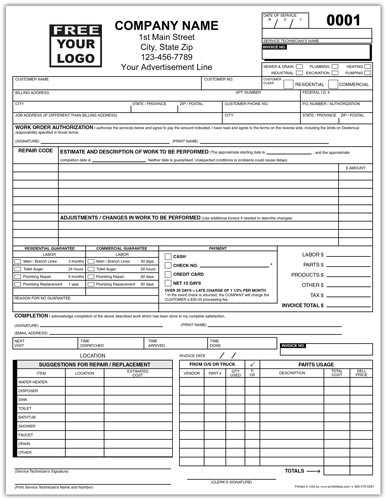

Air Conditioning Repair Invoice Template for Efficient Billing

In the world of heating and cooling services, having a reliable way to document transactions is essential for both businesses and customers. Proper documentation ensures clarity, transparency, and smooth financial processes. By organizing billing in a clear, professional manner, service providers can foster trust and streamline their operations.

Customizable documents are a key tool for service professionals, enabling them to present detailed charges, services rendered, and payment terms in a structured format. These documents not only help in keeping accurate records but also play a role in enhancing business professionalism and customer satisfaction. With the right design and elements, such records can provide significant advantages.

Whether you’re a small business owner or part of a larger operation, utilizing a flexible format to outline service costs and payment details is vital for smooth transactions. The ability to quickly generate clear, error-free forms can save time and reduce confusion, contributing to an overall more efficient service process.

Why Use an AC Repair Invoice Template

For businesses providing maintenance and installation services, organizing payment details is crucial to maintaining a smooth financial workflow. A structured document that outlines service charges, payment conditions, and work completed can prevent misunderstandings and improve efficiency. Without clear documentation, both service providers and customers may face difficulties in managing payments and ensuring proper record-keeping.

Using a flexible document for billing purposes offers several key advantages:

- Consistency: A standardized document ensures that all necessary information is included every time, minimizing the risk of missing key details.

- Professionalism: Presenting a clean, organized form demonstrates reliability and can positively impact customer satisfaction.

- Efficiency: Easily editable formats save time, reducing administrative work and allowing businesses to focus on service delivery.

- Clarity: Clear outlines of charges and payment terms ensure both parties understand the financial aspects of the transaction.

Incorporating such a system into daily operations not only simplifies the billing process but also contributes to better customer relationships. By offering detailed and transparent records, businesses can avoid disputes and enhance overall service quality.

Benefits of Customizing Your Invoice

Tailoring your billing documents to fit your specific needs can provide numerous advantages, both for your business operations and customer relationships. Customization allows you to reflect your brand, streamline processes, and ensure all relevant details are clearly communicated. A personalized approach enhances clarity, making the payment process smoother and more professional.

Improved Brand Identity

Customizing your billing forms gives you the opportunity to showcase your brand’s identity. This can build customer trust and recognition, and make your business appear more professional. Key elements to include are:

- Your logo and company name prominently displayed

- Brand colors and fonts that align with your marketing materials

- A clear and distinct layout that’s easy for customers to navigate

Increased Accuracy and Flexibility

Custom forms allow you to modify fields based on the type of service provided or the customer’s specific needs. This flexibility ensures greater accuracy in your documentation, helping you avoid common errors. Key advantages include:

- Including specific service details relevant to the task completed

- Adjusting payment terms and deadlines as per your agreement with each customer

- Easily adding or removing charges for special equipment or additional services

By customizing your documents, you not only improve efficiency but also create a more organized, professional experience for your clients. This attention to detail can lead to faster payments and better customer satisfaction.

How to Create an Effective Template

Designing a well-structured document to record service details and financial information is essential for maintaining a smooth workflow in any business. A clear, concise, and professional form allows for easy tracking of transactions, prevents errors, and enhances the customer experience. To create an effective record, you need to ensure that it is both comprehensive and user-friendly.

Here are some important steps to follow when creating a functional document:

| Step | Description |

|---|---|

| 1. Include Contact Information | Ensure that both your company and customer’s contact details are easy to find, including addresses, phone numbers, and email addresses. |

| 2. Outline Services Provided | Clearly list the tasks completed, equipment used, and any other relevant details of the work performed. Be as specific as possible to avoid misunderstandings. |

| 3. Specify Payment Terms | Clearly define the payment amount, due date, and any conditions or discounts. This ensures both parties understand the financial expectations. |

| 4. Use a Clean, Organized Layout | A well-organized form with appropriate sections and headings makes it easy to follow and look professional. Avoid cluttered designs. |

| 5. Add Your Brand Elements | Incorporate your business logo, colors, and other branding elements to make the document look consistent with your company’s identity. |

By following these steps, you can create a functional and professional document that will streamline your billing process and ensure clear communication with your clients.

