Auto Detailing Invoice Template for Easy Billing and Professional Invoicing

Managing payments and organizing financial transactions are essential aspects of any vehicle maintenance business. Whether you’re offering exterior cleaning, interior detailing, or full-service care, clear and professional billing helps ensure that customers understand the costs and enhances your credibility. A well-structured document outlining services and charges streamlines communication and improves the payment process for both you and your clients.

Creating a document that clearly lists the work completed, along with corresponding fees, can save time and prevent misunderstandings. By implementing customizable formats, service providers can cater to their specific needs while maintaining a polished and consistent approach to client interactions. This not only makes tracking payments easier but also promotes professionalism in every exchange.

In this guide, we’ll explore how to craft an effective billing document tailored to your business needs. From essential elements to tips on customizing the content, you’ll discover practical steps to streamline your financial operations and improve customer satisfaction.

Auto Detailing Invoice Template Overview

Creating a comprehensive and easy-to-use document for vehicle care services is crucial for ensuring clear communication with clients. This type of document serves as a detailed record of the services provided, including the corresponding charges, making it easier for both service providers and clients to understand the costs involved. It helps maintain transparency in transactions and streamlines the payment process, fostering trust and professionalism.

To make the most of this document, it’s important to include several key components that will guide both the service provider and the customer. These elements ensure that all necessary information is conveyed, helping to avoid any confusion about pricing or services rendered.

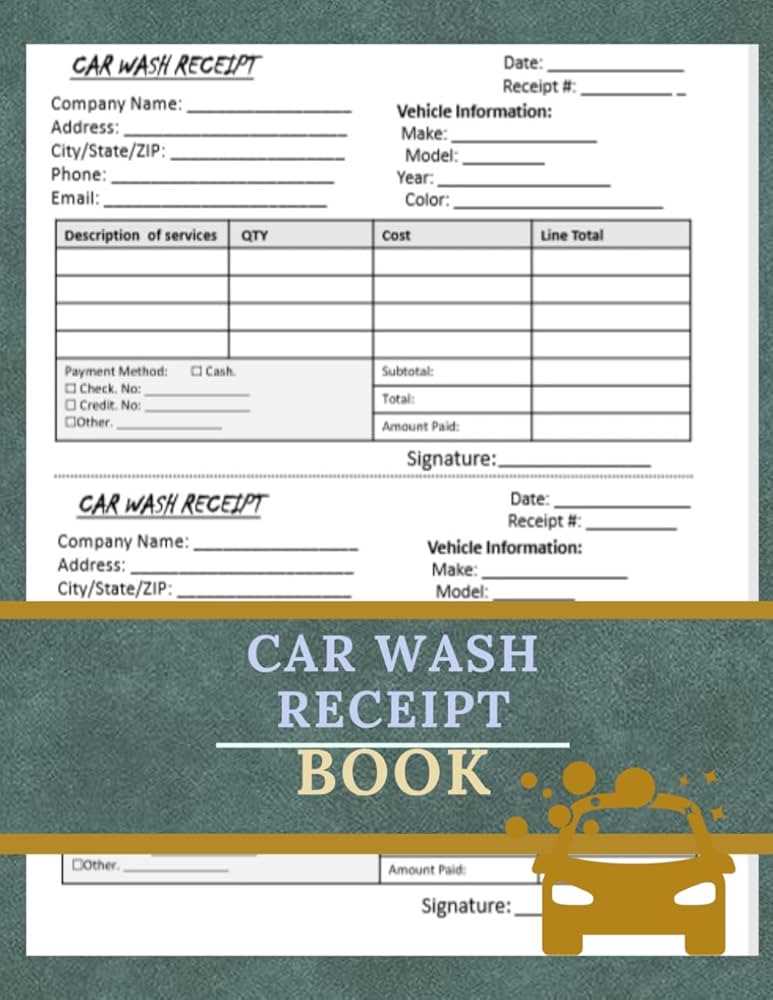

| Section | Description |

|---|---|

| Client Information | Includes the name, address, and contact details of the customer. |

| Service Description | A detailed list of the tasks performed, with brief descriptions for each service. |

| Pricing | The cost of each service provided, including any discounts or promotions applied. |

| Payment Terms | Clarifies when payment is due and what payment methods are accepted. |

| Additional Notes | Space for any special instructions or follow-up details related to the service. |

By incorporating these elements into your document, you ensure a comprehensive and professional approach to handling financial transactions in your vehicle care business.

