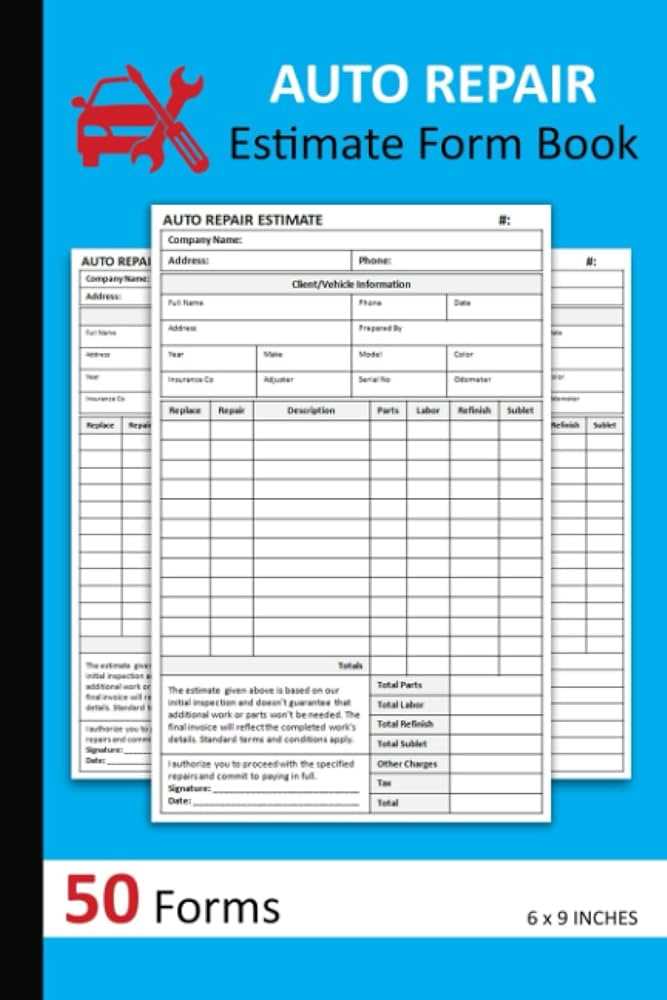

Auto Mechanic Invoice Template for Efficient Billing and Record Keeping

For businesses offering vehicle repair or maintenance services, effective billing is crucial for both smooth operations and professional customer relations. An organized approach to charging clients not only ensures you get paid promptly but also helps maintain clear records for future reference. Providing a detailed and easy-to-understand document for every transaction is essential to avoid confusion and keep things transparent.

Having a reliable tool to create consistent and accurate billing documents can save you time and effort while minimizing errors. With the right structure, these records can outline all services provided, parts used, and labor hours completed in a clear and professional manner. Such documents are not only useful for your business but also help build trust with customers who appreciate clarity and fairness.

In this guide, we will explore how to design and use a customizable billing format tailored to your specific needs. Whether you’re just starting out or looking to improve your current system, understanding the basics of proper invoicing will help streamline your workflow and ensure smooth transactions every time.

Auto Repair Billing Document Guide

Creating a well-structured billing document is essential for ensuring clarity and professionalism in the vehicle repair industry. It serves as a clear record of services rendered, costs, and payment terms, making it easier for both business owners and customers to track expenses and settle transactions. Whether you’re a freelance repair specialist or run a larger shop, understanding how to build an effective billing document can improve efficiency and client satisfaction.

Key Elements to Include

A comprehensive record should include several key details that help both the service provider and customer understand the breakdown of charges. Start by clearly stating the company name and contact information at the top, followed by the client’s information. Then, list the specific services provided, along with labor and parts costs. A well-organized breakdown ensures that every charge is transparent and easy to understand.

Designing for Clarity and Efficiency

Once the essential components are defined, focus on formatting. A clean, professional design enhances readability and helps avoid confusion. Using clear headings, bullet points, and consistent fonts can make the document easier to navigate. Consider including spaces for payment terms and due dates, as this can help manage cash flow and establish clear expectations between parties. A properly formatted document is more than just a tool for billing–it’s a reflection of the professionalism of your business.

Why You Need an Invoice Template

Having a standardized document for billing is crucial for any service-based business. It not only ensures accuracy in capturing all necessary details but also saves valuable time by eliminating the need to create a new document from scratch for every client. A well-designed billing form allows you to maintain consistency, manage transactions efficiently, and keep professional records for future reference.

Without a reliable format, billing can become confusing and prone to errors, which could lead to misunderstandings or delayed payments. By using a pre-designed structure, you ensure that each charge is accounted for properly and that clients receive clear, understandable information about the services they are paying for.

Benefits of a Standardized Billing Form

| Benefit | Description |

|---|---|

| Consistency | Every document follows the same layout, ensuring no important details are left out. |

| Efficiency | Saves time by reducing manual work and streamlining the process for recurring tasks. |

| Accuracy | Helps prevent mistakes in calculations, quantities, or service descriptions. |

| Professionalism | Creates a polished appearance that enhances customer trust and business credibility. |

Benefits of Using Auto Repair Billing Documents

Having a standardized billing format provides numerous advantages for service-based businesses. It simplifies the process of charging clients, reduces errors, and ensures that all relevant information is included in a clear and professional manner. Whether you’re a solo technician or manage a larger repair shop, using a consistent system can streamline operations and enhance overall customer experience.

By relying on a structured document, businesses can improve both internal organization and external communication with customers. It also helps create a more efficient workflow, reducing the chances of misunderstandings and ensuring timely payments.

