Download Free Printable Invoice Template for Easy Billing

Managing payments and keeping track of transactions is a crucial aspect of running any business. Whether you’re a freelancer or a small business owner, having an efficient system for creating and issuing documents is essential for smooth financial operations. A well-organized document that outlines the payment details ensures clarity and professionalism when dealing with clients or customers.

With the right resources, generating these documents becomes much easier and faster. There are various tools available that allow you to produce professional-looking records without the need for expensive software. By using the right design and layout, you can create clear, precise, and effective billing statements that leave a lasting impression.

In this article, we’ll explore how to access and use tools that allow you to generate these essential records quickly and without cost. You’ll learn how to take advantage of simple yet powerful solutions to meet your business’s financial documentation needs.

Free Printable Invoice Templates for Businesses

For businesses of any size, the ability to generate professional payment documents quickly and efficiently is vital. These documents play an essential role in maintaining financial clarity and ensuring that transactions are transparent. With the right tools, entrepreneurs can produce polished, error-free statements that reflect the quality of their service or product.

Many online resources offer the opportunity to download customizable documents that can be used repeatedly for various clients or projects. These tools allow businesses to save both time and money, eliminating the need for expensive software. Whether you are just starting or have an established company, having access to these customizable solutions is invaluable for streamlining your accounting process.

Benefits for Small Businesses

Small business owners often face challenges related to budgeting and managing time effectively. Utilizing ready-made resources enables entrepreneurs to focus on growing their businesses while maintaining organized financial records. By using accessible formats, businesses can create consistent and professional-looking statements without the added expense of hiring an accountant or purchasing specialized software.

How to Customize Your Documents

Many of the available resources are easily editable, allowing you to add your business’s branding, payment terms, and specific client information. The flexibility of these tools ensures that your documents reflect your company’s unique identity and meet your specific needs. Adjusting the layout and details for each project or client ensures accuracy and helps to build trust with customers.

Why Use a Free Invoice Template

Having a consistent and professional format for your billing documents is essential for maintaining trust and clarity with clients. Instead of creating each record from scratch, using pre-designed formats helps to save time and reduce the risk of errors. These resources allow you to quickly generate detailed statements while ensuring all necessary information is included, giving your business a polished and organized appearance.

By utilizing available tools, businesses can focus on other critical areas without getting bogged down by the complexities of document creation. Customizable layouts enable easy adjustments, so you can cater to different client needs or service types. Additionally, these resources often come at no cost, making them an ideal solution for small businesses or independent professionals with limited budgets.

How to Customize Your Invoice Template

Customizing your billing document is an important step in ensuring it reflects your business’s identity and meets your specific needs. The ability to tailor each record allows you to include necessary details like your company’s logo, contact information, and personalized payment terms. This personal touch not only improves professionalism but also builds trust with clients, making the entire process more streamlined and efficient.

Most ready-made resources offer easy-to-use editing tools that allow you to adjust the layout, font styles, and colors. You can modify sections to better fit your services, add unique payment instructions, and even include your branding elements. By customizing your records, you ensure that each one is relevant, clear, and consistent with your business practices.

Top Benefits of Printable Invoices

Using structured billing documents offers numerous advantages for businesses, enhancing both operational efficiency and professionalism. These records not only help maintain transparency in financial transactions but also simplify the process of tracking payments and managing client relationships. By adopting standardized formats, you can ensure consistency in your communications, which ultimately supports long-term business success.

Efficiency and Time Savings: The main benefit of using predefined formats is the time saved during the billing process. These tools allow you to quickly generate accurate statements without starting from scratch each time, reducing administrative burden and enabling you to focus on core business activities.

Improved Accuracy: A well-organized document reduces the risk of errors, such as missing details or incorrect payment terms. When you use structured resources, all necessary fields are included, ensuring that every record is complete and error-free, which enhances the overall professionalism of your business.

Branding and Customization: Customizing these documents with your logo, company name, and contact information allows you to maintain a consistent brand image across all communications. This reinforces your business identity and can even help with client retention, as clients will recognize and trust your consistent approach to transactions.

Easy Steps to Create an Invoice

Creating a document to request payment for goods or services can be a simple and efficient process. Whether you’re an independent contractor, a small business owner, or a freelancer, knowing how to craft a professional billing document is essential. Here are some easy steps to ensure that your request for payment is clear and well-organized.

Step 1: Collect Necessary Information

- Your business details: name, address, contact information.

- The recipient’s information: customer’s name, address, contact details.

- Details of the transaction: list of products or services provided, quantities, and prices.

- Dates: the date of issuance and payment due date.

- Payment terms: including accepted methods and late fee policies.

Step 2: Organize the Information

Once you have all the necessary data, arrange it in a clear and logical order. This will make the document easy to understand and professional in appearance. Include a unique reference number to avoid any confusion for future reference. Be sure to break down the costs in a way that’s transparent and easy to follow.

