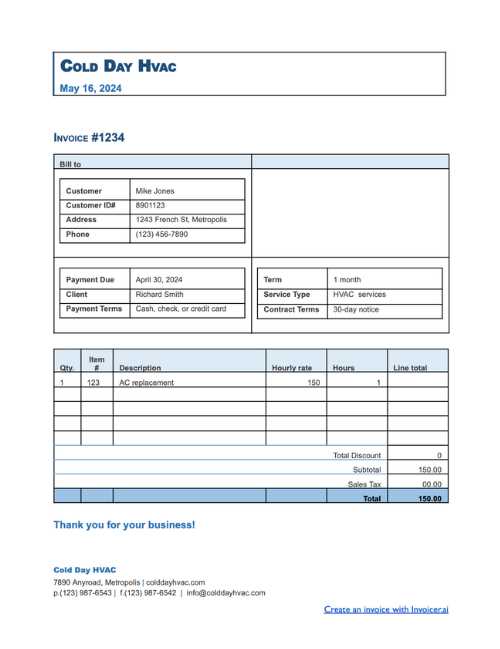

AC Repair Invoice Template for Efficient and Professional Billing

For any air conditioning specialist or technician, managing client payments and keeping accurate records is crucial for smooth operations. When providing services, it’s important to present a clear and professional document that outlines all aspects of the work performed, including costs, services rendered, and payment terms. This document not only helps maintain transparency with clients but also serves as a vital tool for your business’s financial management.

Having a well-structured billing document ensures that clients understand exactly what they’re being charged for and helps businesses avoid disputes. With the right format, it becomes easier to track jobs, manage cash flow, and keep your bookkeeping in order. The ability to quickly generate these documents can also save time and reduce errors, allowing you to focus on delivering top-notch service.

In this guide, we will explore how to create a comprehensive and professional billing statement, and how a well-designed template can make the entire process faster, simpler, and more efficient. Whether you’re a freelancer or run a larger business, using the right tools will help streamline your payment procedures and improve client satisfaction.

AC Service Billing Overview

When providing air conditioning services, it’s essential to create a document that clearly outlines the work completed, the costs involved, and the payment expectations. This professional record helps both the service provider and the customer stay organized and ensures that the transaction is transparent and properly documented. Whether you are an independent technician or part of a larger company, using an effective tool to generate these statements can save time and enhance credibility.

A well-designed billing record serves multiple purposes: it acts as proof of the service rendered, a reminder of the agreed-upon costs, and a tool for managing finances. Creating a consistent and reliable format for these documents will help you stay organized and avoid confusion when dealing with multiple clients. The goal is to ensure accuracy, professionalism, and efficiency in all transactions.

Benefits of Using a Structured Format

Using a pre-defined structure allows for quick generation of accurate documents, reducing the chance of human error. It also helps maintain consistency in your business’s paperwork, which is crucial for keeping clients satisfied and maintaining a professional image. With a clear breakdown of all charges, services, and payment terms, both parties can easily refer to the document for any future queries.

Customization Options for Your Needs

While it’s important to follow a standard format, flexibility is equally important. A customizable billing record allows you to adjust fields based on the unique requirements of each job, whether it’s adding detailed labor costs, including a discount, or specifying terms for future work. This adaptability helps tailor your documentation to the diverse needs of your business and client base.

Why Use an AC Service Billing Document

For any business offering air conditioning solutions, keeping accurate and professional records of completed jobs and associated costs is essential. By utilizing a well-structured document, service providers can ensure clarity, streamline administrative tasks, and maintain a high level of professionalism. This tool not only helps businesses manage transactions but also enhances the relationship with clients by presenting all charges in a clear and organized way.

Here are some key reasons why using a structured billing document is beneficial:

| Reason | Benefit |

|---|---|

| Efficiency | Quickly create accurate records for each job, saving time and effort. |

| Clarity | Clients can easily understand what services were provided and what they’re being charged for. |

| Professionalism | Presenting clear, consistent documents enhances the reputation of your business. |

| Organization | Easily keep track of past jobs, payments, and pending invoices for future reference. |

| Legal Protection | Having a documented record of the services rendered can help avoid disputes and ensure legal compliance. |

By using a standardized method for creating these documents, businesses can not only improve their workflow but also foster trust and transparency with their clients. Whether you are an independent contractor or part of a larger team, having this tool at your disposal will significantly enhance your operational efficiency and client communication.

