Efficient Busy Invoice Template for Quick and Accurate Billing

Managing financial transactions efficiently is crucial for any business, especially when dealing with multiple clients or customers. A well-structured document can help ensure that all necessary information is presented clearly and professionally, reducing the chances of errors and delays. With the right format, you can track payments, manage deadlines, and maintain a smooth workflow.

Customized billing solutions are invaluable for organizations looking to improve their accounting processes. By using pre-designed formats tailored to specific needs, businesses can save time and avoid repetitive tasks. These tools provide flexibility in design while ensuring all essential details, such as services rendered, amounts due, and payment terms, are included.

In this guide, we’ll explore how adopting an efficient structure can make your financial management more organized and less time-consuming. Whether you’re a freelancer or a growing company, mastering these methods can help keep your financial records in order and accelerate cash flow.

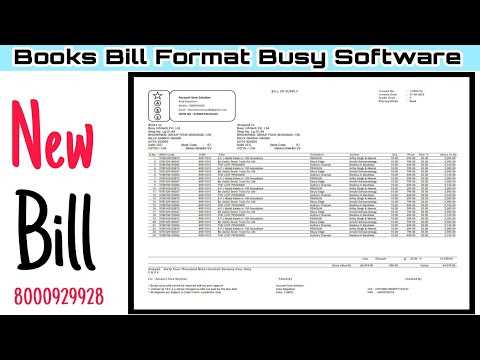

Busy Invoice Template Overview

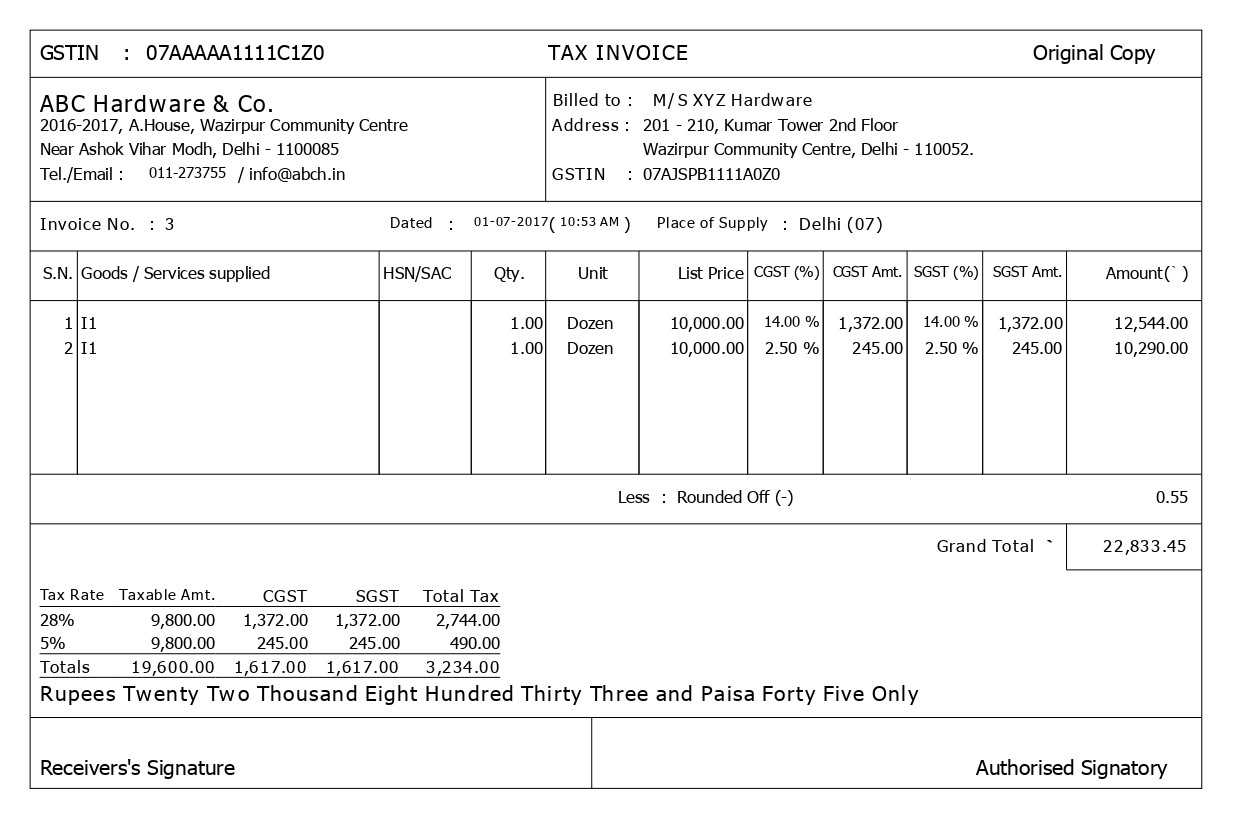

Efficient billing solutions are designed to simplify the process of documenting financial transactions. These structured formats provide a quick and easy way to present essential details, ensuring clarity and accuracy. Whether you are a freelancer, contractor, or small business owner, adopting a well-organized format can save time and reduce the risk of mistakes.

A good billing structure ensures that all key information, such as client details, services rendered, payment terms, and amounts due, are clearly displayed. This minimizes confusion and helps maintain a professional appearance while streamlining your accounting practices. The right format also allows for customization, enabling you to adapt it to specific needs or industries.

