Download the Best Ms Excel Invoice Template for Easy and Professional Billing

Creating clear and effective billing documents is essential for any business or freelancer. Whether you’re managing small transactions or larger projects, having a streamlined system for invoicing can help maintain professionalism and ensure timely payments. In this guide, we explore how you can easily design custom billing documents that suit your unique needs.

With the right tools, you can generate professional-looking statements that are not only easy to fill out but also help you stay organized. Customizing these documents allows you to add all the necessary information without overwhelming the recipient, ensuring a smooth payment process. This approach is particularly valuable for small business owners or independent contractors who require flexibility and efficiency in their billing methods.

Efficient and customizable solutions can make a significant difference in your financial workflow. By leveraging simple features, you can automate calculations, track payments, and reduce errors. Whether you’re new to creating these documents or looking to improve your current system, understanding the essentials of these tools can help you get the most out of your billing practices.

Ultimate Guide to Ms Excel Invoice Templates

Creating a professional billing document is essential for any business to ensure proper record-keeping and smooth financial transactions. This guide will walk you through everything you need to know to design and customize a billing form that meets your specific needs, from simple formats to more complex, feature-rich versions. Whether you are a freelancer, a small business owner, or part of a larger organization, mastering this process will help streamline your operations and enhance professionalism in your financial dealings.

Why Use a Custom Billing Form?

Customizing your billing document allows you to tailor it to your business’s branding, add necessary fields, and create an easy-to-use structure. With a personalized design, you ensure that your clients have clear and organized details about the services rendered, payment terms, and other important information. This customization helps build trust and promotes a smoother transaction process, making it easier for clients to understand the charges and make prompt payments.

