Download Amazon Invoice Template in Word Format for Easy Customization

In today’s fast-paced business environment, maintaining organized and accurate records is essential for smooth operations. Having the right tools at your disposal can significantly reduce the time spent on administrative tasks, especially when it comes to generating essential financial documents. A structured, easy-to-use document format can streamline this process and help ensure consistency in your paperwork.

Whether you’re managing a small business or handling orders for a larger enterprise, customizing your billing statements to reflect your specific needs is key. The ability to adapt a pre-designed format that aligns with your brand’s requirements ensures professional presentation and accuracy. By leveraging flexible document formats, you can quickly create detailed reports for customers, track transactions, and maintain proper financial records.

With the right structure, you can not only save time but also ensure compliance with legal and tax regulations. By choosing a customizable design, you can add necessary elements such as payment terms, customer information, and itemized lists. This approach not only enhances efficiency but also provides a polished and professional appearance for all of your business communications.

Amazon Invoice Template Word Overview

When managing business transactions, it’s crucial to have a reliable and customizable method for creating essential documents that track sales, payments, and other financial details. One of the most efficient ways to accomplish this is by using pre-designed document formats that can be easily adjusted to meet specific needs. These ready-to-use formats offer flexibility, ensuring that your paperwork aligns with both your business requirements and professional standards.

Such a structured document enables you to include important details clearly and efficiently. You can easily customize the layout and design to fit your branding, ensuring that your financial records reflect a polished and professional image. These formats are not only user-friendly but also save valuable time that would otherwise be spent on creating documents from scratch.

- Customizability: Adjust fields, colors, fonts, and logos to reflect your brand’s identity.

- Ease of Use: Pre-set fields and structures allow quick data entry without formatting hassles.

- Time-Saving: Ready-made formats streamline the process, reducing the time spent on administrative tasks.

- Accuracy: Pre-defined fields ensure all essential information is included, minimizing errors.

Moreover, these tools are typically available in popular document formats, making it easy to save, share, and print your records. Whether you’re a small business owner or a large seller, having a dependable solution for generating financial documents can help you maintain a high level of organization and professionalism.

Why Use a Word Invoice Template

Using a customizable document format for billing purposes provides a highly effective solution for businesses that need to manage their financial transactions efficiently. This method allows for quick creation of accurate, professional records while minimizing the effort needed to design and format each document from scratch. A well-organized structure ensures that all necessary details are included without overlooking key information, ultimately saving time and reducing errors.

Streamlined Workflow

One of the main advantages of using a pre-designed document format is the streamlined workflow it offers. By simply filling in the required fields, you can quickly generate a completed record without worrying about layout or design. This results in a more efficient billing process, especially for businesses with high transaction volumes. The ability to customize the content ensures that each document can be tailored to specific needs while maintaining consistency across all records.

Professional Appearance

Another important benefit is the professional appearance that a structured format provides. By using a well-designed layout, businesses can project a polished image to clients and partners. A professional-looking document not only reflects positively on your business but also helps build trust with customers by ensuring clarity and transparency in all financial communications.

Benefits of Customizing Amazon Invoices

Customizing your financial documents offers numerous advantages that can help streamline your business operations and improve customer relations. By adapting the format to your specific needs, you can ensure that each record aligns perfectly with your business requirements, making it easier to track and manage payments. Personalization also enhances the professional appearance of your documents, which can leave a positive impression on your clients.

- Brand Recognition: Customizing your documents with your company logo, colors, and contact information helps reinforce your brand identity.

- Increased Accuracy: Tailoring the structure ensures that all necessary fields are included, reducing the chances of missing important details.

- Better Customer Experience: Personalized documents can make transactions feel more tailored to the client, improving satisfaction and trust.

- Enhanced Efficiency: A customized format allows for faster document generation, as you won’t need to manually adjust standard fields every time.

- Legal Compliance: Customizing your financial documents ensures they meet local or industry-specific regulatory requirements.

