Comprehensive Invoice Approval Policy Template for Businesses

Every organization needs a structured approach to handling financial documents to ensure smooth operations and maintain transparency. A well-defined system helps prevent errors, delays, and misunderstandings that could affect cash flow and business relationships. Having a clear process in place allows teams to work efficiently, ensuring all transactions are processed correctly and promptly.

Creating a standardized framework for reviewing and approving payments is crucial for any business. It not only increases accountability but also minimizes the risk of fraud and mismanagement. With the right structure, organizations can maintain consistency and ensure that all financial tasks are handled in compliance with internal standards and external regulations.

In this article, we will explore how to develop a framework that enhances operational efficiency and accuracy. This process should be simple, adaptable, and easy to implement across various departments, ensuring everyone is aligned and understands their responsibilities. Whether you’re starting from scratch or looking to refine your current system, this guide will provide practical steps to help you get there.

Invoice Approval Policy Template Overview

A well-structured framework for reviewing and processing financial documents is essential for any business. This system outlines clear procedures and responsibilities, ensuring all transactions are verified and validated before being finalized. It serves as a guide to help staff members follow a consistent process, which enhances accuracy, reduces errors, and improves efficiency. A carefully designed framework also provides transparency and accountability, reducing the likelihood of discrepancies and potential conflicts.

Key Elements of a Successful Framework

When creating a structured review process, several critical elements should be considered to ensure its effectiveness. The key components include clear definitions of roles, decision-making criteria, and appropriate timeframes for each step. Additionally, incorporating checks and balances into the process will help prevent unauthorized actions and ensure compliance with internal and external standards.

Steps to Implement a Review Framework

To implement a smooth and efficient procedure, businesses should follow a series of steps, including creating the framework, training staff, and establishing monitoring systems. Regular audits and feedback loops are also essential to maintaining the integrity of the process and making improvements over time.

| Step | Description |

|---|---|

| Define Roles | Clarify who is responsible for each stage of the process to ensure accountability and efficiency. |

| Set Clear Guidelines | Establish rules and criteria for approving financial documents to ensure consistency across the board. |

| Implement Timeframes | Set deadlines for each step to ensure timely processing and prevent delays. |

| Regular Audits | Conduct periodic reviews to ensure the process is followed correctly and identify areas for improvement. |

Key Benefits of a Clear Approval Process

A structured and transparent method for reviewing financial documents brings numerous advantages to any organization. By defining specific steps and responsibilities, businesses can enhance accuracy, reduce delays, and minimize errors in financial transactions. Establishing a clear framework not only improves internal workflows but also fosters greater accountability, ensuring that each transaction is thoroughly vetted before approval.

Improved Efficiency

Having a well-defined procedure significantly speeds up the process of reviewing financial transactions. When everyone knows their role and what is expected of them, there is less time spent on decision-making and fewer back-and-forth communications. This allows for faster processing and more streamlined operations.

- Reduces bottlenecks by clearly assigning tasks.

- Minimizes confusion and delays, ensuring a smoother workflow.

- Enables quicker decisions with less time spent on approvals.

Enhanced Accuracy and Compliance

A clearly outlined system helps reduce errors by ensuring that each document is checked according to set guidelines and standards. It also helps maintain compliance with both internal company rules and external regulations, reducing the risk of costly mistakes or audits.

- Ensures consistency in the review process across departments.

- Reduces the risk of non-compliance with industry standards.

- Helps to identify and correct mistakes before they escalate.

Overall, having a transparent and well-organized approach helps mitigate risks, improve operational effectiveness, and maintain financial integrity within the company.

Steps to Create an Effective Invoice Policy

Developing a streamlined framework for managing financial document approvals requires careful planning and clear guidelines. By following a set of structured steps, organizations can create a system that ensures accuracy, accountability, and efficiency in their financial processes. This process not only minimizes errors but also promotes transparency, which is crucial for maintaining healthy financial operations.

Step 1: Define Roles and Responsibilities

The first step in creating an effective system is to clearly define the roles and responsibilities of each person involved in the review process. Establish who will be responsible for verifying documents, who will make the final decisions, and who will ensure that all steps are followed according to guidelines. This clarity helps to eliminate confusion and ensures that the review process runs smoothly.

- Assign specific individuals or teams to handle different stages of the process.

- Clarify decision-making authority at each step to prevent delays.

- Ensure that all involved parties are trained on their responsibilities.

