Invoice Template for Architectural Services for Easy Billing and Professionalism

Managing payments and ensuring timely compensation is crucial for any design-focused professional. Having a structured and reliable method to document completed projects and associated costs helps maintain financial clarity and smooth client relationships. The right approach to billing can also enhance your professional image and reduce errors in the invoicing process.

Whether you’re handling a single project or multiple clients, a well-organized document can save you valuable time. It allows you to communicate all necessary financial details clearly and concisely, leaving little room for confusion or delay in payment. Moreover, it ensures that all critical information–such as rates, deadlines, and terms–are properly recorded, which ultimately supports better business practices and cash flow management.

In this section, we will explore the essential elements of a billing document and provide useful insights into how to craft one that aligns with your professional needs. By the end, you’ll have a comprehensive understanding of how to design a document that fits both your workflow and client expectations.

Invoice Template for Architectural Services

When it comes to ensuring smooth transactions with clients, having a reliable and efficient method for billing is essential. A well-structured document not only helps clarify the amount due but also enhances professionalism and trust in the eyes of clients. Design professionals can benefit greatly from creating such a document that organizes all the necessary details into one easy-to-understand format.

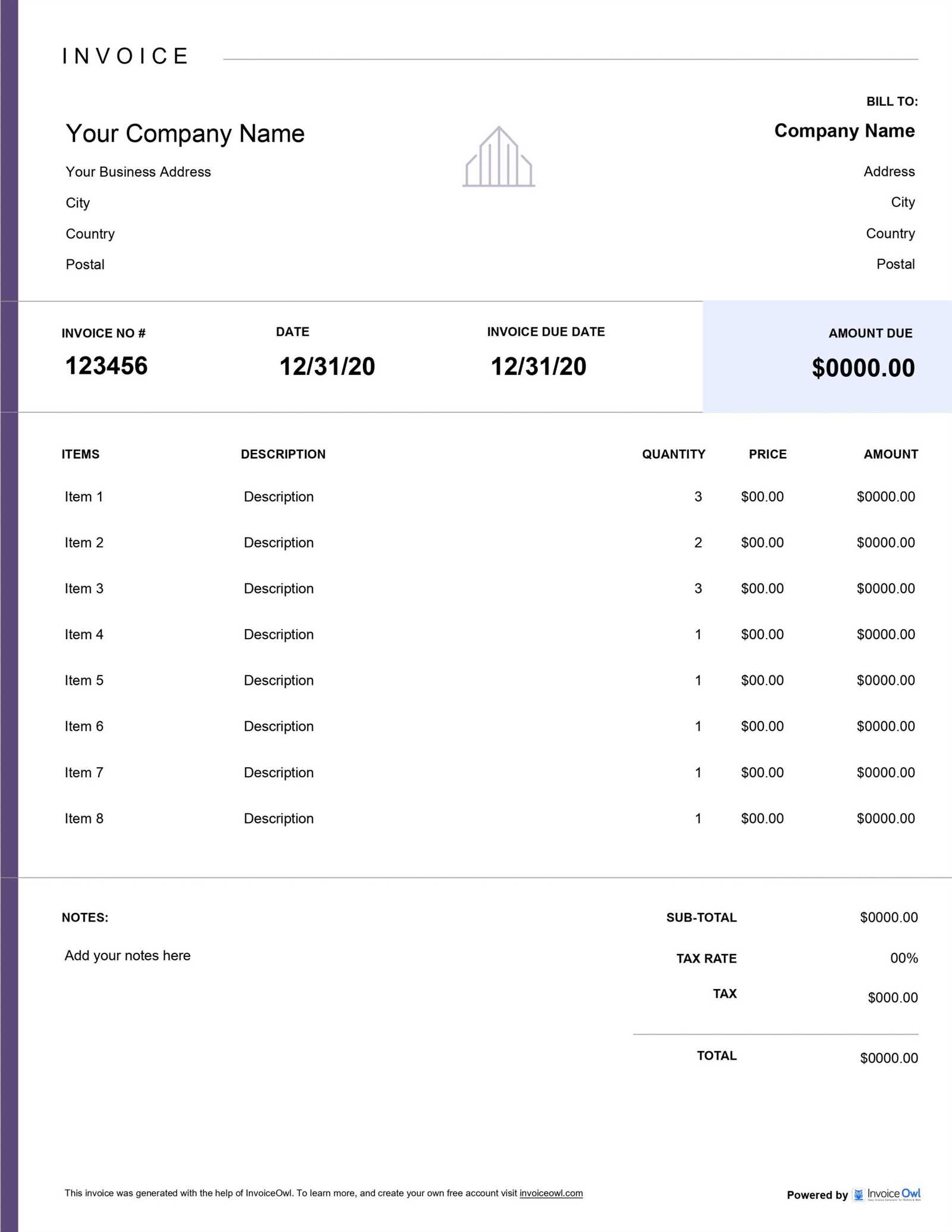

Essential Components of a Professional Billing Document

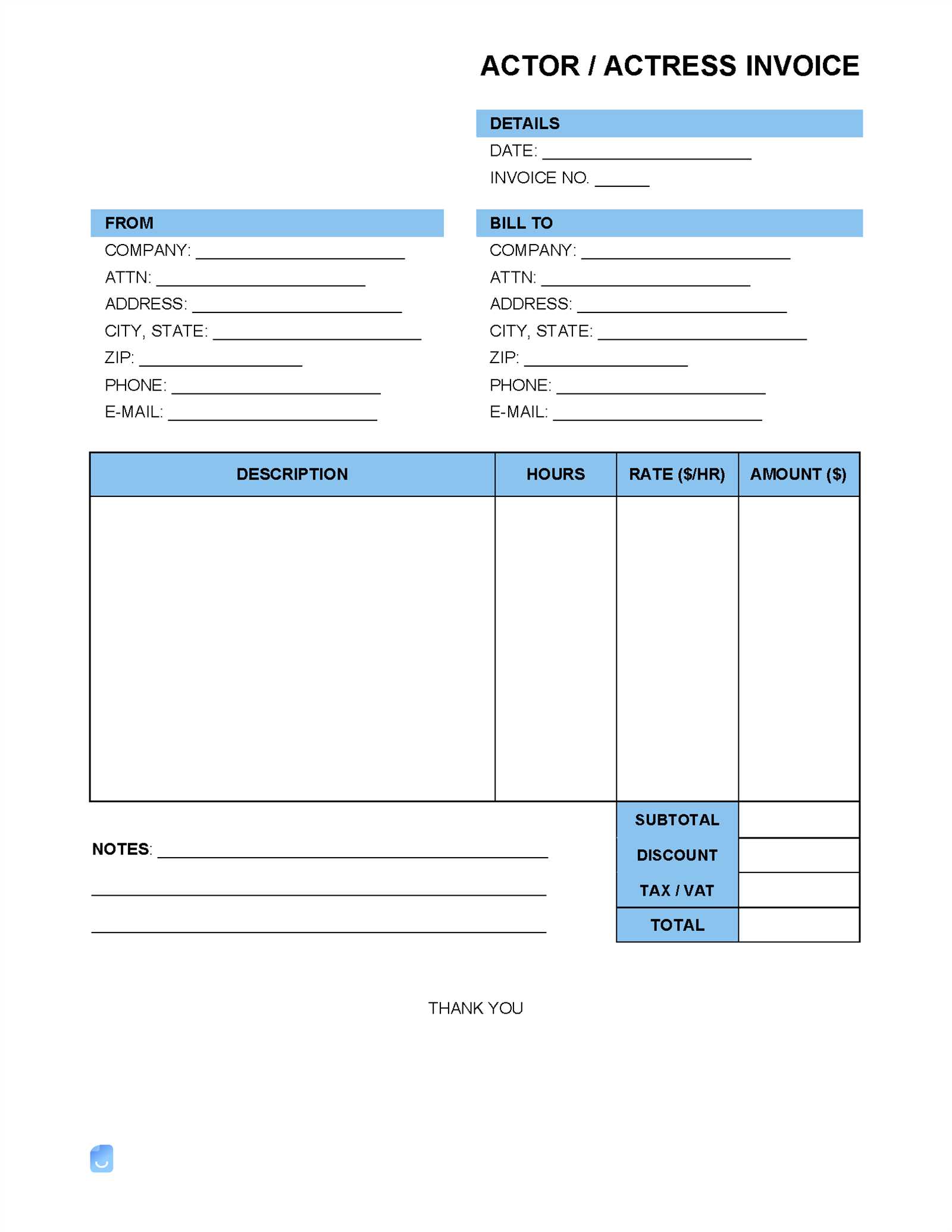

To create an effective document, several key elements should be included. These elements help outline your charges and the terms of payment clearly, minimizing any confusion or delays. Here are the most important sections to consider:

- Contact Information: Include your name, business name, and full contact details. Don’t forget the client’s information as well.

- Project Overview: A brief description of the project or work completed, including relevant dates and milestones.

- Detailed Cost Breakdown: List individual charges for each phase of the project or specific tasks performed.

- Payment Terms: Clearly outline when and how payments should be made, including due dates and any late fees.

- Tax and Additional Costs: Include any applicable taxes and extra charges, such as materials or travel expenses.

Benefits of Using a Structured Billing Document

By employing a structured format, you can save time, reduce mistakes, and ensure clients are billed accurately. The document serves as both a record for you and a clear statement for your client regarding the work completed and financial obligations. The clarity provided by such a system also enhances client satisfaction, ensuring that they understand exactly what they’re paying for.