Advantages of Standardized Billing Documents

| Advantage | Description |

|---|---|

| Improved Organization | Centralizes all relevant billing information in one place, making it easier to track transactions. |

| Time Savings | Reduces the need for manual calculations and formatting, allowing for faster document generation. |

| Clear Communication | Ensures clients fully understand the costs and services provided, fostering better relationships. |

| Reduced Errors | Minimizes mistakes in pricing, descriptions, and calculations, ensuring accurate billing every time. |

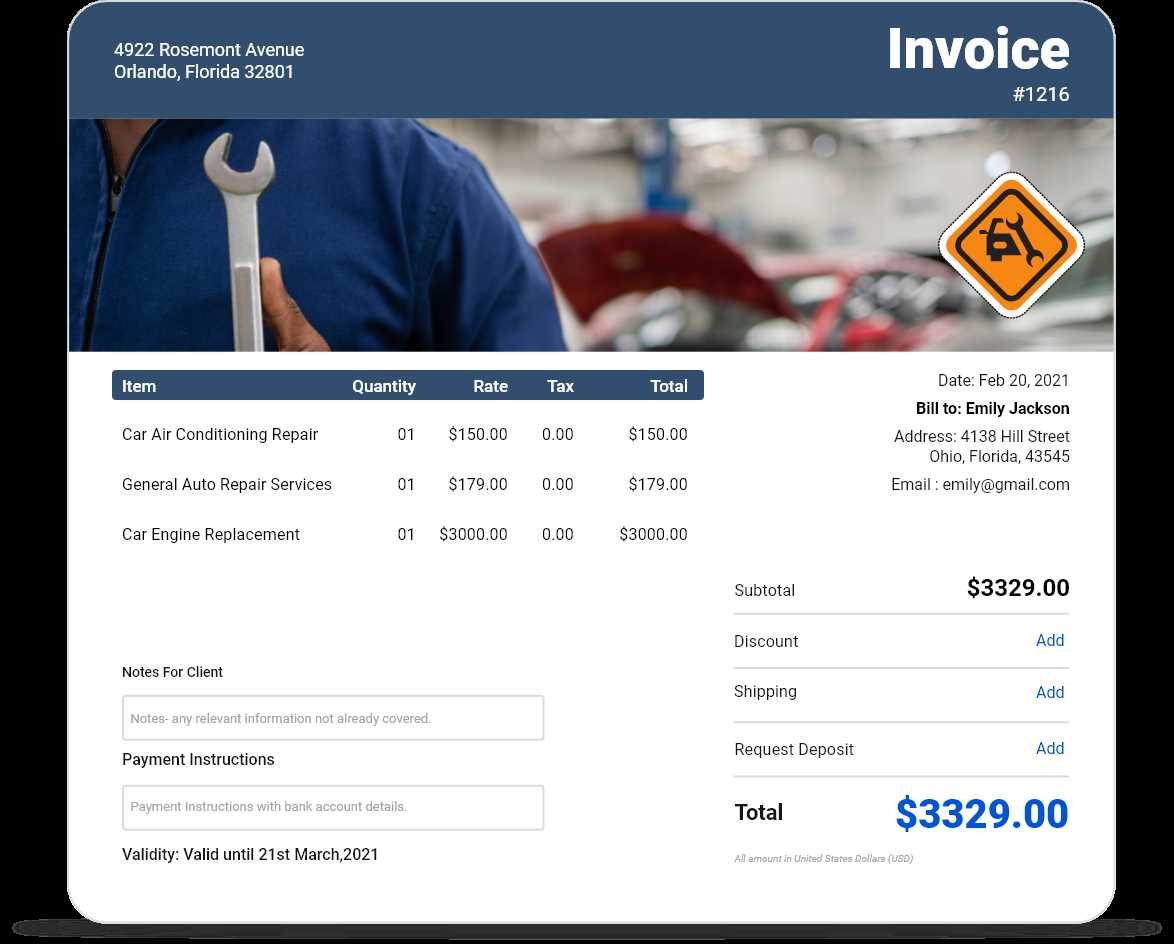

Essential Information to Include in a Billing Document

To ensure that every transaction is clear and properly documented, it’s important to include key details in your billing records. A comprehensive list of information helps avoid confusion, ensures accurate payment, and provides a reliable reference for both you and your customers. When creating a billing record, make sure to capture all the necessary elements to present a professional and transparent statement.

Here are the most critical details you should always include:

- Business Information – Your company name, address, and contact details.

- Client Information – Full name, address, and contact details of the customer receiving the services.

- Unique Document Number – A reference number for the transaction to help track payments and identify specific records.

- Service Description – A detailed list of the services performed, including any parts replaced or labor provided.

- Dates of Service – The date the work was completed or the service was rendered, as well as the billing date.

- Costs Breakdown – Clear itemization of charges, including labor costs, parts, and any additional fees.

- Payment Terms – Include the total amount due, payment due date, and accepted payment methods.

- Tax Information – If applicable, include the tax rate and the total tax amount added to the final cost.

By including all of this information, you ensure that your billing records are thorough and professional, which helps maintain trust and transparency with your customers.

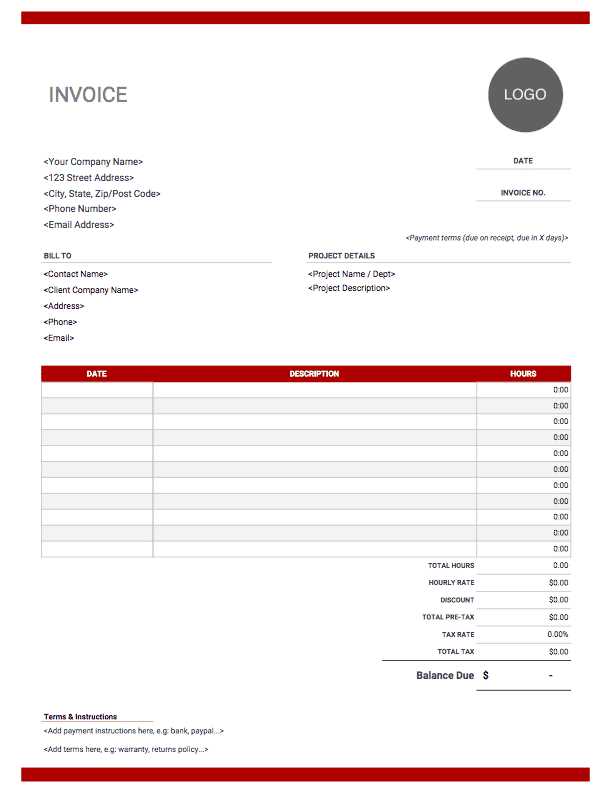

How to Create a Custom Invoice Template

Creating a personalized document for billing purposes allows businesses to maintain a professional appearance while ensuring all necessary details are clearly presented. A well-structured form can enhance communication with clients and streamline the payment process. Customizing such a document to suit the specific needs of your service or industry is an essential step for both clarity and consistency.

