Invoice Review Checklist Template for Efficient Invoice Management

Efficient management of financial transactions is crucial for maintaining healthy business operations. A structured approach to verifying documents before finalizing payments can significantly reduce errors and ensure accuracy. By establishing a reliable system for double-checking essential details, companies can prevent costly mistakes and streamline their accounting workflows.

Implementing a clear procedure for validating records helps to spot inconsistencies, confirm amounts, and verify contract terms. The key is to have a set of guidelines that help users quickly and easily confirm all necessary aspects before proceeding. This method not only promotes accountability but also enhances financial transparency within the organization.

By adopting a systematic process, businesses can improve both efficiency and compliance. Regularly applying such practices leads to smoother operations and a stronger foundation for decision-making, all while minimizing the risk of oversights that could have long-term consequences.

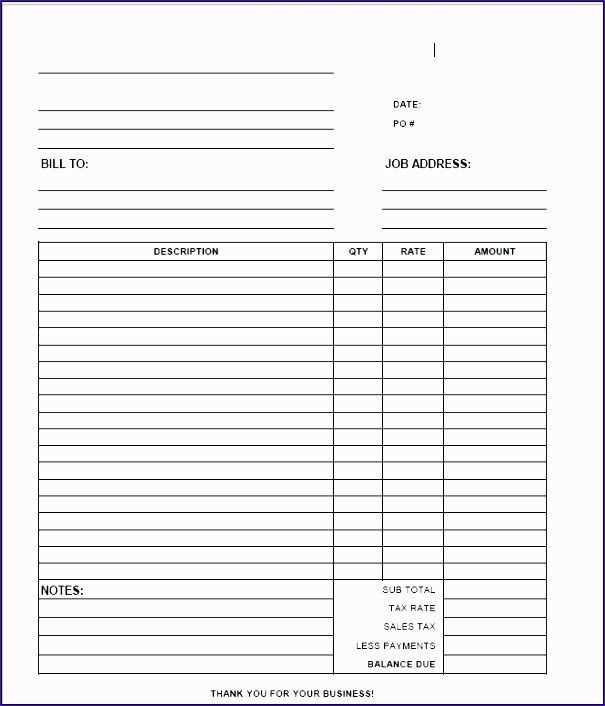

Invoice Review Checklist Template Overview

A comprehensive system for verifying financial documents is essential for preventing mistakes and ensuring smooth business operations. Having a structured approach allows teams to confirm that all details are correct before finalizing payments or processing. This framework aids in identifying errors early and ensures that all necessary steps are completed for a smooth transaction.

These tools are designed to provide a clear, step-by-step process for confirming the accuracy of all relevant information. Whether you are dealing with bills, contracts, or payment requests, the goal is to create a reliable method to catch discrepancies and ensure consistency.

Key Features of an Effective System

- Clear guidelines to confirm amounts, dates, and terms.

- A consistent approach for verifying billing details and payment accuracy.

- Tools to easily track errors and discrepancies.

- Simple steps to ensure that all relevant documents are included and complete.

Benefits of Using a Structured Process

- Reduces errors and minimizes the risk of overpayments or missed charges.

- Improves accuracy by ensuring all essential information is verified before processing.

- Enhances team efficiency by providing a clear set of steps to follow.

- Increases transparency and accountability in financial transactions.

Why an Invoice Review Checklist Matters

Ensuring the accuracy of financial documents is critical to maintaining proper accounting and preventing costly mistakes. Without a structured process, businesses risk overlooking important details, which can lead to overpayments, missed deadlines, or legal issues. A methodical approach to verifying all elements of financial records helps safeguard against these potential errors and keeps operations running smoothly.

By systematically confirming the accuracy of essential information, businesses can enhance both efficiency and reliability. Whether it’s checking figures, dates, or terms, a defined process allows teams to stay on track and reduce the likelihood of issues arising down the line.

Minimizing Financial Mistakes

- Prevents incorrect payments and overcharges.

