Free Amazon Invoice Template Excel for Easy Customization and Use

Managing transactions and ensuring accuracy in your business’s financial documentation can be a time-consuming task. A well-organized, easy-to-use document can greatly improve efficiency, making it easier to track sales, payments, and other essential details. By using a ready-made structure in a flexible spreadsheet, you can save time while ensuring your records are clear and professional.

In this guide, we will explore how to leverage a spreadsheet that suits your needs, allowing for customization and easy updates. Whether you’re running a small business or need a streamlined way to handle payments, having a structured framework in place helps maintain consistency and reduce errors. With the right setup, you’ll be able to manage all necessary information in one place, making your administrative tasks much more straightforward.

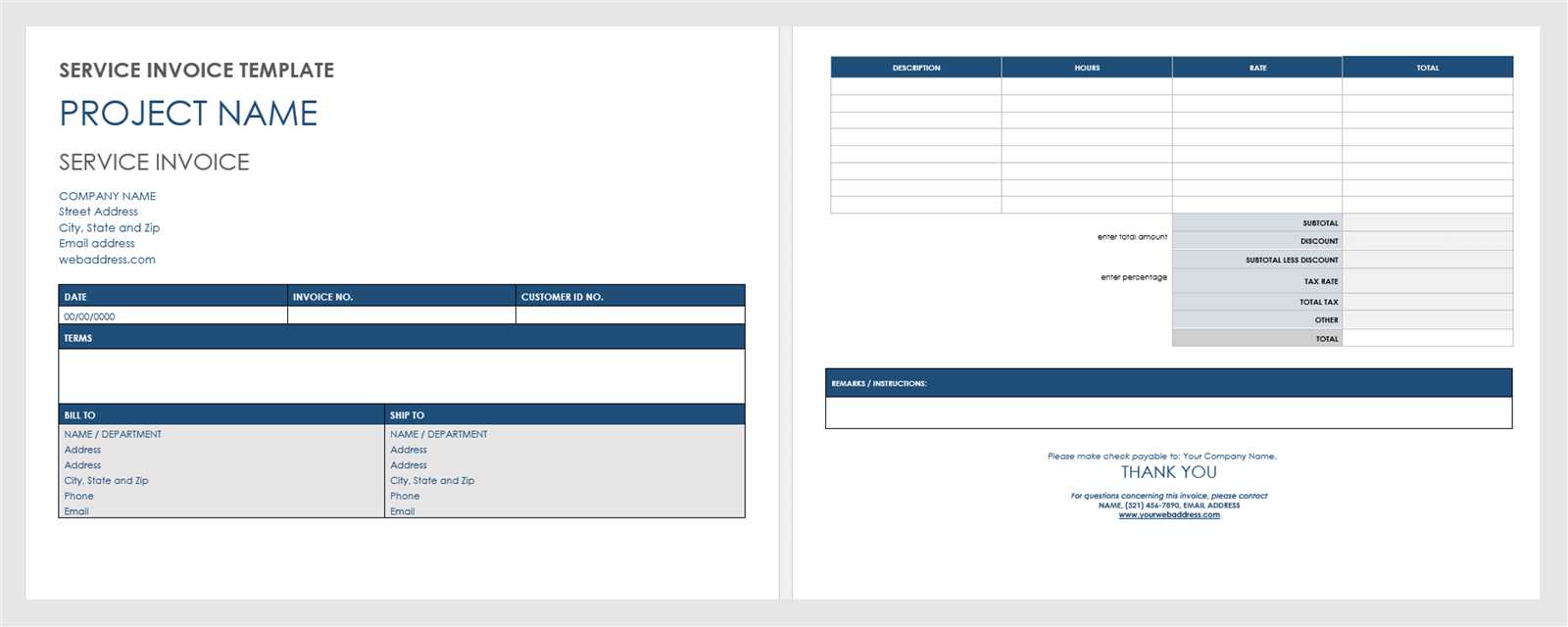

Amazon Invoice Template Excel Overview

Having a pre-structured document for handling financial records simplifies the process of generating and managing sales receipts. By using a flexible spreadsheet designed for this purpose, you can easily track all necessary details such as item descriptions, prices, and payment statuses, without the need for manual calculations or formatting each time. This method not only saves time but also ensures that your financial documents remain organized and consistent.

