Download Amazon Invoice Template for Easy and Fast Invoicing

Managing business transactions efficiently is crucial for any seller or entrepreneur. Having a reliable and professional tool to generate payment records can save time, reduce errors, and ensure smooth communication with clients. These essential tools help organize sales details in a clear, accessible format that is both accurate and customizable to fit your specific needs.

Whether you’re handling a single order or multiple sales, utilizing a standardized document can make your financial operations more consistent and transparent. By using a well-structured form, you ensure that all relevant information, such as product details, pricing, and buyer information, is presented correctly and professionally every time. Additionally, such documents can simplify accounting processes and make it easier to track earnings and outstanding payments.

In this guide, you will find practical advice on how to obtain and use these important tools. You’ll learn how to customize them for your business, organize transaction records effortlessly, and ultimately create a more efficient billing workflow. A simple, yet effective approach to managing your sales and payments can enhance productivity and help maintain a professional image in any business environment.

Amazon Invoice Template: A Comprehensive Guide

Creating well-organized billing documents is essential for smooth business operations. These documents serve as official records of transactions, offering both sellers and buyers a clear summary of the exchanged goods or services. By following a structured format, you can ensure consistency, reduce mistakes, and maintain professional communication with clients. This guide will help you understand the key elements that should be included in a standard transaction document and show you how to customize it according to your specific needs.

Key Components of a Standard Billing Document

A proper transaction document includes several important elements that provide clarity and accuracy. Below are the essential components you should consider when creating your own:

| Section | Description |

|---|---|

| Header | Typically includes your business name, address, and contact details. |

| Client Information | Details such as the buyer’s name, address, and contact information. |

| Transaction Date | Indicates when the sale was made or the service provided. |

| Product/Service Details | A description of the items or services involved in the transaction, including quantities and unit prices. |

| Total Amount | Displays the total cost, including taxes, discounts, or additional fees. |

| Payment Terms | Clarifies how and when payment should be made, including accepted payment methods. |

How to Personalize Your Document for Your Business

Once you understand the key sections of a transaction document, you can begin tailoring it to fit your specific requirements. You can choose to add your logo or branding elements to make it look more professional and aligned with your com

Why You Need an Amazon Invoice Template

Efficiently managing financial records is essential for any business, whether you’re a small entrepreneur or a large-scale seller. Having a structured document to track sales and payments not only ensures transparency but also streamlines administrative tasks. A well-designed billing document helps keep everything in order and ensures that both you and your clients are on the same page when it comes to financial transactions.

Benefits of Using a Structured Document

Using a clear and standardized form for every sale can provide numerous advantages for both business owners and customers. Here are some key benefits:

- Consistency: It ensures that every transaction is documented in the same manner, minimizing the chances of errors or omissions.

- Time-saving: With a pre-designed format, you can quickly fill in transaction details, reducing the time spent on creating custom records for each sale.

- Professionalism: Providing clients with a neat, well-organized document helps maintain a professional image and fosters trust.

- Tax and Accounting Compliance: A detailed record of each transaction can be extremely helpful when filing taxes or auditing your financial activities.

- Transparency: Clear and precise documentation allows both parties to see exactly what has been purchased and at what price, avoiding confusion.

How It Simplifies the Transaction Process

Using a standard format can significantly streamline the process for both buyers and sellers. With all the necessary details already in place, you can focus on fulfilling the order and communicating effectively with your clients. Additionally, it reduces the chances of miscommunication and ensures that payment terms, shipping details, and product descriptions are clearly outlined.

- Creates a

Benefits of Using Amazon Invoice Templates

Utilizing a pre-designed form for documenting transactions offers multiple advantages that enhance efficiency and organization in business operations. With a consistent format, businesses can simplify the process of creating sales records and ensure that all necessary information is clearly outlined. This approach not only saves time but also helps maintain a high level of professionalism and accuracy in financial dealings.

Enhanced Efficiency and Time-Saving

One of the primary benefits of using a ready-made document for each sale is the significant amount of time saved. Instead of creating a new record from scratch for every transaction, you can simply input the relevant details into a pre-designed structure. This allows for faster processing and frees up time to focus on other critical aspects of the business.

- Speed: Quickly generate records with pre-set fields for product details, pricing, and customer information.

- Less Effort: No need to manually adjust the format each time–just add the transaction data and you’re done.

- Reduced Errors: A consistent format reduces the chances of making mistakes when entering information.

Professional Appearance and Consistency

Providing customers with a well-organized and uniform document enhances the professional image of your business. It shows attention to detail and ensures that all necessary information is easily accessible. Clients appreciate clarity, and a consistent, easy-to-read structure builds trust and reliability.

- Branding: Customize the form to include your business logo, which reinforces your brand identity.

- Clear Structure: A consistent layout makes it easy for both parties to understand the transaction at a glance.

- Trust: Clients are more likely to trust businesses that present themselves professionally and maintain transparent financial records.

