Free Art Invoice Template Download

Creating clear and effective billing documents is a vital part of managing any business, especially for creative professionals. Whether you’re an illustrator, designer, or photographer, having the right tools to document your transactions is essential for smooth operations. Proper paperwork ensures both parties are on the same page, reducing misunderstandings and helping to maintain a professional image.

Crafting a well-organized document is more than just about listing services and amounts. It requires attention to detail, clarity in terms, and a format that clients can easily understand. A simple yet comprehensive document can help you get paid on time while reinforcing your credibility. Additionally, the right structure can make your workflow more efficient and reduce administrative time.

In this guide, you’ll discover how to create and utilize an efficient document for your services, from the basic structure to key components that make it effective. Whether you’re just starting or looking to improve your existing process, you’ll find tips and tools to streamline your billing approach.

Free Billing Document Guide

Creating an efficient and professional document to record your transactions can significantly simplify your business operations. Whether you’re an independent creator or working with clients on various projects, having a reliable structure for managing payments is essential. This section will guide you through the process of crafting a simple yet effective document that suits your needs, without any complicated steps.

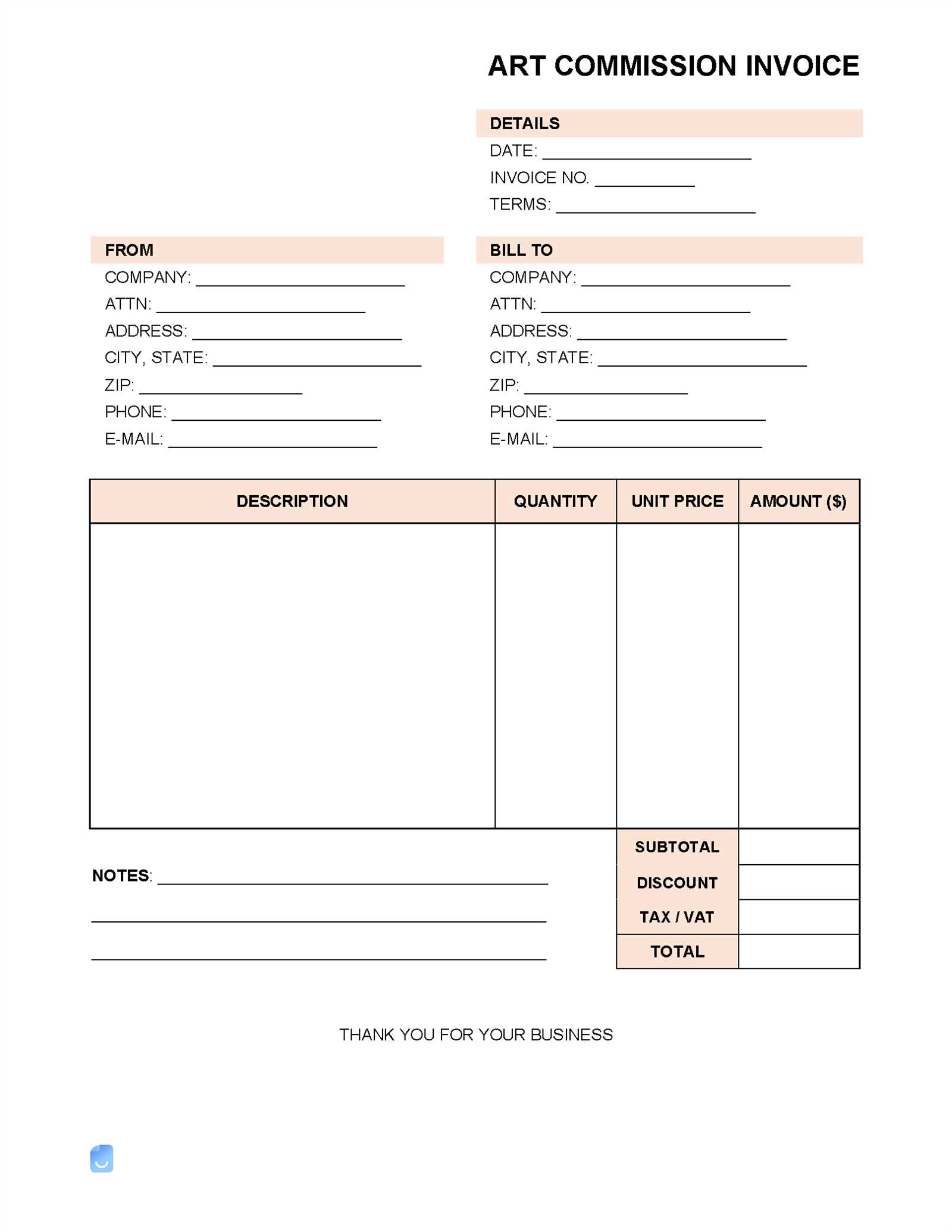

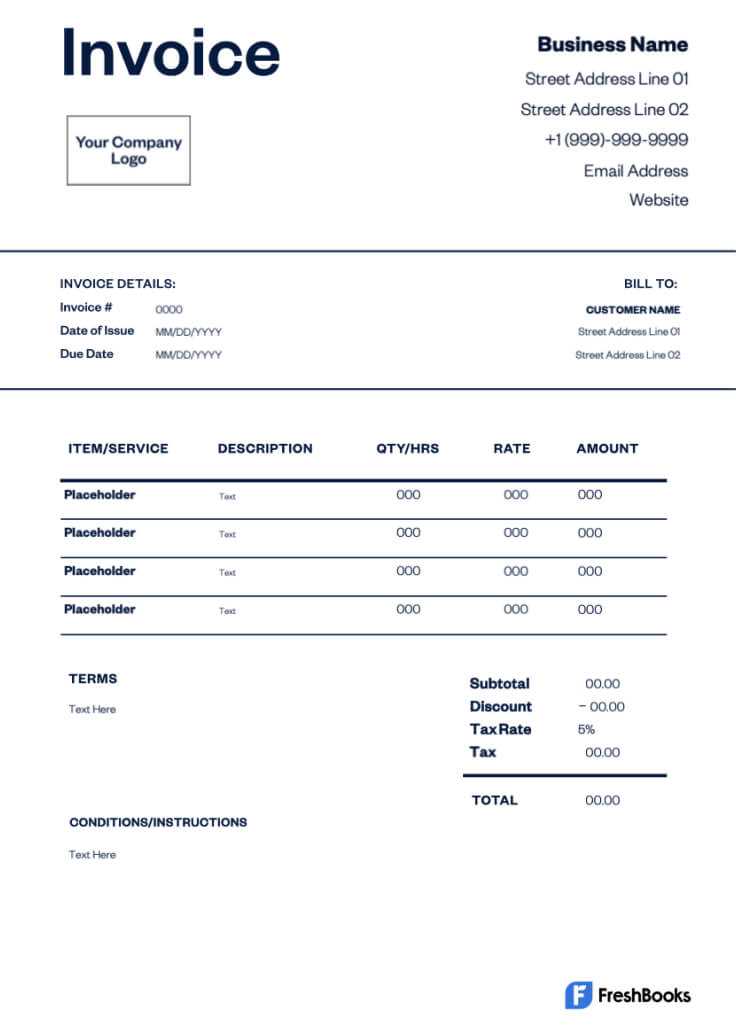

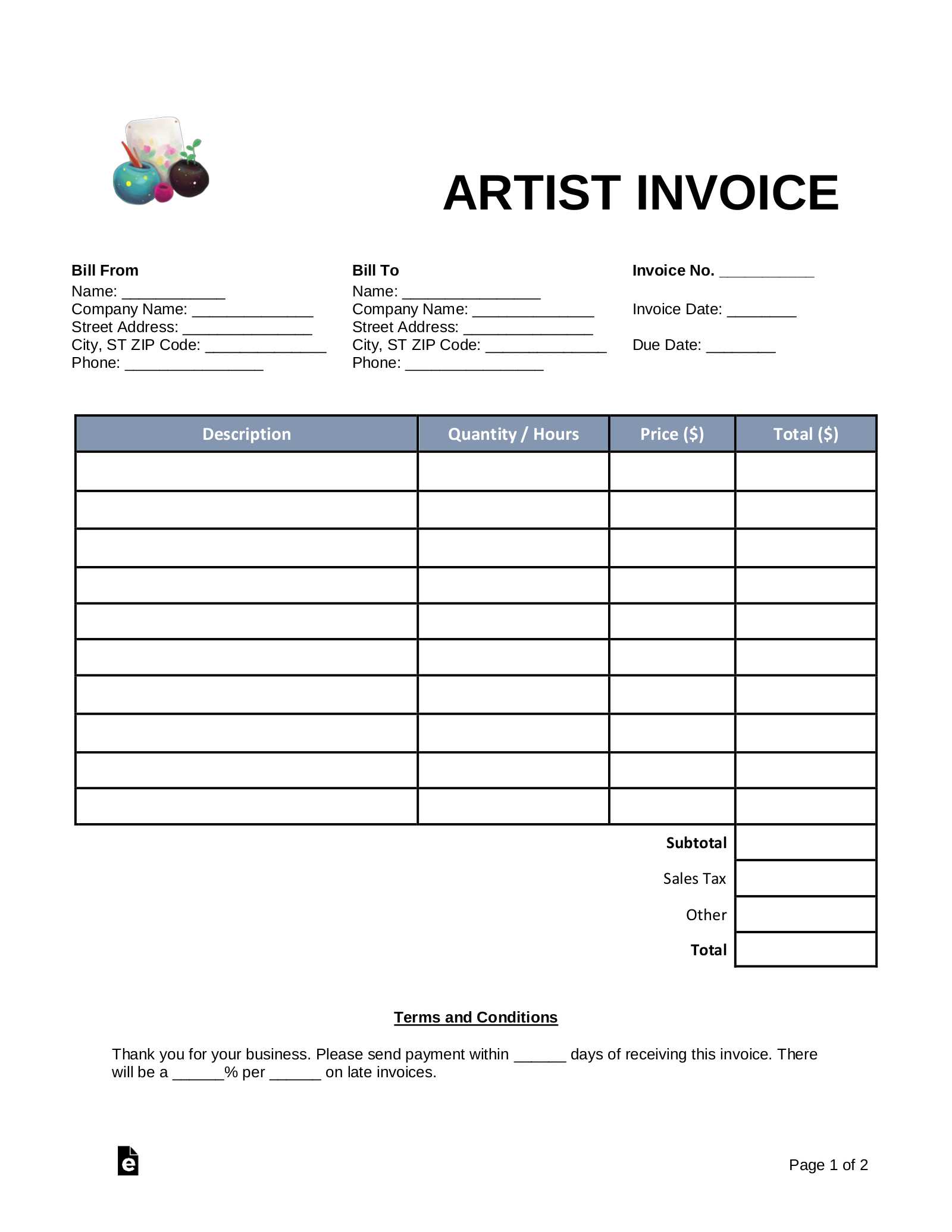

There are several key elements to consider when preparing your document to ensure clarity and professionalism:

- Client Details: Always include accurate information such as the client’s name, address, and contact details to avoid confusion.

- Service Description: Clearly outline the work or products provided. Use simple language to ensure the client understands what they are being charged for.

- Payment Terms: Specify the due date, payment methods, and any additional conditions regarding late payments or deposits.

- Amount Due: Break down the charges, listing each service or product with its corresponding price, and provide a total sum at the end.

- Tax Information: If applicable, make sure to include tax details according to local regulations.

