Security Deposit Invoice Template for Easy Billing

When managing rental properties, clear and precise financial communication is essential. One important aspect is providing tenants with an accurate record of the funds held as a guarantee for the condition of the property. Having a standardized document for this purpose helps avoid confusion and ensures both parties understand their financial obligations.

By using a well-structured form, property owners or managers can outline the agreed-upon amount, the terms for return, and any deductions made at the end of the lease. This approach not only saves time but also reduces the risk of disputes related to the final balance. A streamlined format ensures transparency and fosters trust between landlords and tenants.

Whether you are a first-time landlord or an experienced property manager, knowing how to present this type of financial record is crucial. A simple, professional document can make the process smoother, minimizing misunderstandings and providing clear evidence in case of any disagreements.

Security Deposit Invoice Template Overview

In rental property management, maintaining accurate financial records is a key component of smooth operations. A well-structured document designed to account for the amount held as a guarantee ensures transparency and clarity in transactions between landlords and tenants. This document serves as a detailed receipt, providing both parties with a clear understanding of the agreed terms and conditions for funds held during the rental period.

Having a standardized format for this record helps to avoid confusion, reduce disputes, and streamline the administrative process. It can be easily customized to meet specific needs, making it suitable for a variety of rental situations, from short-term leases to long-term agreements.

- Clearly states the amount held for the property

- Outlines the conditions under which the funds may be withheld

- Provides a breakdown of any deductions or charges

- Establishes clear expectations for both parties

Overall, this tool not only facilitates clear communication but also ensures that both landlords and tenants have an agreed-upon reference for any financial transactions related to the rental agreement. With this document in hand, property owners can mitigate risks while creating a transparent process that fosters trust and cooperation.

Why You Need a Security Deposit Invoice

Having a formal record of the funds held as a guarantee for rental agreements is essential for both landlords and tenants. This document serves as a transparent and organized way to outline the terms surrounding the funds, including the amount being held, potential deductions, and the timeline for returning the balance. Without it, misunderstandings or disputes can arise, especially when it comes to the return of money at the end of the lease.

For property owners, providing this record offers a professional approach to managing finances and sets clear expectations. It helps prevent confusion and provides evidence in case of legal disputes or disagreements over damages or charges. For tenants, it ensures that they are fully aware of how their funds are being managed and what they can expect at the end of their lease term.

- Clarity: Reduces the likelihood of confusion between parties about the terms of the agreement.

- Legal protection: Offers both landlords and tenants a clear record in case of disputes.

- Transparency: Ensures both parties understand any charges or deductions made during the rental period.

- Organization: Helps property managers keep financial records structured and easily accessible.

In summary, this document is a necessary tool for ensuring fairness and clarity throughout the rental process. It protects both parties and contributes to a smooth, professional experience for everyone involved.

How to Create a Security Deposit Invoice

Creating a detailed and professional financial record for the amount held as a guarantee is a straightforward process that requires careful attention to key information. By following a few simple steps, you can ensure that both the landlord and tenant clearly understand the terms of the funds held during the lease. This document should be both clear and easy to follow, providing all necessary details about the amount, conditions, and any deductions that may apply.

Step-by-Step Guide

- Include Property Information: Start by adding the property’s address and details about the rental agreement. This helps both parties identify the specific terms in question.

- State the Amount: Clearly list the total amount held, ensuring it matches the agreed figure in the rental contract.

- Specify Terms for Return: Define the conditions under which the funds will be returned to the tenant. Be specific about any time frames or actions required for a full refund.

- List Possible Deductions: If applicable, provide a breakdown of any charges or deductions, such as damage repair costs or cleaning fees.

- Detail the Process: Outline how and when the remaining balance will be returned, as well as the method of payment.

Customizing the Record

Every rental agreement is unique, and your financial record should reflect the specific terms of the arrangement. Some landlords may want to add additional sections, such as a clause for interest on held funds or special conditions for specific types of properties. Customizing this document ensures that it fits your exact needs, while also maintaining a clear and professional format.

