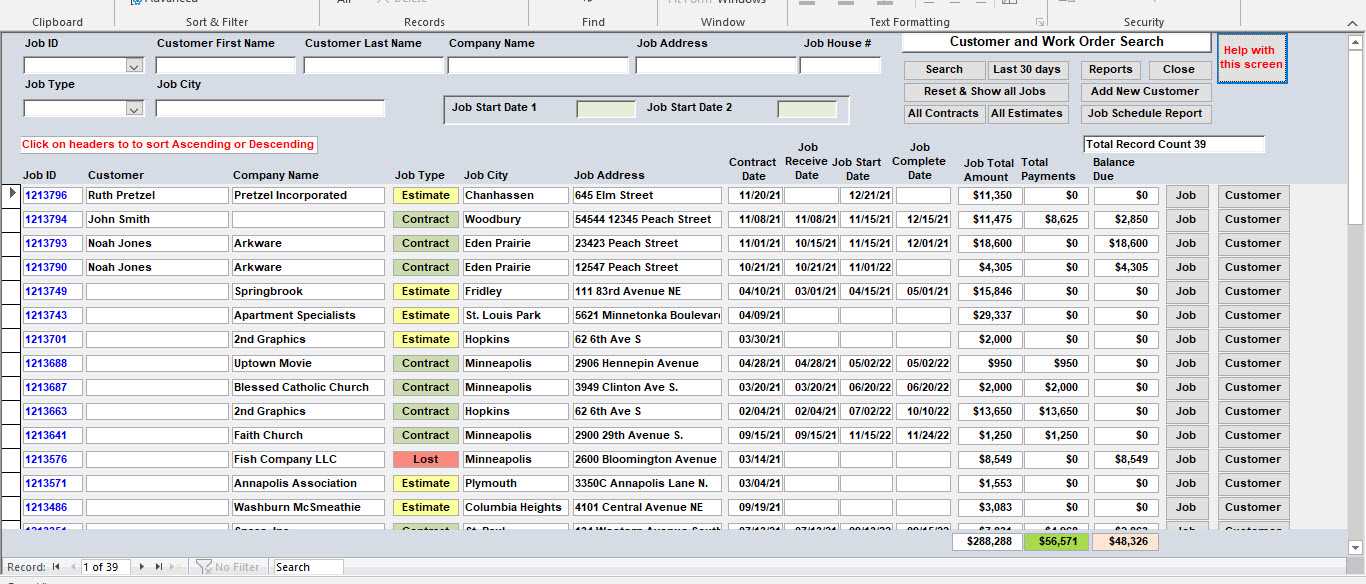

Free Microsoft Access Invoice Template for Effortless Billing

Managing financial transactions efficiently is essential for businesses of all sizes. One of the key elements in this process is creating well-organized documents that detail each transaction accurately. With the right tools, businesses can easily generate these documents without starting from scratch every time, saving both time and effort.

By using pre-designed tools for document creation, you can avoid manual formatting and ensure that your records are consistent and professional. These customizable resources allow you to input necessary details quickly, automate calculations, and focus on what matters most–serving your clients and growing your business.

In this article, we will explore how to leverage simple yet effective tools that help you produce clean, clear, and precise financial statements. Whether you’re just starting out or looking for a better way to manage your billing, these resources offer a solution that simplifies your work and enhances your overall productivity.

Microsoft Access Invoice Template Overview

Efficient management of financial records is essential for any business, and having a structured approach to creating billing documents can significantly simplify this task. The use of ready-made solutions that automate much of the work can save time and reduce errors. These tools allow users to input relevant data and generate consistent, professional-looking documents in no time.

