Auto Repair Invoice Template for Word Easy Customization and Use

Running a vehicle service business involves more than just providing quality work–it requires efficient administrative processes to ensure smooth operations. One of the most important aspects of managing payments is having a well-organized document that outlines charges clearly for your clients. This tool helps avoid confusion and ensures that both parties are on the same page when it comes to payment expectations.

Utilizing a digital document for generating receipts or payment requests can significantly reduce the time spent on manual calculations and formatting. With the right layout, you can quickly add service details, materials used, labor hours, and total costs, giving you more time to focus on your work rather than paperwork.

Customized billing documents are not only professional but can also be tailored to fit the specific needs of your business. By using easily editable files, you can adjust the content as needed, whether it’s offering discounts, including taxes, or breaking down costs by category. These documents are versatile and can be used across various platforms, making it easier to handle transactions and track financial records.

Whether you’re just starting your business or looking to improve existing processes, having a pre-made structure for documenting charges ensures consistency, saves time, and elevates your overall professionalism.

Auto Repair Invoice Template for Word

In any service-oriented business, having an organized system to document payments and charges is crucial. A structured, easy-to-edit document can help ensure clarity and accuracy when dealing with customers. This type of record is essential for maintaining professionalism and managing finances efficiently. Using a ready-to-use digital format allows you to focus on providing quality services while streamlining your billing process.

Why Choose a Pre-made Document?

Having a pre-designed file offers multiple benefits that can save time and reduce errors. Some advantages include:

- Consistency: A fixed layout ensures that all your billing records follow the same format, making them easier to read and understand.

- Time-saving: Quickly generate accurate documents without needing to create each one from scratch.

- Customization: Modify the content according to your specific needs, such as adding service descriptions or adjusting pricing.

- Professional appearance: Present clients with a clean, well-organized statement that reflects your business standards.

Features to Look for in a Suitable Document

When choosing the right document for your needs, ensure it includes the following key elements:

- Client Information: A section to include customer names, addresses, and contact details.

- Service Breakdown: A detailed list of tasks completed, along with time spent and materials used.

- Pricing Details: Clear cost breakdowns for labor, parts, and additional fees.

- Payment Terms: Clearly defined payment expectations, including due dates and accepted payment methods.

- Company Information: Include your business name, logo, and contact details for easy identification.

By using such a format, you

Why Use an Auto Repair Invoice?

Having a formal document that records the details of a service transaction is essential for both businesses and customers. It ensures that both parties have a clear understanding of the work performed, the cost involved, and the terms agreed upon. This document serves as an important tool for maintaining transparency, organizing financial records, and offering legal protection if disputes arise.

Additionally, this record is crucial for accounting purposes, tax reporting, and future references. It not only helps in tracking payments and outstanding balances but also enhances professionalism in the service industry.

| Benefit | Description |

|---|---|

| Clarity | Ensures both parties agree on the scope of work and pricing, minimizing misunderstandings. |

| Legal Protection | Serves as a formal record in case of disputes, offering legal support if needed. |

| Accounting | Helps businesses manage their financials by providing clear documentation for tax and revenue tracking. |

| Professionalism | Enhances the image of a business by offering organized and formal documentation of services provided. |

Benefits of Word Invoice Templates

Using pre-designed documents for billing and transaction purposes offers numerous advantages, especially for businesses aiming to streamline their operations. These ready-made formats provide consistency and ensure that essential details are included, which can save time and reduce errors. With customizable features, users can tailor these documents to suit specific needs, making them versatile and efficient for daily use.

- Ease of Use: These formats are user-friendly, allowing even those with minimal experience in document creation to generate professional reports quickly.

- Customization: Users can easily adjust sections, fonts, and layouts to reflect the unique branding or style of their business.

- Time-Saving: With a structured format, businesses can avoid reinventing the wheel for every new transaction, allowing them to focus more on the work at hand.

- Consistency: Regularly using the same structure ensures that all essential details are consistently captured, reducing the risk of missing important information.

- Professional Appearance: Pre-designed documents help maintain a polished and formal presentation, which can enhance the business’s credibility and trustworthiness.

- Accessibility: Most common word processing software is compatible with these files, making them easy to create, share, and store across various platforms.

Incorporating such a system into daily practices not only enhances efficiency but also helps in managing transactions and maintaining a well-organized record system.