- Time Efficiency: Automating the process with a template saves hours compared to starting from scratch with each client.

- Improved Professionalism: A polished, consistent format helps you stand out and demonstrate reliability.

- Faster Payments: Clear expectations lead to fewer misunderstandings, encouraging quicker payments.

Why Architects Need Professional Invoice Templates

As a design professional, ensuring accurate billing and seamless payment processing is crucial to maintaining a steady cash flow and strong client relationships. Without a well-organized method to document financial transactions, the risk of errors increases, which can lead to misunderstandings, delayed payments, or lost income. A professional document that clearly outlines charges and terms is essential for reducing these risks and promoting financial clarity.

Streamlined Billing Process

One of the primary benefits of using a structured billing system is efficiency. Architects typically handle multiple clients and projects at the same time, making it important to stay organized. By utilizing a predefined format, you can quickly generate documents with all the necessary information included, saving valuable time that would otherwise be spent drafting each bill manually.

- Consistency: Using a standardized format ensures that each document follows the same layout, which reduces confusion for both you and your clients.

- Accuracy: A well-organized structure ensures that all essential details, such as labor rates, project scope, and additional expenses, are included and correctly calculated.

- Time-Saving: Having a reliable system allows you to prepare and send bills faster, making it easier to track payments and follow up when necessary.

Enhanced Professional Image

In any industry, professionalism is key to building trust with clients. A polished, clear, and detailed billing document demonstrates that you take your business seriously. It not only reflects your attention to detail but also shows that you respect your clients’ time by presenting all financial information in an easy-to-read format.

- Clear Communication: Clients will appreciate a document that clearly communicates project costs and payment expectations, minimizing the likelihood of disputes.

- Increased Client Confidence: Professional-looking bills help instill confidence in clients, encouraging prompt payments and fostering long-term business relationships.

- Brand Image: Consistently sending well-organized billing documents contributes to a positive and trustworthy brand image.

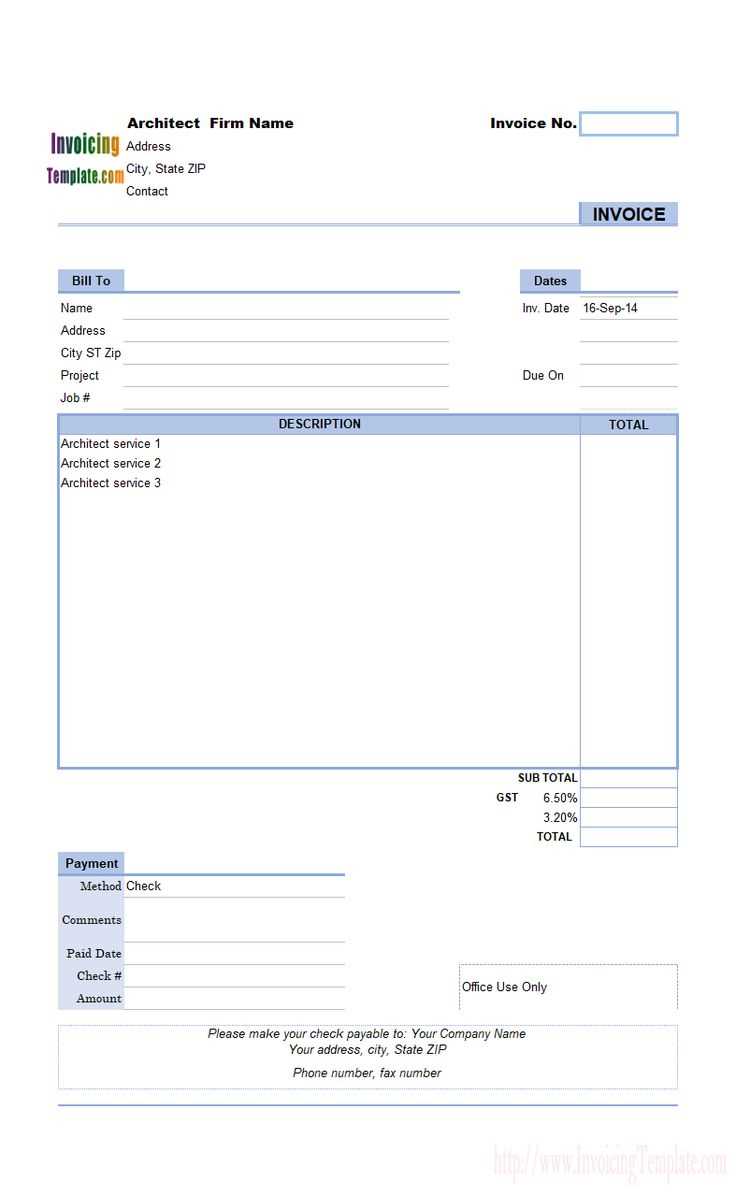

Key Features of an Architectural Invoice

To ensure that clients are properly billed and that financial transactions are handled smoothly, it’s essential to include all the necessary components in any billing document. A comprehensive and well-organized financial statement helps avoid confusion and ensures that the client understands exactly what they are paying for. Key features in such documents serve as a foundation for maintaining clarity and professionalism in every project.