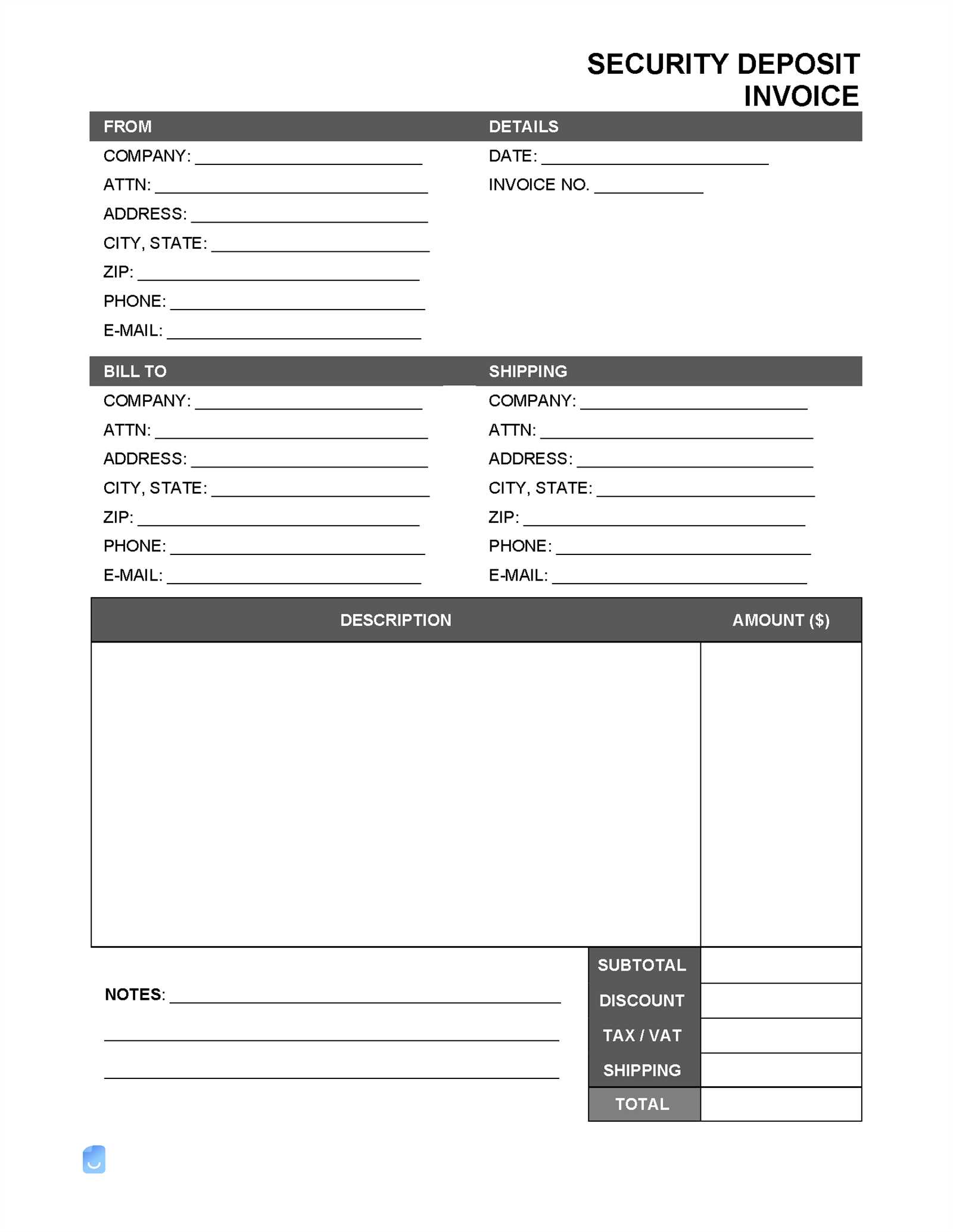

Essential Elements of an Invoice Template

To create a clear and effective financial document for managing rental guarantees, it is important to include all necessary information that ensures transparency and minimizes confusion. A well-organized record should capture key details that both parties can refer to when needed, making it easy to understand the terms, amounts, and any conditions related to the funds being held. Below are the essential components that should be included in such a document.

Key Components of the Record

- Property Information: Include the address and relevant rental details to identify the lease agreement associated with the funds.

- Amount Held: Clearly state the amount being held as a guarantee, ensuring it matches the rental agreement.

- Terms of Return: Outline the conditions for returning the balance, including time frames and requirements for a full refund.

- Deductions: If applicable, provide a detailed list of any charges or deductions, such as repair costs, cleaning fees, or unpaid rent.

- Refund Process: Explain how the remaining balance will be refunded, including the method and timeframe for payment.

Additional Optional Elements

- Interest or Penalties: Some agreements may include interest on the held amount or penalties for late payments or damage, which should be noted.

- Landlord and Tenant Contact Info: Including both parties’ contact details ensures easy communication in case of disputes or questions.

- Signature Section: A signature section for both parties adds an extra layer of formality and confirms mutual agreement.

By including these essential details, the document becomes a reliable reference for both parties, reducing the risk of misunderstandings and ensuring that everyone is on the same page throughout the rental period.

Benefits of Using a Template

Utilizing a pre-designed form for financial records related to rental agreements offers a range of advantages. By relying on a consistent format, landlords and property managers can streamline their processes, saving time and reducing the chance of errors. A well-structured document makes it easier to manage multiple properties, ensures clarity, and helps avoid disputes with tenants. Below are the key benefits of using a standardized record.

Time and Effort Savings

Creating a professional document from scratch each time can be time-consuming. With a ready-made structure, you can quickly fill in the relevant details and generate the record without starting from zero each time.

Consistency and Accuracy

Using a consistent format ensures that all necessary details are included every time, reducing the chance of missing important information. This consistency also helps avoid confusion or disputes, as tenants can easily compare records from different leases and understand the terms more clearly.

| Benefit | Impact |

|---|---|

| Time Efficiency | Reduces time spent on creating documents from scratch for each new tenant. |

| Improved Accuracy | Ensures all required details are captured, minimizing the risk of missing important information. |

| Professional Appearance | Enhances the credibility of the landlord or property manager with a polished, formal document. |

| Clear Communication | Facilitates better understanding between parties, ensuring both know their responsibilities. |

In summary, adopting a standardized form not only saves valuable time but also increases professionalism and clarity in property management. This practice benefits both property owners and tenants by ensuring consistent, accurate, and transparent communication.

