Free Auto Service Invoice Template for Easy Billing

Managing payments and keeping accurate records is a crucial part of running any business. When it comes to repairs and maintenance, providing clients with clear and professional documentation is essential for both customer satisfaction and financial tracking. With the right tools, this process becomes much easier and more organized.

There are numerous resources available to help streamline this task, making it quicker and more efficient. By using ready-made documents designed specifically for this purpose, you can ensure that all essential information is included and formatted correctly. These ready-to-use forms can be tailored to fit your specific needs, whether you work with individual clients or manage large volumes of transactions.

By adopting a structured approach to financial paperwork, you reduce the risk of errors, improve client relations, and speed up payment processes. This simple yet effective method of billing offers a practical solution for any business looking to stay organized and professional.

Why Use an Auto Service Invoice Template

Using structured documents to manage transactions and payments is essential for maintaining order and clarity in any business. Instead of creating each record from scratch, relying on pre-designed forms can help save time, reduce errors, and improve professionalism. With a well-organized form, you ensure that all the necessary details are captured consistently and clearly, which benefits both you and your clients.

Here are some key reasons why adopting ready-made billing documents is a smart choice:

- Time-saving: Ready-to-use forms speed up the process of generating financial documents, so you can focus more on your work and less on paperwork.

- Consistency: Standardized formats ensure that every record follows the same structure, reducing the risk of missing important information.

- Professionalism: A clean, well-organized document reflects positively on your business, making you look more reliable and trustworthy in the eyes of your clients.

- Accuracy: Pre-filled fields and clear sections help reduce human errors and ensure that all important details, such as pricing and contact information, are included.

- Customization: You can easily adjust these forms to suit the specific needs of each job or client, offering flexibility without starting from scratch.

Overall, using these structured forms not only helps streamline your billing process but also enhances your ability to keep everything organized and professional. It’s a simple solution to a common business need, and it can improve both efficiency and customer satisfaction.

How a Free Invoice Template Saves Time

Time is one of the most valuable resources for any business. When it comes to billing clients, creating documents from scratch can be both tedious and time-consuming. By utilizing ready-made forms, you can significantly reduce the time spent on paperwork, allowing you to focus on other essential aspects of your business.

Pre-designed billing forms allow for quick and efficient data entry, eliminating the need to manually structure each document. With all the necessary sections already in place, you only need to fill in specific details such as prices, services, and customer information, saving you from having to design the layout each time.

Here’s a comparison of the time savings:

| Task | Without Ready-made Forms | With Ready-made Forms |

|---|---|---|

| Document layout design | 10-15 minutes per document | 0 minutes |

| Entering client and service details | 5-10 minutes | 1-2 minutes |

| Formatting and final adjustments | 5-10 minutes | 0 minutes |

As shown in the table, using pre-designed forms can reduce the overall time spent on creating each document by more than half. This efficiency helps businesses increase productivity and ensures that client records are completed in a timely manner.

By incorporating ready-made forms into your workflow, you can allocate more time to growing your business, improving customer service, or working on other important tasks, all while maintaining high-quality documentation.

Top Benefits of Using Invoice Templates

In any business, efficiency and consistency are key to maintaining smooth operations. When it comes to generating financial records for clients, using pre-designed documents offers numerous advantages. By relying on structured forms, businesses can save time, reduce errors, and maintain a high level of professionalism in their billing process.

Here are the top benefits of incorporating these ready-made forms into your workflow:

- Time-saving: Ready-made documents allow for quick customization, eliminating the need to create each record from scratch. This speeds up the billing process and helps business owners focus on other important tasks.

- Consistency: These forms follow a standardized structure, ensuring that every record includes the same essential details, making it easier to track and compare documents over time.

- Professionalism: A well-organized, neat document communicates credibility and reliability to clients. A polished record helps build trust and enhances your business’s reputation.

- Reduced Errors: Pre-designed fields and clear sections make it easier to input accurate information, minimizing the chance of missing critical details like prices or contact information.

- Customization: Many forms allow for customization, enabling businesses to tailor documents to suit specific needs, whether that’s adding additional services or adjusting terms and conditions.

By using structured documents, businesses can streamline their billing process, reduce the chances of mistakes, and provide clients with clear and professional records. It’s a simple, effective way to improve both productivity and customer satisfaction.

