Artist Performance Invoice Template for Simple and Accurate Billing

For those who offer creative services, ensuring smooth and timely payments can be crucial. Properly formatted billing documents help build professionalism and foster trust with clients, simplifying payment processes and setting clear expectations. Knowing how to prepare a clear, comprehensive bill for services can make a big difference in maintaining positive working relationships and securing prompt payments.

In the world of events, providing well-organized billing statements is particularly essential. A structured document detailing the specifics of each engagement not only clarifies expectations but also helps both parties stay aligned. Incorporating key details and personalizing the form to suit unique needs enhances clarity and ensures fair compensation for time and expertise.

By using effective tools for payment tracking, freelancers and creatives can save time and avoid potential misunderstandings. A thoughtfully crafted document is a helpful asset for managing finances

Artist Performance Invoice Template Guide

Creating organized billing documents is essential for professionals who work in event-based services, allowing them to communicate expectations and streamline the payment process. These documents outline the necessary details of each engagement, making it easier for clients to understand charges and fulfill payment obligations. Using an adaptable, efficient form simplifies financial tracking and helps prevent potential discrepancies.

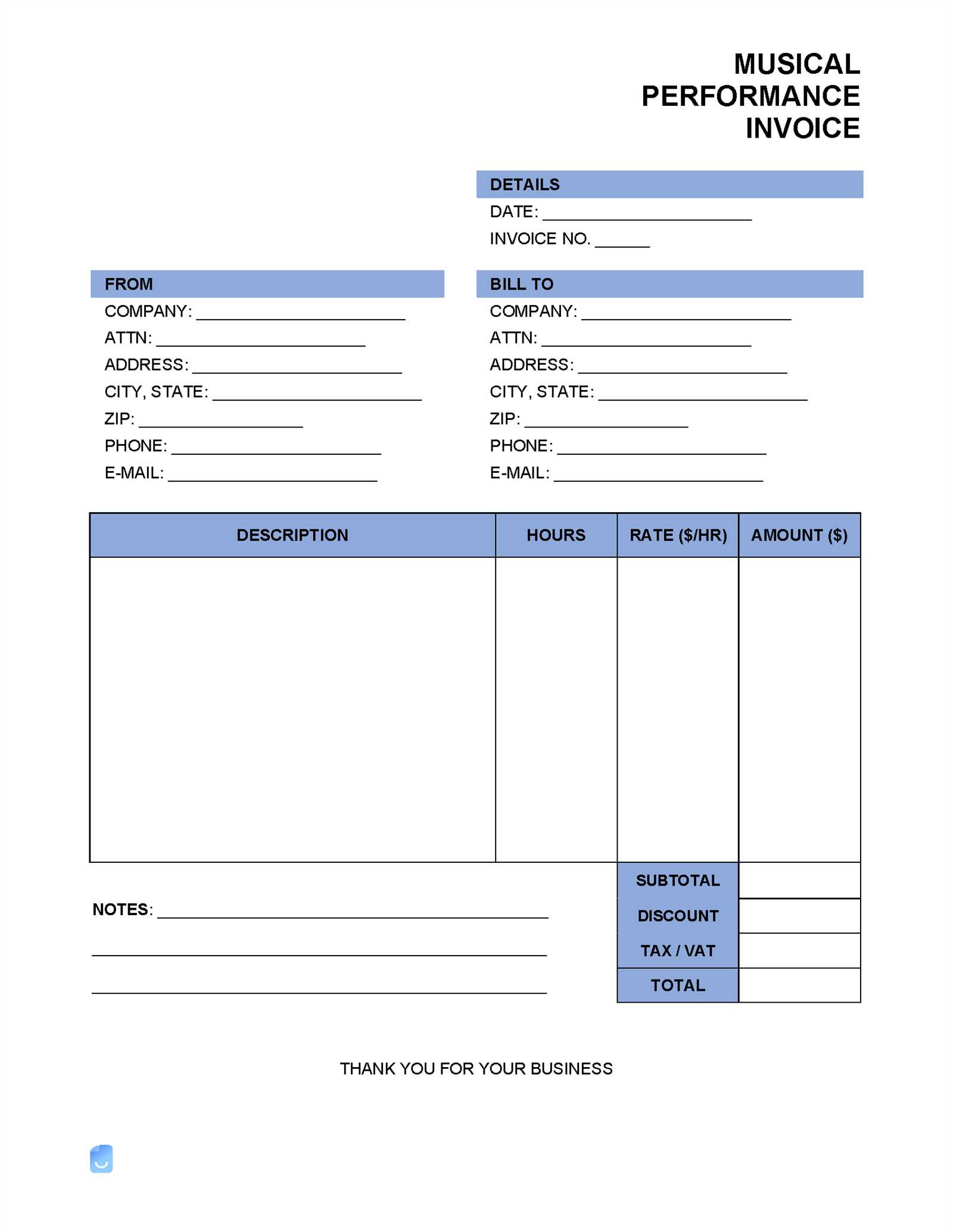

Key Elements to Include

An effective billing format should incorporate specific information to ensure accuracy and clarity. Including the following components will help maintain a professional standard and keep clients informed:

- Service Description: Clearly outline the type of service provided, with any relevant details about the event.

- Rates and Fees: Specify the agreed rates, whether by hour or by event, along with any additional fees or charges.

- Client Information: Include the client’s name, contact details, and any relevant identification details for tracking.

