Mechanical Invoice Template for Accurate and Professional Billing

Efficient billing is a crucial aspect of running any service-based business, especially in fields that require specialized knowledge and expertise. Clear, accurate documentation of work performed and payments due ensures smooth transactions between service providers and clients. Whether you’re a freelancer or managing a team, having a consistent approach to creating and managing financial records can save time, reduce errors, and help maintain professional relationships.

Using structured documents that outline job details, labor, parts, and payment terms allows businesses to avoid confusion and disputes. With the right tools, you can create professional records quickly, helping you maintain cash flow and track the financial health of your operations. Customizable formats can be adapted to suit various service industries, offering flexibility without compromising on precision.

In this guide, we’ll explore the essential components of a well-organized billing record, best practices for customization, and how to enhance your process for better efficiency and accuracy. From easy-to-use digital solutions to important tips for improving financial transparency, these resources will help you streamline your invoicing workflow and focus on what matters most–delivering high-quality service.

Mechanical Invoice Template Overview

In any technical service industry, creating accurate records of work completed and payments owed is essential. A well-organized document that outlines job details, materials used, and costs is a fundamental tool for both businesses and clients. This kind of record serves as a clear reference for both parties, ensuring transparency and minimizing misunderstandings.

Such documents help technicians and service providers keep track of their transactions, ensuring that payments are processed smoothly and on time. With the right structure, these records are easy to create, read, and share, which can greatly improve the efficiency of any service-based operation. A well-crafted form will include key components, such as:

- Service Details: A description of the work performed, including time and labor involved.

- Materials and Parts: An itemized list of products used during the service.

- Payment Terms: Information on the total amount due, due dates, and acceptable payment methods.

- Client Information: Contact details of both the service provider and the client.

For service providers, having access to such structured forms simplifies the billing process and improves overall workflow. Additionally, these documents serve as an important record for both legal and financial purposes, ensuring that all transactions are documented clearly and professionally.

Whether you’re using a physical or digital version, the goal is to maintain consistency and accuracy, helping you build trust with your clients while also streamlining your business operations.

Why Use a Mechanical Invoice Template

Having a standardized document for billing is essential for businesses in any service industry. A structured format ensures that all necessary information is included and helps eliminate errors that could lead to misunderstandings or disputes. Using a consistent format makes the entire process faster, clearer, and more professional, benefiting both the service provider and the client.

By utilizing an organized form, you not only save time but also create a professional impression that builds trust with clients. It enables accurate tracking of payments, jobs completed, and any outstanding balances. Additionally, a consistent structure makes it easier to manage records, particularly when dealing with multiple clients or large volumes of work.

Key Benefits of Using a Structured Document

| Benefit | Description |

|---|---|

| Time Efficiency | Pre-designed formats save time on each transaction, allowing for faster processing and less manual input. |

| Clarity | A clear layout ensures both parties understand the charges, services rendered, and payment terms. |

| Professionalism | Well-crafted documents reflect the professionalism of your business, enhancing client relationships. |

| Legal Protection | Having written records can protect both the client and the provider in case of disputes. |

| Financial Tracking | Consistent billing records make it easier to monitor cash flow and track payments. |

How It Helps Organize Your Business

Using an established format not only makes billing easier but also helps in keeping your financial records organized. It simplifies the process of generating reports and ensures that you have all the necessary details for tax and legal purposes. Whether you’re managing one project or multiple jobs, having a uniform document structure allows you to stay on top of your business’s financial health.