Key Features of a Good Billing Document

Creating a professional and effective record of services rendered is essential for any business that deals with client payments. A well-crafted document ensures both the service provider and the customer have a clear understanding of the work completed and the associated charges. To achieve this, it’s important that certain elements are included to make the document both comprehensive and easy to understand.

Some key features are essential for an effective billing document. These elements help ensure accuracy, prevent misunderstandings, and foster trust between the service provider and the client. Below are the main aspects that should be considered when creating such a document:

Clear and Detailed Breakdown

One of the most important features is a clear, itemized list of all services provided. This allows clients to see exactly what they are being charged for. Include labor costs, parts used, and any other additional charges. Each item should be described with enough detail so there is no ambiguity about the work performed.

Payment Terms and Due Dates

A good billing document should clearly state the payment terms and any applicable due dates. Including this information prevents confusion and helps ensure that payments are made promptly. Be sure to specify whether a deposit is required, the total amount due, and any late fees that may apply in case of overdue payments. This provides clarity for both parties and helps to establish a professional, business-like approach to financial transactions.

By incorporating these key features, businesses can streamline their billing processes, improve client satisfaction, and reduce the chances of disputes. A well-organized document reflects professionalism and contributes to a smooth, transparent service experience for both the provider and the client.

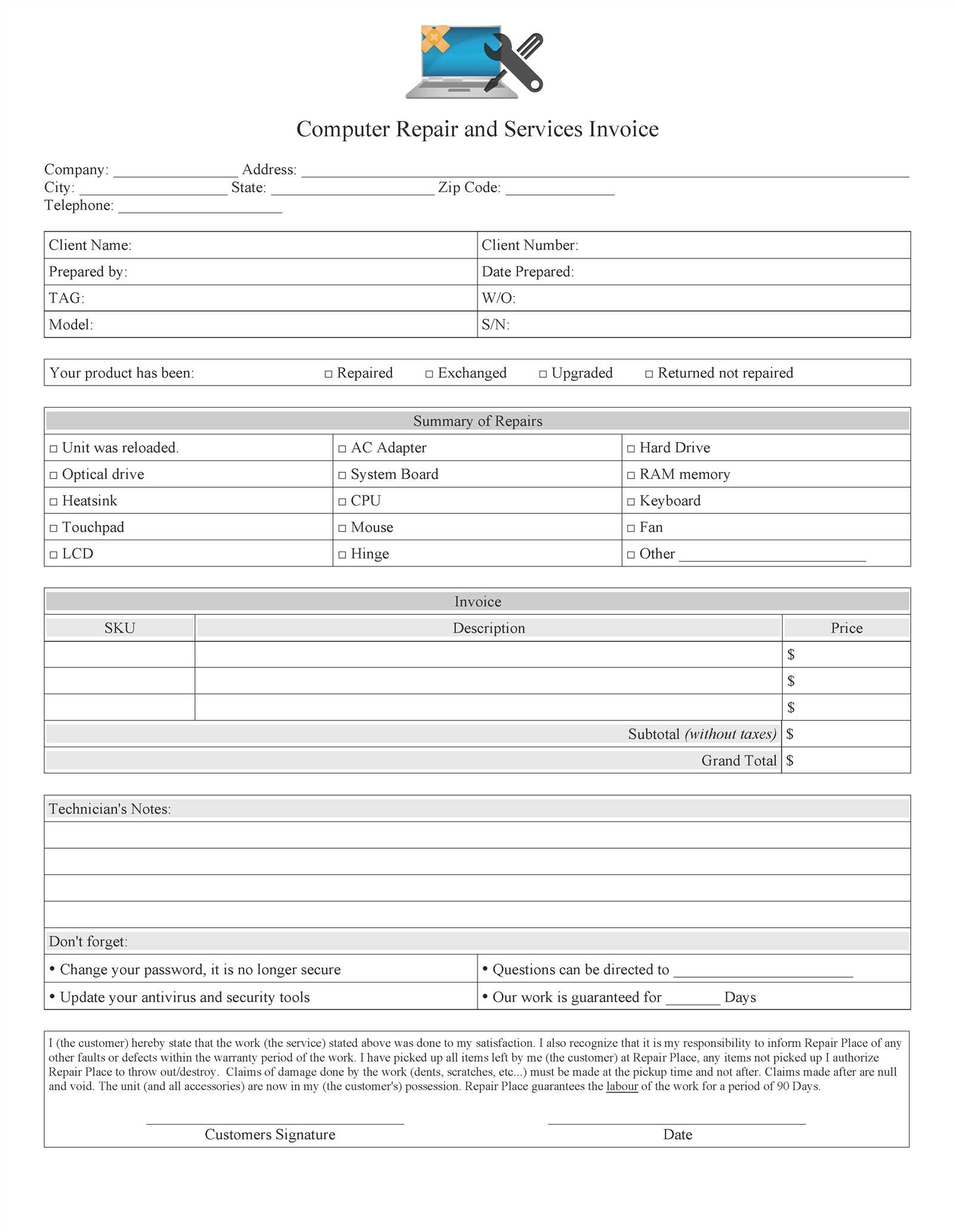

How to Customize Your Billing Document

Customizing your billing document allows you to tailor it to your business’s needs while maintaining a professional appearance. A personalized document not only reflects your brand but also ensures that you capture all the relevant information specific to the services you provide. By adjusting certain elements, you can make sure the document meets both legal requirements and customer expectations.

Here are the key areas you can customize to make your document more suited to your business operations:

- Company Branding: Include your company logo, name, and contact information at the top. This will make the document look official and instantly recognizable to clients.

- Service Descriptions: Adjust the descriptions of the services based on the type of work done. Be clear and specific about the tasks performed, whether it’s installation, diagnostics, or maintenance.

- Payment Details: Customize the payment terms, such as the due date, late fees, and available payment methods. You can also specify any discounts or special offers.

- Client Information: Make sure to include the client’s full name, address, and contact details. This helps keep the document organized and ensures it’s clear who the bill is for.