Why Use an Invoice for Auto Detailing

In any service-based business, providing a clear, formal document that outlines the costs of services rendered is essential. This document acts as a record of the transaction, ensuring that both the customer and the service provider have a mutual understanding of the work completed and the associated charges. Without such a document, confusion and disputes can arise, leading to misunderstandings or delayed payments.

Promotes Professionalism

Offering a formalized billing document enhances the credibility of your business. It shows clients that you are organized and serious about your work. This simple step sets you apart from competitors who may not use such documentation, helping to build trust and customer satisfaction.

Streamlines Payment Process

When a customer receives a clear breakdown of the services provided along with the total cost, the payment process becomes straightforward. This transparency helps ensure that the client knows exactly what they are paying for, reducing the chances of delayed or missed payments.

| Benefit | Description |

|---|---|

| Clarity in Transactions | Prevents any confusion by outlining services and charges in detail. |

| Legal Protection | Provides a documented record that can serve as proof of services if disputes arise. |

| Streamlined Accounting | Helps keep track of payments and balances owed, making accounting easier. |

| Payment Flexibility | Offers options for clients to pay through various methods and clarify terms. |

Using a structured document for every transaction helps solidify your professional image while facilitating smoother financial exch

How to Create an Auto Detailing Invoice

Creating a professional document for vehicle care services involves several essential steps to ensure that all necessary information is included and clearly presented. A well-designed bill is not only an essential business tool but also an important part of customer service, helping to avoid confusion and ensuring prompt payment. Here are the steps to follow when crafting a detailed and accurate record of services provided.

