How to Create a Template Commercial Invoice for Your Business

For any business or freelancer, organizing financial transactions efficiently is crucial. One of the simplest yet most important tools to facilitate smooth operations is a well-structured billing document. This type of document not only helps ensure clarity between the seller and buyer but also serves as a record for accounting and tax purposes.

Understanding the key components of a professional billing sheet is essential. By including all necessary details, businesses can avoid misunderstandings and ensure timely payments. Whether you’re providing goods, services, or both, a comprehensive approach to drafting such a document can save time and reduce the chances of disputes.

Proper formatting, clear itemization, and accurate payment terms are just a few of the vital aspects that should be considered when creating these documents. With the right structure, any transaction can be documented effortlessly, helping to maintain positive business relationships.

Template Commercial Invoice: An Overview

When managing business transactions, it is essential to have a structured document that clearly outlines the terms of sale, products or services provided, and payment expectations. A well-organized document serves as both a record and a formal request for payment. It ensures transparency between the buyer and seller, reducing potential conflicts and misunderstandings.

Such documents typically include detailed information about the transaction, such as the parties involved, the items or services being exchanged, and the total cost. Including specific payment instructions and deadlines is also critical to ensure smooth financial processes. The goal is to create a clear, professional record that both parties can refer to as needed.

Core Components of the Document

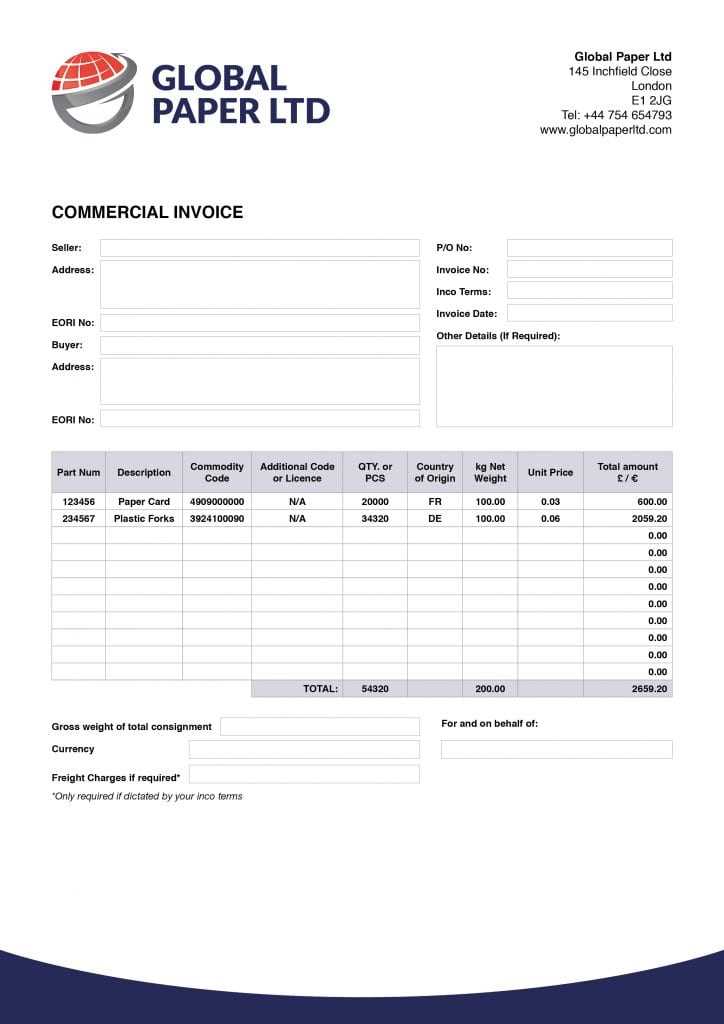

Key elements that should be present include the contact information of both the buyer and the seller, a detailed list of products or services, their quantities, unit prices, and the total amount due. Payment terms and any applicable taxes or shipping fees should also be specified clearly. By including all these components, the document becomes an essential tool for both tracking sales and managing financial records.

Benefits of Using a Structured Billing Document

Utilizing a standard format helps streamline administrative tasks and ensures consistency in all business transactions. Additionally, it aids in compliance with legal and financial regulations, making it easier for businesses to maintain proper records. Furthermore, such documents can be easily shared and stored digitally, offering greater convenience for both business owners and clients.

Why Use a Template for Invoices

Using a predefined structure for billing documents can save time, reduce errors, and ensure consistency across all transactions. A well-designed framework makes it easier to include all necessary details, helping businesses avoid the risk of missing important information. It also allows for faster creation of new documents, ensuring that each transaction is processed smoothly and professionally.

By relying on a structured format, businesses can focus more on the content of the transaction rather than on formatting or organizing the document each time. This consistency not only improves efficiency but also helps build trust with clients who expect clear and reliable documentation.