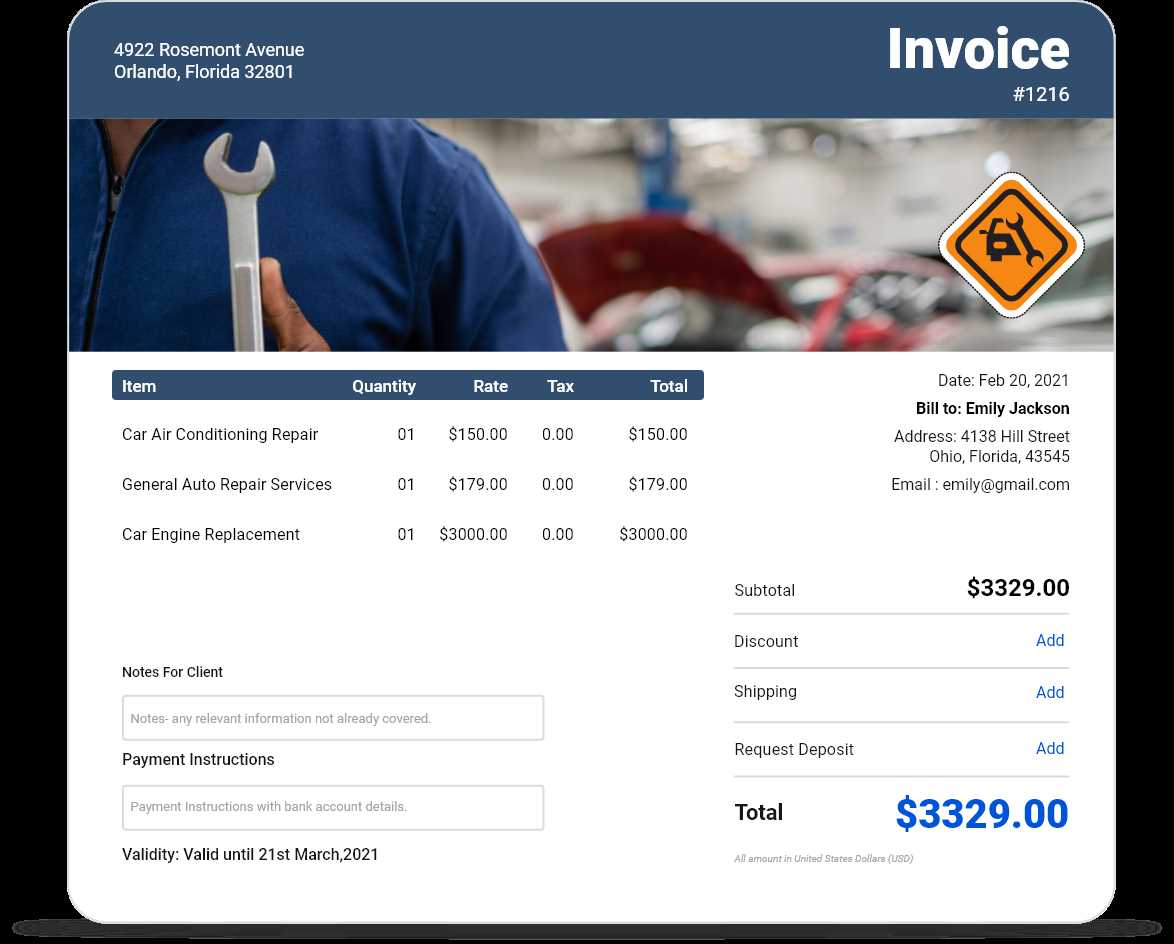

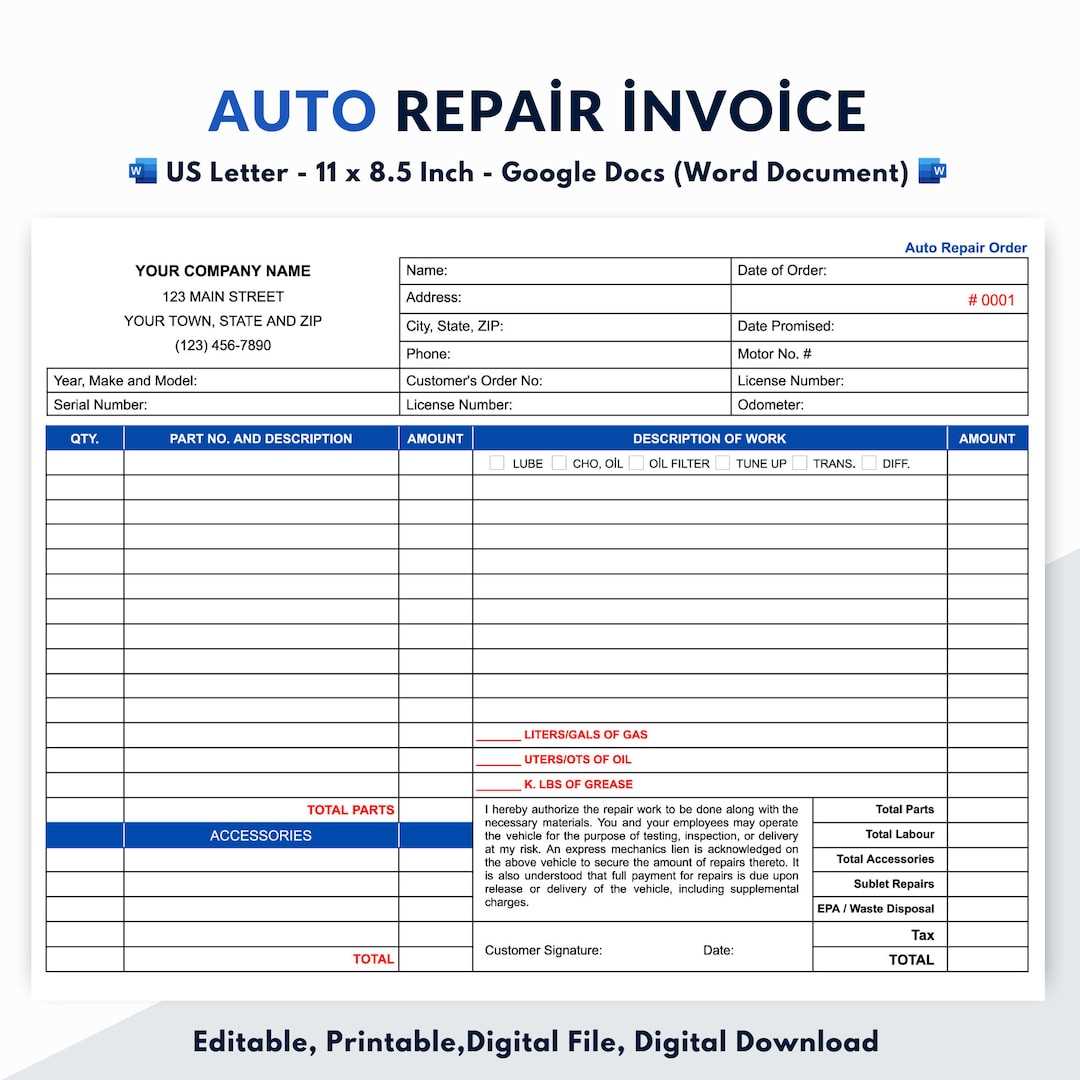

Key Features of a Mechanical Invoice

A well-structured billing document is an essential tool for any service provider, ensuring clarity, accuracy, and professionalism in financial transactions. To be effective, the document must include all necessary details to avoid confusion or disputes. Each section of the document plays a vital role in presenting clear information about the work performed, charges, and payment expectations.

The primary function of such a document is to provide both the service provider and client with a transparent record of the transaction. When properly designed, it ensures that all relevant information is included and clearly communicated, allowing for smooth processing of payments and minimizing any potential misunderstandings.

Essential Components of a Billing Record

- Service Description: A detailed list of the work completed, including tasks performed, hours spent, and any additional services provided.

- Parts and Materials: An itemized list of any products or materials used, with quantities and unit prices for each item.

- Labor Charges: A breakdown of the hourly rate or fixed price for the labor involved in the service.

- Payment Terms: Clearly stated due dates, payment methods, and any applicable late fees or discounts.

- Contact Information: The full contact details of both the service provider and the client to ensure easy communication if needed.

- Unique Identifier: A reference number or code that allows for easy tracking and organization of the transaction.

Why Each Feature Matters

Each of these components contributes to the overall clarity and professionalism of the document. The service description provides transparency about what exactly is being charged for, while the parts and materials section ensures that the client understands the breakdown of costs. Including clear payment terms helps prevent confusion about when and how payment should be made. Contact details facilitate any necessary follow-up or clarification, while a unique reference number makes it easy to track and organize invoices within a larger financial system.

In short, these features work together to ensure a smooth billing process, fostering trust between the service provider and the client while maintaining the accuracy and organization needed for effective business operations.

