Download Free Invoice PDF Template for Quick and Professional Invoicing

Managing financial transactions can be time-consuming and often requires attention to detail. Whether you’re a small business owner, a freelancer, or a contractor, having a well-structured document to request payment is essential. These documents not only ensure that you communicate your payment terms clearly but also help you keep track of services provided or products sold.

With the right tools, creating such documents can be both quick and professional. Simple solutions are available that allow you to generate a polished billing statement in just a few steps. The best part is that you don’t need to start from scratch or invest in expensive software to get the job done. A variety of pre-designed formats are available for download, allowing you to customize and use them as per your needs.

These convenient solutions can save you valuable time while maintaining accuracy and professionalism in your financial communications. With a clear and structured layout, your payment requests will look more reliable and trustworthy, encouraging prompt responses from clients and partners.

Free Invoice PDF Template Benefits

Having access to pre-designed documents for requesting payments offers numerous advantages, especially for small businesses and individuals who need an efficient way to manage financial transactions. These ready-to-use formats simplify the entire process, reducing the time spent on creating custom forms from scratch while maintaining a professional appearance.

Time and Cost Efficiency

One of the primary benefits of using pre-made formats is the time saved. Instead of dedicating hours to creating a document every time a payment is needed, you can easily customize an existing one. This significantly reduces administrative overhead, allowing you to focus more on growing your business. Furthermore, many of these options come at no cost, eliminating the need for costly software purchases or subscriptions.

Professional Appearance

Utilizing well-designed documents for payment requests ensures that your communication appears polished and credible. A professional layout instills trust in clients and business partners, making it more likely they will promptly respond to your request. With consistent formatting and clear details, these documents contribute to a smooth and effective billing process.

Incorporating custom elements into these documents, such as your company logo or personalized payment terms, makes them even more relevant to your business needs. The ability to tailor each form ensures that they align with your branding, which enhances your professional image.

How to Use Invoice PDF Templates

Creating payment request forms is made much easier with pre-designed documents that can be quickly adapted to suit your needs. These resources offer an efficient way to manage billing without having to design each document from scratch. The process is simple and allows you to focus on the content rather than the layout.

Step 1: Download the Document

The first step in using these ready-made formats is to download the document that best suits your needs. Many options are available online, often with no cost involved. Choose a layout that matches the nature of your business and fits the specific transaction you’re handling. Once downloaded, the file can be opened on most devices for easy editing.

