How to Use an Architect Invoice Template in Excel

Managing financial transactions efficiently is essential for any professional service provider. Creating clear, accurate records of payments and charges not only streamlines your work but also enhances client satisfaction. Proper documentation helps ensure that all services rendered are compensated appropriately and on time.

Utilizing the right tools can simplify this process significantly. By organizing payment details, calculating totals automatically, and maintaining an organized system, professionals can avoid errors and reduce the time spent on administrative tasks. A structured approach to billing ensures consistency and minimizes the risk of overlooking important details.

In this guide, we will explore how to design an effective system for tracking your fees, managing adjustments, and communicating payment expectations to clients. With a well-structured approach, you can enhance both your workflow and your professional reputation.

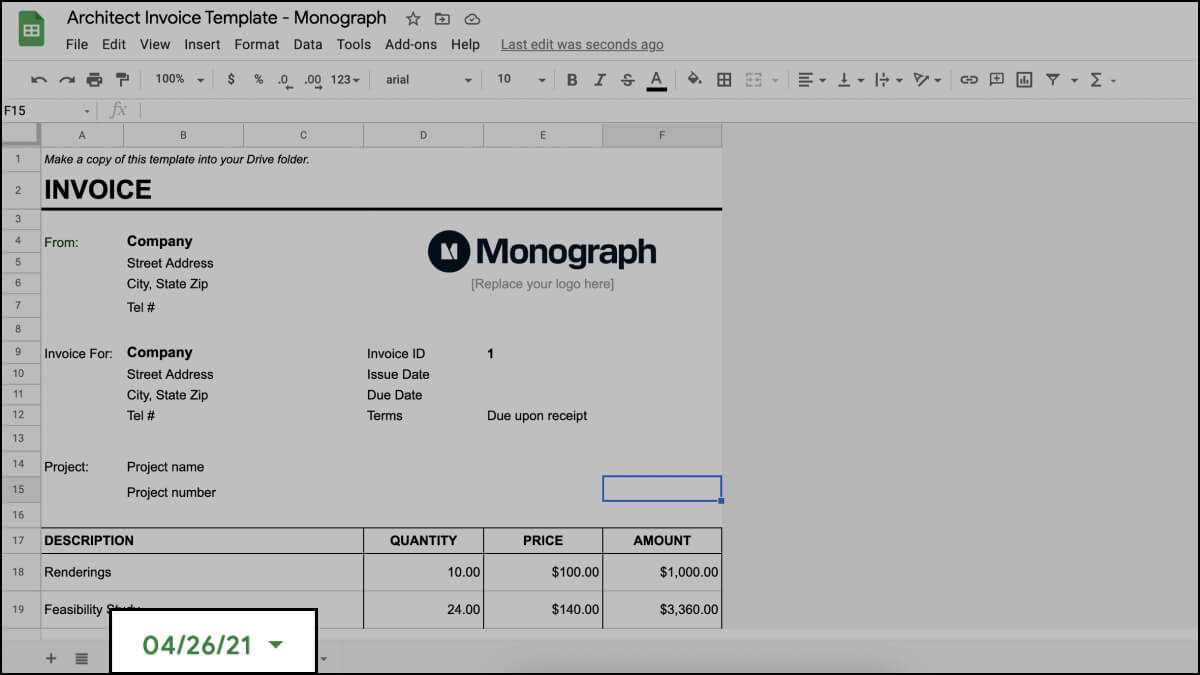

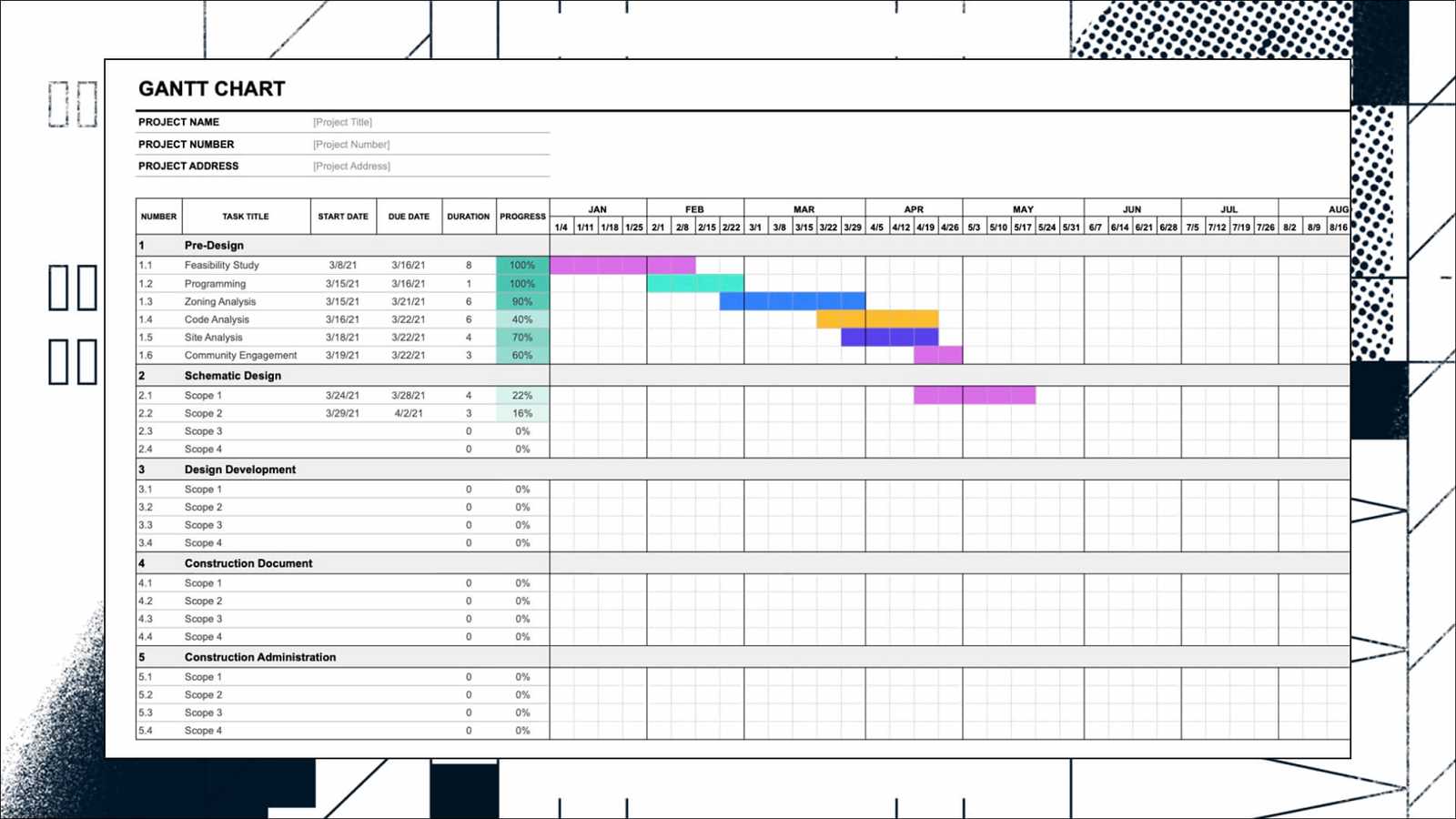

Architect Invoice Template Excel Guide

Managing financial records efficiently is a key part of any professional’s business. Having a reliable system in place to record services provided, calculate amounts due, and track payments ensures smooth transactions. Using a well-organized document can simplify these tasks, making the process quicker and more accurate for both you and your clients.

The key to success lies in creating a customizable document that suits the needs of your projects. By inputting the right information, such as work details, rates, and payment terms, you can generate an accurate record with minimal effort. This approach helps reduce the chance of errors and provides a clear overview of your financial activities.

In this guide, we will walk through how to set up an effective system for organizing your charges and payment details. Whether you’re a freelancer or a small business owner, these tools can help you streamline your operations and maintain professional standards in your financial dealings.

