Auto Repair Shop Invoice Template for Efficient Billing

For any business providing vehicle maintenance services, ensuring smooth and efficient billing is crucial. Clear and professional documentation not only reflects the quality of services offered but also establishes trust with customers. A well-structured bill helps streamline operations, minimizes errors, and accelerates the payment process.

In this guide, we will explore the essentials of creating a functional and detailed document for services rendered. From organizing key details to incorporating proper payment terms, it’s important to create a system that is both comprehensive and easy to use. Customizable documents tailored to specific business needs can greatly enhance productivity and customer satisfaction.

Whether you’re a small garage or a large service center, having an effective system for recording charges can improve the overall workflow. This resource will walk you through the core elements and best practices that contribute to a flawless billing experience, ensuring that your transactions are handled efficiently and professionally.

Vehicle Service Billing Guide

When managing a vehicle service business, organizing the payment process is essential for ensuring clarity and professionalism. Having a structured document that outlines services, costs, and payment terms can significantly improve customer satisfaction and business efficiency. This guide will help you understand how to create and use a professional billing system tailored to your needs.

Key Components of a Service Bill

A comprehensive record should include several essential details to avoid misunderstandings and ensure transparency. These elements will not only clarify the charges for the customer but also keep your financial records organized.

- Client Information: Name, address, and contact details.

- Service Details: Clear descriptions of the work done, parts used, and labor charges.

- Cost Breakdown: Detailed listing of each charge, including tax and any additional fees.

- Payment Terms: Due dates, accepted payment methods, and any late fees.

- Company Information: Business name, contact info, and payment instructions.

Benefits of Using a Customized System

Customizable billing systems are not only time-saving but also enhance professionalism. By tailoring documents to the specific needs of your business, you can ensure accuracy and consistency across all transactions.

- Efficiency: Streamline the billing process, reducing time spent on paperwork.

- Accuracy: Prevent errors by using a system that suits your business model.

- Customer Trust: Clear and transparent documents help build long-term relationships with clients.

- Legal Compliance: Ensure all necessary information is included to meet industry standards and regulations.

Why Use a Billing Document Format

Having a pre-designed format for service records offers a range of benefits that enhance the overall efficiency of managing payments. Instead of creating documents from scratch every time, a consistent structure helps save time, reduces errors, and ensures that all necessary information is included. Using a well-structured format is especially important for businesses aiming to maintain professionalism and transparency in their transactions.

Below is a comparison of the advantages of using a standardized billing method versus a more manual approach:

| Benefit | Manual Approach | Standardized Format |

|---|---|---|

| Time Efficiency | Requires creating new documents each time | Pre-filled sections save time |

| Accuracy | High risk of missing important details | Structured layout ensures all data is included |

| Consistency | Inconsistent formats across different documents | Uniform design across all records |

| Professional Appearance | Varies depending on the creator | Polished and formal look |

Using a standardized document format streamlines the billing process, minimizes mistakes, and helps maintain professionalism, ultimately improving both client trust and business operations. This approach also provides easy scalability as the business grows, allowing for efficient handling of an increasing number of transactions.

Benefits of Customizable Billing Formats

Having the ability to adjust and tailor service documentation to fit specific business needs offers numerous advantages. Customizable billing formats provide flexibility, enabling businesses to create a system that works best for their operations while ensuring that all necessary information is captured in a clear and professional manner. By offering the ability to modify and update details, companies can better manage their financial transactions and improve customer experiences.

Flexibility in Design and Content

One of the primary benefits of a customizable document structure is the flexibility it provides. Business owners can easily modify fields, adjust the layout, and add or remove sections based on their unique requirements. This adaptability allows for:

- Tailored Information: Focus on the key details most relevant to your clients and business needs.

