How to Use the Airtable Invoice Template for Streamlined Billing

Managing financial records efficiently is crucial for businesses of all sizes. One of the key aspects of this is creating professional and accurate documents that can be used for transactions with clients. Whether you are an entrepreneur or part of a larger team, having an easy-to-use system for generating these documents can save time and reduce errors.

Modern digital tools offer versatile options for customizing and automating billing tasks. These platforms allow users to create customizable documents that align with their unique needs, from simple transactions to more detailed accounts. With the right solution, you can ensure consistency, improve organization, and simplify follow-ups.

In this article, we will explore how to leverage such tools to optimize the process. You’ll learn how to set up your documents, automate recurring tasks, and manage your financial records more effectively. By the end, you’ll have the knowledge to enhance your workflow and make your billing process more professional and seamless.

Why Choose Airtable for Invoices

When it comes to managing billing processes, businesses need a solution that offers both flexibility and efficiency. Many tools are available, but some stand out due to their ability to simplify tasks while providing advanced features. By choosing a platform that integrates both data management and document creation, you can streamline workflows and ensure accuracy in every transaction.

Streamlined Organization and Accessibility

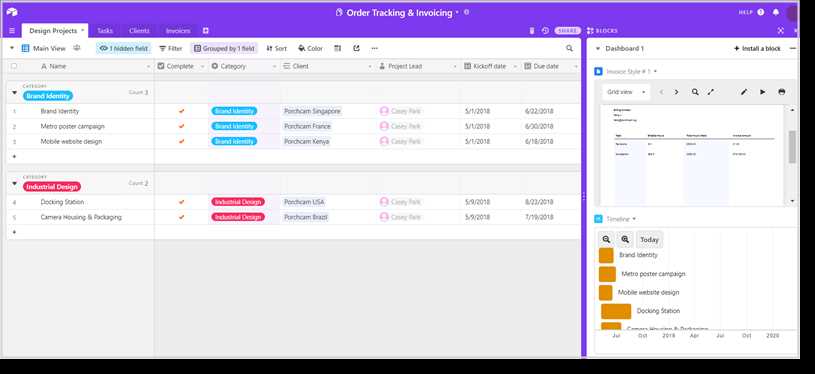

One of the key advantages of using this platform is its ability to keep all your financial records neatly organized. With cloud-based functionality, you can easily access your files from any device, ensuring you never miss an important update. Whether you need to generate a new record or review past transactions, everything is just a few clicks away, reducing the time spent searching for important documents.

Customization and Automation Features

This platform also excels in customization, allowing you to tailor documents according to your specific needs. From adjusting the layout to incorporating essential data fields, you can create the perfect format. Additionally, automation tools enable the system to generate records at set intervals, saving you time and reducing the chance of human error. These features make it easy to manage large volumes of data without feeling overwhelmed.

How to Set Up Your Template

Setting up a system for generating professional documents is a simple process that can be done in just a few steps. The first step involves selecting a platform that allows you to create, customize, and organize all your necessary fields in one place. Once you’ve chosen your platform, you can begin by creating a new document that will serve as the basis for all future records.

To begin, you’ll need to define the structure of your document. This includes adding sections for essential details such as client names, services provided, due dates, and amounts owed. You can choose to organize the information in tables or grids, depending on your preference. Additionally, be sure to include fields that will automatically calculate totals or taxes based on the entered data. With just a few customizations, you’ll have a fully functional setup that meets your needs.

Next, consider automating repetitive tasks. Set up recurring entries or automatic updates to reduce the amount of manual data entry. For example, if you often work with the same clients or charge similar amounts, you can create default values or presets that fill in information automatically. This can save you time and improve accuracy in the long run.

Finally, ensure that your document can easily be updated as your business evolves. Flexibility is key, and being able to modify sections or fields as needed will allow your system to grow with your needs.

Once set up, you’ll have a streamlined process that makes document generation simple and efficient, allowing you to focus more on your business and less on administrative tasks.

Have you already decided which platform you’ll use to implement this system, or are you still considering your options?