By using a pre-built document format, you

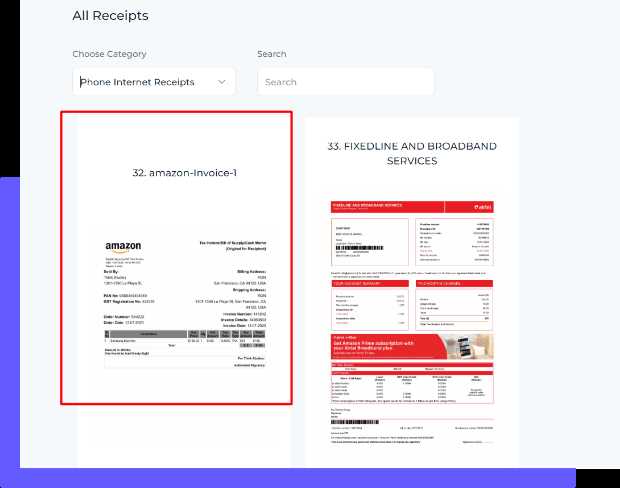

How to Download an Amazon Invoice Template

Acquiring a pre-designed document for managing transactions is a simple process that can greatly enhance your business operations. With just a few steps, you can access customizable forms that are ready for use, saving you time and effort while ensuring accuracy in your records. Whether you prefer using a free option or choosing a premium service, getting the right structure is key to streamlining your sales management.

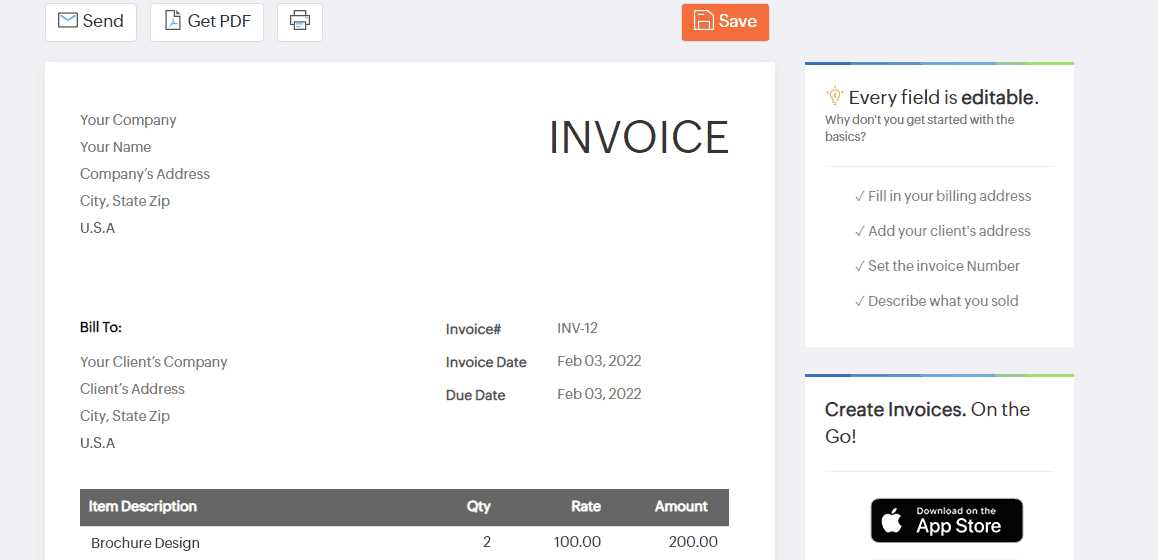

Steps to Access a Ready-Made Document

To begin using a standardized form, follow these easy steps to locate and obtain one that fits your business needs:

- Search Online: Look for reliable sources offering free or paid forms tailored to your requirements. Many websites provide ready-to-use documents designed for various business types.

- Choose the Right Format: Decide whether you need a document in Excel, PDF, or Word format based on how you plan to use and customize it.

- Select the Template: Once you find a form that meets your needs, check its features to ensure it includes all the sections and details you require.

- Download the File: Click the download button to save the file to your device. Make sure to check the file type and open it with the appropriate software.

Customizing the Form for Your Business

Once you’ve obtained the document, you can easily tailor it to match your branding and transaction details. Adjust the fields to include your business name, contact information, and any specific terms or conditions relevant to your sales process. This personalization ensures that each record reflects your unique business style while maintaining the necessary structure.

