How to Use an Apartment Invoice Template for Simple and Professional Billing

When managing rental properties, ensuring smooth and accurate financial transactions is crucial for both landlords and tenants. One of the most important aspects of property management is creating clear and professional documents that outline payment expectations. These documents help to avoid misunderstandings and ensure timely payments, making the process more organized and streamlined for all parties involved.

By using a well-structured document for billing purposes, property owners can easily track payments, apply additional fees, and maintain a professional relationship with tenants. A properly designed form not only simplifies communication but also provides a reliable record for both the landlord and the renter. Customizable solutions make it possible to adapt the content to various property types, payment structures, and local legal requirements.

In this guide, we will explore the key features of a billing document, offer tips for customization, and highlight the best practices to ensure that the payment process is both clear and efficient. Whether you’re managing a single unit or an extensive portfolio, having a professional system in place is essential for success.

Apartment Invoice Template Overview

In property management, having a structured document for billing is essential for smooth transactions between landlords and tenants. This document serves as an official record that outlines the financial details of each rental period, ensuring transparency and reducing the risk of misunderstandings. Whether you’re handling monthly rent or additional charges, creating a clear, professional statement helps establish trust and accountability.

Such a billing tool can be customized to fit the specific needs of each rental situation. From setting up payment terms to detailing services and extra fees, having a reliable framework simplifies the administrative side of property management. A well-crafted document makes it easier for both parties to track payments and manage finances efficiently.