Why Use an Excel Invoice Template

Adopting a digital solution to manage payment records offers numerous advantages. Using a structured, customizable system allows for efficient tracking of services provided, ensuring accuracy and saving time. The ability to quickly create and update financial documents reduces the administrative burden and ensures that you remain organized throughout the process.

One of the main benefits of using a spreadsheet for financial documentation is automation. Built-in functions can help calculate totals, apply taxes, and adjust prices without manual input, eliminating the potential for human error. This makes the process faster and more reliable, ensuring clients receive accurate details of the work completed.

Moreover, such a system is easily customizable to fit specific needs, from adjusting layouts to adding new categories or rates. It also simplifies storage and sharing, as these documents can be easily saved, sent, and retrieved whenever necessary, ensuring that both you and your clients have quick access to the most up-to-date records.

Key Features of Architect Invoice Templates

Effective financial documents are not just about listing charges; they should be designed to capture all relevant information in a clear and structured way. A well-organized sheet includes multiple features that help streamline the billing process and ensure that both the service provider and the client have all the details needed for proper record-keeping.

Customizable Layouts

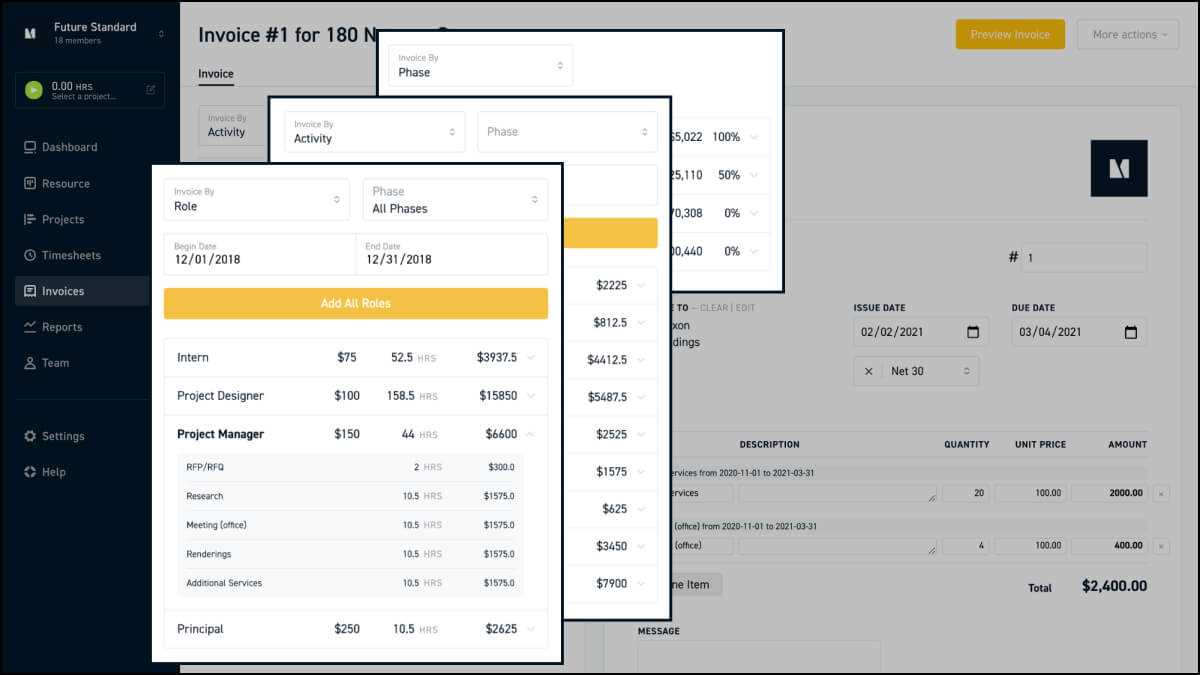

A flexible format allows for personalization, so you can tailor the document to meet the unique needs of your business. This includes adjusting the layout, adding or removing sections, and choosing the best method for displaying payment details. Customization makes it easier to reflect the specific nature of the work performed, whether it’s based on time, project stages, or flat-rate pricing.

