Free Pressure Washing Invoice Template for Quick and Easy Billing

When running a business, managing finances efficiently is crucial for success. Having a well-organized system for tracking payments, issuing receipts, and maintaining clear records can save time and prevent errors. One of the best ways to simplify this task is by using a professionally designed document that ensures accuracy and consistency every time you need to charge a client.

With the right tools, you can create a clear, structured account of the services you’ve provided. This not only helps with keeping your financials in order but also leaves a positive impression on customers. Whether you’re working with residential or commercial clients, having a clear and polished statement for the work completed can make all the difference in getting paid on time and building trust.

Many business owners turn to customizable documents that allow them to include all necessary details. These documents can be adjusted to reflect the nature of each job, with sections for itemizing costs, payment methods, and due dates. By investing a little time upfront to set up your system, you’ll find it much easier to handle billing as your business grows.

Free Pressure Washing Invoice Template Overview

Effective billing plays a key role in maintaining a successful business. Whether you’re a contractor or service provider, having a clear and organized document to summarize the work completed and the associated charges is essential for smooth transactions. This tool not only helps with payment collection but also ensures transparency and professionalism in client interactions.

Why It’s Important for Your Business

Having a structured document to detail the services rendered, labor costs, and other fees allows you to present a polished and professional image to your clients. It simplifies communication, reduces misunderstandings, and serves as a useful reference in case of any disputes. This document can also help you stay organized by keeping track of payments, overdue balances, and other important financial details.