Key Features of Automated Billing Documents

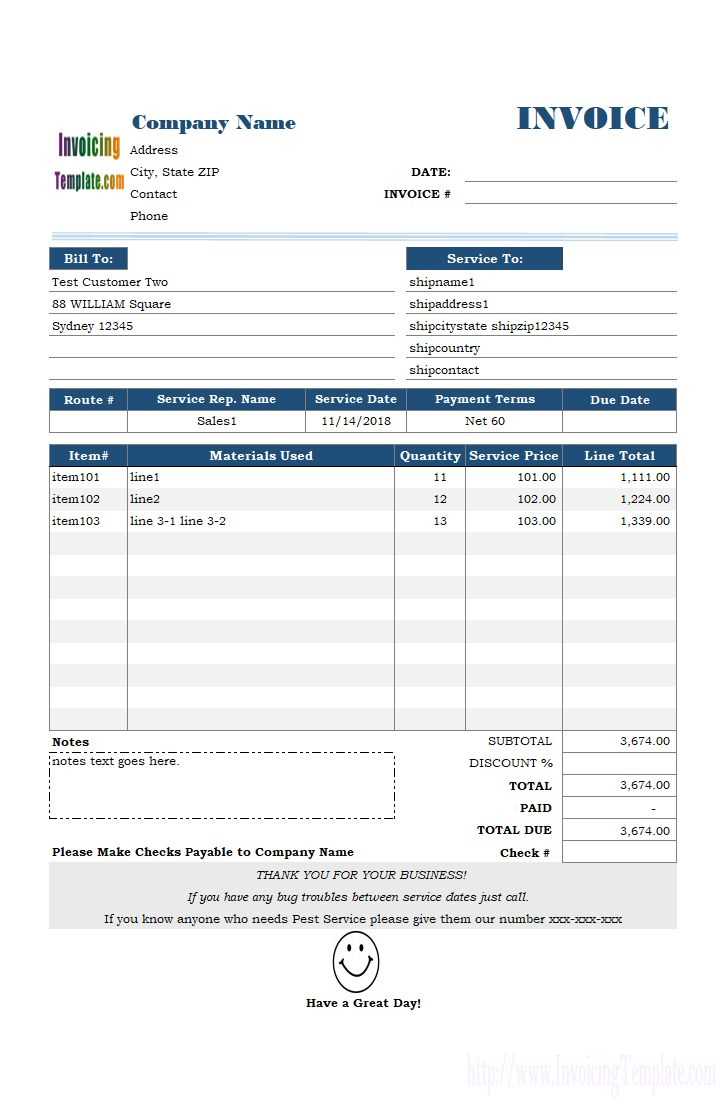

These solutions come with several features designed to streamline the entire billing process. From automatic calculation of totals and taxes to customizable fields for different services and products, these tools help businesses quickly generate comprehensive records. They are particularly useful for companies with regular transactions or varying service offerings, as they allow for easy adjustments and consistent formatting.

Benefits of Using Ready-Made Solutions

One of the primary advantages of these automated tools is the ease of use. Even without extensive technical knowledge, users can quickly create accurate financial statements. The pre-built structure ensures that all necessary fields are included, reducing the risk of missing important information. Moreover, these solutions are designed to be adaptable to different business needs, providing flexibility while maintaining a high level of professionalism in each document.

Why Use Microsoft Access for Invoices

Managing financial records efficiently requires reliable software that can handle data entry, calculation, and document generation with ease. One such tool offers a powerful database management system that enables businesses to organize and generate detailed financial reports with minimal effort. Its robust features help businesses track transactions, store client information, and produce accurate records automatically.

Using this database tool for document generation provides several key benefits. It allows for easy customization, ensuring that each record is tailored to the specific needs of the business. With built-in features for handling complex calculations, users can eliminate errors and improve overall accuracy. Additionally, its integration with other office applications further enhances workflow and reduces manual input.

Another reason to choose this platform for generating billing statements is its capacity to handle large amounts of data without performance issues. Whether a business is dealing with a handful of clients or hundreds, the system remains efficient and scalable, allowing for smooth operations as the business grows.

Benefits of Free Invoice Templates

Using pre-designed documents for financial records offers numerous advantages, especially when they are readily available at no cost. These solutions help businesses save time by eliminating the need to start from scratch with each new record. With structured formats and built-in features, users can quickly generate accurate and professional documents with minimal effort.

Time and Cost Efficiency

One of the most significant benefits of using these ready-made resources is their time-saving nature. Instead of manually creating every new statement, businesses can input the necessary information and generate a document in just a few clicks. This reduces administrative burden and allows business owners to focus on other essential tasks. Additionally, as they require no additional financial investment, these tools are an excellent choice for small businesses and startups looking to keep costs down.

Consistency and Accuracy

Pre-designed documents ensure that each financial record follows a consistent format, reducing the likelihood of errors. With fields already structured and calculations automated, these tools provide a higher level of accuracy. This consistency not only improves internal record-keeping but also enhances professionalism when dealing with clients and stakeholders.

