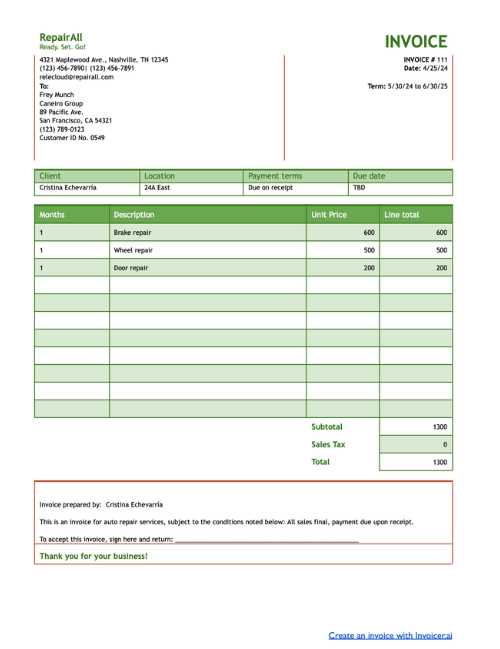

Best Mechanic Invoice Template Excel for Easy Billing and Payment Management

For any professional providing repair services, organizing and managing payments efficiently is crucial. Whether you’re running a small shop or offering mobile assistance, keeping track of the services rendered and corresponding payments can quickly become a time-consuming task. The right tool can save you time, reduce errors, and ensure your business stays organized and professional.

One of the most effective ways to simplify this process is by using a digital solution designed to handle financial transactions. Customizable spreadsheets allow for quick data entry, automatic calculations, and easy tracking of pending or completed payments. With such systems, creating and managing financial records becomes a streamlined process that helps maintain clarity and avoid costly mistakes.

In this guide, we will explore how simple yet powerful tools can enhance your business operations. You’ll learn how to create personalized documents that fit your unique needs, ensuring a smooth workflow and accurate record-keeping every time you issue a payment request. These tools not only help with invoicing but also with client relations, giving your business a professional edge.

Why Use a Mechanic Invoice Template

For any service-based business, keeping financial transactions organized and professional is essential for smooth operations. Using a structured document for billing not only saves time but also ensures accuracy, reduces human error, and helps create a more trustworthy relationship with clients. A standardized approach allows service providers to quickly outline charges, labor hours, and any additional fees in a clear and concise manner.

Consistency and Professionalism

One of the main reasons to adopt a pre-designed document for charging clients is the consistency it offers. Using a uniform format for every transaction ensures that all necessary details are included and that each client receives the same level of service. It enhances your business’s image, demonstrating organization and attention to detail. Clients are more likely to trust a professional-looking statement, which can ultimately lead to faster payments and more repeat business.

Time Efficiency and Ease of Use

By utilizing a ready-made document, service providers save valuable time that would otherwise be spent creating billing statements from scratch. These documents are designed to be user-friendly, with pre-set sections for all required information. With just a few clicks, you can fill in the details, adjust quantities or rates, and send the statement. This efficiency allows you to focus more on delivering quality work rather than managing administrative tasks.

Benefits of Excel for Invoice Creation

When it comes to managing financial records and creating billing statements, spreadsheets provide a versatile and efficient solution. These digital tools offer a wide range of features that make it easier to calculate, organize, and track payments in a clear, structured way. Their flexibility allows service providers to adjust data quickly, ensuring accuracy and reducing time spent on manual calculations.

One of the key advantages of using spreadsheets for billing is their ability to automate complex calculations. With built-in formulas, users can automatically add totals, apply taxes, or calculate discounts, reducing the risk of errors. This automation speeds up the process and ensures that every document is correct, even with large amounts of data.

Additionally, spreadsheets allow for easy customization. Whether you need to add specific details about services rendered or adjust the layout for branding purposes, you can tailor the document to suit your needs. With a few simple tweaks, you can create a professional-looking statement that aligns with your business style and requirements.

