Aia Invoice Template Excel for Easy and Professional Invoicing

Efficient billing is crucial for any business, ensuring timely payments and smooth financial operations. A well-structured document can save valuable time and reduce errors in tracking transactions. With the right tools, managing invoices becomes a streamlined task that helps maintain professionalism and consistency in your accounting practices.

Using an adaptable and easy-to-edit document format can simplify the process significantly. Whether you are a freelancer, small business owner, or managing a larger team, having a reliable method for generating payment requests is essential. Customized sheets allow you to create and organize billing details quickly, offering both flexibility and accuracy in your financial reporting.

Tailoring your documents to suit your specific needs can lead to improved communication with clients and better financial tracking. With simple features like itemization, payment due dates, and clear summaries, you can ensure clarity and avoid confusion. The ease of use and accessibility of editable files make them a preferred choice for businesses of all sizes.

Understanding Aia Invoice Template Excel

Efficient billing is essential for keeping track of payments and ensuring timely financial settlements. A well-organized document helps you record all necessary details, ensuring accuracy and clarity in your transactions. A customizable sheet offers a flexible solution to meet various business needs, from itemizing services to setting payment deadlines. Understanding how to use such tools effectively can significantly improve your overall accounting processes.

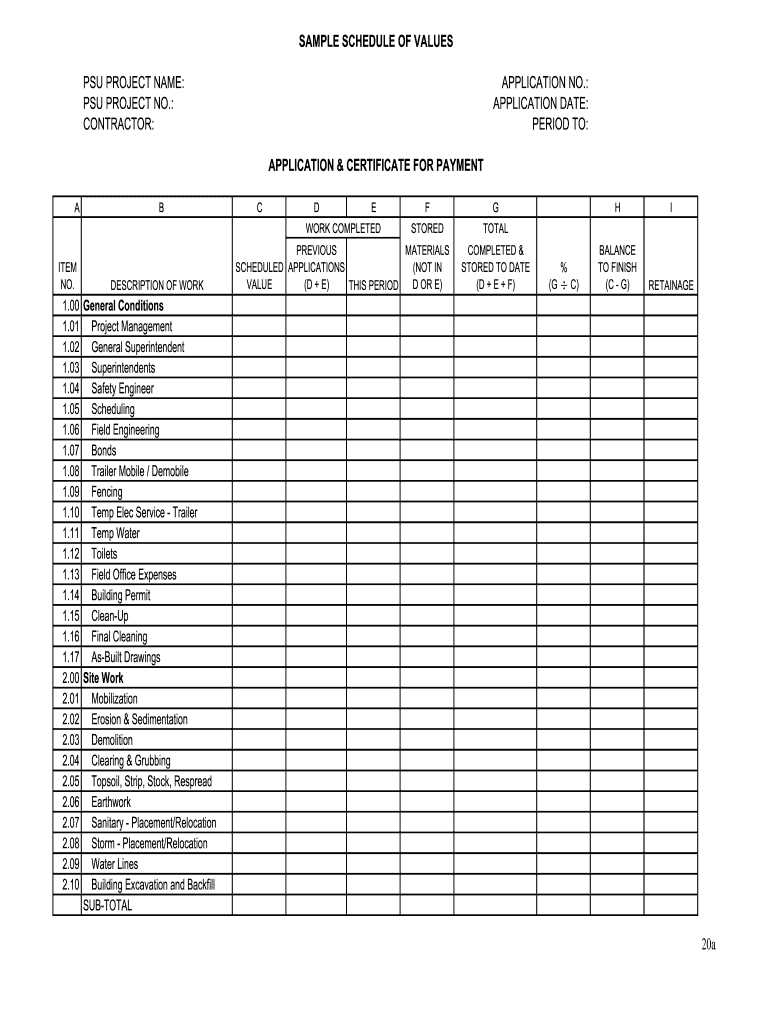

At its core, this tool allows users to input essential data like client information, services rendered, payment terms, and total amounts due. The flexibility of this format ensures it can be adapted to different business types, whether you’re managing a small project or overseeing complex contracts. Here’s why it can be an invaluable asset:

- Customizable Fields: You can modify the layout to fit your specific requirements, whether for itemizing tasks or adding extra charges.

- Ease of Use: The structure is simple enough for anyone to use without advanced technical knowledge.

- Automation Features: Many options include automatic calculations, which reduce the chances of errors when adding totals or applying discounts.

- Tracking Capabilities: You can easily monitor unpaid balances and ensure all transactions are accounted for.

By adopting this approach, businesses can save valuable time and reduce human error, which can be costly when managing client accounts. Once set up, the document becomes a powerful tool for generating consistent, professional-looking records that align with financial standards.