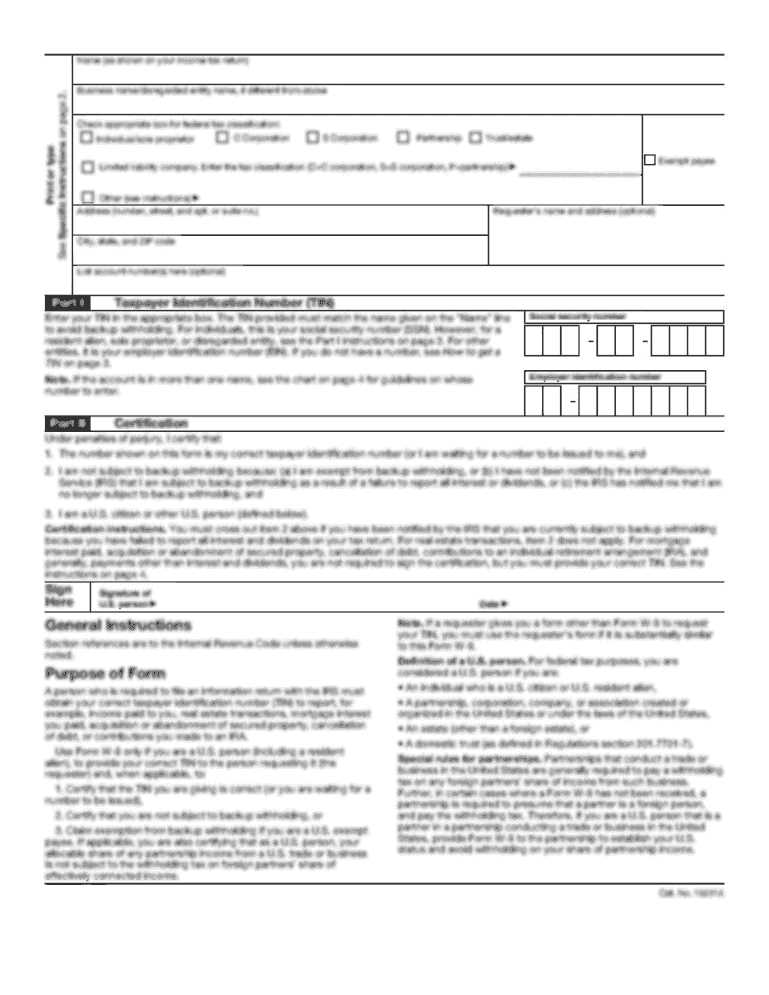

Understanding the Key Elements of an Invoice

When documenting a financial transaction, certain key components must be included to ensure that both parties have a clear understanding of the terms and details. These elements provide essential information about the products or services sold, the agreed-upon price, and the payment schedule. By knowing what to include, you can create a comprehensive and professional record for each sale.

Essential Information for Accurate Transaction Records

A well-organized document should include the following critical sections:

- Seller and Buyer Information: Names, addresses, and contact details for both the seller and the buyer, ensuring clarity on who is involved in the transaction.

- Transaction Date: The date when the sale occurred or the service was provided, which helps track the timing of payments and deliveries.

- Product or Service Details: A clear description of the items or services sold, including quantities, unit prices, and any additional features or specifications.

- Total Amount: The total cost of the transaction, including any taxes, discounts, or additional fees that apply to the sale.

- Payment Terms: Clear instructions on how payment should be made, the due date, and any penalties for late payments, if applicable.

Why These Elements Matter

Including these key elements in each record helps prevent confusion and ensures that both parties have a mutual understanding of the transaction. It also provides a valuable reference for future inquiries, disputes, or financial audits. Additionally, it simplifies the accounting process, making it easier to track income and prepare for tax filings.

Customizing Your Amazon Invoice Template

Adapting a standardized document to fit your specific business needs is a crucial step in ensuring consistency and professionalism. Personalizing these forms allows you to reflect your brand identity, tailor the structure to your workflow, and make it easier for clients to understand the details of the transaction. Customization can involve adjusting the layout, adding or removing fields, and incorporating elements that are important for your business operations.

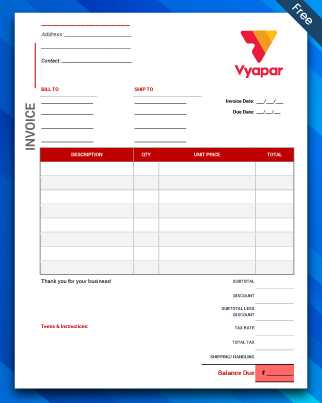

Key Customization Options

There are several ways you can modify the structure to better suit your preferences and business model. The most common customization options include:

- Branding: Add your company’s logo, color scheme, and contact details to maintain a consistent professional image.

- Field Adjustments: Modify existing sections or create new fields to include specific details like order numbers, shipping instructions, or payment terms.

- Layout and Design: Adjust the layout for better readability or add sections for discounts, taxes, or service fees if needed.