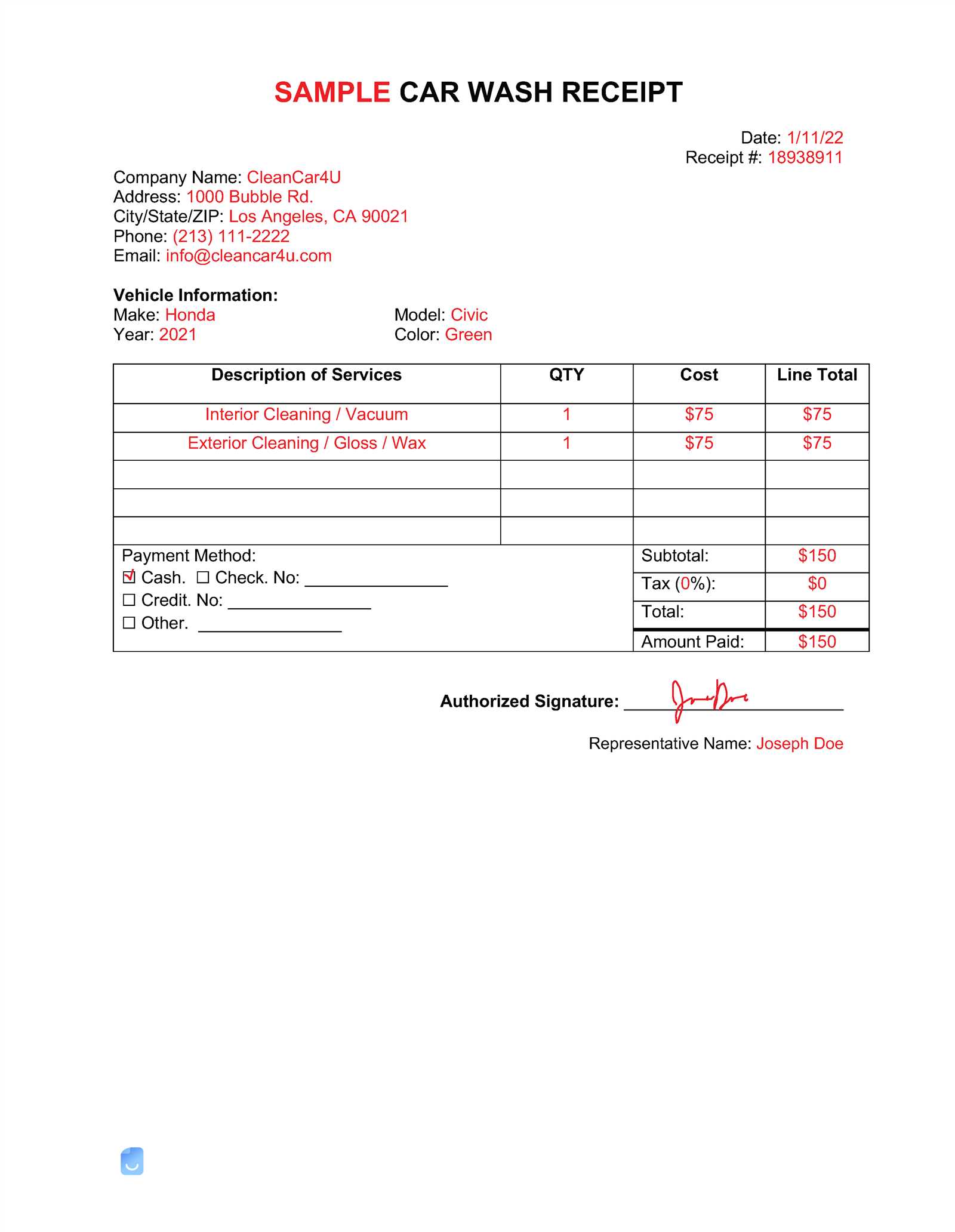

- Step 1: Gather Client Information

Include the client’s full name, contact information, and address. This ensures that the document is specific to the correct recipient and provides a clear point of reference for both parties.

- Step 2: List Services Provided

Clearly describe the services that were completed. Each service should have a brief description along with the individual price for that specific task. Be as precise as possible to avoid any misunderstandings later on.

- Step 3: Add Pricing Details

Include the cost for each service, along with any taxes or discounts that apply. Make sure to list these charges in an easy-to-read format, helping the customer understand exactly what they are being billed for.

- Step 4: Include Payment Terms

Clearly state when the payment is due, acceptable payment methods (credit card, bank transfer, etc.), and any late fees or penalties that might apply if the payment is not received on time.

- Step 5: Provide Additional Notes

If applicable, add any extra instructions or information relevant to the transaction. This could include future service recommendations, reminders about warranties, or contact details for customer support.

By following these steps, you can create a document that is clear, professional, and easy for both you and your clients to reference. A well-constructed bill not only enhances your professionalism but also streamlines the financial process, ensuring that everything is accurately documented and payments are processed smoothly.

Key Elements of a Detailing Invoice

A well-structured document for vehicle care services should include specific details that make the billing process clear and easy for both the provider and the customer. Including the right elements ensures that all parties involved understand the charges, terms, and services provided. These key components not only help maintain professionalism but also avoid confusion and prevent payment delays.

- Client Information

It is essential to include the customer’s full name, address, and contact details. This helps ensure that the record is properly attributed and that the client can be reached for any follow-up or clarification.

- Business Details

Include your business name, contact information, and logo if applicable. This reinforces your brand identity and provides a point of contact for any questions or concerns regarding the bill.

- Service Description

A detailed list of the services provided is crucial. Each task should be described clearly, and you should note any special instructions or unique aspects of the service that might influence the final cost.

- Pricing and Charges

Include the cost for each service rendered, clearly stating the individual charge for each task. Also, note any applicable taxes, discounts, or extra fees that may apply to the total amount due.

- Payment Terms

Clearly specify when the payment is due, the accepted payment methods, and any late fees or penalties for overdue payments. This ensures that the client understands the terms and avoids potential confusion later.

- Payment Instructions

Provide clear instructions on how the customer can pay, whether through credit card, bank transfer, or other methods. This section should include any relevant payment details or links for easy access

Benefits of Professional Car Cleaning Billing Statements

Using a well-structured and professionally designed payment record offers numerous advantages for service providers and customers alike. A properly formatted document helps streamline financial transactions, ensuring transparency, trust, and ease of reference for both parties. Whether for small businesses or large enterprises, maintaining clear, accurate, and organized payment records is key to long-term success and customer satisfaction.

Improved Clarity and Transparency

A professionally crafted payment statement eliminates any confusion regarding services rendered and their associated costs. It clearly outlines the work completed, the pricing structure, and any additional fees or taxes, giving customers a precise understanding of what they are paying for. This transparency builds credibility and helps avoid potential disputes in the future.