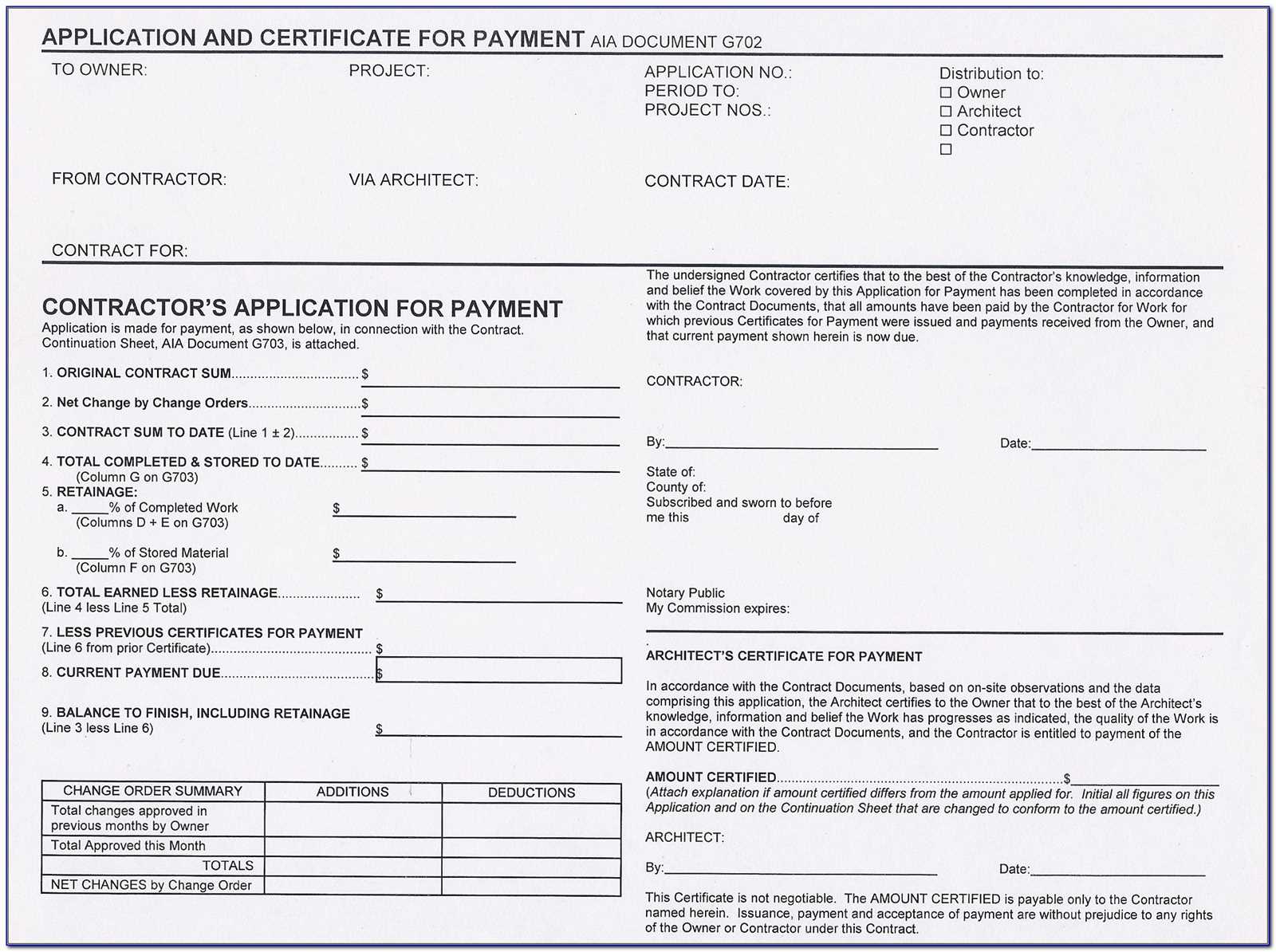

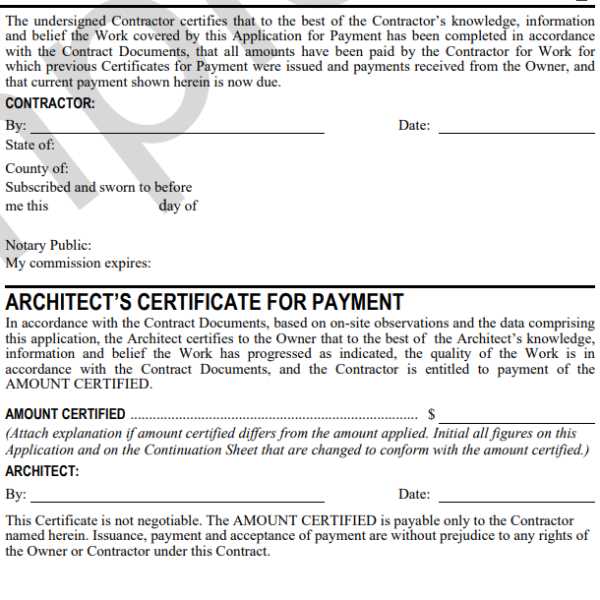

What is an Aia Invoice Template?

At its core, this document serves as a pre-designed structure for recording payment requests between businesses and clients. It allows users to input key financial information in a standardized format, ensuring consistency and clarity in all transactions. With a focus on professional presentation, these documents are meant to simplify the process of billing, helping businesses track payments and services provided.

