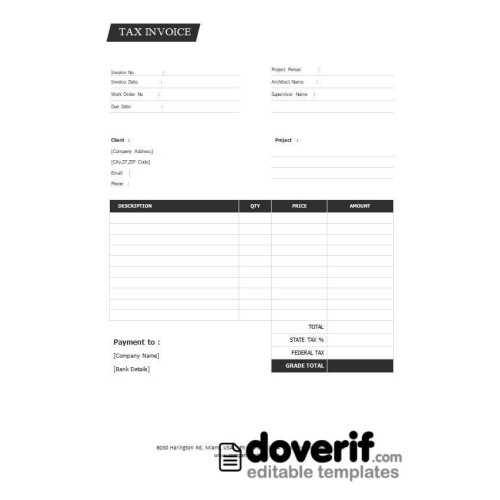

Free Tax Invoice Template in Word Format for Easy Customization

When managing a business, clear and professional billing is essential for maintaining smooth transactions and financial clarity. Creating customized payment documents can save time and ensure accuracy in every deal. Having a standardized document that fits your specific needs is a valuable tool for both small entrepreneurs and large companies alike.

Instead of manually crafting each document from scratch, you can utilize pre-designed formats that allow for easy adjustments and quick generation. These ready-made files ensure that all necessary details are included, reducing the risk of errors. Whether you’re new to managing payments or looking for a more efficient method, adopting customizable billing formats can greatly simplify your workflow.

With the right solution, you can ensure all your business transactions are well-organized and professionally presented. This not only enhances your brand’s image but also helps to keep accurate records for accounting and future reference. Learn how simple it can be to start using these tools to streamline your billing process and improve overall efficiency.

Free Tax Invoice Template Word

When managing financial transactions, having a reliable and customizable document is key to maintaining clarity and professionalism. Utilizing a structured file that can be easily modified to suit different business needs can save valuable time and effort. Such a document helps ensure all the necessary details are included and formatted correctly, streamlining the billing process and reducing the risk of mistakes.

There are many pre-designed formats available that offer flexibility while still meeting all legal and professional requirements. These editable files allow users to personalize their details, such as company name, contact information, and specific terms of payment, to match their unique needs. This approach eliminates the need to start from scratch with every transaction, making it much easier to stay organized.

Using this type of document is not just efficient; it also presents a polished image to clients and partners. Whether you are a freelancer or run a large enterprise, having a consistent and professional payment record is essential. With a few simple adjustments, these ready-to-use files ensure that you can focus more on your business operations and less on administrative tasks.

Why Use a Billing Document Format?

Having a standardized document for your financial transactions is essential for ensuring both accuracy and professionalism. Instead of manually creating each record from scratch, a pre-designed layout offers a quick and easy solution for generating consistent, error-free documents. This is particularly beneficial for businesses that handle multiple transactions and need a reliable system for managing payments.

One of the key advantages of using a ready-made structure is the time it saves. Customizing a document to fit your specific needs becomes much easier when you have a base to work from. You can quickly fill in the required details, such as buyer and seller information, services rendered, and payment terms, without worrying about formatting or missing crucial elements.

Additionally, such documents help maintain a professional appearance, ensuring that every financial interaction with clients or partners is handled smoothly. A polished and consistent presentation not only builds trust but also keeps your records organized for future reference or accounting purposes. By adopting a ready-to-use format, you streamline your workflow and reduce the risk of administrative errors, allowing you to focus more on growing your business.