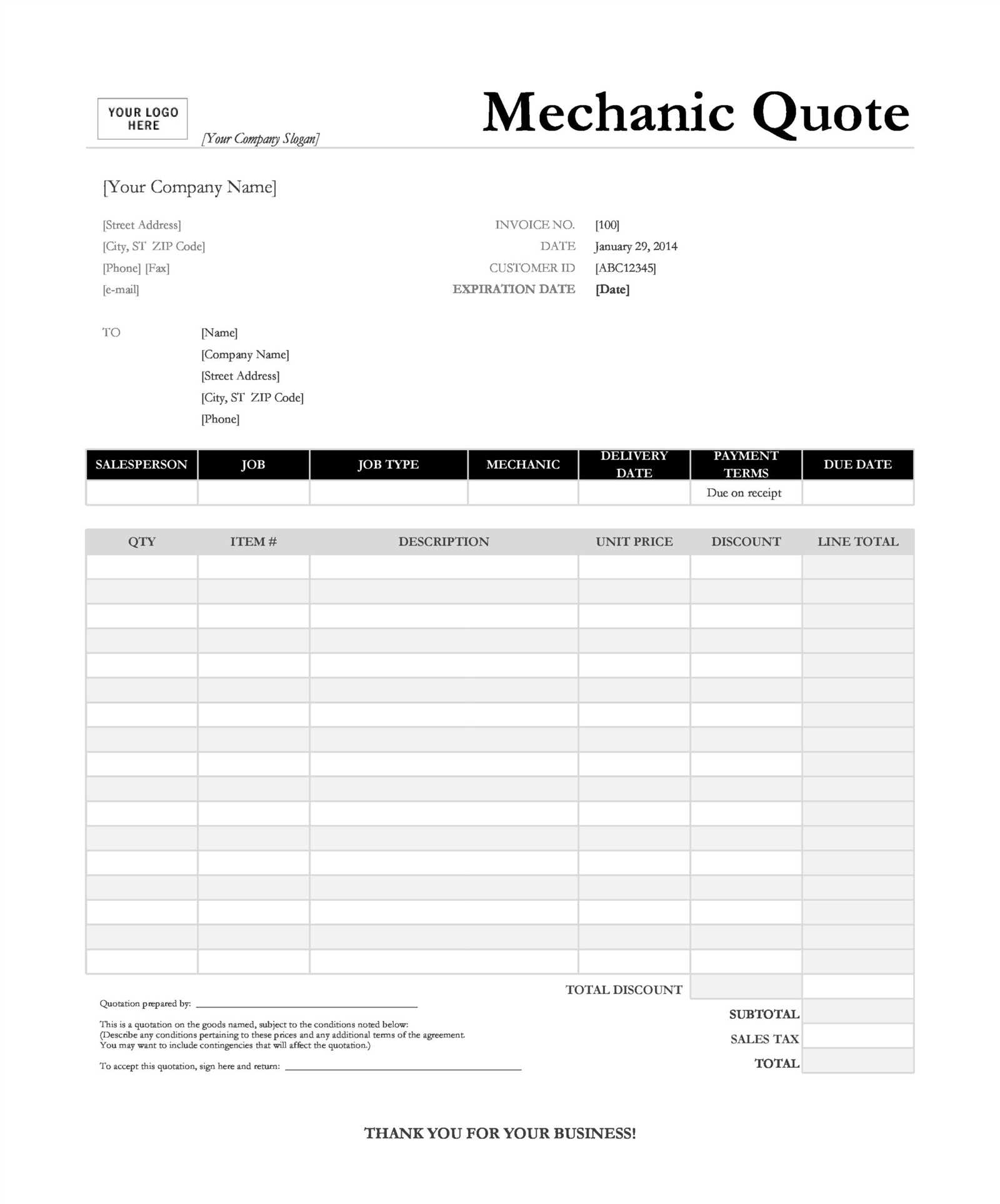

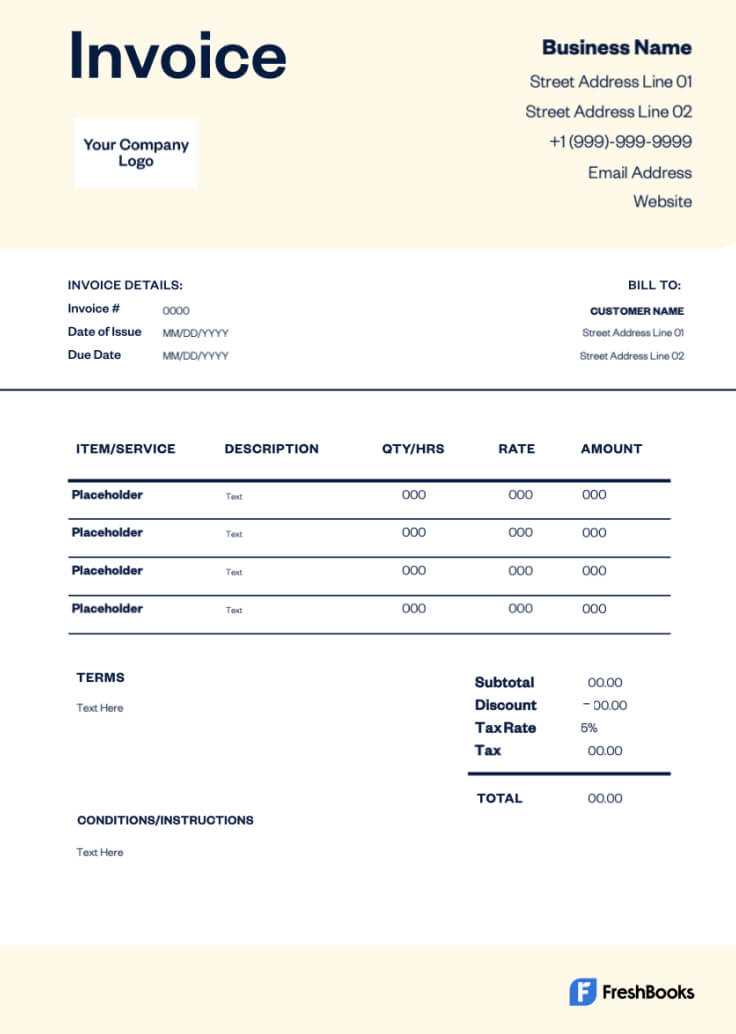

- Professional Branding: Customize headers, logos, and fonts to match your company’s brand identity.

- Enhanced Readability: Design layouts that prioritize clarity and user-friendliness, improving the client experience.

Improved Accuracy and Efficiency

Customizable formats streamline the process of creating accurate records. With pre-defined sections that can be adjusted to suit each transaction, businesses can reduce the risk of omissions or errors. Key benefits include:

- Consistency: Standardized sections ensure the same format is used across all records, preventing discrepancies.

- Faster Document Creation: Reduce time spent on drafting documents from scratch, allowing more time for other important tasks.

- Instant Updates: Quickly modify sections or terms as needed without having to redesign the entire document.

