Attorney Billable Hours Invoice Template for Legal Professionals

Efficient management of client billing is essential for any legal practice. Accurately documenting the time spent on cases and ensuring that clients are billed appropriately can significantly impact the financial health of a firm. Having a well-structured system for tracking time and expenses ensures transparency, minimizes errors, and strengthens client trust.

In this guide, we will explore the key components of a professional billing system tailored to legal services. You’ll learn how to create clear and precise statements that outline the work completed, making it easier to communicate with clients and maintain a steady cash flow. Whether you are a solo practitioner or part of a larger firm, these tools can help streamline the billing process.

By incorporating effective time-tracking methods and customized documentation, legal professionals can enhance their efficiency and focus on delivering quality service. With the right approach, you can simplify the billing process and avoid misunderstandings, ultimately fostering stronger relationships with your clients.

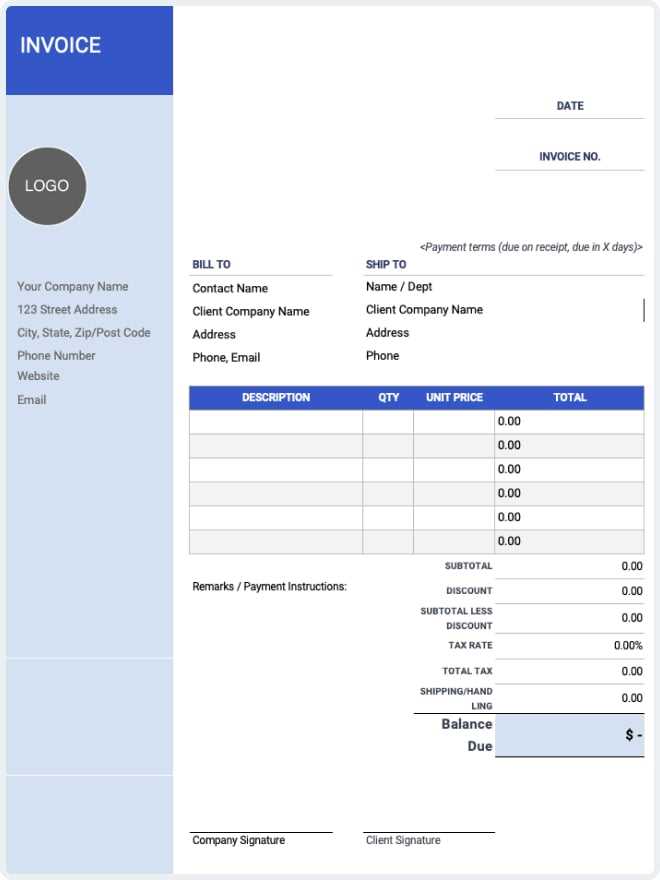

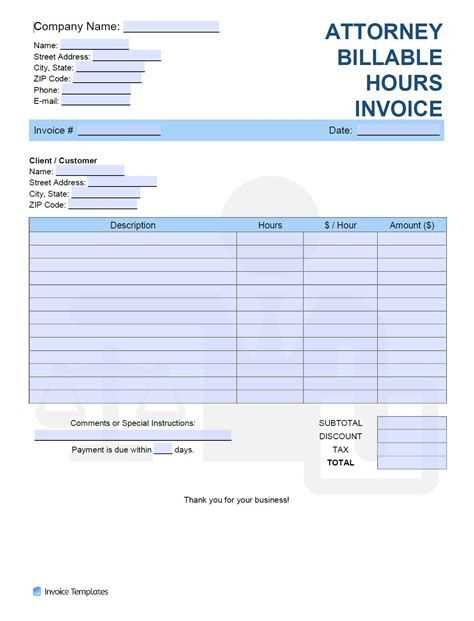

Attorney Billable Hours Invoice Template

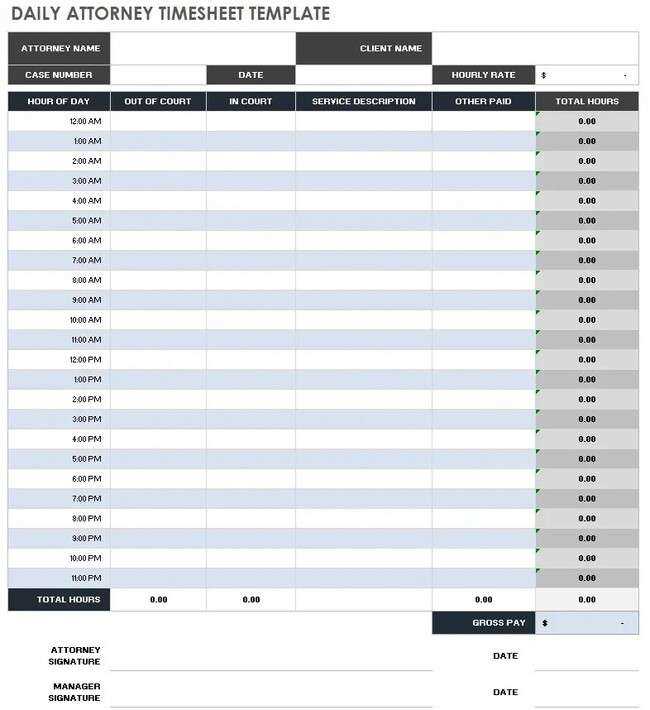

Creating a well-structured document for charging clients for time spent on legal tasks is crucial for clarity and efficiency. A well-designed system not only tracks the time spent on specific services but also ensures that the process of preparing client statements is seamless. Below are the essential components that should be included in any professional billing document.

