Download Free Garage Invoice Template for Easy Billing

Managing payments efficiently is crucial for any business, especially when it comes to handling customer transactions. A well-structured document can help streamline the process, ensuring that all charges are clear and accurate. Whether you’re offering repair services, maintenance, or other solutions, having a reliable tool for recording payments makes tracking and organizing much easier.

Properly formatted documents are essential not only for maintaining organization but also for building trust with clients. A clear and professional layout can reduce errors, prevent misunderstandings, and reflect positively on your business operations. By using the right design, you ensure that all important information is presented in a straightforward manner, helping both you and your customers stay on the same page.

In this guide, we will explore how you can quickly set up a document that suits your needs without the hassle of creating one from scratch. You will discover how to customize it, what essential details to include, and how to make sure it meets both legal and professional standards.

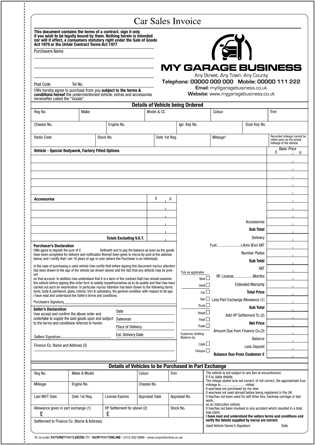

Free Garage Invoice Template Overview

When managing payments for automotive services, it’s important to have a reliable document that ensures all financial transactions are recorded clearly and accurately. A structured and easy-to-use form can save you time, prevent errors, and help you maintain professionalism in your business operations. This type of document typically includes key details such as service descriptions, costs, and payment terms, offering both you and your clients a clear overview of the transaction.

Many businesses rely on pre-designed forms to make billing simple and efficient. These forms are often customizable, allowing you to add your business name, logo, and any specific terms tailored to your needs. By choosing the right format, you can ensure that each transaction is documented in a way that aligns with both your business requirements and client expectations.

| Feature | Description |

|---|---|

| Customizable Fields | Modify sections to suit your business, such as service descriptions and pricing. |

| Professional Layout | Organized design for clarity and better presentation of details. |

| Easy Tracking | Helps monitor payments, outstanding balances, and due dates. |

| Legal Compliance | Meets local and industry-specific standards for documentation. |

With the right tools, creating and managing these documents becomes a seamless part of your business workflow. A reliable document format not only ensures efficient record-keeping but also enhances the overall customer experience.

Why You Need a Garage Invoice Template

When it comes to running a successful business, having a clear and professional method of documenting transactions is essential. Without a standardized approach, keeping track of services rendered, payments received, and outstanding balances can quickly become overwhelming. A well-structured document allows you to communicate all necessary details to your clients, ensuring transparency and preventing potential misunderstandings.

Using a pre-designed format for documenting payments offers numerous advantages. It helps streamline your billing process, making it faster and more efficient. With all the necessary fields organized in a logical manner, you reduce the risk of errors or missing information. This consistency not only enhances the operational efficiency of your business but also builds trust with your customers, who appreciate clear and professional communication.

Additionally, such a tool can be customized to meet the specific needs of your business. Whether you’re providing one-time services or ongoing maintenance, you can adjust the document to include all relevant details, from service descriptions to payment terms. By implementing a reliable billing method, you ensure smooth operations, better cash flow, and a more professional image for your business.

How to Customize Your Garage Invoice

Personalizing your billing document allows you to tailor it to the specific needs of your business and clients. A customizable layout ensures that you can include all the relevant details while maintaining a professional and clean presentation. This not only helps keep track of services rendered and payments made but also enhances the overall customer experience by providing a clear and concise record of the transaction.

Steps to Personalize Your Document

Here are the key steps to make your billing form fit your business perfectly:

- Business Information: Add your company name, logo, contact details, and address at the top of the document to make it easily recognizable.

- Client Information: Include a section to input customer details such as name, address, phone number, and email for easy communication.

- Service Description: Provide a space to clearly outline the services provided, including part numbers, labor charges, or any other specifics relevant to the job.

- Payment Terms: Specify your payment policies, including due dates, late fees, and available payment methods.

Customizing the Layout

The layout is just as important as the content. A well-organized document enhances readability and professionalism. You can adjust the following sections to fit your preferences:

- Header: Choose a simple header design that includes your business name and contact information.

- Itemized List: Organize services into easy-to-read categories, clearly showing costs for each part and labor involved.

