Free Blank Invoice Template PDF for Easy Customization

In today’s business environment, having a streamlined process for managing financial transactions is essential. A well-organized billing document can save time, reduce errors, and ensure prompt payment. Whether you’re a freelancer, small business owner, or part of a larger company, using a well-structured form for detailing payments is crucial to maintaining professionalism.

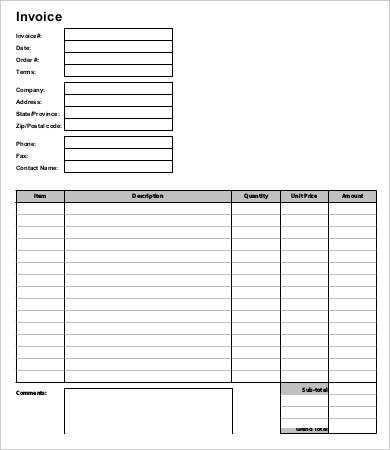

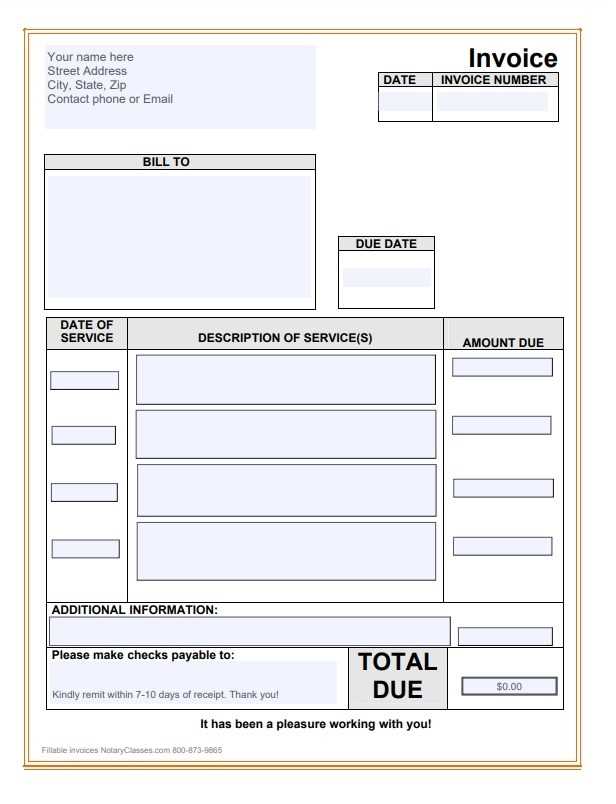

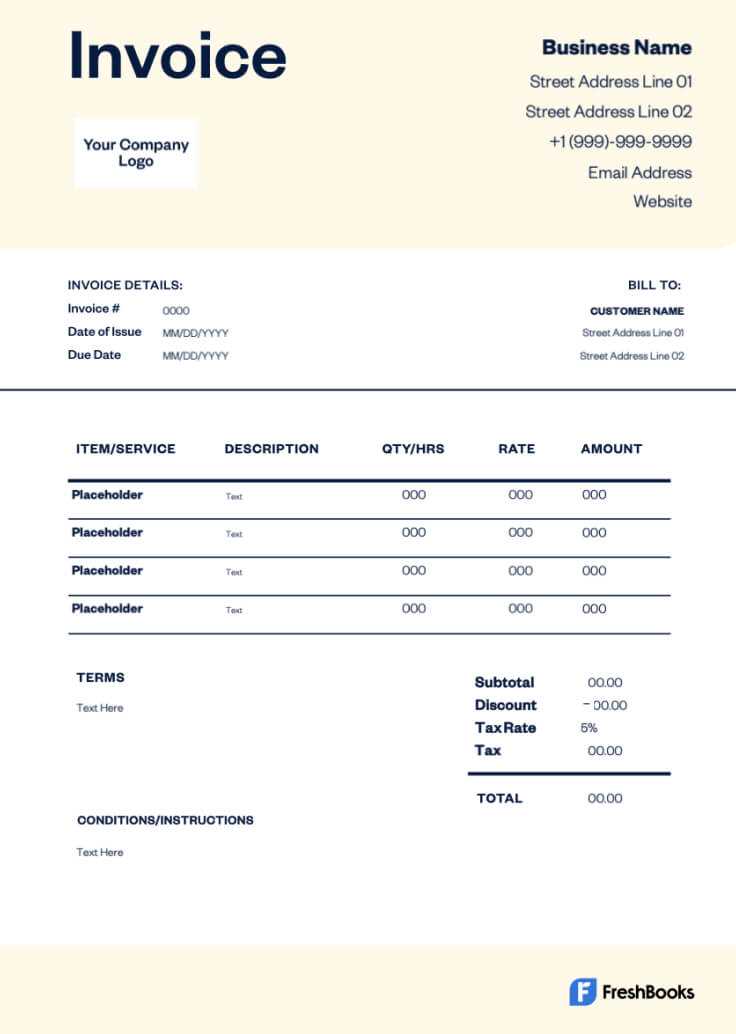

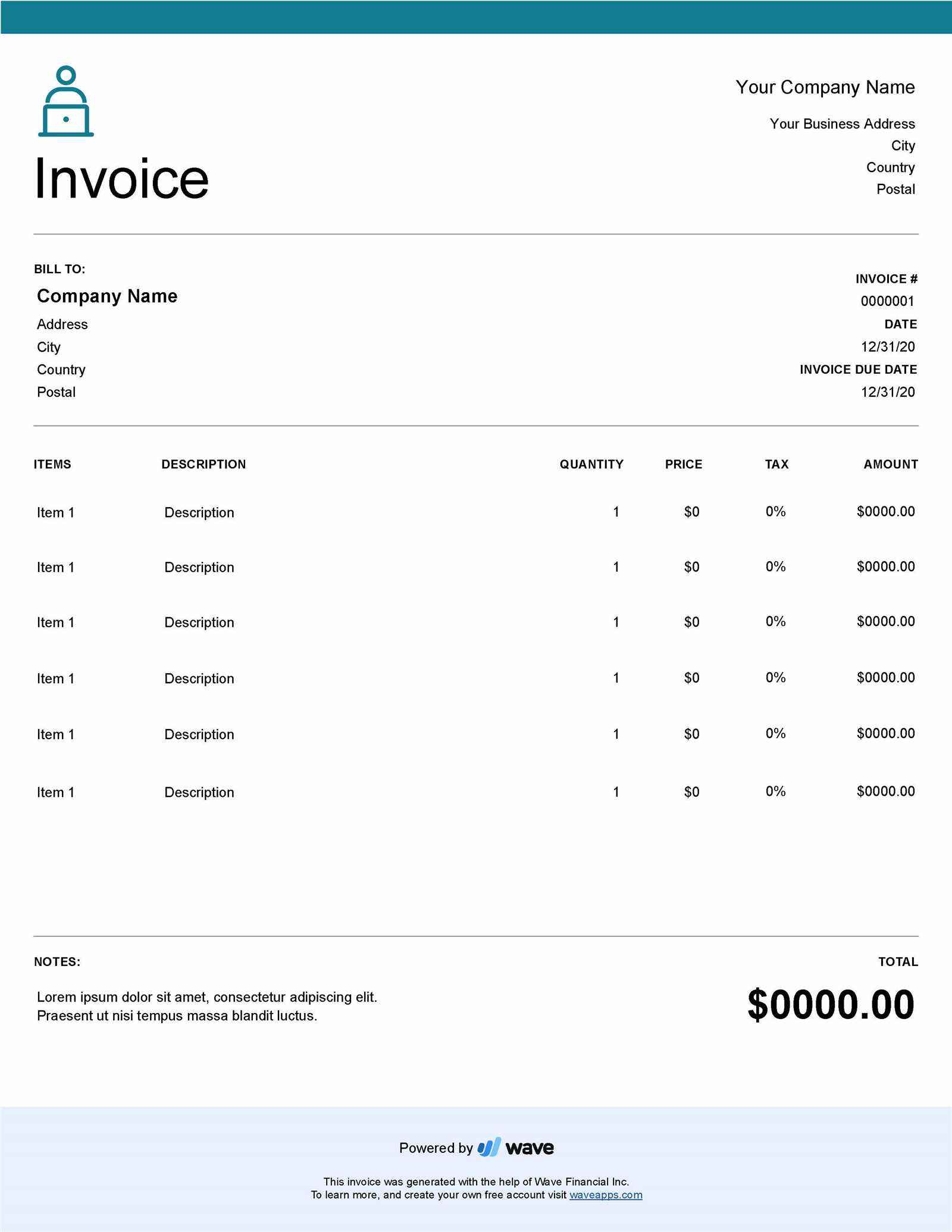

Customization is key when it comes to creating your own documents. By using a pre-made format, you can quickly tailor the details to your specific needs. The flexibility of these formats ensures that you can adjust the layout, fields, and content to fit your brand or industry requirements. This ease of use makes it simple for anyone to generate professional-looking records without needing advanced design skills.

Properly filling out your financial paperwork ensures that you communicate all the necessary information to clients, such as service dates, amounts due, and payment methods. With a ready-to-use document, you avoid common mistakes and maintain consistency across all your transactions.

Why Use a Blank Invoice Template

Having a ready-made document for billing is a simple yet effective solution for individuals and businesses alike. It allows you to focus on what truly matters–tracking payments and ensuring accuracy–while avoiding the repetitive task of creating new paperwork from scratch. With a standard structure in place, the process becomes quicker, more organized, and reliable.

Time-Saving Benefits

By using a pre-designed document, you save valuable time that would otherwise be spent designing or formatting your own. This efficiency is especially important when managing multiple transactions or working under tight deadlines. Some of the time-saving advantages include:

- Instantly available for use with no setup required.

- Predefined sections that guide you on what information to include.

- Reduced risk of formatting errors or missing details.

Professional Appearance

Maintaining a consistent and polished look in all your financial communications can enhance your reputation and build trust with clients. By using a uniform document, you ensure that each transaction appears professional and well-organized. Key advantages of this approach include:

- Clear, easy-to-read layout that communicates key details effectively.

- Ability to incorporate your business logo and branding elements.

- Improved client perception, increasing the likelihood of prompt payments.

Benefits of Free Invoice Templates

Using pre-made forms for financial documentation offers significant advantages, particularly for individuals and small businesses. These forms provide a structured approach, reducing the need for manual design and ensuring consistency in every transaction. By leveraging such resources, you can streamline your administrative tasks and maintain a professional image without added costs.

One of the key benefits of using these resources is their ability to save time. With a structured format in place, all you need to do is input the relevant details, which reduces the time spent on document creation and increases your overall efficiency. Additionally, these forms are often customizable, allowing for adjustments that align with your branding and specific needs.