How to Customize a Billing Document

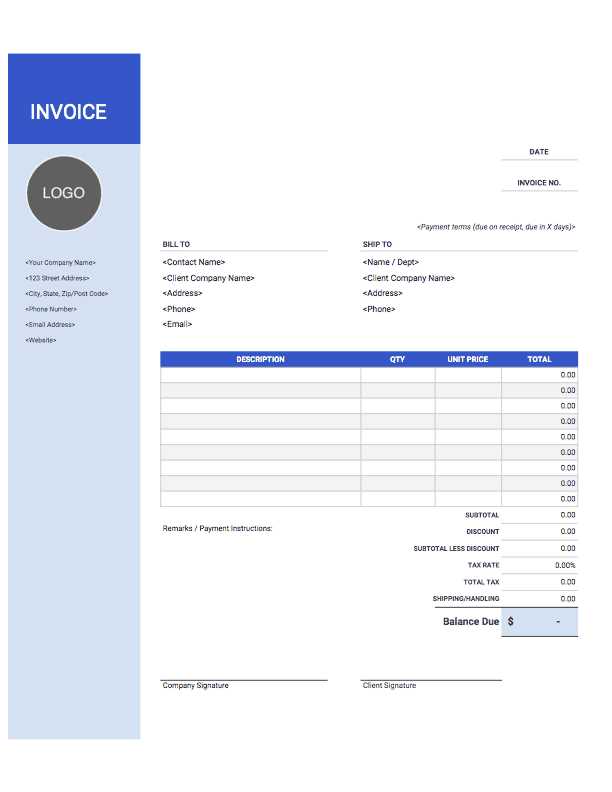

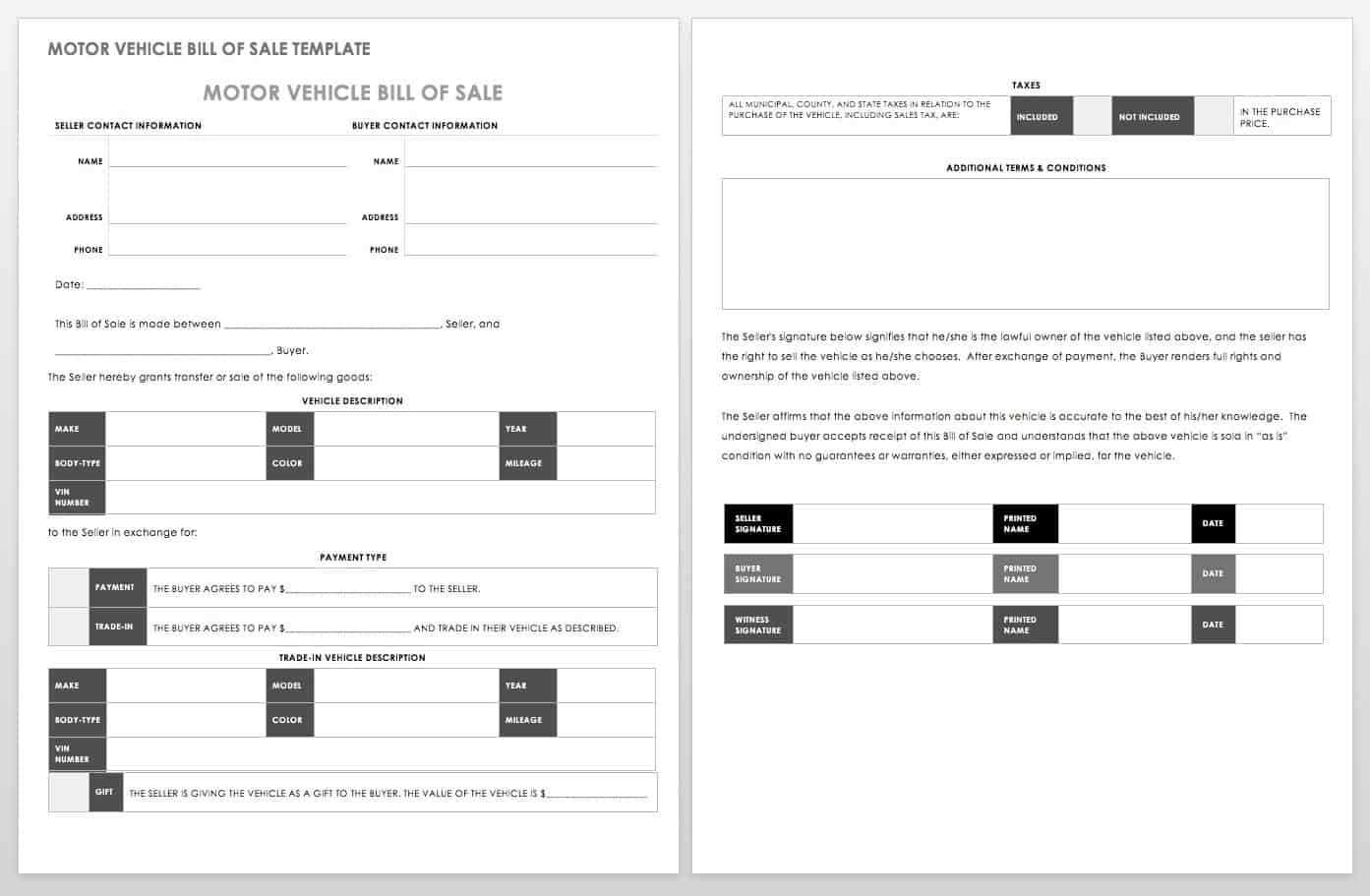

Customizing a pre-designed billing document allows you to tailor it to your specific business needs. The process is simple and can be done by adjusting key sections such as the business name, contact details, item descriptions, and payment terms. This flexibility ensures that the document reflects the unique nature of each transaction, providing clarity and accuracy for both the seller and the buyer.

Begin by replacing default information with your company’s details, including your name, address, and logo. You can also modify the layout to match your brand’s style, ensuring that the document aligns with your business’s visual identity. Additionally, be sure to update the product or service descriptions, quantities, and pricing as required, ensuring all relevant data is accurately displayed.

Once you’ve made the necessary adjustments, you can easily save the file for future use, making it available for quick access when needed. Customizing a billing document in this way not only helps you maintain a professional standard but also speeds up the administrative process, allowing you to focus more on other important aspects of your business.

Top Benefits of Using Word Templates

Utilizing pre-designed documents offers several advantages that can significantly enhance your business processes. One of the main benefits is the time saved in document creation. Rather than starting from scratch, you can quickly customize a ready-made structure to fit your specific needs, allowing you to focus on more important tasks.

Another key advantage is consistency. By using the same format for all transactions, you ensure that every document is uniform in style and content. This not only looks professional but also minimizes the risk of omitting important details, which could lead to confusion or errors. Having a standardized format helps both parties clearly understand the terms of the transaction.

