Invoice Receipt Email Template for Easy Payment Confirmation

When managing business transactions, it’s crucial to provide clear and professional communication with clients after a payment is made. A well-crafted message serves as both a confirmation of the transaction and a reflection of your company’s professionalism. This simple yet effective communication tool can help strengthen client trust and ensure all details are properly recorded for both parties.

Effective payment confirmation messages should include essential details such as the amount paid, the method of payment, and a thank you note to acknowledge the transaction. Additionally, the message should be easy to understand and free of unnecessary jargon. With the right approach, such messages can enhance your customer service and reduce confusion in financial matters.

In this guide, we will explore how to design an effective confirmation message, providing examples and tips to help you communicate with clients in a clear and professional manner. Whether you’re looking to automate your process or craft a custom response, you’ll find valuable insights to streamline your payment confirmation communications.

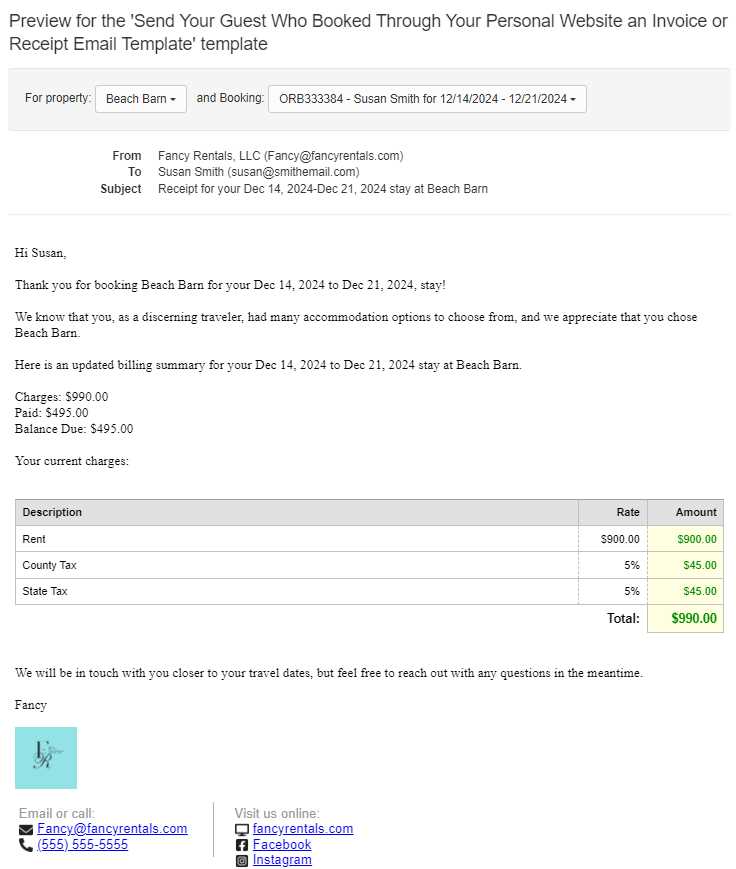

How to Create an Invoice Receipt Email

When confirming a payment, it’s essential to provide your client with a professional message that includes all the necessary details. This communication should clearly acknowledge the payment, offer transparency, and express gratitude for their business. Creating an effective confirmation message involves ensuring that key information is easily accessible while maintaining a courteous and professional tone.

To start, focus on the essential details: the amount paid, the date of payment, and any relevant reference numbers. It’s important to make sure that these elements are presented in a clear, concise manner so the client can quickly verify their transaction. Additionally, include a polite thank you message to show appreciation for their timely payment.

Keep the language straightforward and avoid cluttering the message with excessive information. Use short paragraphs and bullet points if necessary to enhance readability. Always ensure that your communication reflects your brand’s professionalism, whether you’re automating responses or manually crafting each one.