Step 2: Customize the Details

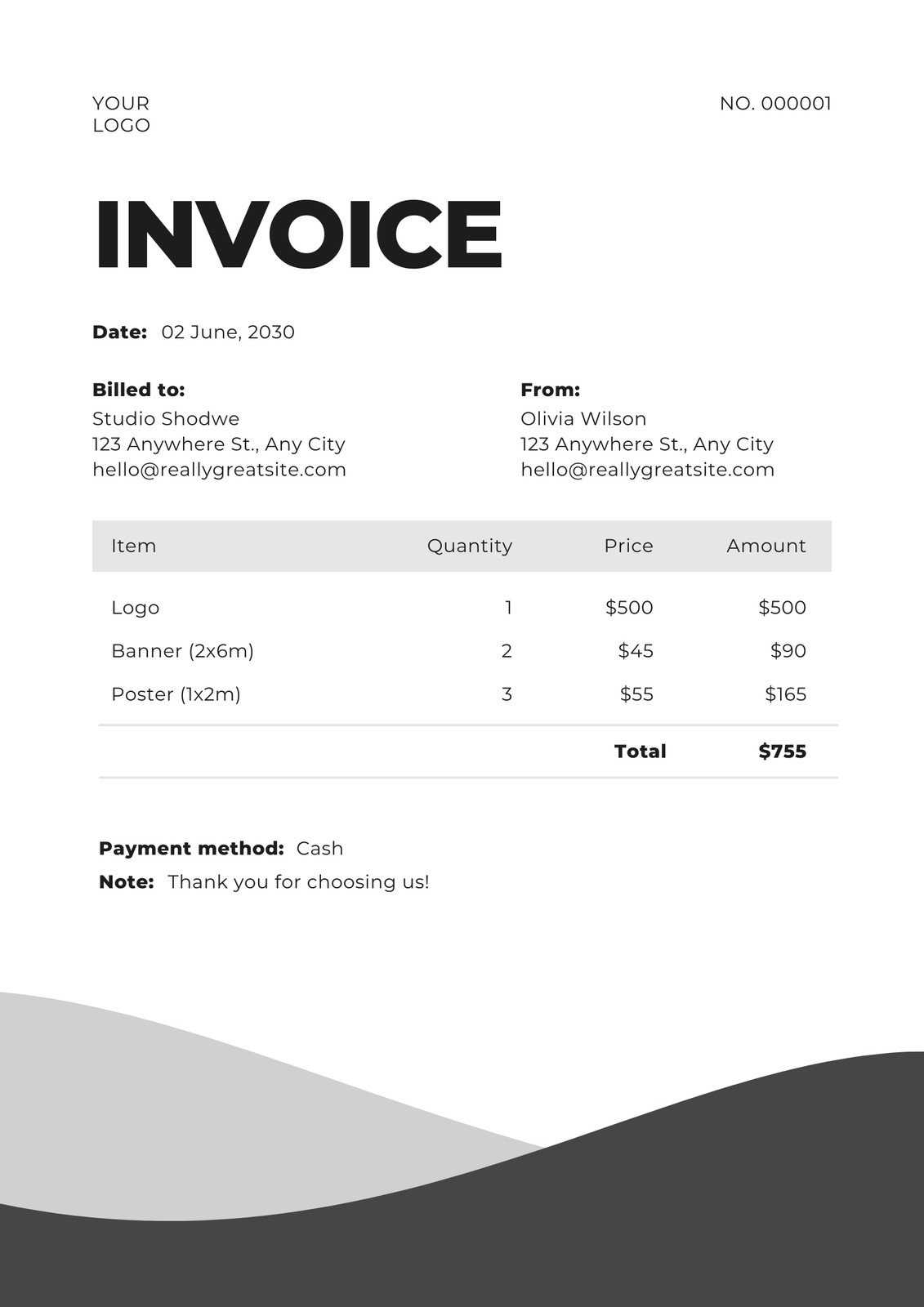

After opening the document, the next step is to add relevant information. This includes your business name, client details, services or products provided, and payment terms. Ensure all fields are completed accurately to avoid misunderstandings or delays. Some formats allow for customization of fonts, colors, and other design elements, letting you tailor the look to reflect your company’s branding.

Once your document is fully customized, review it for accuracy before sending it out. Properly formatted billing requests help establish credibility and ensure clarity in payment expectations. Finally, save the completed form in a secure location, ready for printing or electronic distribution.

Top Features of Free Invoice Templates

When looking for pre-designed billing documents, there are several features that make them both functional and easy to use. These formats are crafted to save time, enhance clarity, and improve the overall professionalism of your financial communications. Understanding the key attributes can help you choose the best one for your needs and streamline your invoicing process.

Customizable Layouts

One of the standout features of these documents is their flexibility. Many are designed to allow customization, meaning you can adjust the layout to suit your specific requirements. You can change fonts, colors, and even the placement of key details such as your company logo or contact information. This ensures that the final result aligns with your business branding while keeping the information clear and accessible.

Pre-Defined Fields

Most ready-made formats come with pre-defined fields that make it easy to input necessary details like client names, product descriptions, and payment amounts. This structured approach reduces the chance of missing important information. These pre-structured forms ensure that your billing documents contain all the essential components, such as transaction dates and payment terms, which helps to avoid any confusion or errors.

Additionally, these documents often come with instructions or tips for completing them correctly, making the process even simpler, especially for those new to creating billing requests.

Why Choose PDF for Invoices

When it comes to creating and sending payment requests, choosing the right format is essential for ensuring smooth communication and easy tracking. Among the various document types, one format stands out for its versatility and reliability. Using this format offers several distinct advantages, making it the preferred choice for businesses and freelancers alike.

- Universal Compatibility: One of the main benefits of this format is its wide compatibility across devices and platforms. Whether your client uses a Mac, Windows, or a mobile device, the document will appear exactly as intended without any formatting issues.

- Preserved Layout: Unlike word processing files, which can change their appearance depending on the software used, this format preserves the document’s layout. Your text, images, and other elements remain in place, ensuring a professional presentation every time.

- Security Features: This format also offers built-in security options such as password protection and encryption, ensuring that sensitive financial information remains private and secure during transmission.

- Easy to Share: Files in this format are small in size, making them easy to email or share via cloud services. Sending and receiving these documents is quick and efficient, minimizing delays in processing payments.

