Download Automotive Invoice Template in Excel for Easy Billing

Managing financial records for your vehicle-related business can be time-consuming and error-prone without the right tools. Whether you’re in car sales, repair services, or fleet management, having a structured method for generating documents is crucial for maintaining professionalism and accuracy. By utilizing an efficient document layout, you can ensure smooth transactions and keep your operations running smoothly.

Creating well-organized payment records doesn’t have to be complicated. With the right format, you can easily track transactions, customize fields to suit your needs, and automate many aspects of your billing system. This approach not only saves you valuable time but also reduces the risk of mistakes that could affect your cash flow.

In this guide, we will explore how a simple, customizable system can help you meet your billing needs. By integrating it into your daily workflow, you’ll experience increased efficiency and clarity, which are essential for the success of any business that deals with vehicles.

Automotive Invoice Template Benefits

Utilizing a structured billing system brings numerous advantages for businesses in the vehicle industry. The main goal is to simplify financial processes while ensuring accuracy and consistency. A well-designed document format offers several key benefits, making it an essential tool for businesses that deal with vehicle sales, repairs, or services.

- Time Efficiency: Pre-designed formats allow you to quickly fill in necessary details, eliminating the need for manual creation of each document from scratch. This streamlines the billing process, saving valuable time.

- Customization: These formats are easily adjustable to fit the unique needs of your business, whether you are managing car repairs, parts sales, or full vehicle transactions. You can add fields for labor costs, parts used, and service details as needed.

- Accuracy: A standardized layout helps reduce human error by providing a consistent structure for recording and calculating costs. Automatic calculations for taxes and totals ensure that every document is error-free.

- Professional Appearance: With a polished, clear design, your documents look more professional, which can improve client trust and enhance the reputation of your business.

- Easy Tracking: Organized records make it easier to track payments, outstanding balances, and transaction histories, improving your ability to manage finances effectively.

These benefits make a structured approach to billing an invaluable asset, enabling businesses to focus more on their core services while maintaining accurate and timely financial documentation.

Why Use Excel for Invoicing

Choosing the right tool for generating payment documents is essential for any business. When it comes to creating detailed and accurate billing records, a widely accessible and flexible software program offers a variety of advantages. One of the most popular options is a spreadsheet application, which provides powerful features to streamline the process and maintain consistency across all transactions.

Flexibility and Customization

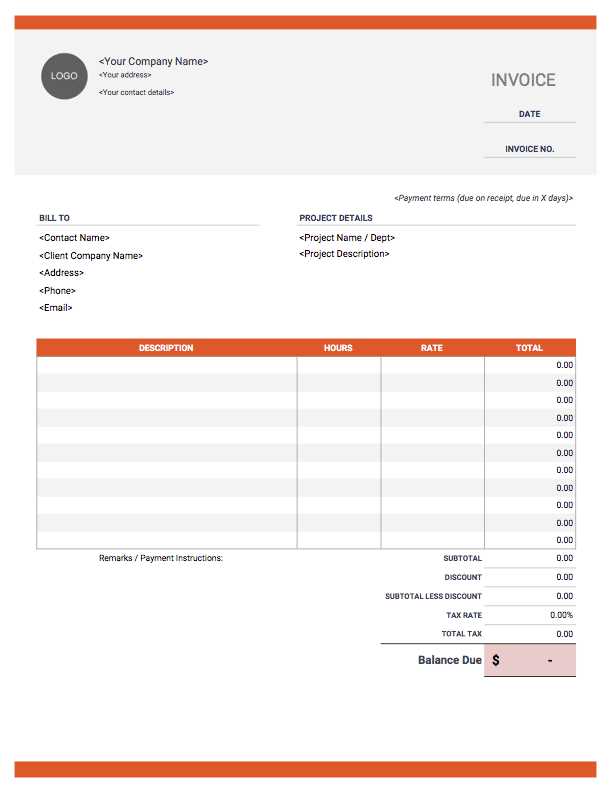

With a spreadsheet program, you can fully customize your document to match your specific needs. This flexibility allows you to adjust the layout, add new fields, and modify formulas, making it easy to tailor the system as your business evolves. Whether you’re selling vehicles, providing services, or managing a fleet, these customizable features ensure that the document fits your unique requirements.

- Customizable Layout: Easily design your record structure by adjusting columns and rows to accommodate different types of information such as labor costs, part numbers, and service descriptions.

- Predefined Formulas: Automatically calculate totals, taxes, and discounts with built-in formulas, ensuring that the numbers are always accurate.

Cost-Effectiveness and Accessibility

Another significant benefit of using spreadsheet software is its affordability. Most businesses already have access to this program, making it a cost-effective solution without the need for additional investments in specialized billing software. Additionally, the software is accessible across multiple devices, allowing you to create and manage your records on the go.