By adapting your billing documents to suit your business needs, you not only improve internal processes but also strengthen the relationship with your customers through clearer and more professional communication.

How to Download Amazon Invoice Templates

Downloading a pre-designed document format for your business needs is a simple and effective way to ensure consistent and professional record-keeping. These ready-to-use layouts are easily accessible online and can be quickly customized to fit your specific requirements. Whether you’re creating records for one-time transactions or recurring orders, the process is straightforward and saves you valuable time.

Step-by-Step Process for Downloading

To begin, search for a reliable source offering free or paid document formats. Once you find a trusted provider, follow these simple steps:

- Visit the Website: Choose a reputable platform that provides customizable business document layouts.

- Choose Your Format: Look for the specific type of document you need, ensuring it aligns with your business’s requirements.

- Download the File: Click the download button to save the document to your computer or cloud storage.

- Open and Customize: Once downloaded, open the file in your preferred application and start personalizing the fields to match your details.

What to Look for When Downloading

When downloading a document, ensure it offers the necessary customization options. Some important features to check include:

- Editable Fields: Ensure that all fields, such as customer information, transaction details, and product descriptions, are easy to modify.

- Professional Design: The layout should be clean and clear, making it easy to read and understand.

- Compatibility: Verify that the downloaded format is compatible with your preferred software or document editor.

By following these steps, you’ll have access to customizable documents that fit your needs and help you maintain efficient business operations.

Key Features of an Amazon Invoice Template

When it comes to documenting purchases and transactions for business or personal use, it’s essential to have a professional and accurate method for organizing financial details. Such documents help ensure clarity in records, facilitate smooth communication between seller and buyer, and provide all the necessary data for legal and financial purposes. A well-structured document can streamline the payment process and make tracking transactions more efficient.

Essential Information for Financial Records

- Seller and buyer contact details

- Unique reference number for each transaction

- Clear description of products or services provided

- Quantity, price, and total amount due

- Payment terms and due dates

Customization and Flexibility

- Ability to adjust the layout according to business needs

- Adding business logos, branding, and personalized messages

- Support for different currencies and tax calculations

- Predefined fields for easy data entry and consistency

Steps to Fill Out Amazon Invoices

Creating a detailed and accurate document for each transaction is crucial for both sellers and buyers. This process helps to maintain clear records and ensures proper communication between both parties. Completing such a document correctly involves a few straightforward steps that ensure all necessary information is included for future reference and financial tracking.

Step 1: Input Seller Information

Begin by entering the seller’s name, address, and contact details at the top of the document. This provides clarity on who is issuing the document and allows for easy follow-up if necessary.

Step 2: Add Buyer Details

Next, include the buyer’s name, shipping address, and contact information. This ensures that the transaction is properly attributed and helps avoid any confusion regarding the recipient.

Step 3: Describe Products or Services

Provide a clear description of the goods or services sold. This section should include the name of each item, along with any relevant specifications such as size, model, or quantity. Make sure that each product is listed accurately for both parties to refer back to.

Step 4: Specify Pricing Information

Enter the unit price for each product or service and then calculate the total amount for each item. Ensure that any applicable taxes or discounts are added, with clear totals showing both before and after-tax amounts.

Step 5: Confirm Payment Terms

Clearly state the payment method and terms. This section should specify the due date, any late fees, and how payments are to be made. Providing this information helps avoid misunderstandings between the buyer and seller.

Step 6: Review for Accuracy

Before finalizing the document, review all entries to ensure that no details have been missed and all calculations are correct. A small error could lead to confusion or delays in payment.

By following these steps, both parties can ensure that the transaction is well-documented and properly tracked for future reference.

Understanding Invoice Formatting in Word

Properly organizing a transaction document requires attention to detail and clarity. When using software to create such a document, understanding the correct layout and structure is essential. Clear formatting ensures that all necessary information is easily accessible, and the document appears professional. This can make a significant difference in both business operations and customer relationships.