Such a tool allows for easy customization to fit the unique needs of your business, whether you’re selling products or providing services. With built-in formulas for automatic totals and tax calculations, it minimizes the risk of human error and ensures accurate reporting. Additionally, using a digital format makes it easier to store, share, and retrieve important financial records whenever needed.

How to Download an Amazon Invoice Template

Getting started with a pre-made document for managing transactions is simple and efficient. To begin, find a reliable source that offers customizable, ready-to-use spreadsheets tailored for your needs. Many online platforms provide free or paid options that can be downloaded directly to your computer or cloud storage, giving you instant access to a structured file designed to streamline your billing process.

Once you’ve identified the right resource, the download process is straightforward. Typically, you’ll just need to click a download link and choose the location where you want the file to be saved. After that, open the file with your preferred spreadsheet software to make any necessary adjustments. It’s important to ensure that the document is compatible with the program you plan to use, ensuring smooth operation and ease of editing.

Benefits of Using Excel for Invoices

Using a spreadsheet for managing financial documents offers significant advantages over traditional manual methods. With its powerful features and flexibility, it allows users to automate calculations, track payments, and create professional-looking records with minimal effort. The ability to customize layouts, add or remove fields, and update data in real-time makes it an ideal tool for businesses of all sizes.

Time-Saving and Efficiency

One of the primary benefits of using a spreadsheet for financial records is the time saved through automation. Built-in formulas allow for automatic calculations of totals, taxes, and discounts, reducing the need for manual entry. This not only speeds up the process but also minimizes the risk of errors that can occur with manual calculations. Additionally, the ability to save and reuse a structured format eliminates the need to create new documents from scratch each time.

Easy Customization and Flexibility

Another key advantage is the ability to tailor the document to fit specific business needs. Whether you need to include additional fields for custom notes, track specific payment terms, or adjust the layout to match your brand’s style, a spreadsheet provides complete flexibility. This adaptability ensures that you can create a record-keeping system that aligns with your company’s unique requirements while maintaining a professional appearance.

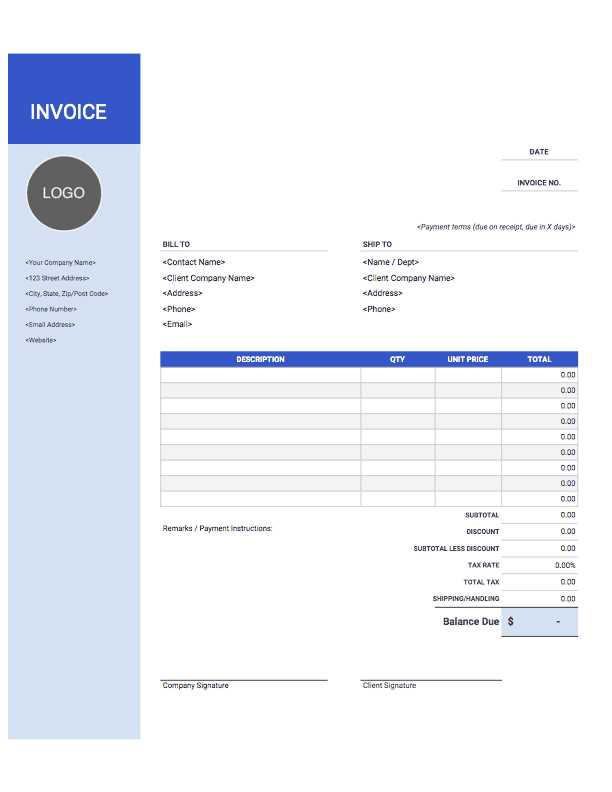

Customizing Your Amazon Invoice Template

Personalizing a financial document to suit your business needs ensures that all relevant information is clearly presented and tailored for your specific operations. With a flexible structure, you can modify the layout, add or remove fields, and adjust the design to create a record that reflects your brand while keeping all necessary details intact. Customization also allows for the inclusion of specific data points that are important to your transactions, ensuring accuracy and completeness.