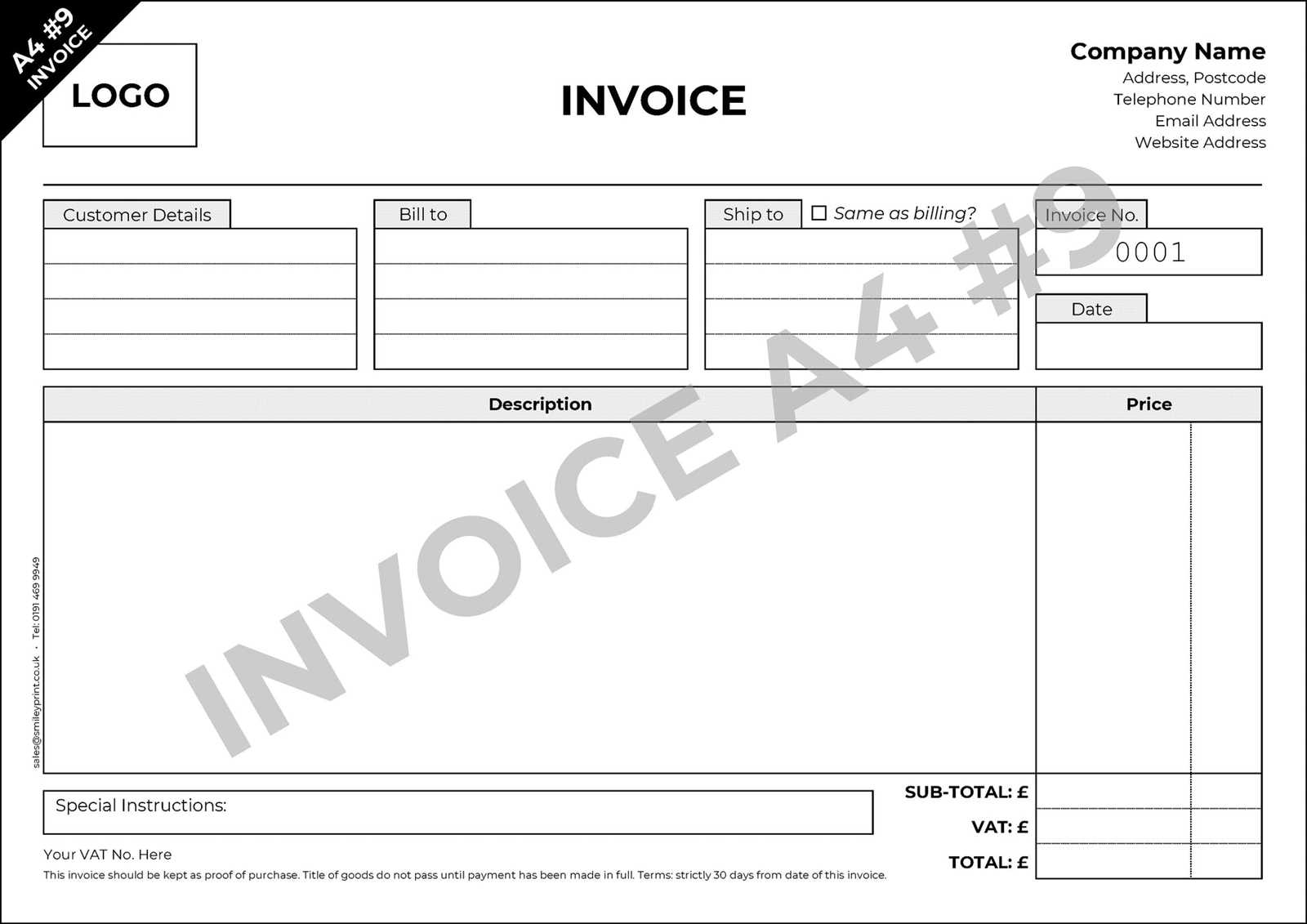

How to Customize Your Template

Customizing your billing document is essential for making it fit your specific business needs. A personalized format not only enhances your brand image but also ensures that all necessary information is captured in a way that works best for you and your clients. Adjusting the layout, fields, and style can make the document more efficient and professional, aligning it with your company’s standards and preferences.

When customizing, consider factors such as the type of services you offer, your payment terms, and how you prefer to present your pricing. A flexible format should allow you to easily add or remove sections depending on the complexity of the job, while maintaining consistency across all records. Additionally, think about branding elements such as logos, color schemes, and fonts that can help make your document stand out.

Here are some key steps to follow when adapting your form:

- Adjust the Layout: Choose a layout that suits your business style–whether it’s simple and clean or more detailed with multiple sections. A balanced design makes it easy for clients to read and understand.

- Include Relevant Fields: Add or remove fields based on your services. For instance, if you offer both hourly labor and fixed-price jobs, ensure you include sections to detail each type of charge separately.

- Incorporate Branding: Add your logo, company colors, and other branding elements to make the document recognizable and professional.

- Modify Payment Details: Tailor the payment section to reflect your specific terms, such as due dates, late fees, or discounts for early payment.

- Consider Digital Integration: If you plan to send the document electronically, ensure it’s optimized for digital use, such as including clickable payment links or integration with accounting software.

By customizing your billing document, you not only enhance your business’s professionalism but also improve the overall efficiency of your financial processes. Make sure to review and update it periodically to reflect any changes in your pricing, policies, or services.

Best Practices for Invoicing in the Mechanical Industry

Efficient billing is crucial in any service-based industry, especially in technical fields where accuracy and clear communication are paramount. By following best practices, service providers can ensure that they maintain professionalism, reduce errors, and streamline their financial processes. Implementing effective invoicing strategies not only helps ensure timely payments but also fosters strong, long-term relationships with clients.

In the technical service sector, where projects may vary in complexity and scope, creating transparent and consistent records is key. Whether you’re handling routine repairs or large-scale installations, there are several best practices you can follow to ensure your financial documentation is both effective and professional.

Here are some essential practices for creating accurate and efficient records:

- Be Detailed and Clear: Provide a thorough breakdown of the work performed, including labor, materials, and any other charges. This transparency helps clients understand exactly what they’re paying for and minimizes potential disputes.

- Use Standardized Formats: Stick to a consistent format for all documents, ensuring that each record includes the same key elements–service descriptions, client information, and payment terms. This reduces the risk of missing critical information and enhances organization.

- Set Clear Payment Terms: Clearly state your payment terms, such as the due date, accepted payment methods, and any late fees for overdue balances. Being upfront about these expectations ensures that both parties are on the same page.

- Timely Submission: Send your documents as soon as the work is completed. The quicker the document is delivered, the sooner you can expect payment. Aim to send it immediately upon completion or within a short timeframe to maintain cash flow.

- Track Payments Efficiently: Keep detailed records of each transaction, including the payment date and method, and follow up on any overdue payments. Implementing a systematic tracking method will ensure that no payments are missed or forgotten.