Key Elements of Effective Layout

- Header: Contains business details such as name, logo, and contact information

- Buyer Information: Includes the recipient’s name, address, and other relevant data

- Transaction Details: A section for listing items, prices, and quantities

- Terms and Payment Instructions: Specifies due dates, payment methods, and any applicable taxes or discounts

- Footer: Often includes additional terms, business registration details, or contact instructions

Formatting Tips for Consistency

- Use tables to neatly organize products, prices, and totals for easy reference

- Align text and numbers to improve readability and reduce errors

- Ensure consistent font styles and sizes throughout the document

- Include sufficient white space to avoid overcrowding information

- Highlight or bold important sections, such as totals and due dates, for emphasis

Amazon Invoice Template for Sellers

For sellers, maintaining accurate and clear transaction records is a key aspect of managing business operations. Having a standardized document for documenting sales not only ensures smooth communication with customers but also simplifies accounting and tax processes. A structured document helps to provide buyers with all the necessary details while keeping a professional appearance. This can improve trust and efficiency in business transactions.

- Seller Details: The document should start with the seller’s business name, address, contact information, and any relevant tax identification numbers. This makes it clear who is responsible for the sale.

- Buyer Information: The buyer’s name, address, and other relevant details must be included. This helps confirm the recipient and ensures the correct delivery of goods or services.

- Product or Service Description: List each item or service sold with details such as product name, model number, and quantity. This provides the buyer with an accurate record of what was purchased.

- Pricing Information: Specify the unit price, total price, taxes, and any discounts applied to each item. Clear calculations are essential to avoid confusion.

- Payment Terms: Indicate the total amount due, the payment method, and any due dates. Including payment terms helps avoid misunderstandings about when and how payments should be made.

- Additional Notes: Use this section for any relevant terms or conditions, such as shipping details, return policies, or other important information that the buyer needs to know.

Having a clearly formatted document that includes all of these elements ensures that both the seller and buyer have a complete and transparent record of the transaction. This level of professionalism helps to build trust and maintain positive business relationships.

Common Mistakes When Creating Invoices

Creating a transaction document might seem straightforward, but there are several common pitfalls that can lead to confusion or delays in payment. Small errors can have a significant impact on both the seller and buyer, causing misunderstandings or disputes. Understanding these mistakes and knowing how to avoid them is essential for maintaining professionalism and accuracy in financial records.

| Mistake | Potential Consequences | How to Avoid |

|---|---|---|

| Missing or incorrect contact information | Buyer may struggle to reach the seller, causing delays or miscommunication. | Double-check contact details before finalizing the document. |

| Incorrect pricing or calculation errors | Can lead to overcharging or undercharging, causing confusion or disputes. | Verify all calculations and ensure tax rates are correct. |

| Omitting payment terms | Confuses the buyer regarding when and how to make payments. | Clearly state due dates, payment methods, and any late fees. |

| Inconsistent formatting | Can make the document look unprofessional and harder to read. | Use a consistent layout, font style, and alignment throughout the document. |

| Not including unique transaction numbers | Can create difficulties when tracking or referencing specific transactions. | Always assign a unique reference number to each transaction. |

By paying attention to these common mistakes, sellers can ensure that their documents are clear, professional, and easy for buyers to understand. This reduces the likelihood of errors and helps maintain smooth business operations.

How to Add Your Logo to Invoices

Incorporating your business logo into transaction documents is an effective way to reinforce your brand identity and maintain a professional appearance. A logo not only makes the document visually appealing but also helps it stand out, making it instantly recognizable to clients. Adding your logo is a simple process that can significantly enhance the overall presentation of your documents.

Steps to Insert Your Logo

- Prepare Your Logo File: Ensure that your logo is in a high-quality image format such as PNG or JPEG. The resolution should be high enough to avoid pixelation when resized.

- Position the Logo: Decide where you want your logo to appear. Typically, it is placed at the top of the document, either in the header section or aligned to the left or right corner for visibility.

