Self Employed Blank Invoice Template for Freelancers and Small Businesses

For freelancers and small business owners, managing finances efficiently is crucial to maintaining healthy cash flow and ensuring timely payments. One of the key aspects of this process is the use of structured documents that request payment for services rendered or goods delivered. Having a ready-made document can save time and reduce the likelihood of errors when billing clients.

Whether you work independently or run a small operation, a well-organized payment request is essential for maintaining professionalism and clarity in your business transactions. By using customizable forms, you can tailor each document to suit your needs while ensuring consistency across all of your transactions.

In this guide, we’ll explore how to make your own payment request forms, the best practices for their structure, and how they can be adapted to meet the legal and financial standards required for smooth business operations. Understanding the importance of these documents can make the process of invoicing more streamlined and effective, allowing you to focus on growing your business.

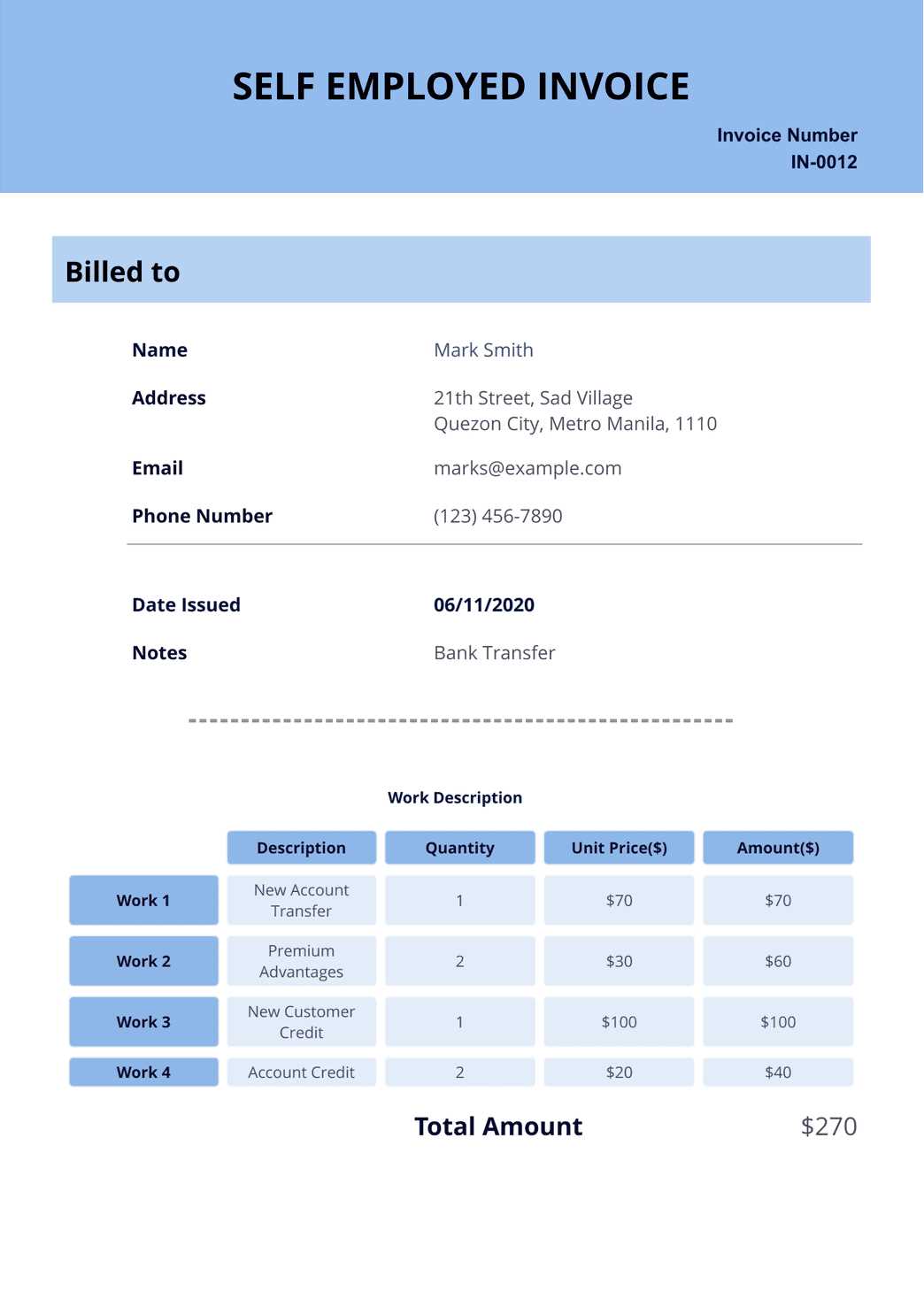

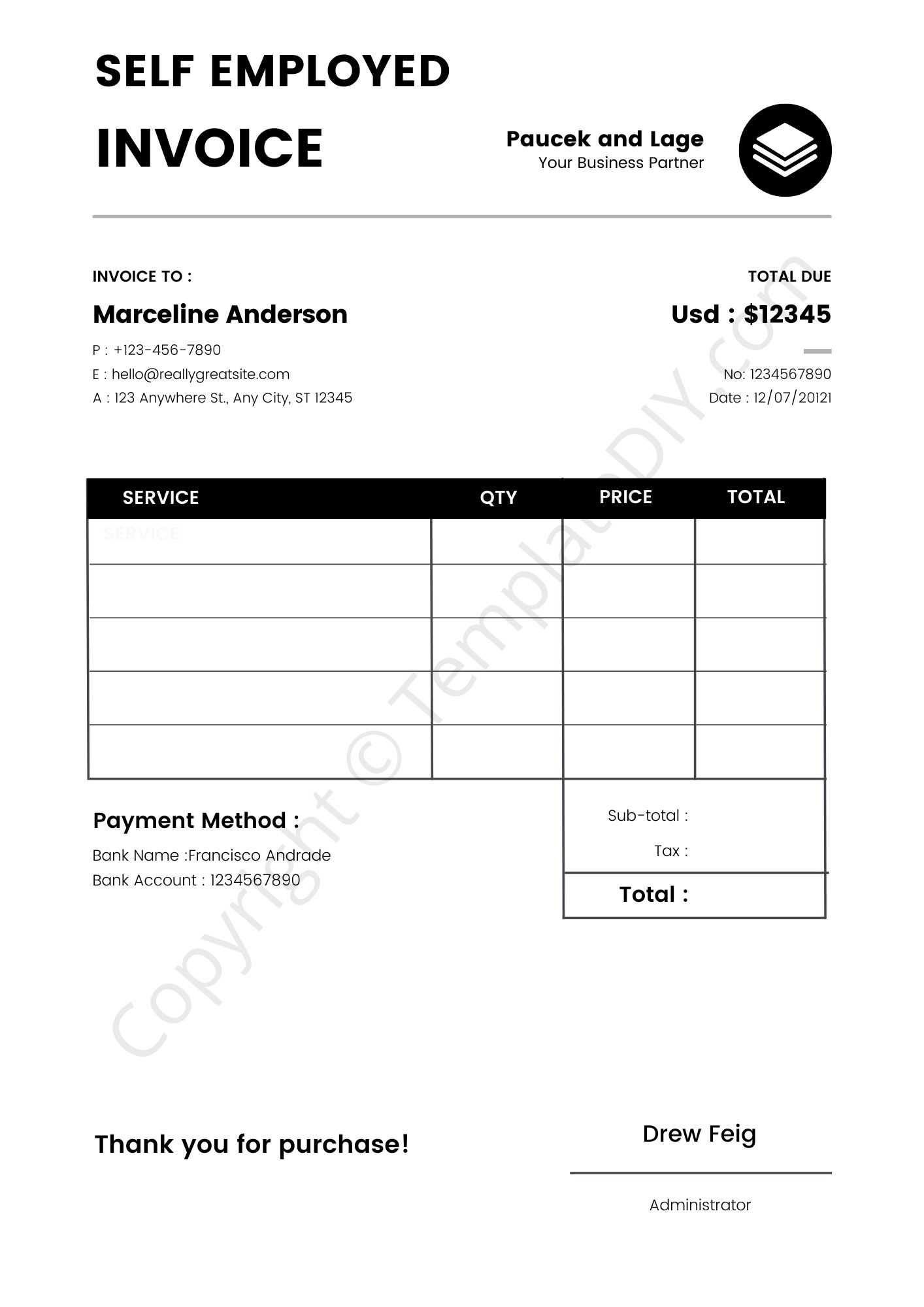

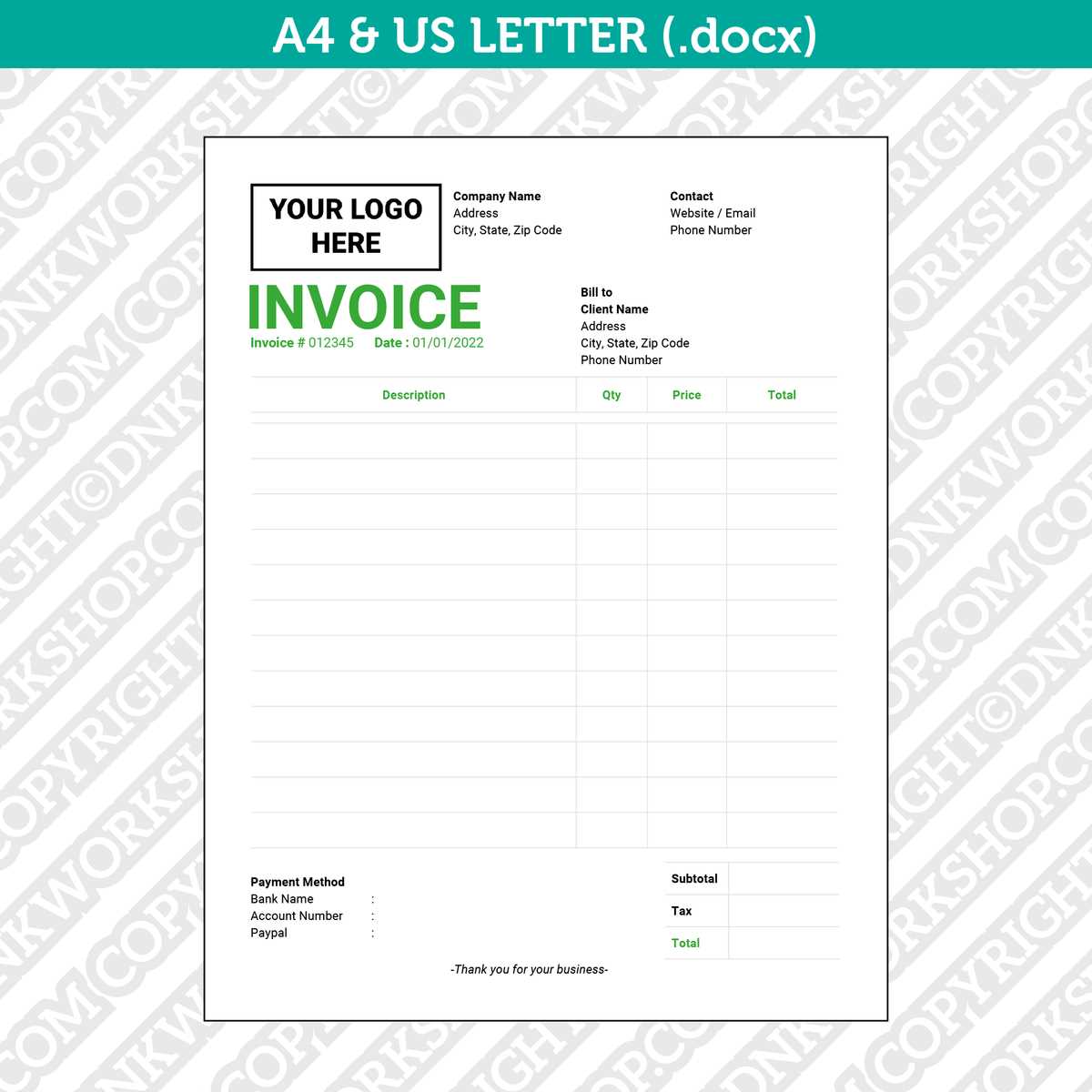

Self Employed Blank Invoice Template

For independent contractors and small business owners, the need for an efficient way to request payment is essential. Having a pre-structured document that can be easily filled out and sent to clients ensures timely payments and helps maintain professionalism. Customizable payment request documents are a practical solution for those who frequently bill clients for their services or products.

Such documents typically include essential fields such as client details, services provided, rates, and payment terms. By using a ready-made structure, you can ensure consistency in your financial records and simplify the administrative tasks that come with invoicing clients.