What to Expect from the Document

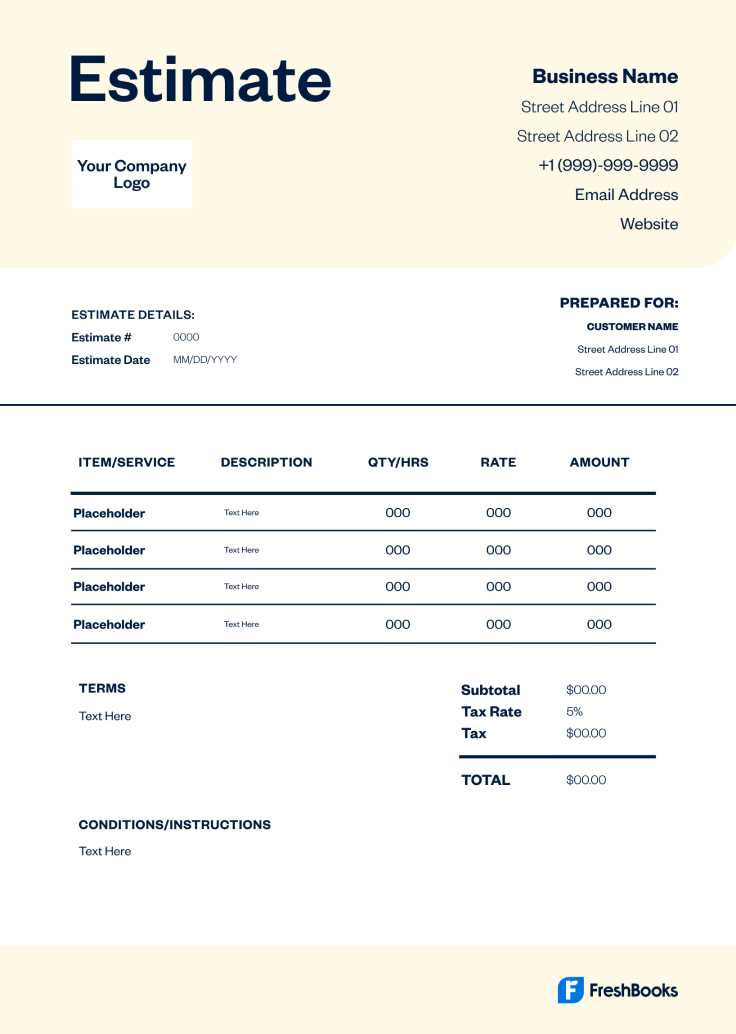

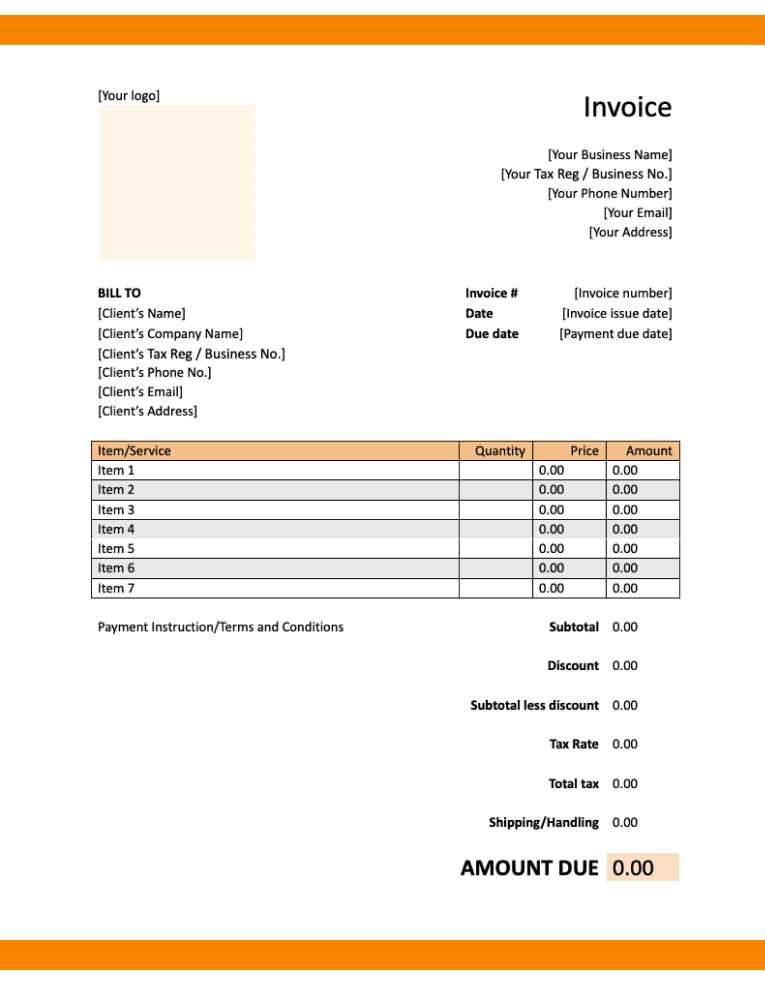

The document you use will typically include essential fields such as your business name, client details, service description, dates of service, and payment terms. You can easily customize it to fit different types of jobs and ensure that all relevant information is captured. The simplicity of the design allows for quick completion, while still providing all necessary details to ensure clarity for both you and your client.

Why Use an Invoice Template

Using a well-organized document to bill clients can significantly improve the efficiency of your business operations. By providing a clear breakdown of services, costs, and payment terms, this tool helps reduce errors and confusion, ensuring both parties are on the same page. Relying on pre-designed formats makes the billing process faster, easier, and more professional.

Advantages of Using a Structured Document

- Saves Time: With a pre-made structure, you don’t need to create new documents from scratch for every transaction.

- Enhances Professionalism: A polished, consistent format helps build trust with your clients and reflects well on your business.

- Reduces Errors: A standardized format helps ensure all the important information is included, minimizing the risk of missing key details.

- Easy to Customize: You can adjust the fields to fit the specifics of each job or client, making it versatile for various service types.

- Improves Cash Flow: Clear terms and dates make it easier for clients to understand when and how to pay, which can speed up payment processing.

How It Helps Keep Your Business Organized

Using a consistent format allows you to keep a well-organized record of past transactions. It provides a quick reference for payment history, overdue balances, and other financial details. Additionally, having a centralized system for managing all your documents helps streamline accounting tasks and ensures nothing is overlooked.

Benefits of Free Invoice Templates

Utilizing a ready-made document for billing clients can offer numerous advantages to business owners. These tools provide a quick, cost-effective way to maintain organized and professional records without the need for expensive software or excessive customization. By simplifying the billing process, these resources help save time while ensuring that every transaction is accurately documented.