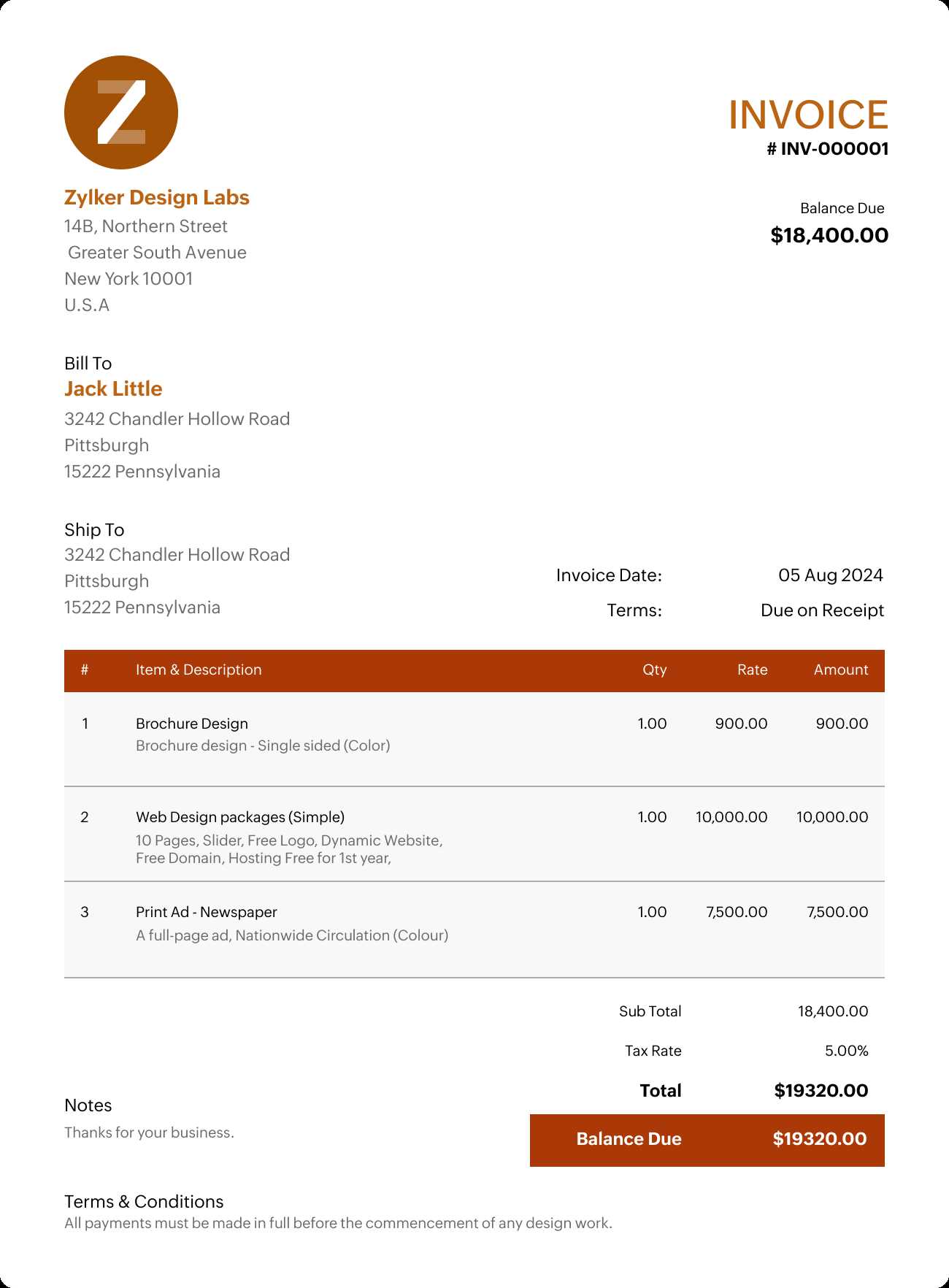

Essential Elements of an Auto Invoice

To ensure smooth transactions and avoid misunderstandings, every billing document must contain specific details. These elements provide a clear breakdown of the work performed, the costs involved, and any terms or conditions that are relevant to the transaction. A well-structured record makes it easier for both the business and the client to review and process payments accurately.

Here are the key components that should be included in every billing document:

| Element | Description |

|---|---|

| Business Information | Includes your business name, contact details, and address. It ensures the client knows who the document is from and how to reach you if necessary. |

| Client Information | Customer name, address, and contact details are essential for identification and future communication. |

| Unique Identification Number | A unique reference number for tracking and record-keeping purposes. |

| Description of Services | A detailed list of the tasks completed, including parts used, hours worked, and any other specifics. This ensures transparency in what was provided. |

| Pricing | Each service or product should have a clear price, with totals for both individual items and the overall amount due. |

| Payment Terms | Include payment due dates, acceptable payment methods, and any late fees or discounts if applicable. |

| Customizing Your Free Auto Service Invoice

Personalizing billing records allows you to better reflect your business identity and meet the specific needs of each client. Customization not only improves professionalism but also helps tailor each document to different types of work or client preferences. Whether you want to add branding, adjust pricing structures, or include additional notes, having the ability to modify your records is essential for effective communication. Steps to Personalize Your Billing Documents

Additional Customization Options

By making these adjustments, you can ensure that your billing records meet your unique business needs while maintaining a professional appearance that builds trust with clients. Where to Find Free Invoice Templates

Finding reliable resources for ready-made billing forms can significantly simplify your administrative tasks. There are many platforms that offer pre-designed documents at no cost, which you can easily download and customize to suit your business needs. These resources are especially useful for small businesses or freelancers who need a quick and efficient solution without spending extra time or money on creating forms from scratch. Here are some great places to look for these ready-made records:

These platforms offer quick access to professional-looking documents that can be adapted to your specific needs. Whether you’re just starting your business or need a fast solution for a specific task, these resources can help you stay organized and save time. Creating Professional Invoices with EaseCreating polished and accurate billing records is essential for any business. A professional document not only ensures clarity for clients but also reflects the quality of your work. With the right tools and a streamlined process, you can quickly generate well-structured documents that meet both your needs and those of your clients, without the hassle of starting from scratch every time. Key Features of a Professional Billing RecordTo create a professional-looking document, certain features should always be included. These elements help you present clear and concise information, making it easier for clients to understand what they are paying for and when payment is due. Some important aspects include:

How to Streamline the ProcessGenerating billing documents doesn’t have to be a complex or time-consuming task. With the right approach, you can easily streamline the process by using pre-designed forms that can be quickly customized. Here’s how to simplify the process:

By incorporating these strategies, you can create professional, accurate, and clear billing records with minimal effort. This not only saves you time but also improves the overall client experience, enhancing your business’s reputation for reliability and efficiency. Common Mistakes to Avoid in InvoicesWhen preparing billing documents, accuracy and clarity are crucial. Small mistakes can lead to confusion, delayed payments, or even disputes with clients. It’s important to be aware of the common errors that can occur when creating these records and take steps to avoid them. Ensuring your documents are clear, complete, and professional will help maintain good client relationships and streamline your financial processes. Here are some of the most common mistakes to avoid when creating billing records:

By avoiding these common mistakes, you can ensure that your billing records are accurate, professional, and easy to understand. This helps maintain good relationships with your clients and ensures that payments are processed smoothly and on time. How to Track Payments with TemplatesAccurate payment tracking is essential for maintaining financial order in any business. By using pre-designed records, you can easily monitor outstanding balances, due dates, and payment status for each transaction. With a clear, organized system in place, you can quickly determine which payments have been made and which are still pending, helping to avoid late fees or missed follow-ups. Here are some effective ways to track payments using structured documents:

By utilizing these features in your billing documents, you can create a system that keeps track of payments efficiently and ensures timely follow-up. This process not only reduces the risk of missed payments but also enhances your financial management practices. Why Automating Invoices is ImportantAutomating the creation and management of billing documents offers significant benefits to any business, particularly when it comes to efficiency and accuracy. Instead of manually generating each record, automation allows you to streamline the entire process, reducing errors, saving time, and ensuring that all payments are tracked and processed promptly. By automating these tasks, businesses can free up valuable resources for other important activities while maintaining a high level of professionalism. Key Benefits of Automating Billing Documents

How Automation Improves Financial Management

Incorporating automation into your billing processes not only enhances efficiency but also ensures that your business operates smoothly and maintains professional standards. This simple yet powerful approach helps businesses stay organized, improve client relationships, and increase profitability. Free Invoice Templates for Small BusinessesFor small businesses, managing billing and ensuring timely payments can be a challenge, especially when resources are limited. However, using pre-designed billing records is an excellent way to streamline financial processes. These ready-made documents can be easily customized to meet the specific needs of a small business, allowing owners to focus more on growing their business rather than spending time on administrative tasks. They are an affordable and efficient solution for organizing payments, keeping track of transactions, and maintaining a professional image. Benefits of Using Ready-Made Billing Records

Where to Find Ready-Made Billing Records for Small Businesses

Using ready-made documents can significantly improve the efficiency of your billing process while keeping costs down. By choosing the right form for your needs, small businesses can ensure their financial processes are smooth and professional, allowing them to focus on what matters most–growing their business. Improving Client Communication with InvoicesEffective communication with clients is key to maintaining a strong business relationship and ensuring smooth transactions. One often-overlooked aspect of communication is the billing document, which can serve as a powerful tool for clarity, transparency, and professionalism. By carefully crafting these documents, businesses can avoid confusion, ensure that expectations are aligned, and foster trust with clients. How Billing Documents Enhance Client Communication

Strategies for Effective Client Communication Through Billing Documents

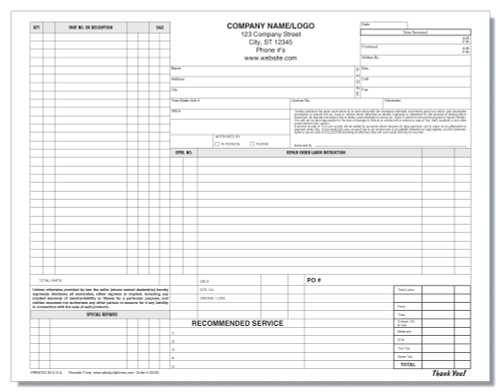

By using billing documents not only as transactional tools but also as communication assets, businesses can improve their interactions with clients, ensure smoother payments, and build stronger, long-lasting relationships. Invoice Templates for Different Auto ServicesDifferent types of repair and maintenance businesses require specialized billing documents tailored to the services they provide. These records help ensure that clients receive accurate and clear information about the work done and the costs involved. Depending on the nature of the work, the structure and details of these forms may vary. Understanding which elements to include for different kinds of automotive repairs and maintenance can make your transactions more efficient and professional. Types of Billing Documents for Automotive Services

Key Features to Include in All Automotive Billing Records

|