For businesses looking to enhance professionalism while maintaining efficiency, this format provides an ideal solution. Its reliability, security, and ease of use make it an excellent choice for managing financial transactions.

Simple Steps to Download Invoice Template

Getting a ready-to-use billing document is a straightforward process that can save you time and effort when creating payment requests. With just a few simple steps, you can quickly download a professional format tailored to your business needs. Here’s how you can get started.

- Search for Reliable Sources: Begin by finding a trusted website that offers customizable billing documents. Look for platforms that provide high-quality, editable formats that are compatible with your device.

- Choose the Right Format: Browse through available options and select a design that aligns with your business. Some platforms offer different styles depending on the industry or type of transaction.

- Click to Download: Once you’ve selected the format you prefer, look for a “Download” button. This will typically start the download process immediately, saving the file to your computer or device.

- Open and Customize: After downloading, open the document using any compatible viewer or editor. Customize the fields by adding your business details, client information, and the services provided.

By following these simple steps, you can have a fully functional and professional payment request ready for use in minutes.

Best Practices for Invoicing with PDFs

When using digital billing documents, following best practices can make a significant difference in how clients perceive your professionalism and how smoothly the payment process goes. Clear, accurate, and well-structured documents ensure that your clients understand the details and avoid any potential confusion. Here are some key practices to keep in mind when managing payment requests with this format.

Essential Tips for Clarity and Accuracy

- Double-Check Information: Before sending out any document, always review the details to make sure everything is accurate. This includes the client’s name, amounts, due date, and any other pertinent information. Accuracy helps build trust and avoids potential delays in payment.

- Include Clear Payment Terms: Make sure your payment terms are easy to find and understand. Specify due dates, late fees, and payment methods in a clear, concise manner. This helps avoid misunderstandings and ensures timely payments.

- Provide a Detailed Breakdown: Instead of listing only the total amount, provide a breakdown of each service or product, along with individual prices. This transparency reassures clients that they are being charged fairly and correctly.

Maximizing Efficiency in Your Billing Process

- Use Consistent Formatting: Ensure that your documents follow a consistent format. This includes uniform fonts, font sizes, and spacing. A clean, organized document reflects professionalism and makes it easier for clients to understand the payment request.

- Save and Share Securely: When sharing the document electronically, ensure that it is password-protected or encrypted to keep sensitive information secure. Avoid sending documents without proper security measures to prevent data breaches.

- Automate When Possible: If you frequently send out payment requests, consider using tools or software that allow for the automation of this process. You can create templates and set up recurring payments, saving time and reducing errors.

By following these best practices, you can ensure a smooth invoicing experience for both you and your clients, leading to faster payments and stronger business relationships.

Customizing Your Invoice Template for Business

Adapting a billing document to suit the specific needs of your business is an essential step in maintaining a professional image and ensuring clarity in your financial communications. By customizing the layout and content of these forms, you can ensure they reflect your brand identity while providing all the necessary details for clients to make timely payments. Personalizing these documents also helps streamline your business processes and ensures consistency across your operations.

To begin with, it’s important to incorporate your company’s branding elements. This includes adding your logo, business name, and contact information at the top of the document. Using your company’s color scheme and fonts further strengthens your brand identity and ensures a cohesive appearance across all business communications.

Another key aspect of customization is tailoring the payment details. Include specific instructions on payment methods, such as bank transfers, credit cards, or online payment options, along with any applicable terms or discounts. This provides clients with clear options on how to pay and helps prevent confusion during the transaction process.

By adapting the structure of these documents to meet the needs of your business, you ensure that all necessary information is included in an easy-to-read format, while also reinforcing your professional image with every communication. A well-customized billing document makes your financial interactions smoother and more efficient, ultimately contributing to better client relationships and faster payments.

Common Mistakes When Using Invoice Templates

When creating billing documents using pre-designed formats, it’s easy to make small errors that can lead to confusion or delays in payment. These mistakes can affect your professionalism and may cause friction with clients. Being aware of the most common pitfalls can help you avoid them and ensure that your financial communications remain clear and accurate.

Missing or Incorrect Information

- Incorrect Client Details: One of the most frequent mistakes is entering incorrect or outdated client information, such as the wrong billing address or contact details. Always double-check the recipient’s data before finalizing the document.