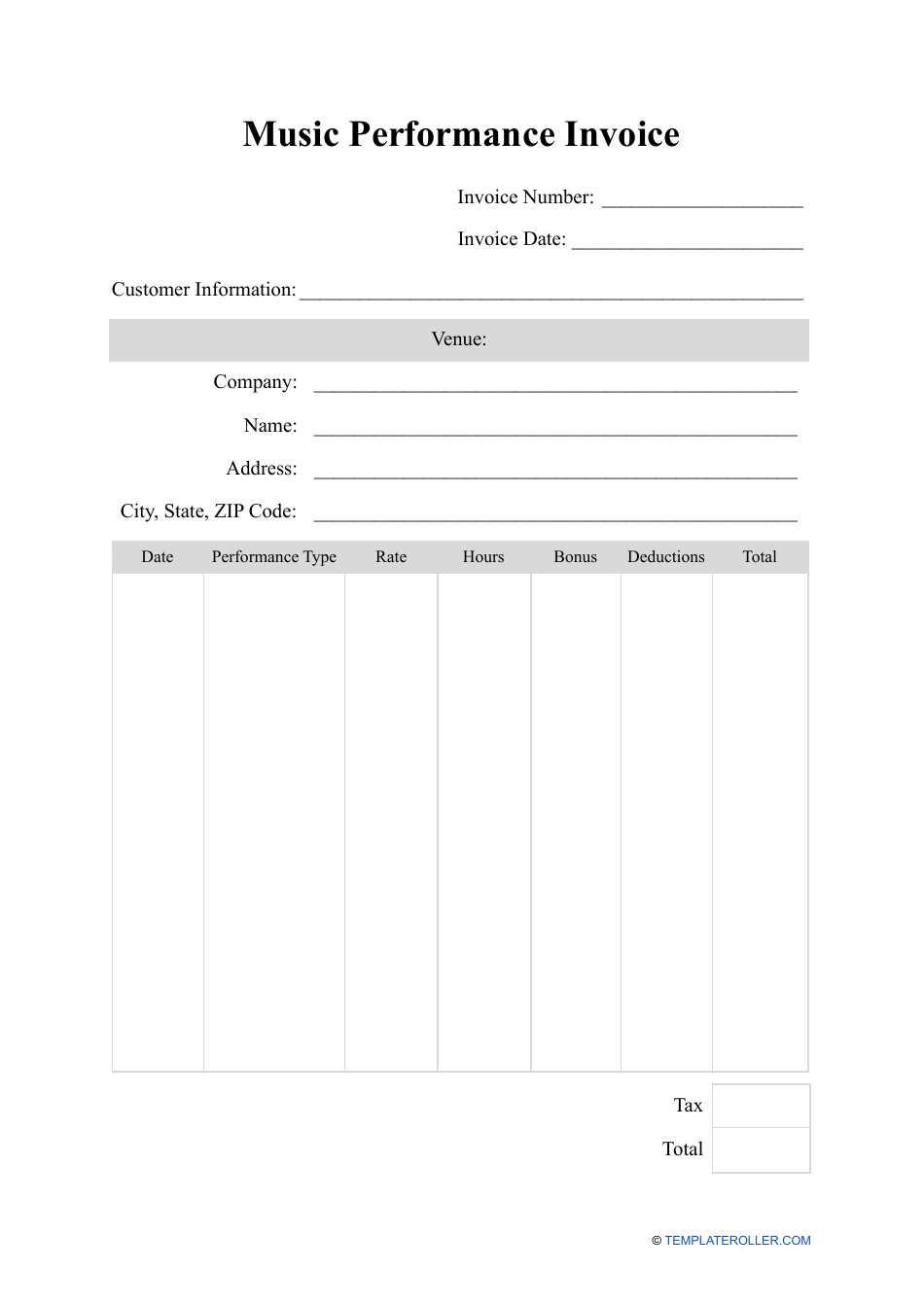

Creating an Invoice for Performances Generating clear billing statements for event services ensures that all parties understand the agreed terms and can follow a straightforward payment process. An effective document provides all necessary details, helping clients review services and charges easily. A structured approach to billing not only boosts professionalism but also minimizes delays in payment.

Essential Information to Include

To ensure your billing is complete and professional, incorporate the following elements:

- Description of Services: Summarize the specifics of the service, including

Creating an Invoice for Performances

Generating clear billing statements for event services ensures that all parties understand the agreed terms and can follow a straightforward payment process. An effective document provides all necessary details, helping clients review services and charges easily. A structured approach to billing not only boosts professionalism but also minimizes delays in payment.

Essential Information to Include

To ensure your billing is complete and professional, incorporate the following elements:

- Description of Services: Summarize the specifics of the service, including event details that clarify the scope of work.

- Rate Calculation: Outline how fees are calculated, whether as a flat rate, hourly charge, or other method agreed upon.

- Client and Service Provider Details: List contact information for both parties, ensuring each is easily identifiable.

- Payment Instructions: Specify preferred methods, payment timeline, and any late fee policies, so clients know exactly what to expect.

