Akaunting Invoice Template for Easy and Professional Billing

Efficient financial management is key to any business, and one of the most important aspects is ensuring that your payment requests are clear, professional, and accurate. With the right tools, you can create documents that not only reflect your brand’s identity but also help keep track of transactions effortlessly. This guide will walk you through how to design and utilize customizable billing documents that fit your business needs, making the process faster and more efficient.

Creating polished and easy-to-understand documents for clients is essential for maintaining a professional image. By using a flexible format, you can tailor each request to include necessary details such as payment terms, discounts, and tax information, all while keeping everything aligned with your unique style. Customization features allow you to adjust the design and content, saving you time and reducing errors.

In this article, we will explore how to set up these financial documents, integrate essential fields, and enhance overall productivity. Whether you’re a freelancer or managing a growing company, these solutions will help you take full control of your billing process.

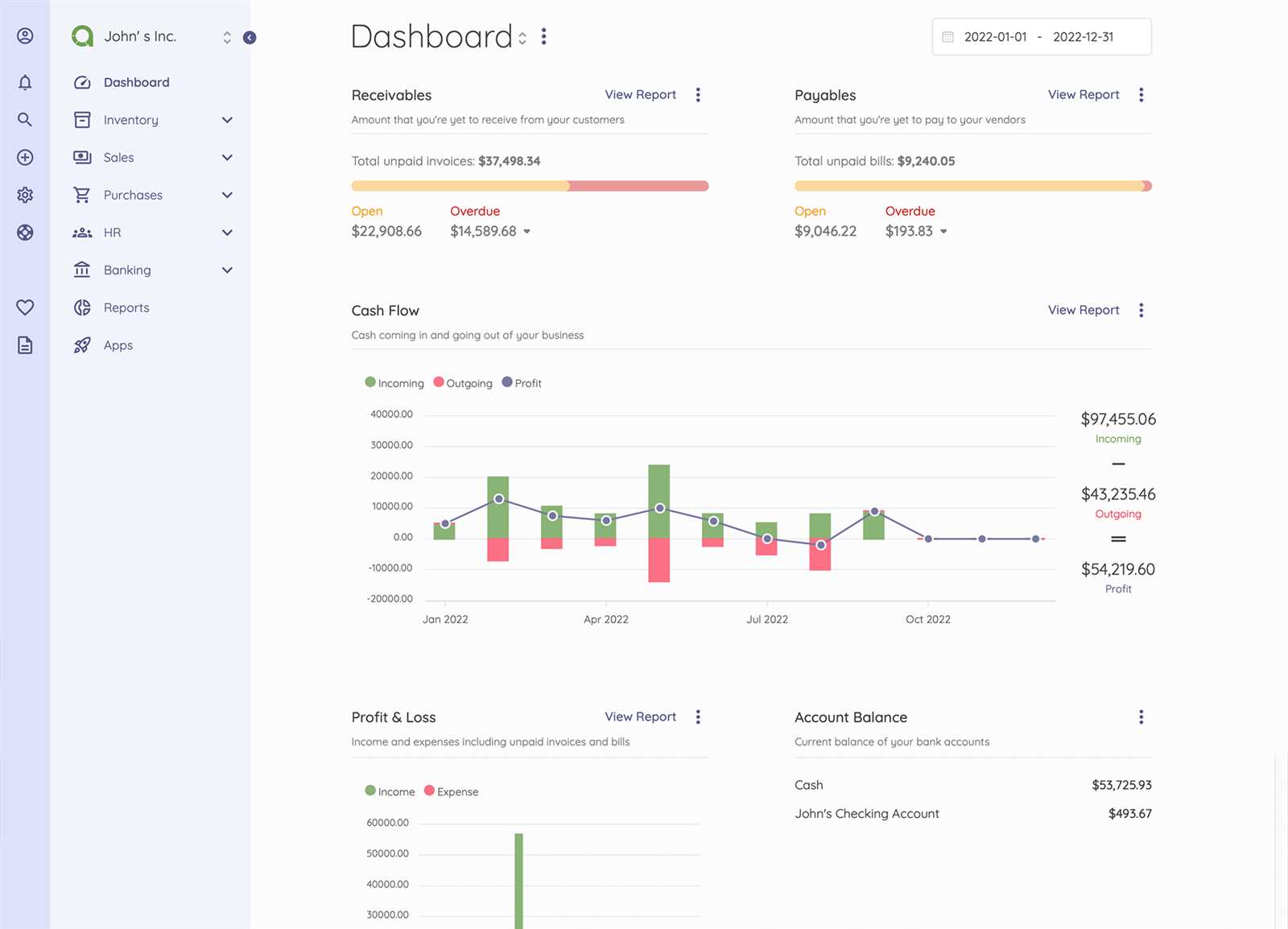

Akaunting Invoice Template Overview

In the world of business, having a structured and professional approach to managing financial documents is essential. Customizable documents allow businesses to create professional payment requests that not only look polished but are also functional and easy to use. These tools provide flexibility, enabling users to modify content and layout according to their specific needs, ensuring accuracy and consistency in every transaction.

Key Features of a Customizable Billing Document

These solutions are designed to simplify the process of generating and sending payment requests. With a variety of customizable elements, businesses can easily adapt the document to their preferences. Some of the key features include:

- Customizable fields: Modify sections such as client information, product/service descriptions, and payment terms.

- Automatic calculations: Built-in formulas that automatically calculate totals, taxes, and discounts.

- Branding options: Add logos, change fonts, and adjust colors to match your company’s visual identity.

- Flexible formats: Choose between PDF, Excel, or other exportable formats to easily share or print your document.

Why Choose a Customizable Solution

Using an adaptable format for billing documents provides several advantages for businesses of all sizes. Not only does it save time, but it also ensures that every request looks consistent and professional. Some of the key benefits include:

- Time efficiency: Streamlined document creation process saves hours on manual entry.

- Professional appearance: Customization options ensure a polished, on-brand look for every document.

- Error reduction: Pre-set fields and automated calculations minimize the chances of mistakes.

- Flexibility: Easily adapt your documents for various industries, clients, or business needs.

