Download Auto Repair Shop Invoice Template PDF for Easy Billing

Managing billing efficiently is crucial for any vehicle maintenance service provider. Using structured documents can simplify the process of tracking payments, detailing services provided, and ensuring transparency with customers. These documents not only serve as a record for both the service provider and the customer but also help maintain professionalism in business operations.

By utilizing a well-organized document format, service centers can easily create professional statements that include necessary details such as labor costs, parts used, and any additional charges. The format provides clarity and ensures all the required information is clearly communicated to the customer.

With the right setup, the process becomes faster, more accurate, and more reliable, allowing businesses to focus on what matters most–providing high-quality service. The use of a digital format makes it even more accessible and convenient, allowing for easier updates, storage, and sharing.

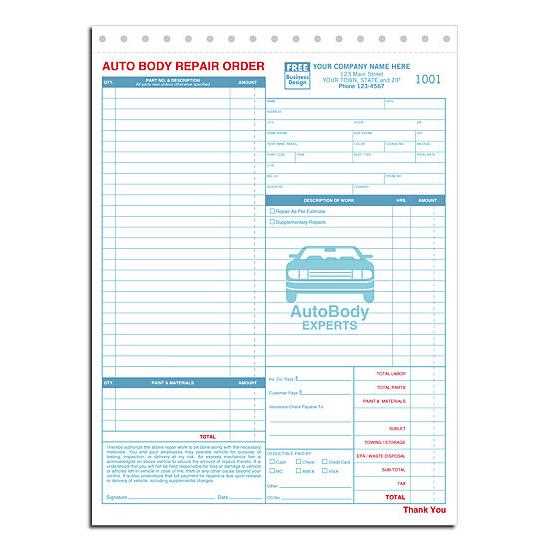

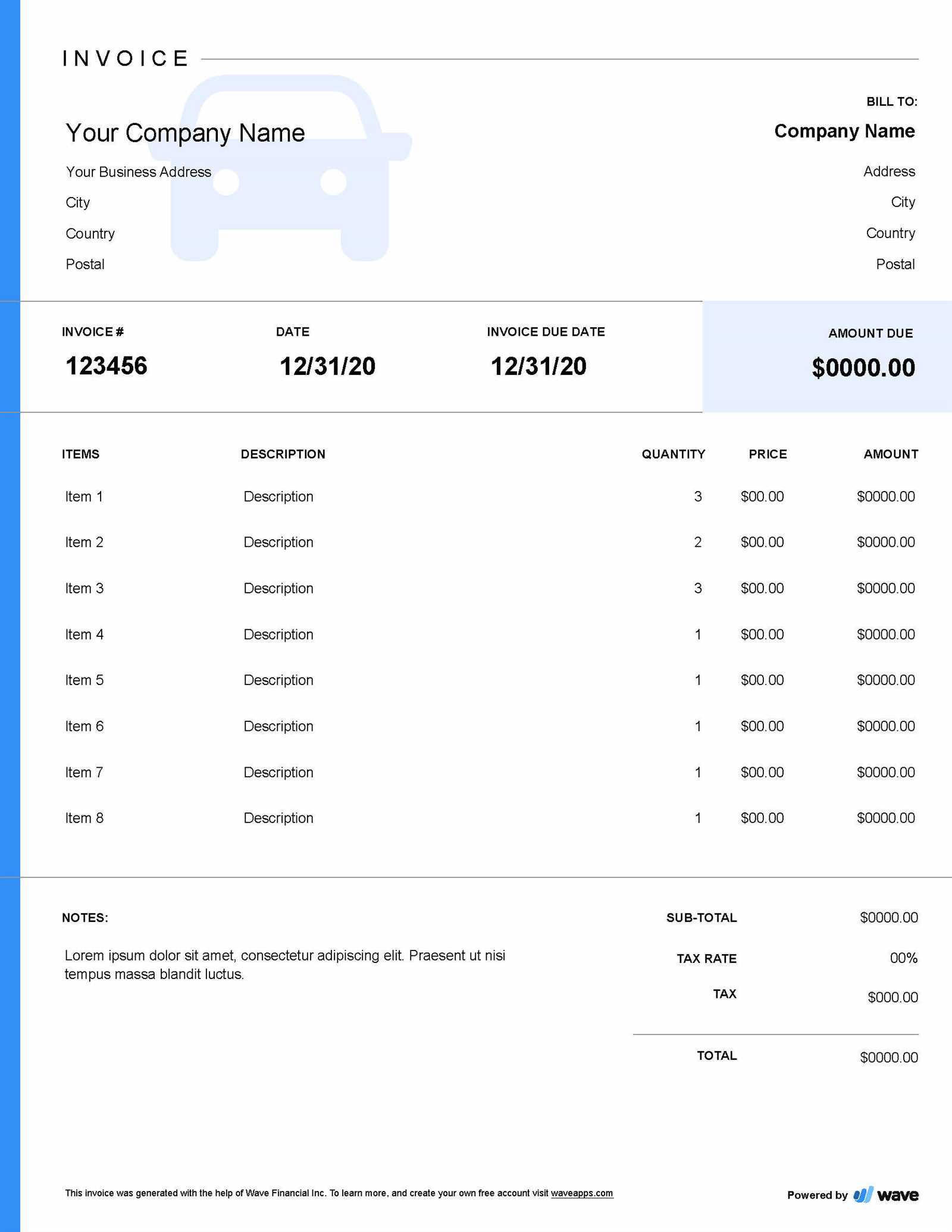

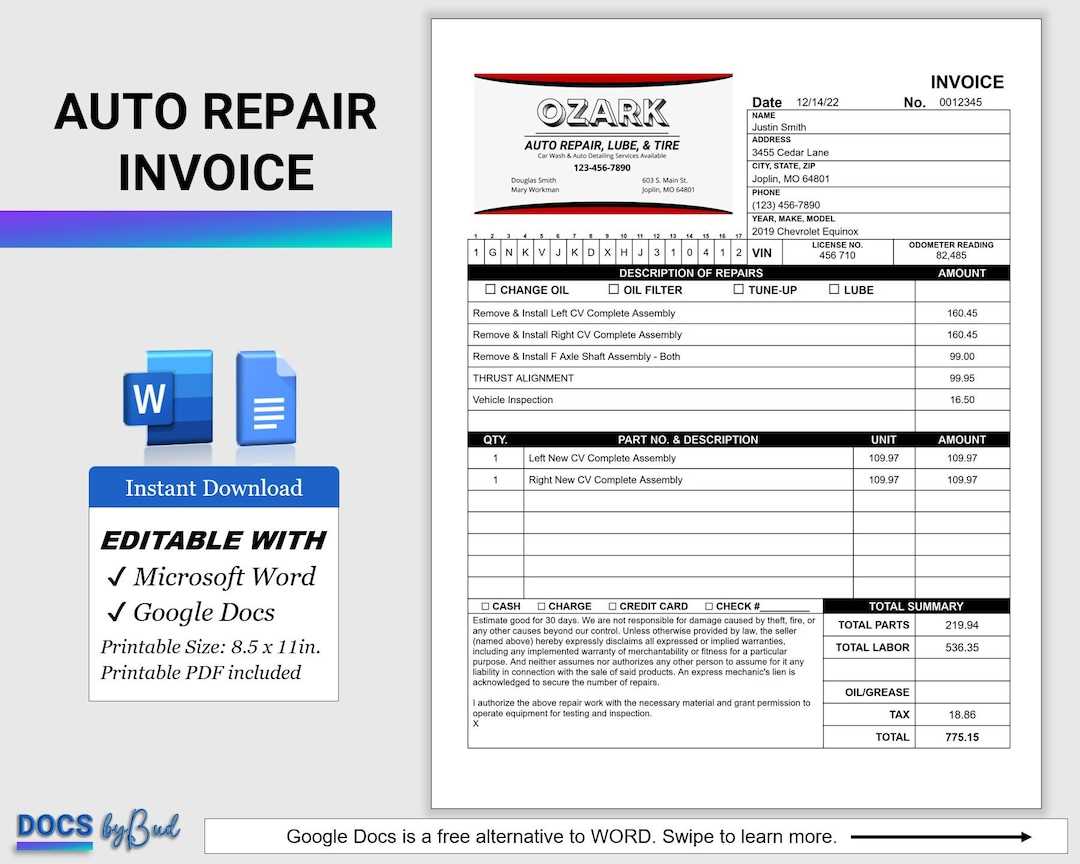

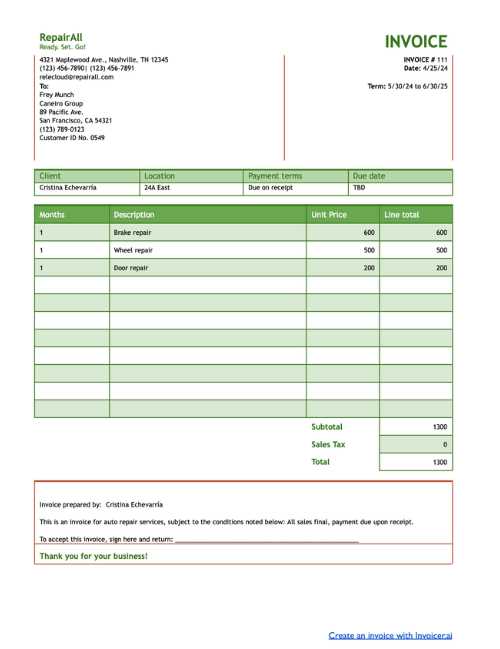

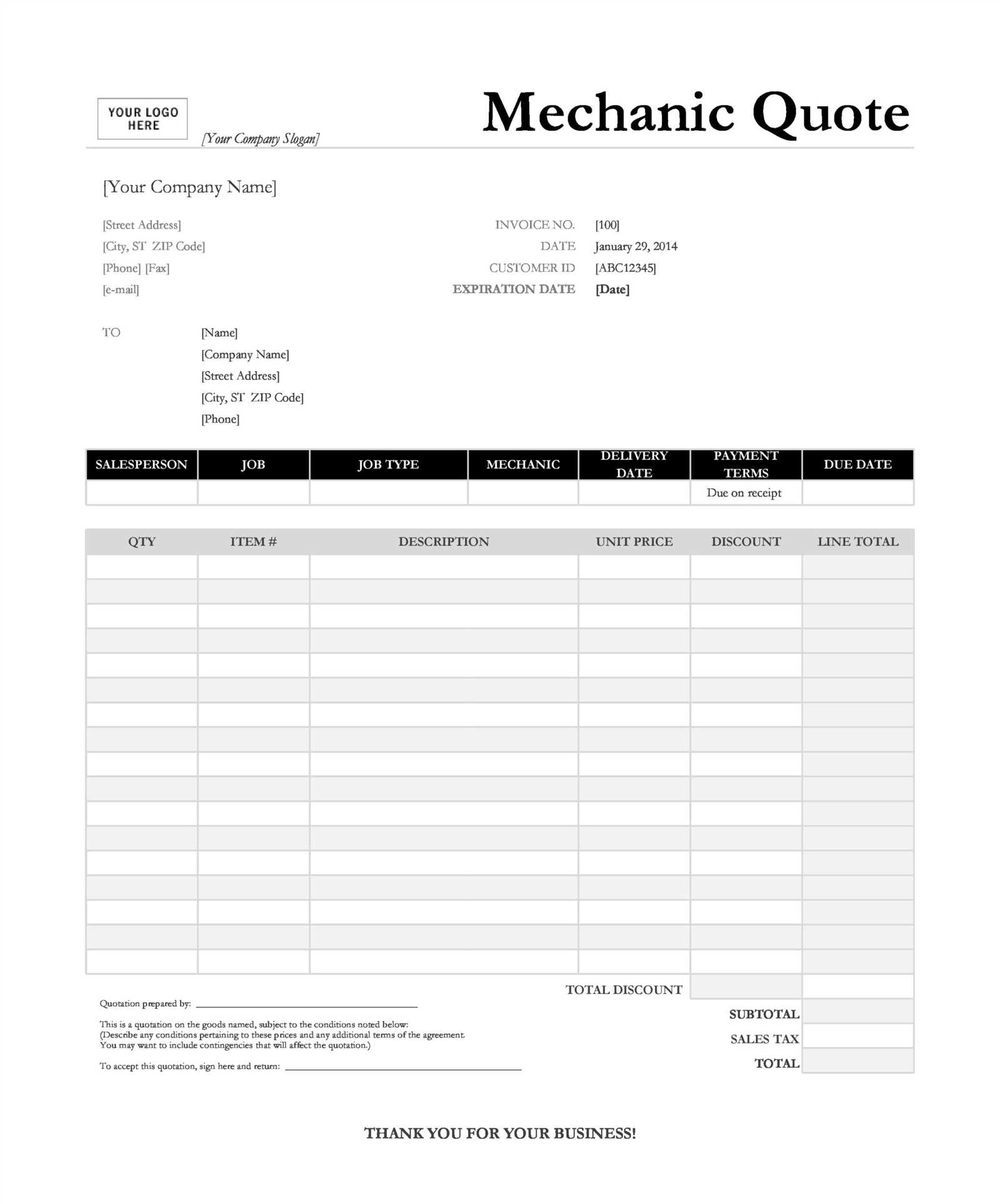

Auto Repair Invoice Template Overview

When managing a service-based business, it’s essential to have a structured document that ensures clear communication of costs and services rendered. Such documents help maintain transparency between the provider and the customer, fostering trust and simplifying payment processes. A good billing form covers all necessary details, such as service description, labor hours, parts used, and applicable taxes.

Importance of Using a Structured Document