Automatic Calculations

One of the most beneficial features is the ability to automate calculations. With the right setup, the sheet can automatically compute totals, taxes, and discounts, helping to avoid errors in the final amount. This feature saves time and ensures that all charges are accounted for accurately.

| Feature | Description |

|---|---|

| Time Tracking | Track hours worked and calculate totals automatically based on hourly rates. |

| Tax Calculation | Automatically apply appropriate taxes to each entry based on predefined rates. |

| Payment Tracking | Easily track payments and outstanding balances for each client. |

| Custom Fields | Include additional fields for unique services or client-specific needs. |

These features ensure that your financial documents are not only func

How to Customize an Excel Template

Customizing a financial document allows you to tailor it to your specific needs, ensuring that it fits the unique requirements of your business and clients. By adjusting the structure, design, and data fields, you can create a professional and efficient document that streamlines the process of managing payments and services.

The first step in customization is adjusting the layout to reflect the type of services you offer. For instance, you may want to add or remove sections, such as hourly rates, project milestones, or flat fees, depending on your pricing structure. This flexibility allows you to present the necessary information in a clear and logical manner.

Another essential aspect is incorporating automatic calculations to simplify the process of determining totals, taxes, and discounts. By setting up formulas that calculate these values based on the inputted data, you can ensure accuracy and reduce the chances of errors.

Finally, consider adding your brand elements, such as your company logo or color scheme, to make the document more professional and consistent with your business identity. Customizing your document not only helps maintain organization but also enhances the client experience by providing a polished and personalized billing record.

Benefits of Excel for Invoice Management

Using a digital solution for managing financial records offers several advantages, especially for professionals who need to track multiple transactions and clients. With its flexible structure and powerful features, a spreadsheet can simplify the billing process, reduce errors, and save valuable time.

Here are some of the key benefits of using a spreadsheet for financial management:

- Automation: Built-in formulas can automate calculations such as totals, taxes, and discounts, eliminating the need for manual entry and reducing the risk of errors.

- Customization: The layout can be tailored to suit your specific business needs, from adjusting sections for different services to adding personalized details like logos and branding.

- Data Organization: A spreadsheet provides an easy way to organize client details, payment history, and service breakdowns, making it simple to track all necessary information in one place.

- Cost-Effective: Using a spreadsheet program eliminates the need for expensive software subscriptions while still offering robust features for managing financial records.

- Scalability: As your business grows, a spreadsheet can be easily expanded to accommodate more clients, services, or projects, ensuring that your system remains adaptable.

- Data Security: Spreadsheets can be securely saved, backed up, and protected with passwords, ensuring that your financial data remains safe and private.

By leveraging the power of a spreadsheet, you can manage payments more efficiently and stay organized while keeping costs down. Whether you are handling a small number of clients or managing large projects, this solution helps ensure smooth financial operations.