Cost Savings and Accessibility

- No Additional Costs: Many templates are available at no cost, which helps reduce expenses for small businesses and freelancers.

- Instant Access: You can download or access these documents immediately, allowing you to start billing without delay.

- No Software Required: These documents can be used with basic word processors or spreadsheet programs, eliminating the need for specialized tools.

Improved Efficiency and Accuracy

- Pre-Designed Format: These resources come with all the necessary fields, ensuring you don’t miss essential details like job descriptions, client info, or payment terms.

- Easy to Customize: Templates are designed to be flexible, allowing you to tailor them to fit the specifics of each job while maintaining a professional appearance.

- Faster Billing: With an organized structure, you can quickly fill in the required details and send your document to clients, speeding up the overall process.

How to Customize Your Invoice

Customizing a billing document to reflect the specifics of each project is crucial for clarity and accuracy. A well-tailored document ensures that clients understand the charges, services provided, and payment terms. Personalizing your form to suit your business needs will also help maintain a professional image and streamline your financial record-keeping.

Here are some key steps to customize your document:

| Step | Description |

|---|---|

| 1. Add Your Business Information | Include your company name, contact details, and logo to make the document official and professional. |

| 2. Client Information | Ensure the client’s name, address, and phone number are correctly listed to avoid confusion. |

| 3. Service Description | Provide a clear description of the work completed, including any specific tasks, materials used, or hours worked. |

| 4. Specify Payment Terms | Clearly state the payment due date, any deposit requirements, and available payment methods. |

| 5. Include Taxes and Discounts | If applicable, specify tax rates or discounts to ensure transparency in the final amount due. |

Once you’ve added the necessary details, review the document for accuracy and consistency. You can also adjust the layout and design to match your branding, ensuring that your document is not only functional but visually appealing as well.