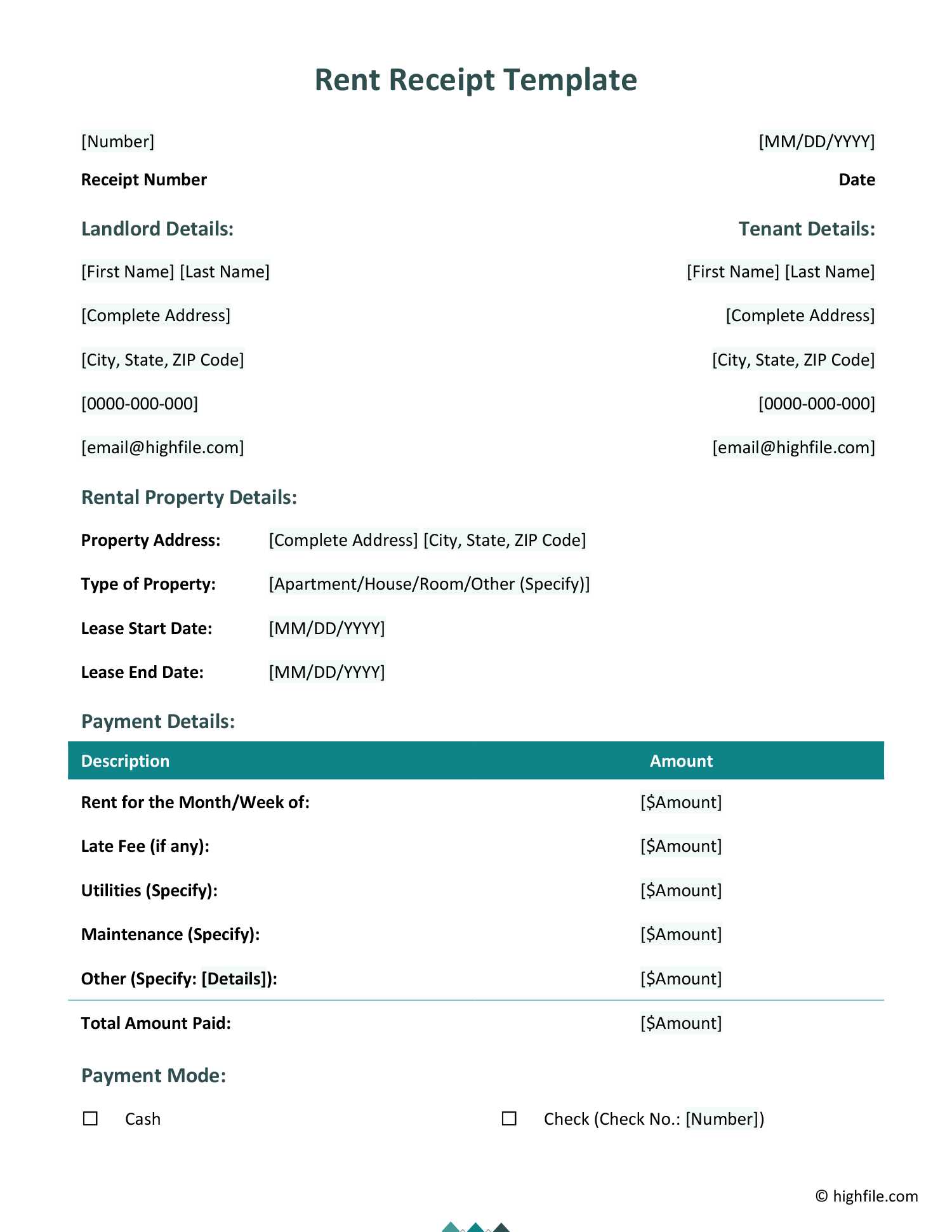

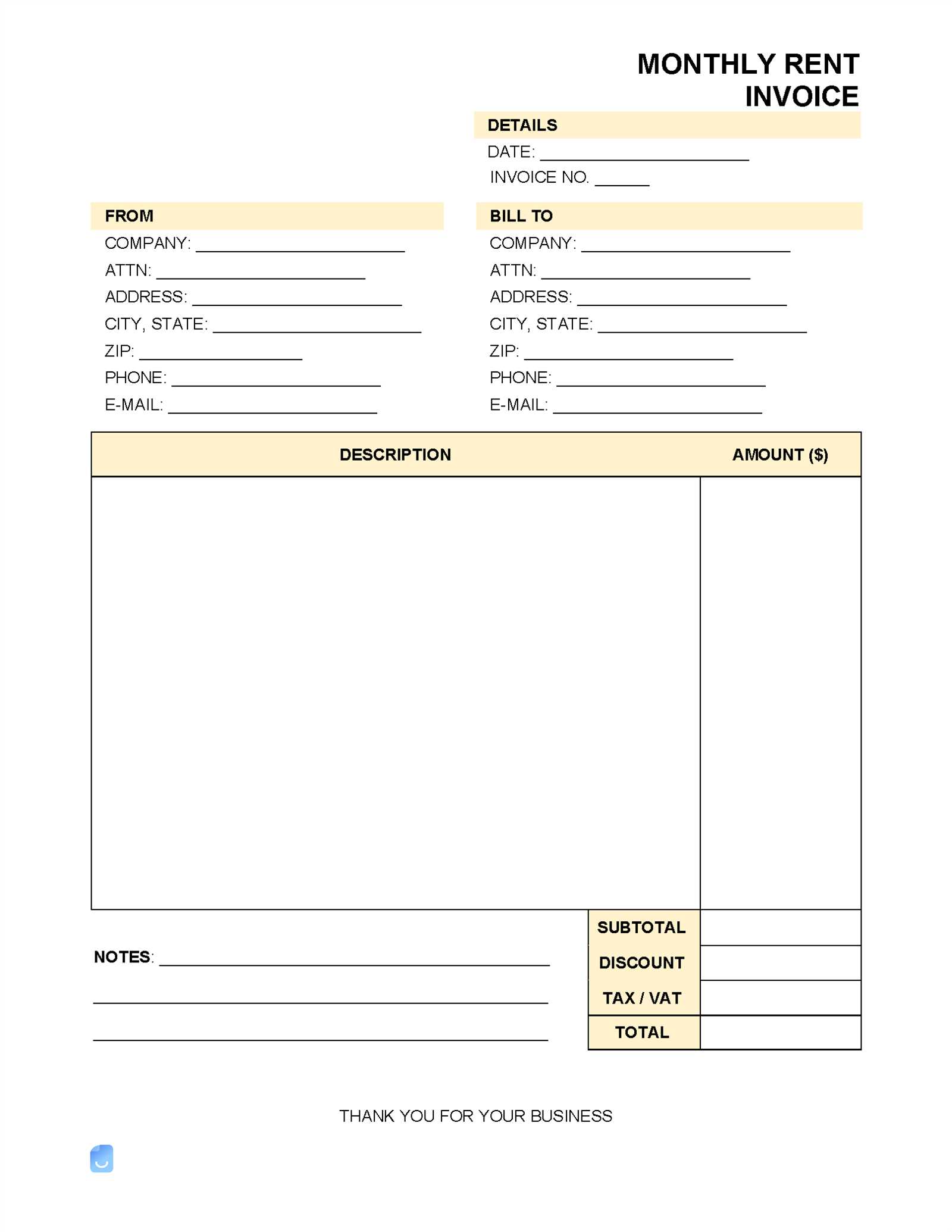

Core Features of a Billing Document

Typically, these documents include fields for essential information such as tenant details, rental period, total amount due, and payment instructions. They may also accommodate additional fees like maintenance costs or utilities, providing a comprehensive overview of the charges. Ensuring all relevant details are included in one place helps avoid confusion and ensures both the property owner and tenant are on the same page.

Customizing the Document for Specific Needs

The flexibility of such a tool lies in its ability to be tailored to various types of rental agreements. Whether for short-term leases, long-term contracts, or even furnished rentals, these documents can be adapted to reflect specific payment schedules, discounts, and other terms unique to each arrangement. This customization not only improves the accuracy of billing but also enhances the overall professionalism of the rental process.

Why Use an Apartment Invoice Template

In property management, maintaining an organized approach to billing is key to ensuring smooth and efficient financial transactions. Using a standardized form for charging tenants helps avoid errors, delays, and confusion. With a clear structure in place, both property owners and tenants have a transparent understanding of what is owed, when, and for what services or charges. This not only saves time but also strengthens the professional relationship between the two parties.

By leveraging a predefined billing structure, landlords can streamline the process and ensure that all necessary information is included, leaving no room for omissions or misunderstandings. Whether managing a few units or an entire portfolio, this method helps to keep everything consistent and reduces administrative burdens.

Improved Accuracy and Consistency

A structured document ensures that every transaction follows the same format, which improves both accuracy and consistency in billing. The set format eliminates the chance of forgetting important details, such as the rental period or extra charges. It provides clear breakdowns of payments, allowing tenants to easily review their charges and for property owners to track payments over time.

Time and Cost Efficiency

Using a pre-designed system not only saves time but also reduces the need for expensive accounting software or manual calculations. A customizable form can be easily adjusted to include unique terms or payment schedules for different tenants, which increases the efficiency of the entire billing process. This leads to faster payment cycles, fewer disputes, and lower operational costs.

Benefits of Customizing Your Invoice

Customizing your billing documents offers numerous advantages that can enhance both efficiency and professionalism in property management. Tailoring each document to meet specific needs ensures clarity and reduces errors, making it easier for both landlords and tenants to understand payment expectations. The ability to adjust content to suit unique agreements or properties helps maintain a streamlined and professional process.

- Reflects Unique Terms: Each rental situation may have different conditions, such as payment schedules, late fees, or additional services. Customization allows for these specifics to be clearly communicated on the document.

