Art Commission Invoice Template for PayPal Simple and Effective Billing Solution

When engaging in freelance work or creative services, ensuring clear and professional financial agreements is essential for both the artist and the client. A well-structured billing document plays a crucial role in maintaining trust and smooth transactions. It is more than just a request for payment; it’s a professional representation of the service provided and an important step in the business process.

By utilizing a suitable structure for your financial requests, you can streamline the payment process, avoid misunderstandings, and ensure timely compensation. Clear, organized records also make it easier to manage finances, track earnings, and fulfill legal or tax obligations. Whether you’re offering design work, illustrations, or any other creative service, the right method for requesting payment can make a significant difference in the way you manage your professional relationships.

Choosing the right format for such financial documents can save time and effort. It can also offer flexibility for both parties to agree on terms. With the right approach, your clients will feel confident in the process, leading to more successful collaborations and long-term business relationships.

Art Commission Invoice Template for PayPal

When requesting payment for creative services, having a professional and organized approach can greatly simplify the process. A well-crafted payment request ensures that both the service provider and the client are on the same page regarding amounts, deadlines, and terms. The right format makes it easy to communicate all necessary details clearly and helps avoid confusion or delays in receiving funds.

For digital transactions, especially through popular payment platforms, it’s essential to use a streamlined, standardized format that aligns with the system’s capabilities. A clear breakdown of services, agreed amounts, and payment deadlines will enhance trust and ensure smooth financial exchanges. By providing a precise document, you also create a formal record of the transaction for both parties.

Using an organized approach also helps in managing different payment methods, currencies, and fees. With the right structure, you can track payments, resolve issues, and maintain a professional relationship with clients. This document acts not only as a request for payment but also as a legal record should any disputes arise, offering both you and your clients peace of mind.

Why Use an Invoice Template

Having a structured format for requesting payment provides both efficiency and professionalism in any transaction. Without a clear outline of services rendered, agreed amounts, and payment details, misunderstandings can easily arise. A standardized approach ensures that all essential information is communicated in a straightforward manner, making the process smoother for both parties involved.

Using a pre-designed format saves time and reduces the chances of overlooking critical details. It helps maintain consistency in your financial dealings and ensures that every transaction is documented in a way that can be easily referenced later. By sticking to a clear and recognizable structure, you create a professional image and build trust with clients.

Furthermore, a properly structured document is vital for record-keeping. It helps you track earnings, manage taxes, and resolve potential disputes quickly. By using a reliable method to present your payment requests, you simplify your administrative tasks and reduce the chances of errors or confusion down the line.

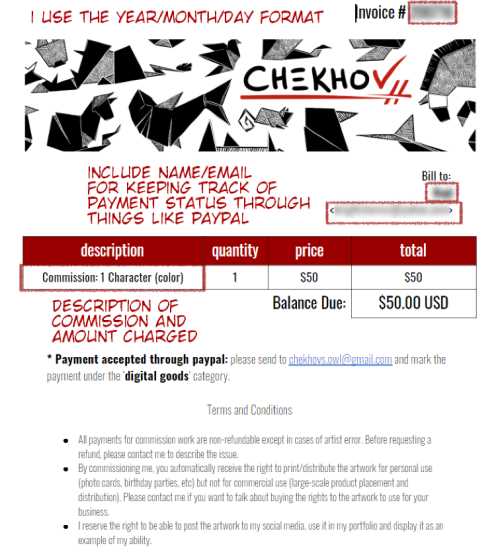

Key Features of a Professional Invoice

A well-designed financial request not only outlines the services provided but also conveys professionalism and clarity. The key to a successful transaction lies in how well you present the necessary details, ensuring that both you and your client have a clear understanding of the agreed terms. A professional document goes beyond simply asking for payment–it serves as a reliable record and a means of maintaining positive business relationships.

Here are the essential elements of a well-structured document:

- Clear Contact Information: Include both your details and the client’s to avoid any confusion in communication.

- Accurate Breakdown of Services: List the specific services rendered, ensuring the client knows exactly what they are paying for.

- Precise Payment Amount: Clearly state the total amount due, including any additional charges or taxes, if applicable.

