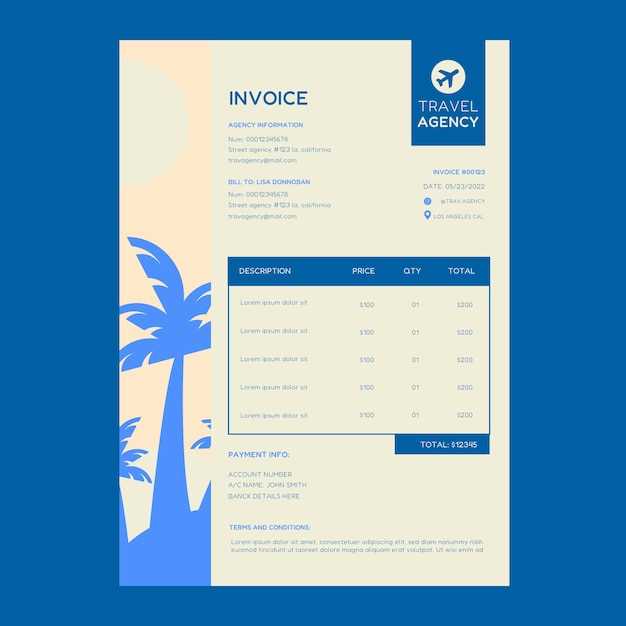

Free Agency Invoice Template for Easy and Professional Billing

For any business that provides services, maintaining a smooth and efficient system for payment is crucial. One of the most important aspects of this process is creating clear, detailed documents that outline the services rendered and the amount due. These documents not only help clients understand the charges but also establish your professionalism and reliability.

Customizing a billing document to suit your specific needs can save you time, prevent misunderstandings, and ensure that payments are processed quickly. Whether you’re a freelancer, consultant, or part of a larger organization, having a well-structured billing document is essential for managing financial transactions and maintaining a good relationship with your clients.

In this guide, we’ll explore how to design a clear, accurate, and professional payment request form. We will also highlight the key components and offer practical advice on customizing it for your business, ensuring that each transaction is recorded properly and with minimal hassle.

Agency Invoice Template Guide

Creating a professional billing document that clearly outlines services rendered and payments due is essential for any business. A well-designed financial statement not only ensures smooth transactions but also reinforces credibility with clients. This section will guide you through the process of crafting a functional and effective payment request form, ensuring it meets both legal and business requirements.

Key Sections to Include

While the structure of a billing document can vary, certain key elements should always be included to ensure clarity and accuracy. These sections provide the necessary details that protect both parties involved in the transaction.

| Section | Description |

|---|---|

| Header | Include your business name, address, and contact information at the top, along with the client’s details. |

| Date | Clearly state the date the document is issued and any relevant due dates. |

| Service Description | Provide a detailed list of the services provided, including quantities, rates, and dates of service. |

| Total Amount | Sum up the total amount due, including taxes or discounts if applicable. |

| Payment Terms | State your payment conditions, including the due date and acceptable payment methods. |

Tips for Effective Customization

Once you have a basic structure in place, it’s important to tailor the document to fit your business needs. You may want to adjust the layout, fonts, or include additional fields based on the nature of your services. For instance, freelancers may require fields for project milestones, while larger companies might need sections for multiple clients or departments.

By following these guidelines and customizing the layout to reflect your brand, you ensure your clients receive clear and concise billing documents that facilitate prompt and accurate payments.

Why You Need an Agency Invoice

When running a business, it is essential to have a clear and organized method for requesting payment for the services you provide. A well-structured document serves not only as a formal request for funds but also as a tool to establish trust with clients and maintain a professional relationship. Without this key document, financial transactions can become unclear, leading to misunderstandings or delayed payments.

Benefits of Using a Professional Billing Document

Utilizing a well-designed payment request form offers several advantages. It ensures that both you and your clients are on the same page regarding the terms of the transaction, reducing the risk of disputes. Additionally, such documents help track payments, making it easier to follow up on outstanding amounts and manage your finances more effectively.

| Benefit | Explanation |

|---|---|

| Clarity | Clear breakdown of services and charges avoids confusion and ensures mutual understanding. |

| Professionalism | Using a formal payment request demonstrates a high level of professionalism, boosting your credibility. |

| Organization | Helps you keep track of payments, due dates, and outstanding amounts efficiently. |

| Legal Protection | Acts as a record of the services provided, protecting both parties in case of disputes. |

Maintaining Efficient Payment Processing

Having an effective system in place for generating payment documents ensures that you can maintain a steady cash flow. It also simplifies accounting processes and helps avoid unnecessary delays in receiving payments. In summary, implementing a structured approach to payment requests is critical to running a successful business and preserving strong client relationships.