- Maintain Professionalism: Ensure that every document reflects your brand identity. Use your company logo, include a clean design, and provide clear and concise language. This contributes to the overall professionalism of your business.

- Use Digital Tools: Take advantage of digital billing solutions to create, send, and store records. These tools can help automate calculations, reduce errors, and even integrate with accounting software to streamline your processes.

By following these best practices, you can improve both the accuracy and efficiency of your billing system. This not only helps you get paid on time but also strengthens the trust and professionalism of your business in the eyes of your clients.

Common Mistakes to Avoid in Invoices

When it comes to billing, accuracy is paramount. Even small errors in your financial documents can lead to confusion, delayed payments, or damaged relationships with clients. Understanding and avoiding common mistakes can save you time, ensure smoother transactions, and improve the professionalism of your business.

While the process of creating a record may seem straightforward, there are several pitfalls that many service providers fall into. These mistakes can be easily avoided with careful attention to detail and a consistent approach to structuring your documents. Below are some of the most frequent errors to watch out for:

Common Errors in Financial Documents

- Incorrect or Missing Contact Information: Failing to include the full name, address, phone number, or email of either party can lead to delays or confusion if follow-up is necessary.

- Unclear Service Descriptions: Vague or incomplete explanations of the services performed make it harder for clients to understand exactly what they are being charged for, potentially leading to disputes over the amount due.

- Not Including a Unique Reference Number: Without a unique identifier, it becomes difficult to track and manage multiple transactions, especially for large or ongoing projects.

- Omitting Payment Terms: Failing to outline due dates, accepted payment methods, or late fees can result in delayed payments and confusion about expectations.

- Errors in Calculation: Simple math mistakes–such as incorrect totals or tax calculations–can lead to either overcharging or undercharging a client, both of which can affect trust and payment speed.

How to Avoid These Mistakes

Ensuring that these common mistakes don’t occur is relatively simple with a careful approach. Always double-check your figures, include all necessary information, and use a standardized format to avoid missing any critical details. Additionally, keeping clear communication with clients about payment terms and expectations can prevent misunderstandings. By paying attention to these factors, you can avoid unnecessary issues and maintain strong, professional relationships with your clients.