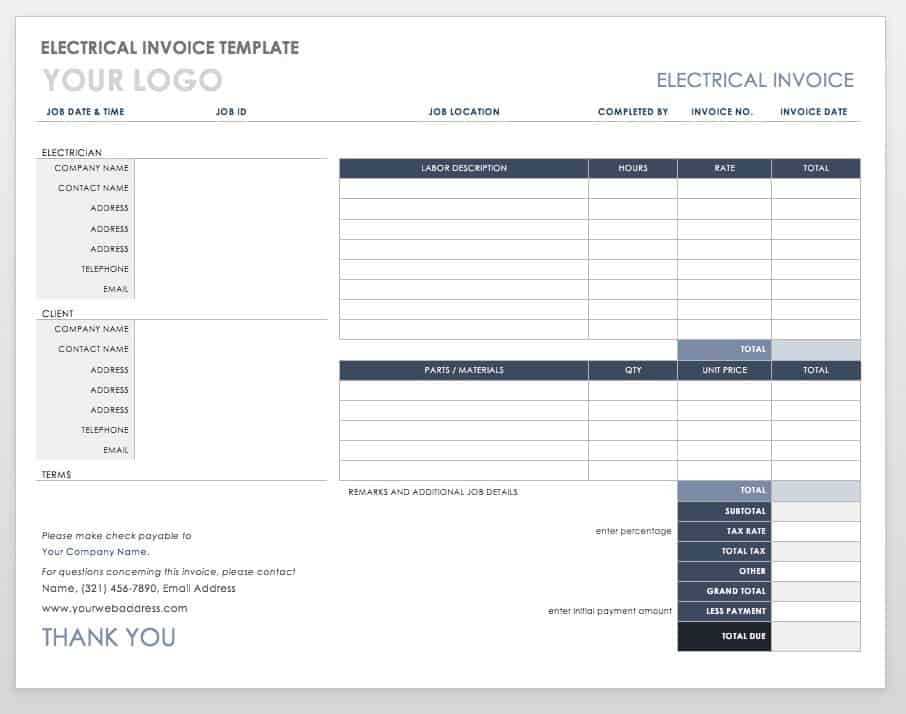

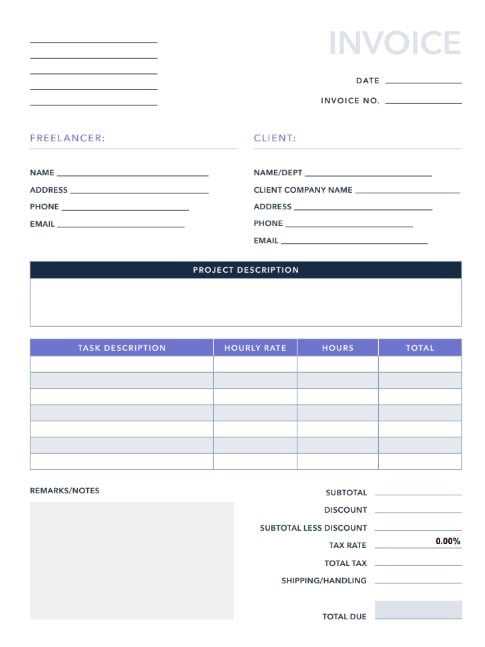

Essential Elements of an Invoice Receipt

When confirming a transaction, it’s important to include all the necessary information that allows the client to easily verify the payment. A well-structured confirmation ensures both parties are aligned and helps avoid misunderstandings. There are several key components that every confirmation message should contain to make it effective and clear.

Key Information to Include

- Payment Amount: Clearly state the total amount that was paid, including any taxes or fees if applicable.

- Transaction Date: Specify the exact date when the payment was processed to avoid confusion about the timing.

- Payment Method: Indicate how the payment was made, whether it was via credit card, bank transfer, or another method.

- Reference Number: If applicable, provide a unique reference number for tracking purposes, such as an order or transaction ID.

- Client Information: Include the name or company name of the client to ensure the confirmation is correctly attributed.

- Thank You Message: A polite expression of appreciation for the client’s business or timely payment fosters positive relations.

Additional Considerations

- Clear Formatting: Use bullet points, headings, and short paragraphs to ensure easy readability.

- Branding: Include your company’s logo or color scheme to reinforce your brand identity.

- Contact Information: Always provide your business’s contact details in case the client has questions or concerns.

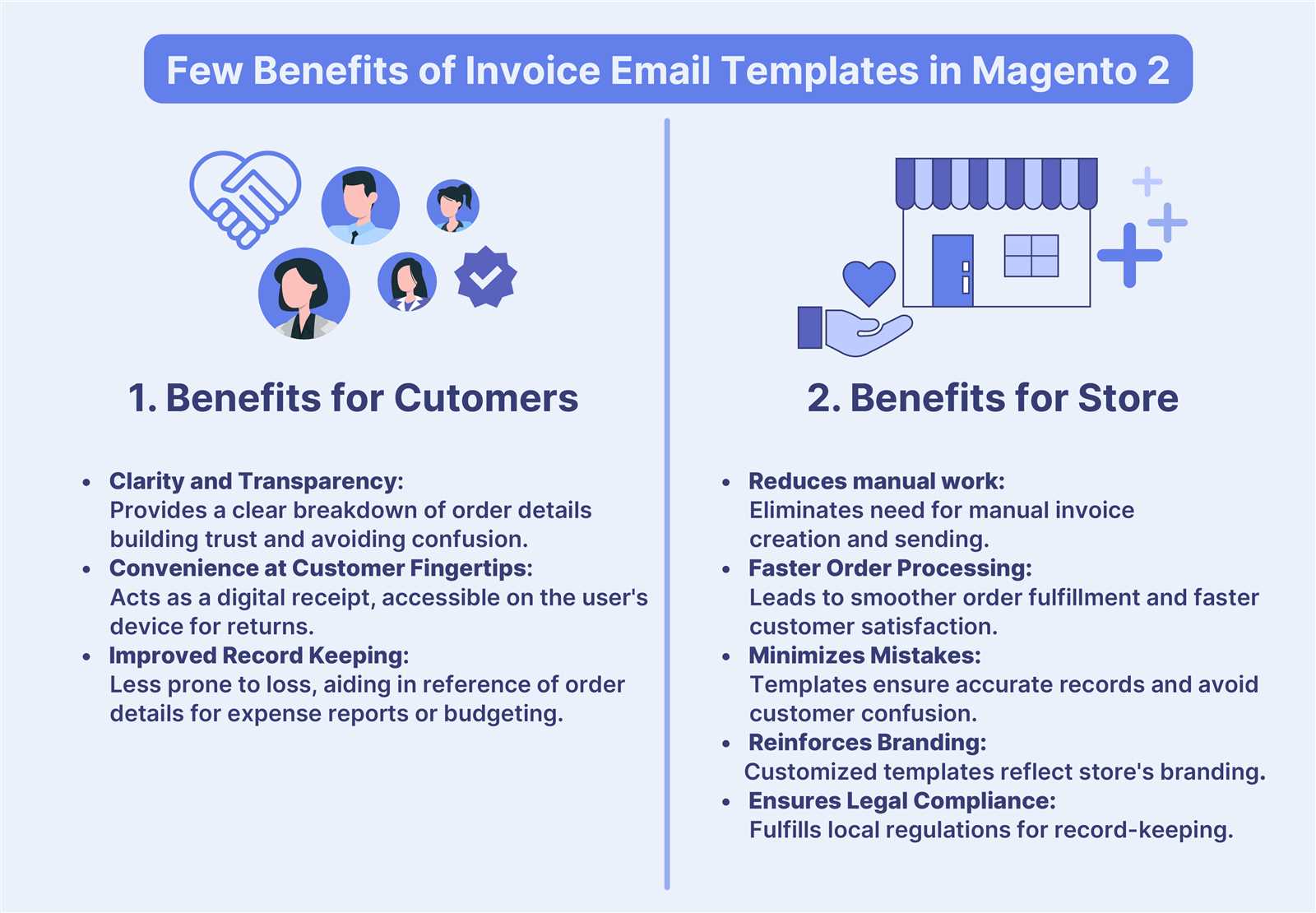

Why Invoice Receipts Matter in Business

Providing clear and professional transaction confirmations plays a crucial role in maintaining transparency and trust between businesses and their clients. These communications not only confirm payments but also serve as important documentation for both parties. They help establish a clear record of financial exchanges and can protect both the business and the client in case of discrepancies or disputes.