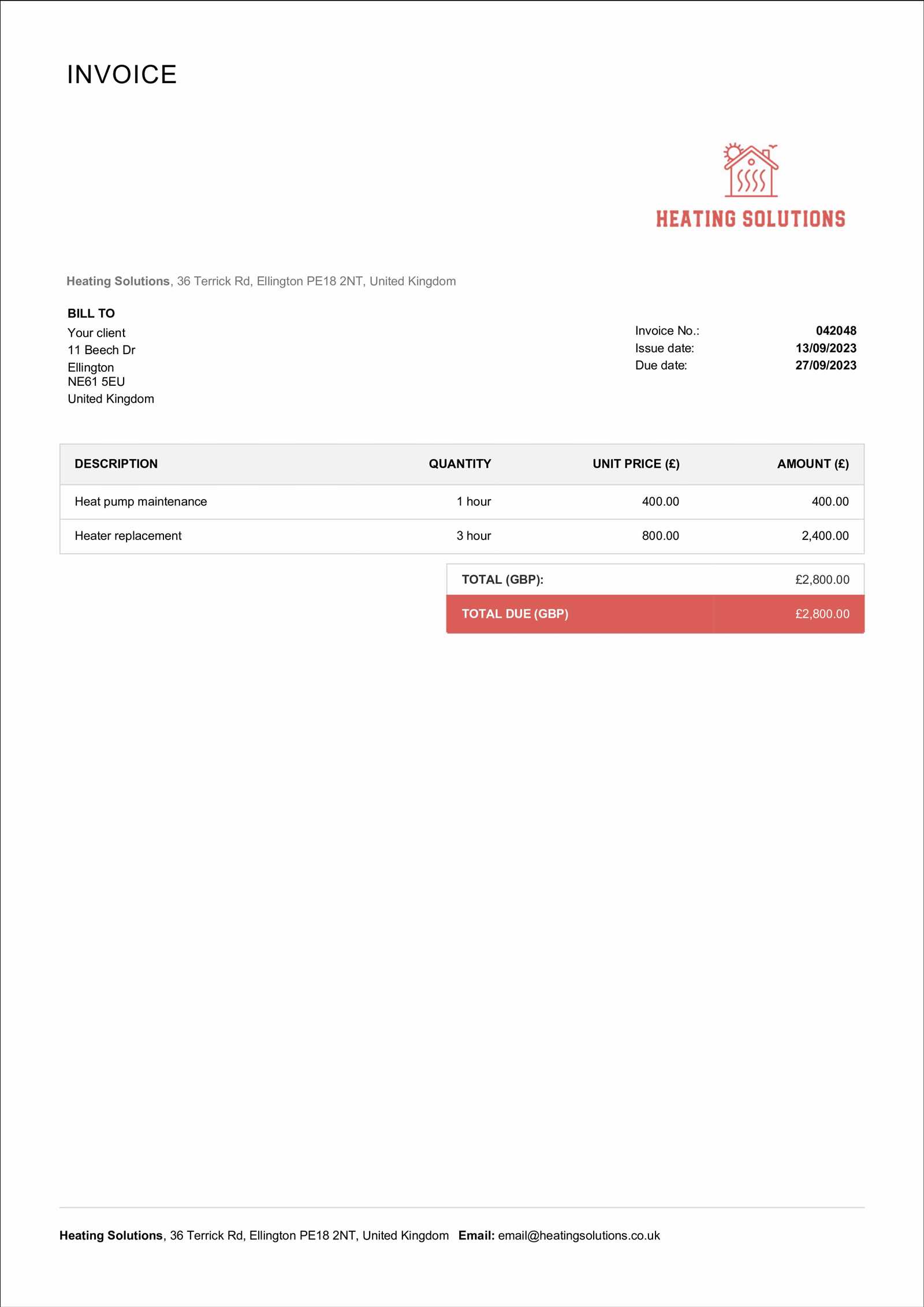

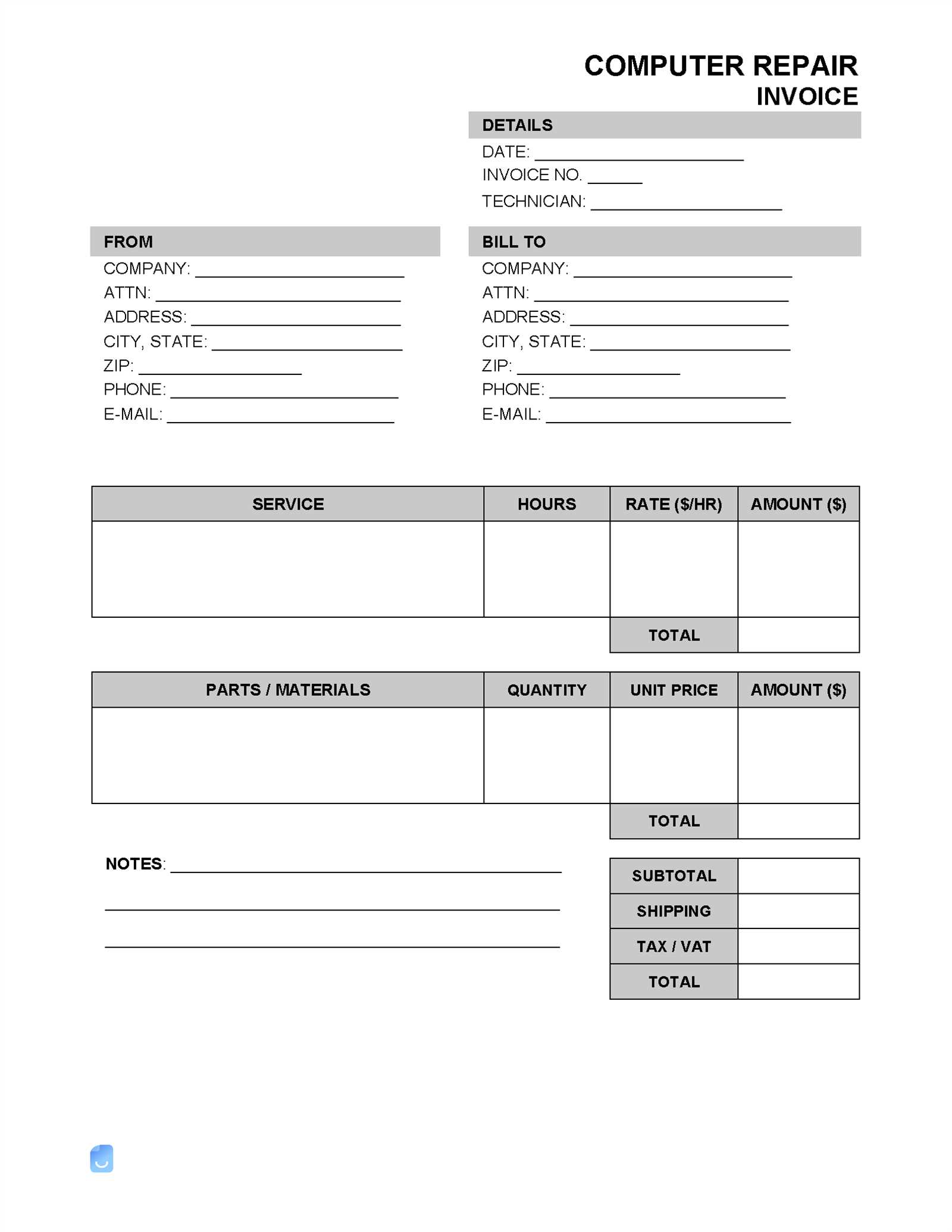

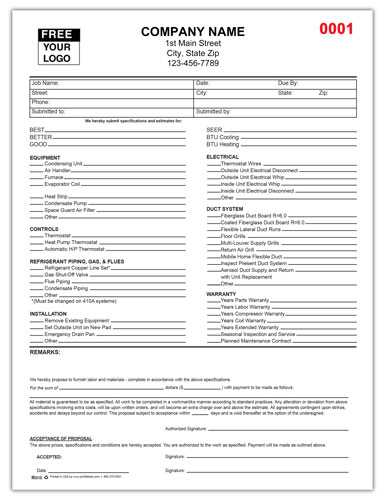

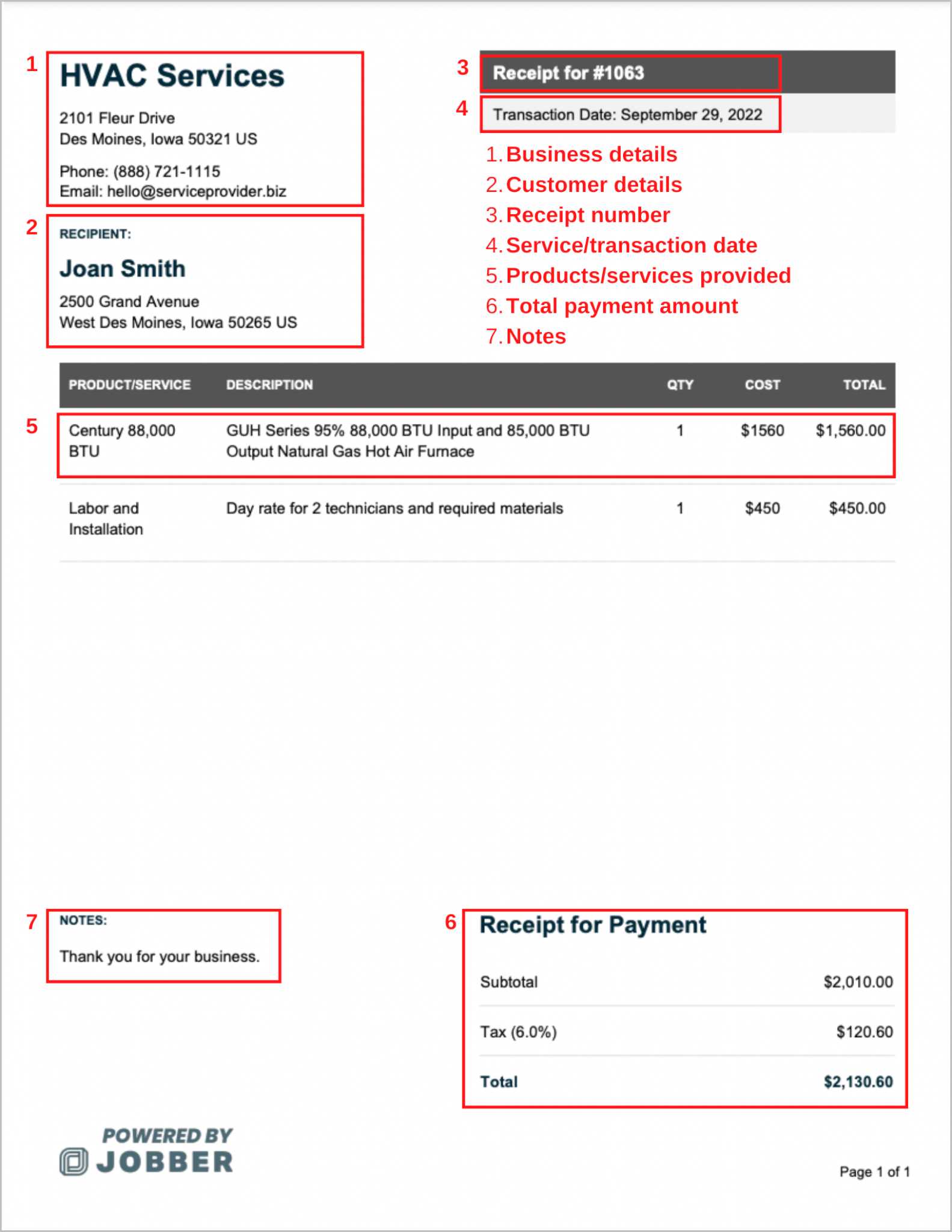

Key Elements of a Repair Invoice

When documenting the completion of a service, having a comprehensive and well-structured record is essential for both the service provider and the customer. A properly constructed document should include all relevant details to ensure clarity in communication, provide proof of transaction, and set clear payment expectations. Below are the key components that should be present in every service billing document.

Essential Information to Include

Each record should contain specific details to avoid confusion and to ensure that all aspects of the service are covered. Key elements include:

- Service Provider Details: The name, address, phone number, and email of the business performing the work.

- Customer Information: The customer’s name, address, and contact information.

- Service Description: A detailed description of the work completed, including any parts or equipment used.

- Cost Breakdown: A clear list of charges for each service provided, including labor, materials, and any applicable taxes.

- Payment Terms: Specifics regarding payment due dates, accepted methods of payment, and any late fees.

Additional Important Sections

For greater transparency and professionalism, including additional information may prove helpful:

- Service Date: The date when the service was completed or when payment is due.

- Invoice Number: A unique identifier for tracking the transaction.

- Terms & Conditions: Clear terms regarding any guarantees, warranties, or follow-up services.

- Contact for Inquiries: A section for customers to reach out with questions or concerns.

Including these components ensures that the document is not only professional but also provides all necessary information to prevent any confusion during the payment process. A complete, transparent record enhances customer satisfaction and reduces the likelihood of disputes.

Essential Information to Include