- Payment Terms and Deadline: Specify the due date and any late fees, as well as the accepted methods of payment.

- Unique Reference Number: This helps both parties keep track of the transaction for future reference.

- Professional Appearance: A clean, organized layout reflects well on your business and fosters trust with clients.

Including these elements ensures that both you and your client are aligned on all aspects of the transaction, minimizing the chance of disputes and promoting timely payments.

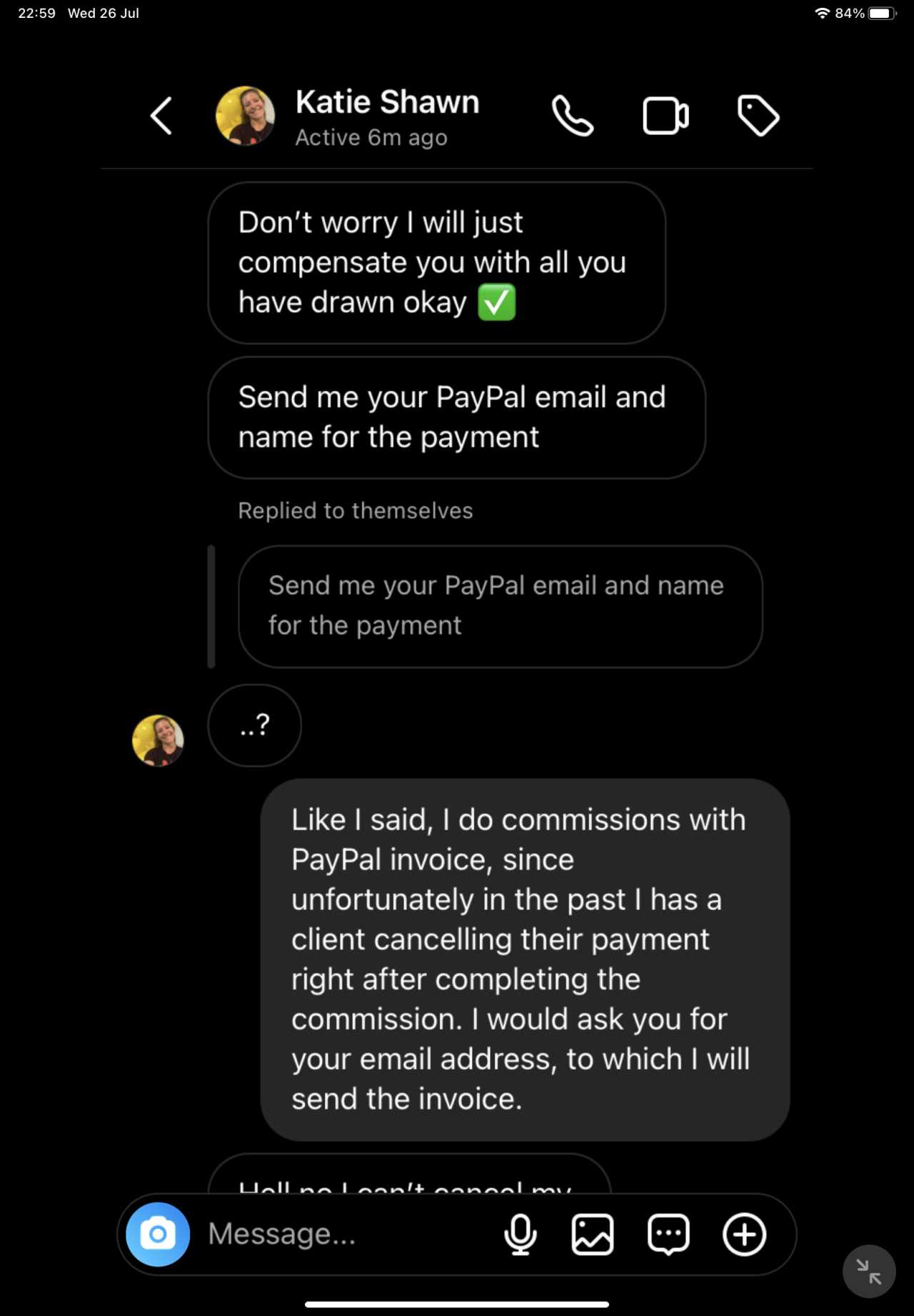

How to Create an Invoice for Art

When requesting payment for creative work, it is essential to provide a well-organized and clear document that outlines the agreed-upon services, payment details, and terms. A professional financial request ensures that both you and your client understand the expectations and responsibilities. The process of creating this document involves several steps to ensure accuracy and completeness.

