Adidas Invoice Template for Professional Invoicing

Creating accurate and professional billing documents is essential for maintaining smooth financial operations in any business. With the right tools, generating these records becomes an efficient and hassle-free task. A well-designed form not only ensures clarity but also enhances your business’s image when dealing with clients.

By using customizable solutions, you can save time and reduce errors, ensuring that your financial transactions are handled seamlessly. Whether you’re a small business owner, a freelancer, or part of a larger company, having a streamlined approach to invoicing can simplify the entire process, from creation to payment tracking.

Customizable billing formats are available for various industries and business sizes. These solutions can be adapted to fit your unique requirements, making sure all necessary details are included while maintaining a professional appearance. With the right setup, you’ll be able to manage your finances with confidence and ease.

Adidas Invoice Template Overview

Effective financial documentation is a key aspect of running a successful business. Whether you are managing a retail operation or providing services, having a structured and professional billing document is essential. These documents serve as official records of transactions and help both the provider and client track payments and services rendered.

Customizable billing forms offer flexibility to meet the specific needs of your business. You can easily adapt them to reflect your branding, payment terms, and any relevant legal requirements. With this kind of solution, you don’t need to worry about missing important information or maintaining a disorganized system for your financial transactions.

Streamlined and easy-to-use formats ensure that every detail is clearly outlined, from client contact information to the total cost of services or products provided. With the right layout, you can present all necessary data in a clean, professional manner that fosters trust and credibility with your clients.

Why Use an Adidas Invoice Template

Having a reliable, professionally designed billing document is essential for any business. It ensures that all transactions are recorded clearly, reducing the chances of errors or misunderstandings between the service provider and the client. By using an organized billing solution, you create a consistent, streamlined process for tracking payments and managing financial records.

Key Advantages of Using a Structured Billing Format

Using a pre-designed, customizable format offers numerous benefits. Here are some of the key reasons why businesses should consider adopting this approach:

| Advantage | Explanation |

|---|---|

| Time-saving | Pre-designed forms reduce the time spent creating documents from scratch, allowing you to focus on more important tasks. |

| Consistency | Maintaining a uniform layout ensures that all your billing documents look professional and contain the necessary information every time. |

| Customization | The ability to adjust the document to your specific needs, such as adding logos or adjusting payment terms, adds flexibility. |

| Clarity | A clean, well-structured document makes it easier for clients to understand payment details and helps avoid disputes. |

How It Enhances Your Business Operations

With a clear, standardized method for generating financial documents, your business can operate more efficiently. Whether you’re a small business, a freelancer, or a larger corporation, using a predefined format ensures that your financial dealings are organized, professional, and easily trackable.