- Footer: Add a footer with payment instructions, business terms, or a thank-you note to show appreciation to your clients.

Customizing your billing form gives you the flexibility to meet your specific business needs, while also ensuring a streamlined and professional presentation every time you complete a transaction.

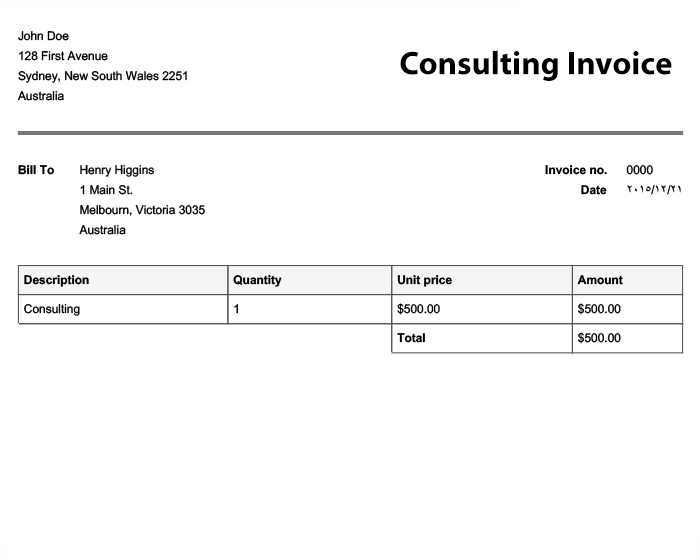

Key Features of a Good Invoice Template

A well-designed document is essential for ensuring clear and efficient transactions between businesses and clients. It should provide all necessary information in an organized manner, reducing the risk of confusion and disputes. A good layout helps maintain professionalism while also making it easier to track payments, monitor due dates, and maintain accurate financial records.

Essential Elements to Include

A high-quality billing document should contain the following key features:

- Clear Business Details: Your business name, logo, address, and contact information should be easy to find at the top.

- Client Information: Include fields to capture the customer’s name, address, phone number, and email.

- Detailed Service Description: Clearly outline the work or goods provided, including quantities, part numbers, and service dates.

- Itemized Pricing: Break down the costs for each individual service or item so that customers understand exactly what they’re paying for.

- Payment Terms: Include your payment policies, including due dates, late fees, and accepted payment methods.

Additional Features for Enhanced Use

Beyond the essentials, here are some additional features that make a document even more functional:

- Invoice Number: Every bill should have a unique identifier to avoid confusion and track payments more easily.

- Due Dates: Highlight the payment due date to make sure your clients are aware of when payment is expected.

- Discounts and Taxes: Include sections for applicable discounts or taxes to provide a clear breakdown of the final amount due.

- Notes or Instructions: An area for additional notes or specific instructions can help clarify anything not covered in the main sections.

By incorporating these elements, you ensure that your billing documents are professional, clear, and easy to understand, which ultimately benefits both you and your clients.

Common Mistakes to Avoid in Invoices

When preparing billing documents, accuracy and clarity are crucial. Small errors can lead to confusion, delays in payment, or even damage to your professional reputation. Whether you’re new to managing payments or have been in business for years, it’s easy to overlook key details that can cause problems down the line. Being aware of common mistakes can help ensure your documents are both professional and effective.

Incorrect or Missing Contact Information: One of the most basic but critical mistakes is failing to include or incorrectly entering your business and client details. If your contact information isn’t clear or complete, customers may struggle to get in touch with you regarding questions or payments. Always ensure that both parties’ names, addresses, phone numbers, and emails are accurate and clearly presented.

Failure to Itemize Charges: A vague description of services or products can confuse your customers and lead to disputes. Always provide detailed information about each service performed or product provided, including quantities, unit costs, and specific descriptions. Itemizing charges allows clients to understand exactly what they are paying for and why.

Omitting Payment Terms: Not specifying payment terms is another common mistake that can cause delays. Make sure to include your payment due date, late fees (if applicable), and accepted payment methods. Clients need to know when and how to make payments, as well as any consequences for missing deadlines.

Inaccurate Totals or Calculations: Double-check all totals and calculations. Even small errors in addition or multiplication can lead to significant discrepancies. Automated systems or tools can help minimize errors, but always verify the final amounts before sending the document to your client.

Failure to Include a Unique Identifier: Every billing document should have a unique reference number. Without this, tracking payments and resolving issues becomes much more difficult. A clear system for numbering helps you organize your records and provides clients with a specific point of reference for any inquiries.