Core Elements of a Billing Document

A well-prepared document must include all relevant details that not only describe the work done but also specify the costs, timelines, and payment expectations. Here are the key sections that should be included:

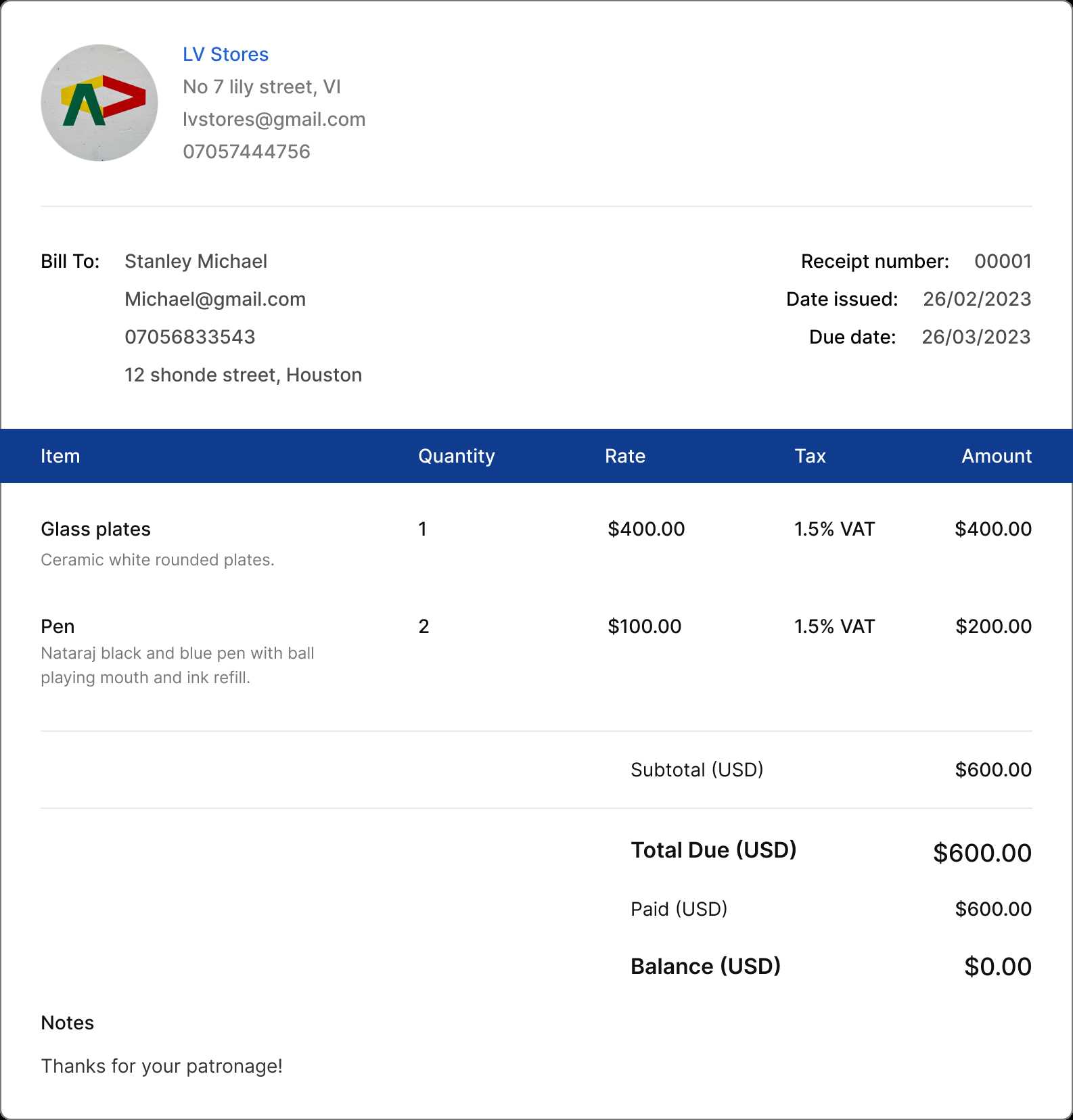

- Client and Provider Details: Always include both your contact information and the client’s. This includes full names, addresses, phone numbers, and email addresses.

- Project Description: A concise overview of the completed project or work performed. This section ensures that both parties agree on the scope of work and deliverables.

- Breakdown of Costs: List the individual charges for each task or phase of the project. This could include consultation fees, design work, and any other specific costs incurred.

- Payment Terms and Due Date: Specify when payment is due and any late fees or penalties for overdue amounts. Clear payment terms help ensure timely compensation for your work.

- Tax Information: Include any applicable taxes or additional charges such as VAT or other relevant local tax rates.

Additional Optional Features

While the core elements are essential, there are additional features that can make a document even more functional and professional:

- Project Milestones: If the project involves multiple phases, break down the charges according to each milestone, allowing for easier tracking of completed work and payments.

- Payment Methods: Clearly state the available payment methods, such as bank transfer, cheque, or online payment platforms.

- Notes and Comments: Include a section for any additional information, such as special instructions, reminders, or future work agreements.

- Discounts or Adjustments: If applicable, include any discounts given or changes made to the original cost estimate based on project scope adjustments.