Customizing Your Invoice Layout

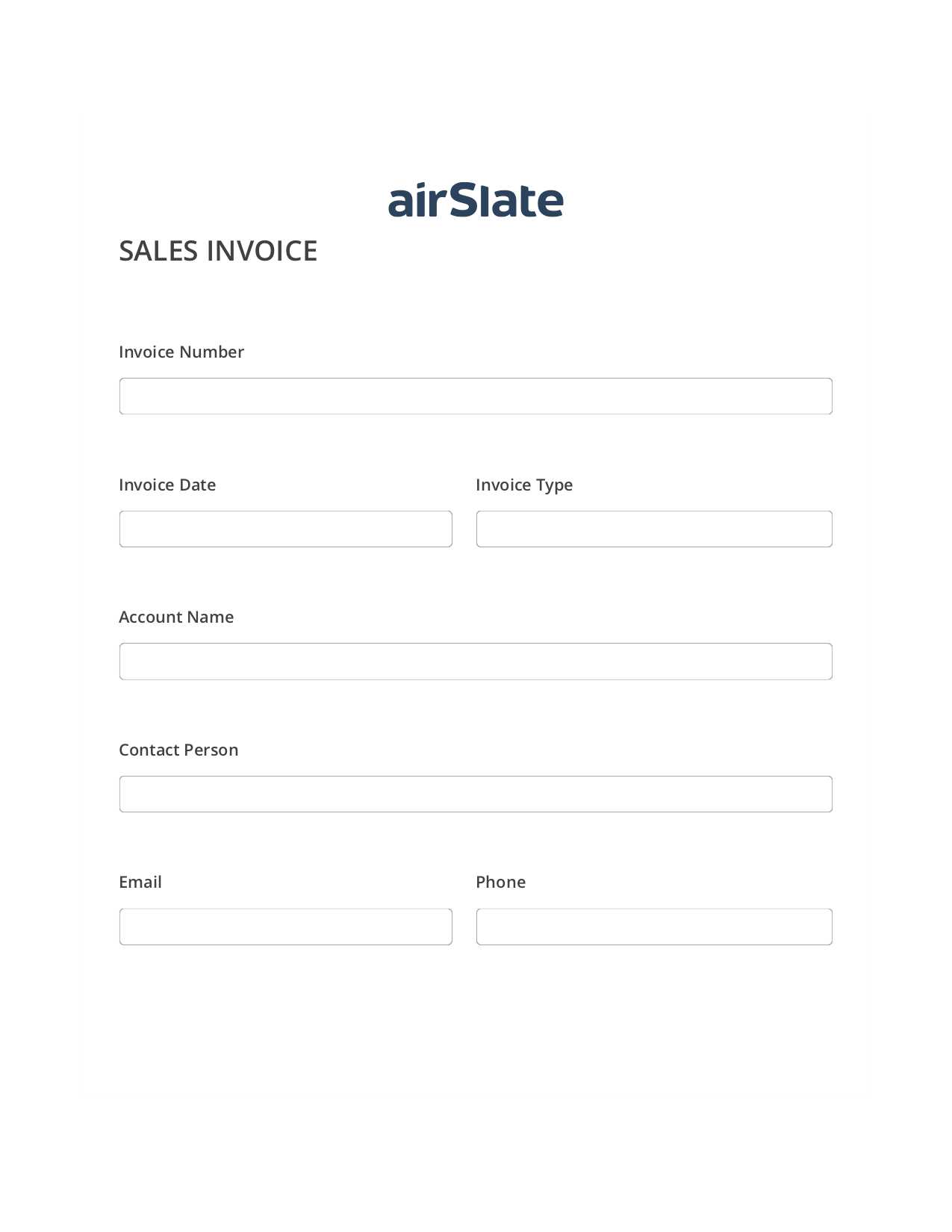

Tailoring the design of your documents is an essential step to ensure they reflect your brand and meet the specific needs of your business. By adjusting the layout, you can make the documents more visually appealing and functional, ensuring all the important information is easily accessible. Customization allows you to prioritize key details and ensure a consistent format for each client or transaction.

Adjusting the Structure

Start by organizing your document layout to ensure clarity and easy navigation. You can define where each section of information will appear, such as the client’s details, the breakdown of charges, and payment terms. Consider using tables or grids to keep everything aligned and easy to read. By placing important sections in a logical order, you help both your clients and your team understand the content quickly.

Adding Visual Elements

Design elements like logos, colors, and fonts can also play an important role in making your documents stand out. Choose a color scheme that aligns with your branding, and select fonts that are professional yet readable. Incorporating your logo can help reinforce your company’s identity, making the documents look more polished and credible.

Additionally, you can include other design touches like borders or shading to separate different sections. This helps draw attention to key areas, like totals or payment deadlines, making them easier for recipients to locate. The overall goal is to create a balance between aesthetics and functionality, ensuring your document is both appealing and easy to understand.