Key Advantages

| Benefit | Explanation |

|---|---|

| Cost-Effective | No need to purchase specialized software or hire a designer, making this an affordable solution. |

| Efficiency | Predefined fields and sections enable quick data entry, saving valuable time on administrative tasks. |

| Consistency | Uniform documents maintain a professional appearance for every transaction, helping build trust with clients. |

| Customizability | Easily adjust the layout and details to fit your unique business needs and preferences. |

How to Download Invoice Templates

Accessing ready-made financial forms online is simple and quick. Most resources are available for immediate download, allowing you to start using them in just a few clicks. Whether you need a document for a one-time transaction or for ongoing use, finding and downloading the right form is a straightforward process.

Here are the general steps to follow when downloading these resources:

| Step | Action |

|---|---|

| 1. Visit a Trusted Source | Search for reputable websites that offer reliable and secure document downloads. Look for platforms with positive reviews and clear instructions. |

| 2. Select the Desired Format | Choose the format that suits your needs, such as a file compatible with text editors or spreadsheet software. |

| 3. Download the File | Click the download link and save the file to your device. Ensure the file type matches your preferred software for easy editing. |

| 4. Open and Customize | Open the downloaded file with the appropriate software, then fill in your details and make any necessary adjustments. |

By following these simple steps, you can quickly obtain the forms you need to streamline your billing process and create professional documents.

Choosing the Right PDF Format

Selecting the appropriate file format for your financial documents is essential to ensure compatibility, ease of use, and security. While there are various options available, the format you choose will depend on how you intend to share or store the document. Understanding the benefits of each option helps you make an informed decision that aligns with your business needs.

Key Considerations When Choosing a Format

Different file formats offer unique advantages, especially when it comes to sharing, editing, and storing important documents. The most common formats are those that maintain the integrity of your design and content, regardless of the device or software used by the recipient. Here are the factors to keep in mind when choosing the right file format:

| Factor | Consideration |

|---|---|

| Compatibility | Ensure that the format is universally accessible across devices and platforms, such as desktops, tablets, and mobile phones. |

| Security | Some formats allow you to add passwords or encryption to protect sensitive data, offering greater control over document access. |

| Preservation of Design | Choose formats that maintain the layout and formatting exactly as you intended, ensuring that your document looks the same on all devices. |

| Editing Flexibility | Consider whether the format allows easy editing or if it locks the content to prevent modifications after sharing. |

When to Use Each Format

Understanding when to use specific file types is crucial to optimizing workflow and ensuring that your document reaches the recipient in the best possible form. Some formats are best for quick edits, while others are ideal for secure sharing and storage. Knowing the right time to choose a particular file type ensures that your document serves its intended purpose effectively.