Here’s a step-by-step guide to creating a clear and effective document:

- Start with Your Information: Include your full name, business name (if applicable), contact information, and the date of the transaction.

- Provide the Client’s Details: Add the client’s name, company name, and contact information to avoid any confusion.

- List the Services Rendered: Describe the specific work completed or provided, such as design, illustrations, or other services, along with a brief description for clarity.

- Set the Price: Clearly state the agreed-upon amount, including any additional charges or fees. Ensure that any taxes or discounts are accounted for.

- Include Payment Terms: Specify when the payment is due, including any late fees or early payment discounts, and the accepted payment methods.

- Assign a Unique Reference Number: This helps both you and your client easily track the transaction for future reference or in case of any issues.

- Double-Check for Accuracy: Ensure all the details are correct, and make sure the document is free from any errors before sending it to the client.

By following these steps, you can create a professional and straightforward financial request that not only ensures timely payment but also strengthens your credibility and professional reputation.

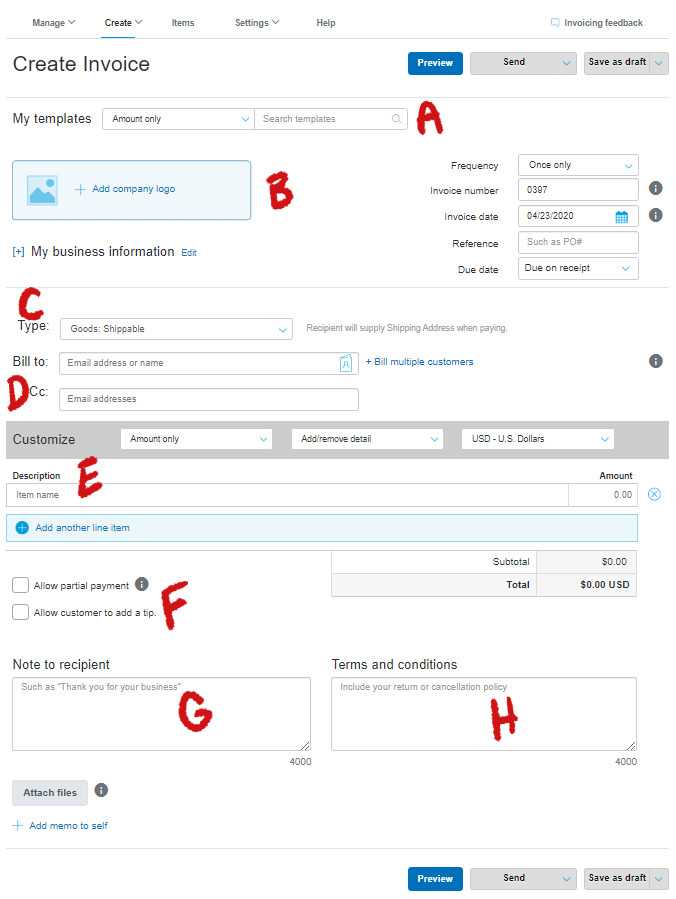

Customizing Your PayPal Invoice Template

When requesting payment online, it’s important to tailor your billing documents to reflect your brand and make the process as smooth as possible for both you and your clients. Personalizing your payment request not only adds a professional touch but also ensures that the document meets your specific needs. Customization options allow you to adjust key elements such as design, content, and layout to match your style and business requirements.

Adjusting the Layout and Design

Many payment platforms offer customizable formats that allow you to choose from various design options. You can add your business logo, change fonts, adjust colors, and select a layout that fits your brand identity. This helps create a cohesive look across all your business materials, giving a professional appearance that reassures your clients.