- Client Information: Always include the client’s name, contact details, and case reference number. This ensures that the billing is attributed to the correct individual or organization.

- Service Description: Clearly describe the work completed. Be specific about the tasks, meetings, and consultations provided, as this increases transparency and reduces client queries.

- Time Entries: List each task performed along with the corresponding time spent. This can be broken down by day or activity to provide a detailed overview.

- Hourly Rate or Fixed Fees: Clearly state the rates for various services or fixed fees for particular tasks. Ensure the client understands what they are being charged for.

- Total Charges: Include the total amount due for services rendered, ensuring that all expenses are accounted for, including additional costs such as filing fees or travel expenses.

- Payment Terms: Specify the payment deadlines and any penalties for late payments, along with accepted methods of payment.

- Contact Information: Provide your business address, phone number, and email address in case the client needs to contact you with questions or clarifications.

By following these guidelines, legal professionals can create clear and professional documents that facilitate effective communication and ensure timely payments. This approach not only makes the billing process smoother but also builds trust with clients who appreciate transparency and attention to detail.

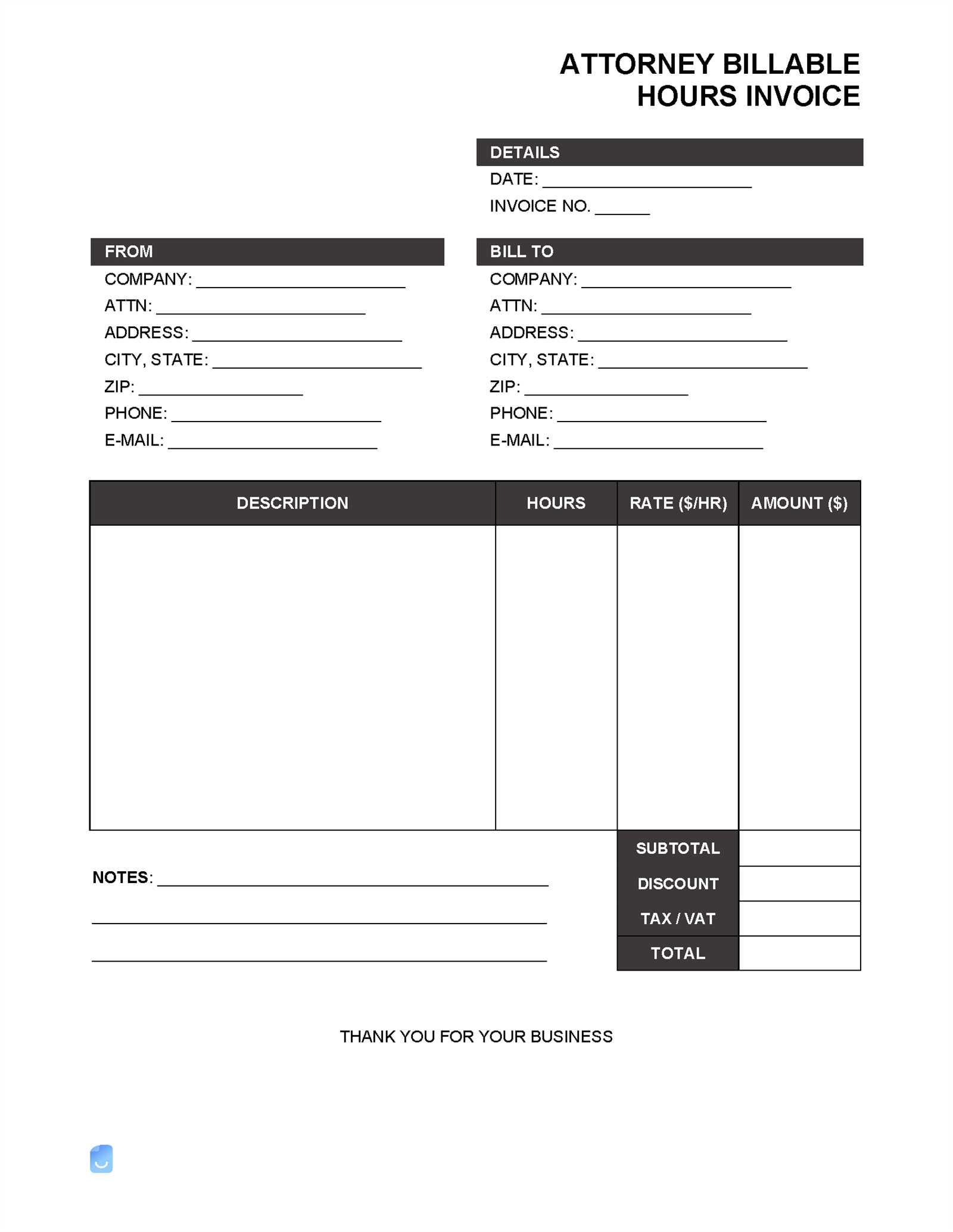

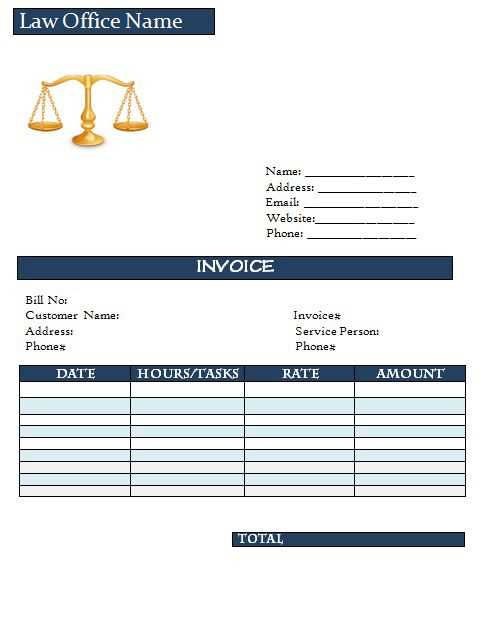

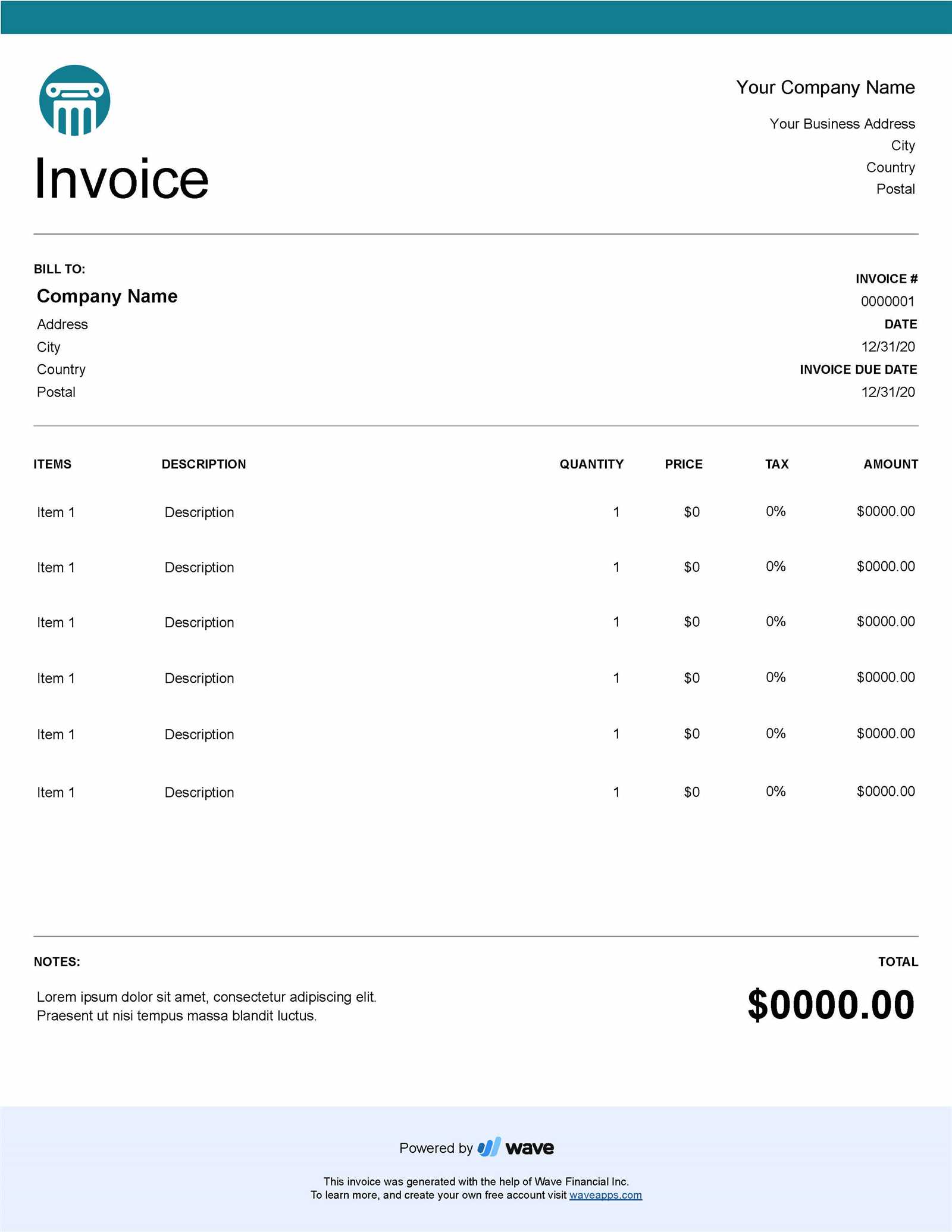

How to Create a Legal Invoice

Designing an effective document for client billing is essential in the legal field. A professional statement not only ensures clients are billed fairly but also reinforces trust and clarity in financial matters. Below is a step-by-step guide to creating a detailed and accurate billing statement for legal services.

Step 1: Gather the Necessary Information

The first step in creating a billing statement is collecting all relevant details. This includes the client’s name, case number, and the list of tasks completed. It is crucial to ensure that all the information is up to date and accurate to prevent any confusion or errors later on.

Step 2: Break Down the Services Provided

For each task performed, include a clear description along with the amount of time spent or fixed cost associated with the task. It is essential to be specific about the nature of the service, whether it’s a consultation, research, or legal representation. This detailed breakdown allows the client to understand exactly what they are being charged for.

Once the details are gathered, calculate the total amount due, including any additional costs like filing fees, administrative charges, or travel expenses. Always specify the payment terms, including when the payment is due and any penalties for delays.

By following these steps, you can ensure that your billing is transparent, professional, and easy for your clients to understand.

Key Elements of a Billable Hours Invoice

Creating an effective billing document requires attention to detail and clear communication. A well-organized statement helps clients understand the charges and minimizes potential disputes. The following key components should be included to ensure clarity and transparency when charging for professional services.

1. Client and Case Information

Each statement should begin with the client’s full name, contact details, and case or project reference number. This ensures that the billing document is accurately matched to the right client and matter, reducing the chance of errors.

