Free Artist Invoice Template PDF for Easy Billing and Payment Management

When it comes to managing your work and payments, staying organized is key. Having a clear and professional way to request payment not only helps you get compensated on time but also ensures that your clients understand the terms of your services. A structured payment document can make a huge difference in how smoothly your transactions go, providing clarity and reducing misunderstandings.

Using a ready-made format for creating these documents can save you time and effort. With just a few simple adjustments, you can personalize the layout to fit your specific needs, ensuring that all necessary details are included. By choosing the right approach, you can make your billing process more efficient, avoid mistakes, and maintain a professional image that reflects your work.

Whether you’re a freelancer or managing a small business, having an organized system for handling payments is essential. With the right tools, you can easily create and send documents that look professional, helping you maintain a seamless workflow and ensuring prompt payments for your services.

How to Create an Artist Invoice

Creating a clear and professional document to request payment for your work is essential for any creative professional. This document not only outlines the terms of payment but also establishes your credibility and ensures that both parties are on the same page. Here’s a step-by-step guide to crafting a perfect payment request.

1. Include Essential Information

To ensure your request is clear, include the following details:

- Your details: Name, business name, and contact information

- Client’s details: Full name or company name, address, and contact information

- Service description: A brief description of the work you’ve completed

- Payment terms: Clearly outline the payment due date, payment methods accepted, and any late fees

- Total amount due: Specify the exact amount the client needs to pay

2. Choose the Right Layout

The layout of your document should be clean and easy to read. Consider the following design tips:

- Simple and clear formatting: Use headings, bullet points, and proper spacing to make the document easy to follow.

- Professional fonts: Choose legible fonts like Arial or Times New Roman for a polished look.

- Branding: Add your logo or any branding elements to give the document a professional feel.

By including these key details and maintaining a clean design, your payment request will not only be functional but also demonstrate professionalism and attention to detail. This approach will help build trust with clients and ensure timely payments for your services.

Why Use an Invoice Template

Using a pre-designed format for creating payment requests offers significant advantages, particularly when managing multiple transactions. By opting for a structured layout, you save time, reduce errors, and ensure that all necessary details are included every time. This consistency builds professionalism and helps maintain smooth communication with clients.

1. Save Time and Effort

Manually creating a payment request from scratch can be time-consuming, especially when you need to do it regularly. A ready-made format allows you to fill in only the specific details for each project, saving you from repetitive formatting tasks.

- Quick to complete: Pre-set fields reduce the need for formatting or organizing each document from the ground up.

- Ready for use: Simply add the relevant details and generate the document in seconds.

2. Avoid Mistakes and Ensure Consistency

Inconsistent or incomplete payment requests can lead to confusion, missed payments, or even disputes. A pre-designed format helps you avoid these issues by ensuring that each document follows the same structure and contains all required information.

- Accurate details: Key sections like payment terms, client information, and service descriptions are clearly defined.

- Uniformity: Using the same layout for every transaction ensures a consistent, professional approach with each client.

By choosing a pre-designed format, you simplify the entire process, ensuring that your requests for payment are always clear, complete, and delivered efficiently. This level of organization not only enhances client relationships but also streamlines your workflow.

Benefits of PDF Invoice Format

When creating payment documents, choosing the right file format can make a significant difference in how professional and easy to manage the final product is. Opting for a universally accepted and widely compatible format offers several advantages, especially when sending documents to clients or saving records for your own use.

1. Universal Compatibility

One of the main benefits of using this format is its universal compatibility across various devices and platforms. Whether your client uses a Mac, Windows, or mobile device, they can easily open and view the document without issues.

- Accessible on any device: Works seamlessly on phones, tablets, and computers.

- No need for additional software: Most systems have built-in readers, eliminating the need for special programs.

2. Professional and Secure Presentation

This format maintains the integrity of your document’s layout, ensuring it looks the same on any device. It also allows you to add security features like password protection or watermarking, which helps protect your content from unauthorized editing or distribution.

- Consistent appearance: The document’s formatting will remain unchanged, preserving the professional look.

- Enhanced security: You can restrict access and prevent alterations, ensuring your details stay intact.

By using this format, you ensure that your payment request is both accessible and secure, giving you peace of mind while presenting a polished, professional image to your clients.