Step 2: Set Clear Guidelines and Procedures

Next, it’s essential to establish clear guidelines for how financial documents should be reviewed, verified, and processed. These guidelines should outline the exact criteria that documents must meet before approval. By creating standardized procedures, businesses ensure that all documents are consistently evaluated, which minimizes the chance of errors or overlooked details.

- List the criteria for document acceptance and review.

- Outline the steps involved in verifying the accuracy of financial records.

- Set timelines for each stage to maintain efficiency and accountability.

Following these steps will ensure that your organization has a clear, effective process that improves accuracy and efficiency in managing financial documentation.

Common Mistakes in Invoice Approval Procedures

When it comes to managing the process of reviewing and confirming financial documents, there are several common pitfalls that businesses often encounter. These mistakes can lead to inefficiencies, errors, or even financial discrepancies. Recognizing and addressing these issues early on can help ensure a smoother, more reliable process in the long run.

1. Lack of Clear Guidelines

One of the most frequent errors is the absence of well-defined procedures. Without clear rules and expectations, staff members may follow inconsistent practices, leading to confusion and delays. Establishing a standard process ensures that everyone knows exactly what to look for and how to proceed.

- Failure to outline specific document requirements.

- Inconsistent decision-making across different departments.

- Unclear criteria for what constitutes an approved document.

2. Inadequate Communication Between Teams

Another common mistake is poor communication between teams or departments involved in the review process. When information is not shared effectively, it can lead to bottlenecks, missed details, and unnecessary delays. A clear communication channel is essential to keep the workflow moving smoothly.

- Lack of coordination between finance and operations teams.

- Failure to update relevant parties about changes or issues.

- Not using a centralized system for document tracking and updates.

By avoiding these common mistakes, organizations can significantly improve the efficiency and accuracy of their financial review processes, saving time and resources while reducing the risk of errors.

How to Customize an Invoice Approval Template

When it comes to managing financial transactions, it is important to establish a clear and consistent process for reviewing and processing requests. Customizing the steps and parameters within your review system can help ensure everything is aligned with your business requirements. Adapting these steps allows for greater control, accuracy, and efficiency in managing incoming payments and expenses.

Define Review Stages and Participants

The first step in customizing your system is to determine the key stages of review. Each stage represents a point where documents are assessed, validated, or authorized. These stages can be adjusted to meet the unique needs of your team or organization. The main stages usually include:

- Initial submission: When the request is first made, it is recorded and submitted for review.

- Verification: The details are checked for accuracy, completeness, and compliance with internal guidelines.

- Authorization: A final review is made to confirm if the request is approved for payment or processing.

Next, decide who will be responsible for each stage. You may assign team members based on roles such as managers, department heads, or financial officers. Clearly defining responsibilities ensures no stage is missed or neglected.

Set Approval Criteria and Limits

Another important aspect of the customization process is establishing clear criteria for approval. This includes defining the parameters under which a request will be authorized. Key factors to consider include:

- Amount limits: You can set a threshold beyond which certain requests need higher-level authorization.

- Vendor validation: Requests associated with approved vendors or contractors may require a simplified process.

- Documentation checks: Specify which supporting documents are required for a request to be eligible for approval.

By setting these limits, you can tailor the workflow to match your financial controls and ensure that requests are processed in a secure and efficient manner. This also reduces the risk of errors or fraud.

Importance of Defining Approval Roles

Clear identification of roles within the review and authorization process is critical for any organization. Without a well-defined structure, there can be confusion, delays, and inefficiencies that undermine the overall effectiveness of financial operations. Establishing who is responsible at each stage helps streamline the workflow, ensures accountability, and reduces the likelihood of mistakes.

Clarity and Accountability

When roles are clearly defined, each individual understands their responsibilities, which prevents tasks from falling through the cracks. By specifying who handles what aspect of the review, you create a transparent system where all parties are aware of their duties and the timeline in which they need to act. This also leads to greater accountability, as each step in the process is tied to a specific person.

Efficiency and Control

Proper role definition ensures that the process runs smoothly by reducing bottlenecks and unnecessary delays. When the right person is in charge at each stage, the entire workflow becomes more efficient. Additionally, assigning roles based on expertise or seniority allows for better control over decisions. For instance, complex or high-value requests can be routed to more experienced personnel, while smaller items are handled by junior staff.

Ensuring Compliance with Invoice Approval Policies

Maintaining consistency and adherence to internal procedures is vital for the integrity of any financial process. Establishing clear guidelines for document review ensures that all requests are evaluated in a standardized way, reducing the chances of errors or fraudulent activities. Regular checks and balances help enforce these standards and promote compliance across all levels of the organization.