- Improves Accuracy: Tailoring the document ensures that all relevant details are included, from the rental period to extra charges. This reduces the likelihood of mistakes and misunderstandings.

- Professional Appearance: A well-designed, customized form gives the impression of organization and professionalism, which can foster better relationships with tenants.

- Efficiency in Management: With pre-defined fields that can be adjusted as needed, customizing billing documents saves time and eliminates redundant work, especially for landlords managing multiple properties.

- Branding Opportunities: Custom forms provide an opportunity to incorporate branding elements, such as logos or company names, further establishing a professional identity.

By taking the time to tailor these documents, property managers can ensure both accuracy and professionalism, leading to smoother transactions and better communication with tenants.

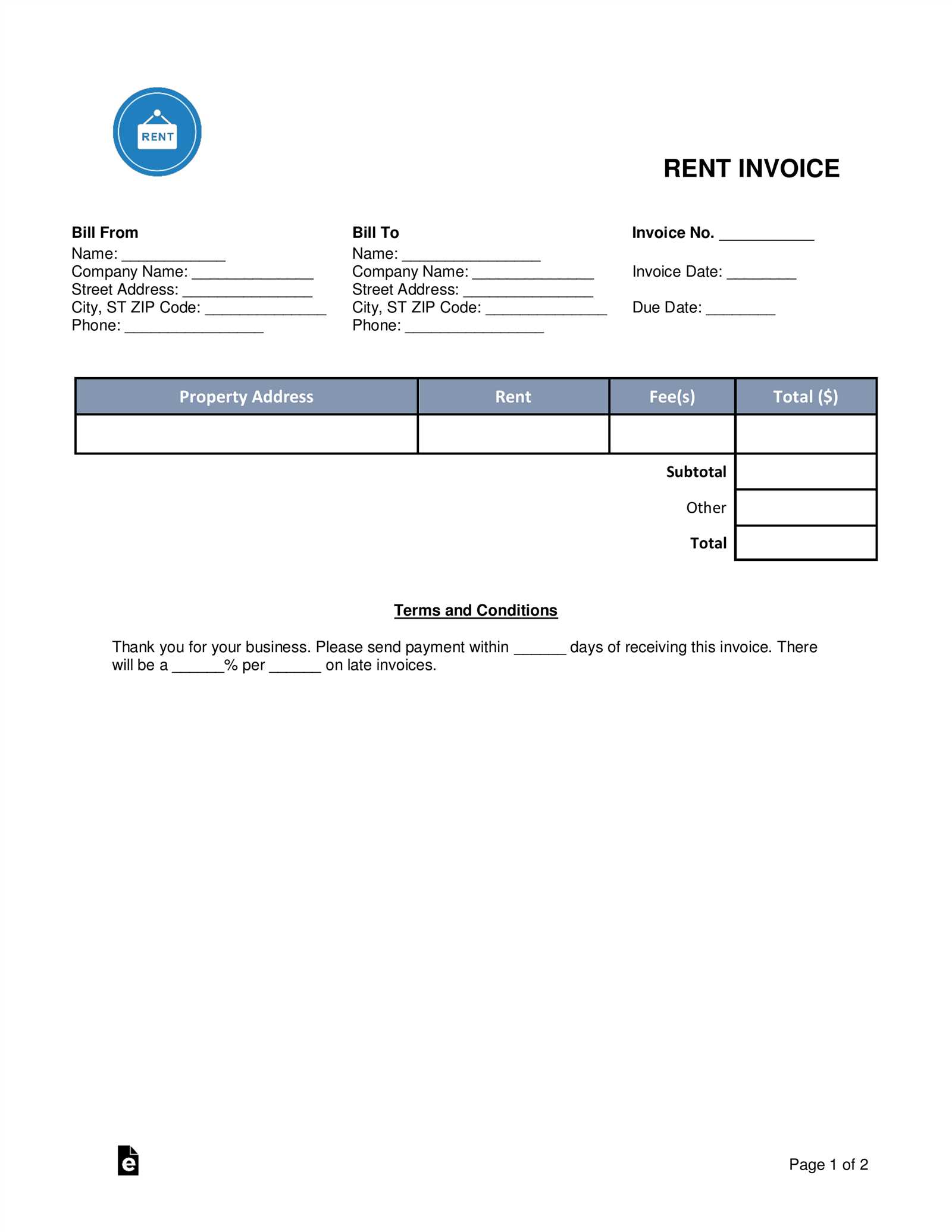

Key Elements of an Apartment Invoice

For rental transactions to be clear and transparent, it’s important to include essential details in any billing document. A well-structured record of charges ensures that both the property owner and tenant understand the amount due, the payment terms, and the services provided. By incorporating all the necessary elements, the document serves as an accurate reference for both parties and reduces the potential for disputes.

Basic Information to Include

At the core of any billing statement, certain details are essential to ensure clarity and accuracy. These basic elements should always be included:

- Tenant Information: The name, address, and contact details of the tenant receiving the bill.

- Landlord Details: The property owner’s name, address, and contact information.

- Rental Period: The time frame the charges cover, such as the start and end dates of the billing cycle.

- Total Amount Due: The full sum owed, including any base rent and additional fees or adjustments.

Additional Charges and Notes

In addition to the basic information, other key elements ensure a complete and comprehensive document:

- Extra Fees: Any additional charges, such as maintenance, utilities, or late fees, should be itemized separately for transparency.

- Payment Terms: Clear instructions on how and when payment should be made, including acceptable methods and any penalties for late payments.