Efficient Record Keeping

For businesses, maintaining consistent and detailed payment records is essential for accounting, tax purposes, and financial planning. A well-organized document makes it easier to track payments, identify overdue balances, and manage business finances. This reduces administrative workload and enhances overall operational efficiency.

Feature Benefit Clear Breakdown of Costs Helps customers understand exactly what they are paying for Professional Appearance Enhances the business’s reputation and trustworthiness Tax Readiness Simplifies the tax filing process with organized records Time-Saving Reduces time spent resolving payment-related issues In conclusion, utilizing a polished and professional payment statement offers both businesses and clients significant benefits. It fosters better communication, improves financial tracking, and ensures a higher level of service quality in every transaction.

Choosing the Right Billing Format

Selecting the most appropriate structure for documenting payments is crucial for ensuring clear communication and efficient transactions. The format should not only be functional but also professional, allowing both service providers and clients to easily understand the terms of the agreement. A well-organized record can enhance the business’s image and streamline the process of managing financial data.

The right format will depend on the specific needs of the business and the complexity of the services offered. Simplicity is key for small businesses or straightforward transactions, while more detailed formats may be necessary for larger operations or intricate services. It is important to strike the right balance between clarity and completeness, ensuring all relevant information is presented without overwhelming the recipient.

Moreover, the format should be flexible enough to accommodate various payment methods, discounts, taxes, and additional fees. Choosing the right structure can reduce administrative errors, improve payment tracking, and ensure timely transactions. Whether using digital or physical records, the format should be easy to update and store for future reference.

Customizing Your Billing Record

Tailoring your payment document to reflect the specific needs of your business can help create a more professional and personalized experience for your clients. Customization allows you to highlight key information, promote your brand, and offer flexibility in how you present charges. By adjusting various elements, you can make the document more relevant to your services and clients, enhancing clarity and improving overall satisfaction.

Here are some key aspects to consider when customizing your billing record:

- Business Branding: Add your logo, company name, and contact details to create a professional appearance and make it easier for clients to reach you.

- Service Breakdown: Clearly list each service performed along with individual prices, ensuring that the customer knows exactly what they are paying for.

- Payment Terms: Specify due dates, late fees, and available payment methods to manage expectations and avoid misunderstandings.

- Personalized Notes: Including a thank-you message or promotional offer can build stronger relationships with clients and encourage repeat business.

- Tax and Discounts: If applicable, ensure that taxes and any promotional discounts are clearly stated to avoid confusion and ensure accuracy.

Additionally, consider the format in which you send the record. Digital versions offer convenience and ease of storage, while printed copies might be preferred by clients who need a physical document for their records. The key is to ensure that the design, structure, and content align with both your business operations and your customers’ preferences.

Common Mistakes in Billing Records

While creating payment documents, certain mistakes can lead to confusion, delayed payments, or even strained relationships with clients. Many of these errors stem from missing details, unclear descriptions, or improper formatting, which can affect the clarity of the charges. It is essential to avoid these common pitfalls to ensure that both the service provider and the client have a smooth, transparent experience.

Omitting Key Information

One of the most frequent mistakes is failing to include important details in the payment record. Essential elements like service descriptions, itemized costs, or payment terms may be overlooked, leaving clients uncertain about what they are being charged for. Always make sure to list each service separately, including any taxes, fees, and discounts applied to the total amount.

Inconsistent or Incorrect Dates

Another mistake is using incorrect or inconsistent dates for service completion or payment deadlines. This can create confusion or lead to missed payments. Ensure that the date of service and payment due date are clearly indicated and accurate. Additionally, avoid changing dates once the document has been issued, as this can cause disputes or misunderstandings.

By taking the time to address these issues, businesses can foster trust with clients and streamline payment processes. Accuracy and clarity are critical for maintaining positive relationships and ensuring smooth financial transactions.

How to Add Taxes to Your Billing Record

Including taxes in your payment documentation is a crucial step in ensuring legal compliance and maintaining transparent financial transactions. Accurately calculating and adding taxes helps both the business and the customer understand the total amount due. Failure to correctly apply the appropriate tax rates could lead to issues with local regulations or confusion for your clients.

To properly include taxes, follow these steps:

- Determine the Tax Rate: Research the tax rates applicable to your location or the services provided. Tax rates can vary by state, city, or type of service, so it’s important to apply the correct rate.