Not Reviewing Before Sending: Finally, one of the simplest yet often overlooked mistakes is failing to proofread. Always review your documents before sending them out to ensure all information is accurate, complete, and professionally presented. Taking a few minutes to check for errors can save you time and prevent future complications.

By avoiding these common mistakes, you can streamline your billing process, improve client satisfaction, and ensure that your financial records are always in order.

How to Download a Free Template

If you’re looking for a simple way to get started with billing documents, downloading a pre-designed form is a quick and effective solution. These forms are often available in various formats and can be easily customized to meet your specific business needs. By downloading a well-structured document, you save time and effort, allowing you to focus on delivering quality services to your customers.

Follow these easy steps to download a ready-to-use billing form:

- Search for Reliable Sources: Look for trusted websites or platforms that offer high-quality documents. Many business resource sites provide downloadable forms tailored to different industries.

- Select Your Desired Format: Choose the file type that suits your needs, such as PDF, Word, or Excel. Each format offers different advantages in terms of customization and ease of use.

- Ensure Compatibility: Make sure the form is compatible with your device or software. Some platforms allow you to edit documents directly online, while others may require you to download and modify them on your computer.

- Check Customization Options: Before downloading, check if the form can be easily customized. Look for options to add your logo, adjust fields, and update payment terms based on your business model.

- Download and Save: Once you’ve chosen the right form, click the download button and save the file to your computer or cloud storage for easy access whenever you need it.

By following these steps, you can quickly obtain a professional and functional document, allowing you to handle your billing process with ease and efficiency.

Step-by-Step Guide to Using Templates

Using pre-designed forms can significantly streamline your billing process, saving you time and ensuring that all necessary details are included in every transaction. Whether you’re creating a document for a one-time service or ongoing work, having a structured format helps maintain consistency and professionalism. Below is a simple guide to help you get the most out of these forms, from customization to finalizing the document for your clients.

1. Download and Open the Document

The first step is to obtain the form you plan to use. Many platforms offer these forms in downloadable formats like Word, PDF, or Excel. Once downloaded, open the file with the appropriate software. Make sure your device has the necessary application installed to edit or view the document.

2. Personalize the Details

After opening the form, the next step is to customize it to fit your specific business needs. Most fields are easily adjustable, and you can make changes as needed.

- Add Your Business Information: Include your company name, logo, contact information, and any other details that identify your business.

- Insert Client Information: Input your customer’s name, address, phone number, and email. This will help you keep track of who you’re doing business with.

- Detail the Services or Products: Be specific about the services you provided, including descriptions, quantities, and pricing for each item or service offered.

3. Customize Payment Terms and Conditions

Make sure to include clear payment instructions and deadlines. Most forms come with pre-set payment terms, but you can modify them to reflect your business policies. Add information about accepted payment methods, late fees, and discounts (if applicable).

4. Review and Double-Check

Once you’ve added all the necessary information, take a moment to review the entire document. Double-check for any spelling mistakes, incorrect pricing, or missing information. Ensure that all figures add up correctly and that the payment terms are clearly stated.

5. Save and Send

After finalizing the document, save it in a format that suits you, whether it’s a PDF for easy sharing or an editable Word document. Then, send it to your client via email or provide a printed copy if required. Keep a copy for your records for easy reference in the future.

By following these simple steps, you can effectively use pre-designed forms to create professional, customized billing documents in n

Choosing the Right Invoice Format for Your Garage

Selecting the right document format is essential for ensuring that your billing process is smooth, efficient, and professional. The format you choose should be easy to understand, flexible enough to accommodate different types of services or repairs, and provide a clear record of all transactions. Having the right structure can also help streamline your accounting and make tracking payments simpler.

When deciding on the best format, consider your specific business needs and the types of services you provide. Some formats might work better for one-time services, while others are more suited for ongoing maintenance or repairs. Below are some common formats and their benefits to help you make an informed choice.

| Format | Best For | Benefits |

|---|---|---|

| Simple Document (Word, PDF) | One-time services or repairs | Easy to use, quick customization, professional appearance |

| Spreadsheet (Excel) | Ongoing services or tracking multiple items | Can calculate totals automatically, good for inventory tracking |

| Online Billing Software | Recurring clients and automated billing | Automates calculations, integrates with payment systems, saves time |

Choosing the right format will depend on how often you provide services, the complexity of your charges, and the tools you prefer to use. For businesses that require flexibility and scalability, spreadsheet formats or online software may offer added benefits. However, if you’re looking for simplicity and ease of use, a basic document format may be the best choice.