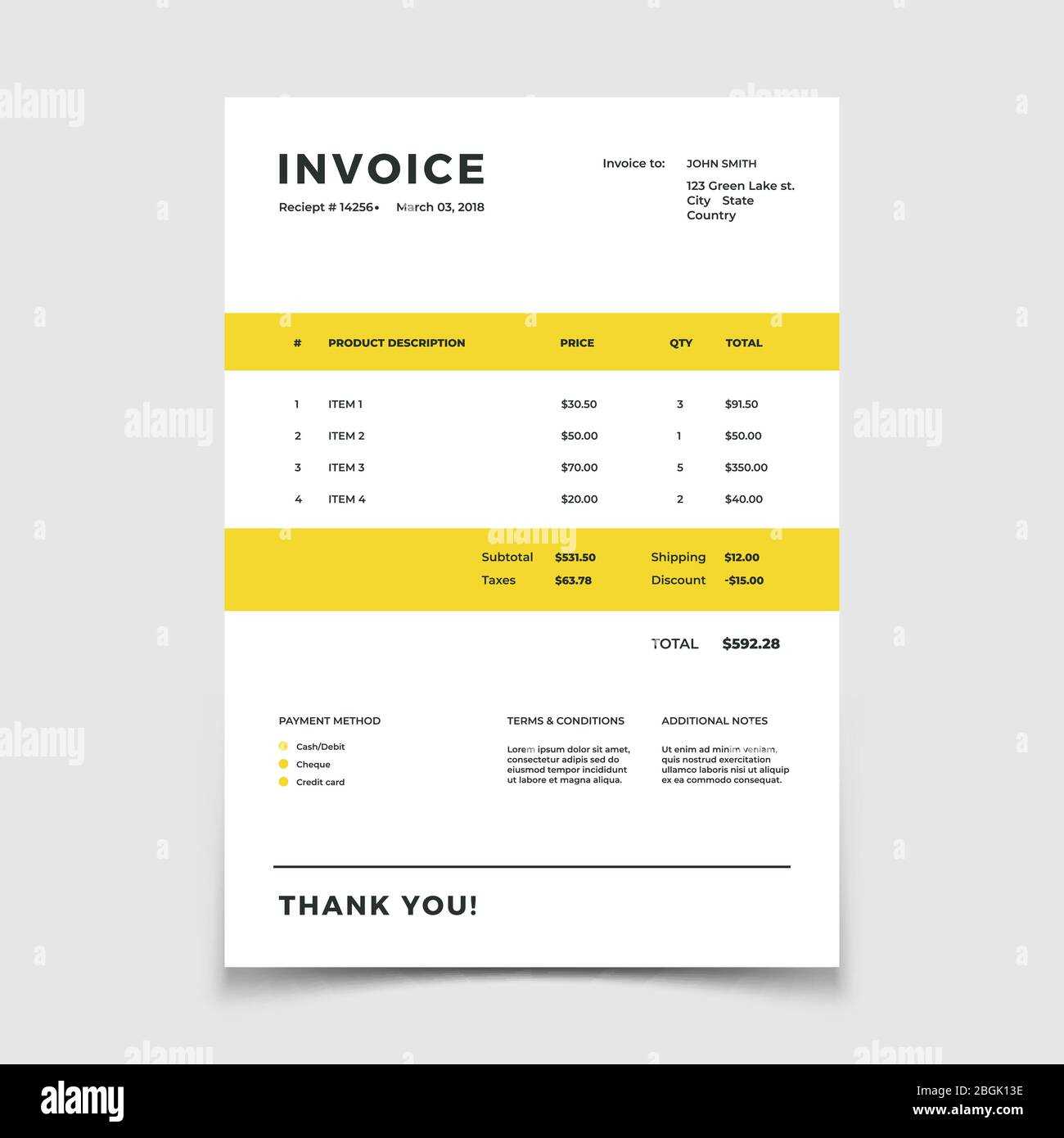

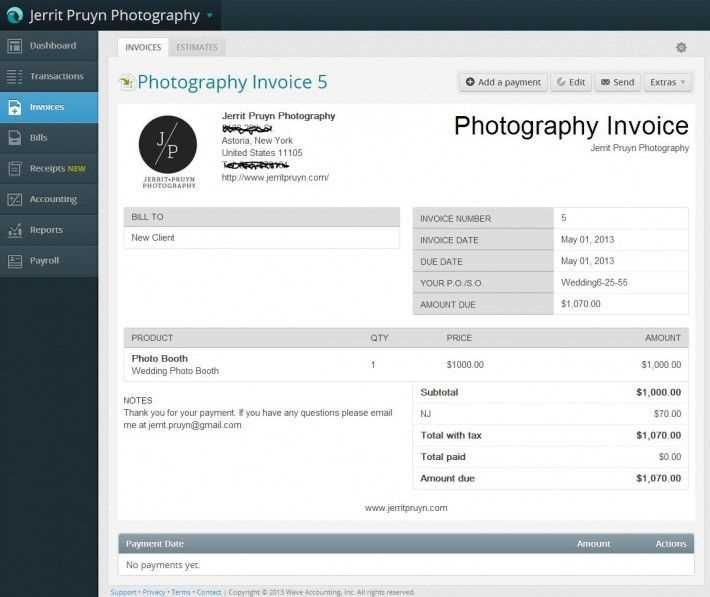

How to Create an Invoice in Akaunting

Creating a professional billing document is a straightforward process when using the right tools. By following a few simple steps, you can generate a document that includes all the necessary details, from client information to payment terms, while ensuring accuracy and clarity. This guide will walk you through the essential stages of preparing a payment request for your business.

First, you’ll need to access the billing section of your software. Once you’re there, follow these steps:

- Enter Client Information: Begin by adding the recipient’s details, such as name, address, and contact information. This is essential for ensuring the document reaches the correct person or company.

- List Products or Services: Clearly outline the items or services you’re charging for, including quantities, unit prices, and any applicable discounts. Be as detailed as possible to avoid any confusion.

- Set Payment Terms: Specify the due date for payment, any late fees, and available payment methods. This section helps your client understand when and how to complete the transaction.

- Apply Taxes and Discounts: If necessary, include tax rates and any discounts that apply to the overall amount. Most systems will calculate this automatically based on the information you’ve provided.

- Review and Finalize: Once all the information is added, double-check for accuracy. Ensure that all figures are correct and that no critical details are missing. This is your chance to make any necessary changes before sending.

After completing these steps, you can save and export the document in your preferred format. It’s now ready to be sent to the client, helping to streamline the payment process and maintain professionalism.

