Advance Invoice Template for Efficient Billing and Payment Management

Managing payments effectively is essential for maintaining smooth business operations. One of the most important tools for ensuring timely payments is a well-structured document that outlines the amount due and the payment terms. This document not only helps to clarify expectations between the service provider and the client but also serves as a professional record of the agreement. By using a customizable payment request format, businesses can enhance their billing processes and improve financial management.

A well-crafted payment request can offer significant benefits, including improved cash flow and clearer communication with clients. It helps businesses set clear payment terms upfront, ensuring both parties are on the same page from the start. Furthermore, it can be tailored to suit various business needs, making it a versatile tool for companies across different industries.

In this article, we will explore how to create and use a payment request document that meets your business’s specific needs. From essential elements to consider when drafting your own form to tips on design and legal compliance, we’ll cover all the aspects that contribute to an efficient and professional billing process.

Advance Invoice Template Overview

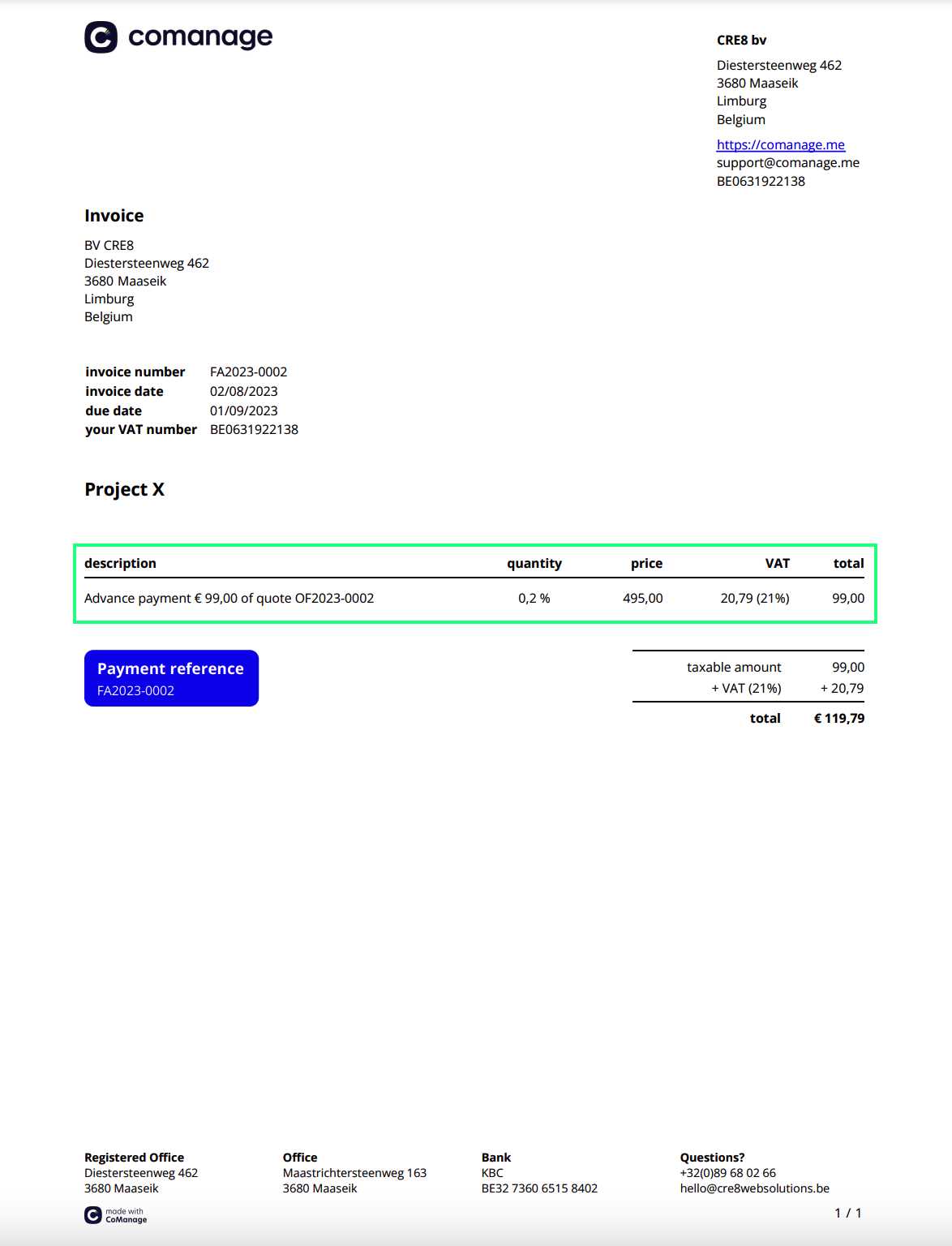

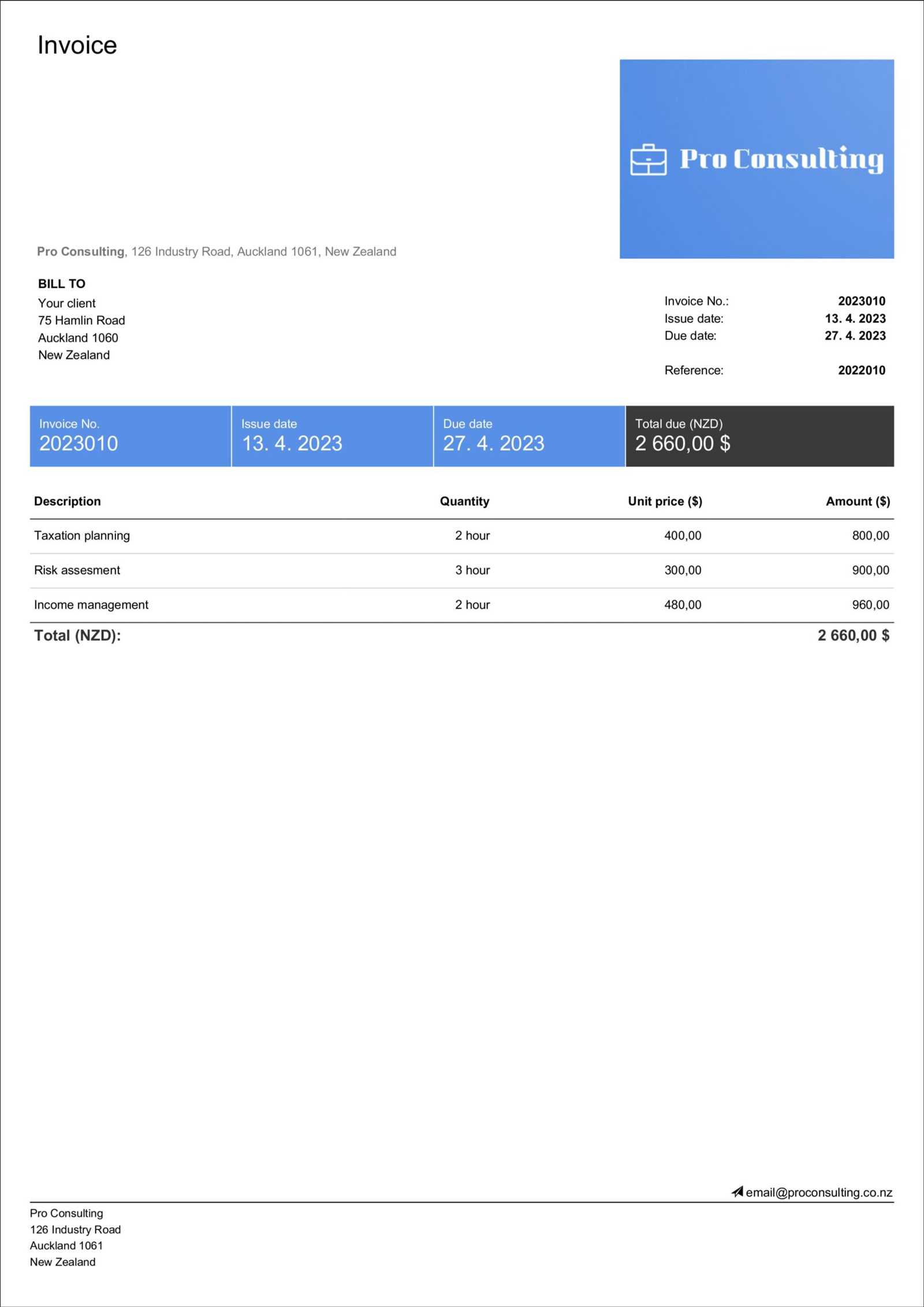

When managing business transactions, it’s crucial to establish clear agreements regarding payment expectations. One effective way to ensure this clarity is through a formalized document that outlines payment details ahead of time. This document is typically used before services or products are fully delivered, helping businesses secure partial or upfront payments. It ensures both parties are aware of the terms and deadlines, fostering trust and reducing misunderstandings.