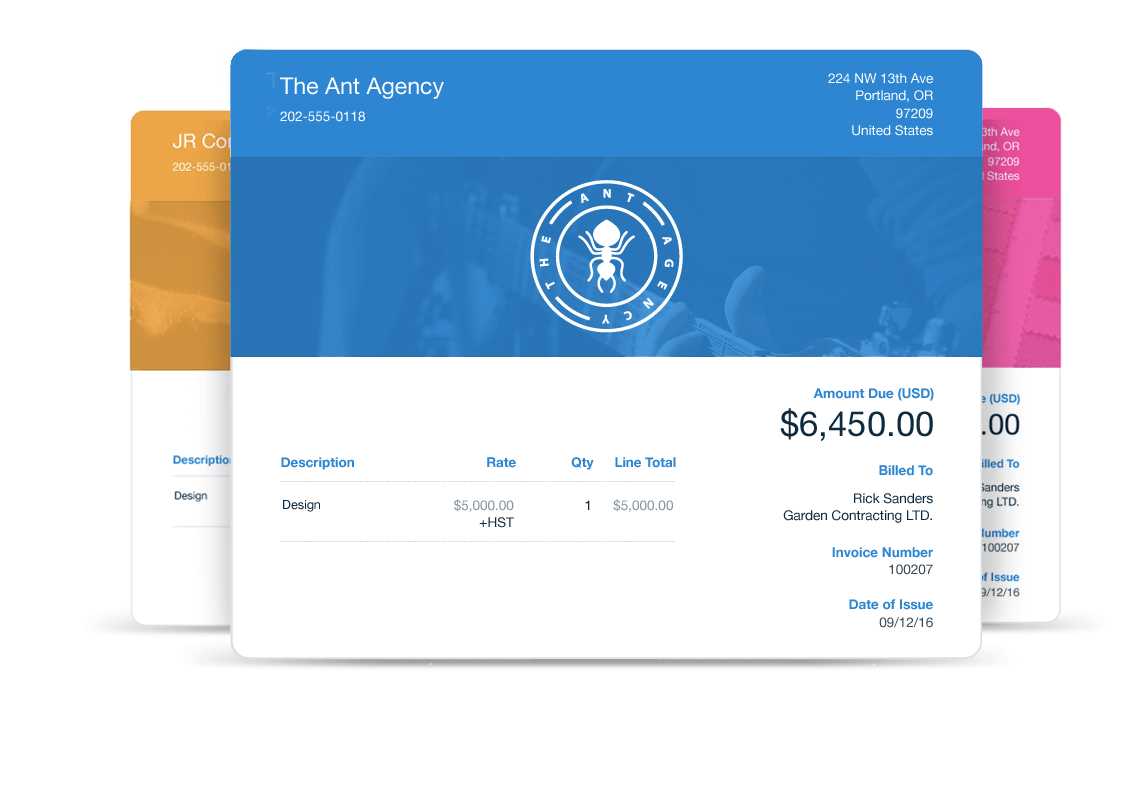

Customizing Your Payment Request Document

Tailoring your payment request to reflect your unique style and business needs not only helps maintain a professional appearance but also ensures that the document includes all the necessary details for smooth transactions. Customization allows you to make adjustments that fit your specific services, branding, and client relationships.

1. Add Your Branding

One of the easiest ways to make your document stand out is by incorporating your branding elements. This includes your logo, business name, and color scheme. A personalized layout can make your request look polished and professional, reinforcing your brand identity.

- Logo placement: Include your logo at the top or in the header to make your document easily recognizable.

- Business information: Ensure your business name, address, and contact information are prominently displayed.

- Custom colors: Use colors that reflect your brand’s identity while keeping the design clean and professional.

2. Tailor the Content to Your Needs

Every project is unique, so it’s important to adjust the content of your payment request accordingly. Whether you’re offering a one-time service or long-term collaboration, your document should reflect the specifics of the work completed and the agreed terms.

- Service description: Clearly describe the work you provided, highlighting the key deliverables and any additional services.

- Payment details: Adjust payment terms based on the agreement, such as deposit requirements, installment plans, or discounts.

- Additional notes: Include any relevant terms, such as late fees, refund policies, or future work options.

By customizing the payment request document, you ensure that it aligns with your professional identity and meets your clients’ expectations, making the payment process clearer and more efficient for both parties.