Overall, customizable formats are a powerful tool for improving efficiency, professionalism, and accuracy in managing service records, ultimately benefiting both the business and its clients.

How to Create a Professional Billing Document

Creating a polished and effective billing document requires attention to detail, clarity, and consistency. A professional record of services ensures that all necessary information is presented in a way that is easy to understand, both for your clients and for your business’s financial tracking. The key to an effective billing document lies in including essential details and maintaining a clean, organized structure.

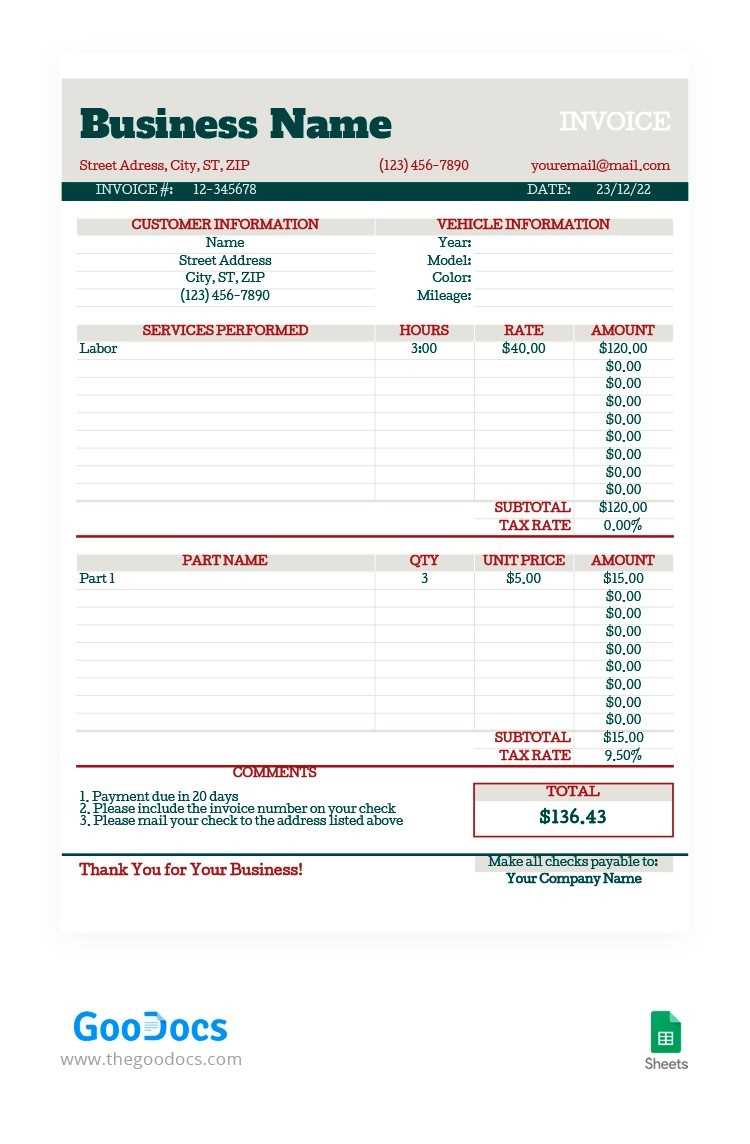

Essential Elements to Include

To ensure that your billing documents are both professional and comprehensive, there are several key components that must always be present. These elements will ensure clarity and avoid confusion for both the service provider and the client:

- Business Information: Include the name, address, contact details, and any other relevant business information.

- Client Information: Name, address, and contact details of the customer receiving the service.

- Service Description: Clear descriptions of the work completed, including parts, labor, and any special services provided.

- Costs and Fees: Breakdown of all charges, including individual service costs, taxes, and any applicable fees.

- Payment Terms: Details about payment methods, due dates, and late fee policies if applicable.

Designing for Clarity and Professionalism

The layout and design of your document play a significant role in its readability and overall impact. To create a visually appealing and easy-to-read record, keep the following points in mind:

- Clean Layout: Ensure that there is adequate spacing between sections, and use clear headings to distinguish different parts of the document.

- Consistent Fonts and Colors: Choose a professional font and color scheme that aligns with your brand identity. Avoid using too many different fonts or colors, which can make the document look cluttered.

- Logical Flow: Organize the content in a way that follows a logical order, from client details to service descriptions and payment terms.

By ensuring that your billing documents are well-organized, professional, and complete with all necessary details, you not only make it easier for clients to understand but also enhance your business’s reputation and trustworthiness.

Essential Information for Service Billing Records

For any business that provides maintenance services, clear and comprehensive documentation is vital for ensuring accurate transactions. The record of services rendered must include all relevant details to avoid confusion, prevent disputes, and maintain transparency with clients. The following essential components should always be included to create a complete and professional billing record.

Key Details to Include

Including the right information is crucial to ensure your document is thorough and effective. Below are the most important details that should be featured in every billing record:

- Client Information: Include the customer’s name, contact details, and billing address to ensure the document reaches the correct recipient.

- Business Information: Clearly state your business name, contact details, and address. This helps identify the service provider and establishes a professional image.

- Service Descriptions: Provide detailed descriptions of each service, including the tasks performed and the materials used. This helps clients understand exactly what they are paying for.

- Cost Breakdown: List all charges separately, including labor, parts, taxes, and any other applicable fees. This transparency builds trust with customers.

- Payment Terms: Specify the accepted payment methods, payment deadlines, and any late fees or penalties for overdue payments.

Additional Elements for Clarity

In addition to the essential details, adding the following information can improve the document’s usefulness and professionalism:

- Unique Document Number: Assign a unique reference number for each transaction to help track and organize records efficiently.

- Date of Service: Ensure the document includes the date the services were provided and the date the bill is issued. This helps establish a clear timeline for payment.

- Warranty Information: If applicable, mention any warranty or guarantee on services provided to reinforce customer confidence.

By incorporating these critical elements into every billing record, you ensure that all necessary information is captured, minimizing the chances of misunderstandings and promoting smooth, professional interactions with clients.

Key Sections in a Billing Document

A well-structured billing document is essential for clear communication between service providers and clients. It helps ensure that both parties understand the terms of the transaction and prevents any potential disputes. The key sections of such a document serve to organize the information in a way that is easy to read and understand, highlighting all necessary details related to the service provided.

Essential Parts of the Document

To create a comprehensive and professional record, several sections must be included. These sections organize the content and make it easier for the client to process the information quickly. The following table outlines the key parts of a complete billing document:

| Section | Description |

|---|---|

| Client Information | Includes customer name, address, phone number, and email address for accurate contact details. |

| Business Information | Lists the service provider’s business name, address, and contact details to ensure proper identification. |

| Service Description | Detailed breakdown of the services provided, including any parts or materials used during the service. |

| Cost Breakdown | Clear listing of individual charges, including labor, parts, taxes, and any additional fees. |

| Payment Terms | Outlines the accepted payment methods, payment due date, and any penalties for late payments. |

Additional Sections for Clarity

While the core sections cover the most important details, you may want to add additional sections to further improve the document’s clarity and functionality:

- Document Number: A unique reference number for tracking purposes.

- Date of Service: The specific date on which the service was performed and the document was issued.