How to Customize Your Invoice

Customizing a billing document allows you to make it fit your business’s specific needs, reflect your branding, and include all necessary details. With a few adjustments, you can personalize the layout, sections, and information provided, ensuring that it aligns perfectly with your business requirements. Here’s a simple guide on how to tailor your document for any transaction.

1. Adjust the Layout and Design

- Change Fonts and Colors: Choose fonts and colors that match your business branding for a professional look.

- Insert Logo: Add your company’s logo at the top to create a more recognizable and personalized document.

- Modify Section Headings: Edit or reorganize titles and categories to suit your business’s specific services or products.

- Include a Payment Section: Make sure to clearly define how payments should be made, including account details or payment methods accepted.

2. Tailor the Content

- Personalize Contact Information: Ensure your business name, address, and contact details are updated and visible.

- Add Custom Terms: Include any special terms and conditions related to your services, such as discounts, late fees, or warranties.

- Specify Work Details: Break down services or items provided in clear, easy-to-understand descriptions, including quantities and individual prices.

- Set Payment Due Dates: Define a clear deadline for payments to help avoid confusion and ensure timely collection of funds.

By making these adjustments, you not only create a document that reflects your business more accurately but also provide a clear, organized record for your clients.

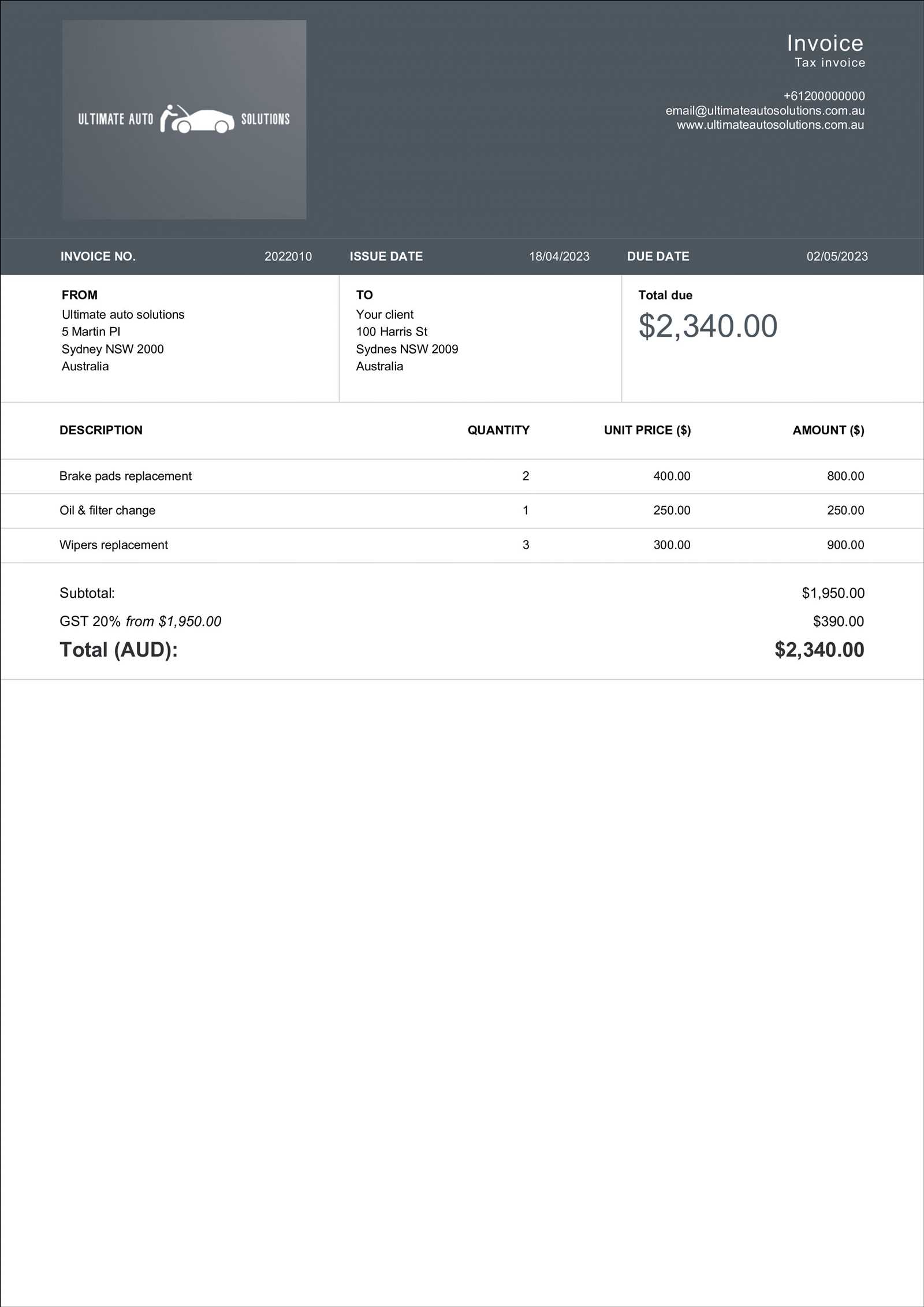

Essential Information on Auto Repair Invoices

To ensure a smooth transaction process and avoid any confusion between service providers and clients, certain key details must always be included in the billing document. These essential pieces of information not only help maintain clarity but also protect both parties by providing a clear record of the services rendered and the agreed-upon costs. Properly documenting these details is crucial for effective communication and maintaining trust.

Key Components to Include

- Service Provider Information: Include the business name, address, phone number, and email for easy contact.

- Client Details: Ensure the customer’s name, address, and contact information are correctly listed.

- Unique Identification Number: Use a unique number or reference code for each document to easily track and identify transactions.

- Description of Services: Provide a detailed list of the services provided, including labor, parts, or additional charges.

- Payment Terms: Clearly outline payment methods, due dates, and any applicable late fees or discounts for early payment.

- Total Amount Due: Include a breakdown of costs with an itemized list showing individual prices for each service or item, as well as the total amount due.

Example Breakdown

| Service Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Labor Charge | 2 hours | $50.00 | $100.00 |

| Parts (Brake Pads) | 2 sets | $60.00 | $120.00 |

| Diagnostic Fee | 1 | $30.00 | $30.00 |

| Total | $250.00 |

Including these elements not only ensures that all aspects of the transaction are covered but also helps build a transparent and professional relationship with your clients.