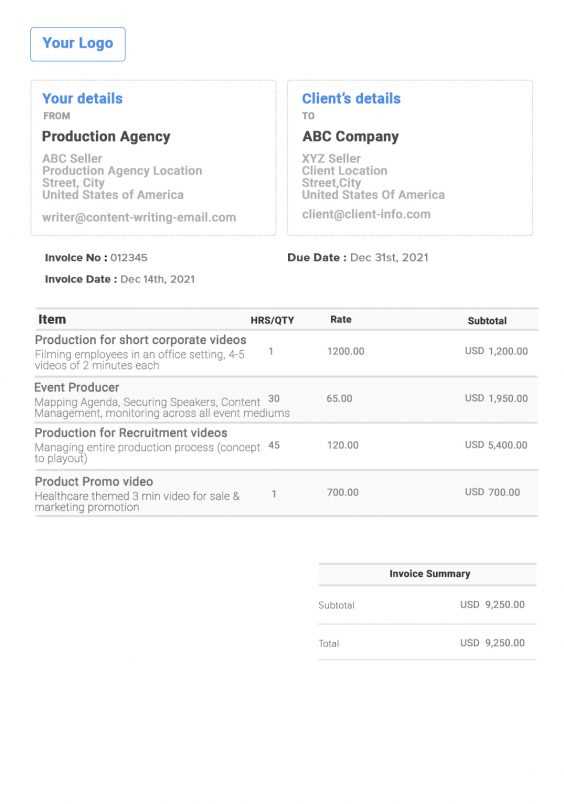

Essential Information to Include

To ensure that your payment request is clear, professional, and effective, it’s crucial to include all the necessary details. Each section of the document should be thoughtfully filled out to avoid confusion and ensure prompt payment. Missing information can lead to delays or disputes, so it’s important to be thorough and precise in every aspect of the request.

1. Your Contact Details

Providing your contact information makes it easy for clients to reach out if there are any questions or issues. It should include the following:

- Your name or business name: Make sure your full name or company name is listed at the top of the document.

- Address: Include your business address or office location, depending on your business setup.

- Phone number and email: Ensure your primary contact details are easily visible so clients can reach you quickly if needed.

2. Client Information

Including the correct details for your client ensures there is no confusion when processing payments. Be sure to include:

- Client’s name: Ensure you list the correct legal name or company name of the individual or entity paying you.

- Client’s address: This is useful for keeping records and may be required for tax purposes.

- Client’s contact details: Include their phone number and email address in case you need to communicate with them regarding the payment.

3. Payment Details

Clearly outline the terms of payment to avoid misunderstandings. This section should include:

- Service description: A concise summary of the work you completed, including any specific deliverables.

- Total amount due: Clearly list the amount the client owes, including any applicable taxes or additional charges.

- Payment due date: Specify when the payment is expected and any late fees that may apply.

- Accepted payment methods: Let your client know how they can pay you, whether via bank transfer, credit card, or other means.

By including these key pieces of information, you ensure that both you and your client have a clear understanding of the transaction, which will help avoid any potential issues and speed up the payment process.