- Insert the Logo: Use the software’s “Insert Image” or “Insert Picture” feature to add your logo. Navigate to the location of your logo file and select it to appear in the document.

- Resize and Align: Once inserted, you may need to resize the logo to ensure it fits well within the layout. Make sure the logo is not too large or too small–just enough to maintain clarity and brand visibility.

- Adjust Image Settings: If necessary, adjust the image’s wrapping style or margins to prevent it from overlapping text or other important elements of the document.

Tips for Logo Placement

- Ensure that the logo does not overshadow essential information, such as transaction details or contact information.

- Avoid placing the logo too close to the edges of the page; leave some space around it for a balanced design.

- Use a version of the logo with a transparent background to maintain a clean, professional look.

By following these simple steps, you can easily integrate your logo into your transaction documents, enhancing your brand’s presence and ensuring a professional image for every transaction.

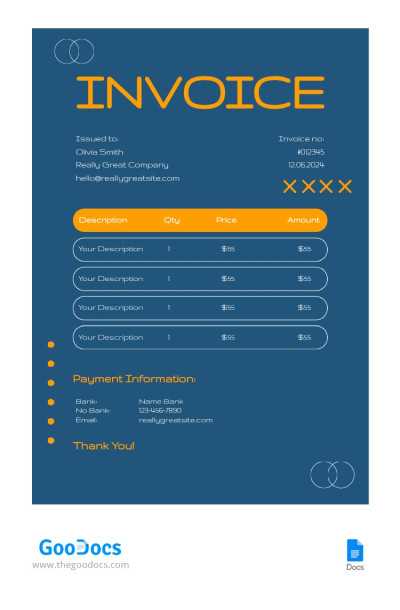

Formatting and Design Tips for Invoices

Creating a professional and easy-to-read transaction document is essential for maintaining clear communication with clients and ensuring timely payments. Proper formatting and thoughtful design not only enhance the document’s appearance but also make it more functional. A well-organized and visually appealing document can leave a lasting impression on clients and reflect positively on your business.

Key Design Considerations

- Use a Clean Layout: Keep the design simple and structured. Avoid cluttering the document with unnecessary elements that might distract from important details. Use clear sections with proper headings to separate different pieces of information, such as contact details, product descriptions, and payment terms.

- Choose Readable Fonts: Select professional, easy-to-read fonts. Stick to one or two font types for consistency, and avoid using overly decorative or complex fonts that might be hard to read.

- Consistent Alignment: Ensure that text and numbers are consistently aligned. For example, align numbers on the right side for easy comparison and make sure all sections are neatly aligned to create a uniform look.

- Include Sufficient White Space: Proper use of white space helps reduce visual clutter and makes the document easier to read. Leave margins around the edges and space between sections to give the content room to breathe.

Color and Branding Tips

- Stick to Your Brand Colors: Incorporate your business’s color scheme to maintain brand consistency. This can include using your company’s primary colors for headings or borders, but be careful not to overuse bright colors that could make the document difficult to read.

- Use Contrast Wisely: Ensure there’s enough contrast between the background and text. Dark text on a light background is the easiest to read, but make sure any highlighted information stands out clearly.

- Logo Placement: As mentioned previously, placing your company logo in a prominent position, such as the top-left or top-right corner, reinforces your brand. Just be sure it doesn’t overshadow important content.