To ensure that all financial transactions are clear and properly documented, it’s important to include key details in any service billing document. Providing comprehensive information helps both the service provider and the customer maintain accurate records, avoiding confusion and ensuring smooth transactions. Below are the core elements that should be included in every billing statement.

Key Details to Include

Each document should feature the following critical information to make it both informative and professional:

- Provider’s Contact Information: Include the business name, address, phone number, and email to allow easy communication.

- Customer Information: Clearly list the customer’s full name, address, and contact details for reference.

- Service Date: Specify the date when the work was completed, or the service provided was finished.

- Itemized List of Services: Break down the work performed, including any labor, materials, or parts used, with corresponding prices for each.

- Total Amount Due: Include a final total that combines all charges, taxes, and additional fees.

Additional Important Sections

Including additional sections can improve clarity and help prevent disputes:

- Unique Reference Number: Assign a unique number for easy tracking of the transaction.

- Payment Terms: Clearly state when payment is due, the acceptable methods of payment, and any penalties for late payments.

- Warranty or Guarantee Information: Include any applicable warranties on services or parts provided.

- Notes or Special Instructions: A section for any specific notes that may be relevant to the customer.

Incorporating these details ensures that the document is comprehensive, professional, and transparent, which helps both parties stay organized and avoid misunderstandings. A well-constructed record fosters a positive business relationship and smooth payment processing.

Common Mistakes to Avoid in Invoicing