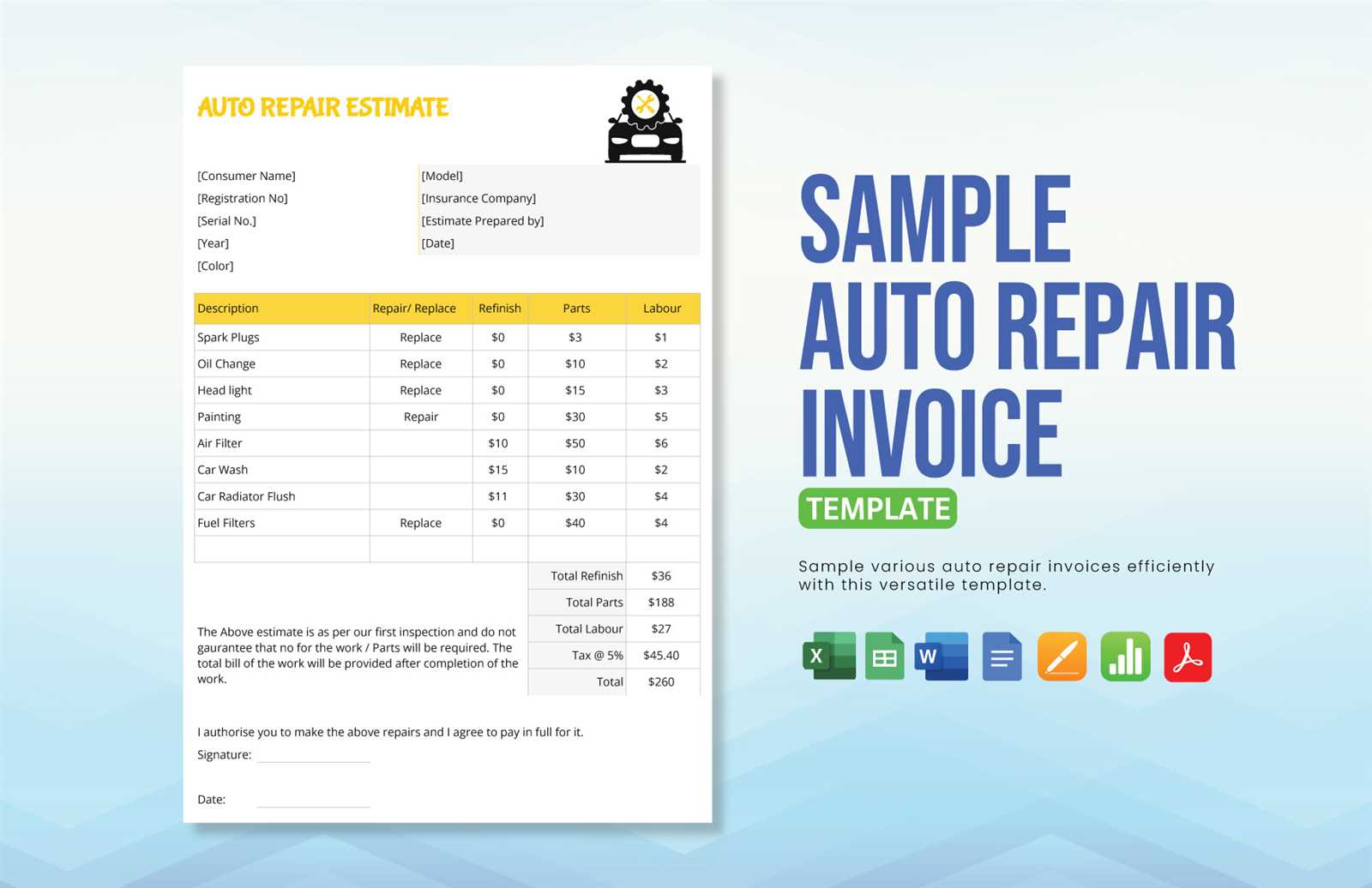

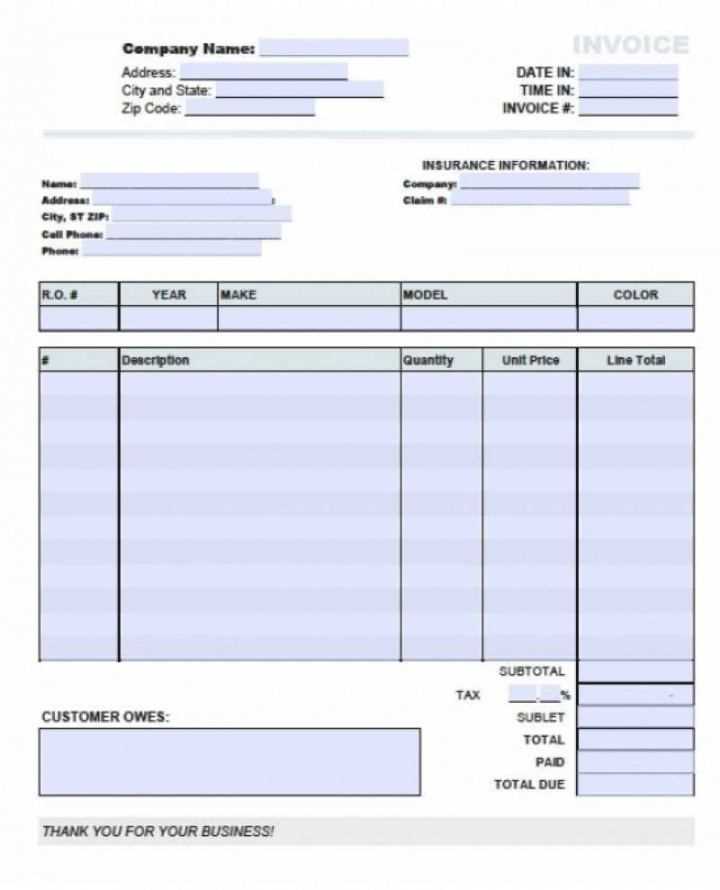

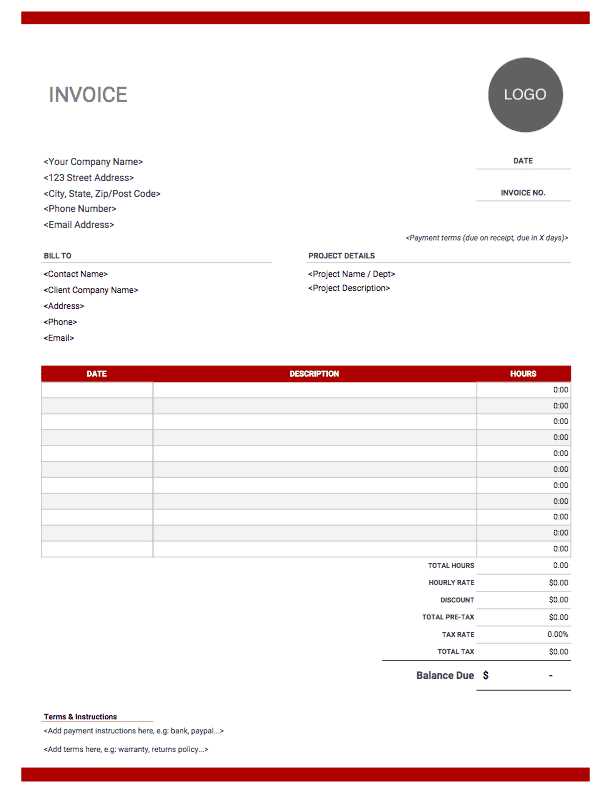

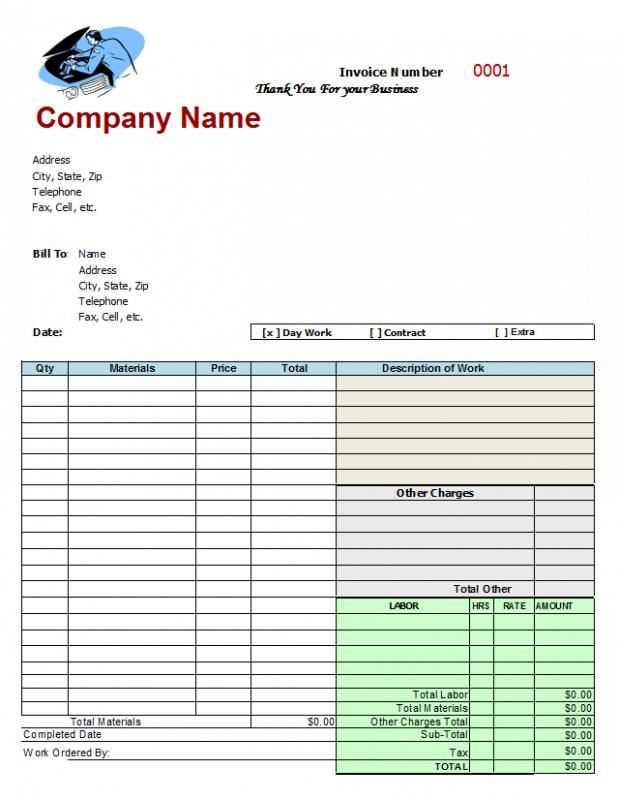

How to Customize a Mechanic Invoice

Creating a personalized billing statement allows you to ensure it meets the unique needs of your business while maintaining professionalism. Customizing a document not only helps you reflect your brand identity but also ensures that all essential information is clearly displayed for your clients. Whether you are adding your logo, adjusting the layout, or including specific service details, customization can make your statements both functional and visually appealing.

To start personalizing your billing document, focus on the following key areas:

| Area | How to Customize |

|---|---|

| Header | Add your business name, logo, and contact information. You can also include a slogan or any important message you want clients to see first. |

| Client Information | Ensure the customer’s name, address, and phone number are clearly listed. This allows for easy identification and communication. |

| Service Details | List the services provided, including quantities, rates, and descriptions. Tailor these sections based on the specific job to ensure all relevant information is captured. |

| Payment Terms | Include payment due dates, accepted payment methods, and any late fees or discounts. This will clarify payment expectations for your clients. |

Once these elements are customized, you can further adjust the design, such as changing fonts, colors, or borders, to create a polished look that matches your brand’s visual identity. Customizing your documents not only makes them more professional but also adds a personal touch, which can strengthen your relationships with clients.