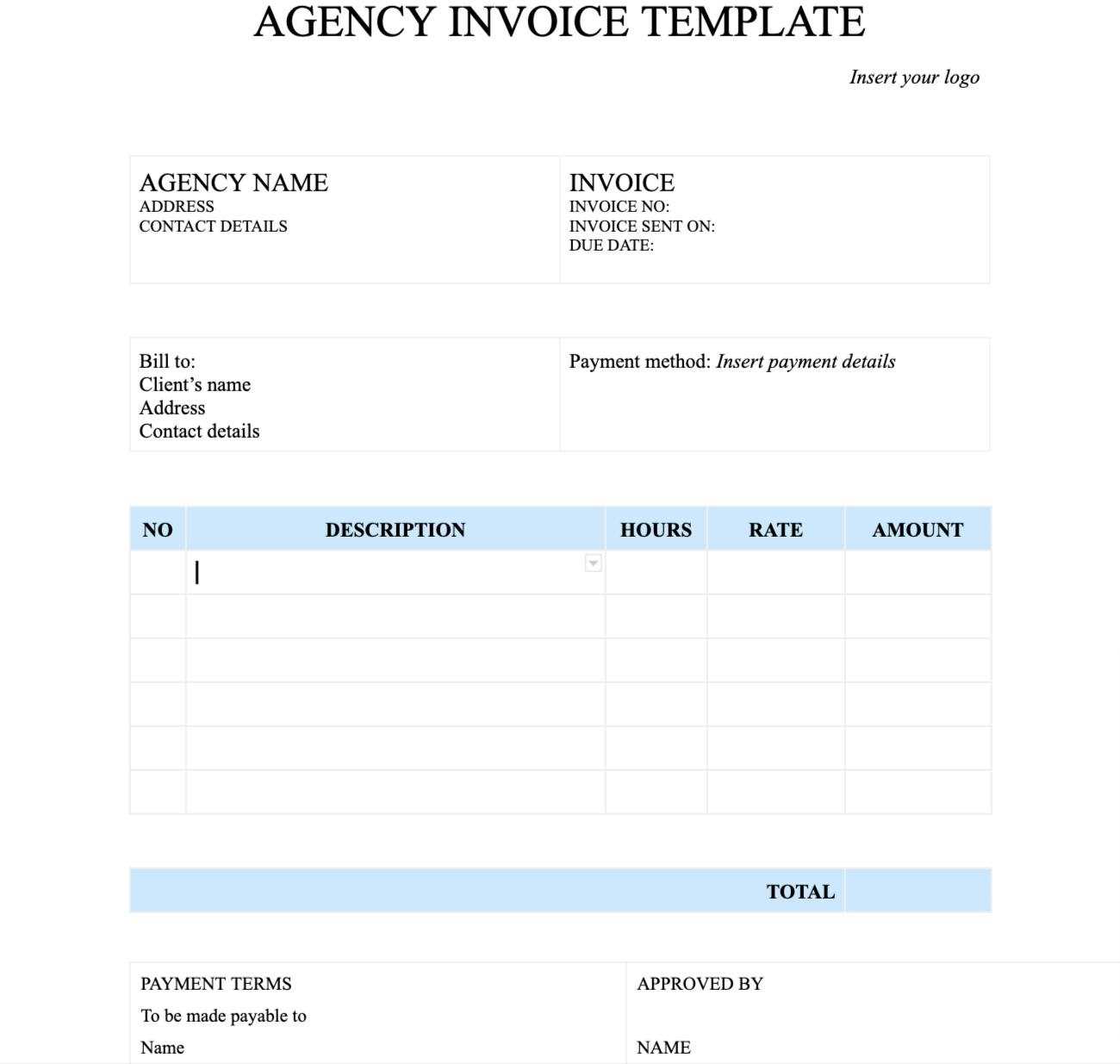

Key Elements of an Invoice

For any business, having a clear and organized payment request is essential to ensure smooth financial transactions. A well-constructed document helps both the service provider and the client understand the terms of the agreement, the work completed, and the amount due. To achieve this, several critical elements must be included in order to provide clarity and avoid any confusion.

Important Sections to Include

A professional payment document must include the necessary sections that outline the services provided, the costs, and the terms of payment. These sections are the foundation for transparency and help ensure that both parties are on the same page regarding the financial details.

| Section | Purpose |

|---|---|

| Header | Includes your business name, logo, and contact details, as well as the client’s information. |

| Invoice Number | Unique identifier for the payment request, helping both parties track the transaction. |

| Dates | Include the date the document is issued and, if applicable, the due date for payment. |

| Service Breakdown | A detailed list of services provided, including descriptions, quantities, rates, and dates of service. |

| Total Amount Due | Summarizes the total charge for all services, including taxes and any discounts or adjustments. |

| Payment Terms | Specifies payment methods, deadlines, and penalties for late payments. |

Why These Elements Matter

Each of these sections plays an important role in ensuring that the payment process runs smoothly. A detailed description of services provided helps avoid disputes, while the clear outline of payment terms makes it easier for clients to follow your expectations. By ensuring that these core components are included, you can streamline the entire financial transaction process, minimizing errors and delays.