- Terms and Conditions: Any special terms related to the services provided, including warranties or guarantees.

By including these sections in a well-organized format, businesses ensure a professional and efficient process for both issuing and reviewing the billing document, helping to avoid misunderstandings and ensuring smooth transactions.

Tips for Streamlining Billing Processes

Efficient billing processes are crucial for maintaining cash flow and ensuring smooth transactions between service providers and their clients. Streamlining these procedures can reduce errors, save time, and enhance overall customer satisfaction. By implementing the right strategies and tools, businesses can simplify their financial documentation process while keeping everything accurate and organized.

Key Strategies for Efficiency

Below are several strategies that can help improve and speed up the billing process, making it more efficient and less prone to mistakes:

| Tip | Description |

|---|---|

| Automate Billing Systems | Use software tools that can generate and send bills automatically, reducing the manual work involved. |

| Standardize Billing Format | Create a consistent layout for all records to ensure all relevant details are included without forgetting key components. |

| Integrate Payment Methods | Offer multiple payment options, such as online payments or credit card processing, to make the payment process easier for clients. |

| Track Outstanding Balances | Implement a system for monitoring unpaid bills, which helps avoid overdue payments and improves cash flow management. |

Optimizing Your Workflow

In addition to these strategies, businesses should also consider optimizing their internal workflow to ensure billing is handled as smoothly as possible. Here are some best practices:

- Reduce Paperwork: Embrace digital systems for easier tracking and storage of billing documents.

- Set Clear Payment Terms: Clearly communicate payment expectations upfront, including due dates and late fees.

- Review Billing Regularly: Schedule periodic audits of your billing processes to identify and resolve any inefficiencies.

By adopting these tips, businesses can ensure that their billing process is not only faster and more accurate but also more transparent, resulting in smoother transactions and better client relationships.

Common Mistakes to Avoid in Billing Records

Creating accurate billing documents is essential for maintaining professionalism and preventing disputes with clients. However, even the most well-intentioned service providers can make mistakes that impact the clarity or accuracy of their records. Avoiding these common errors can save time, reduce confusion, and ensure smooth financial transactions.

Frequent Errors to Watch Out For

The following table highlights some of the most common mistakes in billing records, along with suggestions on how to prevent them:

| Error | Solution |

|---|---|

| Missing Client Information | Always include the client’s full name, address, and contact details to ensure that the document reaches the correct recipient. |

| Unclear Service Descriptions | Provide detailed and specific descriptions of the services performed to avoid misunderstandings about what was provided. |

| Incorrect Pricing or Fees | Double-check all prices and fees before finalizing the document. Ensure that the cost breakdown is accurate and up to date. |

| Omitting Taxes or Discounts | Clearly include any taxes, discounts, or special offers applied to the final amount, ensuring transparency. |

| Failure to Specify Payment Terms | Clearly outline payment methods, due dates, and any penalties for late payments to avoid confusion later on. |

Additional Tips for Accuracy

To further enhance the accuracy and professionalism of your billing documents, consider these additional tips:

- Double-check the Dates: Ensure that both the service date and the date the document was issued are correct and clearly visible.

- Use Consistent Formatting: A consistent layout with clear headings and spacing will make it easier for both you and your client to understand the document.

- Proofread Before Sending: Always review the document for any typographical or factual errors before issuing it to the client.

By being aware of these common mistakes and taking steps to avoid them, you can improve the professionalism and accuracy of your billing records, which in turn will help foster better client relationships and smoother business operations.

Using Digital Tools for Billing

In today’s fast-paced world, digital solutions are transforming the way businesses handle financial records. Instead of relying on manual processes, many service providers now use software tools to create, manage, and track financial documents. These tools not only streamline the process but also improve accuracy, reduce paperwork, and save valuable time.

Benefits of Digital Tools

Utilizing digital platforms offers several advantages for managing financial records. Here are a few key benefits:

- Increased Efficiency: Automated tools can generate records instantly, eliminating the need for manual calculations and entry.

- Reduced Errors: Digital platforms minimize the risk of human error, ensuring that all details are correct and consistent.

- Easy Storage: Digital files can be stored securely and accessed from anywhere, reducing the clutter of paper documents.

- Faster Payments: With integrated payment systems, clients can pay online, speeding up the payment process and improving cash flow.

Popular Digital Tools for Billing

There are various digital tools available that can help simplify the management of financial records. Some of the most popular options include:

- Cloud-Based Platforms: Services like QuickBooks and FreshBooks allow businesses to create and manage records online, making them accessible from any device.