1. Define the Essential Information

Start by identifying the critical elements that need to appear in your document. At a minimum, this should include the name and contact details of your business, the client’s information, a list of services provided or products sold, the total amount due, and any applicable taxes or discounts. It’s also important to include a unique reference number for record-keeping purposes.

2. Choose a Layout and Design

Next, focus on the layout. A simple, clean design is most effective in ensuring that all relevant details are easy to find. Organize the document into sections, with clear headings and well-spaced text. Use bold for section titles and consider incorporating your company’s branding, such as logo or color scheme, to give it a professional touch. Make sure to include a payment due date and the preferred payment method(s) for client convenience.

Customization Tip: Include a personalized note or thank you message at the bottom to reinforce positive client relationships and encourage prompt payments.

Common Mistakes in Auto Repair Invoices

When creating a document for billing after a service, accuracy and clarity are key. Unfortunately, several errors can lead to misunderstandings with clients or delays in payments. These common missteps can be easily avoided with proper attention to detail, ensuring smooth transactions and maintaining a professional reputation.

1. Missing or Incorrect Client Information

One of the most frequent mistakes is failing to include accurate customer details, such as name, address, or contact information. Incorrect data can cause confusion and delay communication. It’s essential to double-check client information before finalizing any document to ensure all details are correct and up to date.

2. Lack of Clear Breakdown of Services

Another common issue is providing vague descriptions of the work performed or not listing all services separately. Clients should always be able to see a detailed breakdown of what was done, including labor charges, parts used, and any additional fees. This transparency helps build trust and reduces disputes over charges.

Tip: Ensure each service is listed with a clear description and associated cost, making it easier for clients to understand the charges.