Key Steps to Maintain Compliance

There are several strategies that can be employed to ensure that all transactions align with established procedures. These include:

- Training and Awareness: Regular training sessions help ensure that all team members understand the rules and the importance of following them. This reduces the likelihood of accidental non-compliance.

- Automated Systems: Using automated tools can help streamline the review process and ensure that every step is completed according to set guidelines. Automation also reduces human error.

- Regular Audits: Periodic audits provide an opportunity to verify that all transactions comply with internal controls. Audits also help identify areas for improvement and prevent potential violations.

Enforcement and Monitoring

It’s important not just to establish rules, but also to actively monitor and enforce compliance. Key measures include:

- Reporting Mechanisms: Establish clear channels for reporting any discrepancies or issues during the review process.

- Tracking and Documentation: Keep thorough records of every step in the review and approval process to ensure transparency and accountability.

By consistently following these

How to Handle Disputed Invoices in the System

When discrepancies arise in financial records, it is essential to have a clear procedure for resolving conflicts. Whether due to errors in amounts, missing documentation, or disagreements over terms, disputes need to be managed promptly and effectively to prevent delays and maintain smooth operations. A structured process helps ensure that each issue is addressed fairly and consistently.

Steps to Resolve Disputes

To handle disagreements in the review process, it is important to follow a systematic approach. These steps can help ensure a resolution is reached efficiently:

- Initial Assessment: Review the specific points of contention, such as discrepancies in pricing, quantity, or terms. Gather all related documentation to fully understand the issue.

- Communication: Contact the vendor or internal team responsible for the disputed entry. Clarify the source of the problem and attempt to find a mutual agreement on how to proceed.

- Documentation: Keep detailed records of all communications and findings during the dispute resolution process. This will be useful for future reference and for transparency.

- Decision Making: Once all relevant facts are gathered, make an informed decision. If the dispute is valid, adjust the details as necessary, or escalate the matter to a higher authority if required.

- Finalization: Once resolved, update the system accordingly and ensure all parties are informed of the final decision. If necessary, initiate corrective actions to prevent similar issues in the future.