Key Features of an Effective Billing Solution

When choosing the right structure, it’s important to look for a few essential elements. First, the layout should be easy to read, with sections clearly marked for different types of information. Second, flexibility in design is essential, allowing you to add or remove fields based on the nature of the transaction. Lastly, the format should be compatible with various software tools for easier integration into your financial system.

Why a Well-Designed Structure Matters

Having an effective structure in place is critical for ensuring timely payments and accurate financial records. A well-organized document reduces the chances of misunderstandings and helps you stay on top of your transactions. With everything in one place, it’s easier to track overdue payments and manage your cash flow efficiently.

Why Use a Busy Invoice Template

Having a streamlined billing solution can significantly improve your financial management process. By using a structured approach to document transactions, businesses can reduce errors, ensure timely payments, and maintain a professional image. A well-organized format helps eliminate the stress of handling multiple details and keeps everything in one place for easy reference.

Key Benefits of Structured Billing Formats

Using a pre-designed billing document offers numerous advantages that help businesses stay organized and efficient. Below are the primary reasons why adopting such solutions is essential:

| Benefit | Description |

|---|---|

| Time-saving | Predefined fields allow for quick filling, reducing the time spent on document creation. |

| Consistency | A consistent layout ensures that all necessary details are included every time. |

| Professionalism | A clean, organized format enhances the business’s image and improves client relationships. |

| Error reduction | Clear sections help prevent omissions or incorrect information, reducing the chances of mistakes. |

How It Enhances Your Business

By adopting a well-structured system, you ensure that all transactions are handled with accuracy and professionalism. This not only boosts your credibility but also helps maintain an efficient workflow, which is crucial for growing businesses that deal with multiple clients or customers regularly.

Key Features of an Efficient Invoice

An effective billing document should be designed to provide clear, concise, and accurate details, ensuring both the sender and recipient can easily understand the transaction. The structure should include all the necessary elements for tracking and processing payments while minimizing confusion. A well-constructed document facilitates quicker approvals and reduces the risk of errors or delays in payments.

There are several essential characteristics that make a billing document efficient and reliable. A good design not only keeps all the information organized but also allows for quick customization, making it adaptable to different business needs. Below are the key features that ensure your billing document works optimally:

- Clear Identification: Include identifiable information such as the client’s name, address, and contact details, along with your own business information, to avoid confusion.

- Detailed Itemization: List each product or service provided, along with the corresponding cost, to ensure transparency and avoid disputes.

- Payment Terms: Clearly state payment due dates, accepted payment methods, and any penalties for late payments to avoid misunderstandings.

- Unique Reference Number: Assign a unique reference number to each document for easy tracking and record-keeping.

- Professional Design: A clean, organized layout reflects professionalism and helps clients navigate the document with ease.

- Accurate Totals: Ensure that all amounts are calculated correctly and display a clear breakdown of totals, taxes, and discounts, if applicable.

By including these features, you can improve your billing process, reduce payment delays, and enhance client satisfaction.

Benefits of Streamlined Billing Templates

Using a streamlined approach to create financial documents offers numerous advantages for businesses and freelancers alike. By adopting a well-organized, pre-designed format, companies can significantly reduce the time spent on administrative tasks while maintaining accuracy. This process not only enhances productivity but also contributes to a more professional appearance when dealing with clients or customers.

One of the key benefits of structured billing solutions is the ability to eliminate redundancy. With predefined sections for all essential information, these formats ensure that no critical details are overlooked. They also help minimize human errors, such as miscalculations or omissions, which can otherwise lead to delays or misunderstandings with clients.

Additionally, streamlined formats help businesses maintain consistency in their financial communications. Each document follows the same layout, which fosters a sense of organization and reliability. Clients will appreciate the clarity and transparency, leading to quicker approval processes and smoother transactions.

Lastly, the time saved by using a pre-designed structure can be invested in other areas of the business. Whether it’s customer relations, marketing, or product development, having a standardized billing approach frees up valuable resources to focus on growth and efficiency.