Regardless of the format you choose, always ensure that it is clear, organized, and easy to read. A well-structured document not only makes it easier for you to manage your records, but it also creates a better experience for your customers.

Benefits of Using an Invoice Template

Utilizing a pre-designed billing document offers a range of advantages for businesses looking to streamline their financial processes. These ready-to-use formats simplify the creation of professional and accurate records for each transaction, saving time and reducing the chances of errors. By adopting a standardized system, you can ensure consistency and maintain a professional image for your business while improving operational efficiency.

Key Advantages

Here are some of the most significant benefits of using a structured billing document:

| Benefit | Description |

|---|---|

| Time-Saving | Ready-made forms eliminate the need to start from scratch, speeding up the process of creating accurate bills. |

| Accuracy | With clearly defined fields for prices, services, and client details, the risk of missing important information is minimized. |

| Professional Appearance | Using a clean, structured layout projects a professional image and helps build trust with customers. |

| Consistency | Templates ensure that every transaction is recorded in the same manner, making your records more organized and easier to review. |

| Customization | Many formats allow easy customization, so you can tailor each document to suit your business and clients’ specific needs. |

How Templates Help Improve Efficiency

By adopting a standardized format, businesses can reduce the time spent on manual billing tasks and focus more on providing services. In addition to time-saving, consistent documentation allows for quicker invoicing, better tracking of payments, and easier integration with accounting or payment systems. Ultimately, using a pre-designed format helps businesses maintain organization, increase customer satisfaction, and enhance overall operational efficiency.

How Invoice Templates Save Time and Money

Using pre-designed billing documents can significantly improve efficiency and reduce operational costs for businesses. By eliminating the need to create records from scratch for every transaction, businesses can automate and streamline their accounting processes. This not only saves time but also minimizes the chances of costly mistakes, ultimately allowing you to allocate resources more effectively and focus on what matters most–serving your customers.

Time-Saving Benefits

Here are several ways using ready-made documents can save time:

- Faster Billing Process: Pre-built forms have all the necessary fields and structure, so you only need to input specific details. This speeds up the creation of each record.

- Consistency Across Documents: Since the format is already set, you don’t have to spend time organizing or designing the layout every time you create a new bill.

- Reduced Mistakes: Templates reduce the chances of errors that can arise when creating a new document from scratch, such as forgetting key details or making calculation mistakes.

Money-Saving Advantages

In addition to saving time, using structured documents can also help you save money in the following ways:

- Less Administrative Work: With a standardized format, you eliminate the need for additional staff to create customized forms, which reduces labor costs.

- Improved Cash Flow: Clear, professional billing ensures clients understand payment expectations, which can lead to quicker payments and fewer follow-ups for overdue bills.

- Avoiding Legal Issues: Well-documented records can prevent disputes or misunderstandings with clients about payments, saving you money on legal costs or lost revenue.

In summary, using a pre-designed document format not only boosts efficiency but also directly impacts the bottom line by saving both time and money. By incorporating these streamlined practices into your daily operations, you can create a more productive and profitable business environment.

Understanding Payment Terms in Invoices

Payment terms are a crucial element in any billing document as they set clear expectations for both parties regarding when and how payments should be made. These terms help prevent misunderstandings and ensure timely compensation for services or products provided. By clearly defining payment timelines, methods, and penalties for late payments, businesses can maintain smoother cash flow and avoid unnecessary delays in payment processing.

Key Components of Payment Terms

When specifying payment terms in a document, it’s important to include the following details:

- Due Date: This is the date by which the client is expected to settle the payment. Be sure to specify whether it is a specific calendar date or a number of days from the date of issuance.

- Late Fees: Indicate the penalties for overdue payments, such as interest charges or fixed late fees. Clearly state the conditions under which these charges apply.

- Accepted Payment Methods: List all available methods for payment, such as credit cards, bank transfers, checks, or online payment platforms, so clients know their options.

- Discounts for Early Payment: Some businesses offer a discount for clients who settle their bills before the due date. If applicable, make sure to outline the terms of the discount clearly.

Why Clear Payment Terms Are Essential

Setting clear payment terms is important for several reasons:

- Reduces Payment Delays: Clearly stating payment deadlines and conditions helps clients understand their responsibilities and encourages them to pay on time.