Organizing the Document Layout

Structuring your billing format thoughtfully helps ensure clarity and ease of use. Here are some tips for arranging key sections:

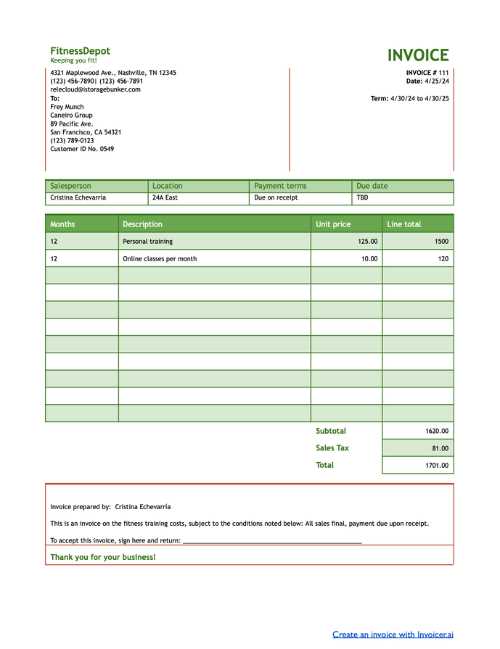

- Header Section: Include your branding or business name along with the client’s name and event date for quick reference.

- Breakdown of Costs: Use itemized lists to make each service and fee transparent, allowing clients to review details at a glance.

- Closing Notes: Add any final notes or reminders, such as thank-you messages or a brief summary of your policies.

With these elements carefully arranged, you create a polished and easy-to-understand document that enhances the client experience and supports efficient financial management.