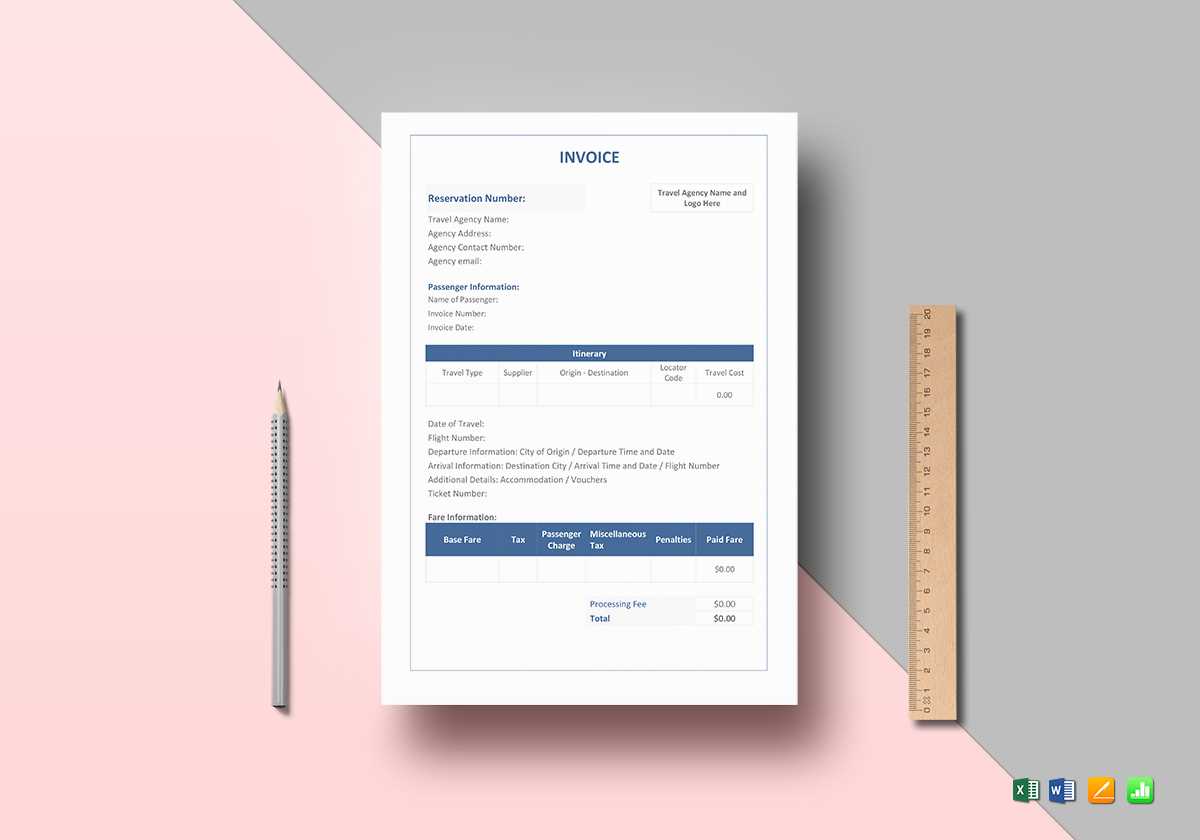

Customizing Your Invoice Template

Creating a personalized payment request form is essential for businesses looking to maintain a professional image while ensuring clarity for their clients. Customization allows you to tailor the document to reflect your branding, add specific details, and adjust sections to meet your unique needs. With the right adjustments, you can create a document that stands out and makes the transaction process smoother for both you and your clients.

When customizing a payment request form, there are several factors to consider in order to create a document that is not only functional but also aligned with your business identity. Below are key aspects to modify to ensure the document suits your specific requirements.

| Customization Aspect | How It Helps |

|---|---|

| Business Branding | Incorporate your logo, colors, and font choices to create a cohesive look that reflects your brand identity. |

| Service Descriptions | Adjust the descriptions of services to match the specifics of your business or industry. |

| Additional Fields | Add custom fields such as project milestones, discounts, or payment history to provide a more detailed breakdown. |

| Payment Instructions | Ensure that your preferred payment methods, terms, and instructions are clearly outlined for ease of use. |

| Legal Requirements | Include any industry-specific terms or legal disclaimers that may be required for compliance. |

By customizing the layout and content of your payment request form, you can ensure that it meets the specific needs of your business while enhancing its professional appearance. Tailoring the document will not only help clients understand the terms of payment but also improve your overall invoicing process, making it more efficient and aligned with your brand’s values.

Best Practices for Professional Invoicing

Maintaining a consistent and professional approach to payment requests is essential for any business. Properly crafted documents ensure that the billing process is smooth, payments are collected on time, and client relationships remain strong. By adhering to industry standards and following best practices, you can improve the efficiency of your financial transactions and avoid unnecessary disputes or delays.