- Low-Cost Solution: Since many people already use spreadsheet software for daily tasks, there are no additional costs for acquiring specialized billing systems.

- Easy Accessibility: You can access and update your documents from any device, ensuring you stay on top of billing even when away from the office.

Using a spreadsheet application for generating billing documents is a smart choice for businesses looking for a flexible, customizable, and cost-effective solution. It simplifies the process of tracking financial data, ensuring efficiency and accuracy in your business operations.

How to Create an Invoice in Excel

Creating a detailed billing document in a spreadsheet application is a straightforward process that can save time and reduce errors. By following a few simple steps, you can produce professional, accurate payment records for your business. This method is both customizable and easy to update, allowing you to adjust it based on the needs of each transaction.

Step 1: Set Up the Document Structure

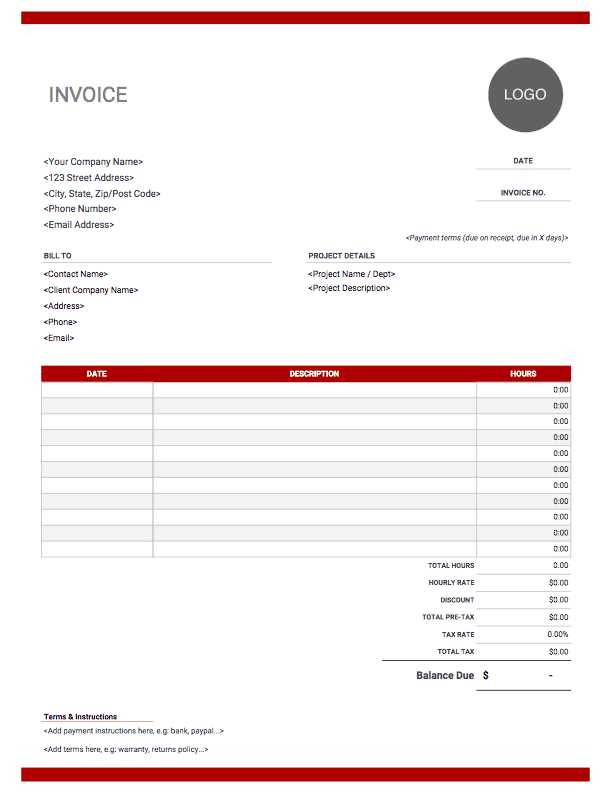

Start by opening a new worksheet and setting up the basic structure of the document. This includes deciding which information you need to include, such as business name, client details, itemized services or products, and payment terms. Organize the data into columns to ensure everything is clear and easy to read.

- Header Section: Add your business name, logo (optional), and contact information at the top of the document.

- Client Information: Include the name, address, and contact details of the customer you’re billing.

- Details Section: List all products or services provided, along with quantities, unit prices, and total amounts.

Step 2: Add Calculation Formulas

Once the layout is in place, it’s time to automate calculations. Adding basic formulas for totals, taxes, and discounts ensures accuracy and saves time. For example, you can create a formula that automatically sums up the total cost of each item and calculates the final amount after taxes are applied.

- Subtotal Formula: Use the SUM function to calculate the total before taxes.

- Tax Calculation: Add a formula to apply a tax rate to the subtotal (e.g., =Subtotal*TaxRate).

- Final Total: Add a final row that sums the subtotal and tax to give the total amount due.

By following these simple steps, you can create a professional and functional billing document that meets your business needs and helps you maintain accurate financial records.