Step 3: Review and Send

- Proofread the document for accuracy.

- Ensure the terms are clear and precise to avoid any misunderstandings.

- Choose the best method to send your document–email or printed version, depending on your client’s preference.

By following these steps, you’ll be able to create a professional and clear document to request payment with ease.

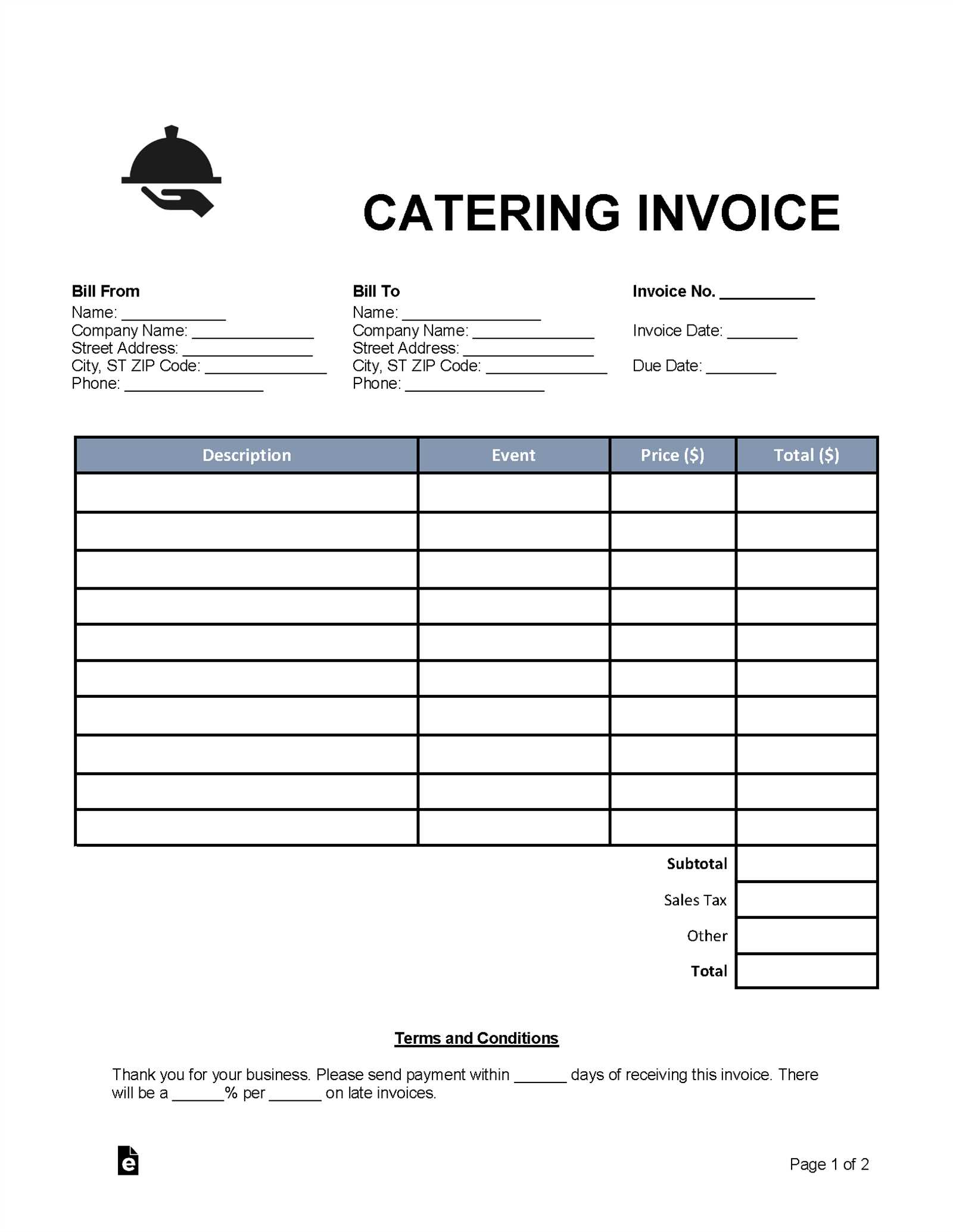

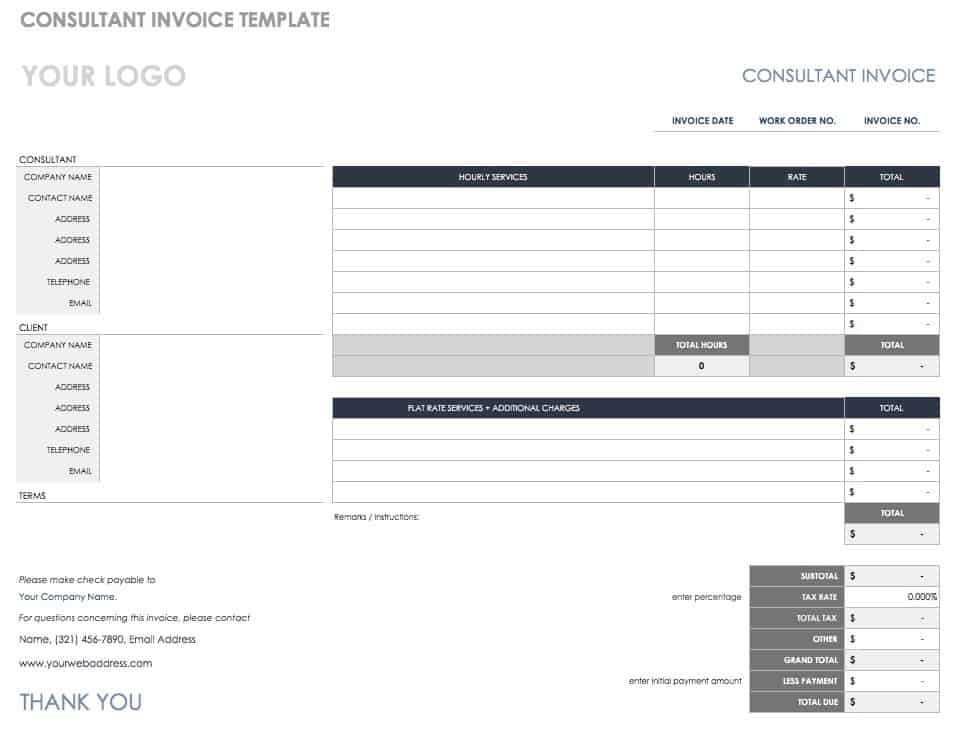

Invoice Template for Freelancers

As a freelancer, it’s crucial to have a document that clearly outlines the work done and the payment expected. This document serves as a professional means to request compensation and keeps your business transactions organized. Below is an example of how to structure a simple yet effective payment request for your clients.

Essential Information to Include

When creating a document for payment requests, ensure it includes the following elements:

- Your business name, contact information, and logo (if applicable).

- Client details such as name, company, and contact information.

- A list of services or goods provided, with quantities and rates.

- Total amount due and payment terms (e.g., payment method, due date).

Sample Format

| Description | Quantity | Unit Price | Total |

|---|---|---|---|

| Consulting Services | 10 hours | $50 | $500 |

| Design Work | 5 hours | $60 | $300 |

| Total Due | $800 | ||

This structure ensures that all necessary details are included for clear communication and smooth transactions with clients.

