Free Invoice Template in Excel for Easy and Professional Billing

Managing finances and keeping track of payments can be a complex and time-consuming task, especially for small businesses or freelancers. Using well-structured documents to track transactions can significantly improve the billing process, reduce errors, and ensure timely payments. With the right tools, anyone can create clear and professional records that streamline these essential tasks.

One of the most convenient ways to create these records is by using a customizable document that allows for easy input of relevant details. This method helps business owners and service providers save time, while also presenting a polished appearance to clients. With the right structure, such documents can automatically calculate totals, taxes, and apply formatting for a more professional presentation.

Whether you are just starting your business or looking to optimize your current processes, having access to a reliable and easy-to-use format can make a significant difference in how you manage your financial transactions. By adopting a simple yet effective solution, you can focus more on growing your business rather than spending hours on paperwork.

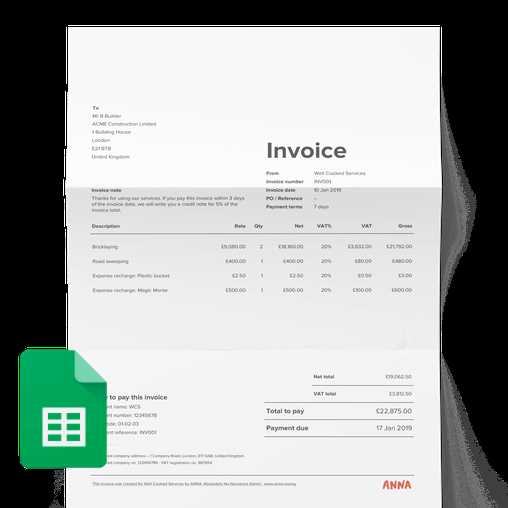

Free Invoice Template in Excel

For anyone who needs a simple and reliable solution to manage financial records, having access to a ready-to-use document can save both time and effort. These customizable tools allow you to quickly generate professional records without the need for complex software or specialized knowledge. With the right structure, you can ensure that all necessary details are included, from itemized services to applicable taxes and total amounts.

Using a structured document offers several advantages, such as the ability to easily track outstanding payments and keep everything organized. By leveraging built-in features, you can automate calculations, adjust formatting, and make updates with minimal effort. This makes it an ideal solution for freelancers, small businesses, or anyone who needs to generate accurate billing statements without spending too much time on paperwork.

What makes this solution even more accessible is the ability to download and customize it according to specific needs. Whether you’re working with clients on a project basis or invoicing for regular services, this flexible tool ensures you always have a professional-looking document ready to go, enhancing both your workflow and client trust.

How to Use Excel for Invoices

Creating detailed records for financial transactions can be an essential part of maintaining a smooth business operation. With the right tools, you can easily track amounts due, manage payment deadlines, and ensure accuracy in your documents. One such tool is a spreadsheet program that offers powerful customization and automation features, allowing you to generate professional statements in just a few simple steps.

To get started, follow these basic steps to use a spreadsheet for generating your financial records:

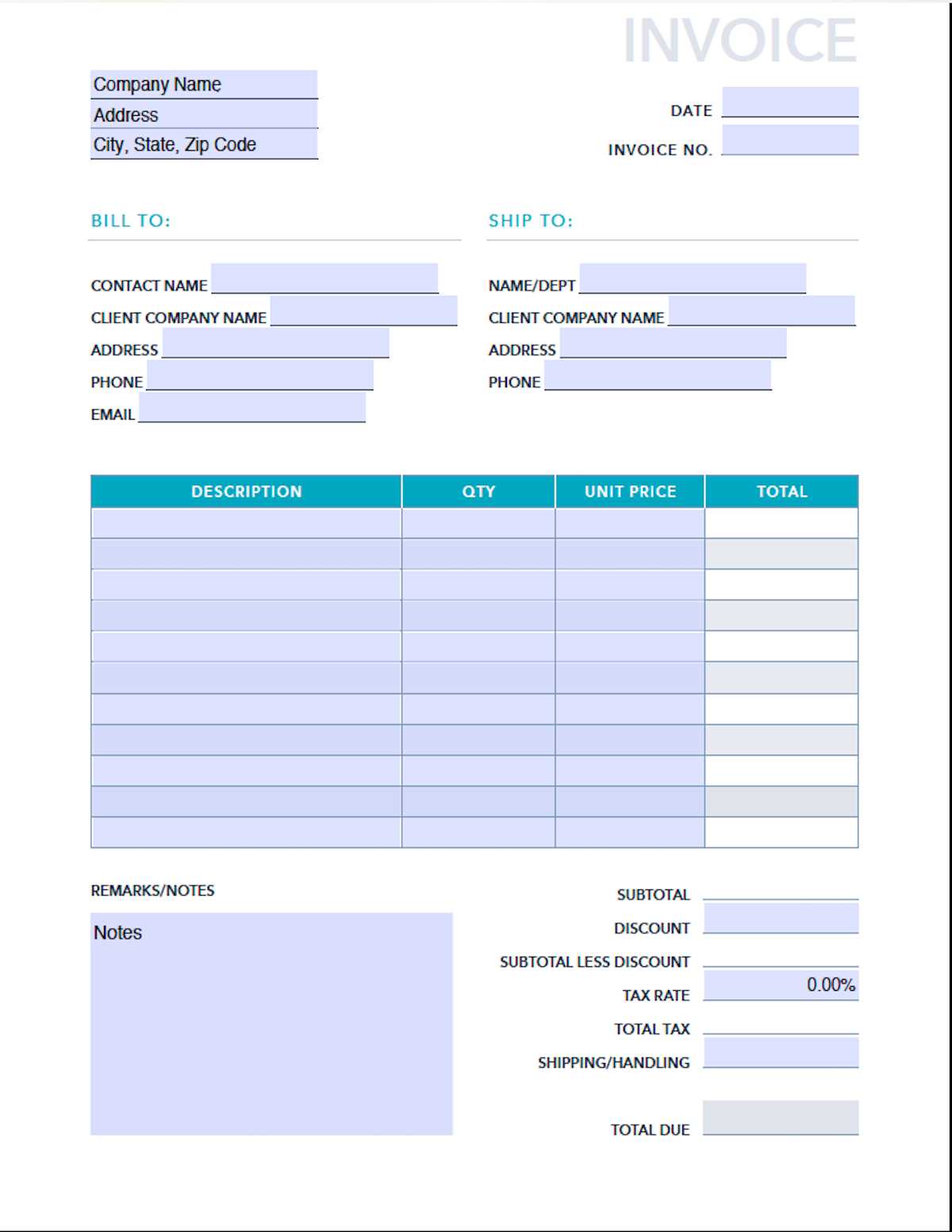

- Set Up the Structure – Begin by creating a layout that includes all the necessary fields, such as the client’s name, date, services or products provided, rates, taxes, and total amount due.