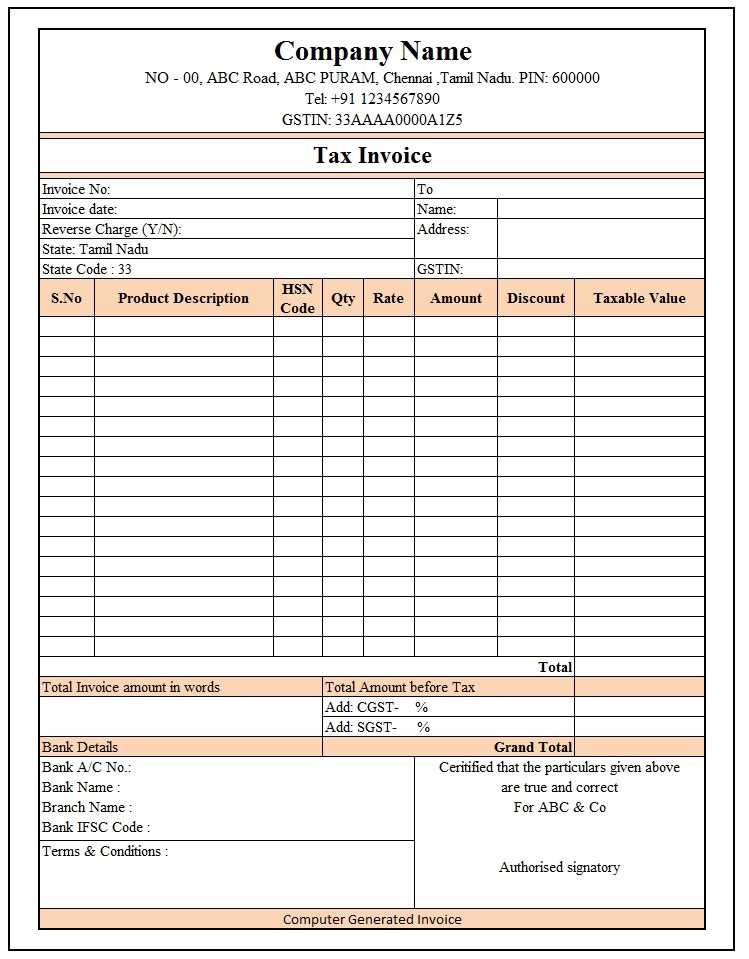

How to Customize Your Busy Invoice

Customizing your billing documents to fit your business needs is essential for maintaining a professional and efficient process. By adjusting key sections to reflect your specific services, products, and branding, you can ensure that every document is tailored to your company’s unique requirements. A personalized layout not only promotes a consistent brand identity but also allows you to include all relevant details necessary for smooth transactions.

Adjusting Key Information

The first step in customization is ensuring that all key information is prominently displayed. Start by adding your company’s logo and contact details at the top of the document. This makes the document more recognizable and helps clients quickly find your information. Similarly, include your client’s details, such as name, address, and payment terms, to avoid any confusion or miscommunication.

Incorporating Branding and Design

One of the most effective ways to make your billing documents stand out is through branding. You can adjust fonts, colors, and layout to align with your company’s visual identity. This creates a professional appearance and reinforces your brand’s image. Additionally, customizing the design to fit your business style ensures that your documents are not only functional but also visually appealing.

Ultimately, customizing your billing document allows you to streamline your workflow while presenting a professional image to clients. By ensuring that all essential details are clearly displayed and personalizing the layout, you enhance both the efficiency and the perception of your business.

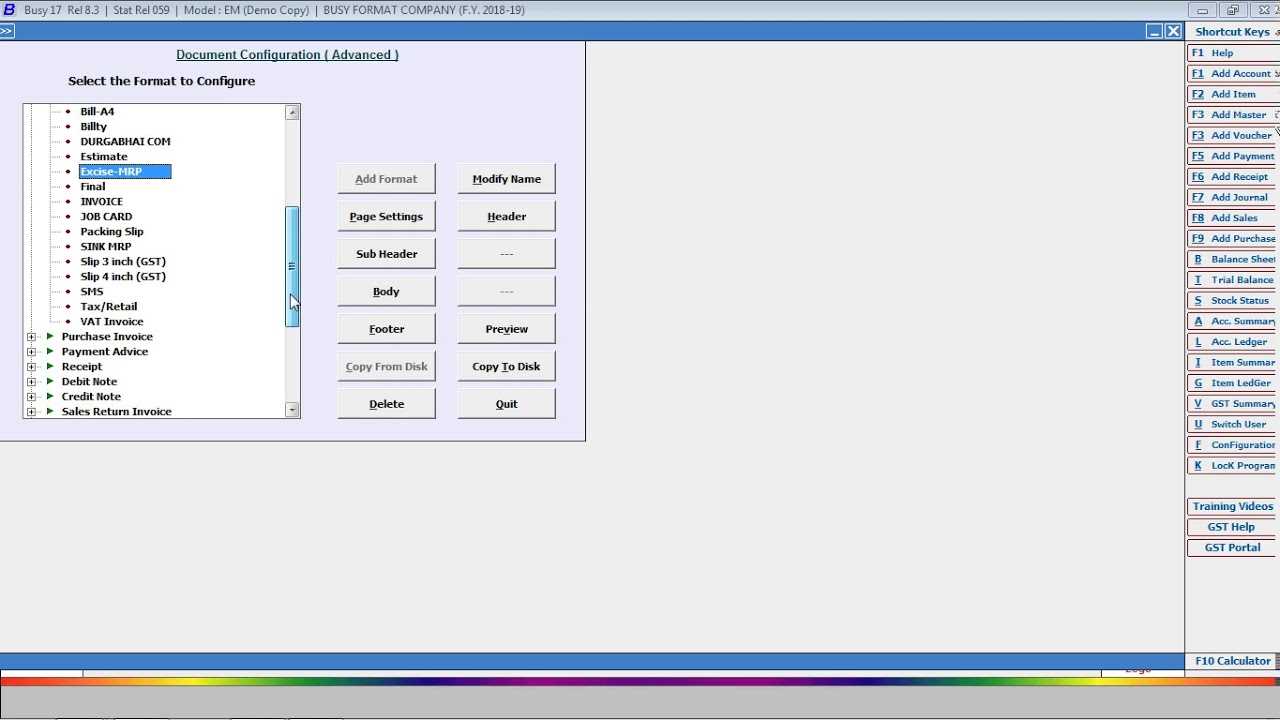

Top Tools for Creating Invoices

When it comes to generating financial documents quickly and efficiently, choosing the right tools can make a significant difference. There are numerous software options available, each offering unique features to help streamline the billing process. These tools can automate many aspects of document creation, saving time and reducing the potential for errors.

Cloud-Based Solutions

Cloud-based tools offer flexibility, allowing you to create and send documents from anywhere with an internet connection. With these solutions, you can easily manage multiple clients and projects, access documents in real-time, and make updates on the go. Popular options include platforms like QuickBooks and FreshBooks, which provide customizable layouts and easy-to-use interfaces for generating clear and professional documents.