Having a predefined format allows service providers to avoid errors and ensure consistency. This streamlined approach reduces confusion for customers and enables businesses to maintain organized records for financial tracking. The ease of use and professional presentation can significantly improve the customer experience, making it easier to understand charges and facilitate payments.

Key Features of a Well-Designed Billing Form

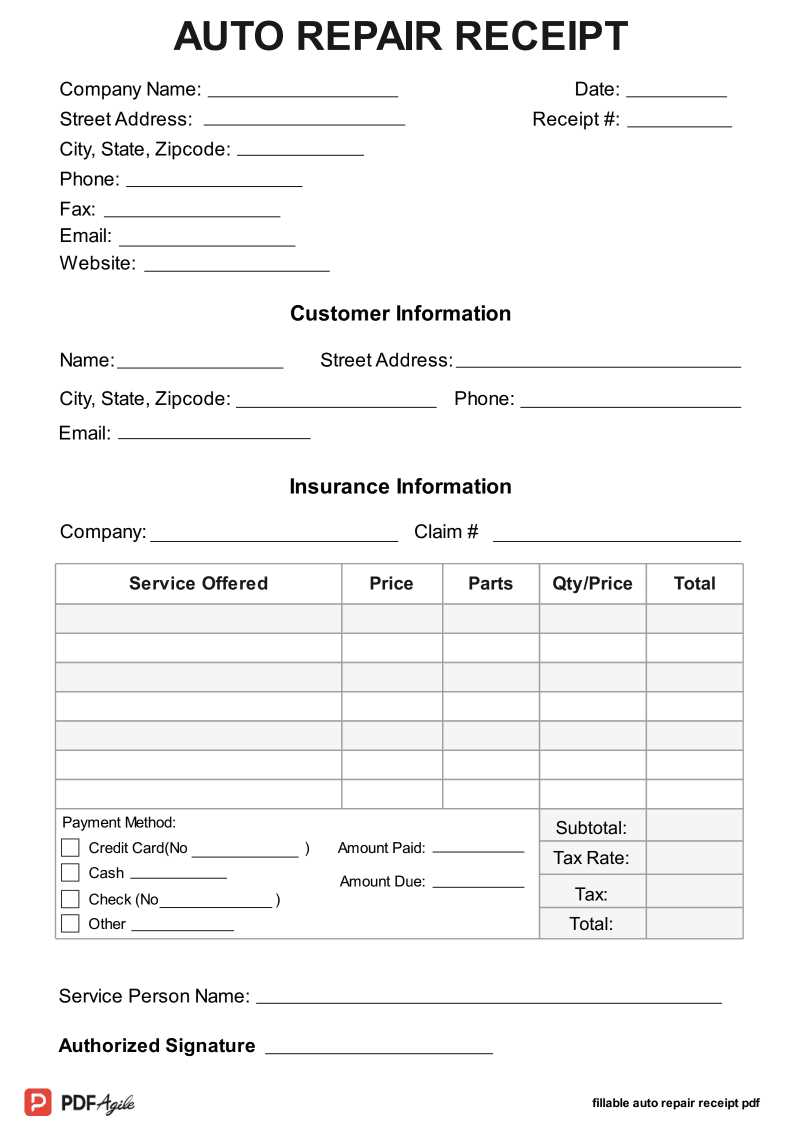

A well-designed document includes essential fields such as customer information, itemized services, and payment terms. It also incorporates necessary legal disclaimers and payment instructions. Customizable fields allow service providers to adapt the document to suit specific needs, enhancing its utility. This ensures that every transaction is accurately recorded and provides a reliable reference for future communications.