To streamline your workflow, consider using online tools or software to quickly generate these documents. Many platforms offer simple, customizable options that allow you to focus on your work rather than paperwork.

By following these steps, you can create a smooth and efficient process for handling client payments while maintaining a professional image.

Why You Need a Professional Billing Document

For anyone offering creative services, having a structured and clear method of recording payments is crucial. A well-organized record not only helps in getting paid promptly but also ensures that both you and your clients are aligned on expectations. Whether you’re working with regular clients or new ones, such a document helps build trust and maintain professionalism.

Clarity in Payment Process

When you use a standardized document, it becomes easier to communicate the terms and conditions surrounding payment. Clear itemization of charges, deadlines, and payment methods reduces the chances of confusion. It serves as a reference for both parties, ensuring that no details are overlooked or misinterpreted.

Streamlining Your Business Operations

By using a consistent approach for every transaction, you save time on administrative tasks. Instead of creating new records from scratch each time, a simple structure lets you focus more on your work. This process also makes it easier to track payments, which can improve your overall financial organization.

How to Customize Your Billing Document

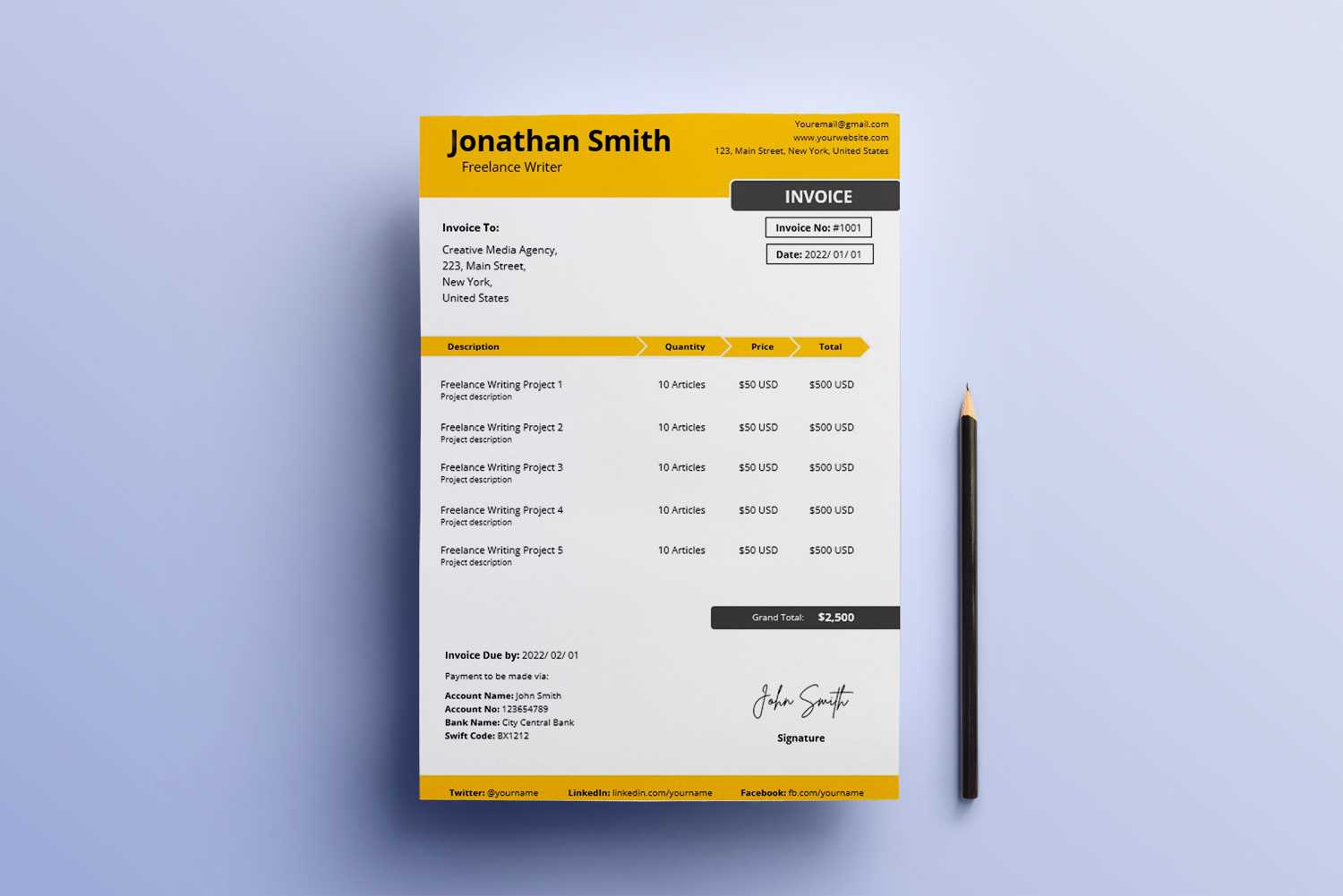

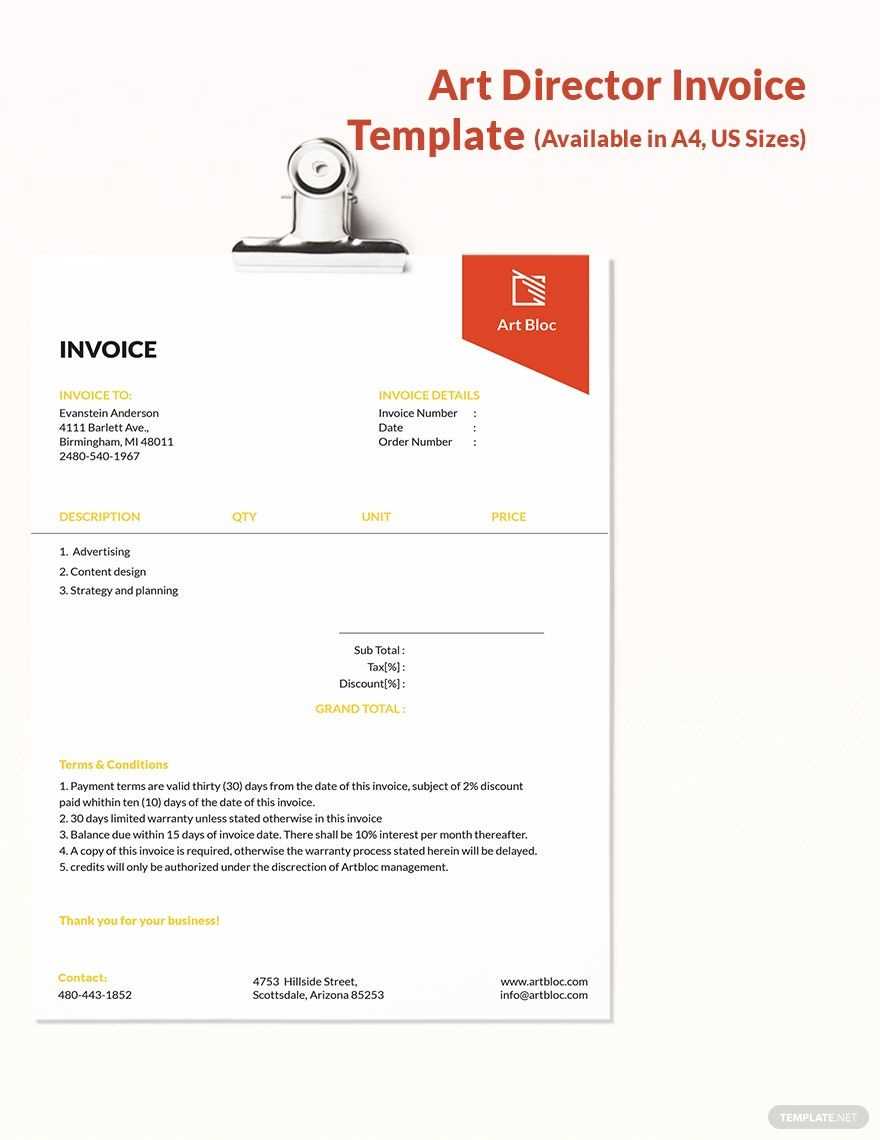

Customizing your billing document allows you to reflect your unique style and meet your specific business needs. Personalizing this essential tool helps establish a clear connection with your clients and ensures that all necessary information is included. A tailored format not only makes the document more professional but also ensures that every detail is accurate and aligned with your brand.

Here are some ways to customize your document effectively:

- Personalized Branding: Include your logo, company name, and contact details to create a more professional look. This adds credibility and reinforces your brand identity.

- Custom Fields: Add custom fields relevant to your services. For example, you can include project or order numbers, specific terms of service, or delivery dates that are unique to your business.

- Flexible Layout: Choose a layout that best fits the nature of your work. You can adjust sections to prioritize what matters most, whether that’s item descriptions, pricing, or payment terms.

- Clear Payment Instructions: Tailor the payment section to your preferred methods, such as bank transfers, online payments, or checks. Make it easy for clients to understand how to complete the transaction.

- Custom Terms and Conditions: If your business has specific policies, include them in the terms section. For example, you might outline deposit requirements or late fees.

By customizing your document in these ways, you make the process more efficient for both you and your clients. It helps ensure that every transaction is clear, well-documented, and professional.