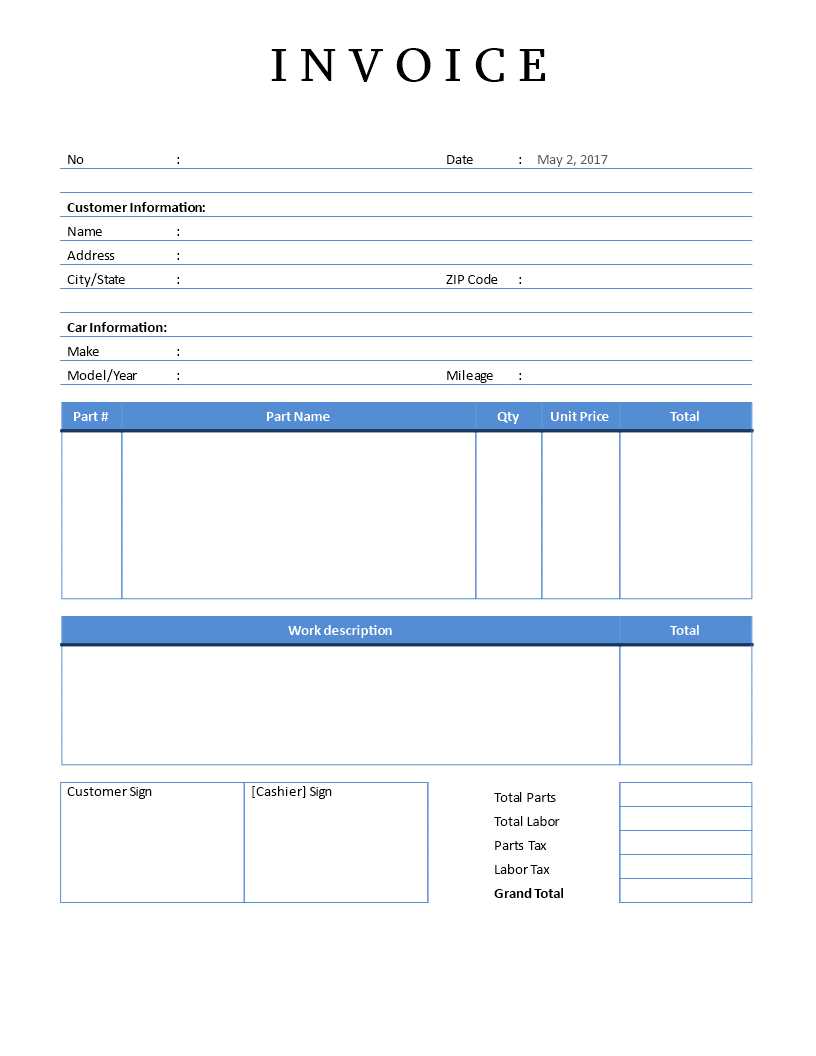

Adding Labor and Parts Costs

When calculating the total amount for services rendered, it is essential to accurately document both the labor and material costs involved. Labor charges usually depend on the time spent working, while parts costs reflect the materials or components used during the process. Properly listing these expenses ensures that clients understand the breakdown of charges and helps maintain transparency in the billing process.

Labor Costs

- Hourly Rate: Specify the rate charged per hour for labor, which may vary based on the skill level required or the type of service performed.

- Total Time Spent: Clearly indicate the number of hours or minutes spent on the task, ensuring it aligns with the service provided.

- Multiple Technicians: If more than one person worked on the project, list the hours worked by each technician along with their respective rates.

- Additional Charges: In some cases, additional labor fees may apply for urgent or after-hours work, so it’s important to specify any such charges.

Parts Costs

- Itemized List: Provide a detailed list of all parts used during the job, including the name, part number, and quantity for each item.

- Unit Price: Clearly state the price per unit for each part, along with any applicable taxes or handling fees.

- Markups: If applicable, include any markup added to the cost of parts to cover procurement or shipping expenses.

- Warranty Information: If parts come with a warranty, make sure to include this information to offer added value to the customer.

By providing a detailed breakdown of labor and material costs, businesses can foster trust with customers while ensuring that all charges are clear and transparent.

Including Taxes in Your Invoice

When creating a billing document, it is crucial to account for taxes, as they are a standard part of any transaction. Including the correct tax amount ensures compliance with local laws and helps avoid potential legal or financial issues. Whether it’s sales tax, service tax, or any other applicable tax, it’s important to calculate and present these charges clearly to the customer.

First, ensure you know the applicable tax rate for your location or industry. Tax rates can vary based on the type of service or product provided, as well as where the transaction takes place. Some areas have a standard sales tax, while others might require additional taxes for specific services or products.