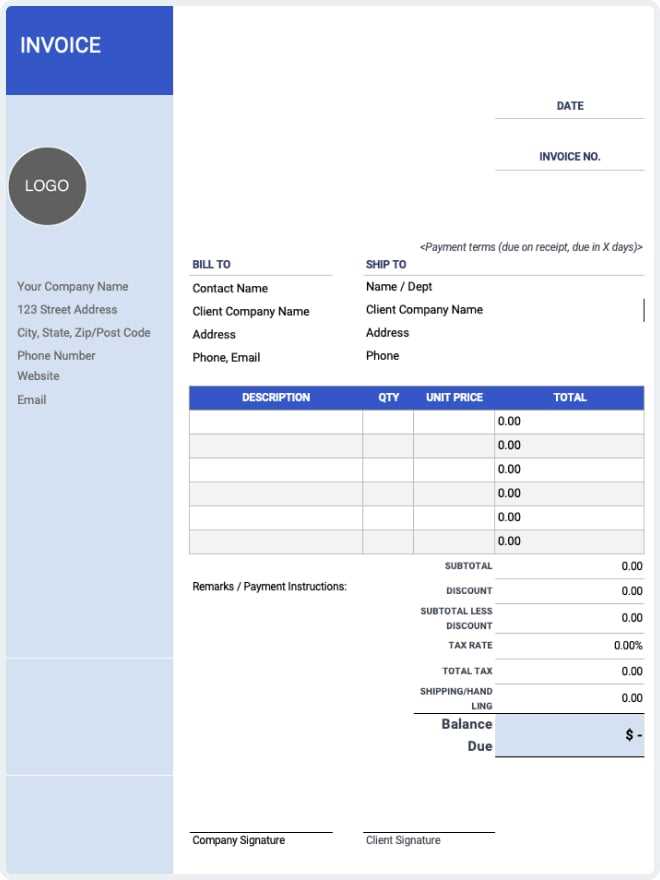

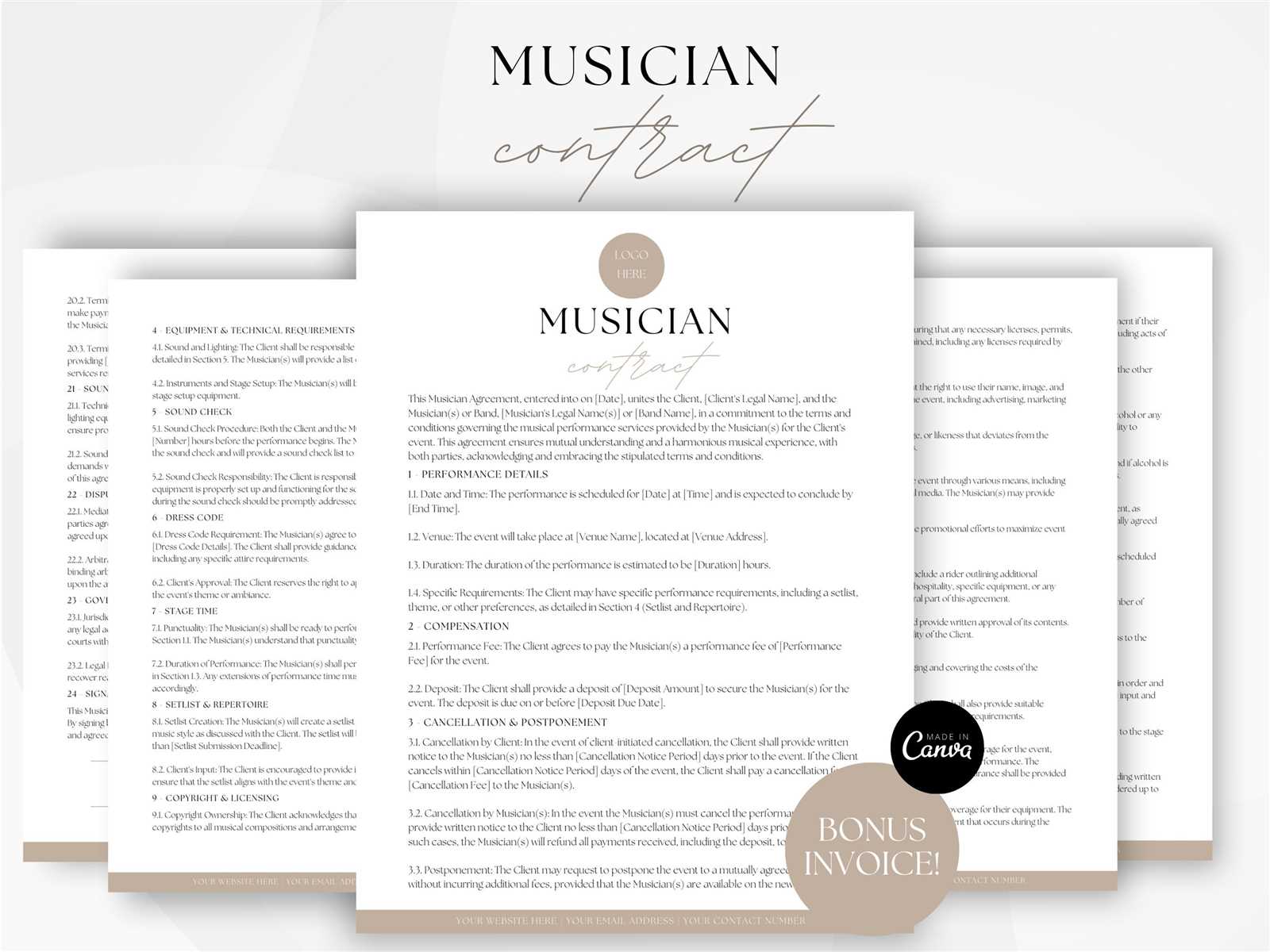

How to Customize Your Invoice

Personalizing your billing document can enhance its professionalism and better reflect your brand. By incorporating unique design elements and specific information relevant to each project, you create a tool that aligns closely with your service style. Customization not only improves readability but also reinforces your brand identity in every client interaction.

Here are some key ways to make your document uniquely yours:

- Add a Logo: Including

How to Customize Your Invoice

Personalizing your billing document can enhance its professionalism and better reflect your brand. By incorporating unique design elements and specific information relevant to each project, you create a tool that aligns closely with your service style. Customization not only improves readability but also reinforces your brand identity in every client interaction.

Here are some key ways to make your document uniquely yours:

- Add a Logo: Including a logo or business name at the top of the document helps clients recognize your brand immediately.

- Personalized Color Scheme: Choosing colors that match your brand creates a cohesive look and makes your document more visually appealing.

- Adjust Fonts: Use fonts that are professional and align with your style, but ensure readability for clients.

- Include Custom Fields: Add sections tailored to your needs, such as project-specific notes or special payment instructions.

- Highlight Important Details: Emphasize due dates or total amounts with bold or larger text to make essential information stand out.

Beyond aesthetics, customizing the structure and details of your billing format can further enhance clarity. Here’s how:

- Section Organization: Group related items together, such as services provided, rates, and any applicable taxes, to streamline the layout.

- Contact Information: Make sure both your and the client’s contact details are easily visible, so any follow-ups are convenient.

- Footer Notes: Use the footer for important notes, such as gratitude messages or brief terms of service.

With these simple adjustments, your document will not only look professional but also communicate all necessary information in a clear and organized way.

Why Artists Need Invoices

Providing well-organized billing documents is essential for professionals in creative fields who wish to maintain transparent and professional relationships with clients. These documents not only streamline the payment process but also serve as records of services rendered, fostering trust and clarity in each transaction. For many, properly documenting work and charges is a key part of managing their careers effectively.

Benefits of Clear Billing Documents

Organized payment requests can help secure timely payments, track completed work, and establish professionalism. Below are some specific advantages of using a

Why Artists Need Invoices

Providing well-organized billing documents is essential for professionals in creative fields who wish to maintain transparent and professional relationships with clients. These documents not only streamline the payment process but also serve as records of services rendered, fostering trust and clarity in each transaction. For many, properly documenting work and charges is a key part of managing their careers effectively.

Benefits of Clear Billing Documents

Organized payment requests can help secure timely payments, track completed work, and establish professionalism. Below are some specific advantages of using a detailed billing format:

Benefit Description Professionalism Clear documents reinforce trust and convey a sense of professionalism, helping clients view the provider as a reliable partner. Accurate Records Detailed forms keep track of work history, which can be helpful for future references or when planning repeat projects. Timely Payments Clear payment terms and amounts encourage clients to pay promptly, reducing delays in income. Clear Communication A thorough outline of services and charges clarifies expectations and reduces the potential for misunderstandings. Setting Clear Expectations

Using organized billing statements helps set clear boundaries around each project. By itemizing tasks and costs, professionals make it easy for clients to understand the full scope of work involved. This approach not only ensures that payments are received as expected but also supports fair compensation for time and expertise.

In conclusion, establishing a routine for creating detailed billing documents can be a vital asset for any creative professional. It simplifies financial tracking, minimizes disputes, and enhances overall business management.