Key Elements to Include

When designing or using a pre-made structure for billing, it’s important to make sure the document contains all necessary fields to avoid confusion and disputes. Here are the primary components that should always be included:

| Field | Description |

|---|---|

| Client Information | Name, address, and contact details of the customer or business you’re billing. |

| Service or Product Description | A clear breakdown of what was provided, including any quantities, rates, or hours worked. |

| Amount Due | The total cost for the services rendered or products delivered. |

| Payment Terms | Specify when payment is due, any late fees, or discounts for early payment. |

| Payment Instructions | How the client can pay, including account numbers, PayPal details, or other payment methods. |

Advantages of Using a Pre-Structured Document

Using a pre-structured document for billing has several advantages. It saves time, reduces the risk of missing crucial information, and provides a more professional appearance to clients. Moreover, it helps ensure that all necessary legal details are included, such as payment terms and due dates, which can protect you in case of late or missed payments.

Why You Need an Invoice Template

For anyone managing a business or freelance work, organizing payment requests in a consistent manner is crucial. Using a well-structured document not only saves time but also ensures that all necessary information is included, reducing the risk of errors. A properly designed document serves as a professional representation of your business and helps foster trust with your clients.

Without a standardized method for creating payment requests, you risk overlooking key details such as payment terms, service descriptions, or client information. This can lead to confusion, delayed payments, and even legal disputes. Having a predefined format streamlines the process, ensuring that all aspects are covered every time you send out a request for payment.

Time Efficiency and Accuracy

Creating payment requests from scratch for every client can be a time-consuming and error-prone task. By using a pre-designed document, you can quickly fill in the necessary information, making the process much more efficient. This consistency also reduces the chances of mistakes, ensuring that important details like amounts, services, and deadlines are never missed.

Professionalism and Legal Protection

Using a standardized form helps maintain a professional image, demonstrating that you are serious about your business. Clients will appreciate receiving clear, well-organized documents, which can improve your reputation and customer satisfaction. Additionally, a formal structure ensures that all legal elements, such as payment terms and penalties for late payments, are properly outlined, offering you protection in case of disputes.