- Identify the Tax Rate: Determine the correct percentage of tax to apply. This is typically set by government authorities and can differ by region.

- Apply the Tax to the Subtotal: Once you’ve calculated the total cost of services and materials, multiply the subtotal by the tax rate to get the tax amount.

- Clearly Show Tax Breakdown: On the billing document, list the tax amount separately from the subtotal, clearly stating both the rate and the total tax charged.

- Include Tax ID Number: For businesses required to collect taxes, include your tax identification number on the document to ensure transparency and credibility.

Example: If the total cost for services and parts comes to $200, and the applicable tax rate is 8%, the tax amount would be $16, making the total amount due $216.

By following these steps, you can ensure that taxes are applied accurately and professionally, helping maintain a smooth and legally compliant business operation.

Setting Payment Terms in Word Templates

Clearly defining the payment terms in a billing document is crucial for both the service provider and the client. By outlining how and when payment is expected, businesses can avoid confusion and ensure prompt transactions. A well-established payment policy helps set the tone for professional relationships and guarantees smooth financial interactions.

Essential Elements of Payment Terms

- Due Date: Specify when payment is expected, whether it’s within a certain number of days (e.g., 30 days from the service date) or by a specific date.

- Accepted Payment Methods: List all the payment options available, such as credit card, bank transfer, checks, or online payment platforms.

- Late Payment Penalties: If applicable, mention any late fees or interest that will be charged if payment is not made by the due date.

- Discounts for Early Payment: Provide details on any discounts for clients who settle their bills ahead of schedule, encouraging quicker payment.

- Payment Installments: If applicable, offer the option for installment payments, and outline the terms for such arrangements (e.g., number of payments, due dates, etc.).

Example Payment Terms

- Due Date: Payment is due within 30 days of the service date.

- Accepted Methods: We accept payments via credit card, bank transfer, or PayPal.

- Late Payment Fee: A late fee of 2% per month will be applied to overdue balances.

- Early Payment Discount: A 5% discount is available for payments made within 10 days.