Why Use an Invoice Template

Utilizing a predefined document for billing purposes brings several advantages to service providers. It offers a streamlined approach for generating consistent and professional statements that accurately reflect the services provided. This method saves time, reduces human error, and ensures all necessary information is included in every transaction.

Efficiency and Consistency

By using a set format, businesses can quickly generate detailed statements without starting from scratch each time. This ensures that every document follows a consistent structure, providing customers with a uniform experience. Consistency in billing not only simplifies financial tracking but also enhances the business’s professional image.

Accuracy and Clarity

Having a standard layout helps reduce the risk of overlooking important details such as itemized costs, taxes, and payment terms. A well-organized document improves clarity for customers, making it easier for them to understand the breakdown of charges. This leads to fewer disputes and faster payments.

Benefits of PDF Format for Invoices

Choosing a digital format for billing documents offers numerous advantages, making the process of generating, storing, and sharing information more efficient. A digital file ensures that the content remains consistent across different devices, providing clear, legible copies for both the service provider and the customer.

- Universal Compatibility: PDF files can be opened on virtually any device without altering the layout or formatting. This ensures that recipients see the document as intended, regardless of the platform they use.

- Security: PDF documents can be encrypted, password-protected, or digitally signed, offering enhanced security for sensitive financial data.

- Compact and Easy to Share: PDF files are compressed, making them smaller in size and easy to email or store. This convenience helps streamline communication between businesses and customers.

- Professional Appearance: PDF ensures that the document maintains a clean and polished look, which is essential for building trust with clients.

Incorporating this format into your billing process provides a reliable and convenient solution for managing records and simplifying transactions.

How to Customize Your Template

Customizing a billing document is essential for tailoring it to your business needs. A personalized format not only helps reflect your brand but also ensures that all the necessary details are included for accurate transactions. Adjusting various sections to suit specific requirements allows for a professional and organized approach to managing payments.

Step-by-Step Customization

To begin customizing your document, consider the following elements:

- Business Information: Include your company name, logo, and contact details at the top. This gives your document a professional appearance and makes it easy for clients to reach you.

- Service Details: Customize the sections where you list services provided, including space for labor hours, parts, and any additional charges. This ensures all relevant information is clear and itemized.

- Payment Terms: Add payment due dates, methods of payment accepted, and any late fees or discounts. This helps manage expectations for both parties.

- Legal Disclaimers: If necessary, include terms of service, warranties, or other legal information to protect your business and clarify policies.

Using Custom Fields

Most document editing tools allow you to insert custom fields. These fields can be tailored to include client-specific information, such as vehicle details or job-specific notes. This flexibility makes it easy to adapt your format as needed.

Key Sections of an Invoice

To ensure a clear and effective billing document, it’s essential to include several key sections. Each part serves a specific purpose and ensures that both the service provider and the client understand the details of the transaction. Having these sections clearly laid out helps avoid confusion and ensures transparency in financial matters.

- Header Information: This section should include the service provider’s name, logo, and contact details. It also typically features a unique document number for tracking purposes.

- Client Details: Including the recipient’s name, address, and contact information ensures that the statement is personalized and directed to the correct individual or business.

- Description of Services: This is a detailed list of the tasks performed, parts used, and any associated charges. Each entry should be clear and itemized to avoid misunderstandings.

- Payment Terms: Specify due dates, accepted payment methods, and any penalties for late payments. This helps manage expectations and encourages timely settlement.

- Subtotal and Taxes: An itemized breakdown of costs, including any applicable taxes, ensures that the client understands how the total amount is calculated.

- Footer Notes: This section can include legal disclaimers, warranty information, or any other notes that are important for the customer to know. It can also feature a thank-you message or additional instructions for payment.

Ensuring Accurate Billing in Repairs

Accurate billing is a critical aspect of maintaining transparency and trust between a service provider and their customers. To avoid disputes and ensure smooth transactions, it is essential to record every detail of the services performed and associated costs. By following a systematic approach, businesses can ensure that clients are properly charged for all work completed.

- Detailed Documentation: Always document the specific tasks performed, materials used, and the time spent on each job. Providing an itemized list prevents confusion and helps justify the charges.

- Accurate Time Tracking: Tracking hours worked is essential for billing accurately. Use precise time logs to ensure that clients are charged only for the actual time spent on their project.

- Parts and Materials: Include a full breakdown of all parts or materials used during the service. If applicable, list part numbers, prices, and any associated labor costs.

- Clear Pricing: Make sure that the pricing structure is clear and consistent. If there are any changes to the agreed-upon costs, communicate these in advance and adjust the final amount accordingly.

- Rechecking Calculations: Before finalizing the document, double-check all calculations. Ensure that tax rates, discounts, and totals are accurate to avoid any discrepancies.

By focusing on these elements, you can guarantee that every client receives an accurate and transparent statement for the services provided, leading to higher satisfaction and fewer misunderstandings.

Common Mistakes in Auto Repair Invoices

When creating billing documents, errors can lead to confusion and disputes with clients. Even small mistakes can impact the trust between a service provider and their customer. It’s important to recognize these common issues and take steps to avoid them, ensuring a smooth and professional transaction every time.

Missing or Incorrect Client Information

One of the most common mistakes is not accurately recording the client’s name, contact information, or service details. This can result in incorrect billing and potential issues with follow-up communication. Always double-check client information to avoid such errors.