Tracking Payments with Airtable

Effective payment tracking is crucial for any business to ensure that all transactions are properly recorded and monitored. Keeping track of who has paid, when payments are due, and any outstanding amounts can significantly streamline financial management. Using digital tools to monitor payments can help avoid confusion and ensure you maintain accurate financial records.

By creating a system that records each payment as it’s made, you can easily stay on top of your transactions. Here are some key benefits of using a platform for payment tracking:

- Real-time Updates: Keep track of payments as they are processed and update your records instantly.

- Customizable Fields: Customize your fields to track payment status, due dates, amounts paid, and remaining balances.

- Automated Reminders: Set up reminders for clients who have not made payments by the due date.

By organizing your payment data in one place, you can also easily filter and sort through transactions to identify patterns, check for late payments, and generate reports. For example, you can create filters to quickly view outstanding balances or sort payments by date to see your cash flow over time. This helps ensure that no payments are missed and that you can follow up promptly with clients if needed.

Additionally, you can set up notifications to alert you when payments are overdue, reducing the chance of missing important deadlines. With this kind of streamlined tracking system, you’ll always have an up-to-date view of your financial situation.

Automating Invoice Generation Process

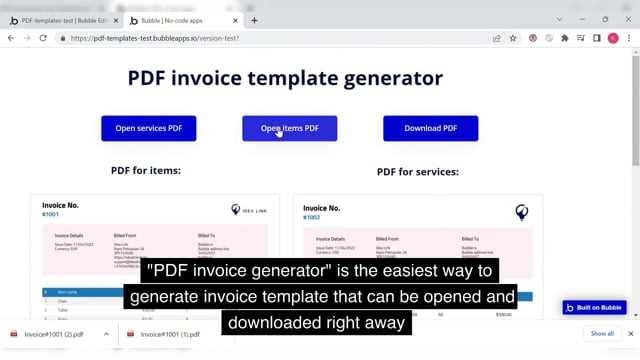

Automation is a powerful tool that can simplify repetitive tasks, save time, and reduce human error. When it comes to generating financial documents, automating the process can streamline your workflow and ensure consistency across all transactions. By setting up systems that create these documents automatically, you can focus on more strategic aspects of your business.

There are several key benefits to automating the creation of your financial records:

- Time Savings: Once set up, the system generates records automatically, eliminating the need for manual entry each time.

- Consistency: Automation ensures that each document follows the same format, maintaining uniformity across all records.

- Accuracy: With built-in calculations and data fields, automation reduces the risk of mistakes often made during manual entry.

To get started with automation, follow these steps:

- Set up triggers: Define events that will trigger the creation of new documents, such as when a service is completed or a payment is received.

- Customize data entry: Ensure all relevant fields are automatically populated, such as client details, dates, and amounts due.

- Schedule generation: Set up your system to generate documents on a recurring basis, or trigger them based on specific conditions, such as a client’s payment cycle.

With these steps, you can ensure that your document generation is fully automated, freeing up your time for other important tasks while maintaining a professional and efficient billing system.