Key Features of Akaunting Invoice Templates

When creating professional financial documents, the features and customization options available can significantly impact the overall efficiency of your billing process. Having access to a well-designed and versatile tool allows businesses to produce error-free, visually appealing, and comprehensive requests for payment. Below are some of the most important features that enhance the functionality and usefulness of these customizable documents.

- Customizable Layout: The ability to adjust the design allows businesses to incorporate their logo, color scheme, and preferred fonts, ensuring each document aligns with their branding.

- Automatic Calculations: Built-in formulas can automatically calculate totals, taxes, discounts, and other variables, reducing the need for manual entry and minimizing the risk of errors.

- Flexible Field Options: Users can easily add or remove fields to suit their business needs. Whether you need additional space for product descriptions, payment terms, or other information, these fields can be customized accordingly.

- Multiple Currency Support: If your business operates internationally, being able to generate documents in multiple currencies can be a major advantage. This feature ensures that your clients receive accurate figures in their preferred currency.

- Invoice Numbering and Tracking: Automatically generated invoice numbers help maintain an organized system for tracking payments and managing records, streamlining your accounting process.

- Export Options: After creating your document, you can export it in various formats, such as PDF or Excel, making it easy to send to clients or store for future reference.

- Integration with Payment Systems: These tools often allow integration with popular payment processors, allowing clients to make payments directly from the document itself, further simplifying the transaction process.

- Recurring Billing Features: For businesses with subscription-based services or regular clients, these systems can set up automated recurring billing, saving time and effort on follow-up invoicing.

With these powerful features, generating accurate, professional financial documents becomes much easier, allowing you to focus on growing your business rather than managing paperwork.

Why Use a Customizable Invoice Template

Utilizing a flexible and adaptable financial document generator offers numerous advantages for businesses looking to streamline their billing process. Customizable solutions provide the freedom to adjust layouts, fields, and other elements to suit the unique needs of each transaction, helping ensure accuracy and professionalism in every request for payment. Here are some of the key reasons why this approach is beneficial.

- Brand Consistency: Customizable documents allow businesses to incorporate their logo, color scheme, and preferred design elements, maintaining a consistent brand image across all communications.

- Time Efficiency: Predefined structures with adjustable fields enable quick document creation, saving time compared to creating payment requests from scratch for every client.

- Improved Accuracy: Automated calculations for totals, taxes, and discounts reduce the likelihood of manual errors, ensuring the correct amounts are always presented to clients.

- Professional Appearance: Customizable documents allow you to create polished, well-organized requests that convey professionalism and enhance your company’s image in the eyes of clients.

- Flexibility for Different Needs: Businesses in various industries can tailor documents to include specific details relevant to their services, such as itemized product lists, payment terms, or additional charges.

- Easy Record Keeping: The ability to automatically number and track requests helps maintain accurate records, making it simpler to manage accounts and track overdue payments.

- Better Client Communication: With a customizable document, you can include clear and specific instructions, helping to avoid confusion and ensuring both parties are on the same page regarding payment expectations.

Overall, the flexibility of these tools helps businesses manage their billing more effectively, enhancing both operational efficiency and customer satisfaction.

Step-by-Step Guide to Downloading Templates

Downloading pre-designed documents for business purposes is a straightforward process that can save you time and effort. Whether you’re preparing a document for billing, financial reports, or other tasks, getting the right format is crucial. This guide will walk you through the process of finding and downloading custom designs that fit your needs.

- Visit the Template Library:

Start by navigating to the platform or service offering the templates. Look for a section dedicated to ready-made designs, usually found under categories such as “Documents” or “Business Tools”.

- Select the Desired Document Type:

Browse through the available options and choose the one that best matches your requirements. You may encounter different designs for varying purposes, such as transaction records, quotes, and more.

- Preview the Design:

Before downloading, take a moment to preview the format to ensure it meets your expectations. Most platforms allow you to open a sample of the document so you can examine the layout and customization options.

- Customize if Necessary:

Some platforms allow for minor adjustments to the design before downloading. Customize elements such as colors, fonts, and text fields to suit your business identity or personal preferences.

- Download the File:

Once you are satisfied with the design, look for the “Download” button. Select your preferred file format (e.g., PDF, DOCX, or others) and save the file to your device.

