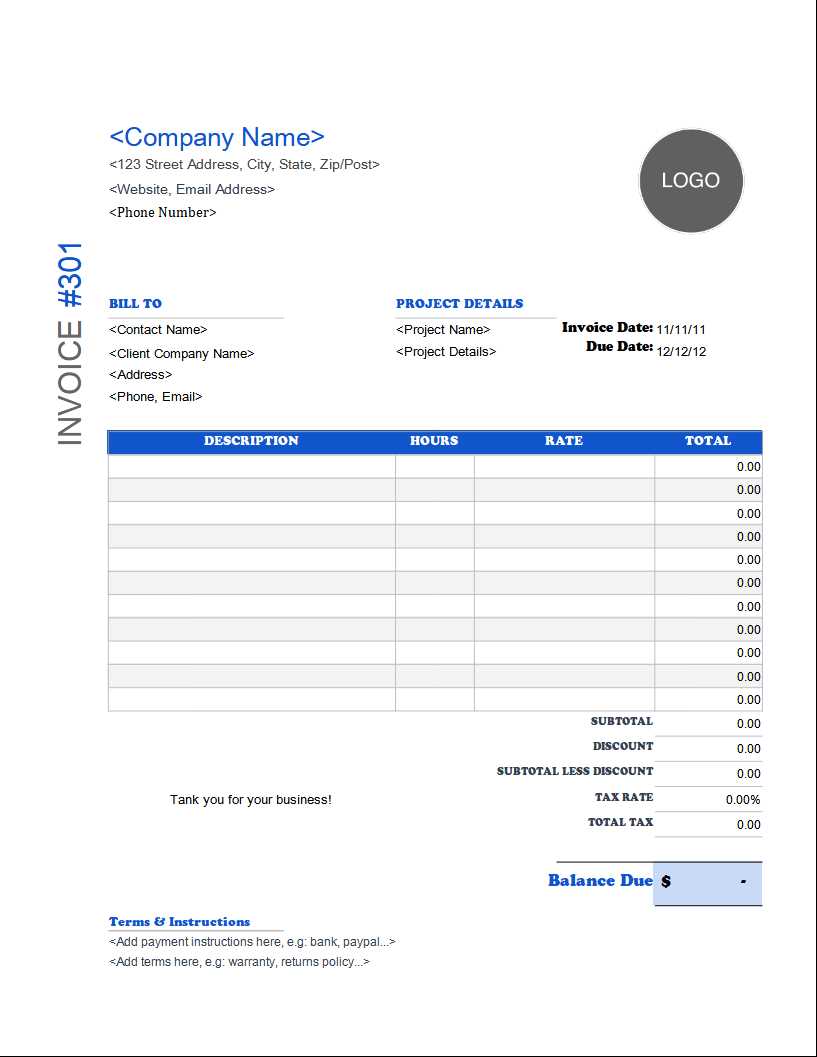

How to Create an Automotive Invoice

Creating a clear and professional document for transactions is essential for maintaining organization and trust in your business dealings. Whether you’re charging for repairs, services, or parts, it’s important to include all relevant information in a structured manner. A well-crafted document not only ensures accurate record-keeping but also helps establish a professional image with your clients.

Steps to Create a Transaction Record

Follow these steps to create a comprehensive and professional document for your business:

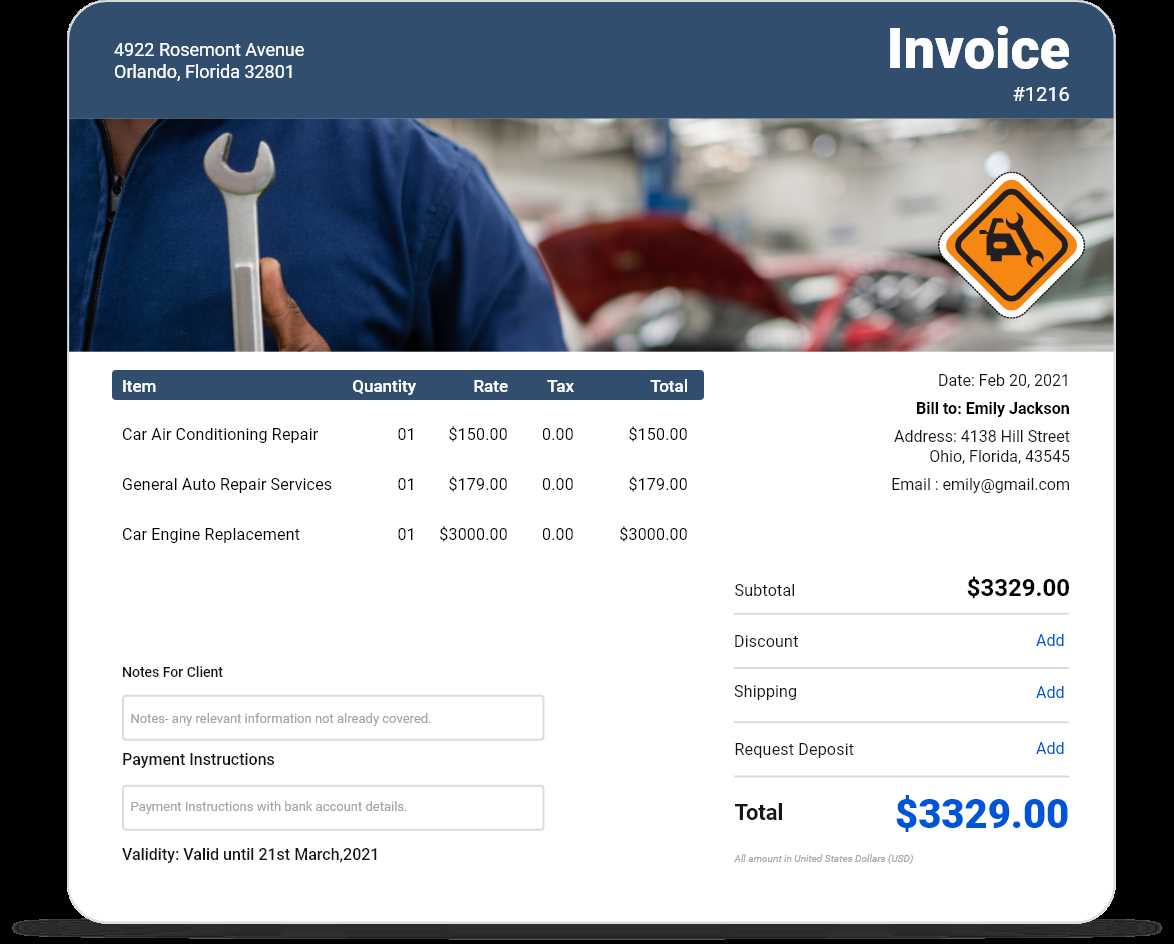

- Include your business details: Start with your company name, address, phone number, and email. This helps clients easily identify the source of the document.

- Customer information: Make sure to include your client’s name, address, and contact details for easy reference.

- Document number and date: Assign a unique reference number for the transaction and the date it occurred to track payments efficiently.

- Description of services/products: List all the services provided or products sold, along with a brief description and quantity where applicable.

- Amount details: Clearly show the price for each service or item and the total amount due. Be transparent with taxes or discounts if applicable.

- Payment terms: Specify the payment method, due date, and any other conditions (e.g., late fees, installment plans).

Customizing Your Document

Once you’ve included all the essential details, customize your document to reflect your business’s branding. You can adjust the layout and design to make it more visually appealing and aligned with your company’s identity. Adding a professional touch with logos or specific fonts can leave a positive impression on your clients, enhancing your business reputation.

Benefits of Using a Template for Invoices

Utilizing a pre-designed document for billing offers several advantages, particularly for businesses that deal with frequent transactions. Instead of creating a new record from scratch each time, these structured formats provide an efficient way to manage financial records with minimal effort. The use of such documents can streamline workflows, reduce human error, and improve overall productivity.

One of the key benefits is time savings. Pre-made forms allow you to quickly fill in the necessary information, reducing the amount of time spent on administrative tasks. This time-saving aspect helps you focus on other aspects of your business, such as providing excellent customer service or managing inventory.

Another significant advantage is consistency. Using the same structure for every transaction ensures that your documents are uniform, making them easier to read and process. This consistency also reflects positively on your business, giving it a professional appearance and fostering trust with your clients.

Additionally, ready-made documents help reduce the risk of errors. The clear, predefined fields minimize the chances of omitting important information or entering incorrect details. This is especially important when dealing with complex financial transactions where accuracy is critical.

Finally, these tools can be easily customized to meet the unique needs of your business. Whether you need to adjust for specific services, pricing, or branding, pre-designed formats can be tailored to reflect your business identity and requirements, providing a flexible solution for your billing needs.

Why Free Templates Are Ideal for Small Businesses

For small businesses, managing costs while maintaining professionalism is crucial. When it comes to handling financial records, using ready-made documents is an effective way to reduce expenses without compromising on quality. These resources provide a cost-effective solution that allows small companies to focus their budget on growth rather than on developing custom paperwork.

Cost-Effective and Accessible

One of the most obvious advantages of using no-cost documents is that they are, well, free. Small businesses with limited resources can save money on software or professional design services by simply downloading these tools online. By using ready-to-go formats, businesses can allocate their budgets to other important areas like marketing, inventory, or employee training.

Easy Customization and Flexibility

Despite being free, these documents offer a high degree of customization. Small businesses can easily modify them to suit their needs. Whether it’s adjusting the layout, changing branding elements like logos and colors, or adding specific details relevant to the business, these resources are flexible and adaptable. They provide a professional appearance without the need for extensive design skills or extra costs.

For businesses that are just starting out, no-cost documents also provide a way to test and refine their financial processes without heavy investment. Once the business grows and its needs become more complex, these documents can still be used as a foundation or upgraded as necessary, keeping expenses in check.

Overall, using ready-made resources helps small businesses operate efficiently, maintain a professional image, and save money, all while offering enough flexibility to cater to their unique needs.

Top Features of an Automotive Invoice Template

When creating professional documents for recording transactions, certain key features can make the process smoother and more efficient. A well-structured form should be easy to fill out, ensuring that all essential information is captured correctly. For businesses in the car repair and parts industry, a well-designed document helps both streamline billing and present a polished image to clients.