- Avoids Disputes: Having well-defined terms in place minimizes the chances of confusion or disagreements about payment expectations.

- Maintains Professionalism: Offering clear, upfront payment terms shows clients that your business operates with transparency and professionalism, fostering trust and reliability.

By carefully specifying payment terms in each document, businesses can improve their financial stability, reduce the risk of non-payment, and build stronger relationships with clients based on mutual understanding and respect.

Free Garage Invoice Template for Small Businesses

Small businesses often face challenges in managing their financial records, especially when it comes to generating accurate and timely billing documents. Using pre-designed, easy-to-edit forms can help streamline this process. These structured forms provide a reliable way to keep track of services rendered, ensuring that payments are processed smoothly and professionally.

Why Small Businesses Benefit from Ready-to-Use Billing Documents

For small businesses, having an efficient system for managing financial transactions is essential. Pre-made forms can save both time and effort, ensuring that every transaction is documented correctly. Here are some key reasons why ready-to-use forms are valuable for small businesses:

- Simplicity: These forms are easy to use, requiring minimal input to create a complete and accurate record of the transaction.

- Consistency: Using a standardized format ensures that all billing documents maintain the same structure, making it easier to organize and track records.

- Professionalism: A well-designed form helps businesses present themselves as professional and reliable, which is crucial when building long-term relationships with clients.

How These Documents Help Manage Cash Flow

By using pre-designed forms, small businesses can enhance their cash flow management. Clear and concise billing reduces the risk of delayed payments and makes it easier to track overdue balances. Additionally, many of these forms allow for easy customization, so businesses can include necessary details like payment terms, accepted methods, and discounts for early payment. This ensures that clients have all the information they need to settle their bills quickly and accurately.

Overall, pre-designed forms provide a quick, simple, and effective way for small businesses to handle billing, allowing them to focus more on growth and customer satisfaction.

How to Organize Your Garage Billing System

Organizing a billing system is essential for ensuring smooth business operations and maintaining clear financial records. For businesses offering services, creating an efficient process for managing transactions not only improves workflow but also ensures timely payments and better client relationships. A well-structured approach to managing payments, from initial estimates to final receipts, helps avoid mistakes and delays.

Step 1: Implement a Structured Process

Start by developing a standardized method for tracking each service provided. This includes creating a system for recording customer details, service descriptions, costs, and payment terms. By using a consistent format, whether digital or physical, you can streamline your entire billing process and make it easier to track outstanding payments. Consider the following elements for an effective process:

- Client Information: Maintain an organized record of your customers’ contact details and service history.

- Service Descriptions: Clearly outline each service performed, including the labor and material costs involved.

- Payment Terms: Specify due dates, payment methods, and any applicable late fees to avoid misunderstandings.

Step 2: Automate and Track Payments

Using an automated system can help you track payments, send reminders, and even generate reports. Consider using software that allows you to create detailed billing documents automatically, helping you save time and reduce errors. Here’s how automation can improve your billing process:

- Easy Updates: Quickly adjust service costs or terms as necessary without needing to manually update multiple documents.

- Payment Reminders: Set up automatic reminders for clients with outstanding balances, which helps reduce delays.

- Comprehensive Reporting: Monitor your cash flow and unpaid invoices, making it easier to manage financial planning and budgeting.

By organizing your system, automating tasks, and ensuring accuracy, you can improve efficiency and reduce the chances of errors or lost revenue. A well-managed billing system is a cornerstone of a successful business, helping you maintain professional relationships and improve your overall operations.

Integrating Templates with Accounting Software

Integrating pre-designed billing forms with accounting software is a powerful way to streamline your business’s financial operations. By combining these tools, you can automate the process of generating, sending, and tracking payment requests, while also keeping your financial records in sync. This integration reduces manual data entry, minimizes errors, and provides a more efficient way to manage your cash flow and client interactions.

Benefits of Integration

Integrating a structured document format with accounting software offers several advantages that can greatly improve the overall efficiency of your business:

- Automation of Data Entry: Accounting software can automatically pull information from your billing forms, reducing the need for manual input and minimizing the risk of errors.

- Faster Processing: With automated generation of invoices and payments, you can speed up your billing process and ensure clients receive accurate records promptly.

- Real-Time Updates: As payments are made or statuses are updated, accounting software can instantly reflect those changes, providing an accurate financial overview.