- Reduces the risk of compliance violations or tax discrepancies.

- Helps identify and address errors before they escalate.

Improving Workflow and Transparency

- Streamlines the verification process and saves time.

- Increases trust between parties by ensuring accurate documentation.

- Enhances accountability across teams involved in financial tasks.

Key Elements of an Effective Checklist

A well-structured approach to verifying financial documents ensures that all critical details are thoroughly checked before finalizing any transaction. To be effective, the system must cover all necessary aspects while remaining simple and easy to follow. A comprehensive yet clear process reduces the chances of errors and provides teams with a reliable method to catch any discrepancies early.

The following elements are essential for creating an effective system that guarantees thoroughness and accuracy in each step:

Essential Components to Include

- Amount verification: Ensure the figures match the agreed-upon terms or contracts.

- Dates and deadlines: Double-check that all time-sensitive details are accurate.

- Party details: Verify that the names, addresses, and other identifying information are correct.

- Service or product descriptions: Confirm that the items or services listed are as agreed upon.

- Tax calculations: Check that any applicable taxes are accurately applied according to local regulations.

Best Practices for Creating a Reliable Process

- Use clear, simple language to outline each step in the process.

- Ensure that each team member understands their role and responsibilities in the verification process.

- Regularly update the system to adapt to any changes in regulations or company policies.

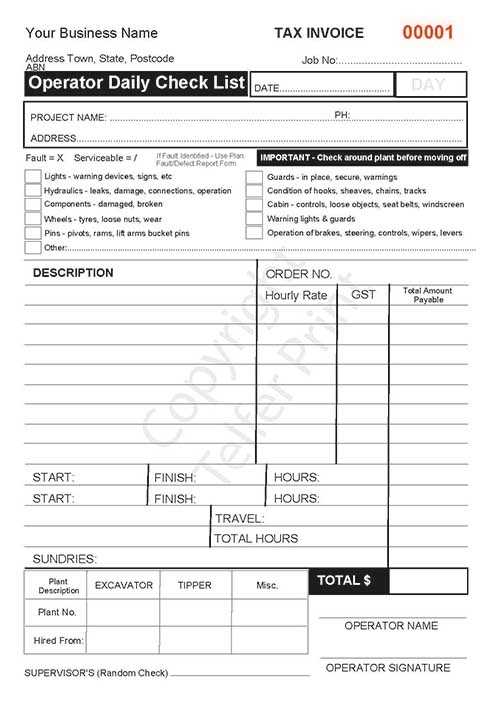

How to Use an Invoice Review Template

To ensure accuracy and avoid costly errors, it’s essential to follow a structured process when verifying financial documents. A well-organized system helps teams systematically check all necessary details, ensuring that everything aligns before moving forward with a transaction. Using a pre-designed framework can save time, reduce mistakes, and make the process more efficient for everyone involved.

Here’s a step-by-step guide on how to effectively use a structured review system:

Step-by-Step Process

- Prepare all necessary documents: Gather all related files, including contracts, agreements, and payment requests, before starting the verification process.

- Follow each step in the framework: Work through the checklist in order, confirming every detail one by one, from amounts to dates.

- Double-check critical information: Pay extra attention to key details, such as the total amount, payment terms, and tax calculations.

- Record findings: Note any discrepancies or issues that arise and address them with the relevant parties before proceeding.

- Final verification: Once all steps are completed, double-check the entire document to ensure nothing has been missed.

Best Practices for Efficiency

- Always involve key team members in the process for cross-checking important details.

- Use digital tools or software to track updates and revisions, which helps maintain an organized process.

- Regularly update the process to account for any changes in financial regulations or internal procedures.

Common Invoice Errors to Look For

When managing billing documentation, it’s important to be on the lookout for common mistakes that can affect both the accuracy and timeliness of financial transactions. Identifying these issues early can help avoid disputes and delays in processing payments. Below are some typical problems you should be aware of when handling financial documents.