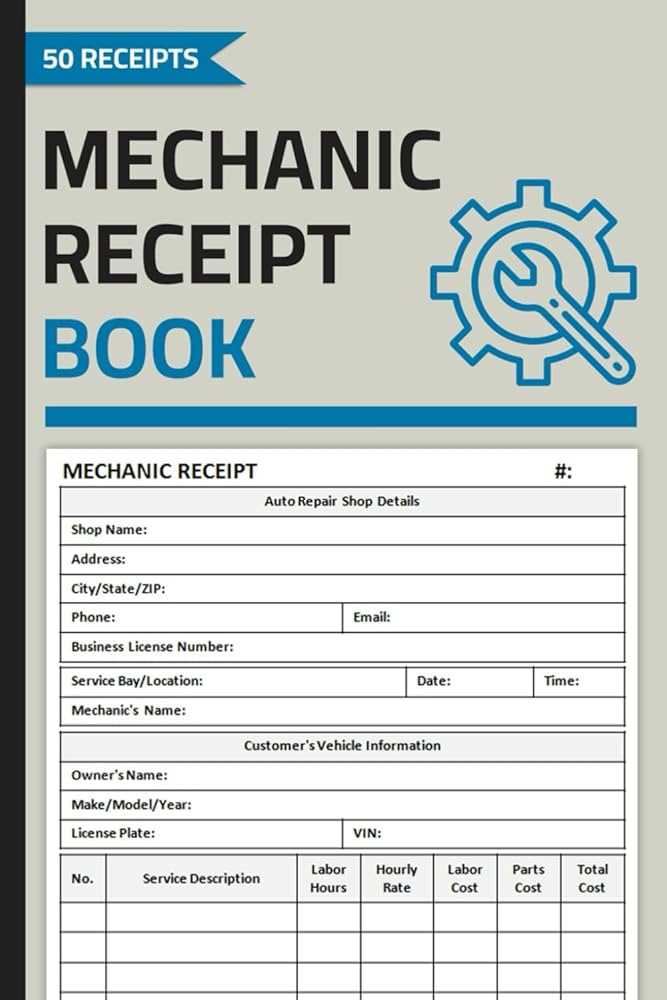

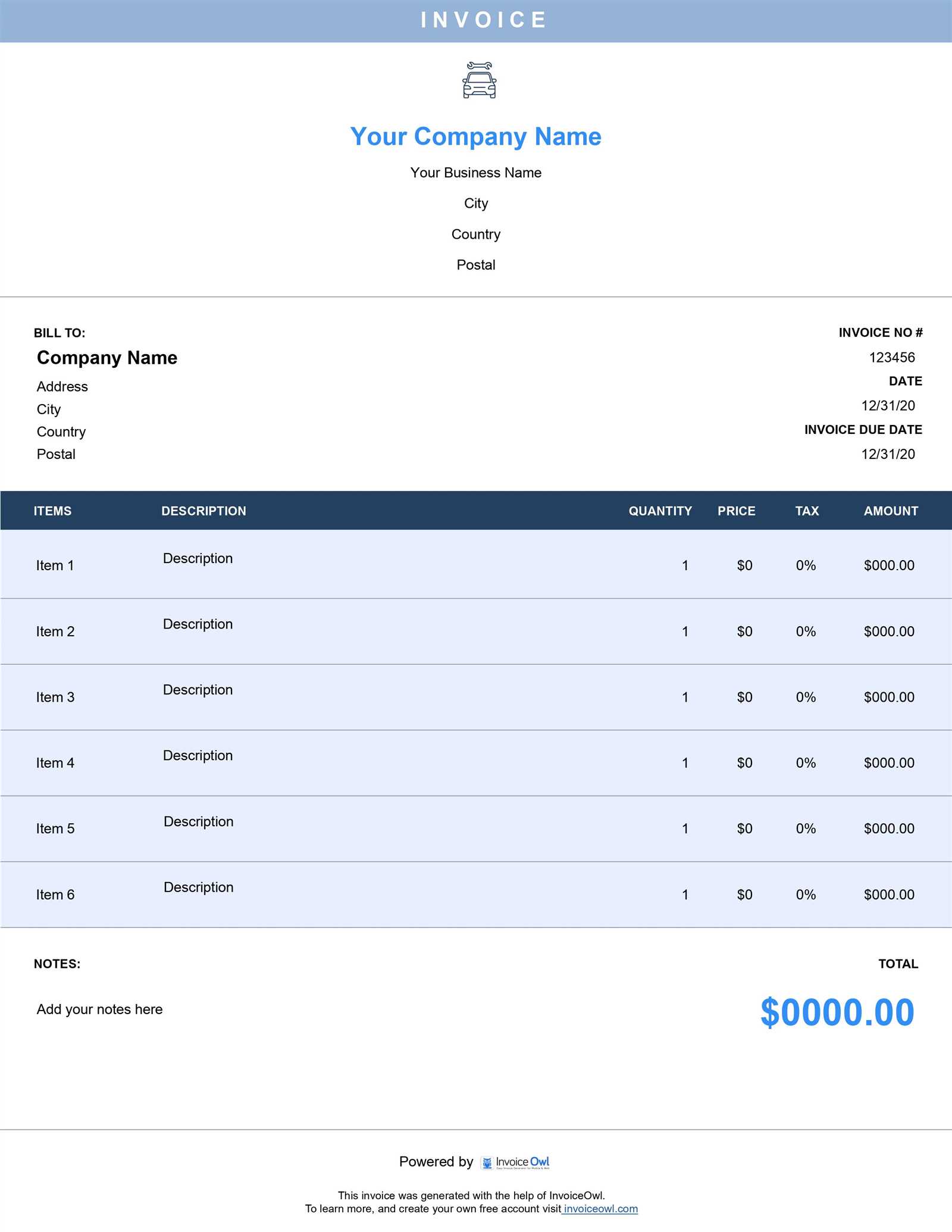

Free Mechanical Invoice Templates for Download

Having access to ready-made, customizable billing documents can save time and ensure consistency for service providers. Downloadable forms offer a simple solution to streamline the process of creating professional and accurate records. These free resources can be easily modified to fit your specific needs, saving you the hassle of designing your own from scratch while maintaining high standards of professionalism.

Whether you are a freelancer or running a larger service operation, utilizing a pre-designed structure can help reduce errors and improve the efficiency of your financial management. The best part is that many of these resources are available for free, making them an accessible option for anyone looking to enhance their invoicing process without additional costs.

When selecting a downloadable form, look for one that suits your business type and includes all the necessary elements such as service descriptions, payment terms, and client details. A good template will also be easy to personalize, allowing you to add your logo, adjust payment terms, or include specific job details for each transaction.

Here are some types of downloadable forms available:

- Basic Service Record: A simple document for straightforward transactions, ideal for smaller or one-time jobs.

- Itemized Billing Form: A more detailed document that includes an itemized breakdown of materials, parts, and labor costs.

- Comprehensive Job Summary: For larger or ongoing projects, this form includes space for multiple services, discounts, and additional notes.

- Digital Options: Some platforms offer downloadable forms that can be easily filled out and sent electronically, perfect for businesses that prefer digital solutions.

These downloadable forms can help ensure accuracy, save time, and maintain a consistent approach to managing your business’s financial records. With just a few clicks, you can start using these ready-made solutions and customize them to meet your exact needs.

How to Add Taxes to Your Invoice

Including taxes in your financial records is an important step to ensure compliance and accuracy when billing clients. Properly calculating and applying the correct tax rates ensures that you meet legal requirements and avoid any confusion or disputes regarding the final amount due. Depending on your location and industry, tax calculations may vary, so it’s essential to include them correctly to reflect the accurate total for both you and your client.

There are several methods for adding taxes, and the process may differ based on whether you’re charging sales tax, VAT, or other local taxes. The key is to understand your tax obligations and clearly outline these charges in the document. Here’s a step-by-step guide on how to incorporate taxes into your financial records:

Steps to Add Taxes

- Determine the Correct Tax Rate: Identify the applicable tax rate for your services or products. This could vary depending on the state, country, or type of work performed. Make sure you’re aware of any local or federal tax regulations that apply to your business.

- Calculate the Tax Amount: Multiply the subtotal of your charges by the tax rate. For example, if your total for services and parts is $500 and the tax rate is 10%, the tax amount would be $50. Ensure the calculation is accurate to avoid discrepancies.

- Add the Tax Line: Include a dedicated line in the billing document that clearly shows the tax applied, the percentage rate, and the total tax amount. This helps the client understand exactly what they are being charged.

- Calculate the Total: Once the tax is added, sum the tax amount and the subtotal to determine the total amount due. This final figure should include both the service charges and the tax charges, ensuring the client sees the complete cost of the transaction.

- List Tax Details for Transparency: It’s important to break down tax charges clearly, especially if multiple rates are applied. For example, if different items or services are subject to varying tax rates, make sure each one is listed separately to avoid confusion.

Best Practices for Including Taxes

- Be Clear and Transparent: Always specify the tax rate, the amount, and what the tax applies to. Clients should never be in doubt about why taxes are being added.

- Check Local Tax Regulations: Tax laws can change, so make sure you’re up to date on the latest rates and rules for your area or industry.

- Consider Automatic Calculators: Many digital tools and software can automatically calculate taxes based on your location and the type of service you provide, reducing the risk of errors.

By carefully adding taxes to your billing documents, you ensure that your clients are aware of the total costs upfront and avoid potential issues when it comes time for payment. Proper tax inclu

Tracking Payments with Mechanical Invoices

Keeping track of payments is an essential part of managing your business’s financial health. Proper documentation and monitoring ensure that you can quickly identify overdue balances, track which clients have paid, and maintain a smooth cash flow. By accurately recording each payment and regularly reviewing your accounts, you can avoid costly mistakes and maintain good relationships with your clients.

Effective payment tracking requires consistency, attention to detail, and the right tools. Whether you’re managing a small operation or a larger service-based business, it’s crucial to have a system in place to record, update, and follow up on payments. Here’s how you can efficiently track payments using structured financial records.

Steps to Track Payments Effectively

- Assign Unique Reference Numbers: Always assign a unique identifier to each transaction. This helps you keep track of payments, especially when dealing with multiple clients or jobs at once.

- Record Payment Status: For each transaction, clearly mark the payment status–whether it’s “paid,” “pending,” or “overdue.” This way, you’ll know at a glance where each payment stands.

- Update Records Promptly: Once a payment is made, update your financial documents immediately to reflect the change. This prevents any confusion about outstanding balances.