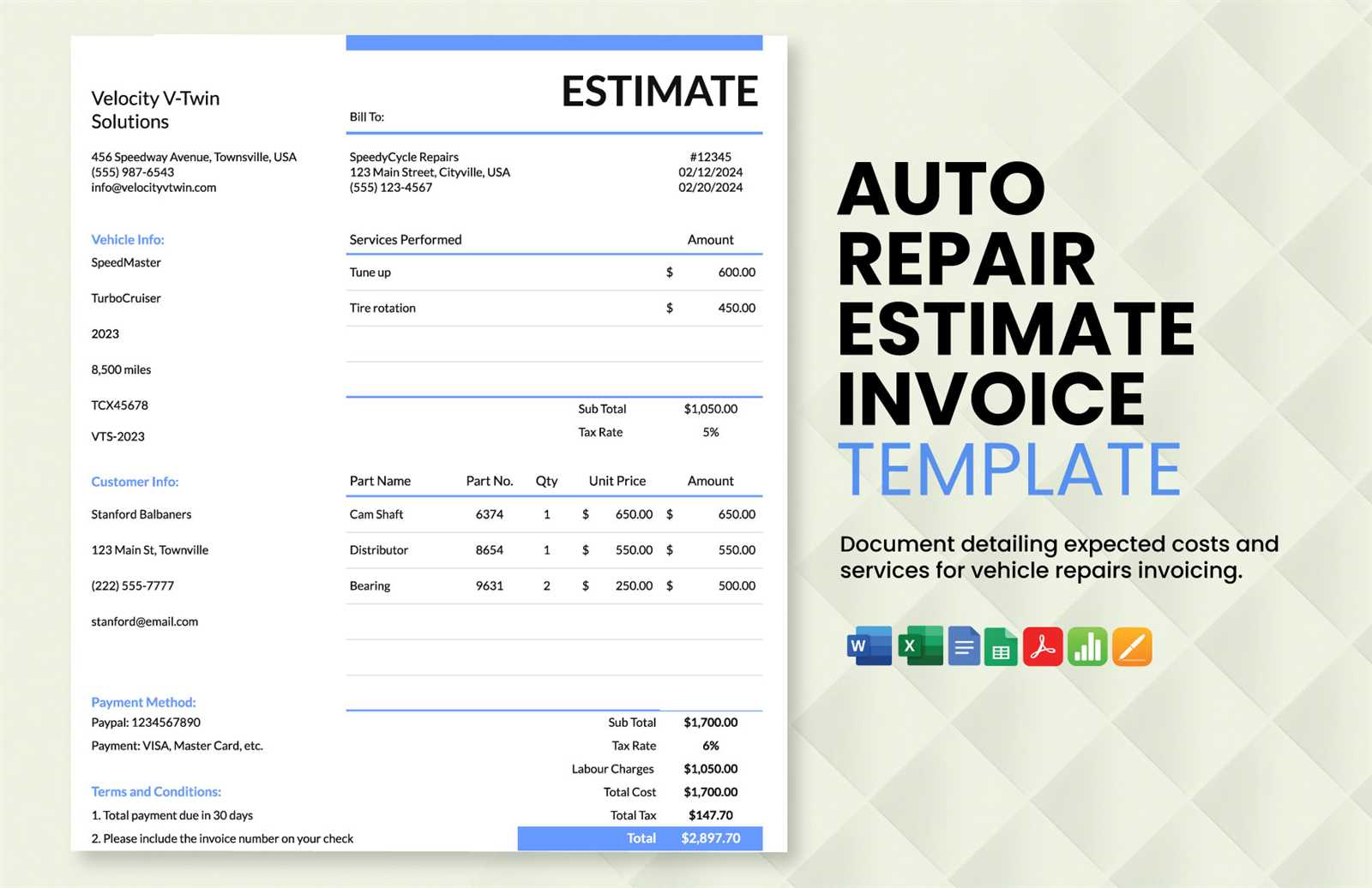

Key Features of an Automotive Invoice

A well-structured billing document serves as a vital tool for businesses that deal with vehicles and related services. The right design ensures that both the seller and the buyer have a clear understanding of the charges, terms, and transaction details. Essential elements must be included to provide clarity, maintain professionalism, and streamline the payment process.

Essential Information for Accurate Billing

The first step in creating a functional billing document is to include all relevant details for both parties. This information ensures that there are no misunderstandings about the transaction and that all charges are clearly laid out. Important sections include:

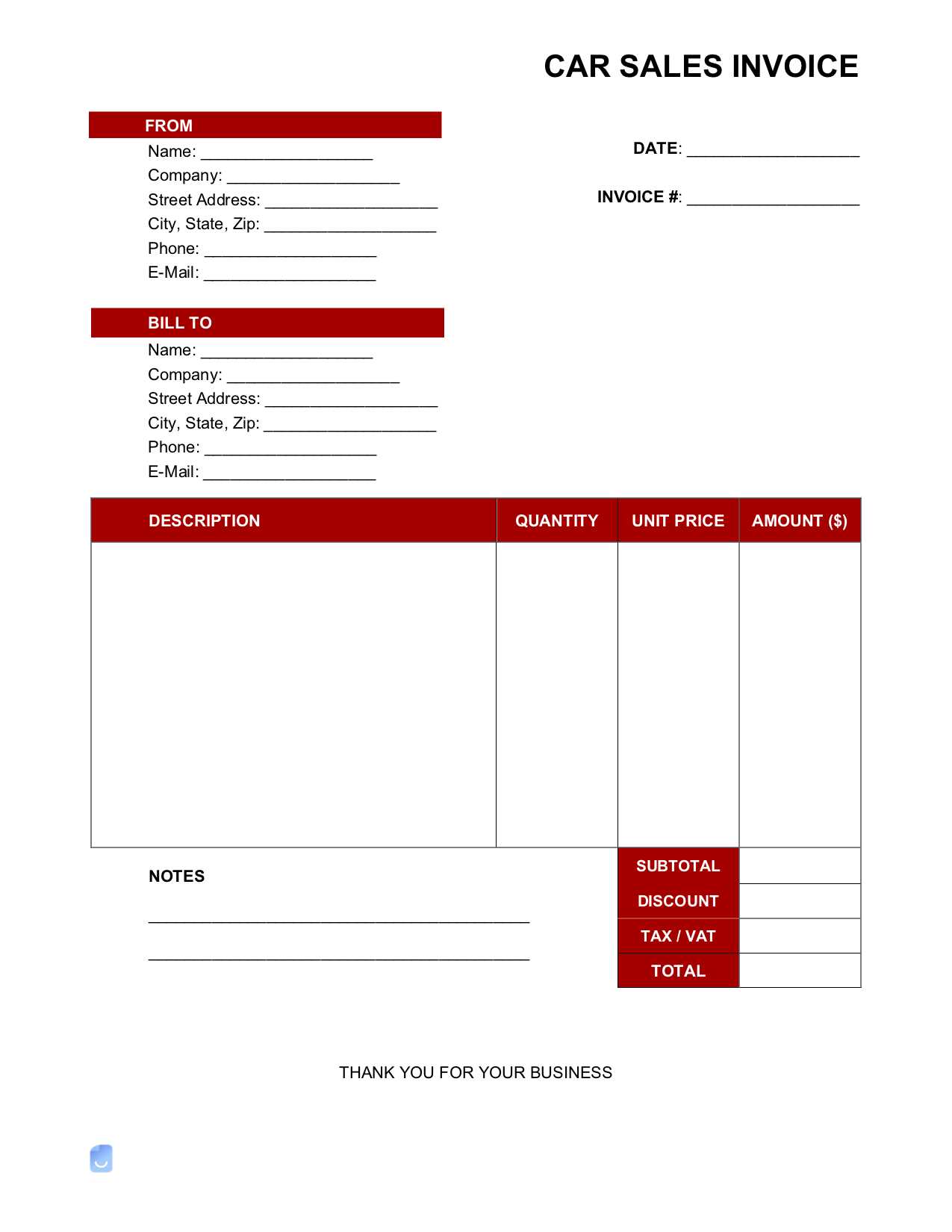

- Business Details: Your company name, address, and contact information should be prominently displayed at the top.

- Client Information: Include the customer’s name, address, and phone number to ensure the document is clearly linked to the correct transaction.

- Unique Reference Number: Assign a unique identifier to each record to help with future reference and organization.

- Issue Date and Due Date: Clearly specify when the document was created and when the payment is due to avoid confusion.

Clear Breakdown of Charges

One of the most important features is providing a detailed breakdown of all services, parts, and additional costs. This section ensures that clients can easily verify the charges and understand what they are paying for. It also helps with tracking expenses and managing inventory.

- Itemized List: Each service or product should be listed individually with its respective cost, allowing transparency in pricing.

- Quantity and Unit Price: For products or services that are sold in units, specify the quantity and unit price to clearly calculate the total cost.

- Taxes and Additional Fees: Include any applicable taxes, surcharges, or additional fees clearly, so the customer understands the full amount due.

By incorporating these key elements into your billing documents, you ensure that transactions are processed smoothly, efficiently, and professionally, fostering trust with your customers and improving overall business operations.

Customizing Your Invoice Template

Customizing a billing document is crucial for businesses that want to maintain a professional appearance and cater to specific needs. By adjusting the layout, fields, and design, you can ensure that each record reflects the unique aspects of your services and aligns with your brand. This customization process can also help streamline your workflow, making it easier to create and process transactions efficiently.

Adjusting Layout and Design

One of the first steps in personalizing your billing document is modifying its layout. This involves choosing the right structure to present key information clearly and professionally. Depending on the type of business, you might want to emphasize certain sections more than others, such as service descriptions, payment terms, or totals. Consider the following elements:

- Header Design: Include your company logo, contact details, and any other branding elements that reflect your business identity.

- Column Arrangement: Adjust the placement of data fields like item descriptions, quantities, and prices to ensure the document is easy to read.

- Fonts and Colors: Use consistent fonts and colors that match your business’s branding while ensuring readability.

Adding Specific Fields for Your Business

Customizing your document also means adding or removing fields based on what your business needs to track. Whether you need to add a section for special discounts, labor costs, or a warranty period, you can modify the layout to reflect these specific details. This can be especially useful for businesses offering varied services or products.

- Service Descriptions: Include detailed fields for describing each service or product to ensure clarity for the customer.

- Discounts and Promotions: Add customizable fields for any discounts or promotions applied to the transaction.

- Payment Terms: Clearly define payment terms, such as deposit requirements, late fees, or installment options, in easily visible sections.

By tailoring your billing document, you can ensure it suits your business’s needs, increases efficiency, and leaves a lasting professional impression with your clients.

