AR Invoice FBDI Template in Oracle Fusion Guide

Efficient data management is critical for businesses aiming to streamline their financial processes. One of the most important tasks is the seamless transfer of transaction records into an enterprise resource planning (ERP) system. This process can often be complex, requiring precise mapping of fields and validation of data to ensure accuracy. By leveraging automation, organizations can reduce manual errors and improve the speed of operations.

One of the most effective methods for achieving this is through structured data import processes. These processes allow businesses to easily upload financial transactions from external sources into their ERP system, facilitating a smooth workflow. With the right approach, organizations can ensure that every transaction is recorded correctly, saving valuable time and reducing the risk of discrepancies in their financial records.

Automation tools designed for data imports are critical in managing high volumes of financial records. They enable businesses to maintain consistency and integrity in their accounting processes. However, understanding the setup, configuration, and troubleshooting of these tools is essential for achieving the desired outcomes. In this article, we will explore the essential aspects of configuring and utilizing such import processes effectively, offering practical insights to maximize their benefits.

Understanding AR Invoice FBDI Template in Oracle Fusion

In modern financial management systems, importing transaction records from external sources into the core system is a critical part of maintaining operational efficiency. A structured format is required to ensure data is mapped correctly, processed without errors, and seamlessly integrated into the platform. This process involves the use of specific files that adhere to predefined structures, allowing for easy data transfers and ensuring consistency across the system.

The key to managing this process is understanding the structure and components of the data file format used for importing. These files are designed to handle large amounts of transactional data, such as sales and payments, and must be configured to meet the requirements of the system. Proper setup of these import files ensures that records are properly categorized, validated, and transferred into the financial module of the system without disrupting the workflow.

Key Elements of the Import Process

Field Mapping is one of the most important elements to consider when preparing the import file. Fields must be accurately mapped from the source data to the corresponding fields in the ERP system to prevent errors or omissions during the import. A mismatch between fields can lead to inconsistencies and may require manual corrections, which defeats the purpose of automation.

Data Validation is equally essential. Before importing any file, it’s crucial to validate the data to ensure that it meets the system’s requirements. This step helps to identify any discrepancies or missing information, which can cause failures during the upload process. Ensuring data integrity at this stage saves time and reduces the need for troubleshooting later on.

Common Errors and Solutions

What is an FBDI Template?

In the context of financial systems, managing large sets of transaction data efficiently is essential for maintaining accurate records and ensuring smooth operations. To automate the process of transferring data from external sources into the system, businesses rely on structured data formats. These formats help ensure that information is properly formatted, validated, and mapped to the correct fields in the system, minimizing errors and reducing manual effort.

At the core of this process is a specialized file format that defines how data should be organized and presented for upload. This format acts as a bridge between the external data and the financial system, ensuring smooth integration. These files are essential for automating the data upload process, reducing the time spent on manual data entry, and ensuring accuracy in the financial records. The file structure includes several predefined fields that must be populated according to specific rules to ensure successful processing.

Purpose and Functionality

The main purpose of these files is to standardize the data import process. By adhering to a predefined structure, businesses can easily upload transactional records without worrying about format errors or missing fields. The format typically includes various data types, such as numbers, dates, and text, which are required by the system for proper classification and processing. This standardization reduces the likelihood of errors during import and helps ensure that the system can process the information correctly.

How Data is Organized

Data organization within these files is critical to their functionality. Fields must be aligned with the system’s specific requirements, and the data must adhere to strict formatting rules. For instance, numerical fields must be in a particular format, dates must follow a certain structure, and text entries must be consistent with the system’s expectations. This structured approach allows for seamless integration of data into the system without disrupting the existing workflows.

How Oracle Fusion Supports FBDI

For businesses seeking to streamline financial operations, integrating external data into an enterprise resource management system is a key step. To support this process, modern ERP platforms provide comprehensive tools that allow for seamless data importation, ensuring accuracy and efficiency. These platforms use structured file formats to facilitate the easy transfer of transaction data from external sources into the system.