Common Mistakes in Security Deposit Invoices

While creating financial records for rental guarantees may seem straightforward, there are several common pitfalls that can lead to confusion, disputes, and even legal issues. These mistakes often arise from unclear terms, missing information, or inconsistencies between the document and the rental agreement. Identifying these errors early on can help ensure a smoother and more professional process for both landlords and tenants.

- Missing Key Details: Failing to include essential information, such as the rental address, the amount held, or the time frame for returning funds, can cause confusion and disputes.

- Unclear Terms for Deductions: If the conditions under which money will be withheld are not clearly stated, tenants may feel blindsided when deductions are made.

- Inconsistent Amounts: Inaccurate amounts, whether from miscalculations or mismatched records, can lead to disputes over the funds owed to tenants.

- Vague Refund Process: Not outlining a clear process for returning the balance, including the time frame and method of refund, can result in frustration and misunderstandings.

- Lack of Signatures: Missing signatures from both parties may reduce the document’s legal weight, making it harder to resolve disputes if they arise.

- Failure to Update Records: Not keeping accurate, up-to-date records of the funds and any changes throughout the lease term can lead to errors in the final settlement.

Avoiding these common mistakes helps ensure that both landlords and tenants are on the same page and that the process remains fair and transparent. Clear, complete, and accurate records protect both parties and help maintain a smooth rental experience.

Customizing Your Invoice Template

Tailoring your financial document to suit specific rental agreements and property details can make the process more efficient and professional. Customization ensures that all relevant information is included, and it also allows you to adapt the document to different types of leases, whether they are short-term or long-term. By adjusting the structure and content, you can create a more personalized and organized record for both the landlord and tenant.

| Customization Area | Purpose |

|---|---|

| Property Details | Including the full address and specifics of the rental property makes the record easy to reference and clearly connected to the lease agreement. |

| Additional Charges | Some rentals may involve special fees (e.g., pet fees, cleaning fees, or maintenance costs). Customizing the document allows you to break down these charges clearly for the tenant. |

| Legal Clauses | Adding any relevant local laws or specific terms that apply to the rental can protect both parties and ensure compliance with legal requirements. |

| Refund Terms | Clarifying the method and timing of refunds, as well as any conditions for partial or full reimbursement, ensures transparency for tenants. |

| Contact Information | Including the landlord’s or property manager’s contact details makes it easier for tenants to reach out if they have questions or concerns about the funds. |

By customizing the document in these areas, you can provide a more accurate and tailored record that meets the specific needs of each rental agreement. This personalized approach not only enhances professionalism but also improves communication and reduces the chances of confusion or disputes.

How to Calculate Security Deposits

Determining the amount to be held as a guarantee for a rental property is a crucial step in the leasing process. This amount is typically based on several factors, including the rental price, the length of the lease, and any additional costs or conditions specific to the property. Understanding how to accurately calculate this amount ensures that both parties are clear on the financial expectations and helps prevent potential disputes.

Factors to Consider

- Rental Price: In most cases, the amount held is directly related to the monthly rent. A common guideline is one or two months’ rent, but this can vary depending on local laws and the landlord’s policies.

- Lease Duration: For longer-term leases, landlords may choose to adjust the amount based on the tenant’s commitment to the property. Short-term rentals may require a different approach.

- Property Condition: The age and condition of the property can influence the amount required. Older or more valuable properties may warrant a higher guarantee to cover potential damages.

- Location: Properties in high-demand areas may have higher guarantee amounts due to market trends and rental prices in the region.

- Additional Costs: Any extra fees, such as pet fees, parking fees, or specific maintenance charges, may be added to the amount held, depending on the lease terms.

Steps for Calculation

- Determine the Monthly Rent: Start by identifying the agreed-upon rent for the property.

- Check Local Laws: Ensure the amount complies with local regulations, as some areas have legal caps on the maximum amount that can be charged.

- Adjust for Property Factors: Consider any additional costs based on the property’s condition, location, or other unique factors.

- Set the Amount: Based on the factors above, calculate the final amount to be held, usually between one and two months’ rent, or a fixed amount as required.

By following these steps, landlords can calculate an appropriate guarantee that provides protection while remaining fair and clear to the tenant. This ensures that both parties have a solid understanding of the financial terms of the agreement before moving forward.