Below are several key practices that will help you create clear, accurate, and professional billing statements, ensuring that both you and your clients are satisfied with the process.

| Best Practice | Explanation |

|---|---|

| Timely Delivery | Send your payment requests promptly after completing the work to ensure a quick turnaround time for payment. |

| Clear Itemization | Provide a detailed list of services rendered with clear descriptions, quantities, and individual costs to avoid confusion. |

| Accurate Due Dates | Clearly specify the payment deadline to help your clients understand when payment is expected and avoid overdue balances. |

| Consistent Formatting | Maintain a consistent structure for all payment requests, including font, layout, and section order, for easy readability. |

| Payment Methods | List multiple payment options to make it easy for clients to settle the amount due, whether by bank transfer, credit card, or other methods. |

| Follow-Up Reminders | In case of late payments, send polite and professional reminders to prompt timely payment without causing tension. |

By integrating these best practices into your financial processes, you can streamline your billing system, minimize errors, and create a more positive experience for your clients. This attention to detail not only ensures timely payments but also reinforces the professionalism of your business.

How to Add Payment Terms

Clearly outlining payment expectations is a critical aspect of any business transaction. Well-defined terms help prevent confusion and ensure that both parties understand when and how payments should be made. By incorporating clear payment conditions into your billing documents, you can encourage timely payments, avoid misunderstandings, and establish a professional relationship with your clients.

Common Payment Terms to Include

Payment terms can vary depending on the nature of the work and the agreement between you and your client. However, there are a few common conditions that should be considered when specifying payment details:

| Payment Term | Description |

|---|---|

| Due Date | Clearly state when the payment is expected, typically within 15, 30, or 60 days from the issue date. |

| Late Fees | Specify any penalties for late payments, such as a fixed fee or interest charge, to encourage timely payment. |

| Payment Methods | Outline the acceptable forms of payment, such as credit cards, bank transfers, or online payment systems. |

| Deposits | If applicable, indicate whether a deposit is required upfront and when the remaining balance is due. |

| Installment Payments | For larger projects, specify if the payment can be broken into installments, with amounts and due dates for each. |

How to Communicate Payment Terms Clearly

It’s important to make payment conditions as clear as possible to avoid confusion. Use simple language and highlight the key details, such as due dates and payment methods, in a prominent place on your payment request. Also, ensure that both parties agree to these terms before work begins. This helps set expectations from the start and can prevent issues later on.

By establishing and clearly communicating your payment terms, you set a professional standard that encourages timely and reliable payments, reducing the likelihood of delays or disputes.

How to Include Client Information

Including accurate and complete client details in your payment request is essential for creating a professional and organized document. Client information not only helps identify the recipient but also ensures that there are no misunderstandings regarding who the payment is coming from and to whom it should be addressed. Clear identification of the client contributes to smoother communication and provides a record for both parties in case of future reference.

There are several key pieces of client information that should be included in your document. These details help establish the formal relationship between you and the client and make the payment process more transparent.

| Client Information | Why It’s Important |

|---|---|

| Client Name | Clearly state the name of the person or business being billed to ensure the payment request is directed correctly. |

| Client Address | Include the client’s full address for postal communication and as part of your formal records. |

| Contact Information | List the client’s phone number or email address to make it easy to follow up if needed. |

| Client ID or Account Number | If applicable, include a unique client identifier to help track their specific transactions, especially for long-term relationships. |

| Client Tax ID | If required by law or your business needs, include the client’s tax identification number for accounting and tax purposes. |

By accurately including these key details, you ensure that your payment request is clear, professional, and complete. This helps avoid confus

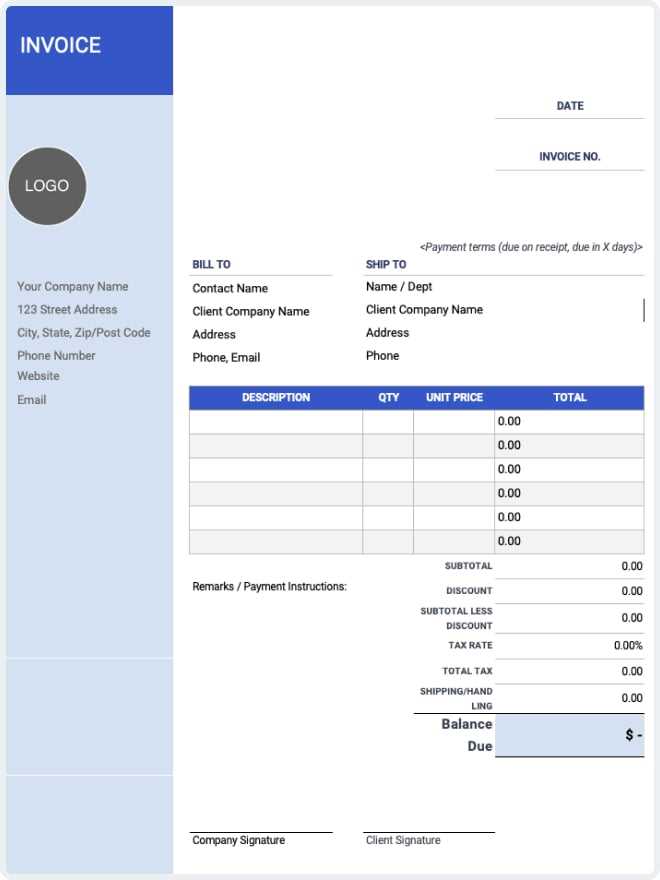

Choosing the Right Invoice Format

Selecting the appropriate format for your payment request is crucial for ensuring clarity and ease of understanding for your clients. The format you choose can affect how professional your documents appear and how easily they can be processed. Whether you are opting for a digital or printed version, the structure should facilitate smooth communication, be easy to read, and align with your business’s needs.