Standalone Software

If you prefer to work offline or need advanced features, standalone software may be a better option. Programs like Microsoft Word or Excel offer built-in templates that can be customized to suit your business needs. For more complex requirements, solutions like Zoho Invoice and Wave Accounting provide powerful tools for creating detailed documents, tracking payments, and managing client records.

Ultimately, selecting the right tool for generating your financial documents depends on your business’s specific needs. Whether you choose a cloud-based service for flexibility or more advanced desktop software for customization, these tools can help you streamline your billing process and maintain professionalism in every transaction.

Steps to Implement a Template

Implementing a well-organized document structure for your billing process can greatly improve efficiency and accuracy. The right system helps ensure that all necessary details are captured consistently and presented clearly to clients. By following a simple set of steps, you can easily integrate a structured format into your workflow.

1. Choose the Right Solution

The first step is selecting the right tool or layout that fits your business needs. There are various options available, from simple pre-designed formats to more advanced software that can be customized. Consider the following when making your choice:

- Ease of use – Choose a solution that is intuitive and user-friendly.

- Customization options – Ensure the layout can be modified to include your business logo and other specific details.

- Compatibility – Verify that the tool integrates well with other software you use for accounting or customer management.

2. Input Your Business Information

Once you’ve selected the right solution, begin by entering your business information. This includes your company name, address, contact details, and any other relevant information. Having these details pre-populated in the structure ensures consistency across all documents.

3. Add Client Details

Next, include the client’s information in the format, such as their name, address, and specific payment terms. By keeping client information on hand, you can quickly generate documents for multiple customers without the need for repeated data entry.

4. Customize Fields and Sections

Modify the sections according to the nature of your business and services. For instance, if you offer multiple types of services or products, you can adjust the fields to include product descriptions, rates, quantities, and taxes. The more tailored the layout, the more efficient the billing process becomes.

5. Save and Automate for Future Use

Once you’ve customized the structure, save it as a reusable document. Many tools allow you to automate certain fields, such as due dates or recurring charges, making it even easier to generate accurate documents for each transaction.

6. Review and Finalize

Before sending out the document to your client, double-check all the details to ensure everything is correct. This includes verifying the totals, payment terms, and any discounts or taxes applied. A final review ensures that you maintain a high level of professionalism and accuracy.

By following these steps, you can efficiently implement a structured document system that saves time, reduces errors, and helps you maintain professionalism in your billing process.