- Mobile Apps: Apps like Wave and Zoho Books offer on-the-go solutions for creating and sending documents directly from smartphones or tablets.

- Payment Integrations: Tools like PayPal, Stripe, and Square can be integrated into your platform to allow for seamless payment collection and tracking.

By switching to digital tools, businesses can streamline their operations, improve accuracy, and enhance their overall efficiency, making the financial process much more manageable and less time-consuming.

Best Practices for Accurate Billing Records

Ensuring that your financial documents are accurate and professional is key to maintaining good client relationships and avoiding misunderstandings. By following a set of best practices, you can improve the precision of your billing records, prevent errors, and ensure that clients receive clear and concise details about their transactions.

Key Strategies for Accuracy

Here are some best practices to help you create precise and well-organized financial documents:

- Double-Check Information: Always verify client details, service descriptions, pricing, and dates before finalizing any document. This helps prevent mistakes that could cause confusion or delays.

- Be Detailed: Provide clear descriptions of the services rendered, including quantities, hourly rates, or materials used. This transparency builds trust and reduces the likelihood of disputes.

- Include All Charges: Ensure all charges, including taxes, discounts, and additional fees, are clearly itemized and included in the final amount.

- Set Clear Terms: Specify payment terms, such as due dates and accepted methods of payment, to avoid any confusion about when and how payments should be made.

Organizational Tips for Consistency

In addition to the strategies above, consider these organizational tips for maintaining consistency and reducing errors:

- Use Consistent Formatting: A uniform layout with consistent fonts and headings makes documents easier to read and reduces the chance of overlooking important details.

- Standardize Service Descriptions: If you offer similar services regularly, create a set of standardized descriptions to ensure accuracy and consistency in your records.

- Keep Track of Past Records: Maintain a record of all past transactions to help with audits, disputes, or repeat business.

By adhering to these best practices, you can ensure that your financial documents are accurate, professional, and transparent, leading to smoother transactions and stronger client trust.

Integrating Payment Methods in Billing Documents

Integrating payment options directly into financial documents can streamline the process for both businesses and clients. By offering multiple payment methods, you can enhance the convenience for your customers, speed up the payment process, and reduce the likelihood of delayed payments. This section explores the different ways to incorporate payment methods into your billing records, ensuring a smooth transaction experience.

Benefits of Including Payment Methods

Incorporating payment methods into your financial documents offers several advantages:

- Faster Transactions: By clearly outlining how payments can be made, clients are more likely to pay promptly, improving your cash flow.

- Reduced Confusion: Providing clear payment instructions helps prevent misunderstandings and ensures that the client knows exactly how to make a payment.

- Better Client Satisfaction: Offering multiple payment methods makes it easier for clients to pay in the way that suits them best, enhancing their overall experience.

- Minimized Errors: Clear payment terms reduce the risk of payment delays or mistakes, ensuring that all parties are aligned on the payment expectations.

Popular Payment Methods to Integrate

There are various payment methods you can integrate into your financial records. Here are some of the most commonly used options:

- Credit/Debit Cards: Allow clients to pay via popular card networks, such as Visa, MasterCard, or American Express.

- Bank Transfers: Provide clients with bank account details for direct transfers, which can be a secure and simple payment method for large sums.

- Online Payment Gateways: Services like PayPal, Stripe, and Square enable clients to pay directly through secure online platforms.

- Checks: For clients who prefer traditional methods, offering a check option remains a viable choice, though this may take longer to process.

By clearly outlining available payment options and providing the necessary details, you help ensure faster, hassle-free payments while enhancing the client experience.

How to Track Payments and Due Dates

Tracking payments and due dates effectively is essential for maintaining smooth financial operations and avoiding late fees or misunderstandings with clients. Properly managing payment schedules ensures that you are paid on time and that both parties are clear on the terms of each transaction. This section will explore how to track payments, monitor due dates, and ensure timely collections.

Steps to Track Payments Efficiently

Following a few key steps will help you stay on top of payments and due dates:

- Record All Details: Always document each transaction, including the agreed-upon payment terms, the amount due, and the payment method.

- Set Clear Due Dates: Clearly indicate the payment due date in your financial documents, and ensure that the client understands when the payment should be made.

- Use Payment Reminders: Automate reminders for upcoming or overdue payments to keep both you and your clients on track.

- Track Partial Payments: If your client makes a partial payment, update your records to reflect the remaining balance and adjust due dates accordingly.