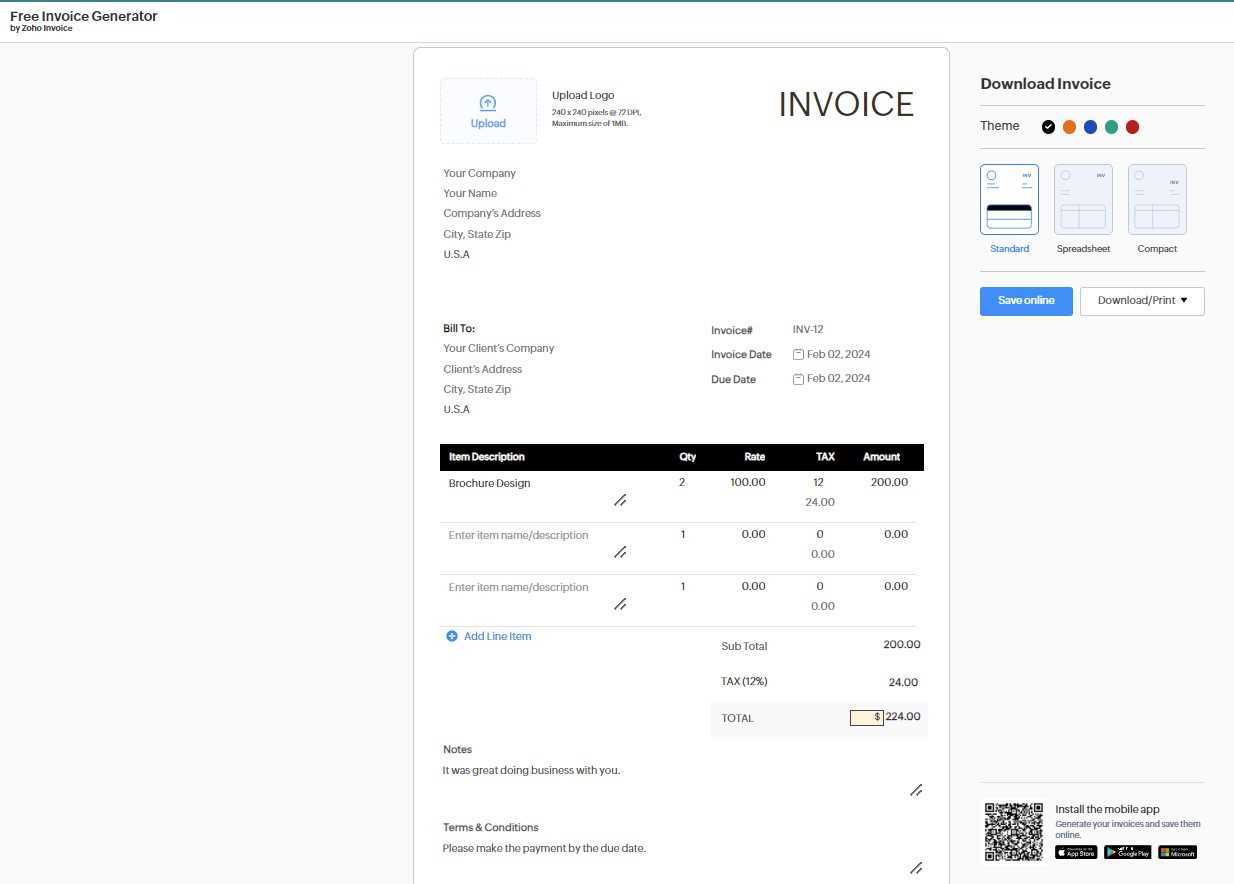

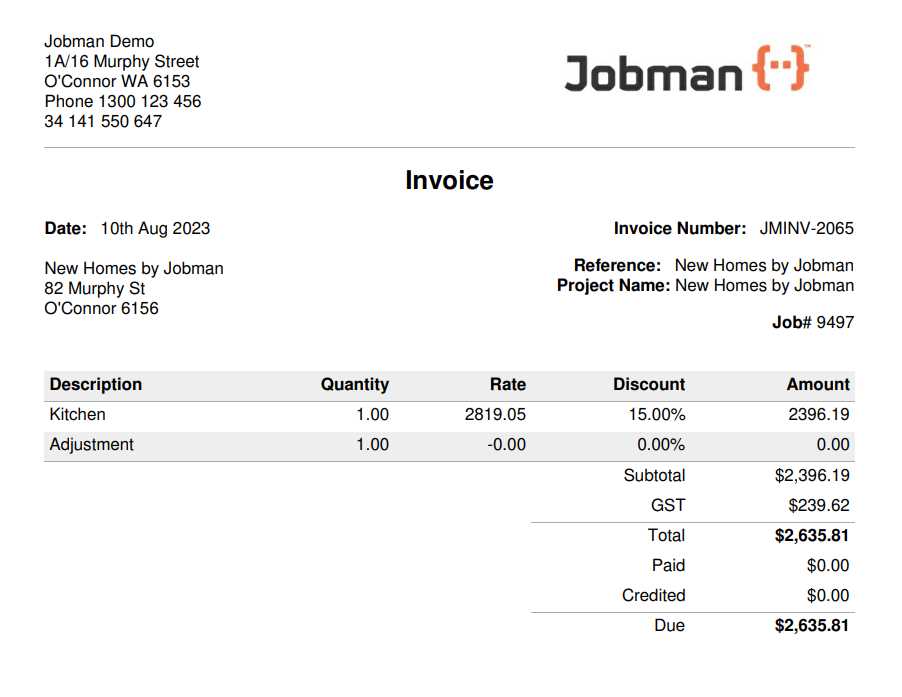

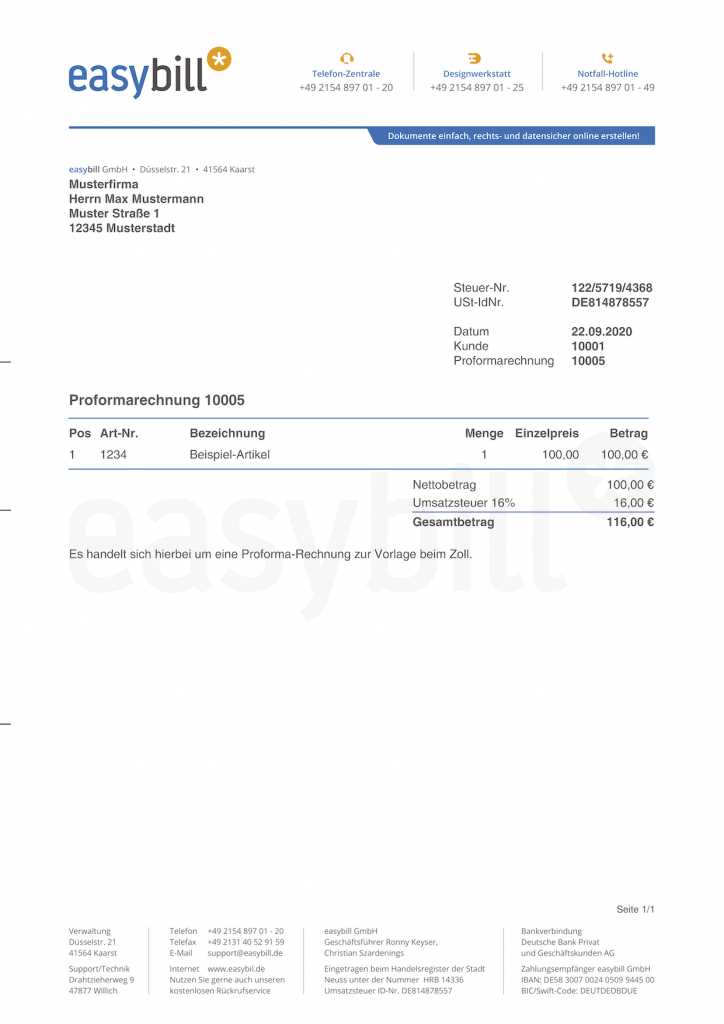

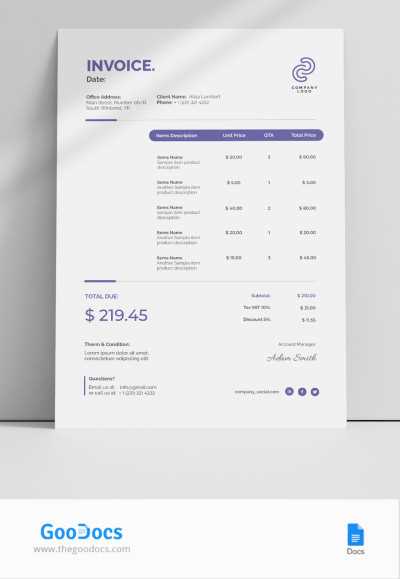

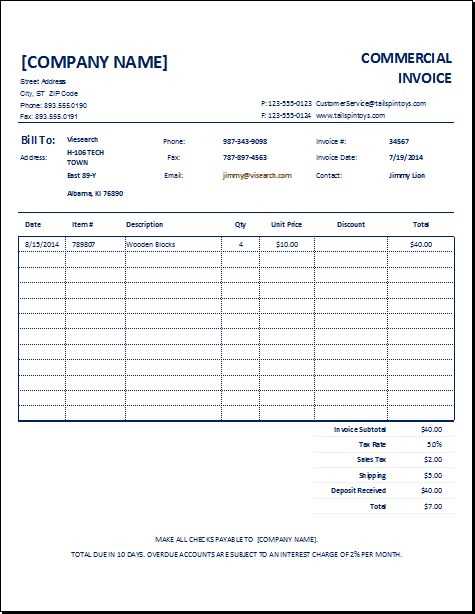

Example of a Customizable Document Layout

Here’s an example of how the layout might look with custom fields added:

Section Description Business Details Include your company name, logo, contact information, and address. Client Information Input the client’s name, address, and contact information for reference. Order Details List the products or services provided, including quantities and unit prices. Discounts or Fees Add any applicable discounts or additional charges, if relevant. Total Amount Due Show the final total, including taxes, discounts, and any fees. By adjusting these sections, you can create a

Common Mistakes to Avoid in Amazon Invoices

Creating accurate and professional financial records is essential for maintaining good relationships with clients and keeping your business operations running smoothly. However, even the smallest mistake in the document can lead to confusion, delays, or disputes. Understanding the most common errors and knowing how to avoid them can help you ensure that your records are both precise and reliable.

Common Errors in Financial Documents

There are several mistakes that can occur when filling out or managing your transaction records. Below are some of the most common ones:

- Missing Client Information: Failing to include the correct contact details of the buyer, such as their name, address, or email, can lead to confusion, especially if there are issues with the payment or delivery.

- Incorrect or Missing Dates: Leaving out the transaction date or entering the wrong date can create discrepancies, particularly when it comes to tracking payments or fulfilling orders.

- Wrong Product or Service Details: Ensure that the description, quantities, and prices are accurate. Incorrect details can lead to misunderstandings or disputes over charges.

- Unclear Payment Terms: If payment instructions or deadlines are not clearly stated, clients may become unsure about how or when to make their payment, which could lead to delays.

- Not Including Taxes or Fees: Forgetting to add sales tax or applicable fees can result in significant issues for your business, especially when it comes to compliance and accounting.