Key Components of the Document

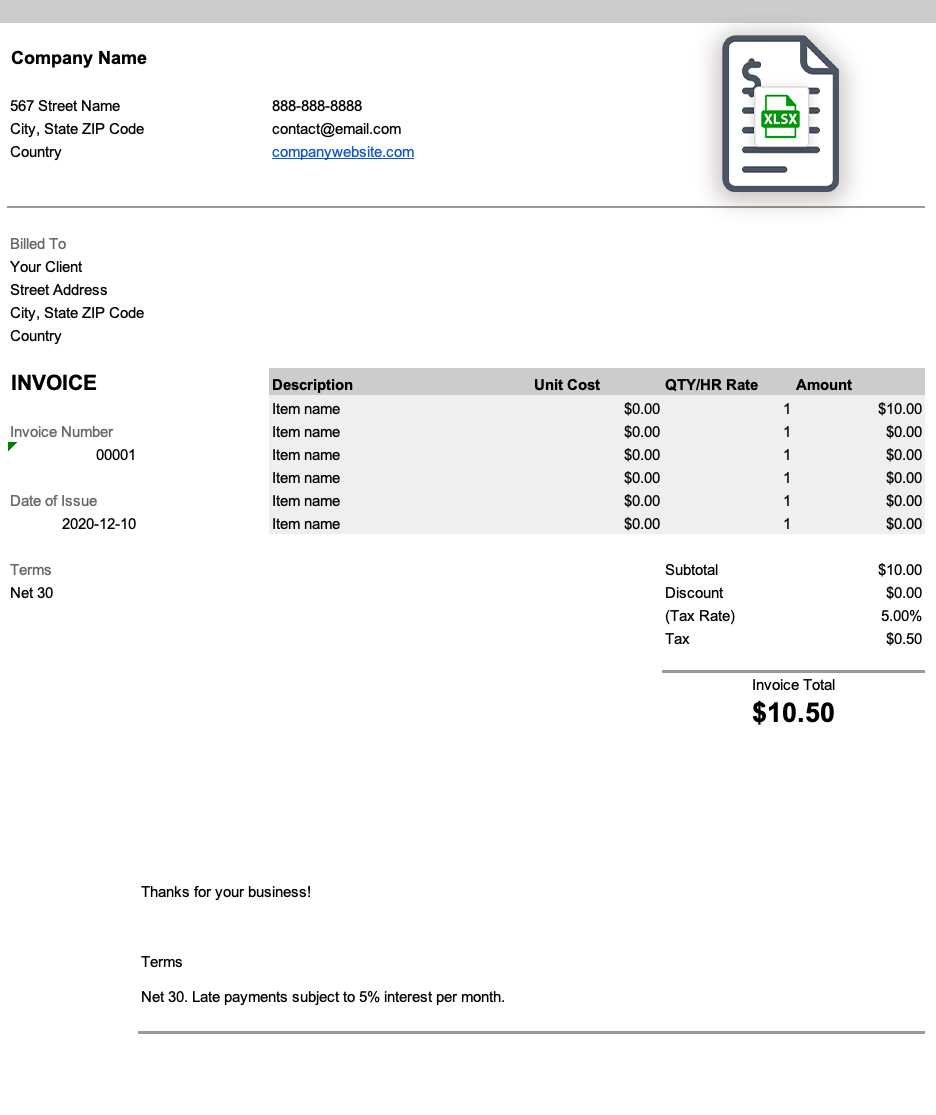

A typical form includes several important sections that capture the details necessary for completing a transaction. These fields are designed to cover all essential aspects of financial exchanges, ensuring that both the business and the client have a clear understanding of the terms. Common components include:

- Client Information: Name, address, and contact details for easy identification.

- Service or Product Details: Descriptions, quantities, and unit prices for each item or service rendered.

- Payment Terms: Specifies the due date, payment methods, and any applicable late fees.

- Total Amount Due: The overall cost calculated by the document based on the provided information.

Why Use This Tool?

This structured approach eliminates the need to start from scratch with each transaction. Instead, you can focus on updating key information while the format ensures everything is aligned. Businesses benefit from the time saved, while clients receive clear, accurate statements. Additionally, using a pre-made structure helps maintain a professional image, regardless of the size of the company.

Benefits of Using Excel for Invoicing

Using a spreadsheet for generating billing documents offers numerous advantages, especially when it comes to managing multiple transactions efficiently. The flexibility and accessibility of this tool allow businesses to create, customize, and track their payment records with ease. Whether you’re a freelancer, small business owner, or managing a larger company, spreadsheets provide an ideal solution for organizing financial information in a way that is both simple and professional.

Key Advantages of Spreadsheet Billing

Spreadsheets are powerful tools that enable users to create detailed financial documents with minimal effort. Some of the key benefits include:

- Automation: Automatic calculations for totals, taxes, and discounts help reduce errors and save time.

- Customizability: The layout can be tailored to suit your specific needs, including adding custom fields or adjusting formats.

- Easy Updates: With editable rows and columns, you can quickly adjust quantities, prices, or other details without starting from scratch.

- Cost-Effective: There is no need for expensive billing software when a basic spreadsheet program can handle all essential tasks.

Improved Accuracy and Tracking

By using built-in functions, businesses can ensure their calculations are accurate every time. Additionally, tracking outstanding payments becomes a more streamlined process, as you can easily sort and filter records to monitor due dates and amounts owed. This level of organization helps maintain better financial control and reduces the risk of missing payments or overcharging clients.

How to Customize Aia Invoice Template

Customizing a billing document to fit your business’s specific needs is a straightforward process that can significantly enhance its efficiency and professionalism. Whether you are tailoring a design for a one-time project or adapting it for regular use, adjusting the fields and layout ensures that the document reflects your brand, services, and payment terms. Here’s how you can make adjustments to suit your requirements.

Adjusting Basic Information

The first step in customization is adding or modifying the fundamental details that make the document unique to your business. These usually include:

- Company Logo: Insert your logo at the top to establish brand identity and make the document look more professional.

- Business Information: Ensure that your contact details (address, phone number, email) are updated and clearly displayed.

- Client Information: Include relevant client details such as name, address, and contact information to personalize each billing document.

Modifying the Layout and Structure

Next, you can modify the structure to ensure that all the relevant information is presented clearly. This includes adjusting:

- Column Widths: Adjust the width of columns to fit different service descriptions or product details.