There are various formats to consider, each offering different benefits depending on the complexity of the services you provide and the preferences of your clients. Below are some factors to keep in mind when choosing the most suitable layout for your financial documents.

| Format Type | Advantages |

|---|---|

| PDF Format | Widely accepted and easily shared, ensuring that the layout remains consistent across different devices. |

| Word Document | Customizable and editable for quick adjustments, making it a good choice for businesses with changing requirements. |

| Excel or Spreadsheet | Ideal for businesses that need to manage multiple line items, complex calculations, or track recurring transactions. |

| Online Tools (Cloud-based) | Provides automation features, such as easy payment tracking, templates, and client management integration. |

| Printed Format | Best for businesses that require physical copies for record-keeping or for clients who prefer paper-based communication. |

Each format comes with its own strengths, so it’s important to choose one that aligns with both your operational needs and the preferences of your clients. Opting for the right format not only helps streamline the payment process but also enhances your professionalism and client satisfaction.

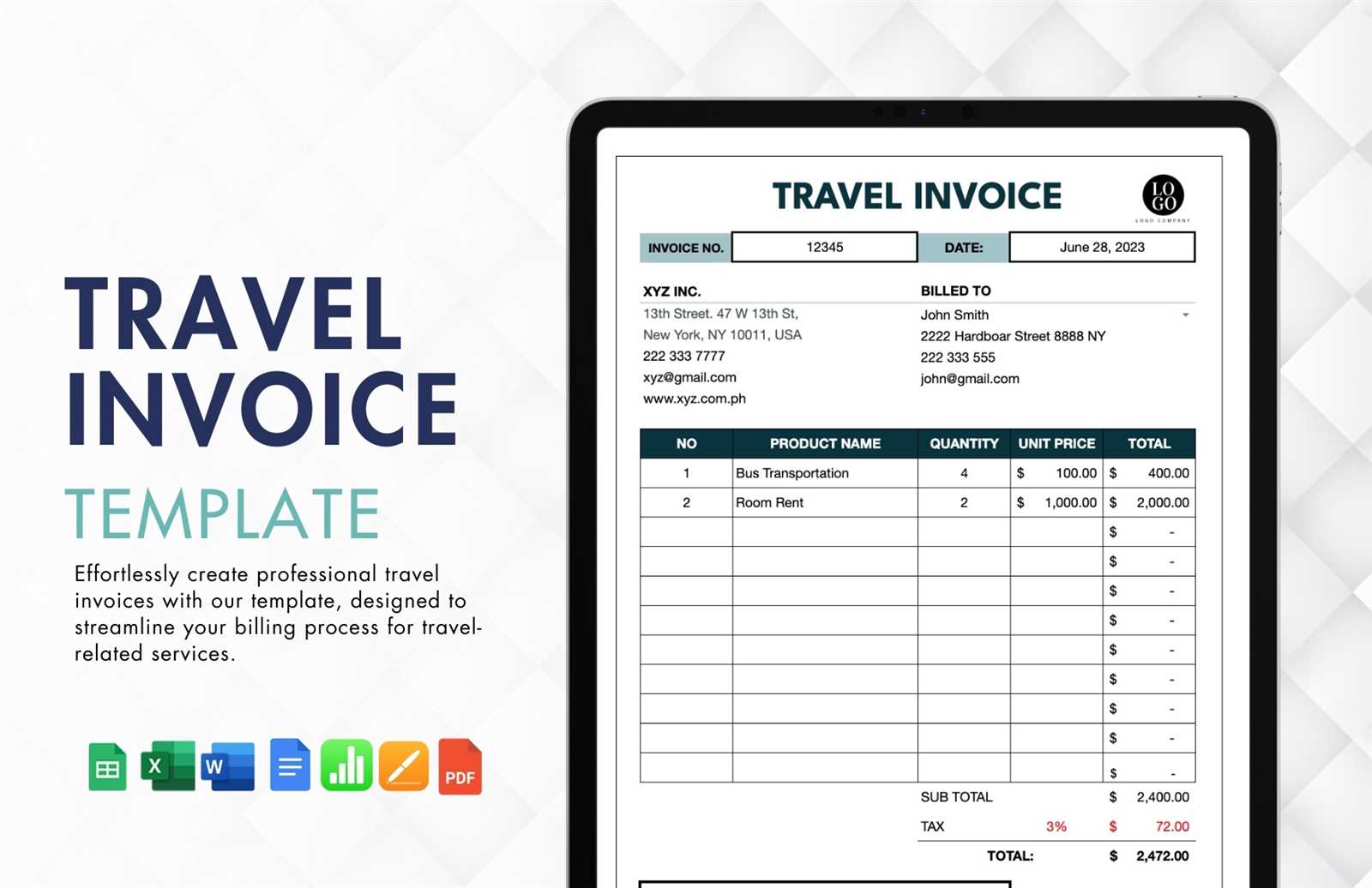

How to Handle Multiple Services on an Invoice

When providing several services to a client, it is essential to present them clearly and organized in your payment request. Detailing each service separately ensures that your client fully understands what they are paying for and helps avoid confusion or disputes. Breaking down the charges for multiple services also promotes transparency and fosters a more professional image for your business.