Furthermore, a well-structured confirmation can enhance the customer experience by providing them with the necessary details in a concise and accessible format. This not only strengthens relationships but also contributes to smoother business operations by ensuring all parties have accurate, documented proof of payments made.

| Benefits of Payment Confirmations | Description |

|---|---|

| Improves Transparency | Clear confirmations help both parties understand the details of the transaction, reducing the likelihood of misunderstandings. |

| Builds Trust | Professional communication enhances trust and shows clients that the business is organized and reliable. |

| Prevents Disputes | Providing accurate, detailed records can help resolve potential conflicts and clarify any confusion regarding payments. |

| Supports Financial Tracking | These communications serve as important documentation for financial records, making it easier to track and reconcile transactions. |

| Enhances Customer Experience | A well-crafted confirmation can leave a positive impression, contributing to overall customer satisfaction and loyalty. |

Best Practices for Invoice Email Communication

Effective communication is key to maintaining professionalism and ensuring that both parties are on the same page during a financial transaction. When sending a payment confirmation, it’s important to follow certain guidelines that will help your message appear clear, concise, and trustworthy. By following best practices, you can improve client satisfaction and reduce confusion or delays in payment processing.

Key Guidelines to Follow

- Keep the Tone Professional: Use formal language and maintain a polite tone. Even though the message is a routine business communication, showing respect helps build stronger relationships with your clients.

- Be Clear and Concise: Provide all the necessary details without overwhelming the recipient with too much information. Keep the message short and to the point to ensure it’s easy to read and understand.

- Provide Complete Details: Include all relevant information, such as the amount paid, the method of payment, the date, and any applicable reference numbers to avoid confusion and allow the client to verify the transaction easily.

- Use a Clear Subject Line: The subject line should immediately communicate the purpose of the message, such as “Payment Confirmation for Your Recent Transaction” or “Thank You for Your Payment.”

- Personalize the Message: Whenever possible, address the client by their name and reference the specific transaction to make the communication feel more personal and tailored to the recipient.

- Proofread Before Sending: Always double-check your message for spelling, grammar, and accuracy to maintain professionalism. Small mistakes can damage your credibility.

- Use a Consistent Format: Maintain consistency in how you structure your messages. Whether you’re manually writing them or automating the process, keeping a uniform style helps your clients know what to expect.

Additional Tips

- Include Contact Information: Always provide a way for clients to reach you if they have questions or need further clarification.

- Be Timely: Send the confirmation shortly after the payment is processed to ensure that clients have the information they need as soon as possible.

- Follow Up if Necessary: If the payment is delayed or a mistake occurs, follow up promptly to resolve any issues and maintain trust.

Common Mistakes in Invoice Receipt Emails

When sending a payment confirmation, it’s easy to overlook details that can impact the clarity and professionalism of the message. Even small mistakes can create confusion for the recipient, damage your credibility, and delay financial processes. Avoiding common errors in communication will help maintain positive relationships with your clients and ensure that your business operations run smoothly.

Common Errors to Avoid

- Missing Payment Details: Not including key information like the amount paid, payment method, or transaction date can lead to confusion. Always ensure that the client has everything they need to verify the payment.

- Unclear Subject Lines: A vague or generic subject line like “Payment Confirmation” doesn’t provide enough context. Be specific about the purpose, such as “Confirmation of Payment for Order #12345.”

- Too Much or Too Little Information: Providing excessive details can overwhelm the recipient, while not giving enough information can leave them unsure about the status of their transaction. Strike a balance between brevity and completeness.

- Failure to Proofread: Typos, grammatical errors, and formatting mistakes can undermine your professionalism. Always review your message for accuracy before sending.

- Not Personalizing the Message: Using a generic greeting like “Dear Customer” can come across as impersonal. Address your clients by their name and reference the specific transaction to make the communication feel more tailored.

- Missing Contact Information: If the recipient has questions or concerns about the payment, not providing a way for them to reach you can cause frustration. Always include your business contact details in case they need assistance.

- Sending Late Confirmations: Delaying the payment confirmation can make the process feel unorganized and lead to confusion. Always send the confirmation as soon as the payment is processed.

How to Correct These Mistakes

- Double-check all payment details: Make sure the amount, date, and payment method are clearly stated and accurate.

- Craft a clear, specific subject line: Make the purpose of the message obvious to the recipient.

- Ensure the message is concise yet informative: Avoid unnecessary details but make sure to include all relevant information.

- Proofread and review: Take the time to check for any errors before sending the message.

- Personalize where possible: Use the client’s name and reference the specific payment.

- Always include contact details: Make it easy for clients to reach you if they have questions.

- Send the confirmation promptly: Aim to send the communication as soon as the payment is received.

How to Personalize Your Invoice Emails

Personalization is a key factor in improving client relationships and ensuring that your communications stand out. When confirming a payment, addressing the recipient directly and tailoring the message to their specific transaction creates a sense of attention and professionalism. A personalized approach not only enhances the overall experience but also helps build trust and fosters loyalty over time.

There are several ways you can personalize your payment confirmation messages to make them feel more individual and meaningful to the recipient. From using the client’s name to referencing specific details about their transaction, a few simple adjustments can go a long way in creating a positive impression.

| Personalization Techniques | Benefits |

|---|---|

| Use the Client’s Name | Personalizing the greeting with the client’s name adds a personal touch and makes the message feel more individualized. |

| Reference the Specific Transaction | By mentioning the exact order, service, or product purchased, you provide clarity and show attention to detail. |

| Include Tailored Payment Details | Highlighting the amount, payment method, or any special offers the client used makes the message more relevant and specific. |

| Thank the Client Personally | A personalized thank-you message helps convey gratitude and reinforces a positive relationship with your client. |

| Use a Customized Closing | Ending the message with a personalized sign-off or call to action, such as “Looking forward to working with you again,” helps maintain a connection. |

By incorporating these simple but effective personalization techniques, you not only make the message more engaging but also demonstrate that you value your clients and their business. This approach can have a lasting impact on client satisfaction and retention.