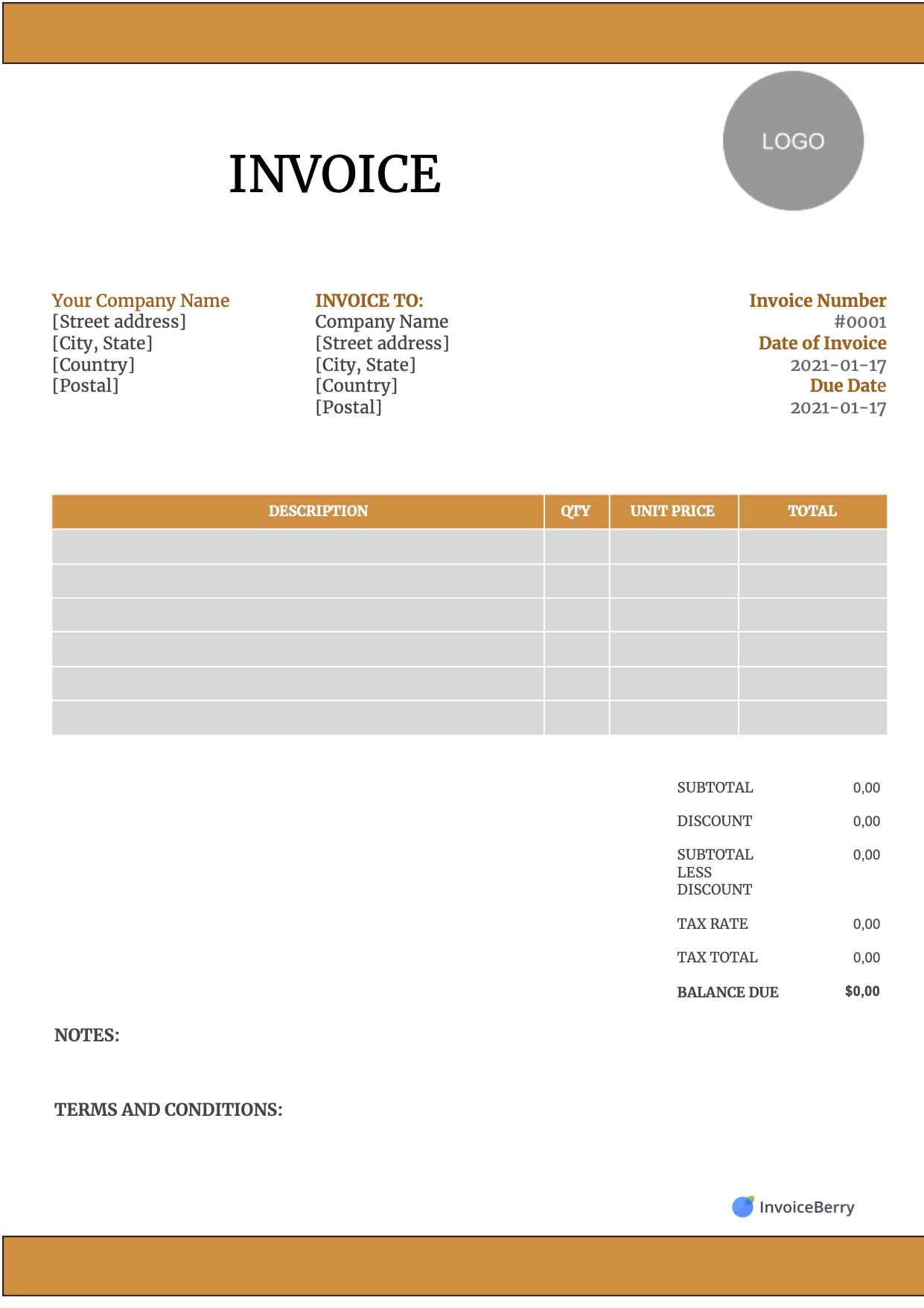

Design Tips for Professional Invoices

Creating visually appealing and easy-to-read billing documents is essential for maintaining a professional image and ensuring clarity. The design of your financial documents plays a key role in how your business is perceived by clients, and it directly impacts the efficiency of the billing process. By following a few simple design principles, you can ensure that your documents are both functional and professional.

1. Keep It Clean and Simple

A cluttered or overly complicated document can confuse clients and slow down the payment process. Focus on keeping the layout clean and straightforward. Here are some tips to achieve a minimalist yet effective design:

- Use clear headings for each section, such as “Services Provided,” “Total Amount,” and “Payment Terms.” This makes the document easier to navigate.

- Limit the use of colors to highlight important details like totals or due dates. Stick to your brand colors to maintain consistency.

- Choose readable fonts and avoid overly decorative styles. Opt for professional, easy-to-read fonts like Arial or Helvetica.

2. Organize Information Logically

Ensuring that all relevant details are well-organized can prevent confusion and errors. A logical flow in the design allows clients to quickly find the information they need. Key elements to focus on include:

- Client and business details: These should be placed at the top of the document for easy identification.

- Itemized breakdown: List services, products, or hours worked with clear descriptions, quantities, and rates. This transparency builds trust with clients.

- Clear totals and payment instructions: Make sure the total amount due and payment terms stand out. This includes the due date, payment methods, and any applicable late fees.

By applying these design principles, your financial documents will not only look professional but also function as effective tools for managing payments and client relationships. Clear, organized layouts ensure that your clients receive all the necessary information and can process payments without delay.

Common Mistakes in Invoice Creation

Creating financial documents is an essential task for any business, but there are several common mistakes that can lead to delays in payment or confusion for clients. These errors can affect your professionalism, hurt your cash flow, and create unnecessary follow-up work. Understanding and avoiding these pitfalls can help ensure that your billing process runs smoothly and that clients have a clear understanding of the details.

1. Missing or Incorrect Contact Information

One of the most common errors is failing to include or incorrectly listing the contact details for both your business and your client. Missing information can cause confusion and delays in payment processing. To avoid this mistake, ensure the following:

- Correct business name, address, and contact number for your company are listed clearly.

- Client’s full name, address, and email address should be accurate to avoid any issues when sending the document.

- Double-check spelling and formatting to ensure consistency throughout the document.

2. Not Including Clear Payment Terms

Another frequent mistake is failing to clearly state the payment terms, which can lead to confusion about when and how the payment should be made. This can result in late payments or misunderstandings with clients. Make sure to:

- Specify the payment due date and be clear about your expectations regarding payment timelines.

- List accepted payment methods and include any bank details, links, or instructions for completing the payment.

- Clarify any penalties for late payments, such as interest charges or additional fees.

3. Lack of Itemized Details

Not providing a clear breakdown of services, products, or hours worked is a common mistake. Clients may be confused if the document only shows a lump sum total without explaining the charges. To avoid this issue, always:

- List each product or service along with a description, quantity, unit price, and total amount for each item.

- Provide subtotals and tax calculations if applicable to ensure clients understand how the final amount was determined.

4. Incorrect Calculations

Simple mathematical errors can undermine your credibility and delay payments. Incorrect totals or tax calculations can cause confusion and require follow-up. Always:

- Double-check all calculations, including totals, taxes, and discounts, before finalizing the document.

- Use automated tools where possible to reduce the risk of errors.

5. Overcomplicating the Design

While it’s important to maintain a professional appearance, too much detail or a cluttered layout can overwhelm the client and make the document har

How to Avoid Invoice Errors

Ensuring the accuracy of your financial documents is essential for maintaining a professional image and avoiding payment delays. Small mistakes can lead to confusion, disputes, or even delayed payments, which can affect your cash flow and client relationships. By adopting a few simple practices, you can minimize the risk of errors and streamline your billing process.

1. Double-Check All Information

The most common errors are caused by incorrect or missing details. Ensuring that every section is complete and accurate is the first step toward avoiding issues. Focus on these key areas:

- Business and client details: Verify that your company’s name, contact information, and logo are correctly listed, as well as your client’s details.

- Service descriptions: Ensure that each product or service is clearly defined with accurate quantities and rates.

- Payment terms: Double-check that payment due dates, methods, and penalties are clearly stated.

2. Use Automated Tools

Manually calculating totals, taxes, and discounts can lead to errors, especially in complex documents. Using accounting software or automated tools can help reduce these risks significantly. Benefits of automated tools include:

- Accurate calculations: Automatic tax and discount calculations reduce the chances of miscalculations.