2. Service Breakdown and Time Tracked

It is important to provide a detailed breakdown of services rendered, including the time spent on each task. The clearer the descriptions of tasks, the easier it is for clients to understand what they are being charged for. Below is an example of how to structure this information in a table format:

| Description of Service | Time Spent | Rate | Total Charge |

|---|---|---|---|

| Consultation on legal matter | 1.5 hours | $150/hour | $225 |

| Document preparation and review | 2 hours | $150/hour | $300 |

| Court representation | 3 hours | $200/hour | $600 |

| Total Amount Due | $1125 | ||

By breaking down the services and time clearly, clients can quickly see how their charges are calculated. Make sure that each task is easy to understand and that time is recorded accurately.

Customizing Your Attorney Invoice Template

Personalizing your billing document is essential for maintaining a professional image and ensuring that clients have a clear understanding of their charges. A customized document not only reflects your brand but also allows you to tailor it to the specific needs of each case or client. By adapting the layout, structure, and details, you can create a more efficient and effective billing process.

To begin with, consider adding your firm’s logo and contact information at the top of the document. This will reinforce your identity and make it easy for clients to reach you with any questions. Additionally, you can choose to highlight specific areas, such as payment deadlines or terms of service, to make key information more noticeable.

Another important customization is how you present the services rendered. For example, you can use categories or labels that fit the nature of the case, such as “Consultation,” “Research,” or “Representation.” This clarity helps clients better understand what they are being billed for and ensures transparency.

By customizing your billing documents, you enhance professionalism, improve clarity, and streamline your billing process, ultimately creating a more positive experience for your clients.

Why Accurate Billing is Crucial for Lawyers

Accurate financial documentation is essential for maintaining trust and transparency between legal professionals and their clients. When charges are unclear or errors occur in billing, it can lead to confusion, disputes, and a breakdown in the client relationship. Proper billing ensures that services rendered are appropriately compensated and helps avoid misunderstandings.

For legal professionals, accuracy is not just about calculating fees, but also about reflecting the work completed. Clients expect to pay for the exact time and services provided, and discrepancies can cause dissatisfaction or even legal action. A clear and correct billing statement not only supports timely payments but also reinforces your professional integrity.

Inaccurate charges can also result in delayed payments, which directly affect the firm’s cash flow and financial stability. Therefore, implementing a system that tracks time and services accurately is not only beneficial but necessary for maintaining a successful practice.