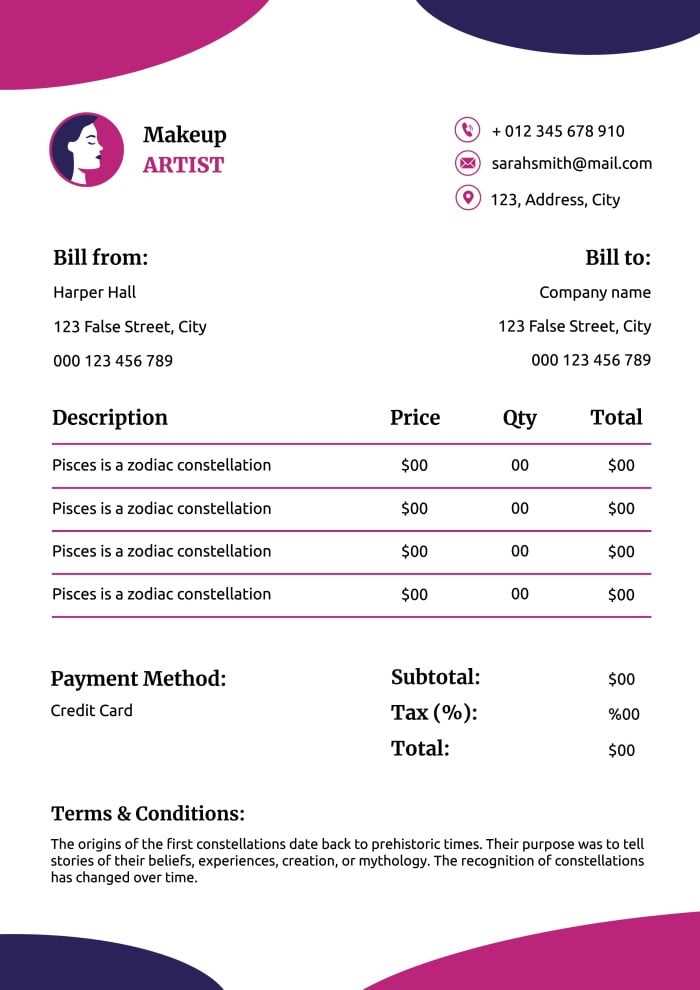

Best Free Payment Request Templates for Creatives

Finding the right layout for your payment requests is essential for maintaining a professional appearance while also saving time. Many free resources are available that offer pre-made designs that you can customize to fit your needs. These formats help ensure you don’t miss any key details and allow you to present your billing information in a polished, organized manner. Here are some of the best free formats available for creative professionals.

1. Simple and Clean Designs

If you’re looking for something minimalistic yet effective, simple layouts can work wonders. These options often feature clear sections and are easy to fill in with your work details and payment terms.

- Minimalist layouts: Clean lines with a focus on clarity and simplicity.

- Easy to personalize: Fields for work descriptions, payment terms, and client details are clearly marked.

- Quick setup: Ideal for those who need to send multiple requests quickly without fuss.

2. Creative and Customizable Options

If you’re looking to make a statement while still staying professional, there are formats available with creative touches. These designs allow you to incorporate branding, colors, and a more artistic look to represent your personal style or business image.

- Flexible layouts: Offers room to add logos, custom colors, and personalized branding.

- Eye-catching but professional: Strikes a balance between creativity and business formalities.

- Tailored for specific needs: Includes sections that can be customized based on the type of services you offer.

By choosing the right design, you can ensure your payment requests not only convey all the necessary information but also reflect your professional image. These free formats provide a convenient and time-saving way to make sure your documents are always on point.

How to Save Time with Templates

When managing payments and projects, efficiency is key. Using pre-designed formats for your payment requests can save significant time and effort. Instead of recreating the same structure for every job, you can quickly fill in the details and focus on your work rather than administrative tasks.

1. Eliminate Repetitive Formatting

One of the biggest time-savers is not having to format each document from scratch. By using a pre-made layout, you can avoid adjusting fonts, borders, or spacing every time you need to send a payment request.

- Consistent structure: The format ensures that your document is organized the same way each time, saving you from redoing the design.

- Quickly fill in details: Simply input the new project information without worrying about layout adjustments.

- Professional appearance: Each document will have a polished look that’s consistent with your previous work.

2. Streamline Client Communication

With a standard format, the communication process becomes more straightforward. You can focus on the specifics of each job and let the structure do the rest, making it easier to maintain a professional approach with clients.

- Faster turnaround: You can quickly create and send documents without wasting time on formatting.

- Clear, uniform messaging: Clients will receive consistent and easily understood payment details every time.

- Time for other tasks: With less time spent on administrative work, you can focus on the creative or productive aspects of your business.

By using a pre-designed structure, you free up valuable time that can be better spent on fulfilling projects, maintaining client relationships, or growing your business. Efficiency in your administrative tasks leads to more time to focus on what truly matters.

Understanding Payment Terms for Creatives

Clear payment terms are essential for ensuring that both parties involved in a transaction are on the same page regarding expectations, timelines, and payment methods. As a creative professional, it’s crucial to outline these details upfront to avoid misunderstandings and ensure timely compensation for your work. By establishing transparent payment terms, you set clear expectations for both you and your clients.

1. Defining Payment Due Dates

Setting a specific date by which payment is expected helps avoid delays and ensures that your cash flow remains consistent. There are several ways to structure the due date, depending on your agreement with the client:

- Immediate payment: Payment is expected upon completion of the work or delivery of the product.

- Net 30/60/90: Payment is due within 30, 60, or 90 days after the document has been issued. This is common for long-term projects or ongoing work.

- Installment payments: For larger projects, payments may be broken down into several installments, with due dates outlined clearly.