Creating accurate and professional billing records is essential for smooth transactions between service providers and clients. However, there are several common mistakes that can lead to confusion, delays, or disputes. By avoiding these errors, businesses can ensure a more efficient payment process and enhance their professional reputation.

Key Errors to Watch Out For

Here are some of the most frequent mistakes that should be avoided when preparing a billing document:

- Missing or Incorrect Contact Details: Ensure that both the provider’s and the customer’s contact information is accurate. Incorrect details can lead to miscommunication and delays.

- Unclear Service Descriptions: Always provide a detailed, clear breakdown of services performed. Vague descriptions can confuse the customer about what they are being charged for.

- Incorrect Pricing: Double-check the rates for services and materials, as well as any applicable taxes. Mistakes in pricing can result in disputes and damaged trust.

- Omitting Payment Terms: Clearly state the due date for payment, accepted methods, and any late fees. Failing to include this information can lead to misunderstandings and delays.

- Failure to Include an Invoice Number: Each document should have a unique reference number for easy tracking and reference. Missing or duplicate numbers can create confusion for both parties.

How to Prevent These Mistakes

To avoid these issues, ensure your billing process is well-organized and systematic. Regularly review documents for accuracy and consistency before sending them to customers. Additionally, consider using digital tools or software to streamline the creation and management of service documents.

By being mindful of these common mistakes, businesses can maintain professional relationships, reduce administrative errors, and ensure timely payments.

Tips for Streamlining Your Billing Process

Efficient management of billing tasks can greatly improve business operations and reduce the time spent on administrative work. By streamlining your process, you can ensure faster payments, fewer errors, and a better experience for both you and your clients. Below are several strategies to simplify and optimize your billing process.

