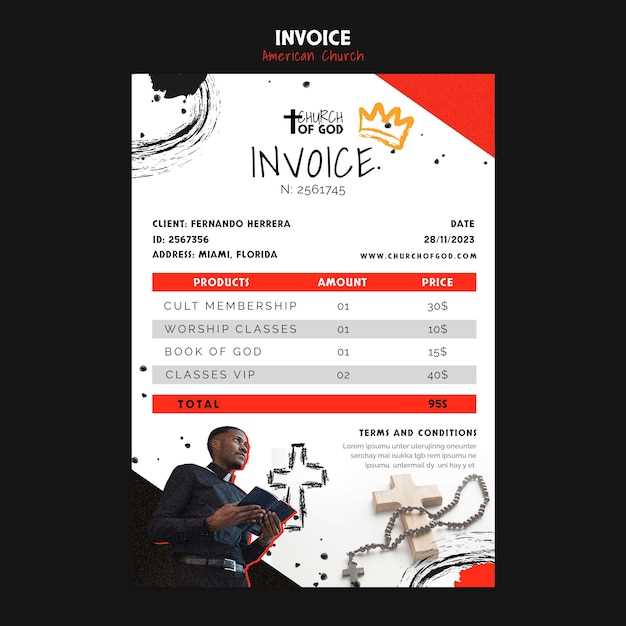

American Invoice Template for Business Professionals

Managing business transactions requires clear and precise documentation for both the provider and the recipient. Crafting well-organized statements that reflect the details of a service or product sold ensures smooth operations and avoids misunderstandings. With the right structure, these documents help maintain professionalism and promote trust between businesses and clients.

In this guide, we will explore how to design a functional and effective document for requesting payment, tailored to meet the needs of businesses of any size. From essential details to design elements, the process of creating such documents is simpler than many might think. With the right tools and approach, you can enhance your billing efficiency and streamline administrative tasks.

Optimizing your billing process can significantly save time, reduce errors, and improve the customer experience. Whether you are working with clients in various industries or need a consistent approach to payments, understanding how to set up these key documents is crucial for smooth business management.

American Invoice Template Overview

For any business, having a consistent and professional method of documenting financial transactions is essential. Properly designed documents help businesses maintain organization and ensure clear communication between service providers and clients. A structured approach to billing can streamline operations, reduce errors, and enhance credibility.

Key Elements of a Well-Designed Document

When creating a payment request document, there are several essential components that need to be included. The document should clearly state the services or products provided, the amount due, payment terms, and any additional information such as taxes or discounts. Including all necessary details ensures that the recipient understands the charges and terms associated with the payment.

Benefits of Using a Pre-Formatted Document

Using a pre-designed document format can save significant time and effort. With a ready-made structure, businesses can focus on customizing specific details, ensuring accuracy and consistency across all transactions. Additionally, having a professional layout can help foster trust and confidence with clients, leading to smoother business relationships.

Why Use a Professional Invoice Template

Utilizing a well-organized billing document ensures clarity, accuracy, and professionalism in every financial transaction. For businesses, presenting a structured and consistent format can help avoid errors, reduce confusion, and streamline communication with clients. This approach not only promotes transparency but also builds trust and credibility, crucial for maintaining strong business relationships.

Time Efficiency and Accuracy

One of the key advantages of using a pre-designed billing format is the significant amount of time saved. By having a consistent structure, the details of each transaction can be quickly filled in without worrying about formatting or layout. This eliminates the potential for human error, ensuring that all relevant details are correctly presented.

Professional Appearance

Maintaining a polished and professional appearance in business dealings is vital for establishing credibility. A clean and well-organized document layout reflects positively on the company and shows