- Legal Information: Add any necessary terms and conditions or disclaimers relevant to your business. These might include warranties, liabilities, or service guarantees.

By adjusting these sections, you can create a document that reflects your specific business practices and improves communication with your clients. Customizing your records not only boosts professionalism but also ensures that all important details are captured correctly.

Benefits of Professional Billing for HVAC Businesses

For any HVAC business, managing finances efficiently is key to long-term success. Utilizing a professional billing system offers several advantages that help streamline operations, improve cash flow, and enhance client relationships. By presenting clear and accurate records for the services provided, businesses not only maintain better financial organization but also build trust and credibility with their clients.

Below are some of the primary benefits that come from using a professional approach to documenting services and payments:

Improved Cash Flow Management

Having a consistent and professional method for documenting transactions ensures that all payments are tracked accurately. By specifying payment terms, due dates, and payment methods, HVAC businesses can reduce delays in payment and avoid confusion. This leads to better cash flow and fewer payment disputes, allowing the business to operate smoothly and efficiently.

Enhanced Client Relationships

Clients appreciate transparency and professionalism. By providing clear and well-structured records for the work done, businesses can build stronger relationships with customers. These documents serve as a clear reference for both parties and help avoid misunderstandings regarding costs or services provided.

| Benefit | Description |

|---|---|

| Efficiency | Save time by using a structured method for generating records instead of creating them from scratch each time. |

| Organization | Keep detailed records of all jobs, payments, and terms, which is essential for bookkeeping and tax purposes. |

| Professional Image | Presenting well-organized documentation helps establish trust and credibility with clients, enhancing your reputation. |

| Reduced Errors | A professional system reduces the likelihood of mistakes in calculations, dates, and client details, ensuring accurate records. |

By adopting a professional approach to documenting services, HVAC businesses not only improve internal operations but also elevate the client experience, contributing to long-term success and growth.

Common Mistakes in AC Service Billing

While managing client transactions, errors in billing documents can lead to confusion, delayed payments, and even damage to customer relationships. It’s essential to pay close attention to detail and ensure that all the information presented is accurate and clear. Even small mistakes can cause significant issues in maintaining professionalism and avoiding misunderstandings with clients.