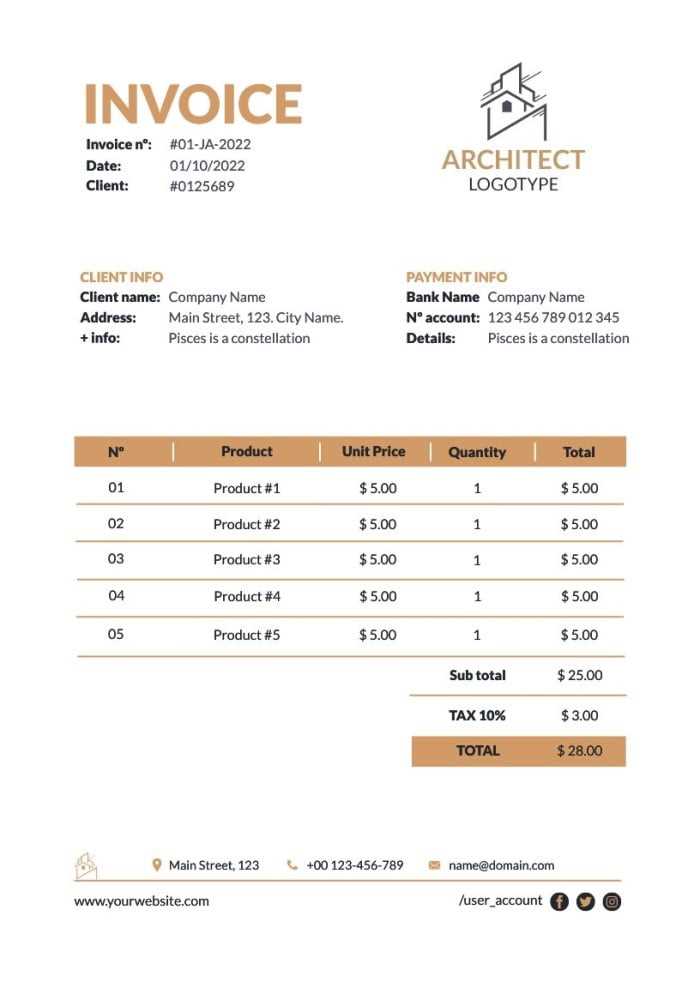

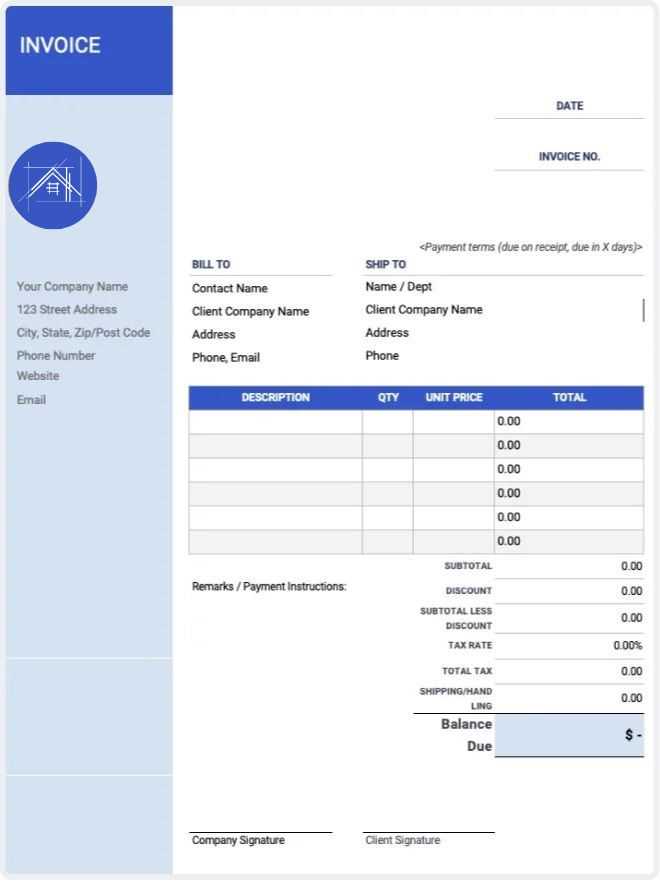

How to Customize Your Billing Document

Creating a personalized and professional billing document can significantly improve the way you manage payments and communicate with clients. Customization allows you to tailor the structure and content to reflect your unique business needs, project types, and client expectations. By adjusting specific sections, you ensure the document fits the nature of the work and provides all necessary details in a clear and concise manner.

Steps to Personalize Your Billing Document

To make your document truly fit your needs, there are several key areas to focus on. These adjustments can help you maintain a consistent, professional approach to billing, while also offering flexibility for different project types and clients.

- Include Your Branding: Add your logo, business name, and any branding elements to make the document look professional and aligned with your company’s identity. This creates a polished image and reinforces your brand.

- Modify Section Layout: Adjust the order of the sections to highlight what’s most important for your clients. For example, some clients may prefer a detailed breakdown of costs at the beginning, while others may appreciate seeing the payment terms first.

- Add or Remove Information: Based on your services, you might need to include extra details such as materials used, subcontractor fees, or hourly rates. Conversely, you can remove unnecessary fields that don’t apply to your work.

- Customize Payment Terms: Set clear and specific payment guidelines based on the nature of your projects. Whether you require a deposit, progress payments, or full payment upon completion, ensure this section reflects the agreed-upon terms.

- Set Unique Discounts or Adjustments: If you offer special pricing, discounts for repeat clients, or specific adjustments based on project conditions, make sure these are clearly stated in your document.

Tools to Help with Customization

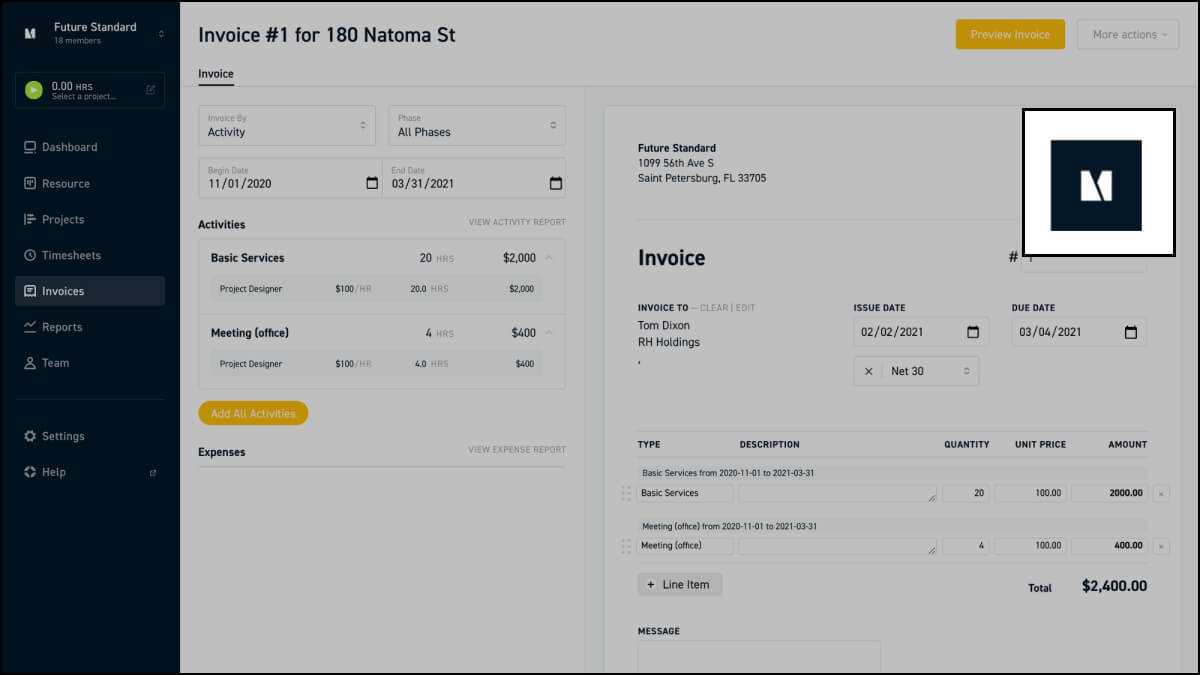

Many software solutions and online tools can assist in customizing your billing documents. These platforms often provide pre-built structures that you can modify, ensuring your document remains organized while also giving you flexibility. Here are some options:

- Word Processors: Programs like Microsoft Word or Google Docs offer easy-to-use formats with customizable fields for all the important details.