Top Features of a Professional Billing Document

A well-crafted billing document not only provides clarity but also conveys professionalism. It should include key details that ensure both you and your client are on the same page. A professional document helps establish trust, reduces confusion, and ensures that all necessary information is communicated effectively.

Here are some essential features that make a billing document professional:

| Feature | Description |

|---|---|

| Client Information | Include the full name, address, and contact details of the client. This ensures accuracy and avoids any mix-ups during communication. |

| Clear Breakdown of Services | Detail each service or product provided with a clear description and pricing. This helps clients understand exactly what they are paying for. |

| Professional Design | A clean and visually appealing layout reinforces your brand identity. Avoid clutter and ensure the document is easy to read and navigate. |

| Payment Terms | Clearly state the payment due date, accepted methods of payment, and any penalties for late payments. This sets expectations and helps avoid misunderstandings. |

| Unique Document Number | Assign a unique reference number for each transaction. This helps with record-keeping and makes it easier to track payments. |

| Tax Information | If applicable, include the correct tax rates and amounts. This ensures you stay compliant with local tax regulations. |

By including these features in your document, you make the billing process smoother, more efficient, and more professional, ensuring that both parties are clear about the terms of the transaction.

Understanding Billing Document Elements for Creators

For any creative professional, having a structured document to record transactions is crucial. This document not only serves as a proof of the work completed but also ensures both you and your clients have a clear understanding of the terms and payments. Knowing which elements to include helps in creating a document that is both functional and professional.

Key Information to Include

Every document should contain certain core elements to avoid confusion and maintain professionalism. Some of the most important details include:

- Client Information: The full name and contact details of the client, ensuring accuracy and clarity.

- Service Details: A brief description of the service or product provided, with clear pricing and quantity if necessary.

- Due Date: Clearly state the payment due date to avoid misunderstandings and ensure timely payments.

- Payment Terms: Outline how payments can be made, including accepted methods and penalties for late payments.

Why These Elements Matter

Each of these components helps to clarify expectations between you and your client. A well-structured document reduces the risk of disputes and ensures smooth transactions. By having all the essential elements in place, you not only protect your business but also build trust with your clients, creating a professional and reliable image.