- Itemization: Add or remove rows to list specific services or items, depending on what you are billing for.

- Payment Terms: Customize the section that outlines the due date, accepted payment methods, and any late fees or discounts.

Making these adjustments will help you create a professional and user-friendly billing document that accurately reflects your business needs and client expectations.

Key Features of Aia Invoice Templates

When selecting a pre-designed billing structure, it’s important to look for key features that can enhance both the efficiency and professionalism of your financial documents. The right features will streamline your accounting process, improve clarity, and ensure that all necessary information is captured in a way that’s easy for both you and your clients to understand. Below are some of the essential elements that make these documents effective tools for managing payments and financial transactions.

Essential Information and Layout

The most effective billing formats include clearly defined sections that capture all relevant information. These sections are designed to be comprehensive yet simple to navigate:

- Client and Business Details: Easily include your business contact information and the client’s details, ensuring a professional look and quick reference for both parties.

- Service/Item Descriptions: A dedicated space to list services provided or products sold, including quantities and rates for transparent billing.

- Total Amount Calculation: Built-in functions that automatically calculate totals, taxes, and any discounts, minimizing errors.

- Due Dates and Payment Terms: Clear sections for payment deadlines, late fees, and other terms to prevent confusion.

Customization and Flexibility

The ability to tailor a billing format to your business’s specific needs is a major advantage. The following features ensure that you can adjust your documents as necessary:

- Editable Fields: Adjust any part of the structure to include custom information, whether it’s extra notes or specific discount codes.

- Branding Options: Personalize with your business’s logo, color scheme, and fonts to maintain brand consistency.

- Multiple Templates: Access different styles and formats to match the nature of the transaction, whether it’s a one-time fee, subscription, or recurring charge.

These key features make it easier to maintain professional, accurate, and customized financial records that are suitable for any business or client relationship.

Free vs Premium Aia Invoice Templates

When choosing a pre-designed document structure for managing billing, businesses often face a decision between free and premium options. While both types offer basic functionality, each comes with distinct advantages and limitations. Understanding the key differences between these two choices will help you select the best option for your specific needs, whether you’re running a small startup or a large enterprise.

Benefits of Free Billing Formats

Free document layouts are an attractive option for businesses with tight budgets or those just starting out. These tools typically offer simplicity and basic features, making them suitable for smaller operations or those with minimal billing requirements. Here are some of the main advantages:

- Cost-Effective: As the name suggests, free options don’t require any upfront investment, making them ideal for businesses with limited financial resources.

- Simplicity: They often feature easy-to-understand layouts that allow quick setup and minimal customization.

- Availability: Free templates are widely available and can be easily found online, making them accessible to anyone with basic spreadsheet software.

Advantages of Premium Billing Documents

On the other hand, premium options come with additional features that provide more flexibility and professional polish. These tools are typically designed for businesses looking for enhanced functionality and customization. Here’s why you might consider investing in a premium format:

- Advanced Features: Premium versions often include automatic calculations, complex reporting functions, and integrated payment tracking, which save time and improve accuracy.

- Customization: More design flexibility, including advanced formatting options, custom fields, and branding, allows you to create a document that fully represents your business.

- Customer Support: Many premium providers offer dedicated support for troubleshooting and guidance, ensuring smoother usage.

- Professional Appearance: Premium layouts often include sophisticated designs that enhance your business’s credibility and client experience.

While free options are a great starting point, premium tools offer greater control, convenience, and scalability, especially as your business grows and requires more complex billing capabilities.

Step-by-Step Guide to Create Invoices

Creating clear, accurate billing documents is essential for maintaining smooth financial transactions with clients. A well-structured payment request helps avoid confusion and ensures that both parties are aligned on the terms. This guide walks you through the process of designing a billing document, from start to finish, ensuring you capture all necessary details in an organized manner.