By clearly setting these terms, you can reduce the chances of payment delays and misunderstandings, while also offering flexibility and incentives to clients for timely payments.

Saving and Sharing Your Invoice

Once you have created a billing document, it is important to save it in an accessible format for future reference and ensure it can be easily shared with your clients. Proper storage and sharing practices not only help keep your financial records organized but also facilitate prompt payments and maintain clear communication with customers.

Saving Your Document

- File Format: Save the document in a commonly used format such as PDF to ensure it can be opened by anyone, regardless of the software they use.

- File Name: Use a clear, descriptive file name, such as the customer’s name or the unique transaction number, to easily identify the document later.

- Backup: Keep a backup of the file on a secure cloud service or an external hard drive to prevent loss of important records.

Sharing Your Document

- Email: The fastest way to send the document is via email. Attach the file to an email and include a polite message with payment details and terms.

- Online Payment Systems: If you use an online payment platform, many allow you to upload and send the document directly to the client, simplifying the process.

- Physical Copy: In some cases, clients may prefer a physical copy. Print the document and mail it to them, ensuring it is properly addressed and formatted.

- Client Portal: If you have a client portal or online account system, upload the document there for clients to access at their convenience.

Example: You can save the billing document as “JohnDoe_Invoice_001.pdf” and email it with a note: “Dear John, Please find your payment request for services rendered on [Date]. Kindly review the details and process payment by the due date.”

By following these steps, you ensure that your document is stored securely, easily accessible, and efficiently shared, contributing to a smooth transaction process with your clients.

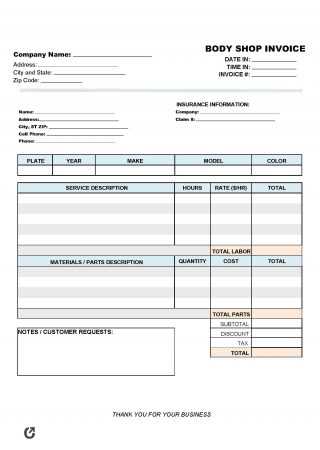

Creating a Professional Look with Word

When preparing a billing document, presentation is just as important as the information it contains. A clean, well-organized layout not only makes the document easier to read but also enhances your business’s professional image. A polished and visually appealing format conveys credibility and fosters trust with clients, making them more likely to return for future services.

Design Tips for a Polished Document

- Use Consistent Fonts: Choose a professional and easy-to-read font, such as Arial, Times New Roman, or Calibri. Stick to one or two fonts for a cohesive look.

- Align and Organize Sections: Properly align text, headings, and tables to avoid clutter. Use bold or larger font sizes for section titles to make them stand out.

- Include Your Branding: Add your company logo and brand colors to personalize the document and reinforce your brand identity.

- Use Tables for Clarity: Organize numerical details such as costs, quantities, and descriptions in tables to make them easier to read and follow.

- White Space: Don’t overcrowd the document with too much information. Leave sufficient white space between sections to make the content more digestible and visually appealing.

Example Structure for Professional Appeal

- Header: Include your business name, logo, contact details, and any other important identifiers at the top.

- Clear Section Dividers: Separate different sections (such as billing details, services, and payment terms) with bold lines or spacing to guide the reader.

- Footer: Place any disclaimers, legal terms, or additional contact information in a footer to keep the main content area uncluttered.

Example: A header with your logo and business name on the left, contact details aligned to the right, followed by a clean, easy-to-read table listing services, with bold section titles to clearly separate different elements, creates an organized and professional appearance.

By focusing on these design principles, you can ensure that your document not only conveys the necessary details but also reflects the professionalism of your business, leaving a lasting impression on your clients.

Free vs Premium Auto Repair Templates

When selecting a format for creating billing documents, businesses often face the decision between using free resources or opting for premium options. While both choices provide essential functionality, the features, customization options, and overall user experience can vary significantly. Understanding the differences between free and paid formats can help determine which option best suits the needs of your business.

Advantages of Free Templates

- Cost-Effective: The most obvious benefit is that free options come with no upfront cost, making them ideal for businesses with limited budgets or those just starting out.

- Easy to Access: Free formats are widely available and can be downloaded or accessed instantly from various online sources.

- Basic Functionality: They typically offer essential features, such as pre-built sections for service details, costs, and payment terms, which are sufficient for simple billing needs.