One of the core features of these systems is their support for structured data files, which play a crucial role in ensuring that transaction information is correctly mapped and uploaded. The system supports a variety of import methods, making it easier for businesses to automate data processing, eliminate errors, and maintain accurate records. By providing predefined formats and built-in validation processes, the platform helps businesses manage large volumes of data with minimal manual intervention.

Key Features of System Support

The system provides several features that enhance the process of importing data, ensuring that each transaction is processed efficiently and without error. These include:

- Predefined File Formats: The platform offers a set of predefined file formats that are compatible with its structure. These formats ensure that data is organized correctly and is ready for processing.

- Data Mapping and Validation: Before importing data, the system performs automatic validation checks to ensure that all fields are correctly formatted and aligned with the system’s requirements.

- Error Handling: If any issues are detected during the import process, the system provides detailed error reports, allowing users to quickly address any discrepancies or missing data.

How the System Simplifies Data Management

By automating the data import process, the platform helps businesses reduce the complexity of managing large datasets. Users no longer need to manually input records, saving time and reducing the likelihood of human error. Key benefits include:

- Time Efficiency: Automated data imports reduce the time spent on manual data entry and verification.

- Data Accuracy: Predefined formats and validation rules minimize the chances of incorrect or missing data.

- Scalability: The system can handle large volumes of data, making it suitable for organizations of all sizes.

Overall, the integration of automated data processing features into the system significantly enhances efficiency, allowing businesses to focus on their core operations rather than spending time on manual data entry and error correction.

Step-by-Step Setup for AR Invoices

Setting up an automated data import process for financial records is crucial for maintaining accuracy and efficiency in accounting workflows. A well-configured import process ensures that transactional data flows seamlessly into the system, minimizing manual errors and reducing the time spent on administrative tasks. Proper setup requires careful attention to detail, including file format configuration, data mapping, and validation checks.

The process involves several key steps that guide users through the correct configuration of the necessary files, the mapping of data fields, and the testing of the system’s capabilities. By following each step closely, organizations can ensure that their financial data is correctly processed and integrated into the system, enabling them to maintain accurate records without unnecessary delays.

Step 1: Preparing the Data

The first step in the setup is gathering and preparing the data for import. This involves ensuring that all the necessary information–such as transaction details, dates, and amounts–is accurately captured in the appropriate format. It is essential to make sure that all records are complete and that any missing or incomplete data is addressed before the import process begins. This will prevent errors during the upload process and ensure the integrity of the data once it is integrated into the system.

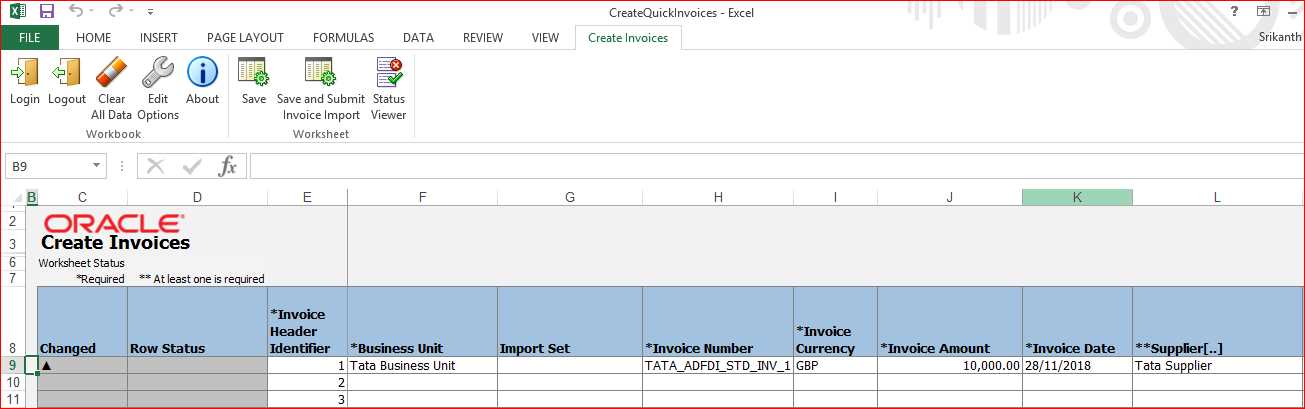

Step 2: Configuring the Import File

The second step is to configure the import file to match the required structure. The file must include the correct fields and data formats as specified by the system. This may include selecting appropriate column headings, defining data types, and ensuring that mandatory fields are included. Once the file is set up, it should be validated to check for any discrepancies in the formatting or missing information. This is a crucial step to avoid errors when uploading the file into the system.