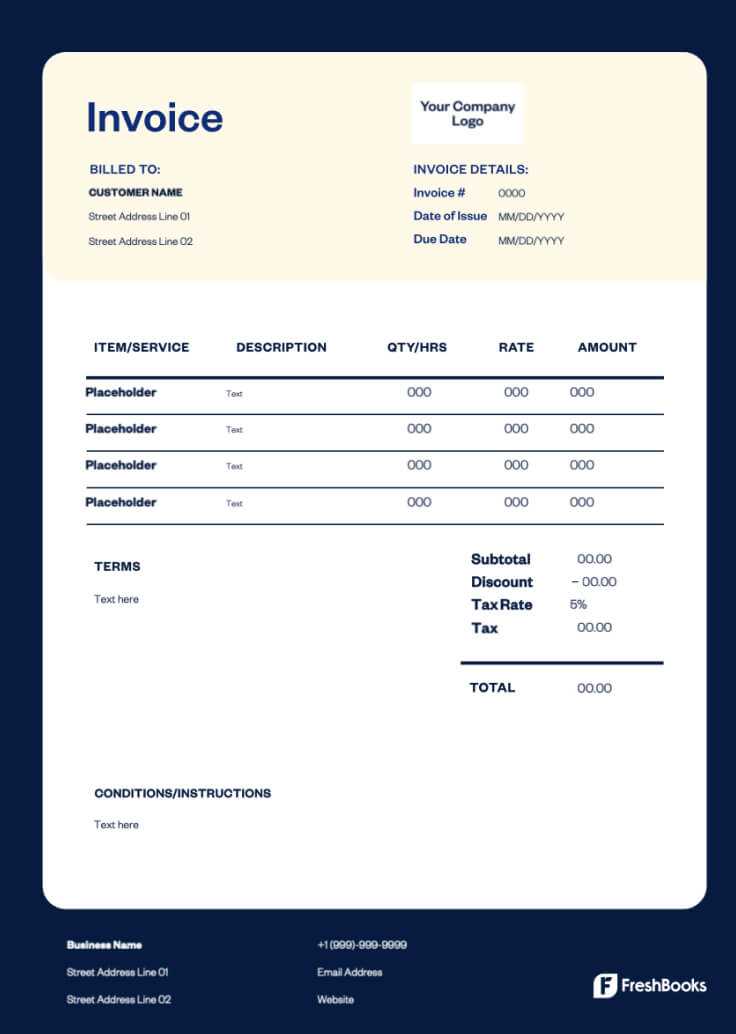

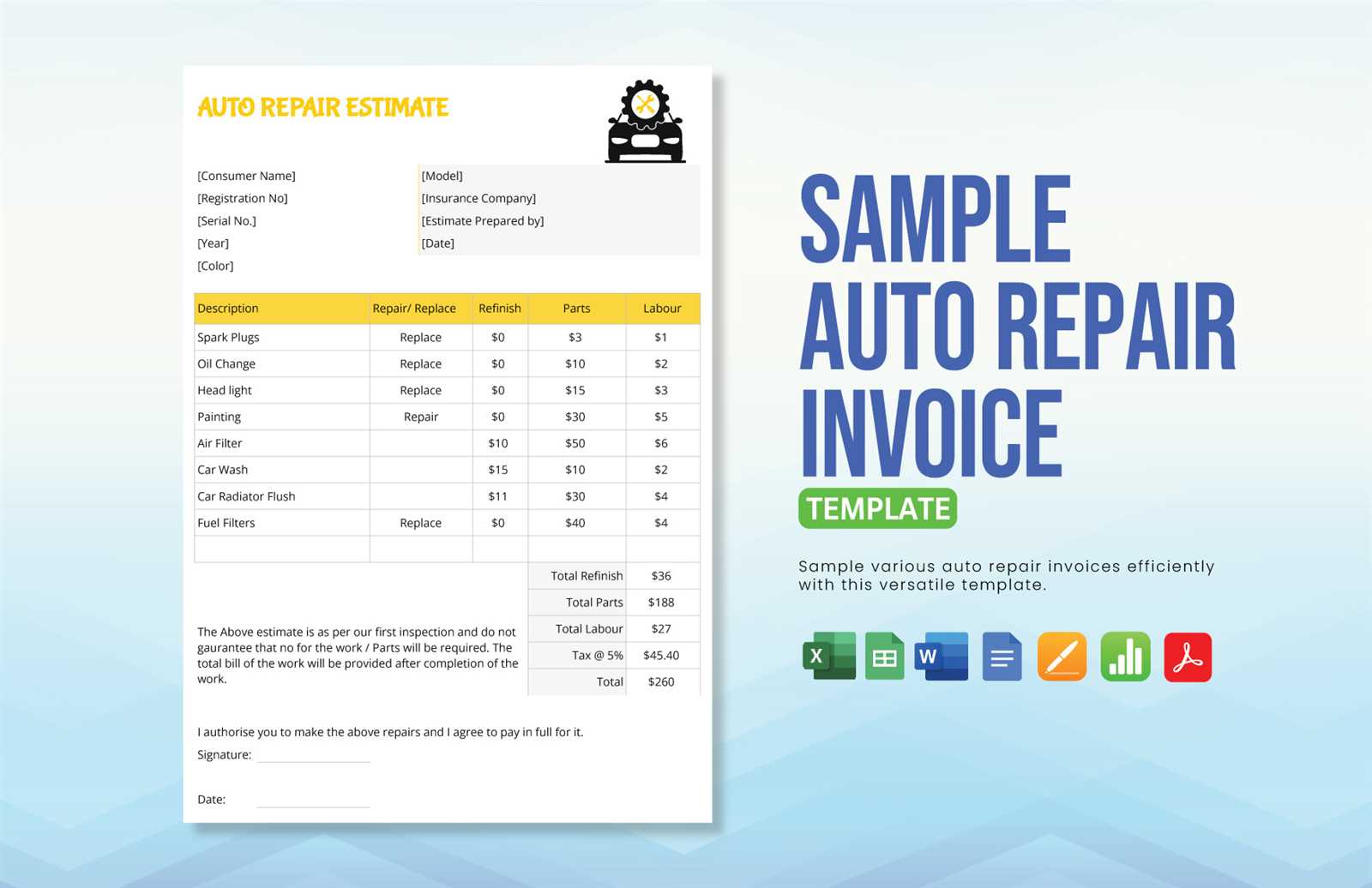

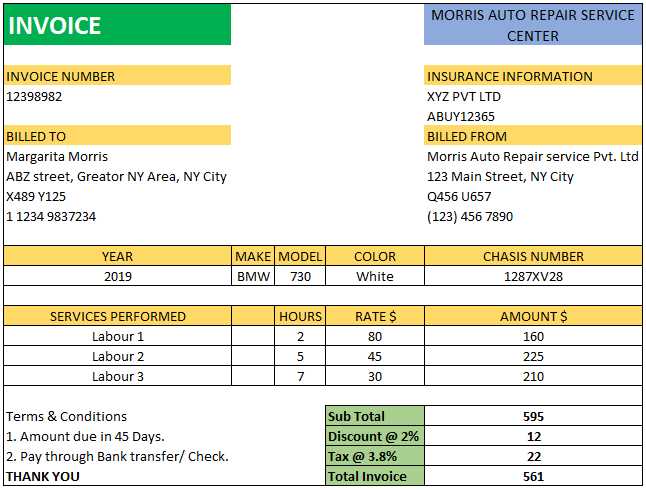

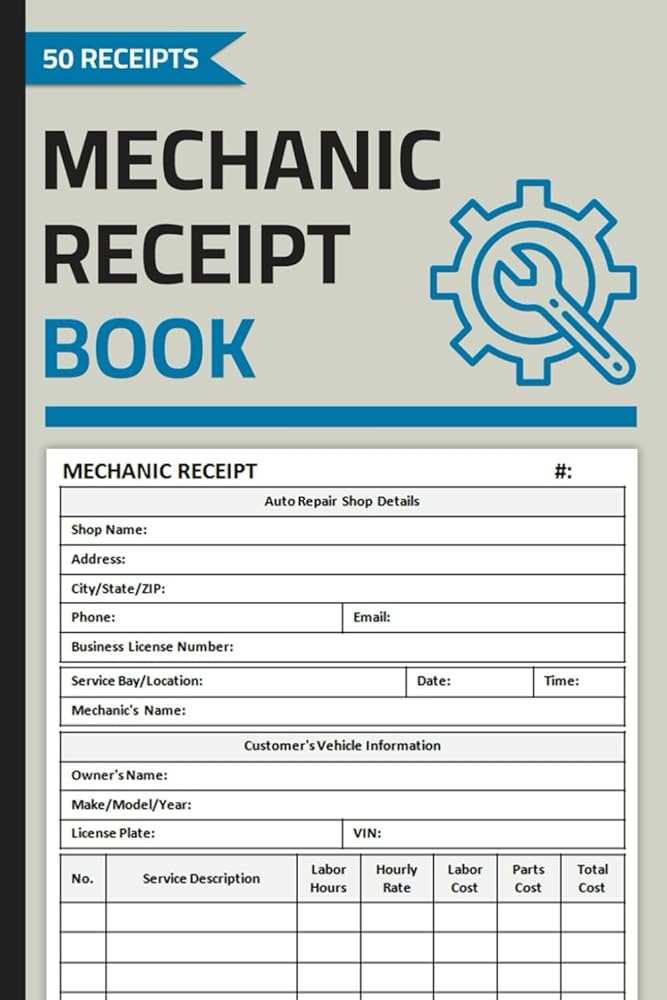

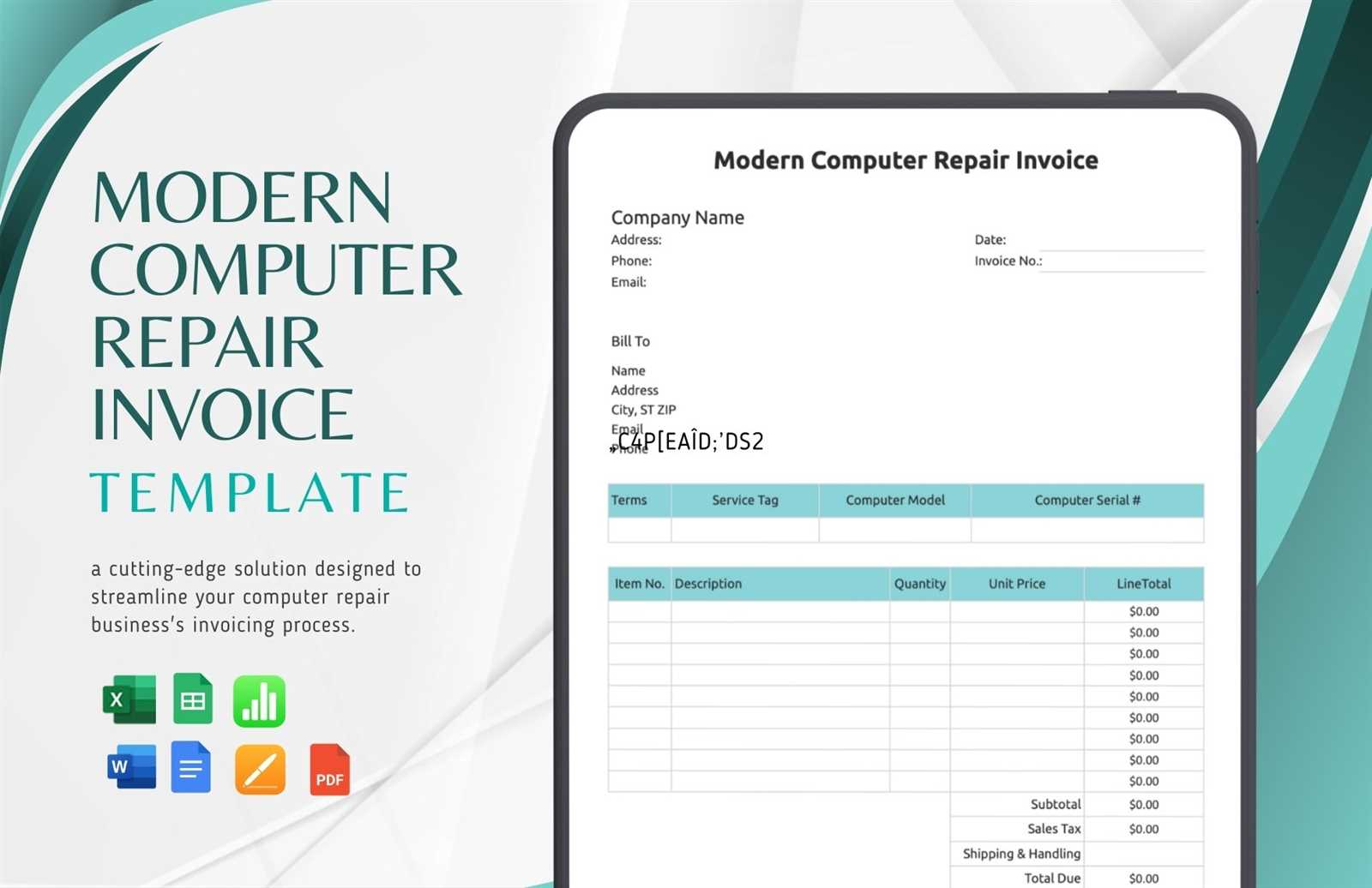

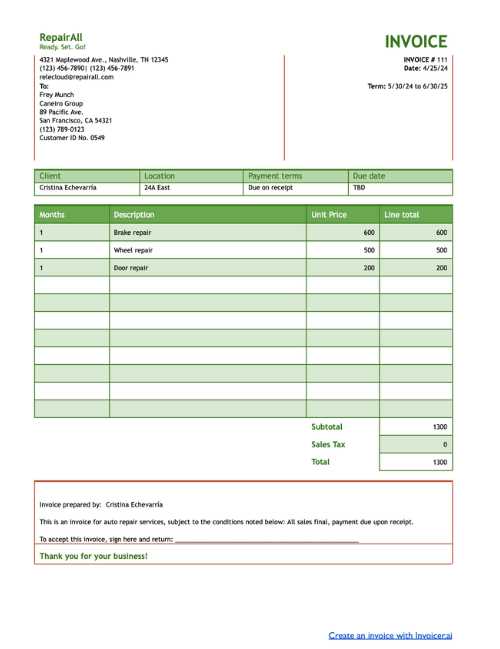

Free Auto Repair Invoice Templates Online

For businesses in the vehicle repair industry, using an online solution for creating billing documents can save time and reduce the risk of errors. Many free resources are available that offer customizable options, allowing you to quickly generate professional forms that meet your specific needs. These online tools can streamline the billing process and help maintain consistency across your transactions.

By choosing from a variety of free options, you can select a design that fits your brand while including all necessary fields, such as service descriptions, charges, and client information. These resources also often provide the flexibility to adjust the layout and content, ensuring you only include the details most relevant to your business.

How to Use an Invoice Generator

An online generator is a practical tool that helps you create professional billing documents quickly and easily. These tools simplify the process by providing pre-set fields and customizable options, making it easy to input the necessary details for your transaction. With just a few steps, you can generate a well-structured and accurate billing statement ready to send to your client.

1. Select a Generator and Create an Account

The first step is to choose an online platform that offers the features you need. Many generators are free, while others offer additional functionality through premium subscriptions. Once you’ve selected a generator, create an account to access and save your documents for future use.