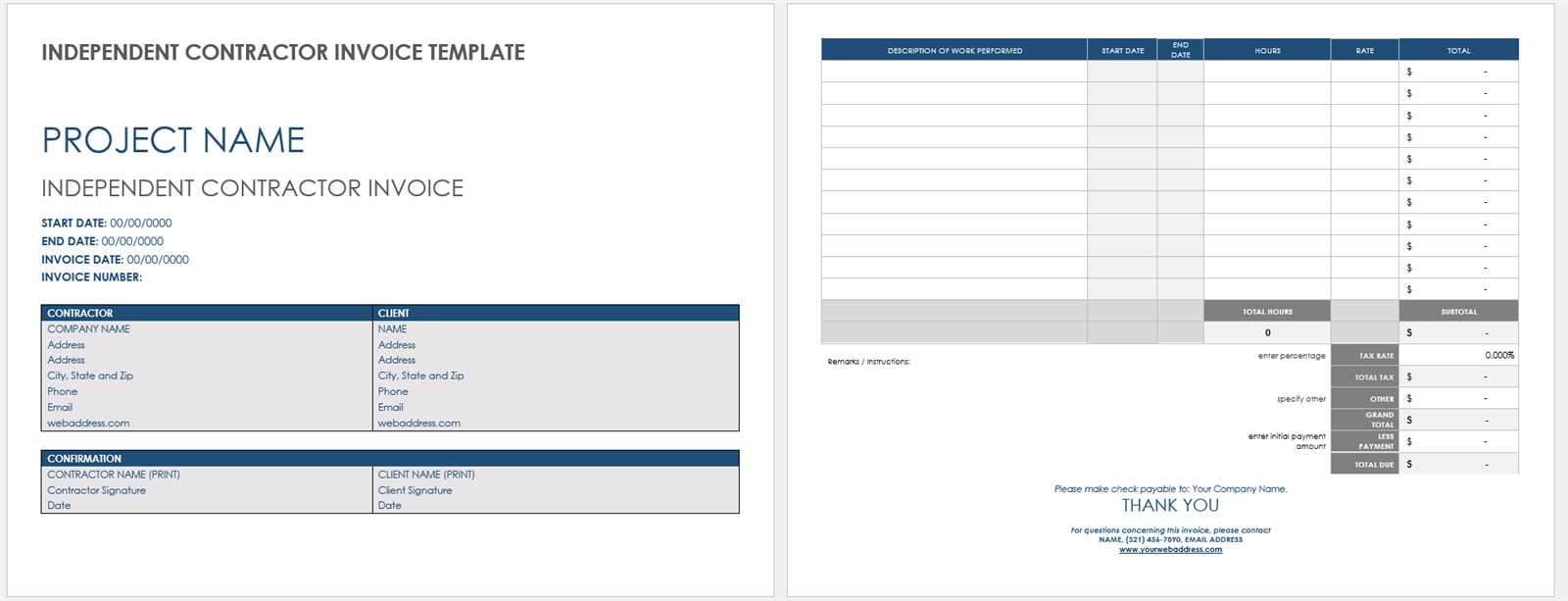

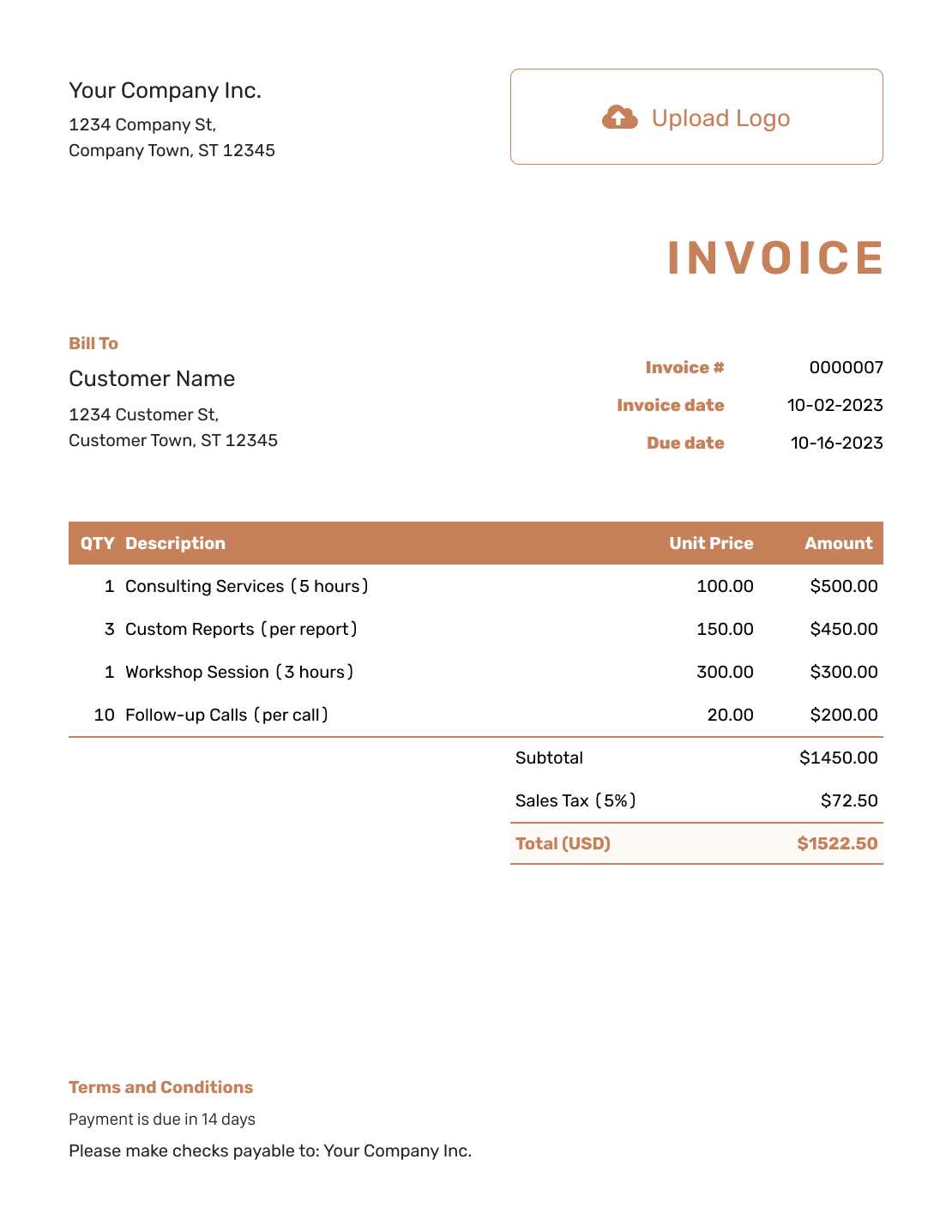

How to Create an Invoice as a Freelancer

For freelancers, the process of requesting payment for completed work requires clear communication and proper documentation. A well-crafted payment request ensures that clients understand the amount due and the services rendered. By following a simple structure, you can create professional and effective documents every time you need to bill a client.

Creating an effective payment request involves including essential information like your contact details, the services you provided, and payment instructions. While the exact format may vary, there are common elements that every request should contain to ensure accuracy and clarity. Below is a step-by-step guide to help you create a comprehensive document for any freelance project.

| Step | Description |

|---|---|

| 1. Add Your Contact Information | Include your full name, business name (if applicable), address, phone number, and email. This lets your client know how to reach you if there are any questions. |

| 2. Include Client Details | Make sure to list the name, address, and contact information of your client. This helps avoid confusion, especially if they have multiple offices or departments. |

| 3. Provide a Clear Breakdown of Services | List each service you provided, including quantities, hours worked, or deliverables. This ensures both you and your client are on the same page regarding the work completed. |

| 4. State the Total Amount Due | Clearly show the total cost for the work done, including any taxes or additional fees. Make sure the amount is easy to spot to avoid any confusion. |

| 5. Set Payment Terms and Due Date | Define when payment is due, and mention any late fees or early payment discounts. This ensures your client understands your expectations for timely payment. |

| 6. Provide Payment Instructions | Indicate how the client can make the payment (bank transfer, PayPal, etc.), and include any relevant account details to make the process as smooth as possible. |

By following these steps and ensuring that your documents are clear and complete, you can streamline your billing process and avoid delays. This simple approach can save you time and ensure that you maintain a professional i

Essential Fields for Self Employed Invoices

When creating a payment request, it’s crucial to include all the necessary information to ensure that both you and your client are clear about the details of the transaction. A well-structured document not only helps avoid confusion but also speeds up the payment process. Including the right fields in your billing statement can make the difference between smooth transactions and potential disputes.

Each payment request should cover the basics, such as your details, the client’s information, and a breakdown of services rendered. Missing or incomplete information can cause delays or misunderstandings, so it’s important to be thorough in every document you create.

The following fields are essential to include in every payment request you send:

| Field | Description |

|---|---|

| Contact Information | Include your full name or business name, address, phone number, and email address, as well as the same details for your client. |

| Unique Identification Number | Assign a unique number to each document to keep your records organized and track payments efficiently. |

| Details of Services or Goods Provided | Clearly outline the services you performed or the products you delivered, along with relevant quantities, hours, or unit prices. |

| Total Amount Due | State the total cost for the work done or goods provided, including any taxes, fees, or discounts. |

| Payment Terms | Specify the payment due date, payment methods, and any penalties for late payments or discounts for early settlement. |

| Notes or Additional Information | Any extra details that are relevant to the transaction, such as specific terms or conditions agreed upon with the client. |

By ensuring that all of these fields are present and properly filled out, you can create professional and accurate payment requests that help avoid misunderstandings and encourage prompt payment.