Efficiency and Accuracy

With a standardized structure, the chances of omitting critical details, such as payment terms or product descriptions, are minimized. It also ensures that all required information is easy to locate, which can help in the event of a dispute or audit. The result is a more streamlined process that saves time and reduces the likelihood of mistakes.

Brand Consistency and Professionalism

Using a consistent format reinforces your company’s branding and enhances the professional image you present to clients. A polished, recognizable document format can help establish credibility and make your business appear more organized. This contributes to stronger client relationships and may even help encourage prompt payments.

Key Elements of a Billing Document

To ensure smooth business transactions, a well-organized document must clearly outline the details of the sale, the parties involved, and the payment terms. A comprehensive record helps both the seller and buyer keep track of the transaction and serves as a formal request for payment. It also plays a crucial role in financial recordkeeping and compliance with regulations.

Essential Details to Include

A properly structured document should contain specific information to avoid confusion and ensure the transaction is clear. The following elements are essential:

- Contact Information: Both the buyer’s and seller’s names, addresses, and contact details.

- Unique Document Number: A distinct number assigned to the document for easy reference and tracking.

- Item Description: A detailed list of the products or services sold, including quantity, unit price, and any applicable codes.

- Total Amount Due: The total price for the goods or services, including taxes, shipping fees, and discounts.

- Payment Terms: Information on when the payment is due, any early payment discounts, and accepted payment methods.

- Shipping Information: Delivery details, including the method of shipment, delivery address, and shipping date.

Additional Considerations

While the key elements mentioned above are crucial, some documents may also require extra details, depending on the nature of the business or specific industry. These could include:

- Purchase Order Reference: If applicable, a reference number linked to a previous purchase order.

- Legal Terms: Any relevant legal or contractual information related to the sale.

- Customs or Import Duties: For international transactions, it may be necessary to include information about customs and import duties.

Customizing Your Billing Document

Tailoring a billing document to suit your business’s unique needs can significantly improve the overall transaction process. Customization ensures that the document reflects your brand’s identity while meeting all the necessary requirements for clarity and professionalism. By adjusting various sections and design elements, you can make the document more efficient, user-friendly, and aligned with your business practices.