Organizing Multiple Services Clearly

To make it easier for your client to review and approve the charges, each service should be listed separately with a clear description, the quantity (if applicable), and the cost. This method allows the client to see how the total is calculated and ensures they are charged accurately for each specific task or product.

| Service | Description | Quantity | Rate | Total |

|---|---|---|---|---|

| Web Design | Custom website design, including layout and content integration | 1 | $2,000 | $2,000 |

| SEO Optimization | On-page SEO improvements for better search engine ranking | 10 hours | $100/hour | $1,000 |

| Content Creation | Blog post writing for the company website | 5 posts | $50/post | $250 |

Summarizing the Total Amount

After listing all services, it is important to provide a summary of the total amount due. This should include any taxes, discounts, or additional charges, giving the client a clear view of the final balance. Make sure that all calculations are accurate and easy to verify. Presenting multiple services in a straightforward and organized manner not only improves client trust but also helps you manage your own records more effectively.

Tips for Creating a Clear Breakdown

Providing a clear and detailed breakdown of the services and charges in your payment request is essential for avoiding confusion and ensuring smooth transactions. A well-structured list of items makes it easier for clients to understand what they are being charged for and ensures transparency. By following a few key guidelines, you can create a breakdown that is both easy to follow and professional.

Here are some helpful tips to keep in mind when organizing the details of your payment request:

- Use Clear Descriptions: Be specific about the work performed, listing each service separately with enough detail for your client to understand the scope of each task. For example, instead of just “consulting,” describe the service as “2-hour business strategy consultation on project planning.”

- Include Quantities and Rates: Where applicable, include quantities and rates to make the calculations clear. For instance, if you’re charging for a certain number of hours, indicate both the number of hours worked and the hourly rate.

- Break Down Complex Charges: If a service involves multiple steps or components, break it down further. This helps the client see exactly how the total is calculated and reduces the chance of disputes.

- Organize Charges Logically: Group similar items together, such as consulting services, design work, and additional materials. This makes the breakdown easier to read and follow.

- Highlight Taxes and Discounts: Make sure to list any applicable taxes or discounts separately, so clients can clearly see how the final amount is impacted by these factors.

Incorporating these tips will not only help you create a clear breakdown but also foster trust and professionalism in your client relationships. A transparent and organized payment request encourages timely payments and minimizes the chance of misunderstandings or disagreements.

Common Mistakes to Avoid in Invoices

While creating a payment request, it’s important to avoid common errors that can lead to confusion, delayed payments, or even strained relationships with clients. Small mistakes can make a big difference in how professional your documents appear and how smoothly the transaction process goes. Being mindful of these frequent missteps will help ensure that your payment requests are clear, accurate, and effective.

Common Errors to Watch Out For

There are several issues that can easily occur when preparing payment requests. Here are a few of the most common mistakes to avoid:

- Missing or Incorrect Client Details: Always double-check the client’s name, address, and contact information. Mistakes here can delay payments or cause confusion.

- Incorrect Dates: Ensure that the issue date and due date are correct. A wrong due date can cause misunderstanding about payment expectations.

- Vague Descriptions: Avoid using ambiguous terms or not providing enough detail about the services rendered. Clients should be able to understand exactly what they are paying for without further explanation.

- Calculation Errors: Double-check your math. Incorrect totals, missing taxes, or incorrect rates can lead to disputes and cause payment delays.

- Omitting Payment Terms: Be sure to clearly outline payment methods, due dates, and any late fees. Failing to include these can create confusion and lead to missed payments.

- Inconsistent Formatting: Ensure that your payment request is formatted consistently. Inconsistent fonts, spacing, or section organization can make the document hard to read and reduce its professional appearance.

How to Avoid These Mistakes

The best way to avoid these mistakes is to develop a checklist or template that includes all the necessary fields and details. Take time to review the payment request before sending it to ensure everything is correct. Using software or digital tools that automate calculations and provide templates can also help reduce errors.

By paying attention to these common pitfalls, you can create clearer, more professional payment requests that foster trust with clients and ensure timely payments.

How to Automate Invoice Creation

Automating the process of generating payment requests can save you significant time and reduce the likelihood of errors. By setting up an automated system, you can streamline your billing process, ensuring accuracy, consistency, and efficiency. Automation allows you to create professional, detailed documents quickly, while also keeping track of your financial records in an organized manner.