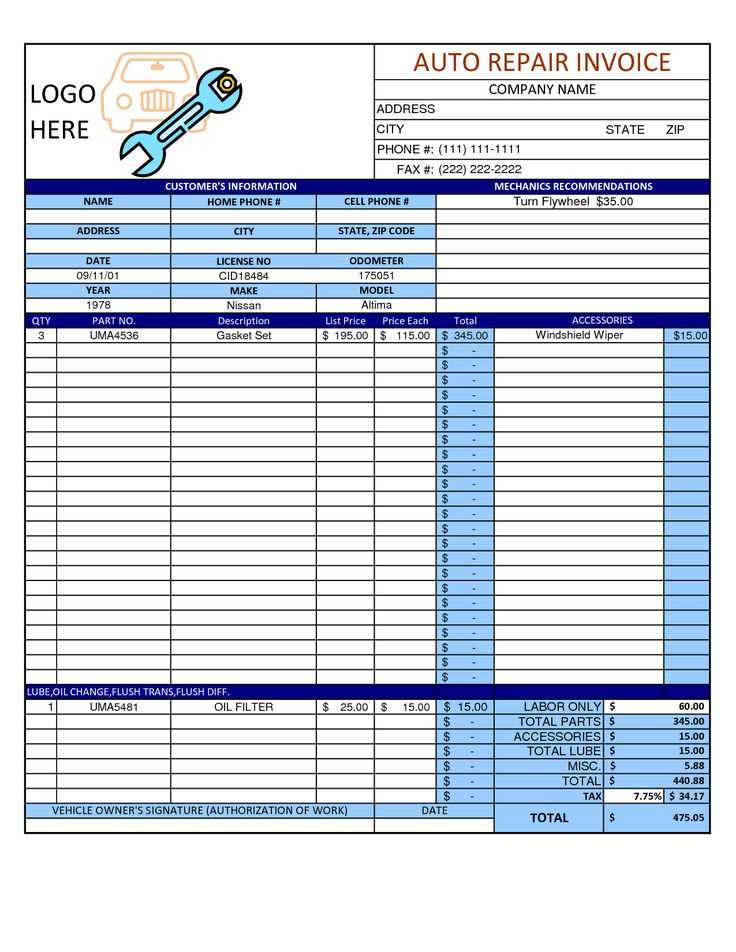

Key Features of an Invoice Template

A well-designed document for billing should include several essential features to ensure clarity, accuracy, and ease of use. These key elements not only help you present a professional image but also make it easier for your clients to understand the charges, payment terms, and other critical details. Whether you’re issuing a bill for repairs, services, or goods, the right structure can make a significant difference in how smoothly the transaction is processed.

Essential Information for Clarity

One of the most important aspects of a well-structured billing document is that it clearly outlines all relevant information. This includes the service provider’s contact details, client information, a detailed description of the work performed, itemized charges, and the total amount due. Ensuring that these details are easy to find and read is essential for smooth communication with your clients.

Automation and Calculation Features

Another critical feature is the ability to automate calculations. With an effective billing document, you can quickly calculate totals, apply taxes, and account for discounts or additional fees. This reduces the risk of errors and speeds up the process, allowing you to focus more on your business and less on administrative tasks. Automated formulas make it easy to update figures without worrying about manual math or mistakes.

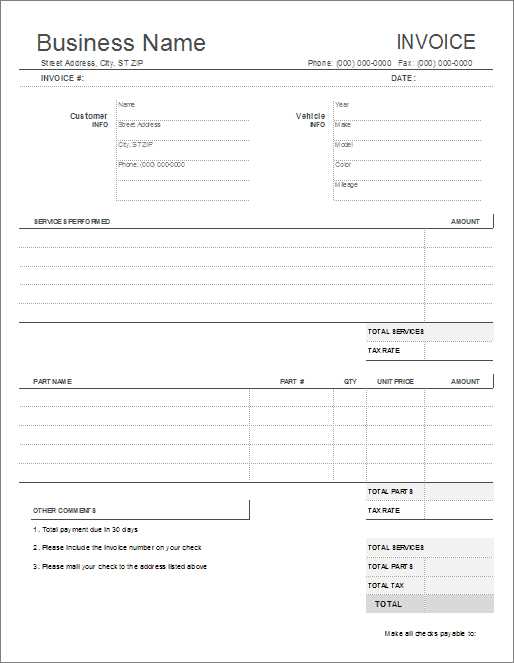

Step-by-Step Guide to Creating an Invoice

Creating a detailed and accurate billing statement is essential for keeping your business organized and ensuring prompt payment from clients. By following a straightforward process, you can efficiently generate professional documents that include all the necessary information, reducing the risk of errors and misunderstandings. Below is a simple step-by-step guide to help you craft a clear and comprehensive statement every time.

Step 1: Open Your Document

Start by opening a new document on your preferred tool or platform. If you are using a pre-designed structure, ensure it’s compatible with your needs. Set up the basic layout, including space for your business details, client information, and the billing items.

Step 2: Add Business and Client Information

Include your business name, logo, address, and contact details at the top. Below that, list the client’s name, address, and contact details. This section ensures that both parties are clearly identified and facilitates easy communication if needed.

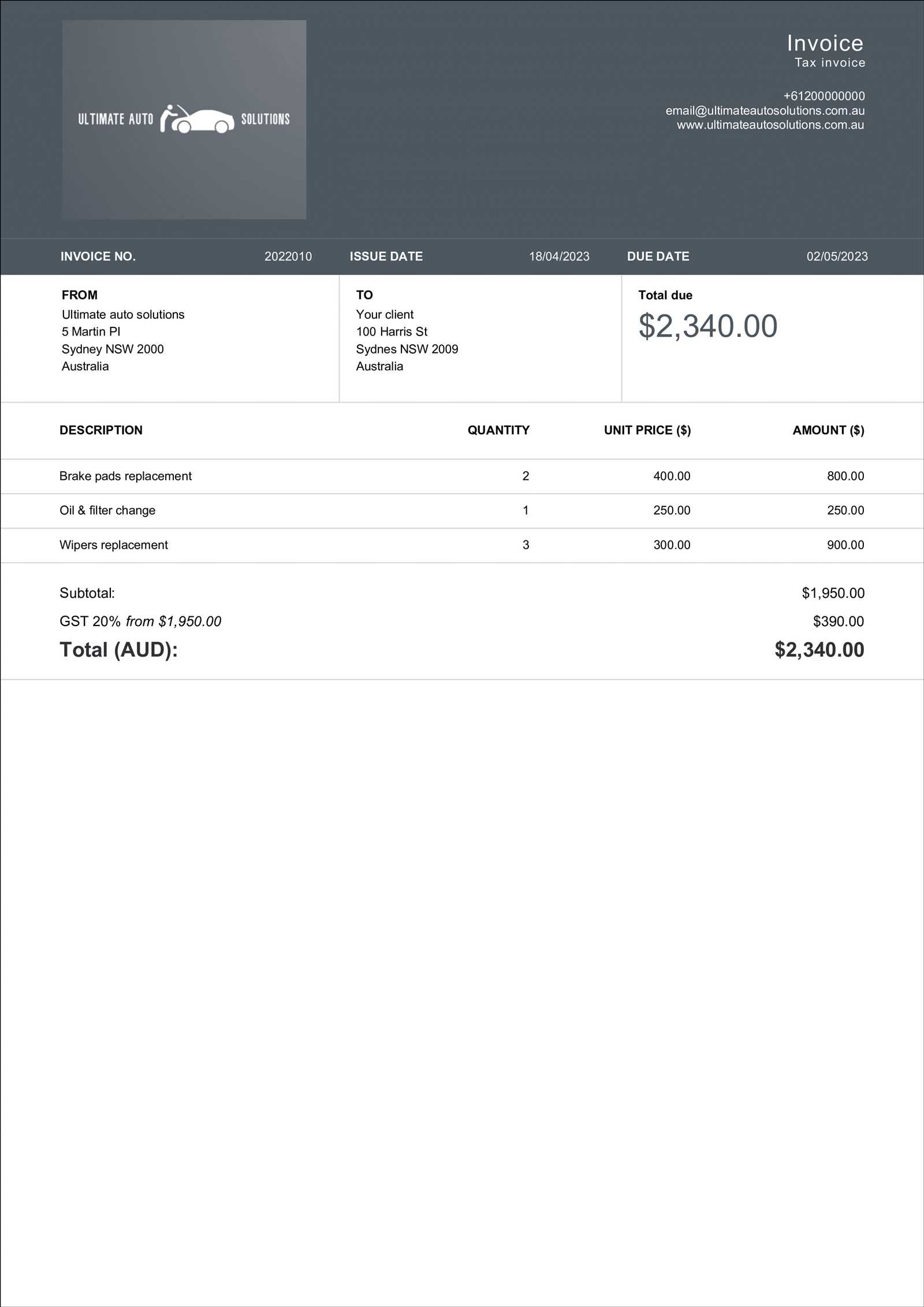

Step 3: List Services or Products

Create a table or itemized list of all services or goods provided. Include columns for descriptions, quantities, unit prices, and total amounts for each item. This helps break down the charges and provides transparency for the client.