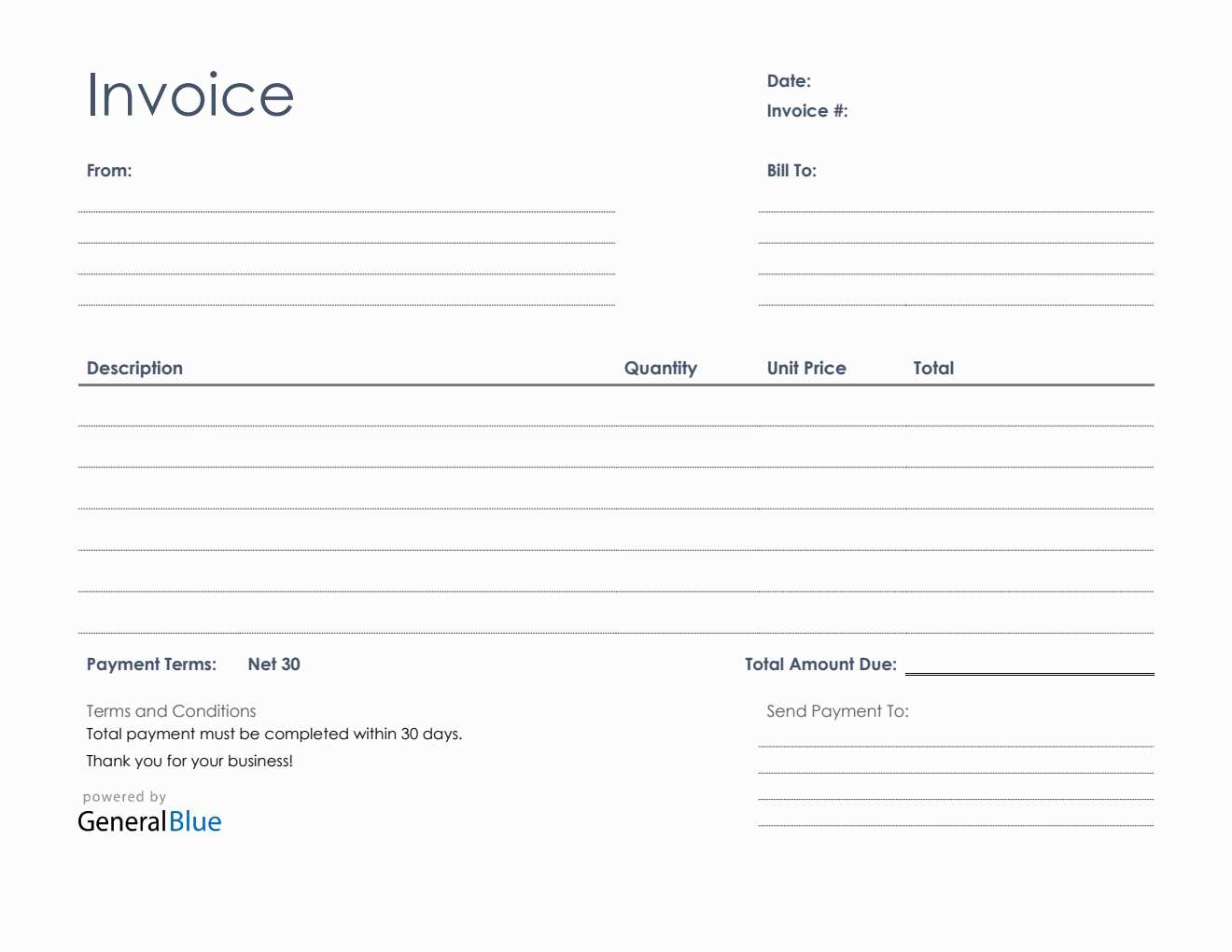

Key Features of an American Invoice

A well-structured payment request document includes several essential components that ensure clarity and effectiveness. These elements are necessary for smooth transactions and to provide a clear overview of the amount due, payment terms, and other important details. Including all the key features helps businesses present a professional image and avoids confusion with clients.

Essential Components

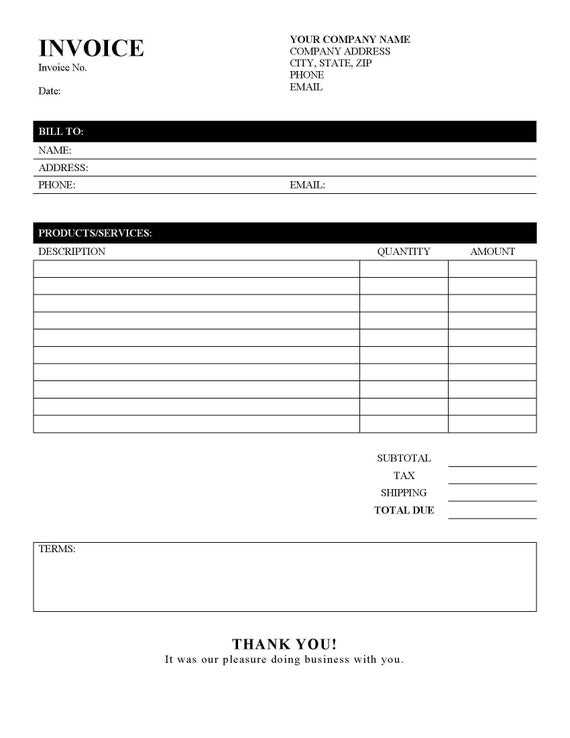

- Header Information: Includes the name of the business, contact details, and logo, which enhances brand recognition.

- Recipient Details: Includes the client’s name, address, and contact information for clear identification.

- Itemized List: A detailed breakdown of products or services provided, with individual costs for transparency.

- Dates: Includes the issue date and payment due date to ensure timely transactions.

- Terms and Conditions: Specifies payment terms, including any late fees or discounts for early payment.

- Tax Information: Clearly indicates applicable taxes, helping both the business and client comply with legal requirements.

Additional Considerations

- Invoice Number: A unique identifier for tracking purposes, which helps with record-keeping and organization.

- Payment Methods: Lists available payment options, such as bank transfer, credit card, or online payment platforms.

- Notes or Comments: Allows space for any special instructions, promotions, or additional information that may be relevant to the client.