- Improved Reporting: Integrating both systems allows for seamless reporting, making it easier to track outstanding balances, revenue, and overall financial health in one place.

How to Integrate the Two Systems

Integrating your billing forms with accounting software doesn’t have to be complex. Here’s how you can set up the process:

- Choose Compatible Software: Make sure the accounting software you use allows for easy integration with document management or billing systems. Many popular software options support this feature.

- Import Templates: Upload your existing documents into the software, ensuring that fields like client details, service descriptions, and costs are correctly matched with the software’s fields.

- Automate Invoicing: Set up your system to automatically generate new entries from your forms, creating consistent and accurate records with each new transaction.

- Track Payments: Use the software’s tools to monitor payments and update the status of each transaction, helping to keep track of overdue accounts and ensure timely collections.

By integrating a billing system with accounting software, you can create a more efficient and error-free process that saves time, reduces costs, and provides you with valuable insights into your financial status. This integration not only enhances your business operations but also improves your relationship with clients by providing clear, professional billing and accounting practices.

Why Professional Invoices Improve Customer Trust

Using well-designed and professional billing documents plays a significant role in fostering trust between businesses and their clients. When customers receive clear, structured, and accurate records of the services they’ve purchased, it creates a sense of reliability and transparency. A professionally formatted bill not only ensures that the client understands what they are being charged for, but also reflects positively on the business’s commitment to quality and professionalism.

How Professional Records Build Trust

Here are some reasons why well-prepared billing documents can enhance customer trust:

- Clarity and Transparency: Clear, detailed billing records make it easier for clients to understand exactly what services were provided, what costs are involved, and any applicable terms or conditions. This transparency reduces confusion and builds confidence.

- Accuracy: A correctly formatted document ensures that all details are captured accurately, helping to avoid disputes or misunderstandings over pricing or services rendered. Clients appreciate receiving error-free and reliable documents.

- Consistency: Using a consistent format for each bill helps clients become familiar with your processes, which contributes to a sense of professionalism and predictability in your business relationship.

- Professional Appearance: A well-crafted document is visually appealing and conveys that your business is serious and reliable. This can leave a positive impression on clients and encourage repeat business.

Impact on Long-Term Relationships

When customers feel confident that they are being treated fairly and professionally, they are more likely to trust your business and return for future services. A polished, organized billing system helps foster long-term relationships by making every transaction feel smooth and secure. Over time, this consistency in communication will strengthen your reputation and encourage customer loyalty.

In conclusion, well-structured and professional billing documents do more than just facilitate transactions–they also play a key role in building lasting trust and credibility with clients. By investing in clear, accurate, and professional records, businesses can create a stronger foundation for customer relationships and future growth.

Where to Find Reliable Free Templates

Finding dependable, easy-to-use billing forms can be a time-consuming task for business owners. Fortunately, there are many online resources where you can access high-quality, pre-designed documents that can be customized to suit your specific needs. These resources allow you to download structured forms that are both professional and functional, saving you time and effort in creating your own from scratch.

Top Sources for Downloading Reliable Forms

Here are some trusted sources where you can find quality pre-designed billing documents:

- Business Websites: Many business-oriented platforms offer downloadable documents designed for various industries. These websites often provide templates that can be customized for your services.

- Online Document Tools: Websites that specialize in document creation, such as Google Docs or Microsoft Office, often have templates available that you can use directly within their platforms.

- Template Marketplaces: Online marketplaces like Etsy or Template.net feature a wide selection of billing forms, often designed by professionals and customizable for different business types.

- Accounting Software Providers: Some accounting software solutions offer free downloadable forms that integrate seamlessly with their systems. These forms are typically designed to be both user-friendly and compatible with the software’s features.

What to Look for in a Reliable Form

When searching for quality documents, make sure to consider the following factors:

- Customization Options: The best forms allow you to easily modify fields such as service descriptions, payment terms, and pricing to meet your specific needs.

- Professional Design: A well-designed document should look polished and easy to read, conveying a sense of professionalism to your clients.

- Compatibility: Make sure the form is compatible with your preferred software or document editor, allowing you to make adjustments as necessary without issues.

- Industry-Specific Features: Some forms are tailored to specific industries, offering built-in sections for unique services or pricing structures that may be relevant to your business.

By utilizing these reliable sources, you can find the right forms to improve your billing process while maintaining a professional image and ensuring efficiency in your business operations.