Integrating Airtable with Other Tools

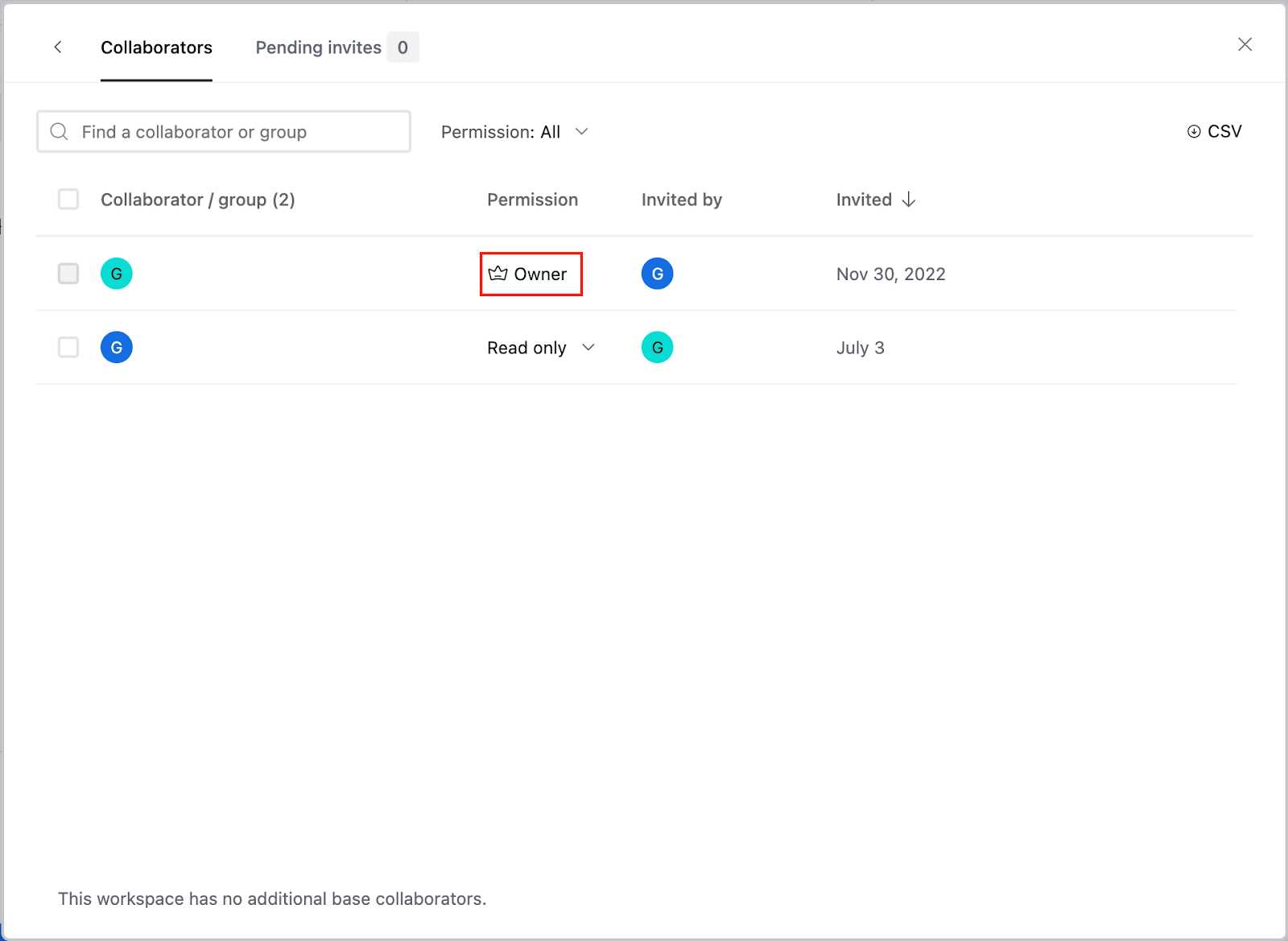

Connecting your document management system with other software can significantly enhance efficiency and streamline your workflow. By integrating various tools, you can automate processes, synchronize data, and ensure all your systems are working together seamlessly. This allows for real-time updates and reduces the need for manual data entry, improving accuracy and saving time.

Benefits of Integration

There are numerous advantages to linking your data management system with other platforms:

- Automation: Set up workflows that automatically transfer data between systems, reducing repetitive tasks and errors.

- Improved Collaboration: Share information between team members across different platforms for better collaboration and transparency.

- Data Synchronization: Ensure all records and information are updated in real-time across all integrated tools.

Popular Integration Options

There are several tools you can integrate with your document management system to enhance its functionality:

- Email Platforms: Automatically send documents directly to clients via email once they’re generated.

- Accounting Software: Sync financial records and transactions to keep your accounting system up-to-date without manual entry.

- Payment Processors: Link payment systems to track incoming payments and mark documents as paid once the payment is processed.

By setting up integrations with the right tools, you can optimize your business processes, reduce administrative workload, and improve overall operational efficiency.

Design Tips for Professional Invoices

Creating well-designed financial documents is crucial for maintaining a professional image and ensuring clarity for your clients. A clean and organized layout not only reflects your brand’s identity but also makes it easier for recipients to understand important details. Whether you’re sending a single document or processing hundreds, design choices play a significant role in how your communication is perceived.

To achieve a polished and effective layout, consider these tips:

- Keep It Simple: Avoid clutter by using a minimalist design with plenty of white space. Ensure that the key information stands out clearly.

- Use Clear Headings: Organize your document with distinct headings and sections. This will help clients quickly find the information they need.

- Maintain Consistency: Use a consistent font, color scheme, and style that aligns with your brand identity to create a cohesive look.

- Highlight Key Details: Important information such as payment due dates, amounts, and client details should be easy to find. Use bold or larger fonts for these elements.