- Customize the Format – Adjust the appearance by adding company branding, modifying fonts, or using colors to make the document more professional.

- Automate Calculations – Use built-in formulas to automatically calculate totals, taxes, and discounts, ensuring accuracy with minimal manual effort.

- Save and Reuse – Once you have created your document, save it as a master copy to use for future transactions. You can easily duplicate and edit it for each new client or project.

By leveraging the features available in a spreadsheet program, you can simplify your billi

Benefits of Excel Invoice Templates

Using a pre-designed document for financial records offers numerous advantages, particularly when it comes to managing payments and staying organized. These ready-to-use solutions streamline the entire process, from creating professional documents to ensuring accuracy in calculations. Whether you’re handling a single project or managing multiple clients, having a standardized approach can make your work significantly easier and more efficient.

Here are some of the key benefits of using a well-structured document for billing:

- Time Savings – Ready-made structures allow you to quickly input information without having to manually design a new document every time.

- Reduced Errors – Automatic calculations for totals, taxes, and discounts help minimize human mistakes and ensure precise financial records.

- Customization Options – You can easily adapt the design and fields to fit your specific business needs, from adding branding to adjusting the layout.

- Professional Appearance – With consistent formatting, your documents will look polished and reliable, helping to build trust with clients.

- Cost-Effective – There is no need for expensive software or complex tools; all the essential features are included in a basic spreadsheet program.

Overall, using this type of document ensures a smoother, more organized billing process, freeing up time to focus on other important aspects of running your business. The simplicity and flexibility of such sol

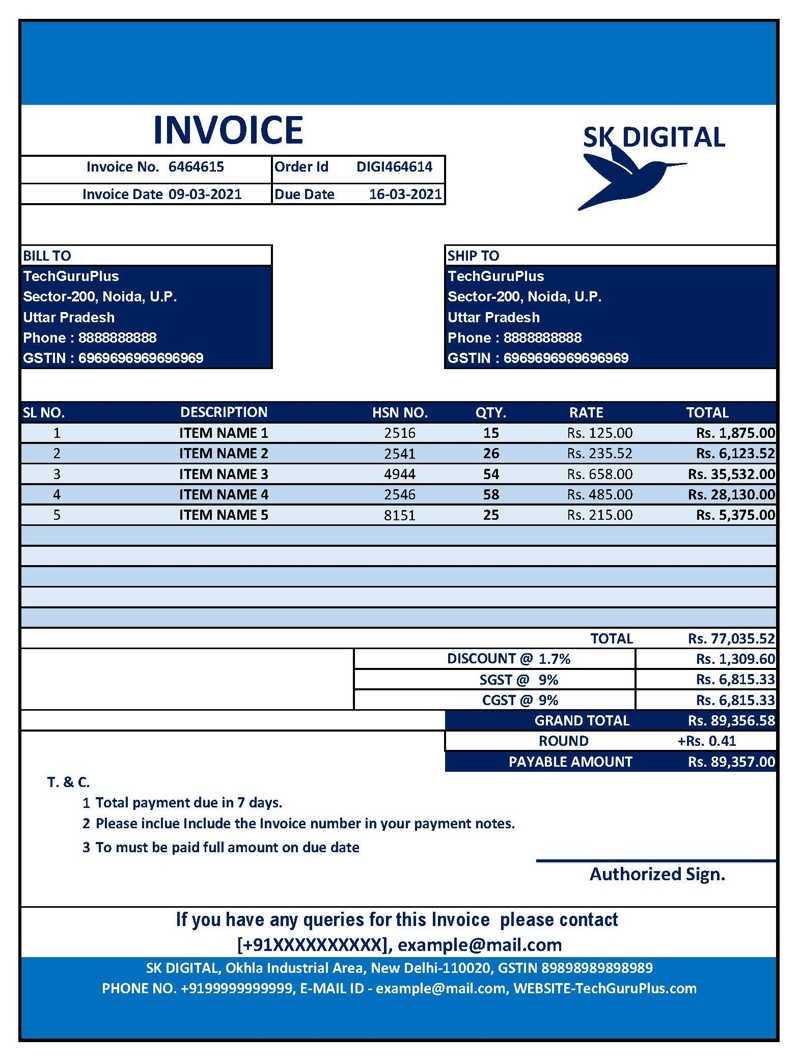

Top Features of an Excel Invoice

A well-structured document for billing and payment tracking is crucial for smooth financial management. The right tool should not only help you organize your transactions but also streamline processes, reduce errors, and present a professional appearance. When using a spreadsheet to generate your billing documents, there are several key features that can enhance your experience and ensure accuracy.

Here are the most important features to look for in a well-designed financial document:

- Pre-built Calculation Formulas – Automatic calculations for totals, taxes, and discounts ensure that numbers are accurate and up to date, minimizing manual entry.

- Customizable Fields – Fields for client information, services or products, dates, and amounts can be adjusted to suit specific needs, giving you full flexibility.