How to Download Access Invoice Templates

Obtaining ready-to-use documents for generating billing statements is a straightforward process that can save valuable time. Many online platforms offer these resources for download, allowing businesses to quickly implement them into their operations. Whether you’re looking for a simple layout or a more advanced setup, there are various options available that suit different needs and preferences.

Step-by-Step Download Process

To begin, simply search for trusted sources that provide these resources. Many websites specialize in offering high-quality, pre-designed solutions that are easy to download and use. Once you’ve located the desired document, follow the provided instructions to initiate the download. Typically, you’ll be asked to click a download button or link, and the file will be saved to your computer or cloud storage for easy access.

Choosing the Right Document for Your Needs

It’s important to select a document that fits your business requirements. Some offer basic functionality with essential fields, while others may include advanced features such as automated calculations and customizable sections. Be sure to review the available options and choose one that matches your workflow and the complexity of your billing needs.

Customizing Your Access Invoice Template

Personalizing your billing document is an essential step in ensuring it meets your specific business needs. Customization allows you to adjust the layout, fields, and overall design to align with your branding and operational requirements. By tailoring these pre-made resources, you can create a more efficient process that reflects the unique nature of your business.

Most tools provide options to modify different elements of the document, such as text fields, fonts, and color schemes. You can also add or remove sections depending on the information you need to include. Customization helps make the document more user-friendly, while maintaining a professional appearance for your clients.

Key Customization Options

| Field | Customization Option |

|---|---|

| Client Information | Modify or add fields for client name, address, contact details, etc. |

| Product/Service Details | Customize item descriptions, prices, and quantities to suit your offerings. |

| Payment Terms | Adjust payment due dates, methods, and other relevant conditions. |

| Branding | Add logos, adjust color schemes, and modify fonts to match your business identity. |

By leveraging these options, you can ensure that the document reflects your brand and the unique aspects of your business, making it not just functional but also aligned with your company’s image and professionalism.

Key Features of Access Invoice Templates

When choosing a pre-designed solution for generating financial records, it’s essential to consider the features that will make the document creation process more efficient. These features ensure that your documents are not only accurate but also tailored to your specific business needs. The most effective tools come with a set of built-in functionalities that streamline data entry, calculations, and document management.

Automated Calculations

One of the standout features of these resources is the ability to automatically calculate totals, taxes, and discounts. This removes the need for manual calculations, reducing errors and speeding up the entire process. By entering the necessary details, the document can instantly update to reflect accurate pricing information, helping to ensure precision and consistency.

Customizable Fields

Adaptability is another key advantage of these resources. Whether you need to add extra fields for additional products or services, or adjust sections to include specific client details, these tools offer great flexibility. You can easily customize sections like payment terms, service descriptions, and contact information, ensuring that each document reflects your exact requirements.

Moreover, these tools allow for the inclusion of branding elements, such as logos and custom color schemes. This level of personalization helps maintain a professional appearance and ensures that all communications align with your business’s identity.

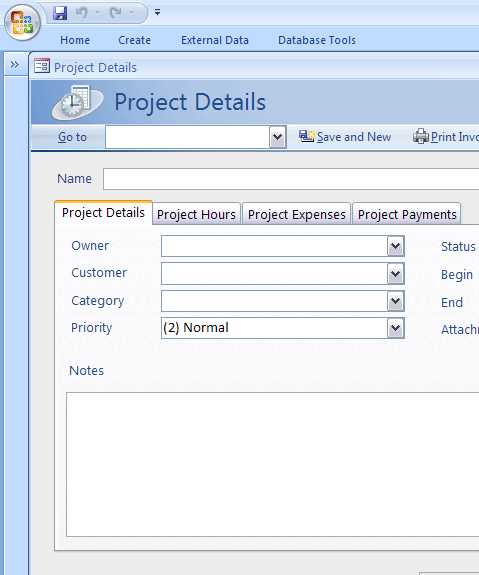

Setting Up Billing Information in Access

Configuring billing details within a document generation system is a crucial step in ensuring smooth and accurate financial management. By properly setting up fields to store client and transaction data, you can automate many aspects of your record-keeping process. This setup allows for quick entry of necessary details and ensures that your records are always up to date and consistent.