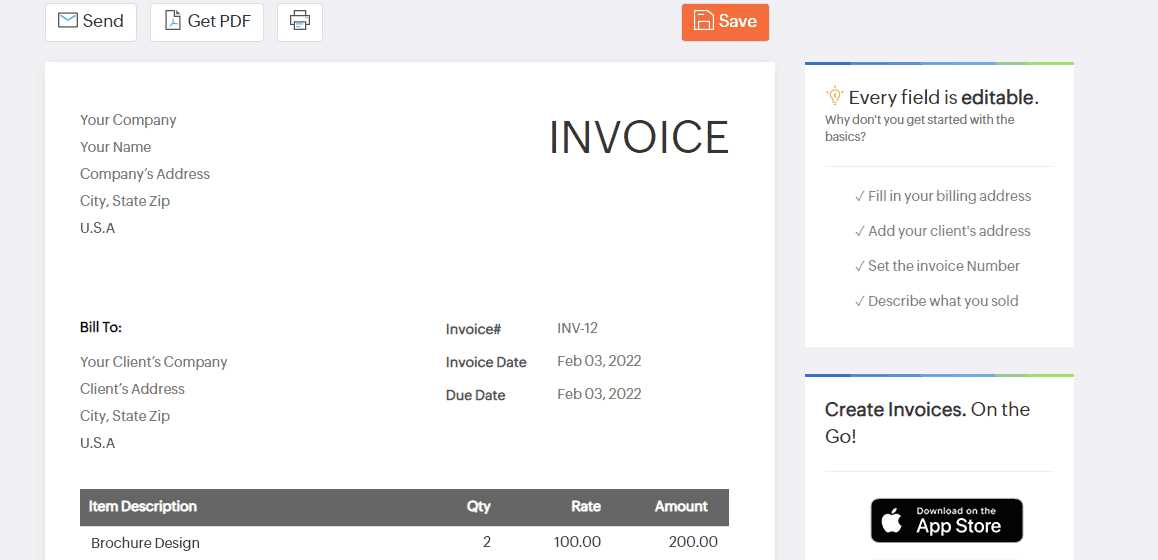

How to Customize Adidas Invoice Templates

Personalizing your financial documents is an important step to ensure that they reflect your brand identity and meet your specific business needs. Customization allows you to adjust essential details such as payment terms, contact information, and overall layout to create a cohesive, professional appearance. With the right tools, this process is both easy and efficient.

Steps to Customize Your Billing Document

Follow these simple steps to make your documents more tailored to your business:

- Choose a Format: Start by selecting a basic format that suits your business. Make sure it covers all the necessary sections, such as payment details, product or service descriptions, and client information.

- Update Business Information: Customize the document with your company’s name, logo, address, and contact details. This adds professionalism and makes the document recognizable.

- Add Payment Terms: Ensure that your payment conditions, such as due dates and late fees, are clearly stated. Customizing this section ensures that clients understand when payments are due and any penalties for late payment.

- Customize Colors and Fonts: Adjust the colors, fonts, and overall design to match your brand’s visual identity. This helps keep your documents consistent with your other marketing materials.

- Include Legal or Tax Information: If necessary, include any legal disclaimers or tax information required by your local regulations to ensure compliance.

Benefits of Customization

- Brand Recognition: Personalizing documents with your logo and business details helps increase brand visibility.

- Clear Communication: Custom formats allow you to tailor the layout to yo

Free Adidas Invoice Template Download

For businesses looking to simplify their financial documentation, a free, downloadable solution can be a great way to get started. These ready-made forms are designed to save time and ensure consistency, allowing you to focus more on running your business. Whether you need a simple bill for a client or a more detailed record of services, a free option can meet your needs without extra costs.

How to Access Your Free Billing Document

Getting started is easy. Follow these steps to download a free billing solution:

- Visit a Trusted Source: Look for reliable websites offering free, downloadable formats. Ensure they are from reputable sources to avoid malware or poorly designed files.

- Select the Right Format: Choose a document format that suits your business needs. Options may include Word, Excel, or PDF files, each offering different levels of customization.

- Download the File: Click the download link and save the document to your computer or cloud storage.

- Customize the Document: Once downloaded, adjust the fields to include your business details, payment terms, and other relevant information.

Benefits of Free Downloads

- Cost-Effective: These solutions are free, meaning you don’t need to invest in expensive software or subscription services.

- Time-Saving: Pre-designed documents reduce the time needed to create professional records from scratch.

- Customization: Even free documents can be tailored to your business, giving you control over layout and details.

- Easy Access: Downloading these forms is quick and convenient, providing immediate access when needed.

With a free, downloadable solution, your business can quickly implement a consistent and professional method of handling payments and client

Top Features of Adidas Invoice Templates

When selecting a ready-made document for managing transactions, there are several key features that make a solution both effective and professional. These attributes help ensure that your financial records are not only clear but also customized to meet your business needs. Whether you’re handling a few clients or many, a well-designed form can streamline the entire process.

Key Features to Look For

Here are some essential elements that make a billing document truly effective:

- Clear Layout: A well-organized design with easy-to-read sections ensures that all the important details are easily accessible for both the client and your business.

- Customizable Fields: The ability to modify fields like company details, payment terms, and client information allows you to tailor the document to your needs.

- Professional Appearance: High-quality formatting that includes your logo, company name, and branding elements helps you maintain a consistent, professional image.

- Tax and Legal Information: The inclusion of necessary fields for taxes, disclaimers, or legal terms ensures compliance with local laws and regulations.

- Payment Tracking: Many forms include built-in sections for tracking payments, outstanding balances, and due dates, making it easier to monitor your finances.