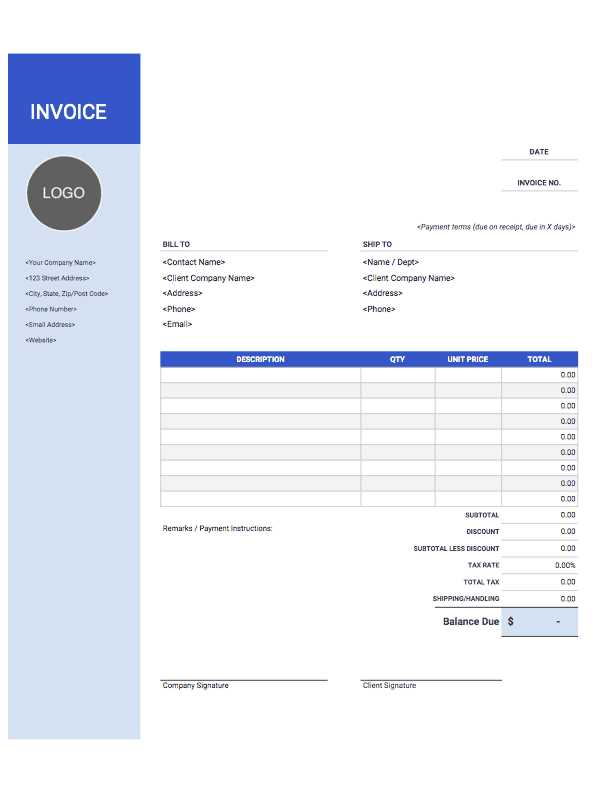

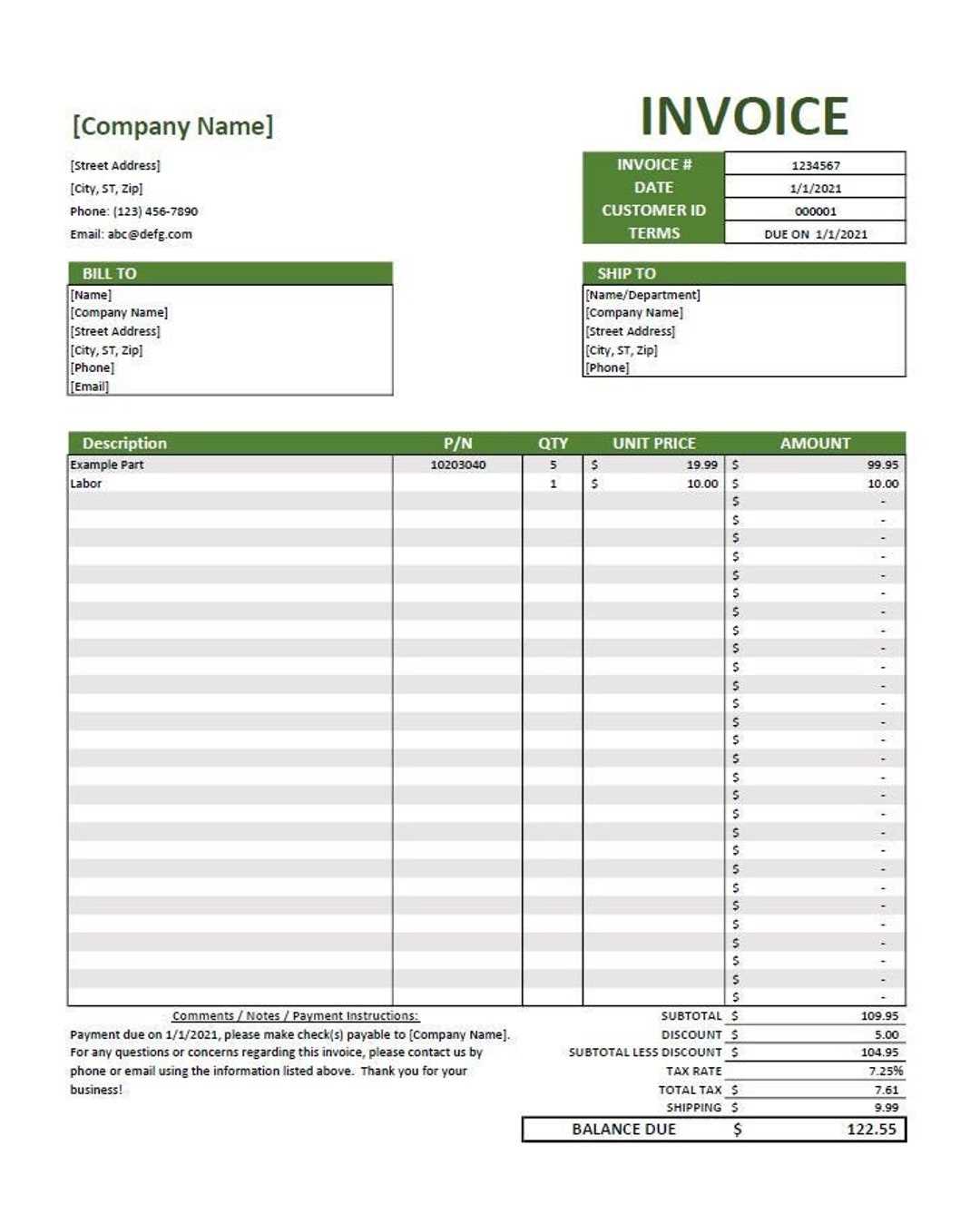

- Professional Layout – Clean, well-organized design helps present a polished look to clients, boosting credibility and trust.

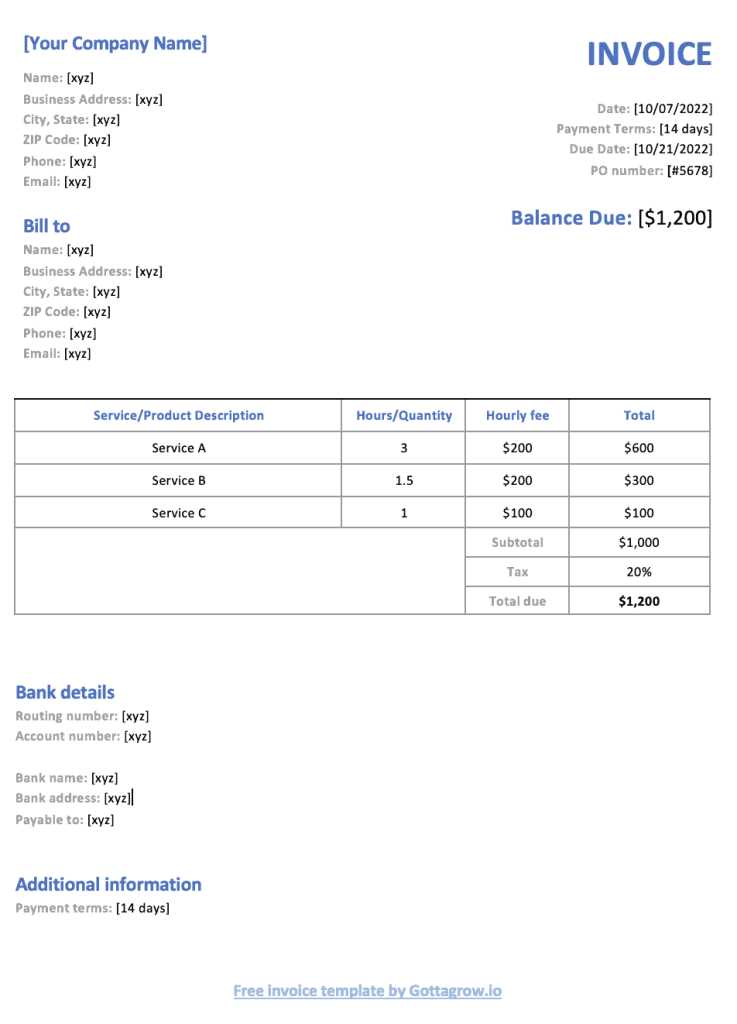

- Itemized Breakdown – Ability to list services, products, or hours worked in detail, making it clear and transparent for the client.

- Branding Options – Space for logos, company name, and contact details, allowing you to personalize the document and make it reflect your brand identity.

- Tracking Features – Some designs include spaces for tracking payments, due dates, and outstanding balances, helping you stay on top of finances.