Additionally, using editable formats simplifies the process of making adjustments. Whether you’re adding new items, changing pricing, or modifying contact information, the flexibility of these documents makes it easy to keep everything up to date. As a result, you can maintain accurate records while presenting a polished image to your clients and partners.

Simple Steps to Create a Tax Invoice

Creating an official document for your business transactions can be a straightforward process when you follow a few essential steps. This document serves as a record of the goods or services provided, including all necessary details for both the seller and the buyer. Here’s a simple guide to help you put together a professional and clear statement for your financial dealings.

Step 1: Add Your Business Details

Begin by including your company name, address, and contact information at the top of the document. This allows your client to easily identify the source of the statement and know where to direct any questions or payments. It’s essential that these details are accurate and clear.

Step 2: Include Client Information

Next, make sure to add the name, address, and contact details of the customer receiving the goods or services. This ensures both parties are correctly identified, reducing the chance of any confusion down the line.

Step 3: Provide a Unique Reference Number

Assigning a unique number to each document is crucial for organizational purposes. This number will help you track your records and serve as a reference in case of any future inquiries or disputes.

Step 4: List the Items or Services

Clearly describe each item or service provided. Include the quantity, unit price, and total cost for each entry. It’s important to be as detailed as possible, ensuring that the buyer understands exactly what they are paying for.

Step 5: Add the Payment Terms

Specify the payment conditions, including the total amount due, any applicable discounts, and the due date. This ensures both parties are on the same page regarding when and how payment should be made.

Step 6: Review and Finalize

Before finalizing the document, review all the details carefully. Double-check the accuracy of the amounts, client information, and any other specifics to avoid any mistakes. Once everything looks good, you can save or print the document for submission.