- Send Payment Reminders: If a payment is overdue, send a polite reminder to your client, referencing the specific document or job in question. Include details about the due date, the amount owed, and any late fees if applicable.

- Use Digital Tools: Consider using digital tools or accounting software that integrates with your financial documents. These tools can automatically update payment status, send reminders, and generate reports for easier tracking.

Benefits of Effective Payment Tracking

- Improved Cash Flow: By staying on top of payments, you can ensure that cash flow remains consistent and your business remains financially stable.

- Time Savings: Automated systems reduce the time spent manually checking and updating payment statuses, freeing up more time to focus on your services.

- Better Client Relationships: Transparent records and prompt follow-ups show clients that you are organized and reliable, helping to build trust and maintain positive business relationships.

By following these steps and implementing a reliable system for payment tracking, you’ll improve both the efficiency of your operations and your ability to manage finances effectively. Accurate payment tracking also helps you spot issues early and maintain the smooth flow of your business’s financial processes.

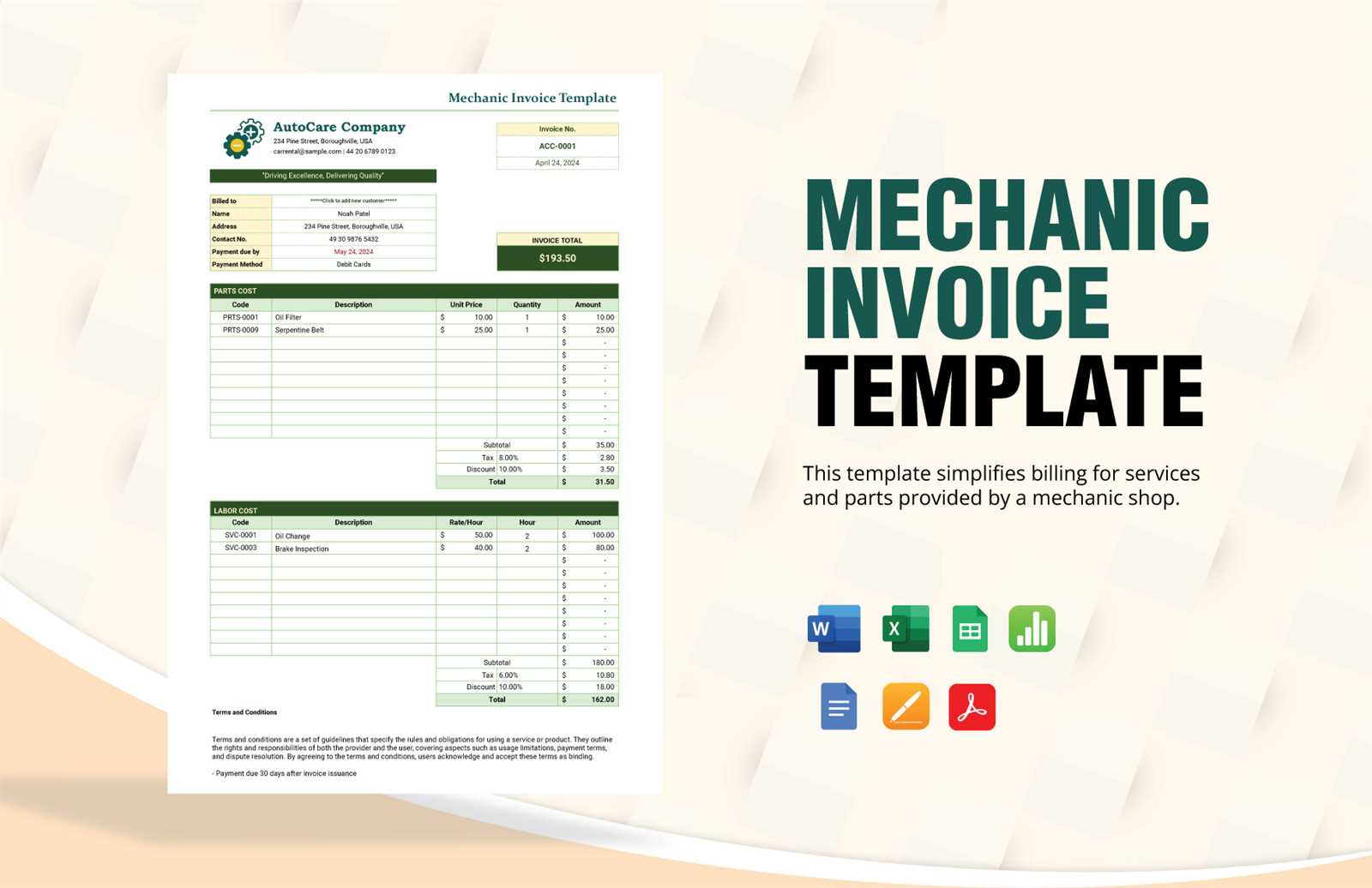

Ensuring Accurate Billing for Labor and Parts

Accurate billing for services and materials is essential to maintain transparency and trust with your clients. When it comes to technical work, such as repairs or installations, the charges for both labor and materials need to be clearly outlined. This ensures that both you and your clients understand exactly what costs are being incurred and why. Proper documentation not only helps with client satisfaction but also with maintaining a well-organized business operation.

To ensure accurate billing, it’s important to track the time spent on tasks, the parts used, and any additional costs that may arise throughout the project. A detailed breakdown of labor and parts helps to justify your charges and avoids confusion or disputes over final amounts. Here’s how to effectively manage billing for both labor and materials:

Best Practices for Billing Labor and Materials

- Track Hours Precisely: Ensure that you record the exact number of hours worked. If applicable, keep a log of when work started and ended for each task. For projects with multiple steps, break down the time spent on each phase.

- Set Clear Hourly or Fixed Rates: Whether you charge by the hour or offer flat-rate pricing, ensure your clients are aware of the rate in advance. Be specific about how labor costs are calculated and include any terms about overtime or weekend rates if applicable.

- Itemize Materials: List each part or material used, along with its cost and quantity. For transparency, include the supplier or source for the parts when possible, so clients can see the legitimacy of the charges.

- Provide Supporting Documentation: If you purchase materials for a client, consider providing receipts or proof of purchase to support the charges. This adds credibility and helps avoid any questions about pricing.

- Include Additional Fees or Charges: Be sure to list any additional charges, such as delivery fees, permits, or other service-related costs. These should be clearly labeled and explained so the client knows exactly what they are being billed for.