Adjusting Layout and Design

One of the first steps in customization is adjusting the layout and design to match your company’s branding. You can change fonts, colors, and logos to give the document a professional and cohesive look. Additionally, you can modify the placement of key elements, such as customer information, itemized lists, and totals, to make the document more user-friendly and easier to read.

Adding Custom Fields and Features

Another important aspect of customization is adding any fields that are unique to your business. Whether you need space for purchase orders, delivery instructions, or a discount section, a spreadsheet allows you to easily insert these additional fields. You can also incorporate formulas for automatic tax calculations or payment due dates to ensure that your records are always accurate and up to date.

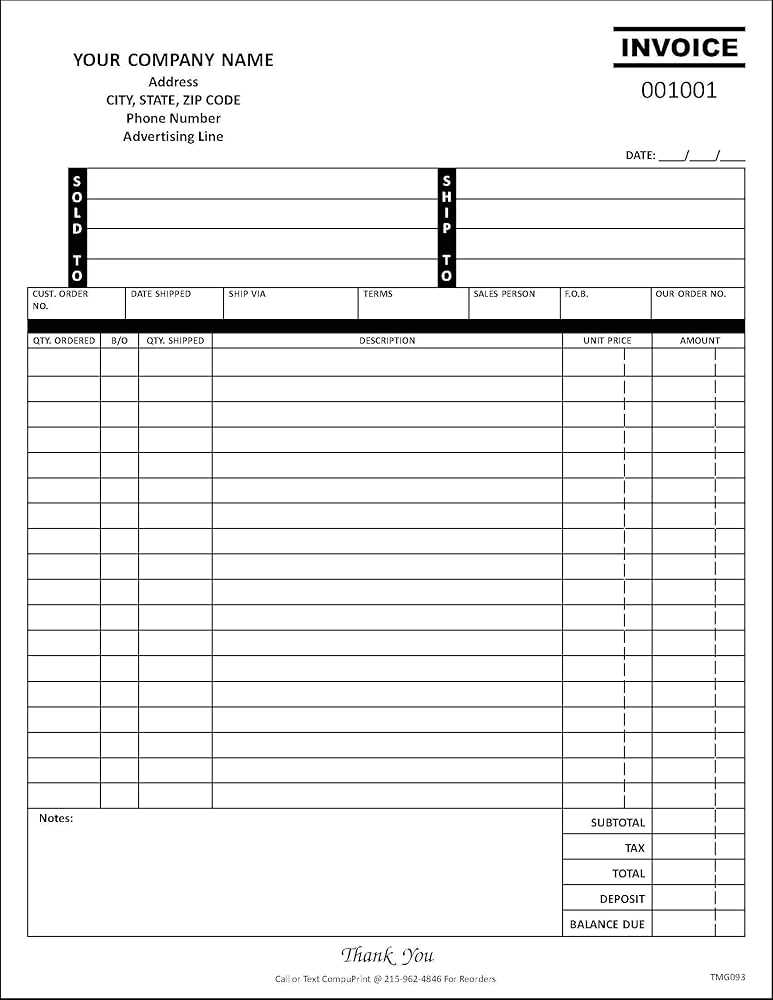

Key Features of an Amazon Invoice

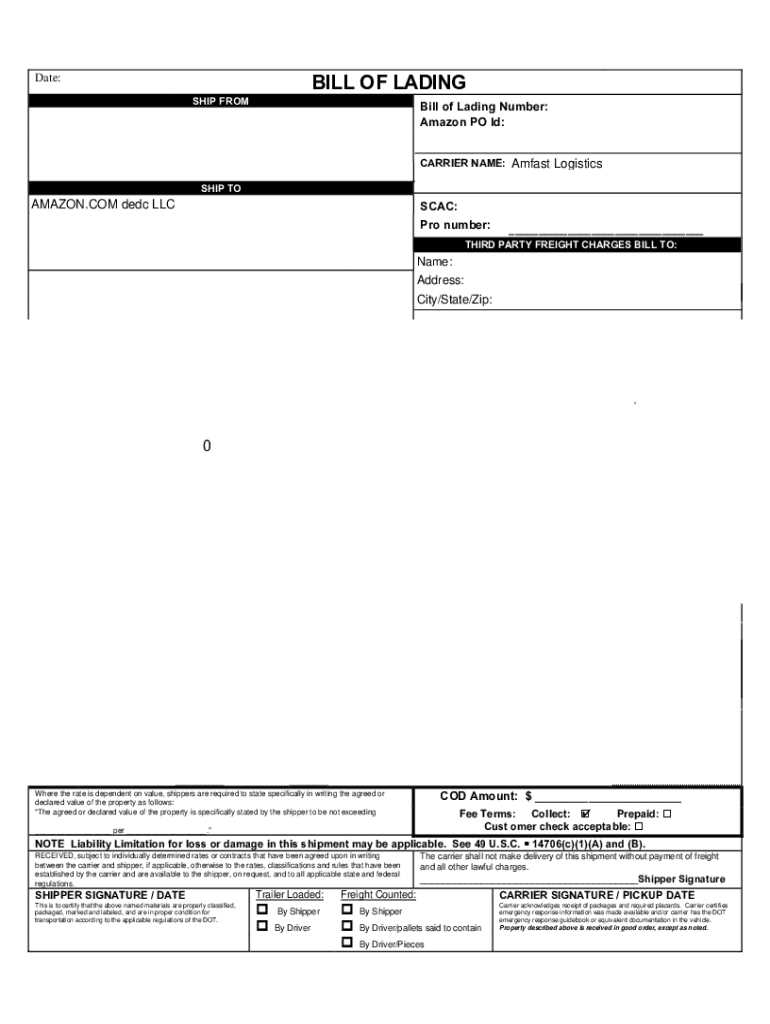

A well-structured financial document includes several key elements that ensure both clarity and accuracy. These features help in detailing the transaction, making it easier to understand for both the seller and the customer. Essential components such as product descriptions, pricing, taxes, and totals are all part of the standard structure, ensuring that all critical information is included and well-organized.

Another important aspect is the ability to track payments and due dates. This ensures that both parties have clear visibility on the status of the transaction, helping to avoid any confusion or disputes. The document should also provide space for relevant contact details, terms of sale, and transaction dates, further enhancing its effectiveness as a reference for future interactions.

How to Fill Out Amazon Invoice Template