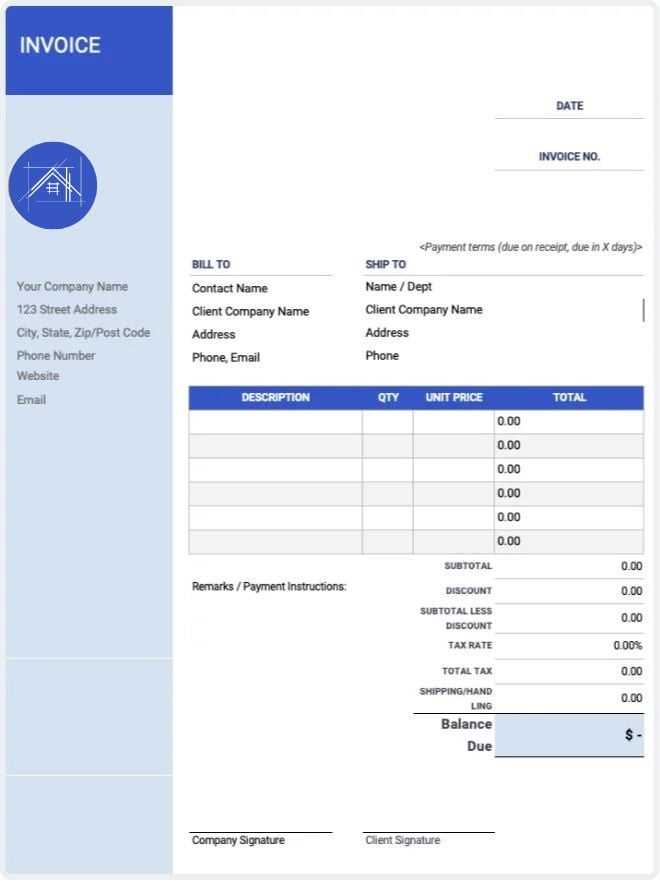

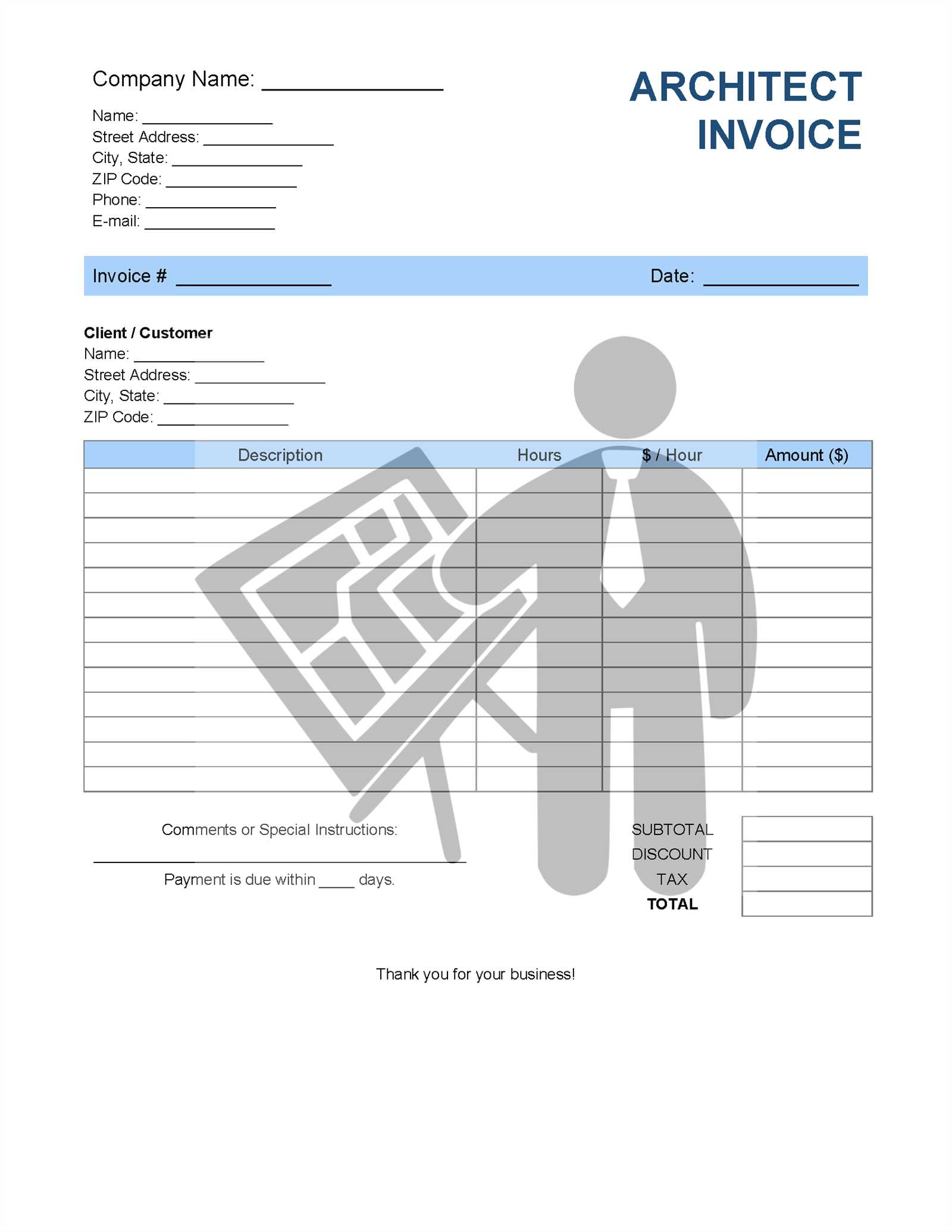

Steps to Create an Architect Invoice

Creating a financial document for services rendered involves a few essential steps to ensure clarity, accuracy, and professionalism. By following a structured approach, you can present a comprehensive breakdown of the work completed, ensuring your clients understand the charges and terms of payment.

Step 1: Input Basic Information

Start by entering the necessary details at the top of the document. This typically includes your name or business name, contact information, and the client’s name and contact details. It’s important to also include the date of creation and a unique reference number for easy identification and future reference.

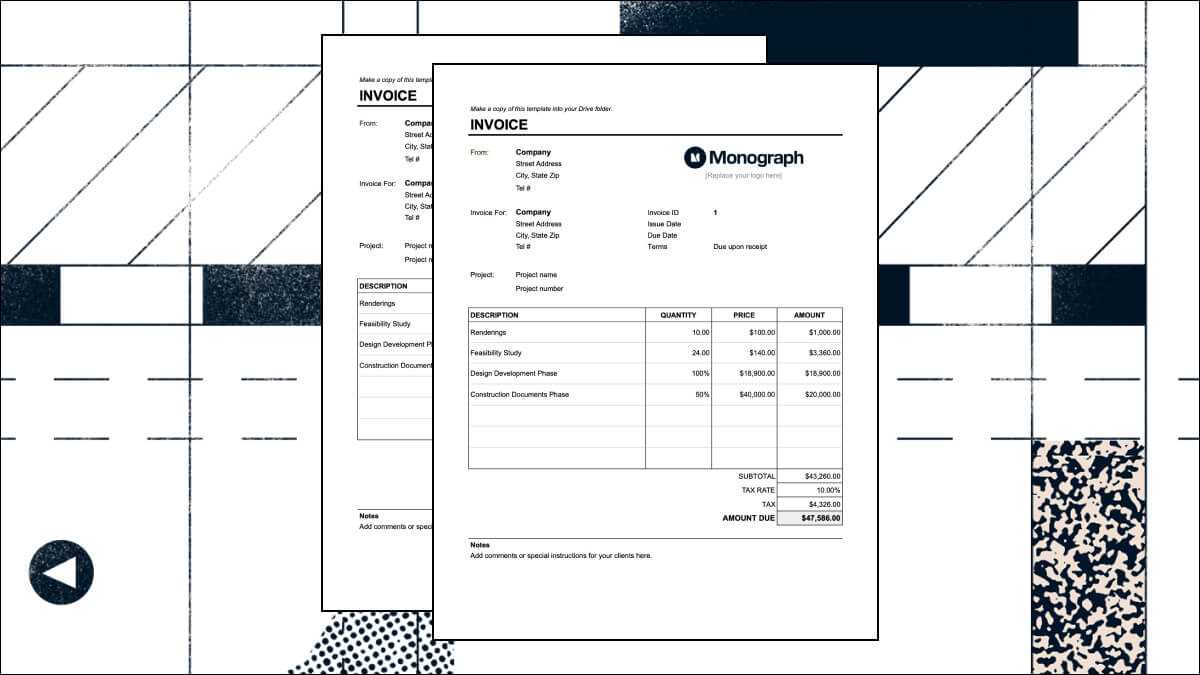

Step 2: Break Down Services and Costs

Provide a detailed list of the services performed, along with the associated costs. This could be based on hourly rates, project milestones, or flat fees, depending on your pricing structure. Each service should have its own line, making it easy for the client to see what they are being charged for.

| Service Description | Quantity/Hours | Rate | Total |

|---|---|---|---|

| Consultation | 5 hours | $100/hr | $500 |

| Design work | 10 hours | $120/hr | $1200 |

| Revisions | 3 hours | $100/hr | $300 |

Each item should clearly display the service description, quantity, rate, and total cost. This transparency helps the client understand the charges and can prevent misunderstandings.