Step 3: Mapping the Data

Data mapping is a critical part of the setup. This step involves linking the data from the import file to the corresponding fields in the system. Each column in the import file must be mapped to a specific field in the system to ensure that the information is correctly interpreted. It is essential to carefully review the mapping to avoid misalignment, which could result in incorrect data being processed or recorded.

Step 4: Testing the Import Process

Before performing a full-scale import, it is important to test the process with a small set of data. This allows users to verify that the data is correctly uploaded and mapped to the system without any issues. During testing, any errors or inconsistencies should be addressed, and the file may need to be adjusted based on feedback from the system. Once the test import is successful, the process can be repeated with the full dataset.

Step 5: Finalizing the Import

After successful testing, the final step is to perform the full import. The system will process the data, applying the necessary validations and mappings. Upon completion, users should verify that all records have been successfully uploaded and that the data appears correctly in the system. If any issues arise, they should be reviewed and corrected before completing the process.

By following these steps, businesses can ensure a smooth, efficient import process, reducing the risk of errors and enhancing the accuracy of their financial records.

Key Fields in AR Invoice FBDI Template

When preparing data for the accounts receivable process, it is essential to accurately map the key information into the appropriate fields. Each field corresponds to specific details that enable the smooth processing of transactions within the financial system. Understanding these fields is crucial for ensuring the integrity and efficiency of the overall process.

Here are some of the most important fields that need to be populated:

- Transaction Type: Defines the nature of the financial transaction, whether it’s a sale, return, or other types.

- Customer Name: Identifies the customer associated with the transaction, typically using a unique identifier or customer name.

- Amount: Specifies the monetary value of the transaction, excluding taxes and discounts.

- Currency Code: Indicates the currency used for the transaction, ensuring compatibility with financial systems worldwide.

- Due Date: Represents the date by which payment is expected, assisting in the management of payment terms.

- Payment Method: Describes the method used for payment, such as credit card, bank transfer, or check.

- Account Code: Links the transaction to the appropriate financial account, ensuring accurate bookkeeping.

- Tax Information: Contains details regarding the applicable taxes, such as the tax rate or tax amount applied to the transaction.

By accurately filling out these fields, businesses can streamline their financial operations and reduce the risk of errors or delays in processing financial transactions.

Common Challenges in AR Invoice Processing

Processing financial transactions efficiently requires addressing various hurdles that can impede accuracy and timely completion. These challenges often arise due to incomplete or incorrect data, system integration issues, and misalignment between departments. Recognizing and resolving these issues is vital to ensure smooth operations and avoid delays in processing.

Data Accuracy Issues

One of the most common challenges in managing financial transactions is ensuring the accuracy of data entered into the system. Even small errors, such as incorrect customer details or missing payment terms, can lead to discrepancies and payment delays.

Integration and System Compatibility

Another significant challenge is the integration of data across multiple systems. Incompatible software and manual intervention can result in data loss or misinterpretation, affecting the entire workflow.

| Challenge | Impact | Solution |

|---|---|---|

| Data Entry Errors | Delays in processing, inaccurate reporting, potential financial discrepancies | Implement automated validation checks and double-entry systems |

| System Integration | Inconsistent data flow, delays in transaction processing | Ensure seamless integration between systems and invest in API solutions |

| Missing Information | Inability to match payments to accounts, extended resolution time | Establish clear data entry protocols and regular audits |

Addressing these challenges proactively can greatly improve the efficiency and accuracy of financial transaction processing, leading to better cash flow management and customer satisfaction.

FBDI Template Formats for Oracle Fusion

When preparing data for bulk processing, selecting the correct format for each file is crucial to ensure smooth integration and processing within financial systems. These formats are designed to capture essential details and align with system requirements, making data import and export efficient and error-free. Understanding these formats helps avoid common issues such as data mismatches and incomplete uploads.