How to Add Your Business Information

Incorporating your company’s details in any official document is essential for clarity and professionalism. This information not only ensures that your clients can easily contact you but also serves as a legal identifier for your business transactions. Here’s how to properly include all the necessary business details in a formal statement.

Step 1: Business Name

The first thing to include is your company’s official name. It should be prominently displayed at the top of the document, typically in bold, to make it easily identifiable. This name should match the registered business name used for tax and legal purposes.

Step 2: Business Address

Below the business name, list the full physical address of your office or place of operation. This ensures your clients know where you’re located and can send any correspondence or payments if necessary.

Step 3: Contact Information

Provide your company’s phone number, email address, and website (if applicable). This makes it easier for your clients to reach out to you with any questions or inquiries regarding the transaction.

Step 4: Registration Number and Tax ID

If applicable, include your business registration number and tax identification number. These numbers help verify your business’s legitimacy and provide transparency for your clients.

Step 5: Company Logo

To add a personal touch and enhance your company’s branding, you may also choose to include your logo. While not mandatory, it’s a good practice for creating a professional-looking document.

| Business Detail |

|---|

| Section | Details |

|---|---|

| Unique Document Number | 123456 |

| Date of Issue | March 1, 2024 |

| Seller’s Information | ABC Company, 123 Business St., City, Country |

| Buyer’s Information | XYZ Ltd., 456 Market Ave., City, Country |

| Description of Goods/Services | Product A – 5 units, Service B – 2 hours |

| Total Amount Due | $500 |

| Payment Terms | Due by March 15, 2024, via bank transfer |

Including these essential details in your business documents ensures transparency and professionalism, making it easier to manage transactions and maintain accurate records for both parties involved.

Common Mistakes in Tax Invoices

When creating a formal document to record a business transaction, it’s easy to overlook some crucial details that can lead to confusion or disputes. Even small errors can cause problems down the line, whether with payment, tax reporting, or record-keeping. Understanding common mistakes in these documents can help you avoid costly mistakes and ensure that your records are accurate and professional.

Frequent Errors to Watch For

Here are some of the most common mistakes people make when preparing official transaction records:

- Incorrect or Missing Document Number: Failing to include a unique reference number or using duplicate numbers can make it difficult to track records or cause confusion when referencing past transactions.

- Inaccurate Dates: Whether it’s the issue date, payment due date, or delivery date, inaccuracies can lead to miscommunication. Ensure all dates are accurate and aligned with the transaction terms.

- Missing Seller or Buyer Details: Omitting essential information such as the full business name, contact details, or addresses can lead to confusion, delays, or even legal issues in case of a dispute.

- Incorrect Item Descriptions: Not providing a clear description of the products or services, or listing the wrong quantity, can result in misunderstandings and disputes. Always double-check item descriptions and quantities.

- Errors in Pricing and Totals: Mathematical errors in unit prices, totals, or taxes can cause discrepancies and lead to overcharging or undercharging. Always double-check calculations before finalizing the document.

How to Ensure Invoice Accuracy

Achieving precision in billing documents is essential for maintaining smooth financial transactions and fostering trust with clients. An accurate document not only helps avoid confusion but also reduces the likelihood of disputes. To ensure correctness, it’s crucial to pay attention to several key factors throughout the creation process.

Double-checking details is the first step in preventing errors. Verify the recipient’s information, including the name, address, and contact details. Any discrepancies could delay payment or lead to miscommunication.

Clear and precise itemization is another important aspect. Each product or service should be listed with clear descriptions, quantities, and agreed-upon pricing. Ensuring that all charges are correctly applied is essential for avoiding misunderstandings later on.

Moreover, calculating totals carefully is critical. Double-check the math, including taxes, discounts, and any other applicable fees. Small mistakes in adding up numbers can have significant consequences, so always use reliable tools or methods to calculate totals accurately.

Reviewing dates and terms also plays a vital role. Ensure that the date of issue, due dates, and any agreed-upon payment terms are correct. Inconsistent or outdated terms can lead to unnecessary delays or confusion for both parties.