Step 4: Apply Taxes or Discounts

If applicable, add any taxes or discounts to the document. Clearly state the tax percentage or discount rate applied and calculate the final total accordingly. Make sure this section is easily visible to avoid confusion.

Step 5: Include Payment Terms

Clearly outline the payment due date, accepted payment methods, and any late fees or discounts for early payment. Setting clear expectations can help avoid delays in receiving payment.

Step 6: Review and Finalize

Before sending the document, review all information to ensure it’s accurate and complete. Double-check numbers, descriptions, and dates to avoid mistakes. Once everything is in order, save the document and send it to your client.

Common Mistakes When Creating Invoices

Creating accurate and professional billing statements is crucial for maintaining a smooth business operation. However, even experienced service providers can make mistakes that can delay payments or cause confusion. Understanding these common errors and how to avoid them can help ensure that your billing process remains efficient and error-free. Below are some of the most frequent mistakes that people make when creating financial documents.

- Missing or Incorrect Client Details: One of the most common mistakes is failing to include accurate client information. Always double-check the client’s name, address, and contact details to avoid confusion or delays in communication.

- Inaccurate Service Descriptions: Another common issue is not clearly detailing the services or products provided. Ambiguous descriptions can lead to disputes. Be as specific as possible when listing each item, including quantities, rates, and hours worked.

- Failure to Include Payment Terms: Not specifying payment terms, such as due dates, late fees, or acceptable payment methods, can lead to misunderstandings and delayed payments. Make sure these terms are clear and easy to find on the document.

- Calculation Errors: Errors in adding totals, taxes, or discounts can make a document look unprofessional and potentially lead to incorrect amounts being charged. Always verify calculations before sending out a document.

- Omitting Dates or Invoice Numbers: Not including the date of service or an invoice number is a frequent oversight. These elements are important for keeping accurate records and ensuring that clients know when to expect payment deadlines.

- Cluttered Layout: Overcrowding the document with too much information or making it visually confusing can make it difficult for clients to understand. Ensure the layout is clean, with sections clearly separated and easy to read.

Avoiding these simple mistakes will ensure that your billing documents are clear, accurate, and professional, reducing the chance of delays or disputes with clients.

How to Track Payments with Excel

Keeping track of payments is crucial for any business, ensuring that all transactions are documented and financial records remain up to date. Using a digital system for tracking incoming payments allows you to monitor outstanding balances, payment status, and ensure everything is accounted for accurately. With the right setup, managing finances becomes an easy and organized task that reduces the risk of errors or missed payments.

To track payments effectively, you can set up a simple yet powerful tracking system using a spreadsheet. Here’s how you can do it:

- Create a Payment Log: Start by setting up a new sheet specifically for tracking payments. Include columns for the client’s name, the amount due, the date of the transaction, the amount paid, and the payment method. This basic structure helps you stay organized and easily review the status of all outstanding and completed payments.

- Use Formulas to Calculate Balances: A key feature of a spreadsheet is the ability to use formulas to automatically calculate totals. By using simple subtraction formulas, you can track how much is still owed for each transaction and update these amounts as payments come in.

- Track Payment Status: Add a column to indicate the payment status, such as “Paid,” “Pending,” or “Overdue.” This lets you quickly see which accounts need follow-up and which ones are settled, reducing the chances of confusion.

- Set Up Conditional Formatting: You can also use conditional formatting to highlight overdue payments. For example, set up a rule to automatically highlight any unpaid balances that have exceeded their due date, so they stand out and can be addressed promptly.

- Generate Payment Reports: Once you have a log of all transactions, you can filter the data by payment status or date range to generate detailed reports. These reports can help you identify trends, track your business’s cash flow, and make more informed financial decisions.

By following these steps, you’ll have a streamlined system for tracking payments that saves time, reduces errors, and helps you stay on top of your financial records.

Improving Accuracy with Templates

Maintaining precision in financial documents is essential for smooth operations and maintaining client trust. One of the most effective ways to improve accuracy is by using structured, pre-designed tools that minimize the chance of human error. These tools ensure that all necessary information is consistently included, calculations are automated, and formatting remains uniform, resulting in clear and reliable records every time.

Automation Reduces Calculation Errors

By using a structured tool with built-in formulas, the need for manual calculations is eliminated, reducing the possibility of errors. This is particularly helpful when dealing with complex figures like tax calculations, discounts, or totals based on quantities. With automatic updates, all figures adjust in real-time, ensuring your records are always accurate.

Consistent Formatting and Structure

Another advantage is the consistency it brings to your documents. Structured systems ensure that every detail, from service descriptions to client information, is consistently placed in the same format, making it easier to read and verify. This consistency not only helps with accuracy but also provides a professional appearance that strengthens your business’s reputation.

| Benefit | Description |

|---|---|

| Automated Calculations | Pre-set formulas ensure that totals, taxes, and discounts are automatically calculated, eliminating manual errors. |

| Standardized Layout | Consistent formatting makes it easier to input, check, and understand information, preventing key details from being overlooked. |

| Faster Document Creation | Using a pre-designed structure speeds up the creation process, reducing the time spent on administrative tasks. |

By leveraging these tools, you not only ensure greater accuracy in your financial records but also create a more efficient and professional process for managing transactions.