Step 3: Include Additional Fees and Taxes

If applicable, add any additional costs, such as taxes, supplies, or travel e

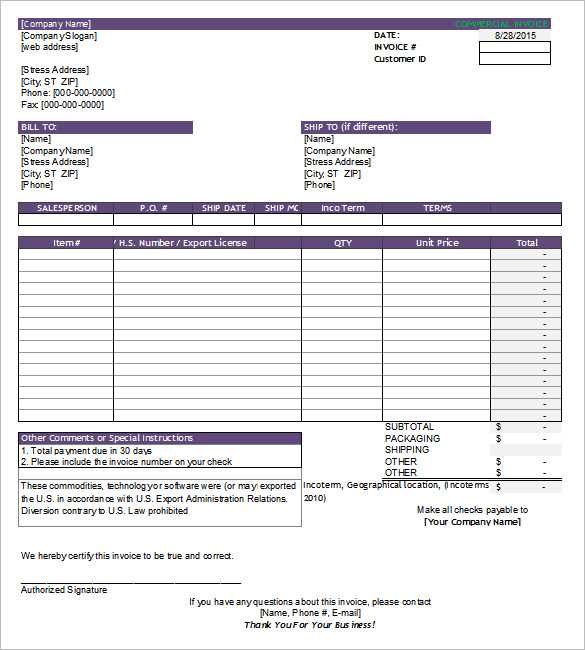

Essential Information for Invoice Creation

To ensure that your billing documents are complete and accurate, there are several key details that must be included. A well-structured document not only helps clients understand the charges but also ensures that you are paid on time and without complications. Below are the most important pieces of information you need to include in your billing document.

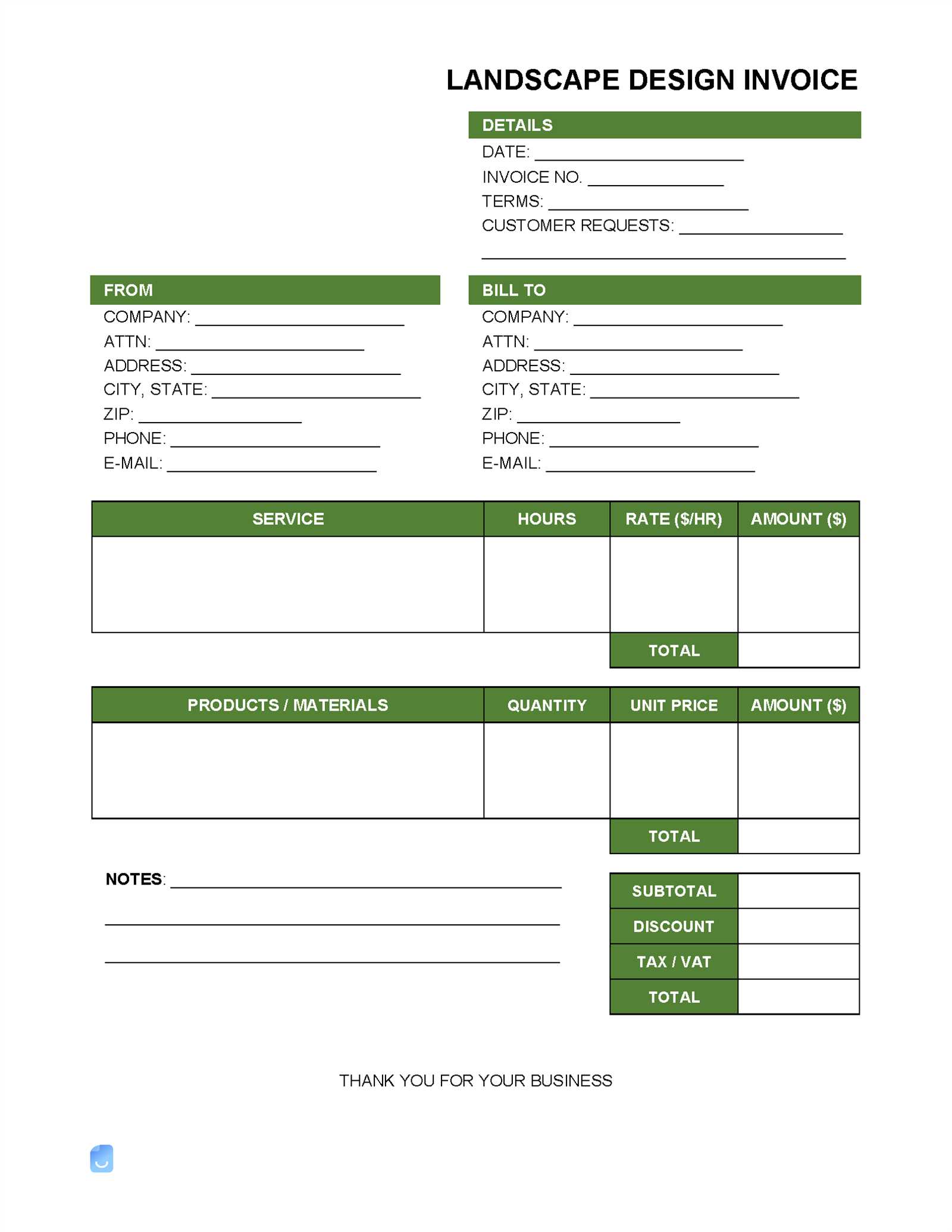

Client and Service Provider Information

Both parties involved should be clearly identified to avoid confusion. This includes the names, addresses, and contact details of both you (the service provider) and your client. This information ensures that the document can be easily referenced and helps maintain clear communication.

- Your name/business name

- Client’s name/business name

- Your contact details

- Client’s contact details

Details of Services and Charges

Be sure to provide a detailed breakdown of the services provided. This will help avoid any misunderstandings and make it clear what the client is paying for. Include specifics like hourly rates, flat fees, or project-based costs along with any quantities or hours worked.

- Service description

- Rate per service or hour

- Total cost for each service

- Any additional fees or costs (travel, materials, etc.)

Payment Terms and Conditions

Clearly stating the payment terms is crucial for both parties. This includes the due date for payment, acceptable payment methods, and any late fees or penalties for overdue payments. Setting expectations helps prevent delays and confusion later on.