Incorporating Key Information

Make sure to include all necessary details for a seamless transaction. This includes a clear breakdown of services, pricing, payment terms, and contact information. Customizing the layout helps ensure that this crucial information is easy to find and understand. Some platforms even allow you to add notes or specific terms, making it possible to further personalize each document for individual clients or projects.

By taking the time to customize your payment request, you not only enhance your professional image but also create a more efficient and user-friendly process for your clients. This simple step can lead to quicker payments and a more streamlined workflow overall.

Best Practices for Art Commission Billing

When it comes to requesting payment for creative work, maintaining clarity and professionalism is key to ensuring smooth transactions and happy clients. Proper billing not only helps to secure timely payments but also fosters trust and long-term business relationships. Adopting best practices for your financial requests can make a significant difference in how your business is perceived and how efficiently payments are processed.

Essential Tips for Clear Billing

Follow these guidelines to ensure your payment requests are organized, transparent, and professional:

- Set Clear Expectations: Agree on the project scope, pricing, and deadlines upfront. This will prevent misunderstandings later on.

- Use Detailed Descriptions: Be specific about the services provided and the agreed-upon amount. Break down the costs into clear categories, if necessary.

- Provide Payment Terms: Specify payment methods, deadlines, and any applicable late fees. Setting clear expectations around these aspects will encourage timely payments.

- Issue Requests Promptly: Send the payment request as soon as the project is completed or as agreed in the contract. This avoids unnecessary delays.

- Keep Records Organized: Maintain a clear record of all payment requests and transactions. This will help you track income and resolve disputes quickly if they arise.

Ensuring Client Satisfaction

Billing can be a source of tension if not handled professionally. Here are some practices that will help maintain positive relationships with clients:

- Be Polite and Professional: Keep the tone of your request respectful and courteous. This fosters goodwill and maintains a positive working environment.

- Offer Flexible Payment Options: Provide clients with a few different ways to pay (e.g., bank transfer, online payment platforms, etc.) to make the process as easy as possible.

- Follow Up Politely: If a payment is overdue, follow up in a friendly, non-confrontational manner. A gentle reminder can go a long way in getting paid without damaging the relationship.

By following these best practices, you create a streamlined process that helps you get paid on time while maintaining professional integrity and client satisfaction.

Common Mistakes in Art Invoices

While creating payment requests may seem straightforward, there are several common errors that can delay payments or create confusion for both you and your clients. These mistakes, if not addressed, can negatively impact your cash flow and your professional reputation. Understanding the potential pitfalls can help you avoid them and ensure smoother financial transactions.

Frequent Errors in Billing Documents

Below are some of the most common mistakes made when creating financial requests, along with tips on how to avoid them:

| Mistake | Consequence | Solution |

|---|---|---|

| Missing Contact Information | Leads to confusion and delays if your client cannot easily reach you. | Always include your full name, business name, email, and phone number. |

| Unclear Payment Terms | Can result in late or partial payments, and miscommunication. | Clearly specify the payment due date, accepted methods, and any late fees. |

| Vague Descriptions of Services | May cause clients to question the charges or misunderstand what they are paying for. | Provide detailed descriptions of each service rendered with corresponding costs. |

| Incorrect Pricing or Math Errors | Can lead to disputes and delays in payment, damaging professional relationships. | Double-check all calculations and pricing to ensure accuracy before sending. |

| Failure to Use a Unique Reference Number | Without a reference number, it may be difficult to track payments and transactions. | Always include a unique reference number to help both you and your client track the payment. |

How to Prevent These Mistakes

To avoid these common errors, take the time to carefully review every detail before sending the request. Creating a checklist for yourself can help ensure that no important information is left out, and using a st

Setting the Right Payment Terms

Establishing clear and fair payment terms is essential for ensuring a smooth transaction process. Without well-defined expectations, misunderstandings can arise, leading to late payments or disputes. By setting the right conditions from the outset, you can ensure that both you and your client are on the same page, which fosters trust and encourages timely compensation for your services.