Creating Clear Payment Terms for Creative Work

Establishing clear payment terms is essential for both the service provider and the client. Well-defined conditions help set expectations, avoid confusion, and ensure timely compensation for services rendered. By specifying the details of payments upfront, you can create a smooth transaction process and build trust with your clients.

Here are key elements to include when setting clear payment terms:

| Payment Term | Description |

|---|---|

| Due Date | Specify the exact date by which the payment should be made. This ensures that both parties know when to expect the transaction to be completed. |

| Accepted Payment Methods | Clearly state the payment methods you accept, such as bank transfers, credit cards, or online platforms, to avoid confusion. |

| Late Fees | Outline any penalties for late payments, such as additional fees or interest, to encourage timely payments and protect your business. |

| Deposit Requirements | If applicable, specify if a deposit is required before work begins and when the remaining balance is due. |

| Refund and Cancellation Policy | Include details about refund procedures or cancellation policies, in case the client needs to change the arrangement. |

By clearly communicating these payment terms, you ensure that both you and your client are on the same page, which minimizes potential misunderstandings and fosters a professional relationship.

Benefits of Using No-Cost Billing Documents

Using no-cost documents to record transactions offers significant advantages, especially for those looking to simplify the payment process without investing in expensive software or services. These ready-made solutions can save time, reduce errors, and make your business operations more efficient. With pre-designed structures, you can focus on what matters most: delivering quality services to your clients.

Here are some key benefits of using these ready-to-use documents:

- Cost-Effective: The primary advantage is the savings. You don’t need to purchase expensive software or hire someone to create a custom layout.

- Time-Saving: With a pre-made design, you can quickly generate documents without needing to start from scratch, saving valuable time.

- Professional Appearance: Many free documents are designed by professionals, ensuring they look polished and organized, helping you maintain a credible image.

- Customizable: Even free documents allow you to adjust the content to suit your needs, ensuring you can tailor them to different clients or services.

- Easy to Use: Most templates are user-friendly and do not require advanced technical skills to fill out, making them accessible for everyone.

By using these accessible and adaptable solutions, you can streamline your billing process and focus more on your work, while still maintaining a professional standard.

Common Mistakes in Billing Documents

Even small mistakes in billing documents can lead to confusion, delayed payments, or even loss of credibility. It’s essential to ensure that every detail is accurate and clear to avoid misunderstandings. By recognizing and addressing common errors, you can maintain a smooth and professional relationship with your clients.

Omitting Essential Information

One of the most common mistakes is failing to include all necessary details, such as the client’s contact information, a description of the services rendered, or the payment terms. Missing information can lead to confusion about the transaction and delay payment.

Inconsistent or Incorrect Pricing

Inaccurate pricing, whether it’s a typo or inconsistent with prior agreements, can cause issues. Always double-check the unit price, quantity, and total amount before sending the document. Incorrect pricing can create frustration for both parties and delay the payment process.

By avoiding these errors and ensuring every detail is correct, you can create a document that is clear, professional, and trustworthy, fostering positive business relationships.

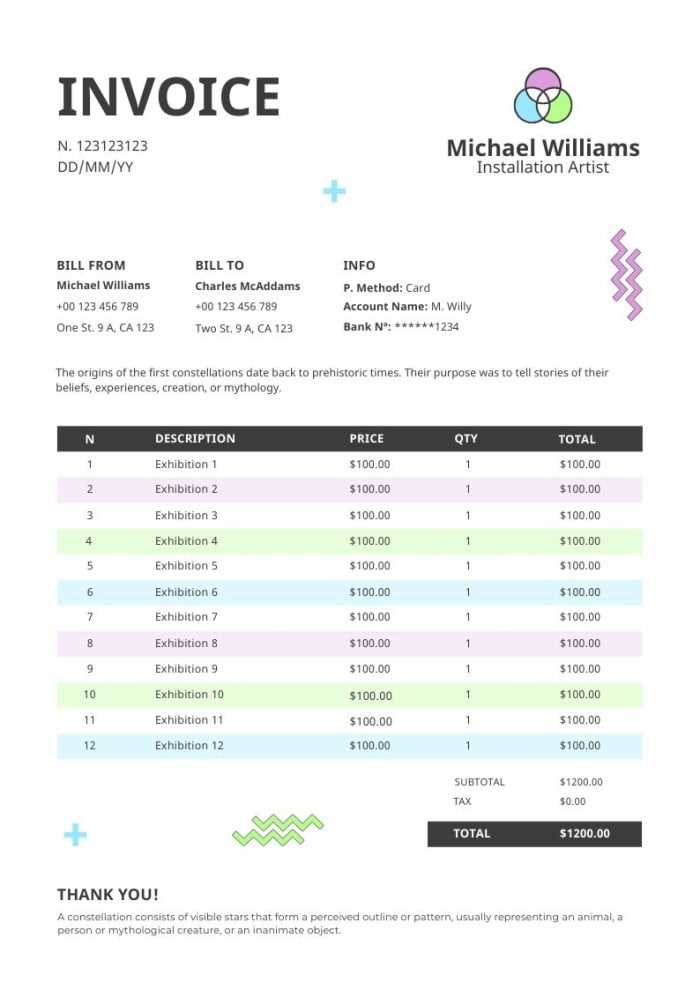

How to Add Artwork Details to Your Billing Document

When documenting a creative project, it’s essential to include clear and comprehensive information about the work itself. By accurately listing details, you ensure that both you and your client understand what has been delivered. This not only helps avoid misunderstandings but also supports your professionalism.

Here are key elements to include when adding creative work details to your billing document:

- Title of the Work: Clearly specify the name of the creation to avoid any ambiguity.

- Medium Used: Mention the materials or techniques applied, such as oils, acrylics, digital, etc.

- Dimensions: Provide the exact measurements of the piece, including height, width, and depth, if applicable.