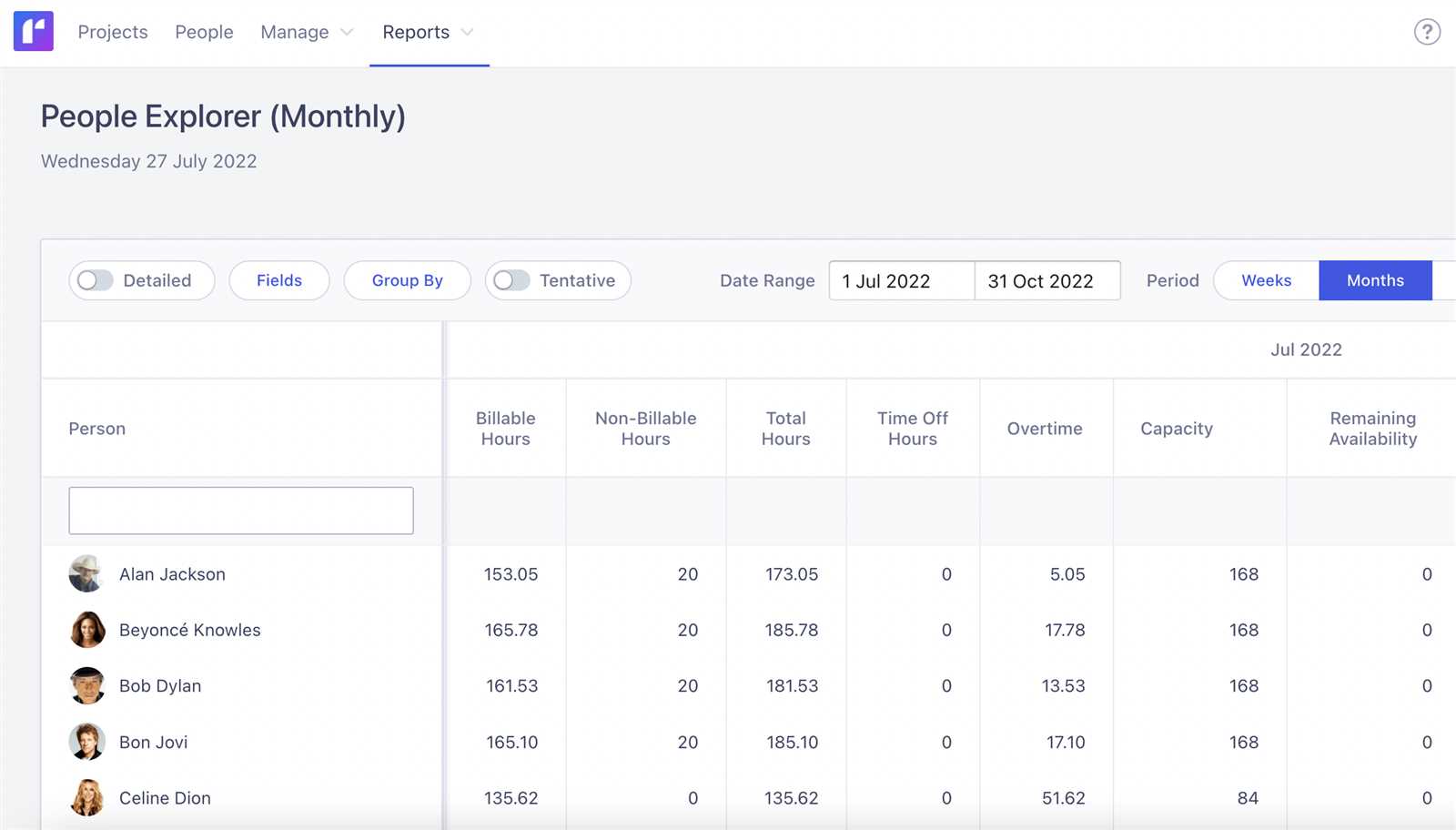

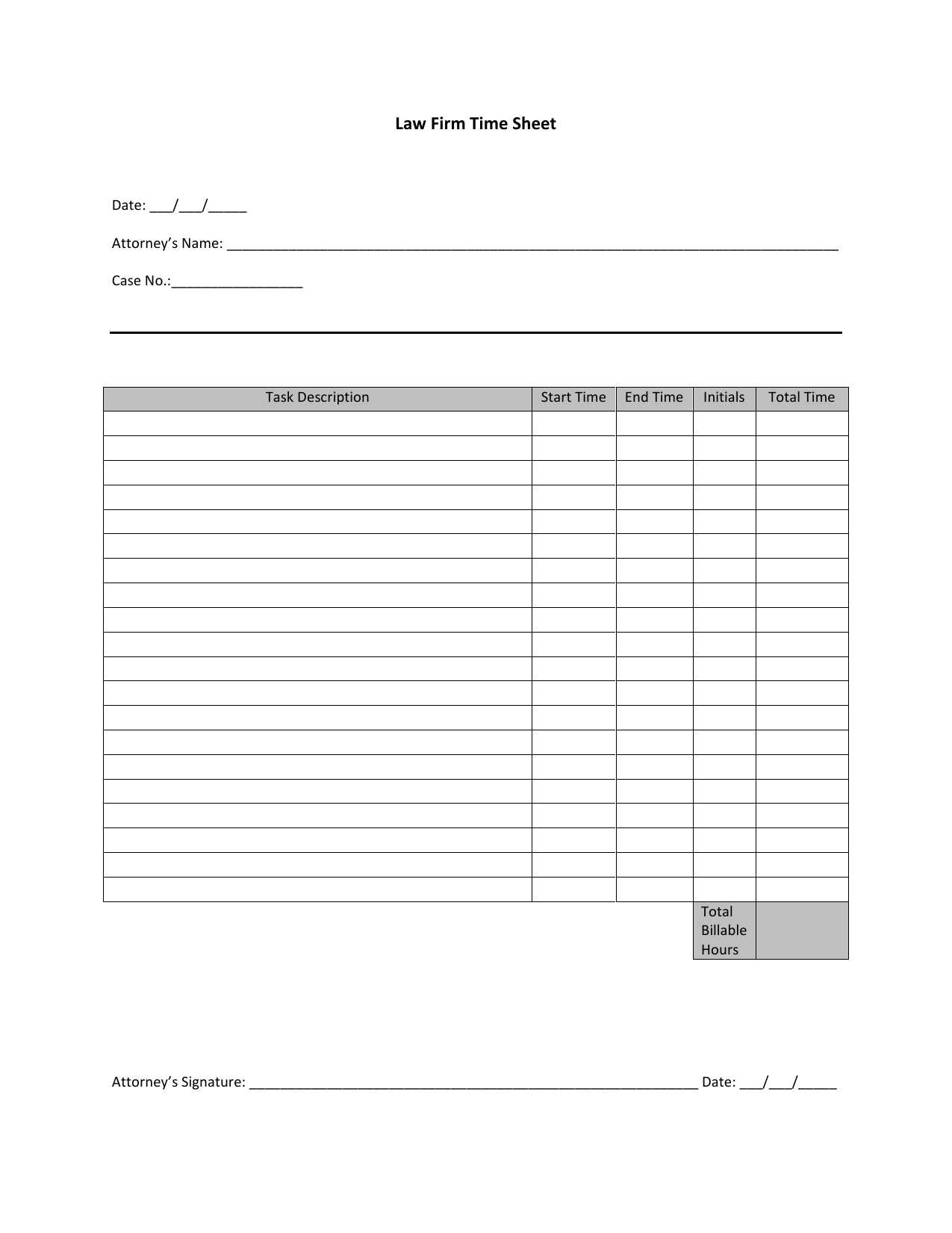

Tracking Billable Hours Effectively

Effective time tracking is essential for ensuring that clients are accurately charged for services rendered. When legal professionals fail to properly document their time, it can lead to billing errors and missed opportunities for revenue. An organized system that tracks time consistently not only enhances financial accuracy but also improves productivity and client satisfaction.

1. Choose the Right Time-Tracking Method

There are various methods available for recording time spent on tasks, including manual logs, digital time tracking tools, and integrated software. The key is selecting a method that fits the workflow of your practice while ensuring accuracy. Digital tools often offer features like automatic timers and the ability to categorize tasks, which can streamline the process and reduce human error.

2. Record Time Immediately After Tasks

To prevent inaccuracies, it’s crucial to log time as soon as a task is completed. Delayed entries may result in forgotten details or miscalculations. By tracking time in real time, you ensure that each task is accounted for accurately, and there is less chance of overlooking important work.

By maintaining an organized and timely approach to recording activities, you can provide clients with precise statements, improving transparency and ensuring you are fairly compensated for all your efforts.

Common Mistakes in Legal Invoices

When preparing financial statements for clients, it’s easy to overlook details that can lead to confusion or disputes. Even minor mistakes in how time and services are recorded or presented can have significant consequences. Understanding the most common errors can help legal professionals avoid issues that could undermine their reputation or result in delayed payments.