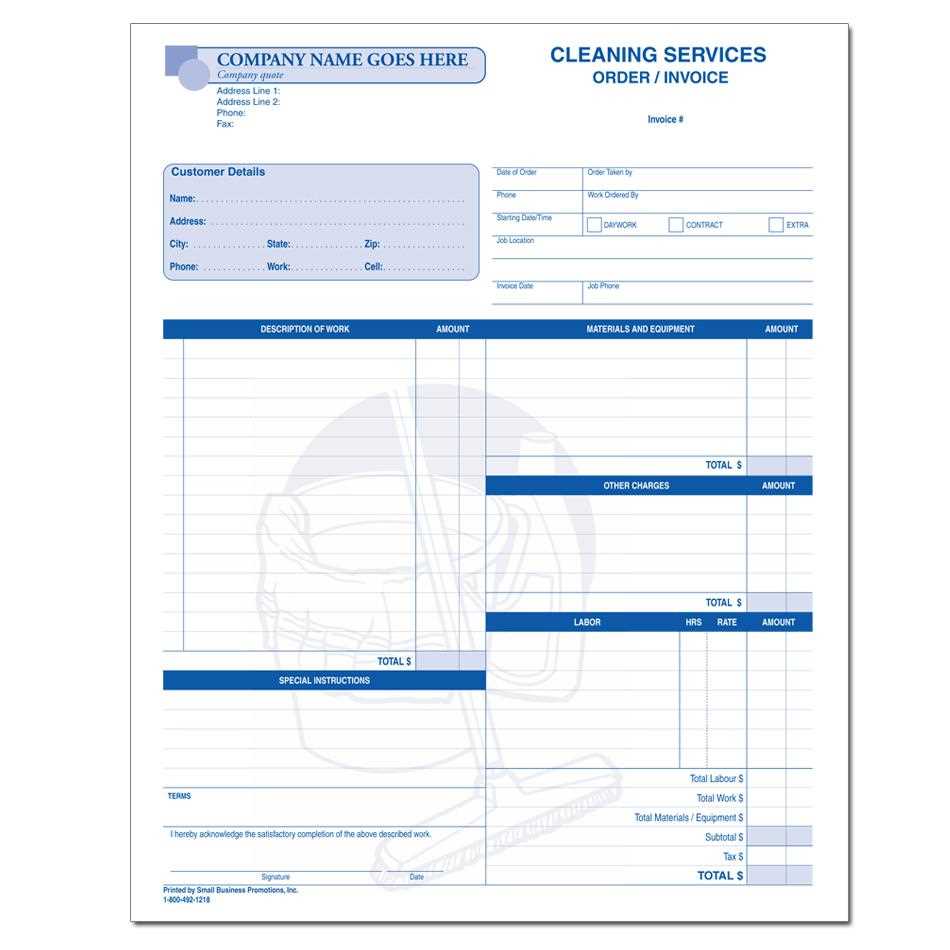

Key Elements of a Pressure Washing Invoice

When creating a billing document for cleaning services, it is essential to include certain components that provide clarity and ensure proper record-keeping. These parts help both service providers and clients stay organized, establish payment terms, and ensure mutual understanding of the services performed.

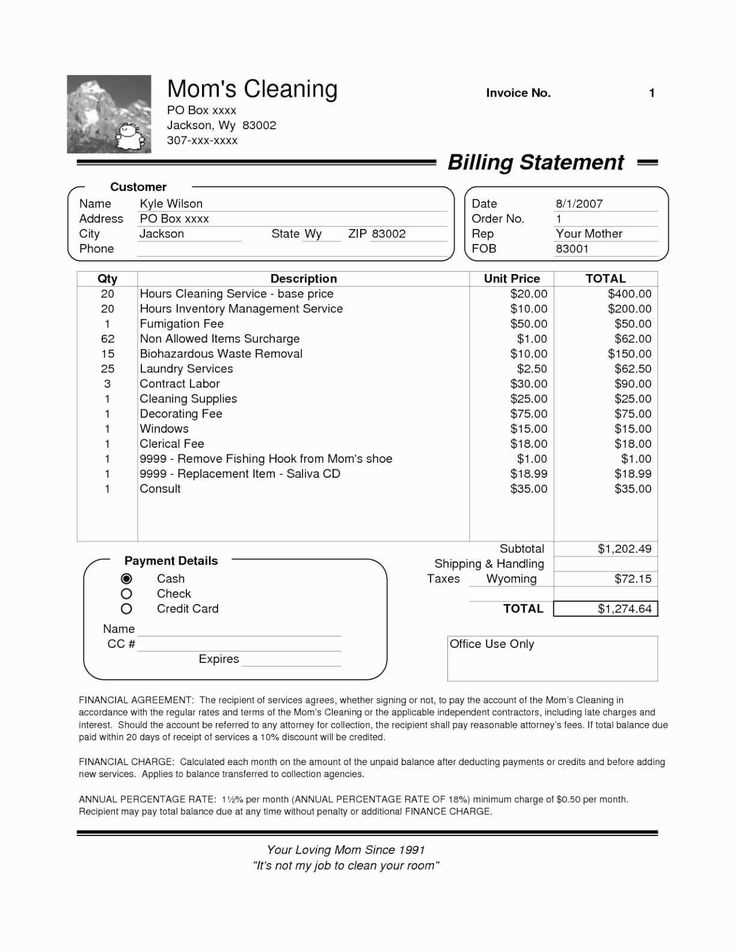

- Service Provider Details: Include the name, address, phone number, and email of the company or individual offering the cleaning services.

- Client Information: Clearly state the customer’s name, contact details, and address where the services were rendered.

- Service Description: List each task completed, such as surface cleaning, maintenance, or any additional work provided, with corresponding prices.

- Dates: Indicate the date the work was carried out and when the document was created for payment purposes.

- Payment Terms: Specify the total amount due, applicable taxes, and acceptable methods of payment, along with the payment due date.

- Terms and Conditions: Include any relevant information regarding warranties, refunds, or penalties for late payment.

These key elements ensure that both parties are informed about the scope of work and the financial aspects of the transaction. Properly documenting this information can help avoid misunderstandings and foster professional relationships.

Best Software for Invoice Creation

For anyone offering cleaning services, choosing the right software to generate billing documents is crucial for streamlining operations and ensuring accuracy. Various tools are available, each offering unique features designed to simplify the creation, management, and sending of payment requests.