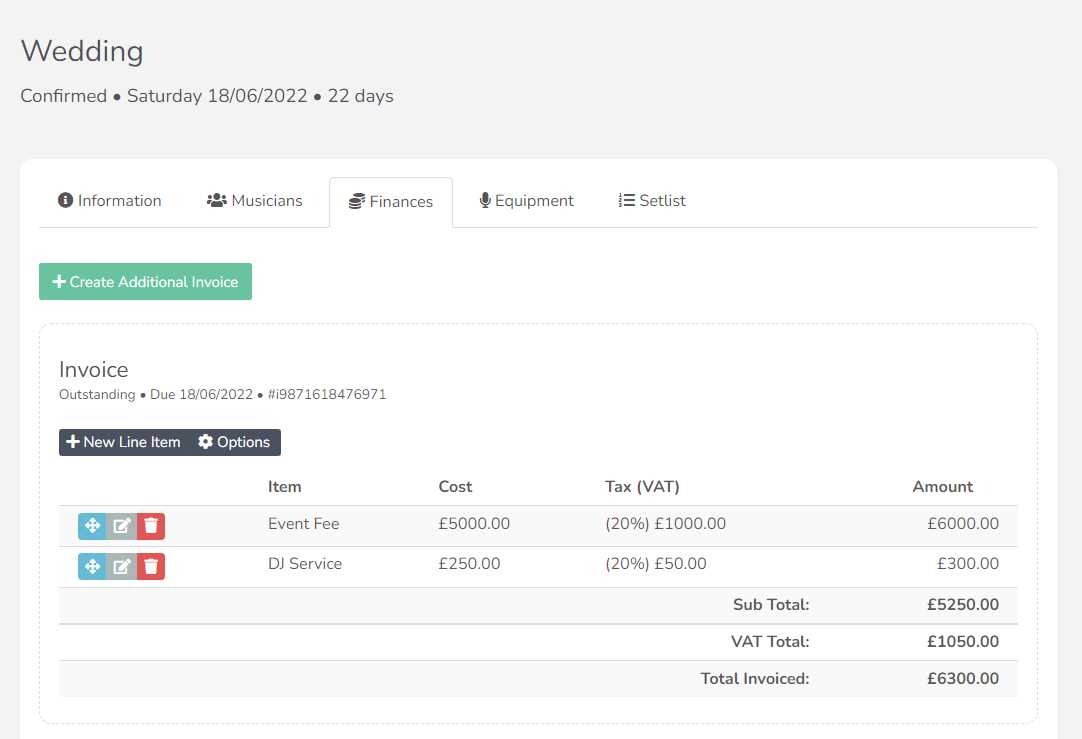

Tracking Payments with Invoice Templates

Keeping a consistent record of received and pending payments is crucial for maintaining smooth financial operations. By using structured documents for billing, professionals can easily monitor income, manage outstanding balances, and ensure that all transactions are recorded accurately. This organized approach to tracking payments supports efficient financial management and allows for greater focus on creative projects.

Here are some effective methods for managing payments with billing documents:

- Maintain Consistent Records: Use standardized formats to keep

Tracking Payments with Invoice Templates

Keeping a consistent record of received and pending payments is crucial for maintaining smooth financial operations. By using structured documents for billing, professionals can easily monitor income, manage outstanding balances, and ensure that all transactions are recorded accurately. This organized approach to tracking payments supports efficient financial management and allows for greater focus on creative projects.

Here are some effective methods for managing payments with billing documents:

- Maintain Consistent Records: Use standardized formats to keep each billing document similar. This consistency simplifies reviewing payment history at a glance.

- Organize by Date and Client: Group documents by client and month to track when payments are due, allowing you to follow up promptly if needed.

- Track Payment Status: Clearly label each document as “Paid,” “Pending,” or “Overdue” to quickly see which accounts need attention.

- Include Payment Terms: List specific due dates and any late fees, as this helps clients understand their obligations and encourages timely transactions.

Using a systematic approach also allows for a streamlined view of overall income. Here’s how to organize your payment tracking:

- Document Storage: Create a dedicated folder for each month or project to easily access records when needed.

- Track Overdue Balances: Set reminders for outstanding payments, helping to reduce delays in receiving payments.

- Analyze Financial Trends: Use past records to identify seasonal patterns in income or trends with specific clients, aiding in future planning.

By following these practices, professionals can achieve a clear overview of their finances and reduce time spent on administrative tasks, making it easier to focus on delivering quality work.