2. Input the Required Information

After logging in, you’ll typically be prompted to fill out various fields. These may include your business details, the client’s contact information, a list of services or products provided, and any relevant pricing information. Some generators also allow you to add your logo or adjust the layout to reflect your business’s branding.

Tip: Double-check the information before finalizing to avoid errors in the document.

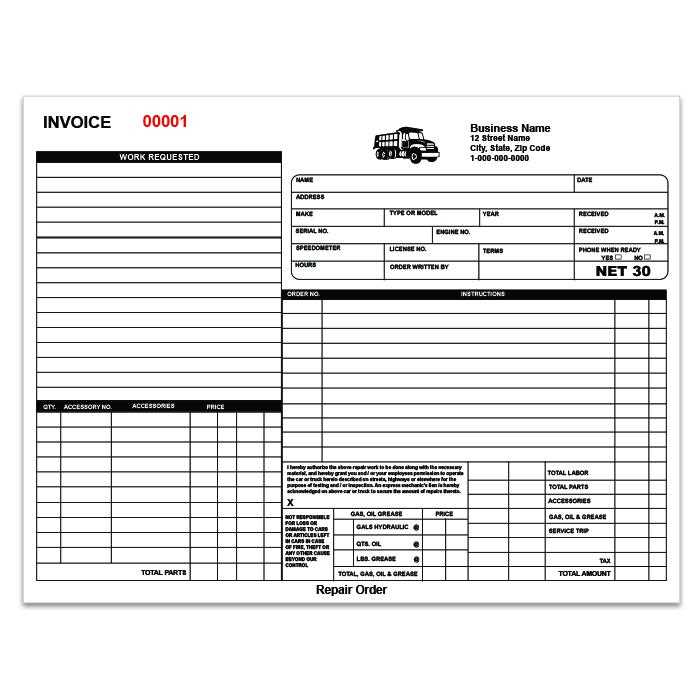

Choosing the Right Invoice Format

Selecting the appropriate layout for your billing document is essential for clear communication and efficient record-keeping. The right format helps ensure that all necessary details are included and easily understood by your clients. It also affects how professional your business appears. A well-chosen structure can improve the payment process and help avoid misunderstandings.

1. Consider the Type of Service Provided

Different types of services require different levels of detail in the billing document. For instance, a basic service may only require a few lines, while more complex repairs or projects may need an itemized list of tasks. Choose a format that fits the complexity of the work completed.

- Simple services: Use a straightforward, minimal format with only essential fields.

- Complex projects: Opt for a more detailed layout with sections for parts, labor, and additional fees.

2. Think About Your Client’s Preferences

Some clients may prefer a basic, easy-to-read document, while others might appreciate a more detailed breakdown of costs. Understanding your target audience can help you select a format that suits their expectations. You can also consider providing options to clients, offering a simple summary as well as a detailed version if needed.

- Standard format: Ideal for clients who need a quick overview.

- Detailed format: Perfect for clients who appreciate a thorough explanation of charges.

Tip: Offering both options can increase customer satisfaction and enhance the professional appearance of your business.

Understanding Invoice Numbering Systems

A well-organized numbering system for your billing documents is crucial for effective tracking and record-keeping. It ensures that each document is uniquely identifiable and that you can easily locate past transactions when needed. A structured numbering system also simplifies accounting processes and helps prevent confusion or duplication in your financial records.

1. Why a Numbering System Matters

Implementing a clear numbering method allows both you and your clients to reference specific transactions with ease. It helps to organize records in chronological order and makes it easier to follow up on outstanding payments. Additionally, having a proper numbering scheme can protect your business in case of audits or disputes.

- Improves organization and tracking of payments.

- Ensures unique identification for each transaction.

- Prevents errors and confusion over document duplication.

2. Common Numbering Approaches

There are several numbering systems that businesses typically use. The right choice depends on your preferences and how you want to organize your documents. Below are some of the most common methods:

- Sequential Numbering: The simplest approach, where each new document gets the next number in line (e.g., #001, #002, etc.).

- Date-Based Numbering: This format includes the date of the transaction, helping to track when each document was issued (e.g., 2024-001, 2024-002).

- Customer-Specific Numbering: Each customer gets a specific prefix or suffix to their document number, helping to identify the client at a glance (e.g., CUST-001, CUST-002).

Tip: Choose a system that aligns with your business needs and is easy to implement consistently for every transaction.

How to Track Payments Using Invoices

Monitoring payments effectively is essential for maintaining a healthy cash flow and ensuring that no transactions are overlooked. A clear system for tracking payments, coupled with properly structured documents, can help you stay on top of outstanding balances and follow up with clients when necessary. By using these tools strategically, you can manage your finances with greater ease and efficiency.

1. Record Payment Information on the Document

Each time a payment is made, it’s important to update the document with relevant details. This includes the payment date, amount paid, and the remaining balance. Many businesses also add a payment status field, such as “Paid,” “Pending,” or “Overdue,” to easily monitor the current state of each transaction.

2. Use a Payment Tracking Table

A payment tracking table is an efficient way to keep all relevant details in one place. Below is an example of a simple table format you can use to track payments:

| Document Number | Client Name | Amount Due | Amount Paid | Remaining Balance | Status | Payment Date |

|---|---|---|---|---|---|---|

| 001 | John Doe | $200.00 | $200.00 | $0.00 | Paid | 2024-10-01 |

| 002 | Jane Smith | $150.00 | $100.00 | $50.00 | Pending | 2024-10-05 |

Tip: Regularly update the payment status and review your records to ensure you do

Legal Requirements for Auto Repair Invoices

Ensuring that your billing documents meet legal standards is essential for protecting your business and ensuring compliance with local regulations. Certain information must be included to make the transaction official and legally binding. These requirements help prevent disputes and ensure that both parties are clear on the terms of the service and payment expectations.