One frequent mistake is failing to provide clear descriptions of the services performed. Vague or incomplete descriptions can lead clients to question the charges, creating unnecessary frustration. Another common error is improper or inconsistent rate application, where different tasks may be charged at incorrect rates, or the hourly rate may not align with prior agreements.

In addition, failing to track time accurately can cause discrepancies in the final amount billed. If time is not logged immediately or if certain activities are not documented, the final statement may miss important services, leading to a loss of revenue. Lastly, not including clear payment terms or due dates can leave clients uncertain about when and how to pay, which may cause delays.

Avoiding these mistakes is crucial for maintaining trust and ensuring that the billing process is smooth, transparent, and professional.

Best Practices for Legal Billing

Implementing best practices in financial documentation is key to maintaining accuracy, transparency, and professionalism. When legal professionals consistently follow a structured approach to charging for services, it not only reduces errors but also fosters positive client relationships. The following practices can help ensure a smooth and efficient billing process.

First, it’s important to provide detailed and clear descriptions of each service rendered. Clients should understand exactly what they are paying for, whether it’s a consultation, legal research, or document preparation. Clear and precise breakdowns help to build trust and minimize any misunderstandings.

Second, always ensure that the rates are consistent with the agreed terms. If there are different rates for different types of work or staff, be sure to itemize them clearly. Accurate and consistent pricing avoids disputes and ensures clients feel they are being charged fairly.

Third, keep time and services well documented. Using an effective time-tracking method allows legal professionals to accurately record the time spent on each task, reducing the chance of missed charges or inflated hours. A transparent and organized approach to time tracking ensures no service goes unbilled.

Finally, maintain clear payment terms and ensure they are communicated upfront. Whether it’s payment deadlines, methods, or penalties for late payments, clients should have a clear understanding of the financial expectations. Having these terms spelled out in the billing statement can help avoid confusion and expedite payments.

By adhering to these best practices, legal professionals can improve their billing processes, reduce errors, and maintain strong client trust.

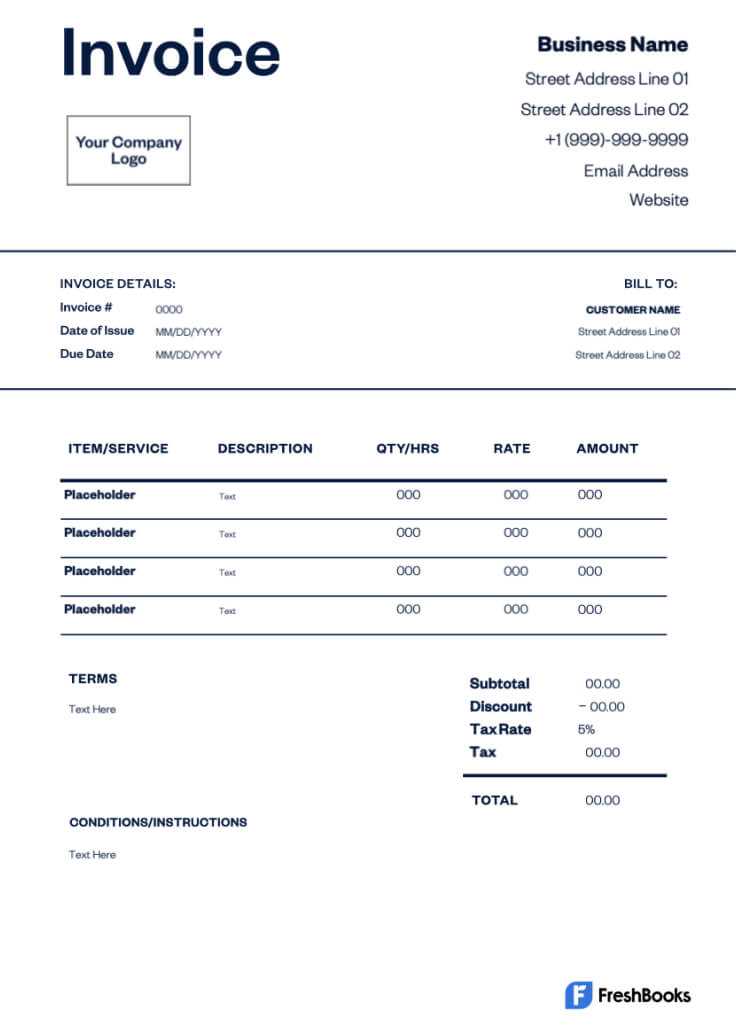

Legal Invoice Formatting Tips

Proper formatting is crucial for creating a clear, professional, and easy-to-read financial statement. A well-structured document helps clients understand the charges, reducing confusion and ensuring timely payments. Here are some essential tips to enhance the clarity and effectiveness of your billing documents.

1. Consistent Layout and Organization

Start with a clean and consistent layout. Use headings, subheadings, and bullet points to break down the information into manageable sections. A clear structure with distinct sections for client details, service descriptions, and payment terms allows clients to navigate the document easily. Keep the font professional and legible, avoiding too many different styles or sizes that can make the document look cluttered.

2. Clear Breakdown of Charges

Always provide a detailed breakdown of services. Include a description of each task, the time spent, and the rate charged. If applicable, categorize services under relevant headings like “Consultation,” “Research,” or “Document Drafting.” This makes it easier for the client to see what they are being charged for, ensuring transparency and minimizing potential disputes.

By following these formatting tips, you can create a billing statement that is both professional and easy for clients to understand, which can help improve payment timelines and client satisfaction.

How to Include Expenses in Invoices

Including additional costs in your billing document is essential for providing an accurate reflection of the total amount owed. Whether it’s for travel, court fees, or office supplies, listing these expenses separately ensures transparency and helps prevent misunderstandings. It’s important to outline these charges clearly, so clients are aware of what they are paying for beyond the standard services.