Unclear Service Descriptions

Another common mistake is not providing enough detail in the service description section. If the tasks performed are not clearly outlined, the client may question the charges. Be specific about the work completed, including time spent and parts used, to ensure transparency.

- Missing Itemization: Failing to break down charges for each individual service or part can create confusion. Always list the individual costs so the client can see how the total was calculated.

- Inconsistent Pricing: If pricing is not consistent or not clearly explained, it can lead to misunderstandings. Ensure that rates are clearly defined and any discounts or additional charges are documented.

- Incorrect Tax Calculations: Errors in tax calculations can lead to discrepancies. Always double-check tax rates and make sure they are applied correctly to the subtotal.

- Not Updating the Payment Terms: Failing to specify payment deadlines or methods of payment can create confusion. Always include this information clearly to set proper expectations for both parties.

By addressing these common mistakes, you can create more accurate and professional documents that improve client satisfaction and reduce the risk of errors in the future.

Legal Requirements for Auto Invoices

When preparing billing documents, it’s essential to comply with legal regulations to ensure the transactions are valid and transparent. These requirements often vary depending on location and industry, but there are common elements that need to be included to meet the legal standards and protect both businesses and consumers.

Essential Information to Include

One of the most important legal requirements is the inclusion of specific details on the billing statement. These often include:

- Business Identification: Your business name, address, and contact details should be clearly listed on the document.

- Client Information: Include the name and address of the person or business being billed.

- Description of Services: A detailed description of the services or products provided, including any parts or materials used.

- Tax Information: Depending on local regulations, you may need to include tax rates and the amount of tax charged on the services or products.

- Payment Terms: Specify payment methods, due dates, and any late payment penalties if applicable.

Legal Considerations for Record Keeping

In many jurisdictions, businesses are legally required to keep accurate records of all transactions for a specified period. This means you should ensure that all details on the document are truthful and verifiable. Proper record keeping helps protect your business in the event of audits or disputes.

Additionally, failing to meet these legal obligations can result in penalties or legal disputes, so it is crucial to ensure that your documents are accurate and meet local compliance standards.

How to Save Time with Templates

Using pre-designed documents can greatly streamline your administrative tasks, allowing you to focus more on the work itself rather than spending time on creating paperwork from scratch. By relying on well-structured formats, you can ensure consistency and reduce the chances of errors, ultimately saving valuable time for your business operations.

Efficiency in Document Creation

One of the key advantages of using pre-made formats is the ability to quickly input necessary information without having to start over each time. Here are some ways templates can help:

- Consistency: Pre-structured documents ensure that every transaction looks professional and includes all the necessary components without missing important details.

- Faster Processing: By filling out predefined sections, you can generate a document in minutes instead of hours, freeing up time for other essential tasks.

- Customization: Templates can be easily adjusted to suit the specific needs of your business, ensuring that each document reflects the required information, while still maintaining speed.

Reducing Mistakes

When you use standardized formats, there’s less room for error in formatting, data entry, and layout. This helps avoid costly mistakes that could result from manually creating each document, providing more reliable and accurate records.

By integrating pre-designed formats into your workflow, you can not only enhance productivity but also improve the overall efficiency of your business processes.

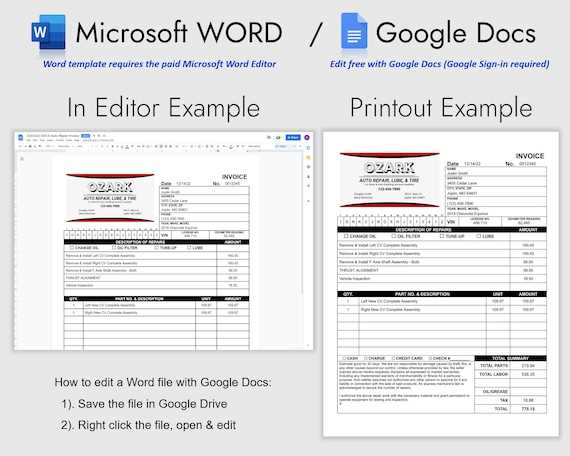

Free vs Paid Invoice Templates

When choosing document designs for business transactions, there are both free and paid options available. Each type offers its own set of benefits and limitations, and the decision often depends on the specific needs of the business. While free designs may seem like an attractive option, paid versions can offer additional features that might be worth the investment.

Advantages of Free Options

Free designs are widely accessible and can be a great starting point for small businesses or individuals just getting started. These options are often simple and easy to use. Key benefits include:

- No Cost: Free options provide an immediate, zero-cost solution, which can be a significant advantage for businesses with tight budgets.

- Quick Access: These formats are readily available online and can be downloaded or used immediately without any financial commitment.

- Basic Functionality: Free designs usually cover basic needs, making them suitable for straightforward transactions or occasional use.

Advantages of Paid Options

Paid formats often come with advanced features, customization options, and premium support that free versions lack. For businesses with ongoing needs, these paid designs can provide significant advantages:

- Customization: Premium formats often allow for extensive customization, helping you tailor the document to match your business’s branding and specific requirements.

- Professional Design: Paid versions typically offer more polished and professional layouts, which can enhance the presentation of your transactions.

- Support and Updates: Access to customer support and regular updates is another key benefit of paid designs, ensuring your documents stay current with any legal or industry changes.

Ultimately, the choice between free and paid options depends on the scale of your business and the complexity of your documentation needs. While free designs work well for occasional use, paid options offer long-term benefits for businesses requiring more sophisticated solutions.