- Save or Share the Document:

After downloading, you can save the file for future use or share it directly with clients or colleagues as needed. Be sure to store the document in a location where you can easily access it for future tasks.

Following these simple steps will help you efficiently download and utilize professionally designed documents, ensuring consistency and accuracy in your business processes.

Best Practices for Using Templates

Utilizing pre-designed documents can streamline your workflow and enhance the professional appearance of your communications. However, to make the most of these ready-made designs, it’s important to follow certain guidelines. By applying best practices, you ensure that the documents you create are not only functional but also align with your branding and client expectations.

1. Customize to Fit Your Brand:

Although pre-made formats come with a standard layout, it’s essential to tailor them to reflect your brand’s identity. Customize the color scheme, fonts, and logo placement to maintain a cohesive look across all business materials. This ensures that your documents consistently represent your business in a professional light.

2. Keep the Content Clear and Concise:

While the layout may be designed to look professional, the content you include is just as important. Ensure that all fields are completed accurately and without unnecessary information. Focus on clarity and precision to avoid confusion and maintain a professional tone.

3. Use the Right Fields:

Each document design typically contains specific sections such as payment details, due dates, and item descriptions. Make sure to fill in only the relevant sections. Avoid overcrowding the document with unnecessary fields, as this could detract from its clarity and usability.

4. Proofread Before Sending:

Even though the format may look perfect, errors in the text can undermine the quality of your communication. Always proofread the document for spelling, grammar, and numerical accuracy before finalizing it. This step ensures that your message is clear and professional.

5. Save and Organize Files Efficiently:

Once you have customized and completed the document, save it in a well-organized manner. Use clear, descriptive filenames and store the files in an organized folder system to easily retrieve them later. This will save you time in future tasks and help maintain an efficient workflow.

6. Stay Consistent Across Documents:

If you use multiple types of documents, such as estimates, contracts, or receipts, ensure that each one follows a consistent structure and style. This uniformity enhances your business’s professional image and makes it easier for clients to navigate your materials.

7. Regularly Update Your Documents:

As your business grows and your needs evolve, make sure to periodically review and update the designs you use. Incorporating new features, adjusting outdated information, or refreshing the layout can keep your documents relevant and functional.

By following these best practices, you can create documents that are not only efficient but also align with your brand’s standards, helping to maintain a polished and professional image across all your business communications.