Essential Information Fields

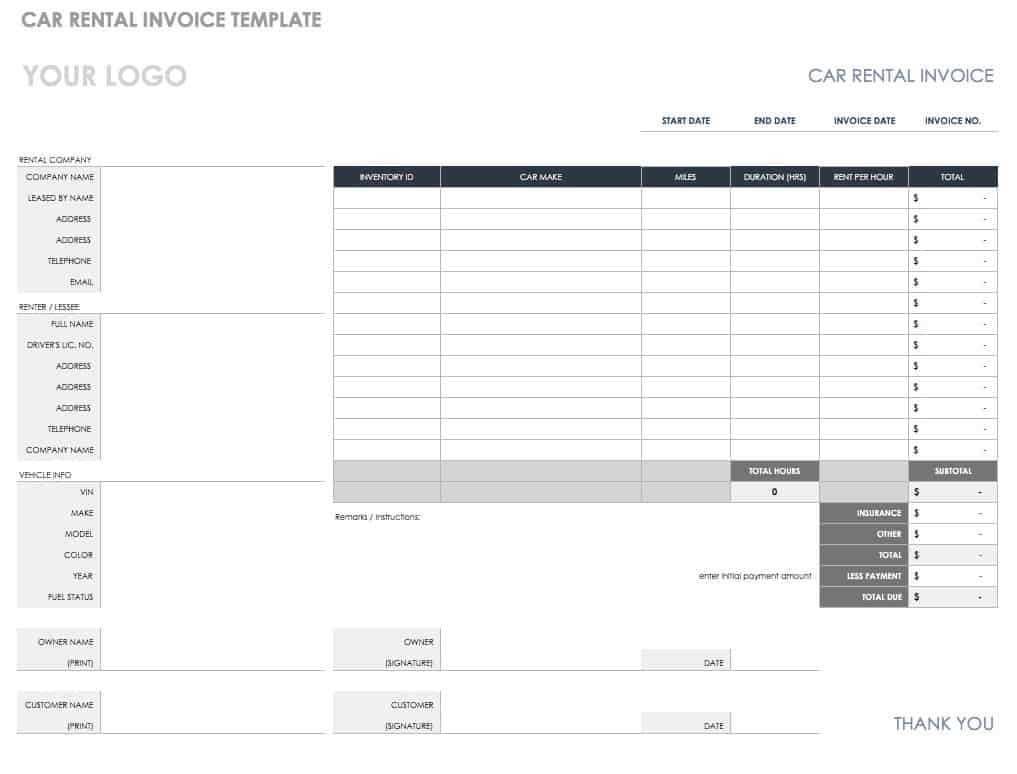

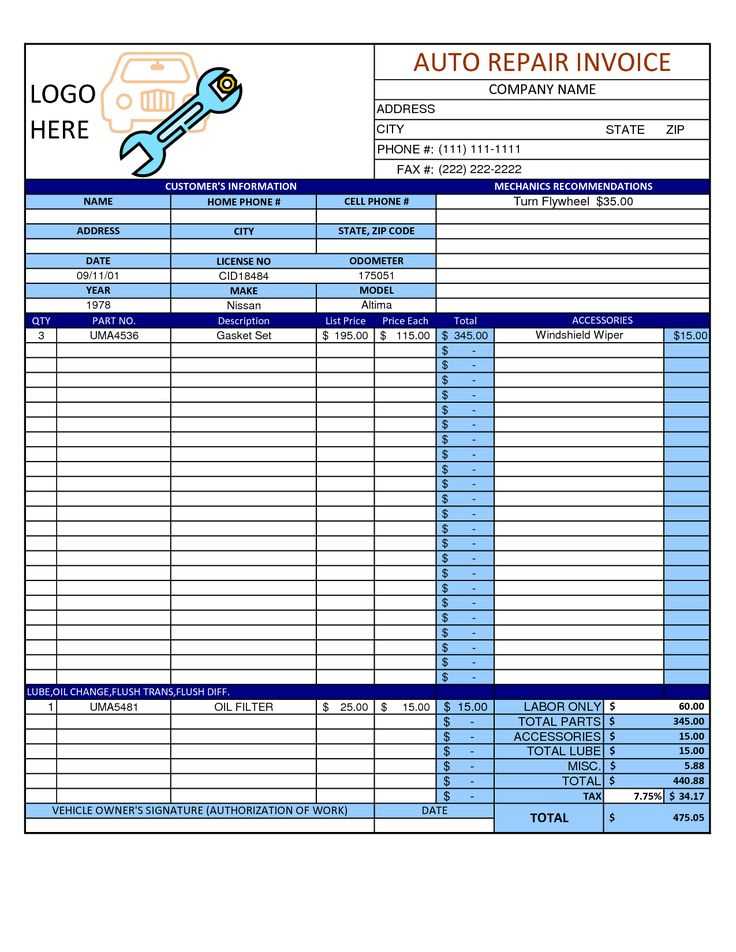

A high-quality document for transactions will include all the necessary fields to capture the most important details. These typically include:

- Business information: Your company name, address, phone number, and email for clear identification.

- Client details: The customer’s name, contact information, and address.

- Transaction number and date: A unique reference number and the date the transaction occurred for easy tracking.

- Description of goods/services: A clear list of services rendered or items provided with relevant quantities and pricing.

- Total amount due: A summary of the charges, including any applicable taxes or discounts.

Customization and Flexibility

One of the greatest advantages of using a structured document is the ability to customize it to fit your specific needs. You can add your business logo, modify the layout, and adjust the design to reflect your branding. Flexibility is also key in ensuring that the document suits different types of services or product sales, providing a versatile tool for various business scenarios.

These features not only help maintain organization but also enhance the professionalism of your business, providing a smooth, streamlined process for both you and your clients.