Why These Features Matter

Having these features in your financial documents ensures that all necessary information is conveyed accurately and professionally. A clear, consistent design not only helps with internal organization but also builds trust with your clients. Additionally, customizable and comprehensive forms ensure that every aspect of the transaction is covered, minimizing the c

Benefits of Using a Professional Invoice

Utilizing a professionally designed billing document can significantly improve your business’s financial processes. Such documents not only streamline the transaction process but also create a positive impression on clients. Whether you are managing a small business or a large enterprise, having a well-structured and polished billing system is crucial for maintaining clear communication and ensuring smooth financial operations.

Improved Clarity: A clean, well-organized layout makes it easy for clients to understand the charges and payment terms. This reduces confusion and ensures that both parties are on the same page regarding the transaction.

Increased Professionalism: When you send a professionally formatted document, it reflects positively on your business. Clients are more likely to trust companies that present themselves in a polished and reliable manner. This professional image can help foster long-term business relationships.

Streamlined Payment Process: A structured document with clear payment instructions helps speed up the payment process. It provides clients with all the information they need to settle the bill promptly, reducing delays and improving cash flow.

Legal and Tax Compliance: Professional documents often include fields for tax numbers, legal disclaimers, and payment terms, helping ensure that your business complies with local regulations. This reduces the risk of legal complications and ensures that your documentation meets industry standards.

Consistency: By using a standardized format, you ensure that all your billing records are consistent. This makes it easier to track payments, issue refunds, or resolve disputes as you always have a clear reference point for each transaction.

Overall, adopting a professional approach to financial documentation brings numerous benefits that go beyond just convenience. It enhances your business’s credibility, promotes smooth operations, and fosters positive relationships with clients.

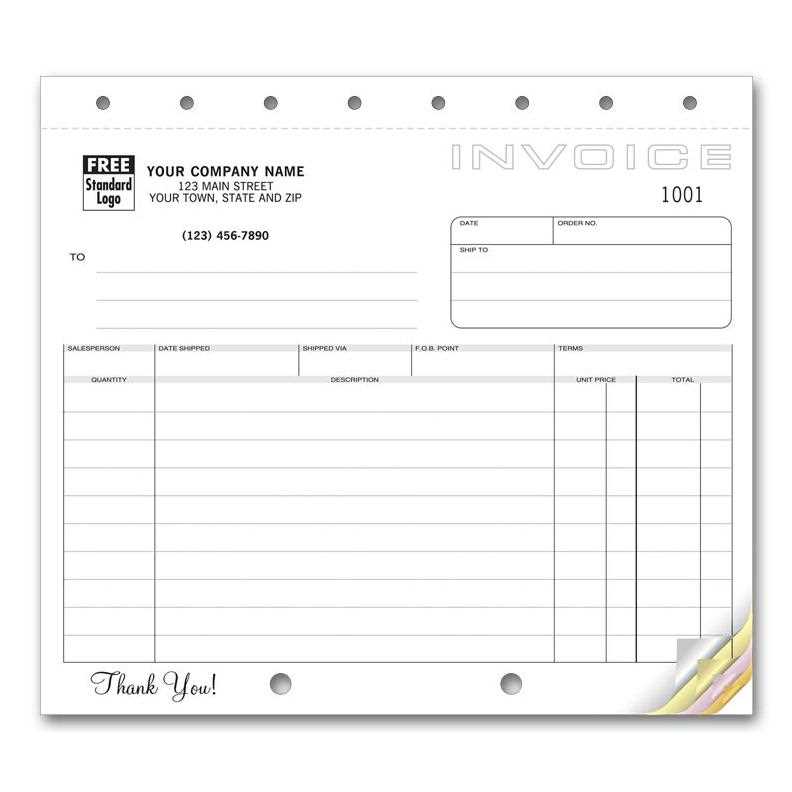

Step-by-Step Guide to Create an Invoice

Creating a billing document from scratch may seem like a complicated task, but it can be done easily with a structured approach. By following a clear process, you can ensure that all necessary details are included and that the document is professional and easy to understand. This guide will take you through each step, from gathering the information to customizing the format.

Essential Information to Include

Before starting the document, make sure you have all the required information. This will ensure that your record is complete and accurate:

- Business Details: Your company name, logo, address, and contact information.

- Client Information: The name, address, and contact details of the client you’re billing.

- Transaction Details: A detailed description of the products or services provided, including quantities, rates, and any applicable taxes.

- Payment Terms: Include the payment due date, accepted payment methods, and any penalties for late payments.