Below are some of the most common mistakes to watch out for when creating billing records for air conditioning services:

Incomplete or Incorrect Client Information

Failing to include the correct details for the client, such as their full name, address, or contact information, can lead to confusion and may even delay payment. Ensure that all client information is accurate and up-to-date before sending any documents. Incomplete records can also make it difficult to track payments and follow up if necessary.

Unclear Service Descriptions and Charges

Vague or missing descriptions of the services provided can create misunderstandings between you and your client. It’s essential to clearly outline what work was performed and specify the costs for each service or part used. Ambiguous charges can lead to disputes and can undermine the trust between the business and the customer.

Paying attention to these common pitfalls will help ensure that your documentation remains professional, accurate, and easy for clients to understand. Avoiding these mistakes fosters positive relationships with your clients and ensures smoother financial transactions in your business.

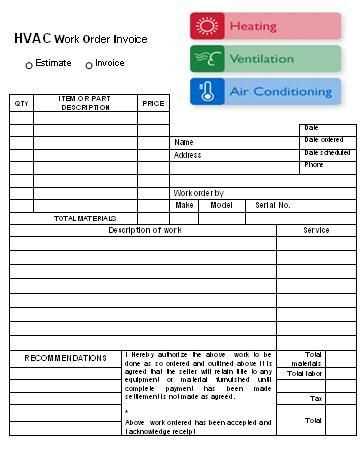

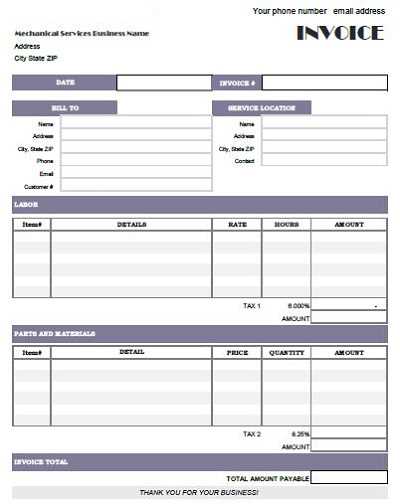

How to Include Labor and Parts Costs

When documenting air conditioning services, it is important to break down the costs clearly to avoid confusion and ensure transparency. Accurately detailing labor charges and parts costs not only helps the client understand the value of the work performed but also ensures that your business is compensated fairly for both time and materials. Properly listing these elements also minimizes the chances of disputes or delayed payments.

Here are some best practices for including labor and parts costs in your service records:

Labor Charges

Labor costs should be listed based on the time spent on the job. Specify the hourly rate or fixed cost for the work and clearly state the total hours worked. If different technicians were involved, it’s helpful to break down the hours for each individual. This approach provides clarity and justifies the charges for your time. For example:

- Hourly Rate: $X per hour

- Total Hours Worked: Y hours

- Total Labor Cost: $X * Y

Parts and Materials

For any parts or materials used, list each item separately along with the cost per unit and the total cost. It’s also a good idea to include the part’s brand, model, and other identifying details if applicable. This ensures full transparency and gives the client a clear understanding of the materials involved. For instance:

- Part Name: Air Filter

- Quantity: 1

- Cost per Unit: $Z

- Total Cost: $Z

By clearly listing both labor and parts costs, you can make your billing process more transparent, professional, and easier for clients to understand. This clarity helps build trust, prevent misunderstandings, and streamline payments.

Simple Steps to Create a Billing Statement

Creating an accurate and professional document to request payment for services rendered doesn’t have to be complicated. By following a few simple steps, you can quickly generate clear and effective billing statements that outline the work performed, the associated costs, and payment terms. A well-structured document not only helps with financial tracking but also maintains good communication with your clients.

Here are the basic steps to follow when preparing a payment request for your HVAC services:

Step 1: Include Your Business Details

Start by adding your business information at the top of the document. This includes your company name, address, phone number, email, and any other relevant contact details. This ensures that your client can easily get in touch with you if needed. It’s also a good idea to include your business logo for a more professional appearance.

Step 2: List the Services Provided and Costs

Clearly itemize the services you provided, along with the costs for each. Include details such as the hours worked, labor rates, and any parts or materials used, specifying the cost for each item. This breakdown not only justifies the total amount but also ensures the client understands exactly what they are being charged for.