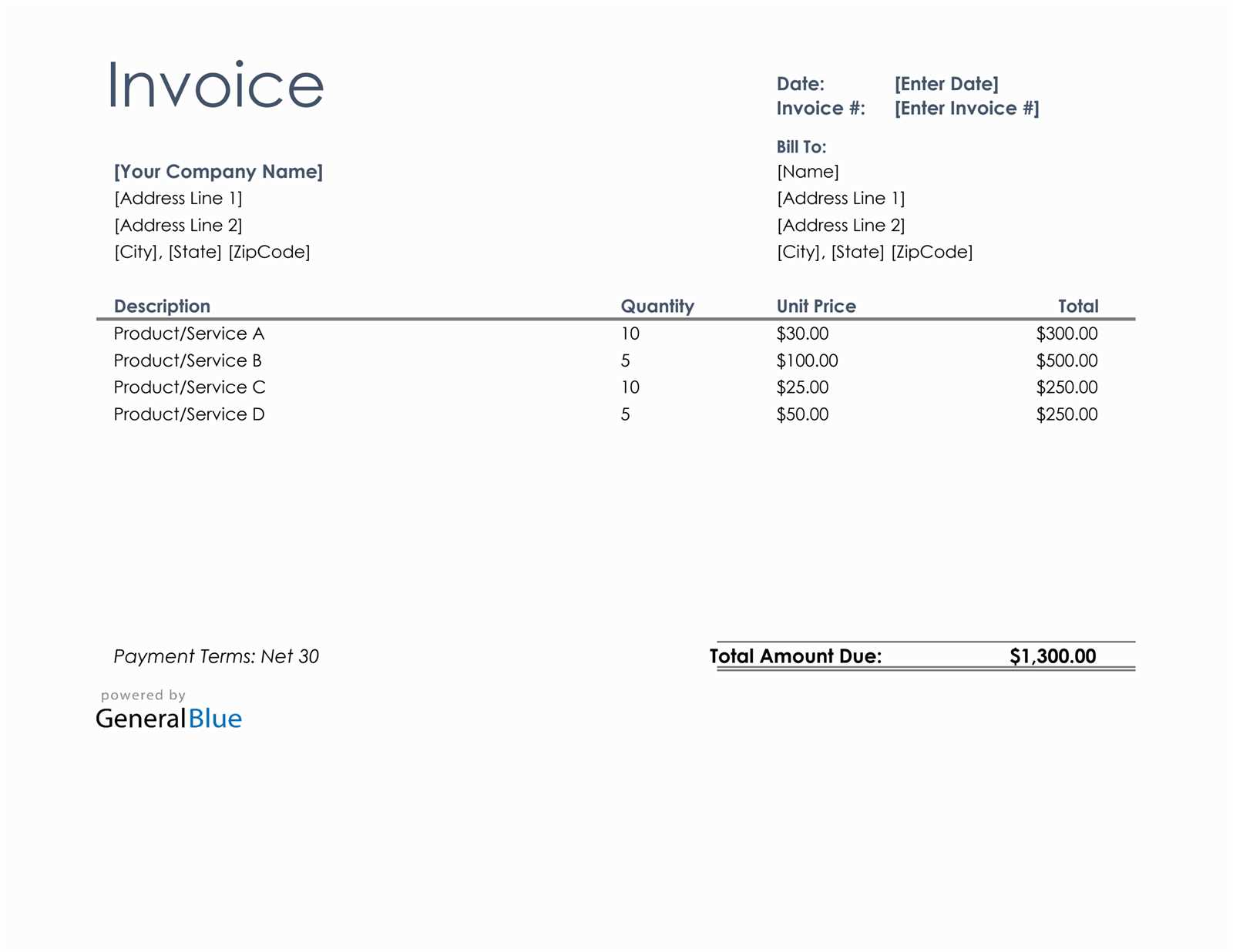

How to Customize Your Invoice Template

Customizing your payment request document allows you to tailor it to your specific business needs and branding. A personalized layout ensures that each document not only looks professional but also reflects the unique identity of your company. By adjusting key elements, you can improve the clarity, relevance, and overall effectiveness of your billing system.

Steps to Personalize Your Document

When customizing your document, there are a few essential areas to focus on for maximum impact:

- Business Branding: Add your logo, company colors, and font style to create a document that matches your brand’s visual identity.

- Contact Information: Make sure your business details are clearly visible at the top, including phone numbers, email, and website.

- Service Details: Adjust the descriptions of the services or products you offer to ensure they accurately reflect your offerings.

Formatting Considerations

The layout and structure of your document play a crucial role in its effectiveness. Below are key elements to consider:

| Element | Customization Options |

|---|---|

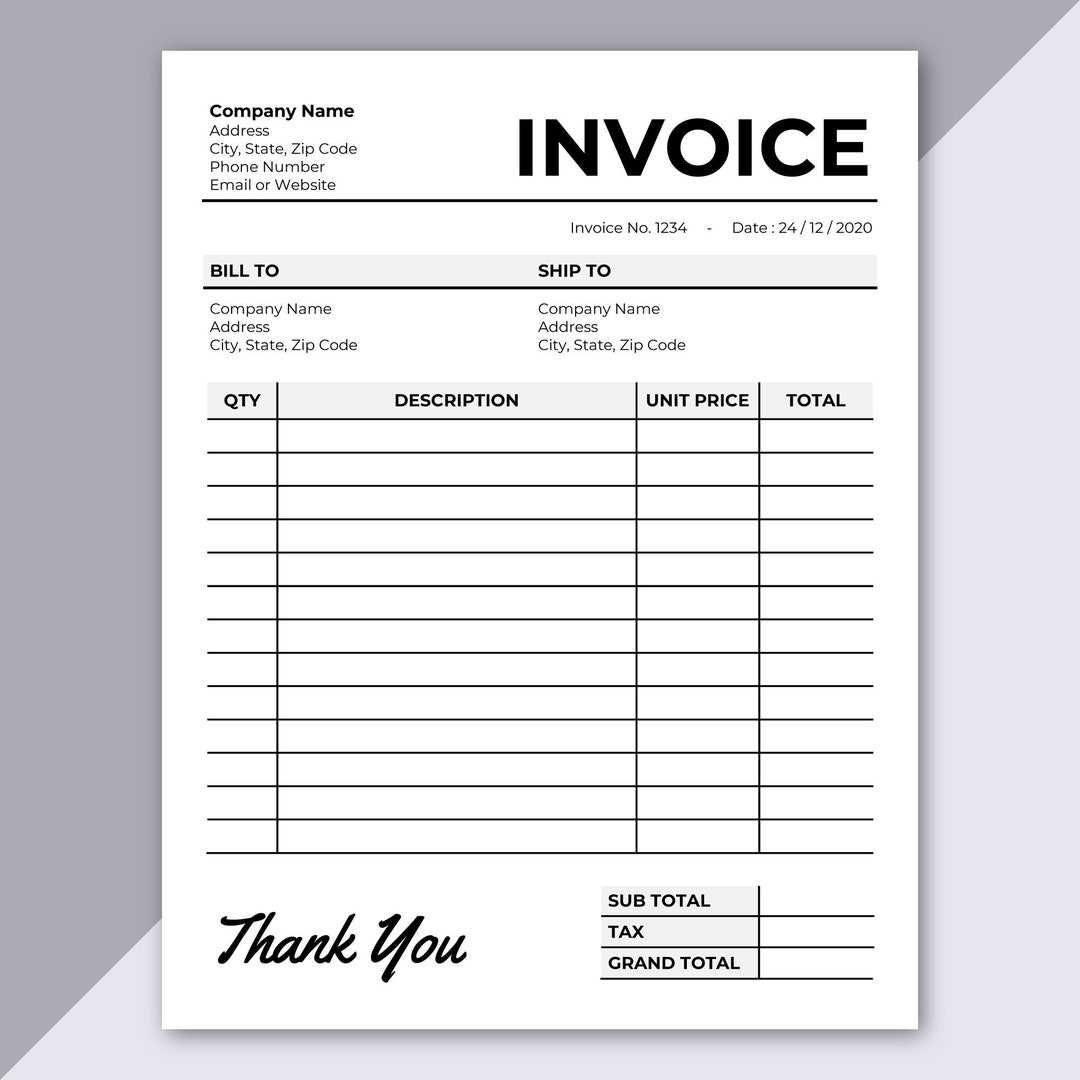

| Header Section | Include business name, logo, and contact details to create a professional look. |

| Itemized List | Use tables or bullet points to clearly display products or services with prices. |

| Payment Instructions | Ensure payment methods, due dates, and terms are clear and tailored to your business processes. |

These small changes can help improve the client experience and ensure that all the necessary information is easy to find and understand. A well-designed, personalized document not only saves time but also enhances the professionalism of your business communication.

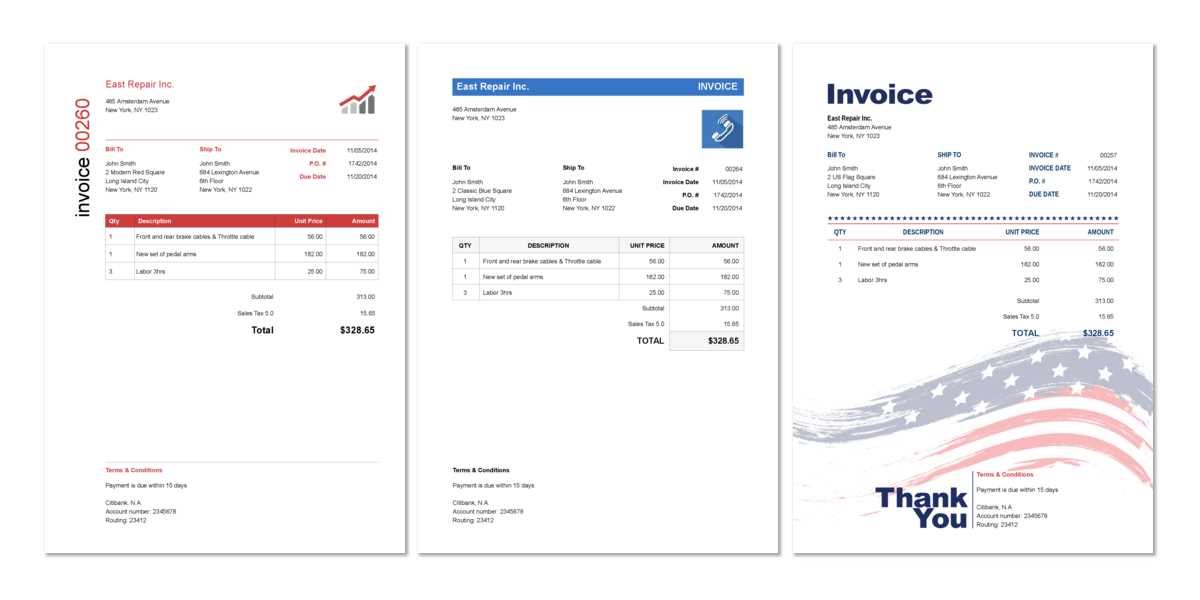

Choosing the Right Invoice Format

Selecting the right structure for your payment request document is crucial for ensuring clarity, efficiency, and professionalism. The format you choose affects how information is presented to your clients and can influence the payment process. A well-structured document not only provides all the necessary details but also aligns with your business style and operational needs.