- Payment due date

- Accepted payment methods

- Late payment penalties or interest

By including these essential elements in your billing documents, you can ensure that the process runs smoothly and efficiently, reducing the likelihood of disputes and ensuring timely payment.

How to Track Payments with Excel

Managing payments effectively is key to maintaining a healthy cash flow in your business. By using a digital system, you can easily track which clients have paid, which are overdue, and the overall status of your financial transactions. A well-organized system ensures that you can quickly access payment details and stay on top of your billing process.

Setting Up a Payment Tracking Sheet

To get started, create a simple sheet with the essential information needed to track payments. This sheet should include columns for client names, services rendered, payment amounts, due dates, and payment status. By entering this data consistently, you’ll have an up-to-date overview of all your transactions.

- Client name

- Service description

- Amount due

- Payment date

- Payment status (paid, pending, overdue)

Using Formulas to Automate Tracking

Automating calculations and statuses can save you time and effort. For example, you can use formulas to calculate the remaining balance or flag overdue payments automatically. This allows you to focus on following up with clients who haven’t paid yet, without manually checking each detail.

- SUM function for total payments received

- IF function to automatically mark payments as paid or overdue based on the due date

- Conditional formatting to highlight overdue payments in a different color

By setting up a simple tracking system and using basic formulas, you can efficiently manage payments and ensure that you always know which clients have paid and which are still outstanding. This helps streamline your billing process and ensures that no payment is missed.

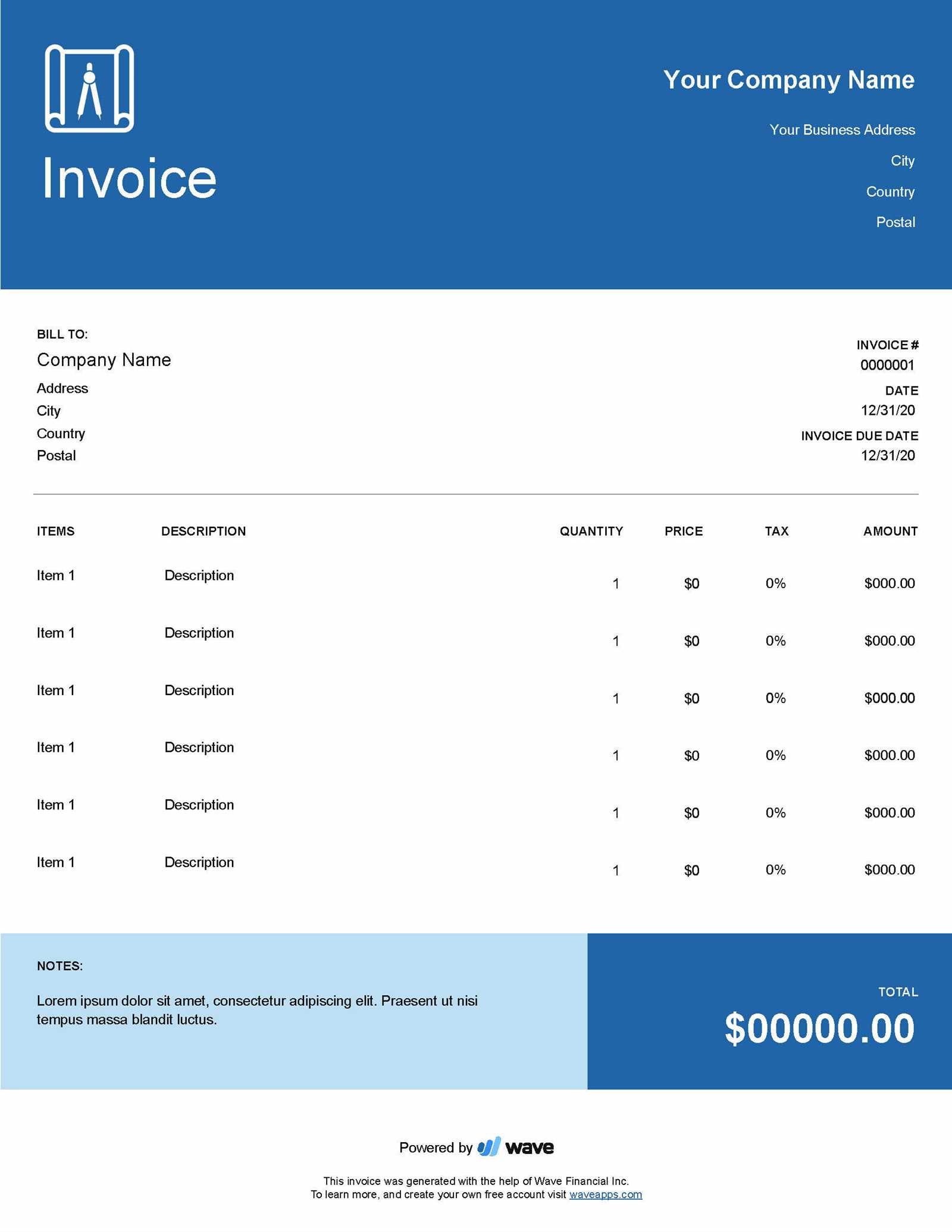

Best Practices for Invoice Design

Creating a clear and professional financial document is essential for maintaining strong business relationships and ensuring that clients can easily understand their charges. A well-designed document enhances readability and can prevent confusion or delays in payment. Below are some best practices to follow when designing your billing documents.

1. Keep the Layout Clean and Organized

A cluttered document can make it difficult for your clients to find the information they need. Keeping a clean, well-organized layout with clearly defined sections ensures that each part of the document is easily accessible. Make use of white space and align text neatly to create a balanced look.

- Use clear headings for each section (e.g., client information, services provided, payment terms).

- Break information into sections so clients can quickly scan through the document.

- Maintain consistent spacing to avoid a crowded or chaotic appearance.

2. Make Important Information Stand Out

Highlight key details, such as the total amount due or payment due date, to ensure they are immediately visible. Using bold or larger font sizes for essential information helps draw attention to the most important aspects of the document.

- Bold the total amount due and the payment due date to make them stand out.