Steps to Create the Document

Once you have all the necessary information, follow these steps to create your billing document:

- Select a Format: Choose a format that is easy to customize, such as a Word, Excel, or PDF file.

- Insert Header: Start with your business name and contact details at the top of the document. This is where your branding will go.

- Client Information: Add the client’s name, address, and contact details, making sure they are clearly separated from your own information.

- Detail the Products/Services: List all the items or services you provided, including the quantity, rate, and total for each. Include any applicable taxes or discounts.

- Calculate the Total: Add up the costs for each item, tax, and discount to find the total amount due. Ensure this total is clearly highlighted.

- Add Payment Terms: Clearly state the payment due date, late fees, and the preferred payment method.

- Review and Save: Double-check for accuracy and clarity. Save the document in your preferred format, and it’s ready to send!

By following these simple steps, you can easily create a professional billing document that ensures clear communication with your clients and helps keep your financial transactions organized.

Common Mistakes to Avoid in Invoices

Creating a financial document may seem straightforward, but there are several common errors that can lead to confusion or delays in payment. These mistakes can negatively impact your business’s cash flow and professional reputation. It’s important to pay attention to the details when preparing these records to ensure accuracy and clarity.

Missing or Incorrect Client Information: Always double-check that the client’s name, address, and contact details are accurate. Incorrect information can lead to miscommunication and may delay payment processing.

Unclear Payment Terms: Clearly state the payment due date, accepted payment methods, and any penalties for late payments. If these terms are vague or missing, clients may not be sure when or how to pay, causing delays.

Omitting Item Descriptions: Make sure each product or service is described in detail, including quantities, unit prices, and any applicable discounts or taxes. Vague or incomplete descriptions can lead to confusion and disputes.

Incorrect Calculations: Always double-check the math, especially when calculating totals, taxes, and discounts. Simple errors can lead to misunderstandings and force you to resend the document.

Failing to Include Your Branding: A lack of branding can make the document look unprofessional. Include your company logo, business name, and contact information to maintain consistency and professionalism.

Not Including Legal or Tax Information: Depending on your location, there may be legal or tax requirements that need to be included on your documents. Failing to do so could lead to complications or non-compliance issues.

Overcomplicating the Layout: While it’s important to include all necessary details, a cluttered or complicated layout can make the document harder to read. Keep the design clean and well-organized to ensure easy navigation for your client.

Avoiding these common mistakes will help ensure that your financial documents are clear, professional, and efficient, ultimately leading to smoother transactions and a stronger rel

How to Add Your Branding to Invoices

Adding your company’s branding to billing documents is an essential step in creating a professional and cohesive appearance across all your communications. This not only helps reinforce your brand identity but also ensures consistency in your business operations. Customizing your documents with your logo, color scheme, and other brand elements can make your financial records stand out and feel more official to clients.

Key Elements of Branding

To effectively incorporate your brand into financial documents, focus on these important elements:

- Logo: Place your company’s logo at the top of the document, ideally in the header. This helps to immediately identify your business and adds a professional touch.

- Color Scheme: Use your company’s primary colors for headings, borders, or accents in the document. This creates a visually consistent experience for clients.

- Font Choices: Select fonts that align with your brand’s style. Using the same fonts across your website, marketing materials, and documents ensures that your brand has a unified look.

- Contact Information: Include your business address, phone number, email, and website in a consistent format, using your brand’s typography and colors.

Steps to Add Branding to Documents

Follow these steps to effectively incorporate your brand into your billing forms:

- Use a Branded Header: At the top of the document, include your bus

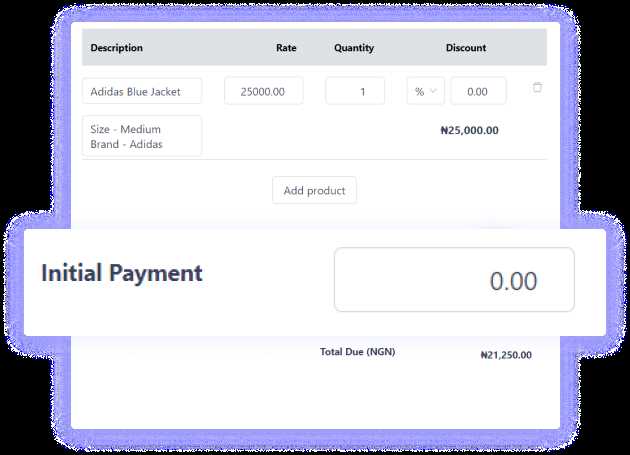

Tracking Payments with Adidas Invoice Templates

Efficiently tracking payments is crucial for maintaining healthy cash flow and ensuring that your business operations run smoothly. By utilizing a structured billing document, you can easily monitor the status of each transaction and stay on top of payments due. These documents can be designed to track both paid and unpaid balances, helping you identify overdue accounts quickly.