Factors to Consider When Choosing a Format

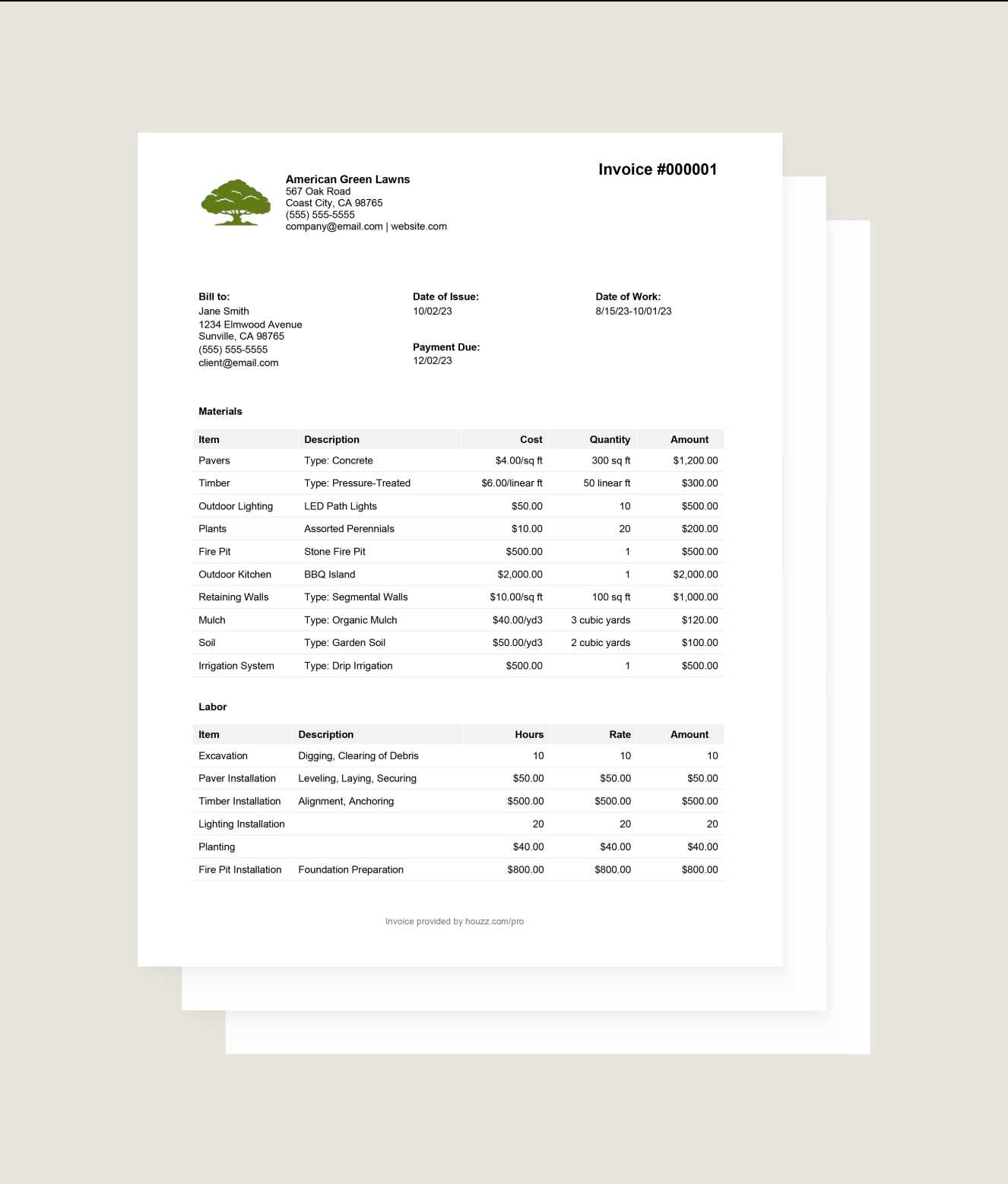

- Business Type: Different industries may require different formats. For example, service-based businesses may need more detailed descriptions, while product-based businesses might focus more on quantities and pricing.

- Client Preferences: Some clients may prefer digital formats for easy processing, while others might prefer printed copies. Understanding your audience can help you decide the best approach.

- Legal Requirements: Ensure your chosen format meets all necessary legal criteria, such as tax details, invoice numbers, and payment terms specific to your location or industry.

Popular Format Types

- Simple Text Format: Suitable for small businesses or freelancers. It’s easy to create and highly customizable, but it may lack a polished, professional appearance.

- Professional Layout: Ideal for businesses seeking a more formal look. Often includes logos, clear itemized lists, and structured tables for ease of reading.

- Online Platforms: Many businesses use invoicing software that automatically generates standardized formats with customizable features, offering convenience and consistency.

Ultimately, the format you choose should reflect your business’s needs and ensure your documents are clear, functional, and easy to process for your clients.

Essential Information on an Invoice

Every payment request document must include specific details that ensure clarity and accuracy for both the business and the client. Without the proper information, the document may lead to confusion, delays, or even disputes. Including all relevant elements from the start helps streamline transactions and maintain professionalism.