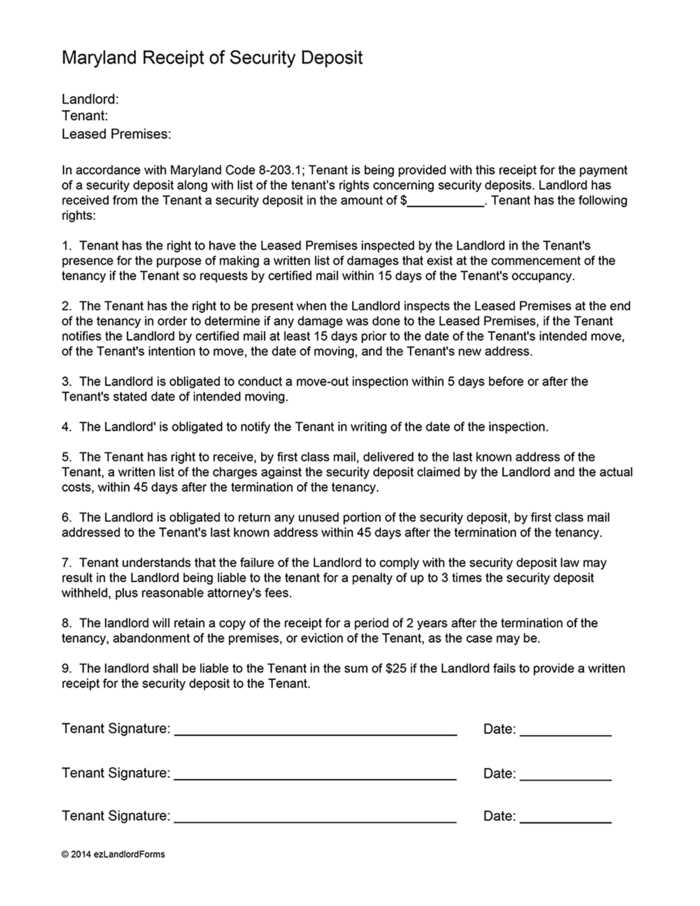

Legal Requirements for Deposit Invoices

When managing rental agreements, it’s crucial to ensure that all financial records comply with local laws and regulations. Certain legal requirements govern the amount that can be charged, the process for holding funds, and the conditions under which they may be retained or returned. Understanding these rules not only protects property owners but also ensures that tenants are treated fairly throughout the rental term.

The legal framework surrounding funds held as a guarantee varies depending on the jurisdiction, but common aspects include limits on the amount that can be requested, timelines for returning funds, and clear documentation of any deductions made. Failure to comply with these regulations can lead to disputes, fines, or even legal action. Therefore, landlords and property managers should familiarize themselves with relevant laws to avoid potential complications.

Key Legal Considerations

- Maximum Amount: Many jurisdictions have caps on the amount that can be requested from tenants, often limited to one or two months’ rent. Exceeding this limit may result in legal penalties.

- Timeframe for Return: There are usually specific time limits within which the remaining balance must be returned to the tenant after the lease ends. These timeframes can range from 15 to 30 days, depending on the location.

- Itemized Deductions: Any deductions made from the funds must be clearly outlined and justified. Landlords should provide an itemized list of damages or charges to avoid disputes over the amount withheld.

- Written Record: In most cases, a formal written record should be provided to both parties at the beginning and end of the rental agreement. This ensures transparency and serves as a reference point in case of disputes.

- Interest on Funds: Some areas require landlords to pay interest on the funds held, especially if they are held for long periods of time. It’s important to check local laws to see if this applies.

Adhering to legal requirements not only ensures compliance but also fosters trust between landlords and tenants. By keeping thorough, accurate records and understanding the rules, property managers can create a transparent, fair rental process that benefits everyone involved.