- Use contrasting colors to separate sections or emphasize certain fields without overwhelming the reader.

- Ensure readability by using a legible font style and size that is easy to read on both desktop and mobile devices.

3. Include Necessary Details

Provide a comprehensive breakdown of services, payment terms, and any applicable taxes or discounts. Clearly stating all charges helps prevent disputes and builds trust with clients.

- Detail each service or product and its corresponding cost.

- Specify payment terms, including due dates and acceptable payment methods.

- Include any additional costs like taxes, fees, or materials used to avoid confusion.

4. Mai

Understanding Invoice Numbering Systems

A well-organized numbering system for financial documents is crucial for tracking, referencing, and maintaining a clear record of transactions. Properly structured numbering not only simplifies your internal processes but also helps clients and your team quickly locate any given document. Below, we will explore the different approaches to numbering and why it’s important to have a consistent system in place.

1. Sequential Numbering

One of the most common methods is sequential numbering, where each document receives a unique number in chronological order. This system is simple to implement and ensures that every document is easily identifiable based on its number.

- Pros: Easy to track, minimizes the risk of missing or duplicated numbers.

- Cons: May not work well for larger businesses with numerous documents unless further categorization is introduced.

2. Date-Based Numbering

Another approach is to integrate the date into the numbering system. This method includes the year, month, and day within the document number, offering a quick way to determine when a transaction occurred without having to cross-reference other data.

- Example: 2024-09-001, where the first part represents the date and the last part is a sequential number for that day.

- Pros: Provides an immediate understanding of when the document was created.

- Cons: Might become cumbersome if the business generates many documents on the same day.

3. Client-Specific Numbering

For businesses that have regular clients, a client-specific numbering system can be helpful. This method assigns a specific prefix or suffix to the document number for each client, making it easier to track their history and transactions.

- Example: CLIENT-001, where “CLIENT” represents a unique identifier for the customer.

- Pros: Helps in organizing records by client and can streamline future reference.

- Cons: Requires maintaining a clear system to ensure numbers don

Handling Multiple Projects in One Invoice

When managing several tasks or projects for a single client, it can be efficient to combine all charges into one document. This approach simplifies the process for both parties, providing a clear breakdown of each project’s costs in a single, easy-to-reference document. Proper organization is key to ensuring that all charges are clearly presented, avoiding confusion and maintaining transparency.

1. Clear Sectioning for Each Project

To avoid confusion, each project should be clearly separated with its own section within the document. This can include a title for each project, followed by a list of services, costs, and relevant details specific to that project. This helps the client easily differentiate between each task or service provided.

Project Name Description of Work Cost Project 1 Design and Planning $2,000 Project 2 Structural Consultation $1,500 Project 3 Final Review $1,000 2. Itemize Costs for Transparency

For each project listed, it’s important to break down the costs into smaller, detailed components, especially when services are varied. This not only provides clarity but also helps prevent disputes by making sure each charge is accounted for separately.

Service Cost Initial Consultation $500 How to Include Taxes and Discounts

In any financial document, it’s essential to accurately reflect both the applicable taxes and any discounts applied to ensure that the total amount due is clear. Including these elements not only helps maintain transparency with clients but also ensures compliance with local tax regulations. Properly formatting these charges ensures that both parties understand how the final price was calculated.

1. Calculating Taxes

When including taxes, it’s crucial to specify the rate and the exact amount being charged. Taxes can vary depending on location, so it’s important to include details such as the tax percentage applied and the base amount from which the tax is calculated. The tax amount should be clearly displayed, either as a separate line item or integrated into the total price breakdown.

Description Amount Base Price $2,000 Tax (8%) $160 Total Price $2,160 2. Applying Discounts

Discounts can be applied for various reasons, such as special offers or early payment. When including a discount, it’s important to specify the percentage or amount being deducted. Discounts should be shown as a line item, and the total after the discount should be clearly indicated to avoid any confusion.

Description Amount Base Price $1,500 Discount (10%) -$150 Total Price After Discount Ensuring Accuracy in Invoice Calculations

Accurate calculations are the foundation of any financial document. Ensuring that all amounts, discounts, and taxes are correctly calculated can prevent discrepancies and disputes. It’s crucial to double-check all figures and use automated formulas to reduce human error. When the figures are precise, clients can trust the accuracy of the final amount, leading to smoother transactions and timely payments.

1. Double-Checking Subtotals

Subtotals should be calculated with great care. Ensure that all services or products provided are correctly priced and that the correct quantity has been applied. Subtotals should be checked both manually and through the use of automated tools to confirm their accuracy. If there are multiple services, they should be clearly listed with individual pricing to avoid confusion.

Description Quantity Unit Price Subtotal Design Consultation 5 hours $100 $500 Project Management 10 hours $150 $1,500 Materials 50 units $20 $1,000 2. Using Automated Calculations

Using software tools with built-in formulas can significantly reduce the chance of errors in calculations. For example, applying the correct tax rate and applying discounts automatically can save time and ensure consistency. Always test formulas to make sure that they are functioning correctly before sending the final document.

3. Verifying Totals

The final total should be the sum of all subtotals, with any applicable discounts and taxes added or subtracted accordingly. Always confirm that the final figure matches what was agreed upon with the client, and consider running a final check using a different method (such as a calculator or separate tool) to verify accurac

Excel Functions to Streamline Invoices

Automating the process of creating financial documents can save a significant amount of time and reduce errors. Leveraging built-in functions allows users to calculate totals, apply taxes, and manage discounts with minimal manual input. By utilizing these features, one can generate professional-looking financial records more efficiently and with greater consistency.

1. SUM Function for Totals

The SUM function is one of the most commonly used functions in any spreadsheet for calculating totals. It allows users to quickly add up a range of numbers without manually entering each value, making it perfect for summing up quantities or costs in financial documents.

Description Quantity Unit Price Total Consulting Fee 3 hours $200 =SUM(B2:B4) Design Services 5 hours $150 Materials 10 units $50 2. IF Function for Discounts and Conditional Calculations

The IF function is useful when applying discounts or conditional pricing based on specific criteria. It allows users to set up rules to automatically apply a percentage discount or price increase based on the criteria of a project or client.