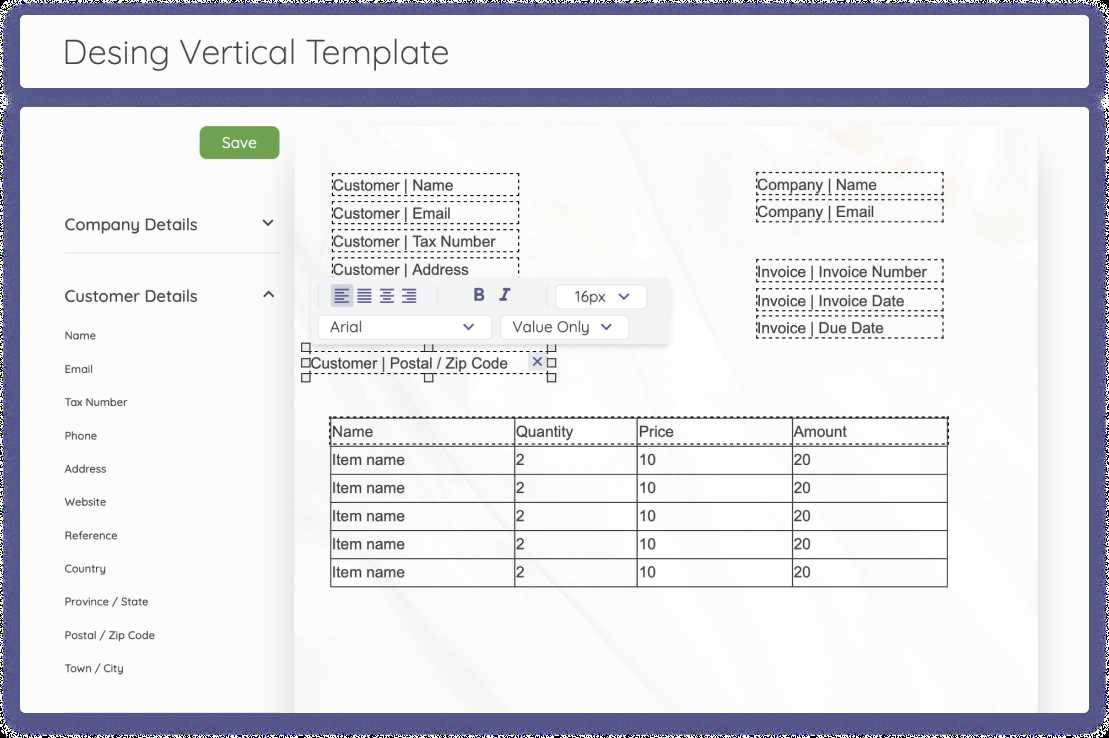

How to Personalize Your Document Design

Customizing a business document layout allows you to make it more aligned with your brand identity and enhance its professional appeal. Personalization goes beyond just adding your logo–it involves adjusting various elements to ensure that your document is unique, clear, and reflective of your business style. Here’s how you can tailor the design to meet your specific needs.

1. Incorporate Your Brand’s Logo:

The logo is a key element of your brand identity. Placing it in a prominent position, such as the top corner or header, immediately makes your document recognizable. Ensure that the logo is of high quality and appropriately sized, so it maintains a professional look.

2. Choose a Color Scheme That Matches Your Branding:

Color plays an important role in creating a cohesive brand presence. Adjust the colors in the document to match your company’s primary color palette. This can include changes to the text color, borders, and background. Make sure the colors are subtle and easy to read, especially for important information like totals or due dates.

3. Use Custom Fonts:

Fonts reflect the tone of your business. You can choose a custom font that aligns with your brand’s personality, whether it’s professional, modern, or casual. Keep readability in mind and ensure that the text is clear and legible on all devices and print formats.

4. Add Your Business Information:

Make sure your contact details, including your business name, address, phone number, email, and website, are clearly visible. This makes it easy for clients to reach you for any inquiries or follow-up. Customizing the document with this information ensures that your brand is always front and center.

5. Tailor the Layout to Your Needs:

Depending on the type of transaction or service you provide, adjust the layout to highlight the most important information. For example, you can move sections around, change the order, or adjust the size of fields such as item descriptions, payment terms, and totals. Keep it organized and balanced for clarity.

6. Personalize the Language and Content:

Consider adding a personalized message or note to your document. This could include a thank-you note, terms and conditions, or a message of appreciation. This adds a human touch and can build stronger relationships with your clients.

7. Make It Mobile-Friendly:

With more clients viewing documents on their phones and tablets, it’s essential that your design adapts well to various screen sizes. Keep it clean and simple, ensuring that all elements are well-spaced and readable on smaller devices.

By applying these customizations, you can create a document that not only looks professional but also resonates with your brand identity, ensuring a positive impression on your clients.

Adding Tax and Discount Fields to Documents

When preparing business documents that involve financial transactions, it’s essential to account for taxes and discounts accurately. Adding fields for these elements ensures that all calculations are clear and transparent for both you and your clients. Here’s how to incorporate tax and discount sections into your document layout.

1. Adding a Tax Field:

To include a tax field, you need a section that calculates the tax percentage based on the total amount of the items or services provided. This field should be clearly labeled to indicate the applicable tax rate, and the tax amount should be calculated automatically or manually entered. Below is an example layout for clarity:

| Description | Amount |

|---|---|

| Product A | $100.00 |

| Product B | $150.00 |

| Total Before Tax | $250.00 |

| Tax (5%) | $12.50 |

| Total After Tax | $262.50 |

2. Adding a Discount Field:

If you are offering a discount, this should be reflected in a separate field. The discount can be applied as a percentage or a fixed amount. Ensure that the discount field is placed before the final total, as it reduces the overall cost. Here’s an example of how a discount field can be displayed:

| Description | Amount |

|---|---|

| Product A | $100.00 |

| Product B | $150.00 |

| Total Before Discount | $250.00 |

| Discount (10%) | -$25.00 |

| Total After Discount | $225.00 |

3. Combining Tax and Discount Fields:

For a complete financial breakdown, both tax and discount fields should be displayed together, giving a clear picture of the adjustments made to the total amount. The tax should be added after any discounts, ensuring the final amount is correctly calculated:

| Description | Amount | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Product A | $100.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Product B | $150.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Before Discount | $250.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Discount (10%) | -$25.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total After Discount | $225.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Tax (5%) | $11.25 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Fi