- Accounting Software: Applications like QuickBooks or FreshBooks allow you to personalize documents while also integrating your financial data for a more streamlined process.

- Online Builders: There are several online tools that let you drag and drop sections, customize text, and download your document in a professional format.

Common Mistakes in Architectural Billing

Even experienced design professionals can make errors when preparing financial documents. These mistakes can lead to confusion, delayed payments, or strained client relationships. Understanding the most common pitfalls in financial documentation can help you avoid costly mistakes and ensure that your billing process runs smoothly and efficiently.

Common Pitfalls to Avoid

There are several key mistakes that often occur when creating financial statements. Recognizing these errors early on can help you develop a more streamlined and professional approach to managing payments.

- Unclear Payment Terms: One of the most frequent mistakes is not specifying clear payment conditions. Without clear deadlines and instructions on how to make payments, clients may delay or misunderstand when and how to pay.

- Lack of Detail in Cost Breakdown: Failing to break down the costs in a detailed and understandable manner can lead to confusion. Always list individual charges for each task or phase of the project to provide transparency.

- Omitting Taxes or Additional Costs: Leaving out taxes or extra charges, such as materials or travel, can lead to misunderstandings and disputes later. Always include these in your financial document to avoid issues.

- Incorrect Contact Information: If your contact information is wrong or outdated, clients may have difficulty reaching you with questions or payments. Double-check that your details are correct before sending the document.

- Not Updating Rates: If your hourly rates or fees have changed, it’s crucial to update them in your documents. Using outdated pricing can result in undercharging or confusion with clients.

How to Avoid These Errors

To prevent these mistakes, it’s important to establish a clear and organized process for preparing your documents. Consistently reviewing your content before sending it and using tools or software designed to assist with creating accurate statements can help reduce errors.

- Review Your Document: Before sending out any billing document, always take the time to double-check for any mistakes. Make sure the cost breakdown is accurate, the payment terms are clear, and your contact information is up-to-date.

- Use Accounting Software: Using software designed for financial management can help reduce manual errors, automatically calculate taxes, and ensure your rates and other details are consistent.

- Establish Clear Guidelines: Set a standard procedure for documenting costs, payment terms, and additional charges. This ensures consistency in every document and prevents oversights.

How to Add Project Details on Invoices

When documenting your work and billing your clients, it’s essential to provide a clear and detailed account of the project. Including specific information about the tasks completed, time spent, and milestones reached helps prevent misunderstandings and ensures that both parties are on the same page. A thorough description of the work performed gives your clients transparency and justifies the charges listed in the document.

Key Project Details to Include

To create a comprehensive record, you need to include specific project details that explain the scope, the work completed, and any milestones achieved. These elements should be easy to understand and provide enough context for your clients to recognize the value of the work done.

- Project Name and ID: Always start with the project’s name or unique ID number to clearly identify the work. This helps both you and the client keep track of multiple projects or different phases of the same project.

- Project Description: Provide a brief but detailed summary of the work completed. Mention key tasks, designs, or deliverables to give the client a clear picture of the project’s progress.

- Dates and Timeline: List the dates when significant work was done or when project phases were completed. This adds context to the billing and aligns with your agreed-upon schedule.

- Work Phases or Milestones: If the project was divided into phases, break down the costs by each milestone. This can make it easier for the client to understand how payments correspond to completed work.

- Materials and Expenses: Include any materials, equipment, or third-party services purchased or used during the project. This ensures that your clients know exactly what they are paying for beyond just labor.

Organizing Project Details for Clarity

Properly organizing the project information is key to creating a clear and professional document. Here are a few tips on how to present the details in a way that is easy for your client to read and understand:

- Use Bullet Points or Lists: Breaking down the work into bullet points or numbered lists helps organize complex information, making it easier to digest.

- Include Clear Descriptions: Be as specific as possible with each task or milestone. For example, instead of just writing “design work,” detail the specific aspects of the design you completed, such as floor plans, 3D models, or permit applications.

- Align with Client Expectations: Cross-check the work described in the document with what was initially agreed upon with the client. This ensures that all charges are aligned with expectations and avoids disputes.

Importance of Clear Payment Terms

Establishing clear payment terms is essential for maintaining healthy financial practices and fostering strong, transparent relationships with clients. Without well-defined expectations around payment schedules, amounts, and methods, confusion can arise, leading to delayed payments or misunderstandings. A clear agreement ensures that both parties are on the same page and that the financial aspects of a project are handled efficiently.

When payment terms are clearly outlined, clients know exactly when and how they are expected to pay, which minimizes the risk of disputes. Additionally, you can set realistic expectations for when you can expect payment, helping you manage cash flow and plan your finances more effectively. These terms should be detailed enough to cover various scenarios, such as late fees, partial payments, or changes in project scope that may affect the final cost.

Clear payment conditions also promote professionalism and trust. Clients are more likely to pay on time if they understand the expectations upfront, leading to smoother project completion and better ongoing relationships. Furthermore, having a formal agreement in place protects you in case of any disputes, as the terms are already clearly stated and agreed upon by both parties.