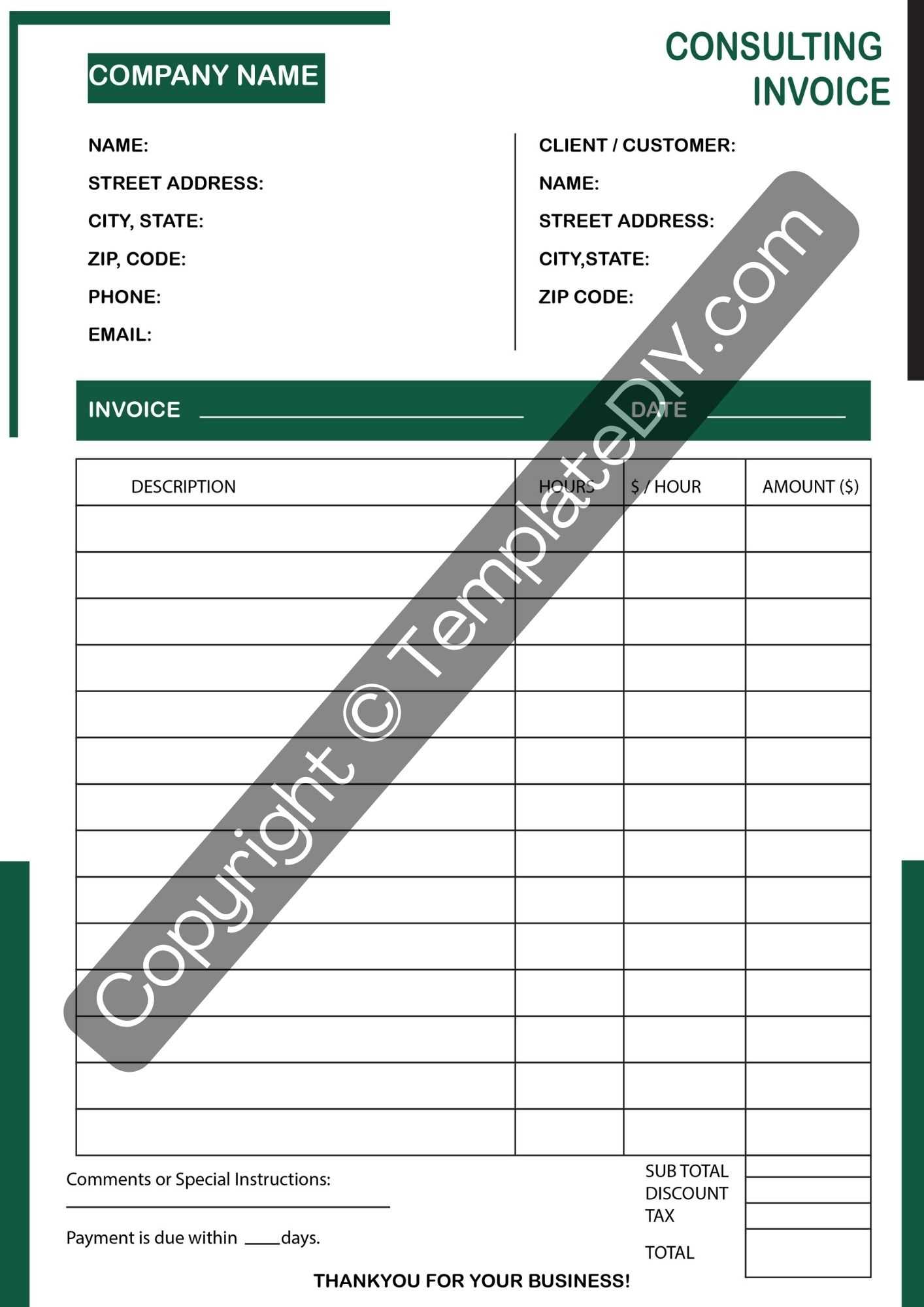

Customization Options for Invoice Templates

One of the key advantages of using pre-designed financial documents is the ability to personalize them to suit your specific needs. Customizing these forms allows you to reflect your business’s identity while ensuring that all necessary details are clearly presented. Whether you’re adding a logo, changing the layout, or adjusting field placements, the flexibility of these forms makes them adaptable to various industries and preferences.

Key Customization Features

Depending on the platform or tool you use, there are several ways to modify the look and content of your documents. Some of the most common customization options include:

- Branding: Add your company logo, color scheme, and business information to align with your brand’s identity.

- Field Adjustments: Modify the fields to include specific details such as tax information, discounts, or payment terms.

- Layout Changes: Adjust the layout to fit the nature of your products or services, ensuring clarity and ease of understanding for your clients.

- Currency and Language: Select the appropriate currency and language to accommodate international transactions.

Why Customization Matters

Customizing your financial documents is not only about aesthetics; it’s also about functionality and clarity. Personalized forms ensure that clients receive the right information in a format that’s easy to read and understand. By tailoring the document to fit your specific business practices, you create a professional impression while streamlining the communication process with your customers.

Easy Invoice Creation with Templates

Creating professional billing documents doesn’t have to be a time-consuming task. By using pre-designed forms, you can easily generate accurate and well-organized financial statements in just a few steps. These ready-made structures eliminate the need to start fro