Key Considerations for Defining Payment Terms

Here are the main factors to consider when setting payment terms for any creative work:

| Consideration | Impact | Best Practice |

|---|---|---|

| Payment Deadline | Clear deadlines prevent delays and set expectations for timely payments. | Set a specific due date (e.g., “Due within 30 days of delivery”). |

| Payment Method | Offering flexibility in payment options can lead to quicker transactions. | Provide multiple payment methods (bank transfer, online platforms, etc.). |

| Late Payment Fees | Incentivizes timely payments and discourages delays. | Clearly state any penalties for late payments (e.g., “2% interest per week”). |

| Deposits or Prepayments | Helps secure commitment from the client and covers initial costs. | Ask for a deposit (e.g., “50% upfront before starting the project”). |

| Currency and Taxes | Ensures transparency and avoids confusion when working internationally. | Clarify the currency of payment and any applicable taxes or fees. |

Communicating Terms Effectively

Once you have established clear payment terms, it is important to communicate them effectively. Be transparent with your client about your expectations, and ensure they understand the consequences of missing deadlines or failing to follow the agreed terms. It’s a good practice to include these terms in a contract or formal agreement, and to remind clients politely as the payment due date approaches.

By setting the right payment terms from the beginning, you establish a foundation for professional conduct and minimize the risk of delayed or disputed payments.

How to Add Taxes on PayPal Invoices

Including taxes in financial requests is an essential part of managing business transactions, especially when working with clients from different regions. Properly applying taxes ensures compliance with local regulations and helps you avoid unexpected financial issues. Whether you’re operating within a specific country or internationally, it’s important to understand how to add the appropriate tax charges to your payment requests.

Understanding Tax Calculation

Before you add taxes to your payment request, you need to understand which taxes apply to your services. This could include sales tax, VAT (Value Added Tax), or any other regional taxes depending on where your business or your client is located. Different jurisdictions have varying rates and rules for tax collection, so it’s important to research what’s applicable to your situation.

Key points to consider:

- Check if your services are subject to tax in your region or the client’s location.

- Understand the specific tax rate that applies, which may vary based on the nature of the service or product provided.

- If operating internationally, ensure you are aware of any cross-border tax regulations, such as VAT for EU clients.

How to Add Taxes to Payment Requests

Once you understand the tax requirements, follow these steps to include taxes in your payment requests:

- Identify the Tax Rate: Determine the appropriate tax rate for your services based on your location or the client’s region.

- Enable Tax Option: In the payment platform you are using, ensure the option to add taxes is enabled. Many systems allow you to set a default tax rate.

- Apply Tax to Total: Add the tax amount to the total cost, ensuring it is clearly displayed as a separate line item. Make sure to indicate the tax rate applied.

- Verify Calculation: Double-check that the tax has been correctly calculated and applied to avoid errors and potential issues with clients.

By properly adding taxes to your requests, you ensure that both you and your clients are aware of the exact amount owed. This also helps in maintaining transparency and trust, preventing any surprises when payments are due.

Choosing the Right Currency for Invoices

When requesting payment for your services, selecting the right currency is a crucial step, especially when dealing with international clients. The currency you choose impacts how clients perceive the transaction and can affect payment speed and clarity. By considering factors like the client’s location and the terms of your agreement, you can ensure that the payment process goes smoothly and without confusion.

Factors to Consider When Choosing Currency

There are several key factors that influence which currency you should use in your financial requests:

- Client Location: If your client is located in a different country, it’s important to know what currency they commonly use or prefer. This helps avoid unnecessary conversion fees and makes the transaction process easier.

- Business Location: If your business is located in a specific region, using the local currency can help simplify accounting and tax reporting.

- International Conversions: If you deal with clients globally, you may need to consider exchange rates and any potential fees associated with converting between currencies.

- Payment Methods: Some payment platforms offer automatic currency conversion, which can be useful for clients who want to pay in their local currency.

Best Practices for Currency Selection

To ensure a smooth financial exchange, here are some best practices for choosing the right currency:

- Communicate with Your Client: Always discuss and confirm the preferred currency with your client before finalizing the payment request.