By following these simple steps, you can create a professional and efficient document that accurately reflects the work performed and the agreed-upon payment terms. Clear communication through these documents helps build trust and improves your cash flow management.

Top Tools for Building Billing Documents

Creating clear and accurate billing records can be a time-consuming task if done manually, especially when managing multiple clients and projects. Fortunately, several tools are available that make the process much easier, offering pre-built templates, automation, and customization features. These tools help streamline the creation of professional payment requests, reduce errors, and improve efficiency in your business.

Here are some of the top tools you can use to generate billing records quickly and professionally:

- QuickBooks – A popular accounting software that allows you to create, send, and track billing records. QuickBooks offers automation features and integrates with other business management tools for seamless operations.

- FreshBooks – Known for its user-friendly interface, FreshBooks is great for small businesses. It allows you to create professional payment documents, track time and expenses, and manage client payments.

- Zoho Invoice – This tool offers customizable templates, automated billing reminders, and multi-currency support. It’s especially useful for businesses that serve clients in different regions.

- Wave – A free tool that helps with invoicing, accounting, and receipt scanning. Wave is ideal for freelancers and small businesses looking for a budget-friendly solution.

- PayPal Invoicing – A simple tool for generating quick billing documents, PayPal allows you to easily create and send payment requests directly to your clients and accept online payments.

Using the right tool not only simplifies your workflow but also ensures accuracy and professionalism in your business dealings. These platforms provide customizable options to suit your specific needs, helping you stay organized and efficient.

How to Manage Payments and Due Dates

Effectively managing payments and due dates is crucial for maintaining cash flow and ensuring that your business runs smoothly. Clear payment terms and consistent follow-ups can help prevent overdue payments and reduce the likelihood of disputes. By staying organized and implementing a structured approach, you can keep track of all outstanding balances and ensure that clients are paying on time.

Here are some strategies for managing payments and due dates in your business:

- Set Clear Payment Terms: From the start, make sure that your clients know when payment is due, whether it’s immediately after service, within 30 days, or at a later date. Be transparent about any late fees or discounts for early payment.

- Use Automated Reminders: Many billing tools allow you to set automated payment reminders. This ensures clients are informed of upcoming due dates without you needing to manually follow up.

- Offer Multiple Payment Methods: Provide various ways for clients to make payments, such as credit cards, bank transfers, or online payment platforms. The more options available, the more likely it is that clients will pay promptly.

- Track Payments Regularly: Keep a close eye on your accounts receivable and monitor overdue payments. Set aside time to review your records frequently so that you can take action when necessary.

- Be Proactive with Late Payments: If a payment is overdue, reach out to the client as soon as possible. Send a polite reminder or contact them to discuss alternative payment options if needed.

By implementing these best practices, you can effectively manage payment schedules, reduce late payments, and maintain a positive relationship with your clients. Consistency and communication are key to ensuring that your business remains financially healthy and that clients understand your payment expectations.

Legal Considerations for Billing Documents

When creating billing records for services rendered, it’s essential to be aware of the legal requirements that govern business transactions. Properly documented records not only ensure that your payments are processed smoothly but also protect you and your clients in case of disputes. Adhering to legal standards helps maintain professionalism and reduces the risk of costly misunderstandings or non-compliance with local regulations.

Here are some important legal considerations to keep in mind when preparing payment requests:

Clear Payment Terms

One of the most important aspects of any payment request is the clarity of payment terms. Specify the total amount due, payment methods, due date, and any applicable penalties for late payments. By clearly outlining these terms, you can avoid confusion and protect your business interests. It is also advisable to include a statement indicating that payment is required upon completion of services unless otherwise agreed upon.

Compliance with Local Laws

Depending on your location, there may be specific regulations governing service agreements, taxes, or invoicing procedures. Make sure to familiarize yourself with local laws and incorporate any relevant requirements into your documents. For example, some regions require the inclusion of tax identification numbers, sales tax rates, or specific disclaimers regarding warranty or service agreements.

| Legal Requirement | Description |

|---|---|

| Tax Information | Ensure that sales tax or VAT (if applicable) is clearly mentioned along with your tax identification number. |

| Service Terms | Specify the terms of service, including warranties, payment terms, and conditions for late fees. |

| Dispute Resolution | Include information about how disputes will be handled, such as through mediation or arbitration, if necessary. |

Including these legal considerations in your service billing documents will help ensure that your transactions are transparent, fair, and legally compliant. Being diligent in this area will also foster trust with your clients and minimize potential conflicts in the future.