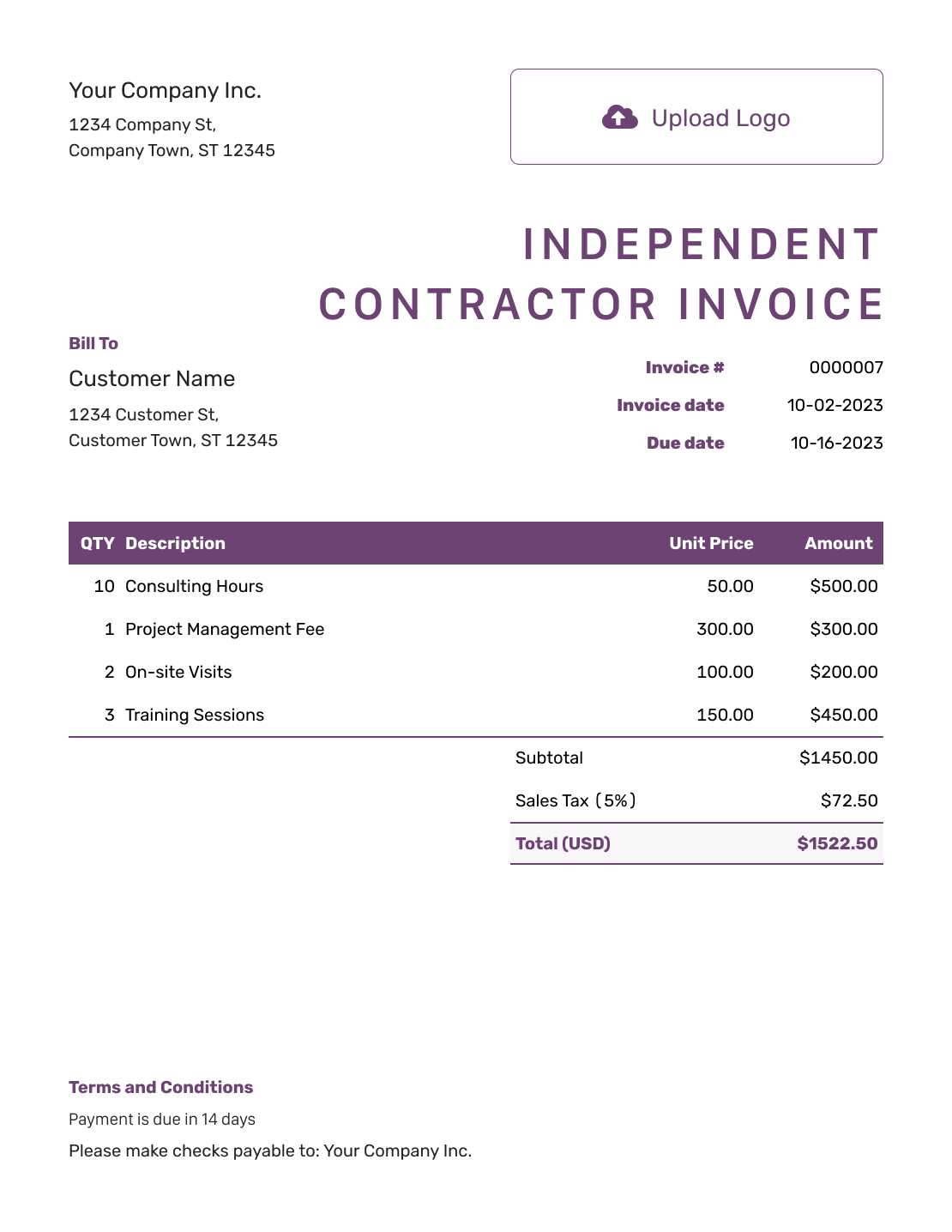

Choosing the Right Format for Your Invoice

When it comes to creating a payment request, selecting the right structure is crucial for ensuring that the document is clear, professional, and easy to read. The format you choose can impact how easily your client processes the information, and can also help you maintain consistency across your billing records. The right format should reflect the nature of your business and make it simple to track payments and organize transactions.

There are various formats available, each with its own advantages. The choice of layout and organization depends on factors like the size of your business, the complexity of your services, and your client’s preferences. Some prefer a straightforward, minimalist approach, while others may require more detailed information or specific design elements. It’s important to find a balance between functionality and simplicity.

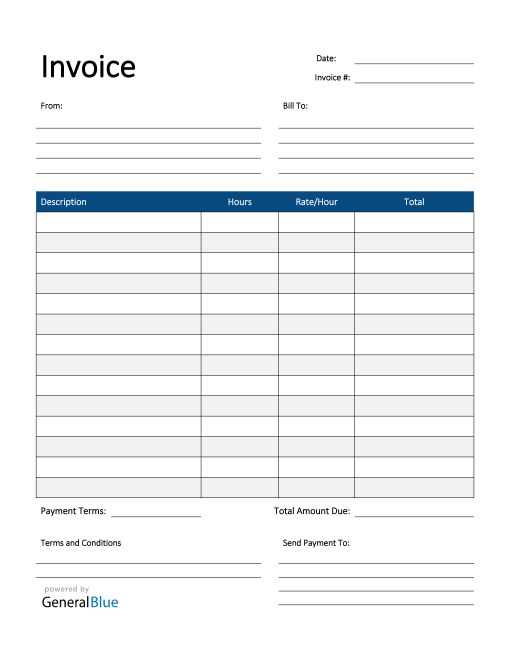

Simple vs Detailed Layouts

Some freelancers and small businesses may prefer a simple and straightforward layout, especially for one-off or small projects. Others, particularly those who handle more complex services or have recurring clients, may benefit from a more detailed structure that includes additional breakdowns of costs, payment schedules, and tax calculations. The key is to choose a format that provides all necessary information while remaining easy to navigate.

Digital vs Printable Formats

Another consideration is whether to use a digital or printable format. Digital formats, such as PDFs or online invoicing tools, are ideal for quick and secure submissions via email or online payment systems. Printable formats might be necessary for clients who prefer physical copies. Many businesses now use a combination of both, offering clients the flexibility to choose their preferred method of receiving payment requests.

| Format Type | Advantages |

|---|---|

| Simple Layout | Quick to create, easy to read, ideal for one-time or small transactions. |

| Detailed Layout | Great for complex services, includes breakdowns, payment schedules, and taxes. |

| Digital Format | Fast delivery, eco-friendly, easy to store and track electronically. |

| Printable Format | Useful for clients who prefer physical copies or for legal documentation purposes. |

Choosing the right format for your billing documents depends on your business needs and the preferences of your clients. By selecting a structure that fits your workflow and client expectations, you ensure that your payment requests are processed smoothly and professionally.

How to Customize Your Invoice Template

Customizing your payment request document is a great way to reflect your business style, make the process more efficient, and provide clarity to your clients. By adapting a pre-designed structure to fit your specific needs, you can ensure that every bill sent is professional, personalized, and clear. Customization also allows you to add key elements that align with your branding and create a cohesive experience for your clients.

Whether you want to adjust the layout, add your logo, or modify the fields, customization offers the flexibility to make your documents truly your own. The right modifications can improve readability, streamline your workflow, and help you stand out from the competition. Here’s how you can personalize your payment request documents to better suit your business needs.

Adding Your Branding Elements

One of the simplest ways to customize your documents is by including your business logo, colors, and fonts. This not only enhances the professional appearance but also reinforces your brand identity with every transaction. Make sure your branding is subtle and does not overwhelm the content of the document, ensuring that the payment details remain clear and easy to understand.

Adjusting Key Fields and Information

While many payment request structures include the basic fields like client details and services provided, you may need to tailor the content based on your specific needs. For example, if you offer multiple types of services, consider adding additional sections for categorizing different services or providing a space for project codes. You can also personalize the payment terms, discounts, or penalties based on the type of work or client relationship.

Customizing a document template doesn’t just mean changing the visuals–it also includes making sure the necessary details are easy to add and update. The more you streamline the process, the less time you’ll spend on administrative tasks, leaving you more time to focus on your core business activities.