Functional Design Tips

- Organize Information with Tables:

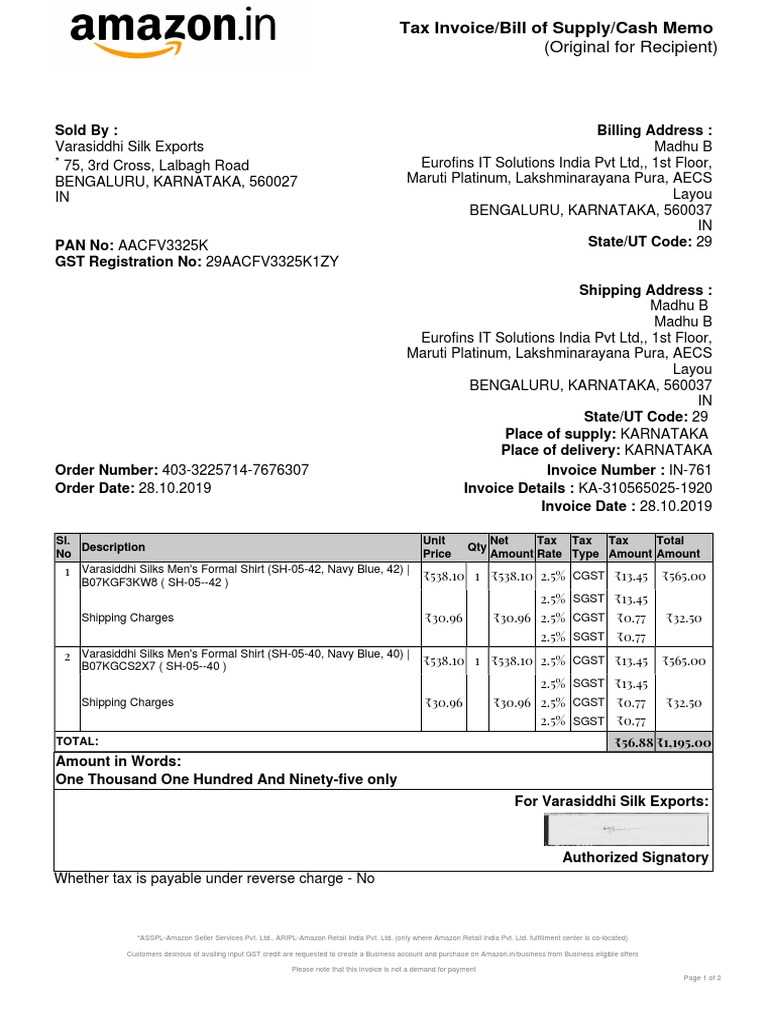

Including Tax Information on Amazon Invoices

When documenting transactions, it’s important to include clear and accurate tax details. Properly displaying tax information ensures compliance with local laws and helps both sellers and buyers understand the financial breakdown of a purchase. Whether you’re calculating sales tax, VAT, or other duties, this information is essential for transparency and legal requirements.

Key Tax Details to Include

- Tax Identification Number: This should be included if required by local regulations. It helps identify both the seller and the buyer for tax purposes.

- Tax Rate: Clearly state the applicable tax rate for the transaction. This ensures that both parties know how much tax is being applied to the sale.

- Taxable Amount: List the amount on which tax is being calculated. This is typically the subtotal of the products or services purchased, excluding shipping or other charges.

- Tax Amount: Indicate the total tax charged. This is calculated by applying the tax rate to the taxable amount.

- Total with Tax: Show the total amount due, including the product cost and the tax amount. This helps the buyer easily understand the full financial obligation.

Best Practices for Displaying Tax Information

- Highlight Tax Breakdown: Make sure the tax details are easy to spot. Consider placing them near the total amount or using bold text to differentiate them from other sections.

- Ensure Accuracy: Double-check the tax rate and calculations. Mistakes in tax amounts can lead to disputes or legal issues.

- Include Regional Tax Information: If your business operates in multiple regions with varying tax laws, clearly indicate the specific taxes for each region, if applicable.

By including accurate tax information in your documents, you not only ensure compliance but also foster trust with your customers. Clear and transparent tax details are essential for maintaining a professional and lawful transaction process.

Free vs Paid Amazon Invoice Templates

When creating a professional transaction document, one of the first decisions to make is whether to use a free or paid design solution. Both options come with their own set of advantages and limitations. Understanding the differences between the two can help you choose the right approach based on your business needs, budget, and desired level of customization.