When adding expenses, always include a brief description of each cost, the amount, and any relevant receipts or supporting documentation. This allows clients to verify the charges and understand the necessity of each expense. Below is an example of how to format these charges in your billing document:

| Expense Description | Amount |

|---|---|

| Travel to Client Meeting | $50.00 |

| Court Filing Fee | $150.00 |

| Document Printing | $20.00 |

By clearly itemizing these costs, clients can easily understand the full scope of charges, which improves transparency and minimizes disputes over payment.

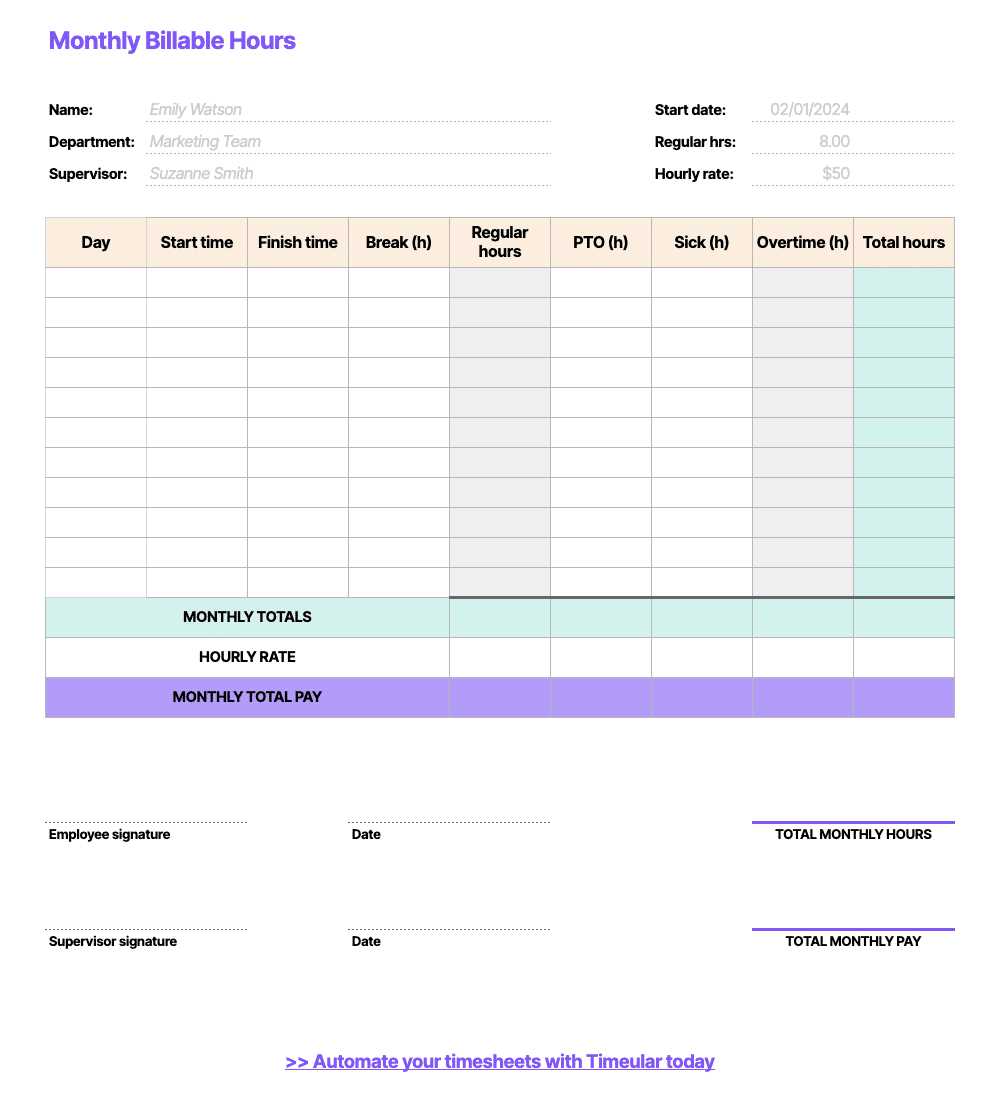

Managing Multiple Clients with One Template

When handling several clients, it’s important to streamline the billing process without sacrificing accuracy. Using a standardized format for all clients can help simplify the process, ensuring that each statement is organized and professional, while still maintaining the flexibility to cater to each client’s unique needs.

1. Use Customizable Sections for Each Client

While using a single format for all clients, it’s essential to ensure each one’s details are clearly separated. Customizable sections for client-specific information, such as service descriptions, rates, and payment terms, will help you easily adjust the document for each client’s requirements. By setting up fields that can be quickly modified, you avoid redundant formatting tasks and reduce the risk of errors.

2. Create Client-Specific Subsections

If you are providing different services or packages to different clients, consider organizing each client’s information into clearly marked subsections. This allows you to maintain clarity when working with multiple clients and ensures that every charge is clearly associated with the correct client and service.

By creating a flexible yet consistent structure for your billing documentation, you can efficiently manage multiple clients without losing track of individual needs or client expectations.

Using Invoice Templates for Faster Billing

Utilizing pre-designed documents for charging clients can significantly speed up the billing process. By relying on a structured format, you can reduce the time spent creating each statement from scratch. This approach allows for consistency, accuracy, and the ability to quickly adjust to the specific needs of each client.

1. Streamlining Document Creation

Pre-made documents offer ready-to-use sections for client information, descriptions of services, rates, and payment terms. By filling in these sections with the necessary details, you can complete the billing process much faster compared to manually formatting each statement every time. This time-saving practice is especially useful when dealing with multiple clients or recurring charges.