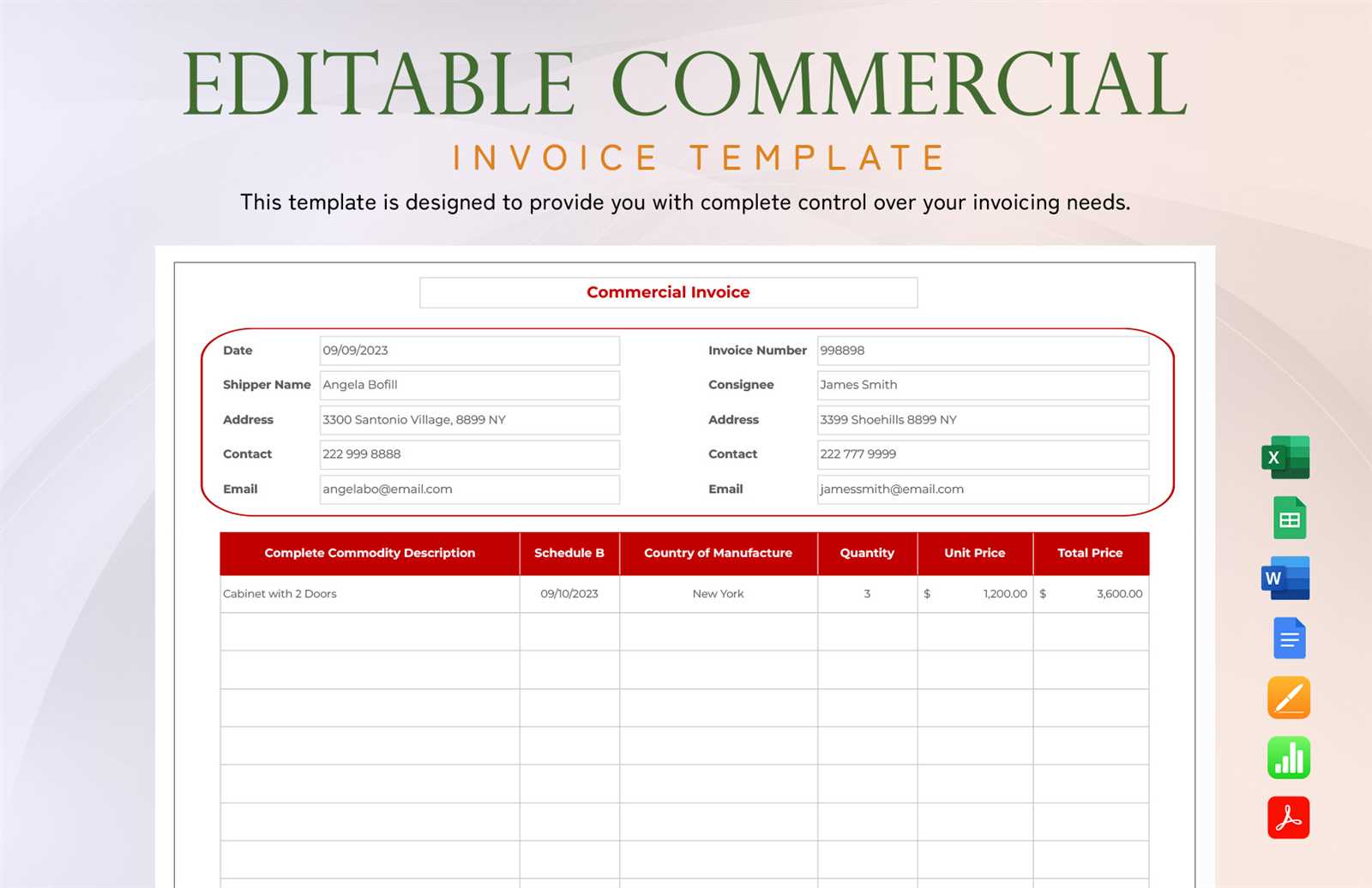

Design and Branding

One of the first aspects to consider when personalizing your billing record is the design. This includes adding your business logo, selecting a color scheme, and choosing fonts that align with your brand’s aesthetic. A visually appealing document helps reinforce your business identity and presents a professional image to your clients.

- Logo Placement: Position your logo prominently at the top of the document to increase brand recognition.

- Consistent Font Choices: Use legible fonts and a consistent size throughout the document for clarity.

- Color Scheme: Choose colors that match your branding, but ensure they don’t overpower the content.

Including Business-Specific Information

Customizing your document allows you to include specific information relevant to your business operations. For example, if you frequently offer discounts, it’s helpful to have a section that automatically calculates them. Similarly, you might want to include payment options, such as bank details, online payment links, or specific instructions for international transactions.

- Discounts and Offers: Add fields that automatically calculate any applicable discounts or promotional offers.

- Payment Methods: Specify accepted payment methods and include your banking or payment processor details.

- Additional Notes: Include space for any additional terms, like late payment penalties or return policies.

Common Billing Document Formats

There are various ways to format a billing document depending on the complexity of the transaction, the industry, and the preferences of the business. Each format has its own set of features and benefits, but the primary goal remains the same: to clearly communicate the details of the transaction, ensuring accuracy and reducing confusion. Understanding the most commonly used formats will help you choose the one that best suits your business needs.

Basic Formats

For many small businesses and freelancers, a simple format is all that’s needed to document sales or services. These basic structures are straightforward and easy to implement, making them ideal for transactions that don’t require additional customization.

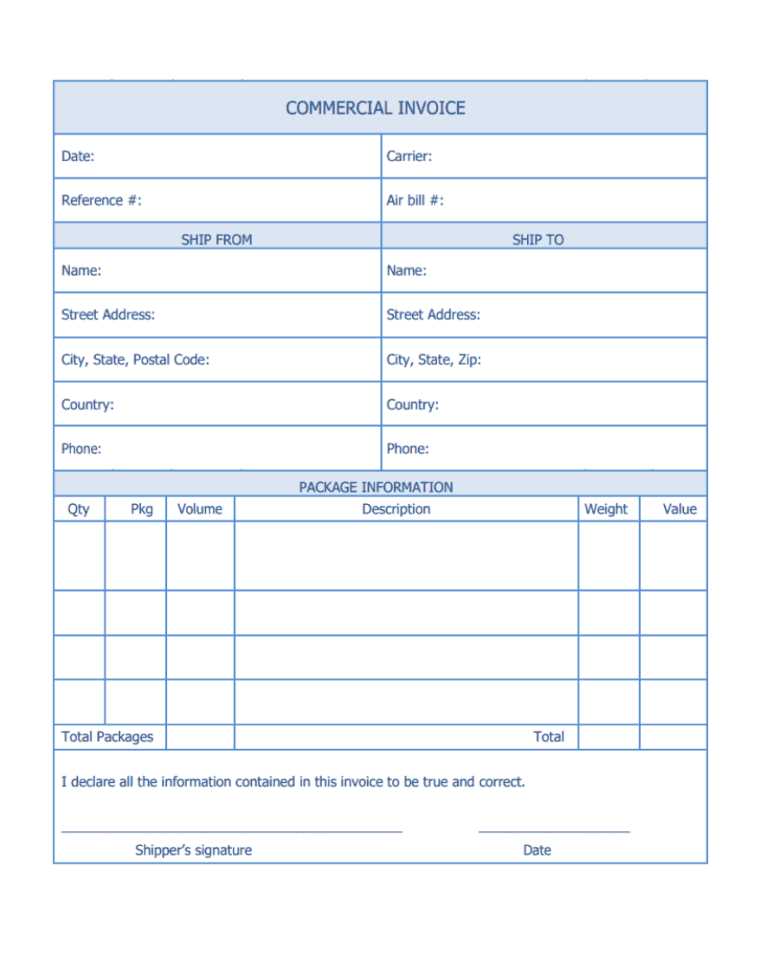

- Single-Page Layout: A compact, one-page design that includes all the essential details like the buyer and seller information, items or services sold, and the total cost.