Saving Time with Excel Templates

Efficient billing is essential for any business, and using a structured format can significantly speed up the process. By implementing a predefined document layout, you can reduce the time spent on creating records from scratch. This allows you to focus on other important aspects of your business while ensuring that each transaction is accurate and professional.

Automating Calculations and Reducing Errors

One of the main advantages of using a digital document format is the ability to automate calculations. By setting up formulas for totals, taxes, and other variables, you can instantly generate accurate results without needing to manually calculate each item. This not only saves time but also eliminates the risk of human error.

| Task | Manual Process | Automated Process |

|---|---|---|

| Total Calculation | Manually adding up each item | Automatic sum of amounts with one formula |

| Tax Calculation | Calculating tax for each item individually | Tax automatically calculated based on percentage |

| Discounts | Calculating discounts manually | Instant discount application based on preset criteria |

Speeding Up Data Entry

Another time-saving feature is the ability to quickly input and update data. Predefined fields allow you to simply fill in the necessary information without having to reformat or adjust the document each time. This makes the process faster, especially when handling multiple transactions at once.

- Pre-filled Fields: Use placeholders for customer names, item descriptions, and prices to streamline data entry.

- Auto-populating Dates: Set up fields that automatically input the current date or due dates, saving time on manual entries.

- Duplicate Entries: For repeat customers or services, duplicate existing records with one click, eliminating the need to start from scratch.

By implementing these time-saving features, you can significantly speed up the billing process and ensure greater consistency and accuracy in your business operations.

Tracking Payments in Automotive Invoices

Keeping track of payments is a vital part of managing finances for any business. Properly recording and monitoring incoming payments ensures that you can manage cash flow, prevent overdue balances, and maintain healthy customer relationships. A well-organized document can help you stay on top of transactions and provide clarity on which payments have been made and which are still outstanding.

By setting up a system to track payments directly within your billing documents, you can easily mark the status of each transaction and quickly identify any issues related to unpaid amounts. Below are some key features that help with payment tracking.

| Field | Description |

|---|---|

| Payment Status | Include a column to indicate whether the payment is “Paid”, “Pending”, or “Overdue”. This helps you track the current status of each transaction at a glance. |

| Payment Date | Record the date when the payment was received, which is useful for both accounting and for tracking overdue balances. |

| Amount Received | Include a field that shows how much has been paid so far. This helps in cases where the total amount is paid in installments. |

| Outstanding Balance | Automatically calculate the remaining balance by subtracting the received payment from the total amount due. This helps you keep track of what is left to pay. |

By setting up these key fields and utilizing automated calculations, you can maintain an up-to-date overview of your payment status, minimizing the risk of missed or delayed payments.

In addition, you can integrate reminders or alerts for overdue payments. This allows you to take prompt action, whether it’s sending a reminder email to a customer or following up with a phone call. With everything organized in one place, you’ll be able to monitor your financial status effortlessly.

Essential Fields for Car Service Invoices

When it comes to billing for vehicle maintenance or repair services, having the right information on your records is crucial for clarity and professionalism. A detailed, well-organized document not only helps customers understand what they are being charged for, but it also ensures that all necessary financial details are properly tracked. To streamline the process and avoid confusion, certain fields should be included in every service document.

Below are some essential fields that should be included to ensure that your billing records are complete, transparent, and easy to follow:

| Field | Description |

|---|---|

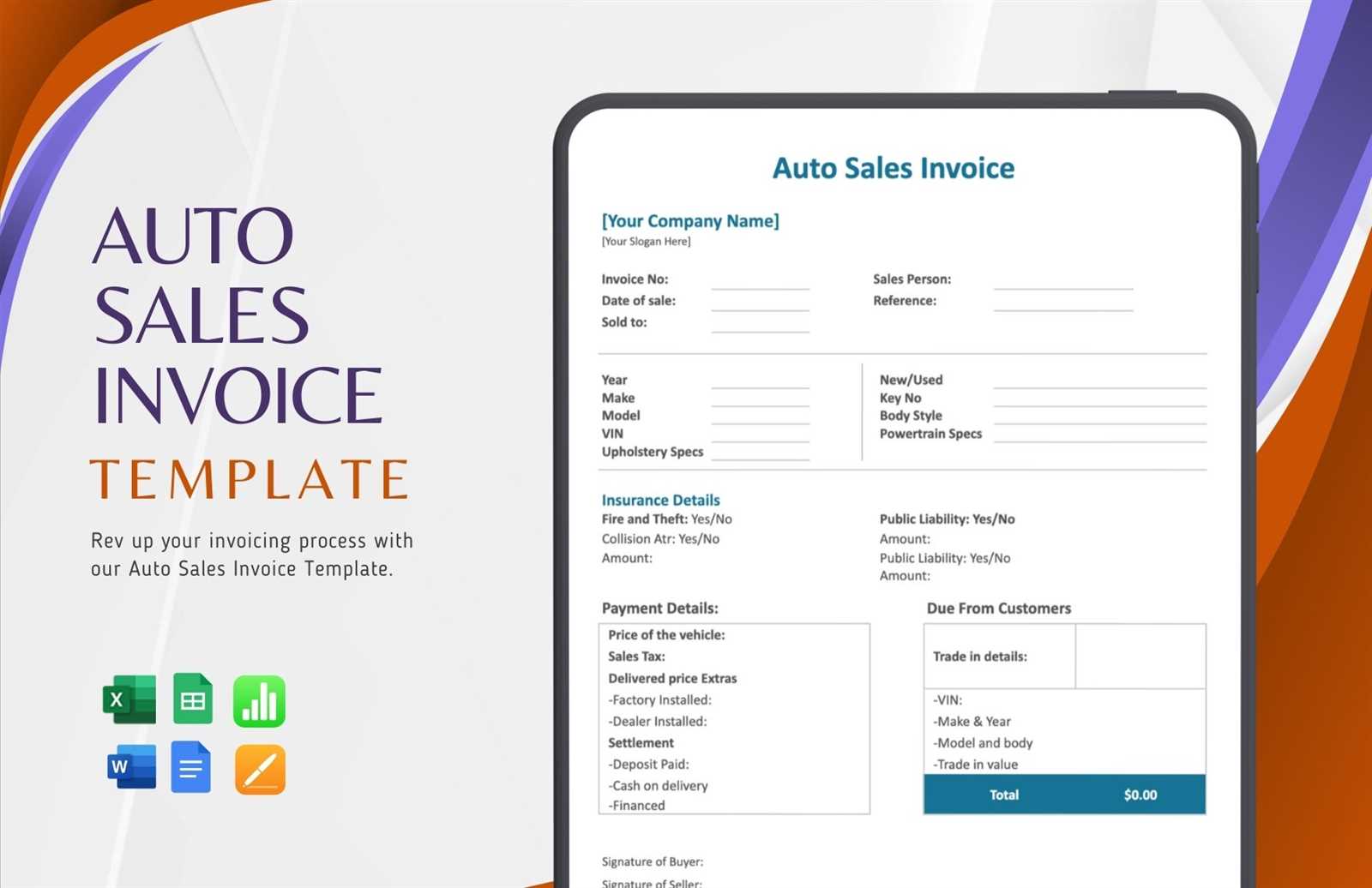

| Service Date | Record the date when the service was completed, as it helps both you and your client reference the specific transaction. |

| Client Information | Include the name, contact details, and vehicle information (e.g., model, license plate) to ensure that the service is accurately linked to the correct customer. |

| Service Description | Provide a clear, itemized list of the work performed, including details such as labor, parts replaced, and any additional services offered. |

| Labor Costs | Break down labor charges by time spent or hourly rates, so the customer can easily understand what they are being charged for in terms of work. |

| Parts Costs | Detail the parts used in the service, including the name, part number, quantity, and price of each part. |

| Total Amount Due | Provide the total amount due after adding the labor and parts costs, along with any taxes or additional fees. |

By ensuring that these fields are included in every service record, you make the billing process transparent and easy to follow for both you and your clients. This also reduces the likelihood of disputes and helps keep track of payments,

Using Excel for Accurate Billing

Accurate billing is critical for maintaining healthy cash flow and professional relationships with clients. Utilizing a digital tool to generate and manage financial records offers the precision needed to ensure every transaction is tracked properly. The ability to use built-in functions and formulas not only simplifies calculations but also minimizes the risk of human error, resulting in more reliable and consistent billing practices.

One of the main advantages of using a spreadsheet application for financial documentation is its ability to automate calculations. With automatic summation of costs, tax applications, and adjustments for discounts or additional fees, you can be confident that all figures are accurate each time. This reduces the time spent on manual calculations and ensures that your records are up-to-date without mistakes.

Key Benefits for Accurate Billing:

- Automatic Calculations: Use formulas to instantly calculate totals, taxes, and discounts based on predefined rates, ensuring every calculation is accurate.

- Instant Updates: Changes made to any part of the record, such as adding services or products, are automatically reflected throughout the entire document.

- Data Consistency: Standardized layouts and formulas reduce the likelihood of inconsistent entries, providing uniformity across all records.

- Error Reduction: Built-in checks and formulas reduce the risk of mistakes in calculations and data entry.

By leveraging these features, you can ensure that your billing process remains efficient and free of errors, ultimately saving time and enhancing the accuracy of your financial documentation.

How to Avoid Common Invoice Errors

Billing errors can lead to confusion, delayed payments, and even strained client relationships. Whether it’s a simple mistake in the calculation or an overlooked detail, these errors can create unnecessary complications. By understanding the most common mistakes and taking proactive steps to prevent them, you can ensure that your financial records are accurate and professional, improving both your efficiency and your reputation.