- Incorrect Totals: Always verify that the sum of all items or services matches the final amount. Simple miscalculations can lead to overcharging or undercharging.

- Missing Information: Double-check for any missing details such as customer names, addresses, or order numbers. Incomplete records can cause confusion during the payment process.

- Wrong Dates: Ensure that the dates are correct, including the issue date and payment due date. Errors here can impact payment schedules and create confusion about timelines.

- Incorrect Item Descriptions: Verify that the items or services listed are described accurately. Ambiguous descriptions may result in misunderstandings about what was provided.

- Wrong Payment Terms: Make sure the payment terms, such as discounts for early payment or late fees, are clearly stated and correctly applied.

- Duplicated Entries: Ensure there are no repeated charges for the same item or service, which could lead to disputes and unnecessary corrections.

How to Customize Your Checklist

Tailoring your task list for managing financial documents allows you to focus on specific needs and priorities. Customization ensures that the process aligns with your unique requirements and helps maintain efficiency. Below are some tips on adjusting your list to suit different situations.

Identify Key Elements

Start by recognizing the most critical details that need attention. For example, if you’re working with recurring transactions, add specific fields for monitoring long-term agreements or payment schedules. Adjust the content to reflect items that matter most in your business workflow.

Adjust for Different Scenarios

Consider varying circumstances that may require additional attention. For instance, if you deal with international transactions, it’s useful to include sections for currency conversion or tax requirements. Customizing for particular scenarios ensures all aspects are covered thoroughly.

Tip: Regularly update your list as your processes evolve. New requirements may emerge as your business grows, so it’s important to keep it flexible and relevant.

Remember: The more specific and relevant your list is, the more efficient the process becomes, saving you time and reducing errors.

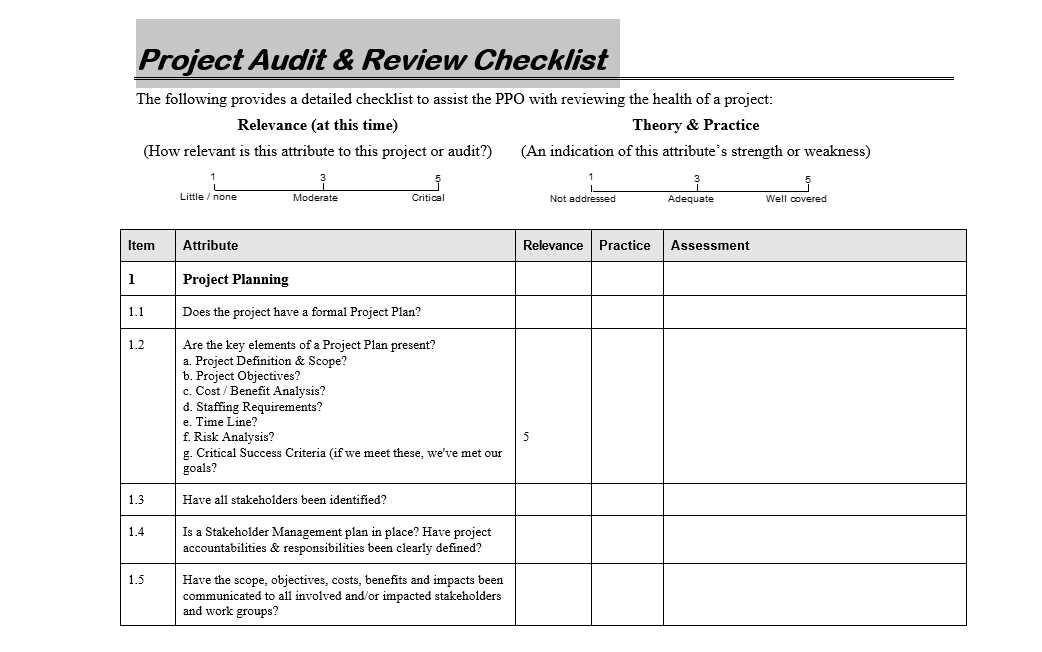

Best Practices for Invoice Audits

Performing thorough audits of your financial documentation helps ensure accuracy and compliance. Following best practices allows for effective detection of discrepancies, improves financial management, and enhances the integrity of your processes. Here are some key steps to implement during an audit process.