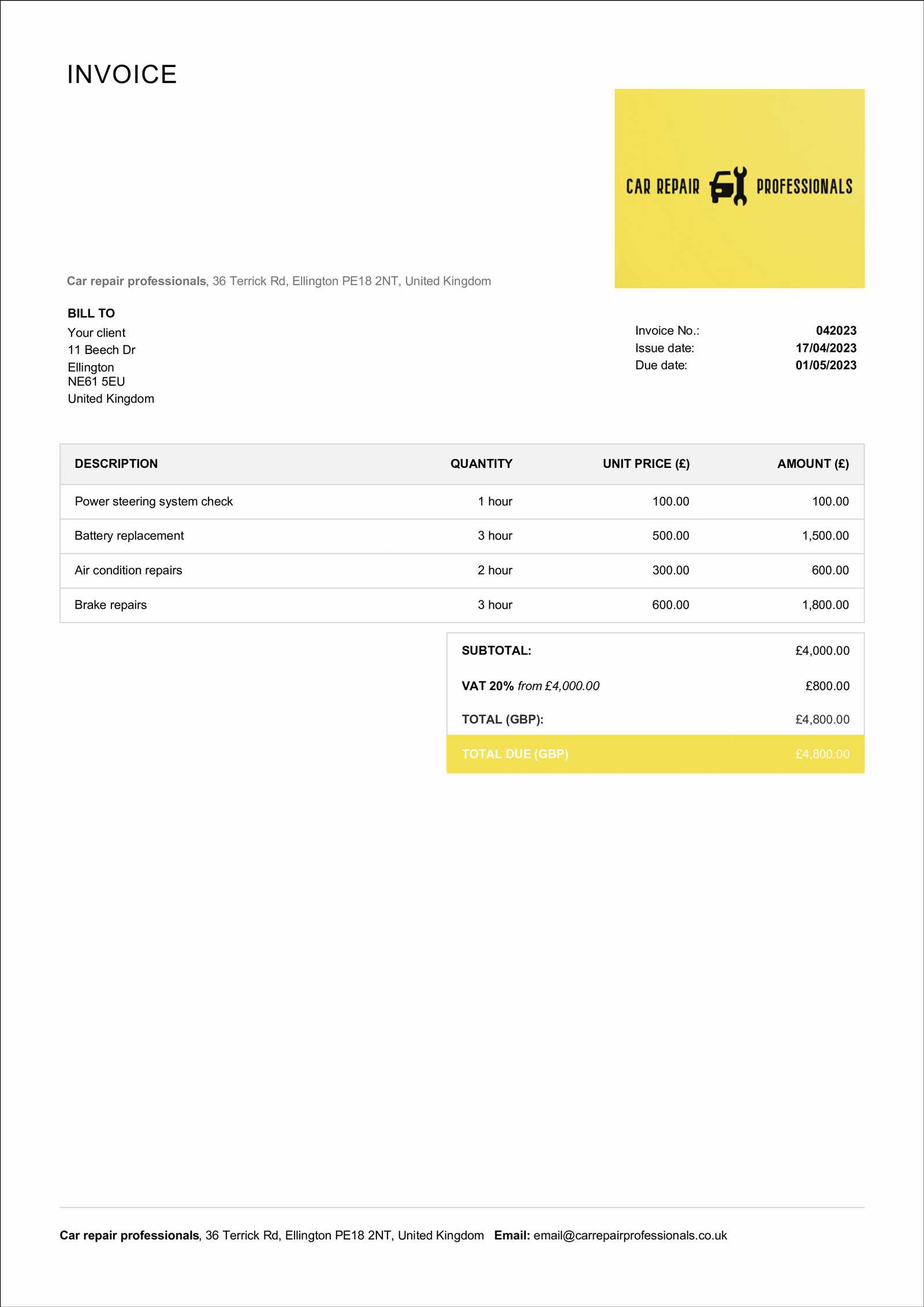

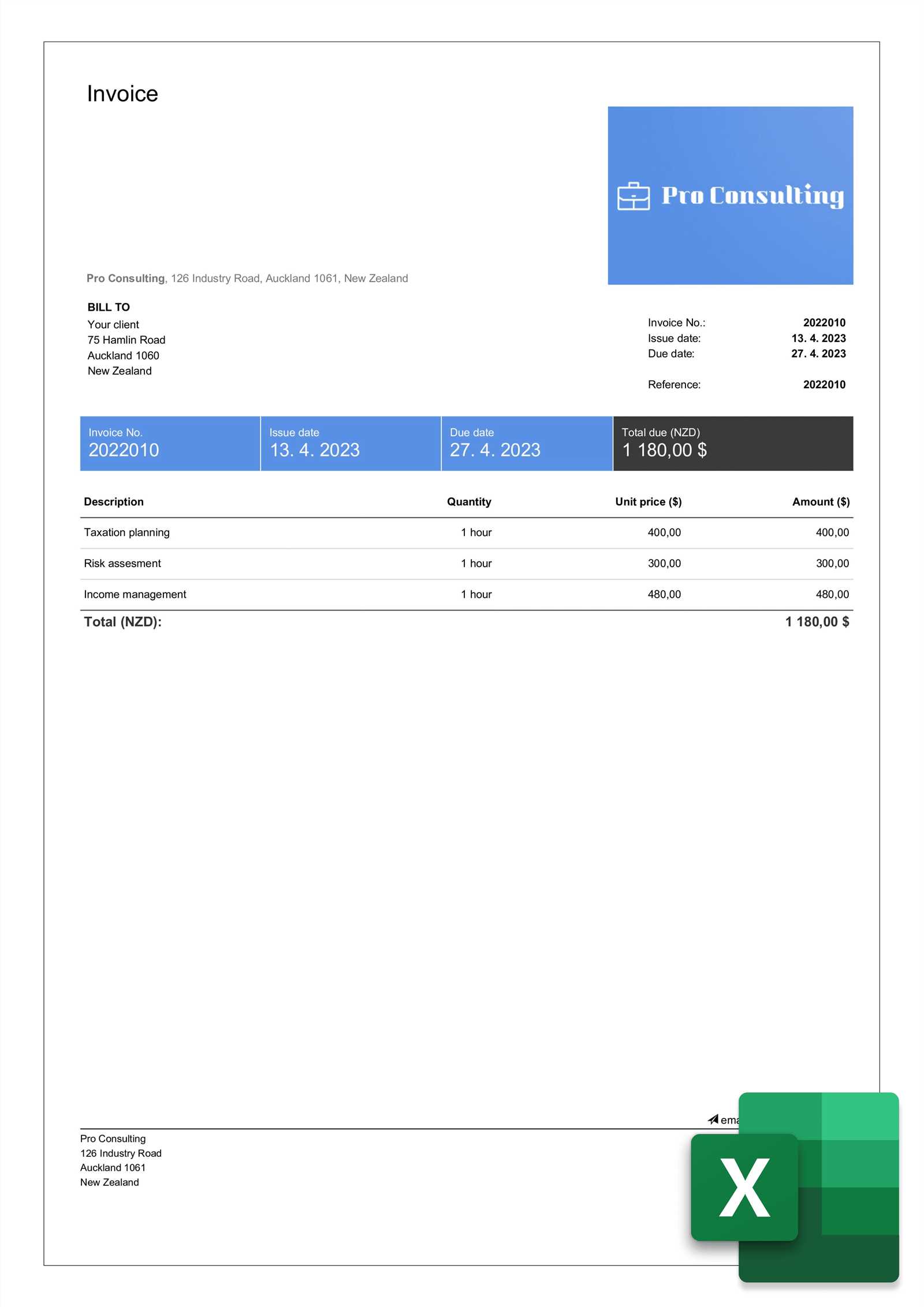

Free Mechanic Invoice Templates Online

Finding a reliable and cost-effective way to create professional billing statements can be a challenge for many small business owners. Fortunately, there are a variety of free tools available online that offer pre-designed formats, making the process faster and more efficient. These tools allow service providers to quickly generate accurate and detailed financial documents without the need for expensive software or complicated setups.

Many of these free resources come with customizable features, allowing users to personalize their documents according to their specific needs. Whether you need to adjust the layout, add your branding, or change the currency, these tools offer the flexibility to meet your requirements while maintaining a professional appearance.

| Feature | Benefit |

|---|---|

| Customizable Layouts | Many free tools allow you to adjust the design to match your business branding, ensuring consistency across all communications. |

| Pre-filled Fields | Save time with automatically included sections for client information, services, and payment terms, reducing the need for manual entry. |

| Export Options | Most platforms offer the option to download your document in various formats (PDF, Word, etc.), making it easy to share or print. |

| Free Access | Many websites offer these resources for free, providing small businesses with an affordable solution for managing financial documents. |

Using online tools to generate billing statements not only saves you time but also helps ensure accuracy, professionalism, and consistency across all of your transactions. With the wide variety of free options available, it’s easy to find a solution that works best for your business needs.

How Excel Simplifies Invoice Management

Managing financial records, including client payments and billing details, is a critical task for any business. The process can quickly become overwhelming without the right tools in place. Using a digital spreadsheet solution can simplify this task by automating many aspects of invoice management, from calculations to organization. The flexibility and functionality of these tools make it easier to track payments, organize records, and ensure that nothing is overlooked.

- Automatic Calculations: One of the most significant advantages of using a spreadsheet program is the ability to automate calculations. By using formulas, you can easily calculate totals, taxes, and discounts, minimizing the chances of errors in your billing process.

- Centralized Data Storage: Spreadsheets allow you to store all your transaction details in one place. This makes it easy to reference past records, check outstanding payments, and generate reports, without the need to search through physical documents or separate files.

- Easy Customization: You can tailor your document layout and design to suit your business needs. Whether you need to add additional columns for specific charges or adjust the overall format, spreadsheets offer the flexibility to create a structure that fits your workflow.

- Quick Payment Tracking: With simple data entry, you can track whether payments have been made, view overdue balances, and monitor outstanding amounts. By color-coding or flagging late payments, you can easily identify accounts that need follow-up.

- Time-saving Templates: Many programs come with pre-made structures that can be used right away, saving you time from designing new documents each time you need to create a bill. You can also modify these templates to suit your specific needs, ensuring that they stay aligned with your business practices.