- Good for Small or One-Time Use: For businesses with minimal invoicing needs or short-term use, free options can be quick and effective.

Advantages of Premium Templates

- Advanced Customization: Premium formats usually provide greater flexibility, allowing for more detailed personalization in terms of layout, branding, and design elements.

- Professional Appearance: These options often come with polished, high-quality designs that reflect a more professional image, which can help businesses make a stronger impression on clients.

- Additional Features: Premium choices may include advanced functionalities such as automated calculations, tax inclusion, and integration with accounting software.

- Support and Updates: Purchasing a premium format often comes with customer support and regular updates, ensuring that the document remains relevant and functional as business needs evolve.

Which Should You Choose?

Choosing between free and premium formats depends on the specific needs of your business. If you’re just getting started and have basic invoicing requirements, a free option may suffice. However, if you need more advanced features, enhanced customization, or a more polished look, investing in a premium option can provide better value in the long run.

Example: A small business owner may begin with a free format to handle basic billing but, as the business grows, may choose a premium version for a more sophisticated look and added functionalities like automated tax calculations or integration with an accounting system.

How to Track Payments with Templates

Tracking payments efficiently is essential for maintaining a healthy cash flow and keeping accurate financial records. By using structured documents, businesses can easily monitor which payments have been received and which are still outstanding. This process not only helps you stay organized but also ensures timely follow-ups with clients who have not yet paid. Implementing a system within your billing documents can simplify this task.

Essential Fields for Payment Tracking

- Payment Status: Clearly mark whether the payment has been received, is pending, or is overdue. This allows for easy reference when checking outstanding balances.

- Payment Date: Record the exact date when a payment is received to help keep an accurate timeline of transactions.

- Amount Paid: Include a column for the amount paid by the customer. This helps to ensure that payments are recorded correctly, especially if they are partial.

- Balance Due: Deduct the payment amount from the total and display the remaining balance, so both parties know what is left to be paid.

- Payment Method: Note how the payment was made, whether by cash, check, credit card, or another method. This can help in resolving any disputes regarding payment methods.

Example Payment Tracking Table

| Invoice Number | Payment Status | Payment Date | Amount Paid | Balance Due | Payment Method | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 001 | Paid | 10/01/2024 | $200.00 | $0.00 | Credit Card | ||||||||||||||||||||||||||||||

| Description of Service | Quantity | Unit Price | Total |

|---|---|---|---|

| Service A: Installation | 1 | $100.00 | $100.00 |

| Service B: Maintenance | 2 | $50.00 | $100.00 |

| Service C: Consultation | 1 | $75.00 | $75.00 |

| Total | $275.00 | ||

By following these steps and ensuring that each service is clearly outlined, you can create an accurate and professional document that makes the billing process clear and straightforward for your clients.

Integrating Word Templates with Accounting Tools

Integrating your billing documents with accounting software can significantly streamline your financial processes, saving time and reducing the risk of errors. By connecting your prepared forms with automated systems, you can track payments, generate financial reports, and manage taxes with greater ease. This integration helps ensure that your business remains organized, efficient, and up-to-date on all financial matters.

Benefits of Integration

- Automated Data Entry: By linking your documents with accounting tools, you can automatically transfer key information such as totals, payment status, and client details, eliminating the need for manual input.

- Accurate Financial Reporting: Integration allows you to generate up-to-date financial reports without the need for cross-checking multiple systems. This improves the accuracy of your financial records.

- Streamlined Tax Calculations: Many accounting systems automatically calculate taxes based on preset rates. When your documents are connected, this calculation happens seamlessly, ensuring that your tax reports are accurate and timely.

- Real-Time Payment Tracking: Integration allows you to track payments in real time, providing you with instant updates on outstanding balances, received payments, and overdue amounts.

- Time Efficiency: Once your system is set up, much of the manual work involved in billing and financial management is automated, saving your business significant time and resources.

How to Integrate Your Documents

- Choose Compatible Software: Select accounting software that supports integration with your document management system. Popular options include QuickBooks, Xero, and FreshBooks, all of which offer integration with billing forms.

- Import Data: Most accounting tools allow you to import customer data and service details directly from your documents. Ensure that your forms are structured in a way that is compatible with the software you are using.