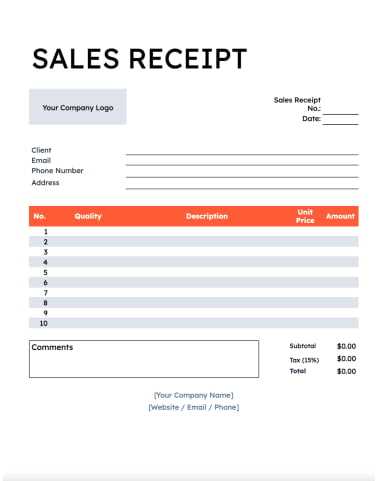

Template for Professional Payment Confirmation Messages

Having a well-structured and professional confirmation message can make a significant difference in how clients perceive your business. A clear, concise, and formal communication not only reassures the client but also reinforces your credibility and organizational skills. Below is an outline of key components to include in your payment confirmation message to ensure it reflects professionalism and fosters trust.

Key Components to Include

- Subject Line: A clear and straightforward subject line that indicates the purpose of the message, such as “Confirmation of Your Recent Payment” or “Thank You for Your Payment – [Transaction ID].”

- Greeting: Personalize the message with the client’s name to make the communication feel individualized. Example: “Dear [Client Name],”

- Confirmation of Payment: A statement confirming that the payment has been received, such as “We have successfully received your payment of [Amount].”

- Transaction Details: Provide important information like the payment date, reference number, and method used for the transaction. Example: “Your payment was processed on [Date] via [Payment Method].”

- Thank You Message: Show appreciation for the client’s business. A simple “Thank you for your prompt payment” can go a long way in building rapport.

- Additional Information: If applicable, provide any additional details, such as next steps or relevant links, e.g., “You can view your order details [here].”

- Closing Statement: End with a friendly and professional closing, such as “If you have any questions, feel free to contact us.” Follow with your signature or company name.

Example of a Professional Confirmation Message

- Subject: Payment Confirmation for Your Recent Transaction

- Greeting: Dear [Client Name],

- Confirmation: We have successfully received your payment of [Amount] for the transaction [Reference Number].

- Transaction Details: Payment Date: [Date], Payment Method: [Payment Method].

- Thank You: Thank you for your prompt payment. We appreciate your business!

- Additional Info: For further information about your order, please visit [Link].

- Closing: If you have any questions, please don’t hesitate to contact us at [Phone/Email]. Best regards, [Your Company Name].

By using this format, you ensure that all the necessary information is communicated clearly and professionally. Adhering to this structure also helps streamline the process and create a consistent experience for

Design Tips for Clear Payment Confirmation Messages

The design and layout of your payment confirmation message play a crucial role in ensuring that the recipient easily understands the information being communicated. A well-structured, visually appealing message not only makes it easier for the client to process the details but also enhances your professionalism. Below are some key design tips to improve the clarity and readability of your payment confirmations.

Key Design Considerations

- Use a Clean, Simple Layout: Avoid clutter and keep the message layout straightforward. Use headings and subheadings to break up the content into easily digestible sections, and ensure there is enough white space between elements.

- Prioritize Key Information: Place the most important details, such as payment amount and transaction date, at the top of the message where they can be quickly accessed. Use bold text or bullet points to make these details stand out.

- Choose Readable Fonts: Select a clear, professional font like Arial, Helvetica, or Times New Roman. Avoid overly decorative fonts that may be difficult to read. Keep the font size large enough for easy reading on both desktop and mobile devices.

- Color and Branding: Incorporate your brand’s colors and logo to maintain consistency with your company’s identity. However, keep the color scheme simple, using a maximum of two or three colors to avoid overwhelming the reader.

- Ensure Mobile Compatibility: Many recipients will view your message on mobile devices, so it’s essential that the design is responsive. Ensure that the layout adjusts well to different screen sizes and that text is legible without zooming.

- Keep Links and Actions Clear: If the message includes links to additional information or actions (such as an invoice history or payment portal), make sure they are clearly visible and easily clickable. Use a contrasting color or button format for important links.

- Avoid Overuse of Images: While including your logo or small relevant icons can enhance the message, avoid using large images that may distract from the core information or slow down loading times.