- Establish Clear Criteria: Define what to look for in your financial records. Establish a set of standards to identify errors, inconsistencies, or missing information. This ensures consistency during each audit.

- Verify Accuracy of Amounts: Double-check all numbers, including totals, taxes, and discounts. A simple mathematical error can lead to larger issues down the line.

- Cross-Reference with Supporting Documents: Always compare entries with contracts, purchase orders, or receipts. Cross-checking ensures that every charge is legitimate and accurate.

- Monitor for Duplicates: Look out for any repeated entries or charges for the same goods or services. Duplications can happen easily, and they should be promptly addressed.

- Ensure Proper Approval: Confirm that all documents have gone through the correct approval channels before being processed for payment. Lack of proper authorization can lead to unauthorized or fraudulent transactions.

- Maintain a Detailed Audit Trail: Keep records of all audit findings and actions taken. This helps maintain transparency and allows for easier follow-up during future audits.

Tip: Regular audits are essential for maintaining control over financial operations and ensuring your business remains compliant with regulations.

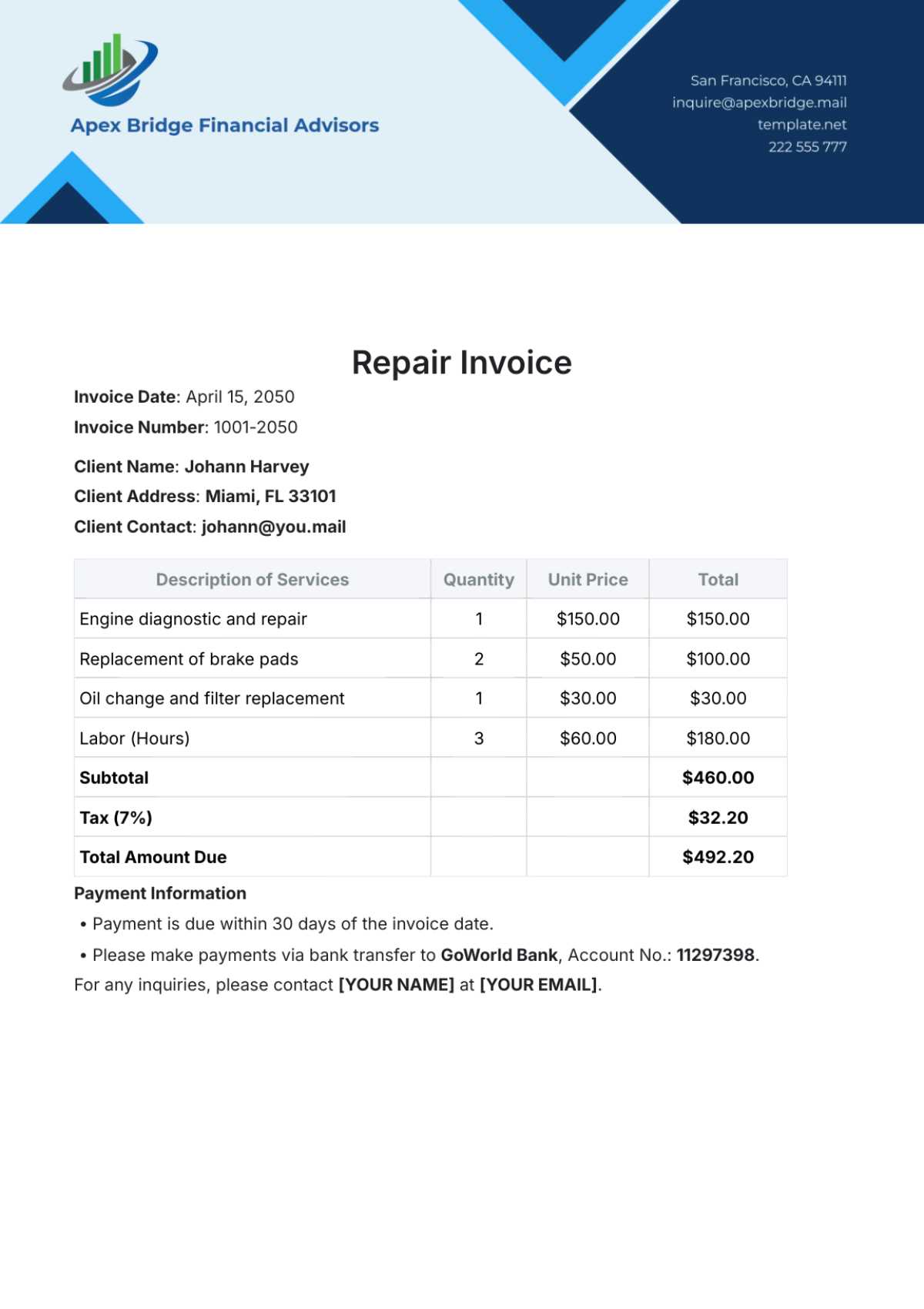

Improving Accuracy with Invoice Templates

Utilizing structured forms to manage financial documents can significantly reduce errors and improve consistency. Pre-designed layouts help ensure that all necessary information is included and formatted correctly, minimizing the risk of omissions or mistakes. Below are some ways in which using these forms can enhance precision in your financial processes.

- Standardized Format: Consistent layouts eliminate confusion, ensuring that important details like dates, amounts, and contact information are always placed correctly.

- Automated Calculations: Many pre-designed forms come with built-in calculation features, reducing the risk of manual errors in totals or taxes.

- Pre-Set Fields: By having predefined sections for each type of data, you are less likely to forget critical information like payment terms or account numbers.

- Quick Customization: These forms can be easily adapted to suit specific needs or scenarios, allowing for fast adjustments without compromising accuracy.