Ensuring Transparency and Accuracy

- Break Down Costs Clearly: Don’t just lump everything into one line item. Break down the cost of labor, parts, and any other fees into separate categories. This helps clients understand exactly where their money is going.

- Double-Check Calculations: Accuracy is critical. Before finalizing any billing document, double-check your math to ensure that no errors are made in totaling costs or calculating taxes.

- Be Transparent About Discounts or Adjustments: If you’re offering a discount, credit, or any adjustments, make sure these are clearly explained. Provide an itemized list showing the original price, the discount, and the final adjusted cost.

By carefully

Benefits of Digital Invoices for Mechanics

In today’s fast-paced world, service professionals are increasingly turning to digital solutions to streamline their operations and improve efficiency. Digital records offer a wide range of advantages over traditional paper-based methods, from reducing errors to speeding up the billing process. For mechanics, switching to electronic billing systems can bring significant benefits in terms of organization, accuracy, and customer service.

Using digital methods for billing and record-keeping allows mechanics to work smarter, not harder. With the ability to generate and send documents instantly, track payments more effectively, and reduce the environmental impact of paper use, adopting digital records can enhance both business operations and client satisfaction.

Advantages of Digital Billing for Mechanics

- Increased Efficiency: Digital records can be created and sent immediately, eliminating the need for time-consuming manual paperwork. Mechanics can generate and deliver billing documents within minutes, speeding up the entire billing process.

- Improved Accuracy: Digital tools reduce the risk of human error in calculations and data entry. Automatic tax calculations, totals, and clear formatting ensure that everything is accurate before the document is sent to the client.

- Easy Storage and Access: Electronic records are easy to store, organize, and access. You can quickly retrieve past transactions or client histories with just a few clicks, saving time on administrative tasks and helping you keep better track of your work.

- Faster Payments: Digital solutions allow clients to pay quickly and easily, often with integrated payment links directly within the billing document. This reduces the time it takes to receive payments and improves cash flow.

- Professional Appearance: Digital records can be customized with your business logo, a clean design, and a professional format. This adds a polished touch to your communications, reinforcing your business’s credibility and professionalism.

- Reduced Paper Waste: By eliminating the need for printing and mailing documents, digital records are an environmentally friendly option that helps reduce paper consumption and minimizes waste.

Additional Features of Digital Solutions

- Automated Reminders: Many digital billing systems can automatically send payment reminders to clients, reducing the need for manual follow-ups and ensuring timely payments.

- Integrated Reporting: Digital platforms often provide detailed reports that help you track payments, outstanding balances, and other key financial metrics, making it easier to manage your business’s finances.

- Security and Backup: Digital records are often stored securely with backup options, reducing the risk of losing important documentation due to physical damage or theft.

Switching to digital records can transform the way you manage your billing and payments, making the process more efficient, accurate, and professional. For mechanics, embracing digital solutions offers a smarter, more streamlined approach to managing business operations and fostering stronger client relationships.

Legal Considerations for Mechanical Invoices

When managing your business’s billing processes, it’s crucial to understand the legal requirements associated with financial documents. Whether you’re providing services, selling parts, or engaging in any other type of work, the way you document transactions and collect payments can have significant legal implications. Ensuring compliance with relevant laws and regulations not only protects your business but also helps foster trust with your clients.

There are several key legal considerations to keep in mind when generating documents that outline charges for services or goods. These considerations can vary based on your location, industry, and the specific terms of your contract with clients. Below are some important points to consider to ensure your records are legally sound and protect both parties involved.

Key Legal Aspects of Billing

- Clear Terms and Conditions: Always ensure that the terms of the agreement, such as payment due dates, late fees, and the scope of work, are clearly outlined in the document. Having a written contract or terms agreed upon upfront can prevent disputes and provide a clear reference in case of disagreements.

- Accurate Tax Calculation: Make sure to include the correct sales tax or VAT, based on your jurisdiction. Incorrect tax charges can lead to legal penalties. Verify the tax rates applicable to your goods and services to ensure compliance with local laws.

- Proper Documentation: In some industries, you may be legally required to keep copies of billing records for a certain period of time. Make sure your documentation is properly stored and accessible for audits or legal purposes.

- Payment Terms Compliance: Be aware of any laws regarding payment terms. For example, in some jurisdictions, businesses are required to provide clients with a minimum period to settle debts, such as 30 or 60 days. Failing to comply with these terms could result in legal challenges.

- Consumer Protection Laws: Be mindful of consumer protection regulations. For example, certain industries may have specific rules regarding pricing transparency, warranty disclosures, and return policies. Ensure that your financial records comply with these legal requirements to avoid potential liabilities.

Common Legal Pitfalls to Avoid

- Ambiguity in Charges: Vague or unclear descriptions of services or products provided can lead to misunderstandings and disputes. Be as specific as possible in your billing records to prevent any confusion about what the client is being charged for.

- Failure to Provide a Receipt: Always provide clients with a copy of the record of services rendered, especially for larger or more complex projects. This is not only good practice but may be required for tax and legal purposes.

- Not Addressing Late Payment Fees: If your payment terms include late fees or interest charges, make sure these are clearly specified and comply with local laws regarding maximum allowable fees. Not addressing them up front can cause issues if payments are delayed.

By considering these legal aspects when generating your financial records, you can avoid potential legal disputes and build trust with your clients. A clear, accurate, and legally compliant billing system ensures that both parties are on the same page, reducing the risk of misunderstandings and promoting smooth business operations.

Integrating Billing Documents with Accounting Software

Integrating your billing process with accounting software can significantly streamline your financial management. By linking your financial records to automated systems, you can reduce manual entry, minimize errors, and save valuable time. This integration helps ensure that all transactions, from services rendered to materials used, are accurately recorded and updated in real time, providing a seamless flow of information between your billing system and your financial tracking tools.

Using accounting software that works in conjunction with your billing system allows for better organization, faster processing of payments, and more accurate financial reporting. With the right integration, you can automate many aspects of your business’s financial workflow, including tax calculations, payment tracking, and even generating reports for tax filings or financial analysis.

Benefits of Integrating Billing with Accounting Software

- Time Savings: Automating the transfer of data between your billing records and accounting software eliminates the need for manual input, saving time and reducing the risk of errors.

- Improved Accuracy: By integrating the systems, you ensure that data is consistent and updated across all platforms. This reduces the chances of discrepancies between your billing and accounting records.