- QuickBooks: A comprehensive solution that allows for easy billing, tracking of payments, and integration with accounting systems. It’s ideal for businesses seeking to manage finances in one place.

- FreshBooks: This platform is user-friendly and designed for service-based businesses. It offers customizable billing formats and automation for recurring tasks, making it a good choice for small business owners.

- Zoho Invoice: A cloud-based option with features like multi-currency support, automated reminders, and time tracking. It’s perfect for businesses working with clients across different regions.

- Wave: A highly rated, no-cost solution with features like recurring billing, expense tracking, and online payment options. Ideal for freelancers and startups.

- Xero: Known for its integration with other financial tools, Xero offers invoicing alongside strong accounting capabilities, making it suitable for growing businesses.

By selecting the right software, service providers can automate much of the administrative work, allowing them to focus more on their core business operations. The right tool not only simplifies billing but also enhances overall business efficiency.

Tips for Accurate Billing

Ensuring precision in billing is essential for maintaining smooth financial transactions and building trust with clients. Accurate documentation of services provided and clear communication of payment details can prevent misunderstandings and ensure timely payments. Below are some practical suggestions to improve the accuracy of your billing process.

1. Double-Check Service Details

Always verify the services rendered before creating a payment request. Ensure that each task is described clearly and corresponds to what was actually completed. This will avoid any discrepancies and ensure that clients know exactly what they are being charged for.

2. Use Automated Tools

Using billing software or tools can help reduce errors by automating calculations, tax inclusion, and formatting. These tools often come with templates, saving you time and ensuring uniformity in your documents.

| Service | Price | Quantity | Total |

|---|---|---|---|

| Surface Cleaning | $50 | 1 | $50 |

| Window Treatment | $30 | 2 | $60 |

| Total | $110 | ||

By breaking down charges in a clear manner, you allow clients to see the exact cost structure, minimizing confusion. This approach also helps prevent mistakes that could arise from manual calculations.

Accurate billing requires attention to detail and an organized approach. By following these tips, you can ensure that your clients receive correct payment requests and maintain professionalism in all transactions.

How to Format Your Invoice Correctly

Proper formatting is essential for creating clear, professional billing documents. A well-structured payment request not only ensures that all necessary information is included but also helps to present your business in a polished manner. Following a logical layout can make it easier for clients to understand the charges and make timely payments.

1. Start with Your Business Information

At the top of the document, include your business name, address, contact number, and email. This makes it easy for clients to reach you in case they have questions or need assistance with the payment.

2. Include Client Details

Below your business information, clearly state the client’s name, address, and contact details. This ensures that there is no confusion about which client the document refers to and helps with future communication.

To ensure clarity and easy navigation, it’s essential to use a simple, consistent layout. Key sections to include are:

- Service Description: A detailed list of all the tasks performed, including the specific charges for each one.

- Dates: Include both the date the services were completed and the date the payment request is issued.

- Payment Terms: Clearly state the total amount due, tax rates (if applicable), and the payment due date.

Using clear headings and bullet points will help guide the client’s eye to the relevant information. A clean and readable format can make the entire process smoother for both you and your customer.

Adding Taxes and Discounts to Invoices

When preparing a billing document, it’s important to account for any additional charges or reductions that may apply, such as taxes or discounts. Properly adding these elements ensures that the total amount due is accurate and aligns with any legal or promotional requirements.

Taxes should be clearly stated, including the percentage applied and the total amount charged. Depending on the location and the type of service, different tax rates may be required. Ensure that this information is visible and easy to understand to avoid confusion.

Similarly, discounts should be applied in a transparent manner. If you are offering a promotional price, seasonal discount, or loyalty offer, be sure to list the percentage or amount discounted and the reason for the reduction. This not only clarifies the final charge but also helps maintain a positive relationship with the client.

Here are some tips to ensure accuracy when adding taxes and discounts:

- Clearly separate the original amount and the taxes or discounts to avoid confusion.

- Ensure that tax rates align with local laws or agreements.

- If offering a discount, state any conditions or expiration dates for clarity.