Free vs Paid Invoice Templates for Freelancers

When choosing a document structure for requesting payment, freelancers often face the decision between using free or paid options. Both types come with their own advantages and drawbacks, depending on your specific needs. The right choice largely depends on factors such as the volume of work, the complexity of your billing, and the level of customization you require.

Free options are often a good starting point, offering basic designs and layouts that can be easily modified for simple transactions. Paid options, however, typically come with more features, advanced designs, and added functionalities, which can be beneficial for more established freelancers or businesses with more complex billing needs. Below, we will examine both types in detail to help you decide which is best suited for your workflow.

Benefits of Free Options

Free document structures are widely available and can be a great way to get started without any upfront costs. They are often simple and easy to use, providing all the basic fields you need to create a functional request for payment. Many free versions are also customizable to a certain extent, so you can adjust the content to fit your business needs. However, the features may be limited, and the design may not stand out as much as a paid option.

Advantages of Paid Options

Paid solutions typically offer more robust features, such as professional-looking designs, the ability to integrate with accounting software, and advanced customization options. These options may allow you to automate certain aspects of the process, such as calculating taxes or applying discounts. Additionally, paid templates often come with customer support and frequent updates, making them a more reliable choice for freelancers who need a more polished or comprehensive solution. However, they do come at a cost, which may not be justifiable for those with minimal billing needs.

Ultimately, the decision between free and paid options depends on your business size, budget, and the level of professionalism you wish to convey. If you are just starting out and only need basic functionality, a free option may suffice. If you need more advanced features or a highly customizable design, investing in a paid solution may be worth considering.

Common Mistakes to Avoid on Invoices

Creating a payment request document may seem straightforward, but there are several common mistakes that can lead to confusion, delayed payments, or even disputes with clients. These errors can affect your professionalism and hinder cash flow, making it essential to pay attention to detail when preparing these important documents. Below are some of the most frequent mistakes to avoid when generating payment requests for your services or products.

One of the most common errors is failing to include all the necessary information. Missing details such as the due date, payment instructions, or a clear breakdown of charges can cause confusion for your clients and delay the payment process. Another issue is not keeping the format consistent or professional, which can make your document appear disorganized or unreliable.

Missing or Incorrect Contact Information

Always double-check that both your contact details and your client’s information are correct. Incorrect addresses or phone numbers can cause delays, especially if there are any follow-up communications or issues with payment. Furthermore, ensure that your business name (if applicable) is clearly stated and easily recognizable.

Unclear or Incomplete Descriptions of Services

One of the biggest causes of disputes arises from unclear descriptions of the services rendered. Always be specific about what work was completed, including quantities, hours worked, or any agreed-upon deliverables. Vague or overly broad descriptions can lead to confusion and may result in delayed payments as the client might request clarifications or adjustments.

By avoiding these common mistakes, you ensure that your payment request documents are professional, clear, and free from errors. Taking the time to review and double-check all the details will not only enhance your reputation but also contribute to faster and smoother payment processing.

How to Use Invoice Templates with Accounting Software

Integrating payment request documents with accounting software can streamline your business operations, improve accuracy, and save you time. By using a digital document structure alongside automated financial tools, you can easily create, send, and track requests for payment while keeping your books organized. Many accounting programs offer customizable templates that can be linked to your financial records, making it easy to create professional and accurate billing statements with just a few clicks.

When using these documents with accounting software, you can benefit from features like automatic calculations, seamless data entry, and even integration with payment platforms. By eliminating manual entries and ensuring consistency across your records, you reduce the risk of errors and speed up the entire invoicing process. Below is a guide on how to effectively use document templates in combination with accounting software to optimize your business workflow.

Integrating Templates with Accounting Software

Most accounting tools allow you to either create or import pre-designed payment request documents. Here’s how you can integrate them into your process:

| Step | Action |

|---|---|

| 1. Choose an Accounting Software | Select an accounting program that fits your business needs. Popular options like QuickBooks, FreshBooks, or Xero offer invoicing capabilities integrated into their platforms. |

| 2. Select or Customize a Document Format | Many accounting programs offer pre-built designs that you can customize. Modify them to fit your business branding and specific billing requirements. |

| 3. Link Financial Information | Input your business details, payment methods, and tax rates. This allows the software to automatically fill in relevant fields when generating a payment request document. |

| 4. Automate Calculations | Use the software’s automated features to calculate totals, taxes, and discounts, saving you time and reducing the chance of errors. |

| 5. Send and Track Payments | After creating the document, use the software to send it directly to your client via email or another preferred method, and easily track when payments are received. |

Benefits of Using Accounting Software for Payment Requests

By combining document creation with accounting software, you can enjoy a range of advantages such as:

- Increased Efficiency: Automate calculations and reduce manual data entry, speeding up the invoicing process.

- Consistency: Ensure all your payment requests follow a professional format and contain the necessary details every time.

- Real-Time Tracking: Monitor when clients receive and pay their bills, and send reminders if needed.

- Legal Requirements for Self Employed Invoices

When requesting payment for services or goods, it’s important to ensure that the document you send complies with local laws and regulations. Many countries have specific legal requirements for payment requests, and failing to meet these can result in delays, legal issues, or even penalties. Understanding what information needs to be included, as well as any applicable tax rules, is essential to protect both your business and your client.

In many jurisdictions, certain details must be clearly outlined on every request for payment, regardless of whether you’re a freelancer, contractor, or running a small business. These details help ensure transparency, prevent misunderstandings, and ensure that your transactions are legally valid. Below, we outline the key legal requirements for a compliant document.

Key Information to Include

To meet legal standards, your payment request must contain several key elements. These details may vary depending on where you operate, but generally, the following should be included:

Required Information Description Business Name and Contact Information Include your full name or business name, address, email, and phone number. If applicable, add your business registration number or tax ID number. Client Information Provide the name, address, and contact details of the client you’re billing. This helps avoid confusion, especially in larger companies. Unique Reference Number Each document should have a unique identification number for easy tracking and reference in your records. Description of Goods or Services Clearly list the work performed or goods delivered, including quantities, hours, or any other relevant details. Total Amount Due State the total amount payable, including taxes, fees, and any applicable discounts. Tax Information If applicable, include any relevant tax rates (such as VAT), and provide a breakdown of the tax amount charged. Payment Terms Specify the due date, accepted payment methods, and any late payment penalties if applicable. Taxation and Other Legal Considerations

Depending on your location, taxation rules vary significantly. For example, if you’re based in a region with value-added tax (VAT) or sales tax, you’ll likely need to include the tax rate and tax number on your request. Some countries also require specific wording, such as indicating whether you are registered for VAT or other business taxes. Not adhering to these rules can result in fine

How to Set Payment Terms on Your Invoice

Establishing clear and concise payment terms is essential for maintaining a smooth cash flow and avoiding misunderstandings with your clients. These terms outline the expectations for when and how payment should be made, including deadlines, payment methods, and any penalties for late payments. Setting proper payment conditions upfront not only helps to ensure timely payments but also communicates professionalism and fairness.