With its powerful features, a spreadsheet application can streamline the management of financial documents, allowing businesses to reduce errors, save time, and maintain organized records. Whether for small projects or large-scale operations, this tool provides an efficient solution for tracking and managing payments effectively.

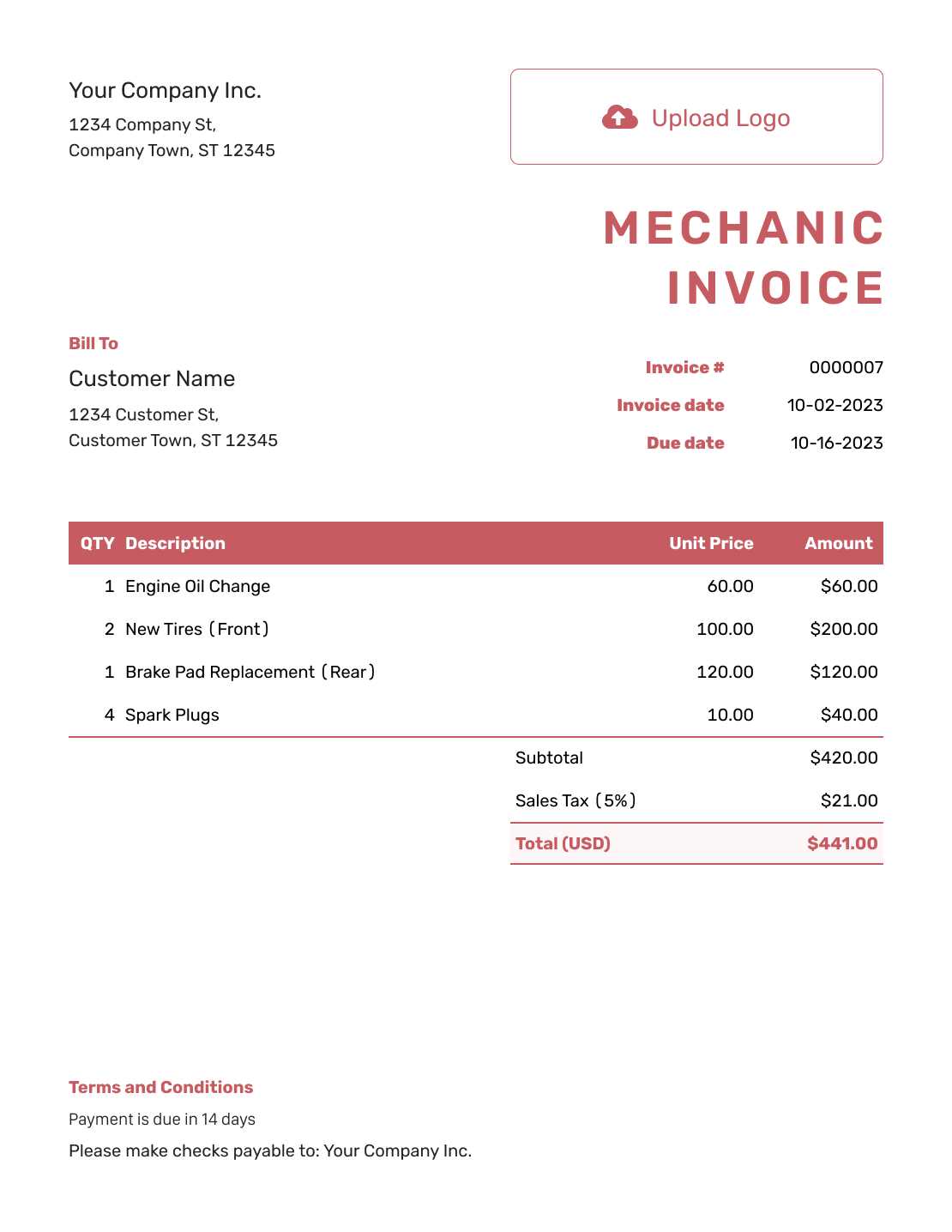

Best Practices for Invoice Formatting

Effective document formatting plays a key role in ensuring that billing statements are clear, professional, and easy for both the sender and the recipient to understand. A well-structured document not only helps in providing essential information but also fosters trust and transparency with clients. Whether you’re sending a detailed breakdown of services or a simple bill for products, following best practices in formatting can help streamline communication and avoid misunderstandings.

1. Clear and Organized Layout

Ensure that your document is easy to read by maintaining a clean, organized layout. The use of headings, bold text for important sections (like totals or due dates), and ample white space between different sections improves readability. Avoid overcrowding the page with too much information in one place–this can lead to confusion.

2. Consistent Fonts and Sizes

Use consistent font styles and sizes throughout the document. This creates a sense of uniformity and professionalism. Typically, a clean and simple font like Arial or Times New Roman works best. Reserve larger or bold fonts for headings, totals, or key dates to make them stand out.

3. Include Essential Details

Always make sure that the document includes all necessary information, such as your business name and contact details, the client’s information, a description of services or goods provided, dates, and payment terms. Missing details can cause confusion and delay payments.

4. Use Tables for Itemized Listings

For documents that list multiple items or services, using a table to organize the data is essential. Tables allow for clear breakdowns of quantities, unit prices, and total amounts, making it easy for clients to see exactly what they are being charged for. Ensure the columns are properly labeled and easy to follow.

5. Highlight Key Information

Make it easy for the client to find important details like the total amount due, due date, and payment instructions. This can be done by bolding the text or using a larger font size. You may also choose to place this information in a separate section or box for emphasis.

6. Maintain a Professional Tone

While formatting is important, the tone of your document is equally crucial. Use polite and formal language, especially when specifying payment terms or reminders. A professional and respectful tone can help maintain positive business relationships.

By adhering to these formatting practices, you not only create a more professional appearance but also make it easier for your clients to understand the charges and pay on time, ultimately improving cash flow and reducing confusion.