These features help make the billing process more efficient, accurate, and professional, ensuring you can easily manage multiple clients and transactions without complications. With these tools in place, your financial

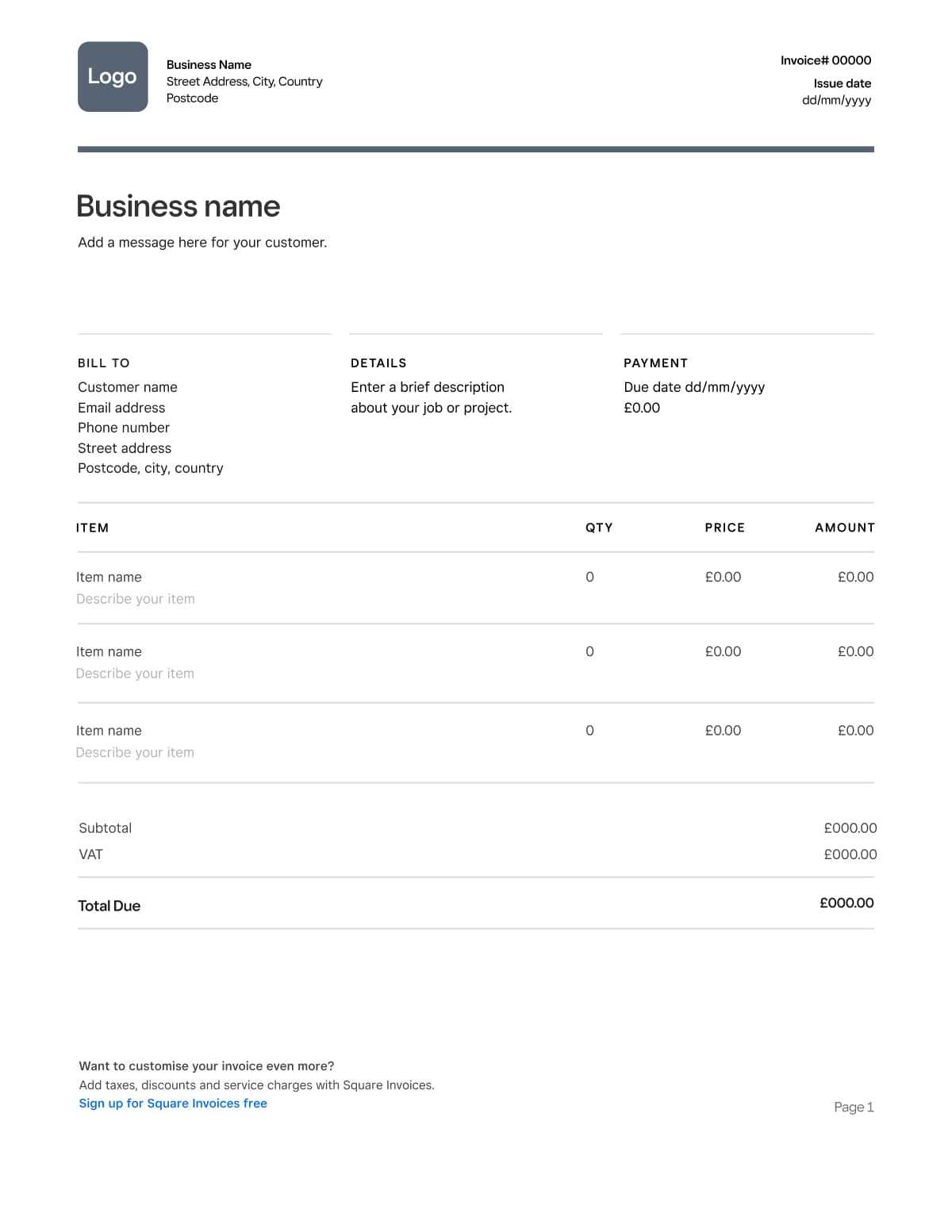

Customizing Your Invoice in Excel

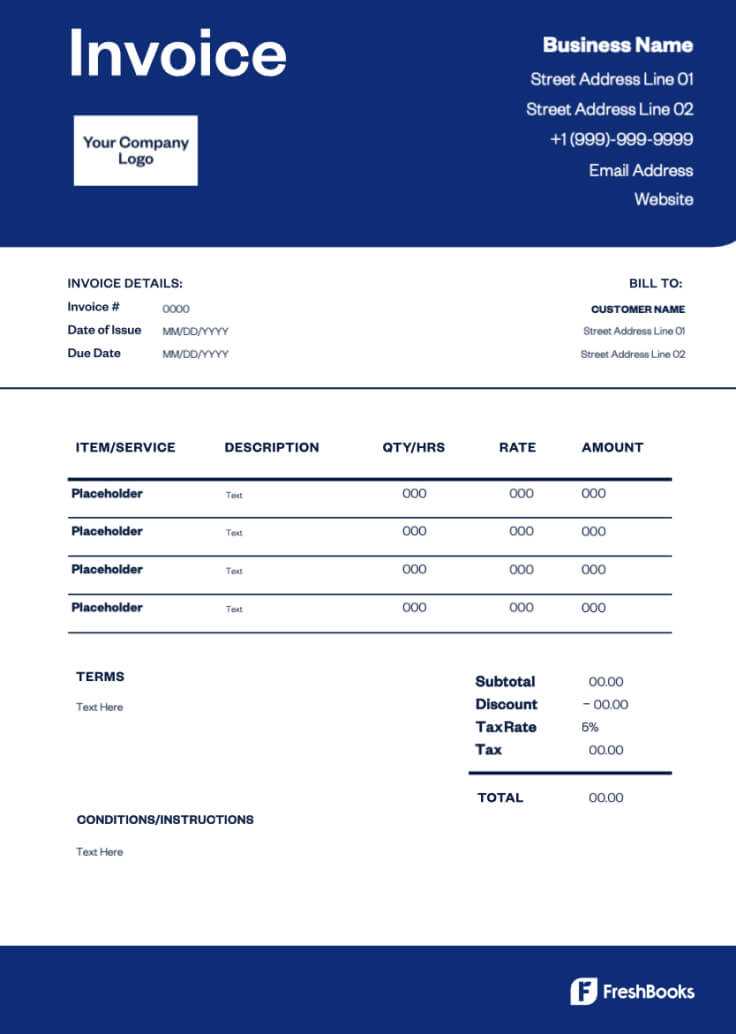

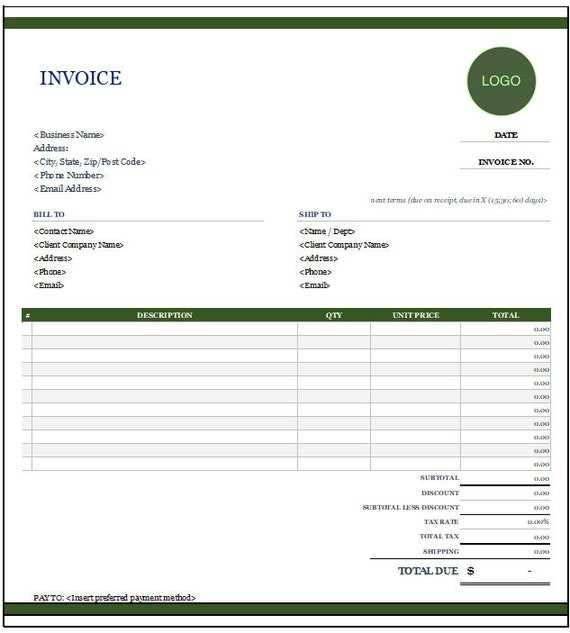

When creating a financial document, it’s important to make sure it aligns with your business branding and specific needs. Adjusting the layout, color scheme, and sections can help you create a more professional and personalized document. By doing so, you ensure that all necessary details are clearly presented while maintaining an organized structure. This allows for easier readability and better management of the payment process.