- Pre-filled details: Save time and reduce errors by pre-filling common fields like your business name, contact details, and terms of service.

- Template reuse: Once you have a template set up, you can easily reuse it for multiple clients without the need to recreate each document from scratch.

3. Maintain Consistency in Format

Consistency is key to minimizing errors and ensuring clarity. A clear and consistent format makes it easier to spot missing information or incorrect entries. Here are a few tips:

- Use a consistent structure: Follow a standard layout for each document, with clearly defined sections like itemized charges, totals, and client details.

- Clear and simple design: Avoid clutter and use legible fonts and colors that are easy to read.

- Label each section: Ensure that headings for each section are consistent and easy to identify, such as “Services Provided,” “Amount Due,” or “Payment Instructions.”

4. Review Before Sending

Even with automated tools, it’s important to review the document before sending it to your client. A quick review helps catch any remaining mistakes or omissions. Make it a habit to:

- Check the final amount: Verify the total, including any taxes or discounts.

- Look for missing fields: Ensure that all necessary information is filled in, especially the payment terms and client information.

- Proofread: Check for spelling or grammatical errors that could detract from your professionalism.

By following these simple steps, you can significantly reduce the chances of making errors in your financial documents. A sma

Improving Payment Tracking with Templates

Efficiently tracking payments is crucial for maintaining cash flow and avoiding misunderstandings with clients. Using a standardized structure to create financial documents can simplify the process of recording and monitoring payments. A well-organized system not only helps you stay on top of outstanding balances but also ensures that every transaction is documented clearly, reducing the risk of missed or delayed payments.

1. Organizing Payment Information

One of the key advantages of using a structured document format is the ability to easily track payment details. With predefined fields for payment dates, amounts, and statuses, you can quickly see which payments have been received and which are still pending. To improve payment tracking, consider including the following:

- Payment due dates: Clearly state when each payment is expected to be made to prevent confusion.

- Payment status: Include fields for marking whether payments are “Paid,” “Pending,” or “Overdue.”

- Transaction reference numbers: Add a space for clients to include payment confirmation numbers or transaction IDs for easy cross-referencing.

2. Automating Payment Reminders

Another advantage of using a pre-designed document system is the ability to automate reminders. Many billing platforms allow you to set up automatic reminders for upcoming or overdue payments. Automating this process reduces the administrative burden of manually following up with clients. Here’s how it can help:

- Due date reminders: Send clients automated notifications a few days before the payment is due.

- Late payment reminders: Automatically send polite reminders when a payment has passed its due date, helping you maintain positive client relationships while ensuring timely payments.

- Tracking history: Automatically track the status of payments across multiple transactions and clients.

By organizing payment information and automating reminders, you can reduce the time spent on manual follow-ups and ensure that your payments are tracked accurately. A structured, consistent approach helps improve efficiency and reduces the risk of errors or missed payments, giving you more control over your business’s financial health.

Integrating Billing Systems with Accounting Platforms

Integrating your billing documents with accounting systems can greatly enhance the efficiency and accuracy of your financial operations. By automating the transfer of data between these two systems, you can reduce manual entry errors, streamline reporting, and ensure that your financial records are up to date. This integration helps you maintain better control over cash flow and simplifies the process of managing payments, taxes, and financial statements.

1. Benefits of Integration

Integrating your billing process with accounting software offers several key advantages that can save you time and reduce errors:

- Improved Accuracy: Automatically syncing billing data with your accounting system ensures that there are no discrepancies between what has been billed and what has been recorded in your books.

- Time-Saving: Reduces the need for double entry, as once a financial document is created, its data is automatically populated in your accounting system.

- Real-Time Tracking: Having real-time updates allows you to track payments, outstanding balances, and overall financial performance instantly.

- Compliance and Tax Management: Streamlined integration helps you maintain accurate records for tax purposes and ensures you are prepared for audits.

2. Steps for Integration

Integrating your billing documents with an accounting system requires a few essential steps. Here’s how you can set it up:

- Choose Compatible Software: Ensure that your billing and accounting software are compatible or offer integration features. Popular options like QuickBooks, Xero, and FreshBooks support this kind of setup.

- Link Both Systems: Many accounting platforms offer direct integration with billing software. Connect both systems using APIs or available integration tools provided by the software vendors.

- Sync Data Fields: Ensure that the necessary fields (e.g., client information, itemized charges, due dates) are mapped correctly between the billing and accounting systems.

- Automate Data Transfer: Set up automatic syncing for data transfers. This can help ensure that new transactions are reflected in both systems without manual intervention.

By integrating your billing system with accounting software, you can significantly improve the efficiency of your business operations and ensure that your financial data remains accurate and up to date. This seamless connection allows you to focus more on growing your business while automating and streamlining key financial processes.

How to Automate Your Billing Process

Automating your financial documents is an effective way to save time and reduce the risk of human error. By using automated systems, you can streamline the process of creating, sending, and tracking your billing records. This approach helps you maintain consistency, improve cash flow, and reduce administrative overhead, all while ensuring that your clients receive accurate and timely information.

1. Choose the Right Automation Tools

The first step in automating your billing process is selecting the right tools. Various platforms and software can integrate with your existing systems to automate tasks like document generation, payment reminders, and reporting. Consider the following:

- Accounting Software: Choose accounting platforms like QuickBooks, FreshBooks, or Xero that offer built-in automation features.