Such documents can be customized to suit various business needs, allowing for flexibility in the payment structure. Whether you’re requesting a deposit or a full pre-payment, a well-constructed form helps set clear expectations, prevents confusion, and improves cash flow management. In the following section, we will discuss the key elements and features that make up an effective document for securing payment in advance.

Key Elements of an Effective Payment Request

An effective form should contain certain essential components to ensure transparency and accuracy. Here are some key elements that should be included:

| Element | Description |

|---|---|

| Business Information | Includes the name, address, and contact details of the business issuing the document. |

| Client Information | Details of the customer or client receiving the request, including their name, address, and contact details. |

| Payment Terms | Clear statement of the amount due, due date, and any payment methods or instructions. |

| Description of Goods/Services | Explanation of the products or services for which the payment is being requested. |

| Deposit Amount | If applicable, details of the amount that needs to be paid in advance before the full delivery. |

Customization and Flexibility

One of the key advantages of using such a document is its adaptability. Depending on your business type, you can modify the layout and content to meet specific requirements. Some businesses may need more detailed descriptions, while others may prefer a simpler format. The ability to tailor the document ensures that it aligns with your brand and specific payment structures, making it a powerful tool for managing transact

Why Use an Advance Invoice Template

Utilizing a structured document to outline payment terms before goods or services are provided offers significant benefits for both businesses and their clients. This approach ensures clarity regarding expectations, helps secure timely payments, and establishes a formal record of the transaction. When used effectively, such a document can be a powerful tool to maintain a healthy cash flow and avoid misunderstandings that can arise during the course of business dealings.

One of the primary reasons for using this type of document is its ability to minimize financial risk. By requesting partial payment upfront, businesses can ensure they are compensated for their work or products before delivery is completed. This is especially important for larger projects or when dealing with new clients, as it reduces the likelihood of non-payment or delays.

Another advantage is the professional appearance it lends to a business’s operations. A well-designed and clear payment request helps set the right tone with clients, signaling that your business is organized and trustworthy. It also communicates to clients that they are entering into a formal agreement with clear terms, which can help in maintaining strong, long-term relationships.

Additionally, this document can streamline the billing process by standardizing the payment collection method. When the format is consistent and easy to understand, both the business and client can quickly agree on the terms, accelerating the overall transaction and making payment collection more efficient.

Key Features of an Advance Invoice

A well-structured payment request form contains several essential elements that ensure both the business and the client have a clear understanding of the terms. These key features provide clarity, professionalism, and consistency, making it easier for both parties to follow the agreed-upon payment plan. By including all the necessary details, businesses can avoid confusion and ensure smooth financial transactions.

Essential Information for Clarity

One of the most important features of a payment request form is the inclusion of accurate and detailed information. This includes both the business’s and client’s contact details, a description of the goods or services provided, and a clear breakdown of the amount due. This transparency ensures that there are no misunderstandings about the transaction and helps prevent disputes down the line.

Clear Payment Terms and Deadlines

Another crucial aspect is the definition of the payment terms. This feature includes specifying the amount to be paid upfront, the final payment due date, and acceptable payment methods. Clear payment instructions, including any necessary bank account or online payment details, can significantly streamline the transaction process, making it easier for the client to fulfill their obligations.

Additionally, having clearly defined deadlines helps businesses maintain cash flow and better manage their finances. When the payment date is explicit and agreed upon beforehand, businesses are in a better position to track outstanding balances and reduce delays in receiving payment.

How to Create an Advance Invoice

Creating a formal payment request requires attention to detail and an understanding of the essential components that ensure clarity and accuracy. Whether you are requesting a deposit or a full pre-payment, following a structured approach helps to avoid confusion and ensures both parties are clear about the terms of the transaction. Below is a step-by-step guide to crafting a well-organized document that will effectively outline the terms of the payment agreement.