Finally, it’s important to have a second pair of eyes review the document before sending it. Having someone else go over the details can catch mistakes that you might have missed, helping to ensure that everything is correct before finalizing the transaction.

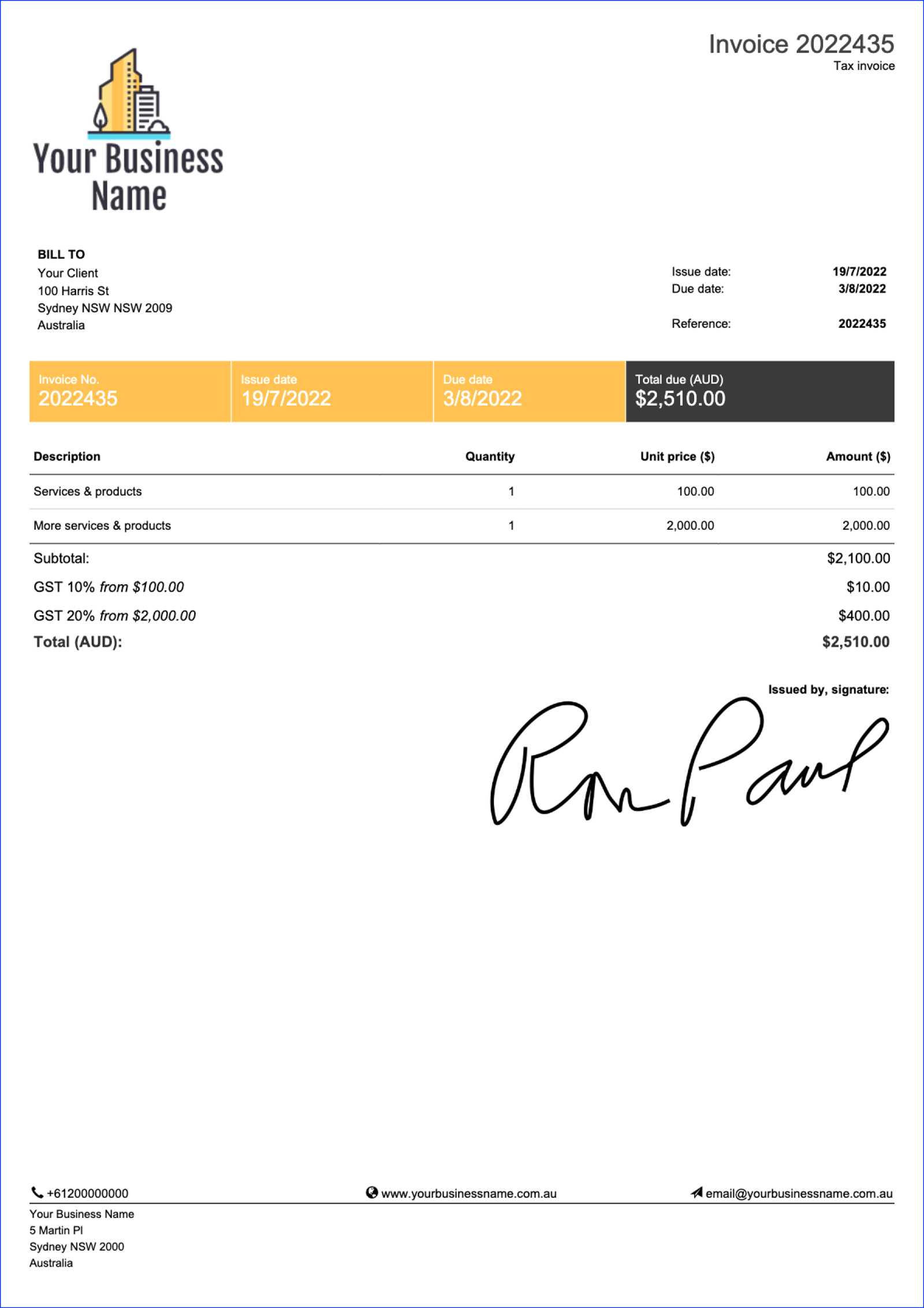

Customizing Invoice Layouts in Word

When creating professional billing documents, personalizing the layout to fit your brand and business style is key. A well-organized design not only enhances readability but also reinforces the professionalism of your business. Modifying the structure of your document allows you to present all the necessary details in an intuitive and visually appealing way.