Preventing Future Disputes

To reduce the likelihood of future conflicts, consider implementing th

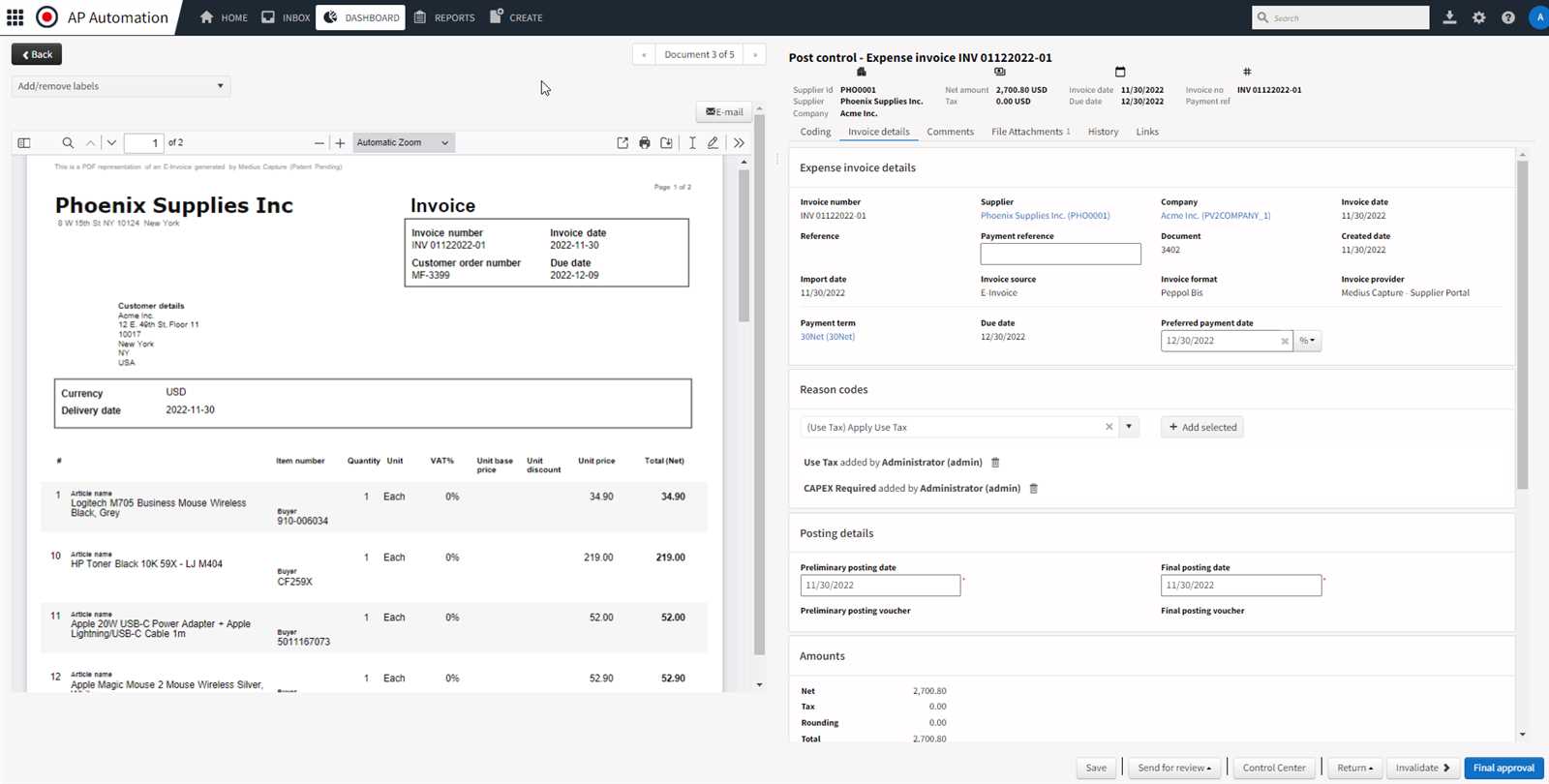

Using Technology to Streamline Invoice Approvals

Integrating digital tools into your review and authorization process can significantly enhance efficiency and reduce manual errors. Technology allows for automation, better tracking, and improved communication, all of which contribute to a faster and more accurate handling of financial transactions. By leveraging the right systems, you can simplify complex workflows and ensure a smoother process for all stakeholders involved.

Key Technologies to Consider

Several types of software and systems can help streamline the entire process, making it easier to manage and execute tasks efficiently. Consider implementing the following tools:

- Automated Workflow Software: These systems help automate the steps involved in document review and approval. They can route requests to the appropriate individuals, track progress, and send notifications when action is needed.

- Cloud-Based Document Management: Storing documents in the cloud allows for easy access, collaboration, and version control. It also ensures that all stakeholders have access to the latest information without the risk of losing critical data.

- Electronic Signature Tools: Implementing digital signature solutions reduces the need for physical paperwork and speeds up the authorization process. These tools can verify authenticity and ensure that documents are legally binding.

- Data Analytics Tools: Data analytics can help monitor the efficiency of the review process, identify bottlenecks, and provide insights into trends or recurring issues, enabling better decision-making.

Benefits of Technology Integration

Using technology to handle financial documentation offers numerous advantages that can improve your organization’s overall workflow:

- Faster Processing: Automation and cloud-based tools allow for quicker turnaround times, reducing delays in the review cycle.

- Improved Accuracy: Automated systems minimize human errors by eliminating manual data entry and cross-referencing, leading to more accurate decisions.

- Enhanced Transparency: With real-time tracking and automated notifications, all parties involved can monitor the status of requests, ensuring better visibility and accountability.

- Cost Savings: By reducing paper usage and manual labor, technology helps lower operational costs and frees up staff to focus on higher-value tasks.

Adopting these technological solutions not only enhances the efficiency of the process but also ensures greater accuracy, security, and scalability for future growth.

Best Practices for Timely Invoice Processing

Efficient management of financial transactions requires a well-organized and prompt approach to handling requests for payment. To ensure that all requests are processed in a timely manner, it is crucial to establish a structured workflow that minimizes delays and reduces the risk of errors. By following best practices, organizations can maintain smooth operations and avoid unnecessary backlogs.

Key Strategies for Efficient Processing

To ensure timely completion of all payment requests, consider the following best practices:

- Establish Clear Guidelines: Set clear expectations for submission deadlines, required documentation, and approval steps. This helps eliminate confusion and ensures consistency throughout the process.

- Implement Automated Systems: Use software that automates the workflow, tracks progress, and sends reminders. Automation helps reduce human error and speeds up the entire process.

- Prioritize Urgent Requests: Develop a system to quickly identify and prioritize high-priority requests. This ensures that urgent payments are processed without unnecessary delay.