Step 1: Include Contact Information

Start by including the contact information for both your business and the client. This ensures that both parties can reach each other if there are any questions or issues regarding the payment. The contact information should include:

- Business name, address, and contact details

- Client’s name, address, and contact details

Step 2: Provide a Clear Description of Services or Goods

Be specific about the goods or services being provided. This section should clearly outline what the client is paying for and any relevant details about the transaction. For example:

- Itemized list of products or services

- Quantity and unit price (if applicable)

- Any additional fees, taxes, or charges

Including this level of detail helps avoid disputes and ensures the client understands exactly what they are paying for.

Step 3: Specify Payment Terms and Deadlines

Clearly outline the amount due, the payment schedule, and any deadlines for partial or full payment. This is critical for both parties to have a mutual understanding of when the payment is expected. Consider including:

- Amount due upfront or as a deposit

- Due date for the balance

- Accepted methods of payment (e.g., bank transfer, credit card)

Step 4: Include Legal and Tax Information

If applicable, include any necessary legal terms or tax-related information that may apply to the payment. This could include:

- Payment terms regarding late fees or interest on overdue amounts

- Tax identification numbers or business registration numbers

- Applicable sales tax or VAT

Including this information upfront can help avoid any legal issues later on and ensure that the transaction

Benefits of Customizing Your Invoice

Tailoring your payment request document to fit the unique needs of your business can offer numerous advantages. Customization allows you to create a document that not only reflects your brand’s identity but also meets specific requirements for your industry or client base. By making your request form personalized, you ensure a more professional, efficient, and transparent transaction process that benefits both you and your clients.

Enhance Professionalism and Branding

Customizing your payment request allows you to incorporate your company’s logo, color scheme, and contact details, which can significantly boost your brand’s visibility and professionalism. A branded document creates a consistent image across all your business communications, fostering trust and confidence in your clients. When a client sees a professionally designed form, it reinforces your business’s credibility and reliability.

Improve Communication and Clarity

By adapting the document to reflect the specifics of each transaction, you can ensure that all important details are easy to understand. Customization allows you to emphasize key aspects such as payment terms, due dates, and any special conditions relevant to the agreement. This reduces the likelihood of misunderstandings and provides a clear outline of expectations for both parties.

Additionally, tailored forms allow you to include any special instructions or relevant information specific to the project or service, which can improve communication and prevent errors or delays in payment.

Free Downloadable Advance Invoice Templates

Many businesses prefer using ready-made documents that can be easily customized to suit their needs. Free downloadable forms offer a convenient solution, providing you with a structured layout that can be quickly adapted to fit your transaction requirements. These pre-designed documents save time and effort, allowing you to focus more on your work and less on administrative tasks.

Advantages of Using Free Downloadable Documents

Opting for a free document download offers several key benefits:

- Time-saving: Pre-designed documents allow you to avoid starting from scratch, letting you quickly input necessary details and send the form.

- Cost-effective: Free downloads help businesses save money on professional software or custom design services, especially for smaller operations.

- Easy customization: Most free forms come in editable formats, so you can modify text, fields, and design elements to suit your specific needs.

- Professional appearance: Many free downloads are designed by professionals, ensuring that the document looks polished and is structured properly.

Where to Find Free Downloadable Forms

There are numerous online platforms that offer free, downloadable payment request forms. Some websites even offer additional resources, such as guides on how to fill out the form or explanations of the legal terms. Here are some popular sources:

- Business resource websites that specialize in financial documents

- Template-sharing platforms with a variety of business forms

- Online invoicing software providers offering free downloadable versions of their product

By selecting a reliable source, you can ensure that your document is both legally sound and professionally formatted, helping to streamline your payment process.

Essential Information to Include in Your Template

To ensure your payment request document is clear, professional, and legally sound, it’s crucial to include specific details. A well-structured form not only provides the client with the necessary information but also helps avoid confusion or disputes. By including all relevant components, you ensure that both parties have a mutual understanding of the terms, leading to a smoother transaction process.

Key Elements to Include

Here are the essential components that should be included in any payment request document:

- Business Information: Include the full name, address, phone number, and email of your business to make it easy for the client to contact you.

- Client Information: Provide the name, address, and contact details of the client receiving the payment request to ensure accurate billing and communication.

- Document Title: Clearly label the document as a payment request or similar term to make its purpose immediately obvious to the recipient.

- Description of Goods/Services: Include a detailed breakdown of the products or services being provided, specifying quantities, unit prices, and any applicable taxes or additional fees.