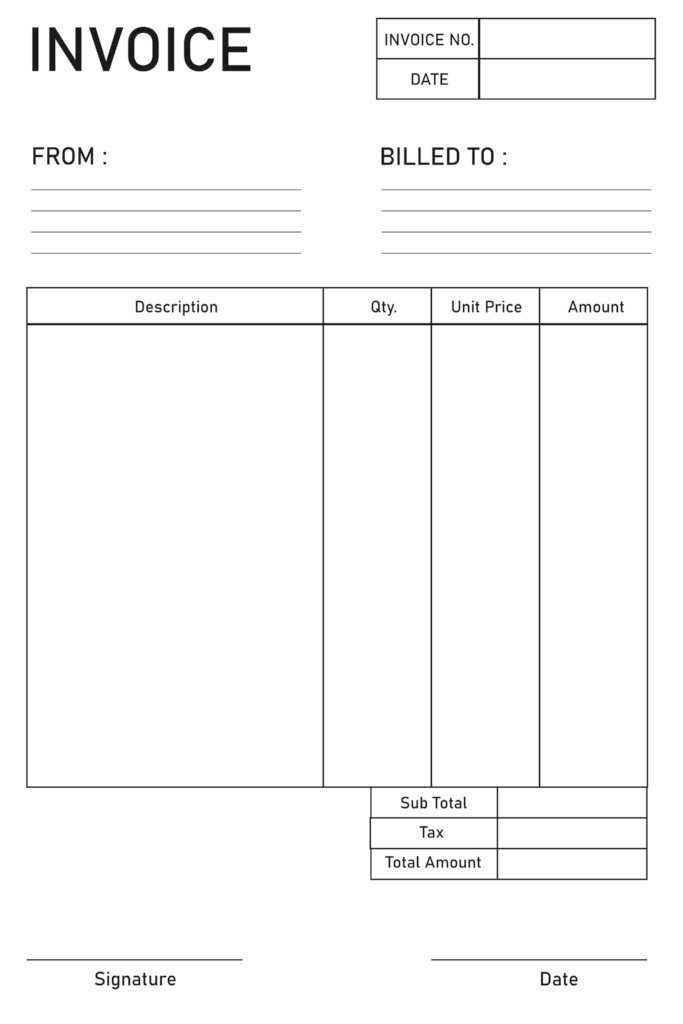

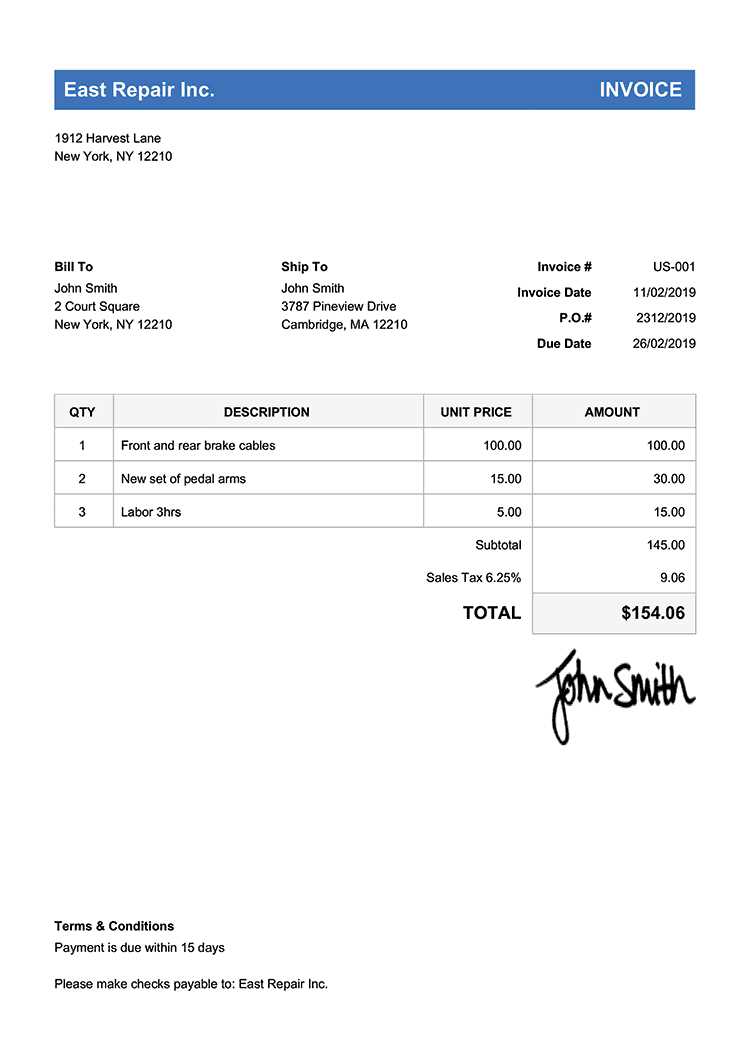

Essential Information to Include on Invoices

When creating billing documents, it’s crucial to ensure that all necessary details are included for clarity and legal purposes. An accurate and comprehensive document helps prevent disputes, ensures timely payments, and maintains a professional image. Including the right information not only facilitates smooth transactions but also meets business and legal requirements.

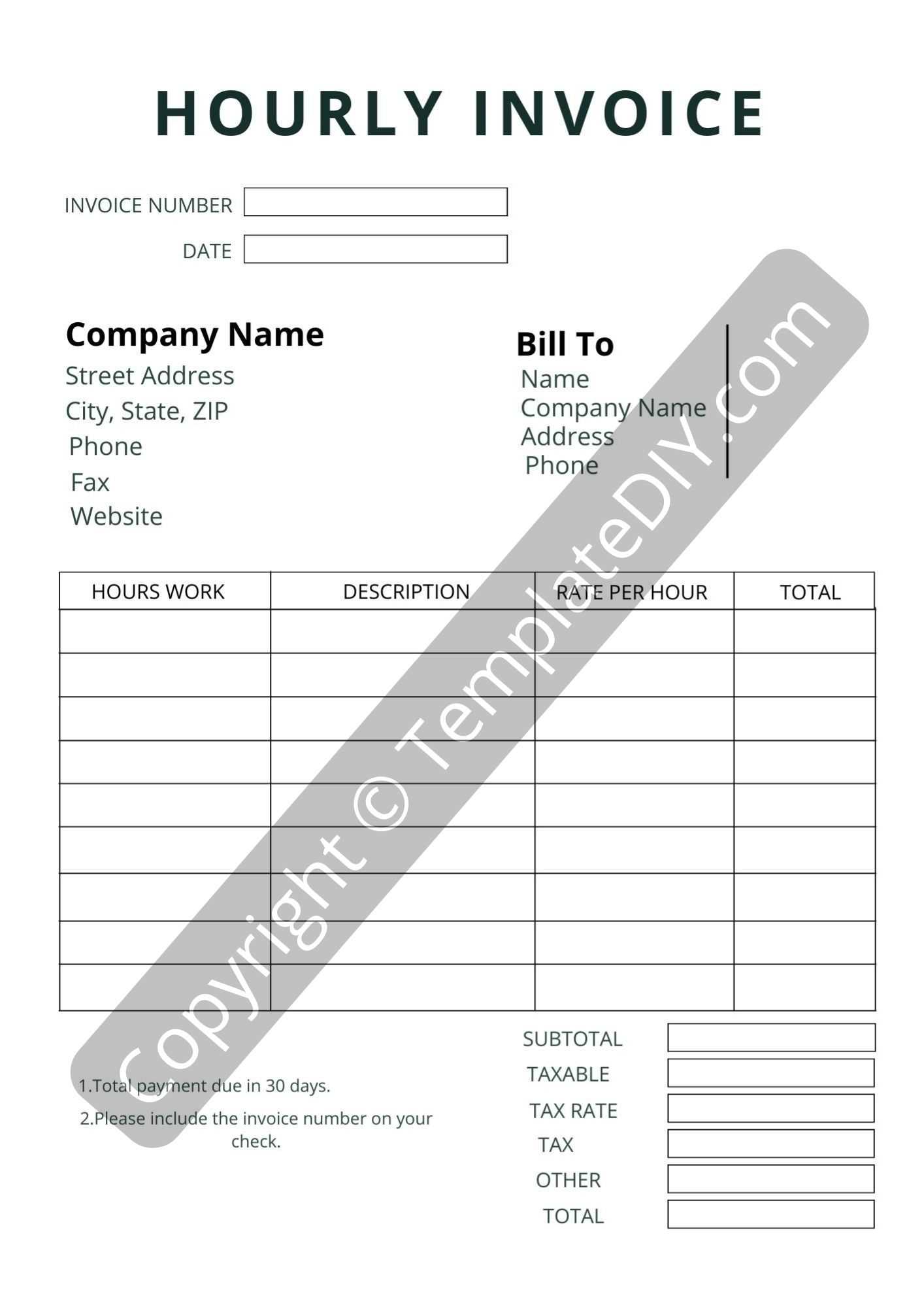

Key Details to Include

Here are the most important elements that should be present on every financial statement:

| Item | Description |

|---|---|

| Contact Information | Include your business name, address, phone number, and email. Also, provide the recipient’s contact details for reference. |

| Document Number | A unique identification number for each transaction, helping both parties track the document. |

| Issue and Due Dates | The date the document is created and the payment due date to set expectations for the client. |

| Itemized List of Services/Products | A clear breakdown of the goods or services provided, including descriptions, quantities, and unit prices. |

| Payment Terms | Detail any conditions such as payment deadlines, accepted methods, and late fees. |

| Total Amount | Include the total amount due, factoring in any taxes, discounts, or additional charges. |

Why This Information Matters

Ensuring that your billing document contains all necessary information promotes transparency and reduces the risk of misunderstandings. This also serves as a legal record in case of disputes, providing both parties with a clear reference to what was agreed upon. By including all relevant details, you maintain professionalism and establish a reliable foundation for your financial transactions.

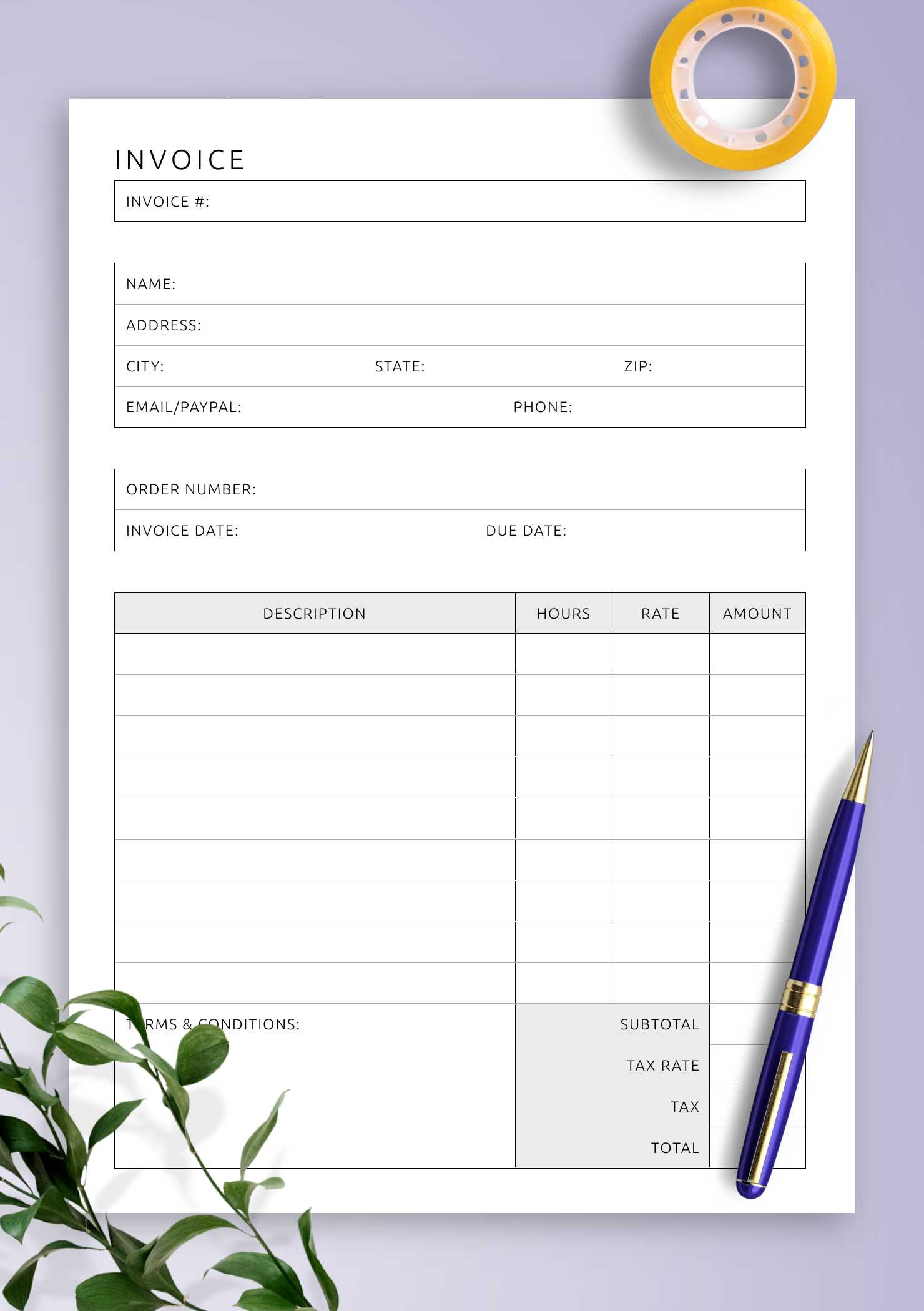

How to Fill Out an Invoice

Completing a financial document involves entering all relevant details in the correct sections to ensure that it is both clear and accurate. Properly filling out the form helps to avoid misunderstandings and guarantees that the recipient has all the necessary information to process the payment promptly. Whether you’re working with a one-time client or managing ongoing transactions, following a systematic approach will save time and reduce errors.