While the exact requirements may vary depending on your location, there are a few key elements that are typically necessary to meet legal standards. These details not only protect your business but also provide transparency to your clients, fostering trust and professionalism.

1. Required Information

To comply with legal regulations, every document should include the following details:

- Business Details: The name, address, and contact information of the business providing the service.

- Client Information: The name and contact details of the person receiving the service.

- Clear Description of Services: An itemized list of the work completed, including parts used and labor charges.

- Price Breakdown: The total cost, including taxes, fees, and any discounts or additional charges.

- Payment Terms: Clear details regarding payment due dates and acceptable payment methods.

- Unique Reference Number: A sequential number or code to identify the transaction for record-keeping purposes.

2. Tax and Regulatory Compliance

Many regions require businesses to include tax identification numbers or VAT (Value Added Tax) information on billing documents. Make sure that your business is properly registered with relevant authorities and that your documents comply with local tax regulations. Failure to include the correct tax information could result in fines or delays in payments.

Tip: Always consult with a legal advisor or accountant to ensure that your billing practices are in line with local laws and tax codes.

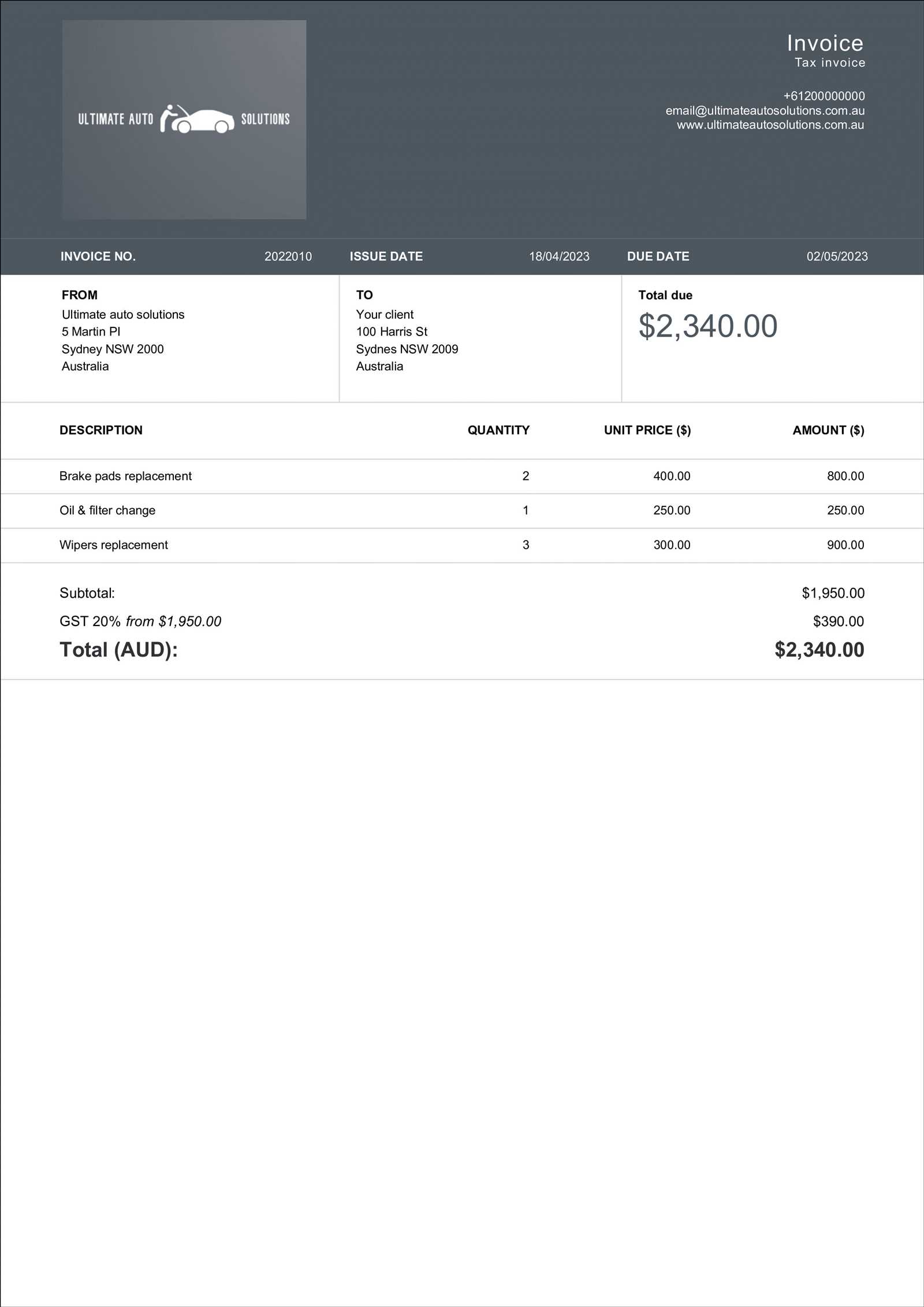

How to Add Taxes to Your Invoice

Including taxes in your billing documents is an essential part of ensuring compliance with local tax laws and providing transparency to your clients. Calculating the correct amount and clearly displaying it on your documents helps avoid confusion and prevents any issues with tax authorities. It’s important to understand the tax rates applicable to your services and how to integrate them into your payment calculations.

1. Determine the Applicable Tax Rate

The first step is identifying the tax rate that applies to the service or product provided. This will depend on your location, the nature of your business, and the specific tax laws in your jurisdiction. Common types of taxes include sales tax, VAT (Value Added Tax), or service tax. Make sure to check with a local accountant or tax authority to confirm the correct rate for your area.

2. Calculate and Add the Tax

Once you’ve determined the applicable tax rate, you can calculate the tax by multiplying the total amount of the service or product by the tax percentage. For example, if the total amount is $100 and the tax rate is 10%, the tax amount would be $10, making the total due $110. It’s essential to clearly list both the tax amount and the total due so clients can easily understand the breakdown.