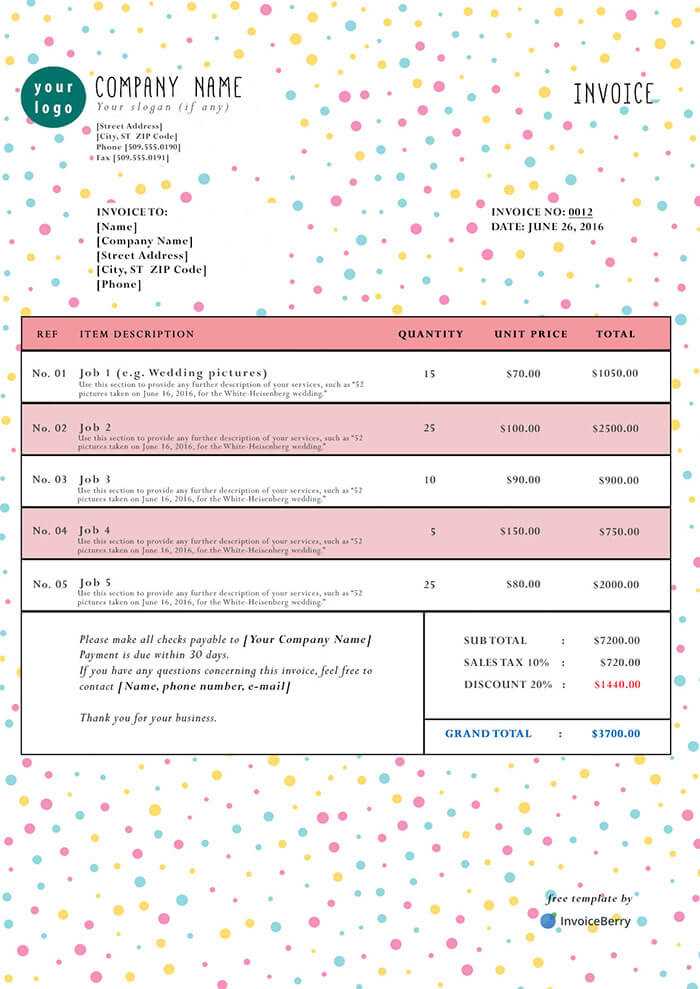

Customize Your Invoice with Ease

Personalizing your transaction records is an important step in ensuring that they reflect your business’s unique identity. A customizable document allows you to adjust every detail, from the layout and design to the specific fields and information included. This flexibility not only helps you match your branding but also ensures that the form meets the specific needs of your operations.

With user-friendly tools available, modifying your document has never been easier. Most ready-made solutions provide simple options to add logos, adjust color schemes, and even change fonts to match your brand’s look. You can also reorganize sections to emphasize the most important details, such as services rendered or payment terms, to ensure clarity for your clients.

Key areas to customize include:

- Business branding: Add your logo and adjust the color scheme to align with your company’s visual identity.

- Field arrangement: Rearrange sections to prioritize the most relevant information for your clients, such as service descriptions or total amounts.

- Payment terms: Tailor payment instructions to suit your preferred methods, due dates, or policies.

- Additional notes: Include custom fields for discounts, warranties, or terms specific to your business.

By customizing your documents, you can create a professional, branded experience for your clients while maintaining a clear and organized approach to tracking payments and services. This customization not only enhances your business’s image but also makes the process of managing financial records more efficient and aligned with your unique business model.

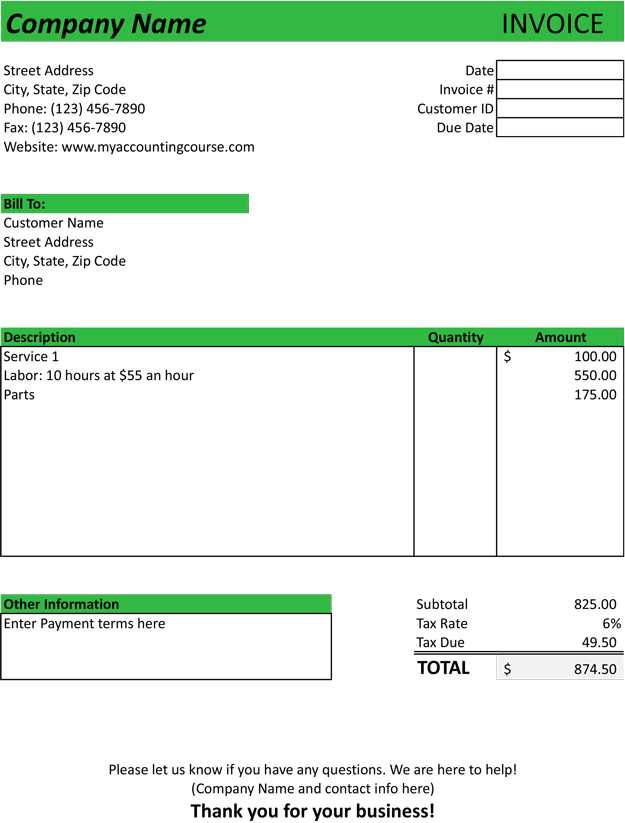

How to Download a Free Automotive Invoice

Downloading a ready-made document for your business transactions is a simple process that can save you time and effort. These downloadable resources are available from various online platforms, and they provide an excellent starting point for managing your billing needs. Whether you’re just starting out or looking to streamline your current process, downloading a pre-designed document ensures that you’re set up with a professional, organized format right away.

Steps to Download the Document

Follow these simple steps to quickly download a pre-made record for your business:

- Search for a reliable platform: Look for reputable websites that offer ready-to-use resources for business transactions. Be sure to choose a site that provides customizable and high-quality formats.

- Browse available options: Select a format that suits your business needs, whether it’s for service charges, product sales, or both. Most platforms will provide multiple designs to choose from.

- Choose the right document: Look for documents that match the style and structure you need, paying attention to the sections it includes (such as business info, customer details, payment terms, etc.).