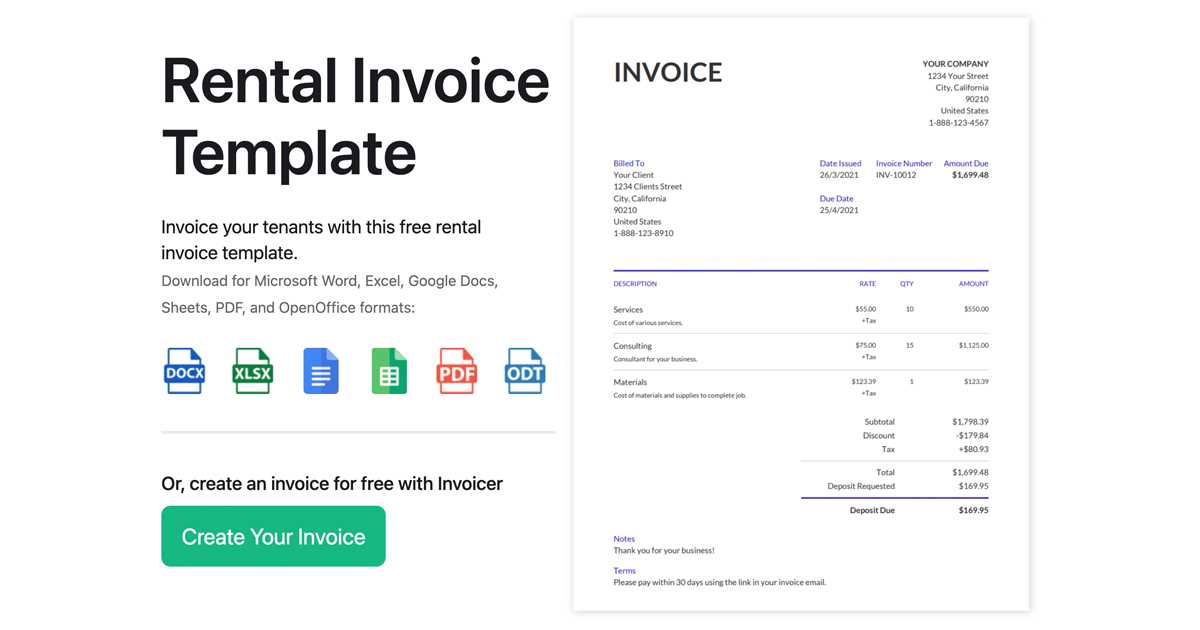

Choosing the Right Format for Invoices

When creating a financial record for rental agreements, selecting the appropriate format is crucial for clarity, ease of use, and legal compliance. The format should be clear, structured, and adaptable to various situations, ensuring both landlords and tenants have a mutual understanding of the terms and conditions. The choice of format will also impact how easily the document can be updated, shared, and referenced over time.

Factors to Consider

- Clarity: The format should be easy to read and understand. Key details, such as the amount held, deductions, and return conditions, should be clearly highlighted.

- Legal Compliance: Ensure that the format includes all necessary information required by law, such as time frames for return, possible deductions, and the total amount held.

- Customization: The format should be flexible enough to accommodate different types of rental agreements, whether it’s for a short-term lease or a long-term contract.

- Professional Appearance: A polished, formal design can add credibility to the document, which can be important for building trust with tenants.

- Ease of Storage and Sharing: Consider how the document will be stored and shared. Formats that are easy to digitally store and send (such as PDF or Excel) offer greater convenience.

Popular Formats for Financial Records

- Word Documents: Ideal for those who prefer to create custom documents with easy-to-edit sections. However, they may lack some professional formatting features.

- Excel Spreadsheets: Useful for keeping track of multiple records or if you need to calculate amounts automatically. Excel also allows for easy updates and adjustments.

- PDF Files: A highly professional and universally accepted format. PDF ensures that the document will appear the same on all devices, preventing accidental formatting errors.

- Online Forms: Digital forms can be filled out, stored, and emailed easily. These formats are especially useful for property managers handling multiple properties and tenants.

Ultimately, the right format depends on your specific needs. Choose a format that balances ease of use, professional appearance, and legal requirements while also considering how you will manage and share the document over time.

Tools for Creating Deposit Invoices

Creating a professional financial record for rental agreements can be made easier with the right tools. The right software or service can help automate calculations, ensure legal compliance, and streamline the creation process. These tools allow property managers and landlords to focus on other aspects of property management while ensuring that all financial documents are clear, accurate, and legally sound.

Popular Tools and Software

- Microsoft Excel: A widely-used tool that allows users to create customized spreadsheets with built-in formulas for automatic calculations. Excel is ideal for tracking multiple records and making real-time adjustments.

- Google Sheets: A free, cloud-based alternative to Excel that offers similar functionality. Google Sheets allows for easy sharing and collaboration with tenants or property managers, making it an excellent choice for team-based environments.

- QuickBooks: A comprehensive accounting tool that can help with invoicing, financial reporting, and expense tracking. QuickBooks is designed for businesses and can handle complex calculations and store records securely.

- Zoho Invoice: An online invoicing platform that lets you create and manage financial records. It offers professional-looking templates, automated reminders, and payment tracking features, which make the process much simpler for landlords and property managers.

- FreshBooks: A user-friendly cloud-based accounting tool that helps with invoicing, tracking payments, and managing finances. It is ideal for landlords managing multiple properties or small property management companies.

- Canva: A design tool that offers customizable templates for various documents, including rental agreements. Canva provides a professional aesthetic and allows landlords to easily create visually appealing records without needing design experience.

Benefits of Using These Tools

- Efficiency: These tools save time by automating repetitive tasks such as calculations and record-keeping, allowing for faster document creation.

- Accuracy: Built-in formulas and templates reduce the chances of human error, ensuring the amounts and details are accurate.

- Professional Appearance: Many of these tools offer polished, professional templates that can help you present a clean, formal document to tenants.

- Easy Sharing and Storage: Many of these tools store documents in the cloud or allow for easy sharing through email, making it convenient to distribute records to tenants or legal entities.

By using the right tools, landlords and property managers can simplify the process of creating financial documents, improve accuracy, and ensure they meet legal requirements. These tools can make a significant difference in managing rental properties more efficiently and professionally.