- Missing Payment Terms: Failing to include clear payment terms can lead to misunderstandings. Always specify the due date, accepted payment methods, and any late fees or discounts clearly in the document.

- Omitting Descriptions: Not providing a breakdown of services or products listed on the document can cause confusion. Clients should be able to easily see what they are being charged for, so include detailed descriptions of each item or service.

Formatting Issues

- Inconsistent Layout: Using inconsistent fonts, sizes, or spacing can make the document look unprofessional. Stick to a clean and organized layout that’s easy to read.

- Unreadable Text: Ensure the font color contrasts well with the background, and avoid using overly complex fonts. The document should be legible on all devices and in print.

- Cluttered Design: Overcrowding the document with too much information or unnecessary graphics can distract from the key details. Keep the design simple, focusing on the essentials.

By staying mindful of these common errors and taking the time to review your document before sending, you can ensure that your billing process remains smooth and efficient. Accurate and professional documents not only improve the client experience but also help ensure prompt payment and better business relationships.

How PDF Templates Improve Billing Efficiency

Streamlining the billing process is essential for businesses looking to save time and reduce errors. Using pre-designed formats helps automate the creation of payment requests, allowing you to quickly generate accurate and professional documents. These solutions improve efficiency by minimizing the amount of time spent on administrative tasks while ensuring consistency in your financial communications.

Speed and Convenience

By utilizing pre-made documents, you can eliminate the need to design each payment request from scratch. Once you’ve selected and customized a layout, the process of generating new documents becomes incredibly fast. Instead of manually inputting information into a blank document each time, you simply update the necessary fields and save the finished form. This reduces the time spent on paperwork and allows you to focus on other critical aspects of your business.

Minimizing Errors

Consistency is key when managing billing documents, and using pre-designed formats ensures that each one follows the same layout and structure. This reduces the risk of missing critical details or making formatting errors. With well-structured documents, it becomes easier to spot mistakes and correct them before sending them to clients, ultimately improving the accuracy of your financial communication.

Standardized designs also help prevent common mistakes such as missing fields or incorrect item descriptions. With all essential components already included in the format, you only need to fill in the details, ensuring that nothing is overlooked.

Incorporating these solutions into your billing process not only saves time but also boosts professionalism, helping to ensure that payments are processed smoothly and promptly.

Free vs Paid Invoice Templates: Pros and Cons

When selecting a billing format for your business, you have two main options: using a no-cost solution or opting for a premium version. Both come with their advantages and disadvantages, and the best choice depends on your business needs, budget, and the level of customization you require. Understanding the key differences between free and paid options will help you make an informed decision.

Advantages of Free Billing Documents

- No Initial Cost: The most obvious benefit of using a free solution is that it requires no investment. For startups or small businesses on a tight budget, this is an attractive option.

- Quick and Easy Access: Free formats are often readily available online, meaning you can download them almost instantly and start using them right away.

- Simplicity: Many free options are simple and straightforward, which can be ideal for small businesses that don’t need advanced features or heavy customization.

Drawbacks of Free Billing Documents

- Limited Customization: Free formats typically offer limited options for personalization, meaning you may not be able to fully align them with your branding or specific needs.

- Basic Features: While free solutions often include the core elements, they may lack advanced functionalities such as automated calculations or integration with accounting software.

- Quality and Professionalism: Some free options may look less polished or have fewer design choices, potentially affecting the professionalism of your business’s financial documents.

Advantages of Paid Billing Documents

- Advanced Features: Paid solutions usually come with more advanced tools, such as automated totals, tax calculations, and export options, which can help simplify the billing process.

- Customization and Branding: Premium options often allow for more customization, so you can fully tailor the document to reflect your business’s brand identity, from colors to logo placement.

- Support and Updates: With paid versions, you typically receive customer support and regular updates, ensuring that the documents remain functional and up to date with any changes in tax laws or industry standards.

Drawbacks of Paid Billing Documents

- Cost: The most significant downside of paid solutions is the upfront expense. This might not be feasible for all businesses, particularly those just starting out.

- Complexity: Some premium formats come with many features that could be overwhelming for users who need a simple solution. There may be a learning curve involved in using the advanced tools effectively.

Ultimately, the choice between free and paid formats depends on your business’s needs. If you’re just starting out and have limited resources, a free solution might

Ensuring Accuracy with Invoice PDFs

Accuracy in financial documents is crucial for maintaining trust with clients and ensuring timely payments. When using digital billing forms, it’s essential to focus on verifying all information before sending out the request. Small errors in amounts, client details, or payment terms can lead to misunderstandings, delays, or even disputes. Here are some best practices to help ensure that your documents are accurate and professional every time.