Key Details to Include

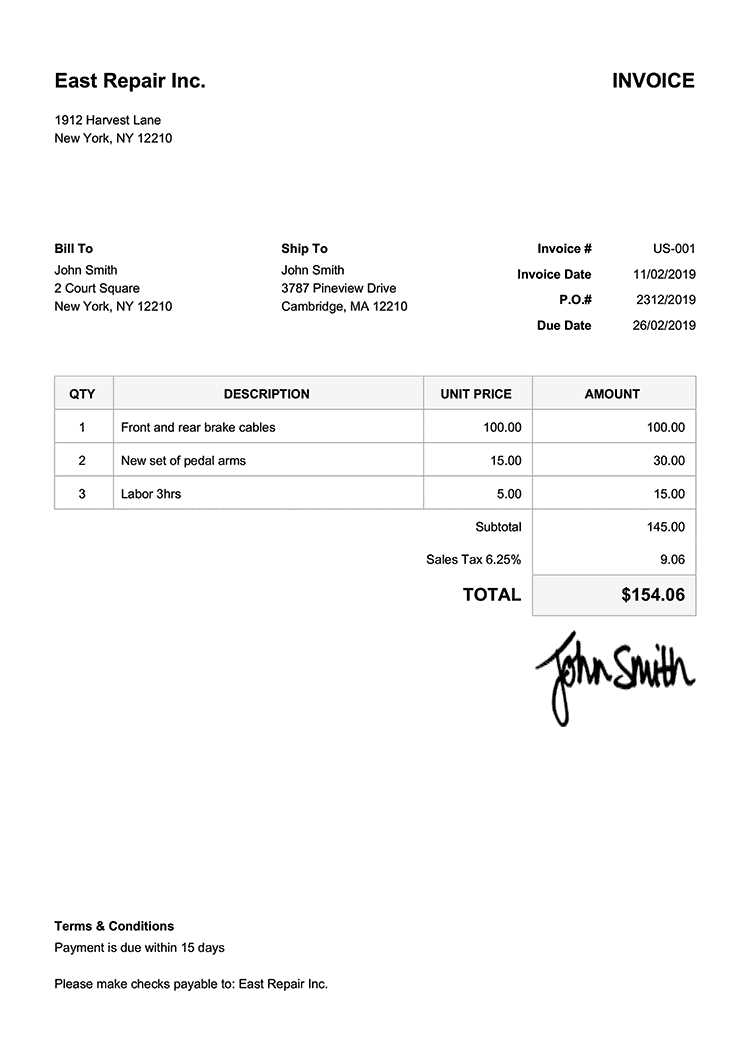

- Document Number: A unique identifier that helps both parties track and reference the document for future communication.

- Business Information: This includes the name, address, contact number, and email of the company issuing the request.

- Client Information: Similar to business details, the recipient’s name, address, and contact information should be clearly visible.

- Description of Goods/Services: A detailed breakdown of what has been sold or provided, including quantities, unit prices, and total amounts.

- Dates: The date when the document was issued and the payment due date to ensure timely processing.

- Payment Terms: Specify payment methods, due dates, and any discounts or late fees that apply.

Additional Information

- Tax Information: Ensure that any applicable taxes, such as sales tax, are clearly indicated with the appropriate rates and amounts.

- Notes or Special Instructions: This section can be used to add personalized messages or further details that might be relevant to the transaction.

Including all of these details ensures that the document is comprehensive, transparent, and easy to process, minimizing any potential confusion or delays in payment.

Common Mistakes in Invoice Creation

When preparing a payment request document, small mistakes can lead to major issues, such as delayed payments, confusion, or even disputes. Ensuring that every detail is correctly filled out is crucial for maintaining a professional image and ensuring timely payments. Here are some of the most common errors to avoid when creating a billing document.

Frequent Errors in Document Preparation

- Missing or Incorrect Contact Information: Not including the correct details for both the sender and recipient can lead to confusion and delayed payments.

- Unclear Payment Terms: Vague or missing payment terms, such as due dates, late fees, or acceptable payment methods, can cause misunderstandings.

- Omitting Tax Details: Forgetting to include taxes or failing to properly calculate tax rates can lead to complications with the client or legal authorities.

- Unorganized Breakdown of Charges: A lack of clarity in listing products or services, quantities, and prices can confuse the recipient and cause disputes.

- Incorrect Invoice Number: Reusing or skipping invoice numbers can cause issues with record-keeping and may create confusion when trying to track payments.

Formatting Issues to Avoid

- Inconsistent Layout: A poorly formatted document with inconsistent fonts, spacing, or alignment can appear unprofessional and make it difficult for the recipient to understand.

- Lack of Clear Due Date: Not specifying a clear due date for payment can cause unnecessary delays and lead to payment issues.

- Missing or Ambiguous Notes: Leaving out important details, such as payment instructions or additional charges, can result in confusion and incomplete payments.

By being aware of these common mistakes and taking steps to avoid them, you can ensure your payment request documents are clear, professional, and effective in securing timely payments.

Best Practices for Invoicing Clients

Creating clear and professional payment requests is essential for maintaining good client relationships and ensuring timely compensation for your services or products. By following established best practices, you can minimize misunderstandings and keep your billing process smooth and efficient. Here are some key recommendations to follow when preparing and sending payment requests to your clients.

Clear and Transparent Communication

- Ensure Detailed Descriptions: Provide a comprehensive breakdown of all services rendered or products delivered. This includes quantities, unit prices, and a clear description of each item to avoid confusion.

- Specify Payment Terms: Always include clear terms regarding payment deadlines, acceptable methods, and any penalties for late payments. This helps manage expectations and encourages timely payments.

- Send Invoices Promptly: Issue the payment request as soon as the work or transaction is completed. Delayed invoices can lead to delayed payments, affecting your cash flow.

Maintain Professionalism and Consistency

- Use a Consistent Format: Adopting a standardized format for all your payment requests gives your business a professional image and makes it easier for clients to process payments.

- Double-Check for Errors: Always review the document for accuracy before sending it out. Ensure that the figures are correct, all details are included, and there are no typographical errors that could cause confusion.

- Include Clear Contact Information: Make sure your business name, contact details, and payment instructions are easy to find, so clients can reach out with any questions or concerns.

Follow Up Professionally

- Send Friendly Reminders: If payment is not received by the due date, send a polite reminder. This should be professional and courteous, reiterating the agreed-upon terms.

- Be Transparent About Late Fees: If your payment terms include late fees, ensure they are clearly communicated upfront. If applicable, politely inform clients when these fees come into play.

By following these best practices, you can foster strong client relationships, maintain a steady cash flow, and ensure a seamless billing process for your business.

How to Save Time with Templates

Using pre-designed structures for your payment requests can significantly streamline your business processes. By eliminating the need to manually create a new document for each transaction, you can focus more on providing quality service and less on administrative tasks. Templates save you valuable time and ensure consistency across all documents, making the billing process quicker and more efficient.