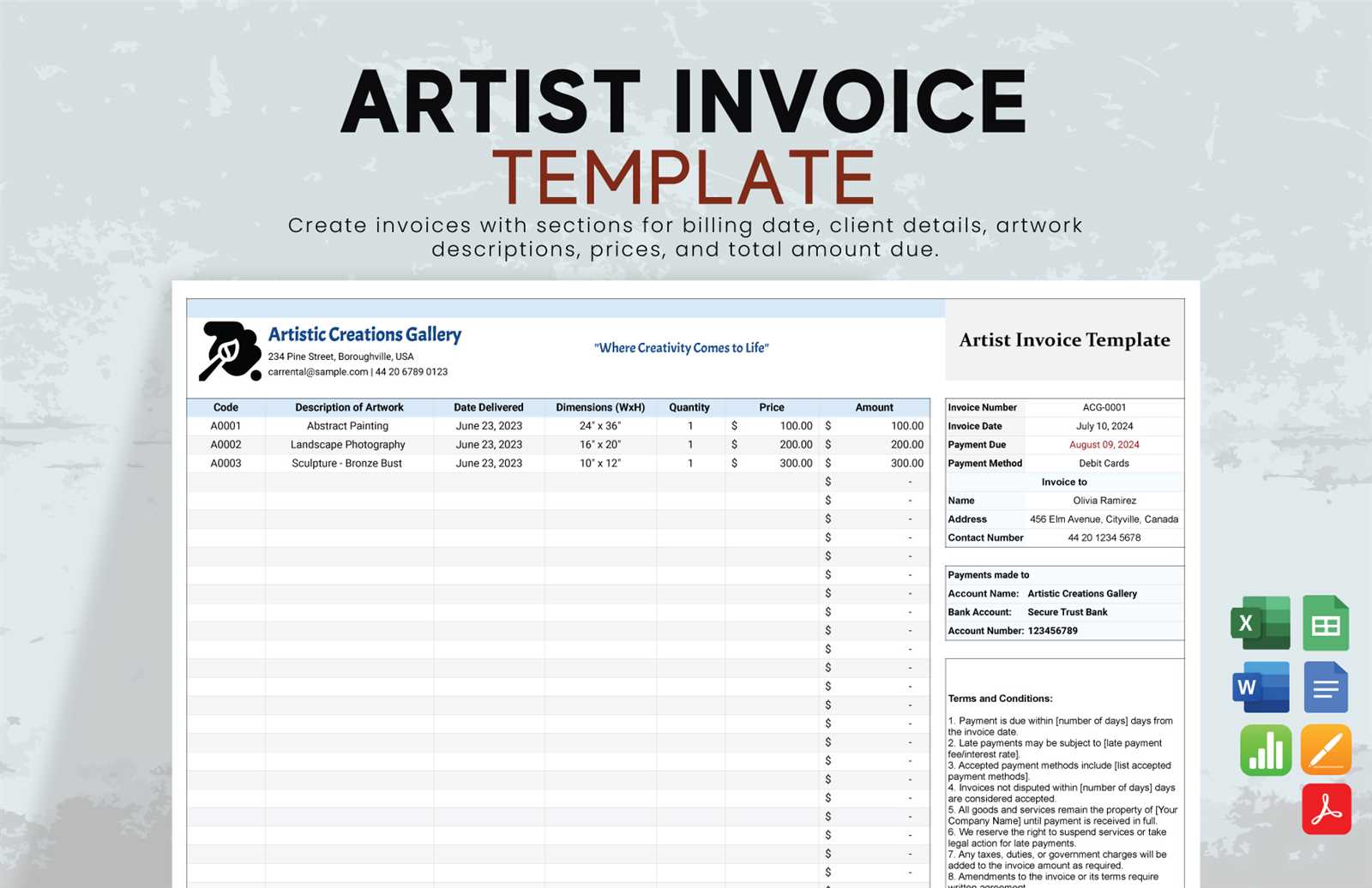

Details to Include in Invoices

To ensure clarity and professionalism, it is important to include specific details in your billing documents. These elements help avoid confusion, ensure timely payments, and provide clear records for both you and your clients. A well-organized document leaves little room for ambiguity, making it easier to manage financial transactions effectively.

Here are some essential details to include:

Detail Description Your Contact Information Include your full name or business name, address, phone number, and email so clients can easily reach you. Client’s Contact Information Ensure the client’s name, company, and contact details are correctly listed for proper communication. Service Description Clearly describe the work or services provided, including dates, locations, and specific tasks completed. Amount Due List the total cost for the work performed, along with any additional fees, taxes, or discounts applied. Payment Terms Include payment deadlines, accepted methods, and any late fee policies to establish clear expectations. Unique Document Number Assign a unique reference number to each billing document for easier tracking and organization. Date of Issue Provide the date the document is issued, along with the payment due date to ensure timely processing. By ensuring these key elements are included in your documents, you can maintain clear communication, build trust with clients, and manage your finances more effectively.

Invoice Templates for Live Performances

For those involved in live events, using structured documents for billing is essential for maintaining clear financial records and ensuring timely payments. A well-organized document helps outline the work completed, the agreed-upon terms, and the payment process. This approach not only protects both parties but also streamlines the process of receiving payments and managing finances.

Why These Documents Matter

Structured documents serve as legal records and a professional way to present your charges. These documents also help establish transparency with clients and ensure all details are properly tracked. Whether for a single event or multiple engagements, it is vital to include key details that facilitate smooth transactions.

Key Components for Live Events

Here are the crucial elements that should be included in your billing documents for live events:

Detail Description Event Description Provide a clear description of the event, including the venue, date, and type of work done. Hourly or Flat Rate Indicate how much you charge per hour or for the entire event, and be clear about the payment method. Payment Terms List the agreed-upon payment terms, including deadlines and any late fees if applicable. Client Information Ensure the client’s contact details are correct for follow-up and payment processing. Service Charges and Taxes Include any additional charges like travel expenses, accommodation, or taxes that may apply to the total cost. Special Requests or Notes List any specific conditions, requests, or important details to ensure clarity between both parties. By including these details, you ensure that both you and your client are on the same page regarding financial expectations. This helps prevent misunderstandings and allows for smoother transactions in the future.