- Amount Due: Clearly state the total amount due for the goods or services being requested. If applicable, include a deposit amount or partial payment.

- Payment Terms and Methods: Specify the payment method(s) you accept (e.g., bank transfer, credit card) and outline the due date for the full payment.

- Terms and Conditions: Include any relevant terms, such as late payment penalties, cancellation policies, or specific conditions related to the transaction.

- Unique Reference Number: Assign a reference or invoice number to the document for easy tracking and record-keeping.

Why These Details Matter

Including these essential details ensures that the client knows exactly what is expected and helps prevent delays or confusion. A well-detailed document can also protect your business legally, as it provides clear evidence of the agreed-upon terms. When clients receive all the necessary information upfront, they’re more likely to pay on time and with minimal follow-up needed.

Legal Considerations for Advance Invoices

When issuing a payment request before delivering goods or services, it’s crucial to ensure that the terms outlined in the document comply with legal requirements. A well-crafted document not only protects both parties in case of disputes but also establishes clear terms regarding payment expectations. It is important to be aware of the legal implications surrounding pre-payment requests to avoid potential issues with clients or authorities.

Key Legal Aspects to Consider

Here are several legal considerations to keep in mind when creating a payment request:

- Clarity of Terms: The terms of payment must be clearly stated, including the amount, payment due date, and method of payment. Vague or ambiguous terms can lead to misunderstandings and legal challenges.

- Jurisdiction and Law: Specify the jurisdiction under which the terms of the agreement will be governed. This is particularly important if you are dealing with clients from different locations or countries.

- Cancellation and Refund Policy: If applicable, include any terms regarding cancellations or refunds, as these can vary depending on the nature of the service or product provided.

- Tax Compliance: Ensure that any taxes (e.g., VAT, sales tax) are correctly calculated and included in the total amount due. Different jurisdictions have varying tax laws, and compliance is essential to avoid fines or disputes.

- Late Payment Penalties: Clearly state any penalties or interest charges for late payments, as permitted by law. These terms should be reasonable and in accordance with local laws regarding overdue payments.

- Deposit and Refund Terms: If you require a deposit, outline whether it is refundable or non-refundable in case the client changes their mind or the service is canceled.

Protecting Your Business

By addressing these legal considerations, you can reduce the likelihood of disputes and protect your business interests. A legally sound document ensures that both parties understand their obligations and provides a foundation for resolving any issues that may arise. It’s recommended to consult with a legal professional to ensure that your payment request complies with local laws and industry regulations, providing additional protection and peace of mind.

Common Mistakes to Avoid with Advance Invoices

When creating a payment request for goods or services provided in advance, it’s easy to make mistakes that could lead to delays, misunderstandings, or legal complications. By being aware of the most common errors and taking steps to avoid them, businesses can ensure smoother transactions and build stronger relationships with clients. Below are some frequent mistakes to watch out for when issuing these types of documents.

Key Mistakes to Avoid

- Ambiguous Payment Terms: Failing to clearly state the payment amount, due date, or method can lead to confusion. Always specify how much is due, when it is due, and how the payment should be made.

- Missing Client Details: Leaving out important client information, such as their full name, address, or contact details, can create issues if you need to follow up on the payment or issue a receipt.

- Not Including a Unique Reference Number: Without a reference number, tracking payments can become difficult. Always include a unique identifier to make it easy to reference and organize your documents.

- Overlooking Tax Requirements: If taxes are applicable, ensure they are calculated correctly and included in the total amount. Failing to include or incorrectly applying taxes can lead to legal or financial issues.

- Unclear Description of Goods/Services: A vague or incomplete description of what the payment covers can cause misunderstandings. Always provide a detailed breakdown of the products or services being provided.

- Inadequate Legal Terms: Not specifying your cancellation or refund policy, late payment fees, or any other legal terms can expose your business to risks. Make sure these terms are clearly stated and aligned with local laws.

- Ignoring Payment Flexibility: Not offering enough flexibility in payment methods or failing to provide clear instructions on how to make the payment can frustrate clients. Ensure you list all accepted payment methods and provide easy-to-follow instructions.

How to Avoid These Mistakes

To prevent these errors, take the time to review each document carefully before sending it. Double-check that all required details are included, the terms are clear, and the payment process is easy to follow. Consider using a checklist or standard form to ensure consistency and completeness in your payment requests. This proactive approach can help avoid costly mistakes and improve the efficiency of your billing process.