Filling out a financial document is a straightforward process, but it’s important to include all relevant details to ensure accuracy and completeness. Each section of the document is designed to capture specific information about the transaction, from customer details to item descriptions and payment terms. Following a clear, step-by-step approach will help ensure that you don’t miss any crucial data.

Step-by-Step Process

- Customer Information: Start by filling in the customer’s name, address, and contact details. This ensures the document is correctly attributed to the right individual or company.

- Transaction Date: Enter the date the sale took place. This is essential for tracking payment timelines and ensuring timely follow-ups.

- Itemized List: Include a detailed list of the products or services sold. Each item should have a description, quantity, unit price, and total cost. This section is critical for transparency and clear communication.

- Tax and Discounts: If applicable, input any taxes or discounts applied to the sale. Ensure the tax rate is accurate based on your region or business rules.

- Total Amount: Calculate the total amount due by adding the costs of each item, including tax and any discounts, and ensure the total is clearly visible at the bottom of the document.

- Payment Terms: Specify the payment due date and any terms regarding late payments or penalties, if necessary.

Finalizing and Reviewing

- Double-Check Information: Before finalizing, review the entire document for any errors, such as incorrect pricing or missing details.

- Save and Send: Once everything is filled out correctly, save the document in your preferred format and send it to the customer via email or print for physical delivery.

Tips for Accurate Invoice Creation

Creating accurate financial documents is essential for maintaining clear records and avoiding misunderstandings with customers. Small mistakes, such as incorrect pricing or missing details, can lead to payment delays and disputes. By following a few key guidelines, you can ensure that your records are precise, professional, and easy to understand.