Saving and Exporting DocumentsOnce you have created and customized your business document, it’s essential to save and export it properly to ensure that you can access, share, or print it whenever needed. Storing your documents in the right format and location can improve your workflow and make it easier to manage your financial records. Below are the key steps for saving and exporting your completed documents. 1. Saving Your Document: After customizing your document with all necessary information, the first step is to save it. Make sure to choose a clear and descriptive filename, which will help you identify the document quickly in the future. Most systems allow you to save your file locally or within the platform, so choose the location that works best for you. It’s a good idea to organize your documents into folders by date, client, or project to streamline your filing system. 2. Choosing the Right Format: Depending on your needs, you can save the document in various file formats. The most common formats are PDF, DOCX, and Excel. PDF is widely used for its universal compatibility and fixed formatting, making it a great choice for sharing finalized documents with clients. DOCX is ideal for editable documents, while Excel is useful for those requiring spreadsheet-style layouts for further calculations or adjustments. 3. Exporting the Document: Once your document is ready, exporting it to the desired format is simple. Most platforms offer an export option, allowing you to download your document directly to your computer or cloud storage. Choose the appropriate format and ensure that the export process is complete before closing the document. If you plan to send it via email, you can also directly export and attach it without leaving the platform. 4. Sending the Document: Once exported, you can send the document to clients, colleagues, or partners. For email, attach the exported file, making sure to include a brief message with any necessary context. If the document is shared through a cloud-based service, ensure that proper permissions are set so that the intended recipients can access the file securely. 5. Storing Documents for Future Use: Storing your finalized documents in an organized way will help you retrieve them quickly in the future. Consider using cloud storage solutions or dedicated document management systems to securely store your files. These platforms often offer search functionalities, so finding specific records is easy. Also, back up important documents regularly to avoid loss due to technical issues. By following these simple steps to save and export your documents, you can ensure that they are secure, accessible, and ready to be shared whenever necessary. How to Integrate Payment Methods into DocumentsIncluding payment options in your business documents is essential for ensuring smooth transactions and providing clients with clear instructions on how to pay. By offering multiple payment methods, you increase convenience for your clients while improving your cash flow. This guide will walk you through how to effectively integrate payment methods into your document design. 1. List Available Payment MethodsStart by clearly listing all available payment methods that your clients can use to settle their bills. This makes it easier for clients to choose the option that suits them best. You can include:

2. Add Payment Due Date and Instructions

To avoid confusion and late payments, include a clear due date for payment. Additionally, provide concise instructions on how to complete the transaction. This ensures your client understands the process and can act promptly. Below are key points to consider:

By including these details, you ensure that your clients have all the information they need to make a payment correctly and on time, leading to fewer payment-related issues. Improving Document Accuracy with Pre-Designed Formats

Ensuring that your business documents are accurate is crucial to maintaining professionalism and avoiding errors that could lead to financial discrepancies. Using pre-designed formats can significantly enhance accuracy by reducing manual entry, providing consistent structure, and minimizing the risk of mistakes. Below are some key strategies to improve the precision of your business paperwork. 1. Use Automatic Calculations: Many pre-designed formats offer fields that automatically calculate totals, taxes, and discounts based on the input data. By using these built-in features, you eliminate the need for manual calculations, reducing the chances of errors and ensuring that the final amounts are always correct. 2. Include Predefined Fields: Pre-designed formats often come with predefined sections that guide you through the necessary information. These sections typically include spaces for item descriptions, quantities, unit prices, and totals. By filling in the appropriate fields rather than freeform text, you ensure that all required details are included in a consistent and organized manner. 3. Standardize Terms and Conditions: Using a consistent structure for terms and conditions ensures that all clients receive the same information, which helps prevent misunderstandings. Pre-built formats often include standard language for payment terms, deadlines, and other contractual elements. By incorporating these elements, you save time and reduce the likelihood of errors or omissions. 4. Keep Track of Client Details: Pre-designed formats may allow you to save client information such as addresses, tax identification numbers, and billing contacts. Storing this data reduces the risk of incorrect information being entered each time you create a new document and makes it easier to reference previous records when needed. 5. Customize for Specific Needs: Although pre-built formats provide a basic structure, they can often be customized to meet your specific needs. Whether you need to add additional fields or adjust the layout, tailoring the document ensures that it fully reflects your business processes while maintaining accuracy. By leveraging the built-in features of pre-designed formats, you can significantly improve the accuracy of your documents, avoid costly errors, and present a more professional image to your clients. Managing Multiple Clients with Pre-Designed Formats