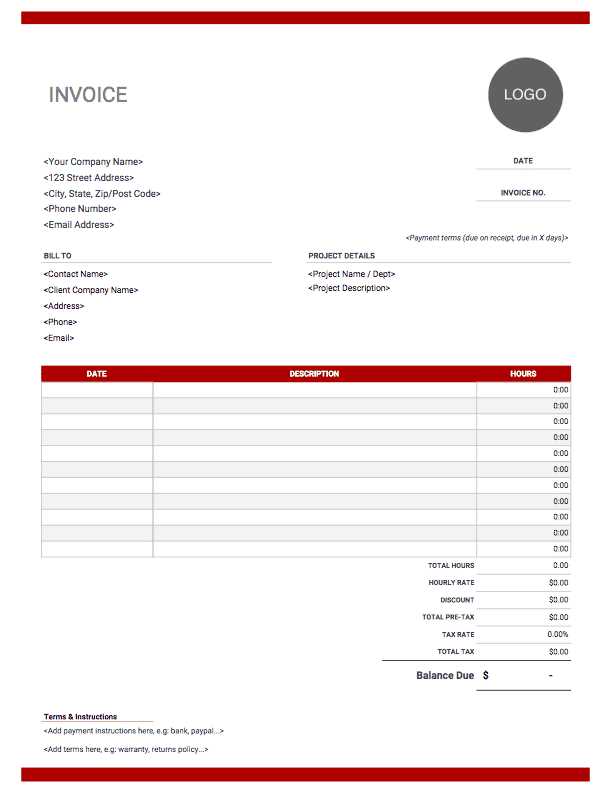

Design Tips for Professional Invoices

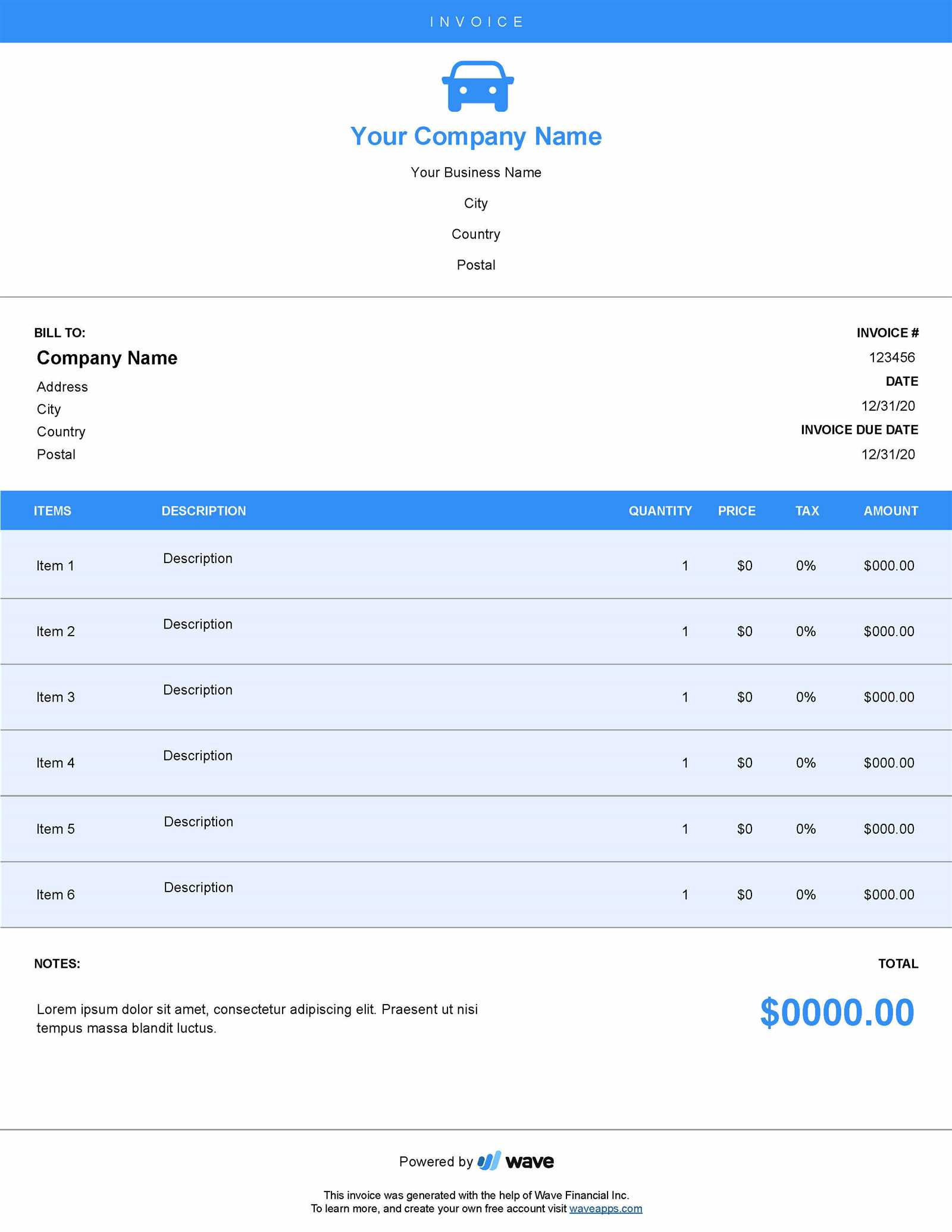

Creating clear, professional, and visually appealing documents is essential for maintaining a credible and trustworthy image. The design of these documents plays a significant role in how your business is perceived by clients. Proper organization, legibility, and the inclusion of necessary details can elevate the experience and ensure smoother transactions.