1. Double-Check Customer Information

Make sure the name, address, and contact details of the client are correctly entered. Any errors here can lead to confusion and delivery issues. Always confirm this information before finalizing the document.

2. Be Clear with Item Descriptions

Provide accurate, detailed descriptions of each product or service, including the quantity and price. Ambiguities can lead to questions from the client and delay the payment process.

3. Use Built-In Calculations

Leverage automatic calculations for totals, taxes, and discounts to minimize the risk of human error. This helps ensure that all amounts are correct, especially when dealing with complex pricing structures or varying tax rates.

4. Include Clear Payment Terms

Specify the payment due date, methods of payment, and any penalties for late payments. Having this information clearly stated in the document can help avoid future misunderstandings.

5. Review Before Sending

Take the time to review the document for any inconsistencies or missing information. An extra review ensures that everything is accurate and professionally presented before it is sent to the customer.

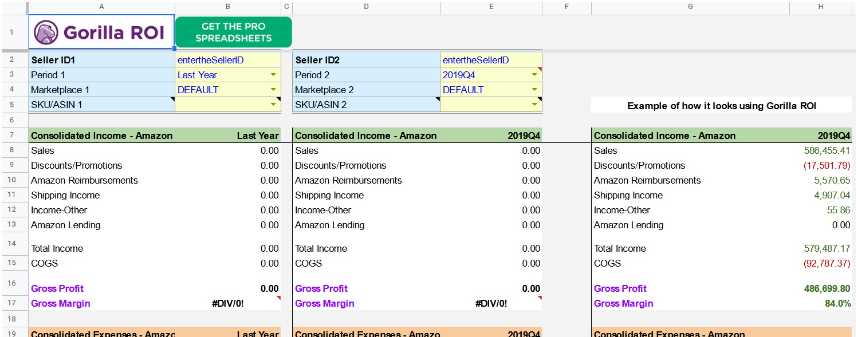

Managing Multiple Invoices in Excel

Handling numerous financial documents can quickly become overwhelming, especially when they need to be tracked, updated, and organized efficiently. A well-structured spreadsheet allows you to manage multiple records at once, ensuring that all relevant details are easy to access and update. By using a central system for all your transactions, you can streamline your workflow, track payment statuses, and stay on top of pending amounts without losing track of important information.

Organizing Financial Records

To effectively manage multiple records, create a separate row for each transaction, ensuring that all data is clearly labeled and organized. This includes customer details, itemized lists, totals, and payment terms. You can use different columns for specific categories, such as payment status, due dates, and amounts, which makes it easier to sort and filter through large volumes of data.

Using Filters and Sorting

Leverage the filtering and sorting features to quickly find specific transactions based on key information such as payment status, dates, or customer names. This helps you stay organized without manually searching through numerous files. For example, you can easily sort by the due date to see upcoming payments or filter by “paid” status to see completed transactions.

Additionally, consider using conditional formatting to highlight overdue amounts or unpaid records, which will help you quickly identify outstanding payments and take appropriate action.

Amazon Invoice Template for Small Businesses

For small business owners, managing sales records and payment tracking can quickly become a complex and time-consuming task. A customizable document that simplifies the process of recording transactions is an invaluable tool for staying organized. By using a structured spreadsheet, small business owners can easily create professional-looking financial records, monitor outstanding payments, and ensure that all relevant details are captured accurately and consistently.

Benefits for Small Business Owners

One of the key advantages of using a structured spreadsheet for financial documentation is the ability to streamline administrative tasks. With clearly defined sections for customer information, itemized purchases, tax calculations, and total amounts, business owners can create detailed records quickly and without errors. Additionally, these documents can be easily updated as payments are received or statuses change, providing real-time insights into the financial health of the business.

Simple Customization for Unique Needs

Small businesses often have unique requirements, whether it’s offering discounts, tracking custom fees, or listing multiple services. A flexible spreadsheet allows for easy customization of fields, ensuring that the document fits the business’s specific needs. For example, you can include additional columns for special notes, promotional codes, or custom payment terms, providing greater control over your record-keeping system.