- Download the file: Once you’ve selected your preferred option, click on the download button. Files are usually available in editable formats like Word, Excel, or PDF, which can be customized as needed.

- Customize the document: Open the file on your computer and modify it with your business details. Most templates allow you to easily replace text, adjust formatting, and add your logo.

Tips for Finding Quality Resources

While many websites offer downloadable resources, it’s important to choose ones that are designed for businesses like yours. Look for platforms that offer easy-to-edit formats and provide clear instructions for customization. Some resources also come with guides on how to use them effectively, which can be a huge help when you’re just getting started.

With just a few clicks, you can download a professional, ready-made document and start using it to streamline your business’s transaction processes right away.

Key Information to Include in Your Invoice

When preparing a document to record business transactions, it’s crucial to ensure that all the necessary details are included. A well-organized record not only helps maintain clarity but also ensures that both the service provider and the customer are on the same page regarding payment and services rendered. Including the right information can help avoid confusion and disputes while maintaining a professional image.

Essential Fields to Include

There are several key pieces of information that should always be present in a business document for transactions. These fields help clearly outline what was provided, the payment terms, and other essential details. Below is a table that highlights the key components you should include:

| Information | Description |

|---|---|

| Business Details | Your company’s name, address, phone number, and email for identification and easy contact. |

| Customer Information | Name, address, and contact details of the client to ensure clarity in identifying the recipient. |

| Transaction Number | A unique reference number for the document, making it easy to track and reference future communications. |

| Date | The date the transaction took place, helping establish timelines and payment schedules. |

| Service/Item Description | A breakdown of services provided or goods sold, with clear descriptions and quantities where applicable. |

| Total Amount Due | Clear and detailed calculation of the total charge, including any taxes, discounts, or additional fees. |

| Payment Terms | Information about how payment is to be made, including due date, payment methods, and any late fees or discounts. |

Additional Optional Details

In some cases, you may want to include additional information, such as:

- Terms and conditions: Specific clauses related to your services, warranties, or returns.

- Custom notes: Any personalized message for the client, such as “Thank you for your business” or special offers.

- Payment instructions: Clear guidance on how to make payments, whether through bank transfer, check, or online platforms.

By ensuring these critical details are included, you can maintain professional communication, ensure clarity, and build trust with your clients.

How Automotive Invoices Improve Billing Efficiency

Efficient billing is essential for any business, and using well-structured documents for transactions plays a key role in streamlining the entire process. By adopting standardized formats, businesses can reduce administrative work, improve accuracy, and speed up payment collection. With a well-organized structure, the time spent on creating, reviewing, and tracking records is minimized, allowing businesses to focus on what matters most.

One of the main advantages of using a pre-designed structure is its ability to reduce human error. With predefined fields and organized layouts, it’s easier to ensure that all necessary details are included, and it’s much less likely that important information will be overlooked or missed. This leads to clearer communications and fewer discrepancies that require follow-up.

Key Benefits of Using Structured Documents for Billing

- Time-saving: Ready-to-use forms allow you to quickly enter necessary details, eliminating the need to create documents from scratch. This saves valuable time for both you and your clients.

- Consistency: By using a standardized format, each record looks the same, making it easy to track and compare transactions. It also provides clients with a consistent experience, improving trust and professionalism.

- Improved accuracy: Pre-set fields and logical organization reduce the chances of making mistakes, ensuring that information such as prices, quantities, and totals are calculated correctly every time.

- Faster payment processing: Clear and accurate documents are easier for clients to understand, reducing delays in payment due to misunderstandings or missing details.

- Better organization: Structured forms make it easier to store and retrieve transaction records, helping to keep financial data organized and accessible when needed.

Additional Considerations

Besides improving efficiency, using a streamlined approach to document creation also enhances your business’s reputation. Clear and professional-looking records reflect well on your business, reinforcing the idea that you are organized and reliable. This can lead to quicker payments, fewer disputes, and stronger relationships with clients.

Ultimately, using pre-designed formats not only simplifies your billing process but also helps you maintain control over your financial operations, increasing overall productivity and ensuring that your business runs smoothly.

Common Mistakes to Avoid on Invoices

Creating accurate and professional documents for transactions is crucial for maintaining a smooth billing process. However, even the smallest errors can lead to confusion, delays in payments, and potential disputes. Understanding the most common mistakes made when preparing financial records can help you avoid these issues and ensure your documents are clear, complete, and reliable.

Common Errors to Watch Out For

There are several mistakes that are frequently made when creating billing records. Below is a table outlining these errors and tips on how to avoid them:

| Mistake | How to Avoid It |

|---|---|

| Missing Business Information | Ensure your company’s name, address, phone number, and email are clearly listed at the top of the document for easy identification. |

| Incorrect or Missing Client Details | Double-check that the customer’s name, address, and contact information are accurate and complete. |

| Unclear Service Descriptions | Provide detailed descriptions for each service or item, including quantities, model numbers, or any other important specifics. |

| Calculation Errors | Ensure that all calculations, including taxes, discounts, and totals, are correct. Consider using automated tools to reduce human error. |

| Missing or Vague Payment Terms | Clearly state the payment due date, acceptable methods, and any late fees or discounts for early payments. |

| Omitting a Unique Transaction Number | Assign a unique reference number to each transaction to make tracking and future reference easier for both parties. |

Additional Tips for Accuracy

- Proofread: Always review your document before sending it to ensure that all details are correct and there are no typos or formatting issues.

- Consistency: Use a consistent layout for all your records, which makes it easier for both you and your clients to read and understand the document.