When setting up these details, it’s important to include key information such as client names, addresses, contact details, and payment terms. In addition, organizing your system to track product or service descriptions, quantities, and prices will provide a clear and concise overview of each transaction. Having all of this information readily available can help you reduce errors and avoid the need for time-consuming manual data entry.

Essential Fields for Billing Setup

To ensure you’re capturing the right information, here are a few fields that should be configured during the setup process:

- Client Information: Name, address, contact number, email, and other relevant details.

- Transaction Details: Date, item description, quantity, unit price, and total cost.

- Payment Terms: Due date, payment methods accepted, and any discounts or late fees.

- Tax Information: Tax rates, exemptions, or calculations for different regions or jurisdictions.

Once these fields are established, you’ll be able to quickly create accurate and professional financial records with minimal manual input. The system can also be programmed to automatically calculate totals and taxes, further streamlining the process.

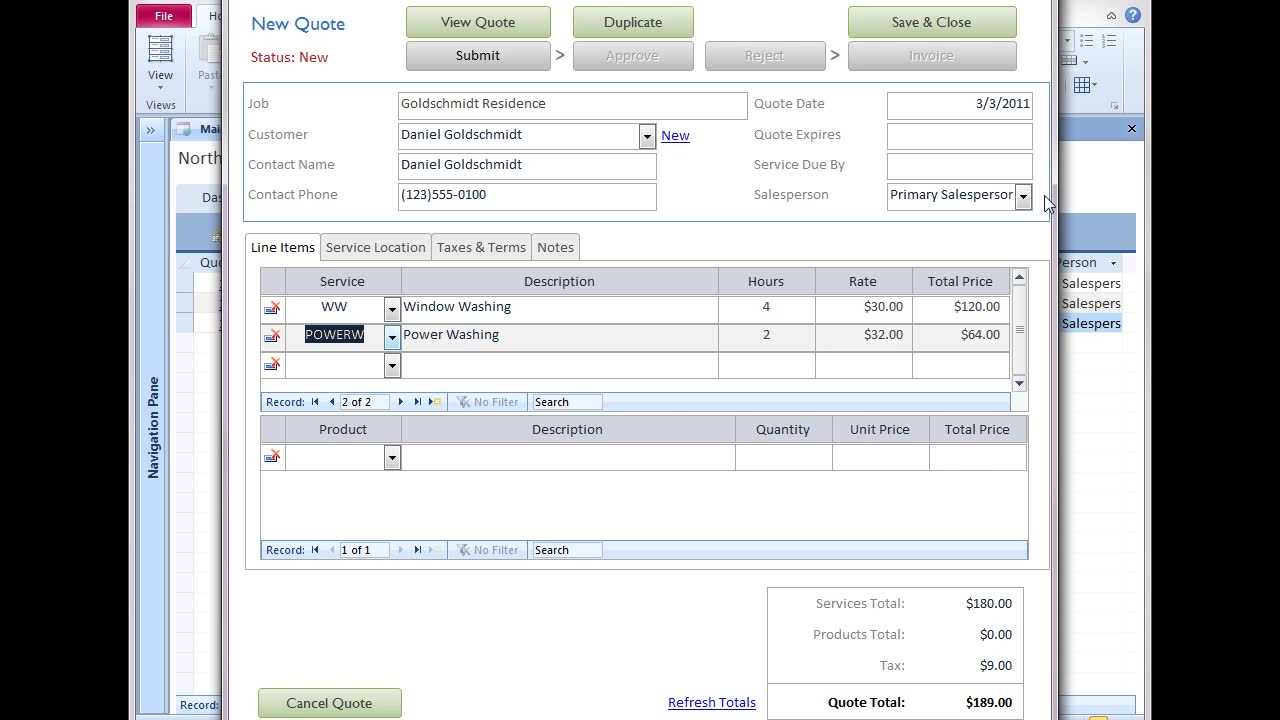

How to Automate Invoice Creation in Access

Automating the creation of financial documents is a game-changer for businesses looking to save time and reduce errors. By setting up a system that can automatically generate records based on entered data, you can eliminate repetitive tasks and ensure consistency across all your transactions. The automation process involves using pre-configured fields and calculations to produce accurate and professional records at the click of a button.

The first step in automating the creation of your documents is to set up a database or tool that can store all relevant client and transaction data. Once this is done, you can link this data to specific fields in your document layout. This enables you to input new information once, and have it automatically populate across all necessary areas in the document.