2. Specifying Accepted Payment Methods

Clearly listing the payment methods you accept helps your clients know how they can pay you, avoiding confusion or delays. The more payment options you offer, the easier it will be for clients to settle their balances on time.

- Bank transfer: A secure and reliable way for clients to pay, often used for larger amounts.

- Online payment platforms: Services like PayPal, Venmo, or Stripe provide a convenient way for clients to send payments quickly.

- Checks or cash: While less common in the digital age, some clients may still prefer traditional methods.

3. Handling Late Payments

It’s important to have a plan for dealing with overdue payments. By including terms for late fees or penalties, you encourage timely payments and protect your income. Common practices include:

- Late fees: Specify a percentage or fixed amount that will be added to the total if payment is not received on time.

- Grace period: Allow for a certain number of days after the due date before penalties apply, giving clients a little flexibility.

- Interest on overdue amounts: Some creatives choose to charge interest on late payments, especially for larger su

How to Track Payments Effectively

Tracking payments is a crucial part of managing your business and ensuring that you are paid promptly for your work. Effective tracking helps you stay on top of your finances, avoid misunderstandings with clients, and maintain a steady cash flow. By implementing the right strategies and tools, you can easily monitor payments and follow up when necessary.

1. Use a Payment Tracking System

Having a system in place to track payments can save you time and reduce the risk of errors. Whether you choose to use accounting software or a simple spreadsheet, the key is consistency and accuracy.

- Accounting software: Tools like QuickBooks or FreshBooks can automate the tracking process, generate reports, and send reminders for overdue payments.

- Spreadsheets: For those on a budget, a well-organized spreadsheet can help track the date of payment, amounts, and client details.

- Manual log: If you prefer pen and paper, keeping a physical log of payments is another option, though it may require more time and attention to detail.

2. Maintain Detailed Records

Keeping detailed records of each transaction ensures you have accurate information when following up with clients or reviewing your finances. Include all relevant information such as payment amount, client details, payment method, and due date.

- Record payment date: Note when payments are made to keep track of your cash flow.

- Document payment method: Whether it’s cash, bank transfer, or online payment, recording the method can be helpful for reference.

- Notes on payment status: Indicate whether payments are partial, overdue, or completed, and make note of any issues.

3. Send Reminders for Overdue Payments

Sometimes, clients forget or delay payments. Sending gentle reminders can encourage timely settlements without damaging the relationship. You can automate reminders through accounting software or set up manual email alerts.

- Polite follow-up emails: Send a friendly reminder a few days before or after the due date.

- Late fee notices: If your payment terms include late fees, notify the client promptly and professionally when the payment deadline has passed.

- Escalation process: In cases of non-payment, have a clear procedure for escalating the issue, whether it’s a final notice or involving a collections service.