Standard Formats for Data Import

There are specific formats designed for transferring various types of financial information. These formats are structured to ensure that each piece of data aligns with the system’s expectations, minimizing errors and improving the overall workflow.

- CSV (Comma Separated Values): The most common format for importing large datasets, with each field separated by a comma.

- Excel (XLSX): A flexible format for more complex data, often used when importing detailed transaction records and reports.

- Flat File (TXT): A plain text format, typically used for legacy system integrations or when dealing with large amounts of unformatted data.

Mapping Fields to System Requirements

Accurate field mapping is necessary to ensure that the data flows correctly into the system. Each field in the input file must correspond to the correct field in the destination system, whether it’s customer information, transaction amounts, or payment terms.

- Transaction Reference Number: The unique identifier for each transaction, ensuring it can be traced through the system.

- Customer Information: This includes fields such as name, address, and customer ID, which are required to associate data with the right account.

- Amount Details: Precise figures for the transaction, including taxes and discounts, which must align with the system’s accounting practices.

- Payment Terms: The agreed-upon payment terms such as due dates, early payment discounts, and late fees.

By carefully selecting the appropriate format and ensuring proper mapping, businesses can streamline their data processing and improve the efficiency of their financial workflows.

Data Mapping in AR Invoice Template

Data mapping is a critical step in ensuring that all required fields are correctly aligned with the corresponding elements in the financial system. This process involves matching data from external files with the system’s internal structure, allowing for accurate processing and reporting. Proper mapping reduces errors, ensures consistency, and helps maintain the integrity of financial data throughout the workflow.

Key Components of Data Mapping

The mapping process involves several key elements that need to be accurately aligned to ensure smooth integration. Each data field in the input file should directly correspond to the appropriate field in the target system, with no mismatches or missing information.

- Transaction Details: Data such as transaction type, amount, and reference number must be mapped correctly to facilitate accurate reporting and tracking.

- Customer Information: It is crucial to align customer-related fields, such as customer ID, name, and contact details, with the corresponding entries in the system.

- Payment Terms: Mapping payment terms, including due dates and discounts, ensures that the system reflects the correct payment schedule and conditions.

- Tax Information: Fields for tax rates, taxable amounts, and tax codes must be carefully matched to ensure accurate tax calculations and reporting.

Best Practices for Data Mapping

Following best practices in data mapping can significantly improve the accuracy and efficiency of the process. These practices help minimize common mistakes and ensure that data flows smoothly between systems.

- Standardize Field Names: Ensure that the field names in the input file match the standard naming conventions used by the system to avoid confusion.

- Use Validation Rules: Implement automated checks to ensure that all fields contain valid data, such as ensuring numeric fields do not contain text or that required fields are not left blank.

- Test the Mapping: Before processing large datasets, conduct tests with a small sample to verify that all mappings are correct and data flows smoothly through the system.

- Maintain Documentation: Keep detailed records of the mapping process, including field definitions and transformation rules, to ensure consistency and facilitate future updates.

By carefully mapping data and following best practices, organizations can ensure accurate financial processing and improve the overall efficiency of their operations.

Best Practices for Using FBDI Templates

When preparing data for bulk system processing, following established best practices can significantly reduce errors and ensure smooth integration. Proper preparation, accuracy in data entry, and adherence to system requirements are essential for achieving reliable results and preventing costly mistakes during processing.

Ensuring Accurate Data Entry

One of the most crucial steps when using data import files is ensuring that all information is accurate and complete. Even small mistakes, such as incorrect field entries or missing data, can disrupt the entire process. Here are key practices to follow:

- Double-check the data: Before uploading, carefully review the data for errors. Ensure that each field is filled in correctly and completely.

- Validate formats: Confirm that the data follows the required format for each field (e.g., dates, numeric values, and customer IDs). Incorrect formats can lead to failed imports.

- Use pre-defined templates: Whenever possible, utilize the standard templates provided by the system, as they are designed to meet specific requirements and minimize human error.

Optimizing File Organization

Properly organizing your data files is critical for streamlining the import process and ensuring everything is properly matched in the system. Follow these recommendations:

- Label files clearly: Use consistent naming conventions for your files to avoid confusion. Ensure that each file name reflects its content and purpose.