- Notes or Instructions: Specia

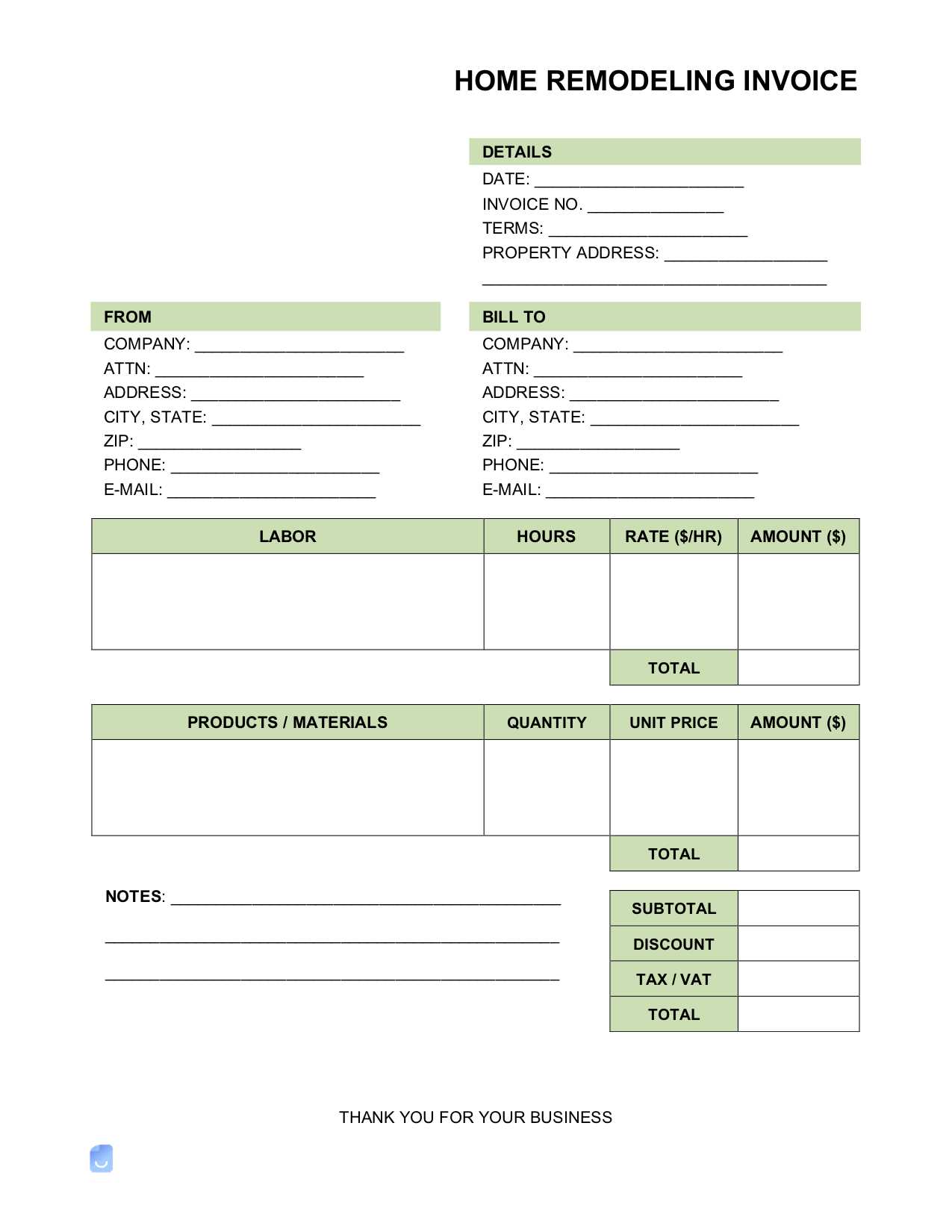

How to Create a Simple Invoice

Creating a straightforward document for billing purposes is a simple process that requires careful attention to detail. This document serves as a formal request for payment, outlining the services or goods provided, their respective costs, and the terms for settling the amount due. By including all necessary information in a clear and organized manner, you can ensure smooth transactions and avoid misunderstandings between parties.

The first step is to include a header with essential details such as the recipient’s name, address, and contact information. This is crucial for proper identification and correspondence. You should also specify your own business or personal contact details to ensure the recipient knows who to reach out to for any queries.