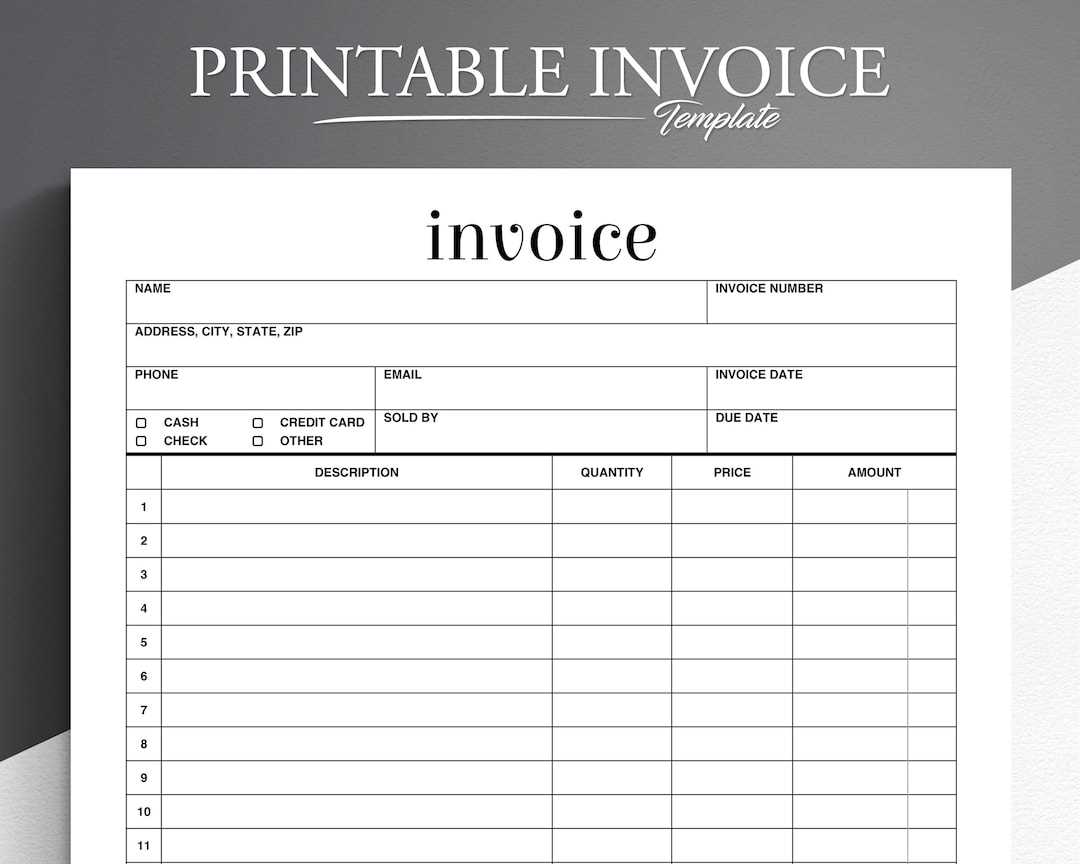

Best Invoice Template Formats to Choose

Choosing the right format for a payment request is essential for maintaining professionalism and ensuring that all necessary information is clearly communicated. There are various styles available, each suited to different needs and business types. The goal is to select one that makes it easy for clients to understand the details while ensuring smooth processing of payments.

1. Basic Format

A simple and straightforward structure is ideal for those who need a clean, no-frills document. This format typically includes the necessary details such as services or products provided, amounts due, and payment terms in a minimalistic design. It’s perfect for freelancers and small business owners who prefer simplicity.

2. Professional Format

If you’re working with larger clients or wish to present a more polished look, a professional format might be the best choice. It often includes branded elements, itemized lists, and space for additional terms and conditions. This style is great for businesses looking to make a lasting impression with a refined appearance.

3. Creative Format

For those in creative industries, the design of your request document can reflect your brand’s personality. Using a more visually engaging layout, including colors, logos, and custom fonts, can help convey a unique style while still maintaining clarity in terms of pricing and services offered.

Regardless of the format, it’s essential to ensure that the core information is easy to find and clearly presented to avoid any confusion or delays in payment.

Free Invoice Templates for Small Businesses

For small businesses, having an effective and easy-to-use document for billing clients is essential. There are various options available that can help simplify the process, from basic structures to more detailed designs. Below are some common choices that can suit the needs of entrepreneurs and startups looking for simplicity and cost-effectiveness.

Common Options for Small Business Owners

- Basic Layouts: Ideal for businesses with straightforward services or products, these are minimal designs with clear sections for listing products, prices, and payment terms.

- Itemized Designs: Best suited for businesses that offer a range of services or products, these layouts allow you to break down each item separately, ensuring transparency.

- Professional Styles: A more polished option for businesses that require a formal and sophisticated presentation, these formats often include branding elements such as logos, company names, and custom fonts.

Benefits of Using Simple Billing Structures

- Time-saving: Pre-designed layouts allow you to create and send documents quickly without spending extra time on design.

- Consistency: Using the same format for all clients ensures a professional and uniform appearance across your business transactions.

- Easy Customization: Most of these options are customizable, allowing small business owners to adjust fields as needed, such as payment terms or contact details.

By choosing the right billing format, small businesses can save time, reduce errors, and enhance professionalism in their dealings with clients.

Common Mistakes to Avoid When Invoicing

Properly requesting payment for services or goods is a crucial aspect of any business. However, there are common pitfalls that can lead to confusion, delays, or even lost income. Recognizing and avoiding these mistakes can help ensure that your payment requests are clear, professional, and easily processed by your clients.

1. Incorrect or Missing Information

One of the most frequent errors is failing to provide complete or accurate details. Always double-check that the following are included:

- Your contact details and business name.

- Client information and address.

- A clear breakdown of the goods or services provided.

- Correct pricing and payment terms.

- A unique reference number to avoid confusion.

2. Unclear Payment Terms

Ambiguity regarding payment terms can lead to misunderstandings. Always be explicit about:

- The total amount due and the due date.

- Accepted payment methods (e.g., bank transfer, credit card).

- Late payment fees or interest, if applicable.

By clearly stating these terms, you help clients understand their obligations and avoid payment delays.

Where to Find Free Invoice Templates

There are various resources available for those looking for pre-designed documents to request payment. Whether you’re a freelancer, small business owner, or entrepreneur, you can easily access templates that suit your needs. Below are some of the most popular sources for finding these resources online.

1. Online Document Creation Platforms

Many online platforms offer ready-made structures that can be customized to suit your business. These services typically allow you to:

- Choose from a variety of designs that range from simple to professional layouts.

- Customize fields to include your business name, client information, and transaction details.

- Download or email the document directly to your client once completed.