Additionally, make sure your document is easy to read across different devices and formats. Whether viewed on a computer screen or printed out, the content should be legible and professional. A well-designed layout will not only improve your image but also enhance the recipient’s experience with your business.

Creating Templates for Different Clients

When managing multiple clients, it’s essential to have a flexible and customizable document system that can adapt to the unique needs of each client. By tailoring your layouts and content to suit different industries, preferences, and branding guidelines, you can offer a more personalized experience. This approach not only strengthens client relationships but also improves the efficiency of your workflow.

Customizing Layouts Based on Client Type

Different clients may require distinct layouts depending on their business model or preferences. Consider the following approaches when adjusting the design for specific needs:

- Corporate Clients: Opt for a professional, formal layout with clear structure and minimalistic design. Ensure your document reflects the client’s corporate branding and includes all necessary legal and financial details.

- Creative or Freelance Clients: For more creative clients, feel free to incorporate unique elements such as custom colors, fonts, and graphics that match their style and brand identity.

Including Client-Specific Details

Each client may have specific information they want to see included in their documents. To keep things organized and efficient, consider setting up placeholders or fields that can be quickly populated with the following:

- Contact Information: Automatically pull the client’s contact details such as address, phone number, and email.

- Custom Payment Terms: Include payment terms that are unique to the agreement you have with each client.

- Unique Branding: Adjust the colors, logos, and fonts to align with the client’s branding for a more personalized touch.

By creating custom layouts and content for each client, you can enhance the professionalism of your communications while also improving client satisfaction and trust.

Organizing and Sorting Your Invoices

Efficiently managing financial documents is crucial for maintaining a smooth workflow and ensuring that you never miss important details. By organizing and sorting your records systematically, you can save time, reduce errors, and streamline your accounting process. Proper organization allows you to access any document when needed, track payments, and stay on top of your financial responsibilities.

To stay organized, consider using a structured system that categorizes documents by relevant parameters such as:

- Client Name: Grouping your documents by client helps you quickly locate and track the status of specific transactions.

- Due Dates: Sorting documents by due date ensures you can prioritize pending payments and meet deadlines.

- Document Status: Categorizing based on whether the document is paid, pending, or overdue provides a clear overview of the current financial situation.

Another effective way to manage documents is by implementing a consistent naming convention. This way, you can instantly recognize the document’s contents without having to open it. For instance, including the client’s name and the date in the file name makes it easy to search and retrieve the necessary documents when needed.

How Airtable Handles Multiple Currencies

When dealing with global transactions, it’s important to manage different currencies effectively. Some tools offer features that allow users to work with multiple currencies in a seamless way. By allowing users to input, track, and calculate values in various currencies, these tools help businesses operate across borders with ease and precision.

In order to manage this efficiently, it’s essential to set up the appropriate fields and use the right data formats. This can be done by selecting the correct currency format for each record, ensuring consistency across all financial entries.

For example, here’s how different currencies can be managed in a sample layout:

| Client | Amount | Currency | Exchange Rate |

|---|---|---|---|

| Client A | 1000 | USD | 1 |

| Client B | 850 | EUR | 1.18 |

| Client C | 700 | GBP | 1.36 |

By using such structures, businesses can ensure they are accurately calculating and reporting values across different monetary systems. This makes financial management smoother and more accurate for users operating on a global scale.

Using Airtable to Track Expenses

Tracking business expenses is crucial for maintaining financial control and staying on top of your budget. By organizing and categorizing costs, you can gain valuable insights into where your money is going and make informed decisions for the future. Many platforms offer a simple way to record and manage these expenditures, making it easier to keep track of both small and large purchases.

With the right setup, it’s possible to track every transaction efficiently, ensuring that all expenses are properly logged and categorized. Using customizable fields, you can capture essential details such as amounts, categories, dates, and even receipts or invoices linked to each entry.

For instance, consider this structure when tracking expenses:

| Category | Amount | Date | Description |

|---|---|---|---|

| Office Supplies | 150 | 2024-11-01 | Purchase of printer paper |

| Travel | 400 | 2024-10-28 | Flight to New York |

| Marketing | 250 | 2024-10-25 | Advertising on social media |

By setting up similar records, users can easily monitor how money is spent, identify potential savings, and maintain an organized view of financial activities. This helps improve budgeting accuracy and ensures that every expense is accounted for properly.

Managing Invoice History and Records

Maintaining a thorough record of all business transactions is essential for financial clarity and efficient operations. By organizing and storing past records, you ensure easy access to critical information when needed. A systematic approach allows for quick retrieval of payment history, facilitating smoother reconciliation, audits, and client communication.