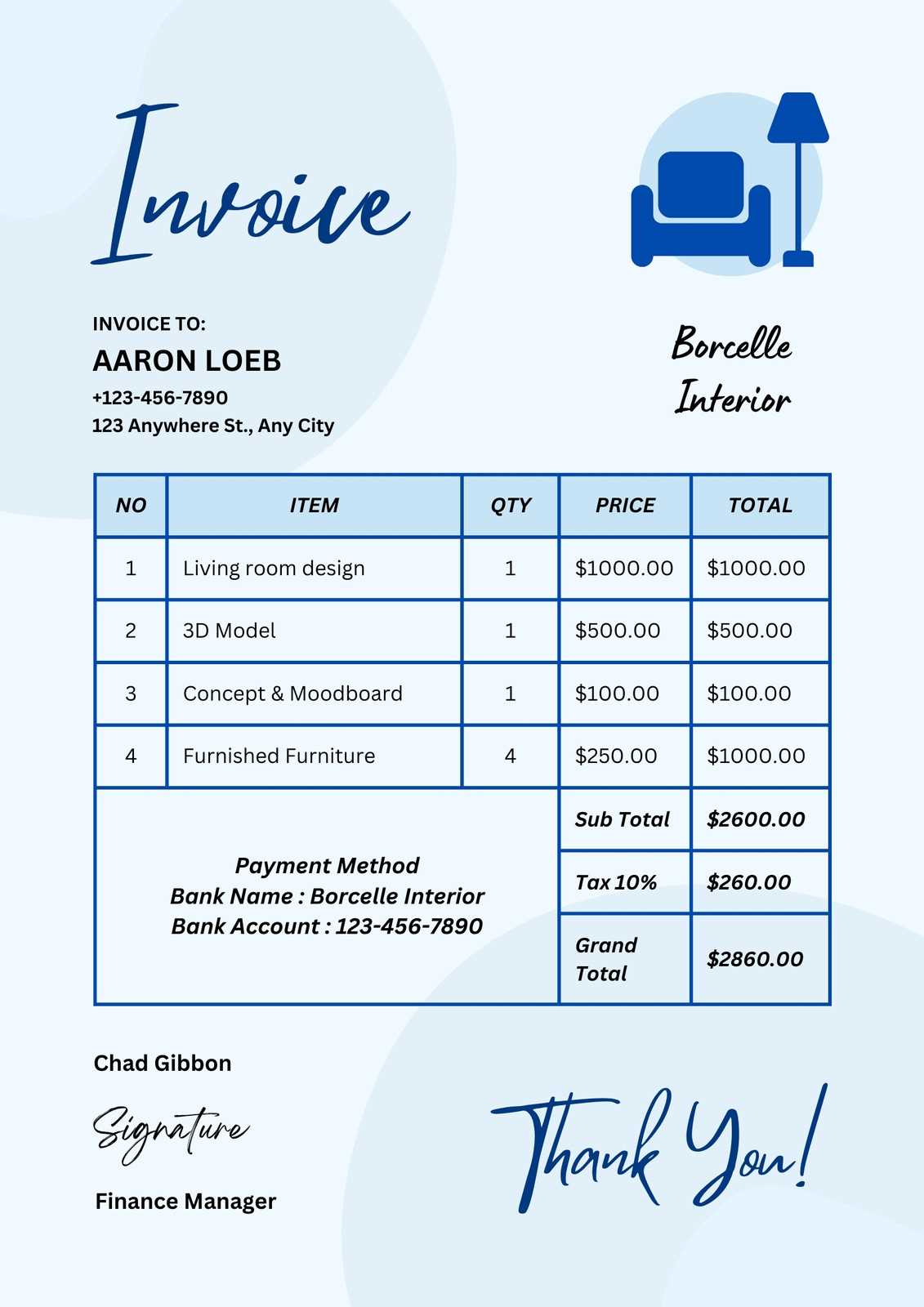

Next, clearly list the items or services provided. For each, include a brief description, the quantity, and the rate or unit price. Make sure to calculate the total amount due, adding any taxes or additional fees if applicable. The breakdown should be transparent and easy to follow.

Don’t forget to specify payment terms, including the due date and acceptable methods of payment. This helps set clear expectations for when and how the amount should be settled. You can also add a thank you note or a short reminder about the payment terms, enhancing professionalism and encouraging timely payment.

Finally, double-check the document for accuracy before sending it to the recipient. A well-prepared billing document fosters trust and promotes smooth financial transactions.

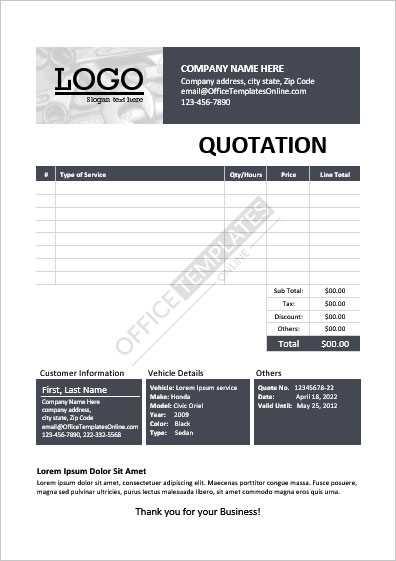

Choosing the Right Invoice Format

Selecting the appropriate structure for your billing document is essential for ensuring clarity and professionalism. The right format not only makes it easier for both parties to understand the terms of payment but also helps avoid any confusion or delays. A well-organized billing sheet reflects positively on your business and fosters trust with clients or customers.