2. Business Websites and Blogs

Numerous websites dedicated to small business resources provide downloadable documents at no cost. These sources often include:

- Specialized formats that are tailored to different industries (e.g., creative, consulting, retail).

- Guides and tips to help you fill out the document correctly and professionally.

By exploring these options, you can easily find a suitable structure that meets your needs without spending time or money on custom designs.

How to Print and Use Your Invoice

Once you have created your document to request payment, it’s time to ensure it’s ready for use. Printing and sending it to your clients can be done quickly and efficiently. Below are some simple steps to follow for printing and utilizing your payment request effectively.

1. Review the Document

Before printing or sending, double-check that all the information is accurate. Ensure that the following details are correct:

- Your business name and contact information.

- Client’s name, address, and contact details.

- List of services or products, quantities, and prices.

- Total amount due and payment terms.

- Payment method and due date.

2. Printing and Sending the Document

Once you’re confident everything is accurate, it’s time to either print or send the document digitally:

- Print: Ensure your document is formatted correctly and fits well on the page. Use good quality paper for a professional appearance.

- Email: If you’re sending the document electronically, save it as a PDF for easy access and security. Attach it to an email with a brief cover note.

- Post: If you prefer to send a physical copy, print multiple copies and mail them to the client along with any additional necessary documents.

By following these simple steps, you can ensure that your payment request is clear, professional, and ready for processing.

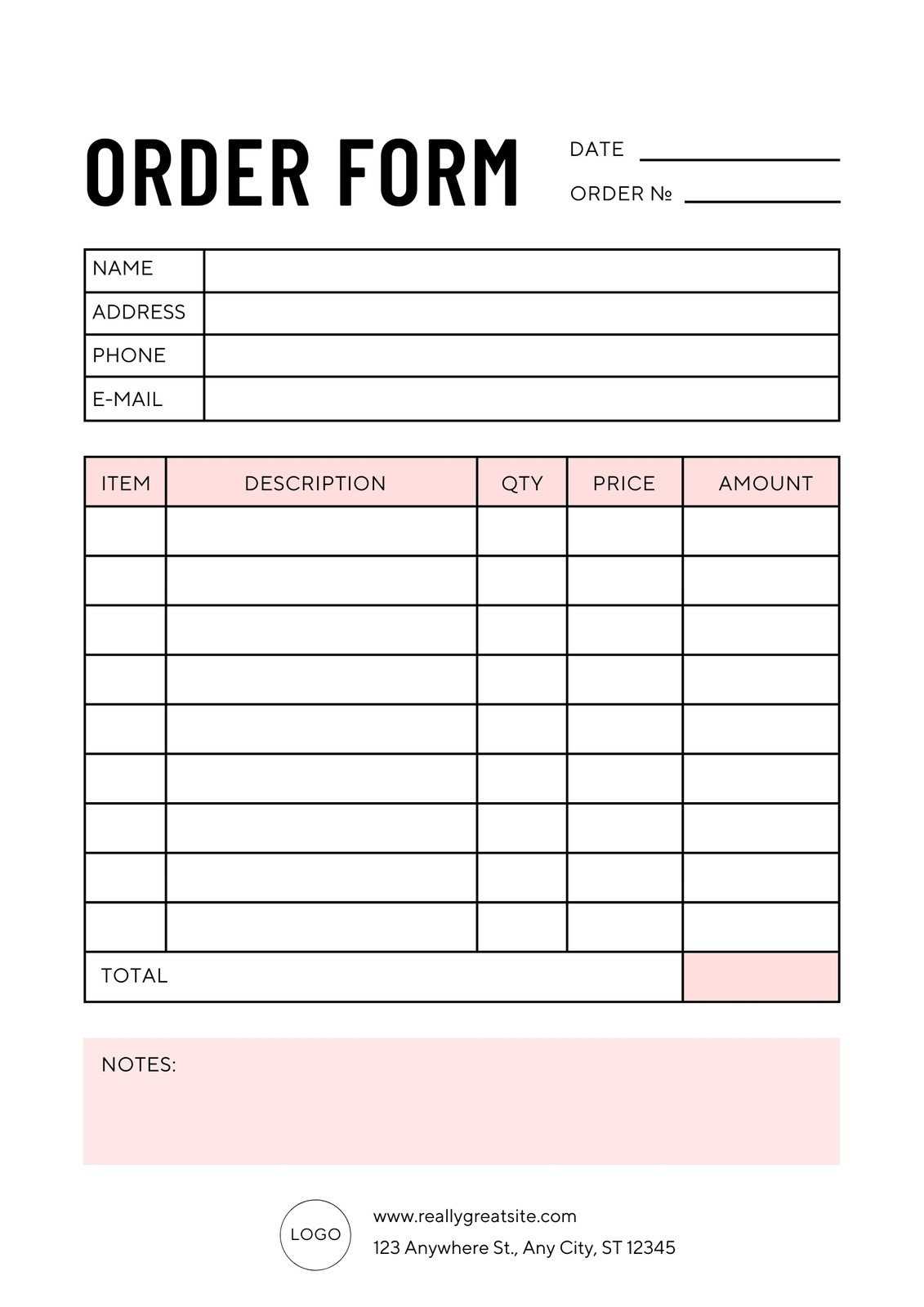

What Information Should Be on an Invoice

For a payment request to be effective and professional, it must include key details that clearly communicate the terms of the transaction. Including all necessary information ensures that your client understands what they are being charged for, how to make the payment, and when it is due. Below are the essential components that should be included in every payment document.