Personalizing the Design

One of the first things to customize is the overall design. You can change fonts, adjust column widths, or apply borders and shading to emphasize key areas. For instance, using your company’s brand colors for headings or section dividers can make the document more visually appealing and recognizable. Don’t forget to format the document so it is neat and well-organized, ensuring all important fields are easy to locate.

Adding Custom Fields

Custom fields allow you to include additional details that are relevant to your business, such as payment terms, tax rates, or specific project references. This customization can help ensure that the document meets all necessary criteria for your accounting processes. You can easily add or remove rows, columns, or sections based on your unique requirements. Incorporating these fields provides clarity and streamlines communication with clients.

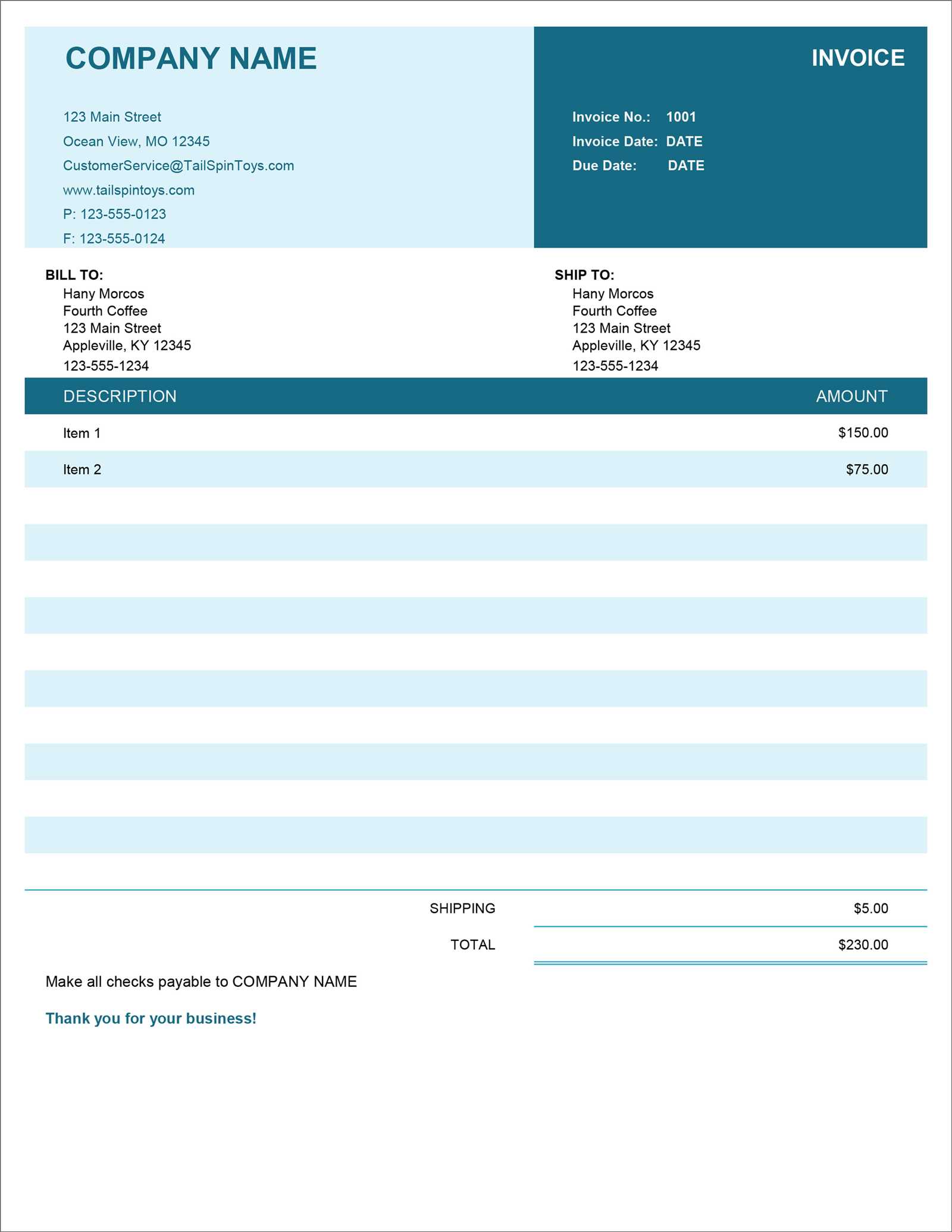

How to Create a Professional Invoice

Creating a polished financial document requires attention to detail and a clear structure. A well-designed bill not only conveys professionalism but also helps ensure that the transaction process is smooth and efficient. Key components such as accurate contact information, a breakdown of services or products, and clear payment terms are essential for both you and your clients to stay on the same page.

The first step is to include all necessary business information, such as your company’s name, address, and contact details. It’s important to also include the recipient’s details to avoid confusion. Organize the document in a way that highlights the most important sections, like the list of charges, payment instructions, and due date. Using a clean and simple layout with consistent fonts and headings can enhance readability. Lastly, always ensure that the totals are clearly visible and that all necessary calculations are correct to avoid disputes.

Saving Time with Invoice Templates

Streamlining the process of creating financial documents can significantly reduce the time spent on administrative tasks. By utilizing pre-designed layouts, you can quickly input necessary details without starting from scratch each time. This not only speeds up the process but also ensures consistency and accuracy in all your transactions. With a structured format in place, you can focus on the core aspects of your business rather than reformatting each document individually.

| Benefit | Description |

|---|---|

| Consistency | Using a predefined layout ensures that all documents follow the same structure, making them easily recognizable and professional. |

| Efficiency | By eliminating the need to design a new document each time, you save valuable time that can be better spent on other tasks. |

| Accuracy | With a set structure, calculations and key details are less likely to be missed, reducing the chances of errors. |

Tracking Payments with Excel Invoices

Keeping track of payments is crucial for maintaining healthy cash flow and ensuring that no transaction is overlooked. By using an organized system, you can easily monitor outstanding balances, due dates, and payment statuses. This helps you stay on top of your finances and follow up with clients efficiently when necessary. A well-structured document can also generate reports to quickly summarize paid and unpaid amounts, making financial management much more streamlined.