- Calculate the Tax: Once you have the tax rate, apply it to the subtotal of the services rendered. For example, if the subtotal is $100 and the tax rate is 8%, the tax amount would be $8, bringing the total to $108.

- Clearly Display the Tax: In your payment document, ensure that the tax is listed separately from the base price. Include a line item labeled “Tax” or “Sales Tax” to show the exact amount applied. This transparency helps the client understand the breakdown of costs.

- Check for Exemptions: If your service is exempt from taxes, clearly indicate that no tax has been applied and note the reason for the exemption.

Always double-check the final total, including taxes, to avoid errors. Clear tax calculation

Incorporating Payment Terms in Billing Records

Clearly outlining payment expectations in financial documents helps to prevent misunderstandings and ensures smooth transactions between businesses and clients. Payment terms define when and how the payment is expected, including any penalties for late payments or discounts for early settlement. By incorporating these terms in your billing records, you establish transparency and create a structured process for handling payments.

Key Elements of Payment Terms

When specifying payment conditions, it is essential to include several key components to avoid ambiguity:

- Due Date: Clearly state the date by which payment should be made. This ensures that the client knows when to pay and helps you track overdue payments.

- Late Fees: Specify any penalties that will apply if the payment is not made by the due date. For example, you could state that a certain percentage will be added for every week the payment is delayed.

- Early Payment Discounts: Offering a discount for early payments can encourage prompt settlement. Include the percentage discount and the timeframe in which it applies.

- Accepted Payment Methods: Indicate the methods of payment you accept, such as credit card, bank transfer, or cash, to avoid confusion.

Making Payment Terms Clear

Be sure to highlight these terms in a prominent place within the payment document. This ensures that your client can easily find and review the payment conditions. It’s also important to keep the language simple and clear so there is no room for misinterpretation. Clarity in payment terms fosters trust and helps maintain positive business relationships.

Using Software for Billing Records

Leveraging software to manage payment documents can significantly enhance efficiency and accuracy for businesses. Specialized tools automate many aspects of the billing process, from generating documents to tracking payments, ensuring that every transaction is well-organized and easily accessible. By using software, businesses can save time, reduce errors, and maintain consistency in their financial documentation.

Here are some benefits of using software for managing your payment records:

Feature Benefit Automation Generate consistent and accurate payment documents without manual input. Customization Easily tailor records to match your branding and service offerings. Tracking Keep track of payments, outstanding balances, and overdue accounts with minimal effort. Reporting Generate financial reports for easier tax preparation and performance analysis. By using software, businesses can streamline their financial operations, improve accuracy, and create a more professional experience for their clients. The convenience of digital tools also allows for easy storage and retrieval of records whenever needed.

How to Track Payments

Effectively managing and tracking payments is vital for maintaining smooth business operations and ensuring financial stability. Whether you are working with a few clients or handling a high volume of transactions, staying on top of payments is essential to prevent errors, missed payments, and confusion. By setting up a reliable system for tracking financial exchanges, businesses can maintain healthy cash flow and foster positive relationships with clients.

There are several key methods to track payments effectively:

- Use of Payment Software: Implementing digital tools that automatically track payments can save time and reduce human error. Software can record every transaction and provide real-time updates on balances and due amounts.

- Organize Payment Records: Keep a dedicated and organized record of all payments received, including dates, amounts, and payment methods. This can be done manually or through an automated system for easier reference.

- Set Up Payment Reminders: Use reminders or alerts to notify clients about upcoming due dates or overdue payments. This can be done via email or automated systems to ensure timely payment.

- Reconcile Accounts Regularly: Regularly compare your payment records with bank statements or payment processor reports to identify discrepancies and ensure accurate tracking of all payments.

By adopting these practices, businesses can maintain an efficient payment tracking system that minimizes errors and improves financial visibility. Properly tracking payments also contributes to more informed decision-making and better long-term financial planning.

Creating Recurring Billing Records for Regular Clients

For businesses that provide ongoing services, setting up a system to manage regular payments can significantly improve efficiency and reduce administrative work. Recurring billing helps maintain consistent cash flow and ensures that clients are invoiced automatically on a regular schedule. This system is especially beneficial for long-term clients, making transactions predictable for both parties and minimizing the risk of missed payments.