- Billing Software: Look for solutions specifically designed for creating and sending professional billing documents with automated capabilities.

- Payment Gateways: Utilize payment gateways that allow you to automate payment processing and updates to your financial records.

2. Set Up Recurring Billing

If you offer subscription-based services or regular payments, setting up recurring billing can save you a lot of time. This feature automatically generates and sends billing documents to clients on a set schedule. To implement recurring billing:

- Define payment schedules: Set up billing intervals (weekly, monthly, annually) for each client based on your agreement.

- Automate delivery: Schedule automatic delivery of financial documents to clients via email or through a client portal.

- Set reminders: Configure automatic reminders for upcoming or overdue payments to keep clients informed.

3. Personalize and Standardize Documents

Although the process is automated, it’s important to maintain a personalized touch in your documents. Personalization can be done while keeping the structure standardized. Key steps include:

- Pre-fill client information: Set up templates that automatically include client-specific data such as names, addresses, and payment terms.

- Customizable design: Choose a standard design for your financial documents but allow for minor customization, such as adding your logo or adjusting the layout.

- Itemized records: Automatically generate detailed breakdowns for each service or product provided, ensuring consistency across all documents.

4. Integrate with Payment Systems

Automating the payment collection process is just as important as automating document creation. By integrating your billing system with payment processing platforms, you can automatically track and reconcile payments. To integrate payment systems:

- Link to payment gateways: Connect platforms like PayPal, Stripe, or direct bank payments to allow clients to pay directly from their billing documents.

- Track payment statuses: Automatically update payment statuses in your system, marking transactions as “paid,” “pending,” or “overdue” based on real-time data.

- Send automatic receipts: Ensure that clients receive payment confirmations immediately after they make a transaction.

5. Monitor and Optimize

Once your automation system is in place, it’s important to regularly mon

Billing Documents for Freelancers and Small Businesses

For freelancers and small business owners, having a professional and organized system for creating financial records is crucial. A well-structured billing document not only ensures timely payments but also enhances credibility and helps maintain a smooth workflow. By using a consistent format, you can simplify the invoicing process and keep track of all financial transactions with ease.

1. Essential Elements of a Billing Document

When creating billing documents for your freelance work or small business, it’s important to include the key elements that will clearly communicate the details of the services provided and payment expectations. The following sections should be included:

- Contact Information: Include your business name, address, phone number, email, and logo, as well as the client’s contact details.

- Itemized List of Services: Break down the services or products provided, including quantities, descriptions, and rates. This transparency ensures that your client understands the charges.

- Payment Terms: Specify the payment due date, payment methods, and any applicable late fees or discounts for early payment.

- Total Amount: Clearly state the total amount due after taxes, discounts, and other adjustments are applied.

2. Customizing Billing Documents for Your Business

Customization is key when adapting your billing documents to your business’s needs. While having a standard format is useful, personalizing the document ensures it aligns with your brand and client expectations. Here are a few ways to customize:

- Branding: Add your logo, business colors, and fonts to create a cohesive and professional look.

- Payment Instructions: Include specific instructions on how clients can make payments, such as bank account details, PayPal links, or other payment platforms.

- Discounts and Add-Ons: If applicable, include special discount rates or additional services, such as consulting hours or project management fees, to clarify the total cost.

- Payment History: For repeat clients, add a payment history section to track past transactions and help you maintain better records.

3. Benefits for Freelancers and Small Businesses

For freelancers and small businesses, using a professional and clear billing system offers several benefits:

- Improved Cash Flow: Clear payment terms and easy-to-understand documents reduce delays in payments and ensure smoother cash flow.

- Time Savings: Having a pre-made structure for billing saves you time, allowing you to focus on your core business activities.

- Better Record-Keeping: Maintaining accurate financial records is essential for tax purposes, budgeting, and overall business management.

- Enhanced Professionalism: Providing clients with clean, well-organized billing documents boosts your reputation and increases the likelihood of repeat business.

By implementing a consistent and professional approach to creating billing documents, freelancers and small business owners can enhance their workflow, maintain organization, and build trust with clients. A simple, clear, and customizable system makes it easier to manage payments and ensures that your business operates smoothly.

Best Practices for Timely Payments

Ensuring that payments are received on time is essential for maintaining a healthy cash flow and building strong business relationships. By implementing a few key strategies, you can encourage clients to pay promptly, minimize late payments, and improve the efficiency of your financial processes. The key lies in clear communication, structured payment terms, and leveraging automation where possible.

1. Clearly Define Payment Terms

One of the most important steps in ensuring timely payments is to define your payment terms upfront. This includes specifying when payments are due, acceptable payment methods, and any penalties for late payments. By setting clear expectations, clients will know exactly when and how to pay, reducing confusion and delays.

| Payment Term | Description |

|---|---|

| Due upon receipt | Payment is expected immediately after the document is issued. |

| Net 30 | Payment is due within 30 days from the date of the financial document. |

| Net 60 | Payment is due within 60 days from the date of the financial document. |

| Late Fee | A fixed fee or percentage charged if payment is not made within the agreed timeframe. |

2. Offer Multiple Payment Methods

Providing clients with a range of payment options can increase the likelihood of receiving payments on time. Offering online payment gateways, such as PayPal, credit card processing, or bank transfers, allows clients to pay quickly and conveniently. The more accessible the payment process, the less likely clients are to delay their payments.

- Online Payment Systems: Enable easy and secure payments via popular platforms like PayPal, Stripe, or Square.