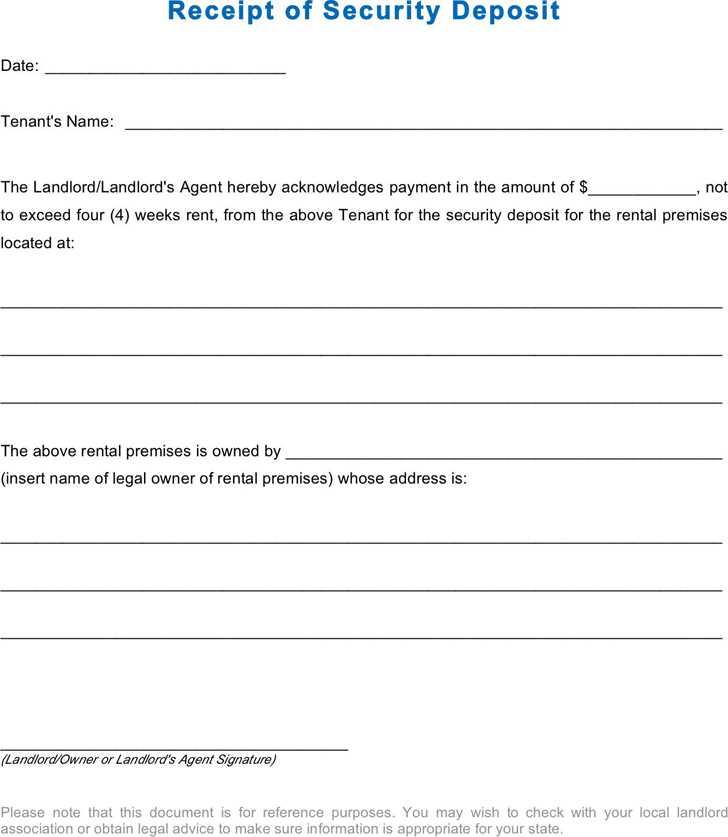

How to Send Security Deposit Invoices

Once the financial record for a rental guarantee has been created, it’s essential to ensure it is delivered to the tenant in a timely and professional manner. The method of delivery plays a crucial role in ensuring that both parties have a clear understanding of the amounts involved and the terms of the agreement. Whether you are using a physical document or an electronic version, sending this record effectively can help maintain transparency and avoid any potential disputes.

Methods of Sending the Document

- Email: Sending the document via email is the quickest and most convenient option. You can attach the file as a PDF or Word document, ensuring that it is easy for the tenant to open, view, and save for their records.

- Postal Mail: For those who prefer a physical copy or when required by law, sending a printed version via postal mail is a valid option. Ensure the document is securely packaged and sent via a traceable method, such as certified mail, to confirm receipt.

- Online Portals: Many property management systems offer online portals where tenants can access their records. This is an efficient option for landlords managing multiple properties, allowing tenants to view and download their financial documents directly.

- Text Message or Messaging Apps: For smaller amounts or short-term leases, you might choose to send a notification with a link to the document via text message or a messaging app. Ensure the link is secure and that the document is easily accessible.

Best Practices for Sending the Document

- Clear Subject Line: When sending via email, use a clear and professional subject line, such as “Final Account Statement for [Property Address].”

- Confirmation of Receipt: Request a confirmation email or receipt from the tenant to ensure they have received the document and acknowledge its contents.

- Secure Storage: Ensure that sensitive information is protected when sending electronically. Use secure methods, like password-protected PDFs, or send the document through a protected platform.

- Timeliness: Be sure to send the document within the required time frame, as specified in the rental agreement or local regulations. This helps build trust and avoids legal complications.

By choosing the appropriate delivery method and following best practices, you can ensure that the financial record is received promptly and securely, fostering clear communication between both parties and reducing the likelihood of misunderstandings.

Managing Security Deposits with Invoices

Effectively managing financial guarantees for rental properties involves maintaining accurate records and ensuring transparency for both landlords and tenants. Using detailed documents that outline the amounts, conditions, and any deductions ensures that the entire process is clear and legally compliant. Keeping track of these records systematically helps property owners avoid disputes and guarantees that tenants are informed about the status of their funds.

| Step | Action | Purpose |

|---|---|---|

| 1 | Record the Amount | Clearly document the amount held, based on the agreed terms of the lease or rental agreement. This sets expectations from the start and avoids any confusion later on. |

| 2 | Track Deductions | If any deductions are made (e.g., for property damage or cleaning costs), these should be carefully documented with detailed explanations to ensure both parties agree on the charges. |

| 3 | Provide Regular Updates | Keep tenants informed by sending periodic updates, particularly if there are any changes or deductions made during the rental period. This builds trust and ensures clarity. |

| 4 | Finalize and Return | Once the lease ends, finalize the balance owed and ensure that any remaining funds are returned within the legally required time frame. |

| 5 | Store Documents Securely | Ensure that all documents are securely stored for future reference or if any disputes arise, keeping both digital and physical copies if necessary. |

By following these steps, landlords and tenants can ensure that the handling of financial guarantees is done in a fair, transparent, and organized manner. This helps foster a good relationship between both parties and ensures compliance with all relevant laws and regulations.

Handling Disputes Over Deposits

Disputes over the funds held for rental agreements are unfortunately common, but they can be minimized with clear communication and proper documentation. When disagreements arise regarding the return of these funds, it’s essential to address the issue professionally and according to the agreed terms. Ensuring that both parties understand their rights and responsibilities can prevent conflicts and facilitate a smoother resolution process.

Steps to Address Disputes

- Review the Agreement: The first step in resolving a dispute is to revisit the rental contract. The terms regarding the handling, deductions, and return of the funds should be clearly outlined. Both parties should review these clauses to ensure they are in agreement with the agreed-upon procedures.