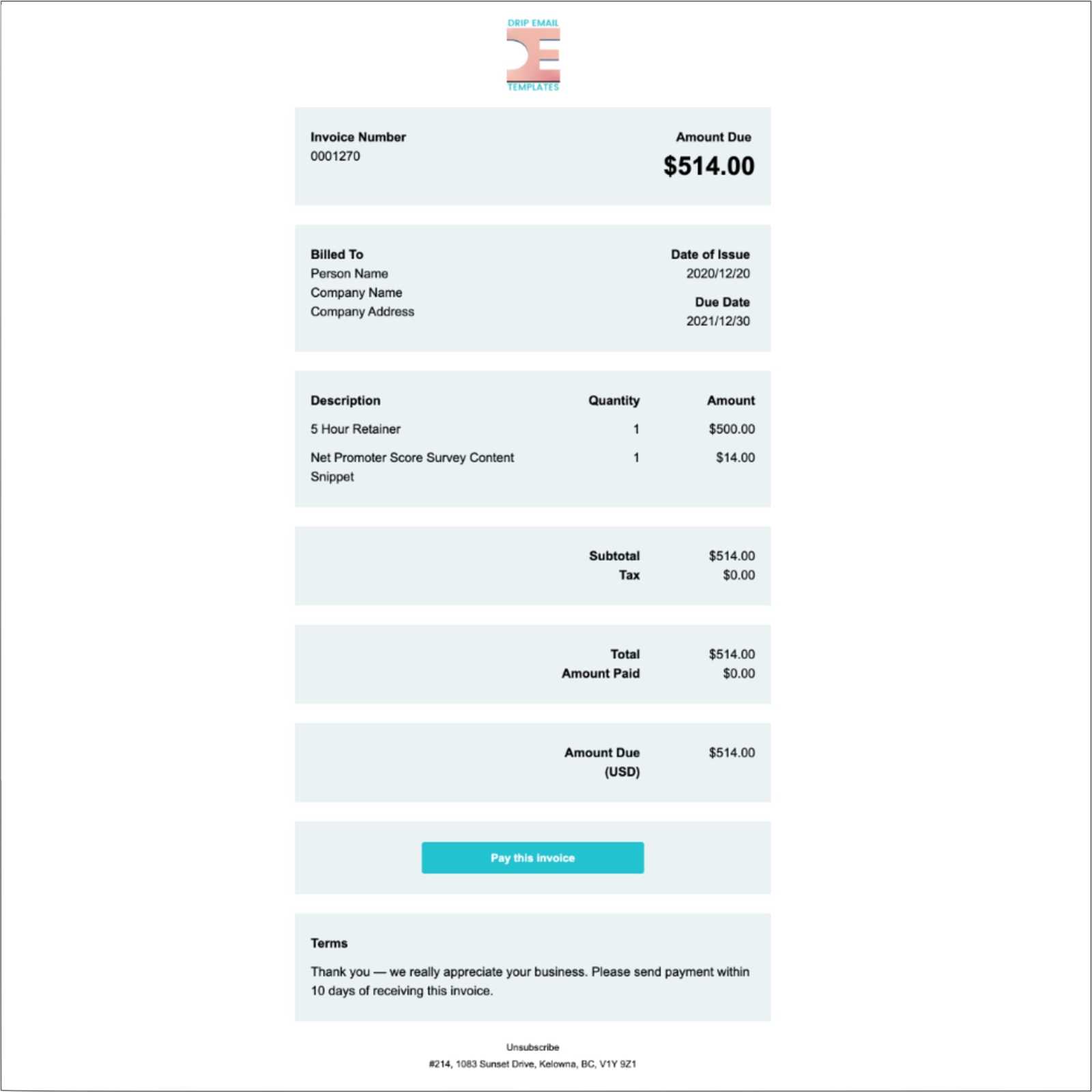

Example Layout for a Clear Payment Confirmation

- Header: Include your company logo and a brief subject such as “Payment Confirmation.” This sets the tone and allows the recipient to recognize the message immediately.

- Body: Use short paragraphs with bold headings like “Payment Received,” “Transaction Date,” and “Amount Paid.” Each section should be easy to scan.

- Footer: Include your contact information, links to your website, and any relevant support options. Keep this section minimal but helpful.