How to Use Tools for Tracking

Using software or digital tools can significantly improve the tracking process, especially for businesses with multiple transactions. Here’s how you can use these tools:

| Tool | Feature | Benefits |

|---|---|---|

| Accounting Software | Automates payment tracking, sends reminders, and updates payment statuses. | Increases efficiency, reduces human error, and keeps records organized. |

| Online Payment Systems | Track incoming payments in real time, manage due dates, and receive notifications. | Provides instant updates and easily integrates with your financial system. |

| Spreadsheets | Manually track payments and due dates with customizable columns and filters. | Flexible and low-cost, ideal for smaller operations. |

By implementing these tracking methods and tools, you can manage your finances more effectively, ensuring that all payments are made on time and reducing the risk of overdue accounts.

Customizing Billing Documents for Vehicle Services

Tailoring your financial documents to suit the specific needs of your business is essential for maintaining professionalism and clarity. Customization allows you to add relevant details, create a recognizable brand image, and ensure that all necessary information is included. This section covers the importance of adapting your billing records for vehicle service providers and offers tips on how to do so efficiently.

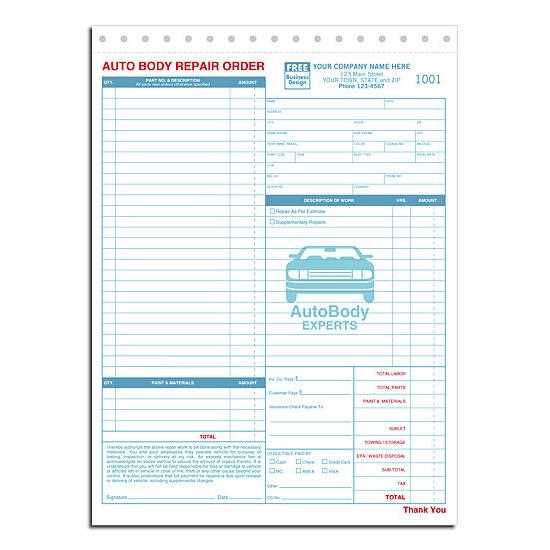

Key Elements to Customize

Customizing your billing statements can improve both the user experience and the functionality of the document. Here are some key elements to consider:

- Business Information: Ensure that your business name, logo, and contact details are prominently displayed for easy identification by the client.

- Service Description: Provide a detailed breakdown of the services performed, including parts used, labor hours, and any additional fees.

- Payment Terms: Clearly define the payment due dates, any applicable taxes, and available payment methods to avoid confusion.

- Unique ID Numbers: Assign a unique identifier to each record for easy tracking and reference, helping to keep your records organized.

- Notes Section: Add a field for additional comments, such as reminders about future services, warranties, or customer feedback.

Tools for Customization

There are several tools and software available to help you customize your billing statements with ease:

- Online Billing Software: Many platforms allow for the easy creation and customization of financial documents, offering pre-built templates that can be personalized to fit your business.

- Spreadsheet Software: For a more hands-on approach, spreadsheets offer flexibility to design custom layouts and formulas that automatically calculate totals and taxes.

- Customizable Document Builders: Use specialized software to create fully branded documents with your specific design and information requirements.

Customizing your financial documents is a simple yet effective way to communicate professionalism, ensure accuracy, and build customer trust. By adjusting key details and utilizing the right tools, you can streamline the billing process and create a more efficient experience for your clients.

Ensuring Legal Compliance in Billing

Ensuring that your financial records are legally compliant is crucial to maintaining the integrity of your business and protecting it from potential legal disputes. Accurate documentation and adherence to tax laws not only safeguard your company but also foster trust with your customers. This section covers the key considerations for maintaining legal compliance when managing financial transactions.

Key Legal Requirements to Follow

When preparing billing records, it is important to comply with various legal standards. Below are the main elements you should consider to ensure your documents align with regulatory requirements:

- Tax Identification: Include your business’s tax identification number (TIN) to ensure that the transaction is recognized by tax authorities.

- Tax Rates and Compliance: Be sure to apply the correct local, state, or federal tax rates. Incorrect tax calculations can lead to penalties.

- Accurate Service Descriptions: Clearly outline the services provided or goods sold, ensuring there are no ambiguities that could lead to misunderstandings or disputes.

- Legal Terms: Include necessary terms such as payment due dates, late fees, and refund policies to protect your business in case of a dispute.

- Record Retention: Maintain copies of all financial records for the required period, typically several years, depending on your local regulations.

How to Stay Up-to-Date with Laws

Business laws, including tax and billing regulations, are subject to change. Here’s how you can stay compliant:

- Consult Legal Advisors: Regularly check with legal professionals to ensure your documents and processes comply with local and national laws.