Choosing the Right Structure

The first step is to select an appropriate layout that suits the needs of your business. A clear and simple arrangement ensures that all relevant information is easy to find. Here are some essential elements to consider:

- Header: This section should include your business name, logo, and contact details. Make sure the font is readable and the design reflects your brand identity.

- Client Information: Organize the recipient’s details, including name, address, and phone number, in a clean and clear manner.

- Itemized List: Each product or service provided should be clearly separated and easy to distinguish. Include columns for quantities, descriptions, and prices.

- Total Amount: Clearly highlight the total sum, including taxes, discounts, and any additional fees to avoid confusion.

Editing the Layout

Once you’ve chosen a basic structure, you can modify the layout by adjusting fonts, colors, and spacing to fit your preferences. Here are a few tips for customizing the design:

- Modify the Margins: Adjusting the margins can help give the document a cleaner look or provide more space for additional details.

- Use Tables: Insert tables for a structured format that makes it easier to align information and improve readability.

- Incorporate Branding: Add your logo and use brand colors to make your document stand out and be instantly recognizable.

- Adjust Fonts and Styles:

Tips for Professional Invoice Design

Creating a well-designed billing document is essential for leaving a lasting impression on your clients. A polished and professional layout helps convey your attention to detail and enhances trust. By incorporating clean design elements, clear structure, and consistent branding, you ensure that your document is both effective and visually appealing.

Maintain a Clean and Simple Layout

A cluttered or overly complex design can confuse the recipient and diminish the overall professionalism of the document. Keep the layout simple and organized by focusing on the key information. Here are some pointers:

- Use White Space: Adequate spacing between sections and around text helps improve readability and gives your document a more open and organized appearance.

- Stick to a Grid: Aligning text and numbers using a grid system ensures consistency throughout the document and creates a structured, balanced look.

- Limit Color Usage: While using color can enhance the design, avoid excessive colors that may distract from the content. Choose a color scheme that matches your branding.

Incorporate Brand Identity

Including elements of your brand, such as your logo, color palette, and font choices, not only makes your document more professional but also reinforces your business identity. Consider the following:

- Logo Placement: Position your logo prominently at the top of the document, where it is easily seen by your client.

- Consistent Fonts: Use fonts that align with your brand style guide. Limit the use of different fonts to two or three to maintain a cohesive look.

- Professional Typography: Choose legible and clear fonts for all sections of the document. Avoid using overly decorative or hard-to-read fonts.

By

How to Use Tax Invoices for Accounting

Properly managing billing records is crucial for maintaining accurate financial records and ensuring smooth accounting operations. These documents serve as an essential tool for tracking sales, monitoring expenses, and managing cash flow. Using them effectively within your accounting system helps to ensure compliance and provides a clear overview of your business’s financial health.

Recording Transactions: Each billing document acts as proof of a transaction. When you receive or issue a billing statement, it should be entered into your accounting software or ledger. Ensure that you capture details such as the date, the goods or services provided, amounts, and payment terms. This will help you keep track of both income and expenses accurately.

Tax Calculation and Reporting: For businesses that are subject to tax, billing documents are critical for calculating the amounts due. They outline applicable charges, rates, and the total sum, including any applicable percentages. Properly documenting these charges will assist you in preparing accurate tax returns and in ensuring you’re compliant with local tax laws.

Cash Flow Management: Monitoring the status of pending payments through these documents allows you to manage your cash flow efficiently. Make sure to keep track of the due dates and follow up on any outstanding amounts. This can help you avoid late fees and potential issues with clients who delay payments.

Auditing and Compliance: These documents also play an important role during audits. Having a well-organized record of all transactions makes it easier for auditors to verify your business’s financial activities. Store these documents securely and in an organized manner to ensure easy retrieval when needed.

By integrating these records into your regular accounting processes, you streamline financial management and ensure that