- Bank Transfers: Offer clients the option to pay directly into your business bank account.

- Credit/Debit Cards: Allow clients to pay via credit or debit card, providing additional flexibility.

3. Send Timely Payment Reminders

Even when you set clear terms, it’s important to send reminders to clients before and after a payment is due. Automated reminders are an effective way to reduce delays. You can set up a schedule to notify clients in advance and send follow-up emails if payments aren’t received on time.

- Pre-Due Reminders: Send a gentle reminder a few days before the due date to keep the payment top of mind.

- Post-Due Follow-Ups: Send a polite follow-up if payment hasn’t been made by the agreed date, outlining any late fees and the next steps.

- Clear Payment Instructions: Ensure that each reminder contains detailed instructions on how to make the payment and provide contact information in case of issues.

4. Automate Your Bil

Legal Considerations for Billing Documents

When creating financial records for your business, it is essential to understand the legal aspects associated with them. These documents not only serve as a tool for tracking payments but also play a critical role in ensuring compliance with tax laws and regulations. A properly constructed financial document can protect your interests in case of disputes, while also meeting the legal requirements set by local authorities and international standards.

1. Essential Legal Elements of Financial Records

There are specific details that must be included in your financial records to ensure they are legally compliant. These elements help provide transparency, accountability, and protect both parties involved in a transaction. Below are some key components:

| Element | Description |

|---|---|

| Business Identification | Include your business name, legal structure (LLC, sole proprietorship), and contact details. |

| Tax Identification Number (TIN) | Include your tax ID number, which is required for tax purposes in many jurisdictions. |

| Client Identification | Make sure to include the full legal name and address of the client or company being billed. |

| Unique Reference Number | Assign a unique reference number to each document for record-keeping and tracking purposes. |

| Clear Payment Terms | Clearly define payment due dates, applicable penalties for late payments, and accepted payment methods. |

| Detailed Description of Services or Products | Include a breakdown of all products or services provided, along with corresponding prices. |

2. Tax Compliance and Requirements

In addition to the basic elements, it is essential that your financial records comply with local tax laws and international regulations. Different jurisdictions may have specific requirements for tax calculation, such as VAT, sales tax, or service tax, which must be reflected in your documents. Consider the following:

- Tax Rates: Ensure that your documents reflect the appropriate tax rate for the products or services being sold. This varies depending on the region and the type of goods or services.

- Tax Exemptions: In some cases, you may need to specify whether certain items are tax-exempt and the reasons for such exemptions.

- Invoice Format for Tax Authorities: Some countries require businesses to use specific formats or include additional details for tax compliance. Research local regulations to ensure adherence.

- Retaining Records: Legally, businesses are often required to retain financial records for a certain period of time. Be sure to maintain accurate records for tax audits or legal disputes.

3. Legal Protection and Dispute Resolution

In case of disagreements or legal disputes with clients, having a well-structured financial document can serve as vital evidence. Including certain clauses in your billing documents can help protect your business interests and outline the steps to resolve issues.

- Late Fees and Penalties: Clearly state your policies on late payments and the penalties that will apply, such as interest charges or fixed late fees, to discourage delays.

- Refund Policy: Clearly outline your policy for refunds or returns, including conditions under which refunds will be granted.

- Dispute Resolution Clause: Consider including a clause specifying how disputes will be resolved–whether through negotiation, mediation, or arbitration–before

Saving Time with Ready-Made Templates

Streamlining business operations often involves adopting tools that can save time and reduce manual effort. One of the most effective ways to enhance efficiency is by utilizing pre-designed documents that can be quickly customized and used repeatedly. These ready-made solutions eliminate the need to start from scratch, enabling you to focus on core tasks while ensuring consistency and professionalism in your financial records.

Instead of spending valuable time designing each document from the ground up, ready-made solutions provide a structure that you can easily modify to fit your specific needs. Whether it’s adding client details, updating service descriptions, or adjusting amounts, these pre-built formats make the process quicker and more reliable.

By using such tools, businesses can handle multiple tasks simultaneously, without the worry of losing time on repetitive document creation. The time saved can be directed toward other important aspects, such as customer service, marketing, or product development, which ultimately contributes to business growth.

Choosing the Right Billing Document Format

Selecting the appropriate format for your financial documents is crucial for maintaining professionalism and ensuring clarity. The right design not only helps to organize and present important information efficiently but also creates a positive impression on clients. It’s important to choose a format that fits your business model, matches your branding, and complies with relevant regulations.

There are several factors to consider when choosing the right format for your financial records. These include the complexity of your services, your target audience, and how easily you can integrate the format into your existing workflow. A clear and straightforward layout is key to making sure clients understand the details and can easily process the document without confusion.

Key Features to Look For

When evaluating different document formats, look for features that best align with your business needs. Here are a few essential features to consider:

Feature Description Simple Layout A clear, minimal design that highlights essential details without clutter. Customization Options The ability to personalize with your business logo, colors, and fonts to match your brand identity. Payment Terms Section A section clearly defining payment due dates, methods, and any penalties for late payments. Itemized List A breakdown of products or services with individual pricing for clarity. Tax Calculation A place to easily calculate and display applicable taxes based on your jurisdiction. Legal Information Space for including important legal details, such as terms and conditions, and dispute resolution clauses. By selecting a format with the right features, you ensure that your documents are not only functional but also reflect the professionalism and reliability of your business. Whether you’re handling a large volume of transactions or just starting, the right choice can streamline your billing process and foster better relationships with your clients.