Here are a few steps you can take to automate the creation of your payment requests:

- Use Specialized Software: There are various online tools and accounting software available that allow you to automatically generate payment documents. These tools often come with pre-built templates that can be customized to fit your business needs.

- Integrate with Your Time Tracking: For service-based businesses, integrate your time-tracking system with your billing platform. This way, when hours are logged, they can automatically populate the payment request with accurate details and calculations.

- Set Up Recurring Billing: If you offer subscription-based services or recurring projects, use automation to schedule regular payment requests. You can set the frequency (weekly, monthly, etc.) and let the system generate and send invoices automatically.

- Link Payment Methods: Link payment gateways (like PayPal or Stripe) to your system. This way, your clients can pay directly through the document, and payment confirmations will be automatically tracked.

- Customize Templates: Customize your payment documents within your chosen platform. You can include your logo, business details, and preferred format, allowing each document to look professional and align with your brand.

- Automate Notifications: Set up automatic email notifications for when a payment request is generated or when a payment is due. These reminders can help ensure that your clients stay on track with payments without any manual follow-up.

By incorporating these strategies, you can significantly improve your efficiency, reduce the chance of manual errors, and create a smoother experience for both you and your clients. Automation not only saves time but also enhances your professionalism and helps you stay organized.

Legal Requirements for Invoices

When issuing payment requests, it’s essential to ensure that they meet the legal requirements set by local tax authorities and business regulations. Having the correct legal elements in your documents not only ensures compliance but also protects both parties in case of any disputes. Different countries and regions have specific rules regarding what must be included in these documents, and it is important to familiarize yourself with those obligations to avoid penalties or complications.

Key Legal Information to Include

In order to comply with legal requirements, certain information should always be included in your payment requests. Here are some of the most important elements to consider:

- Business Information: Your full business name, address, and contact details should be clearly displayed. This helps identify you as the service provider and ensures that clients can reach you if needed.

- Client Information: Include the name and address of the client being billed. This is especially important for tax purposes and record-keeping.

- Unique Document Number: Each payment request should have a unique identification number. This helps with tracking and organizing your records, as well as making it easier to reference specific requests in the future.

- Issue Date: The date when the payment request was generated must be clearly stated. This is critical for calculating payment due dates and for record-keeping.

- Due Date: Specify the date by which payment must be made. This ensures clarity on when the transaction is expected to be completed.

- Clear Breakdown of Charges: Each service or product provided should be itemized with its corresponding price. This breakdown is necessary for clarity and helps prevent disputes regarding the amounts charged.

- Tax Information: Depending on your location, you may be required to include applicable taxes (e.g., VAT or sales tax). Clearly show the tax rate and the total amount of tax charged on the document.

- Payment Terms: Include information on the accepted payment methods, and any penalties or fees for late payments. This protects both you and your client and ensures that the terms are clear from the beginning.

- Payment Instructions: Provide clear details on how the payment should be made, including your bank details, payment links, or other preferred payment methods.

Regional Variations and Compliance

Legal requirements can vary significantly depending on your location. For instance, some countries may require specific tax codes or mandates on the way payments are documented. It is important to consult with a local tax advisor or legal expert to ensure that your documents comply with the laws and regulations of

How to Track Payments Effectively

Managing and tracking payments is a crucial aspect of running a successful business. Proper tracking not only helps ensure that all payments are received on time but also allows you to keep accurate financial records, which are vital for tax purposes and overall business planning. By using the right tools and practices, you can streamline the payment tracking process, minimize errors, and improve cash flow management.

Effective Methods for Tracking Payments

To keep track of incoming payments efficiently, consider implementing the following strategies:

- Use Accounting Software: Modern accounting tools are designed to automatically track payments. They can generate reports, match payments to specific requests, and send reminders for overdue amounts. Tools like QuickBooks, Xero, or FreshBooks can simplify payment tracking and reduce manual errors.

- Create a Payment Log: Maintain a detailed log of all payments received, including the payment date, amount, client name, and the corresponding payment request number. This can be done manually in a spreadsheet or through a digital tool that syncs with your accounting system.

- Set Up Payment Reminders: Automating reminders for upcoming or overdue payments can help ensure timely settlements. You can set up automatic email reminders or notifications through your accounting software, prompting clients to pay before the due date or follow up on overdue payments.

- Monitor Payment Methods: Keep track of how payments are being made (bank transfer, online payment systems, checks, etc.). This will help you identify patterns, track processing times, and ensure that all methods are accounted for accurately.

- Reconcile Payments Regularly: Reconciliation is the process of ensuring that the payments recorded in your system match the actual funds received in your bank account. Regular reconciliation can help catch discrepancies early and ensure that your financial records are accurate.

Utilizing Reports for Better Visibility

Most accounting systems provide detailed reports that help you track payments over time. These reports allow you to see which clients have outstanding balances, the total amount of unpaid invoices, and the overall status of your cash flow. Regularly reviewing these reports can give you a clear picture of your business’s financial health.