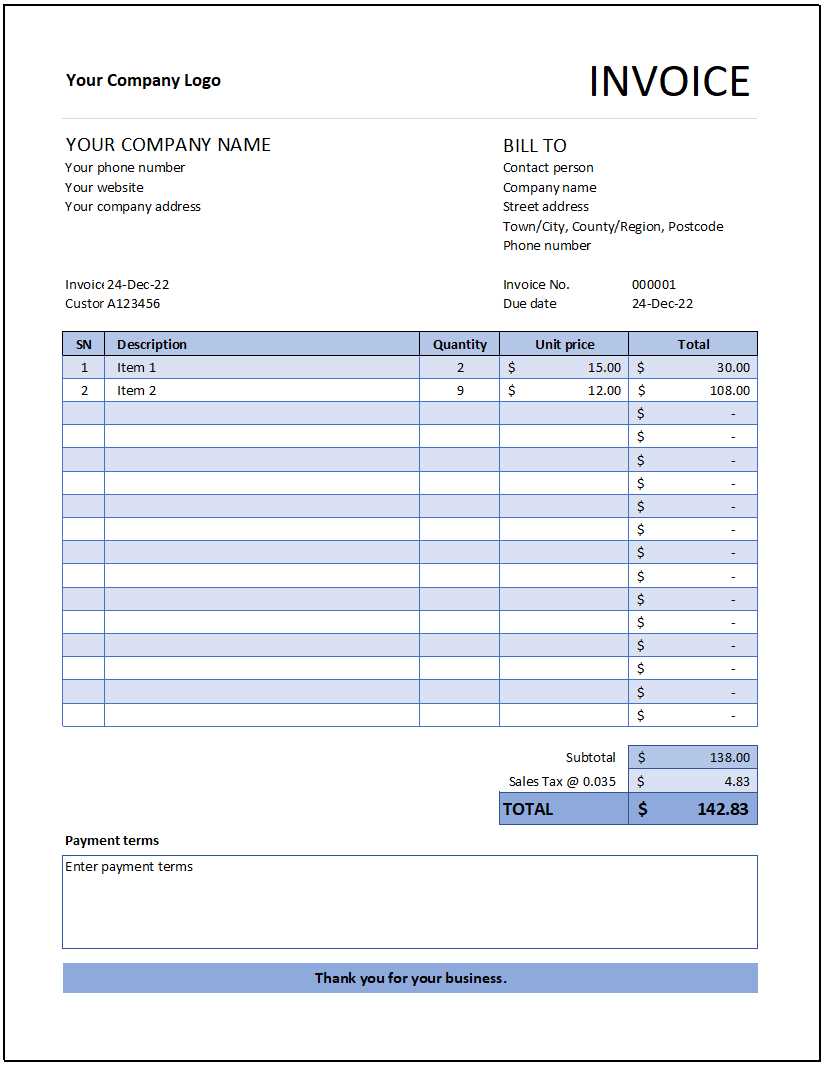

Step 1: Set Up Your Document

The first step in creating a billing document is to set up a clean, professional layout. Start by opening a new sheet and adjusting the size of the columns to accommodate the required information. At the top, include your business name, logo, and contact details. This will ensure the recipient can quickly recognize the document as coming from your company.

- Business Information: Include your company name, address, phone number, and email.

- Client Details: Leave space for the client’s name, address, and contact information.

- Document Title: Label the document clearly, such as “Payment Request” or “Statement of Charges,” depending on your preference.

Step 2: Add the Transaction Details

Now, you’ll need to input the specifics of the transaction. This typically involves breaking down the services or products provided, as well as their respective costs. List each item or service on a separate row, along with any relevant details like quantity, unit price, and total amount. Be sure to leave room for additional notes or terms if needed.

- Description: Clearly describe the services or items provided.

- Quantity/Hours: If applicable, include the number of items or hours worked.

- Unit Price: Specify the cost per item or service.

- Total: Calculate the total cost for each item/service and for the entire bill.

Once all the transaction details are filled in, add a row for the total amount due, including any applicable taxes or discounts.

Step 3: Finalize Payment Information

After listing the services or products and calculating the total, it’s essential to provide payment terms. Clearly state the due date, payment methods (bank transfer, credit card, etc.), and any penalties for late payments. You can also include a section for additional comments, such as reminders for future work or special offers for clients who pay early.

- Due Date: Specify the date by which the payment should be received.

- Payment Methods: Indicate the available methods for making the payment.

- Late Fees: Outline any fees for overdue payments.

Once everything is filled in, review the document for accuracy before sending it out. A clear, accurate billing document ensures that both you and your client are on the same page, reducing the chances of disputes and ensuring a smooth transaction.

How to Manage Payment Terms in Excel

Effectively managing payment terms is essential for ensuring timely transactions and maintaining healthy cash flow. A well-organized document allows you to set clear expectations for both your business and your clients, reducing the likelihood of late payments. By using spreadsheet software, you can easily automate and track payment deadlines, discounts, and other payment-related conditions to streamline the financial process.

Here’s how you can manage payment terms in a structured document to ensure clarity and efficiency:

- Define Due Dates: Include a clear due date for each transaction. This can be manually entered or automatically calculated based on the invoice date using simple formulas to add a certain number of days to the current date.

- Apply Payment Terms: Specify the terms, such as “Net 30” (payment due within 30 days) or “2/10 Net 30” (2% discount if paid within 10 days, otherwise full amount due in 30 days). You can create a column to track the payment terms for each client or transaction.

- Late Fees: To encourage timely payments, it’s helpful to include a section outlining late fees for overdue balances. This can be a flat fee or a percentage of the total due. Excel’s calculation functions allow you to easily apply these penalties when the payment date passes.