By including taxes and discounts in a structured way, you maintain transparency and professionalism in all your financial documents.

Professional Design for Your Invoice

Creating a visually appealing and organized billing document is essential for leaving a positive impression on clients. A well-designed document not only enhances professionalism but also makes it easier for clients to understand the details and structure of their payment obligations. A clear and polished layout can help streamline the transaction process and reflect the quality of your services.

To ensure your document looks professional, focus on the following design elements:

- Consistency: Use consistent fonts, colors, and formatting throughout the document to maintain a uniform appearance. This creates a cohesive look and makes the content easier to read.

- Branding: Incorporate your business logo, colors, and any other branding elements to help reinforce your brand identity. This makes the document feel official and aligned with your business’s image.

- Clear Structure: Break the document into sections, such as contact details, service description, and payment terms. Using headings and bullet points helps make the information digestible and guides the reader’s eye.

- White Space: Leave enough space around text and elements to avoid a cluttered look. Adequate spacing improves readability and gives a more polished and refined feel.

By focusing on these design principles, you ensure that your billing document not only communicates necessary information clearly but also enhances your professionalism and leaves a lasting positive impression.

Saving and Sharing Your Invoice

Once your billing document is complete, it’s important to save it in a secure and accessible format, as well as to share it efficiently with your client. Proper handling of this document ensures that both you and your customer have a record of the transaction, making it easier to track payments and resolve any potential issues.

Here are some key points to consider when saving and sharing your billing document:

- Save in PDF Format: Saving your document as a PDF ensures that the formatting remains intact, no matter where or how it’s viewed. It also makes the file easily shareable and professional in appearance.

- Organize Your Files: Store your completed documents in a dedicated folder or cloud storage for easy access. Organizing them by date or client name helps keep everything in order for future reference.

- Send via Email: Email is one of the quickest and most professional ways to send your payment request. Attach the document and include a brief message with the payment details to ensure clarity.

- Confirm Receipt: After sending the document, it’s a good practice to follow up and confirm that the client has received it. This ensures there are no delays in the payment process.

By saving and sharing your billing documents in a secure and organized way, you help maintain professionalism and make the payment process more efficient for both parties involved.

Tracking Payments with Invoice Templates

Effectively monitoring payments is essential for managing cash flow and maintaining financial accuracy. Utilizing a well-organized billing structure allows you to easily track payments, identify overdue balances, and keep records of all transactions. A clear payment tracking system ensures you can follow up promptly and stay on top of your finances.

1. Record Payment Status

Including a payment status field on your billing document is crucial for tracking whether payments are pending, partially paid, or completed. This field should be updated as soon as payment is received to maintain up-to-date records. It helps prevent confusion and makes it easy to see outstanding balances at a glance.

2. Include Payment Due Dates

Always specify the due date for payments on your documents. This serves as a reminder for clients and helps you maintain a timeline for when payments should be made. If a payment is late, you’ll know exactly when it was due and can follow up accordingly.

Tracking payments efficiently not only improves your financial management but also builds trust with your clients by showing that you are organized and proactive in handling payments.

Legal Requirements for Pressure Washing Invoices

When creating payment documents, it is important to adhere to legal requirements to ensure compliance with tax laws and business regulations. A properly formatted billing statement not only helps maintain professionalism but also protects your business in case of disputes or audits. Knowing the key legal elements that should be included is essential for avoiding any potential legal complications.

1. Business Identification Information

Every document should include the legal name of your business, address, and tax identification number (TIN) if applicable. This ensures that the client knows exactly who they are transacting with and provides a clear point of contact should any issues arise.

2. Accurate Tax Information

In many regions, sales tax or service tax must be included in the total amount. Make sure that the tax rate is clearly stated along with the amount being charged. This is crucial for both your business and the client, as it provides transparency and ensures that all taxes are correctly handled.

Failure to include these legal elements can lead to penalties or issues with tax authorities. Therefore, ensure that your payment documents comply with local laws to protect your business interests and maintain trust with your clients.

How to Invoice Multiple Clients

When handling multiple clients, managing billing can become challenging. It is essential to ensure that each client receives a clear and accurate statement reflecting the services rendered. Streamlining the process will not only save time but also reduce the risk of errors, ensuring that you maintain a professional relationship with each client.