To track payments effectively, you can incorporate a section into your document that records payment status and relevant details. This allows for easy monitoring and follow-up, ensuring that nothing slips through the cracks.

Payment Details Status Amount Paid Due Date Service 1 Paid $200 October 15, 2024 Service 2 Unpaid $150 October 30, 2024 Product 1 Paid $100 October 20, 2024 By organizing payments in this way, you can quickly identify which invoices have been settled and which ones are still outstanding. Additionally, this method allows you to keep a detailed record for future reference or reporting purposes.

Incorporating payment tracking features into your financial documents not only makes your business more organized but also helps improve your cash flow management. Clients will appreciate the clear communication, and you will have peace of mind knowing that all financial transactions are properly recorded and monitored.

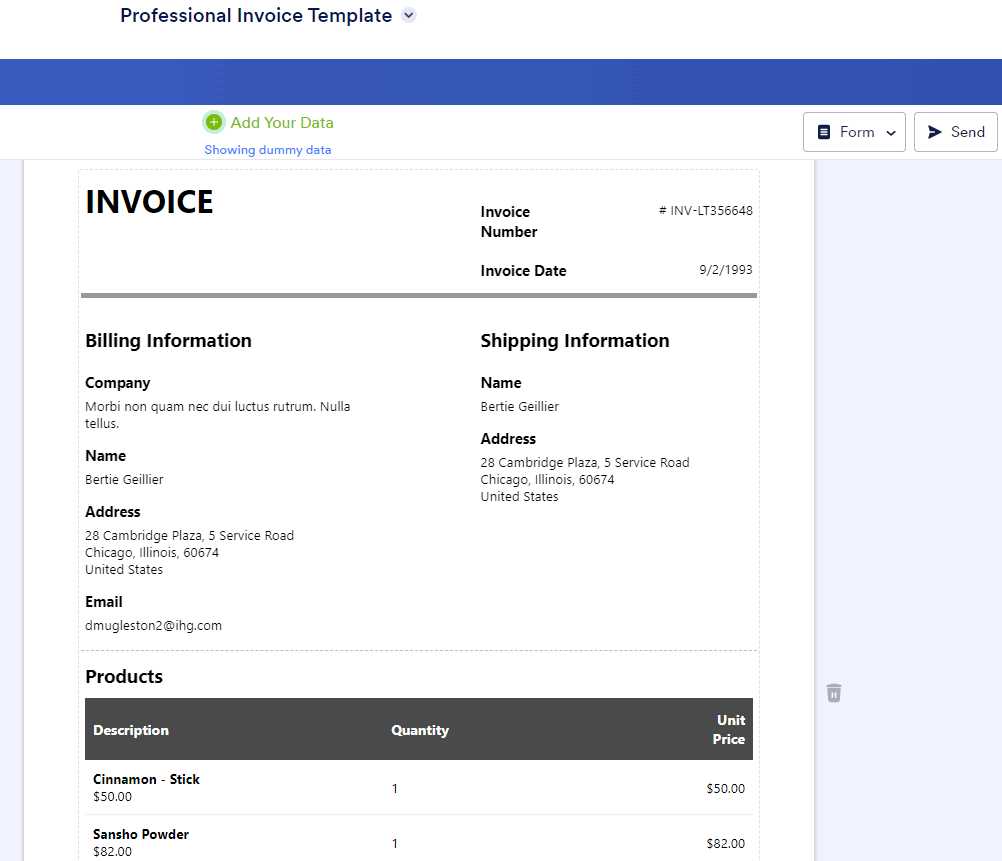

Adidas Invoice Template for Small Businesses

For small businesses, having a reliable and professional billing document is crucial for maintaining organization and ensuring timely payments. Using a structured and easy-to-use billing format can help small business owners stay on top of their financials, avoid errors, and build trust with clients. A well-designed document not only communicates professionalism but also saves time, allowing entrepreneurs to focus on growing their business.