- Simple List Format: A basic itemized list, where each product or service is listed with its description, quantity, and price, followed by the total amount.

Advanced Formats

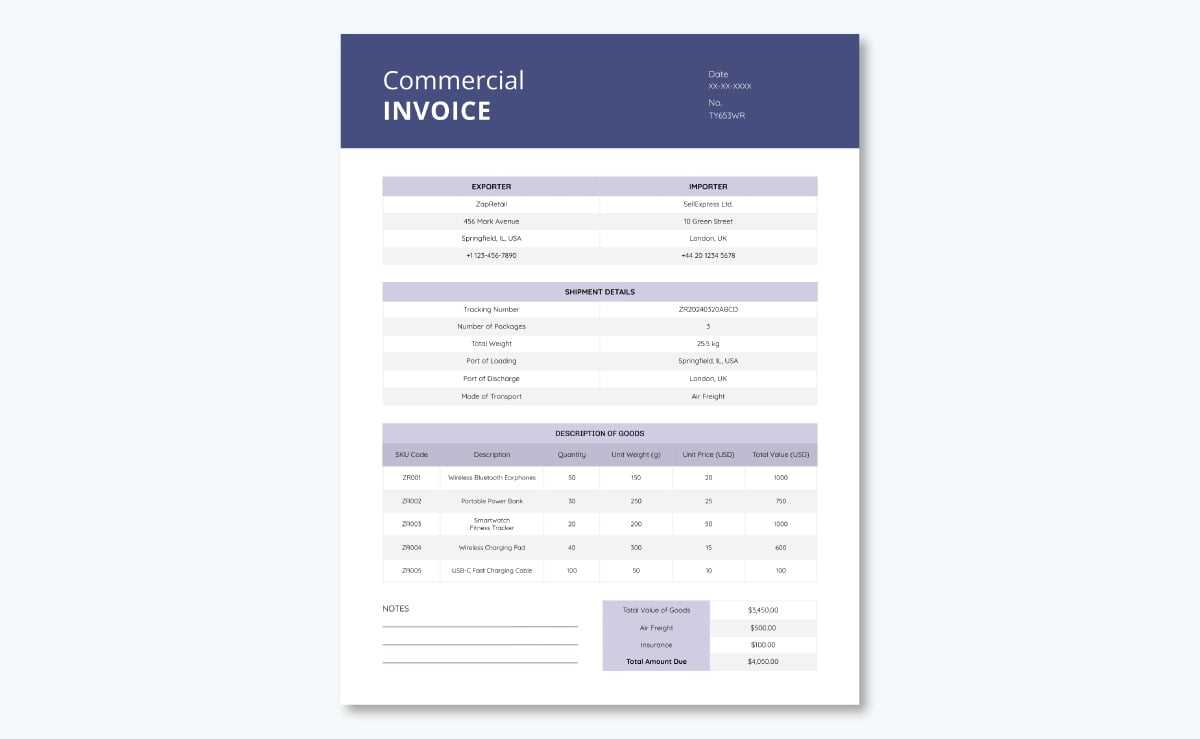

For larger businesses or more complex transactions, an advanced format might be necessary. These formats offer more sections for detailed information and include additional calculations for taxes, discounts, and shipping fees.

- Itemized Breakdown: A detailed format that lists each product or service separately, often with a breakdown of taxes and shipping costs.

- Multi-Page Layout: Used for larger or international transactions, this format may include multiple pages to accommodate additional information such as terms and conditions, payment instructions, and shipping details.

- Template with Payment Terms: Includes fields for payment deadlines, late fees, and accepted payment methods, helping to streamline the payment process.

How to Include Payment Terms

Clearly specifying payment terms in your billing document is essential for ensuring timely and accurate payments. These terms outline when and how the buyer is expected to pay, as well as any additional fees for late payments or early settlement discounts. Including these details not only clarifies expectations but also helps prevent misunderstandings between both parties.

Key Payment Terms to Include

When drafting payment terms, it’s important to be precise and concise. Here are the most common terms businesses use to set clear guidelines for payments:

- Due Date: Clearly state the exact date by which payment should be made, such as “Payment due within 30 days from the date of the document.”

- Accepted Payment Methods: List the methods you accept, such as credit card, bank transfer, or online payment platforms (e.g., PayPal, Stripe).

- Late Payment Penalties: If applicable, specify any late fees or interest charges that will apply if the payment is not received on time.

- Discount for Early Payment: Mention any discounts or incentives offered for early payment, such as “2% discount if paid within 10 days.”

- Currency and Exchange Rates: For international transactions, include the currency in which the payment should be made and any exchange rate considerations.

Additional Considerations

While the above payment terms are standard, you may need to customize them based on your business model or industry-specific requirements. Including payment terms that reflect your unique needs helps maintain a smooth cash flow and fosters positive client relationships.