How Advance Invoices Impact Cash Flow

Requesting payment before delivering goods or services can have a significant effect on a business’s cash flow. By securing partial or full payment upfront, companies can better manage their financial resources and ensure they have the necessary funds to operate smoothly. This practice can help mitigate the risks of delayed payments and improve financial stability, especially for businesses that deal with large projects or high-value items.

Positive Impact on Cash Flow

One of the main benefits of receiving payment in advance is the immediate increase in available working capital. This upfront payment allows businesses to cover operating costs, invest in resources, and avoid relying on credit to fund operations. This can be especially important for small businesses or those with tight profit margins, as it helps maintain a steady flow of funds without the need to wait for payments from clients.

Additionally, advance payments reduce the likelihood of cash flow problems that can arise from slow-paying clients. By securing funds before beginning work, businesses have the financial backing to continue operations without worrying about delays or the potential for non-payment.

Potential Risks and Considerations

While advance payments offer several advantages, there are also potential downsides to consider. For example, some clients may be hesitant to pay upfront, especially if they are unfamiliar with the business or unsure of the quality of the product or service. This could lead to lost sales or strained customer relationships. Additionally, businesses should clearly outline the terms of the agreement to avoid disputes over refunds, cancellations, or deliverables.

Furthermore, it’s important for businesses to manage the funds responsibly. If advance payments are not allocated properly, businesses may find themselves in a difficult position if unforeseen expenses arise or if the client does not fulfill the agreement as expected.

Best Practices for Sending Advance Invoices

Sending a payment request before delivering goods or services requires careful attention to detail to ensure the process is smooth for both your business and the client. By following best practices, you can improve your chances of receiving timely payments, maintain a professional reputation, and minimize any potential disputes. Clear communication and proper documentation are essential for a successful transaction.

Clear Communication and Transparency

Ensure that all terms are outlined clearly from the beginning. The client should understand exactly what they are paying for, how much they owe, and when the payment is due. Being transparent about payment terms, deliverables, and the schedule will reduce misunderstandings and foster a good relationship with the client. It’s also a good idea to remind clients of your payment policies in advance to avoid any surprises.

- Provide a clear breakdown of the products or services being provided

- State the payment amount, due date, and any taxes or additional fees

- Offer clear instructions on how to make the payment

Professionalism and Proper Documentation

Always send the payment request in a professional format that is easy to read and understand. This includes using a formal template, maintaining consistent branding, and including all required information, such as business and client details, payment terms, and the unique reference number for tracking purposes. Also, ensure that your document is free of errors, as mistakes can cause confusion and delays.

Additionally, keep a record of all communications related to the payment, including the sent request and any follow-ups. This documentation can be valuable in case any issues arise later in the process.

How to Track Payments with Advance Invoices

Tracking payments for pre-arranged transactions is essential for maintaining accurate financial records and ensuring that all funds are received as agreed. By properly managing your payment requests, you can easily monitor outstanding amounts, prevent overdue payments, and keep your accounting organized. Implementing effective tracking methods will help streamline your business’s financial processes and avoid unnecessary follow-ups or confusion.

Steps to Track Payments Effectively

Here are several strategies to help you track payments when you have received an advance or partial payment:

- Use a Unique Reference Number: Assign a unique identifier to each payment request. This makes it easier to track specific transactions and ensures that all related payments are connected to the right client or project.

- Monitor Payment Status: Regularly check whether payments have been received by marking them as “paid” or “pending” in your accounting system. This can be done manually or using invoicing software that automatically updates the status.

- Set Up Payment Reminders: If a payment is due but not yet received, set up reminders for clients. You can automate these reminders or send a polite follow-up email or message with the payment details and due date.

- Record Partial Payments: If clients make partial payments, ensure these are accurately recorded. This can help you track remaining balances and reduce confusion about amounts due.

Using Software for Payment Tracking

Incorporating invoicing software or accounting tools can significantly simplify the process of tracking payments. Many tools allow you to generate and send professional requests, track payments automatically, and generate reports on outstanding balances. This reduces manual errors and provides a clear overview of your financial situation in real-time.

- Look for software that integrates with your bank account to automatically detect incoming payments.

- Ensure that the software sends automatic reminders for unpaid or overdue transactions.

- Use reports to track the payment history for each client, which can help you manage your cash flow more effectively.