- Clear Formatting: Organize the document logically, separating different sections (e.g., service details, payment terms, totals) for better readability.

By avoiding these common mistakes and following best practices, you can create professional, accurate documents that make the billing process smoother and faster, ultimately improving

Using an Automotive Invoice Template for Different Services

When offering a variety of services, it’s essential to have a flexible document that can be easily adapted to meet the needs of each transaction. Whether you’re providing maintenance, repairs, or selling products, a well-structured record can help you maintain professionalism and clarity. By using a customizable format, you can ensure that all essential details are included while making the document appropriate for the specific service rendered.

One of the main advantages of using a ready-made structure for your business transactions is its versatility. These documents can be easily tailored to different types of services, allowing you to modify descriptions, quantities, and pricing models without having to start from scratch each time. This not only saves time but also ensures consistency in how you communicate with your clients.

Adapting the Document for Different Services

Depending on the service provided, the content of your document may vary slightly. Below are some examples of how you can adjust the format to suit different types of transactions:

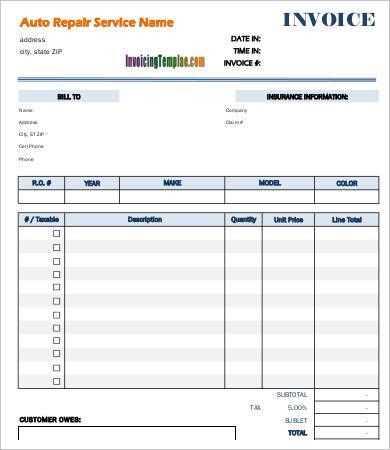

- Repair Services: For repair work, you can list the specific issues addressed, parts replaced, and labor charges. Providing clear details on each task helps the customer understand the work performed and the associated costs.

- Maintenance Services: For regular maintenance services, such as oil changes or tire rotations, you can include the type of service, the vehicle model, and the frequency of the service. Discounts or packages for repeat customers can also be added.

- Product Sales: When selling parts or accessories, the document should list each item sold, including product descriptions, serial numbers, and quantities. You can also include any warranties or return policies related to the sale.

- Consultations: If offering consultations or diagnostics, include the time spent on consultation, any advice given, and any follow-up actions or recommendations. You might also want to note any potential future services.

Customizing Key Sections for Each Service

Regardless of the service you are providing, certain sections of the document will need to be adjusted to match the specifics of each transaction. These may include:

- Service Descriptions: Always update the descriptions to reflect the particular work completed or products provided.

- Pricing Details: Adjust prices based on the type of service, parts used, or any discounts applicable to the customer or service type.

- Payment Terms: Specify any terms unique to the service, such as payment schedules for larger repairs or upfront deposits for parts.

By using a flexible document, you can maintain consistency across all your transactions while ensuring that the details reflect the nature of the work or products provided. This approach not only improves your billing process but also builds trust with your clients, as they can clearly see what they are paying for and why.

How to Stay Organized with Invoice Templates

Maintaining an organized system for your financial records is crucial for smooth business operations. Using pre-designed documents for your transactions not only helps you stay consistent but also ensures that every important detail is captured and easy to track. By organizing your records effectively, you can save time, reduce errors, and have a clear overview of your business’s financial status at any given moment.

One of the best ways to stay organized is to adopt a streamlined approach to how you create and store your transaction records. With an organized structure in place, you can easily manage the flow of payments, follow up on overdue bills, and keep accurate financial records. Below are a few key strategies for maintaining order in your billing system:

Strategies for Staying Organized

- Use a consistent format: By using the same structure for all your records, you can quickly spot any missing information or inconsistencies. This also makes it easier to compare different transactions and track trends over time.

- Keep digital copies: Storing all your records digitally helps you easily retrieve and manage them. Use cloud storage or dedicated financial software to securely save and organize your documents.

- Number your records: Assigning unique numbers to each document helps you track transactions chronologically. This system ensures you can easily locate any specific record when needed.

- Include due dates and payment status: Ensure each document includes a clear due date and payment status (paid, pending, overdue) so you can stay on top of collections and follow up with clients as necessary.

- Use categories for services: Organize documents by service type (e.g., maintenance, repair, sales) to easily manage different aspects of your business and retrieve relevant records when needed.

Additional Tips for Streamlined Billing

- Set up automatic reminders: For documents with overdue payments, automatic reminders can help you keep clients informed and encourage timely payments.

- Keep client information updated: Always ensure that client contact details and business information are accurate and up-to-date to avoid any miscommunications.

- Regularly review your records: Set a schedule to review your financial records periodically to ensure that everything is organized, up to date, and aligned with your accounting practices.

By staying organized with your billing system, you can improve efficiency, reduce stress, and ensure your business runs smoothly. Consistency in how you manage your documents leads to better communication with clients and provides a solid foundation for effective financial management.

How to Save Time on Invoicing

Managing billing efficiently is key to maintaining smooth operations in any business. The faster and more streamlined the process, the more time you can spend focusing on your core services and growing your business. By automating certain aspects of your billing workflow and using a standardized approach, you can reduce the time spent on creating, sending, and tracking records.

Saving time on transaction records doesn’t just mean working faster–it also involves reducing the chances of making mistakes, which can lead to time-consuming corrections. Below are some practical strategies for speeding up the billing process without sacrificing accuracy.