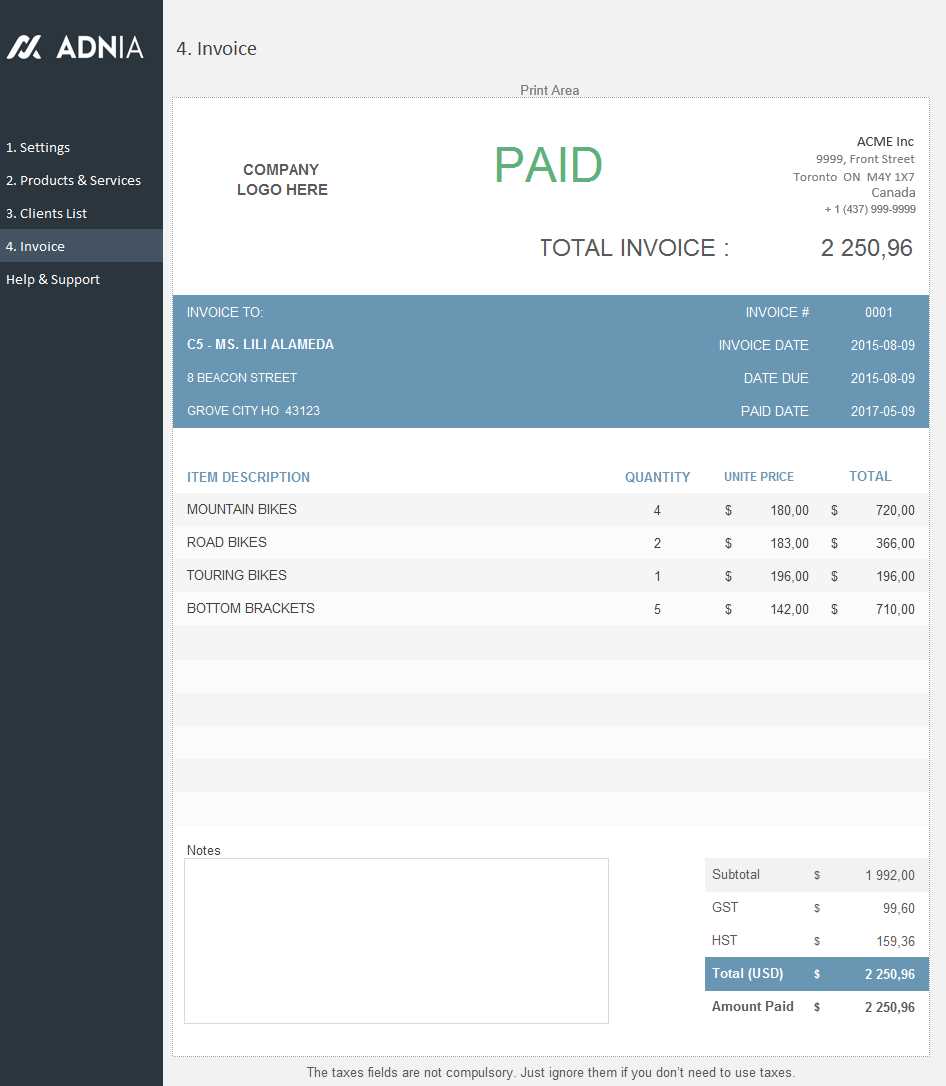

- Track Payment Status: Use conditional formatting or checkboxes to monitor whether payments have been received. Highlight overdue payments automatically to keep track of outstanding balances and follow up accordingly.

With these tools, you can ensure that your payment terms are clearly outlined, tracked, and managed with ease. This helps both you and your clients stay on top of financial obligations and ensures that all transactions are completed on time.

Common Mistakes in Invoice Creation

Creating accurate and professional payment requests is crucial for maintaining good client relationships and ensuring timely payments. However, there are several common mistakes that can lead to confusion, delays, or even disputes. By being aware of these errors, you can avoid costly mistakes and streamline your billing process.

Here are some of the most frequent issues that arise when creating billing documents:

| Common Mistake | Explanation | How to Avoid |

|---|---|---|

| Incorrect or Missing Client Information | Omitting or misspelling client names, addresses, or contact details can cause delays and confusion. | Double-check all client information before finalizing the document. Use templates with fields that are easy to update. |

| Not Including Payment Terms | Failure to clearly specify payment deadlines and terms can lead to misunderstandings about when payments are due. | Always include specific due dates, late fees, and acceptable payment methods on every document. |

| Math Errors in Total Calculation | Manual calculations are prone to errors, which can lead to incorrect amounts being charged. | Use automated formulas in your document to calculate totals, taxes, and discounts to minimize mistakes. |

| Omitting Detailed Descriptions | Vague descriptions of services or products can lead to confusion and disputes over what was delivered. | Provide clear and detailed descriptions of each item or service, including quantities and unit prices. |

| Not Tracking Payments | If you fail to track which payments have been made and which are still outstanding, it can lead to missed follow-ups. | Maintain a separate tracking sheet or use built-in functions to mark payments as received and overdue. |

By carefully avoiding these common mistakes, you can ensure that your payment requests are clear, accurate, and professional. This not only improves communication with clients but also reduces the chances of payment delays and misunderstandings.

Best Practices for Aia Invoice Templates

Creating efficient and professional billing documents requires following certain best practices that ensure clarity, accuracy, and a smooth payment process. By adhering to these best practices, businesses can avoid common mistakes, streamline their workflow, and maintain a positive relationship with clients. Below are some essential guidelines to follow when preparing billing documents.

| Best Practice | Description | Benefits |

|---|---|---|

| Clear and Complete Client Information | Ensure that all client details, including name, address, and contact information, are accurately filled out. | Helps avoid miscommunication and ensures easy follow-up if needed. |

| Detailed Descriptions of Products/Services | Provide specific and clear descriptions of the goods or services provided, including quantities and unit prices. | Reduces confusion and helps clients understand exactly what they are being billed for. |

| Consistent Format and Design | Maintain a clean, easy-to-read design with consistent fonts, headings, and spacing. | Enhances professionalism and makes it easier for clients to navigate the document. |

| Accurate Payment Terms | Clearly state payment due dates, available payment methods, and any late fees or discounts. | Prevents misunderstandings and encourages timely payments. |

| Automated Calculations | Use automated formulas to calculate totals, taxes, and discounts. | Reduces the risk of human error and ensures accurate billing. |

| Tracking Payment Status | Include a column or section to track whether payments have been received or are overdue. | Helps manage outstanding payments and ensures timely follow-up. |

By implementing these best practices, businesses can improve their invoicing process, enhance client satisfaction, and maintain financial accuracy. Whether you are invoicing for a one-time project or managing recurring billing, following these principles will contribute to smoother transactions and a more professional business image.

How to Automate Your Invoicing Process

Automating your billing system can save you time, reduce errors, and improve efficiency. By implementing automated processes, you can streamline repetitive tasks like generating, sending, and tracking payment requests. This allows you to focus more on running your business while ensuring that payments are processed smoothly and on time.