Creating Payment Status Columns

Adding a “Payment Status” column to your document allows you to mark whether a transaction is pending, partially paid, or fully settled. This simple addition can make it easy to spot outstanding amounts and prevent any delays in the payment process. You can color-code these statuses to visually differentiate between completed and pending payments for quicker access to critical information.

Using Formulas for Automatic Calculations

By using built-in formulas, you can automate calculations for totals, taxes, and payment amounts. This eliminates the need for manual tracking, reducing errors and ensuring that your records are up-to-date. Setting up formulas to calculate balances after partial payments or automatically adjusting totals based on changes can save time and improve accuracy in financial tracking.

Why Excel is Ideal for Invoices

Creating detailed and professional financial documents requires flexibility, ease of use, and the ability to quickly update or modify information. A popular tool for generating such documents is a spreadsheet program, which allows users to manage data efficiently while offering powerful functions for calculations and customization. This versatility makes it an ideal choice for those who need to generate recurring or one-time records without the hassle of complex software.

Customizable Layouts

One of the main advantages of using a spreadsheet for financial records is the ability to tailor the layout to suit individual needs. You can easily adjust column sizes, change fonts, and apply styles to highlight important information. Whether you need a simple design or a more elaborate format, this tool provides the flexibility to create the perfect document every time.

Built-in Calculation Tools

Spreadsheets come with built-in formulas that can automatically calculate totals, taxes, and discounts, which eliminates the risk of manual errors. This functionality is particularly useful when managing large numbers of entries or dealing with changing figures. The program can automatically update calculations when values are altered, saving time and increasing accuracy. Automated number crunching ensures that your financial documents are always correct.

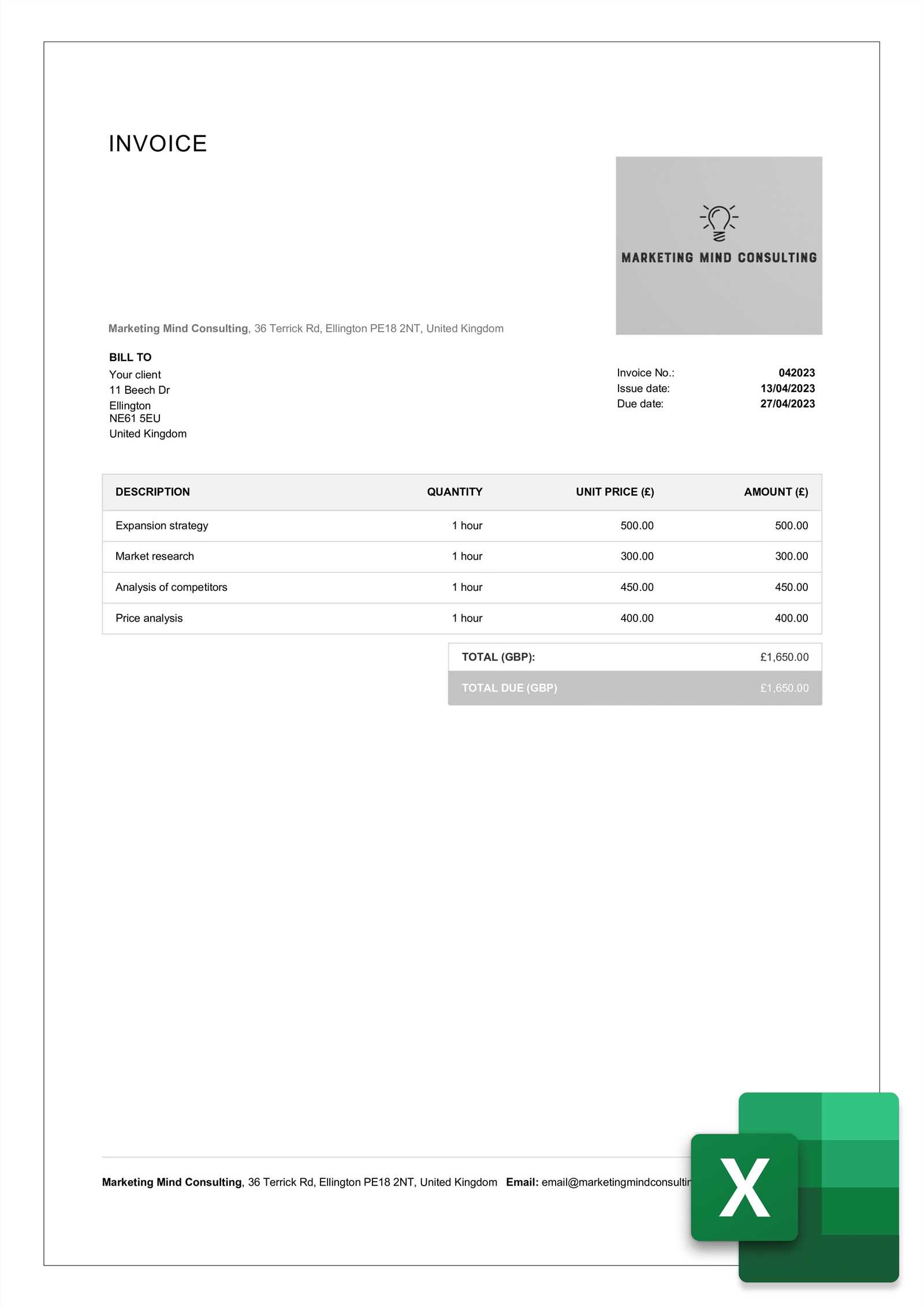

Easy Invoice Template for Small Businesses

For small businesses, managing financial records and ensuring timely payments can be a challenge. An intuitive, customizable document that simplifies the process of billing clients can save valuable time and reduce administrative effort. By using a straightforward design, business owners can easily track transactions, while maintaining a professional appearance for their clients. This allows them to focus on growing their business while keeping financial tasks under control.

Key Features for Small Business Billing

An efficient billing system should include several key elements: clear contact information, a detailed list of services or products, the total amount due, and a due date. A well-organized document ensures that all the necessary details are included without overwhelming the recipient. For small businesses, simplicity is often the best approach, as it ensures all information is accessible and easy to understand.