Saving Time with Excel Invoice Templates

Time is one of the most valuable resources for any business owner, especially when it comes to managing administrative tasks like generating sales records. Using a pre-structured document that automates calculations and organizes essential information can save considerable time. By eliminating the need for manual data entry and reducing errors, you can focus on more critical aspects of your business.

Key Time-Saving Benefits

- Pre-Built Structure: With a ready-to-use document, all the necessary fields are already in place, so you don’t need to create one from scratch every time. This drastically reduces the time spent on setup.

- Automated Calculations: Built-in formulas for totals, taxes, and discounts automatically adjust as you input data, saving you the trouble of doing the math manually.

- Consistency Across Records: Using the same layout for every transaction ensures uniformity and reduces the chance of missing important details. This consistency saves time when reviewing or modifying records.

- Easy Updates: Once the format is in place, you can quickly update and modify fields as needed for different clients or services, without starting over each time.

- Quick Access to Information: Storing all your financial documents in one organized file allows for easy searching and retrieval, reducing the time spent looking for past records.

Maximizing Efficiency with Templates

- Reusability: Simply save and reuse the document for every new transaction. The structure remains the same, and you only need to change the details for each customer.

- Batch Processing: If you’re dealing with multiple transactions, you can quickly duplicate a record and update it, streamlining the process of handling several documents at once.

How to Track Payments Using Excel

Tracking payments effectively is essential for maintaining a clear view of your business’s financial status. Using a structured spreadsheet can help you monitor the status of outstanding amounts, record payments received, and ensure that nothing slips through the cracks. With a few simple tools and practices, you can easily stay on top of all your transactions and manage cash flow with confidence.

Setting Up Payment Tracking

To start, create a dedicated section within your spreadsheet to track payment details. This section should include key fields such as:

- Customer Name – To identify who made the payment.

- Amount Due – The total amount that needs to be paid.

- Amount Paid – The sum received from the customer.

- Payment Date – The date when the payment was made.

- Outstanding Balance – The remaining amount, calculated automatically by subtracting the payment from the amount due.

- Payment Method – Whether the payment was made by cash, credit card, or another method.

Using Formulas for Real-Time Updates

By using formulas, you can automate the tracking process to reduce errors and save time. For example, you can use a formula to calculate the outstanding balance by subtracting the “Amount Paid” from the “Amount Due.” You can also use conditional formatting to highlight overdue payments or unpaid balances, making it easy to spot transactions that need follow-up.

With these tools in place, you’ll be able to quickly see which payments have been received, which are still pending, and the total amount left to collect. This makes it easier to manage cash flow and ensure timely follow-ups on outstanding debts.

Common Mistakes to Avoid in Invoices

While creating financial records, it’s easy to overlook important details that can lead to confusion or delays in payment. Even small mistakes can create issues with clients or customers, leading to frustration and unnecessary back-and-forth. By being aware of common errors, you can ensure your documents are accurate, clear, and professional, minimizing the chance of misunderstandings.

1. Incorrect or Missing Contact Information

Failing to include the correct details for both your business and the customer can cause delays in payment and communication issues. Ensure that names, addresses, and contact numbers are accurate and up-to-date.

2. Lack of Clear Payment Terms

Not specifying payment due dates, late fees, or acceptable payment methods can lead to confusion and missed payments. Make sure to clearly state when payments are due and any conditions tied to them.

3. Overlooking Tax and Discount Calculations

Errors in calculating taxes or discounts can lead to discrepancies between what is owed and what was charged. Always double-check these amounts, especially when working with fluctuating rates or offering special deals.

4. Using Inconsistent Item Descriptions

Vague or inconsistent product descriptions can cause confusion. Always ensure that items are clearly listed with enough detail to avoid any ambiguity, particularly if you offer services or custom products.

5. Failing to Include a Unique Identifier

Each financial document should have a unique number or reference code for easy tracking. Not including this can make it difficult to organize records or follow up on outstanding payments.

6. Not Double-Checking Totals

Simple mathematical errors can easily occur when entering numbers manually. Always review the totals before sending out any documents to ensure the calculations are correct.