- Date of Creation: Include the date the work was completed or the time frame it took to finish.

- Edition/Version (if applicable): For limited edition works or multiple versions, state the edition number or version.

- Description: Include a brief description of the work, providing context or inspiration behind it if necessary.

By incorporating these details, you provide your client with all the information needed to understand the value of the work, making the billing process smoother and more transparent.

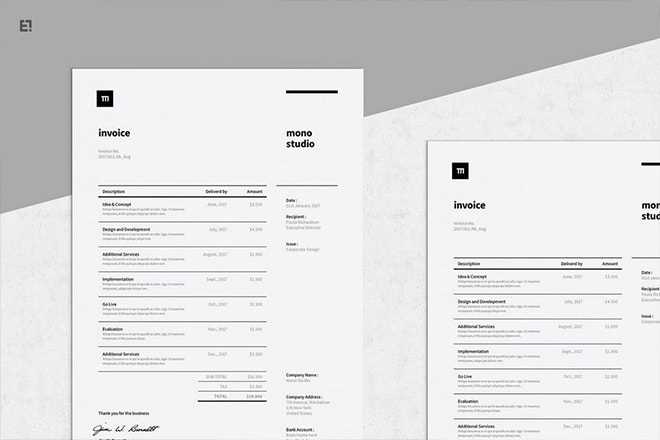

Best Practices for Creative Billing Document Design

Creating a visually appealing and easy-to-read billing document is crucial for making a positive impression on your clients. A well-designed layout not only conveys professionalism but also ensures that all important details are clear and accessible. By following a few design principles, you can create documents that are both functional and attractive.

Here are some best practices to consider when designing your billing document:

- Keep It Simple: Avoid clutter by using a clean, minimalist design. Too many elements can distract from the essential details.

- Use Consistent Branding: Include your logo, business name, and any brand colors to maintain a professional and consistent look.

- Readable Fonts: Use easy-to-read fonts with a good size for body text and headings. Stick to no more than two font styles to maintain clarity.

- Clear Layout: Organize the content logically, grouping related sections together. For example, separate client information, services, and payment terms for easy reference.

- Highlight Important Information: Use bold or different font sizes to emphasize key details, such as the total amount due or payment terms.

- White Space: Make use of margins and spacing between sections to avoid a crowded look and give the document a polished feel.

By following these guidelines, you can ensure that your billing documents are not only professional but also easy for clients to understand, fostering trust and smooth transactions.

How to Track Payments Using Billing Documents

Efficiently tracking payments is essential for maintaining healthy cash flow and managing your finances. A well-organized billing document not only helps you record the transaction details but also makes it easier to track when payments are made or still pending. By incorporating clear payment tracking information, you can stay on top of your financial records.

Here are some essential steps for tracking payments effectively:

- Assign Unique Numbers: Each document should have a unique identification number. This allows you to track payments more easily and refer to specific records when needed.

- Include Payment Terms: Clearly specify the due date and any late fees associated with overdue payments. This helps set expectations and encourage timely payment.

- Track Payment Status: Always update the payment status (e.g., Paid, Unpaid, Partially Paid) to maintain an accurate record.

Additionally, you can use a table format to track the details of each payment received:

| Billing Document Number | Client Name | Amount Due | Payment Date | Payment Status |

|---|---|---|---|---|

| 001 | John Doe | $500 | 2024-10-01 | Paid |

| 002 | Jane Smith | $750 | 2024-10-15 | Unpaid |

By regularly updating the status and reviewing payment details, you can easily monitor outstanding balances and ensure that no payment goes unnoticed.

Tips for Sending Billing Documents to Clients

Sending billing documents to clients is a critical step in the transaction process. It’s important to make sure your communication is clear, professional, and timely. Properly handling the delivery of your financial documents helps maintain a positive relationship with your clients and ensures you are paid on time.

Here are some key tips to consider when sending billing documents:

- Send Promptly: Send the document as soon as the work is completed or the service is rendered. Delays in sending billing paperwork can cause confusion and delay payment.

- Use a Professional Email: When sending your document electronically, ensure that your email address and subject line reflect professionalism. Include a polite message introducing the document and confirming any necessary details.

- Provide Clear Instructions: Be sure to include the payment terms, due date, and any instructions for making the payment. The more straightforward you make the process, the smoother the transaction will go.

- Double-Check for Accuracy: Review the billing document for any errors in the details, such as the payment amount, contact information, or work description. Mistakes in these areas can create confusion and delay payment.

- Consider Multiple Payment Options: Offering a variety of payment methods makes it easier for clients to pay promptly. Include bank transfer details, online payment options, or other methods that are convenient for your clients.

By following these guidelines, you can ensure that your billing process is smooth and professional, leading to faster payments and better client relations.

How to Handle Billing Disputes Effectively

Disputes over financial documents are not uncommon, but handling them efficiently and professionally can prevent escalation and preserve client relationships. When disagreements arise, it’s essential to stay calm, communicate clearly, and resolve the issue with mutual understanding. By approaching the situation in a structured way, you can ensure that both parties are satisfied with the outcome.

Steps to Resolve Disputes

- Review the Details: Carefully go over the billing document in question to ensure all the details are accurate. Double-check the services or goods provided, the agreed-upon pricing, and any relevant terms.

- Communicate Promptly: Once you identify the issue, reach out to the client right away. A prompt response shows professionalism and can prevent the situation from becoming more complicated.

- Stay Professional: Keep your tone polite and objective, focusing on facts rather than emotions. Avoid getting defensive or argumentative; instead, express your willingness to work together toward a solution.

- Offer Solutions: Propose clear solutions, whether it’s a corrected document, a payment adjustment, or further clarification. Be flexible and open to discussion, but make sure any changes are mutually agreed upon and documented.

- Document All Communication: Keep a record of all conversations and agreements made regarding the dispute. This documentation can be valuable if the issue needs to be escalated or revisited in the future.