How to Avoid These Mistakes

To prevent these common errors, always double-check the

Choosing the Right Format for Your Invoice

Selecting the appropriate format for your financial records is a critical step in streamlining your business transactions. The format you choose can affect how easily you manage and share your documents, as well as how easily clients can access and process the information. There are several formats available, each offering different advantages depending on your needs, preferences, and the tools you use.

Common Formats for Business Documents

When deciding on a format, consider how you plan to distribute, edit, and store your documents. Below are some of the most commonly used formats:

- PDF (Portable Document Format): This format is ideal for sharing finalized documents, as it maintains the exact layout and can be easily viewed on any device without modification. It’s great for email or digital filing.

- Excel (XLSX): Excel is useful if you need to make calculations, manage data, or create templates that you can update frequently. It allows for easy customization and automated calculations for tax, totals, and discounts.

- Word (DOCX): Word documents are flexible and easy to edit, making them a good option for businesses that need to adjust their documents often. However, they may not always maintain the formatting as well as PDFs when shared with clients.

- Google Docs/Sheets: Cloud-based tools like Google Docs or Sheets provide the advantage of real-time collaboration and access from any device. They can be particularly useful for teams or businesses that require constant updates and sharing.

Choosing the Best Format for Your Needs

Each format offers distinct advantages, so the best choice will depend on how you plan to use the document. For example, if you need to send a document that can’t be edited by the recipient, a PDF is the most secure option. If you’re working with a team and need real-time edits, cloud-based formats like Google Docs or Sheets may be ideal. Excel is great for businesses that require auto

Step-by-Step Guide to Filling Out Your Invoice

Filling out a financial transaction document may seem straightforward, but ensuring all necessary information is accurately included is essential for smooth business operations. By following a clear and structured approach, you can avoid errors and create a professional record for both you and your clients. This guide will walk you through the key steps to efficiently complete your business records.

Step 1: Add Your Business Information

Start by entering your business name, address, phone number, and email. This ensures that the client can easily reach you if needed. Including your logo here can also help maintain your brand identity.

Step 2: Include Client Details

Next, enter your client’s name, company name (if applicable), address, and contact information. It’s important to ensure that this data is up to date, as any errors could result in delivery issues or confusion during payment processing.

Step 3: Specify the Transaction Date and Due Date

Always include the date when the transaction took place and the due date for payment. These dates help both parties keep track of payment timelines and prevent misunderstandings. Be sure the due date is clear to avoid delays.

Step 4: List Product or Service Details

Provide a clear description of the goods or services that were exchanged. Include quantities, unit prices, and any other relevant details. If applicable, break down the pricing into line items to make the information easy to understand for your client.

Step 5: Calculate Total Amount

Ensure that you calculate the total amount due, including any taxes, shipping fees, or discounts. Double-c

How to Save and Print Amazon Invoices

Once you’ve completed your financial transaction document, it’s important to save and print it properly for both record-keeping and sharing purposes. This ensures that you have a copy for your files and that you can easily provide the document to your client when needed. In this section, we’ll explore the steps to save and print your document efficiently, ensuring that the format remains intact and accessible.

Saving Your Document

After filling out the necessary details, it’s crucial to save the document in a format that preserves the layout and is easy to access later. Here are the most common saving methods:

- PDF Format: Saving the document as a PDF is the most reliable option, as it preserves the layout and formatting across all devices and operating systems. To save, simply select “Save as PDF” in your document editor.

- Excel or Word Format: If you want to make future edits or track data in a spreadsheet, saving in Excel or Word format is ideal. Keep in mind that these formats may not maintain the same level of consistency when shared across different platforms.

- Cloud Storage: For easy access across devices, you can also save the document to cloud storage platforms such as Google Drive, Dropbox, or OneDrive. This allows you to access and share the document from anywhere.

Printing Your Document

Once the document is saved, you may need to print a hard copy for your records or to hand over to your client. Here’s how to do it:

- Select Printer: Choose the printer you want to use, ensuring it is connected and ready to print.

- Preview Before Printing: Always preview the document to ensure the layout and formatting are correct before printing. This step helps avoid wasted paper a

Best Practices for Amazon Invoice Management

Effective management of financial transaction documents is key to maintaining smooth business operations. By following best practices, you can ensure that your records are organized, accurate, and accessible when needed. Proper management also helps you track payments, reduce errors, and comply with tax regulations. Below are some best practices that can help you streamline your document management process.

Organizing Your Records

Keeping your financial documents organized is essential for easy access and efficient management. Here are a few tips to help you stay organized:

- Use Folders and Categories: Organize your documents into folders based on categories such as sales, purchases, refunds, or date ranges. This will make it easier to locate any record quickly.

- Label Documents Clearly: Give each document a clear, consistent name, including relevant details like the client name, date, and transaction number. For example, “ClientName_TransactionID_Date” can be an effective naming convention.

- Utilize Cloud Storage: Storing your documents in cloud-based platforms like Google Drive or Dropbox ensures that they are easily accessible from any device while being securely backed up.

Tracking and Updating Records

Regularly tracking and updating your documents will help ensure that your financial records remain accurate. Consider the following strategies:

- Review Documents Regularly: Make it a habit to review and update your records periodically. This can help you catch any discrepancies early and avoid issues with clients or tax filings.