- Provide Documentation: If there are any claims for deductions (e.g., cleaning, repairs), the landlord should provide clear, itemized documentation, including receipts, photographs, or statements from contractors. Tenants should do the same if they have evidence to counter any claims.

- Open Communication: A direct and respectful conversation can often resolve misunderstandings. Both parties should discuss the issue calmly and focus on reaching a fair agreement.

- Consider Mediation: If the dispute cannot be resolved through direct communication, both parties may benefit from professional mediation services. Many areas offer low-cost or free mediation for landlord-tenant disputes.

- Know Your Legal Rights: Both landlords and tenants should be familiar with local laws regarding the handling and return of funds. In many regions, there are strict timeframes for returning the funds, and specific conditions under which deductions can be made. If necessary, seeking legal advice can provide clarity on the situation.

Preventing Future Disputes

- Clear Documentation: At the beginning of the lease, both parties should agree on the terms in writing and document the condition of the rental unit. This could include photographs or videos to avoid disagreements over damages later.

- Timely Communication: Keep tenants informed about the status of their funds throughout the lease. If any issues arise during the rental period, communicate them immediately to avoid surprises when the lease ends.

- Proper Itemization: Always provide an itemized list of any deductions taken from the funds, including detailed descriptions and proof of expenses. This transparency helps to avoid confusion and ensures both parties understand the reasons behind the financial decisions.

By following these steps, landlords and tenants can manage potential disputes effectively, ensuring a fair and transparent process. With the right communication, documentation, and legal knowledge, many conflicts can be resolved without the need for formal legal action.

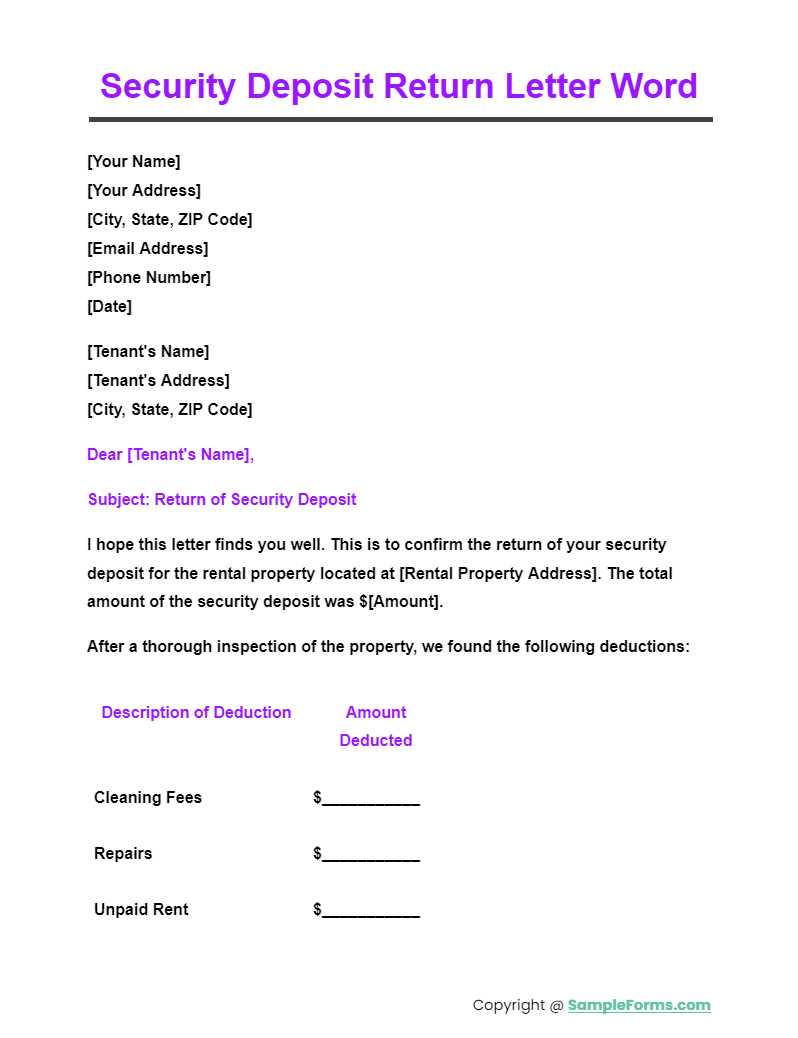

Sample Templates for Different Needs

Every rental agreement is unique, and as such, the financial records associated with it should be tailored to reflect the specific needs of the situation. Different types of properties, lease terms, and agreements may require distinct approaches to documenting the amounts held and any deductions made. Below are some examples of how such documents can be structured to address varying requirements, ensuring clarity and professionalism in each case.

Standard Lease Agreement

For most traditional rental situations, a simple, clear record of the funds held is sufficient. This type of document typically includes essential details such as the total amount held, the date of receipt, and any conditions for its return.

- Amount Held: The total amount of money collected at the beginning of the lease.

- Conditions for Return: The terms under which the funds will be returned, such as a specified time frame after the lease ends.

- Itemized Deductions (if any): A list of deductions, such as for damages or cleaning fees, with explanations and relevant receipts or photos.