- Partial Payments: If you allow installment payments, be sure to outline the schedule and amounts for each installment.

- Refund Policy: If applicable, clearly state your refund policy, especially if your goods or services are non-refundable or come with conditions.

Numbering and Organization Tips

Properly numbering and organizing your billing documents is crucial for maintaining order in your financial records. A clear and systematic approach not only helps you track payments more efficiently but also ensures that you stay compliant with accounting practices. By implementing an organized structure, you can quickly locate past transactions and prevent confusion over document references.

Best Practices for Numbering

Consistent numbering helps both you and your clients easily track payments and identify specific transactions. Here are some tips for creating an effective numbering system:

- Sequential Numbers: Always use a consecutive numbering system. Each new document should have a unique number that follows the last one to maintain a logical order.

- Include Prefixes or Dates: To categorize and organize your records, consider adding prefixes or dates to the numbers, such as “INV-2024-001” for documents issued in 2024.

- Avoid Gaps: Never skip numbers, as this could create confusion and make it harder to track the flow of payments and orders.

Organizing Your Documents

Efficient organization of your billing records ensures that all relevant details are easy to find when needed. Here’s how you can keep your documents well-organized:

| Tip | Description |

|---|---|

| Digital Filing System | Use folders or cloud storage to categorize your documents by year, client, or project for easy access and retrieval. |

| Consistent Naming Convention | When saving files digitally, use consistent naming formats, such as “ClientName_InvoiceNumber_Date” to make searching more efficient. |

| Track Payments | Maintain a spreadsheet or financial software where you can log payments against each document number, ensuring you always know the payment status. |

By adopting these numbering and organization practices, you’ll improve your ability to track, manage, and reference all your business transactions with ease. This structured approach also enhances professionalism, fostering stronger relationships with your clients.

Tips for Accurate Product Descriptions

Providing clear and accurate product descriptions is essential for both the buyer and seller to ensure that the details of the transaction are understood and agreed upon. A well-written description helps avoid misunderstandings, ensures transparency, and serves as a reference point for both parties. It also reduces the chances of disputes, returns, and refund requests.

Key Elements of an Effective Description

When drafting a product description for your billing document, consider the following tips to ensure accuracy and clarity:

- Be Specific: Provide precise details about the product, including size, color, material, model, and any other distinguishing features. The more specific you are, the less room there is for confusion.

- Use Clear Language: Avoid jargon or ambiguous terms. Use straightforward language that anyone, even without technical knowledge, can understand.

- Include Quantities: Always state the quantity of each product being sold. This is crucial for both pricing and inventory tracking.

- Include Serial Numbers or SKUs: For inventory or warranty purposes, list any relevant serial numbers, stock keeping units (SKUs), or barcodes.

- Highlight Customization: If the product is customized, include details of any specific modifications or personalized features requested by the customer.

Additional Considerations

Beyond the basic details, there are other important factors to consider when crafting product descriptions:

- Accuracy in Pricing: Ensure the price for each item matches the agreed-upon cost and reflects any discounts or promotions accurately.

- Descriptions of Services: If selling services, describe the scope of work, timeline, and any deliverables or milestones clearly.

- Dimensions and Weight: For physical products, including dimensions and weight helps avoid confusion about shipping costs or storage requirements.

By providing accurate and detailed descriptions, you enhance the professionalism of your business and foster trust with your clients, leading to more successful transactions.

Shipping Information in Billing Documents

Including accurate shipping details in your billing records is essential for smooth and efficient delivery of products. Proper shipping information not only ensures that the buyer receives their items promptly but also serves as a reference in case of any issues with the delivery. Clear shipping terms help manage expectations and prevent misunderstandings regarding delivery times and costs.

Key Shipping Details to Include

To ensure your customer receives their order correctly and on time, it’s important to provide specific information related to shipping. Here are the most essential shipping details to include:

- Delivery Address: Clearly state the recipient’s full address, including the street name, city, postal code, and country. Double-check the accuracy to avoid delivery issues.

- Shipping Method: Specify the carrier or shipping service being used (e.g., FedEx, UPS, DHL) and the type of service (standard, expedited, etc.).

- Shipping Date: Indicate when the product was shipped or when it is expected to ship, as well as any tracking information if available.

- Shipping Costs: Outline any charges related to shipping, including any special fees for expedited or international shipping.

- Estimated Delivery Date: If possible, provide an estimated delivery date to help the buyer plan accordingly.

Additional Considerations

Beyond the basic shipping details, there are a few additional points that can help ensure smoother transactions:

- Handling Fees: If applicable, mention any packaging or handling fees associated with the shipment.

- Customs Information: For international orders, include any customs duties, taxes, or import restrictions that might apply to the shipment.

- Special Instructions: If there are any specific instructions for delivery, such as requiring a signature upon arrival or leaving the package in a specific location, be sure to include those details as well.