Description Price Discounted Price Design Consultation $500 =IF(B2>300,B2*0.9,B2) Project Management $1000 =IF(B3>30 How to Save and Share Invoices

Storing and distributing financial documents efficiently is essential for maintaining organized records and ensuring smooth communication with clients. By using digital tools, these documents can be saved securely and shared quickly, helping you stay on top of payments and project documentation. There are several methods available to store and send these important files, each offering various benefits based on your needs.

Saving Documents Securely

To ensure your financial records are safe and easy to access, it’s important to save them in secure, organized locations. Digital storage options such as cloud services or dedicated folders on your device provide the necessary security for sensitive information.

- Cloud Storage: Platforms like Google Drive, Dropbox, or OneDrive allow you to store files securely and access them from anywhere. These services also offer automatic backups, so your files are protected even in the event of device failure.

- Local Folders: If you prefer to store documents on your device, ensure they are organized in clear folder structures. Regular backups on external drives or additional cloud services can prevent data loss.

- File Naming Conventions: Use consistent and descriptive file names to easily identify documents. Including project names, dates, and document types in the file name will make it easier to search and locate files when needed.

Sharing Financial Documents Efficiently

When sharing financial documents with clients or collaborators, it’s important to ensure they are easily accessible and protected. Here are some best practices for sharing:

- Email Attachments: Attach your document to an email, ensuring the recipient’s address is correct. You can also password-protect the document for added security.

- Shared Cloud Links: If the file is too large to email or you want to give the recipient access to multiple files, share a link to the document stored in your cloud account. Make sure to set appropriate permissions (view-only or editable) depending on the situation.

- Digital Signatures: For formal agreements, consider using digital signature platforms like DocuSign or Adobe Sign, w

Common Mistakes to Avoid in Invoices

Creating accurate and professional financial documents is crucial to ensuring timely payments and maintaining good client relationships. However, there are several common errors that can cause confusion or delays in the payment process. Understanding these pitfalls and taking steps to avoid them can significantly improve your workflow and help maintain financial transparency.

Common Errors to Watch Out For

Here are some of the most frequent mistakes made when preparing financial documents:

- Incorrect or Missing Contact Information: Always ensure that both your details and the recipient’s are accurate and complete. Missing or incorrect information can lead to confusion and delays in processing payments.

- Unclear Payment Terms: Clearly specify the payment due date, any late fees, and the payment method. Ambiguities can lead to misunderstandings about when payments are expected.

- Omitting Taxes or Discounts: Ensure all applicable taxes or discounts are calculated correctly and clearly displayed. Overlooking these can lead to discrepancies and disputes.

- Inconsistent Formatting: A lack of consistency in the layout or style of your document can make it difficult for clients to understand. This includes using different fonts, unclear headings, or inconsistent alignment.

How to Avoid These Mistakes

Preventing common mistakes requires attention to detail and consistency. Here are some best practices to follow:

- Double-Check Details: Always verify that all contact information is correct before sending a document.

- Clear and Precise Language: Be explicit with your terms, such as payment deadlines, service descriptions, and amounts.

- Use Templates: Utilize standardized document formats to ensure all necessary elements are included and organized properly.

By carefully reviewing your documents and adhering to best practices, you can avoid these common pitfalls and maintain a smooth payment process.

Template Security and Data Protection Tips

When creating and managing financial documents, ensuring the safety and confidentiality of sensitive information is paramount. Protecting client data, business details, and transaction information from unauthorized access or potential breaches should be a priority. Following best practices for document security will help safeguard against risks and ensure compliance with privacy regulations.

Key Security Measures for Documents

Implementing the following security strategies can help minimize risks:

- Use Strong Passwords: Protect your documents with strong, unique passwords. Avoid using easily guessed passwords, and consider using a password manager to securely store and generate them.

- Limit Access: Only allow access to the document to those who absolutely need it. Set permissions and restrict editing, printing, or copying, where possible, to maintain control over sensitive data.

- Use Encryption: Encrypt your files to add an additional layer of security. Encryption ensures that even if a file is intercepted, it cannot be read without the decryption key.

Data Protection Best Practices

Aside from protecting the document itself, it’s important to follow general data protection guidelines:

- Secure Storage: Store your documents in a secure cloud service or offline in a password-protected file. Avoid leaving sensitive files in shared locations where unauthorized individuals could access them.

- Backup Files: Regularly back up important documents to ensure that you have a copy in case of data loss or system failure.

- Regular Software Updates: Keep your devices and software up to date to protect against security vulnerabilities that may be exploited by cybercriminals.

By adhering to these tips, you can enhance the security of your financial documents and ensure that both your business and clients are protected from data theft and misuse.

Improving Client Communication with Invoices

Effective communication is crucial in maintaining positive client relationships, especially when it comes to financial transactions. A clear and well-structured document can help ensure that clients fully understand the services provided, the associated costs, and the payment expectations. By utilizing certain strategies in how these documents are presented, you can foster transparency, trust, and satisfaction with your clients.

Clear and Concise Breakdown

To avoid confusion and potential disputes, it’s important to provide a detailed breakdown of charges. A well-organized list of services or products provided, along with their corresponding costs, can help clients understand exactly what they are paying for. This transparency helps to avoid misunderstandings and promotes trust in your business practices.

- Itemized List: Presenting each service or product separately, along with its associated cost, helps clients see the value they are receiving.

- Clear Descriptions: Including a brief description of each service or item ensures that the client is fully informed about what they are being charged for.

Professional Design and Consistency

A professional-looking document that follows a consistent format makes a positive impression on clients. It signals that you value your business relationship and are committed to professionalism in all aspects of your work. Consistency in layout and design can also make it easier for clients to read and understand the details.

- Branding: Use your company logo, brand colors, and consistent fonts to reinforce your brand identity.

- Easy Navigation: A simple layout with sections clearly marked for services, totals, taxes, and payment details helps clients quickly find the information they need.

By adopting these practices, you enhance communication with your clients, ensuring they are informed, confident, and satisfied with your work and the financial details associated with it.