Automate Where Possible

Automation can save significant time and effort when managing service records and payment requests. Consider these options:

- Use Billing Software: Choose software that automatically generates and tracks service records, reducing manual input and the chance for errors.

- Set Up Recurring Payments: For regular services, set up automated billing cycles to ensure consistent payment without needing to send individual requests each time.

- Pre-set Templates: Use predefined forms to ensure consistency and reduce the time spent on document creation.

Maintain Consistency in Your Process

By following a consistent approach for all transactions, you can minimize confusion and ensure that nothing is overlooked. Here are a few practices to follow:

- Standardize Document Layout: Create a uniform layout for all billing documents, making them easier for customers to understand and for you to track.

- Regularly Review Your Records: Conduct routine checks to ensure that all charges, taxes, and discounts are applied correctly to each document.

- Clear Payment Instructions: Always provide easy-to-follow payment details and terms to ensure that clients know how and when to pay.

By streamlining your billing process, you can improve efficiency, reduce errors, and create a smoother, more professional experience for both your business and your clients. With these tips, managing your financial transactions will be faster and more organized.

Why Accurate Invoicing Matters for AC Repairs

Proper documentation of completed services is essential for maintaining transparency and trust between service providers and their clients. An accurate billing record not only reflects the quality of work but also ensures smooth financial transactions. In the context of maintenance and fixes, precision in charging helps prevent disputes and fosters a reliable relationship between the business and customer.

Building Trust and Professionalism

When a service provider delivers a well-detailed and error-free document, it signals professionalism and reliability. Accurate records help customers feel confident in the work performed, making them more likely to trust the business for future needs. A precise summary of charges, labor hours, and materials used ensures that customers understand what they are paying for, which reduces the likelihood of confusion or dissatisfaction.

Ensuring Financial Clarity

A clear and accurate document helps both the service provider and the customer maintain proper financial records. Here’s why accuracy is key:

- Prevents Misunderstandings: An accurate summary of costs avoids any discrepancies that may arise regarding the charges for labor, materials, or other fees.

- Facilitates Timely Payments: Clear documentation ensures that customers know exactly how much to pay and when, speeding up the payment process.

- Legal Protection: Having well-organized and correct billing records can serve as legal protection in case of disputes or audits.

Overall, proper documentation is more than just a formality; it’s a crucial aspect of maintaining a professional image, ensuring transparency, and protecting the interests of both parties involved. By focusing on accuracy in service billing, businesses can provide a better customer experience and streamline their financial operations.

How to Track Payments Using Templates

Effectively managing payments is essential for any business to ensure timely cash flow and maintain financial order. By using organized forms, service providers can easily track payment statuses, monitor outstanding balances, and follow up on overdue amounts. With the right structure, the process of recording and checking payments becomes seamless, saving time and reducing errors.

Setting Up Your Tracking System

A clear tracking system helps to easily monitor the status of each transaction. Follow these steps to create an efficient process:

- Create a Payment Log: Use a structured document to track all transactions. This should include the customer’s name, service provided, payment amount, and the date the payment was made.

- Include a Status Column: Add a section that indicates whether the payment is pending, completed, or overdue. This will help you quickly identify which transactions need attention.

- Note Payment Methods: Track the method of payment (credit card, bank transfer, cash) for each transaction, ensuring that the correct payment method is reflected in the logs.

Tips for Effective Payment Tracking

To ensure the payment tracking system is efficient and helpful, consider the following tips:

- Use Automation Tools: Software can automate payment reminders and keep track of due dates. This ensures that nothing is missed, and customers are notified in a timely manner.

- Regularly Update Your Records: After every payment, promptly update the tracking document to avoid confusion or discrepancies later on.

- Review Your Payment History: Periodically review past transactions to spot any issues, such as late payments or recurring payment issues, so you can address them early.

By creating an organized and methodical payment tracking system, businesses can ensure smoother cash flow management, reduce the risk of missed payments, and maintain clear financial records. Whether using manual logs or automated software, tracking payments effectively leads to better control over finances and a more organized billing process.

Ensuring Professionalism with Custom Invoices

Presenting clear and personalized documents for services rendered plays a key role in building a professional reputation. Customized records not only help in establishing a unique brand identity but also ensure that clients feel respected and informed. By tailoring these documents to meet specific needs, businesses can elevate the customer experience and project professionalism at every interaction.

A well-designed, customized document reflects attention to detail and showcases your business’s commitment to quality. When clients receive clear, visually appealing, and informative records, they are more likely to trust the business, enhancing your brand’s credibility. Customization goes beyond just adding a logo–it’s about making sure the document accurately reflects the scope of work, pricing structure, and other important terms in a clear, easy-to-read format.

Key Elements of Customization

When customizing your service records, it’s important to focus on several key areas:

| Element | Purpose |

|---|---|

| Branding and Logo | Helps establish your business identity and makes documents recognizable. |

| Detailed Service Breakdown | Ensures clarity on what services were provided and their corresponding costs. |

| Payment Terms | Clearly outlines due dates, payment methods, and any applicable late fees to avoid confusion. |

| Contact Information | Provides easy access to your business details for future inquiries or follow-ups. |

Benefits of Customization

Customizing your records provides several advantages:

- Improved Client Perception: Custom, detailed records help create a positive impression, making clients feel valued and confident in your services.

- Increased Brand Recognition: Consistent branding on all documents ensures your business stands out and is easily recognizable to customers.