- Return Date: The date when the remaining funds will be returned to the tenant, if applicable.

Short-Term Rental Agreements

For short-term rentals, such as vacation properties or temporary leases, the financial record may need to be adjusted to account for different expectations and quicker turnarounds. This type of document may emphasize the promptness of fund returns and the condition of the property at check-out.

- Amount Collected: A statement of the agreed-upon sum, typically collected in advance for short-term stays.

- Damage Inspection: A brief inspection note regarding the condition of the property at the time of check-out, with clear photos or descriptions of any damage or cleaning issues.

- Quick Return Policies: A shorter time frame for returning the funds, often within 7–14 days of the rental’s conclusion.

- Potential Charges: Any additional fees for damages, cleaning, or missing items, with a clear breakdown of the costs involved.

Commercial Property Leases

Commercial leases often involve larger amounts of money and more complex terms. In these cases, the record should reflect the details of the commercial lease and any negotiated terms regarding the holding of funds and possible deductions.

- Amount and Terms: A more detailed agreement outlining the total funds held, including whether they are used to cover repairs, insurance, or other property-related expenses.

- Legal Conditions: A section that specifies legal terms, such as compliance with local laws and the time frame for returning the funds.

- Detailed Deductions: Clear breakdowns of any deductions for maintenance or repairs, with explanations and evidence.

- Documentation of Communication: References to previous communications or agreements that clarify the terms and ex

Digital vs Paper Invoices for Deposits

When managing rental funds and the associated documentation, landlords and tenants have the option to choose between digital or physical records. Both methods offer distinct advantages and challenges depending on the specific needs of the parties involved. Understanding the benefits and limitations of each approach can help make an informed decision about which method best suits the situation.

Advantages of Digital Documents

- Speed and Convenience: Digital records can be created, sent, and received in minutes, making them ideal for time-sensitive transactions. Tenants can quickly access the document from anywhere, and landlords can avoid delays in postal mail.

- Reduced Paperwork: Using digital methods reduces the need for physical paperwork, which can be cumbersome to store and organize. Everything can be kept securely in digital files, making it easier to manage and access.

- Environmental Impact: Digital records are eco-friendly, as they eliminate the need for paper, ink, and other resources associated with physical documents.

- Searchability and Organization: Electronic files can be easily categorized, searched, and retrieved, making it simple to track past transactions and resolve disputes efficiently.

- Security Features: Digital records can be encrypted, password-protected, and backed up to ensure safety and prevent unauthorized access.

Advantages of Paper Documents

- Legal Requirements: In some jurisdictions, physical copies may be required by law for certain types of transactions. Printed records can also be considered more official and can sometimes hold up better in court or legal proceedings.

- Personal Preference: Some tenants or landlords may simply prefer having a tangible copy of the document, as it may feel more secure or formal compared to an electronic version.

- Access Without Technology: Paper documents don’t require access to computers, email, or internet services, making them more reliable in situations where digital devices may not be available or convenient.

- Physical Record Keeping: For landlords who manage properties without digital systems, paper documents offer a straightforward way to keep track of financial records without the need for technological solutions.

Which Method Is Best for You?

The decision between digital and paper records ultimately depends on factors such as convenience, legal requirements, and the preferences of both parties. Many landlords opt for a hybrid approach, providing digital records for ease of use and quick communication, while also offering paper copies upon request for tenants who prefer them. Ultimately, both methods can serve their purpose effectively when used in the appropriate context.

Best Practices for Security Deposit Invoices

When managing funds held for rental agreements, ensuring that all related documents are clear, detailed, and legally compliant is essential. Adhering to best practices not only helps maintain transparency but also prevents misunderstandings and disputes between landlords and tenants. By following a few key guidelines, both parties can ensure the entire process runs smoothly and professionally.

Clear and Comprehensive Documentation

One of the most important aspects of managing these funds is providing a thorough, well-organized document. Both landlords and tenants should be able to understand all the terms and conditions outlined in the financial records. Some best practices include:

- Itemized List: Always include a detailed breakdown of all charges, including any deductions for damages or cleaning. This should cover specific amounts and reasons for any costs that were taken out of the original sum.

- Clear Terms: Ensure that the terms for the release of funds are clearly stated, including the timeline and any conditions under which the funds might not be fully refunded.

- Legal Compliance: Verify that all practices and terms comply with local laws, including any mandated time frames for returning the funds and the conditions for any deductions.

Timely Communication and Updates

Maintaining open and timely communication with tenants throughout the lease is crucial for preventing disputes. Some effective practices include:

- Regular Updates: Keep tenants informed about the status of their funds, particularly if there are any potential deductions or issues with the property.

- Quick Processing: Process any returns or adjustments to the funds promptly, adhering to the agreed-upon timeframes. Delays can cause frustration and potentially lead to disputes.

- Provide Receipts: Whenever funds are deducted for repairs or cleaning, always provide receipts or invoices to validate the expenses. This transparency is essential for building trust with tenants.

By implementing these best practices, landlords can ensure that the handling of rental funds is transparent, professional, and legally sound. This not only helps avoid disputes but also fosters positive relationships with tenants, ensuring smoother transactions in the future.