- Split large files: If your data set is very large, consider splitting the files into smaller, more manageable parts. This will help prevent errors caused by file size limitations and improve upload efficiency.

- Backup your data: Before uploading any files into the system, make sure to keep backup copies. This will help you recover quickly in case of a mistake or system failure.

By following these best practices, businesses can improve the reliability and efficiency of their data processing efforts, reduce errors, and enhance overall operational productivity.

Uploading AR Invoices in Oracle Fusion

Uploading financial transaction records into a system requires careful preparation and adherence to specific steps to ensure smooth data processing. This process involves importing transaction data into the system using structured files, ensuring that all required details are captured and correctly mapped for proper accounting and reporting.

Preparing Data for Upload

Before beginning the upload process, it is essential to ensure that the data is complete, accurate, and formatted correctly. Follow these steps for proper preparation:

- Verify all fields: Double-check that all required fields are populated, including transaction amounts, customer details, and payment terms.

- Ensure correct file format: Make sure the data file is in the appropriate format, such as CSV or Excel, that the system can recognize and process efficiently.

- Data validation: Validate that all entries conform to the system’s rules, including date formats, numeric values, and currency codes.

Steps to Upload Data

Once the data is ready, follow these steps to upload it into the system:

- Navigate to the import section: Access the area of the system where data imports are handled.

- Upload the file: Select the prepared file from your local system and upload it into the platform. The system will automatically begin processing the data.

- Monitor progress: Track the upload status and ensure that no errors are encountered during the process. Many systems will provide feedback on the success or failure of the upload.

Following these steps and ensuring that data is correctly prepared and formatted will result in a seamless upload, minimizing errors and improving operational efficiency.

Validating AR Invoice Data in Oracle Fusion

Ensuring that the financial data entered into the system is accurate and complete is a critical step in preventing errors during processing. Validation checks help identify inconsistencies, missing fields, and incorrect formats, ensuring that all transaction records conform to the system’s requirements before they are processed.

Data validation typically involves verifying that all required fields are filled out correctly, checking for formatting errors, and ensuring that there are no discrepancies between related data points. This step is essential for maintaining the integrity of the financial system and preventing costly mistakes.

Common validation tasks include:

- Field Completeness: Ensuring that all necessary fields, such as transaction amounts, customer details, and payment terms, are populated.

- Correct Format: Checking that fields are in the correct format (e.g., date formats, numeric values, and currency codes).

- Cross-field Validation: Verifying that related fields, such as amounts and taxes, align properly to avoid calculation discrepancies.

- Duplicate Entries: Identifying and removing any duplicate records to ensure that each transaction is unique.

By implementing robust validation checks, organizations can significantly reduce the risk of errors, streamline data processing, and improve overall operational efficiency.

How to Troubleshoot AR Invoice Errors

When processing financial records, errors can occasionally occur, disrupting workflows and delaying transactions. Identifying and resolving these issues quickly is essential to maintaining smooth operations. Effective troubleshooting involves carefully analyzing error messages, reviewing data inputs, and checking system logs to identify the root cause of the problem.

Below are common types of errors and steps for addressing them:

| Error Type | Possible Causes | Solutions |

|---|---|---|

| Missing Data | Required fields like customer details or transaction amounts are empty. | Review the data input to ensure all mandatory fields are filled correctly. |

| Incorrect Format | Data entered is in an unsupported format (e.g., wrong date format or non-numeric characters). | Verify that all fields follow the required format as specified by the system. |

| Field Mismatch | Related fields such as amounts and tax rates do not align or are inconsistent. | Check the relationships between fields to ensure that amounts and taxes are properly calculated. |

| Duplicate Records | Entries are being duplicated, leading to multiple records for the same transaction. | Run a check for duplicate records and remove any unnecessary repetitions. |

By following these troubleshooting steps, users can address common issues and restore the integrity of the data processing workflow. If the problem persists, further investigation may be required, such as reviewing system logs or consulting with technical support for more complex issues.