When defining your payment terms, it’s important to consider factors such as your business needs, the nature of your relationship with the client, and the type of work you are providing. Well-crafted payment terms will provide both you and your client with clarity on financial expectations and reduce the likelihood of disputes down the road.

Key Elements of Payment Terms

There are several important elements to include when setting payment terms for your documents. These guidelines ensure that both parties are on the same page about expectations:

- Due Date: Specify when payment is expected. Common terms include “Net 30” (payment due within 30 days) or “Due on Receipt” (payment expected immediately upon receipt of the request).

- Payment Methods: Clearly list the acceptable forms of payment, such as bank transfer, credit card, online payment services, or checks.

- Late Fees or Penalties: Include any late fees or interest charges if payment is not made by the due date. For example, you might charge a specific percentage per day or week past due.

- Discounts for Early Payment: Offering a small discount for early payment can incentivize clients to pay sooner. For example, “2% discount if paid within 10 days.”

- Partial Payments or Installments: If applicable, outline how partial payments or installment plans work, including the due dates and amounts of each payment.

Common Payment Terms Examples

Different industries and businesses may use varying payment terms depending on the agreement with their clients. Below are a few common examples:

- Net 30: Payment is due within 30 days of the payment request date.

- Due on Receipt: Payment is expected immediately upon receipt of the payment request.

- Net 60: Payment is due within 60 days, typically used for larger or more complex projects.

- 50/50: A 50% upfront deposit is required before work begins, with the remaining 50% due upon completion or delivery.

- Milestone Payments: Payments are broken into parts, paid as specific milestones are completed. This is common for long-term projects or contracts.

By clearly defining your paym

Best Practices for Sending Invoices to Clients

Sending a payment request to clients is a crucial step in ensuring that your business receives timely payments. However, how you send these documents can significantly impact the speed and efficiency of the payment process. By following best practices for delivery, you can reduce confusion, enhance professionalism, and improve client relationships.

From choosing the right method of delivery to clearly communicating payment terms, the way you send a payment request is just as important as the content. Below are some key best practices to ensure your payment requests are delivered effectively and processed quickly.

Choosing the Right Delivery Method

Selecting the appropriate method to send your request for payment can help ensure that it is received on time and acted upon promptly. Consider the following options:

- Email: Sending a digital version via email is the most common and efficient way to deliver payment requests. It allows for instant delivery and can include a PDF attachment, which is easy for clients to download and print.

- Online Payment Platforms: Many businesses use services like PayPal, Stripe, or other invoicing platforms. These systems often allow you to send payment requests directly, track the status, and sometimes even integrate payment options directly into the request.

- Postal Mail: Although less common in the digital age, some businesses still prefer to send physical copies of payment requests, especially for larger clients or more formal industries. This method ensures that there is a paper trail and may be required in some legal contexts.

- Client Portals: For larger businesses or ongoing contracts, clients may have a dedicated portal where you can upload your payment requests. This ensures a smooth process and provides a record for both parties.

Timing and Frequency of Sending Payment Requests

Timing is critical when it comes to sending payment requests. Being proactive about sending these documents can help ensure timely payments. Here are some timing best practices:

- Send Early: Send your request as soon as the work is complete or the agreed-upon milestone is achieved. This ensures that the payment request is fresh in the client’s mind.

- Follow Up: If the payment is not made by the due date, don’t hesitate to send a polite reminder. This can be a gentle nudge that encourages clients to act without feeling pressured.

- Set Clear Deadlines: Include a due date on your document, and make sure the client is aware of this deadline in your communications. You may also want to set a reminder date for yourself to follow up if payment is not received.

- Sen

How to Track Unpaid Invoices

Effectively tracking outstanding payments is crucial for maintaining healthy cash flow and ensuring that your business remains financially stable. When a client fails to make payment by the agreed-upon date, it is important to have a systematic way of monitoring these unpaid amounts. Implementing an efficient tracking system helps you stay on top of your accounts and follow up promptly without missing any payments.

Whether you handle this process manually or use digital tools, keeping track of unpaid amounts requires careful attention and organization. Below are some methods and tips to help you track overdue payments effectively and take appropriate action when necessary.

Manual Tracking Methods

For smaller businesses or freelancers who deal with a limited number of clients, manually tracking unpaid payments can be a manageable option. Here are some common ways to keep track:

- Spreadsheet Tracking: Use tools like Excel or Google Sheets to create a simple ledger that lists all issued payment requests, amounts due, due dates, and payment statuses. This can be easily updated and customized to fit your needs.

- Paper Ledger: For those who prefer physical records, a paper ledger or notebook can be used to track each client’s outstanding balance, along with a space to note payment received dates and any follow-up actions.

- Calendar Reminders: Set up calendar reminders (either digital or physical) for each due date to prompt you to check if payment has been made. This is a basic but effective way to keep track without relying on complex systems.

Using Digital Tools for Tracking

For a more automated and efficient solution, many small businesses and freelancers opt for digital tools and accounting software that specialize in tracking unpaid amounts. These tools can save you time, reduce errors, and help you stay organized:

- Accounting Software: Platforms like QuickBooks, FreshBooks, or Xero automatically track unpaid payments, allowing you to see at a glance which clients still owe money and send reminders or late payment notifications easily.

- Online Payment Platforms: Services like PayPal, Stripe, or Square often offer invoicing and tracking features built into their systems. These tools can automatically mark payments as received and send you alerts when payments are overdue.

- Dedicated Billing Software: Tools like Zoho Invoice or Wave Accounting allow you to create, send, and track payment requests, as well as set reminders for overdue payments. These systems often come with features like automatic payment reminders and overdue notices.

By leveraging digital tools or keeping a manual ledger, you can easily track unpaid balances and follow up with clients in a timely manner. Regardless of the method you choose, having a clear, organized system is essential to maintaining financial stability and ensuring that no payment slips through the cracks.