- Consistent Branding: A uniform layout helps maintain a professional appearance, enhancing the credibility of your documentation and reducing the likelihood of confusion.

Tip: Make sure to periodically update your forms to reflect any changes in regulations or internal policies to maintain accuracy in the long run.

Streamlining Financial Processes with Checklists

Organizing tasks related to financial management through structured lists helps simplify workflows and ensures nothing is overlooked. By following a systematic approach, you can reduce errors, increase productivity, and enhance the overall efficiency of your financial procedures. Here are a few ways these tools can optimize your operations.

Improve Task Organization

Structured lists help break down complex tasks into smaller, manageable steps. This not only makes it easier to track progress but also ensures that each step is completed accurately. A clear structure helps reduce confusion and makes it easier to prioritize critical activities.

Reduce Risk of Oversights

Having a detailed list in place ensures that important actions are not missed. By systematically following each step, you minimize the chance of forgetting essential details or overlooking key elements that could disrupt the process.

- Consistency: Ensure uniformity across all tasks, from payments to document management.

- Timeliness: Establish deadlines for each task to maintain efficient cash flow management.

- Accountability: Assign specific tasks to responsible individuals to track progress and accountability.

Tip: Regularly update your lists to keep up with changes in business needs, regulations, or internal procedures. This will keep your financial operations running smoothly and help you stay on top of critical tasks.

How to Spot Payment Discrepancies Early

Identifying inconsistencies in payments as soon as they arise can save your business time and money. Catching discrepancies early helps prevent potential cash flow issues and can improve communication with clients or vendors. By staying vigilant and following specific steps, you can detect these problems before they become major obstacles.

Monitor Payment Trends

Regularly checking payments can help you identify any unusual patterns or delays. By keeping a close eye on incoming and outgoing transactions, you can spot discrepancies that might otherwise go unnoticed.