Understanding AR Invoice Import Logs

Import logs are essential tools for tracking the success or failure of data uploads into a system. They provide a detailed record of each operation, highlighting any issues that may have occurred during the process. These logs help users diagnose problems, monitor data transfers, and ensure that all records have been successfully processed or identify errors that need attention.

Key Information in Import Logs

The import log contains vital information that helps users troubleshoot issues efficiently. Key sections of an import log typically include:

- Timestamp: The date and time when the data import was attempted, helping to track and monitor processes.

- Status: Indicates whether the operation was successful or encountered errors. It may show messages such as “Completed,” “Failed,” or “Pending.”

- Error Details: If an error occurred, the log will provide specific messages or codes related to the problem, such as missing data or formatting issues.

- Record Count: Shows the number of records processed and any discrepancies between the number of records submitted and those successfully uploaded.

How to Interpret Import Log Errors

Understanding and interpreting the information in import logs is crucial for resolving errors efficiently. Here’s how you can address common issues:

- Missing Fields: If the log indicates missing data, review the input file to ensure that all required fields are properly filled.

- Incorrect Data Format: If errors indicate that data formats are incorrect (e.g., incorrect date formats or invalid characters), adjust the format in the input file to meet system specifications.

- Data Mismatch: Logs may report inconsistencies between related fields (e.g., amount discrepancies). Double-check related fields to ensure they align correctly before uploading again.

By carefully reviewing and interpreting import logs, users can quickly identify and resolve issues, ensuring that data is successfully uploaded into the system with minimal delays.

Automating Invoice Processing with FBDI

Automating the processing of financial records can greatly improve efficiency, reduce manual errors, and ensure faster data handling. By utilizing automated import tools, businesses can streamline the flow of transaction data from external sources into their accounting systems, eliminating the need for time-consuming manual entries and decreasing the likelihood of mistakes.

Steps to Automate Data Processing

To fully automate the process, certain key steps should be followed to ensure the data is correctly captured and transferred to the system without errors:

- Data Preparation: Ensure that all external data sources are formatted according to the system’s requirements. This includes organizing the data into structured files with the correct fields and formats.

- System Integration: Set up automated import processes that connect external data sources directly to the system. This may involve using pre-configured file formats that are accepted by the platform.

- Scheduling Imports: Set up regular schedules for data imports, allowing for automated processing of records without requiring manual intervention.

- Monitoring and Error Handling: Even with automation, monitoring tools should be in place to quickly identify any errors or discrepancies in the import process. Logs can help flag issues that need manual attention.

Benefits of Automating Data Imports

Automating the transfer of transaction data offers numerous advantages:

| Benefit | Explanation |

|---|---|

| Reduced Manual Effort | Automation eliminates the need for manual data entry, saving time and reducing human errors. |

| Improved Data Accuracy | Automated processes ensure data consistency and accuracy, preventing common mistakes caused by manual entry. |

| Faster Processing | Automating imports speeds up the overall data processing time, enabling quicker financial reporting and decision-making. |

| Scalability | Automated systems can easily handle large volumes of data, making it easier to scale operations without increasing manual workload. |

By automating the data import process, businesses can ensure greater efficiency, minimize errors, and improve the overall speed of their financial operations.

Integrating AR Invoices with Other Modules

Integrating financial records with other business functions can create a seamless flow of data across different systems, ensuring that all departments work with consistent and up-to-date information. By linking accounts-related data with inventory, procurement, and other operational modules, organizations can streamline workflows, reduce errors, and improve decision-making capabilities.

To successfully integrate transaction records with other modules, certain key steps should be followed:

- Data Synchronization: Ensure that data across modules remains synchronized to avoid discrepancies. This may involve real-time updates or periodic data transfers between systems.

- Cross-Module Workflows: Develop workflows that allow different departments to collaborate on the same data sets. For example, linking sales orders with billing processes can reduce redundant work.

- Automated Data Transfers: Use automated tools to facilitate data transfers between modules, ensuring that records are updated in all systems simultaneously without requiring manual intervention.

- Consistency in Formats: Ensure that data formats are consistent across modules, so information flows smoothly from one system to another without issues.