1. Your Business Information

It’s important that the recipient knows who the document is from. Include:

- Your company name or personal name if you’re a freelancer.

- Your address and any relevant contact information (email, phone number).

- Your tax identification number, if applicable.

2. Client Information

Just as important is the client’s information. Make sure to include:

- Client’s full name or company name.

- Client’s address and contact details.

- Client’s reference number or order number, if applicable.

3. Transaction Details

The core of the document is the breakdown of services or goods provided:

- Description of each product or service provided.

- Quantity and unit price for each item or service.

- Total amount due, including taxes and discounts, if applicable.

- Unique reference number for easy identification.

4. Payment Terms

Clarify how and when the payment should be made:

- Payment methods accepted (e.g., bank transfer, credit card).

- Due date for payment.

- Late fee policies, if any.

By including these key details, you create a clear and professional payment request that helps ensure timely and accurate processing.

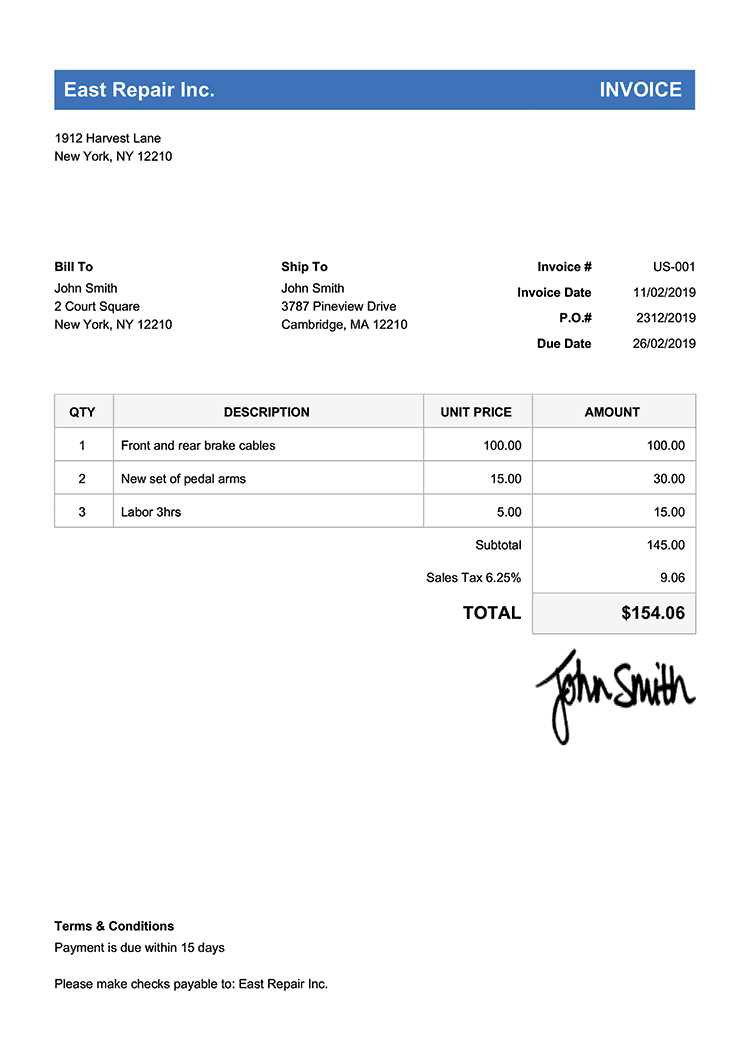

Creating Professional Invoices with Templates

Designing an effective payment request can help establish trust and professionalism with your clients. Using pre-designed formats can streamline the process and ensure that your documents look polished and consistent. Below are some tips on how to create high-quality documents that clearly communicate the transaction details and reflect your business’s brand identity.

1. Choose a Clean and Clear Design

When selecting a layout, simplicity is key. A clean, well-organized design ensures that your clients can easily understand the details of the transaction. A good format should:

- Highlight the most important information, such as the total amount due, due date, and services rendered.

- Use clear headings for each section, such as contact details, payment terms, and pricing.