Advantages of Free Options

- No Cost: The most obvious benefit of free solutions is that they come at no expense, making them an ideal choice for small businesses or startups with limited budgets.

- Easy to Use: Free options are generally straightforward, with basic functionality that allows quick creation of documents without much setup or learning curve.

- Pre-Designed Layouts: Many free solutions come with ready-to-use designs, which can save time for businesses that don’t need highly customized layouts.

- Basic Features: Free options typically include essential fields like product descriptions, prices, and totals, making them suitable for simple transactions.

Benefits of Paid Options

- Advanced Customization: Paid solutions offer more design flexibility, allowing you to tailor the document to your specific brand, including custom fonts, logos, and color schemes.

- Enhanced Functionality: Many premium options include additional features like automated tax calculations, multiple currency support, and integration with accounting software.

- Professional Appearance: Paid solutions often come with more polished and sophisticated layouts, ensuring a higher level of professionalism and consistency in your documents.

- Customer Support: With paid options, you often get access to customer support, which can help resolve issues or assist with complex formatting needs.

While free solutions may be sufficient for small, one-off projects or personal use, businesses looking for more robust features, greater flexibility, and a polished appearance may find that a paid option offers better long-term value. Ultimately, the choice between free and paid solutions depends on your specific requirements and how much you’re willing to invest in your documentation process.

How to Print Your Amazon Invoice

Printing a transaction record can be a helpful way to keep track of purchases and manage personal or business finances. Follow these steps to quickly access and print a document detailing your order information.

Step 1: Begin by logging into your account and navigating to the section where you can view recent orders. This area will display a list of all purchases made on your account, organized by date.

Step 2: Select the specific transaction for which you need a detailed record. Once selected, you will find an option to view a summary or detailed breakdown of the purchase.

Step 3: Look for a “Print” or “Download” button, typically available on the document viewing page. Clicking this option will eithe

How to Save Invoices in Word Format

Converting purchase records into editable files can be beneficial for organizing and customizing transaction details. Here are simple steps to save these records in a format that allows for easy editing and formatting.

- First, locate and download the document you need. Make sure to save it in a standard format like PDF if available, which will ensure compatibility when converting.

- Open the downloaded file on your computer. If it’s in PDF, you may need a PDF reader or editor that allows for conversion.

- Use a converter tool to change the file into an editable format. Many online tools and software options can convert a PDF into a document ready for text editing.

- Once converted, open the file in your text editor. You can now adjust layout, add notes, or make any other modifications as needed.

Saving your records in this format provides flexibility in managing and archiving important purchase information for future use.

Using Amazon Invoice Templates for Record-Keeping

Maintaining organized records of transactions is essential for both personal and business accounting. Customizable document templates offer a streamlined way to categorize, store, and manage purchase information effectively. Below is a guide on how to leverage these templates for efficient record-keeping.

Benefits of Customized Templates

Using tailored document formats allows you to include only the details you need, making records more readable and organized. Templates can be set up to track various elements of each transaction, making it easier to locate specific information when needed.

Example of a Basic Record Structure

Below is a sample layout that can be used to keep detailed transaction records:

Transaction ID Purchase Date Item Description Cost Automating Invoice Creation with Templates Automating document creation for transactions can save time and reduce manual errors. By using customizable formats, you can streamline the process, making it easier to generate consistent records for each sale or purchase. Here’s a guide on setting up automation for document creation.

Steps to Set Up Automated Templates

- Choose a Suitable Tool: Select software that supports automation and document generation. Many platforms offer integration options with existing data management systems.

- Customize the Format: Set up your document to include necessary fields like date, item details, cost, and transaction ID. This allows each record to be auto-filled with specific information.

- Configure Data Inputs: Link your format to data sources, such as spreadsheets or databases. This setup ensures that new entries automatically populate the template, creating a new file with each transaction.

- Test and Adjust: Run a test to ensure