Using a Structured Layout

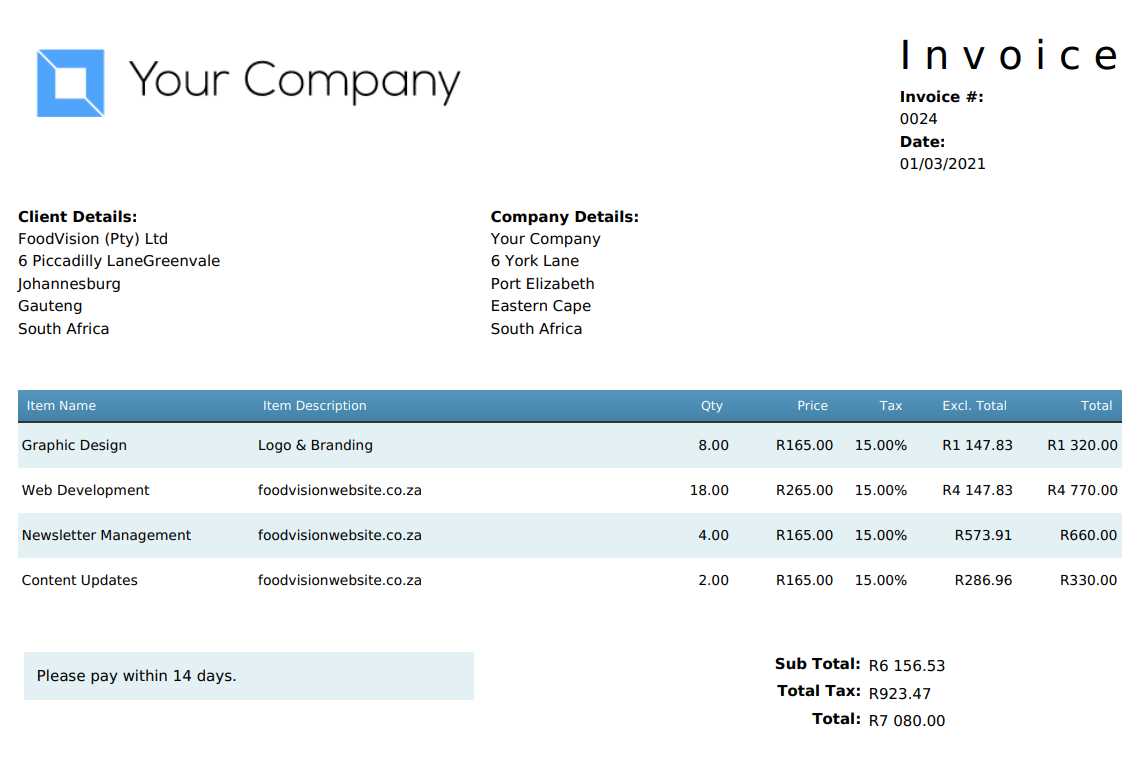

A well-structured layout makes it easier to input data and provides clarity for both the sender and the recipient. Consider using a table to break down charges and payments. Here is an example of how such a layout can be used:

| Description | Amount |

|---|---|

| Service 1 | $100.00 |

| Service 2 | $150.00 |

| Total | $250.00 |

This simple format makes

Step-by-Step Guide to Invoice Creation

Creating a well-organized financial document is essential for businesses to ensure smooth transactions and proper record-keeping. This guide will walk you through each step, from setting up your document to adding the necessary details, ensuring a professional result every time. By following these steps, you can create accurate and clear records that will streamline your billing process.

1. Set Up Your Document

Start by opening your preferred software or platform for creating the document. Set the layout with enough space to include all the necessary fields. You can organize the content into sections, such as business information, client details, and payment breakdowns.

2. Add Business and Client Information

- Your Information: Include your company name, address, phone number, and email.

- Client Details: Add the client’s name, address, and contact information to personalize the document.

3. List Products or Services

Next, provide a detailed list of the products or services rendered. For each item, include the description, quantity, unit price, and the total cost. This breakdown makes it clear to the client what they are paying for and prevents misunderstandings.

- Service/Product Description: Briefly describe the item or service.

- Quantity: Specify the number of items or hours worked.

- Unit Price: List the price per item or hour.

- Total Cost: Calculate the total by multiplying quantity by unit price.

Common Excel Invoice Mistakes to Avoid

When creating financial documents, it’s easy to overlook small details that can lead to errors or confusion. Avoiding common mistakes can ensure that your records are accurate, professional, and clear to your clients. This section highlights some of the most frequent errors that people make and how to avoid them to keep your billing process smooth and efficient.

1. Incorrect Calculations

- Missing Formulas: Forgetting to add formulas for automatic calculations can lead to manual errors, especially in totals and taxes.

- Manual Math Errors: If calculations aren’t done automatically, there’s a higher risk of mistakes in summing up charges or adding discounts.

- Incorrect Tax Rates: Double-check the tax rate applied to ensure it reflects the correct percentage for your location or industry.

2. Formatting Issues

- Unreadable Text: Small or unclear fonts can make your document difficult to read. Stick to standard, readable font styles and sizes.

- Poor Alignment: Misaligned columns and rows can make the document look unprofessional and harder to navigate.

- Overcrowding: Including too much information in one document can overwhelm your client. Keep it simple and organized.

3. Missing Important Details

- Client Information: Always double-check that you’ve included the client’s full name, address, and contact details.

- Due Date: Failing to specify a du

How to Add Taxes to Your Invoice

Adding taxes to financial documents is an essential part of the billing process, especially for businesses that are required to charge sales tax. It’s important to accurately calculate and display the tax amounts to ensure that clients understand the charges and comply with legal requirements. This section will guide you through the process of applying taxes to your documents, ensuring clarity and compliance.

1. Determine the Tax Rate

The first step in adding taxes is to know the correct tax rate for your location or industry. Tax rates vary depending on your country, state, or even the type of goods and services you provide. Once you know the tax rate, you can apply it to the applicable items in your document. For example, if your local tax rate is 10%, you will multiply the total cost by 0.10 to find the tax amount.

2. Add Tax to Each Line Item

If the tax applies to individual items or services, you should add a separate tax column to your document. For each item, calculate the tax by multiplying the price by the tax rate. Then, add the tax amount to the total for each line item. You can display this amount next to the item description to make it clear to the client how the tax is calculated.

- Formula: Item Price × Tax Rate = Tax Amount

- Example: $100 × 0.10 = $10 (Tax Amount)

3. Apply Total Tax to the Overall Amount

After calculating the tax for each item, sum up the indivi

Integrating Excel Templates with Accounting Tools

Efficient financial management requires seamless coordination between various systems. By integrating your custom financial documents with accounting software, you can streamline processes, reduce errors, and enhance productivity. This integration allows you to automatically transfer data from one platform to another, eliminating the need for manual entry and ensuring consistency across your records.

1. Choose the Right Accounting Software

The first step in integrating is selecting an accounting tool that supports importing and exporting data from your documents. Most accounting platforms, such as QuickBooks, Xero, or FreshBooks, allow easy integration with common spreadsheet formats. It’s important to choose a system that fits your business needs and provides the features required for accurate bookkeeping and reporting.