By providing clear and detailed shipping information, you not only improve the customer experience but also reduce the chances of delivery-related issues. This level of transparency helps build trust with clients and contributes to overall satisfaction with your service or products.

Legal Requirements for Billing Documents

When creating billing records, it’s important to understand the legal requirements that govern them. These requirements ensure that the document is valid for business and tax purposes and compliant with local and international regulations. By including the necessary legal information, businesses protect themselves and avoid potential disputes with customers, tax authorities, and customs officials.

Essential Legal Information

Billing documents should include specific details to meet legal standards. Below is a summary of key elements typically required by law:

| Required Element | Description |

|---|---|

| Seller’s Details | The full legal name, address, and tax identification number of the seller. This ensures the document is tied to a legitimate business entity. |

| Buyer’s Details | The full name and contact information of the buyer, including the address. This helps identify both parties in the transaction. |

| Unique Document Number | A unique identifier for the document, often sequentially numbered, ensuring proper tracking and referencing of each transaction. |

| Date of Issue | The date the document was generated. This is crucial for determining payment deadlines, taxes, and other timelines. |

| Payment Terms | Clearly outlined terms regarding the payment due date, method of payment, and any penalties for late payment. |

| Itemized List | A detailed description of goods or services provided, including quantity, price, and applicable taxes, to avoid ambiguity. |

| Tax Information | Depending on the jurisdiction, tax rates, VAT/GST numbers, and the total tax amount must be clearly stated. |

International Considerations

If your business involves cross-border transactions, additional legal requirements may apply. International laws often require specific information, such as:

- Customs Declaration: For exports, customs paperwork may need to be included to declare the value and nature of goods for duty and tax purposes.

- Currency and Conversion: International transactions should specify the currency in which the payment is due, and conversions must be clearly noted if necessary.

- Export Licenses: In some cases, exporting goods may require proof of an export license, which must be referenced in the billing document.

By ensuring compliance with legal requirements, businesses can protect themselves from financial and legal risks while maintaining transparency and professionalism in all transactions.

How to Handle International Billing Documents

Managing cross-border transactions requires careful attention to detail, as international sales come with unique challenges. In addition to meeting standard requirements, businesses must navigate different currencies, tax laws, customs regulations, and payment methods. Understanding how to properly manage international billing documents helps ensure smooth transactions and compliance with all relevant rules.

Key Considerations for International Transactions

When handling billing records for international customers, it’s essential to account for various factors that may differ from domestic sales. Below are the most important aspects to include:

| Aspect | Details |

|---|---|

| Currency and Conversion Rates | Specify the currency in which the payment is due and include any applicable exchange rate information if payment is made in a different currency. |

| Customs and Duties | Clearly outline the responsibility for customs fees and import duties. In many cases, the buyer may be responsible for paying these fees upon arrival of goods in their country. |

| Tax Requirements | Include the appropriate tax rates (such as VAT or GST) based on the destination country. Ensure compliance with international tax rules. |

| Shipping Terms | Indicate the shipping method, expected delivery time, and any special shipping terms like Incoterms (e.g., FOB, CIF) that define who is responsible for shipping costs, risks, and duties. |

| Payment Methods | List acceptable payment methods, such as wire transfers, credit cards, or online payment platforms like PayPal. Specify if payments should be made in the seller’s local currency or another currency. |

Best Practices for International Billing

Aside from the key details mentioned, following these best practices can help facilitate international transactions:

- Clear Language: Use straightforward and clear language to avoid confusion over terms, especially if dealing with language barriers. Consider providing a translated version of the document if needed.

- Documentation: Include all necessary documents for customs clearance and proof of delivery. This may include a commercial receipt, packing list, or certificate of origin for specific products.

- Time Zones and Deadlines: Be mindful of time zone differences when setting payment due dates and handling follow-ups.

- Track Payments: Use reliable tracking systems to monitor international payments, as cross-border transactions can sometimes face delays or issues with currency conversions.

By addressing these specific needs and ensuring that all aspects of international billing

Choosing the Right Currency for Your Billing Document

When conducting international transactions, selecting the correct currency is a critical step in ensuring smooth and accurate financial exchanges. The currency you choose impacts the overall cost of the transaction, as well as how both parties manage payments and exchange rates. It’s essential to consider factors such as the buyer’s location, the currency stability, and any applicable conversion fees when making your decision.

Factors to Consider When Selecting Currency

Several key aspects should be evaluated before determining the appropriate currency for your billing document:

- Location of the Buyer: The most straightforward option is to use the buyer’s local currency, as this simplifies the payment process for them and avoids confusion. However, this may not always be feasible if you deal with multiple international clients.

- Currency Exchange Rates: If you are dealing with multiple currencies, keep an eye on the exchange rates between them. A fluctuating exchange rate could either benefit or disadvantage you, depending on market conditions.

- Transaction Costs: Certain currencies may incur higher fees for conversion or cross-border payments. Consider these additional costs when deciding on the billing currency to avoid unexpected charges for either party.