Key Features to Include

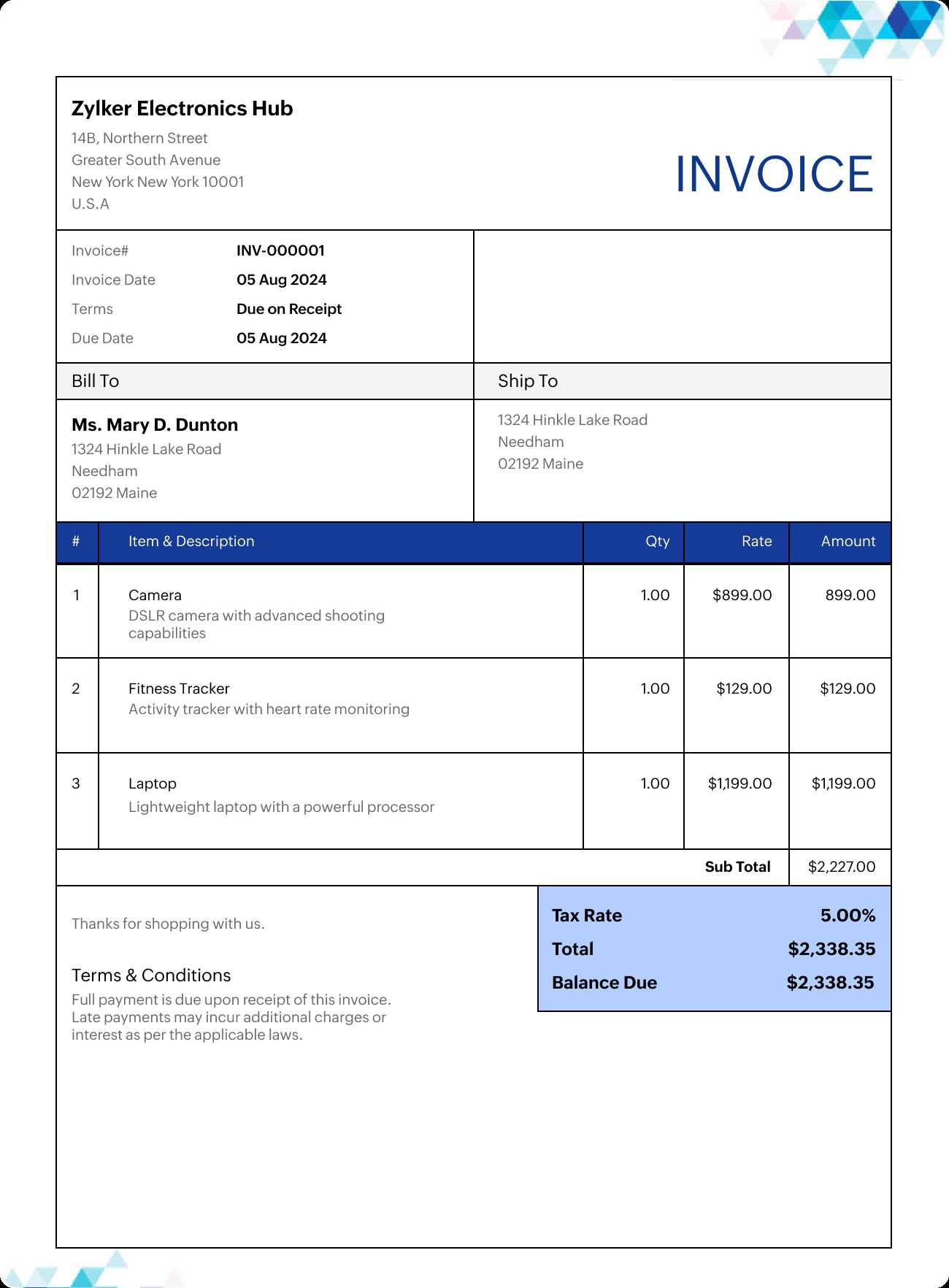

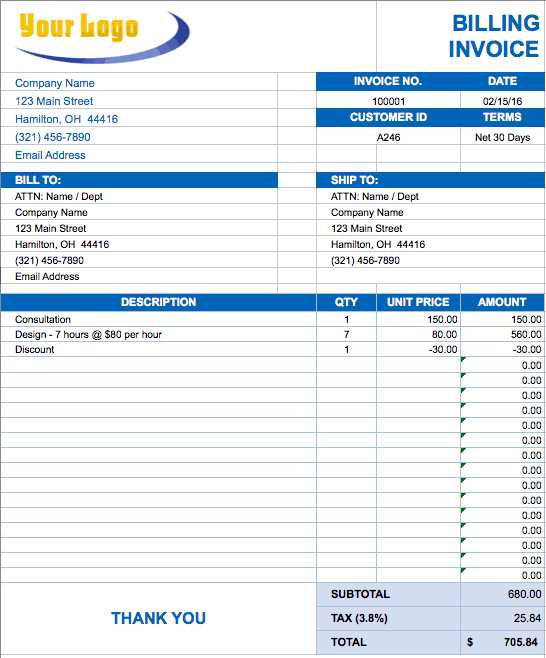

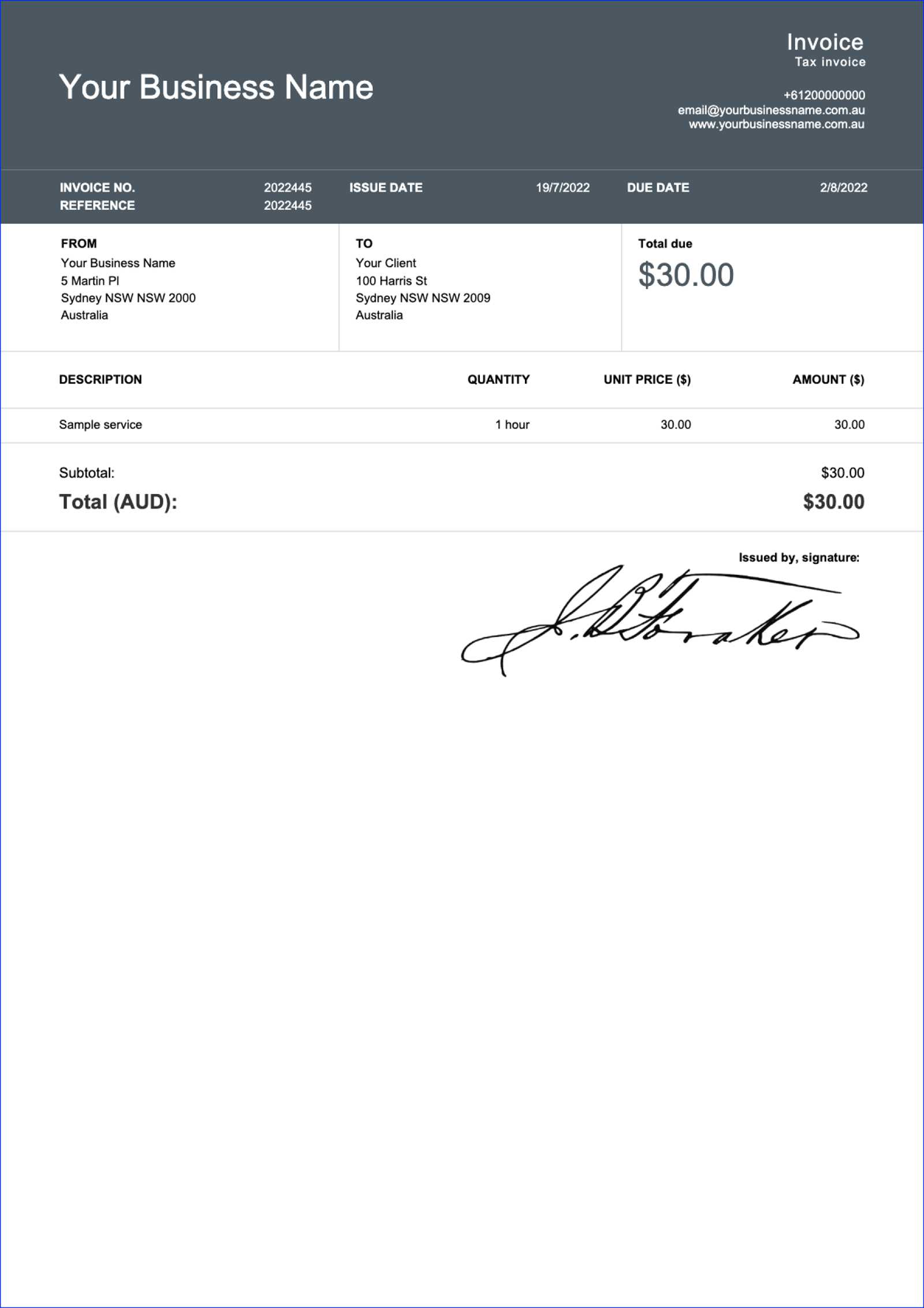

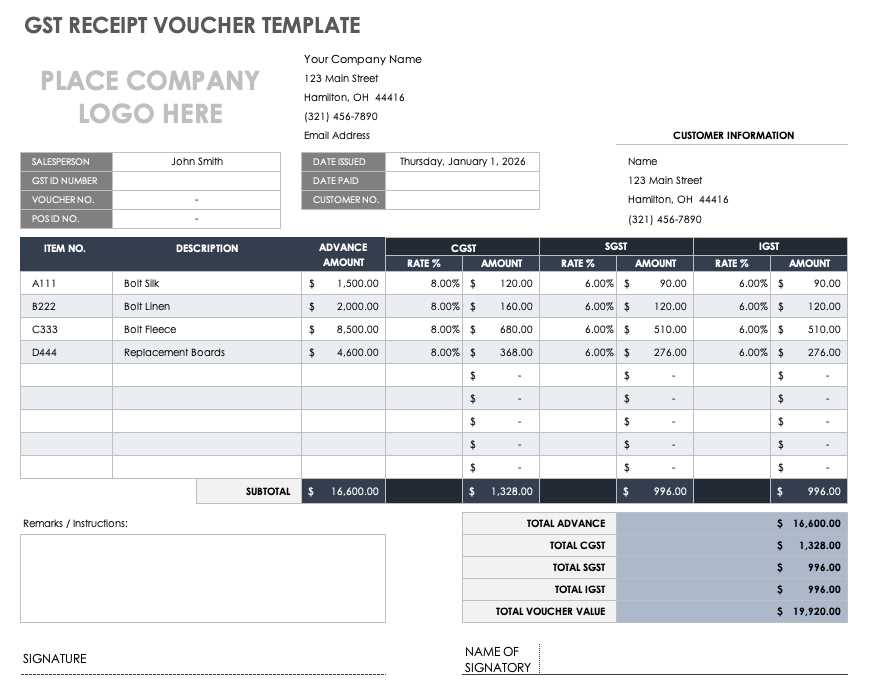

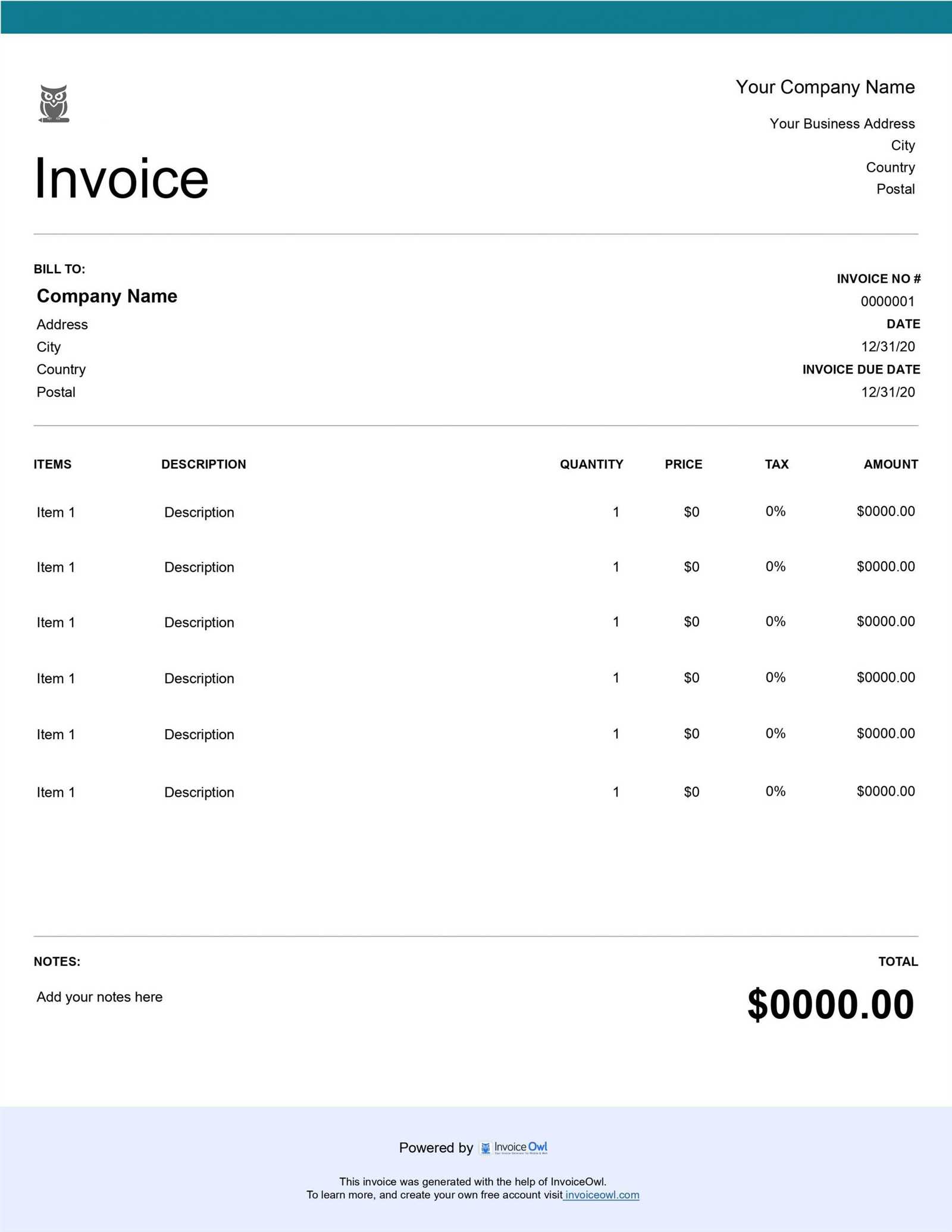

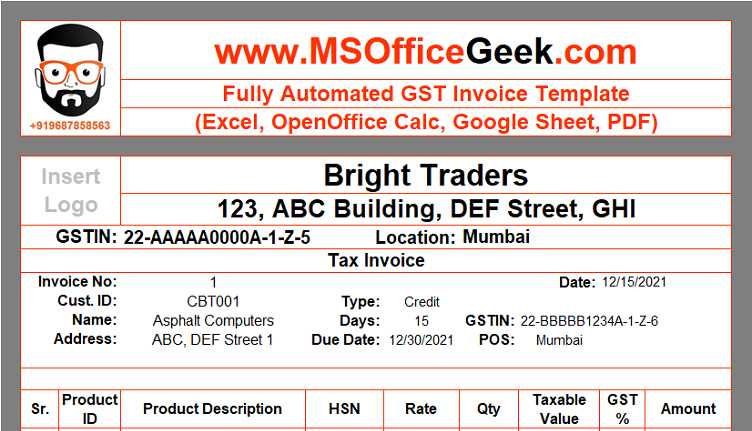

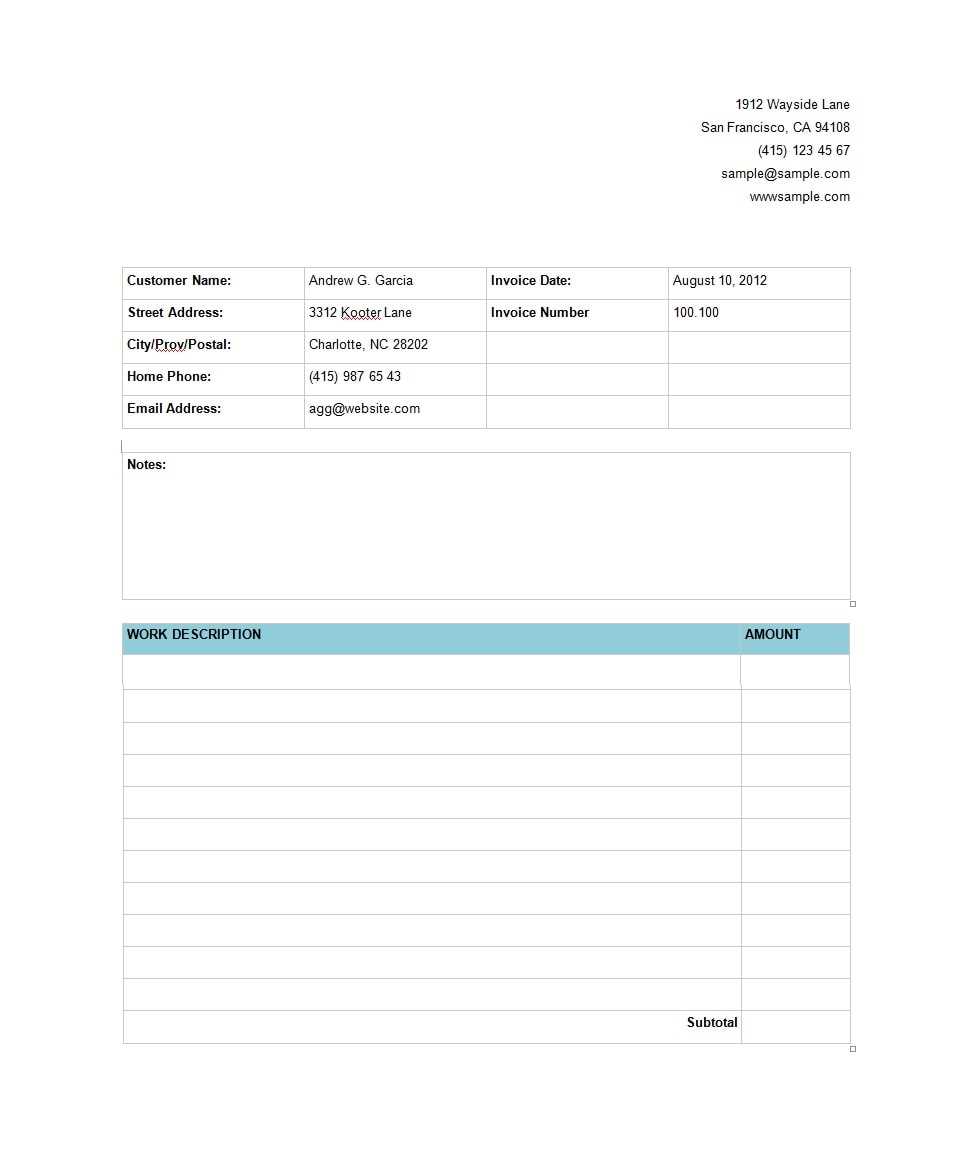

When designing your billing document, it’s crucial to include all the necessary fields to avoid confusion and ensure completeness. Key elements typically include the business name, contact details, the recipient’s information, a list of products or services, payment terms, and the total amount due. Advanced features like automatic calculations and the ability to track payments can also save time and reduce human error, making the entire process more efficient.

Why Choose Excel for Invoicing

When it comes to creating professional billing documents, using a widely available and flexible software program offers numerous advantages. The ability to customize, automate calculations, and easily manage data makes this tool a popular choice for individuals and businesses alike. It provides a simple yet powerful solution that enhances the efficiency and accuracy of financial transactions without requiring advanced technical skills.