Step-by-Step Guide to Completing the Form

Follow these steps to accurately complete a financial document:

- Enter Your Information: Start by adding your business name, address, phone number, and email at the top of the form.

- Client Details: Include the recipient’s name, company, and contact details for easy reference.

- Assign a Unique Number: Provide a unique reference number for tracking purposes. This helps both you and the client keep records organized.

- List the Goods or Services: Break down what was provided, including a description, quantity, and price for each item or service. Be as specific as possible.

- Set the Dates: Clearly mark the date the document is issued and when the payment is due. This sets clear expectations.

- Calculate the Total: Add up the costs and ensure you include taxes, discounts, or any additional charges, if applicable.

- Payment Terms: Specify the payment methods accepted, and any late fees or conditions if applicable.

Double-Check for Accuracy

Once you’ve filled out the form, take a moment to review all the details for accuracy. Ensuring that there are no typos, incorrect amounts, or missing information will make the process smoother for both you and your client. A well-filled document reflects professionalism and builds trust.

Common Mistakes in Invoice Creation

While generating financial documents is a straightforward process, several common errors can hinder their effectiveness and create confusion. These mistakes can lead to delayed payments, miscommunications, or even legal issues if not addressed properly. Understanding and avoiding these pitfalls will help ensure a smoother transaction process and maintain professional relationships with clients.

Frequent Errors to Avoid

Here are some of the most common mistakes that occur when filling out financial statements:

- Incorrect or Missing Details: Forgetting to include important contact information, such as business or client details, can cause delays and confusion.

- Unclear Descriptions: Failing to clearly describe goods or services provided may result in misunderstandings and disputes over what was delivered.

- Not Including a Unique Reference Number: Every document should have a unique reference for tracking and organizing. Without it, both parties may have difficulty referring to specific transactions.

- Errors in Calculation: Mistakes in adding up totals, taxes, or discounts can lead to incorrect charges and lost trust.

- Omitting Payment Terms: Clearly outlining when payments are due and what payment methods are accepted can avoid confusion and ensure timely payment.

How to Prevent These Mistakes

To reduce the likelihood of making these errors, it’s important to establish a checklist. Double-checking your entries, ensuring that all required fields are filled out, and confirming calculations can save time and effort later on. Additionally, using an organized structure for each document can further minimize the risk of overlooking essential information.

Tips for Professional Invoicing

Creating well-structured and polished financial documents is an essential part of maintaining a professional image and ensuring that your business transactions run smoothly. Proper documentation not only ensures clarity but also builds trust with clients. By following a few key strategies, you can streamline the process and avoid common mistakes, resulting in better communication and timely payments.

Best Practices for Creating Clear Documents

Here are some helpful tips for enhancing the professionalism of your billing documents:

- Use a Consistent Format: Maintain a uniform structure for all financial documents. This consistency helps clients easily recognize your communications and understand the information presented.

- Be Clear and Concise: Avoid overloading the document with unnecessary details. Focus on the essential information, such as descriptions, quantities, prices, and dates.

- Keep It Legible: Use clear fonts and a readable layout. Ensure that all text is aligned and well-spaced to enhance readability and professionalism.

- Provide Multiple Payment Methods: Offering clients different options for paying helps speed up the process and accommodates their preferences.

- Set Clear Payment Terms: Clearly state payment due dates and any penalties for late payments. This establishes expectations and reduces confusion.

Enhancing Client Relationships

Professional billing documents can foster better relationships with clients by showing attention to detail and reliability. Prompt, accurate, and courteous invoicing encourages timely payments and promotes trust. Additionally, responding quickly to any questions about the document can enhance your reputation as a reliable partner.

Invoice Template for Small Businesses

For small enterprises, managing finances efficiently is crucial, and having the right document to request payments is an essential part of the process. A well-structured financial statement can streamline cash flow and ensure that transactions are processed smoothly. With the right layout, even small businesses can maintain a professional image while keeping administrative tasks manageable.

Key Features for Small Business Documents

When creating financial documents for your small business, consider these critical elements:

- Clear Contact Information: Ensure that both your details and your client’s contact information are easy to find. This includes names, addresses, phone numbers, and email addresses.

- Simple Structure: Keep the design simple yet functional. It should highlight the most important aspects: what was provided, how much it costs, and when it’s due.

- Tracking Number: Adding a unique reference number will help both you and your clients track the document for easy future reference.

- Payment Terms: Specify when payments are due and outline any late fees. This will help set clear expectations and reduce delays in payments.

- Breakdown of Services or Products: List out each service or product provided, with a brief description, quantity, and cost. This transparency helps avoid disputes later on.

Why It Matters for Small Businesses

For small business owners, professionalism is key to building long-term client relationships. A well-organized financial statement reflects the business’s attention to detail and fosters trust. Furthermore, using a standardized format for all requests ensures consistency and efficiency in tracking payments, which is vital for managing cash flow in a growing business.

Why PDF Format is Ideal for Invoices

When it comes to sending formal payment requests, the format of the document plays a crucial role in ensuring that it is professional, secure, and easily accessible. One format, in particular, stands out for its versatility and reliability. Understanding why this format is often the best choice can help improve the way you manage financial communications.