Key Elements to Double-Check

- Client Information: Always verify that the client’s name, address, and contact details are correct. Even minor mistakes in spelling or address formatting can cause confusion.

- Payment Amounts: Double-check all amounts to ensure that they are correct, including taxes, discounts, and any additional charges.

- Dates and Terms: Ensure that the payment due date and any other terms are clear and accurate to avoid late payments or miscommunication.

- Service or Product Descriptions: Confirm that the descriptions of the items or services provided are complete and accurate, as this helps prevent client disputes.

Using Tables to Improve Clarity

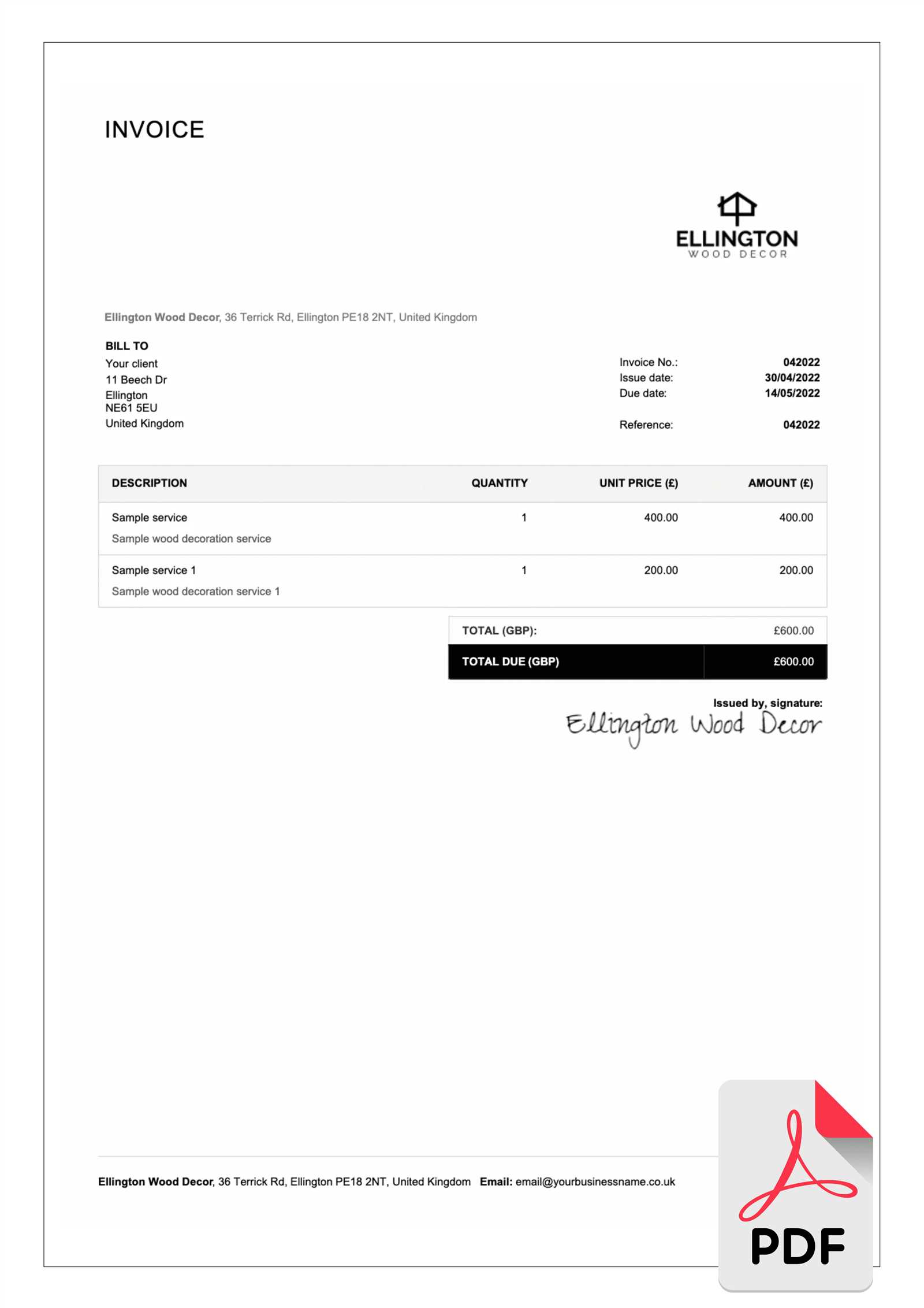

Using tables in your billing forms helps clearly present itemized charges, making it easier for clients to understand what they are being charged for. Here’s an example of how you can organize your details:

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 5 hours | $50 | $250 |

| Website Design | 1 project | $500 | $500 |

| Discount | -$50 | ||

| Total | $700 |

By clearly organizing the charges in a table format, you make it easier for the client to see exactly what they are being billed for, reducing the chance of errors or confusion.

Ensuring accuracy in your documents not only promotes professionalism but also helps maintain smooth financial transactions. Taking the time to verify the details before sending out any payment request can save you from potential issues down the line.

Free Templates for Different Business Needs

Every business has unique requirements when it comes to documenting financial transactions. Whether you’re a freelancer, a small business owner, or a large enterprise, the right form for creating billing requests can make all the difference. Many no-cost solutions are available, catering to various industries and business types. These forms can help streamline the process, enhance professionalism, and ensure clarity for both you and your clients.

Common Business Types and Their Needs

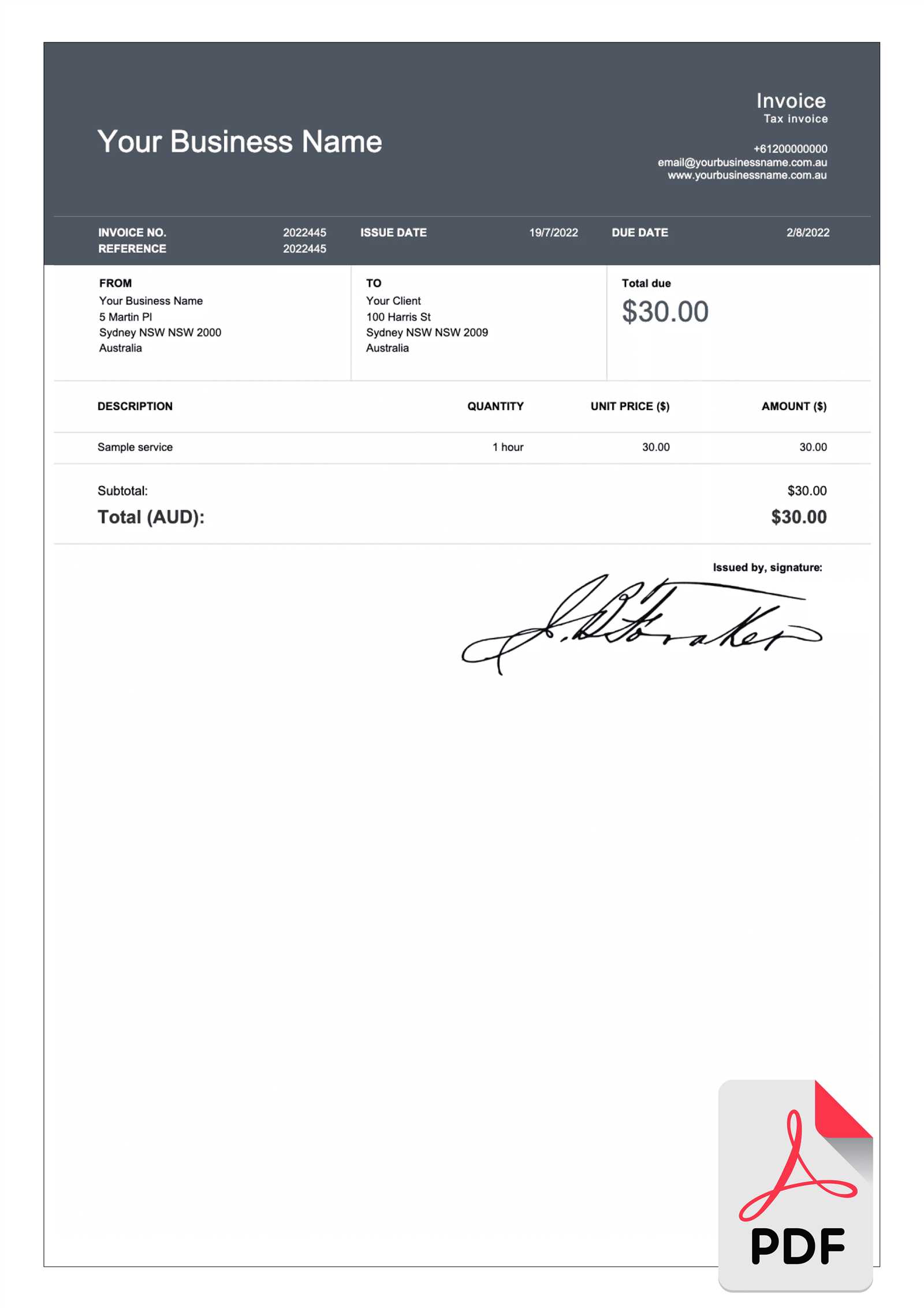

- Freelancers: Freelancers often need simple, easy-to-use formats that allow them to quickly create requests for their services. A straightforward, customizable solution with space for hourly rates or project-based pricing works well for this group.

- Small Businesses: Small business owners may require more detailed documents to track various products or services sold, taxes, discounts, and payment terms. Templates with itemized lists and the ability to adjust tax rates are ideal in this case.

- Consultants: Consultants often provide services on a per-project basis, which requires a more professional layout with detailed descriptions of each task or consultation session. Customizable formats that allow for clarity in outlining services and payment terms are key for this group.

- Online Retailers: E-commerce businesses might need a more complex solution, especially when dealing with multiple items in one sale. Look for customizable forms that can list individual product details, shipping charges, and offer flexibility for bulk orders or returns.

- Service Providers: Whether it’s plumbing, cleaning, or IT support, service providers benefit from templates that break down costs for each job or hour worked. This ensures transparency for clients and helps avoid any misunderstandings regarding the scope of work or pricing.

Choosing the Right Template for Your Needs

- Look for Industry-Specific Options: Some platforms offer templates tailored to specific industries, providing features that are relevant to your business, such as space for project codes or hourly rates.

- Consider Customization Options: A good template should be easily editable. This allows you to add your logo, change fonts, and adjust colors to match your brand identity, creating a more cohesive and professional look.

- Ensure Legal Compliance: Some templates are designed to meet legal requirements, such as including proper tax information or specific payment terms. This is especially important in industries that require strict documentation for tax purposes.