By

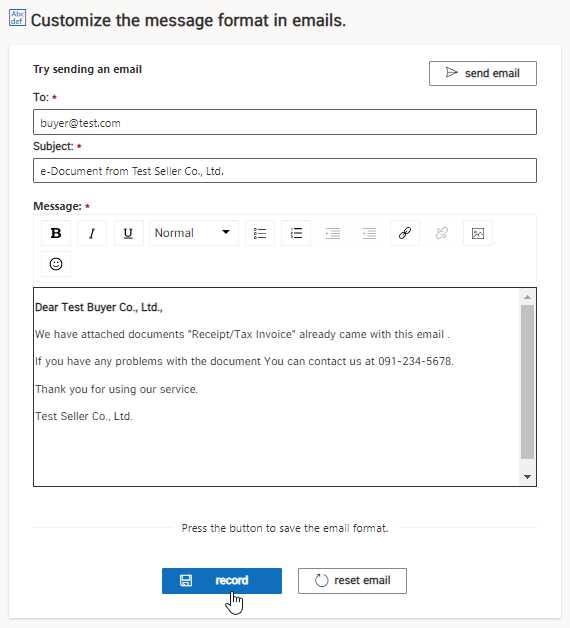

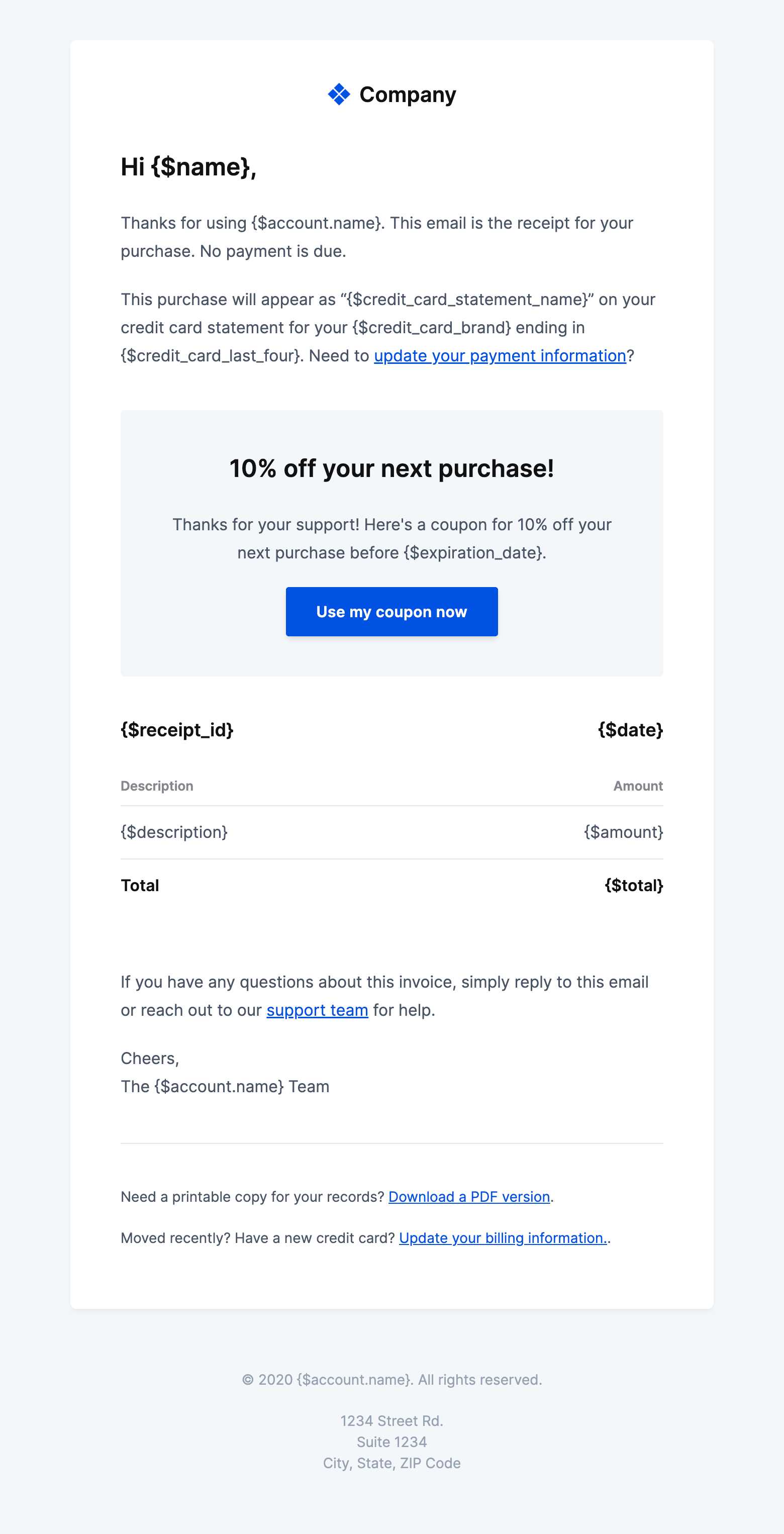

Automating Payment Confirmation Responses

Automating payment confirmation messages can save time, reduce errors, and ensure consistency in your communication with clients. By using automated systems, businesses can instantly send out personalized responses when payments are processed, without the need for manual intervention. This not only improves efficiency but also enhances the customer experience by providing immediate confirmation of their transaction.

Automation tools allow businesses to set up triggers that send out messages based on specific actions, such as when a payment is received or when a subscription is renewed. These systems can be integrated with your payment processor to streamline the process, ensuring that the client receives the necessary details promptly and accurately.

Benefits of Automating Responses

- Time Efficiency: Automation reduces the need for manual processing, allowing staff to focus on other tasks while ensuring timely responses to clients.

- Consistency: Automated messages ensure that all clients receive the same high-quality response with all relevant details, reducing the likelihood of mistakes or inconsistencies in communication.

- Instant Confirmation: Clients can receive immediate acknowledgment of their payments, providing reassurance and enhancing customer satisfaction.

- Personalization: Many automation tools allow for personalized content, such as inserting the client’s name, transaction details, and specific amounts paid, making the communication feel tailored to each client.

- Reduced Human Error: Automation eliminates the risk of human mistakes, such as sending the wrong amount or missing key details in the message.

Setting Up Automated Payment Confirmations

- Select an Automation Tool: Choose a tool that integrates well with your payment system and allows you to create customized, automated messages.

- Define Triggers: Set up specific conditions that will automatically send the confirmation message, such as when a payment is successfully processed or a certain time period has passed.

- Personalize Content: Use dynamic fields to insert client-specific information, such as name, transaction amount, and payment method, to enhance the personalization of the message.

- Test the System: Before fully implementing the automation, run tests to ensure that the messages are sent correctly and contain all necessary details.

- Monitor and Adjust: Regularly review the automated responses to ensure they are functioning as expected and adjust them based on feedback or changes in business needs.

By automating your payment confirmations, you can enhance efficiency, maintain professionalism, and improve customer satisfaction–all while minimizing the time s

How to Acknowledge Payments in Emails

Acknowledging payments effectively in business communications is crucial for building trust and ensuring that both parties are aligned. When clients make payments, it’s important to promptly confirm receipt, express appreciation, and provide relevant transaction details. A well-crafted acknowledgment not only reassures clients but also fosters a sense of transparency and professionalism in your business.

In this section, we will explore how to structure your payment acknowledgment messages to ensure clarity, professionalism, and a positive client experience. Below are the key elements to include in any payment acknowledgment response.

Key Elements to Include

- Clear Confirmation of Payment: Start by explicitly confirming that the payment has been received. A simple statement like “We have successfully received your payment of [Amount]” sets the tone for the rest of the message.

- Transaction Details: Include essential details such as the payment date, method, and reference number. This ensures the recipient can easily match the payment with their records. Example: “Your payment of [Amount] was processed on [Date] using [Payment Method].”

- Personalized Greeting: Address the client by their name to create a more personal connection. Using a greeting such as “Dear [Client Name],” shows that the communication is tailored to them.

- Expression of Gratitude: Thanking your clients for their prompt payment helps reinforce a positive business relationship. Example: “Thank you for your timely payment. We appreciate your continued trust in our services.”

- Next Steps or Additional Information: If applicable, provide further instructions or details regarding the next steps, such as shipment tracking or access to services. Example: “Your order will be processed shortly, and you will receive an update within the next 24 hours.”

- Contact Information: Include a contact number or email address for any follow-up questions. Example: “If you have any questions, please don’t hesitate to contact us at [Phone Number] or [Email Address].”

Example of a Payment Acknowledgment Message

- Subject: Payment Confirmation – [Transaction ID]

- Greeting: Dear [Client Name],

- Confirmation: We have successfully received your payment of [Amount] for [Product/Service Name].

- Transaction Details: Payment Date: [Date], Payment Method: [Payment Method], Reference Number: [Reference Number].

- Gratitude: Thank you for your timely payment! We appreciate your business.

- Next Steps: Your order will be processed immediately, and you will receive tracking information once shipped.

- Closing: If you have any questions, feel free to contact us at [Phone/Email]. Best regards, [Your Company Name].