How to Use Formulas in Invoice Templates

Using formulas in financial documents allows you to automate key calculations, such as totals, taxes, and discounts, making the process more efficient and accurate. By integrating formulas into your document, you can save time and reduce the risk of errors, ensuring that all amounts are calculated correctly every time. With just a few basic formulas, you can turn a simple record into a powerful tool for managing payments and transactions.

Common Formulas for Financial Documents

- Sum Formula: This basic formula adds up multiple numbers in a column or row. For example, you can use it to calculate the total amount for all items sold. The formula looks like this: =SUM(B2:B10).

- Tax Calculation: To calculate tax automatically, use the formula =Amount * Tax Rate. This allows you to update the tax rate without manually adjusting each item’s total.

- Discount Formula: Apply discounts by using the formula =Amount * (1 – Discount Percentage), which reduces the total amount based on the discount you offer.

- Balance Due: To calculate the remaining amount to be paid, subtract the paid amount from the total due: =Total Due – Paid Amount.

How to Implement Formulas in Your Document

- Step 1: Select the cell where you want the result to appear, such as the total or balance due.

- Step 2: Enter the formula by starting with the equals sign (=), followed by the appropriate function or operation (e.g., SOMME for summing values or PRODUCT for multiplication).

- Step 3: Press Enter, and the result will be displayed in the selected cell.

- Step 4: If needed, copy the formula to other cells to apply it across multiple rows or columns.

By using these formulas, you can automate many aspects of your record-keeping, ensuring accuracy while saving time in the long run.

Best Practices for Amazon Invoice Formatting

Proper formatting is key to creating professional and easy-to-read financial documents. A well-organized structure not only enhances clarity but also ensures that all necessary information is present, reducing the chance of errors or misunderstandings. By following a few best practices for layout, design, and content, you can improve the overall effectiveness of your financial records, making them clear and consistent every time.

Key Formatting Tips

- Use Clear Headings and Sections: Divide the document into distinct sections, such as “Customer Information,” “Itemized List,” and “Total Amount.” This makes it easier for both you and your client to navigate and understand the content.

- Consistent Fonts and Sizes: Choose a legible font and keep the font sizes consistent for easy readability. Use larger font sizes for headings and section titles to help guide the reader’s eye.

- Align Data for Clarity: Ensure all numbers are aligned correctly, such as right-aligning amounts and totals. This makes it easier to compare values and ensures everything is visually organized.

- Include Necessary Details: Always include the transaction date, payment due date, and any reference numbers, such as order IDs or customer numbers. These details are essential for tracking and clarifying the transaction.

- Leave Space for Notes: Include a section for additional notes, such as payment terms or instructions. This helps clarify any special conditions without cluttering the main sections of the document.

Enhancing Professional Appearance

- Use Branding: If applicable, add your company logo and use your business’s colors to create a branded look. This adds professionalism and makes your documents easily recognizable.

- Maintain Consistent Margins: Ensure that your document has uniform margins around the edges for a neat, organized appearance. This creates a balanced layout that’s visually appealing.

By applying these best practices, your financial documents will be clear, professional, and easy to read, helping ensure smoother transactions and better customer communication.

Sharing and Printing Your Amazon Invoice

Once your financial document is complete and ready, it’s essential to share and print it in a way that maintains its professionalism and ensures it reaches the right audience. Whether you’re sending the document to clients via email or printing hard copies for records, the process should be smooth and efficient. By following the right steps, you can guarantee that your documents look polished and are easy to distribute.

Sharing Your Document

- Email as a PDF: One of the most common ways to share financial documents is by converting them into a PDF format. PDFs maintain their formatting, ensuring that the document looks exactly as intended when opened by the recipient. Simply save the file as a PDF and attach it to your email.

- Cloud Storage Links: For larger files or when you need to share multiple documents at once, you can upload the file to a cloud storage service, like Google Drive or Dropbox. Share the download link with your client or business partner for easy access.