By choosing the right document for your business, you ensure that your financial communications are effective and aligned with your company’s needs. Whether you

Creating Professional Invoices with PDFs

Creating well-organized and polished billing documents is a critical step in ensuring your business maintains a professional image. A professional-looking payment request not only fosters trust but also simplifies the payment process for clients. By using a structured and visually appealing format, you can present all necessary details clearly and effectively, ensuring that there is no confusion regarding the services provided or the amounts due.

To start, it’s important to include all the essential information in a clear and structured way. This includes your company name and contact details, the recipient’s information, a detailed breakdown of products or services, and the payment terms. Ensuring each element is easy to find and clearly labeled helps prevent any misunderstandings.

Consistency in design plays a key role in establishing professionalism. Use clean fonts and maintain a consistent layout throughout the document. Consider adding your company logo and matching your brand colors to strengthen your business identity. A balanced design with appropriate spacing makes the document easier to read and understand, which enhances the client’s experience.

Using a well-organized layout is also crucial. Include a clear section for the itemized list of products or services, with columns for descriptions, quantities, unit prices, and totals. This helps clients quickly understand the charges. Additionally, be sure to include a prominent section for the total amount due, as well as any applicable tax or discounts.

For enhanced credibility, consider adding payment instructions and available methods in a separate section. This reduces confusion by making it clear how clients can settle their bills, whether through bank transfer, credit card, or online payment systems.

By paying attention to detail and maintaining consistency in your documents, you can create professional billing requests that not only improve your brand’s image but also help expedite payment processing and minimize errors.

Invoice Templates for Freelancers and Contractors

Freelancers and contractors often work on a variety of projects with different clients, which makes having a reliable and professional way to request payment essential. A well-structured billing document helps ensure that clients understand the work completed and the total amount due, ultimately leading to timely payments. Having the right format can save time, reduce errors, and project a professional image, which is crucial for maintaining good client relationships.

For freelancers and independent contractors, the billing process is typically straightforward but needs to be efficient. The right format should include essential details such as the work completed, payment terms, and the client’s information. It’s also important to include a section for specifying hourly rates, project fees, or retainer agreements, as these types of projects often have unique payment structures.