Step 1: Set Up Automation Tools

The first step in automating your billing process is selecting the right tools. Many software programs offer features for generating billing documents automatically, based on pre-set templates. These tools often include options to:

- Automatically generate documents: Set up recurring billing or one-time charges that are generated with the click of a button.

- Track payment status: Automatically mark invoices as paid or overdue based on the payment date entered.

- Send notifications: Set up automatic reminders for clients who haven’t paid by the due date, or send thank-you notes for completed payments.

Step 2: Use Formula-Driven Templates

For businesses that prefer using spreadsheets, formula-driven templates can be an effective way to automate calculations and ensure accuracy. You can use built-in functions to automatically calculate totals, taxes, discounts, and balances due. This reduces the risk of errors in manual data entry and ensures that the documents remain consistent. Some of the key benefits include:

- Time-saving calculations: Use formulas to calculate totals, taxes, and discounts instantly.

- Data consistency: Once set up, the template will automatically update every time you input new data, ensuring accuracy across multiple documents.

- Easy tracking: Automatically track outstanding balances and payments, making it easier to manage cash flow.

By integrating automation into your invoicing process, you can eliminate repetitive tasks, reduce the likelihood of mistakes, and free up time to focus on other aspects of your business.

Integrating Excel Invoices with Accounting Software

Integrating your billing system with accounting software helps streamline the financial management process. By connecting your pre-designed payment request documents to accounting platforms, you can ensure that all financial data flows seamlessly, reducing manual input and minimizing errors. This integration simplifies tasks like tracking payments, managing taxes, and generating financial reports. Below are some common methods to integrate spreadsheet-based billing with accounting systems.

| Integration Method | Description | Benefits |

|---|---|---|

| Manual Import/Export | Export billing data from spreadsheets to a compatible format (like CSV) and import it into your accounting software. | Simple process; works with most software programs. |

| Automated Syncing | Use tools that automatically sync data between your spreadsheet and accounting platform, often through cloud-based integration. | Reduces manual entry; ensures up-to-date financial records in real time. |

| Third-Party Integration Tools | Leverage third-party software or add-ons to bridge the gap between your spreadsheets and accounting system. | Provides more customization; automates more complex workflows. |

By linking your payment request process to accounting software, you can reduce administrative tasks, minimize human error, and maintain accurate financial records. Whether you opt for manual imports or automated syncing, integrating these systems allows for smoother financial operations and faster access to essential business insights.

How to Track Invoice Payments in Excel

Effectively tracking payments is an essential part of maintaining healthy cash flow and staying on top of your financial records. With the right tools and organization, you can easily monitor which payments have been made, which are still pending, and identify overdue amounts. Using spreadsheet software to track payment statuses allows you to automate much of the process and ensure that all financial transactions are recorded accurately.

Step 1: Set Up a Payment Tracking System

Begin by creating a new sheet or section within your existing spreadsheet dedicated to payment tracking. In this section, you’ll need to include key columns that provide important information about each payment. Here are some essential fields to include:

- Client Name: The name of the client associated with the payment.

- Due Date: The original date the payment was due.

- Amount Due: The total amount that the client owes.

- Amount Paid: The amount that has been paid by the client.

- Payment Date: The date when the payment was received.

- Balance Remaining: The outstanding balance that needs to be paid (calculated by subtracting the paid amount from the total due).

- Payment Status: Mark whether the payment is pending, partial, or complete.

Step 2: Use Formulas to Automate Tracking

To make tracking payments more efficient, use formulas that automatically calculate the balance and update the payment status. For example:

- Balance Remaining: Use a simple formula to subtract the “Amount Paid” from the “Amount Due” (e.g., =C2-D2).

- Payment Status: Use conditional logic (IF function) to automatically label payments as “Paid,” “Partial,” or “Pending” based on the balance remaining (e.g., =IF(E2=0,”Paid”,IF(E2>0,”Partial”,”Pending”)).

By setting up these basic formulas, you can automate the process of calculating outstanding amounts and identifying overdue payments. This approach helps keep your records up-to-date and minimizes the risk of errors.

Tracking payments in this way not only saves time but also provides you with real-time insights into your financial situation, helping you take proactive steps if any payments are overdue.

Improving Accuracy in Your Invoices

Ensuring accuracy in your billing documents is crucial for maintaining professionalism and avoiding costly mistakes. Even minor errors in calculations, details, or formatting can lead to confusion, delayed payments, or disputes. By adopting a systematic approach to creating and reviewing your payment requests, you can enhance their precision and make your financial processes more reliable.

Here are several strategies to improve the accuracy of your billing documents:

- Double-Check Client Information: Ensure all client details, such as names, addresses, and contact information, are correct before generating the document. This prevents miscommunication and potential errors in delivery.

- Use Automated Calculations: Leverage formulas to calculate totals, taxes, and discounts automatically. This reduces the risk of human error when performing complex calculations.

- Standardize Descriptions: Provide clear and consistent descriptions for each product or service rendered. Ensure the same format is used across all billing documents, which helps eliminate confusion.

- Include Clear Payment Terms: Clearly outline payment due dates, accepted payment methods, and any applicable late fees or discounts. This reduces misunderstandings and sets clear expectations.

- Use Templates: Start with a well-designed, pre-set structure that includes all essential fields. This helps ensure that nothing important is omitted, and the format remains consistent every time.