Use Clean and Simple Layouts

One of the keys to an effective document design is simplicity. Avoid clutter and excessive information that can overwhelm the reader. Instead, focus on a clean layout that allows your clients to quickly find the information they need. Key considerations include:

- Minimalist Design: Keep the layout simple with plenty of white space to enhance readability and prevent the document from feeling too busy.

- Logical Structure: Arrange information in a logical order, such as contact details, item descriptions, and payment terms, to make it easier for your clients to navigate.

Incorporate Branding Elements

Including your business’s logo, color scheme, and font choices in the document design helps maintain consistency with your overall branding. This reinforces your business’s identity and can make the document feel more personalized. Some tips to consider are:

- Logo Placement: Position your business’s logo at the top of the document for easy recognition and brand continuity.

- Consistent Colors: Use colors that align with your branding to maintain a cohesive look and create a visually pleasing document.

- Professional Fonts: Stick to clear, legible fonts that reflect a professional image. Avoid overly decorative or hard-to-read fonts.

By applying these design principles, you can create documents that are both functional and aesthetically pleasing. A well-designed document can make a lasting impression and contribute to smoother business interactions.

Tracking Payments Using Templates

Managing financial transactions efficiently is crucial for keeping accurate records and ensuring a smooth cash flow in your business. Utilizing predefined documents for monitoring payments can simplify the process and help you stay organized. By integrating essential details such as payment dates, amounts, and outstanding balances, you can easily track the financial status of each transaction.

Key Information to Include

To effectively monitor payments, it’s important to incorporate specific data points into your documents. This allows for clear tracking and prevents confusion. Here are some key elements to include:

- Payment Date: Record when the payment was made to track payment timelines.

- Amount Paid: Specify the exact amount that has been settled to avoid discrepancies.

- Remaining Balance: Clearly show any outstanding amounts, helping both parties stay informed about pending payments.

- Payment Method: Include details of how the payment was made (e.g., credit card, bank transfer, cash) for reference and future verification.

Benefits of Using Predefined Documents for Payment Tracking

Using ready-made documents to track payments offers several advantages for businesses:

- Efficiency: Quickly access payment histories and update statuses without needing to create new documents each time.

- Consistency: Ensure uniformity in how payments are recorded across all transactions, making it easier to maintain organized records.

- Transparency: Provide a clear and detailed record of payments for both your business and clients, reducing misunderstandings and disputes.

By utilizing well-structured documents to track payments, you can save time and avoid errors, while also improving your ability to manage finances effectively.

How to Include Tax Information

Including tax details in your documents is essential for ensuring compliance with local regulations and providing transparency to your clients. It’s important to clearly outline any applicable taxes, rates, and calculations to avoid confusion and to maintain professional standards in your business dealings. By properly documenting these amounts, you make the process smoother for both your clients and your accounting team.

Key Elements to Include

When incorporating tax information, there are a few critical components that should be present:

- Tax Rate: Clearly specify the percentage or fixed rate applied to the total amount.

- Tax Amount: Indicate the exact amount of tax charged, calculated based on the applicable rate.

- Total Amount After Tax: Include the final amount, which is the sum of the original amount plus the tax.

- Tax Identification Number (TIN): If required by local laws, include the relevant tax ID number for your business.

Best Practices for Presenting Tax Information

It’s important to present tax details in a way that is clear and easy to understand. Here are some best practices:

- Highlight the tax charge: Ensure the tax amount is clearly separated from the base amount, making it easy to identify.

- Use consistent terminology: Use familiar and standard terms such as “Sales Tax” or “VAT” to avoid confusion.

- Include jurisdiction-specific tax info: If operating in multiple regions, adjust the tax details to comply with each location’s specific regulations.

By following these guidelines, you ensure that tax information is presented professionally and in full compliance with the relevant laws.

Customizing Your Template for Branding

Personalizing your business documents is an essential step in creating a professional image and reinforcing your brand identity. By adapting these forms to reflect your company’s colors, logo, and style, you enhance your brand recognition while maintaining a cohesive and consistent message across all communication channels. A well-branded document helps build trust with your clients and ensures that your business stands out in a competitive market.

Key Elements to Customize

To effectively align your forms with your brand, consider the following elements:

- Logo Placement: Position your business logo prominently on the document. This is often placed at the top or in the header area, where it is easily visible to the recipient.

- Brand Colors: Integrate your brand’s color scheme into the design. This can include text colors, borders, and background shades, helping the document match your overall branding.

- Fonts: Use fonts that are consistent with your brand’s style guide. This ensures that the document feels cohesive with other marketing materials you produce.

- Contact Information: Include your business’s contact details in a standardized format, such as email addresses, phone numbers, or website links, using your brand’s specific font and layout preferences.

Why It Matters

Branding your business documents adds professionalism and can make a significant impact on customer perception. It conveys attention to detail and shows that you are invested in your business’s success. Customizing these forms enhances recognition, encourages repeat business, and reflects a polished, well-established business identity.

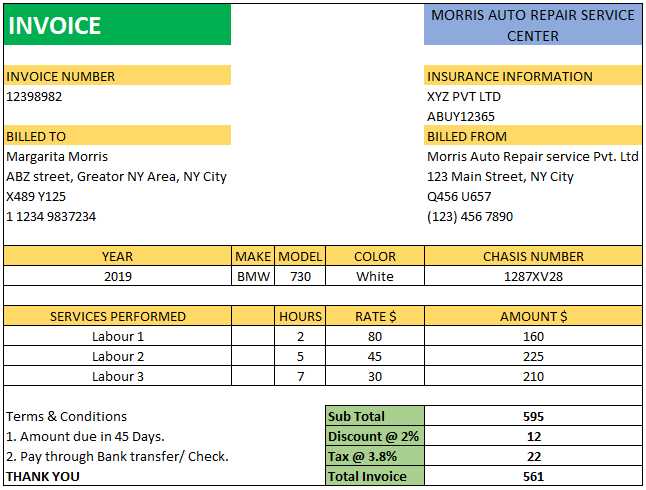

How to Handle Discounts on Invoices

Offering discounts is a common practice to encourage customer loyalty and incentivize purchases. However, it’s important to document these price reductions accurately to ensure clarity and transparency in your financial records. Properly handling discounts on billing statements helps maintain trust with clients while ensuring you receive the correct payment for your services or goods.