Efficient Document Creation

- Pre-filled Fields: Templates allow you to store common information such as your company name, logo, and payment terms. This eliminates the need to re-enter these details each time you create a new document.

- Standardized Layout: With a consistent layout, you won’t have to worry about organizing the document every time. A well-structured format ensures all required information is included without having to think about the arrangement.

- Faster Customization: Most templates offer editable sections, so you can easily adjust quantities, descriptions, or pricing without needing to create the entire document from scratch.

Consistency and Accuracy

- Reduced Errors: By using templates, you’re less likely to forget important details or make formatting mistakes, as most of the work is already done for you.

- Brand Uniformity: A template ensures all your documents maintain a professional and cohesive look, helping reinforce your brand image with every transaction.

Ultimately, using ready-made structures for billing can save time, reduce errors, and enhance the professional appearance of your business documents, allowing you to focus on growth rather than paperwork.

Understanding Invoice Terms and Conditions

Clear terms and conditions are essential in any payment request document. These elements define the expectations for both parties involved in the transaction, ensuring that the terms are understood and agreed upon. By including well-defined conditions, you protect your business and set clear guidelines for your clients regarding payments, deadlines, and responsibilities.

Key Elements of Terms and Conditions

- Payment Due Date: A specified date by which the payment must be made. This helps set clear expectations and reduces the risk of delayed payments.

- Late Fees: Terms that outline the penalty for not meeting the payment deadline, such as a percentage added to the total amount due after a certain period.

- Accepted Payment Methods: Clearly stating which methods of payment are accepted (e.g., bank transfer, credit card, online payment) prevents confusion and streamlines the payment process.

- Discounts or Early Payment Incentives: If applicable, these terms outline discounts available for early payments, motivating clients to pay sooner.

- Return and Refund Policies: This is important for businesses offering products, as it sets guidelines on returns, exchanges, or refunds in case of dissatisfaction.

Common Pitfalls to Avoid

- Vague Terms: Ambiguities or lack of clarity in the conditions can lead to disputes. Be specific about due dates, amounts, and penalties.

- Missing Details: Leaving out essential details, such as the accepted payment methods or the refund policy, can cause unnecessary confusion.

- Overly Complex Language: Use clear and simple language. Overly complicated terms may make the conditions hard to understand and deter clients from agreeing to them.