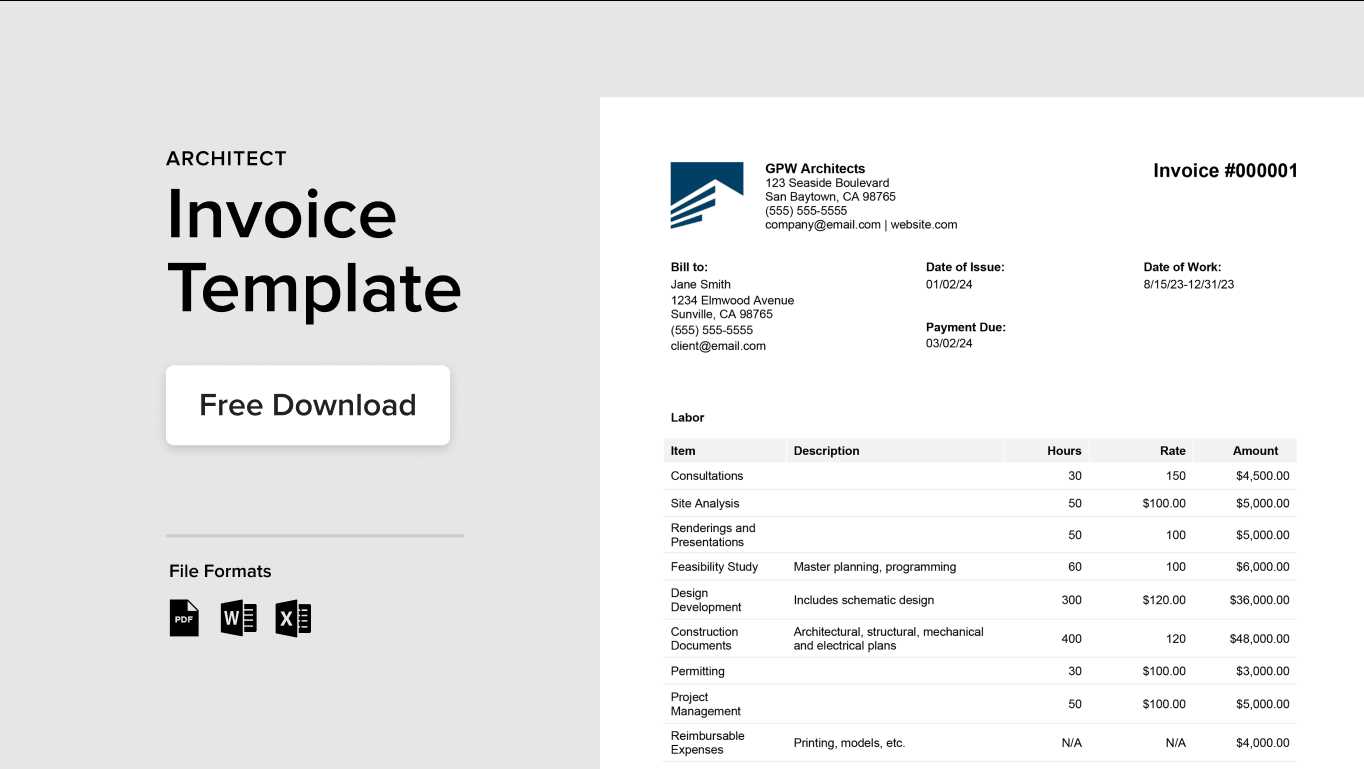

How to Calculate Fees for Architectural Services

Accurately calculating the cost of your work is crucial for ensuring that you are compensated fairly while also maintaining transparency with your clients. The process of determining the right fee can vary based on several factors, such as the type of work, the project’s complexity, the time required, and additional expenses. By establishing a clear and consistent method for fee calculation, you can provide clients with a transparent breakdown of costs while also protecting your business interests.

There are several common methods to calculate fees, depending on the nature of the project and your working style. Below are some of the most widely used approaches:

| Fee Calculation Method | Description | When to Use |

|---|---|---|

| Hourly Rate | Charging based on the time spent on the project, usually calculated by an hourly rate. | Ideal for smaller, ongoing projects or tasks where the scope may evolve. |

| Fixed Fee | A set fee agreed upon in advance, often based on the estimated time, complexity, and project scope. | Suitable for projects with a well-defined scope and clear deliverables. |

| Percentage of Project Cost | Charging a percentage of the total cost of the project (materials, labor, etc.), often used for large-scale projects. | Best for large projects where the total cost can be easily estimated. |

| Per Square Foot | A fee calculated based on the square footage of the project, commonly used for residential or commercial buildings. | Ideal for construction projects or when working on properties with a clear measurement. |

Choosing the right method depends on the type of work and client expectations. You may also combine several methods for larger projects that require detailed pricing, such as using an hourly rate for design and a fixed fee for construction management. Always ensure that your calculation is fair, transparent, and reflects the value of your expertise.

Legal Requirements for Architectural Invoices

When preparing billing documents, it’s essential to comply with legal standards to ensure that the document is valid, enforceable, and accepted by clients and authorities. Legal requirements for these documents can vary depending on your location, the scope of work, and the nature of the project. Ensuring that you meet these standards helps avoid potential disputes and protects your business in case of legal challenges.

Key Legal Elements to Include

There are several mandatory details that must appear on financial documents, regardless of the type of project or client. These elements are necessary to make the document legally sound and prevent any confusion about payment expectations or contract terms:

- Business Details: Your full legal business name, contact information (address, phone number, and email), and business registration number (if applicable) should be included to identify the service provider clearly.

- Client Information: The client’s full name, address, and contact details must be listed. This ensures that the document is directly tied to the client receiving the work and the payment.

- Tax Identification Number (TIN): In many countries, a TIN or VAT registration number must be included on the document for tax purposes. This allows for proper tracking of business transactions by tax authorities.

- Clear Description of Work: A concise description of the work completed or the services provided, including any milestones or deliverables, is necessary to ensure transparency between you and the client.

- Payment Terms: These should specify the amount due, the payment method, the due date, and any penalties or late fees associated with overdue payments. Clear payment conditions prevent misunderstandings.

- Tax Breakdown: If applicable, make sure to include the amount of tax charged and its specific rate. This is particularly important for businesses operating in regions with VAT or other local taxes.

Ensuring Compliance with Local Laws

Beyond the standard elements, it’s crucial to be aware of any specific regulations that apply to your region or industry. Different countries or states may have unique requirements regarding what must be included in billing documents, such as additional clauses or certifications. For instance, certain jurisdictions may require contractors or consultants to provide proof of insurance or include specific language related to the work’s scope.

- Consult Local Regulations: Familiarize yourself with the tax laws, labor laws, and other regulations that apply to your business operations in your area.

- Professional Requirements: If you are a licensed professional, there may be additional requirements related to how you document your work. For example, some licenses require specific language in financial documents or the inclusion of certain professional certifications.

- Record Keeping:

How to Handle Multiple Clients with One Template

Managing billing for multiple clients using a single structure can save time and improve efficiency. By customizing a general framework that can be easily adapted to each client, you streamline your processes without having to create a new document from scratch each time. However, it’s essential to make sure each client’s specific details, project scope, and payment terms are correctly included without confusion.

Steps to Customize a Single Structure for Multiple Clients

Using one framework for different clients requires flexibility and a clear process for adapting the structure to fit each individual project. Here are some strategies to effectively handle multiple clients:

- Client-Specific Information: Ensure that the client’s name, contact details, and project reference numbers are updated for each new billing document. This ensures each document is unique and properly directed to the correct recipient.

- Adjust Project Descriptions: Tailor the work description section for each client, clearly outlining the specific tasks or deliverables related to that particular project. Be sure to update any milestones or progress notes accordingly.

- Flexible Payment Terms: Customize the payment schedule and conditions based on the agreement with each client. Some may prefer upfront payments, while others might need progress payments or final amounts due after project completion.

- Update Rates and Fees: If your rates differ for each project or client, make sure to adjust the cost structure accordingly. Ensure the fee breakdown is accurate for each individual engagement.