By following these guidelines, you can ensure that your payment acknowledgment messages are clear, prof

Legal Aspects of Sending Payment Acknowledgments

When it comes to confirming and acknowledging payments, businesses must be aware of the legal obligations and requirements that govern such communications. Sending confirmation messages or transactional records is not only a professional courtesy, but it also serves as a legal document in many jurisdictions. These communications must meet certain legal standards to ensure that they are valid, enforceable, and compliant with tax regulations and consumer protection laws.

In this section, we will explore the key legal considerations that businesses should keep in mind when sending payment confirmations to clients, including compliance with local laws, providing accurate records, and the importance of clarity in terms of payment terms and conditions.

Key Legal Considerations

- Accuracy of Information: It is essential that all the details included in the confirmation, such as the payment amount, date, and method, are accurate and correctly match the transaction. Incorrect information can lead to disputes or legal challenges.

- Record Keeping Requirements: Many jurisdictions require businesses to keep records of all transactions for a certain period of time. Payment confirmations are often a part of these records and may need to be stored for tax or audit purposes.

- Consumer Protection Laws: Payment acknowledgment messages may be considered legally binding in certain circumstances. Businesses must ensure that the terms outlined in these communications comply with consumer protection laws, such as refund policies or warranty information.

- Privacy and Data Protection: Businesses should take care to avoid including sensitive customer information, such as full credit card numbers, in confirmation messages unless appropriate encryption or security measures are in place. Compliance with data protection regulations, such as GDPR or CCPA, is critical.

- Electronic Signature Requirements: In some cases, electronic payment confirmations may require an electronic signature to be legally valid. Understanding when and how an electronic signature is necessary can help businesses avoid legal issues down the line.

- Jurisdiction-Specific Requirements: Legal requirements for payment communications can vary greatly depending on the country or region. Businesses should familiarize themselves with local laws governing transactions and be sure to follow the relevant regulations in the jurisdictions they operate.

How to Ensure Legal Compliance

- Consult Legal Experts: To ensure full compliance with applicable laws, businesses should consult legal professionals who specialize in commercial law and data protection regulations.

- Use Secure and Reliable Platforms: Implement secure systems for processing and storing payment records and ensure that the confirmation process adheres to industry best practices for security and data protection.

- Clearly State Terms: Include clear terms and conditions in your payment confirmation messages, such as refund po

Using Payment Acknowledgments to Build Trust

Building trust with clients is an essential aspect of any successful business relationship. One way to achieve this is by sending clear, accurate, and professional confirmation messages after payments are made. These communications serve as both a record of the transaction and a reassurance that the business is organized, reliable, and transparent. When done correctly, they can significantly enhance your credibility and help foster long-term, trusting relationships with your customers.

In this section, we will explore how using payment acknowledgment messages can positively impact your business by establishing trust, ensuring transparency, and improving customer satisfaction. Let’s look at how a well-crafted acknowledgment message can go beyond merely confirming a transaction and play a key role in relationship-building.

Key Ways Payment Acknowledgments Build Trust

- Transparency: Providing clear, detailed information about the transaction reassures customers that there are no hidden fees or misunderstandings. This transparency is essential in building confidence in your business.

- Consistency: Regularly sending prompt, professional payment confirmations demonstrates that your business is organized and dependable. Clients will feel more secure when they know they can rely on timely and accurate communications.

- Appreciation: A simple thank-you message expressing appreciation for a timely payment helps clients feel valued. Showing gratitude fosters goodwill and strengthens the relationship between business and customer.

- Customer Assurance: By promptly acknowledging receipt of a payment, you offer peace of mind to clients, reassuring them that their transaction has been successfully completed and that they can continue with any next steps (e.g., receiving a product or accessing a service).

- Professionalism: A well-crafted acknowledgment reflects the professionalism of your business. It shows that you take your operations seriously and care about providing a high-quality experience for your customers.

How to Make Payment Acknowledgments More Trustworthy

- Be Timely: Responding quickly after receiving a payment shows your customers that you prioritize their business. Aim to send acknowledgments as soon as possible after payment is processed.

- Provide Detailed Information: Include key details such as payment amount, date, method, and reference number. This transparency helps avoid confusion and reinforces your reliability.

- Use a Polite, Warm Tone: Make your acknowledgment message personable and polite. A friendly, courteous tone shows that you value your customer’s business and helps build a positive relationship.

- Offer Next Steps or Support: Provide information about the next steps in the transaction, such as shipping details or access to services. This shows that you are pr

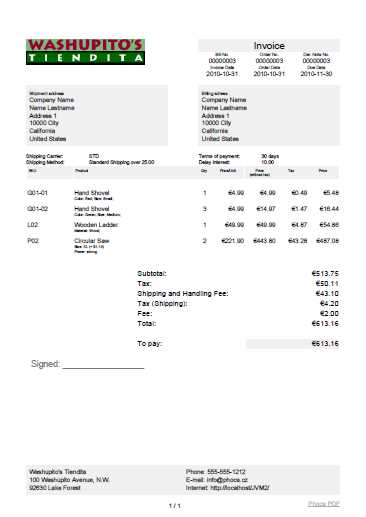

Sending Payment Confirmations for International Transactions

When conducting business across borders, it’s important to ensure that payment confirmations are clear, legally compliant, and appropriately formatted for international clients. Different countries have varying expectations regarding documentation, and businesses must account for these differences to maintain professionalism and compliance. In addition to language barriers, factors such as currency, tax regulations, and payment processing systems can add complexity to cross-border transactions.

This section explores key considerations and best practices for sending payment acknowledgments when dealing with international transactions, ensuring that your communications are effective, accurate, and compliant with local laws.

Key Considerations for International Payment Confirmations

- Currency and Payment Method Details: When dealing with international clients, always include the currency in which the payment was made, as well as the method used (e.g., wire transfer, credit card, PayPal). This helps prevent confusion and ensures both parties are on the same page regarding the transaction details.