Sample Payment Terms Table

| Term | Details |

|---|---|

| Due Date | Payment is due within 30 days from the issue date. |

| Late Fee | A 5% fee will be applied for payments made after 30 days. |

| Accepted Methods | Bank transfer, credit card, PayPal. |

| Early Payment Discount | 5% discount for payments made within 10 days. |

| Refund Policy | Refunds are availab

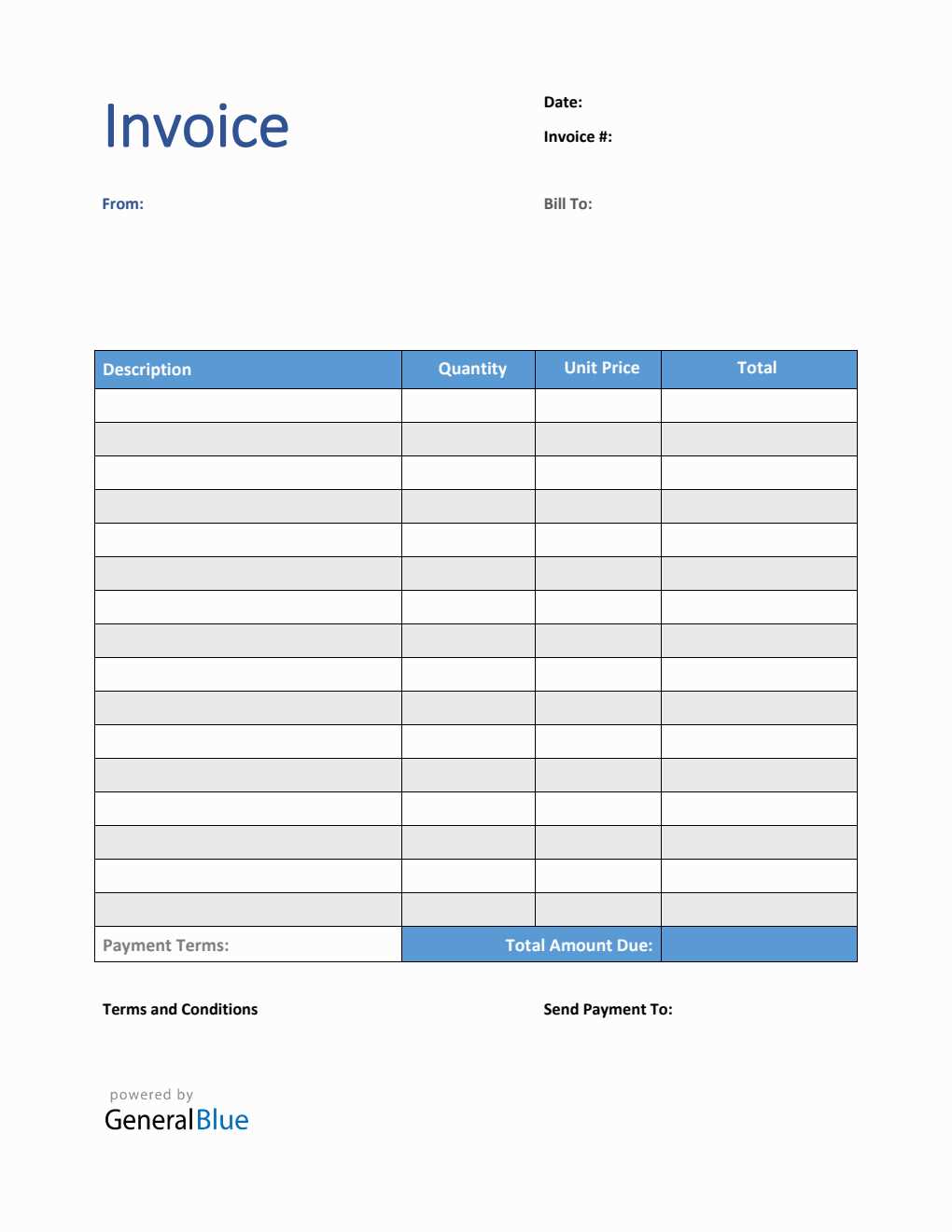

Free Payment Request Templates OnlineMany businesses seek convenient, cost-effective solutions for creating professional payment documents. Fortunately, there are numerous online resources offering free pre-designed structures that can be customized to meet specific business needs. These tools save time and effort, allowing users to quickly generate clear and professional payment requests without needing advanced design skills. Benefits of Using Free Online Resources

Popular Online Platforms for Free Templates

By utilizing these free online platforms, businesses can create professional and efficient payment documents without investing in expensive software or services. With a wide selection of customizable options, these tools offer a cost-effective way to enhance your billing process and maintain consistency in all transactions. How to Automate Your Payment RequestsAutomating the process of creating and sending payment requests can significantly reduce administrative workload and streamline your business operations. By using automation tools, you can ensure that invoices are generated on time, with accurate details, and are sent to clients without manual intervention. This not only saves time but also minimizes human error, helping maintain a smooth cash flow. Steps to Automate the Billing Process

Tools to Help Automate Your Payment Requests

By automating your payment request process, you can ensure that invoices are generated on time, improve payment tracking, and free up valuable time for other business tasks. This approach enhances efficiency, accuracy, and helps maintain a steady revenue stream for your business. Designing an Invoice for Your Business

Creating a professional and clear payment request is essential for establishing trust with clients and ensuring smooth transactions. The design of these documents should reflect your brand identity while including all necessary details to avoid confusion or delays in payment. A well-designed payment request not only helps maintain professionalism but also enhances your business’s credibility. When designing a payment request for your business, consider the layout, fonts, and inclusion of essential information like your business name, payment terms, and the breakdown of services or products provided. A clean, easy-to-read document helps clients understand what they’re being charged for and when payment is expected. Focus on simplicity and clarity, ensuring that the document is both aesthetically pleasing and functional. Including your logo, brand colors, and a clear structure will make your requests stand out while also conveying professionalism. Additionally, ensure that all legal and financial details are accurately included, such as tax rates, payment methods, and due dates. Legal Requirements for Invoices in the USWhen creating payment requests, it’s crucial to comply with the legal standards in your region to ensure the document is both valid and enforceable. In the United States, there are specific regulations that businesses must follow to avoid disputes and ensure proper tax reporting. Understanding these requirements helps you maintain legal compliance while facilitating smooth transactions. While the precise requirements can vary depending on the state, certain elements must be included in all payment requests issued by businesses. These elements ensure transparency and accuracy in the billing process. Below are some common legal requirements for payment requests in the US:

By adhering to these legal requirements, businesses can protect themselves from disputes and ensure that their payment requests are compliant with federal and state regulations. This practice also helps streamline financial processes and enhances professionalism with clients. How to Send Invoices EfficientlySending payment requests in a timely and organized manner is key to maintaining healthy cash flow for your business. Efficiently delivering these documents not only ensures that clients receive the information they need but also helps you keep track of pending payments and avoid delays. By streamlining your process, you can focus more on growing your business and less on administrative tasks. There are several strategies you can implement to improve the speed and accuracy of sending payment requests. Consider using automated systems that allow you to send multiple requests at once, saving time and reducing the risk of errors. Additionally, ensure that your documents are easy to access and understand, as clear and professional communication can speed up the payment process. To send payment requests efficiently, consider the following best practices:

By adopting these strategies, you can enhance your business’s efficiency and improve relationships with clients, ensuring that the payment process is smooth and stress-free for both parties. Tracking Payments and Managing InvoicesEffective management of payments is essential for maintaining financial stability in any business. Tracking payments and keeping a clear record of all transactions ensures that you have accurate insights into your cash flow. It also helps avoid missed payments, delays, and potential disputes with clients. By organizing these processes, businesses can stay on top of their financial obligations and plan more effectively for future growth. There are several methods to ensure proper tracking and management of payment requests, each aimed at improving accuracy and efficiency. Whether you use manual tracking systems or integrate automated solutions, it’s important to maintain a consistent approach to ensure nothing is overlooked. Manual Tracking MethodsFor small businesses or freelancers, manual tracking may be sufficient. This involves creating a spreadsheet or maintaining paper records that document each payment request and its status. While this method is straightforward, it can be time-consuming and prone to errors, especially as the number of transactions increases. Automated SystemsAutomated solutions, such as accounting software or cloud-based platforms, can significantly improve the tracking process. These systems not only create payment requests automatically but also track their status in real time. Most platforms allow you to send reminders for overdue payments, update records instantly, and generate detailed reports on the financial health of your business. To effectively manage payments, consider the following tips:

By integrating effective tracking methods and managing payment requests efficiently, businesses can maintain better control over their finances and foster stronger client relationships, ensuring a steady stream of revenue and minimizing risks associated with overdue payments. |