Establish Clear Payment Terms

Clearly defining payment terms with clients or vendors from the outset ensures that both parties are on the same page. This transparency makes it easier to track if the amounts paid match the agreed-upon terms.

| Transaction Date | Expected Payment | Paid Amount | Discrepancy | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 01/10/2024 | $500.00 | $450.00 | $50.00 short | |||||||||||||||||||

| 05/10/2024 |

| Tip | Description |

|---|---|

| Clear and Concise Descriptions | Ensure that all products or services are described clearly and accurately to avoid confusion. |

| Agree on Terms Upfront | Establish payment terms and conditions before any transactions take place to prevent misunderstandings later. |

| Provide Detailed Breakdown | Include a comprehensive breakdown of charges, taxes, and any additional fees to make everything transparent. |

| Maintain Consistency | Ensure the same format, terminology, and style is used across all financial documents to reduce ambiguity. |

| Timely Communication | Address any questions or concerns promptly, ideally before the document is processed or paid. |

Tip: Establish a system for tracking payments and communicating with clients early on to prevent any issues from escalating into disputes.

Digital vs Paper-Based Invoice Reviews

As businesses adapt to new technologies, the process of handling financial documents has evolved. While traditional methods involving physical paperwork are still in use, digital solutions offer advantages that can improve efficiency, accuracy, and accessibility. Understanding the benefits and drawbacks of both approaches can help businesses decide which method works best for their needs.

Advantages of Digital Systems

Digital tools streamline the management of financial documents by allowing instant access, quick updates, and easy sharing. With automation built into many digital systems, calculations and data entry errors are significantly reduced. These systems also make it easier to store and search for past records, saving time and resources. Additionally, digital methods support real-time collaboration, making it easier for teams to work together regardless of location.

Benefits of Paper-Based Methods

Despite the rise of digital solutions, paper-based systems are still preferred by some businesses for their tangible nature. They offer a sense of security and simplicity, as there’s no need for technical infrastructure or internet access. Paper documents are also familiar to many employees, requiring little training to handle effectively. In some cases, companies find that physical documentation is better for retaining signatures and other important markings that are hard to replicate in digital formats.

Tip: For businesses considering a switch to digital solutions, start with a hybrid approach to ease the transition. Combining the best of both worlds can offer the most efficient and flexible solution.

Tracking Changes and Revisions in Invoices

Maintaining a clear record of all modifications made to financial documents is crucial for transparency and accountability. Whether due to errors, updates, or adjustments, tracking changes helps prevent misunderstandings and ensures that all parties are on the same page. By implementing a system for documenting revisions, you can ensure that every update is captured and properly reflected in the final version.

Version Control is essential in managing updates to financial documents. Each time an alteration is made, a new version should be saved with a unique identifier, such as a version number or timestamp. This allows you to easily reference past versions and track the progression of changes over time.

Audit Trails are another key element in tracking changes. An audit trail logs every modification made to a document, including who made the change, when it occurred, and the nature of the change. This not only ensures accuracy but also provides a useful reference in case any disputes arise regarding the adjustments made.

Tip: Use digital systems with built-in revision tracking features, as they often automate the process and make it easier to manage updates efficiently.

Ensuring Compliance with Tax Regulations

Staying compliant with tax regulations is vital for avoiding penalties and ensuring smooth business operations. Properly documenting transactions, applying the correct tax rates, and adhering to the relevant legal frameworks are essential to maintaining compliance. Businesses must be diligent in keeping up with ever-evolving tax laws and applying them accurately to all financial documents.