Effective Time-Saving Strategies

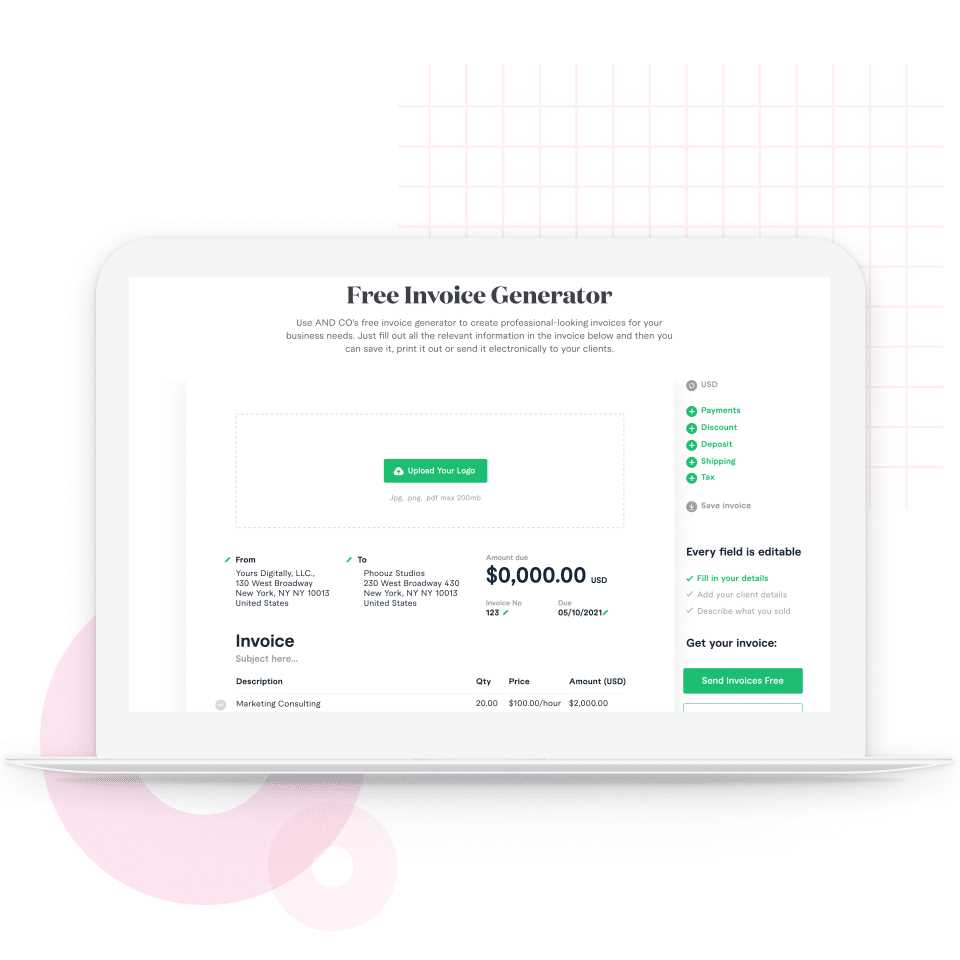

- Use Pre-designed Documents: By using a structured format, you can fill in the required information quickly without having to start from scratch each time. This minimizes the amount of time spent organizing each transaction.

- Automate Calculations: Many tools and software solutions can automatically calculate totals, taxes, and discounts. This reduces human error and speeds up the process of generating accurate records.

- Set Up Templates for Recurring Services: For clients with regular services, create a default version of your record that only requires minor updates, such as dates and specific service details. This can save you time when generating repeat transactions.

- Batch Processing: Rather than generating records one at a time, consider processing multiple transactions in bulk. This is particularly useful if you are working with several clients or jobs that share similar details.

- Utilize Digital Tools and Software: Use invoicing software or cloud-based tools that can automate and store records, manage payment status, and send reminders to clients automatically.

Additional Tips to Streamline the Process

- Use Pre-filled Client Information: Store client contact details in your software or system so you don’t have to re-enter them every time you generate a document. This saves time and reduces the chance of errors.

- Set Payment Terms in Advance: Define clear terms (such as due dates or discounts for early payments) with clients upfront, so they are included automatically in each transaction document.

- Track Payments Automatically: Use accounting software to automatically track and update payment statuses, so you can focus on other tasks without having to manually check whether payments have been made.

By applying these time-saving techniques, you can dramatically reduce the effort and time spent on billing tasks, allowing you to focus on providing high-quality services and growing your business. Efficient billing practices not only save time but also improve cash flow by ensuring payments are processed quickly and accurately.

Free Invoice Templates vs Paid Alternatives

When choosing the right tool for generating transaction records, businesses often face a decision between using free options or investing in premium solutions. Both free and paid options offer unique benefits, but they come with different levels of functionality, customization, and support. Understanding the differences between these two types of solutions can help you choose the one that best suits your business needs.

Free options often come with basic features that can get the job done, but they may lack advanced functionalities that are useful as your business grows. On the other hand, paid alternatives typically offer more robust features, higher customization, and professional support, making them ideal for businesses with complex needs. Below, we explore the pros and cons of both choices to help you make an informed decision.

Advantages of Free Options

- Cost-effective: Free solutions are an obvious choice for small businesses or startups with limited budgets. They provide the core features needed to generate basic transaction records without any upfront costs.

- Ease of use: Many free tools are simple and easy to use, making them ideal for businesses with straightforward billing processes.

- Accessibility: Free tools are often available online and don’t require installation or subscriptions, making them easy to access from any device with an internet connection.

- Quick setup: Free options typically require minimal setup, allowing you to start generating documents almost immediately.