Key Elements for Freelance Billing Documents often include:

- Work Description: A clear, concise description of the services rendered or the project completed, with specific dates or milestones.

- Payment Terms: Clear terms outlining when payment is due, any late fees, and acceptable methods of payment (bank transfer, online payment, etc.).

- Hourly Rates or Project Costs: A breakdown of hourly rates, the total hours worked, or a fixed project fee.

- Taxes: If applicable, specifying the tax rates or including a note about whether taxes are included in the total amount.

- Client Details: Accurate contact information for the client, ensuring that there’s no confusion when sending the request.

Customization is especially important for freelancers and contractors, as each client may require different billing arrangements. Many solutions allow for easy customization of details such as logo placement, payment terms, and even the structure of the document itself. This flexibility is important for creating documents that are not only accurate but also match the freelancer’s or contractor’s brand.

By using a well-organized format that highlights all the necessary details and presents them professionally, freelancers and contractors can ensure smooth communication with clients and prompt payments. This simple step is a reflection of professionalism and can contribute to building long-term business relationships.

Security Features in PDF Invoice Templates

When handling financial documents, ensuring their security is of utmost importance. As businesses increasingly rely on digital documents to request payments, safeguarding sensitive information becomes crucial to prevent fraud, unauthorized access, or tampering. Using secure formats for creating billing requests can provide several layers of protection, helping to keep your and your clients’ data safe while maintaining the integrity of your transactions.

One of the key aspects of secure billing documents is password protection. By adding a password to your file, you can limit access to only authorized recipients. This is particularly useful when sending payment requests via email, as it ensures that only the intended client can view or make changes to the document.

Another important feature is encryption. Encrypting the file ensures that, even if the document is intercepted during transmission, it remains unreadable to anyone without the proper decryption key. Many digital document creation tools offer built-in encryption options, making it easier for businesses to secure their sensitive data.

Digital signatures are another essential security feature. By adding a digital signature to your document, you can verify that the document hasn’t been altered after it was created. A digital signature also confirms the identity of the sender, offering an added layer of trust between you and your client.

Watermarks can also be used as a deterrent against unauthorized copying or distribution of your financial documents. Placing a watermark on the document ensures that any unauthorized copies of the file are clearly marked, helping to protect your business’s confidential information.

Furthermore, many digital document solutions allow you to restrict editing permissions. This ensures that recipients can view the document but are unable to make any changes to the content, preserving the integrity of the information within. This feature is especially useful for businesses that want to prevent accidental or intentional alterations.

Incorporating these security features into your billing forms helps ensure that sensitive financial data remains protected, giving both you and your clients peace of mind throughout the transaction process. As digital threats continue to evolve, it’s important to stay proactive in implementing these measures to maintain a high level of confidentiality and security in your financial communications.

How to Save Time with Invoice Templates

Time is one of the most valuable resources for any business, and the process of creating billing documents can quickly become a time-consuming task if not streamlined. By using a pre-designed form, businesses can avoid the repetitive work of starting from scratch each time they need to send a payment request. This not only helps to reduce the time spent on document creation but also ensures consistency across all billing communications.

One of the main benefits of using a standardized form is automation. With a ready-made format, you only need to input essential details such as the client’s name, work completed, and amounts due. Many solutions allow for the automatic calculation of totals, taxes, and discounts, saving you from manually performing calculations each time you generate a new document.

Pre-built sections are another time-saving feature. Instead of retyping common phrases or descriptions, you can reuse the same sections for each document. For example, payment terms, business information, and general terms and conditions can be pre-written into the document, eliminating the need to enter these details repeatedly.

Additionally, customizable fields allow you to adjust the format based on your client’s needs without needing to start over. For instance, you can easily modify sections to reflect hourly rates, project costs, or specific tax calculations based on the client or service provided. This flexibility makes it easier to tailor the document to each unique transaction without the need for time-consuming revisions.

Another great feature is the ability to save frequently used details, such as business information or payment methods, to be auto-filled whenever needed. This helps you save time and avoid errors by not having to re-enter the same data every time you create a new request for payment.

By utilizing a structured and ready-to-use solution, you can greatly reduce the amount of time spent on administrative tasks, freeing up more hours to focus on core business operations. Streamlining the document creation process with pre-designed solutions ultimately helps your business run more efficiently and consistently.