- Automate Data Entry: Use software that allows you to automate the process of entering data into your transaction forms. This can reduce human error and save time in the long run.

- Maintain a Clear Payment History: Keep detailed records of payment status for each document. This can include notes about whether a payment has been received, if a reminder has been sent, or if there are any outstanding balances.

Ensuring Compliance and Security

It’s crucial to ensure that your documents meet legal requirements and are stored securely. Here are some tips to help with compliance:

- Stay Informed on Regulations: Regularly check the latest tax and financial regulations to ensure tha

How to Use Invoice Templates for Multiple Orders

Managing multiple orders can be time-consuming, but using a structured document format for each transaction can help you keep everything organized and reduce errors. When dealing with several orders at once, it’s important to be able to efficiently manage and customize records to include all necessary details. Here’s how you can use a standardized format for multiple orders, ensuring accuracy and consistency across all your transactions.

Steps to Handle Multiple Orders Efficiently

Using a structured format for multiple transactions allows you to consolidate details in one document while maintaining clarity. Follow these steps to manage several orders with ease:

- Group Orders by Client: If you have multiple orders from the same client, consider grouping them together under a single record. List all products or services purchased along with their quantities and prices in separate line items.

- Separate Orders by Date: For a large number of orders, it’s helpful to organize the records by the date of transaction. This makes it easier to track when each order was placed and ensures that any time-sensitive information is properly noted.

- Use Order Numbers: Assign unique order numbers to each transaction to avoid confusion and ensure easy reference. This also helps with tracking payments and shipments.

- Include Summary Details: After listing each order, provide a summary at the bottom of the document that includes the total number of orders, total amount due, and any applicable taxes or fees. This helps both you and the client quickly see the overall cost of all orders combined.

Organizing the Information for Multiple Orders

When managing multiple transactions, organizing the information in a clear, easy-to-read format is crucial. Consider the following tips:

- Use a Table for Clarity: A table format allows you to present the details of each order in a clean and easy-to-read manner. Each order should be displayed on a separate row with columns for product details, quantity, price, and subtotal.

Can You Automate Amazon Invoices?

Automating financial document creation can save time, reduce errors, and improve efficiency, especially for businesses dealing with a large volume of transactions. Instead of manually filling out details for each order, automated systems can streamline the process, ensuring consistency and accuracy across all records. This section explores how automation can be applied to your transaction documentation process and what tools are available to assist with it.

Benefits of Automating Financial Documentation

By automating the process of generating transaction records, businesses can enjoy several key benefits:

- Time Savings: Automating the creation of documents eliminates the need for manual data entry, allowing employees to focus on other critical tasks.

- Consistency: Automated systems use predefined templates to generate documents, ensuring that each record follows a consistent structure and format.

- Accuracy: With automation, human errors such as data entry mistakes or missing information are minimized, leading to more accurate records.

- Better Record Keeping: Automated systems can automatically save and store documents, making it easier to organize and retrieve them when needed.

How to Automate Transaction Documentation

There are various tools and software solutions that can help automate the creation and management of financial documents:

- Accounting Software: Many accounting platforms (e.g., QuickBooks, Xero, FreshBooks) offer automation features that allow you to generate financial documents based on sales and transactions. These systems can pull information directly from your sales data and create the necessary records without manual intervention.

- Customer Relationship Management (CRM) Systems: CRMs like Salesforce or HubSpot often integrate with accounting software to automate document creation. These systems can track customer purchases, calculate totals, and generate documents accordingly.

- Automated Billing Solutions: Tools designed specifically for b

Can You Automate Amazon Invoices?

Automating financial document creation can save time, reduce errors, and improve efficiency, especially for businesses dealing with a large volume of transactions. Instead of manually filling out details for each order, automated systems can streamline the process, ensuring consistency and accuracy across all records. This section explores how automation can be applied to your transaction documentation process and what tools are available to assist with it.

Benefits of Automating Financial Documentation

By automating the process of generating transaction records, businesses can enjoy several key benefits:

- Time Savings: Automating the creation of documents eliminates the need for manual data entry, allowing employees to focus on other critical tasks.

- Consistency: Automated systems use predefined templates to generate documents, ensuring that each record follows a consistent structure and format.

- Accuracy: With automation, human errors such as data entry mistakes or missing information are minimized, leading to more accurate records.

- Better Record Keeping: Automated systems can automatically save and store documents, making it easier to organize and retrieve them when needed.

How to Automate Transaction Documentation

There are various tools and software solutions that can help automate the creation and management of financial documents:

- Accounting Software: Many accounting platforms (e.g., QuickBooks, Xero, FreshBooks) offer automation features that allow you to generate financial documents based on sales and transactions. These systems can pull information directly from your sales data and create the necessary records without manual intervention.

- Customer Relationship Management (CRM) Systems: CRMs like Salesforce or HubSpot often integrate with accounting software to automate document creation. These systems can track customer purchases, calculate totals, and generate documents accordingly.

- Automated Billing Solutions: Tools designed specifically for billing and invoicing (e.g., Zoho Invoice, Invoice Ninja) can automate the process of generating and sending transaction records. These platforms typically offer templates that automatically populate with data such as product names, quantities, prices, taxes, and discounts.