- Real-Time Updates: With integration, any changes made in your billing documents–such as payments received or adjustments made–are immediately reflected in your accounting system, providing up-to-date financial information.

- Automated Tax Calculations: Many accounting tools can automatically calculate sales tax, VAT, or other local taxes based on your region and the services you provide, ensuring that tax charges are accurate and compliant with regulations.

- Better Financial Reports: Integrated systems generate detailed, accurate financial reports with minimal effort, making it easier to analyze your business’s performance, track cash flow, and prepare for tax season.

How to Integrate Your Billing System with Accounting Software

- Select Compatible Software: Choose accounting software that supports integration with your billing system. Many modern tools offer plugins or API connections that allow seamless data transfer between different platforms.

- Map Your Data Fields: Ensure that the data fields in your billing documents (such as payment amounts, tax rates, and itemized charges) align correctly with the corresponding fields in your accounting software.

- Test the Integration: Before fully committing to the integration, test the system with a few transactions to ensure that data flows accurately and there are no discrepancies between the two systems.

- Maintain Regular Backups: Even with automated integration, it’s important to maintain regular backups of your financial data to protect against system failures or data loss.

By linking your billing documents with accounting software, you can automate many administrative tasks, improving both the efficiency and accuracy of your financial operations. The integration ensures that you can focus more on providing services and less on managin

How to Handle Late Payments Effectively

Late payments can create challenges for businesses, particularly when cash flow is essential for maintaining operations. Dealing with overdue balances is an inevitable part of running a business, but how you manage these situations can significantly impact your relationship with clients and your financial stability. Having a clear, structured approach to addressing late payments is crucial to ensure that your business stays on track while maintaining professionalism.

Handling late payments effectively involves clear communication, setting firm expectations, and taking the right actions when payments are delayed. The key is to balance assertiveness with professionalism to ensure that clients understand the importance of timely payments without damaging the relationship.

Steps to Address Late Payments

- Set Clear Payment Terms: From the outset, make sure that your clients understand your payment terms, including due dates and late fees. Clearly communicate when payments are expected and what consequences there may be for overdue balances.

- Send Friendly Reminders: Sometimes, clients simply forget about payments. A gentle reminder sent shortly after the due date can often resolve the situation. A polite email or phone call can serve as a reminder while keeping the tone professional.

- Follow Up Consistently: If the payment continues to be overdue, follow up regularly. Provide clear details of the outstanding balance and request immediate payment. Be firm but polite, emphasizing the importance of

Importance of Professional Invoice Design

A well-designed billing document plays a crucial role in establishing your business’s credibility and professionalism. When clients receive a clear, organized, and aesthetically pleasing financial record, it not only reflects the quality of your work but also enhances trust and confidence in your services. A professional design ensures that the information is easy to read and comprehend, making the transaction process smoother and reducing the likelihood of disputes or delays in payment.

The visual appeal of your financial records impacts how clients perceive your business. A cluttered, hard-to-read document can create confusion and may even lead to missed payments or misunderstandings. On the other hand, a clean, polished design not only improves communication but can also reinforce your brand identity, making a positive and lasting impression on clients.

Key Elements of Professional Design

- Clarity and Organization: A well-structured layout with clearly labeled sections–such as client details, service descriptions, and total amounts–makes it easier for clients to quickly find the information they need.

- Consistent Branding: Including your logo, color scheme, and contact information helps reinforce your brand identity, presenting your business as professional and established.

- Readable Fonts: Use legible fonts and appropriate text sizes. Avoid cluttering the document with too many font styles or sizes, as this can make it hard to read and create a disorganized appearance.

- Accurate Details: A professional design includes all the essential information–service details, terms, and payment instructions–without excess information that might distract or confuse the recipient.

Benefits of a Professional Design

- Increased Credibility: A well-crafted document signals to your clients that you take your business seriously. This professionalism can increase client satisfaction and encourage timely payments.

- Improved Client Experience: An easy-to-read and visually appealing document ensures that clients understand their charges clearly, reducing the chances of disputes and improving their overall experience.

- Stronger Brand Recognition: Consistently using a professional design across all your financial records helps reinforce your brand identity, making your business more memorable and recognizable.

In summary, a professional design is more than just about aesthetics–it enhances the effectiveness of your financial documents, improves communication with clients, and strengthens your business’s overall reputation. By investing in high-quality, well-organized designs, you ensure that your billing process contributes to long-term success and client satisfaction.

How to Send and Store Invoices Securely

Ensuring the security of your financial records is essential for protecting sensitive information and maintaining the trust of your clients. Sending and storing your billing documents in a secure manner helps prevent unauthorized access, data breaches, and potential fraud. By adopting best practices for digital document management, you can safeguard both your business and your customers’ data.

In this section, we’ll explore key strategies to securely send and store your financial documents. From encrypting emails to using secure cloud storage, these methods ensure that your records are protected throughout the billing process.

Best Practices for Sending Documents Securely

- Use Encrypted Email: Always encrypt emails containing sensitive information, such as payment details, to ensure that only the intended recipient can access the content. Many email platforms offer end-to-end encryption options to safeguard communication.

- Utilize Secure File Sharing Services: When sending files that include private data, use trusted file-sharing services with robust security protocols. Services like Dropbox, Google Drive, and OneDrive allow you to share documents safely with password protection and encryption.

- Set Expiration Dates: For added security, set expiration dates on shared links. This limits the time frame in which documents can be accessed, reducing the risk of unauthorized access after the file has been viewed.

- Enable Two-Factor Authentication: Use two-factor authentication (2FA) on email accounts and file-sharing services to provide an additional layer of security when sending or receiving financial documents.

How to Store Your Documents Securely

- Use Cloud Storage with Encryption: Store your financial records in a secure cloud environment that offers data encryption, ensuring that the files are protected both during transmission and while at rest in storage.

- Regularly Backup Your Files: Keep regular backups of your billing records in case of system failures or data loss. These backups should be stored in a secure location and be easily accessible when needed.

- Control Access: Limit access to your financial documents by setting permissions on files or folders. Ensure that only authorized personnel can view or modify these documents.

- Store Physical Copies Securely: If you need to keep physical copies of your records, store them in a locked cabinet or safe to protect them from theft or damage.

Comparison of Secure Storage Methods

Method Security Features Advantages Encrypted Email End-to-end encryption, password protection Easy to use, ensures confidentiality during transmission Cloud Storage Data encryption, access control, regular backups Accessible from anywh