- Avoid clutter to keep the document easy to read and navigate.

2. Include Your Branding Elements

Including your company’s branding helps make the document look professional and recognizable. Ensure that the following are present:

- Your business logo at the top of the document.

- Consistent color schemes that match your brand identity.

- Clear contact information, including your email, phone number, and address.

By using a structured and well-branded format, you can create a professional-looking document that builds credibility with your clients and streamlines the payment process.

Advantages of Digital vs. Printed Invoices

When it comes to requesting payments, businesses often face a choice between sending digital documents or physical ones. Both methods have their own set of benefits, and the decision largely depends on factors such as convenience, speed, and environmental considerations. Below, we explore the key advantages of each approach to help you determine which one is right for your business.

1. Advantages of Digital Documents

Digital payment requests offer several significant benefits that make them an attractive option for many businesses:

- Cost-effective – No need for paper, ink, or postage.

- Fast delivery – Documents can be emailed instantly, speeding up the entire process.

- Easy tracking – Digital records are simple to store, organize, and search for in the future.

- Environmentally friendly – Reduces paper waste and lowers the carbon footprint of your business operations.

- Automation – Many digital systems allow for automated payment reminders and follow-ups.

2. Advantages of Printed Documents

While digital methods are widely used, there are still cases where printed documents might be the preferred choice:

- Personal touch – Some clients may appreciate receiving a physical document, as it feels more personal and formal.

- Less reliance on technology – For clients who are not tech-savvy or do not have email access, a printed document may be easier to handle.

- Better for certain industries – Certain sectors, such as construction or retail, may still prefer paper-based transactions for record-keeping.

Ultimately, choosing between digital or printed documents depends on the specific needs of your business and your clients. Many businesses find it beneficial to use a combination of both methods to cover all bases.

How to Track Payments Using Templates

Tracking payments is essential for maintaining a smooth cash flow and ensuring that all transactions are properly accounted for. Using pre-structured documents can help streamline this process, making it easier to monitor outstanding amounts, due dates, and payment status. Below are steps on how to effectively track payments using customizable formats.

1. Include Payment Status Information

One of the most important elements of tracking payments is updating the status of each transaction. Ensure that your document includes a section that clearly indicates whether the payment has been:

- Pending – when the payment is yet to be made.

- Paid – once the client has completed the transaction.

- Overdue – if the payment is not received by the due date.

- Partial Payment – if only a portion of the total amount has been paid.

2. Use a Tracking System for Multiple Entries

If you’re handling multiple clients or projects, consider adding a tracking section with columns that help you organize and follow up on each payment. This could include:

- Client Name – to easily identify who the payment request is for.

- Due Date – to know when the payment should be made.

- Amount Due – showing the total amount that needs to be paid.

- Amount Paid – to track payments as they come in.

- Balance Remaining – to calculate any outstanding balance.

By incorporating these details into your system, you can easily monitor the status of payments and ensure you follow up on overdue accounts promptly.