Flexibility and Customization

The key reason for choosing this software is its high level of customization. You can design your billing form to match your specific needs, adding or removing fields as required. Custom formats allow for the inclusion of company logos, payment instructions, and any unique details, making the document truly personalized. Furthermore, with a wide range of functions, users can adapt the system to various billing structures and scenarios.

Automation and Efficiency

Another significant benefit is the ability to automate repetitive tasks, such as calculating totals, applying discounts, or tracking payment statuses. Built-in formulas ensure accuracy and reduce the risk of human error, making the entire process quicker and more reliable. Users can focus on the content rather than manually computing sums, ensuring both efficiency and precision in financial reporting.

| Benefit | Advantage | ||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Customization | Tailor forms to business needs, adding or removing fields | ||||||||||||||||||||||||||||||||

| Automation | Automatically calculate totals and track pa

How to Create a Custom InvoiceDesigning a personalized billing document that fits the needs of your business can seem daunting, but with the right approach, it’s a straightforward process. By starting with a clean and organized layout, you can ensure that all the necessary information is clearly presented, making it easier for your clients to understand and process their payments. Customizing a document allows you to include only the relevant fields, making it both professional and functional. Step 1: Set Up the Layout

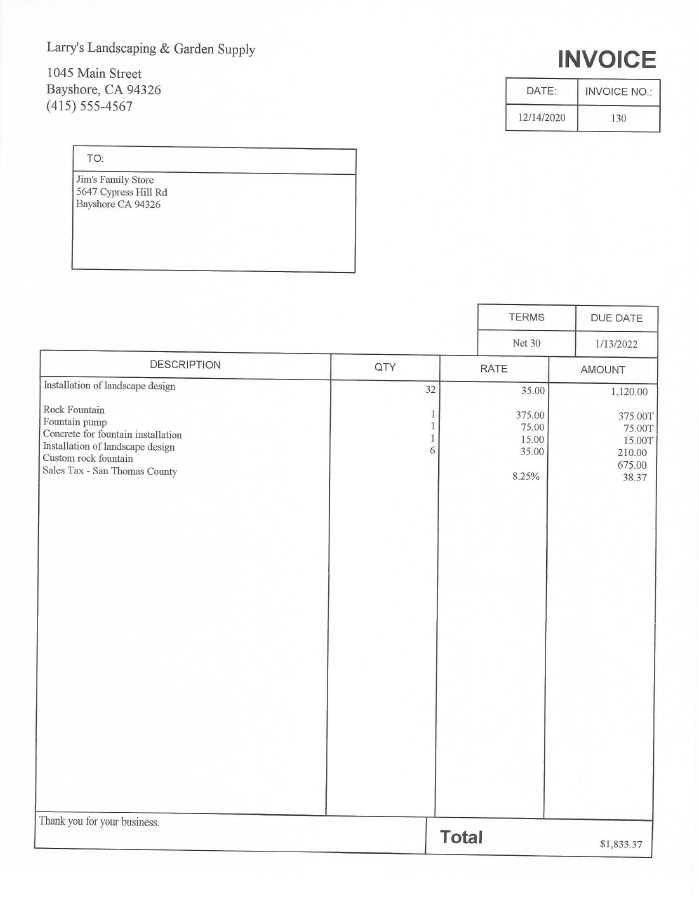

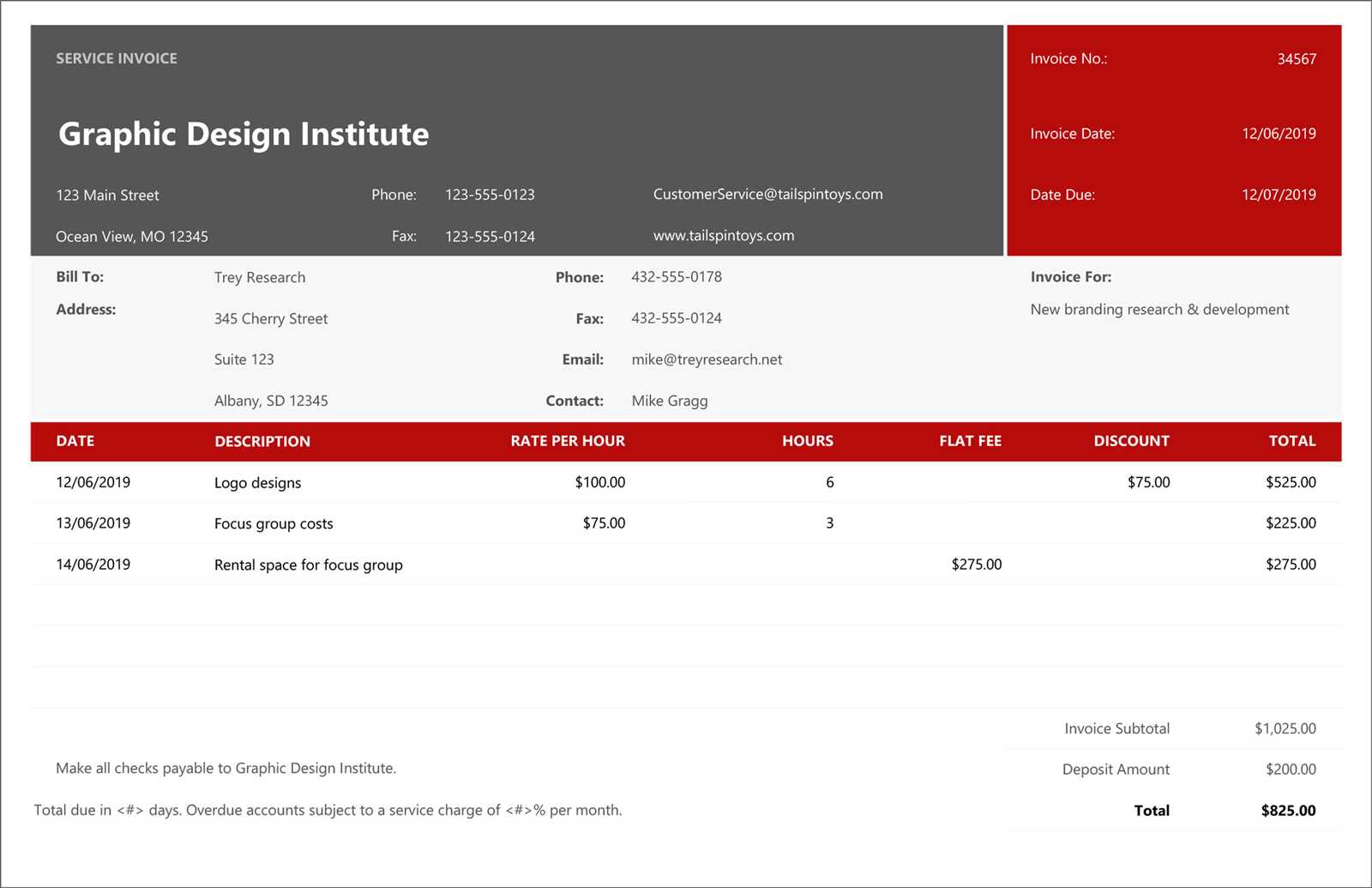