By staying organized and consistent with your tracking methods, you can avoid payment delays, reduce confusion with clients, and improve your business’s financial management.

Integrating Invoice Templates with Accounting Software

Integrating your payment request documents with accounting software can significantly streamline your business’s financial operations. By linking the two systems, you can automate the creation, sending, and tracking of payment documents, while also keeping accurate records for reporting and tax purposes. This integration reduces manual data entry, minimizes errors, and enhances efficiency across your financial processes.

Many accounting software solutions offer built-in options to customize and generate payment requests, ensuring consistency and professionalism. By linking these systems, you can automatically update client records, track outstanding payments, and manage financial reports without needing to manually reconcile multiple platforms.

Integration also simplifies invoicing, as it allows you to create payment requests directly within your accounting software, eliminating the need for separate spreadsheets or external tools. This unified approach ensures that all financial data is stored in one place, which can be crucial for maintaining compliance and making data-driven decisions.

How to Handle Partial Payments on Advance Invoices

When a client makes a partial payment for a prearranged transaction, it’s important to have a clear process for managing and tracking these payments. Handling partial payments correctly ensures that both you and your client understand the remaining balance, helps avoid confusion, and keeps your financial records accurate. Below are best practices for managing these situations efficiently.

Track and Record Partial Payments

Accurately record each partial payment as soon as it’s received. This ensures that your financial records remain up-to-date and reflects the remaining balance due. You can use accounting software or manual tracking systems to log payments and adjust the outstanding amount accordingly. It’s important to update the payment status after each transaction, indicating whether the full amount has been paid or if further payments are required.

- Log the amount received and update the balance accordingly.

- Ensure the client is notified of the remaining amount due and the payment schedule.

- If applicable, include the partial payment details in the next payment request or final statement.

Communicate with Clients

Clear communication is key when handling partial payments. Always inform the client of the updated balance and any upcoming payment deadlines. Send regular reminders if necessary and be transparent about the terms, including whether the partial payment is refundable or non-refundable. If a client misses a payment, follow up promptly to avoid delays in receiving the full amount.

Being organized and proactive about partial payments can help maintain a positive relationship with your clients while ensuring your business remains financially stable.

Comparing Advance Invoices to Regular Invoices

Understanding the differences between prepayment requests and standard billing documents is essential for businesses to decide which approach best suits their needs. While both serve the purpose of requesting payment for goods or services, they differ in timing, structure, and the way they affect cash flow. Here’s a breakdown of how prepayment requests compare to regular payment requests in terms of key aspects.

Timing of Payment

Prepayment requests require a portion or full payment before the service is rendered or the product is delivered. This ensures that the business has funds upfront to cover costs and reduce the risk of non-payment. In contrast, regular billing documents are issued after the goods or services are provided, and payment is typically expected within a certain period (e.g., 30 days).

For businesses that face cash flow challenges or work on large projects, requesting payment in advance can provide financial security. However, clients may be more hesitant to pay before receiving the product or service, which can be a barrier in some industries.

Risk Management

One of the primary advantages of prepayment requests is that they help manage risk by securing payment before the work begins. This is especially important for businesses with large or high-risk projects, where the chance of clients defaulting on payment can be a concern. Regular payment requests, on the other hand, rely on trust and may involve more risk if the client delays payment or fails to pay altogether.

Businesses that deal with new clients or high-value contracts often prefer prepayment arrangements to ensure they won’t be left without compensation. Regular payment requests, however, are common in industries where the relationship with clients is established, and the likelihood of late payments is lower.

Cash Flow Impact

Prepayment requests offer a clear advantage in terms of cash flow. By securing funds before beginning work, businesses can cover operational expenses, invest in resources, and avoid relying on credit. Regular payment requests, while standard, do not provide this upfront funding, and businesses may face periods of financial strain as they wait for payments to come through.

Ultimately, choosing between these two methods depends on the nature of the business, client relationships, and financial needs. Prepayment requests are ideal for businesses needing upfront capital, while regular payment requests are more common when services are delivered on credit or payment terms are flexible.