2. Consistency and Accuracy

Another key advantage of using a set format is the consistency it provides. Every statement will look professional and contain all the essential elements in a clear, organized manner. This reduces the risk of errors and ensures that clients receive accurate, comprehensive billing information each time.

By incorporating pre-designed documents into your workflow, you can significantly improve the efficiency of your billing system while maintaining high-quality and consistent outputs.

Legal Invoice Tools and Software

Managing financial records efficiently is crucial for legal professionals. Using the right software tools can simplify the process of creating and tracking payment requests. These tools automate many tasks, from generating detailed reports to tracking expenses and client payments, helping to streamline the billing process and reduce errors.

1. Benefits of Billing Software

Billing software offers several advantages, such as customizable templates, automated time tracking, and the ability to generate professional statements quickly. It helps reduce the manual effort required to create accurate billing documents, saving time and ensuring consistency across all client accounts. Additionally, many tools allow you to track overdue payments, helping maintain cash flow management.

2. Popular Software Options

There are many software solutions available for legal professionals looking to optimize their billing process. Some popular options include:

- Clio: Known for its ease of use and comprehensive features, including time tracking, client management, and billing.

- Bill4Time: Offers a simple interface for time tracking and invoicing, making it ideal for small to medium-sized firms.

- QuickBooks: A widely used accounting software that integrates invoicing with financial management, ideal for firms with complex needs.

These tools offer a range of features that can greatly improve the accuracy, speed, and efficiency of billing, helping legal professionals stay organized and focused on their work.

What to Include in a Legal Invoice

Creating clear and detailed statements for legal services is essential to ensure transparency and maintain professional standards. Each statement should include key elements that reflect the work completed, any associated costs, and the agreed-upon terms between the service provider and the client. Including all relevant details helps avoid misunderstandings and facilitates prompt payments.

Some essential components to include are:

- Client Information: Ensure that the client’s full name, address, and contact details are clearly listed.

- Services Provided: A breakdown of the services rendered, including detailed descriptions of the tasks performed or legal work completed.

- Rates and Fees: The rate for services should be clearly specified, along with the total for each type of work performed. If applicable, include hourly rates, flat fees, or other pricing structures.

- Payment Terms: Outline the payment due date, acceptable methods of payment, and any penalties for late payments.

- Expenses: Any additional costs incurred, such as filing fees or court costs, should be listed separately, with appropriate details about each charge.

- Payment Instructions: Provide clear instructions on how to make payments, including bank account details or online payment options.

By including these key details, legal professionals can create clear, effective billing statements that ensure transparency and help maintain strong client relationships.

Ensuring Clarity and Transparency in Billing

Effective financial documentation is crucial in maintaining a strong and trustworthy relationship between service providers and clients. Clear and transparent billing ensures that clients understand the charges, feel confident in the accuracy of the amounts, and can easily follow up with any questions or concerns. When creating financial records, it is essential to avoid ambiguity and provide sufficient details to make the process straightforward and easy to comprehend.

1. Clear Descriptions of Services Rendered

One of the most important aspects of transparent billing is offering a clear breakdown of services performed. Each task or service should be detailed with a brief description, so the client knows exactly what was done, why it was necessary, and how it relates to the overall work. Vague terms or a lack of explanation can create confusion and make clients hesitant about paying the bill.

2. Transparent Pricing Structure

It’s essential to provide an easily understandable pricing structure. Whether using hourly rates or flat fees, clients should know the cost for each service upfront. If there are any additional charges, such as for administrative tasks or third-party expenses, these should also be listed clearly. This helps avoid any surprises when the client receives the final statement.

By ensuring that all charges are itemized and explained, both service providers and clients can maintain an open line of communication, which ultimately leads to smoother financial transactions and stronger client satisfaction.

How to Handle Late Payments in Legal Billing

Managing overdue payments is an important part of maintaining financial stability in any business, including legal services. When clients fail to make payments on time, it’s essential to address the situation professionally while ensuring that the provider’s rights are protected. A clear and consistent process can help minimize delays and avoid misunderstandings.

1. Set Clear Payment Terms Upfront

To prevent late payments, establish and communicate clear payment terms at the start of a professional relationship. This should include:

- The due date for payment.

- The consequences of late payments, such as late fees or interest.

- The accepted methods of payment and any associated processing fees.

Having these terms in writing from the outset can help ensure that clients understand the expectations and obligations they are agreeing to.

2. Send Friendly Payment Reminders

If a payment is overdue, it’s often best to start with a polite reminder. A friendly email or letter can prompt clients to make the payment without feeling pressured. It can include details of the original agreement and a gentle nudge for payment.

3. Follow Up with Formal Communication

If the payment remains outstanding after the initial reminder, it may be necessary to send a more formal communication. This can include:

- A letter detailing the overdue balance and any applicable late fees.

- A request for payment within a set period to avoid further action.

- Details about possible next steps if payment is not made, such as suspension of services or referral to a collections agency.

4. Offer Flexible Payment Plans

Sometimes clients may be facing financial difficulties. In such cases, offering a payment plan can help them settle their debts over time. Ensure that the terms are clear, including the installment amounts and due dates, to avoid confusion.

5. Consider Legal Action as a Last Resort

If all attempts to collect payment fail, legal action may be necessary. This could include referring the matter to a collections agency or filing a claim in small claims court. It’s important to weigh the costs and benefits of this approach before proceeding, as it can strain relationships and potentially harm future business opportunities.

By following a clear, structured approach to handling late payments, service providers can protect their cash flow while maintaining positive client relationships.