Using Automation to Simplify the Process

To make handling multiple clients even easier, consider using automation tools or software that allow you to store client information and quickly populate the necessary fields. This reduces the risk of errors and ensures consistency across all your documents.

- Pre-saved Client Details: Use software that allows you to store client profiles, including their contact information, billing preferences, and project history. With this, you can quickly generate personalized documents for each client without starting from scratch.

- Template Software: Some accounting or document creation tools offer customizable fields, making it easy to update specific sections of the document–like rates or work description–while keeping the core structure intact.

Time-saving Benefits of Using Templates

Creating financial documents manually for each project can be time-consuming and repetitive, especially when dealing with multiple clients. By using a pre-designed structure, you can automate much of the work, freeing up valuable time to focus on other aspects of your business. Streamlining your documentation process allows you to maintain consistency, reduce errors, and ensure that all necessary details are included with minimal effort.

Incorporating standardized frameworks not only speeds up the process but also ensures that your documents remain professional and accurate. This approach can save significant time in the long run, especially when dealing with complex billing or frequent client interactions.

Benefit Description Impact on Time Consistency Using a standard structure ensures that each document includes all necessary information and is formatted in a professional way. Reduces time spent on revisions or creating new designs for each project. Speed Templates allow you to quickly fill in details specific to each client or project, reducing manual input. Speeds up the process of creating documents, especially when dealing with multiple clients. Reduced Errors With predefined fields and sections, the chance of forgetting important details or making mistakes is significantly lowered. Saves time on corrections or follow-ups with clients regarding inaccuracies. Reusability Once the structure is created, it can be reused for various clients and projects, making future billing even faster. Eliminates the need to start from scratch each time, resulting in quicker document generation. By using a consistent and reusable framework, you ensure that your billing process is both efficient and professional, allowing you to dedicate more time to managing your projects and clients.

Choosing the Right Format for Your Invoices

Selecting the appropriate format for your billing documents is essential to ensure clarity, professionalism, and smooth transactions. Whether you choose to create your documents manually or use software to automate the process, the structure should cater to your specific needs, the client’s expectations, and legal requirements. A well-chosen format can help you reduce errors, improve payment efficiency, and maintain a high level of professionalism.

Factors to Consider When Choosing a Format

There are several key factors to consider when deciding on the most suitable layout for your billing records. Taking these elements into account will help you select a format that is easy to use and ensures all necessary details are included:

- Client Preferences: Some clients may have specific preferences regarding how they like to receive billing documents, such as PDF or printed copies. It’s important to accommodate these preferences for ease of communication.

- Professionalism: Your document format should reflect the quality and standard of your work. A clear, concise, and well-organized layout ensures that clients view your business as credible and reliable.

- Legal and Tax Requirements: Different regions and industries have specific requirements for what must appear on billing documents. Ensure that the format you choose accommodates these legal obligations, such as tax IDs, payment terms, and applicable taxes.

- Customization and Flexibility: The format should allow you to adjust the content based on the specifics of each project or client. Whether you need to add custom notes or detailed cost breakdowns, flexibility in the layout is important.

- Ease of Use: Choose a format that is easy to navigate and understand. A simple, organized document helps clients quickly process and review charges, which can lead to faster payments.

Common Formats for Billing Documents

There are various formats available, each offering its own advantages. Depending on your needs and client preferences, you can choose from the following options:

- PDF Format: A widely accepted and professional format that is easy to share digitally. This format ensures your document appears exactly as intended across different devices.

- Excel or Spreadsheet Format: Useful for clients who require detailed breakdowns or when you need to track multiple projects. This format allows for easy calculations and adjustments, though it may not appear as polished as a PDF.

- Word Document Format: A flexible option for smaller businesses, especially when including custom text or formatting. It’s easily editable but can sometimes be less secure for client sharing comp

How to Include Taxes and Discounts

When preparing billing documents, it’s essential to accurately account for taxes and discounts, as these can significantly affect the total amount due. Clear presentation of these amounts helps ensure transparency and prevents misunderstandings. Including taxes and applying discounts correctly not only aligns with legal requirements but also enhances client trust and satisfaction by providing an itemized breakdown of charges.

Including Taxes

Taxes are a necessary part of many financial transactions, and it’s important to calculate and display them clearly. Depending on your location, the applicable tax rate may vary. Always ensure that tax rates are up-to-date and that the tax amount is correctly calculated based on the total cost of the project or product.

- Identify Applicable Taxes: Determine whether your transaction is subject to sales tax, VAT, or other local taxes. Different jurisdictions have different rules on what goods or services are taxable.

- Calculate the Tax Amount: Apply the correct tax rate to the subtotal (before any discounts). The tax can be calculated as a percentage of the total cost or as a fixed amount, depending on local regulations.

- Separate Tax Lines: Clearly list the tax as a separate line item in the document to ensure transparency. This allows the client to easily see the tax amount applied to their total bill.

- Provide Tax Details: Include the specific tax rate, such as “VAT 15%” or “Sales Tax 7%”, along with the total tax amount. This detail ensures that clients understand how the tax is calculated.

Applying Discounts

Offering discounts is a common practice to encourage early payment or reward loyal clients. However, it’s essential to apply and show these reductions clearly to avoid confusion. The type of discount–whether it’s a percentage or fixed amount–should be specified alongside the original cost to highlight the discount’s value.

- Specify Discount Type: Clearly state the discount type: either a percentage off the total amount (e.g., “10% off”) or a fixed amount (e.g., “$50 off”).

- Apply Discount Before Taxes: Typically, discounts are applied to the subtotal before taxes are added. This way, taxes are calculated on the discounted amount, which can save the client money.

- Show Discounted Amount: Include a line item showing the discount, along with the percentage or amount subtracted. This helps clients see the benefit they are receiving.

- Set Clear Terms for Discounts: If the discount is conditional (e.g., “10% discount for early payment”), be sure to include the terms clearly, specifying the timeframe or conditions required to receive the discount.

By including taxes and discounts correctly and clearly, you ensure that your billing process is transparent, accurate, and professional, ultimately fostering

Digital vs Printed Invoices for Architects

When it comes to managing financial documents, professionals in the design and planning industry face a choice between digital and printed formats. Both options offer advantages depending on the type of work, client preferences, and the scale of operations. Understanding the benefits and limitations of each approach is essential for making an informed decision that aligns with your business needs and ensures smooth transactions with clients.

Advantages of Digital Documents

Digital records have become increasingly popular in recent years due to their efficiency and ease of use. They allow for quick generation, storage, and sharing, making them a preferred choice for many professionals. Here are some of the key benefits:

- Instant Delivery: Digital documents can be emailed or shared via cloud storage, ensuring that clients receive them immediately, speeding up the payment process.

- Environmentally Friendly: Using digital formats eliminates paper waste, contributing to sustainability and reducing the need for physical storage space.

- Easy to Track and Store: Electronic records are easy to organize, search, and back up, making it simpler to maintain long-term financial documentation.