- Set Up Automatic Syncing: Enable automatic syncing between your document system and accounting software. This ensures that updates to billing documents (lik

Setting Up Discounts and Coupons

Offering discounts and promotional codes is an excellent way to attract new customers, retain loyal ones, and boost sales. By incorporating these incentives into your billing process, you not only encourage more purchases but also create a positive customer experience. Properly setting up and applying discounts ensures that clients understand the savings they receive and that your business maintains accurate pricing records.

Types of Discounts to Include

- Percentage Discounts: These are calculated as a percentage of the total amount, providing a straightforward and scalable reduction for customers.

- Fixed Amount Discounts: This type offers a specific dollar or euro amount off the total price, making it easy to calculate and apply.

- Buy One, Get One (BOGO): A popular promotion, where customers receive an additional item for free or at a reduced price when they purchase a qualifying product or service.

- Seasonal or Holiday Discounts: Special offers given during specific times of the year, often tied to holidays or events, to encourage customers to make a purchase.

- Volume Discounts: These discounts are given based on the quantity of items or services purchased, rewarding customers who buy in bulk or book multiple services.

Steps to Set Up Discounts and Coupons

- Define the Discount Type: Decide whether the discount will be a percentage, fixed amount, or other types like BOGO or seasonal. Choose the one that best fits your promotional strategy.

- Set Terms and Conditions: Clearly define the terms of the discount, such as the minimum purchase amount, specific products or services eligible, and expiration dates. Make sure these are easily understood by your customers.

- Input Discount Details: When creating your billing document, add a section for discounts where you can apply the specified reduction. Include a description, the discount value, and how it affects the total cost.

- Generate Coupon Codes: If using coupon codes, create unique codes that customers can enter during checkout. Ensure that the codes are easy to use and track.

Ensuring Invoice Compliance with Local Laws

When issuing billing documents, it is crucial to ensure that they comply with the legal requirements specific to your region or industry. Compliance helps prevent disputes, avoids legal penalties, and ensures that your business operates within the law. It’s essential to familiarize yourself with local regulations regarding taxes, payment terms, and required information to maintain a transparent and lawful financial practice.

Key Elements for Legal Compliance

- Tax Information: Include all necessary tax details, such as tax identification numbers and applicable tax rates. Many regions require businesses to display these details to ensure proper tax reporting and compliance.

- Required Business Information: Depending on your location, certain business details like your company’s registration number, address, and contact information may need to be included on the document.

- Payment Terms: Clearly outline the payment terms, including due dates and accepted methods of payment. This helps avoid misunderstandings and ensures that your terms align with local business practices.

- Itemized Charges: It is often required to break down the charges for each product or service rendered, providing clear descriptions and corresponding costs. This transparency helps ensure compliance with consumer protection laws.

- Currency and Language Requirements: Make sure that your billing documents use the correct currency and language according to the local norms and laws.

Steps to Ensure Compliance

- Research Local Laws: Take the time to understand the legal requirements in your jurisdiction. Local government websites and industry associations are often valuable resources.

- Use a Standardized Format: Follow the typical structure recommended by local authorities to ensure all necessary details are included, such as tax codes or mandated fields.

- Consult a Professional: If unsure about certain legal requirements, consider seeking advice from a tax professional or legal consultant to ensure full compliance.

- Update Your Documents Regularly: Laws and regulations change over time, so it’s important to keep your forms up to date with the latest legal changes.

Example: In some jurisdictions, failure to include a tax identification number or an accurate description of services can result in fines or delayed payments. Therefore, it’s crucial to ensure that your billing documents meet all necessary legal standards.

By taking the time to ensure that your billing documents comply with local regulations, you safeguard your business agains

Why Use an Auto Repair Invoice?

Having a formal document that records the details of a service transaction is essential for both businesses and customers. It ensures that both parties have a clear understanding of the work performed, the cost involved, and the terms agreed upon. This document serves as an important tool for maintaining transparency, organizing financial records, and offering legal protection if disputes arise.

Additionally, this record is crucial for accounting purposes, tax reporting, and future references. It not only helps in tracking payments and outstanding balances but also enhances professionalism in the service industry.

Benefit Description Clarity Ensures both parties agree on the scope of work and pricing, minimizing misunderstandings. Legal Protection Serves as a formal record in case of disputes, offering legal support if needed. Accounting Helps businesses manage their financials by providing clear documentation for tax and revenue tracking. Professionalism Enhances the image of a business by offering organized and formal documentation of services provided.