- Local Tax and Regulatory Compliance: Different countries have different tax and financial reporting requirements. Make sure your confirmation includes all necessary tax information, such as VAT or GST, in the format required by the customer’s jurisdiction. If applicable, include your business’s tax identification number to ensure compliance.

- Language and Localization: If you’re dealing with clients in non-English speaking countries, consider providing a translation of the payment acknowledgment message. This can improve customer satisfaction and demonstrate respect for cultural differences.

- Time Zone Considerations: For international clients, it’s important to mention the time zone in any date or time-related information. Always specify the time zone when referencing the payment date or any follow-up timelines to avoid confusion.

- Legal Requirements for Documentation: Some countries may require businesses to provide specific documentation for cross-border transactions, especially for high-value payments. Ensure that your communication complies with these legal requirements by providing any necessary records or additional documentation as required.

Best Practices for International Payment Confirmations

- Include Complete Transaction Details: Clearly outline all relevant details such as the payment amount, payment method, transaction ID, and the currency used. This ensures that both parties have accurate records of the transaction.

- Provide Multilingual Support: For global clients, it’s beneficial to offer payment confirmation messages in multiple languages. This can be achieved by using automated tools or translation services that help cater to a diverse customer base.

- Follow Up on Payment Status: After sending a payment acknowledgment, consider sending a follow-up message with details about the next steps or expected delivery timelines. This can be especially helpful for international transactions where shipping or service delivery might take longer due to geographic distance.

- Transparency: Stating the payment method makes it clear how the transaction was completed, helping both you and your customer track the source of payment.

- Record Keeping: Having a clear record of payment methods is essential for your accounting and auditing purposes, allowing for accurate financial reporting.

- Dispute Resolution: If any issues arise, having the payment method specified can simplify the process of resolving discrepancies, such as identifying incorrect charges or confirming the source of funds.

- Customer Confidence: Providing payment method details demonstrates that you are organized and transparent, which can enhance customer trust and satisfaction.

- Legal Compliance: In certain jurisdictions, providing accurate details about payments–including the method used–may be required by law for tax or auditing purposes.

- Credit and Debit Cards: If the payment was made via a card, mention the card type (Visa, MasterCard, etc.) and the last four digits to help the customer verify the payment method.

- Bank Transfers: If the payment was made via a bank transfer, include the name of the bank and the transaction reference number, which will help the customer track the payment in their account.

- Online Payment Platforms: For payments via services like PayPal, Stripe, or Square, specify the platform used and include any relevant transaction or confirmation numbers for easy identification.

- Cryptocurrency: If the payment was made using cryptocurrency, mention the type (e.g., Bitcoin, Ethereum) and include the wallet address or transaction ID to provide the customer with proof of payment.

- Checks or Cash: If a traditional check or cash was used, be sure to include the check number, amount, and any other pertinent information to track the transaction properly.

- Stay Calm and Professional: Always approach the situation with a calm and neutral tone. Avoid placing blame, and instead focus on resolving the issue collaboratively. Maintaining professionalism helps prevent the situation from escalating.

- Address the Customer’s Concerns: Acknowledge the issue raised by the customer. Let them know that you understand their concern and are committed to resolving it. This demonstrates that you are actively listening and value their business.

- Provide Clear Information: Include specific details in your response, such as payment dates, amounts, and any discrepancies identified. Reference transaction records or other supporting documents to help clarify the situation.

- Clarify Terms and Agreements: Revisit the agreed-upon terms of the transaction. If the customer made a mistake or misunderstood the terms, gently remind them of what was initially agreed upon without being accusatory.

- Offer Solutions: Provide options to resolve the issue. This may include issuing a partial refund, adjusting the amount owed, or explaining any errors that led to the discrepancy. A clear resolution path demonstrates your willingness to make things right.

- Subject Line: Payment Discrepancy – Resolution of [Transaction ID]

- Greeting: Dear [Customer Name],

- Acknowledgment: Thank you for reaching out regarding the recent payment for [Product/Service]. I understand that there seems to be a discrepancy with the amount paid.

- Clarification of the Issue: Upon reviewing the payment details, it appears that the payment of [Amount] was received on [Date], but the agreed-upon amount was [Correct Amount].

- Provide Context or Explanation: This discrepancy may have occurred due to [explain reason, e.g., exchange rate differences, miscommunication about taxes, or a system error].

- Resolution Steps: To resolve this, I propose the following options: [outline options such as refunding the difference, sending a corrected payment request, or applying a credit to the customer’s account].

- Offer Assistance: If you have any further questions or require additional clarification, plea

Including Payment Methods in Payment Confirmation Messages

Clearly communicating the method through which a payment was made is essential for transparency and record-keeping. By detailing the payment method in your acknowledgment messages, you provide both the customer and your business with a reference point for the transaction. This information can also help prevent confusion, streamline accounting processes, and ensure that any disputes can be resolved quickly and efficiently. Including this detail not only adds professionalism but also builds trust with your clients.

In this section, we will explore the importance of mentioning payment methods in your payment confirmation communications, the types of payment methods to include, and how to present this information in a clear and professional manner.

Why Including Payment Methods Is Important

Types of Payment Methods to Include

When communicating payment method details, clarity is key. It’s important to balance the need for transparency with maintaining privacy. Always be mindful of sensitive information–avoid sharing the full card number or banking details, and instead focus on the last few digits or a transaction reference number to protect your customers’ security.

By including payment methods in your payment acknowledgment messages, you ensure that your clients have a clear record of how their paymen

How to Handle Payment Discrepancies via Communication

When a payment doesn’t match the expected amount or the terms agreed upon, it’s essential to address discrepancies quickly and professionally. Addressing such issues via written communication provides a clear, traceable record of the situation, which can help avoid confusion and maintain a positive relationship with the customer. Clear communication is key to resolving disputes, ensuring both parties understand the issue, and finding a mutually agreeable solution.

In this section, we’ll outline effective strategies for handling payment discrepancies, the tone to adopt, and the necessary information to include when addressing these matters via correspondence.

Steps to Handle Payment Discrepancies Professionally

Example of How to Address Payment Discrepancies