Benefits of Recurring Billing

Setting up recurring billing offers several advantages for both businesses and clients:

- Time-Saving: Automating the billing process saves time and effort, eliminating the need to manually create a new record for every transaction.

- Consistency: Regular payments ensure a predictable cash flow, helping businesses plan and manage finances more effectively.

- Client Convenience: Clients benefit from not having to remember to make payments or schedule transactions, improving their overall experience.

- Reduced Errors: By automating payments, the risk of human error, such as forgetting to send a bill or entering incorrect amounts, is minimized.

Setting Up Recurring Billing

To set up recurring payments for regular clients, follow these steps:

Step Description 1. Determine Payment Frequency Decide on how often the client will be billed, whether it’s weekly, monthly, or quarterly. 2. Set Up Payment Terms Clearly outline the agreed-upon amount, due dates, and any applicable discounts or taxes. Integrating Auto Detailing Invoices with Accounting

Connecting billing records with financial management systems can significantly enhance the efficiency and accuracy of your business operations. By syncing payment documentation with accounting software, you streamline the tracking of earnings, expenses, and taxes. This integration provides a seamless flow of data, ensuring that all financial information is up-to-date and error-free, saving valuable time and reducing the risk of manual entry mistakes.

Benefits of Integration

When payment records are linked with accounting tools, business owners gain real-time insights into their financial status. This integration allows for quick and easy generation of financial reports, reducing the need for separate tracking systems. Additionally, automating the transfer of financial data minimizes human error and enhances transparency across departments.

Steps for Integration

To successfully integrate payment documentation with your accounting system, follow these key steps:

Step Description 1. Choose the Right Software Ensure that your billing system and accounting software can be integrated or use platforms that support this functionality. 2. Automate Data Import Set up automatic data transfers from your billing system to your accounting software to reduce manual entry. 3. Categorize Financial Entries Ensure that each payment entry is properly categorized (e.g., revenue, taxes, expenses) to keep records organized. 4. Reconcile Regularly Perform routine reconciliation of your accounts to verify the accuracy of your financial data. By implementing these steps, businesses can create a unified system that helps maintain accurate financial records and provides a solid foundation for informed decision-making.

How to Send and Manage Invoices Efficiently

Effective management of billing documents is essential for maintaining cash flow and ensuring prompt payments. Streamlining the process of sending and tracking financial statements can save time, reduce errors, and improve client satisfaction. By adopting organized systems and utilizing the right tools, businesses can ensure that all payments are processed on time and that records are kept in order.

Key Practices for Efficient Billing Management

To handle billing documents efficiently, businesses should implement several key strategies to simplify the entire process, from creation to tracking. Automation, clear communication with clients, and regular follow-ups can prevent delays and misunderstandings, ensuring smooth financial operations.

Steps for Streamlining the Billing Process

Step Description 1. Use Automated Billing Software Leverage tools that can generate and send financial documents automatically, reducing the need for manual entry. 2. Set Clear Payment Terms Clearly define payment deadlines and conditions within each document to avoid confusion and late payments. 3. Send Timely Reminders Use automated reminder systems to notify clients of upcoming or overdue payments, ensuring nothing is missed. 4. Track Payments and Outstanding Balances Monitor the status of each transaction and follow up with clients on overdue amounts to maintain cash flow. By following these

Best Practices for Auto Detailing Billing

Efficient financial management is crucial for any business, especially when it comes to billing clients. Adopting effective strategies ensures smooth operations, timely payments, and satisfied customers. Implementing best practices in managing financial documents can help avoid errors, reduce delays, and foster trust between service providers and clients.

Clarity and Transparency are essential in every billing transaction. Always provide clear, detailed records that outline all charges, services rendered, and any additional fees. This transparency not only prevents misunderstandings but also promotes a sense of professionalism, which can strengthen customer loyalty.

Key Billing Practices

Implementing the following practices can greatly enhance the efficiency of your billing process:

Practice Description 1. Use Professional Templates Having a structured format helps present a polished, organized look, improving the perception of your business. 2. Itemize Services Break down each service provided so clients can see the value they are receiving for each charge. 3. Set Clear Payment Terms Clearly define when payment is due, and include any penalties for late payments to avoid confusion. 4. Track Outstanding Balances Keep a record of unpaid amounts