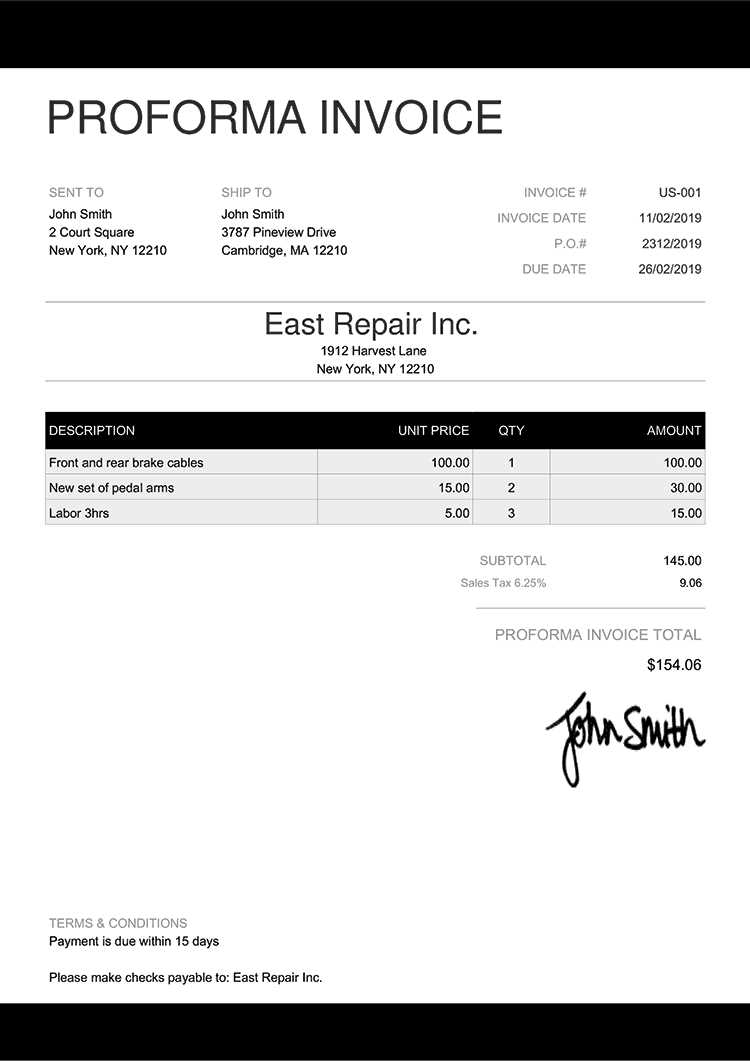

Best Practices for Accurate Billing

Maintaining precise billing practices is essential for smooth financial transactions and building trust with clients. Ensuring all charges are clear and transparent helps avoid disputes and ensures timely payments. By following effective strategies, you can create clear documents that outline the agreed-upon services and compensation.

Key Strategies for Effective Billing

Here are some best practices to ensure that your billing is both accurate and professional:

Practice Explanation Clear Itemization Break down the services provided with detailed descriptions to prevent any confusion. Include hours worked, rates, and any additional charges. Double-Check Details Ensure all information, such as the client’s contact details and payment terms, is accurate. Verify amounts and dates before sending. Set Clear Payment Terms Define the payment deadline, any late fees, and accepted methods of payment. This sets expectations and helps with timely transactions. Provide Payment Options Offer various ways for clients to make payments, such as credit card, bank transfer, or online platforms, making it easier for them to pay. Regular Invoicing Send billing documents promptly after the work is completed. Regular invoicing builds a routine and ensures payments are made without delays. Follow Up on Outstanding Payments Send reminders for overdue payments. A professional follow-up can help maintain cash flow and encourage timely settlements. By incorporating these practices into your billing process, you can help ensure that all financial interactions are handled accurately, fostering better client relationships and smoother business operations.

How to Send Invoices to Clients

Sending payment requests to clients efficiently is crucial to ensure timely compensation for services rendered. Properly delivering these documents not only helps with cash flow but also maintains professionalism in your business dealings. By following a clear and organized process, you can make the payment procedure smoother for both you and your clients.

Steps for Sending Payment Requests

To effectively send documents requesting payment, consider the following steps:

- Choose the Right Method – Decide whether to send the document via email, post, or a secure online platform based on the client’s preferences. Email is typically faster and more efficient.

- Ensure Accuracy – Before sending, double-check the details. Ensure the services, amounts, and payment terms are correctly listed to avoid confusion later.

- Attach Necessary Documents – Include all relevant documents that support the charges, such as receipts, contracts, or time logs, as this can help clarify the details.

- Use Professional Language – Even in informal industries, professionalism matters. Ensure the message accompanying the document is courteous and clear, outlining expectations for payment.

- Confirm Delivery – If you’re using email, request a read receipt or follow up to confirm the client has received the request. For physical mail, consider using certified delivery for tracking purposes.

- Send Reminders – If the payment is not received by the due date, politely remind the client. Make sure to keep the tone respectful and professional.

Recommended Tools for Sending Payment Requests

There are various tools available to simplify the process of sending documents requesting payment:

- Email Platforms – Sending documents via email is fast and convenient. Ensure you use an email account that looks professional and set up an automated response system if necessary.

- Online Payment Systems – Tools like PayPal, Stripe, or other payment platforms often allow you to create and send professional payment requests directly to clients, along with tracking and confirmation features.

- Cloud-Based Accounting Software – Programs like QuickBooks or Xero allow you to generate, send, and track payments in one centralized location, streamlining the process.

By following these steps and utilizing the right tools, you can simplify the process of sending payment requests, making the transaction as smooth and efficient as possible.