- Use Updated Software: Many accounting or billing software platforms are designed to stay updated with the latest legal and tax regulations, automatically applying any changes.

- Monitor Legal Changes: Keep an eye on industry news and legal updates to stay informed about any changes that may affect your financial documentation.

By staying on top of these compliance requirements, you can minimize the risk of legal issues and ensure smooth financial transactions for your business. Being proactive about legal compliance will also reinforce your reputation as a reliable and trustworthy service provider.

How to Handle Invoice Disputes

Disputes over financial records are a common issue that can arise in any business transaction. Handling these situations efficiently and professionally is essential for maintaining positive customer relationships and protecting your financial interests. This section provides guidance on how to effectively address and resolve billing conflicts.

Steps to Resolve a Dispute

When a customer raises a concern or dispute about a payment request, it’s important to approach the situation calmly and systematically. Below are the steps to follow when handling a dispute:

- Review the Discrepancy: Carefully examine the transaction details and compare them with your own records. Verify the amounts, dates, services, and products listed.

- Communicate Clearly: Contact the customer promptly to discuss the issue. Make sure to listen actively to their concerns, and express your willingness to resolve the situation.

- Provide Documentation: Offer clear evidence of the work completed, terms agreed upon, and any previous communications that confirm the accuracy of the charges.

- Negotiate a Resolution: If an error is identified, offer a reasonable solution. If the dispute involves a misunderstanding, clarify the details and ensure both parties are on the same page.

- Formal Agreement: Once the issue is resolved, document the agreement in writing. This helps prevent future disputes and ensures that both parties have a clear record of the settlement.

Preventing Future Disputes

While some disputes may be unavoidable, there are several proactive steps you can take to minimize the likelihood of future conflicts:

- Clear Documentation: Ensure all transactions are documented in detail, with clear terms, pricing, and service descriptions. This can help prevent misunderstandings.

- Set Expectations Early: Make sure customers are fully informed of costs and timelines upfront. This reduces the chances of surprise or confusion later.

- Offer Payment Plans: For larger amounts, consider offering flexible payment terms to avoid potential payment issues down the line.

- Regular Communication: Stay in touch with customers throughout the process. Frequent updates can prevent issues from escalating into larger disputes.

By handling disputes professionally and proactively, you can resolve conflicts efficiently while maintaining strong relationships with your clients. Clear communication and proper documentation play a key role in avoiding misunderstandings and ensuring that your business practices remain transparent and trustworthy.

Improving Customer Satisfaction with Invoices

Clear, accurate, and well-structured payment documents can have a significant impact on customer satisfaction. By ensuring that every transaction is communicated in a transparent and professional manner, businesses can not only avoid disputes but also enhance the overall customer experience. In this section, we explore strategies to improve satisfaction through billing practices.

Key Elements That Boost Customer Confidence

Providing clients with precise and easy-to-understand payment details helps foster trust and confidence. Here are some key elements to include that can improve customer satisfaction:

- Clarity: Ensure that the charges are broken down in a clear, itemized manner. This helps clients easily understand the services or products they are paying for.

- Transparency: Be upfront about any additional costs or fees. Surprise charges often lead to dissatisfaction, so it’s important to avoid them.

- Timeliness: Send payment documents promptly after a service is completed, allowing customers enough time to review and process the payment.

- Professional Design: Use a clean, professional format that conveys reliability and attention to detail. A polished document reflects positively on your business.

Building Trust with Consistency

Consistency in billing practices is key to maintaining long-term customer satisfaction. Customers appreciate knowing what to expect in each interaction. Some ways to ensure consistency are:

- Standardized Format: Use the same structure for all payment requests. This reduces confusion and helps your clients familiarize themselves with the document layout.

- Follow-Up Communication: If payments are due or reminders are necessary, always follow up in a polite and professional manner.

- Easy Payment Options: Offer multiple payment methods and ensure that clients have a seamless, hassle-free process for settling their balances.

Table of Common Payment Information to Include

| Section | Description |

|---|---|

| Service Details | Provide a breakdown of each service or product provided, with corresponding costs. |

| Due Date | Clearly state the payment due date to avoid any confusion or delays. |

| Payment Methods | List the available methods for making payments, such as credit cards, bank transfers, or online payment systems. |

| Customer Support | Provide contact information for any questions or concerns related to the payment or services provided. |

By focusing on transparency, clarity, and consistency in your billing process, you can significantly improve customer