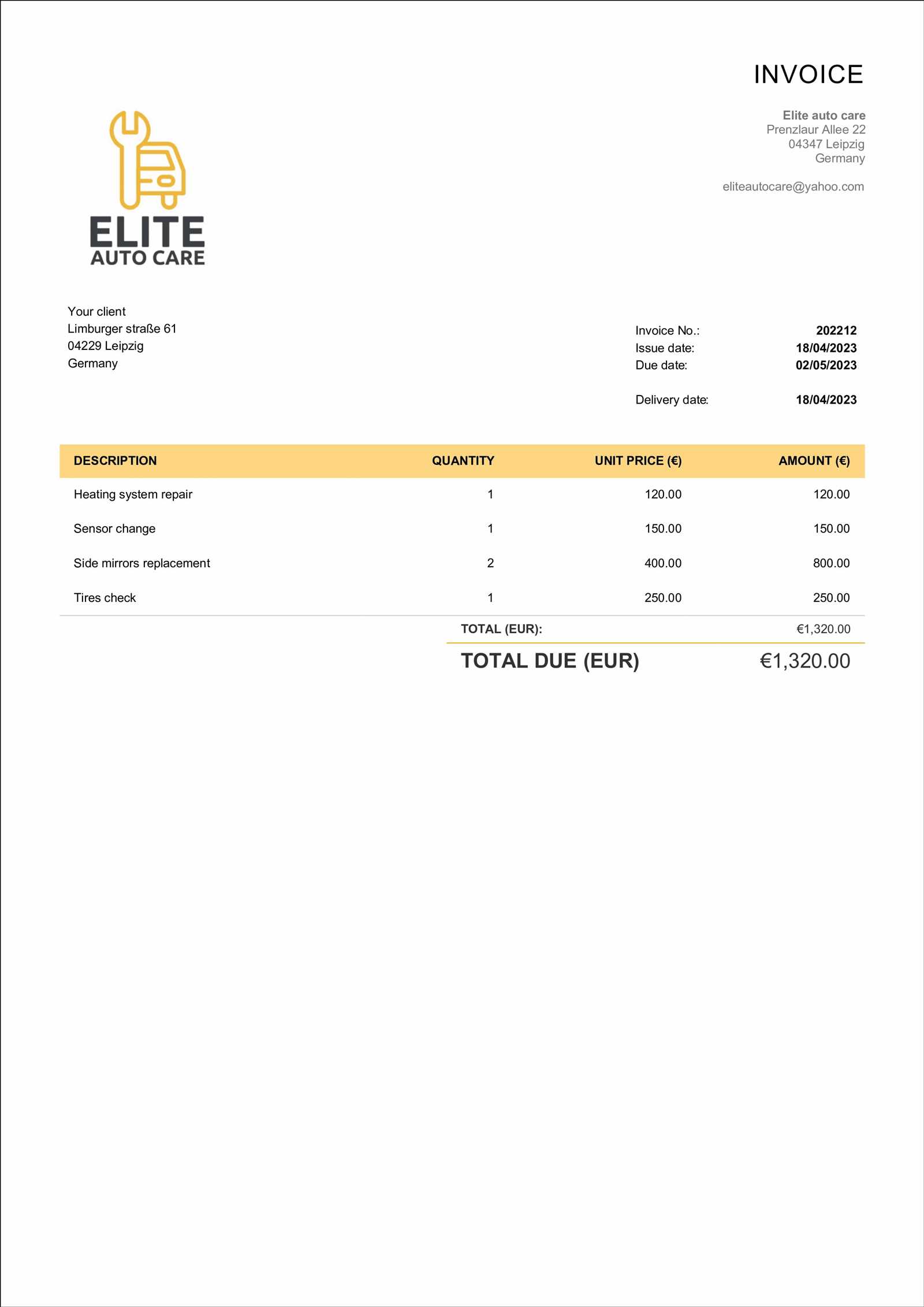

How to Include Service Details in Invoices

Including clear and comprehensive service details in your billing documents is crucial for ensuring transparency and avoiding misunderstandings with clients. A well-documented breakdown of the work performed helps clients understand exactly what they are being charged for and provides a clear reference for any future questions or disputes. By providing specific and organized information, you not only demonstrate professionalism but also build trust with your clients.

Here are some key points to consider when including service details in your financial documents:

- Be Specific and Descriptive: Include a detailed description of each service provided. Instead of simply stating “Repair,” specify the type of repair (e.g., “Replaced brake pads”) or “Maintenance” (e.g., “Oil change and tire rotation”). The more specific you are, the clearer the charges will be for the client.

- List Quantities and Rates: If applicable, include quantities and unit prices for services provided. For instance, if you are charging by the hour, list the total number of hours worked along with the hourly rate. This allows the client to easily verify the calculations.

- Provide Dates of Service: Always include the date when the service was provided. This is important for both record-keeping and for clients to track when the work was completed.

- Show Any Discounts or Promotions: If you are offering a discount or running a promotion, make sure to clearly indicate the amount or percentage of the discount applied. This helps clients understand the pricing breakdown and reassures them they are getting the best value.

- Include Parts and Materials: If you have used specific parts or materials during the service, list them separately, along with their costs. This helps in providing a full breakdown of charges and allows clients to see exactly what was used in the work.

By following these practices, you will ensure that all services and charges are clearly documented and easily understood by your clients, reducing the chance of confusion and ensuring smooth financial transactions.

Customizing Your Invoice for Branding

Personalizing your billing documents is a powerful way to reinforce your brand identity and create a professional, cohesive look across all customer communications. A branded document not only enhances your business’s credibility but also creates a memorable experience for clients. By integrating your company’s logo, colors, and fonts, you can make a strong impression and increase brand recognition every time a document is sent.

Key Elements to Customize

There are several key elements that you can personalize to align your billing documents with your brand’s style:

- Logo and Business Name: Place your logo prominently at the top of the document along with your business name. This immediately identifies the document as coming from your company and gives it a professional look.

- Colors and Fonts: Use your company’s brand colors and preferred fonts for headings, titles, and other text. This simple adjustment can make your documents feel more integrated with your marketing materials and other branding efforts.

- Header and Footer Design: Consider including additional branding elements, such as your business slogan or contact information, in the header or footer section. This helps ensure your brand stays top of mind even after the transaction is completed.

- Personalized Message: Add a custom note or thank-you message to make your communication feel more personal. A simple “Thank you for your business” can leave a positive impression and foster customer loyalty.

How Customization Adds Value

Customizing your billing documents goes beyond aesthetics–it can add significant value in terms of customer experience and professionalism. By making sure that all client-facing materials align with your branding, you establish consistency and trust. A well-designed document can also reflect the quality of service you provide, demonstrating attention to detail.

| Customization Element | Branding Benefit |

|---|---|

| Logo | Instant brand recognition and professional appearance |

| Colors | Aligns documents with your business identity for a cohesive brand experience |

| Fonts | Creates consistency with other marketing materials, making your brand easily identifiable |

| Personalized Message | Enhances customer relationships by making communications feel personal and thoughtful |

By taking the time to customize your billing statements, you not only improve the visual appeal but also strengthen your brand’s presence, helping to leave a lasting impression with clients.