Preventing Future Disputes

To minimize the risk of disputes, consider the following practices:

- Be Clear from the Start: Establish clear terms and expectations before the work begins. This will help avoid misunderstandings later on.

- Provide Detailed Documents: Ensure that your billing documents are comprehensive, with precise descriptions of the work and costs involved. The more transparent you are, the less likely disputes are to arise.

By approaching billing disputes professionally and with a problem-solving mindset, you can protect both your reputation and your relationships with clients.

Free Online Tools for Billing Documents

Managing financial paperwork can be time-consuming, but using online platforms can simplify the process. There are various free tools available that allow you to create, customize, and track payment requests with ease. These platforms are designed to streamline your workflow and ensure that your financial documents are clear, professional, and well-organized.

Top Free Tools to Use

- Wave: Wave offers a comprehensive suite for managing financial documents, including customizable billing forms. It’s user-friendly and allows you to send documents directly to clients, track payments, and even generate reports.

- Zoho Invoice: Zoho provides a simple yet powerful solution for creating professional payment requests. It includes features for automating reminders, tracking expenses, and customizing your documents according to your brand.

- PayPal Invoicing: PayPal’s invoicing tool is an easy and reliable choice for those who use PayPal for payments. It allows you to create documents with detailed line items, apply taxes, and add a secure payment link.

- Invoicely: This tool offers both free and paid plans, with the free version providing an intuitive interface for creating and sending payment requests. Invoicely supports multiple currencies, making it ideal for international transactions.

Benefits of Using These Tools

- Time-Saving: By automating many aspects of the document creation and payment tracking process, these tools save you significant time and effort.

- Customizability: Many online platforms allow you to personalize your documents, ensuring they reflect your brand or style while still maintaining professionalism.

- Easy Payment Integration: With built-in payment processing options, clients can pay quickly and securely through a variety of methods, including credit cards or online transfers.

- Tracking and Reporting: These platforms often come with tools to track payments and provide detailed reports, giving you a clear overview of your finances at any time.

Utilizing these online tools can make managing your financial transactions much more efficient, helping you focus on your work while ensuring that payments are processed smoothly and accurately.

How to Protect Your Billing Documents

Securing your financial documents is essential for preventing fraud, ensuring accuracy, and maintaining professional integrity. Whether you’re working with clients locally or internationally, it’s important to implement strategies that safeguard your records and transactions. Here are some steps to consider to protect your payment requests and related documents.

Use Secure Digital Platforms

- Cloud Storage: Store your financial documents on trusted cloud platforms with encrypted connections. This ensures that your records are safe from unauthorized access and can be recovered if needed.

- Secure File Sharing: When sharing documents with clients, use secure methods like encrypted email services or password-protected files. Avoid sending sensitive information through unprotected channels.

Implement Payment Tracking and Confirmation

- Payment Links: Incorporate secure payment links within your documents. This reduces the risk of errors or fraud in the payment process, allowing for real-time tracking of transactions.

- Confirmation Receipts: Always request or generate confirmation receipts for payments made, and ensure both parties have access to these records. This helps prevent misunderstandings and disputes.

Regularly Update and Backup Documents

- Document Backups: Keep regular backups of all your financial documents, either on a local drive or in the cloud. This protects against data loss or corruption.

- Software Updates: Ensure that the software or platforms you use for creating and managing financial documents are regularly updated. Updates often include security patches that prevent vulnerabilities.

Keep Your Personal Information Safe

- Limit Sensitive Data: Avoid including excessive personal information in your payment requests. Only share what’s necessary for the transaction.

- Use Strong Passwords: Protect access to your accounts and software with strong passwords and two-factor authentication when possible.

By taking these precautions, you can effectively protect your financial documents from unauthorized access, errors, and potential fraud. Ensuring the security of these records not only helps maintain a professional reputation but also safeguards your business’s financial well-being.