By applying these best practices, you can minimize mistakes, save time, and build a more professional billing process. Accuracy not only enhances client trust but also ensures that your cash flow is managed effectively, with fewer issues arising from disputes or payment delays.

Security Tips for Your Excel Invoices

When managing financial documents, it’s crucial to ensure that your data is protected from unauthorized access or manipulation. Billing records often contain sensitive information, such as client details, payment amounts, and due dates. Securing this data not only protects your business but also helps maintain trust with your clients. Below are some essential security measures to consider when handling digital payment records.

1. Protect Your Documents with Passwords

Password-protecting your files is one of the simplest and most effective ways to keep unauthorized individuals from viewing or editing your documents. Set a strong, unique password that includes a combination of letters, numbers, and special characters. Ensure that the password is shared only with trusted personnel.

- Use strong passwords: Avoid common passwords or easily guessable phrases.

- Change passwords regularly: Update your passwords every few months to prevent unauthorized access.

- Enable encryption: For an extra layer of security, enable file encryption to make your documents even more secure.

2. Use Secure File Sharing Methods

When sharing financial documents with clients or team members, it’s important to use secure methods to prevent interception or unauthorized access. Avoid sending sensitive files via unsecured email or through cloud storage platforms without proper protection. Consider using encrypted email services or file-sharing platforms with built-in security features.

- Choose encrypted email services: Some email platforms offer built-in encryption for better protection.

- Utilize secure file-sharing platforms: Use services like Google Drive or Dropbox that offer permission-based access and encryption.

- Limit access: Only grant access to those who absolutely need it, and regularly review permissions to ensure proper control.

3. Backup Your Files Regularly

Regularly backing up your financial records ensures that you can recover them in case of accidental deletion, hardware failure, or cyberattack. Store backups in secure locations, such as external drives or cloud services with robust security protocols.

- Automate backups: Set up automatic backups to ensure your documents are regularly saved.

- Store backups offsite: Consider using a secure cloud service or external storage device that is not connected to your main network.

- Test backups: Periodically test your backups to ensure that they are functioning properly and can be restored when needed.

By implementing these security practices, you can protect your billing documents from unauthorized access, data loss, or theft. Safeguarding your financial information helps you maintain the integrity of your business operations and secure sensitive client data.

Tips for Professional Invoice Design

A well-designed billing document not only ensures clarity but also enhances your business’s professionalism. A clean, organized layout helps clients understand the details at a glance and can leave a positive impression that contributes to timely payments. Whether you’re creating a simple payment request or a more detailed statement, following a few key design principles can make a significant difference.

1. Keep It Simple and Clear

Simplicity is key when designing a billing document. Avoid clutter by limiting the amount of text and using clear headings for each section. Your clients should be able to quickly identify key information such as the total amount due, payment terms, and due date.

- Use headings: Break down the document into sections with clear, bold headings (e.g., “Client Information”, “Payment Details”, “Amount Due”).

- Limit the number of fonts: Stick to one or two complementary fonts to maintain readability.

- Utilize white space: Ensure there’s enough spacing between sections to avoid visual overload.

2. Organize Information Logically

The order in which you present information can significantly impact how easy it is for your client to read the document. Follow a logical sequence that leads the reader through the necessary details without confusion.

- Client and business details at the top: Start with the client’s name and your business contact information for quick reference.

- List items or services: Include a clear breakdown of products or services provided, with columns for descriptions, quantity, unit price, and total.

- Highlight the total amount: Ensure the total amount due is clearly visible, either in a larger font or in a bold section at the bottom.

3. Use Consistent Branding

Incorporating your business’s branding into your billing documents helps reinforce your identity and creates a cohesive experience for your clients. A professional design with consistent use of colors, logos, and fonts makes your document look polished and aligned with your business’s image.

- Logo placement: Place your company logo at the top of the document for easy recognition.

- Brand colors: Use your business’s primary colors for headings or accents to create a unified look.

- Professional fonts: Choose clean, easy-to-read fonts that reflect your business’s tone (e.g., modern, classic, or minimal).

4. Include Important Legal Information

To avoid any misunderstandings, make sure to include all the necessary legal details that are relevant to your business and your industry. This might include tax IDs, payment terms, and late payment policies. This information protects both you and your client.

- Payment terms: Clearly state when the payment is due and if there are any penalties for late payments.

- Tax information: Include any applicable tax rates, such as sales ta

Where to Find Invoice Templates Online

Finding the right document formats for creating payment requests can save you time and effort. Whether you’re starting a new business or looking to streamline your billing process, there are various online resources that offer customizable document structures. These platforms provide options that can be adapted to suit your specific needs, from simple designs to more advanced formats.

Here are some reliable places where you can find ready-made documents for your business:

- Template Websites: Websites like Template.net and TemplateLab offer a variety of document layouts for different industries. These sites typically have free and premium options available, giving you flexibility in terms of design and complexity.

- Office Suites: Popular office software providers like Microsoft Office and Google Docs often feature free downloadable files for billing and payment requests. These can be easily edited within their respective programs and tailored to your needs.

- Online Marketplaces: Platforms like Etsy or Creative Market sell professionally designed document formats. These may come with more advanced features and design elements that help you maintain a polished look.

- Accounting Software Providers: Many accounting software platforms, such as QuickBooks or FreshBooks, offer customizable document layouts as part of their service. While these options may require a subscription, they often integrate with other financial tools for streamlined operations.

By exploring these sources, you can find a suitable document layout to help you efficiently create professional billing documents that meet your business needs. Whether you choose a free or premium option, always ensure that the design aligns with your branding and business requirements.