Start by structuring the document in a way that is easy to navigate. Begin with your business name and contact details at the top, followed by the client’s information. Then, create sections for a detailed list of services or products provided, including quantities, rates, and totals. The layout should be clean and uncluttered to ensure readability and to avoid overwhelming the recipient with unnecessary information. Step 2: Add Key InformationAfter setting the layout, it’s important to include all essential fields. These include the date of issue, payment terms, and a unique reference number for tracking purposes. Don’t forget to include the total amount due, as well as any taxes or discounts applied. Additionally, providing clear payment instructions and contact information helps to facilitate smooth transactions and resolve any questions your client may have. Top Features of Excel Invoice Templates

When creating billing documents, having certain features can significantly enhance both the functionality and professionalism of the final product. From automation tools that streamline calculations to customizable designs that reflect your brand, these features are essential for anyone looking to improve their financial processes. A well-designed document can save time, reduce errors, and create a more polished experience for both the sender and the recipient. One of the most valuable features is the ability to automatically calculate totals, taxes, and discounts, which ensures accuracy and reduces the likelihood of human error. Customizable fields allow users to tailor the document to their specific needs, whether that’s adding extra details or adjusting the layout for different types of services or products. Additionally, the inclusion of payment tracking helps users stay on top of pending and completed transactions, providing a clear record for both parties. Free vs Paid Excel Invoice Templates