By staying organ

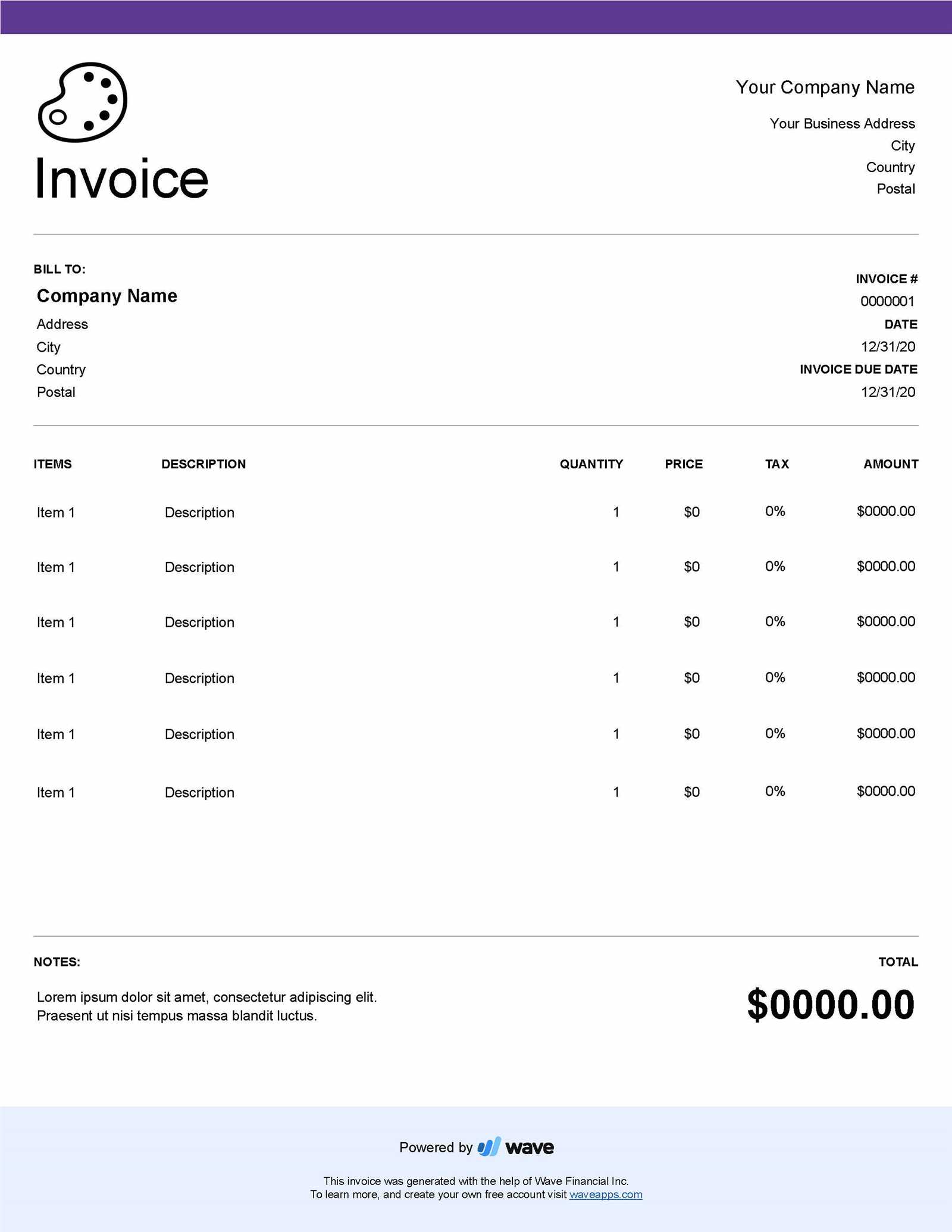

Creating a Professional Payment Request Layout

Designing a professional layout for your payment requests is key to ensuring that your documents are both visually appealing and easy to understand. A well-organized structure not only enhances the clarity of your payment terms but also helps build trust and credibility with your clients. The right layout should reflect your professionalism while making it easy for clients to review and process payments.

1. Include Clear Header Information

The top section of your payment document should include essential details that identify both you and your client. This section should be clean and easy to read to establish credibility right from the start.

Your Information Client Information Name or Business Name Client’s Name Address Client’s Address Phone Number Client’s Phone Number Email Address Client’s Email Address 2. Organize the Details of the Work

In the body of your payment request, it’s important to list the services or products provided in a clear and organized manner. Break down the information into sections so clients can easily understand what they are being charged for.

Description of Service Quantity Unit Price Total Service 1 1 $100 $100 Service 2 2 $50 $100 Total Due $200 3. Specify Payment Terms Clearly

Clearly stating the payment terms in the footer section of your document is essential. This includes the total amount due, payment due date, and accepted methods of payment. Also, outline any penalties for late payments to avoid confusion later on.

- Total Amount Due: $200

- Due Date: 30 days from the date of issue

- Payment Methods: Bank transfer, PayPal, credit card

- Late Fee: 5% of the total amount after 30 days

By following these basic guidelines, you can create a clean, professional payment request that ensures all necessa

Common Mistakes to Avoid in Payment Requests

Creating a professional and clear payment request is vital to ensure you are paid promptly and avoid unnecessary confusion with clients. However, there are several common errors that many people make when drafting these documents. By being aware of these mistakes, you can ensure your requests are accurate, clear, and effective.

1. Incomplete or Incorrect Client Information

One of the most common mistakes is failing to include or inaccurately entering your client’s details. This can lead to delays in payment and confusion about where the money should be sent. Always double-check the client’s name, address, and contact information.

- Incorrect client name: Ensure that the client’s full legal name or business name is correct.

- Wrong address: Double-check the client’s billing address to avoid any mail issues.

- Missing contact details: Ensure that both phone number and email are included for any follow-ups.