- Better Communication: Custom records provide an effective way to communicate the scope of services and payment expectations, preventing misunderstandings.

By customizing your service documentation, you show clients that you take pride in your work and value professionalism. This simple step can significantly enhance client satisfaction and contribute to the long-term success of your business.

Integrating Your Template with Accounting Software

Linking your service documents with accounting tools can significantly streamline your financial processes. By automating the flow of data between your documentation and accounting software, you can save time, reduce errors, and ensure accuracy in your financial records. This integration not only improves efficiency but also provides a seamless way to manage invoicing, payments, and reports, all from a central platform.

Integrating your records with accounting software allows you to directly transfer details such as customer information, services provided, and amounts due into your financial system. This eliminates the need for manual data entry and minimizes the risk of discrepancies between what was billed and what was recorded in your books.

Advantages of Integration

There are several benefits to linking your service documentation with accounting systems:

- Time-Saving Automation: Once set up, the integration automatically updates records, saving you from manually entering data each time.

- Increased Accuracy: Reduces the possibility of human error when entering transaction details into your accounting system.

- Real-Time Updates: Provides immediate access to payment status, outstanding balances, and other financial data, keeping you up to date at all times.

- Simplified Reporting: With automated data flow, generating financial reports becomes a quicker and more reliable process.

How to Integrate

To integrate your service documents with accounting software, follow these general steps:

- Choose Compatible Software: Ensure the software you are using for both documentation and accounting can sync with each other or use third-party integration tools.

- Set Up Templates in the Software: Customize your service records within your accounting platform to include fields such as customer names, service details, and amounts.

- Test the Integration: Run a few test transactions to ensure that data is being accurately transferred between your service documents and the accounting system.

- Regularly Sync Your Data: Schedule periodic synchronization to ensure that all transactions are correctly updated in your financial records.

Integrating your service documentation with accounting software makes financial management smoother, more accurate, and efficient. By reducing manual work and ensuring real-time updates, you can focus on growing your business while keeping your books in perfect order.

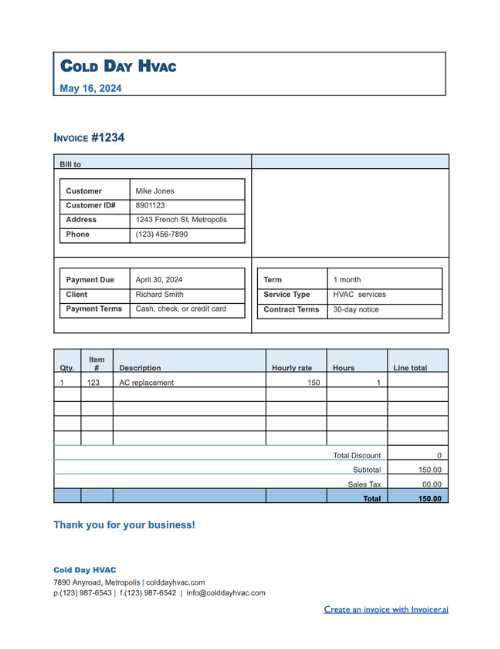

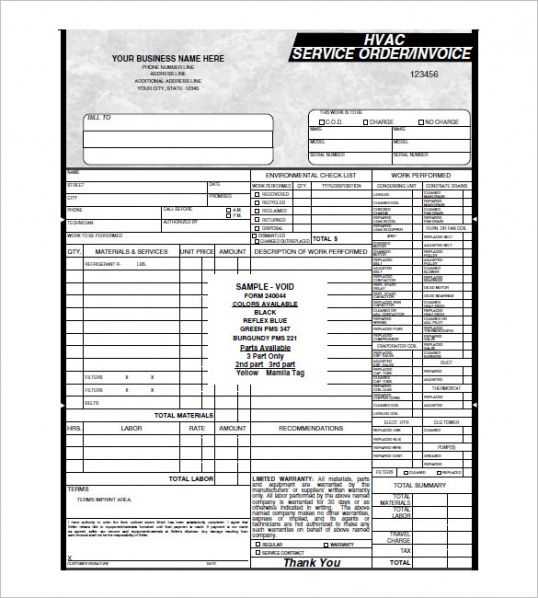

How to Handle Multiple Services on One Invoice

When providing a variety of services to a client, it’s essential to present all charges clearly and concisely on a single document. This allows clients to easily see the breakdown of what they are being billed for and helps maintain transparency. Properly organizing multiple services ensures that customers understand the value of each task performed and facilitates a smooth payment process.

To handle multiple services on one document, it’s important to categorize each service properly and assign a corresponding price. This makes it easy for both the service provider and the client to review the details. Additionally, clearly stating any applicable discounts or package deals will help the client see the total cost and any savings they might be receiving.

Steps to Include Multiple Services

Follow these key steps to ensure your document is clear and professional:

- List Services Separately: Each task should be listed as a distinct item, with a description, quantity (if applicable), and price for each service.

- Group Similar Services: If you offer related services, consider grouping them under a common heading, such as “Installation Services” or “Maintenance Tasks,” to simplify the layout.

- Provide Detailed Descriptions: For each service, include enough detail to help the client understand exactly what was done, such as the scope of work, time spent, and any materials used.

- Show Subtotals: For each category of service, show a subtotal before adding the overall total, including any taxes or additional fees.