- Stability of the Currency: Some currencies are more volatile than others, which could affect the final amount your client pays. Using a stable and widely accepted currency, such as the US dollar or Euro, can help mitigate the risk of currency fluctuation.

Common Currency Options for International Transactions

While the choice of currency will depend on your specific circumstances, here are some common options that are often used in global transactions:

- US Dollar (USD): Widely accepted and recognized around the world, the USD is a popular choice for international trade, particularly in industries like technology and commodities.

- Euro (EUR): The Euro is commonly used in the European Union and beyond, making it a good option for transactions involving clients in European markets.

- British Pound (GBP): If your business is based in the UK or your client is located there, the British Pound might be the best choice for both parties.

- Local Currency: Using the client’s local currency is often the most customer-friendly option, although it may come with additional complexity in terms of conversion rates and processing fees.

Ultimately, the right currency for your billing document will depend on your business model, customer preferences, and any financial considerations you must account for. It’s essential to communicate with your client in advance to ensure that both parties are comfortable with the chosen currency and any potential fees associated with it.

Invoice Software vs Manual Creation

When creating billing documents, businesses have two primary options: using specialized software or manually crafting the document from scratch. Both methods have their advantages and drawbacks, and the choice between them depends on factors such as the size of the business, frequency of transactions, and the level of customization needed. Understanding the differences between these approaches can help businesses choose the most efficient solution for their needs.

Advantages of Using Software

Using software to generate billing documents can provide several benefits, especially for businesses that deal with a high volume of transactions or require more advanced features. Some key advantages include:

- Efficiency: Software automates many aspects of the document creation process, significantly reducing the time and effort required to generate accurate bills.

- Accuracy: Many software programs include built-in calculations for taxes, totals, and discounts, minimizing the risk of human error.

- Customization: Invoice software often allows for easy customization, enabling businesses to incorporate their branding, add payment terms, and include specific fields that suit their industry.

- Record Keeping: Most software options offer storage features, making it easy to organize and retrieve past records, which is especially useful for audits and reporting.

- Integration: Software solutions often integrate with accounting and payment systems, simplifying financial management and improving overall workflow.

Drawbacks of Using Software

Despite its benefits, software may not be the ideal solution for all businesses. Some drawbacks to consider include:

- Cost: Many software solutions require a subscription or one-time payment, which can be a significant expense for small businesses or those with a limited budget.

- Learning Curve: Some software options may require time to learn, especially if they offer advanced features or complex interfaces.

- Dependence on Technology: Relying on software means you must ensure your computer systems are always up and running, with occasional updates and maintenance to keep everything functioning smoothly.

Advantages of Manual Creation

For businesses with fewer transactions or those that prefer a hands-on approach, manually creating billing documents may be a suitable option. The key advantages include:

- Cost-Effective: Manual creation involves no ongoing subscription costs or software purchases, making it a budget-friendly option for small businesses.

- Flexibility: When manually creating documents, businesses have full control over the structure,

How to Avoid Common Billing Document Errors

Creating accurate billing records is crucial for maintaining a smooth financial workflow and avoiding disputes with clients. However, even small mistakes can lead to delays in payments, confusion, or legal issues. By being aware of common errors and taking proactive steps to avoid them, businesses can ensure their records are both accurate and professional.

One of the most frequent mistakes is incorrect contact information. This includes misspelled names, incorrect addresses, or missing details. Always double-check the buyer’s contact information to ensure that payments are processed without delay. Additionally, it’s essential to make sure the document includes the correct legal and financial data, such as tax identification numbers and payment terms, to avoid compliance issues.

Another common error is failing to properly list or describe products and services. Ensure that each item is clearly described, with accurate quantities, prices, and any applicable discounts or taxes. Ambiguous descriptions can lead to confusion or disputes over what was delivered or the total amount due.

It is also important to check the payment terms, including the due date, payment method, and any applicable late fees. Failure to clearly outline these terms can result in delayed or missed payments. Additionally, be sure to properly number your billing records and follow a consistent numbering system to maintain accurate records and avoid duplication.

Lastly, always verify the totals. Errors in calculation are easy to make but can be costly. Double-check all math, especially tax calculations, discounts, and the final amount due. Using automated tools or software can help reduce the likelihood of errors in calculations.

By taking the time to carefully review each document, businesses can minimize the risk of errors and ensure their billing process runs efficiently, helping maintain good relationships with clients and avoiding unnecessary complications.

Best Practices for Billing Document Design

The design of a billing document plays a significant role in ensuring clarity, professionalism, and efficiency in financial transactions. A well-designed document not only helps the recipient quickly understand the details of the payment but also reflects positively on your business. By following a few best practices in the design and layout of your documents, you can avoid confusion and make it easier for clients to process payments on time.