- Be Transparent About Conversion Fees: If you need to convert currencies, make sure your client is aware of any potential fees or exchange rate fluctuations.

- Standardize Currency in Contracts: If you frequently work with international clients, it might be helpful to establish a standard currency for all your transactions, simplifying the process for everyone.

- Consider the Payment Platform: Ensure that the payment system you’re using supports the currency you’re selecting and that there are no restrictions on the currencies available.

By taking these factors into account, you can avoid confusion and ensure that your clients have a smooth, hassle-free payment experience. Choosing the right currency will not only streamline your billing process but also help you build trust and professionalism with clients across the world.

Understanding PayPal Fees for Artists

When using online payment systems, it’s essential to understand the associated costs. While these platforms offer convenience and security, they also come with transaction fees that can impact your earnings. For anyone offering creative services and accepting payments through such systems, it’s crucial to be aware of the fees involved and how they may affect your bottom line. Being informed helps ensure that you price your work appropriately to account for these costs.

Types of Fees to Consider

There are several different fees you might encounter when receiving payments online. Understanding each of these can help you prepare and avoid unexpected deductions:

- Transaction Fees: This is the standard fee for receiving payments. It’s typically a percentage of the total amount you receive, with a fixed fee for each transaction.

- Currency Conversion Fees: If you’re dealing with clients in other countries, be aware of additional fees for converting the payment from one currency to another. These fees vary based on the currency and are typically charged as a percentage of the total amount.

- Cross-Border Fees: For international transactions, many payment platforms charge an additional fee for processing payments from different countries.

How to Manage Payment Fees

Knowing these fees upfront allows you to plan accordingly and avoid any surprises. Here are some ways to manage and reduce the impact of fees on your payments:

- Account for Fees in Your Pricing: If you know that payment processing fees will take a chunk of your earnings, factor them into the cost of your services to ensure you’re still making a fair profit.

- Explore Alternative Payment Methods: While online platforms are convenient, they might not always be the most cost-effective. Consider offering clients other ways to pay, such as bank transfers, which may have lower fees.

- Use Business Accounts: Many payment systems offer business accounts with lower fees and additional features designed to benefit freelancers and small businesses. Check to see if this option is available to you.

By understanding the various fees associated with receiving payments online, you can make informed decisions that help protect your earnings and keep your pricing structure clear and fair for both you and your clients.

How to Ensure Timely Payments

Receiving payments promptly is essential for maintaining a healthy cash flow and sustaining your business. However, delays in payments can occur for various reasons, from unclear terms to clients forgetting the due date. By setting clear expectations, streamlining your payment process, and communicating effectively, you can encourage clients to pay on time and avoid unnecessary delays.

Effective Strategies to Encourage On-Time Payments

Here are several strategies you can implement to help ensure that your clients pay you on time:

- Set Clear Payment Terms Upfront: Clearly outline the payment schedule, due dates, and any late fees in your agreement. The more transparent you are from the start, the less likely there will be confusion about when payments are due.

- Offer Multiple Payment Options: Make it as easy as possible for clients to pay by offering several payment methods (bank transfers, online payment systems, etc.). The more convenient the payment process, the more likely clients will pay promptly.

- Send Reminders: If the payment deadline is approaching, send a friendly reminder a few days beforehand. After the due date has passed, send a polite follow-up message to remind clients about the overdue payment.

- Request a Deposit: Asking for an upfront payment or a deposit can reduce the risk of delays and ensures you receive some compensation before starting a project.

- Be Professional and Firm: While maintaining a friendly tone, ensure that your payment terms are non-negotiable. If clients understand that late payments have consequences, they are more likely to pay on time.

Automation Tools for Timely Payments

In addition to setting clear expectations and following up manually, there are also automation tools that can help you track and remind clients of their payment obligations:

- Automated Payment Requests: Use online platforms that allow you to automate the sending of payment requests based on your pre-set terms. This can reduce manual effort and ensure consistency.

- Payment Reminders: Set up automatic reminders for your clients to notify them of upcoming or overdue payments. This takes the burden off you and ensures timely follow-ups.