Managing several clients simultaneously requires efficient organization and streamlined processes. Using pre-designed formats for creating business documents helps maintain consistency while ensuring that each client receives the correct details tailored to their specific needs. This approach allows you to handle multiple accounts without sacrificing accuracy or professionalism. To effectively manage multiple clients, consider the following steps when using pre-designed formats for your documents:

Example Table for Managing Multiple Clients:

By keeping track of these details in an organized manner, you can ensure that each client receives the correct document and that payments are managed efficiently. This approach helps build better client relationships and maintain a professional reputation. Setting Up Document RemindersTimely reminders for pending payments or upcoming deadlines are crucial for maintaining smooth cash flow and ensuring that clients do not forget about their obligations. Setting up automatic reminders within your document management system allows you to stay on top of due dates without needing to manually track each payment. Below are the key steps to set up reminders efficiently. 1. Determine Reminder Timing

The first step in setting up reminders is deciding when they should be sent. Here are a few common options:

2. Customize Reminder ContentPersonalizing the content of your reminders can make them more effective and maintain a professional relationship with your clients. Key elements to include in the reminder emails or messages are:

Customizing your reminder content not only ensures clarity but also builds a better rapport with clients by showing that you are organized and attentive to their needs. 3. Automate the Reminder Process

To reduce manual effort, take advantage of automation tools in your system to send reminders on your behalf. Many platforms allow you to set up automated workflows that trigger reminders based on predefined conditions, such as:

By automating the reminder process, you save time and ensure consistency, reducing the chances of missed payments. Setting up reminders not only improves your cash flow management but also enhances your professionalism by showing clients that you are proactive and detail-oriented. With these reminders in place, you can ensure that clients are informed and that your payments are processed in a timely manner. Common Mistakes to Avoid in Invoice CreationCreating financial documents might seem straightforward, but there are several pitfalls that can lead to confusion, delays in payments, or even disputes with clients. It’s important to pay attention to the details to ensure accuracy and professionalism. Below are some frequent errors that businesses should avoid when preparing their billing statements. One of the most common issues arises from insufficient or incorrect information. Missing details such as the recipient’s name, address, or contact information can cause unnecessary delays. Additionally, unclear payment terms or incomplete descriptions of services provided can lead to misunderstandings.

By addressing these issues, you can improve the clarity and reliability of your financial statements, ensuring smoother transactions and a stronger professional reputation. Common Mistakes to Avoid in Invoice CreationCreating financial documents might seem straightforward, but there are several pitfalls that can lead to confusion, delays in payments, or even disputes with clients. It’s important to pay attention to the details to ensure accuracy and professionalism. Below are some frequent errors that businesses should avoid when preparing their billing statements. One of the most common issues arises from insufficient or incorrect information. Missing details such as the recipient’s name, address, or contact information can cause unnecessary delays. Additionally, unclear payment terms or incomplete descriptions of services provided can lead to misunderstandings.

By addressing these issues, you can improve the clarity and reliability of your financial statements, ensuring smoother transactions and a stronger professional reputation. Common Mistakes to Avoid in Invoice CreationCreating financial documents might seem straightforward, but there are several pitfalls that can lead to confusion, delays in payments, or even disputes with clients. It’s important to pay attention to the details to ensure accuracy and professionalism. Below are some frequent errors that businesses should avoid when preparing their billing statements. One of the most common issues arises from insufficient or incorrect information. Missing details such as the recipient’s name, address, or contact information can cause unnecessary delays. Additionally, unclear payment terms or incomplete descriptions of services provided can lead to misunderstandings.

By addressing these issues, you can improve the clarity and reliability of your financial statements, ensuring smoother transactions and a stronger professional reputation. |