Key Elements of Effective Billing Design

When designing your billing document, it is important to include several key elements that contribute to both functionality and aesthetics. These elements help organize the information in a clear and logical manner:

Element Description Branding Incorporate your company logo and color scheme to ensure your document is immediately recognizable. This helps to reinforce your brand identity and maintain professionalism. Header Information Include the date, unique document number, and contact details at the top of the document. This ensures easy reference and helps avoid confusion. Clear Itemization List products or services in a clear, detailed manner with descriptions, quantities, unit prices, and total amounts. This eliminates any ambiguity for the recipient. Payment Details Clearly state the payment due date, payment methods, and any applicable terms, such as late fees or discounts. This helps clients understand their obligations and avoid delays. Total Calculation Ensure that all calculations, such as taxes, discounts, and final amounts due, are displayed clearly. Break down totals to show transparency and avoid errors. Design Tips for Maximum Clarity

While the key elements are important, the overall layout and presentation also contribute to the document’s effectiveness. Here are some design tips to keep in mind:

- Simplicity: Keep the design clean and uncluttered. Avoid excessive text or unnecessary graphics that could distract from the essential details.

- Readable Fonts: Use clear, easy-to-read fonts.

Tracking and Storing Your Billing Documents

Efficiently tracking and storing your billing records is essential for smooth business operations, ensuring that you can quickly access past transactions, manage finances, and remain compliant with tax regulations. Whether you’re managing a few records or thousands, implementing a reliable system for organizing and retrieving these documents is key to maintaining accurate financial data and preventing errors.

Why Proper Tracking is Essential

Maintaining a record of every transaction not only helps you monitor payments but also protects you in case of disputes or audits. Without proper tracking, you risk losing important financial information, which can lead to missed payments, duplicated entries, or legal complications. By implementing a structured tracking system, you ensure that all data is accounted for and easy to access when needed.

Here are some best practices for tracking your billing documents:

- Unique Document Numbers: Always assign a unique number to each record. This helps you keep track of each document’s status and prevents confusion with other records.

- Regular Updates: Ensure that your tracking system is updated regularly with each new transaction. Whether it’s through software or manual logs, staying current is key to maintaining accuracy.

- Set Reminders: Use reminders or alerts to notify you when payments are due or when a record requires follow-up. This keeps you proactive in managing accounts.

Best Methods for Storing Billing Documents

Once your records are properly tracked, it’s important to store them in an organized, secure manner. You can choose between physical storage or digital options, depending on your business’s needs. Here’s a comparison of both methods:

Storage Method Advantages Disadvantages Physical Storage Easy to access in the office, no technology required, tangible records. Space-consuming, hard to organize efficiently, vulnerable to damage or loss. Digital Storage Space-saving, easy to back up, allows for quick search and retrieval, secure with encryption. Requires reliable technology, potential security risks if not properly managed. For most businesses, digital storage is the most efficient and secure option. Cloud storage systems, in particular, provide flexibility and accessibility from anywhere, making it easier to manage and organize large volumes of records. Additionally, digital records can be easily backed up and protected with password encryption, reducing the risk of losing valuable data.

Whether you choose to store your records physically or digitally, the key is consistency. Keep your documents organized by date, client, or project, and always ensure they are easily accessible when needed. A good tracking and storage sys

Benefits of Digital Billing Documents

In today’s digital world, switching from traditional paper records to electronic billing systems offers numerous advantages. Digital solutions provide greater efficiency, accuracy, and flexibility, making it easier for businesses to manage their financial transactions. By adopting electronic billing, companies can streamline their processes, improve customer experience, and reduce operational costs.

Key Advantages of Using Digital Documents

Here are the main reasons why businesses should consider utilizing digital billing records:

- Faster Processing: Digital documents can be created, sent, and received almost instantly. This reduces delays compared to manual, paper-based systems, helping businesses accelerate their cash flow.

- Cost Efficiency: By eliminating the need for paper, printing, and postage, businesses can save money on administrative expenses. Digital solutions often come with affordable pricing models that scale with business needs.

- Easy Customization: Digital records allow for greater flexibility in design and content. You can easily adjust layouts, branding, or content to meet specific customer requirements without the need for reprints.

Security and Accuracy Benefits

Digital billing documents also provide enhanced security and accuracy, which are essential for maintaining business integrity.

- Reduced Errors: Automated tools can calculate totals, taxes, and discounts, minimizing the risk of human error. The accuracy of digital records also makes them easier to audit or review.

- Improved Security: Electronic records can be protected with encryption, password access, and other security measures to prevent unauthorized access or tampering. This reduces the risk of data loss compared to physical records.

Environmental and Practical Considerations

Going digital not only benefits your bottom line but also helps the environment. The reduction in paper usage leads to fewer resources consumed and less waste generated, contributing to a more sustainable business model. Furthermore, storing documents electronically eliminates the need for physical storage space, saving both office space and resources.

Comparison of Digital vs. Paper-Based Systems

Aspect Digital Solution Paper-Based Solution Speed Instant creation and delivery Time-consuming, requires manual mailing Cost Low cost, minimal overhead Printing, postage, and storage expenses