Streamlining Your Payment Process

Efficient payment collection is essential for maintaining smooth financial operations in any business. By automating certain aspects and reducing manual effort, you can ensure quicker and more accurate transactions. Streamlining the process not only saves time but also reduces the risk of errors, fostering better relationships with clients and ensuring consistent cash flow.

Use Digital Payment Systems

One of the best ways to speed up your payment process is by utilizing digital payment platforms. These tools enable clients to make payments instantly, securely, and in their preferred method, whether by credit card, bank transfer, or online wallets. This eliminates the delays associated with checks and manual processing.

Automate Reminders and Due Dates

Setting up automated reminders for clients before and after payment due dates is an excellent way to ensure timely payments. This can be done through accounting software or automated email systems, which send reminders without the need for manual intervention. This helps avoid delays without having to chase clients individually.

Offer Multiple Payment Methods

Providing a variety of payment options allows clients to choose the one most convenient for them. Offering services like credit/debit card payments, bank transfers, and online payment platforms like PayPal or Stripe makes the process easier and faster for everyone involved. The more choices clients have, the more likely they are to make a timely payment.

Set Clear Payment Terms

Clear and concise payment terms should always be established upfront. This includes outlining the payment due date, any late fees, and accepted methods of payment. By setting expectations from the start, clients are more likely to follow through with timely payments, and misunderstandings are less likely to arise.

Track Payments Efficiently

Keeping track of payments in real time is crucial for maintaining a smooth cash flow. Using cloud-based accounting software can automate much of the tracking, sending real-time updates and helping you manage overdue payments without hassle. This system also allows you to easily keep a record of all transactions and simplify financial reporting.

By streamlining these processes, you will not only save time but also create a more professional and reliable system for collecting payments, leading to improved client satisfaction and better financial health for your business.

How Invoice Templates Save Time

Creating detailed bills from scratch can be a time-consuming task, especially when handling multiple clients. Using pre-made structures can significantly streamline this process, allowing you to quickly input necessary details without redoing the entire document every time. These structured formats allow you to focus more on your work and less on administrative tasks.

Quick Setup and Easy Customization

With a ready-made structure, you can simply fill in the specific information for each transaction, saving you time compared to designing a new document from the ground up. These tools are highly customizable, allowing you to add unique elements, such as specific service descriptions, payment terms, or branding, with just a few clicks.

- Pre-defined fields for easy data entry

- Customizable sections for different services

- Personalized branding options like logos and fonts

Reduce Mistakes and Ensure Consistency

One of the key benefits of using a structured document is the consistency it offers. Since the layout and sections are standardized, you avoid missing important details. This reduces the likelihood of errors that could lead to confusion or delays in payments.

- Consistent format across all bills

- Minimized errors through pre-set sections

- Faster to process and review

Ultimately, utilizing a pre-built layout helps you spend less time creating and reviewing documents, enabling you to allocate more focus to your core work. This streamlined approach not only boosts productivity but also enhances professionalism, ensuring clients receive accurate and timely bills.

Understanding Invoicing for Freelance Creators

For independent professionals, managing payments and ensuring timely compensation is a crucial aspect of their business operations. A well-structured billing system allows them to clearly communicate the services rendered and the corresponding fees. This practice not only ensures financial clarity but also establishes professionalism with clients.

Key Components of a Payment Request

When sending a request for payment, it is essential to include all necessary information to avoid confusion or delays. Below are the key elements that should be included in every bill:

- Client and professional details: Both parties’ contact information and business identifiers.

- Service description: A clear explanation of the work completed or services provided.

- Payment amount: The total amount owed, along with any applicable taxes or fees.

- Payment terms: Information on due dates, accepted payment methods, and any late fees.

Why Clear Payment Requests Matter

Clear and accurate payment requests benefit both the freelancer and the client. For the freelancer, it ensures that all agreed-upon terms are met and provides a record of the transaction. For the client, it reduces confusion, providing transparency and the necessary details to process the payment efficiently.

Moreover, having a consistent structure helps to avoid misunderstandings and promotes faster payment processing, which is essential for maintaining a steady cash flow.

Top Billing Tools for Creators

For independent professionals, having the right tools for generating payment requests can simplify the process of getting paid efficiently. With the right software, individuals can streamline their billing, maintain organized records, and ensure they’re paid on time. Below are some of the top tools that help independent creators create customized and professional payment requests.

Features to Look for in Billing Tools

When selecting a tool to assist with creating payment documents, it’s important to choose one that suits both the creator’s needs and their clients’ preferences. Key features to consider include:

- Customization options: Ability to tailor the request document to suit your business style and client preferences.

- Payment integration: Options to link directly to payment gateways, allowing clients to pay easily.

- Tracking and reminders: Built-in features to track due payments and automatically send reminders.

- Multi-device compatibility: Access to tools on both desktop and mobile devices for easy use on the go.

Popular Tools for Creating Payment Requests

Tool Name Key Features Pricing FreshBooks Easy customization, automatic reminders, integrated payment options Starts at $15/month Wave Free, basic billing, customizable templates, payment tracking Free Zoho Invoice Customizable billing, time tracking, multi-currency support Starts at $9/month PayPal Invoicing Simple, quick payments, integration with PayPal, easy tracking Free (fees for payments) Choosing the right tool can save valuable time, reduce errors, and improve the efficiency of the billing process. These tools not only help with creating clear and professional payment requests, but also help track and manage finances with ease.

- Description of Services: Summarize the specifics of the service, including