- Streamline Communication: Ensure that all parties involved are easily reachable and aware of their responsibilities. Clear communication between departments and vendors can help resolve issues promptly and prevent bottlenecks.

- Set Realistic Timeframes: Define achievable timelines for each step of the process. Ensuring that timelines are realistic prevents rushes at the last minute and minimizes errors due to haste.

Tips for Avoiding Delays

To further enhance the efficiency of your process and avoid delays, consider these additional tips:

- Pre-approve Vendor Information: Verify vendor details in advance to prevent delays caused by missing or incorrect information.

- Regularly Review and Update Procedures: Periodically evaluate your workflow and make necessary adjustments to keep the process running smoothly. This includes updating procedures, training staff, and optimizing systems for better efficiency.

- Monitor Key Performance Metrics: Track the time taken at each stage of the process to identify potential bottlenecks. Regular monitoring helps ensure that any issues are detected and resolved quickly.

By implementing these practices, organizations can significantly improve the speed and accuracy of financial transaction processing, ensuring that all requests are handled efficiently and in a timely manner.

Setting Up Approval Limits for Different Roles

In any financial system, it is important to establish specific boundaries for decision-making to maintain control and efficiency. By defining clear limits based on the roles of individuals within the organization, you ensure that the right people are making the right decisions, according to their level of responsibility. This helps balance the workload, maintain accountability, and prevent unauthorized actions.

Defining Approval Boundaries

Each role within the organization should have defined thresholds for the amount or type of requests they are authorized to approve. Setting these limits helps to prevent bottlenecks and ensures that tasks are processed by the appropriate person. Consider the following approaches:

- Junior Staff: Typically, entry-level roles may have approval limits for lower-value requests. These individuals can handle routine transactions that fall within a specific financial threshold.

- Mid-Level Managers: These individuals are generally responsible for approving more significant amounts and overseeing department-related expenditures. Their limits should be higher than those of junior staff but still controlled to maintain oversight.

- Senior Leadership: Senior roles such as department heads or executives often have broader approval authority. They should handle large-scale transactions or complex decisions that may require a more strategic perspective.

- Special Roles: Certain employees, such as financial officers or procurement specialists, may have specific limits depending on their area of expertise. These roles often requ

Auditing and Reviewing the Invoice Process

Regularly auditing and reviewing the payment request handling process is essential to ensure accuracy, compliance, and efficiency. A structured review helps identify weaknesses, prevent fraud, and improve the overall workflow. By implementing consistent audits, organizations can maintain transparency and ensure that all financial transactions align with internal controls and regulations.

Key Steps in Auditing the Process

To effectively audit and review the financial documentation process, consider following these steps:

- Define the Audit Scope: Determine the areas that need to be reviewed, whether it’s a specific department, type of transaction, or a general review of all requests within a given period.

- Collect Supporting Documentation: Ensure that all relevant documents and records are available for review. This includes contracts, receipts, communications, and any other supporting material that can validate the transaction.

- Verify Compliance with Internal Guidelines: Compare the process against established rules and procedures to ensure that all actions are in line with internal standards. Look for any deviations or inconsistencies.

- Assess Financial Accuracy: Double-check calculations, amounts, and vendor information to confirm that all figures are correct and that there are no discrepancies or errors.

- Evaluate Timeliness: Review the time taken at each stage of the process. Delays or bottlenecks can be identified and addressed for improved efficiency.

Review

Training Employees on the Approval Workflow

To ensure the smooth execution of the payment review process, it is essential that all team members are well-trained on the specific steps, expectations, and tools involved. Effective training helps employees understand their roles, follow the correct procedures, and respond to issues quickly, reducing the likelihood of errors or delays. A well-informed team ensures that the process runs efficiently and that each step is carried out in compliance with internal standards.

Key Areas for Employee Training

Training should cover various aspects of the workflow to ensure all employees know what is expected at each stage. Focus on the following key areas:

- Overview of the Process: Provide employees with a clear understanding of the entire process, from submission to final approval. This helps them grasp the bigger picture and how their role fits into the overall workflow.

- Roles and Responsibilities: Clearly define each person’s responsibilities in the process. Ensure that employees know what they are authorized to handle and what requires escalation or review from higher authorities.

- Common Pitfalls and How to Avoid Them: Teach employees about frequent mistakes or issues that arise during the review process and how to identify them early. This helps prevent delays and ensures that the review is done right the first time.

- Tools and Systems: Familiarize employees with the software or platforms they will use for submitting, tracking, and reviewing requests. Effective use of these systems helps streamline the process and minimizes errors.