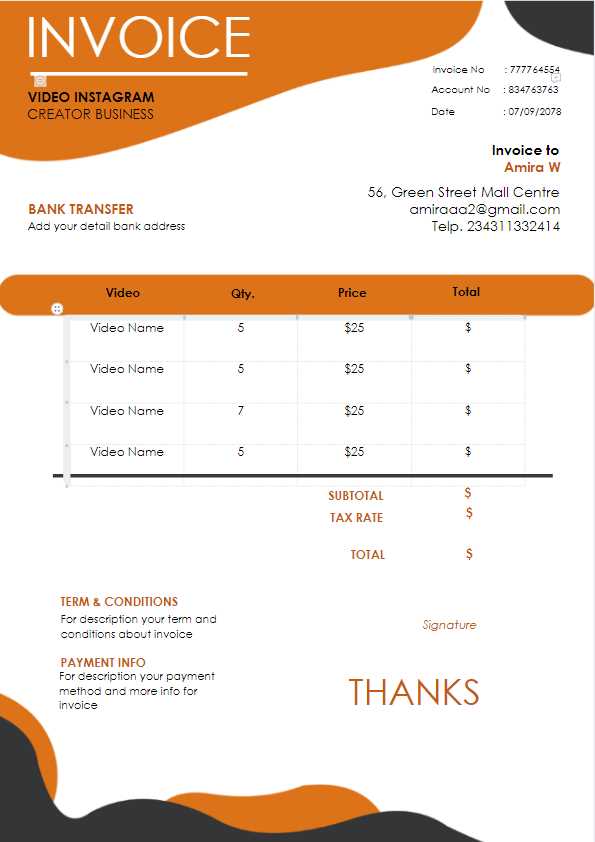

Design Tips for Professional Invoice Templates

Creating a visually appealing and professional document for payment requests is essential for any business. A well-designed document not only ensures clarity but also enhances your brand’s credibility and fosters trust with clients. By following a few key design principles, you can make sure your request for payment looks polished and organized, which will help streamline the payment process and reflect your professionalism.

Keep It Clean and Simple

Simplicity is key when designing a payment request document. Avoid cluttering the page with too much text or overly complex graphics. The document should be easy to read, with a clear structure that highlights important details, such as the payment amount, due date, and services provided. Use plenty of white space to make the document feel open and not overwhelming.

- Use large fonts for key information (e.g., total amount due, payment terms).

- Include clear section headings (e.g., “Client Details,” “Payment Breakdown”).

- Avoid overly decorative fonts that may reduce readability.

Brand Consistency and Personalization

Incorporate your business branding into the document. Use your company logo, colors, and fonts to create a cohesive brand identity. Personalizing your payment request helps to make the document feel more official and aligned with your business’s image. Clients are more likely to trust a professional-looking document that reflects your brand, and it adds a personal touch to the transaction.

- Ensure your logo is visible but not overpowering.

- Match the color scheme to your business’s brand identity.

- Customize the layout to reflect your company’s values, whether formal or casual.

By keeping the design clean, simple, and aligned with your branding, you’ll create a more effective and professional document that helps maintain clear communication with your clients.

Choosing the Right Advance Invoice Format

Selecting the appropriate format for your payment request document is crucial for ensuring clarity and professionalism. The format you choose will affect how easily your clients understand the terms of the transaction, as well as how efficiently you can manage and track payments. With numerous options available, it’s important to pick the one that best suits your business needs, project type, and client preferences.

Consider the Type of Business

Different industries have different requirements when it comes to requesting payments. For example, creative services, contractors, and large project-based businesses may need a more detailed payment request, outlining milestones, payment percentages, and due dates. On the other hand, smaller transactions or businesses with simple offerings may only need a basic format with clear terms and a total payment amount.

- For project-based work, consider using a format that includes a payment schedule or milestone breakdown.

- For retail or smaller businesses, a simple document with total charges may be more appropriate.

- If your business involves recurring payments, consider a format that includes subscription terms and payment intervals.

Client Preferences and Expectations

Understanding your client’s preferences is another important factor in choosing the right format. Some clients may prefer digital formats, such as PDFs or online invoicing systems, while others may expect traditional paper requests. Tailoring the format to their expectations can speed up the process and improve client satisfaction.

- Digital formats allow for easy customization and fast delivery, making them ideal for most modern businesses.

- For clients who prefer hard copies, ensure your document is print-friendly and formatted for clarity.

- Consider incorporating easy-to-use payment links or instructions for clients who prefer online payments.

By carefully considering your business’s needs, the type of transaction, and your client’s preferences, you can choose the right format that ensures smooth communication and efficient payment processing.