Example:

Service Total: $100.00

Tax (10%): $10.00

Total Due: $110.00

Ensure that the tax is clearly labeled on your document, and consider including a note about the tax rate for full transparency.

Invoice Template Tips for Better Customer Communication

Clear and effective communication with clients is essential for building trust and ensuring smooth transactions. By using well-designed documents that outline services and costs, businesses can foster transparency and minimize misunderstandings. Providing detailed and easy-to-understand records helps both the service provider and the customer maintain clarity regarding expectations and financial matters.

To enhance communication, ensure that the document includes all relevant information in a structured format. Clients should easily find service descriptions, pricing breakdowns, and payment terms. A logical flow of information helps avoid confusion and reinforces professionalism.

Consistency is key. Using a uniform layout across all records creates familiarity and allows clients to quickly grasp important details. This consistency also reflects a business’s attention to detail and commitment to customer satisfaction.

Additionally, it’s helpful to include clear contact details and available channels for further questions. When clients can easily reach out for clarification, it shows the business’s willingness to provide support and resolve any issues promptly.

How to Handle Invoice Disputes

Disagreements over billing can arise at any point during a transaction. Addressing these issues swiftly and professionally is key to maintaining positive relationships with clients and ensuring mutual satisfaction. When conflicts arise, a structured approach to resolution can make a significant difference.

Here are steps to effectively handle billing disputes:

- Stay Calm and Professional: Keep emotions in check and approach the situation with a mindset focused on resolution.

- Review the Details: Go over the records carefully to identify any discrepancies, errors, or misunderstandings.

- Communicate Clearly: Reach out to the client to discuss the issue. Provide a detailed explanation and be open to hearing their concerns.

- Offer Solutions: Propose a fair resolution, such as a discount, payment plan, or adjustment to the charges, if applicable.

- Document Everything: Keep detailed records of the dispute, communications, and any agreements made to avoid future misunderstandings.

By following these steps, both parties can resolve issues efficiently and preserve a good business relationship. It’s crucial to address disputes promptly and with a solution-oriented approach.

Best Practices for Invoice Delivery

Timely and professional delivery of financial documents is essential for smooth business operations and client relationships. Ensuring that the records are sent in a clear, accessible manner helps avoid delays in payments and fosters trust between parties. The way these documents are delivered can impact how quickly they are processed and whether any issues arise.

Here are some best practices for effective delivery:

- Send Promptly: Deliver records as soon as the service or transaction is complete. The sooner clients receive the details, the sooner they can process payments.

- Choose the Right Delivery Method: Opt for an efficient, secure delivery method. Email is common for fast, easy delivery, but physical mail may be necessary in some cases. Make sure the method suits both your business and the client’s preferences.

- Ensure Clarity: Ensure the document is easy to read and well-organized. Use clear language and include all necessary details like dates, charges, and payment terms.

- Provide a Clear Payment Link: If possible, include a direct payment link or clear instructions for clients to follow, making it easier for them to settle their balance.

- Follow Up: If you don’t receive a response within a reasonable time frame, send a polite reminder. This helps avoid delays and shows that you are proactive in managing your accounts.

By following these practices, businesses can ensure that their financial records are delivered efficiently, minimizing confusion and promoting timely payments.

Integrating Invoices with Accounting Software

Seamlessly connecting financial records with accounting systems is a crucial step for streamlining business operations. Automation reduces human error, improves efficiency, and ensures accurate tracking of payments, expenses, and financial reporting. Integrating these documents with accounting platforms allows businesses to save time, reduce administrative work, and maintain up-to-date financial data.

Benefits of Integration

Integrating financial documentation directly into accounting systems offers several advantages:

- Accuracy: Automatically syncing payment details and charges reduces the chance of mistakes or inconsistencies.

- Time-Saving: Eliminates the need for manual data entry, allowing staff to focus on other important tasks.

- Real-Time Updates: Integration ensures that your financial records are always up to date, providing accurate insights into your cash flow.

- Better Financial Reporting: Streamlined data makes it easier to generate detailed financial reports without additional effort.

How to Implement Integration

Integrating documents with accounting software can be done through several methods:

- Use Pre-built Integrations: Many accounting platforms offer built-in integrations with popular document management systems, allowing for quick syncing with minimal setup.

- Custom Solutions: If pre-built integrations are not available, custom APIs can be developed to connect your financial documentation system with the accounting software.

- Cloud-Based Tools: Using cloud-based solutions ensures easy access from anywhere and allows for real-time synchronization across multiple devices.

By integrating your financial records into your accounting software, you can ensure more accurate, efficient, and timely financial management for your business.

Saving Time with Automated Invoicing Tools

Manual preparation of financial documents can be time-consuming and prone to error, leading to inefficiencies in daily operations. By using automated tools, businesses can streamline the process, saving both time and effort while ensuring accuracy. Automation allows for faster processing, quicker delivery to clients, and eliminates the need for repetitive tasks.

Key Benefits of Automation

Automating the creation and delivery of financial records offers a range of advantages:

- Efficiency: Automatically generated documents save time by eliminating manual data entry and reducing administrative tasks.

- Consistency: Automation ensures that every document follows the same format and includes all necessary details, reducing the likelihood of mistakes.

- Faster Turnaround: Automation speeds up the process of sending records to clients, improving cash flow and reducing delays.

- Reduced Administrative Work: Automated systems track payments and outstanding balances, freeing up valuable time for other critical tasks.

How Automated Tools Work

Automated tools typically offer features such as:

- Pre-Set Templates: You can customize document formats that are automatically populated with relevant details like service dates, charges, and client information.

- Recurring Billing: Set up recurring transactions for repeat clients, which ensures timely billing without needing to manually recreate documents each time.

- Instant Delivery: Automated systems can instantly email or send digital copies of financial documents as soon as they are generated.

- Payment Integration: Many systems offer integrated payment gateways, allowing clients to settle their balance directly from the document with just a few clicks.

By leveraging these automated tools, businesses can save valuable time, reduce errors, and improve the overall experience for both the provider and the client.