Steps to Automate Document Creation

Follow these steps to set up automated document creation:

- Input Client and Product Information: Start by entering client names, addresses, and other contact details into your system. Additionally, input your product or service descriptions, quantities, and pricing information.

- Set Up Automated Calculations: Configure the system to calculate totals, taxes, and discounts automatically based on the entered data. This will help eliminate manual errors and ensure your numbers are always accurate.

- Create and Link Templates: Design a document layout that includes all necessary fields, such as client details, pricing, and payment terms. Link these fields to your data source so that the system can automatically fill in the information when generating a document.

- Generate Documents with One Click: Once everything is set up, you can create a new record or document by simply clicking a button, and the system will fill in all the relevant details, ready for review or printing.

With automation in place, you can significantly speed up the process of generating billing statements while ensuring all documents are consistent, professional, and error-free.

Managing Multiple Clients with Access Templates

Efficiently handling records for multiple clients is crucial for businesses that deal with numerous transactions on a regular basis. By using structured resources that can store and organize client details, you can streamline the entire process, making it easier to track and manage each client’s information. These tools provide a centralized location for all client data, allowing you to generate accurate documents quickly, even when managing a large client base.

With the right system in place, you can easily input client information once and use it across various documents without having to re-enter the details each time. This not only saves time but also reduces the risk of errors, ensuring that every document remains consistent and accurate. Furthermore, the ability to filter and search client records makes it easy to find specific details whenever needed, improving overall workflow and efficiency.

Organizing Client Data Effectively

To manage multiple clients effectively, consider structuring your system with the following key elements:

- Client Profiles: Create individual records for each client, storing their contact information, transaction history, and payment terms in one place.

- Transaction Tracking: Track each sale or service provided, including dates, product details, quantities, and prices. This helps maintain an organized history of every client’s interactions with your business.

- Easy Retrieval: Set up a search and filter system that allows you to quickly find specific clients or transactions. This can be especially useful for large client lists or when you need to generate multiple documents at once.

By structuring your client data in this way, you can easily manage and generate accurate documents for each customer, ensuring smooth operations and a professional experience for both you and your clients.

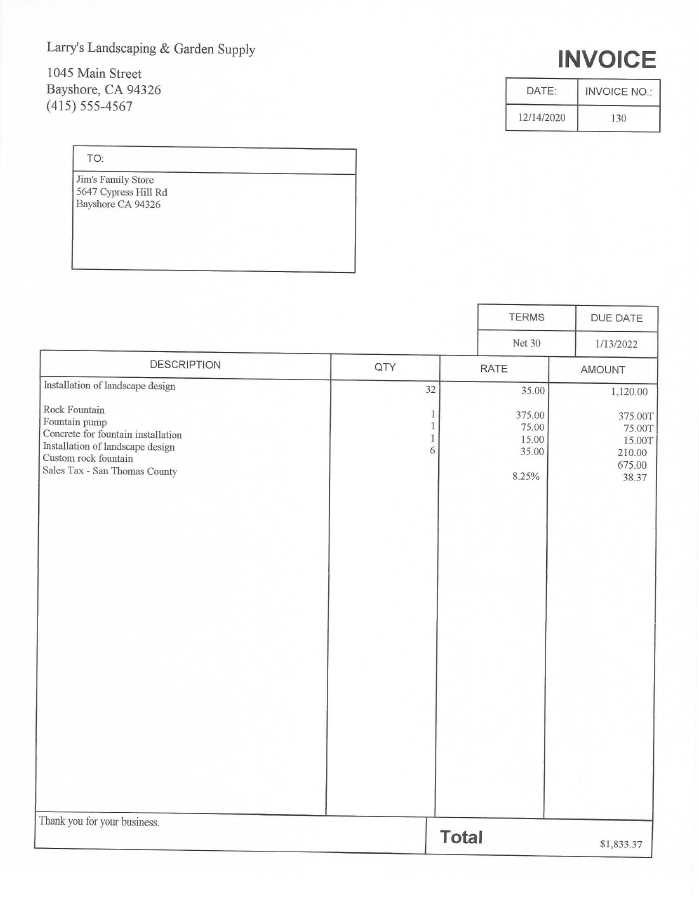

Steps to Add Tax Calculations to Invoices

Adding tax calculations to financial documents is an essential step in ensuring accuracy and compliance with local regulations. Properly integrating tax rates into your billing system allows for automatic calculations, saving time and reducing errors when generating records. By setting up the right formulas and fields, you can easily apply taxes to individual items and compute totals without the need for manual adjustments.