- Cost-Effective: Digital documents eliminate the costs of printing, postage, and handling, making them a more affordable option over time.

- Integration with Software: Many digital tools integrate seamlessly with accounting or project management software, making it easier to automate billing and track payments.

Advantages of Printed Documents

Although digital records offer numerous advantages, printed documents are still preferred in certain situations, especially when dealing with clients who prefer tangible paperwork or formal presentations. Here are some reasons why printed records might be the right choice:

- Client Preferences: Some clients prefer receiving a physical copy of the document, particularly in industries where face-to-face interactions are common or when formal agreements are required.

- Professional Appearance: A printed document on high-quality paper can make a strong impression, offering a sense of formality and credibility to the recipient.

- No Technological Barriers: Printed records do not require clients to be familiar with digital tools or software. This can be useful for clients who are not comfortable with technology or who prefer a traditional approach.

- Legal and Contractual Needs: In some cases, printed documents may be necessary for legal or contractual

How to Maintain Consistency in Billing

Consistency in financial documentation is crucial for ensuring professionalism, reducing errors, and building trust with clients. Maintaining a uniform approach across all your billing processes ensures that clients can easily understand the charges and reduces the risk of confusion or disputes. Whether you’re handling multiple projects or clients, a consistent structure helps streamline your workflow and keeps things organized.

Establish Standardized Formats

One of the key elements in achieving consistency is creating a standardized format for all your financial documents. This includes having a consistent layout, structure, and content in every record you produce. By following a predefined pattern, you can ensure that all necessary details are included, and the document is easy to read.

- Use a Consistent Layout: Stick to the same layout for each document, including where key information like dates, project names, and charges are placed.

- Standardize Language: Ensure that the language used in each document remains the same. Avoid using different terms for the same concept, such as calling the same charge “labor fee” in one document and “work cost” in another.

- Include All Essential Information: Always ensure that your documents contain the same core elements: client details, project breakdowns, payment terms, and any applicable taxes or discounts.

Automate the Process

Automation tools can significantly help in maintaining consistency across all your documents. By using invoicing software or online platforms, you can set up predefined fields that automatically fill in client information, pricing details, and other variables. This reduces the chance of human error and ensures each document adheres to the same format.

- Use Templates: Set up reusable document formats within your invoicing software. Templates allow you to quickly generate consistent documents while ensuring all fields are filled out correctly.

- Save Predefined Items: Store frequently used project descriptions, cost categories, and payment terms so that you don’t have to re-enter the same information each time.

- Set Default Payment Terms: Define your payment terms in the software so they are automatically included in each document.

By establishing a clear system for maintaining consistency and leveraging automation tools, you can improve your overall billing efficiency, save time, and avoid unnecessary mistakes.

Best Software for Architectural Invoice Templates

Managing billing documents efficiently is crucial for design and planning professionals. Choosing the right software can streamline the process, automate repetitive tasks, and ensure accuracy. Various tools are available that help professionals create and manage financial documents with ease. These platforms offer user-friendly interfaces, customizable features, and integration capabilities that simplify the billing process and improve overall business productivity.

Top Software for Streamlined Billing

Here are some of the best software options to consider when looking to optimize your financial documentation process:

- FreshBooks: Known for its simplicity and ease of use, FreshBooks is ideal for small businesses. It offers customizable templates, automatic tax calculations, and easy invoicing for recurring billing. The platform integrates with a variety of accounting tools and has a professional, clean interface.

- QuickBooks Online: A comprehensive accounting solution, QuickBooks Online allows for efficient management of both client billing and project finances. It features invoicing tools, expense tracking, and customizable templates, making it perfect for professionals looking for an all-in-one solution.

- Zoho Invoice: Zoho offers powerful customization features with a focus on simplicity. It supports automatic reminders, recurring billing, and multi-currency invoicing. Zoho also integrates seamlessly with other Zoho tools and third-party applications like PayPal and Stripe.

- Harvest: Harvest is a time-tracking and invoicing tool that simplifies the process of creating billing documents based on time spent on projects. It allows easy integration with other software, supports online payments, and provides detailed reports for financial analysis.

- Xero: Xero is a cloud-based accounting platform that offers advanced invoicing features, including custom branding and invoice tracking. It’s known for its intuitive design and flexibility, allowing professionals to create highly tailored billing documents.

Factors to Consider When Choosing Software

When selecting the right software, keep the following factors in mind to ensure it fits your specific needs:

- Customization: Look for software that allows you to tailor the billing documents to your brand, including logo placement, color schemes, and custom fields.

- Integration: Choose a platform that integrates with other tools you use, such as project management, accounting, and payment processing software.

- Automation Features: Opt for software that automates repetitive tasks such as payment reminders, recurring billing, and tax calculations to save time and reduce errors.

- Ease of Use: The software should have an intuitive interface with minimal learning curve to help you create documents quickly without frustration.

By selecting the right tool, professionals can not only enhance the efficiency of their financial workflows but also ensure that their billing process remains accurate, professional, and streamlined.

Tips for Ensuring Timely Payments

Ensuring that payments are made on time is essential for maintaining a smooth cash flow and avoiding unnecessary delays in business operations. While a well-structured financial document can help, the key to getting paid promptly lies in clear communication, strong processes, and proactive follow-up strategies. Here are some tips to help you secure timely payments from your clients.

Set Clear Payment Terms from the Start

One of the most important steps in ensuring timely payments is to establish clear terms at the outset of every project. This includes setting expectations regarding due dates, late fees, and payment methods. Clients are more likely to make timely payments when they understand the payment schedule and the consequences of delayed payments.

- Be Specific About Deadlines: Include a specific due date for payment, and avoid vague terms like “due on receipt” or “net 30.” Instead, set a concrete date, such as “due within 15 days from the project completion date.”

- Specify Payment Methods: Clearly list acceptable payment methods, whether it’s bank transfer, credit card, or online payment platforms. The easier you make it for clients to pay, the faster you will receive payments.

- Include Late Fees: State any penalties for late payments upfront to encourage clients to pay on time. For instance, you could apply a fixed fee or a percentage-based fee for overdue payments.

Send Regular Reminders

Even with clear terms in place, some clients may forget or delay payments. Sending polite, regular reminders can help ensure that the payment process stays on track. These reminders should be professional and friendly, reinforcing the payment deadline without sounding too forceful.

- Set Automated Reminders: Use accounting software that automatically sends reminders when a payment is approaching or past due. Automated systems save time and ensure consistency.

- Send a Thank You Note: After receiving payment, send a short thank-you message to show appreciation. This positive communication helps maintain a strong relationship and encourages future timely payments.

- Follow Up Consistently: If payments are late, send follow-up emails promptly and politely. Be clear about the next steps, whether it’s applying late fees or stopping work until the balance is paid.

By setting clear expectations, simplifying the payment process, and staying consistent with reminders, you can greatly reduce delays and ensure your business receives payments on time.