Why Small Businesses Need a Structured Document

For small business owners, managing cash flow is essential. A well-organized document allows you to easily track payments, manage due dates, and create consistent records for future reference. It also ensures that clients know exactly what they are being charged for, helping to prevent confusion or disputes. Additionally, a professional-looking document can enhance your brand’s credibility and create a positive impression with clients.

Key Features for Small Business Documents

When creating a billing record for a small business, consider these essential features:

- Simple Layout: Keep the layout clean and straightforward to ensure clarity. Avoid cluttering the document with unnecessary details.

- Customizable Sections: Ensure that you can adjust the details such as client information, service descriptions, and pricing to fit your business needs.

- Clear Payment Terms: Include the payment due date, accepted methods of payment, and any late fee policies to avoid misunderstandings.

Description Quantity Unit Price Total Consultation Service 1 $150 $150 Product Purchase 2 $45 $90 Total $240 For small businesses, using an organized and customizable document is key to maintaining financial clarity. By adopting such a system, you can ensure that your transactions are clear, professional, and easily manageable, which contributes to smoother business operations and improved client relationships.

How to Send Invoices Efficiently

Efficiently sending financial documents is essential for maintaining smooth operations and ensuring timely payments. By adopting a systematic approach to the process, businesses can save time, reduce errors, and improve client relations. Sending documents promptly and through the right channels will help keep cash flow steady and minimize administrative overhead.

Steps to Send Financial Documents Effectively

Follow these steps to streamline the process of sending out billing records:

- Use a Consistent Format: Ensure that all your records follow a uniform structure, making it easier to manage and track. This consistency helps clients recognize your documents and prevents confusion.

- Double-Check Information: Before sending, verify that all client details, amounts, payment terms, and service descriptions are correct. Simple errors can delay payments and damage your professionalism.

- Choose the Right Delivery Method: Consider using digital methods like email or invoicing software to send your documents. This is faster, more secure, and allows for quicker payments. Physical copies can still be sent if required, but they tend to take longer and incur extra costs.

- Set a Clear Payment Deadline: Clearly state the due date for payment and any penalties for late payments. This helps avoid delays and encourages clients to pay on time.

- Track Sent Documents: Keep a record of all documents you send, along with the date of submission. This can be done manually or using invoicing software, which often provides tracking features.

- Send Payment Reminders: If the due date passes and you haven’t received payment, send a friendly reminder. A follow-up message can speed up the process without seeming too pushy.

Best Practice

Tips for Managing Client Invoices

Managing client billing records effectively is vital for keeping your business running smoothly and ensuring timely payments. Whether you are a freelancer, a small business owner, or part of a larger organization, staying organized and proactive in tracking payments can make a significant difference. By implementing a few best practices, you can reduce errors, prevent missed payments, and improve cash flow management.

Best Practices for Managing Client Billing Records

Here are some tips to help you stay on top of your billing process:

- Keep Detailed Records: Always keep an organized record of all financial documents sent to clients, including the amounts, dates, and services provided. This will help you track outstanding balances and serve as a reference for any disputes.

- Establish Clear Payment Terms: Make sure your clients are aware of your payment policies, including due dates, late fees, and accepted payment methods. Clear terms prevent confusion and ensure timely payments.

- Set Up a Payment Tracking System: Use a software system or spreadsheet to monitor which documents have been paid and which are outstanding. A simple system will save time and effort when following up with clients.

- Follow Up on Unpaid Balances: If a payment is overdue, send a polite reminder. Regular follow-ups are essential to avoid cash flow disruptions.

Table Example for Tracking Payments

Using a table format can help you track the status of each payment efficiently:

Client Name Service Provided Amount Status Due Date John Doe Consulting $300 Paid October 10, 2024 Jane Smith Web Design $1,200 Unpaid October 15, 2024 Acme Corp Marketing Services $500 Paid October 12, 2024 This table format allows you to easily see which clients have paid and which still owe you, along with their due dates. A simple system like this ensures nothing is missed and helps maintain a professional relationship with clients.