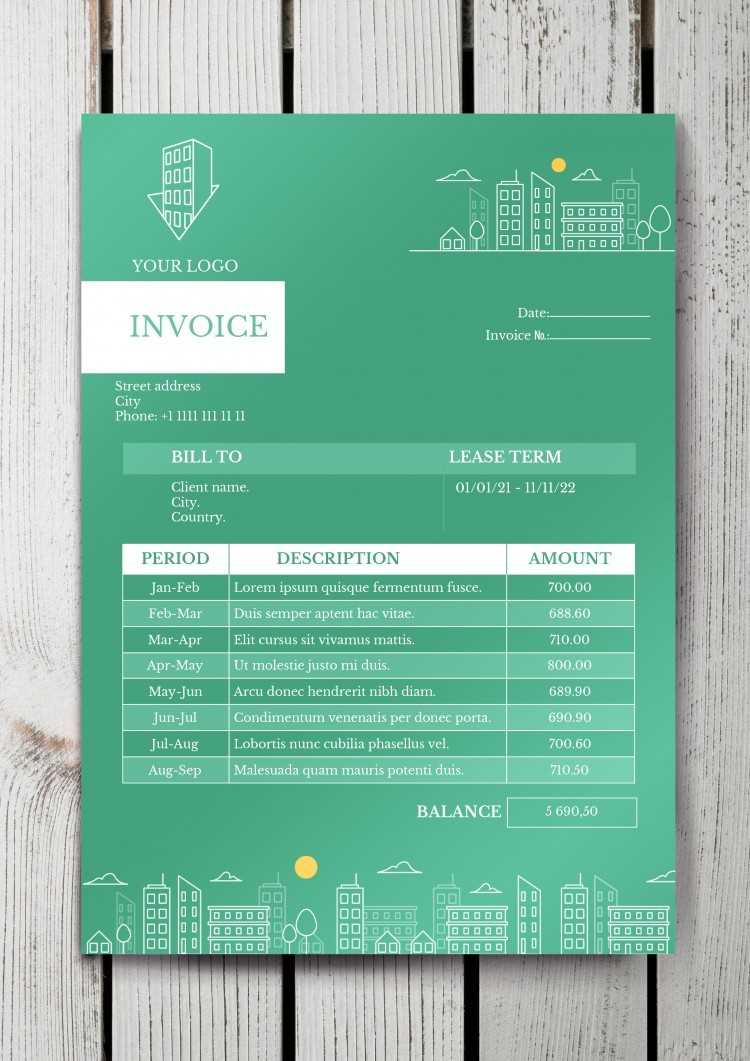

Simple vs. Detailed Layout

The format you choose should depend on the nature of the transaction. If the exchange is straightforward, with minimal items or services, a simple structure will suffice. This typically includes basic information such as the date, a brief description of the provided goods or services, and the total amount due. On the other hand, if the transaction involves multiple items, discounts, or additional charges, a more detailed layout will help break down each element clearly, ensuring transparency and accuracy.

Digital vs. Printed Formats

Another consideration is whether to use a digital or printed format. A digital version offers convenience, especially for online transactions, and can be easily shared or stored. It also allows for automation, making it quicker to generate documents. Printed formats may still be necessary in certain situations, such as for formal agreements or when a hard copy is required for records. The choice depends on your business practices and the preferences of your clients.

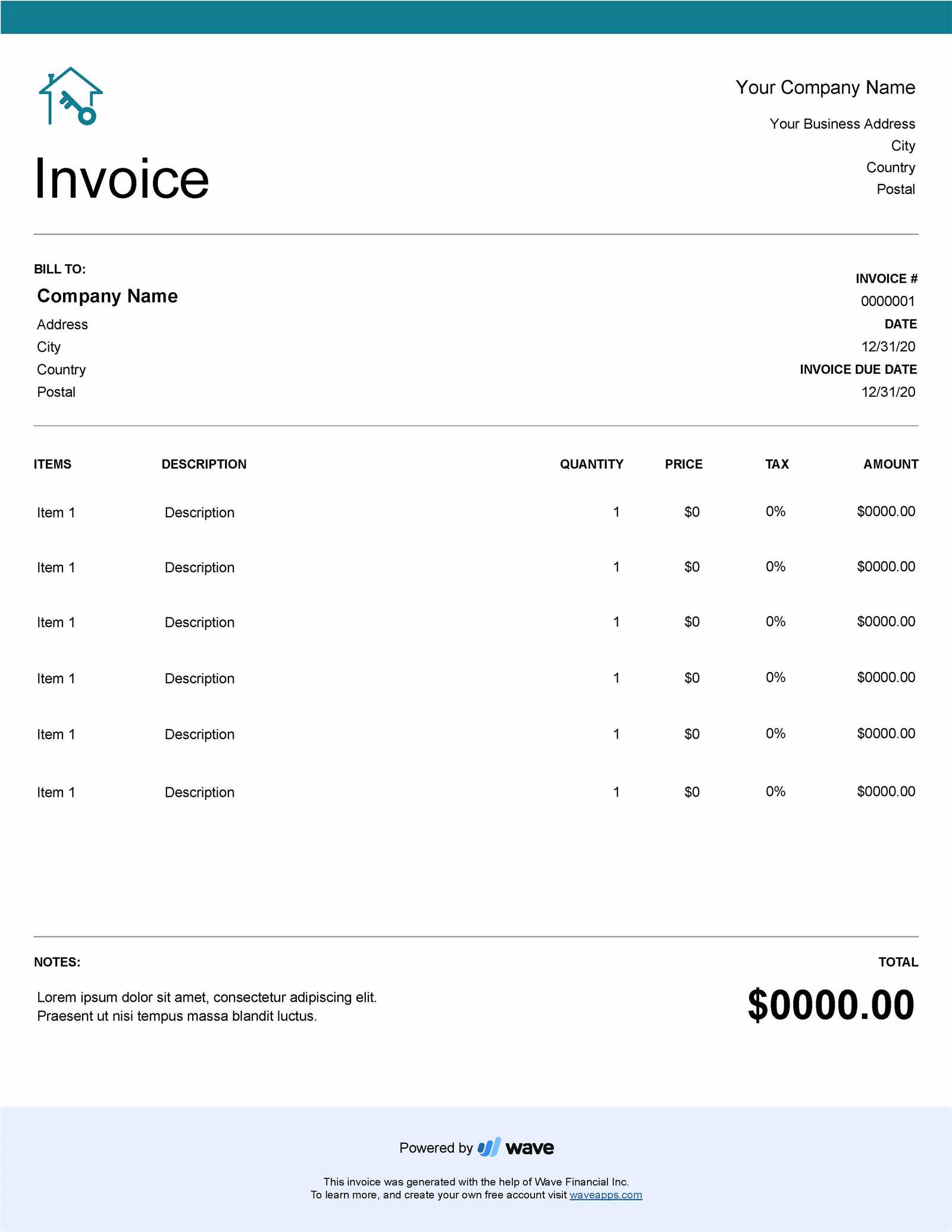

Essential Information to Include in the Template

When creating a billing document, it’s crucial to ensure that all necessary details are clearly presented. Including the right information not only helps maintain transparency but also ensures that both parties are on the same page regarding the transaction. A comprehensive and well-structured document can streamline the payment process and reduce the risk of misunderstandings.

Key Contact Details

Start by including the essential contact information for both parties. This typically consists of the name, address, and contact numbers for both the service provider and the recipient. This ensures that either party can easily reach out in case of questions or concerns. Additionally, providing email addresses can facilitate faster communication, especially for digital transactions.