Key Areas to Focus On

To ensure full compliance, there are several key factors to monitor during transaction processing:

| Area of Compliance | Action to Take |

|---|---|

| Tax Rates | Ensure the correct tax rate is applied based on location and the type of goods or services involved. |

| Tax Identification Numbers | Verify that all tax IDs (e.g., VAT numbers) are valid and correctly listed for both parties involved. |

| Exemption Status | Check for any applicable exemptions and make sure they are accurately documented in the transaction records. |

| Record Keeping | Maintain detailed records of all transactions to support tax filings and potential audits. |

Staying Updated with Changes

Tax laws are subject to change, so it’s important to stay informed about new rules and regulations. Regularly review government guidelines, consult with tax professionals, and ensure that your processes are updated

Automating the Invoice Review Process

Automating the process of managing and validating financial documents can significantly enhance efficiency, reduce errors, and save time. By implementing software solutions that can automatically perform routine tasks, such as matching purchase orders to payments or flagging discrepancies, businesses can focus on more strategic activities while maintaining accuracy and consistency in financial processing.

Key Benefits of Automation

- Increased Efficiency: Automation speeds up document handling, allowing for quicker processing and fewer delays in approvals.

- Reduced Errors: With automation, the chances of human error are minimized, especially in tasks such as data entry or calculations.

- Improved Compliance: Automated systems can help ensure that all legal and tax requirements are met consistently, avoiding potential penalties.

- Real-Time Tracking: Automation tools can track and log every step of the document lifecycle, providing real-time insights into progress and status.

Steps to Automate the Process

- Implement an Automated Matching System: Set up software to match incoming documents with existing records, such as purchase orders or contracts, reducing manual checks.

- Use Optical Character Recognition (OCR): OCR technology can extract key data from documents, ensuring faster and more accurate data entry.

- Set Up Alerts and Notifications: Automate alerts for any discrepancies or overdue items, helping teams act quickly when issues arise.

- Integrate with

How to Train Your Team on Invoice Reviews

Ensuring that your team is equipped with the right skills and knowledge is essential for maintaining accuracy and efficiency in financial processes. Proper training ensures that everyone involved in document handling understands the key tasks, potential pitfalls, and the importance of attention to detail. By providing clear guidance and hands-on practice, you can help your team successfully manage and verify financial documents with confidence.

Steps to Effective Training

- Start with the Basics: Ensure that all team members understand the fundamentals of financial documentation, including common terms, processes, and regulations that apply.

- Demonstrate the Process: Walk your team through the entire process, from receiving documents to final approval. Use examples and real scenarios to make the training relatable.

- Provide Hands-On Experience: Allow team members to practice the tasks in a controlled environment, where they can ask questions and receive immediate feedback.

- Offer Regular Reviews: Conduct periodic check-ins to address any questions, refresh knowledge, and ensure that procedures are being followed accurately.

Key Topics to Focus On

- Common Errors: Teach your team how to spot and resolve common mistakes, such as incorrect calculations, mismatched data, or missing information.

- Regulatory Compliance: Emphasize the importance of staying compliant with relevant tax laws, industry standards, and internal policies.

- Tools and Technology: Ensure that your team is proficient in using any digital systems, software, or tools that aid in the manag

Benefits of Regular Invoice Audits

Consistently evaluating financial documents plays a crucial role in maintaining the integrity and efficiency of business operations. By regularly auditing transactions, companies can identify discrepancies, prevent fraud, and ensure compliance with financial regulations. This proactive approach helps businesses maintain accurate records, improve financial transparency, and reduce costly errors.

Key Advantages of Routine Audits

- Improved Accuracy: Regular checks help identify errors in calculations, missing data, or misapplied rates, ensuring that all documents are processed correctly.

- Cost Savings: Spotting overcharges, duplicate payments, or incorrect charges early can prevent unnecessary expenses, saving the company money.

- Enhanced Fraud Detection: Routine audits act as a safeguard against fraudulent activities, as they make it harder for discrepancies to go unnoticed.

- Better Compliance: Audits help ensure that all financial documents meet the necessary legal and tax requirements, reducing the risk of non-compliance penalties.

Long-Term Impact

By integrating regular audits into your operations, you can build a culture of financial accountability. This not only improves internal processes but also strengthens your organization’s reputation with external stakeholders, such as suppliers and regulatory bodies. Over time, frequent evaluations can streamline operations, reduce errors, and contribute to more informed decision-making at all levels of the business.