- Customizable Sharing Settings: If you’re using a cloud-based tool to manage your documents, make sure you adjust sharing permissions accordingly. You can set files as view-only, prevent editing, or restrict access to specific people.

Printing Your Document

- Ensure Proper Formatting: Before printing, check that the document’s layout is properly adjusted for the print format. Make sure there is enough margin space and that all content fits neatly on the page.

- Print in High Quality: Always choose high-quality printing settings to ensure that the text and numbers are crisp and legible. This is especially important for official documents where clarity is key.

- Keep Multiple Copies: It’s wise to print multiple copies of your financial documents, especially if they are part of your business record-keeping. Keep one copy for your records and another for your client or customer.

By following these guidelines, you can efficiently share and print your documents, ensuring that both electronic and physical copies look professional and are easily accessible.

Why Choose Excel for Invoice Management

Managing financial records efficiently is crucial for any business, and having the right tool to streamline the process can save both time and resources. One of the most popular choices for handling financial documentation is a spreadsheet program, which offers flexibility and powerful features for organizing and tracking payments. Whether you’re a freelancer or running a small business, using this tool can help you maintain accurate records with minimal effort.

Key Advantages of Using a Spreadsheet for Financial Records

- Easy Customization: Unlike predefined software, you have the freedom to create and adjust the layout of your records to suit your specific needs. You can easily add or remove fields, change the structure, and include additional information like taxes, discounts, or shipping charges.

- Automated Calculations: Built-in formulas allow you to automatically calculate totals, taxes, and discounts. This eliminates the need for manual calculations, reducing the chances of errors and ensuring that every number is accurate.

- Cost-Effective: Spreadsheet programs are often included in office software packages or available at a low cost. This makes them an affordable solution compared to expensive accounting software, especially for small businesses or independent contractors.

- Data Organization and Analysis: You can easily track and organize all your financial documents in one place. This makes it easier to generate reports, analyze trends, and manage your cash flow with a few clicks.

- Accessibility and Portability: These files can be saved on your computer, cloud storage, or shared with others, giving you the flexibility to access and update your records from anywhere, at any time.

Seamless Integration with Other Business Tools

- Efficient Record Keeping: You can integrate your financial records with other tools you may already be using, like inventory management or customer relationship management (CRM) systems, making it easier to consolidate all aspects of your business in one place.

- Easy Updates and Modifications: As your business grows or your pricing structure changes, you can quickly modify the document to reflect those updates without having to switch to a different software solution.

For these reasons, a spreadsheet program stands out as a reliable, efficient, and flexible tool for managing financial records, making it a top choice for many businesses looking to streamline their documentation process.

Free Amazon Invoice Template Downloads

Accessing ready-made documents for managing transactions can be a time-saver for businesses looking to streamline their accounting processes. Many free resources offer downloadable versions of financial record templates that can be customized to meet your specific needs. These templates allow you to quickly create well-structured documents for billing, sales, or other financial activities, saving you the hassle of starting from scratch.

Where to Find Free Downloadable Templates

- Online Template Repositories: There are numerous websites dedicated to offering free, customizable financial record templates. Many of these sites allow you to download documents in various formats, such as Word, PDF, or spreadsheet files, depending on your preference.

- Business Resource Platforms: Platforms like Google Docs, Microsoft Office, or other cloud-based business tools often provide free templates as part of their service offerings. These templates are easy to access and integrate directly into your workflow.

- Accounting Blogs and Forums: Many blogs and forums focused on small business accounting offer free downloadable templates. These resources are usually shared by professionals looking to help others simplify their business processes.

Benefits of Using Free Templates

- Cost Savings: Using free downloadable documents eliminates the need to purchase expensive software or services, making it an affordable option for businesses of all sizes.

- Time Efficiency: Pre-designed templates help you save time by providing a ready-made structure for your documents. You don’t have to spend time designing from scratch or figuring out the necessary elements.

- Easy Customization: Most downloadable templates are fully customizable, meaning you can adjust the layout, fonts, and fields to align with your business’s branding or specific requirements.

By using these free resources, you can quickly and effectively manage your business transactions without the need for complex or costly software, ensuring that your records are both professional and consistent.