The process of adding tax calculations typically involves defining the applicable tax rates and associating them with the items or services being billed. Once the rates are set, the system can automatically apply them to each transaction, providing accurate totals and reducing the risk of mistakes. Additionally, having tax calculations integrated within your system ensures that all financial documents are consistent and in line with current tax laws.

Steps to Set Up Tax Calculations

- Define the Tax Rates: Begin by specifying the tax rate(s) applicable to your business. This could include local, state, or national tax rates, depending on where your business operates. For businesses dealing with multiple regions, ensure that you can manage varying rates based on location.

- Associate Tax Rates with Items or Services: Next, link the tax rates to the relevant products or services. This can usually be done by setting up categories or tax classes, allowing the system to apply the correct rate to each item automatically.

- Implement Calculations: Create formulas within the system that automatically calculate the tax for each item or service based on the predefined rate. Ensure that totals are updated in real time as new items are added or removed.

- Verify and Test: Before generating documents, test the system to ensure that the tax calculations are accurate. Run a few test transactions to verify that tax is being calculated properly and reflected in the final total.

By following these steps, you can ensure that tax calculations are seamlessly integrated into your document creation process, reducing manual work and ensuring accurate financial records every time.

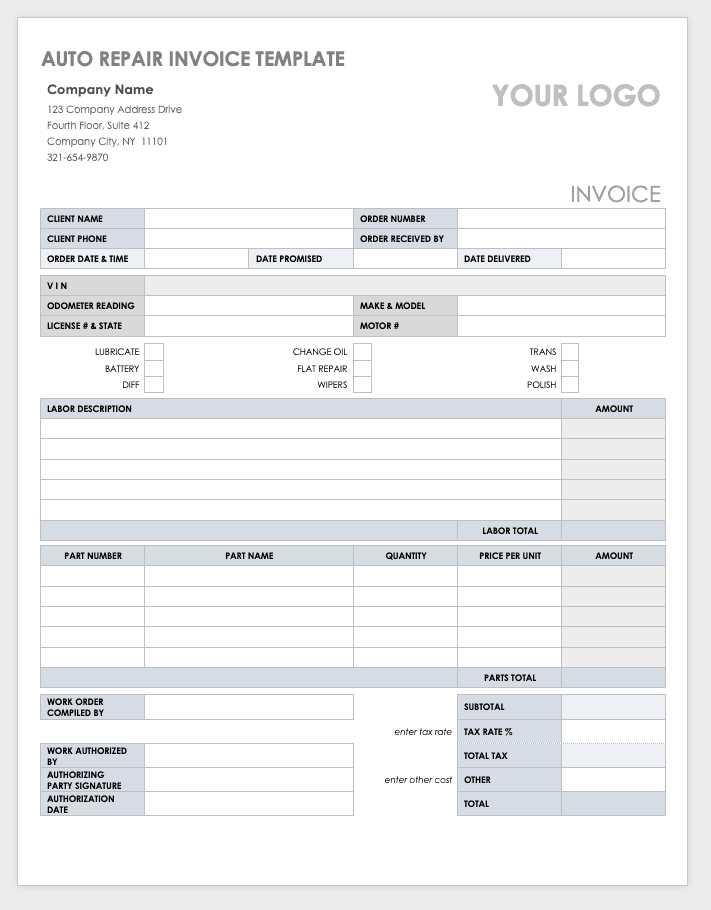

Designing Professional Invoices in Access

Creating well-designed billing documents is essential for maintaining a professional image and ensuring that your clients receive clear and accurate information. A well-structured document not only makes it easier to communicate details but also helps establish trust and credibility. By leveraging design elements and customization options, you can create documents that reflect your brand and meet your business needs.

When designing your billing statements, it’s important to consider the layout, typography, and overall appearance. A clean, organized document that highlights key details like client information, product descriptions, totals, and payment terms is essential. Additionally, incorporating your logo and company colors can reinforce your brand identity, making the document look polished and professional.

Key Design Elements for Professional Billing Documents

- Company Branding: Include your business logo, brand colors, and fonts to ensure that the document aligns with your company’s identity.