- Include Discounts or Promotions: If applicable, list any discounts or promotional offers, ensuring the client knows they are receiving special pricing.

Example Breakdown

| Service Description | Quantity | Price | Subtotal |

|---|---|---|---|

| Basic Maintenance Check | 1 | $100 | $100 |

| Filter Replacement | 2 | $20 each | $40 |

| System Performance Test | 1 | $50 | $50 |

| Total | $190 |

By following these steps and providing a clear breakdown, you ensure that the client can easily understand the charges and see the value of each individual service. This practice not only helps in avoiding confusion but also promotes trust and professionalism i

Protecting Your Business with Clear Terms

Establishing clear, concise, and well-defined terms is essential for safeguarding your business in any service-based industry. By outlining expectations upfront, you ensure that both you and your clients are on the same page regarding the scope of work, payment expectations, and other important details. Clear terms help avoid disputes, streamline communication, and protect your business from potential misunderstandings that could lead to lost revenue or damaged relationships.

When it comes to any agreement, setting transparent terms benefits both the service provider and the client. It sets boundaries, clarifies responsibilities, and creates a mutually understood framework for doing business. With well-structured guidelines, you not only build trust with your clients but also ensure that your business operates smoothly and is legally protected.

Key Elements to Include in Your Terms

To ensure your terms cover all the necessary aspects, consider including the following points:

- Scope of Services: Clearly outline what services will be provided, ensuring no ambiguity about the work to be completed.

- Payment Terms: Specify the agreed-upon pricing, payment methods, and payment deadlines. Mention any late fees or penalties for overdue payments.

- Liability Clauses: Include provisions that protect your business in case of unforeseen issues or damages during the service process.

- Cancellation and Refund Policies: State any conditions under which cancellations are allowed, and whether refunds will be issued under certain circumstances.

- Confidentiality Agreements: If applicable, clarify how client information will be handled and whether any confidentiality agreements are in place.

Why Clear Terms Are Important

- Avoid Legal Disputes: With defined terms, both parties are aware of their rights and obligations, reducing the likelihood of legal issues.

- Prevent Payment Delays: Clear payment terms help to ensure clients understand when and how they need to pay, minimizing delayed payments.

- Build Client Trust: Transparency in your terms shows professionalism and builds confidence in your business practices.

By clearly outlining your terms, you not only protect your business but also set the stage for strong, professional relationships with clients. A well-structured agreement ensures both parties have realistic expectations, leading to fewer disputes and smoother transactions.

Design Considerations for an AC Invoice

Creating a well-organized and professional document is essential for any business transaction. The design of your billing document plays a critical role in ensuring clarity and efficiency. A well-structured layout not only helps you convey information accurately but also reflects your professionalism and attention to detail. By focusing on key design elements, you can enhance the client experience and streamline the entire billing process.

When designing your document, several factors should be taken into account. These include readability, ease of navigation, and the inclusion of all necessary information. A clean and clear layout helps prevent confusion and ensures that your client can easily understand the charges, terms, and payment methods. Below are some key considerations for designing an effective document.

Essential Design Elements

Ensure your document includes the following elements for a professional appearance:

- Branding: Incorporate your business logo and contact information to establish your brand identity and maintain consistency across your documents.

- Clear Header: Use a prominent header to identify the document type and provide a simple, easy-to-read title.

- Itemized List: Clearly list all services and products provided with associated costs for transparency.

- Payment Terms: Highlight the payment due date, accepted methods, and any late fees or penalties for overdue payments.

- Contact Information: Include your business contact details, such as phone number and email address, for any follow-up or inquiries.

Layout and Structure

Effective design also depends on the layout and structure of the document. A well-organized structure ensures that the recipient can quickly find and understand the important details. Below is an example of how to structure your document:

| Section | Description |

|---|---|

| Header | Company name, logo, and contact information clearly displayed. |

| Client Information | Include the client’s name, address, and contact details for easy identification. |

| Itemized Breakdown | A list of services and charges with clear descriptions, quantities, and prices. |

| Summary | Total amount due and applicable taxes, if any. |

| Payment Terms | Clear instructions on how and when to pay, including any discounts or penalties. |

By focusing on these design elements and ens

Digital vs Paper Invoices for HVAC Businesses

When it comes to managing client payments, businesses in the heating, ventilation, and cooling industry face a key decision: whether to use digital or paper documents for billing purposes. Both methods have their advantages and disadvantages, and the choice between the two can impact workflow efficiency, client communication, and overall business operations. This section explores the differences between digital and traditional paper-based billing methods to help you decide which approach is best suited for your business.

Advantages of Digital Billing

Digital billing offers numerous benefits for businesses, especially those seeking to streamline their operations and improve customer service. Below are some of the key advantages:

- Efficiency: Digital documents can be created, sent, and stored quickly, reducing administrative time and the need for physical paperwork.

- Accessibility: Clients can receive their bills instantly via email or online portals, making it easier for them to track and pay their balances from any device.

- Cost-Effective: With digital billing, businesses save on paper, printing, and postage costs, making it a more budget-friendly option in the long term.

- Environmentally Friendly: By eliminating paper usage, digital billing contributes to sustainability efforts and reduces the business’s environmental footprint.

- Security: Digital records can be stored securely in the cloud, ensuring easy access and backup in case of emergencies or audits.