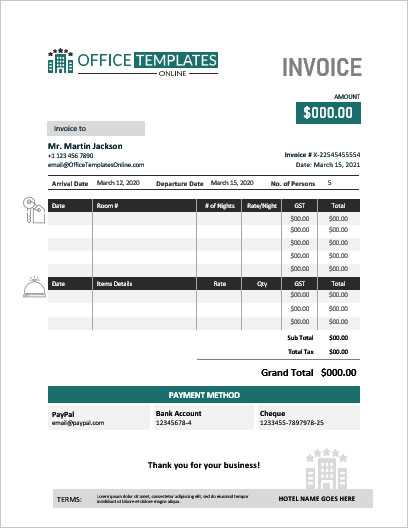

Importance of Professional Invoice Design

A well-designed payment request not only ensures that all relevant information is clearly presented but also plays a key role in establishing your business’s credibility and professionalism. The way you present your financial documents can have a significant impact on how clients perceive your business. A polished and clear design can improve communication, enhance trust, and even expedite the payment process.

In today’s competitive marketplace, standing out is essential. A professional layout signals to your clients that you are organized, reliable, and serious about your work. It provides a lasting impression and reinforces the quality of the service or product you provide. Whether you are a freelancer or a small business owner, investing time in creating a well-designed request for payment can pay off in the long run.

Visual Appeal and Client Perception

How your document looks can influence how clients view your business. An attractive and easy-to-read design can enhance your brand image and help you build trust with clients. Consider the following design elements:

- Consistency: Ensure that your branding is consistent across all documents. Using the same colors, fonts, and logo as your website or marketing materials creates a cohesive brand experience.

- Clarity: A clean, simple layout with clear headings, bullet points, and organized sections makes it easy for clients to quickly understand the details of the payment request. Avoid clutter and unnecessary information.

- Professional Fonts: Choose easy-to-read fonts that reflect your business’s tone. Avoid overly decorative fonts that may detract from the seriousness of the request.

Improved Communication and Efficiency

A professional design helps ensure that all essential information is easy to find. This reduces the likelihood of errors, misunderstandings, or delays in payment. Key elements such as the amount due, payment terms, and client details should stand out clearly. A well-organized request for payment makes it simple for both you and the client to verify the information quickly.

Moreover, when clients see a well-structured document, they are more likely to treat it with the same level of professionalism, which can contribute to faster processing and payment. Including detailed but clear information, such as payment methods and deadlines, ensures that there are no questions or confusion, resulting in fewer follow-up communications and quicker payments.

In conclusion, the design of your payment request is not just about aesthetics. It’s a powerful tool that reflects the quality and professionalism of your business. A carefully crafted layout improves communication, strengthens your brand identity, and helps ensure that your payment process runs smoothly and efficiently.

Using a Template for Tax Purposes

When managing your financial records, especially for tax filing, keeping accurate and organized documentation is essential. Utilizing a structured format for your payment requests can streamline this process by ensuring that all necessary information is recorded consistently. A well-organized record not only helps you stay compliant with tax laws but also makes it easier to track income, expenses, and other financial details required by tax authorities.

By using a pre-designed structure for your payment requests, you can automate many aspects of record-keeping, making it easier to produce the necessary documentation when it’s time to file taxes. Whether you are filing quarterly or annually, having your records neatly laid out saves time and reduces the risk of errors that could lead to penalties or audits.

Key Tax Information to Include

When preparing your financial documents for tax purposes, it’s important to ensure that the necessary information is included to meet regulatory requirements. Here are some essential details to include:

- Business Details: Always include your business name, address, and tax identification number (TIN). This ensures that the payments are properly attributed to your business when reported to tax authorities.

- Client Information: Record your client’s name, address, and any relevant identification numbers, such as their TIN. This helps track which clients owe you money and is also required for tax reporting.

- Payment Date and Amount: Make sure the payment amount and date are clearly indicated. This allows you to report accurate earnings and helps avoid discrepancies in your income reporting during tax season.

- Taxes Collected: If applicable, list any sales tax or VAT that has been collected. This is especially important if you are selling goods or services subject to sales tax and need to report this information for tax purposes.

Advantages of Using a Structured Format

Using a pre-designed format for your payment records offers several advantages when it comes to managing your taxes:

- Efficiency: A consistent layout makes it easier to track and categorize payments, so you don’t waste time organizing your finances before tax season.

- Accuracy: A well-structured document reduces the risk of errors and omissions, which can cause problems when filing taxes or lead to incorrect deductions.

- Compliance: A clear and consistent record ensures you meet all required tax reporting standards, helping you avoid potential audits or fines from tax authorities.

In conclusion, using a structured format for your payment requests is not only about streamlining your invoicing process–it’s also an essential tool for maintaining accurate tax records. With the right system in place, you can ensure that your financial records are organized, compliant, and ready for tax season with minimal effort.

How Invoice Templates Save Time and Money

Using a predefined format for billing can greatly improve the efficiency of your financial processes. It eliminates the need to create each payment request from scratch, which can save you valuable time. A structured document not only speeds up the task of issuing requests but also reduces the chances of errors, helping you avoid costly mistakes. By automating many aspects of your billing system, you can focus more on your business operations and less on administrative tasks.

Furthermore, a streamlined approach to creating payment requests can lead to more consistent cash flow and better overall financial management. By cutting down on the time spent drafting individual documents and ensuring accuracy, businesses can allocate their resources more effectively, improving productivity and minimizing unnecessary costs.

Time-Saving Benefits

- Quick Setup: Predefined formats allow you to insert the necessary information and generate a complete payment request in a matter of minutes, rather than starting from scratch each time.

- Consistency: With a consistent layout for all payment requests, you save time by not having to redesign or reformat documents, making the whole process more predictable and efficient.

- Automation: Many systems enable you to save client details and other relevant data, allowing you to automatically populate fields without needing to enter the same information repeatedly.

Cost-Effective Advantages

- Reduced Errors: By using a standardized format, you reduce the likelihood of making mistakes in calculations or missing crucial information. This reduces the need for corrections and follow-up, saving both time and money.

- Faster Payment Processing: Clear, professionally designed payment requests can help avoid confusion and result in quicker payments, improving your cash flow and reducing the need for repeated reminders.

- Reduced Administrative Costs: Automating the billing process reduces the need for additional staff time or outsourcing, helping to lower overall operational costs.

In conclusion, using a well-structured document for payment requests offers significant time and cost-saving benefits. By reducing manual work, minimizing errors, and speeding up the payment process, businesses can increase operational efficiency and keep more money in their pockets. This simple yet effective solution enhances both productivity and profitability, making it an essential tool for any business.