Commonly integrated modules include:

- Inventory Management: Sync sales or delivery data with inventory records to track stock levels and prevent over-ordering or under-stock situations.

- Procurement: Link purchase orders and supplier invoices with payment and financial records to streamline purchasing workflows and ensure accurate financial reporting.

- Customer Relationship Management (CRM): Integrate customer data with financial records to ensure accurate tracking of payments, billing, and customer history.

- General Ledger: Ensure that financial data from various modules is accurately reflected in the general ledger for comprehensive financial reporting.

Integrating accounts-related data with other business functions enhances efficiency, improves communication between departments, and enables better overall management of resources. By maintaining smooth data flow between systems, organizations can make more informed decisions and improve operational effectiveness.

Security Considerations in AR Invoice Processing

In any financial data handling process, ensuring the security and integrity of information is crucial. Protecting sensitive transaction data, preventing unauthorized access, and ensuring data confidentiality are key components of a robust security strategy. By implementing secure procedures throughout the transaction processing workflow, organizations can mitigate risks and comply with industry standards.

There are several critical security considerations when handling transaction data:

- Access Control: Limiting access to sensitive data is one of the first lines of defense. Only authorized personnel should have permission to modify or view confidential information. Role-based access control ensures that users only have access to the data necessary for their tasks.

- Data Encryption: Encrypting sensitive data both in transit and at rest helps protect information from unauthorized access during data transfers or while stored in databases. This ensures that even if data is intercepted, it cannot be read without the proper decryption keys.

- Audit Trails: Maintaining a detailed log of all actions taken within the system allows organizations to track changes and identify any suspicious activity. Regular audits of these logs help identify vulnerabilities and improve data security.

- Data Masking: Masking sensitive information ensures that only authorized users can view complete data. For example, displaying partial customer details while hiding confidential information can prevent unauthorized users from accessing critical information.

Best Practices for Securing Transaction Data

Following industry-standard practices is essential for maintaining data security:

| Practice | Explanation |

|---|---|

| Two-Factor Authentication (2FA) | Requiring users to authenticate using two methods–such as a password and a one-time code sent to their phone–adds an extra layer of security. |

| Secure File Transfer Protocols | Use encrypted file transfer protocols like SFTP or HTTPS to ensure that data transmitted over networks is protected from unauthorized interception. |

| Regular Security Training | Employees should be trained on the latest security threats, such as phishing attacks, and taught how to handle data securely to avoid unintentional breaches. |

| Data Backups | Regularly back up all financial data to secure locations to prevent data loss in the event of an attack, hardware failure, or other emergencies. |

By adopting strong security practices, organizations can safeguard financial data, reduce risks of fraud, and ensure compliance with regulatory standards.

Future Updates to Oracle Fusion FBDI Templates

As businesses continue to evolve and adopt new technologies, it is important for data processing systems to adapt as well. Upcoming updates to data import tools will focus on enhancing efficiency, improving user experience, and integrating emerging technologies. These changes are designed to streamline processes and accommodate evolving business needs.

Future enhancements may include:

Improved Data Validation and Error Handling

- Automated Error Detection: Future updates are expected to provide advanced error detection mechanisms, which will help identify issues in the data faster and more accurately.

- Intelligent Data Mapping: New tools may offer smarter, context-aware data mapping to ensure that information is correctly aligned with the target fields, reducing the likelihood of errors during the import process.

- Enhanced User Feedback: Clearer and more actionable error messages will allow users to quickly understand and resolve issues without the need for extensive troubleshooting.

Integration with Emerging Technologies

- AI and Machine Learning: Future updates could leverage artificial intelligence to enhance decision-making in data processing. Machine learning algorithms may be implemented to predict and automate certain aspects of data handling based on historical trends.

- Cloud Integration: As cloud computing continues to gain prominence, future updates may offer deeper integration with cloud-based services, enabling easier data synchronization and scalability.

- Blockchain for Transparency: For greater transparency and security, blockchain technology might be introduced to ensure that every transaction and data exchange is immutably recorded and auditable.

These anticipated updates are designed to provide businesses with more powerful and flexible tools, ultimately improving data accuracy, reducing manual intervention, and increasing operational efficiency.