Tracking AC Service Billing for Accounting

Efficiently tracking billing records is a crucial part of managing your business’s finances. By keeping accurate and up-to-date documentation of all transactions, you can ensure that payments are properly recorded, avoid discrepancies, and streamline your accounting process. This also allows you to generate financial reports, stay on top of overdue balances, and maintain clear records for tax purposes.

Here are some best practices for tracking billing records related to air conditioning services:

- Use Accounting Software: Leverage accounting software such as QuickBooks or FreshBooks to automate the tracking of billing documents. These tools can automatically categorize expenses, generate reports, and keep track of payments, saving you time and reducing errors.

- Maintain a Detailed Ledger: Keep a detailed ledger of all transactions. For each job, record the date, client information, service details, labor and materials costs, and payment status. This will allow you to quickly reference any past transactions and maintain organized financial records.

- Track Payment Status: Regularly check the payment status of each transaction. Record whether the payment is pending, paid, or overdue, and follow up accordingly. Many businesses use a color-coded system or different labels to indicate the status of payments in their accounting system.

- Reconcile Accounts Monthly: At the end of each month, reconcile your billing records with your bank statements to ensure that all payments have been accounted for. This step helps identify discrepancies and ensures that your financial records are accurate and up-to-date.

- Keep Digital Copies: Store digital copies of all billing records for easy access and to reduce the risk of losing important documents. Most accounting software allows you to upload and store these files securely in the cloud.

By implementing these practices, you can streamline your accounting process, keep accurate financial records, and ensure your business remains financially organized. Regular tracking of your billing documents also helps you avoid payment issues and improves overall business efficiency.

Creating Recurring Billing for Regular Clients

For businesses that provide ongoing services, creating recurring payment requests can save time and improve cash flow. By automating this process, you can ensure that clients are billed consistently for regular services, reducing administrative tasks and minimizing the chance of missed payments. This approach is particularly useful for businesses with long-term clients who require routine maintenance or periodic check-ups.

Here are some steps to set up recurring billing for clients who need regular services:

- Define the Service Frequency: Determine how often the client requires services, whether it’s monthly, quarterly, or annually. Be sure to set clear billing intervals and confirm them with the client to avoid any confusion.

- Establish Clear Payment Terms: Set payment terms for recurring charges, including due dates, acceptable payment methods, and any discounts for early payment. Be transparent about any fees or additional charges that might apply over time.

- Use Automated Billing Tools: Many accounting and billing platforms allow you to set up recurring billing cycles automatically. Once configured, the system will generate and send payment requests to your clients on the agreed schedule without requiring manual intervention.

- Keep Track of Payment History: Maintain a record of all recurring transactions and payment status. This will help you monitor whether payments are being made on time and identify any overdue accounts.

- Notify Clients in Advance: Sending a reminder before the payment is due can be helpful for both you and the client. Some tools can automatically send notifications or reminders about upcoming payments.

By setting up recurring billing, you can focus more on providing services and less on administrative tasks. This helps streamline the payment process and ensures a steady income from regular clients, creating a more predictable cash flow for your business.

How to Send Your Billing Document to Clients

Once you’ve created a detailed and accurate payment request, the next step is ensuring it reaches your client in a timely and professional manner. The way you send your billing statement can impact both client satisfaction and the speed at which you receive payment. Choosing the right method of delivery is essential for maintaining a smooth and efficient business operation.

Here are some effective ways to send your billing document to clients:

Email Delivery

One of the most common and convenient methods for sending payment requests is via email. It is fast, cost-effective, and provides a clear digital record of the transaction. To ensure your email is professional and clear, follow these steps:

- Attach the Document: Always attach the billing record as a PDF or another easily accessible file format to ensure it cannot be altered. Include a short message in the email body explaining the document’s contents.

- Subject Line: Use a clear subject line that includes the client’s name and the purpose of the email, such as “Payment Request for [Service Name] – [Date].”