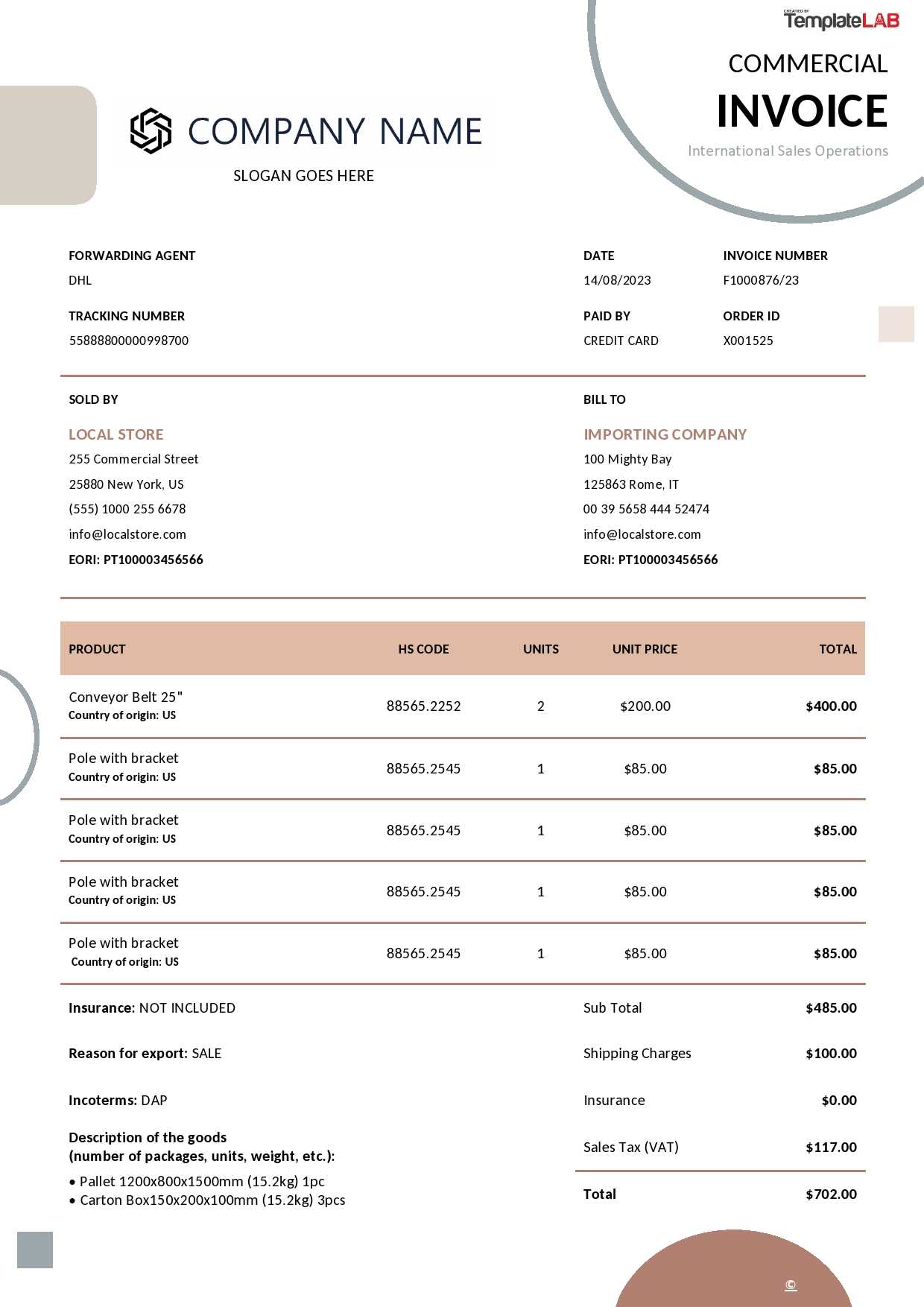

Legal Considerations for Billing Documents

When creating and managing billing documents, it’s essential to understand the legal aspects involved. These documents not only serve as a record of a transaction but also ensure that both parties–service providers and clients–are protected under applicable laws. Here are some key legal factors to keep in mind when generating financial documents for your business.

Essential Information for Legal Compliance

Every billing document should contain specific details to comply with legal and tax regulations. Below are essential components that should be included:

| Element | Description |

|---|---|

| Business Information | Include your legal business name, contact details, and registration number if applicable. This helps identify the service provider and ensure transparency. |

| Transaction Date | Ensure that the date of the service or product delivery is clearly stated. This helps in setting clear terms and obligations for both parties. |

| Payment Terms | Specify when the payment is due and any penalties for late payment. Clear terms help avoid disputes and set expectations upfront. |

| Tax Information | Include tax rates and the total amount of tax applied, as required by your jurisdiction. This helps maintain legal compliance for tax reporting purposes. |

| Itemized Breakdown | Provide a detailed list of goods or services rendered, including quantity, unit price, and total amount. This ensures transparency and avoids misunderstandings. |

Contracts and Agreements

Along with billing documents, it’s crucial to have clear contracts or agreements with clients. These documents outline the terms of the relationship, including payment schedules, deadlines, and what happens in the case of a dispute. Some important points to consider:

- Agreement Clarity: Be sure that the terms are easy to understand and cover key aspects of the transaction, such as delivery, payment terms, and dispute resolution.

- Dispute Resolution Clauses: Outline the procedures for resolving any conflicts that might arise during or after the transaction. This could include methods like mediation or arbitration.

- Legal Jurisdiction: Indicate the legal jurisdiction under which the agreement will be governed, should any legal issues arise.

By ensuring that your documents include all the necessary legal elements and by maintaining clear contracts, you safeguard yourself and your clients from potential legal issues. Being proactive about legal considerations can help ensure smooth business operations and protect your rights and interests.

How to Integrate Billing Documents into Accounting

Integrating your billing documents into the overall accounting process is vital for accurate financial management and record-keeping. Whether you are a freelance creator or running a small business, seamless integration ensures that all transactions are accounted for, simplifying tax preparation and financial reporting. This process involves aligning your financial records with your earnings and expenses, creating a transparent and organized system for managing finances.

Linking Payments to Financial Systems

One of the first steps in integrating billing into your accounting workflow is linking payments with your financial software or system. Many accounting tools offer automatic synchronization, which makes it easier to track payments and categorize expenses. Here’s how to effectively manage this:

- Automated Record Keeping: Use accounting software that can automatically import transaction details from your billing documents. This helps maintain real-time financial records without manually entering data.

- Reconcile Regularly: Perform regular reconciliations between your payments and bank statements. This ensures that all amounts match, reducing the risk of discrepancies.

- Custom Categories: Create custom categories for your business activities. For example, categorize transactions related to materials, shipping, or other business expenses to make financial analysis easier.

Tracking and Reporting Financials

Once payments are integrated, tracking and reporting becomes essential. Accurate tracking of your financial documents allows for precise tax calculations, budgeting, and forecasting. Some important steps for effective tracking include:

- Organized Reporting: Generate monthly or quarterly reports summarizing your income and expenses. This gives a clear overview of your financial performance and highlights any trends or areas for improvement.

- Tax Readiness: Keep track of tax-related information, including VAT, sales tax, and other deductions, to ensure you’re prepared for tax filing without delays.

- Invoice Aging: Monitor outstanding payments using aging reports, which show how long invoices have been unpaid. This helps you manage cash flow and follow up on overdue payments.

By effectively integrating billing documents into your accounting system, you ensure smooth financial operations, maintain accuracy, and avoid any surprises when it comes to tax time. This streamlined approach allows for better financial control and sets the foundation for future growth and success.