Proper tracking ensures that every past transaction is accounted for, enabling businesses to follow up on outstanding balances, verify payments, and resolve disputes promptly. It also helps in preparing reports and analyzing past trends, contributing to better financial planning in the future.

Organizing Your Payment History

To effectively manage historical records, categorize the data in a clear and organized manner. This includes grouping entries by date, client, status, and amount, allowing you to easily track the progress of each transaction. Here is a sample structure for organizing past financial entries:

| Client | Amount | Date | Status | Notes |

|---|---|---|---|---|

| John Doe | $200 | 2024-10-15 | Paid | Paid via credit card |

| Jane Smith | $350 | 2024-09-25 | Pending | Awaiting payment confirmation |

| Acme Corp | $1,500 | 2024-08-30 | Paid | Paid via bank transfer |

Tracking Payment Status and Communication

It’s important to monitor the status of payments to ensure no overdue amounts go unnoticed. Tracking the method of payment and communication history will allow you to address any discrepancies efficiently. Regularly reviewing past transactions can also help prevent mistakes and ensure all client obligations are fulfilled.

Common Invoice Template Mistakes

When creating structured records for business transactions, it’s easy to overlook small details that can lead to errors and confusion. Whether it’s incorrect formatting, missing details, or improper categorization, these mistakes can delay payments, create misunderstandings, and damage professional relationships. It’s important to identify common pitfalls in the setup process to ensure everything is accurate and easy to follow.

1. Missing Key Information

- Not including essential client details such as name, contact information, and address.

- Leaving out payment terms or due dates, which can create confusion about when payment is expected.

- Failing to list the correct service or product descriptions, making it unclear what the charges are for.

2. Inconsistent Formatting

- Using varying fonts or styles that can make the document appear unprofessional and difficult to read.

- Inconsistent or missing column alignment in tables, which can cause key information to be overlooked.

- Failure to maintain a consistent layout, resulting in disorganized or cluttered sections.

3. Incorrect Calculations

- Forgetting to apply discounts or taxes correctly, leading to discrepancies between the total charge and what’s due.

- Inputting incorrect rates or amounts that cause mismatched figures between individual items and the overall total.

- Omitting calculation formulas that can automatically update totals when changes are made.

4. Not Using a Clear Payment System

- Failing to clearly indicate accepted payment methods or account details for transfers.

- Not including payment instructions that are easy to understand, which can delay the processing of funds.

By addressing these common mistakes, you can ensure that your records are organized, transparent, and error-free, ultimately helping to maintain positive relationships with clients and streamline your payment process.

Best Practices for Billing Management

Effective management of financial records is crucial for maintaining smooth cash flow and ensuring timely payments. Establishing clear processes and best practices can help streamline your billing operations, reduce errors, and improve communication with clients. By implementing these strategies, you can ensure your records are accurate, well-organized, and efficient.

1. Keep Your Records Organized

Having a well-organized system is key to avoiding confusion and maintaining accuracy. Whether you’re managing multiple transactions or a single client, ensure all details are consistently tracked and updated.

- Group records by client or project for easy reference.

- Maintain a clear categorization for different types of charges and services.

- Use unique identifiers for each record to prevent mix-ups and ensure quick retrieval.

2. Automate Repetitive Tasks

Automating routine tasks can save time and reduce human errors. Many platforms offer automation features that can handle recurring billing, reminders, and updates on outstanding payments.

- Set up automatic reminders for upcoming due dates or overdue payments.

- Automate the generation of standard billing records for repeat clients.

- Use formulas to calculate totals, taxes, or discounts automatically.

3. Maintain Consistency Across All Documents

Maintaining a consistent format across all billing records helps both you and your clients easily track and understand charges. Consistency reduces confusion and fosters professionalism.

- Use a uniform structure for listing services, prices, and terms.

- Ensure the same branding and visual elements across all documents.

- Make sure that payment instructions and terms are always clear and consistent.

4. Track Payments Effectively

Keeping track of payments ensures that no amount is missed and helps you stay on top of your cash flow. A reliable tracking system helps you see which clients are paying on time and which are overdue.

| Client Name | Amount Due | Payment Date | Status |

|---|---|---|---|

| Client A | $500 | 01/15/2024 | Paid |

| Client B | $1,200 | 01/20/2024 | Pending |

By adhering to these best practices, you can ensure smoother billing processes, which in turn will help maintain good relationships with clients and ensure you are paid in a timely manner.