Advantages of Using This Format for Billing

Here are some reasons why this format is highly recommended for business-related documents:

- Universally Accessible: Almost every device, whether it’s a computer, tablet, or smartphone, can easily open and view files in this format, ensuring that your document is accessible to clients around the world.

- Maintains Consistency: Documents in this format retain their original formatting, meaning fonts, colors, and layout remain unchanged regardless of the device used. This ensures a professional appearance at all times.

- Secure and Non-editable: Once saved in this format, the file cannot be easily edited, making it a secure choice for sending sensitive financial details. This helps prevent tampering or unauthorized alterations.

- Small File Size: Documents in this format are typically compressed, making them easy to send via email without taking up too much storage or bandwidth.

- Easy to Print: This format is printer-friendly, which is useful if your clients prefer to receive a hard copy of the document for their records.

How to Leverage This Format for Efficiency

By utilizing this file type, businesses can ensure that their payment requests look professional, are secure, and are easy for clients to open. Whether sending through email or offering a downloadable link, this format provides a reliable and effective way to manage billing and financial correspondence.

How to Save and Print Your Invoice

Once you have created your payment request document, it’s important to save it in a way that ensures it remains secure and easily accessible. Additionally, printing a hard copy can be necessary for record-keeping or for clients who prefer a physical document. Here’s how you can efficiently save and print your financial statement for professional use.

To begin with, saving the document in a secure format is crucial. After ensuring that all the information is correct, choose a file format that will preserve the integrity of the document’s layout and content. You can then store it in a specific folder on your computer or cloud storage for easy access when needed.

When it comes to printing, make sure your document is aligned and formatted properly for a clear and professional presentation. Double-check that all the necessary details–such as your business information, payment terms, and itemized charges–are included before printing. Use a high-quality printer for the best results, and choose a clean, crisp paper for a polished appearance.

Free Invoice Templates vs Paid Options

When choosing a format for creating your billing documents, you may come across both free and paid solutions. While both options serve the same purpose of helping you generate professional payment requests, they come with different features, limitations, and benefits. Understanding the differences between these two can help you determine which one best suits your needs.

Advantages of Free Solutions

Free options are often a go-to for small business owners or individuals looking for basic functionality without any upfront cost. Here are some benefits:

- No Cost: As expected, free formats allow you to create billing documents without any initial investment.

- Simple to Use: Most free options are straightforward, allowing users to fill in essential details quickly and easily.

- Accessible: Many free formats are available online, which means you don’t have to download or install anything to get started.

Benefits of Paid Solutions

On the other hand, paid options typically provide enhanced features that can benefit businesses as they grow. Here’s why some choose to pay for these services:

- Customization: Paid solutions often offer greater customization options, allowing you to tailor your billing documents to your business’s unique needs.

- Advanced Features: With a paid plan, you may have access to features like automatic calculations, integration with accounting software, or the ability to create recurring billing schedules.

- Better Support: Many paid options come with customer support, providing assistance if you encounter any issues or have specific questions.

Ultimately, the decision to use a free or paid solution depends on your business requirements and the level of customization and functionality you need to create and manage your payment requests efficiently.

How to Share Invoices Digitally

Sharing your billing documents electronically has become an essential part of modern business practices. Not only does it save time and resources, but it also allows for faster transactions and easier record-keeping. Below are some efficient methods for sending your payment requests to clients in a digital format.

One of the most common ways to share your billing documents is by email. After saving the document in a format that preserves its layout, attach it to an email and send it directly to the recipient. Ensure the subject line is clear, and include any relevant details in the body of the email for easy reference.

Another option is using cloud storage services. Platforms like Google Drive, Dropbox, or OneDrive allow you to upload the document and share a link with the recipient. This method is particularly useful for larger documents or if you need to provide access to multiple clients at once.

For businesses that need regular or automated distribution of billing documents, consider using an invoicing or accounting software. These tools often have built-in features that allow you to send documents automatically via email or through secure online portals. This can streamline your workflow, ensuring that invoices are sent on time without manual effort.

Protecting Your Invoice Files

When managing payment records and financial documents, ensuring their security is crucial. Protecting your files from unauthorized access, tampering, or accidental loss is necessary for maintaining confidentiality and compliance. Below are some strategies for safeguarding your documents throughout their lifecycle.

1. Password Protection

One effective way to secure your documents is by using password protection. Many document editing tools offer the ability to set a password for files, restricting access to only those who know the code. This is especially useful when sharing files via email or online platforms.

2. Use Encryption

For an additional layer of protection, consider encrypting your files. Encryption transforms the document into an unreadable format without the appropriate decryption key. Even if someone intercepts the file, they will be unable to view its contents without access to the correct password or key.

3. Backup and Cloud Storage

Backing up your financial documents regularly is an essential step in protecting against data loss. Cloud storage services can offer automatic backups and secure data encryption. Choose a reputable service that offers a combination of security features and easy access for authorized users.

4. Secure Sharing Methods

When sharing files, always opt for secure methods such as encrypted email services or file-sharing platforms with secure links. Avoid sending sensitive files through unsecured channels like regular email attachments or unprotected websites to minimize the risk of data breaches.

5. Regular Updates

Ensure that your software, including any applications used to create, store, or manage these documents, is kept up-to-date. Regular updates often contain security patches that protect your data from known vulnerabilities.