- Recurring Billing: For ongoing projects, consider setting up recurring billing to automatically charge your clients at regular intervals. This removes the need for manual invoicing and ensures payments are collected on time.

By implementing these strate

Benefits of Using PayPal for Art Commissions

When managing client payments for creative projects, selecting a reliable and secure payment system is essential. A widely trusted online payment platform offers various advantages for both creators and clients, including ease of use, global reach, and enhanced security. By choosing an established system, you can streamline your payment process, reducing friction and encouraging smooth transactions for both parties.

Ease of Use and Convenience

One of the key benefits of using an online payment system is its convenience. Clients can make payments quickly from anywhere in the world, without the need for complex procedures or long wait times. This simplicity benefits both parties, ensuring that funds are transferred without unnecessary delays.

- Quick Setup: Setting up an account is straightforward, allowing creators to start accepting payments almost immediately.

- Multiple Payment Options: Clients can pay through various methods such as credit or debit cards, bank accounts, and even digital wallets, making the process flexible for all parties involved.

- Mobile-Friendly: With mobile apps and browser-based systems, clients can make payments anytime, anywhere, using their smartphones or computers.

Security and Buyer Protection

Security is a major concern for both clients and sellers. An online payment system provides multiple layers of protection, ensuring that transactions are safe and secure. This reassures clients that their personal and financial information is protected, while also offering a level of security for creators in case of disputes.

- Encryption: Payments are processed through encrypted connections, ensuring that sensitive data remains safe from unauthorized access.

- Buyer and Seller Protection: Both buyers and sellers are provided with protections in case of fraud or disputes, reducing the risk of chargebacks or misunderstandings.

- Transaction Tracking: Both parties can track payment statuses, providing transparency throughout the process and helping avoid any confusion or errors.

By using a trusted online payment system, you can not only simplify the payment process but also ensure that both you and your clients feel secure throughout your business dealings. This creates a smoother, more professional experience for everyone involved.

Tracking Your Invoices in PayPal

Efficiently managing your financial transactions is key to running a smooth and successful business. Keeping track of payments, receipts, and outstanding balances ensures that you stay organized and maintain good relationships with your clients. By utilizing an online payment system, you can easily monitor the status of each transaction and have full visibility of your earnings.

Most online platforms offer built-in tools for tracking all incoming and outgoing payments. These tools give you detailed records of each transaction, allowing you to easily track paid and pending requests, identify any issues, and reconcile your accounts. With just a few clicks, you can access a comprehensive overview of your financial activities.

How to Track Payments

Here are a few ways to efficiently monitor the status of your transactions:

- Transaction History: Your account typically provides a detailed transaction history, listing all payments received. This allows you to see the date, amount, and status of each payment.

- Notifications: Many systems offer automatic email notifications when payments are made or when there’s an update on the payment status, helping you stay informed without constantly checking your account.

- Search and Filter Options: You can often use search features to find specific transactions based on criteria such as date, amount, or client name, streamlining the process of finding relevant records.

Managing Outstanding Balances

Another benefit of using an online payment system is the ability to easily track unpaid transactions. This helps you follow up with clients and avoid overdue payments. Here’s how to stay on top of outstanding balances:

- Outstanding Requests: Many platforms allow you to create and manage requests for payment. You can view which requests are still unpaid and follow up with clients accordingly.

- Reminders: Setting up automatic reminders or manually notifying clients of overdue payments ensures you don’t miss any outstanding balances.

- Reports: Regularly checking your financial reports helps you quickly identify unpaid amounts and plan for future follow-ups.

By utilizing the tools available in your online payment system, you can easily track your financial records, stay organized, and ensure you receive payments promptly and accurately.

Making the Most of Invoice Templates

Utilizing ready-made document structures can significantly streamline your payment collection process, allowing you to maintain a professional appearance while saving time. By using standardized formats, you can easily create consistent, clear payment requests, which help in reducing errors and ensuring all necessary details are included. Whether you are managing a single project or multiple clients, having an efficient and customizable format can enhance your workflow and improve client satisfaction.