By consistently applying these methods, you can stay on top of payments and ensure a smooth and efficient payment process, which will ultimately help maintain a healthy financial flow for your business.

Why Consistency Matters in Invoicing

Maintaining uniformity in billing practices is crucial for any business transaction. When all financial documents follow a consistent format, it becomes easier for both parties to track, process, and manage payments efficiently. This consistency fosters a professional image, builds trust with clients, and minimizes the risk of errors or misunderstandings regarding payment terms or amounts.

When the same structure and design are used for every financial statement, clients can quickly familiarize themselves with the layout and key details. This reduces confusion, ensuring that essential information, such as due dates, payment methods, and itemized charges, are immediately recognizable. Furthermore, a predictable format streamlines the internal accounting process, making it simpler to review, file, and reference past transactions.

In addition to operational benefits, consistency also plays a role in legal and regulatory compliance. Many industries have strict requirements for documenting financial exchanges, and regularizing the format of all records ensures that these standards are consistently met. This can help avoid potential disputes or complications, as well as ensure that businesses are always prepared in case of an audit.

Free Resources for Invoice Templates

Finding reliable and cost-effective resources for creating billing documents can save both time and money. Whether you’re a freelancer, small business owner, or independent contractor, using high-quality, free tools to generate professional-looking financial statements is an essential part of managing your transactions smoothly. Fortunately, there are a variety of online platforms that offer templates at no cost, making it easy to customize and tailor your billing process to your needs.

Top Platforms Offering Free Billing Resources

- Microsoft Office Online – A great option for users familiar with Word and Excel, offering customizable templates for different business types.

- Google Docs – Provides easy-to-use templates that can be accessed and edited from any device with a Google account.

- Canva – A design-focused platform that offers visually appealing and customizable options for creating professional-looking documents.

- Zoho – A free online tool with a range of templates designed specifically for small businesses and freelancers.

Additional Free Resources

- Invoicely – Offers a free plan with templates that include basic features like the ability to track payments and customize layout.

- Wave – A free, user-friendly platform with professional templates for both invoices and receipts, ideal for small businesses.

- Invoice Generator – A straightforward website offering quick, no-frills templates with options to add taxes, discounts, and other custom elements.

By utilizing these free resources, you can create professional financial documents without the need for expensive software or subscriptions, helping you maintain a polished and organized workflow.

How to Manage Late Payments

Late payments can disrupt cash flow and create unnecessary stress for any business. Whether due to client forgetfulness, financial issues, or miscommunication, it’s essential to have clear strategies in place for handling overdue balances. A proactive approach can help ensure payments are received promptly while maintaining professional relationships.

Steps to Minimize Delays

- Set Clear Terms – Establish payment deadlines and terms upfront, ensuring clients are aware of due dates and any late fees that may apply.

- Send Reminders – Implement an automated system or manual follow-ups to remind clients before and after the payment deadline.

- Offer Multiple Payment Options – The easier you make it for clients to pay, the less likely they are to delay payments. Provide various payment methods like credit cards, bank transfers, and digital wallets.

Steps to Take When Payments Are Late

- Follow Up Professionally – If a payment is overdue, reach out with a polite, clear reminder. Keep the tone professional and courteous.

- Send a Formal Notice – If the payment remains unpaid, send a formal notice outlining the outstanding balance, due dates, and any penalties or interest charges that have accrued.

- Offer Payment Plans – If clients are facing financial difficulties, consider offering installment plans or extended deadlines to make it easier for them to pay.

- Seek Legal Advice – For persistent non-payment, consult with a legal professional to explore options such as sending a collections letter or taking further legal action.

By taking these steps, you can reduce the frequency of late payments and protect your business from the financial strain they cause, while maintaining strong, professional relationships with clients.

Improving Client Relationships with Invoices

Billing documents play a key role in building trust and transparency with clients. When presented professionally and accurately, they not only serve as a record of financial transactions but also reflect your business values and commitment to quality. Well-structured statements can enhance communication, prevent misunderstandings, and improve overall client satisfaction.

How Billing Documents Impact Client Relationships

Clear and timely billing helps clients feel valued and respected, as it shows that you are organized and committed to smooth business interactions. A properly designed document can also prevent disputes over amounts, terms, and deadlines, keeping the focus on the work rather than administrative issues. By providing clients with easy-to-read, detailed statements, you create a sense of reliability and professionalism.

Key Elements to Include for Stronger Relationships

| Element | Importance |

|---|---|

| Clear Payment Terms | Ensures both parties are aligned on expectations, reducing confusion and fostering trust. |

| Itemized List of Services | Provides transparency, helping clients understand what they are paying for and why. |

| Professional Design | Reflects your business’s attention to detail and professionalism, which can enhance your reputation. |

| Contact Information | Allows clients to easily reach you for clarifications or inquiries, promoting open communication. |

By incorporating these elements into your billing documents, you show clients that you value their business and care about maintaining a smooth, transparent partnership. This not only helps in resolving any potential issues quickly but also reinforces the foundation of trust and cooperation in your working relationship.