Benefits of Paid Alternatives

- Advanced features: Paid solutions often come with enhanced functionality, such as automated calculations, recurring billing, integrated payment gateways, and multi-currency support, making them ideal for businesses with complex needs.

- Customization: Premium options provide greater flexibility to customize documents to reflect your brand’s identity, including logos, fonts, colors, and personalized fields.

- Professional support: Paid alternatives typically offer customer service and technical support, ensuring that any issues or questions can be addressed promptly.

- Integration with accounting systems: Many premium tools integrate seamlessly with accounting and financial management software, streamlining your entire workflow and reducing the risk of errors.

While free solutions can be an excellent starting point, investing in a paid alternative may offer more long-term benefits, especially as your business grows and requires more advanced features. If your needs are simple and you don’t require specialized functionality, a free solution may be all you need. However, for businesses with more complex billing processes or those looking for customization, paid options provide added value through features and support.

Best Software for Customizing Automotive Invoices

Choosing the right software to customize your transaction records can significantly enhance your billing process. With the right tools, you can streamline your workflows, ensure consistency, and create professional documents tailored to your business needs. Whether you’re looking to add logos, adjust layouts, or automate calculations, the right software solution can save you time and improve accuracy.

There are various software options available for customizing your records, each offering different features. Some provide simple customization tools, while others offer comprehensive solutions that integrate with accounting software and payment platforms. Below, we explore some of the best software options to help you customize your records efficiently and effectively.

Top Software for Customizing Your Documents

- QuickBooks: A popular accounting software that offers customizable templates for transaction records. QuickBooks allows you to personalize your documents with your company’s logo, select different fonts, and adjust layouts. It also integrates seamlessly with accounting functions to track payments, taxes, and expenses.

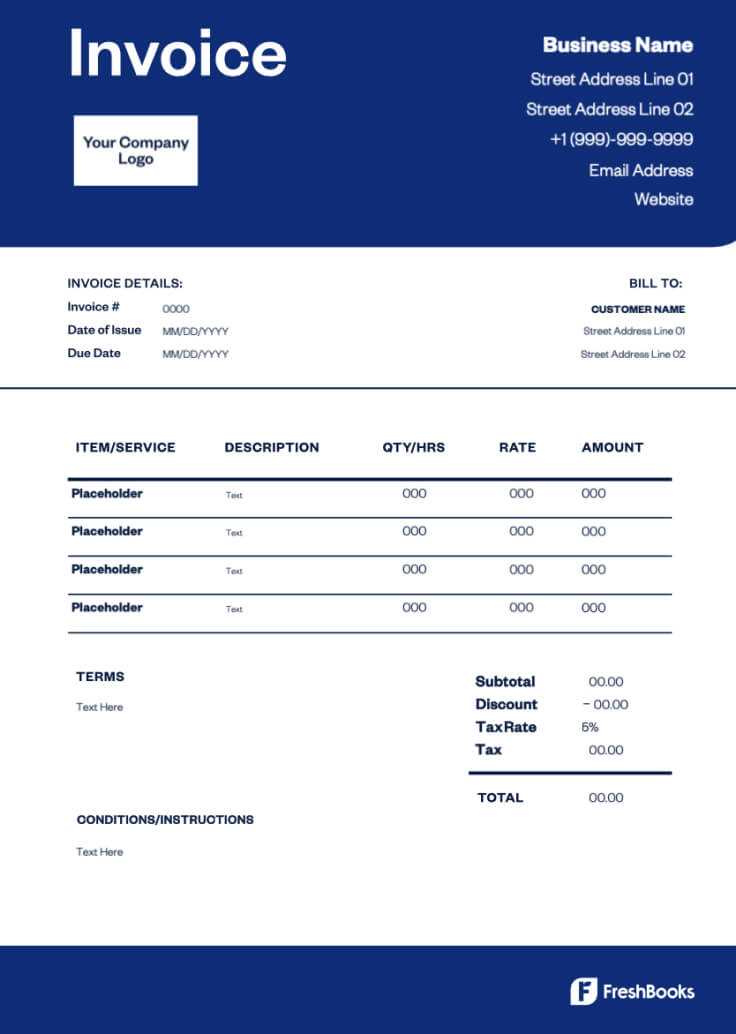

- FreshBooks: Known for its user-friendly interface, FreshBooks allows you to create fully branded documents with ease. You can add custom fields, set up recurring payments, and track time and expenses. It also integrates well with banking systems to streamline your payment process.

- Zoho Books: A comprehensive accounting solution that offers detailed customization options for documents. With Zoho Books, you can modify templates, set payment terms, and create detailed records that meet your specific needs. It also provides in-depth reporting and automatic reminders for overdue payments.

- Invoicely: This online platform allows users to create fully customizable documents with a variety of professional designs. It offers features like recurring billing, multiple currency support, and payment tracking, making it ideal for businesses with international clients.

- Wave: A free, yet powerful solution for small businesses, Wave allows you to customize your records easily. You can personalize your documents with logos, colors, and fonts, and the platform also provides payment processing and financial tracking features.

Choosing the Right Software for Your Needs

- Ease of Use: Look for software that is intuitive and easy to navigate, especially if you’re not tech-savvy. Most of the tools listed above have user-friendly interfaces with drag-and-drop features for quick customization.

- Integration: Consider software that integrates with other business tools, such as accounting software, payment processors, and customer management systems. This will help you keep everything connected and ensure that your financial data is always up to date.

- Scalability: As your business grows, you’ll need a solution that can handle more complex tasks. Choose software that can scale with your business, whether it’s handling more transactions or offering additional features as your needs change.

By selecting the right software, you