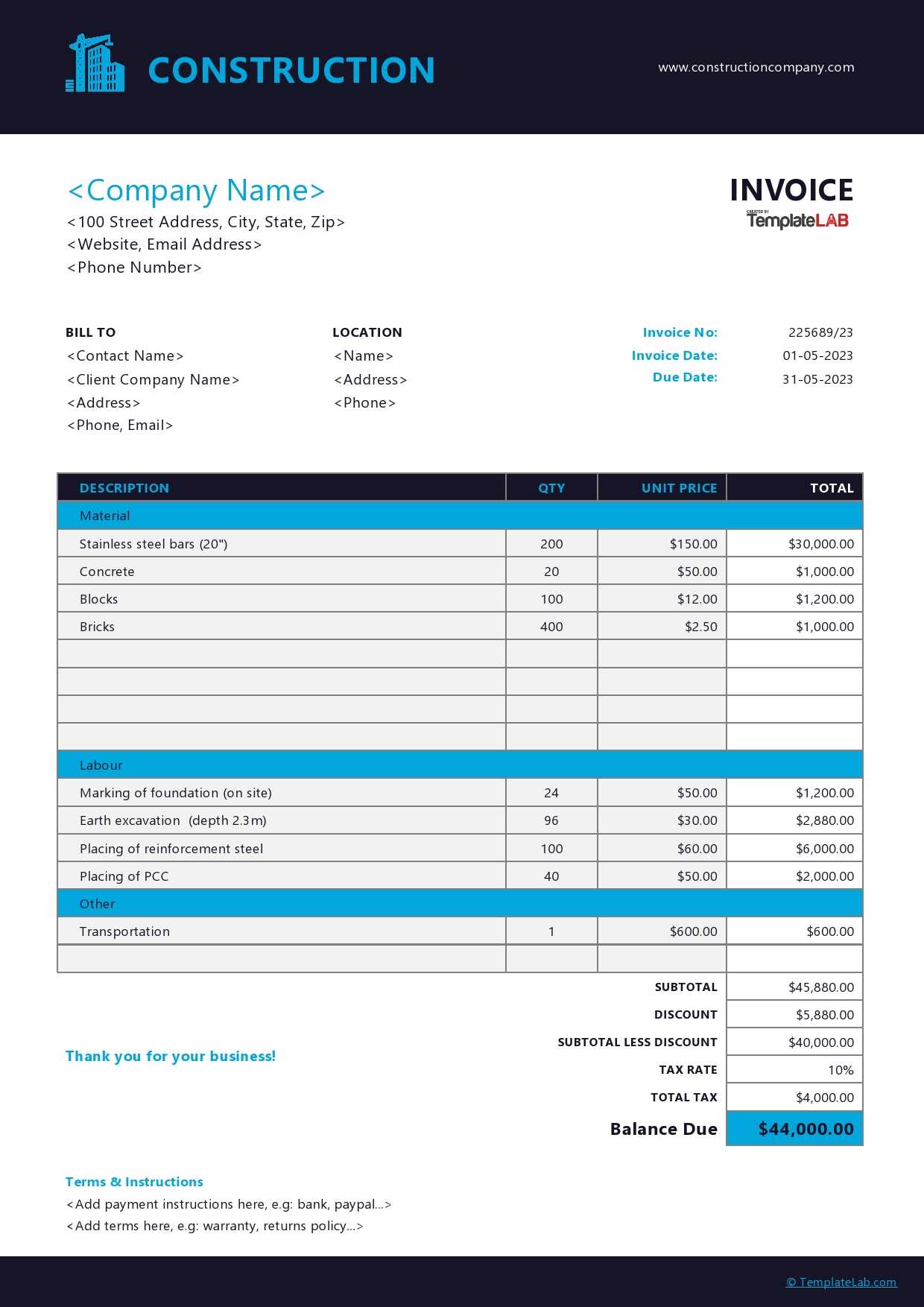

Invoice Template Options for Different Industries

Every industry has unique needs when it comes to payment requests, and tailoring the format of these documents can help streamline the process and ensure all necessary information is included. Different fields may require specialized layouts to accommodate specific services, products, or billing practices. Below are some options for customizing documents based on industry requirements.

1. Creative Industries (Freelancers, Designers, Artists)

For creative professionals, payment documents often need to reflect the nature of their services and the personalized attention they give to each project. Here are some features that are useful for those in creative industries:

- Detailed project breakdown – Include specific tasks or milestones to clarify what was completed.

- Hourly rates – If billing hourly, make sure to list hours worked and rate per hour.

- Client approvals – Space for indicating that the client has approved specific phases of work.

2. Service-Based Industries (Consulting, IT, Maintenance)

In service-based industries, it’s important to list the work provided in a clear and structured manner. Here’s what to include:

- Service descriptions – Provide a detailed explanation of each service provided or project completed.

- Fixed pricing or hourly rates – Clearly distinguish whether services are billed at a set price or hourly.

- Service periods – Indicate the time period during which the service was rendered, especially for ongoing contracts.

3. Product-Based Industries (Retail, Wholesale, Manufacturing)

For businesses that sell physical products, it’s essential to include clear product information. Consider adding:

- Itemized list – Each product sold, including descriptions and quantities.

- Unit prices – Ensure that unit prices are clearly listed next to each item.

- Shipping costs – Include any shipping or handling fees, if applicable.

Customizing your documents for the specific requirements of your industry ensures that you provide your clients with all the necessary information for a smooth transaction.

How to Keep Your Invoices Organized

Maintaining an organized system for tracking payments and outstanding amounts is crucial for any business. A well-organized approach ensures that you can easily access and manage all your records, making it simpler to follow up on overdue amounts and stay on top of your finances. Below are some strategies to help keep your records neat and efficient.

1. Use a Numbering System: Assigning a unique number to each document helps in tracking and referencing specific transactions. A chronological numbering system makes it easy to find and manage records, especially when dealing with a large volume of documents.

2. Maintain Separate Folders: Organize your documents into separate folders for paid, unpaid, and overdue transactions. This physical or digital sorting method helps in quickly identifying the status of each record and allows you to focus on the ones that need attention.

3. Implement Digital Solutions: Utilize accounting software or online platforms that can help you store and manage your records. These tools often come with features for automating reminders, generating reports, and keeping all your records in one place, reducing manual work and potential errors.

4. Regularly Update Your Records: Consistency is key to maintaining an organized system. Make it a habit to update your records immediately after any payment is made or a new document is issued. This ensures that all information is current and accurate.

By adopting these practices, you can keep your transaction history in order, reduce stress, and ensure that your business operations run smoothly.