- Clear Structure: Organize the document into clearly defined sections–such as client details, product/service list, taxes, and totals–to improve readability and ensure that all necessary information is easy to find.

- Legible Fonts: Use simple, easy-to-read fonts for both headings and content. Avoid using too many different font styles or sizes, as this can make the document look cluttered.

- Aligned Tables: Ensure that itemized lists, quantities, and prices are aligned neatly in tables, which helps with clarity and organization. Each entry should be easy to locate and understand.

- Space for Notes: Include a section for additional notes or payment instructions at the bottom of the document. This is particularly useful for offering clients discounts, providing payment methods, or sharing terms and conditions.

Steps to Design Your Document

- Choose a Clean Layout: Start by selecting a simple, clean design that allows key information to stand out. Avoid cluttered elements and unnecessary graphics that can distract from the main details.

- Incorporate Essential Sections: Add sections such as client details, a breakdown of items or services provided, payment due dates, and a space for additional notes. These areas should be clearly labeled and easy to locate.

- Customize the Design: Personalize the document by incorporating your business logo, choosing the appropriate color scheme, and adjusting fonts to match your brand’s style.

- Test for Readability: Before finalizing, ensure that the document is easy to read and visually appealing. Check that all sections are aligned properly and that no crucial information is left out.

By focusing on these design elements and steps, you can create a polished, professional-looking billing document that not only conveys the necessary information but also strengthens your brand image and enhan

Exporting and Printing Access Invoices

Once you’ve created and customized your financial documents, the next step is to export and print them for distribution. The ability to export your records to different formats and print them efficiently is crucial for business operations, as it allows you to share and deliver billing statements to clients in a professional manner. Whether you need to send the document electronically or provide a physical copy, having these options available is essential for streamlining your invoicing process.

Exporting your document to common formats such as PDF, Excel, or Word makes it easy to share via email, upload to cloud storage, or save for record-keeping. Printing the document allows you to maintain a hard copy that can be sent by mail or kept for internal purposes. In both cases, the goal is to ensure that the exported or printed version of your document is clear, accurate, and formatted properly for a professional presentation.

Exporting Your Document

To export your financial record, follow these simple steps:

- Choose the Export Format: Select the format that best suits your needs, such as PDF for easy sharing, Excel for detailed data analysis, or Word for editable documents.

- Adjust Settings: Before exporting, ensure that all relevant sections are included, such as item descriptions, totals, and client details. You may also need to adjust formatting to make sure the exported document looks as intended.

- Save or Share: Once exported, save the document to your desired location or share it directly via email, cloud storage, or other methods.

Printing Your Document

If you need a hard copy, follow these steps to print your billing record:

- Preview the Document: Always preview the document before printing to ensure that it’s formatted correctly and that all the necessary information is visible on the page.

- Select Printer Settings: Choose the appropriate printer and adjust settings such as paper size and orientation. Make sure the document fits within the printable area and that margins are set correctly.

- Print and Distribute: Once satisfied with the preview and settings, print the document. You can then mail it to your client or store it in your records.

By understanding the export and print process, you can easily provide your clients with professional and accurate billing statements, whether electronically or in physical form.

Integrating Microsoft Access with Other Tools

Integrating your document management system with other tools can greatly enhance the efficiency and capabilities of your workflow. By connecting your primary system with external applications, you can automate tasks, streamline processes, and increase overall productivity. Whether you want to synchronize data with accounting software, connect to cloud storage, or automate email distribution, integration can help eliminate repetitive tasks and ensure seamless data flow across platforms.

With the right integrations, you can easily transfer information between different tools, ensuring that all your records are accurate and up to date without manual data entry. These integrations can save time, reduce human error, and provide additional functionalities that might not be available in your main system alone. This is especially valuable for businesses that handle large amounts of data or interact with clients frequently.

Popular Integrations for Business Tools

Here are some common integrations that can benefit your business by linking your primary system with other essential tools:

| Integration | Benefits |

|---|---|

| Accounting Software | Automatically sync transaction data for accurate financial reporting and tax preparation. |

| Cloud Storage | Store and access documents from anywhere, allowing for secure backup and easy sharing with clients or team members. |

| Email Platforms | Send documents directly to clients from within your system, saving time on manual emailing and improving client communication. |

| Payment Gateways | Automatically track payments and update transaction statuses, reducing administrative effort and improving cash flow management. |

By integrating your system with the tools listed above, you can enhance your operational efficiency and ensure that all your documents, transactions, and client interactions are managed in one streamlined process.