Advantages of Paper Billing

While digital options are becoming increasingly popular, paper billing still holds value for certain businesses, particularly those serving clients who prefer traditional methods. Below are some of the reasons businesses may choose paper billing:

- Personalization: Paper documents can sometimes feel more personal and official, which might be appreciated by certain clients who prefer tangible copies of their bills.

- Client Preferences: Some customers may not be comfortable with digital methods or may not have easy access to email or the internet. Paper documents ensure they can still receive and review their bills in a way that’s familiar to them.

- Physical Record Keeping: Certain industries or clients may prefer having a hard copy of billing documents for their own record-keeping or tax purposes, which could be easier with physical paperwork.

- Local Businesses: For smaller or local businesses serving an older demographic, paper billing may be the norm, and clients may expect this method of communication.

Ultimately, the choice between digital and paper billing methods depends on your business’s needs, the preferences of your clients, and the specific operational requirements of your company. Many businesses today are choosing to integrate both systems, offering clients the flexibility to choose how they’d like to receive and pay their bills. Regardless of your decision, it’s essential to ensure that the process

How to Automate Your Invoicing System

Automating the billing process can save time, reduce human errors, and improve overall business efficiency. With the right tools and strategies, businesses can streamline their financial operations by eliminating manual tasks and ensuring that client payments are processed quickly and accurately. In this section, we’ll explore how to implement an automated billing system that can help your business stay organized and on track.

Key Steps to Implement Automation

Here are the essential steps to automate your billing system:

- Select Automation Software: Choose a reliable billing platform that integrates well with your existing systems. Many software solutions offer features such as automated calculations, recurring billing, and payment reminders.

- Set Up Templates for Different Services: Create customized billing structures for each service you provide. This allows you to quickly generate accurate bills for each customer based on the services rendered.

- Enable Recurring Billing: For clients who have ongoing services or subscriptions, set up automatic recurring payments. This ensures regular income without needing to manually create invoices every month.

- Integrate Payment Processing: Link your billing system to payment gateways like credit cards, bank transfers, or online payment services. This enables quick and secure transactions for clients.

Benefits of Automation

Implementing an automated billing system brings several key benefits:

- Time Efficiency: Once set up, the system works on autopilot, allowing you to focus on more important tasks without manually creating and sending bills.

- Accuracy: Automation eliminates the risk of human error in calculating charges, taxes, and discounts, ensuring accurate billing every time.

- Consistency: Automated systems ensure that billing is done on time, with no missed deadlines or delayed payments.

- Enhanced Client Experience: Clients appreciate timely and transparent billing. An automated system ensures they receive their bills promptly and can pay easily through integrated payment methods.

Tracking Payments with Automation

Most automated systems offer real-time tracking, allowing you to monitor when payments are received, when reminders are sent, and whether any actions are required. This transparency ensures that your business stays on top of its financials and minimizes the risk of missed or overdue payments.

Choosing the Right Tool

When selecting automation tools, it’s crucial to choose one that fits your business’s needs. Consider factors such as:

- Ease of use and integration with existing software.

- Cost-effectiveness, with options for scaling as your business grows.

- Customer support and resources for troubleshooting

Legal Requirements for Air Conditioning Invoices

When conducting business that involves providing services or goods, ensuring that your billing documents meet legal standards is crucial. Properly structured documentation not only protects your business but also ensures compliance with local regulations. In this section, we will explore the key legal considerations to keep in mind when creating and managing payment records.

Key Legal Elements to Include

There are several important elements that must be included in your documents to meet legal requirements:

- Business Identification: Always include your business name, contact information, and relevant registration or tax numbers. This ensures that the recipient can clearly identify the origin of the charge.

- Detailed Breakdown of Services: Clearly outline the services or goods provided. This includes a description, quantity, rate, and any other relevant details to avoid ambiguity.

- Pricing and Tax Information: The total amount charged, including applicable taxes (such as VAT or sales tax), should be clearly shown. This helps to prevent any disputes related to tax obligations.

- Payment Terms: Specify when payment is due and any penalties or interest that will apply to late payments. This sets clear expectations and helps avoid misunderstandings.

- Payment Methods: Indicate acceptable payment methods and provide any relevant details for electronic payments or bank transfers.

- Issue Date and Unique Reference: Every document should have a unique reference number and an issue date to facilitate tracking and ensure accuracy for both parties.

Compliance with Local Regulations

Legal requirements can vary depending on the country or region in which you operate. It’s important to familiarize yourself with the specific laws in your area, as non-compliance can lead to fines or other legal consequences. Some key considerations include:

- Tax Laws: Understand the tax obligations related to the services you provide. This might include sales tax, service tax, or other industry-specific levies.

- Consumer Protection Laws: Ensure that your documentation complies with laws designed to protect consumers, including transparency and fair business practices.

- Record-Keeping Requirements: Most jurisdictions have regulations on how long business records must be kept. Be aware of retention periods to avoid legal issues during audits or disputes.

Digital vs. Paper Documents

With the rise of digital solutions, many businesses are opting for electronic billing, which is just as legally valid as paper documents. However, you must ensure that your electronic documents comply with legal standards, such as providing a digital signature or storing them securely in a way that can be easily retrieved in case of an audit or dispute.

Adhering to legal requirements when creating payment documents not only ensures compliance but also helps to build trust with your clients. Proper documentation protects both parties and contribut