These structured documents are designed to provide a simple way to fill in essential information without having to start from scratch each time. With predefined fields for payment details, dates, services rendered, and amounts owed, you can save effort and reduce the chances of missing key information. Additionally, many platforms allow you to personalize these documents with your logo, payment terms, and other relevant details, adding a professional touch that reflects your business brand.

By adopting such a format, you not only ensure consistency but also make the payment process easier for your clients, reducing delays and confusion. A well-organized structure sets clear expectations from the outset, contributing to a smoother transaction and helping you stay organized in the long run.

How to Protect Your Work with Invoices

When providing creative services or selling digital or physical works, it’s essential to secure both your intellectual property and payment. A clear, documented agreement between you and your client serves as a legal safeguard, outlining the terms and expectations for both parties. By using well-structured documents for transactions, you can ensure that your rights as a creator are protected, and the terms of your business dealings are properly established and agreed upon.

Why Documentation is Important

Having a formal record for every transaction not only helps ensure timely payments but also protects you in case of disputes. These records clarify your terms, including pricing, delivery timelines, usage rights, and other specifics, which can help prevent misunderstandings with clients. Additionally, in case of legal concerns or non-payment, having a detailed account of the transaction can serve as evidence in your favor.

Key Elements to Include

To properly safeguard your work, make sure the following elements are always included in your documentation:

| Element | Description |

|---|---|

| Payment Terms | Clearly state the agreed amount and the due date for payment, as well as any late fees or penalties for overdue payments. |

| Usage Rights | Define the scope of how your work can be used, whether it is for personal use, commercial use, or restricted in some way. |

| Delivery Details | Outline when and how the final product or service will be delivered to the client, including any specifics related to digital files or physical items. |

| Copyright and Ownership | Clarify whether you retain ownership of the work, or if it is transferred to the client upon payment, and how the work may be credited or displayed. |

| Signatures | Ensure both parties sign the document to acknowledge and agree to the terms, adding an extra layer of protection in case of disputes. |

By ensuring that every transaction is documented with clear terms and expectations, you protect both your creative output and your business. This level of professionalism not only safeguards your interests but also builds trust with clients, establish

Alternatives to PayPal for Artists

For creators looking to manage payments and transactions, there are several platforms available that offer flexible and secure options. While a popular online payment service is widely used, there are many other solutions that may better suit the needs of certain businesses. Depending on your preferences, the type of work you do, and your target audience, alternative platforms can provide varying benefits in terms of fees, features, and ease of use.

Payment Processors for Creators

Various payment processors offer similar features to the widely known systems but with different fee structures, transaction options, and global reach. Some platforms are tailored specifically for freelancers, small businesses, or digital transactions, while others are better suited for international payments or physical goods sales.

- Stripe: A strong alternative for creators who want to accept payments directly on their websites or via online stores. It supports a variety of currencies and payment methods, making it versatile for international clients.

- Square: Popular with small businesses, Square offers a comprehensive solution with point-of-sale options and a free online store, making it an excellent choice for those who sell both digitally and in person.

- Venmo: A peer-to-peer payment service often preferred for smaller transactions between individuals. It’s simple to use and integrates easily with mobile devices, which can make it ideal for smaller-scale transactions and informal payments.

- TransferWise (now Wise): If you’re working with international clients, Wise is a great option for handling multi-currency transactions with low fees. It offers a transparent exchange rate and ensures funds are transferred quickly and securely.

Benefits of Exploring Other Platforms

Exploring alternatives to the most common online payment systems can give you more control over your transactions and potentially reduce fees. Each platform has its own strengths, and understanding these can help you choose the one that aligns best with your business model.

- Lower Fees: Some platforms may offer lower transaction fees, especially for international payments or larger sums, which can be beneficial for keeping costs down.

- Better Customer Experience: Depending on your clientele, certain platforms may be more familiar or convenient for them, improving the overall payment experience.

- Security and Fraud Prevention: Many alternatives provide additional security measures, such as two-factor authentication and fraud detection, giving you peace of mind during transactions.

By researching the available options and choosing the best payment system for your needs, you can ensure that your payment process is efficient, secur