2. Export Data from Your Documents

Once your financial document is complete, the next step is to export the relevant data. Depending on the software you’re using, this can be done by saving your document in a format compatible with the accounting system, such as CSV or TSV. After exporting, you can upload or link the data directly to the accounting tool.

- CSV Format: A common format that supports easy data transfer between applications.

- QuickBooks Integration: Many accounting tools offer a direct link to save time and reduce errors when transferring data.

- Manual Data Entry: If direct integration isn’t possible, you can still enter data manually but streamline the process by using consistent formats.

3. Automate Updat

Free Invoice Templates vs Paid Options

When choosing between no-cost and premium options for creating financial documents, it’s important to consider the features, flexibility, and support offered by each. Both free and paid solutions come with their own set of advantages and potential drawbacks. By understanding the differences, businesses can make informed decisions based on their needs and budget.

1. Customization and Flexibility

Free solutions often provide basic structures that can be used right away but with limited customization options. These options may lack the ability to tailor design elements or add specialized fields required by your business. On the other hand, paid alternatives usually offer more flexibility, allowing you to personalize every aspect of your document, from layout to specific data fields.

- Free Option: Pre-built formats with basic customization (color, fonts, etc.).

- Paid Option: Full customization, including advanced fields, logos, and specific branding elements.

2. Features and Automation

Paid options typically include features that streamline your workflow, such as automated calculations, recurring billing setups, and integration with accounting software. These advanced functions can save time and reduce the chance of errors. In contrast, free options may require manual calculations or lack integration with other systems, increasing the workload.

- Free Option: Simple features that require manual updates.

- Paid Option: Automatic tax calculation, built-in payment tracking, and export functions.

3. Support and Updates

When using free solutions, you generally have little to no customer support, and updates are not always guaranteed. Paid se

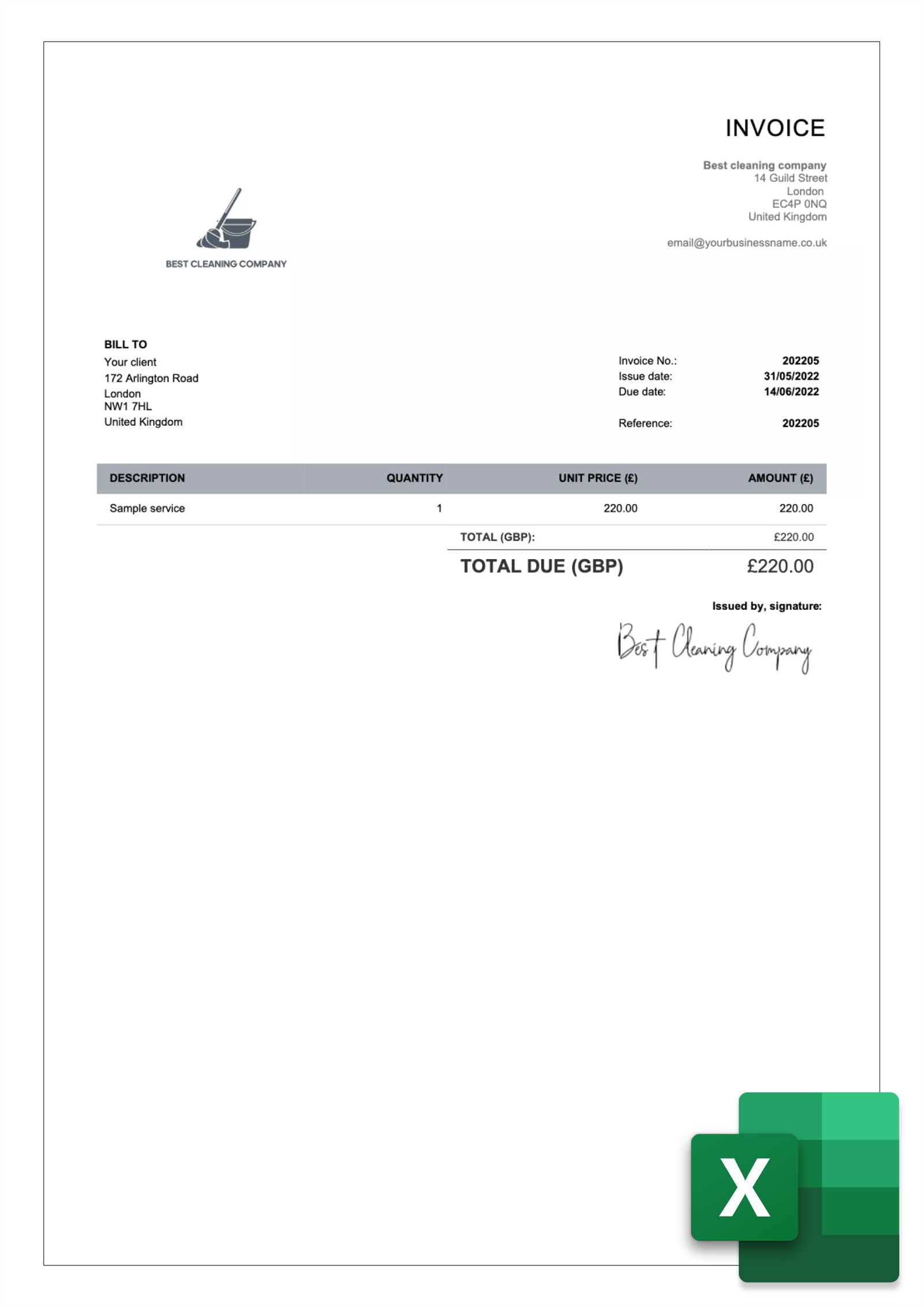

Where to Download Free Invoice Templates

Finding customizable and ready-to-use solutions for creating financial documents can be a real time-saver for small businesses and freelancers. Various online platforms offer downloadable options that allow users to quickly generate professional documents. These resources often provide a range of designs and formats suitable for different industries and needs.

1. Online Resources for Basic Templates

Many websites provide downloadable financial documents at no cost. These platforms typically offer a wide range of designs, from simple, minimalist styles to more complex layouts. Most options are compatible with spreadsheet software, allowing for easy editing and updates. Some popular resources for downloading financial document solutions include:

- Microsoft Office Templates: A wide selection of pre-designed documents that can be downloaded and customized for personal or professional use.

- Google Docs and Sheets: Offers free, cloud-based templates that can be accessed, edited, and saved directly in your Google account.

- Template.net: Provides a collection of downloadable documents in various formats, including spreadsheets and PDFs.

2. Specialized Platforms for Business Use

If you need templates tailored to specific business needs, there are specialized platforms offering targeted options. These services often include enhanced functionalities such as tax calculations or automatic data updates. While some may offer premium versions, there are still plenty of free options for those just starting out.

- Zoho: A platform offering customizable solutions for different business types, with the option to download and edit documents as needed.

- Invoicely: A cloud-based service providing free, downloadable options for busin