- Follow-Up Reminders: If the payment is not received by the due date, send a polite reminder email. Many accounting tools allow you to set up automated reminder emails to be sent when payments are overdue.

Paper Delivery

For clients who prefer physical copies, or when required by law, sending a printed version of the billing document may be necessary. Ensure that the document is clear, accurate, and signed if needed. Here’s how you can efficiently manage paper billing:

- Postal Services: Use reliable postal services to send your documents. Consider using certified mail for tracking purposes, especially if the payment request is of a higher value or involves contractual terms.

- Include a Return Envelope: To make the process easier for your clients, include a pre-addressed return envelope with payment instructions.

Choosing the appropriate delivery method depends on your client’s preferences and your business requirements. While email is the fastest and most convenient option, paper delivery may still be necessary in some cases. Regardless of the method, it’s important to ensure that the payment request is clear, professional, and easily accessible to the client.

Best Practices for Billing Document Formatting

Properly formatting your billing documents is essential for maintaining professionalism and ensuring clarity. A well-organized and easy-to-read document helps clients understand the services provided, the total amount due, and the payment terms. Proper formatting not only ensures your payment requests are professional but also reduces the likelihood of errors and disputes.

Here are some best practices for formatting your payment requests:

- Use a Clean and Simple Layout: Keep the layout simple and organized. Avoid cluttering the document with excessive details. A clean design with clear headings and sections makes the document easy to navigate.

- Include Essential Information: Always include key details such as your business name, client information, a list of services, payment due date, and total cost. Make sure these details are placed prominently so they’re easy to find.

- Use Consistent Fonts and Colors: Stick to a professional font such as Arial or Times New Roman, and avoid using too many different font styles. Keep the color scheme minimal to maintain a formal appearance and improve readability.

- Itemize Charges Clearly: Break down the services provided into individual line items, each with its own price. This makes it easier for the client to see exactly what they are paying for and prevents misunderstandings.

- Highlight Important Information: Use bold or underlined text to emphasize key details, such as the total amount due and the payment due date. This ensures that clients can quickly identify the most critical parts of the document.

- Include Terms and Conditions: If applicable, add a section that outlines your payment terms, late fees, and any other relevant conditions. This can help set clear expectations and protect your business in case of disputes.

By following these formatting best practices, you can create billing documents that are clear, professional, and easy to understand. Well-formatted documents foster trust and ensure that both parties are on the same page, helping to facilitate prompt payment and prevent confusion.

How to Improve Client Payment Time

Timely payments are crucial for maintaining healthy cash flow and ensuring the smooth operation of your business. Delayed payments can create financial strain and disrupt your ability to meet operational needs. Improving client payment times is an essential aspect of business management, and there are several strategies you can implement to encourage faster settlements.

Here are some effective ways to speed up payment processing from clients:

- Set Clear Payment Terms: Be upfront with clients about when payments are due and any applicable late fees. Clearly state your payment terms in your contracts, quotes, and billing statements. This sets expectations early and can encourage prompt payments.

- Offer Early Payment Discounts: Providing a discount for early payment is a great incentive. For example, offering a 2-5% discount for payments made within 10 days can motivate clients to pay sooner.

- Send Reminders: Sending friendly reminders as the due date approaches can prevent forgetfulness. Automated reminders via email or through accounting software can help you stay consistent and professional in your communication.

- Make Payment Easy: Provide multiple payment methods, such as credit cards, bank transfers, or online payment systems. The more options your clients have, the easier it is for them to settle their accounts on time.

- Invoice Promptly: Sending your billing request immediately after completing a service or delivering a product can reduce delays. The quicker you bill, the sooner clients can process and pay the amount due.

- Communicate Payment Expectations: Discuss payment terms with your clients before starting any work. Make sure both parties understand when payment is expected and agree on the payment method. This can prevent future confusion and delays.

- Track Payments and Follow Up: Keep track of outstanding payments and follow up regularly on overdue amounts. Being proactive in tracking overdue payments shows that you are serious about getting paid and can help expedite the payment process.

By implementing these strategies, you can reduce payment delays, improve cash flow, and foster stronger client relationships. Ensuring a consistent and clear process for handling payments can greatly impact your business’s financial stability and growth.