Here are some common errors that businesses often encounter and how to avoid them:

- Incorrect Calculations: One of the most common mistakes is miscalculating totals, taxes, or discounts. Always use automated formulas or double-check numbers manually to avoid this error.

- Missing Payment Terms: Failing to clearly state the payment terms–such as due dates, late fees, or installment options–can create confusion. Make sure to clearly outline these terms at the beginning or end of your record.

- Unclear Descriptions: Vague or insufficient descriptions of services or products can leave customers confused about what they are being charged for. Be specific and clear about the details of each service or product.

- Omitting Client Information: Missing client details such as names, addresses, or contact information can cause confusion or delays in payments. Always ensure that your client’s details are accurate and up-to-date.

- Wrong Dates: Using incorrect issue or due dates can lead to misunderstandings or delays. Always verify dates before finalizing the document.

Pro Tip: Before sending out any record, review it carefully to ensure that all fields are complete and accurate. It can also help to use a checklist to verify that all key information is included, such as the correct amounts, dates, and customer details.

By being aware of these common pitfalls and taking simple precautions, you can significantly reduce the risk of errors and ensure that your records are both accurate and professional, ultimately making the payment process smoother for everyone involved.

Automotive Invoice Template for Small Businesses

For small businesses, maintaining organized and accurate financial records is essential for smooth operations and effective cash flow management. Using a structured document to record transactions not only helps ensure clarity but also builds professionalism with clients. A well-designed record format can simplify billing processes, reduce errors, and save time when managing multiple transactions.

For businesses in the vehicle repair or service industry, having a specialized layout that addresses their unique needs is crucial. By incorporating fields specific to the type of services offered, such as parts, labor, and vehicle information, small business owners can ensure they track all relevant details while keeping records simple and easy to understand.

Key Benefits for Small Businesses:

- Professional Appearance: A clean, well-organized document enhances your company’s image and builds trust with clients.

- Easy Data Entry: With predefined fields and formulas, entering customer and service details becomes quick and efficient.

- Tracking and Reporting: By maintaining accurate records, small businesses can easily monitor outstanding payments and financial performance.

- Cost-Effective: Using a digital document format eliminates the need for expensive software, allowing businesses to generate detailed records without additional costs.

For small businesses, streamlining the billing process with a tailored format helps reduce the administrative burden, freeing up time to focus on service quality and customer relationships. By using the right structure, small businesses can ensure that their transactions are well-documented, reducing the chance of errors and providing a solid foundation for future growth.