Types of Discounts

There are several types of discounts you can apply, depending on your business strategy and customer relationships:

- Percentage-Based Discount: A set percentage is subtracted from the total amount. For example, a 10% discount on a service or product cost.

- Fixed Amount Discount: A specific dollar or monetary amount is deducted from the total. This is often used for promotional offers.

- Seasonal or Promotional Discounts: Discounts offered during certain times of the year, or as part of a marketing campaign to attract more business.

- Bulk Purchase Discounts: These are applied when customers buy in large quantities, often calculated based on the total amount purchased.

Including Discounts in Your Documentation

When applying discounts to a billing statement, it’s essential to include them clearly to avoid confusion:

- Line Item Display: Make sure the discount is listed as a separate line item, showing both the original price and the discounted amount.

- Total Discount Section: Include a section where the total discount is clearly shown to help clients easily identify the reduced amount.

- Terms of Discount: If applicable, note any terms, such as whether the discount applies to specific items or only under certain conditions.

By following these guidelines, you ensure that your billing process is both transparent and professional, fostering good relationships with your clients while keeping your records organized.

Invoice Security and Protection Tips

Ensuring the safety of your financial documents is crucial in preventing unauthorized access, fraud, and data breaches. Protecting your billing records not only secures sensitive information but also maintains the integrity of your business operations. Implementing effective strategies to safeguard these documents will help you avoid potential risks and ensure that you remain compliant with industry standards.

Best Practices for Protecting Billing Records

- Use Strong Passwords: Make sure to secure your electronic files with strong, unique passwords. Avoid using easily guessable combinations and update passwords regularly.

- Encrypt Digital Files: Encrypting your billing documents adds an additional layer of protection, ensuring that even if they are intercepted, they cannot be accessed without the proper decryption key.

- Limit Access: Only authorized personnel should have access to sensitive financial documents. This reduces the risk of internal leaks or misuse of information.

- Secure Cloud Storage: When using cloud-based storage for your records, ensure that the provider offers strong encryption and two-factor authentication to protect your data from unauthorized access.

Physical Security Measures

- Lock Paper Records: If you maintain paper copies of your financial documents, store them in a locked and secure location. Restrict access to these records to only those who need them.

- Shred Sensitive Documents: Always shred old or outdated documents that contain sensitive information to prevent unauthorized access through physical means.

By following these security measures, you can significantly reduce the risk of data breaches and ensure that your financial records are protected from both digital and physical threats.

Integrating Templates with Accounting Software

Streamlining your business processes is made easier by integrating your financial documents with accounting systems. This connection allows for automatic updates, real-time data synchronization, and simplified record-keeping. By linking your document format with accounting software, you can save time and reduce errors, all while ensuring consistency across your financial management tasks.

Benefits of Integration

- Automated Data Transfer: Integration eliminates the need for manual data entry, ensuring that information from your billing records is automatically recorded in your financial system.

- Accurate Financial Tracking: With seamless integration, financial data such as payments, taxes, and totals are accurately updated in your accounts, providing a clearer overview of your business finances.

- Time Savings: By reducing manual effort, you free up time for other important tasks, leading to increased efficiency and productivity.

Integration Process

When integrating documents with accounting software, the process typically involves the following steps:

| Step | Description |

|---|---|

| 1. Choose Compatible Software | Ensure that the accounting software you choose supports integration with your chosen financial document format. |

| 2. Set Up API or Import Functionality | Use an API or import function to allow the two systems to communicate and exchange data securely. |

| 3. Map Data Fields | Identify which data from your documents should be transferred to the accounting system, such as amounts, dates, and customer details. |

| 4. Test and Verify | Run tests to ensure that the data is being transferred correctly and that there are no discrepancies in the accounting system. |

By integrating your financial records with accounting software, you can ensure smoother operations, enhance the accuracy of your data, and focus more on growing your business.

How to Share and Send Invoices Efficiently

Efficiently sending and sharing financial documents is crucial for maintaining timely payments and smooth business operations. By using the right tools and methods, you can ensure your clients receive the necessary information promptly and securely. Whether through digital platforms or traditional methods, there are several effective ways to distribute your records that can save you time and enhance communication with your customers.

One of the most efficient ways to send financial documents is by utilizing email. By attaching the documents in a format that is easy to open, such as a Word file or a spreadsheet, clients can access them quickly. It’s essential to ensure that the document is clearly named, and that the subject line in the email is direct and relevant to the content. Some businesses opt for specialized invoicing software that allows for direct email integration, reducing manual steps.

If you prefer a more formal method, printing the documents and sending them by mail is still an option. However, this method takes longer and involves additional costs. To save on postage, consider sending multiple documents in one envelope, or offer customers the choice between digital and printed versions.

For added convenience, online platforms or client portals allow for secure document sharing. This provides both the sender and recipient with an easy-to-track record of communication and ensures that the documents are safely stored and can be accessed at any time. This option is especially useful for businesses that deal with recurring transactions, as clients can access their financial records at their convenience.

Regardless of the method you choose, be sure to follow up promptly if payment has not been received within the expected time frame. This demonstrates professionalism and ensures your business stays on top of outstanding balances.