Clear Description of Goods or Services

It’s important to provide a clear breakdown of the goods or services that were provided. For each item or service, include a brief description, the quantity, and the price. This level of detail prevents confusion and allows the recipient to verify the charges. If applicable, include any additional charges, such as taxes or handling fees, to ensure the total amount due is fully understood.

Lastly, specify the payment terms, such as the due date, accepted methods of payment, and any late fees if applicable. This helps set clear expectations and encourages prompt payment.

Design Tips for a Professional Look

A well-designed document plays a crucial role in conveying professionalism and attention to detail. The layout, fonts, and overall style can significantly impact how the recipient perceives the document and, by extension, your business. A polished and clean design can create a lasting impression and enhance trust with clients or customers.

- Keep it Clean and Organized: A clutter-free layout is essential for readability. Avoid overcrowding the page with unnecessary elements. Use clear headings and sections to guide the reader’s eye through the document.

- Use Consistent Fonts: Choose a professional and easy-to-read font, such as Arial, Helvetica, or Times New Roman. Stick to one or two fonts throughout the document to maintain consistency and avoid visual chaos.

- Incorporate Your Branding: Adding your logo or business colors can make the document feel more personalized and reinforce your brand identity. However, keep it subtle to avoid overwhelming the layout.

- Utilize White Space: Ample white space around text and sections improves readability and makes the document feel less cram

How to Calculate Rent and Additional Charges

Accurately calculating the amount due for a rental agreement involves more than just the basic rent. It is essential to factor in any additional costs or fees that may apply. By carefully considering all elements that contribute to the total charge, both the provider and the recipient can ensure fairness and transparency in the payment process.

Calculating the Base Rent

The starting point is the base rent, which is typically set based on the size, location, and amenities of the space. To determine the correct amount, simply refer to the agreed-upon rate and the duration of the lease or rental period. If the payment is monthly, divide the annual rate by 12 to find the monthly rent. For weekly or daily rentals, adjust accordingly to match the time period specified in the agreement.

Adding Extra Charges

Additional charges are common and should be calculated separately from the base rent. These might include, but are not limited to, maintenance fees, utilities, or parking fees. Each charge should be listed clearly, along with the amount, so the recipient understands what they are being billed for. For example, if a utility fee is based on usage, estimate the charge according to previous consumption or the agreed-upon method. Don’t forget to include any applicable taxes, as these can affect the overall total.

Finally, calculate the total amount due by adding the base rent and any additional charges. Ensure that the total is prominently displayed to avoid confusion and to provide a clear expectation of the payment that is required.

Incorporating Payment Terms and Conditions

Including clear and comprehensive payment terms is essential for ensuring both parties understand the expectations regarding when and how payments should be made. By outlining these conditions explicitly, you help prevent any misunderstandings or delays in the transaction process. Well-defined payment terms can also establish a sense of professionalism and trust between you and the recipient.

Payment Due Date

One of the first elements to include is the due date. This is the specific date by which the payment must be made. Setting a clear deadline helps the recipient understand the timeframe in which they need to settle the amount. Be sure to mention whether payments are due on a specific day of the month, within a certain number of days after the document is issued, or according to another agreed-upon schedule.

Accepted Payment Methods

Specify the payment methods you accept, such as bank transfers, credit card payments, checks, or online payment platforms. Providing multiple options can make it easier for the recipient to complete the transaction in a way that is most convenient for them. It’s also important to note any required details, such as bank account information or instructions for online payments, to ensure a smooth process.

Lastly, consider adding any penalties for late payments, such as interest charges or late fees. Clearly outlining these conditions will encourage timely payments and reinforce the seriousness of adhering to the agreed-upon terms.

Common Mistakes to Avoid in Invoices

Creating a billing document might seem straightforward, but there are several common errors that can cause confusion or delay in payments. These mistakes can undermine the professionalism of the document and create unnecessary complications. By being mindful of these pitfalls, you can ensure that your document is clear, accurate, and easy to process.

Missing or Incorrect Contact Information

One of the most common mistakes is failing to include or incorrectly listing the contact details for both the service provider and the recipient. This can lead to difficulties in communication or even missed payments. Always double-check that the name, address, and contact numbers are correct. Additionally, if you’re sending the document digitally, include an accurate email address for easy correspondence.

Unclear Breakdown of Charges

Another frequent mistake is not providing a clear and detailed breakdown of the charges. Avoid vague descriptions such as “services rendered” without further explanation. Clearly list each item or service provided, along with its quantity and cost. This transparency helps the recipient understand exactly what they are paying for, reducing the likelihood of disputes. If applicable, ensure that taxes, fees, and other additional charges are clearly listed and calculated correctly.

Finally, ensure that the due date and payment methods are clearly specified. A lack of clarity in these areas can lead to confusion about when payment is expected and how it should be made.

Digital vs. Paper Apartment Invoices

When deciding how to send a billing document, the choice between digital and paper formats can impact both efficiency and convenience. Each method has its advantages and considerations, and understanding these differences can help determine the best approach for your business or personal needs. Both options serve the same purpose, but their delivery and management can vary greatly.

Advantages of Digital Formats

One of the primary benefits of using a digital format is convenience. Digital documents can be generated, sent, and stored instantly, reducing the time and cost associated with printing and mailing physical copies. This is particularly useful for businesses that deal with high volumes of transactions or need to send documents across long distances. Additionally, digital formats can be easily edited or updated, ensuring that any mistakes can be corrected quickly without the need to reprint and resend.