2. Failing to Specify Payment Terms

Another major issue is neglecting to include clear payment terms. If the terms of payment are vague or missing, it can lead to confusion about when payment is due or how much should be paid. Always be clear about your expectations.

- No due date: Clearly state when you expect payment to avoid misunderstandings.

- Unclear late fees: If you have late fees, make sure they are specified upfront to encourage timely payment.

- Unspecified payment methods: Be specific about the methods you accept, such as bank transfer, credit card, or PayPal.

3. Overcomplicating the Design

While it’s important to make your document look professional, overly complicated designs can make it difficult for clients to quickly identify important information. Keep the layout simple and straightforward.

- Too many colors or fonts: Stick to one or two fonts and a minimal color scheme to ensure readability.

- Unnecessary graphics: Keep logos or images minimal and only include what’s necessary for the document’s purpose.

- Cluttered layout: Use clear sections and enough space between different areas to make the document easy to scan.

4. Not Double-Checking the Amounts

Another common error is making mistakes in the amounts listed, whether it’s the total sum, taxes, or additional fees. These mistakes can lead to disputes or delays in payment. Always double-check your numbers before sending any request.

How to Handle Late Payments

Late payments are an unfortunate reality in business, but knowing how to handle them effectively can help maintain a positive relationship with your clients while ensuring that you are compensated fairly and promptly. Having a clear strategy in place for dealing with overdue payments can help prevent confusion and frustration. It’s essential to be firm but professional when addressing late payments to ensure that your business’s cash flow is not disrupted.

1. Send a Friendly Reminder

When a payment is overdue, the first step is usually to send a polite reminder. Sometimes, clients simply forget or overlook the due date, and a friendly nudge can resolve the situation without causing any friction.

- Keep it professional: Use polite language, acknowledging that sometimes oversights happen.

- Offer assistance: Ask if they require any additional information or clarification to complete the payment.

- Set a new deadline: Clearly restate the new expected payment date to avoid further delay.

2. Establish Late Fees

If reminders do not lead to payment, you can include late fees in your terms to encourage quicker settlements. Late fees act as an incentive for clients to pay on time and deter further delays.

- Be clear about fees: Clearly outline the late fee in your payment terms, including the percentage or fixed amount added after the due date.

- Enforce the terms: If the payment is still delayed, apply the agreed-upon late fee, and let the client know about it professionally.

- Use it sparingly: Late fees should be a deterrent, not a first step, so ensure they are only applied after initial reminders.

3. Offer Flexible Payment Options

If a client is genuinely struggling to make the payment, offering more flexible payment terms or installment plans can help resolve the situation without damaging your relationship. Flexibility can be a key factor in maintaining good client relationships while still ensuring that you get paid.

- Installment payments: Break down the total amount into smaller, more manageable payments over time.

- Alternative payment methods: Offer other ways to pay, such as through online platforms, which may be more convenient for the client.

- Negotiate new terms: Work out a mutually agreeable payment schedule that works for both you and the client.

By taking a proactive and professional approach to late payments, you can maintain positive client relationships while ensuring that your business continues to thrive. Consistent communication, clear terms, and the option for flexibili

Sending and Managing PDF Payment Requests

Efficiently sending and managing payment requests is crucial for maintaining smooth cash flow and ensuring timely payments. The ability to send clear, professional, and secure payment documents can help avoid confusion and improve the client’s experience. Additionally, keeping track of sent requests and responses ensures that you can follow up promptly on overdue payments and keep your financial records organized.

1. Best Practices for Sending Payment Requests

Sending payment requests electronically is one of the most efficient ways to ensure quick and secure delivery. When using digital files, such as those in PDF format, there are several key practices to follow to ensure your documents are professional and well-received.

- Use a professional email: When sending payment requests, use a formal and clear subject line, such as “Payment Due for Services Rendered” or “Request for Payment – [Project Name].”

- Attach the file securely: Always send the document as a PDF attachment to avoid formatting issues or tampering. PDFs are universally accessible and maintain their format across different devices.

- Include a brief message: In the body of your email, provide a concise explanation of the attached document and payment instructions. Keep the tone polite and professional.

2. Tracking and Managing Payment Requests

Once a payment request is sent, it’s important to track its status to ensure that payments are made on time. Effective management will help you stay organized and minimize the chances of missing payments or important details.

- Use accounting software: Tools like QuickBooks, FreshBooks, or Xero can automate the process of tracking sent documents and payments. These platforms also allow you to send automatic reminders if payment is overdue.