By following these tips and using an organized system, you can stay on top of client billing, improve payment collection, and maintain the financial health of

Adidas Invoice Template for Freelancers

For freelancers, maintaining a professional appearance in all client interactions is essential, and having a reliable document for billing is a key part of that. A well-designed billing record not only streamlines the payment process but also helps freelancers stay organized and manage their cash flow more efficiently. Whether you’re offering consulting, design, or writing services, a custom document can ensure your financial transactions are clear and structured.

Using a streamlined, easy-to-fill format tailored to your needs can save you time and prevent errors. It helps communicate all the necessary details to your clients, such as the work completed, the agreed-upon rates, and any additional charges. A professional layout also contributes to building trust with clients, which is crucial for getting paid on time and maintaining long-term working relationships.

For freelancers, the ability to customize these documents to reflect your brand, include your terms, and track payments is essential. An organized record system allows you to follow up with clients when payments are overdue, ensuring that nothing is missed.

Creating your own version of a billing document offers flexibility. You can adapt it to your business style, include any relevant terms, and add branding elements such as your logo or contact information. This customization gives your documents a personal touch, aligning them with your business identity.

Legal Considerations in Invoice Creation

When creating billing documents, it’s important to ensure that they are not only clear and professional but also comply with applicable legal requirements. Understanding the legal aspects of creating and sending financial records can help avoid disputes, ensure timely payments, and maintain your business’s credibility. There are several key legal elements that should be included in any billing document to ensure compliance with local tax laws and contractual agreements.

Key Legal Elements to Include

Here are some essential legal considerations when preparing billing records:

- Business Information: Include your business name, address, and tax identification number (if applicable). This ensures the document is valid for tax and legal purposes.

- Client Information: Clearly list the client’s full name or business name, as well as their contact details, for proper identification.

- Detailed Service Description: Provide a thorough breakdown of the products or services rendered, including quantities, rates, and any applicable taxes. This prevents misunderstandings and protects both parties in case of disputes.

- Terms and Conditions: Specify payment terms, including due dates, payment methods, and late fees for overdue payments. Having these terms in writing helps avoid potential conflicts with clients.

- Tax Information: Ensure that your billing document reflects the correct tax rates and provides a clear indication of any taxes included in the total amount. This is particularly important for businesses that are VAT or sales tax registered.

- Unique Reference Number: Each billing document should have a unique number for tracking purposes. This helps to maintain a clear record of transactions and ensures compliance with tax regulations.

Table of Legal Elements Example

Item Description Business Information Include your business name, address, and tax ID number Client Information Full name or business name, along with contact details Service Description Details of services/products, including quantities and rates Payment Terms Due date, accepted payment methods, and late fee clauses Tax Information Include applicable tax rates and amounts Unique Reference Number Each record should have a unique identification number Incorporating these legal elements in your financial documents ensures compliance with the law and helps maintain a transparent and trustworthy relationship with your clients. Additionally, it protects your business in case of legal disputes or audits. Always stay updated on local regulations regarding billing documents to avoid any potential issues with tax authorities or clients.

How to Save Time with Templates

Using pre-designed documents can greatly streamline your administrative tasks and save valuable time, especially when it comes to managing financial records. By having a ready-made structure, you eliminate the need to create a new document from scratch every time you need to send a billing statement or track payment details. This approach not only reduces repetitive work but also ensures consistency and accuracy across all your transactions.

Here are a few ways in which using a predefined structure can help you save time:

- Consistency: Pre-designed documents ensure uniformity in formatting and content, which reduces errors and ensures that all necessary information is included.

- Speed: Instead of writing each document from scratch, you can quickly fill in the required fields, such as client details, amounts, and services rendered.

- Easy Customization: Many pre-made structures are customizable, allowing you to tailor them to specific clients or services without starting from the ground up.

- Reduced Admin Work: By using ready-made formats, you can focus on more important tasks like business growth, customer relations, or service delivery.

- Professional Look: Ready-to-use formats often have a polished and consistent appearance, which adds a professional touch to your communications.

Incorporating these pre-made structures into your workflow can improve efficiency, reduce stress, and help you stay on top of your administrative responsibilities. Whether you’re handling multiple clients or tracking different projects, this approach ensures that you’re working smarter, not harder.