When creating professional documents for billing purposes, choosing between free and premium options can be a challenge. Both types offer advantages, but they differ significantly in terms of features, customization, and overall quality. Whether you’re a small business owner or a freelancer, the decision often comes down to your specific needs and budget. Advantages of Free TemplatesFree tools can be a great starting point, especially for individuals or businesses that are just getting started and need a simple solution without investing money upfront. These options typically include basic layouts that allow for quick customization. Many free options are readily available online and can be downloaded with minimal effort. However, while they are accessible, their functionality may be limited, and they might lack advanced features such as automatic calculations or customizable design elements. Benefits of Premium TemplatesPaid solutions, on the other hand, tend to offer more robust features. They often come with professional-grade layouts, better aesthetics, and advanced capabilities such as auto-calculation for totals, taxes, and discounts. Premium options also provide more flexibility when it comes to customization, enabling users to tailor the document to better suit their branding and specific business needs. For those who prioritize quality and efficiency, investing in a paid option may be worthwhile in the long run. Step-by-Step Excel Invoice SetupSetting up a billing document from scratch can seem overwhelming, but with a few simple steps, you can create a professional-looking and efficient file. Whether you’re managing client transactions or tracking payments, organizing the information in a structured way helps ensure accuracy and clarity. Here’s a quick guide to help you set up a customized billing document that meets your specific Essential Fields in an Invoice TemplateCreating a professional billing document requires attention to detail, with certain key elements being crucial for clarity and functionality. These fields not only ensure proper communication between the service provider and the client but also help streamline the payment process. Here are the most important components to include in a well-structured document. 1. Contact InformationOne of the first things to include is the contact information for both parties. This should cover the provider’s name, business address, phone number, and email, as well as the recipient’s details. Accurate contact information ensures that any issues or questions can be resolved promptly. Additionally, it’s useful to include a website or social media links if applicable. 2. Detailed Billing ItemsA comprehensive list of the goods or services provided is essential for clarity. For each item, provide a description, quantity, unit price, and the total amount for that line. Including this breakdown makes it easier for clients to understand exactly what they are being charged for, minimizing disputes and confusion. Ensure the layout is clear and organized for easy reading. Tips for Professional Invoice DesignA well-designed billing document not only conveys important financial information but also reflects your business’s professionalism. The layout, clarity, and overall aesthetic of the document can influence the perception of your brand and help ensure timely payments. Here are some key tips for creating a polished and effective billing document. 1. Keep It Clean and OrganizedA cluttered or disorganized layout can confuse clients and lead to errors. Use clear headings, ample white space, and consistent formatting to make the document easy to read. Ensure that all relevant sections are logically arranged and easy to find. A well-organized design helps avoid mistakes and allows for quicker review and approval. 2. Use a Clear Table for Billing ItemsA table is the most efficient way to present the details of the products or services provided. The rows should be neatly aligned with clear columns for descriptions, quantities, unit prices, and totals. This makes it easier for your client to understand the breakdown of charges. Here’s an example of how to format the table:

Sharing Your DocumentOnce your document is saved, sharing it with others can be done in several ways. If you’re using a cloud storage service, you can simply send a link to the file. Alternatively, you can attach the file to an email or send it through a file-sharing platform. Ensure that the recipients have the appropriate software to view or edit the document as needed. Additionally, using password protection for sensitive financial data can add an extra layer of security when sharing your document online. By properly saving and sharing your financial records, you can ensure that all parties involved have the information they need while keeping your data secure and well-organized. Customizing Your Template for BrandingPersonalizing your document to reflect your business’s identity is a key step in creating a professional and cohesive appearance. By incorporating your brand’s colors, logos, and fonts, you can make your financial records look polished and aligned with your overall branding strategy. This not only helps reinforce your brand’s image but also adds a level of professionalism that enhances your credibility with clients and partners. To start, focus on the visual elements that make your business unique. Adding your company logo to the header of the document ensures immediate recognition. You can also adjust the color scheme to match your brand’s palette, using your primary and secondary colors for headings, borders, and background shading. This consistency across all documents will help to make your business easily recognizable in all communications. In addition to colors and logos, customizing the fonts is an important aspect of brand identity. Choose fonts that align with the tone of your business–whether modern, classic, or playful–and apply them consistently throughout the document. This can make a simple record appear more polished and professional, and it also gives a cohesive feel to all business documents. Finally, consider adding custom fields or text that reflect your brand’s voice, such as a personalized message in the footer or a tagline that reinforces your values. Small touches like these create a more memorable experience for recipients and can improve brand recall. |