Another advantage is the environmental impact. By eliminating paper, ink, and postage, digital formats are more eco-friendly, aligning with sustainability efforts. Furthermore, digital documents are easily accessible, and clients can save them for future reference or make payments directly through digital platforms, streamlining the entire process.

Benefits of Paper Formats

While digital options are efficient, some clients may still prefer receiving a physical copy. Paper documents can carry a sense of formality and professionalism, especially for certain business practices or when a hard copy is required for legal or accounting purposes. In addition, physical bills might be easier to track for individuals who are less comfortable with technology or prefer to manage their finances using paper records.

Paper documents can also be delivered with a personal touch, such as a handwritten note or signature, which can enhance the client relationship. However, it’s important to consider the added c

How to Automate Your Billing Process

Automating your billing process can save you significant time and effort, reducing the risk of errors and streamlining your operations. By leveraging technology, you can handle recurring payments, generate documents, and track transactions with minimal manual input. This not only improves efficiency but also ensures timely and accurate billing for your clients.

- Use Accounting Software: Many accounting platforms and applications are designed to automate the creation and sending of billing documents. These tools allow you to input payment terms, rates, and client information, which can be automatically applied to future transactions.

- Set Up Recurring Payments: For ongoing services or regular fees, set up automated billing cycles. This ensures that payments are processed on time, without the need for manual invoicing each month or period. Most payment processors offer this feature.

- Integrate Payment Gateways: Integrating payment systems directly into your billing system enables clients to pay online, directly from the document. This simplifies the payment process, reduces delays, and ensures you receive payments faster.

- Send Automated Reminders: Many digital tools allow you to schedule automatic reminders for upcoming or overdue payments. Setting up these notifications ensures that clients are reminded without you needing to send individual follow-up messages.

- Track Payments and Status: Automated systems can track the status of payments, highlighting those that have been completed and those that are overdue. This helps you stay organized and ensures you don’t miss any unpaid balances.

- Generate Reports: Automation can also help generate financial reports that summarize your transactions over a given period. These re

Integrating Payment Methods into Your Invoice

Including various payment options in your billing documentation is essential for providing convenience and flexibility to your clients. By offering multiple ways to settle the amount due, you cater to different preferences and enhance the chances of timely payments. This approach not only improves the customer experience but also simplifies the financial transaction process.

When listing payment methods, ensure clarity by specifying each available option, such as bank transfers, credit card payments, or digital wallets. Additionally, include any relevant details like account numbers, payment links, or instructions to guide the client through the process. It’s important to be transparent about any associated fees or conditions that may apply to specific payment methods.

By clearly outlining these options, you promote a smoother, more efficient payment flow and reduce the likelihood of delays. This also encourages clients to complete their payments promptly, as they can select the method that works best for them.

Free vs. Paid Invoice Templates

When choosing a document format for billing, businesses often face the decision between using a free version or investing in a premium option. Both have their advantages, but understanding the differences can help you make the right choice for your needs. Free solutions might be appealing due to their zero cost, while paid alternatives typically offer more advanced features and customization possibilities.

Benefits of Free Templates

Free options are a great starting point for individuals or small businesses with minimal requirements. They offer basic functionality and can be a simple solution for generating straightforward billing documents. Common advantages include:

- Cost-effective – no financial investment required.

- Easy to access – many free versions are available online without the need for registration.

- Simple to use – basic designs and easy-to-fill forms, ideal for quick tasks.

Advantages of Paid Templates

On the other hand, paid versions come with enhanced features that can streamline the billing process and present a more professional appearance. These often include:

- Customizable layouts – tailor the document to your brand or specific business needs.

- Advanced functionalities – such as automatic calculations, payment tracking, and integration with accounting software.

- Support – customer service and technical assistance if needed.

Ultimately, the choice between free and paid options depends on the complexity of your requirements and the resources you are willing to invest in optimizing your billing process.

Legal Considerations When Creating Invoices

When preparing billing documents, it’s crucial to be aware of the legal requirements and standards that govern their creation and distribution. These regulations help ensure clarity, prevent disputes, and protect both the service provider and the recipient. Compliance with laws and industry standards is essential for maintaining transparency and avoiding unnecessary legal complications.

Here are some key legal factors to consider when preparing these financial records:

Legal Aspect Description Correct Identification Include full details about the parties involved, such as names, addresses, and tax identification numbers where applicable. Clear Payment Terms Clearly state the due date, accepted payment methods, and any late fees or interest charges that may apply. Itemized Details Provide a clear breakdown of the services or goods provided, with quantities, prices, and applicable taxes. Legal Compliance Ensure that the document complies with local tax laws, including correct application of VAT or sales tax where required. Signature or Authorization Some regions require signatures or other forms of authorization to validate the document. Adhering to these guidelines helps ensure that billing records are legally binding and protect the interests of all parties involved.

Tips for Sending Apartment Invoices Effectively

Efficiently sending billing documents is an essential part of managing financial transactions. By ensuring that these records are delivered accurately and promptly, you can maintain a positive relationship with clients and streamline payment processes. There are several strategies to help make the distribution process smoother and more professional.

1. Choose the Right Delivery Method

Selecting an appropriate delivery method can greatly impact how quickly and securely payments are received. Whether you opt for electronic delivery or traditional mail, it’s important to ensure the method is reliable and convenient for both parties involved.

Delivery Method Advantages Email Fast, cost-effective, and easy to track with read receipts. Postal Mail May be preferred for formal records, especially for clients who are not comfortable with digital methods. Online Portals Secure and convenient for clients who prefer managing transactions digitally through a specific platform. 2. Set Clear Expectations and Deadlines

Clearly outline payment deadlines and instructions in the billing document. This helps avoid confusion and ensures that your clients understand when and how to submit their payments. Sending reminders a few days before the due date can also be effective in encouraging timely pay