How Access Templates Save Time and Money

Using pre-built systems for generating financial documents can significantly reduce both the time spent on administrative tasks and the costs associated with manual processing. These systems are designed to automate many of the repetitive tasks involved in creating detailed records, ensuring consistency and accuracy with minimal effort. By streamlining workflows and eliminating errors, businesses can focus more on core activities while reducing the risk of costly mistakes.

One of the biggest advantages of utilizing such systems is the ability to quickly generate multiple records without needing to input the same information repeatedly. With the right structure in place, data is automatically populated into predefined fields, saving time and ensuring that all details are accurate. Additionally, these systems can perform automatic calculations, reducing the likelihood of human error, which can be both time-consuming and expensive to correct.

Moreover, automation allows for quicker updates, faster document generation, and easier integration with other business tools, such as accounting software or email platforms. This means that businesses can handle more clients or transactions with less effort, ultimately saving both time and money in the long run.

Common Mistakes to Avoid with Access Templates

While using pre-designed systems for generating financial records can greatly improve efficiency, there are some common errors that can hinder the process if not properly addressed. These mistakes can lead to incorrect data, poor document formatting, and other issues that ultimately waste time and resources. It’s essential to be aware of these pitfalls and take proactive steps to avoid them in order to maintain smooth and accurate workflows.

One of the most frequent errors involves not regularly updating the system to reflect the latest changes in business practices, tax rates, or client information. Another mistake is failing to properly test the system before using it to generate documents, which can lead to missing or incorrectly displayed data. Below are some of the common mistakes and how to avoid them.

Common Mistakes and How to Avoid Them

| Mistake | How to Avoid |

|---|---|

| Not Updating the Data Regularly | Ensure that client information, pricing details, and tax rates are updated regularly to avoid errors and outdated data. |

| Incorrect Data Entry | Double-check input fields and use automation to reduce the chances of manual errors. |

| Overcomplicating the Layout | Keep the design simple and intuitive. Avoid unnecessary details or excessive styling that can make the document confusing. |

| Skipping Testing Before Use | Always perform a test run to check for alignment, formatting, and accurate data population before sending out any documents. |

| Failure to Backup Data | Regularly back up your documents and system settings to avoid data loss in case of technical issues. |

By being mindful of these common mistakes and taking preventative measures, you can ensure that your document creation process remains efficient, accurate, and professional. With proper setup and maintenance, you can fully leverage the benefits of pre-designed systems while avoiding costly errors.

Comparing Access with Other Invoice Software

When it comes to creating and managing billing documents, there are many tools available, each offering its own set of features and benefits. Some businesses prefer using a more specialized software designed solely for billing, while others opt for a more versatile system that integrates with other business functions. The choice between these tools largely depends on factors such as ease of use, customization, automation, and the level of control you need over your document management process.

While some dedicated billing software is tailored specifically for handling payments and tracking invoices, using a system that is more customizable and adaptable for various business functions can offer greater flexibility and control. Below, we’ll compare a versatile database management tool with specialized billing software to highlight the pros and cons of each approach.

Key Differences: Customizability vs. Specialization

One of the main advantages of using a flexible system for creating financial records is the ability to fully customize the process. This gives businesses the freedom to adjust templates, automate workflows, and integrate with other tools like accounting software or CRM systems. On the other hand, specialized billing platforms are designed specifically to manage financial transactions and typically come with built-in features like payment gateways, tax calculations, and reporting tools, making them easier to use for businesses that primarily need a solution for generating and tracking invoices.

Pros and Cons of Both Approaches

- Customizable Systems:

- Pros: Greater flexibility, ability to integrate with other business tools, control over design and functionality.

- Cons: May require more time to set up and configure, may not have built-in features specific to billing or payments.

- Dedicated Billing Software:

- Pros: Easy to use, pre-built templates, automated features for payment tracking and reporting.

- Cons: Limited customization, may not integrate well with other business systems, less flexibility for unique business needs.

Ultimately, the decision comes down to the unique needs of your business. If you’re looking for an all-in-one solution that can handle a wide range of tasks beyond billing, a more customizable system might be a better fit. However, if your primary concern is simply creating and managing billing documents quickly and easily, a dedicated billing platform might be the right choice for you.