- Dealing with Exceptions: Provide training on how to handle special cases, discrepancies, or exceptions in the process. This will help employees know how to escalate issues or resolve conflicts quickly.

Effective Training Methods

Consider using a mix of approaches to make training engaging and effective:

- Interactive Workshops: Hands-on workshops allow employees to practice real scenarios and gain a deeper understanding of how the process works. Role-playing exercises can be particularly useful for illustrating the review and decision-making process.

- Documentation and Guides: Provide employees with clear, accessible manuals or guides they can refer to when needed. This serves as a valuable resource for clarifying any doubts or questions during the process.

- Ongoing Support and Feedback: Offer continuous support through follow-up sessions, Q&A forums, or one-o

Impact of Poor Invoice Management on Business

Effective financial oversight is crucial for any organization, and mishandling of transaction records can lead to a cascade of negative consequences. Inaccurate tracking and processing of financial documents not only disrupt cash flow but can also tarnish relationships with suppliers and clients. A lack of proper organization or delayed documentation handling creates inefficiencies that ripple across various areas of a business.

Financial Disorganization can quickly escalate into cash flow issues. Without timely verification and processing of payments, a business may face overdue obligations, which could affect its ability to operate smoothly. Late payments or missed deadlines lead to potential late fees, damaged credit scores, and strained financial stability.

Supplier Relationships are often the first to suffer. When payments are not handled properly or on time, trust between a business and its suppliers can erode. This can result in delays, higher prices, or even the loss of business partners. Strong vendor relationships rely heavily on transparent and prompt financial transactions.

Internal Efficiency also takes a hit. Staff resources are often wasted on chasing down missing or incorrect records, diverting attention from more strategic tasks. The lack of streamlined processes increases administrative burden, leading to higher operational costs and wasted time.

Lastly, compliance risks should not be overlooked. Mishandling financial records can result in regulatory violations, fines, or legal disputes, especially if the company fails to meet tax reporting requirements or neglects to properly document payments. This can severely damage a business’s reputation and financial standing.

Integrating Your Template with Accounting Systems

Seamless connection between internal processes and financial management tools is essential for improving efficiency and reducing errors. By linking your document handling workflows to accounting software, you can automate many aspects of financial tracking, ensuring accurate and timely data transfer. This integration creates a streamlined approach to managing financial transactions and enhances overall operational effectiveness.

To successfully integrate workflows with your accounting system, consider the following steps:

- Choose Compatible Software: Select accounting platforms that support integration with your existing document management system. Look for systems with APIs or built-in features for smooth data transfer.

- Automate Data Entry: Link your processes to automatically populate financial entries in your software. This minimizes the risk of manual input errors and reduces the need for redundant data entry.

- Define Data Flow: Establish a clear flow of information between the two systems. Decide how documents will trigger updates in the accounting platform and what data should be shared between systems.

- Ensure Real-Time Syncing: Ensure that both systems update in real-time or at regular intervals to maintain accurate and up-to-date financial records across platforms.

- Monitor Compliance: Confirm that the integration supports compliance with relevant financial regulations, ensuring that all data transferred aligns with reporting requirements and legal standards.

By implementing these integration steps, businesses can ensure smooth data management, enhance transparency, and reduce the risk of errors. Ultimately, this reduces administrative overhead and leads to more accurate financial reporting, facilitating better decision-making.

How to Improve Invoice Approval Efficiency

Streamlining financial document handling processes is essential for enhancing productivity and minimizing delays. Efficient management of transaction-related documents ensures that approvals are processed swiftly, reducing the risk of errors and missed deadlines. By optimizing workflows, businesses can enhance operational efficiency and maintain smooth cash flow.

1. Automate Document Flow

Implementing automation tools can significantly reduce the time spent on manual tasks. Automating document routing and approvals helps avoid bottlenecks, ensures that every document reaches the right person at the right time, and reduces the likelihood of human error. Automated systems can trigger reminders for pending tasks and even initiate the next step in the workflow once one stage is completed, speeding up the overall process.

2. Centralize Communication and Tracking

Centralizing communication related to financial documents helps avoid confusion and reduces the need for back-and-forth emails. Using a unified platform where all involved parties can view the status of each document allows for quick resolutions to any issues that arise. Additionally, tracking the approval stages in real-time provides transparency and accountability, making it easier to identify and address delays.

By optimizing these aspects, businesses can significantly cut down the time and effort required to process financial documents, ensuring that payments and other related tasks are handled efficiently and on time.