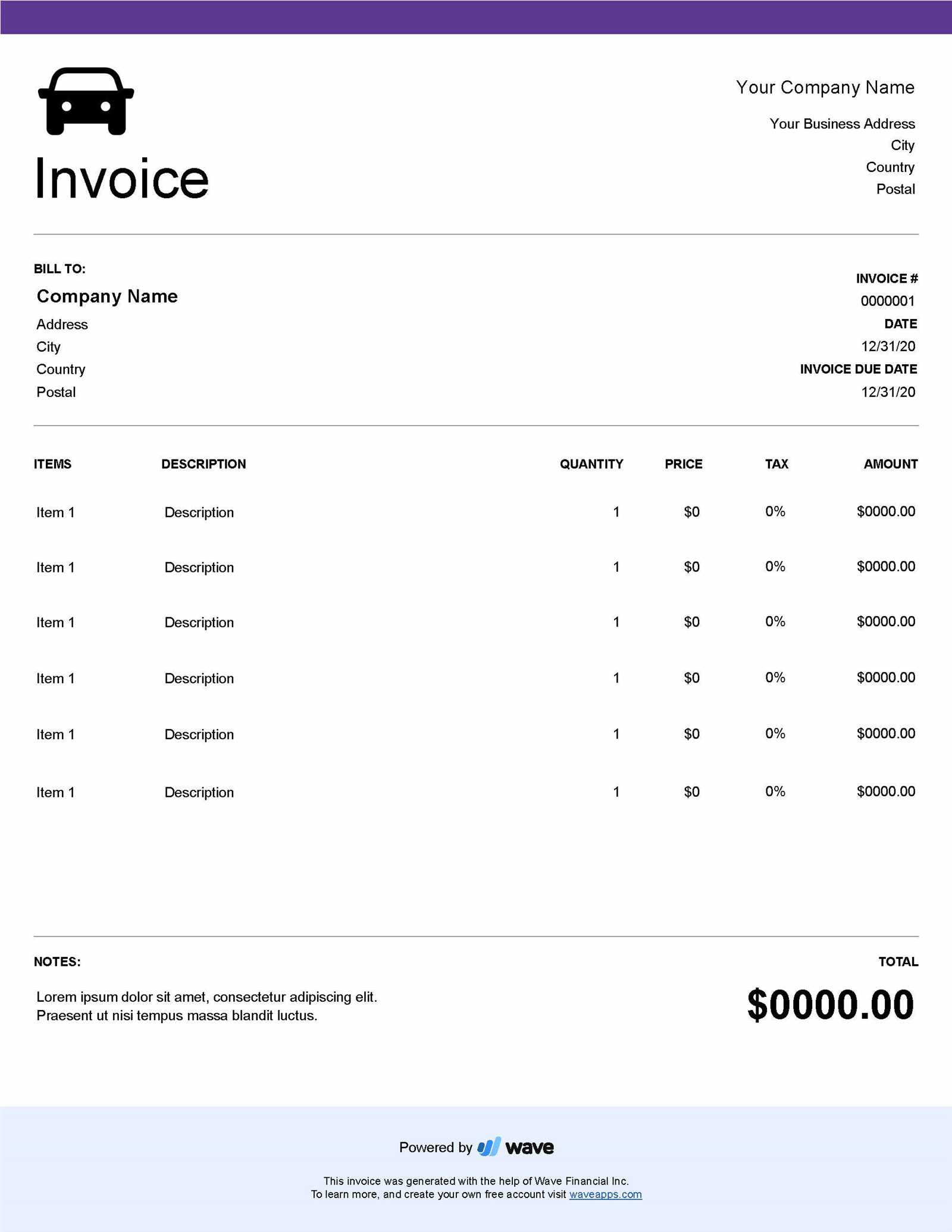

Designing a Professional Invoice Layout

A well-designed billing document is more than just a way to request payment; it serves as a reflection of your business’s professionalism and attention to detail. A clean and organized layout ensures that clients can easily understand the charges, payment terms, and any other important details. Whether you are offering products or services, creating a visually appealing and functional document is key to maintaining trust and clarity in business transactions.

When designing your document, it’s important to focus on several key elements to ensure that all the necessary information is clearly presented. A well-structured layout not only makes it easier for customers to read, but it also enhances your overall business image. Below are some essential design tips for creating a professional layout:

Key Elements of a Professional Layout

- Header Section: Include your company’s logo, contact details, and any other identifying information, such as business registration numbers or tax IDs. This establishes your brand’s identity right from the start.

- Itemized List: Make sure to list services or products clearly, providing descriptions, quantities, unit prices, and total amounts. This transparency helps prevent misunderstandings.

- Payment Terms: Clearly state the due date, payment methods, and any additional fees or discounts to avoid confusion later.

- Footer Section: Include additional contact information or thank-you notes. A simple “Thank you for your business” can make the document more personal and professional.

Example Layout

| Section | Content Example | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Header | Company logo, business name, address, contact number, and email. | ||||||||||||

| Customer Details | Client name, address, contact details, and reference number. | ||||||||||||

| Service/Product List | Description of service or item, quantity, unit price, total amount. | ||||||||||||

| Payment Terms | Due date, payment met

Best Practices for Invoice CreationCreating a clear, professional billing document is an essential part of maintaining strong relationships with clients and ensuring smooth financial operations. A well-crafted record can make the payment process straightforward, reduce errors, and improve communication. By following best practices, you can create effective, reliable documents that reflect your business’s professionalism and help ensure timely payments. Here are some best practices to consider when preparing your financial documents:

By following these best practices, you can create effective financial documents that not only help streamline your operations but also enhance client satisfaction. A simple, organized approach to billing will save time, reduce confusion, and ultimately ensure that your business runs smoothly and efficiently. Automating Invoice Updates in ExcelKeeping financial records up-to-date and accurate can be a time-consuming task, especially when dealing with numerous transactions. However, automating the update process can significantly reduce manual effort, minimize errors, and improve efficiency. By utilizing built-in features and formulas, you can ensure that your records are always current, making the task of managing client accounts much easier. Automating updates involves setting up formulas and functions to calculate totals, taxes, and other important information based on the data entered. This reduces the need to manually update values and ensures consistency across your financial documents. Below are some ways to automate updates and improve the efficiency of your records: Key Automation Features to Use

Benefits of Automating Updates

By setting up au Choosing the Right Template for Your BusinessSelecting the appropriate structure for your billing documents is crucial for ensuring smooth operations and clear communication with clients. The right layout should match the needs of your business, offering functionality, ease of use, and the flexibility to accommodate various services or products. A well-chosen format will help streamline your administrative tasks and ensure that all necessary information is included in each transaction. When choosing a document format for your business, consider the specific requirements of your industry, the types of transactions you typically process, and how much customization you need. It’s important to have a structure that allows you to present relevant details clearly while also maintaining a professional appearance. Factors to Consider When Selecting a Format

Example of Key Features in a Business Layout

|