- Maintain a record of all sent requests: Keep a digital or physical file of all requests you’ve sent, noting the date and amount. This will help you quickly reference any document if questions arise later.

- Set reminders for follow-up: If the payment hasn’t been received by the due date, set a reminder to send a follow-up email or make a call. Ensure you document every interaction for reference.

By following these strategies, you can efficiently manage your payment requests and maintain a streamlined process that saves you time and ensures that you are paid promptly.

Printable vs Digital Payment Requests

When deciding how to send payment documents, professionals often choose between printable hard copies and digital files. Both methods have their advantages and limitations, and the choice depends on factors such as convenience, professionalism, and client preferences. Understanding the pros and cons of each approach can help you select the best option for your business needs and ensure smooth communication with clients.

1. Advantages of Printable Payment Documents

Printable payment documents are traditional and offer the advantage of being physical, which some clients may prefer for their records. This format can also be useful when dealing with clients who are not comfortable with digital files or when you need a physical copy for legal or archival purposes.

- Physical Record: Provides a tangible record of the payment request, which can be stored in physical filing systems.

- Formality: Some clients may view printed documents as more formal, lending a sense of professionalism.

- Suitable for Certain Clients: Older or less tech-savvy clients may appreciate receiving a hard copy instead of a digital file.

2. Benefits of Digital Payment Documents

On the other hand, digital payment documents have become increasingly popular due to their convenience and efficiency. Sending digital files, especially in formats like PDF, has many advantages that can streamline your business operations and improve communication.

- Instant Delivery: Digital files can be sent instantly via email, ensuring fast delivery and receipt of payment requests.

- Environmentally Friendly: Reduces paper waste and is more eco-friendly, which is important for many businesses and clients today.

- Easy to Store and Retrieve: Digital files can be stored and organized in cloud storage or accounting software, making it easier to manage and access them later.

- Customization and Flexibility: Digital formats allow for easy customization, such as adding hyperlinks for payment or integrating with automated payment systems.

3. Comparison of Printable and Digital Options

Feature Printable Documents Digital Documents Delivery Speed Slow (via mail or in-person delivery) Instant (via email) How to Use Payment Requests for Tax Purposes

Managing payments accurately is crucial not only for ensuring timely transactions but also for complying with tax regulations. Payment documents can serve as important records when it comes to filing taxes. By keeping thorough records of all issued payment requests, you can simplify tax reporting, track business expenses, and substantiate your income. Understanding how to use these documents effectively will help you maintain good financial practices and avoid potential issues during tax season.

1. Record Income Properly

Each payment request you issue is a representation of income earned, which must be reported for tax purposes. Keeping detailed records of all payments ensures you have the necessary documentation to report earnings accurately.

- Track total income: Keep a log of all issued requests and payments received, ensuring they match up with your earnings throughout the year.

- Document partial payments: If your client pays in installments, record each payment separately and track the remaining balance.

- Include taxes collected: If applicable, make sure you note any sales taxes or VAT that you collect on your payment documents, as this needs to be reported separately in tax filings.

2. Deduct Business Expenses

In addition to income tracking, payment requests can also help you track business-related expenses, which may be deductible when filing taxes. Keeping clear records of costs associated with your work will help reduce taxable income.

- Track project-related expenses: Any materials, supplies, or tools purchased for specific projects should be noted in your financial records for possible deductions.

- Document professional services: Payments for subcontractors, freelancers, or other professionals hired for your projects can also be tracked through payment records for expense deduction.

- Organize receipts and bills: Store any receipts or invoices for business-related expenses to support your deductions during tax reporting.

3. Keep Payment Documents Organized

Proper organization is key to using payment records effectively for tax purposes. Maintaining a clear system of storing these documents will make it easier when tax time comes.

- Digital filing: Use cloud storage or accounting software to store and categorize your records. Many tools allow for easy categorization by month, client, or project.

- Physical copies: If you prefer paper copies, keep organized files with clear labels for each tax year and client.

- Backup your data: Whether digital or physical, ensure your records are safely backed up to avoid loss due to unforeseen circumstances.

By following these best practices, you can ensure that your financial records are accurate, organized, and ready for tax season. Keeping a detailed record of all payments and expenses not only simplifies your tax filing but also helps in the event of an audit, giving you confidence that you have all the necessary documentation to support your claims.