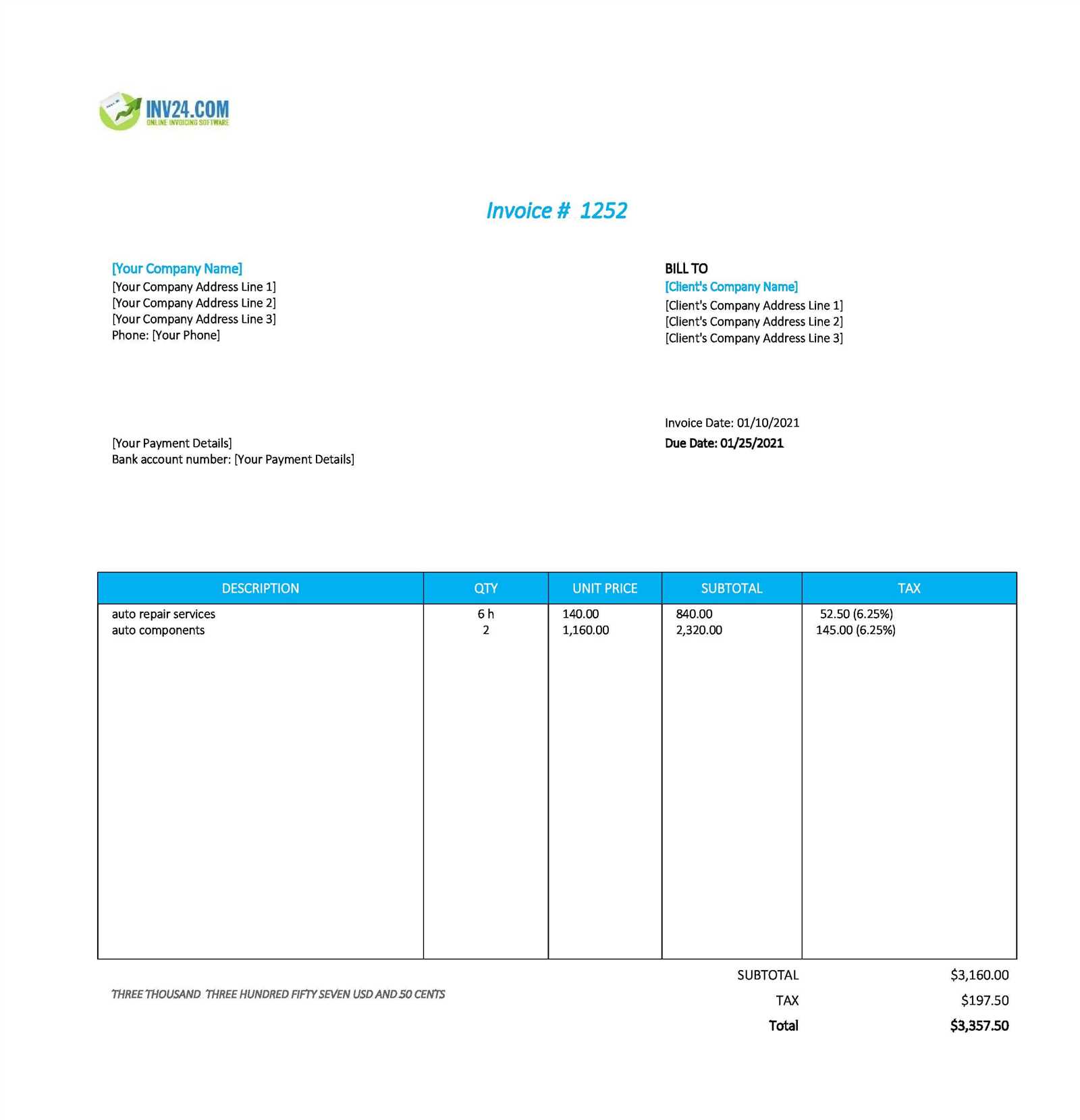

Adding Taxes and Discounts to Invoices

Incorporating taxes and discounts into billing documents is essential for accurate pricing and ensuring that both the service provider and the client are clear on the final amount due. These adjustments can vary depending on the location, type of service, or any promotional offers, and they need to be clearly documented to avoid confusion. By correctly applying these adjustments, businesses can ensure compliance with local tax regulations while offering incentives to customers, all while maintaining transparency in the billing process.

Including Taxes

Taxes are often a necessary addition to the total amount owed, especially in regulated industries. To ensure compliance, it’s important to correctly apply the applicable tax rate to the subtotal before calculating the final total. Here are some best practices:

- Specify Tax Rate: Always include the applicable tax rate and the total amount charged as tax. This way, the customer can clearly see how much of the total amount is tax.

- Different Tax Categories: In some cases, different services or goods may be taxed at different rates. Make sure to break down the tax for each category if applicable, ensuring transparency in the total tax amount.

- Check Local Tax Regulations: Tax rates can vary depending on location, so it’s important to stay updated on local tax laws to ensure correct application.

Applying Discounts

Offering discounts is a common way to encourage customer loyalty or promote sales. Discounts can be a percentage off the total, a fixed amount, or even a special promotion for specific products or services. Here’s how to handle them:

- Clearly State Discount Amount: Whether it’s a flat amount or a percentage, always list the exact discount applied. This helps customers understand how much they’re saving and gives clarity on the pricing breakdown.

- Include Discount Terms: If the discount is part of a promotional offer or applies only under certain conditions (e.g., first-time customers, seasonal offers), be sure to note these conditions on the billing document.

- Apply Discount Before Tax: When calculating a discount, it’s generally best practice to apply it to the subtotal before taxes are added. This ensures that both the customer and the business are benefiting from the discount in the most advantageous way.

Correctly applying taxes and discounts is not only a matter of compliance but also an opportunity to build trust with clients. By being transparent about the calculations and ensuring that all adjustments are clearly noted, you can mai

How to Save and Share Invoices in Excel

Efficiently saving and sharing billing documents is a critical part of managing client transactions. Whether you are working with customers in person or remotely, having a streamlined process for storing and distributing your documents ensures that both you and your clients can easily access and track payment information. With the help of digital tools, such as spreadsheet software, you can save time and enhance organization by maintaining a well-organized record of all your transactions and sharing them effortlessly.

Saving Your Document

After creating and finalizing your billing statement, saving the file in an appropriate format is essential for ensuring that it can be easily accessed, edited, or shared later. Here are some options:

- Save in a Standard File Format: The most common file formats for digital documents are .xlsx (standard spreadsheet format) and .pdf (for a non-editable version). Choose the format that works best for your needs. .xlsx allows for future edits, while .pdf is ideal for sharing finalized documents.

- Use Cloud Storage: Storing your files on a cloud service like Google Drive, Dropbox, or OneDrive offers convenient access from any device and allows you to easily share your files with clients or colleagues by simply providing a link.

- Organize Files in Folders: Keep your files organized by saving them in clearly labeled folders, categorized by client name, date, or service type. This will make it easier to locate past records when needed.

Sharing Your Document

Once your billing statement is saved, sharing it with your client can be done quickly and efficiently. Below are some common methods for sharing your digital document:

- Email: Attach the saved document to an email and send it to the client directly. If you’re using a .pdf file, it’s a good practice to provide a brief message summarizing the key details of the billing statement in the email body.

- Cloud-Based Link Sharing: If you have stored your file in cloud storage, you can share the document by sending a link via email or messaging app. This allows clients to access the file without the need to download large attachments.

- Online Platforms: For businesses that use platforms like QuickBooks, FreshBooks, or other financial management tools, you can directly share your billing documents through these platforms, often with options for tracking when the document is viewed or paid.

| Method | Benefits |

|---|---|

| Direct, simple, and widely accessible. Allows for easy communication with the client. | |

| Cloud Storage | Convenient access from any device, easy to organize, and can be shared with multiple people at once. |

| Online Platforms | Streamlined process for invoicing and payment tracking, with additio

Protecting Your Invoice Files in Excel

Ensuring the security of your financial documents is crucial in today’s digital world. These files often contain sensitive client information, pricing details, and personal data that need to be protected from unauthorized access. Whether you’re storing your documents locally on your computer or in the cloud, it’s important to use best practices for safeguarding them against accidental loss, theft, or corruption. There are several ways to protect your files and ensure they remain safe from unauthorized access or accidental alterations:

By following these practices, you can effectively protect your financial documents from unauthorized access, ensuring that both your and your clients’ information remains secure at all times. Tracking Invoice Status and HistoryMonitoring the status and history of your financial records is a key part of managing your business’s cash flow and maintaining accurate records. Keeping track of whether a document has been paid, is pending, or requires follow-up can help you stay organized and prevent errors. A detailed history of your past transactions also provides insights into trends, client behavior, and payment cycles, all of which are valuable for improving your overall business operations. Ways to Track the Status of Financial Documents

Effective tracking involves more than just noting when a document is sent–it includes regularly updating the status to ensure accuracy and providing a clear overview of outstanding and completed transactions. Below are some methods for tracking the status of your records:

Tracking Historical Records

Having a clear history of all your transactions is essential for maintaining organized financial records. This helps when preparing for tax filing, audits, or simply evaluating your business performance. Below are some tips for tracking historical records:

By implementing these strategies, you can streamline the process of managing financial records, ensuring that you stay on top of outstanding payments and have a clear history of past transactions at your fingertips. How to Avoid Invoice Payment Delays

Ensuring timely payments is vital for maintaining healthy cash flow in any business. Payment delays can disrupt operations, create financial stress, and strain client relationships. To minimize the risk of delayed payments, it’s important to implement proactive strategies that clearly communicate payment expectations and streamline the payment process. Clear Communication and TermsOne of the primary reasons for delayed payments is a lack of clarity regarding payment expectations. Establishing clear terms from the outset helps prevent confusion and ensures that clients know exactly when and how they should make payments. Below are some effective strategies:

Streamlining the Payment ProcessMaking the payment process as easy and convenient as possible for clients can significantly reduce the chances of delays. Here’s how to simplify the process:

Tracking Payment History

Keeping track of payments is another key step in preventing delays. By maintaining organized records, you can quickly identify any overdue payments and follow up accordingly. Below are some useful practices:

|