1. Use a Separate Document for Each Client

To avoid confusion, always create a separate payment request for each client. Even if the services are similar, keeping each billing document distinct ensures that you can easily track payments, terms, and client information. It also makes it easier to provide detailed descriptions specific to each project.

2. Keep a Consistent Format

Using a consistent layout and structure for all your billing documents helps maintain professionalism and makes it easier to manage. This includes using the same headings, sections, and format for details like service description, costs, and payment terms for every client.

By organizing and personalizing each statement while maintaining a consistent approach, you can efficiently manage multiple client payments without risking mistakes or confusion. Clear communication will enhance your client relationships and keep your accounting process smooth.

Common Invoice Mistakes to Avoid

Creating a billing document requires attention to detail to ensure accuracy and clarity. Even small errors can lead to confusion, delayed payments, or even disputes with clients. It is essential to be aware of common mistakes and take steps to avoid them to maintain a smooth and professional billing process.

1. Missing or Incorrect Client Information

One of the most frequent errors is failing to include complete or accurate client information. Double-check that the client’s name, address, and contact details are correct. Any discrepancies in this information can delay the processing of payments and cause unnecessary back-and-forth communication.

2. Unclear Payment Terms

Ambiguous or missing payment terms can lead to misunderstandings with clients. Be sure to specify the due date, accepted payment methods, and any penalties for late payments. Clearly stating these terms helps manage client expectations and ensures timely payments.

Avoiding these common mistakes will not only help streamline your billing process but also enhance your professional image and foster better relationships with your clients.

How to Get Paid Faster with Invoices

Timely payments are crucial for maintaining a healthy cash flow in any business. By implementing effective strategies, you can speed up the payment process and reduce delays. Clear, concise, and professional billing documents play a significant role in encouraging prompt payment from your clients.

1. Set Clear Payment Terms

One of the most effective ways to ensure faster payments is by setting clear and concise payment terms. This eliminates confusion and provides a clear understanding of when the payment is due and what happens if it’s late.

- State due dates: Always include a clear due date to avoid ambiguity. Specify whether it is due in 30 days, 15 days, or within another time frame.

- Late fees: Consider adding a late fee clause to encourage timely payments. This can be a percentage of the total amount or a flat fee for overdue payments.

2. Offer Multiple Payment Methods

Providing various payment options makes it easier for your clients to pay you promptly. The more convenient you make it for them, the more likely they are to pay on time.

- Bank transfers: Offer bank transfer options for those who prefer direct payments.

- Online payment systems: Accept payments through services like PayPal, Stripe, or other digital platforms that allow quick transactions.

- Credit or debit cards: Allow payments via card to speed up the process, especially for clients who may not use online transfer services.

By setting clear terms and offering convenient payment methods, you create an environment where prompt payments are more likely, helping to maintain your business’s financial stability.

Where to Find More Invoice Templates

When looking for billing documents, there are several resources available that can help streamline the process. From pre-designed options to customizable formats, these sources can save you time while ensuring that your documents are professionally crafted and meet your needs.

1. Online Platforms and Software

Many online platforms offer customizable document creation tools, allowing you to generate professional bills quickly. Some platforms provide both free and paid options, with various features to suit different business needs.

- Invoice creation websites: Websites like Invoice Ninja, Zoho, and FreshBooks offer ready-to-use designs that you can customize with your details.

- Accounting software: Software like QuickBooks and Xero also provide built-in document creation tools that can be tailored to your business.

2. Document Editing Tools

If you prefer a more hands-on approach, various document editing tools allow you to create your own billing statements from scratch. These platforms offer templates that can be easily modified to fit your specific needs.

- Microsoft Word: Word provides several basic billing document templates that can be customized according to your business requirements.

- Google Docs: Google Docs also offers free templates that are easily accessible and can be edited online.

- Canva: Canva is another option for those who want visually appealing and customizable designs.

By exploring these resources, you can find the right tools to create professional, error-free billing documents that meet both your clients’ expectations and legal requirements.