Automation Features to Look For

When selecting automation tools for your business, consider the following features:

- Customizable Templates: Ensure the system allows you to customize the format and layout of the documents to match your business’s branding.

- Integration with Sales Data: Look for tools that can integrate with your sales or e-commerce platform so that transaction details are automatically pulled into the document without manual input.

- Automatic Payment Tracking: Choose a system that can automatically update payment status and send reminders for overdue payments.

- Cloud-Based Storage: Cloud storage options help ensure that your documents are securely stored and easily accessible, reducing the risk of lost or misplaced records.

Example of Automated Record Creation

Below is an example of how an automated system might populate a transaction document based on data pulled from an e-commerce platform:

Item Quantity Unit Price Total Product A 2 $25.00 $50.00 Product B 1 $40.00 $40.00 Subtotal $90.00 Tax (10%) $9.00 Total $99.00 This example shows how a simple automated system can accurately calculate totals, apply tax, and generate the necessary details without manual input.

By integrating automation into your business processes, you can significantly reduce the time spent on document creation, minimize errors, and ensure consistent, professional records for every transaction.

Tracking Payments with Amazon Invoice Templates

Keeping track of payments is crucial for maintaining a smooth cash flow and ensuring that your financial records are up to date. Having a well-structured document format for each transaction allows you to efficiently monitor whether payments have been received, what amounts are still outstanding, and which clients require follow-up. In this section, we will explore how to use structured documents to track payments and manage financial transactions more effectively.

Monitoring Payment Status

Tracking the status of payments can be simplified by including specific fields and information within your transaction documentation. Here’s how you can manage payment statuses:

- Mark Payment Status: Add a section in your document to indicate whether the payment is “Pending,” “Completed,” or “Overdue.” This makes it easy to quickly see the status of any transaction.

- Record Payment Date: Include a field for the payment date. This helps you track when payments are made and ensures that overdue amounts are promptly addressed.

- Track Partial Payments: In cases where payments are made in installments, note the amount paid and the remaining balance. This will help you keep track of what is still owed and avoid confusion.

Using a Table to Organize Payment Information

A table format can help you clearly organize the payment details for multiple transactions. Below is an example of how you might structure your document to track payments:

Transaction ID Client Name Total Amount Amount Paid Remaining Balance Payment Status Payment Integrating Amazon Invoices with Accounting Software

Integrating financial transaction records with accounting software can streamline your financial management process and reduce manual entry. By connecting your transaction documents directly to your accounting platform, you can automate many tasks, such as tracking expenses, managing income, and generating reports. This integration helps maintain accurate records, reduces errors, and saves time by eliminating the need to input the same data multiple times. Here’s how you can integrate your financial documentation with accounting software for a smoother workflow.

Why Integration Is Important

Integrating your transaction records with accounting software offers several key advantages:

- Improved Efficiency: Automatically syncing transaction data with your accounting system saves time on manual data entry, allowing you to focus on other important tasks.

- Accurate Financial Reports: With all your transaction details already in the accounting software, generating financial statements becomes much more straightforward and accurate.

- Real-Time Data Updates: Integration allows your records to be updated in real-time. Any changes made to a transaction or payment status will be reflected instantly in your financial software.

- Reduced Human Error: By automating the transfer of data, you reduce the risk of mistakes that can happen with manual data input.

How to Integrate Transaction Records with Accounting Platforms

There are a few ways to link your transaction records with accounting software:

- API Integrations: Many modern accounting platforms offer API connections that allow you to automatically push your transaction records from your sales platform into the software. These integrations typically require minimal setup and provide real-time data synchronization.

-

Free vs Paid Amazon Invoice Templates

When it comes to creating professional transaction records, you have two main options: using free or paid solutions. Both types offer distinct advantages and limitations, and choosing the right one depends on your business needs, budget, and desired level of customization. In this section, we’ll explore the key differences between free and paid options for transaction documentation, helping you make an informed decision about which solution works best for your business.

Advantages of Free Options

Free templates are often an appealing choice, especially for small businesses or those just starting out. Here are some reasons you might consider using a free solution:

- Cost-effective: Free templates come at no cost, making them an ideal choice for businesses with limited budgets or for those who are just beginning to handle financial records.

- Easy to Use: Many free options are straightforward and user-friendly, designed for quick setup and immediate use without requiring advanced technical knowledge.

- Basic Features: While not as customizable as paid options, free templates typically provide the essential elements needed for basic transaction documentation.

Drawbacks of Free Options

While free templates may suit basic needs, they do come with some limitations:

- Limited Customization: Free options often lack advanced customization features, meaning you might not be able to tailor the format to your exact requirements.

- Basic Design: The design and layout of free templates can sometimes be quite basic, which might not align with the professional image you wish to project for your business.

- Less Support: Free solutions often come with limited customer support, meaning you may struggle to resolve any issues that arise.

Advantages of Paid Options

Paid solutions often provide more advanced features and greater flexibility. Here’s why you might opt for a premium choice:

- Customization and Flexibility: Paid templates typically offer a wide range of customization options, allowing you to tailor the layout, colors, fonts, and other elements to match your business branding.

- Advanced Features: Many paid options include additional features such as a